1. Introduction

In the transportation sector, plug-in electric vehicles (PEVs) are among the most promising alternatives to the exploitation of fossil fuels [

1] and are expected to reach increasingly large market penetrations in the near future [

2]. However, even moderate PEVs market penetrations may create new demand peaks in the electricity grid [

3,

4,

5] and lead to serious issues concerning the grid stability [

6]. Consequently, the need has emerged to coordinate the charging schedule of PEVs so as to mitigate the demand peaks, or to use the Energy, stored in the PEVs batteries as a source for providing ancillary services [

7,

8,

9,

10,

11]. This proposal belongs, more generally, to the wider concept of demand-side management in smart grids. In order to regulate the charging of PEVs, centralized [

12] as well as decentralized [

13,

14,

15,

16] approaches have been studied, the former approach being clearly less attractive in view of a real application. The decentralized approach typically relies on a game-theoretic framework and looks for Nash equilibria, where players cannot decrease their own costs by unilaterally changing their individual controls. The game describing the PEV problem falls within the class of aggregative games [

17,

18,

19], where players are linked by a quantity depending on the sum of their controls. In recent years, a notable effort has been made to develop algorithms to compute or approximate Nash (or generalized Nash) equilibria in a decentralized or semi-decentralized way [

20,

21,

22,

23,

24,

25,

26,

27,

28]. The PEV problem is among the most relevant applications of the above-cited decentralized algorithms (see e.g., [

23,

24,

25,

26,

27]).

In this paper, we address a Nash-equilibrium-seeking problem for charging PEVs under stochastic dynamics and for a finite number of players. Players wish to minimize their own expected cost for charging PEVs, but at the same time, they must reach a full battery charge before the end of a given time interval. The curve describing the aggregate non-PEV demand for electricity is regulated by an underlying stochastic process. This, in turn, affects the real-time price of electricity, which is modeled as a function depending on the total instantaneous electricity demand. Building upon the model developed in [

29], we employ the S-adapted information structure (firstly introduced in [

30] and applied for instance in [

31,

32,

33,

34,

35]) to describe the stochastic dynamics. More specifically, we assume that players can inspect in real-time the evolution of the stochastic process affecting the non-PEV demand, and accordingly adapt their charging controls. By contrast, players are not allowed to observe the other player’s actions. Several studies have already been devoted to the decentralized computation (or approximation) of Nash equilibria under stochastic dynamics (see e.g., [

36,

37,

38,

39,

40,

41]). However, as pointed out in [

29], these papers are not concerned with the specific time dynamics and with the corresponding S-adapted information structure that is used in the present paper.

We show that, in the basic model discussed in this paper, the obtained Nash equilibria do not correspond to a social optimum, i.e., to a control curve minimizing the expectation value of the

total (PEV and non-PEV), aggregate costs for electricity. This is a consequence of the finite number of players (see also [

24,

42]). In this case, indeed, single players are capable of affecting the price by modifying their charging controls alone, and can therefore steer the equilibrium towards a particular configuration they prefer, but which differs from a social optimum. To overcome this issue, we introduce some additional taxes/incentives on the price of electricity for charging PEVs, with the aim of recovering a socially optimal solution in correspondence with the Nash equilibrium (see for instance [

43], however, in a slightly different context). We then show that such taxes/incentives are not uniquely defined, and analyze the possible options to tune them. As a main result of this paper, we show that it is possible to tune them so that the total tax (or incentive) that is paid (or received) is zero in correspondence with the Nash equilibrium. Remarkably enough, this holds true for any scenario realization of the stochastic process. As a consequence, we obtain a mechanism that allows the social optimum to be reached, but according to which, apart from the payment of the real cost of electricity, no additional money transfer is needed. More specifically, we formulate two variants of the proposed mechanism. In the first case, taxes/incentives are the same for all players, and the condition of zero total tax/incentive is valid at the aggregate level. In the second case, we allow taxes/incentives to be personalized for single players, and the condition of zero total tax/incentive is valid at the individual level.

The paper is structured as follows. In

Section 2, we introduce the basic stochastic PEV problem and formulate it as a game involving

N players. In

Section 3, we introduce the concepts of Nash equilibrium and of social optimum in the context of our problem and show that, in general, they do not overlap. In

Section 4, we discuss the proposal of modifying the game by adding some taxes or incentives on the price of electricity used for charging PEVs.

Section 5 contains the main results of this paper; the additional taxes/incentives are tuned so as to achieve a vanishing total tax. A brief summary of the proposed mechanism is then described in

Section 6. Finally, in

Section 7, we discuss a simple numerical example in which the findings of this paper are applied.

Notation: We use boldface (e.g., ) to denote vectors. A notation of the type , where and , is used to denote a collection of vectors (or scalars) into a larger vector. Given a function , where , the gradient is defined as the vector . The Euclidean scalar product is denoted by . We also use the following matrix notation: is the identity matrix, is the column vector of length N whose elements are all equal to one, and finally, given a matrix X, denotes its element-wise square root.

2. The Stochastic PEV Charging Problem

The problem studied in this paper is similar to the one discussed in [

29] (see also [

13,

24]).

N PEV batteries (possibly different in size) must be fully charged before the end of a given time interval

. We will assume that

is divided into a set of

T periods. As in [

13,

24,

29], we use a real-time electricity tariff depending on the total instantaneous grid load, and model the problem as a game with

N players, in which each player wishes to minimize the cost of charging her own PEV. We then look for PEV-charging controls

that satisfy a Nash equilibrium of the game (see below for more details). Within our model, the non-PEV electricity demand of single players can be neither programmed nor predicted. However, at the aggregate level, we assume that the average non-PEV demand

is actually known. To add some uncertainty, we include possible random fluctuations in the time-evolution of

, which in turn imply a stochastic dynamics affecting the electricity price. Following [

29], we describe these dynamics by using an S-adapted information structure. This means that, during the evolution of the game, players are not assumed to inspect the other player’s actions, but can nevertheless observe the evolution of the stochastic process, i.e., they know the value of the average instantaneous non-PEV demand

.

Let us first introduce the notation describing the stochastic model. Given a probability space

, the stochastic dynamics induces a natural filtration

of the

-algebra

, where

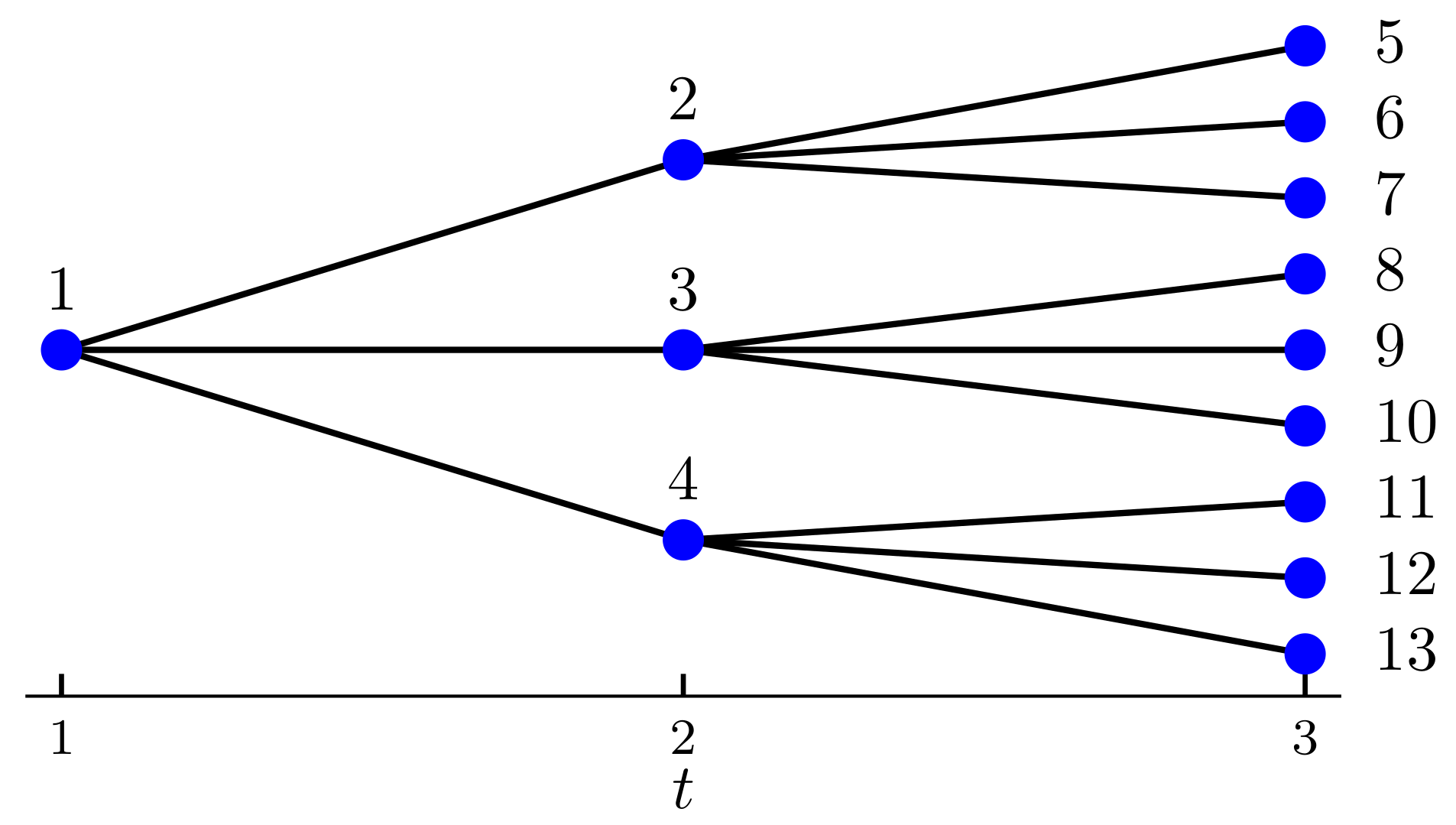

. In this paper, the stochastic process is discrete, and the filtration can consequently be described by an event tree (see

Figure 1) with

K nodes and

T periods. We denote by

the set of all nodes corresponding to the time step

, where

is the set of all nodes in the event tree. To be more precise,

is made of the root node alone; the children nodes of

define the set

; in turn, all children nodes of the nodes in

define the set

, and so on, until the leaf nodes

are reached. We use the notation

to denote an arbitrary node belonging to

, i.e., referring to the time step

t. Furthermore, we define

as the set containing the node

and all of its ancestors. Notice that, for every node

, there is a unique path

leading to

from the root node

. Given a leaf node

, we call

a sample path of the stochastic process. We use the letter

S to indicate the number

of sample paths in the event tree. We further assume that, given any node

, the probability

that node

is realized during period

t is known in advance (we refer to [

44] for more details about event trees in the S-adapted information structure).

The non-PEV demand of electricity on the node

averaged for a single player is denoted by

Including the case of zero demand,

, is, of course, possible, but would require the addition of a constant term in the price function

(see below) to avoid vanishing prices. To keep the notation simple, we prefer thus to define

as given by Equation (

1).

Let

be the set of players. To each node

, and for each player

, the control

describes the amount of power used by player

n to charge her own PEV battery on the node

of the event tree. Notice that this formulation reflects nonanticipativity; indeed, for any

, the controls up to period

t are clearly unique (and given by

) for every sample path passing through node

. This means that

only depends on the information gained up to the time step

t, and therefore, nonanticipativity holds. We call the vector

collecting the controls of player

n an S-adapted strategy for player

n. The vector

collecting the controls of all players is simply called an S-adapted strategy. For the sake of consistency, a well-defined ordering of the nodes of

must of course be maintained in the definition of

and

.

We can now describe the problem we are facing in a more precise way. For every node

, the aggregate control

is defined as the average control over all players:

Furthermore, for each node

we consider an electricity tariff of the type

where

is a price function, and

is the generation capacity averaged for a single player. For each player, the S-adapted cost function describes the expectation value of the cost for charging the PEV battery. Notice that we do not describe the total electricity cost for each player because, as mentioned, we consider the non-PEV electricity consumption of single players to be unpredictable. As discussed in [

29], the S-adapted cost function for player

n can be written as

where

represents the collection of strategies of all players other than

n.

As mentioned, each player wants to fully charge the battery before the end of the time interval

. The state-of-charge of battery

n in correspondence with node

can be described by a number

, such that

. More precisely, we use the following convention (notice that this convention differs from the one used in [

29]):

is the state-of-charge at the end of the time step

t, and at the beginning of the time step

. Requiring a full charge at the end of the time step

T means that

for each leaf node

. Denoting by

the charging efficiency and by

the battery size, the time evolution of the state-of-charge is governed by the equation

where

is the state-of-charge at the beginning of the time interval

, and where

is the parent node of

. By repeatedly inserting Equation (

5), we can formulate the full-charge requirement according to

Notice that, for each player

n, we are actually dealing with

S distinct constraints (let us recall that

is the number of different sample paths of the stochastic process). We can now define the feasibly set

for player

n as the set of S-adapted strategies

satisfying Equations (

2) and (

6):

where

. To model the players’ wish of minimizing their individual costs, we introduce the following game:

Notice that players are linked to one another by the price of electricity, which depends on the aggregate demand. In the next section, we will investigate game in some more detail.

3. Nash Equilibrium vs. Social Optimum

We start by identifying some standard properties of the feasibility set .

Proposition 1. The set of feasible controls is nonempty, compact, and convex for any . For , it further satisfies Slater’s constraint qualification, i.e., its relative interior contains points for which

Proof. The proof is straightforward. □

Let us now make some technical assumptions regarding the price function.

Assumption 1. On the domain , the price function is positive, convex, twice differentiable, has a strictly positive first derivative, and satisfies the following relation:for any . This assumption is a proposal to relax the linear price function used, among others, in [

24]. One can easily verify that, for instance, any function of the type

, with

and

, satisfies Assumption 1. As pointed out in [

29], it may be possible to further relax this assumption to include a broader (and perhaps more simply defined) class of price functions. We leave this study for future research.

We can now proceed to define Nash equilibria (NE) of the game .

Definition 1. A Nash equilibrium of the game is an S-adapted strategy such that, for every player n, it is not possible to reduce the cost by only modifying the controls of player n: A Nash equilibrium of the game

can be found, according to the standard procedure, by solving the corresponding Variational Inequality. Defining the pseudogradient

, and letting

, the Variational Inequality is solved by the S-adapted strategy

if

The following proposition is important to characterize the existence and uniqueness properties of solutions of the Variational Inequality (

11).

Proposition 2. Under Assumption 1, the pseudogradient is strictly monotone on , i.e., The proof of Proposition 2 follows as the special case for

of Proposition A1, and can be found in the

Appendix A.

Proposition 3. Under Assumption 1, the game has a unique Nash equilibrium , which is also the unique solution of the Variational Inequality (11). Proof. The proof is standard (see e.g., Theorems 1 and 2 in [

45]) and relies on the fact that

is strictly monotone (Proposition 2). □

Let us now turn to a different kind of equilibrium. We consider this time the expectation value of the total (both PEV and non-PEV) cost for electricity averaged over all players, which is described by the cost function

Definition 2. A social optimum for the (stochastic) PEV charging problem is an S-adapted strategy minimizing the total expected cost, i.e., for which Let us stress that, while we have included both PEV and non-PEV costs in the definition of the social optimum, the game

introduced above aims at the minimization of costs for charging PEV alone. From a global perspective, a social optimum clearly is the most desirable charging strategy. As shown by [

13], in the deterministic case

any social optimum of the PEV problem satisfies the

valley-filling property, i.e.,

The valley-filling level

is uniquely defined by (a) the shape of the non-PEV demand curve

and (b) the total amount of power to be charged. In the S-adapted case, the valley-filling property is of course violated, since one is obliged to choose controls

before knowing the exact evolution of non-PEV demand, i.e., before that it is possible to calculate the valley-filling level

. In

Figure 2, an example of a valley-filling charging profile is plotted (blue curve). The figure also shows an example of social optimum in a stochastic environment, which clearly violates the valley-filling condition (red, dash-dotted curve). The model is borrowed from

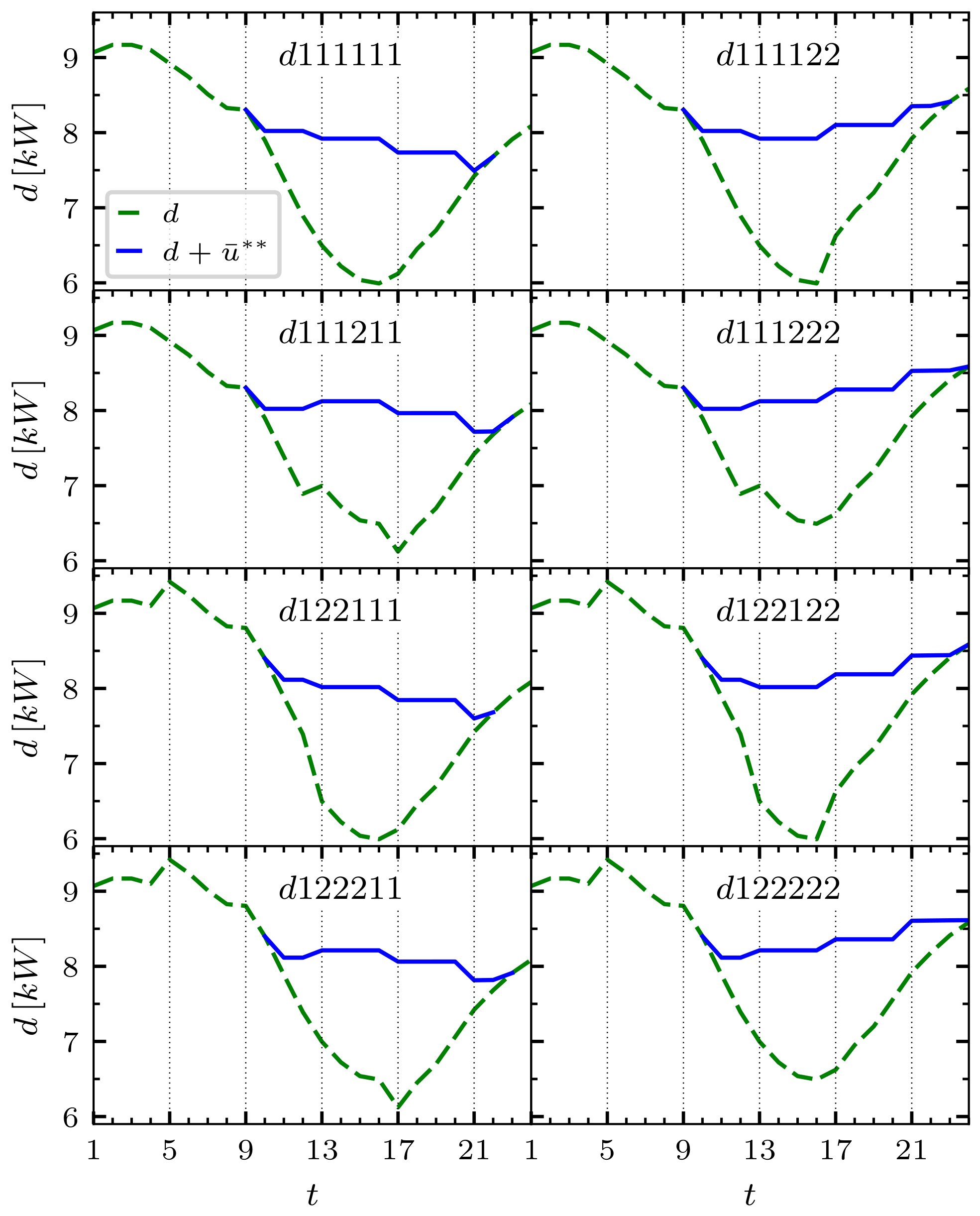

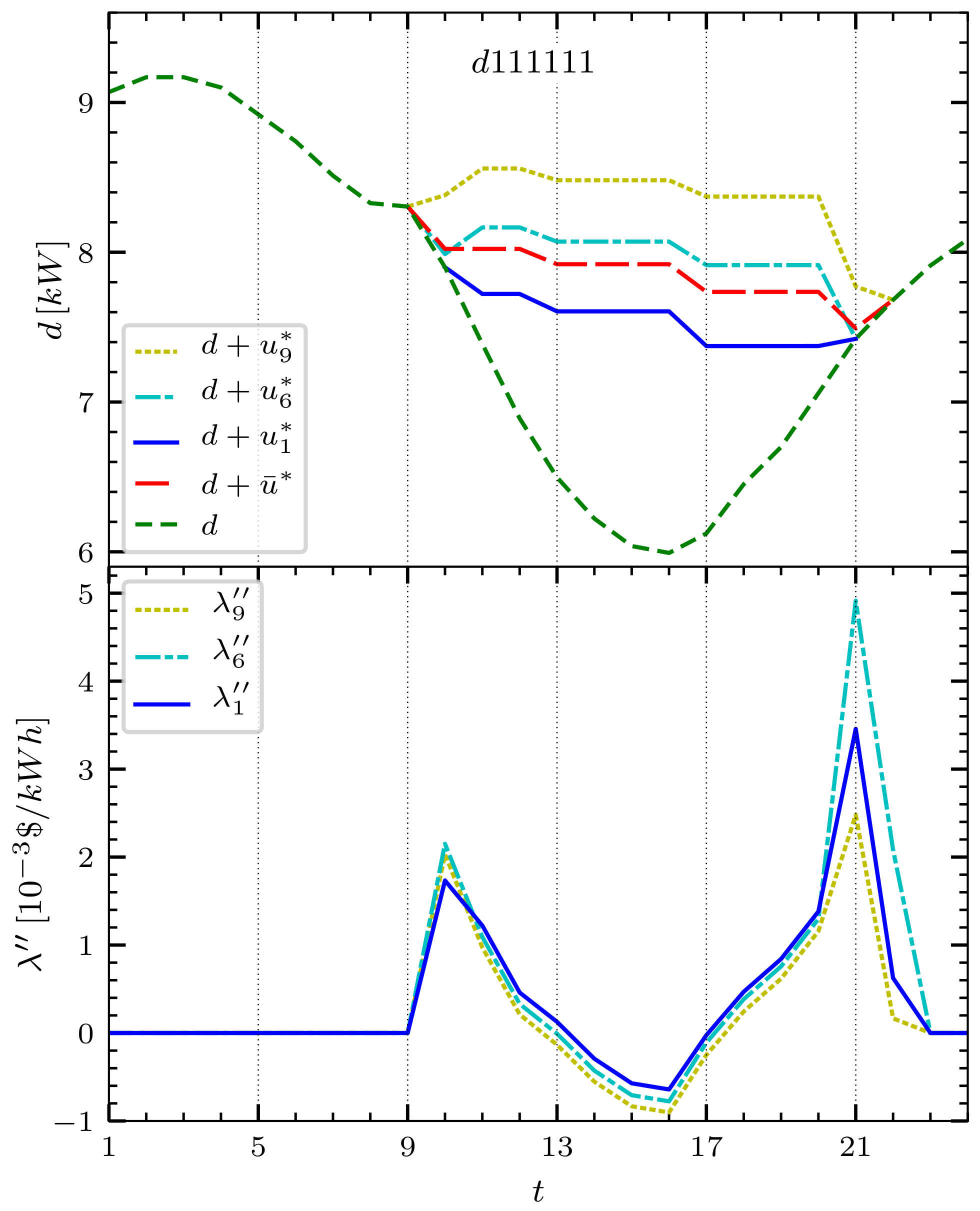

Section 7, where it is discussed in detail. Here, let us just point out that the step-wise structure in the S-adapted total demand is due to the particular features of the example in question, which is piecewise deterministic.

At this point, it may be natural to wonder whether the Nash equilibrium of

is also a social optimum. The example plotted in

Figure 3 (calculated again, for the sake of simplicity, within a deterministic framework) shows that this is, in general, not true. The main reason is due to the fact that the cost functions of

only reflect the costs for charging PEVs. In more detail, we may interpret the obtained Nash equilibria as follows: players realize that, by modifying their individual controls, they can affect the price. When

is small and charging controls are large, they conclude that it is better to reduce the price by consuming a bit less than in the valley-filling solution. This implies that they must afford larger prices during other periods, where total demand rises above the valley-filling level. In these periods, however, charging controls are small, and the price increase has a smaller impact on the cost of charging PEV. In conclusion, the total aggregate demand

has a convex shape, as opposed to the flat, valley-filling solution. The figure suggests, however, that the valley-filling social optimum is reached in the case

. When

N is large, indeed, individual charging controls have almost no effect on the price of electricity. If during a given period, prices were sufficiently low, individual players would be incentivized to exploit this favorable condition by charging as much as possible during the period in question, and at the same time believing that price would stay almost unaffected. Since the same reasoning is made by all players, however, the total aggregate demand tends to get levelized, and a valley-filling equilibrium is approached. The convergence of the Nash equilibrium of

towards the valley-filling solution for

is proven in [

13] in a framework very similar to the one presented here (see also [

24,

42]).

Figure 2.

Two examples of aggregate control curve

solving the social optimum condition. The green, dashed curve describes the non-PEV demand, and follows the non-PEV demand curve

introduced in

Section 7. The blue curve represents total demand in the deterministic case and is valley-filling. The red, dash-dotted curve is calculated in a stochastic framework with the S-adapted information structure. It represents the total demand for the scenario realization corresponding to the depicted non-PEV demand curve

. Details about the numerical settings are discussed in

Section 7. In particular, the stochastic curve is borrowed from the upper-left subplot in

Figure 4.

Figure 2.

Two examples of aggregate control curve

solving the social optimum condition. The green, dashed curve describes the non-PEV demand, and follows the non-PEV demand curve

introduced in

Section 7. The blue curve represents total demand in the deterministic case and is valley-filling. The red, dash-dotted curve is calculated in a stochastic framework with the S-adapted information structure. It represents the total demand for the scenario realization corresponding to the depicted non-PEV demand curve

. Details about the numerical settings are discussed in

Section 7. In particular, the stochastic curve is borrowed from the upper-left subplot in

Figure 4.

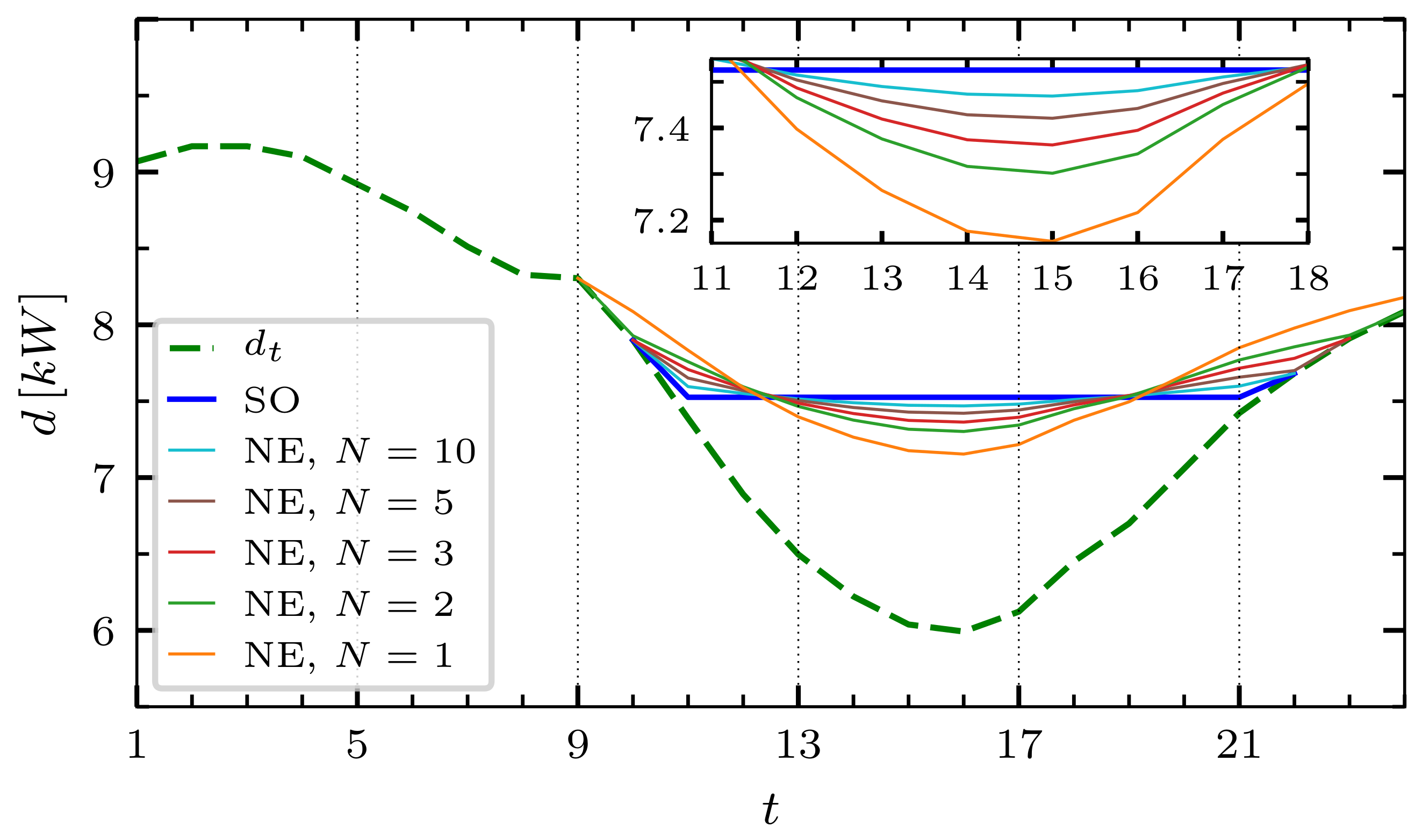

Figure 3.

Examples of Nash equilibria of the game

for different numbers

N of identical players. The thick blue curve corresponds to the (valley-filling) social optimum and is reached in the limit

. Details about the game settings are discussed in

Section 7; however, with the following differences: (a) the game evolution is deterministic, and follows the non-PEV demand curve

introduced in

Section 7; (b) players are homogeneous, and their parameters are equal to those of players 1–5 in the numerical example of

Section 7.

Figure 3.

Examples of Nash equilibria of the game

for different numbers

N of identical players. The thick blue curve corresponds to the (valley-filling) social optimum and is reached in the limit

. Details about the game settings are discussed in

Section 7; however, with the following differences: (a) the game evolution is deterministic, and follows the non-PEV demand curve

introduced in

Section 7; (b) players are homogeneous, and their parameters are equal to those of players 1–5 in the numerical example of

Section 7.

4. Social Optimum as the Nash Equilibrium of a Game with Taxes and Incentives

In this section, we address the question of whether it is possible to modify the game

in such a way that the Nash equilibrium corresponds to a social optimum

. Let us consider the cost functions

where an additional tax or incentive

has been added to the price of electricity used for charging PEVs. The idea is to calibrate

so as to obtain a game whose Nash equilibrium

is also a social optimum. Notice that, because of the

, the total costs afforded by players do not correspond anymore to Equation (

13). It is possible to overcome this problem by redistributing the excess/missing costs by means of a lump-sum

so that the net tax paid by players is zero, and the social optimum defined in Equation (

14) can still be interpreted as the aggregate control for which total costs are minimized.

We will now show that it is possible to define an extended game involving as additional controls so that the controls at the equilibrium correspond to the sought taxes or incentives to achieve social optimality.

At first, we calculate the aggregate control

at the social optimum, by simply solving Equation (

14) as a convex optimization problem. Notice that, given Assumption 1, the cost function

is actually convex for

, as it is the product of two convex, nondecreasing, positive functions (see e.g., Exercise 3.32 in [

46]). Let us now employ the formalism developed in [

24] (and extended in [

29] to the S-adapted case) to find generalized Nash equilibria in a distributed way. We consider a game

with

players, and with cost functions given by

Here,

is the strategy of the additional player, which can be understood as a central regulator. The game is simply defined as

Proposition 4. Under Assumption 1, game admits the existence of a Nash equilibrium . Furthermore, the S-adapted strategy at the Nash equilibrium is unique.

Proof. Since the feasibility region for

is unbounded, one cannot infer the existence of the Nash equilibrium for

as directly as it was achieved for Proposition 3. We formulate instead a generalized Nash equilibrium (GNE) seeking problem with feasibility set

. The game reads

The set

is bounded and satisfies the standard technical assumptions mentioned in Proposition 1. As a consequence, according to [

45], a specific generalized Nash equilibrium of

(called a normalized equilibrium) exists and can be found by solving the Karush–Kuhn–Tucker (KKT) Equations (

24)–(

29). More precisely, several normalized GNE’s may exist. The equilibrium discussed here is obtained by setting to 1 the coefficients

defined in [

45]. Since the latter KKT conditions are equivalent to finding a Nash equilibrium of

, it is clear that a Nash equilibrium of

exists. Moreover, [

45] shows that the GNE of

solving the KKT Equations (

24)–(

29) is unique. This is equivalent to the uniqueness of the controls

at the Nash equilibrium of

(notice that, by contrast, no uniqueness property is established for

). □

It is clear that any Nash equilibrium

of

is a social optimum, i.e., satisfies the equality constraint

Indeed, if Equation (

22) were violated at node

, the (

N+1)-th player would try to choose a value of

with

, so that no equilibrium would be reached. We point out that, since Equation (

22) is an equality constraint, the controls

are allowed to be both positive or negative, and can thus be interpreted as taxes or incentives, respectively. This is a difference with respect to [

24,

29], where the coupling constraints are of the inequality type, and the multipliers

have to be nonnegative. This fact will play a major role in the following section, where a weighted sum of the parameters

will be set equal to zero.

Furthermore, it is clear that the unique S-adapted strategy

corresponds to the Nash equilibrium of the game

which is equal to the original game

, but with cost functions of the type given by Equation (

16).

Let us make some comments about the results we have obtained so far:

We have actually found the first possible way to calculate the correct taxes/incentives

to achieve a social optimum. A Nash equilibrium of the extended game

can indeed be obtained by solving the corresponding Variational Inequality. As we are going to propose a slightly different procedure for calculating

in

Section 5, we prefer here to omit further details about possible numerical methods to solve this Variational Inequality.

At this stage, however, we have no control over the value of the lump-sum that is redistributed or demanded by each player at the end of the game. If the lump-sum is large as compared to the cost reduction made possible by social optimality, the whole mechanism could be perceived negatively by players.

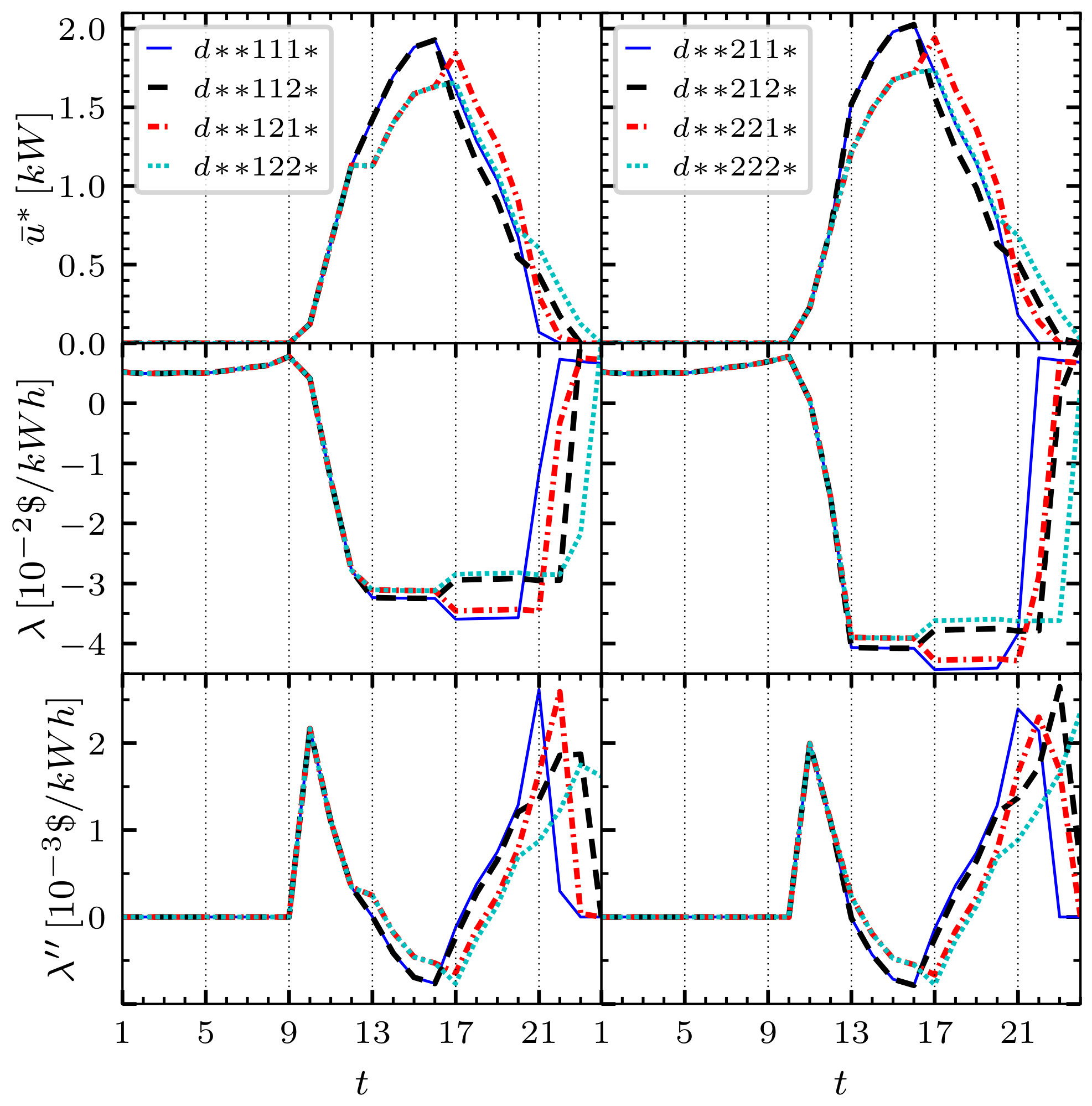

The taxes/incentives at the Nash equilibrium of are not expected to be unique. It may therefore be interesting to investigate whether it is possible to tune them to reduce the lump-sum. In the next section, we will show indeed that it is possible to choose such that the aggregate lump-sum for each . We will also propose a variant with personalized price/incentives , and show that, in this case, the personalized lump-sum can be made to vanish individually for each player.

To be socially accepted, a system with tax/incentive must be egalitarian, i.e., everybody is treated the same way, and fair, i.e., the total tax/incentive must be zero. If all players are homogenous, equality and fairness are possible. If players are not homogenous, this can be partially attained and we have two cases depending if we put the priority on equality or fairness. In the first case, the tax/incentive should be the same for everybody even if the players are different (for example people and big firms should be treated the same way). The price to pay for this is that fairness is only valid at the aggregated level. In the second case, fairness is valid for each player. The price to pay for this is that the tax/incentive might differ. However, it is important to say that players with the same characteristics have the same tax/incentive.

5. Choosing the Level of Taxes/Incentives to Obtain a Vanishing Total Tax/Incentive

Finding a Nash equilibrium of

is equivalent to solving the KKT equations

where

are the Lagrangian multipliers corresponding to the full-charge constraint (Equation (

29)), and where

are the Lagrangian multipliers corresponding to the constraint of nonnegative controls (Equation (

28)). In Equation (

24), the set

is the set of leaf nodes having

as common ancestor.

Assume now that the S-adapted strategy

solves the KKT equations. We are going to show that, because of some redundancy in the constraints, the parameters

,

and

are not uniquely defined. We can indeed find transformations of these parameters that keep the solution

invariant. Consider for instance the transformations

which are determined by a set

of

S parameters. We can easily observe that these transformations leave Equation (

24) unchanged. In the deterministic case (

), the transformation of

reduces to a constant shift

, which makes the redundancy between

and

easy to be understood. Indeed, since players need to consume a well-defined amount of power before the end of the time interval (this is the constraint having

as Lagrange parameters), it is clear that adding a constant term to the price will not change the player’s behavior. In light of this interpretation, we can also consider the transformation in the stochastic case, Equation (

31), as the addition of

S different constant terms to the price of electricity, one for each scenario. In addition to that, transformations of the type

can be performed for all nodes

in which the charging controls of all players are identical to zero, i.e., in which

. Notice that, in order to preserve the validity of Equation (

26),

must be in the range

. We can interpret this transformation as follows: in the nodes where controls are already zero, increasing the price will obviously keep controls equal to zero, since controls must be nonnegative (this is the constraint having

as Lagrange parameters). Decreasing the price may keep the controls equal to zero as well, provided that the price decrease is sufficiently small.

5.1. Tuning the ’s So That, at the Equilibrium, the Total Tax/Incentive Is Zero at the Aggregate Level

In this subsection, we show that it is possible to tune the

in such a way that, at the equilibrium, the aggregate control

does not pay any tax nor receives any incentive, i.e.,

. As a quite remarkable result, this is true for any sample path

of the tree. In order to perform the next calculations, it may be convenient to switch to a matrix and vector notation. In addition to the already defined vectors

,

and

, we introduce

, and

. All vectors defined here are intended to be column vectors. We also denote by

the diagonal matrix having all node probabilities

on the diagonal, and by

the diagonal matrix having the aggregate controls

on the diagonal. Moreover, we introduce the incidence matrix

, with elements

if the sample path indexed by

contains the node indexed by

, and

otherwise. With this new notation, Equation (

24) writes

Equations (

30) and (

31) can be accordingly written as

We formulate the condition of zero total tax or incentive for the aggregate control as

Inserting Equation (

36) into Equation (

37), we obtain the equation

Proposition 5. Equation (38) always admits a solution . Proof. We have to show that a solution

of Equation (

38) exists. If the matrix

is nonsingular, the result is trivial. Let us consider the case where

is singular, i.e., when there is a

with

, and

A solution of Equation (

38) exists provided that

and

have the same rank. By taking the transposed of these two matrices, and since

is symmetric (recall that both

and

are diagonal), this can be translated into the condition

Define

by

(which exists since all elements of

X are nonnegative). Equation (

39) can be reformulated as

, and thus,

We can conclude that

Therefore, the condition for the existence of a solution of Equation (

38) is satisfied. □

Proposition 5 implies that a vector

exists (Equation (36)) such that

and

solve Equations (

34) and (

37). In other words, the taxes/incentives

allow to achieve a social optimum, and at the same time guarantee that, at the equilibrium, no total tax (or incentive) is paid (or received). We shall now isolate a particular case where an explicit solution of Equation (

38) can easily be found.

Proposition 6. If the matrix has maximal rank (i.e., equal to S), then the symmetric matrix is nonsingular.

Proof. As in the proof of Proposition 5, let

. If

has a maximal rank, then

X has maximal rank as well. Then, the matrix

is symmetric and positive definite, and hence invertible. □

Thus, if

has maximal rank, we can invert

in Equation (

38), so that the transformations given by Equations (

35) and (

36) become

Finding

in the case where

does not have maximal rank is a bit more technical. In order to simplify the discussion in the current section, we leave this construction to the

Appendix B. Here, we just point out that a similar version of Equation (

46) is used in this case (see Equation (

A11) in the

Appendix B, with the difference that some particular redundant scenarios must be removed from

B in a suitable way.

To summarize, we have found a procedure allowing us to calibrate the

so as to guarantee the aggregate zero-tax condition

,

, which can be written as

We still have the degrees of freedom given by Equations (

32) and (

33). As discussed before,

whenever

, so that any allowed choice of

does not alter the zero-tax condition. We can thus use this transformation to adjust the taxes in the nodes where prices already are too large, and no power is consumed to charge PEVs. Seeking simplicity, one possible option is to set the taxes or incentives to be as close as possible to zero, so as to avoid unnecessary large taxes or incentives. Defining

, our proposal is the following. For all nodes

where

, define:

otherwise, if

, leave

. Notice that, in this transformation,

is such that the nonnegativity of

is guaranteed for any

n.

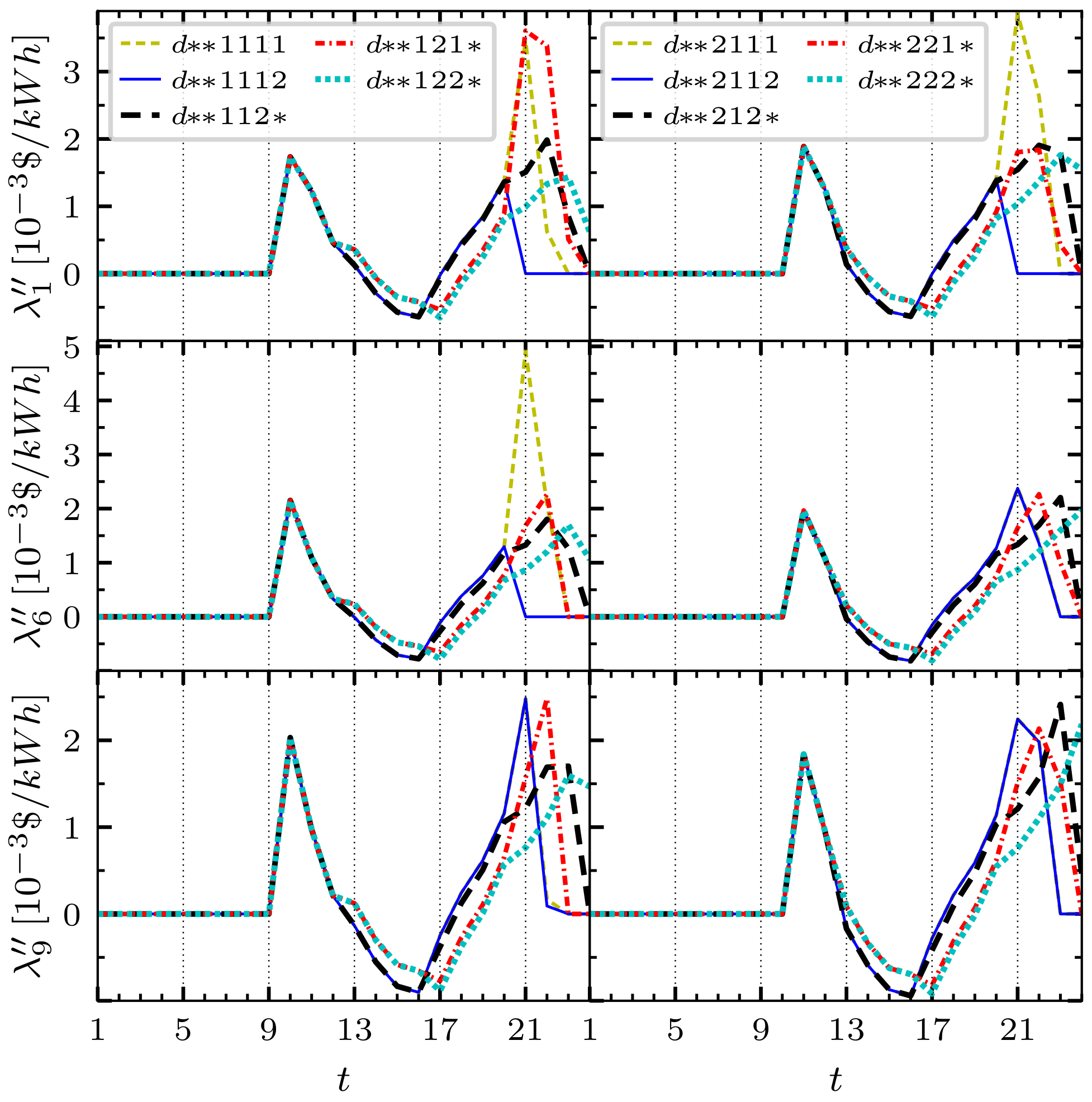

5.2. Personalizing the ’s So That, at the Equilibrium, the Total Tax/Incentive Is Zero at the Individual Level

In the previous subsection, we have found a way to obtain a zero total tax or incentive for each separate scenario. This result is valid, however, only at the aggregate level. At the individual level, unless all players are homogeneous (i.e., have the same charging requirements), single players will continue to pay a nonzero tax or receive a nonzero incentive, which must in turn be compensated by the payment of a nonzero lump-sum

. It is clear that, by keeping the taxes/incentives

to be the same for all players, there is no way to resolve this issue. In this subsection, we show that assuming that the taxes/incentives can be personalized for each player, then it is possible to extend the zero-tax condition to every single player. We thus consider cost functions of the type

for each player

n. The personalized zero-tax condition reads

Notice that the l.h.s. of Equation (

49) corresponds to the personalized version of the lump-sum

defined in Equation (

17). The idea to achieve the fulfillment Equation (

49) is quite straightforward. Assume that

,

,

,

solve the KKT Equations (

24)–(

29). For each player

, consider first the common taxes/incentives

, then transform them to the personalized

according to the formula

where

is the diagonal matrix having the elements of

on the diagonal. Analogously as in

Section 5.1, and as discussed in the

Appendix B, if

does not have maximal rank it is possible to eliminate some columns from

B so that the vector

defined by Equation (

50) always exists and fulfills the zero-tax condition. We may now continue to follow the proposal described in the previous subsection, and perform a second transformation into

according to the following prescription. For all nodes

where

, define:

otherwise, if

, leave

. Finally, we simply play the game with personalized taxes/incentives

which is nothing but

with personalized values of

.

Proposition 7. Let be as described in this subsection. Then, the unique Nash equilibria of and of coincide.

Proof. From Proposition 1, Assumption 1, and Proposition A1, it follows as a standard result that Nash equilibria for the games

and

exist and are unique. We denote these equilibria by

and

, respectively. Assume now that

,

,

and

solve the KKT Equations (

24)–(

29). Since the KKT conditions equivalent to

look exactly the same as Equations (

24)–(

29), we conclude that the control vector

coincides with the Nash equilibrium

of

. Pick now an arbitrary

and transform

into

, according to the prescriptions of

Section 5.2. The solution

of the KKT equations does not get modified, and therefore

is the unique Nash equilibrium of the game

as well. In particular, this means that

Repeat Equation (

53) for every

n, each time with a personalized

. We obtain exactly the inequalities defining the Nash equilibrium of

. Because of uniqueness, this means that

. □

To conclude, we have found a procedure for personalizing the additional taxes/incentives, so that, at the equilibrium, the social optimum is attained, and each player pays a zero total tax (or receives a zero total incentive) independently of the scenario that is realized.

8. Summary and Conclusions

We have studied a stochastic PEV charging problem, where N players must achieve a full charge of their PEV batteries before the end of a given time interval, under a real-time electricity tariff depending on the total (PEV and non-PEV) electricity demand. The non-PEV demand of single players can be neither scheduled nor predicted. However, a probabilistic knowledge of the aggregate non-PEV demand evolution is assumed to be given in terms of an event tree with known node probabilities. We have considered a game where players wish to minimize the costs for charging their own PEVs, and shown that the obtained Nash equilibrium does not correspond, in general, to a social optimum (although it converges towards a social optimum for ). Some additional taxes/incentives were thus introduced with the aim of correcting the Nash equilibrium so that a social optimum is obtained.

As a main result of this paper, we have found a procedure to uniquely fix the so as to guarantee that, at the Nash equilibrium, the total tax (or incentive) that is paid (or received) is zero for any sample path of the event tree. In particular, we have selected two variants of this procedure:

- (a)

Taxes/incentives are the same for all players, and the total tax/incentive at the equilibrium is zero at the aggregate level.

- (b)

Taxes/incentives are personalized for each player, and the total tax/incentive at the equilibrium is zero at the individual level.

The existence of such taxes/incentives is guaranteed provided that the assumptions discussed in the paper are valid. Moreover, the procedure we found allows us to set the taxes/incentives as close as possible to zero. As a result, the obtained are quite essential, in the sense that they allow us to obtain a Nash equilibrium which is also a social optimum, and at the same time they interfere as little as possible with the price of electricity and with the cost sustained by the players. For instance, in the simple numerical example discussed here, the tuned taxes/incentives turn out to be approximately one order of magnitude smaller than the typical found without applying our procedure. Once the taxes/incentives are known, they can be implemented in a distributed mechanism to obtain the social optimum in a decentralized way.

This innovative method can be easily extended to other aspects of smart grid management. For instance, for further research, we aim to adapt this method in the field of the production of electricity from domestic photovoltaic panels. More precisely, households equipped with a small battery could be coordinated, with a price incentive in order to optimize production and consumption at the grid level.