Abstract

The agenda for sustainable development actualizes sustainability analysis of countries’ social, ecological, and economic conditions, as well as the necessity of designing practical recommendations to realize the sustainable development goals (SDGs). Sustainability analysis is a part of decision making and policy development in a broad environmental, economic, and social context. That is why this analysis goes beyond simple technical assessment. In order to make sustainability a target variable in development strategies, it is necessary to use special methods combining mathematical tools and managerial content. The paper systematizes modern mathematical methods for assessing economic sustainability and proposes a methodology for the integrated assessment of the social, economic, and environmental sustainability of countries, which were tested on data from 24 EU countries over 12 periods. The case study results derived from spatial and temporal samples are consistent with the currently observed processes in the EU. The content basis is the UN concept of sustainable development, the instrumental basis is multivariate comparisons, the Mahalanobis distances method, the correlation and regression analysis, analysis of variance, time series analysis, and trends analysis. Composite indices of social, economic, and environmental sustainability of the EU countries, each of them including five indicators, were developed in this study; the levels of social, economic, and environmental sustainability of EU countries were determined, as well as individual instability indicators. Mahalanobis distances and relative and absolute sustainability indicators were calculated and determined. Cluster analysis of the EU countries by levels of social, economic, and environmental instability and Mahalanobis distances, the diagnosis of the current situation and dominant trends were carried out for testing the hypothesis that there are positive relations between the instability of development and Mahalanobis distances. Hypotheses about the relationship between instability and the level of country development, reflected in the values of socio-economic and environmental indicators, and whether countries with good values of social, environmental, and economic indicators are the most sustainable, were investigated.

Keywords:

resilience; sustainable development; instability; multivariate comparisons; Mahalanobis distance; time series; trends analysis; correlation and regression analysis; cluster analysis; analysis of variance MSC:

37M10

1. Introduction

The concept of resilience as a system’s ability to exist despite the unfavorable effects of factors of various geneses is used in different sciences in which objects are complex systems—in technology, biology, economics, and others. For economic systems, the concept of resilience as the ability to recover from a shock or disturbance has become widespread in the last decade. Hence, resilience is defined as the ability to anticipate, react to, and recover from disorder [1]. The term “sustainability”, used in macroeconomics, has been understood as a long-term equilibrium between the exploitation of resources and the development of human society. The currently used term “sustainable development” implies balanced development from the position of three components—economic, environmental, and social. In recent years, the concept of sustainable development has not only attracted much attention from scientists, practitioners, and international organizations, but has also been firmly embedded in politics. The focus is on the problems of resource scarcity, environmental degradation, climate change, natural disasters, pandemics, social disproportions, digital inequality, supply chain instability, rural development problems, the impact of disruptive innovations and new digital business models, and urban sustainability problems [2,3,4,5,6,7,8,9,10,11,12].

The current sustainable development agenda necessitates the creation of methods for analyzing the sustainability of territorial entities; social, ecological, and economic conditions; and the development of practical recommendations for achieving sustainable development goals. Sustainability assessment is conducted as a stage of decision making and policy development in broad environmental, economic, and social contexts, and it goes beyond technical assessment. Meanwhile, there is currently no universal methodology to quantify the sustainability of a socio-economic system. This is due to the diversity of conceptual and methodological approaches. Thus, the authors understand sustainability as resilience or resistance to the impact of internal and external shocks, the ability to recover from them, and taking a new trajectory of development; as well as sustainability or the development of nonantagonistic orientation, characterized by the achievement of social, environmental, and economic objectives, taking into account the interests of all participants, and present and future generations.

2. Literature Review/Background

There is no single approach to the definition of sustainability, as the methods of assessing sustainable development are diverse. We conducted systematization of existing approaches to analyze the sustainability of countries and regions and the economic–mathematical models used in them, is based on research of contemporary authors and international organizations’ documents [3,4,5,6,7,8,9,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42].

The systematization of approaches to the analysis of sustainability of territorial entities is presented in the Table 1.

Table 1.

Approaches to analyzing the sustainability of territorial entities.

A report by the Leadership Council of the Sustainable Development Solutions Network [13] examines 100 global monitoring indicators covering all Sustainable Development Goals and targets. A discussion paper on Principles of Using Quantification to Operationalize the SDGs and Criteria for Indicator Selection, prepared by the United Nations Statistics Division, focuses on principles of using quantification to operationalize the SDGs and criteria for indicator selection. It includes criteria for selecting SDG indicators, including Relevant, Methodologically sound, Measurable, Easy to communicate and access, limited in number, and Outcome focused at the global level [13].

The interaction of multiple extreme events with the coronavirus pandemic and the impact on progress towards the SDGs is the subject of a study [9]. Studies on the identification of sustainable development targets with a focus on justifying their relevance are of interest [14]. In [13,15], the authors emphasize the need to link social, environmental, and economic indicators with the public vision of sustainable development and with the UN SDGs. Sustainable transformation of markets and society is necessary to assess sustainable development [16]. Current measurements and approaches to sustainability assessment focus on reducing negative environmental impacts [17]: while measuring sustainability it is necessary to identify positive contributions to sustainable development that facilitate stakeholder decision making. The relationship between digital transformation and sustainability is addressed by [18]. Digital transformation enhances corporate sustainability through mechanisms that improve human capital, strengthen innovation capabilities, ease financial constraints, and strengthen internal controls. To understand the political and governance aspects of resilience, in [19], the authors showed that national policies largely explain both the resilience of regions to previous crises and their vulnerability to the current economic crisis.

Analyzing the sustainability of economic development implies identifying the factors determining it and testing the relevant hypotheses based on the construction of econometric relationships [20]. Spatial economy models based on panel samples of countries and regions prove the influence of intersectoral interactions and spatial effects on sustainability [14]. For example, in [15], it is shown that the level of sustainability of regional development depends on both the sectoral diversification of the economy and the sustainability of the economies of neighboring regions.

Using the concept of spatial economic resilience, researchers [4] consider resilience and vulnerability through the prism of evolutionary dynamics and exposure to shocks. In [5], it is substantiated that the regional economic system is able to adapt its structure (firms, industries, technologies, and institutions) to an acceptable trajectory of production and employment growth; using the concept of “hysteresis” (movement from one equilibrium area to another), and possible reactions of the system to crisis shocks are considered. The central issue of [6] is the impact of global shocks on regional resilience.

Two statistical indices are used to measure resilience based on the dynamics of economic processes [7]: the first one characterizes the resilience of the region to economic shocks:

where is the employment at regional level (persons) is the employment at the EU-27 level (persons); is the starting year of the crisis period (2008); and is the end year of the economic recovery period (2015);

The second demonstrates recovery from the crisis:

where is the employment at country level (persons).

A positive index implies that the region experienced smaller relative employment losses (or higher relative employment gains) and/or recovered faster than national employment changes. The assessment of sustainability indicators is categorized into four groups:

- Group I: Low resistance and slow recovery ().

- Group II: Low resistance and fast recovery ().

- Group III: High resistance and slow recovery ().

- Group IV: High resistance and fast recovery ().

The first group, i.e., the group with the worst performance (low resistance/slow recovery), is the reference category for which all parameters and random errors are set to zero. A three-level random intercept logistic regression model () is applied to capture the interactions between resistance and recovery phases:

where ( denotes the number of NUTS-3 regions in NUTS-2 region within country ); ( denotes the number of NUTS-2 regions in country ); ( denotes the number of countries); is the NUTS-2 regional random intercept; is the country random intercept; and is the NUTS-3 regional error term.

To build a regional index of sustainable development [21], three types of measurements were used:

- (1)

- Arithmetic mean index—the average of six regional development performance indicators: economic growth rate (EGR), open unemployment rate (UNP), poverty rate (POV), human development index (HDI), Gini index (GI), and environmental quality index (IKLH);

- (2)

- Geometric mean index ():

Using the geometric mean eliminates the disadvantage of linear measuring.

- (3)

- Entropic index ():

A number of works investigate the sensitivity of sustainable development of regions to their sectoral and institutional structure. Thus, in [22], the authors applied vector autoregressive modeling (VAR) (used to study linear interdependencies between several time series) and impulse response function (IRF) (the response of the national economy to a unit shock in each sector, thus revealing the endogenous mechanism of national economic turbulence). As a result, the key sectors of the economy with the greatest potential for its imbalance were identified: construction, real estate, and financial services, while the industrial sector has the greatest potential for “stabilization”.

where denote vector of the cyclical component of GDP growth rate of the nation and each sector. are coefficient matrices and is a fixed vector of intercept terms. is a white noise vector process satisfying the conditions of and for .

In [6], the relationship between sustainable development and the effectiveness of public administration in regions was investigated using Bayesian Model Averaging (BMA) by calculating the posterior probability of the model (Posterior Model Probability ):

where is the marginal likelihood and is the prior model probability.

In [8] a weighted sum of indices characterizing the performance of basic economic functions by sectors of the economy is used to measure sustainability at the industry level, using the multicriteria decision-making method Simple Additive Weighting (SAW). This approach is highly operational and is based on an additive function:

where are the weights of resilience functions and .

Using an empirical approach, applying the residuals vector autoregression (VAR) method, in [24] estimated resilience through the correlation between the change in output and the total shock due to institutional characteristics and the level of industrialization:

where

In [25], the authors, using econometric methods of panel data, showed that sustainable economic development is determined by the relationship between embeddedness ) and resilience. Embeddedness has a positive effect on resilience up to a certain point, after which increasing embeddedness has a negative effect on resilience:

where is the intermediate flows between sectors and ( being the total number of sectors), stands for domestic flows (e.g., transactions between sectors within the same region), and represents imported inputs from outside the region.

In [26], a theoretical framework for incorporating sustainability indicators into the decision-making process for transportation projects at the conceptual planning level is proposed, according to which economic sustainability planning requires consideration of regional characteristics, including industrial diversity and human capital, in addition to transportation accessibility.

The approach [27] to achieving sustainability, includes equilibrium and econometric analysis, the use of the Chi-Square Test of Homogeneity (Chi-Square Test of Homogeneity ) to identify endogenous and exogenous factors of the regional economy, including industrialization:

where is the observed value in population for level of the categorical variable, and is the expected frequency count in population for level of the categorical variable.

In [28], the authors, using the smooth transition autoregressive (STAR) method, evaluated the economic sustainability of Italian regions. The identified regional characteristics are related to the presence of spatial interactions and factors such as economic diversity, export performance, financial constraints, and human and social capital. For a univariate time series , the STAR model is as follows:

where , , are parameters to be estimated, and is a white-noise error process with mean zero and variance .

In [29] the factors determining crisis resilience in European regions were studied. Using a multilevel logistic regression model the authors studied regional employment in crisis periods and substantiated the need to reduce regional differences by developing differentiated regional development policies:

where is the regional (level 1) residual and is the country (level 2) residual.

The relationship between the diversity of industries and economic stability of the territory was investigated in [30] by assessing the impact of industrial diversity and concentration on the stability of the unemployment rate. For this purpose, the authors used a fixed effects model .

where is the county unemployment rate in year ; is a row vector of regressors; is the corresponding vector of coefficients; is the relevant national or local shock indicator; is the lag of the national or local shock indicator and is the corresponding coefficient; and the corresponding coefficients represents the interaction between population density and diversity capturing urbanization; with as the corresponding coefficient is the interaction of the diversity term with the shock variable, with as the corresponding coefficient; and represents the interaction of the diversity term with the lag of the local shock variable, with as the corresponding coefficient.

The authors proved that although unemployment was lower in more concentrated counties, employment was higher in counties with more diverse industry structures in the face of national or local shocks [30].

In the context of rapidly developing urbanization, the concepts of resilience and urban sustainability, are interrelated paradigms, acting as elements of preventive protection. The key indicators of urban resilience in the authors’ model [31] were three components: adaptive capacity (education, health, food and water), absorptive capacity (community support, urban green spaces, protective infrastructure, and access to transportation), and transformative capacity (communication technologies, multi-stakeholder collaboration, emergency services for public, and community-oriented urban planning).

The study [32] is devoted to measuring the economic sustainability of cities. The authors used six indicators: economic growth, openness, social development, environmental protection, natural conditions, and technological innovation. The Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS) methods and the Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS) methods were used to identify spatial and temporal trends. A four-step approach was used to create the TOPSIS model.

Step 1: Construct a standardized matrix: , to standardize all indicators:

where is the normalized value of the th indicator of the th city.

Step 2: Determine the “optimal plan” and “worst plan”:

where is the optimal value of the indicator and is the worst value of the indicator.

Step 3: Calculate the sum distance between the individual samples and :

where is the weight coefficient between the indicator data.

Step 4: Calculate the relative closeness of each sample to the “ideal” sample:

where, is the closeness of the ith sample and the “optimal plan”; .

In [33], a social sustainability assessment framework for residential buildings is developed using a weighted aggregation approach to improve their operational value. A multidimensional approach supported by building information modeling (BIM) has been proposed to ensure the sustainability of building materials supply [34].

Despite the availability of a variety of assessment methods and tools, the most commonly used approach is the use of a system of indicators [35]. According to [36], sustainable development assessment models should (have to be) balanced, include reasonable indicators, and take into account both the existing interrelationships between indicators and the subjectivity of the used qualitative criteria of sustainable development. For a comprehensive assessment of sustainable development [37], the economic sustainability index is used, which assesses the results in four areas—macroeconomic stability, microeconomic efficiency of the market, good governance, and social development.

The article [40] proposes a cluster approach as the most effective tool for managing sustainable development of territories based on the TOPSIS method (Technique for Ordered Preference through Similarity to Ideal Solution (TOPSIS) methods). To analyze quantitative changes in individual sustainability criteria and to assess structural shifts of the region territorial-production system, the index of structural differences—V.M. Ryabtsev’s index—has been used:

where is the index of structural differences of the -th territory sustainability component; is estimated values of -th stability criterion of -th territory, achieved under the influence of changes in economic relations, market processes, interregional, and intersectoral relations; is assessed values of the -th stability criterion of -th territory, determined at the initial stage of study (before assessing the impact of territories interaction within a cluster).

The assessment of the sustainability of regional socio-economic systems in [41] is carried out using a systematic approach and a combination of methods of comparative, abstract-logical and statistical analysis, as well as the calculation and graphic method “radar (polygon) of competitiveness”. The determination of the integral assessment of the parameters of each region is based on the determination of the areas of their polygons according to the formula:

where —coordinates of the polygon (radar) vertices in the coordinate axes with the origin in the center of the circle for the region; —number of individual evaluated criteria.

Using the resistance index and recovery index in [42] the authors study the resistance of regions to recessionary shocks in times of economic crises. The resistance index is calculated by the formula:

where and —percentage changes in employment at the regional and national levels, respectively.

The recovery index is calculated:

Higher values of the resistance and recovery indices indicate a more stable position of the region relative to the national economy.

Based on the analysis results, a number of conclusions can be drawn. There are numerous studies analyzing the achievement of the Sustainable Development Goal in individual countries. As a rule, the methods used in them are based on the comparison of normative values, UN SDGs, and actual data for individual countries. Separately, there are studies on how national economies can recover from shocks. In our research we are guided by the idea that the methodology of resilience assessment should combine both the UN ideology of sustainable development, i.e., simultaneous consideration of social, environmental, and economic components, and resilience, which implies maintaining the trajectory of social, environmental and economic development, i.e., achieving and maintaining the specified levels of indicators that form social, environmental, and economic sustainability. At the same time, the development trajectory should be assessed not only within a single country (internal comparison), but should be comparative in nature, taking into account the approximation or removal of country indicators to the average values of the sample (external comparison).

There is no single methodological approach for sustainability assessment of countries and territorial entities. This is caused by the shortcomings of the rating approach, different units of measurement of used indicators, as well as the problem of indicators justification. The barrier is also the complexity of managerial use of composite indicators, in which it is difficult to determine the contribution of individual sustainability factors. In addition, new types of sustainability are appearing now, making sustainable development a complex and multifaceted concept encompassing various dimensions. The problem of comparative analysis of sustainability is the lack of harmonized statistical data, due to the heterogeneity of countries development.

Each of presented in Table 1 methods and described above can be characterized by its merits and are aimed at solving certain problems. However, currently there is a research gap consisting in the need to combine in one methodology the diagnostic potential, or assessment of the social, economic, and environmental development sustainability level, and the management potential, or revealing the countries features by comparison indicators of each country with the average ones. Remarkably, in the challenges of overcoming development imbalances, macroeconomic and microeconomic inequalities remain relevant. This study aims to address this research gap (Section 3)

The core of modern approaches in measuring sustainability is the principle of balancing social, environmental, and economic aspects that form the policy of sustainable development management. In order to make sustainability a target variable in development strategies, it is necessary to use special methods combining mathematical tools and managerial content.

3. Materials and Methods

The dynamic approach has been used to analyze the sustainability of the EU countries as open social, economic, and ecological systems [38]. The dynamic stability of a socio-economic system is understood as its movement near a certain stable trend and weak reaction to the impact of internal and external shocks.

The distinctive feature of the developed method is its universality, i.e., the possibility of using it for different sets of indicators that form composite indices of social economic and environmental sustainability. The main limitation for the choice of private indicators is the availability of statistical information in the context of individual countries throughout the period under consideration.

The developed methodological approach for analyzing the dynamic sustainability of countries as open systems includes 7 stages, presented in the Table 2. The framework presented in the table consists of 3 blocks, developed in accordance with the existing research gap in the field of dynamic analysis of countries sustainable development.

Table 2.

Methodology for analyzing the dynamic sustainability of countries as open socio-economic systems.

First, the economic, social, and environmental space under study is multidimensional. Therefore, for the analysis, it is necessary to use complex composite indices that include a set of indicators for each development direction and reflect the current content of the UN Sustainable Development Goals. The development of indices is of a variable nature. Their number is determined by the objectives of the analysis, and the indicators forming them are determined by the availability and quality of statistical data. In the study we used three composite indices of economic, environmental, and social sustainability. The indicators selected in their composition reflect the nine existing pillars of sustainable development. The problem of comparative analysis of sustainability is the lack of harmonized statistical data due to the heterogeneity of countries’ development, so the statistical stage includes testing for the presence of a unit root in panel data using the Dickey–Fuller test.

Secondly, the assessment of sustainability of development should have the character of external evaluation, i.e., it is necessary to study not just the dynamics of change in the indicators forming composite indices, but the trajectory of social, economic, and environmental development of countries in relation to the average values in the sample. Therefore, the Mahalanobis distance method is chosen as the basis. The use of the Mahalanobis method distances to assess the sustainability of multidimensional and scale-invariant development is characterized by a number of merits. First, it solves the problem of multidimensional indicators, and invariant to their scale due to the normalization of private indicators. Second, it allows us to solve the problem of collinearity of private indicators due to through the inclusion of the covariance matrix. Third, the average distance of countries from the center for a number of indicators is used as a basis for comparison (benchmark). Fourth, the analysis of Mahalanobis distances over a certain time interval allows us to reveal how the place of a particular country relative to the central tendency changes in dynamics and how smooth this change is [38].

Third, in order to make sustainability a target variable in development strategies, it is necessary to use special methods that combine mathematical tools and managerial content. Based on the analysis, it is necessary to identify the unevenness of social economic and environmental development of countries. To identify the indicators that have the greatest impact on sustainable development, a correlation and regression analysis between Mean indicator values included in composite indices and absolute instability level was conducted. Thus, microeconomic aspects of instability were considered. In order to identify macroeconomic aspects, a cluster analysis using k-means clustering has been carried out. Clusters were developed according to the parameters of actual annual mean of Mahalanobis distance and Absolute level of instability. At the same time, to ensure completeness, accuracy, and visualization of the results, logarithms of indicators were used.

Adhering to the principles of the UN concept of sustainable development [13], 3 composite indices reflecting social, economic, and environmental components were developed to study the dynamic sustainability of the EU countries. The Mahalanobis distance method was used to assess the sustainability of development. To identify fluctuations of composite indices and their constituent indicators from a stable trend, time regressions were used.

The use of the Mahalanobis method distances to assess the sustainability of multidimensional and scale-invariant development is characterized by a number of merits. First, it solves the problem of multidimensional indicators, and invariant to their scale due to the normalization of private indicators. Second, it allows us to solve the problem of collinearity of private indicators due to through the inclusion of the covariance matrix. Third, the average distance of countries from the center for a number of indicators is used as a basis for comparison (benchmark). Fourth, the analysis of Mahalanobis distances over a certain time interval allows us to reveal how the place of a particular country relative to the central tendency changes in dynamics and how smooth this change is [38].

The study is based on the data of Eurostat [39]. The sample consists of 24 EU countries: Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, and Sweden. Data for a 9-year time period from 2012 to 2020 has been used. Fifteen indicators were selected to construct composite indices of economic, environmental, and social sustainability (Table 3). Economic indicators determine the level of economic development of countries. Environmental indicators characterize the state and trends in their environment. Social indicators are indicators of the standard of living of the population of the countries.

Table 3.

Composition of composite sustainability indices of the EU countries.

While developing the composite indices, we drew from the nine pillars of sustainable development highlighted today—social equity, environmental protection, economic value added, eco-innovation, resource efficiency, circular (cyclical economy), low carbon, equity (equality), and good governance and partnership.

It should be emphasized that such indicators as return on investment, local economy, and market capacity characterize the economic sustainability of the national economy most fully. However, the possibilities of their use in the study are limited by the following factors. The return on investment is determined by sectoral affiliation and can vary significantly within the economy of one country. In the conditions of globalization and internationalization of business, integration of individual countries’ economies into the world supply chains, it is quite difficult to assess the capacity of local markets in relation to the national economy. The existing statistical observation in Eurostat does not allow providing reliable data on all countries and ensuring the convergence of results. It is also logical that the assessment of the vulnerability of the local economy determined by the level of its diversification has a great predictive potential. However, in the proposed study the local economy was assessed using universal macroeconomic indicators.

Aggregation of indicators into composite indices of economic, environmental, and social sustainability was carried out by calculating Mahalanobis distances—mean normalized distances of each country to the center. The level of instability is measured using the mean square deviation of the Mahalanobis distances regression residuals: the greater the deviation, the greater the instability, as it indicates the large discrepancies between the observed and predicted values.

4. Main Part/Results

As a result of using developed methodology, an economic, social, and environmental sustainability of 24 EU countries was analyzed. Regressions of three composite resilience indices for each of the five indicators in the three indices that contribute to the integral level of sustainability was determined. Absolute and relative levels of economic, social, and environmental instability for each country were calculated.

Currently, there is a limited amount of research on the application of stationary and nonstationary time series in calculating the Mahalanobis distance. This aspect requires additional attention and indepth investigation to fully assess the impact of stationarity and nonstationarity of time series on the process of calculating the Mahalanobis distance.

The Mahalanobis distance, utilized to measure the extent of data points’ remoteness in a multidimensional space of variables, does not seek to confine the analysis to the stationarity or nonstationarity of time series. However, its efficacy is accentuated when dealing with multidimensional data, where variables are measured in a coordinated manner, and the assumption of normal distribution of data is maintained. The application of this method is particularly advantageous in the context of outlier detection or identification of structural features in the data.

In order to analyze the presence of a unit root in panel data and to confirm the suitability of the chosen method of analysis in this study, we applied the Dickey–Fuller test (Table 4).

Table 4.

Results of the Dickey–Fuller test for various indicators and countries.

The study involved the Dickey–Fuller test, which assesses the presence of a unit root in panel data and serves as a crucial tool in time series analysis. This test helps determine whether a time series is stationary or contains a unit root, indicating nonstationarity. For each time series, the Dickey–Fuller test is applied to assess the presence of a unit root. The test results typically include the ADF (Augmented Dickey–Fuller) statistic and p-value. If the p-value is less than the significance level (e.g., 0.05), we can reject the null hypothesis of a unit root.

In practice, the Dickey–Fuller test exhibited both a p-value lower than the significance level and confirmation of the null hypothesis regarding the presence of a unit root. However, our perspective is based on the notion that when calculating the Mahalanobis distance, the hypothesis of a unit root lacks statistical significance. This is explained by the unique characteristics of the multidimensional space of variables in which the Mahalanobis distance operates, which may not fully align with the assumptions of the Dickey–Fuller test.

It is also noteworthy that the Mahalanobis distance, utilized in a multidimensional space, considers correlations and variability between variables, making it more sensitive to structural changes in the data.

Furthermore, in the context of analyzing multidimensional data, especially in the case of time series, the application of the Dickey–Fuller test may be limited by the assumption of independence and homogeneity in the structure of time series, which does not always correspond to the real conditions of the data. These factors can influence the statistical significance of the Dickey–Fuller test in assessing the presence of a unit root.

Therefore, our opinion is that in this context, the hypothesis of a unit root, confirmed by the Dickey–Fuller test, does not necessarily translate into statistically significant associations in the multidimensional space of variables used for calculating the Mahalanobis distance.

The conducted research results and the case studies—the findings in terms of individual indicators included in the composite indices of economic, environmental, and social sustainability—are presented in Table 5, which shows the annual mean values, maximum and minimum values of Mahalanobis distance by country, as well as the levels of instability for each indicator and composite indices.

Table 5.

Sustainability assessment of the EU countries.

Based on the results of the economic, environmental, and social instability development study of the EU countries, the following conclusions can be drawn.

For the period under review from 2012 to 2020, Germany is characterized by the lowest level of economic instability and Slovenia by the highest one. France is characterized by the lowest level of social instability and Estonia by the highest one. France is characterized by the lowest level of environmental instability and Finland by the highest one. These results obtained are consistent with the ongoing political, economic, and social developments in the EU countries. Thus, the social sustainability of France is also supported by the ongoing unrest in the country due to the pension reform.

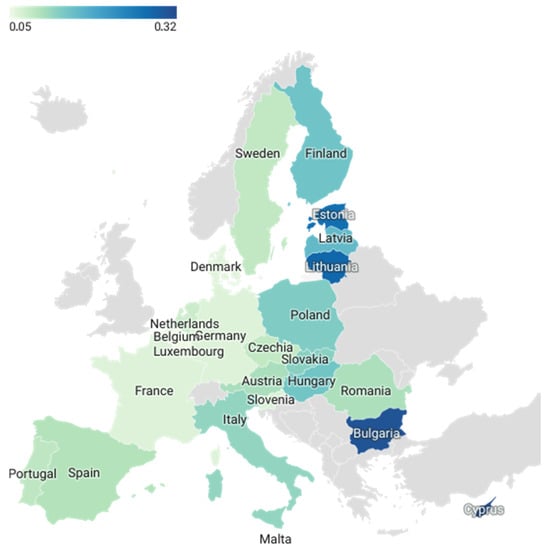

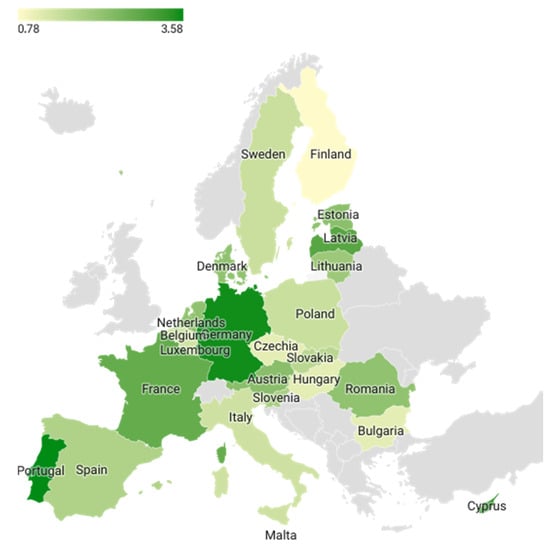

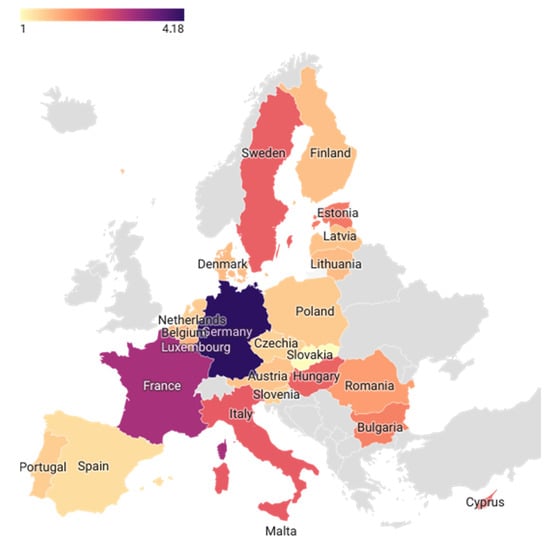

Maps of economic, social, and environmental instability of the countries has been developed and presented in Figure 1, Figure 2 and Figure 3.

Figure 1.

Absolute level of social instability in EU countries.

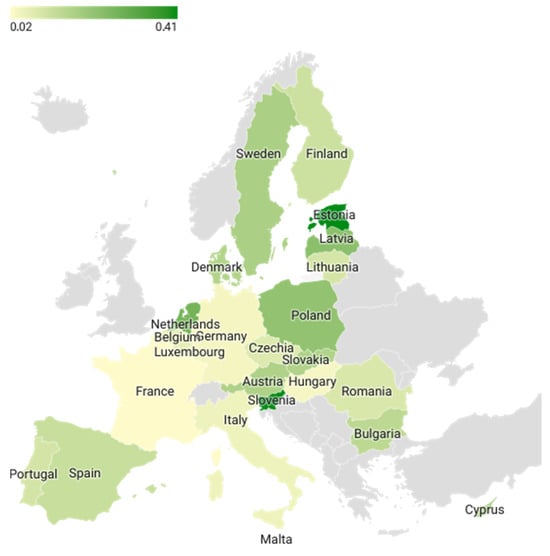

Figure 2.

Absolute level of environmental instability in EU countries.

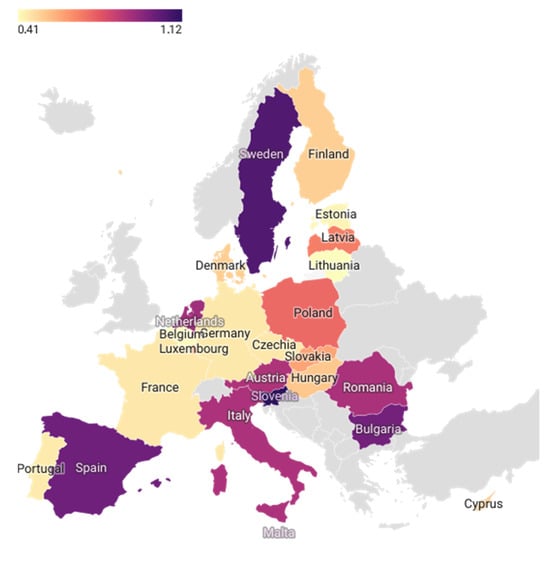

Figure 3.

Absolute level of economic instability in EU countries.

Germany and France stand out from other countries on economic, social, and environmental instability maps, having good values of indicators and positive trends. This indicates a more effective approach to addressing challenges.

Economic stability: Both countries have large economies that are well developed and diversified. This allows them to sustainably cope with economic crises and maintain a high standard of living for their citizens.

Environmental stability: Germany and France are actively investing in environmental technologies and innovations such as renewable energy, electric vehicles, and waste management. This allows them to reduce emissions of carbon dioxide and other harmful substances and protect the environment.

Social stability: Both countries have developed social protection systems that provide their citizens with access to healthcare, education, and other social services. This helps reduce inequality and poverty in society.

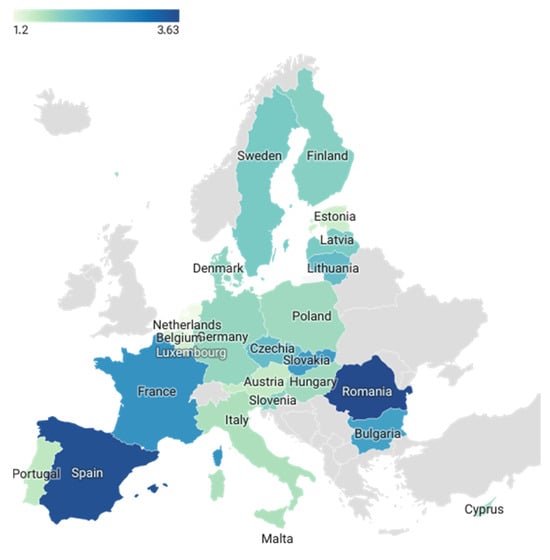

Maps of Mahalanobis distance for economic, social, and composite indices were developed and presented in Figure 4, Figure 5 and Figure 6.

Figure 4.

Mahalanobis distance: social composite index.

Figure 5.

Mahalanobis distance: environmental composite index.

Figure 6.

Mahalanobis distance: economic composite index.

It should be emphasized that countries with the lowest values of social, environmental, and economic instability can be characterized by both high and low Mahalanobis distances. Analyzing the sustainability of countries as dynamic systems, two hypotheses are of interest. The first is whether the positive relationship between instability and the level of country development, reflected in the values of socio-economic and environmental indicators. For this purpose, a correlation and regression analysis between the level of absolute instability and the mean value for each indicator included in the composite sustainability indices was carried out, presented in Section 4.1.

The second is whether countries with good values of social, environmental, and economic indicators are the most sustainable. Or, vice versa, sustainability is characterized by countries with worse values of social, environmental, and economic indicators. Does the value of a country’s distance from the center in terms of each component (social, economic, and environmental Mahalanobis distance) affect the countries level of instability? To identify regularities in this process, a cluster analysis of countries by these characteristics has been carried out, presented in Section 4.2

4.1. A Visual Representation of the Level of Absolute Instability of Development of the EU Countries in the Context of Individual Indicators

In order to analyze the impact of individual indicators on country dynamics relative to sustainable development goals, the calculation of the indicators mean for the observed period has been performed for each of the countries under consideration. This stage of the analysis provided insights into impact of countries mean levels for them sustainable development. The calculation of the mean values of the indicators for the observed period has been provided a systematic way to analyze the dynamics of the countries’ development based on the selected indicators. This allowed us to draw more informed conclusions about the relationship between the variables under study and their impact on the sustainable development.

To further analyze the impact of the selected indicators on the level of countries’ instability, a regression model was constructed. The mean values of 15 indicators for each country were calculated and supplemented by data on levels of absolute instability of indicators. The construction of the regression model made it possible to assess the link between the level of instability and sustainable development indicators. This methodological approach facilitates a more indepth examination of the relationships between the variables analyzed, which in turn allows for the identification of key factors that influence the degree of instability in development.

The regression model, built on the basis of the mean values of indicators for each country, provides a tool for a deeper understanding of the relationships between selected variables and the level of instability in development. Using linear regression, we can assess how changes in instability are associated with changes in levels of sustainable development indicators.

The use of time series in the analysis provides an opportunity to account for the dynamics of variable changes over time. Linear regression allows us to model these dynamics and determine the impact of each indicator on the overall degree of instability. Such analysis is applicable to identify key factors determining sustainable development in countries.

Thus, the methodology chosen for the study offers a systematic approach to the analysis and interrelation of different variables, enabling more well-founded conclusions about the factors influencing the degree of instability in the development of countries.

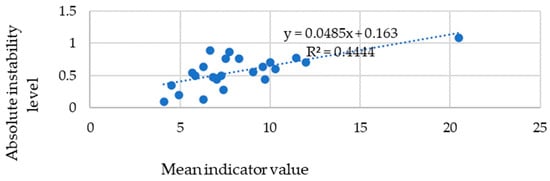

4.1.1. Absolute Instability of the EU Countries Social Development: Individual Indicators Analysis

The unemployment rate is one of the key indicators of economic and social development. The indicator reflects the number of people who are unemployed and looking for work as a percentage of the total working-age population. As can be seen in Figure 7, there is a weak positive correlation between the mean unemployment rate and the absolute level of indicator instability. A high unemployment rate can have a negative effect on the economy and social development of the country, as it leads to a decrease in consumer demand, deterioration in the quality of life of the population and a possible increase in social tensions. In turn, this may lead to a decrease in investment and economic activity, which further aggravates the situation.

Figure 7.

Unemployment rate.

The Figure 7, Figure 8, Figure 9, Figure 10, Figure 11, Figure 12, Figure 13, Figure 14, Figure 15, Figure 16, Figure 17, Figure 18, Figure 19, Figure 20 and Figure 21 show the results of the analysis for the indicators determining social, economic, and environmental sustainability, the relationships between its means and instability level.

Figure 8.

Working poverty rate.

Figure 9.

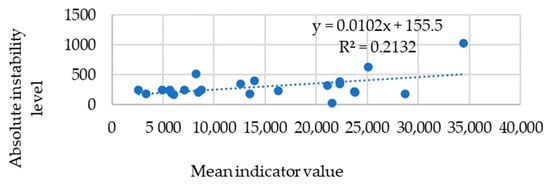

Average and median income by age and sex.

Figure 10.

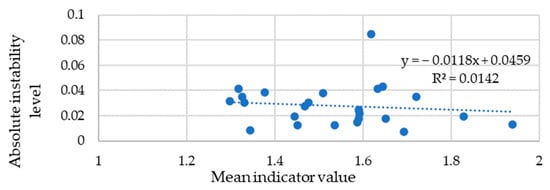

Fertility rates by age group.

Figure 11.

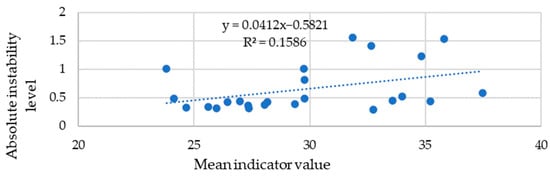

Gini coefficient of equivalent disposable income.

Figure 12.

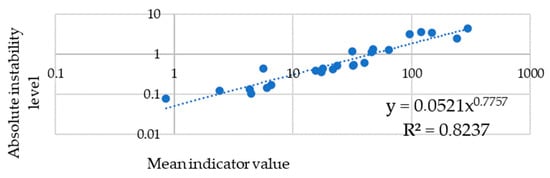

Primary energy consumption.

Figure 13.

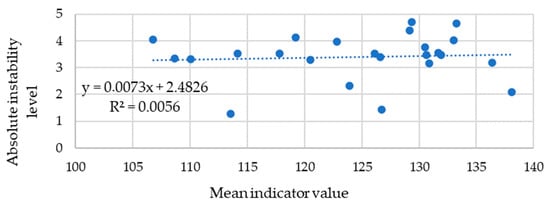

Average CO2 emissions per kilometer from new passenger cars.

Figure 14.

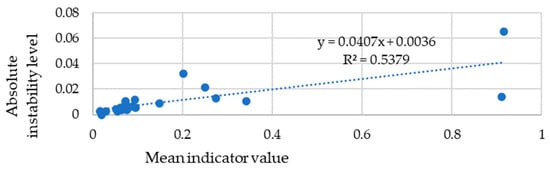

Emissions intensity from industry.

Figure 15.

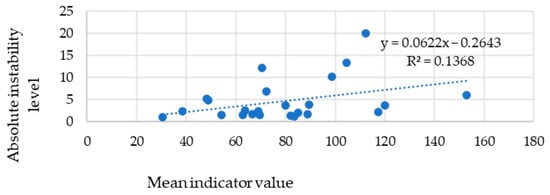

Greenhouse gas emissions.

Figure 16.

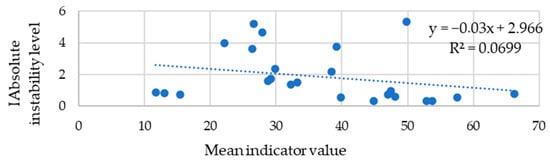

Recycling rate of municipal waste.

Figure 17.

Real GDP per capita.

Figure 18.

Housing Price Index.

Figure 19.

The Harmonized Index of Consumer Prices.

Figure 20.

Compensation of employees.

Figure 21.

Gross fixed capital formation.

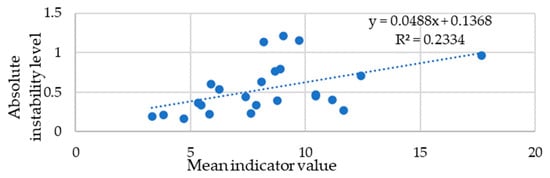

There is no link between the mean working poverty rate unemployment rate and the absolute level of indicator instability (Figure 8). One of the main goals of sustainable development is the fight against inequality and poverty. The Working Poverty Rate relates to the economic and social well-being of people working in different sectors of the economy. The indicator measures how large a percentage of workers are at risk of poverty, i.e., earning below the poverty threshold. Poverty risk indicators depend on many factors, including economic growth, employment, social protection, education, and health care systems, and government antipoverty policies. Different countries may have their own characteristics and reasons that explain the high poverty risk rate among working people.

There is no link between the mean of average and median income by age and sex and the absolute level of indicator instability (Figure 9). Average and median per capita income are indicators that reflect the average and median level of income in a country divided by the number of inhabitants. In general, average and median per capita income are important indicators for assessing the economic well-being of a country and its population. In the framework of sustainable development, this indicator shows how the population’s income is distributed across age groups and gender. This indicator can help identify population groups that have particular difficulty in generating sufficient income to meet their needs and improve their economic situation. It can also help the government and other stakeholders to develop programs and support measures for those who are more vulnerable.

There is no link between the mean of fertility rates by age group and the absolute level of indicator instability (Figure 10). Fertility rates by age group are an important component of sustainable development because they allow us to assess the demographic situation in a country and to predict its future changes. For example, if fertility rates among young women are low, this may lead to a decline in the population in the long-term and cause problems with the pension system and the economy as a whole. On the other hand, if fertility rates are high among young women, this can create problems with overpopulation and environmental problems. Therefore, it is important to analyze and monitor age-disaggregated fertility rates and take appropriate measures to support the sustainable development of the country.

There is no link between the mean of Gini coefficient of equivalent disposable income and the absolute level of indicator instability (Figure 11). The Gini coefficient of equivalent disposable income is a measure of income inequality in a society. It shows how income is distributed in a society, and the higher the Gini coefficient, the greater the inequality in income distribution. To achieve sustainable development, it is necessary to reduce the level of inequality in income distribution. This can be achieved by creating fairer and more efficient taxation systems, raising wages, creating new jobs, and increasing access to education and health care. Reducing inequalities in income distribution can also lead to more balanced economic development and sustainable use of resources, which contributes to the achievement of sustainable development as a whole.

4.1.2. Absolute Instability of the EU Countries Environmental Development: Individual Indicators Analysis

There is a strong link between the mean of primary energy consumption and the absolute level of indicator instability (Figure 12). Reducing energy consumption is one of the keys to reducing pollution and combating climate change. Studying primary energy demand can determine how much energy is used in different sectors of the economy and what measures can be taken to reduce consumption. Studying primary energy demand indicators allows countries to participate in the global dialog on climate and sustainable development. By comparing data between different countries and regions, best practices can be identified and strategies can be developed to reduce energy consumption and combat climate change.

There is no link between the mean of average CO2 emissions per kilometer from new passenger cars and the absolute level of indicator instability (Figure 13). The indicator of average CO2 emissions per kilometer from new passenger cars is used to evaluate the environmental performance of cars and to compare their environmental performance. This indicator allows consumers to compare different car models and choose more environmentally friendly options. CO2 emissions are a major source of greenhouse gases that contribute to global warming and climate change. Passenger cars are a major source of CO2 emissions, so reducing emissions from new cars can have a significant impact on reducing air emissions and slowing global warming. Average CO2 emissions per kilometer from new passenger cars is also an important tool for government regulators, who can use it to set emission standards and implement legislative measures to reduce CO2 emissions. Some countries have already set strict standards for CO2 emissions from new cars to encourage car manufacturers to develop and produce more environmentally friendly models.

There is a link between the mean of emissions intensity from industry and the absolute level of indicator instability (Figure 14). Emissions intensity from industry is an important tool for achieving sustainable development. It reflects the amount of pollution emitted by an industry per unit of output or unit of service, which allows measuring resource efficiency and identifying opportunities to improve the environmental performance of industrial processes. Emission intensity can be used to compare different industries and companies and to assess the effectiveness of measures aimed at reducing emissions. An increase in emission intensity may be associated with increased production, but a lack of attention to reducing emissions can lead to environmental degradation and adversely affect human and ecosystem health.

There is no link between the mean of greenhouse gas emissions and the absolute level of indicator instability (Figure 15). Net greenhouse gas emissions reflect the level of atmospheric pollution and the impact of human activity on climate change. Net greenhouse gas emissions are the amount of gases that would be emitted into the atmosphere in the absence of any emission reduction measures. Greenhouse gases such as carbon dioxide (CO2), methane, and nitrogen dioxide cause the greenhouse gas effect, which leads to climate change and global changes such as increases in the Earth’s surface temperature, sea level rise, and extreme weather events. Estimating the net greenhouse gas emissions indicator is an important step in assessing the environmental sustainability of businesses, industries, and countries as a whole. This indicator helps to develop a clearer understanding of how changes in economic activity affect climate change and the extent to which these changes are aligned with sustainable development goals.

There is no link between the mean of recycling rate of municipal waste and the absolute level of indicator instability (Figure 16). The recycling rate of municipal waste—reflects the ability of a society to use resources efficiently and reduce the negative impact on the environment. Utility waste management reduces the amount of waste that ends up in landfills and interacts with the environment, including causing soil and water pollution, methane, and other greenhouse gas emissions. In addition, proper waste management can provide additional opportunities for energy and material production. For example, recycling technologies can produce biogas that can be used to generate electricity and heat, as well as produce secondary raw materials that can be used in the production of new goods.

4.1.3. Absolute Instability of the EU Countries Economic Development: Individual Indicators Analysis

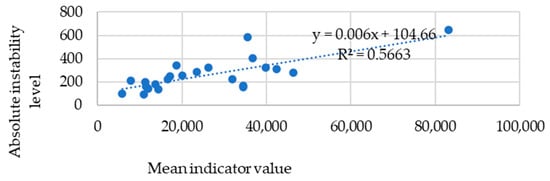

There is a link between the mean of real GDP per capita and the absolute level of indicator instability (Figure 17). Real GDP per capita is a measure of economic development that reflects the average income earned by each person in a country. It is one of the key indicators used to assess the standard of living in a country. In the context of sustainable development, real GDP per capita can serve as an indicator, but not as the main criterion. It can be used to measure the level of economic development in combination with other indicators such as the happiness index, human development index, and equity index. These indicators can complement real GDP per capita and provide a broader understanding of sustainable development, taking into account its social and environmental aspects.

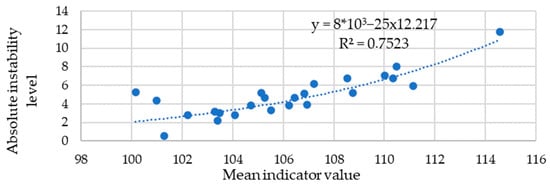

There is a strong link between the mean of Housing Price Index and the absolute level of indicator instability (Figure 18). The house price index is an important indicator in the economy that reflects changes in the cost of housing in the market. Determining housing affordability: The house price index measures the level of affordability of housing for the population. If housing prices are rising too fast, it may mean that many people cannot afford to buy a home, which can lead to social problems. On the other hand, if housing prices are too low, it may indicate that investment in the sector is limited, which could lead to a housing shortage in the future. Impact on Economic Growth: The house price index can have a significant impact on a country’s economic growth. If housing prices rise too fast, it can lead to an economic bubble that can eventually burst, causing an economic crisis. On the other hand, if housing prices are too low, it could mean that investment in the sector is limited, which could slow economic growth. Determining the stability of the financial system: The house price index can also be used to determine the stability of a country’s financial system. If house prices fluctuate widely, it may indicate that the country’s financial system is unstable. On the other hand, if house prices are rising steadily and predictably, it may indicate that the country’s financial system is stable and sound. Sustainable urban development: The house price index can also be used to assess the sustainable development of cities. If housing prices in cities are rising too fast, this can lead to housing becoming unaffordable for many people, as well as urban infrastructures such as the transportation system and utilities.

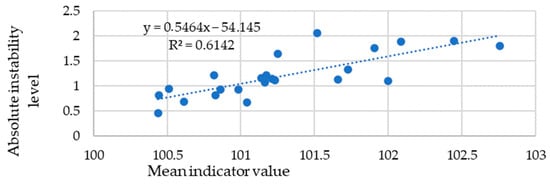

There is a link between the mean of Harmonized Index of Consumer Prices and the absolute level of indicator instability (Figure 19). The Harmonized Index of Consumer Prices is a measure of inflation in the Eurozone and the European Union and key indicator of price stability limiting economic growth and sustainable development in case of high meanings.

There is a strong link between the mean of compensation of employees and the absolute level of indicator instability (Figure 20). The employee compensation has an important role in sustainable development, as it is a key factor in ensuring a decent standard of living for working people, reducing social inequality, and increasing economic stability. A high level of employee compensation helps improve the quality of life of the population, which in turn contributes to higher levels of life satisfaction, better health, and better educated people. Higher wages can also lead to lower crime rates and higher levels of social stability. In addition, high levels of pay can stimulate economic growth as it can lead to increased consumer demand, investment, and production of goods and services. Overall, employee compensation plays an important role in the sustainable development of the economy and society as a whole.

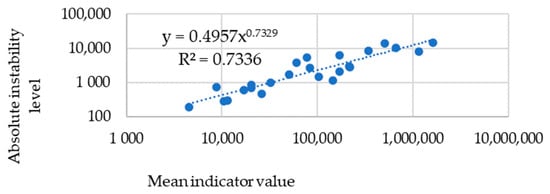

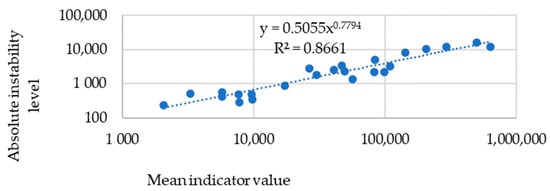

There is a strong link between the mean of gross fixed capital formation and the absolute level of indicator instability (Figure 21). The gross fixed capital formation is an important indicator in sustainable development, as it reflects the amount of investment aimed at creating new and modernizing existing production facilities and infrastructure. This makes it possible to improve production efficiency, reduce resource consumption and environmental emissions, and create new jobs. High indicators of gross fixed capital formation indicate that the state and private companies invest significant resources in the economy aimed at the development of production and infrastructure. This increases the level of productivity and competitiveness of the economy, which contributes to sustainable development.

4.1.4. The Results of the Analysis of the EU Countries Composite Sustainability Indexes Are Summarized in Table 6

Based on conducted study, the conclusion about more significant influence of economic indicators on sustainable development can be made. According to the analysis results positive relationships between the absolute instability and the mean values of indicators were revealed for all five economic development indicators (Real GDP per capita R2 = 0.5663, Housing Price Index R2 = 0.7523, The Harmonized Index of Consumer Prices R2 = 0.6142, Compensation of employees R2 = 0.7336, Gross fixed capital formation R2 = 0.8661). For environmental development, significant positive relationships were found only for two indicators (Primary energy consumption R2 = 0.8237 and Emissions intensity from industry R2 = 0.5379). There were no significant positive relationships found for social indicators.

Thus, the hypothesis about the positive relationship between absolute instability and the level of economic development were confirmed.

Table 6.

Results of the composite indices analysis of EU countries sustainability (Instability level by Mean indicator value).

Table 6.

Results of the composite indices analysis of EU countries sustainability (Instability level by Mean indicator value).

| Indicator | Description | R2 Coefficients of Determination |

|---|---|---|

| Social development | ||

| Unemployment rate, % | The absolute minimum instability was recorded in Germany and the maximum in Cyprus. | R2 = 0.4444 |

| Working poverty rate, % | The maximum level of instability is reached in Bulgaria, while the most stable countries are Belgium. | R2 = 0.2334 |

| Average and median income by age and sex, euros | France is the most stable country in terms of average and median income, while Cyprus is the most instable. | R2 = 0.2132 |

| Fertility rates by age group | The highest instability is in Latvia and the lowest in Belgium. | R2 = 0.0142 |

| Gini coefficient of equivalent disposable income, scale from 0 to 100 | The most unstable country is Cyprus and the most stable is Italy. | R2 = 0.1586 |

| Environmental development | ||

| Primary energy consumption, million tons of oil equivalent | The absolute minimum instability was recorded in Germany and the maximum in Malta. | R2 = 0.8237 |

| Average CO2 emissions per kilometer from new passenger cars | The highest instability is in Cyprus and the lowest in Malta. | R2 = 0.0056 |

| Emissions intensity from industry, grams per euro | Germany is the most stable in terms of emission intensity, while Estonia has the highest level of instability. | R2 = 0.5379 |

| Net greenhouse gas emissions | The highest instability is in Slovenia, the lowest in Lithuania. | R2 = 0.1368 |

| Recycling rate of municipal waste, % | Slovenia has the maximum level of instability, and the Netherlands is the most stable. | R2 = 0.0699 |

| Economic development | ||

| Real GDP per capita, euros per capita | Cyprus has the highest instability of this indicator, while Latvia has the lowest one. Relative volatility is high in Cyprus, Romania, and Slovenia. A significant positive correlation between real GDP per capita and its absolute instability was found. | R2 = 0.5663 |

| House price index, annual average | The lowest instability is found in Sweden and Finland, explained by high living standards and social infrastructure, government programs, and relatively low population density. The highest instability is observed in Hungary. | R2 = 0.7523 |

| Harmonized Index of Consumer Prices, average annual index | The most sustainable economy by this criterion is Denmark, the least sustainable is Romania. | R2 = 0.6142 |

| Compensation of employees, million euros | France has the lowest level of instability; Malta has the biggest one. | R2 = 0.7336 |

| Gross fixed capital formation, million euros | Lithuania has the lowest level of instability; Slovenia has the biggest one. | R2 = 0.8661 |

4.2. Countries Clustering by Instability Level and Mahalonobis Distance

To comprehend the differences in the level of absolute instability of countries in relation with their location relative to the center, clustering has been conducted, and the results are presented in Table 4, Table 5 and Table 6. Additionally, with the aim of reducing the variability of values and approaching the distribution of data to normal, logarithmic transformation of variables was applied. This transformation is particularly valuable when dealing with data that exhibit pronounced differences in scale. Logarithmic transformation contributes to stabilizing the variance, which is especially beneficial in the analysis of data with significant disparities in measurement scales. Remarkably, against the backdrop of this logarithmic transformation of variables, distinct data clusters became apparent on the graphs, providing additional rationale for conducting cluster analysis. This analytical approach, coupled with logarithmic transformation, yields a deeper understanding of the data structure and reveals potential groupings, thereby complementing our study. The study employed cluster analysis, taking into account the trendline and coordinate axes, to analyze the grouping of data in a multidimensional space of variables. As a result of this analysis, clusters were formed, encompassing data points close to the trendline or sharing similar values along the coordinate axes. Such an approach allows for the identification of not only general trends in the data but also the delineation of groups that exhibit similar behavior regarding specific parameters.

This analytical approach provides additional insight into the structure of the data, highlighting groups that behave similarly in the context of the examined parameters. The obtained results contribute to a more indepth analysis of relationships and groupings within the data, enriching the study from both practical and theoretical perspectives.

The chosen method for cluster analysis in this study was implemented using the k-means method. The process commenced with determining the optimal number of clusters through hierarchical analysis on a randomly selected sample of observations. This stage precisely identified the required number of clusters for further analysis.

Subsequently, cluster centers were computed, and all objects were grouped within a specified threshold value relative to these centers. This method effectively classifies objects and highlights groups based on similarities in characteristics.

Three groups of countries characterized by a certain combination of the Mahalanobis distance and the level of absolute instability were identified for each component of sustainable development.

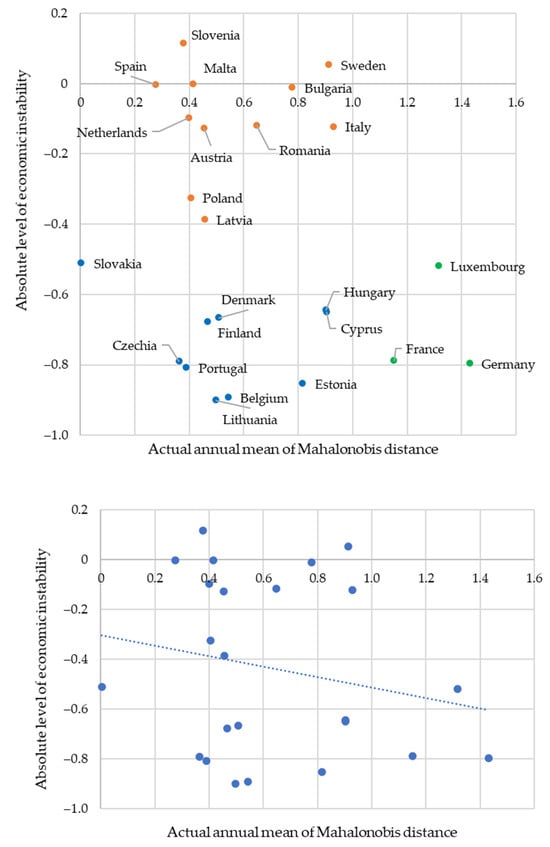

4.2.1. Economic Instability and Mahalonobis Distance

Table 7.

Countries clustering by instability level and Mahalonobis distance: economic component.

Figure 22.

Countries clustering by instability level and Mahalonobis distance: economic component.

Countries in the first group (Belgium, Czech Republic, Denmark, etc., blue dots) are characterized by low levels of both economic instability and Mahalonobis distance.

This indicates a stable economic situation, the proximity of countries to typical economic conditions and structures, it is “stability of averages”.

The second group of countries (Bulgaria, Spain, Italy, etc., yellow dots) with high levels of economic instability, have a variety of Mahalanobis distance. This shows the different factors and reasons behind the instability and dynamics. For some countries, instability is associated with an improving economic situation, while for others it is associated with a deteriorating economic situation. It can also mean an uneven distribution of risks and opportunities within the group.

The countries of the third group (Germany, France, and Luxembourg, green dots) are characterized by a low level of economic instability with high values of Mahalonobis distance. This is the stability of the strong, indicating their higher degree of structural and institutional development.

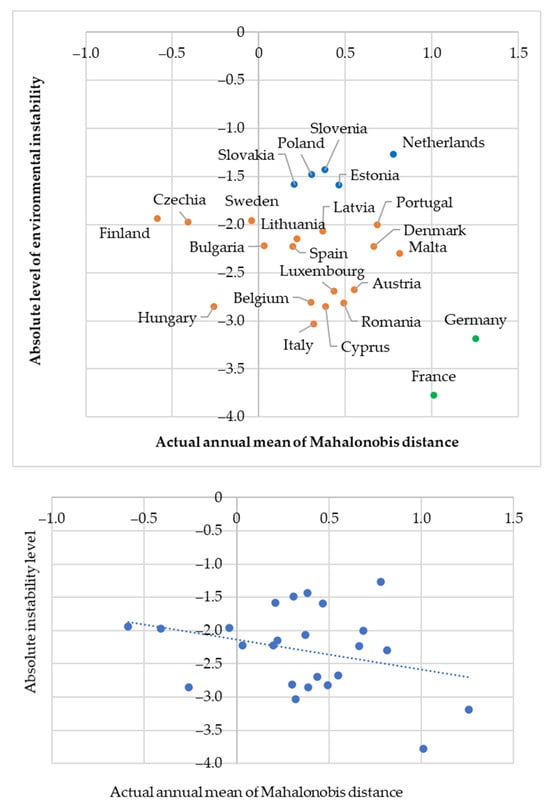

4.2.2. Environmental Instability Mahalonobis Distance

Table 8.

Countries clustering by instability level and Mahalonobis distance: environmental component.

Figure 23.

Countries clustering by instability level and Mahalonobis distance: environmental component.

Group 1 combines countries (Belgium, Finland, Sweden, etc., yellow dots) with a low level of environmental instability and average values of Mahalonobis distance, this is explained by balanced indicators of environmental development.

Group 2 (blue dots) combines countries with high values of ecological instability at different values of Mahalonobis distance, indicating the need for additional efforts to improve the ecological situation.

Group 3 (green dots) combines countries with low levels of environmental instability with high values of Mahalanobis distance. These countries can be titled environmentally sustainable: they are distinguished with high environmental indicators, which indicates an effective approach to solving environmental challenges by the government.

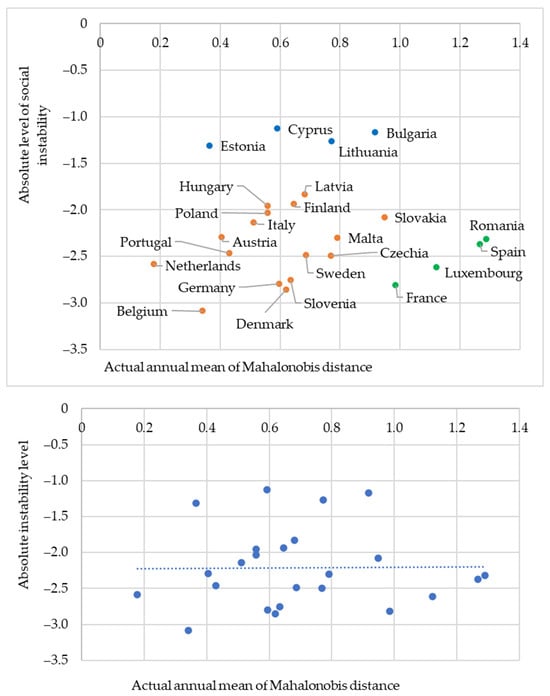

4.2.3. Social Instability and Mahalonobis Distance

Table 9.

Countries clustering by instability level and Mahalonobis distance: social component.

Figure 24.

Countries clustering by instability level and Mahalonobis distance: social component.

Group 1 (yellow dots) includes countries with low indicators of social instability and moderate Mahalonobis distance, which is associated with stable social indicators, relative equilibrium in social variables. This may be the result of a combination of different factors such as social programs, social safety nets, education, and health care.

Group 2 (blue dots) includes countries with high social instability with moderate Mahalonobis distance. The social challenges evidenced by the values of social indicators may be the result of complex social and economic dynamics that require careful consideration and appropriate measures to improve the situation. Social instability related to average values cause Mahalonobis distance to be small, which can be explained by the insufficient availability of quality social services, limited access to education and health care, and insufficient social support for vulnerable populations.

Group 3 (green dots) includes countries with low levels of social instability with high Mahalonobis distance. It includes countries with high social indicators, with a high level of social infrastructure development, including high-quality education and health care systems, extensive social programs, and support for the population. High social indicators with high Mahalonobis distance are also a consequence of the general economic situation, which is conducive to social well-being.

Characterized by higher socio-economic indicators, developed countries demonstrate sustained dynamic economic development and high levels of environmental sustainability, with attention to environmental conservation. While countries with lower levels of socio-economic development, facing challenges in economic sustainability and achieving certain living standards, also require support in ensuring environmental performance, environmental sustainability, and reducing negative impacts on the environment.

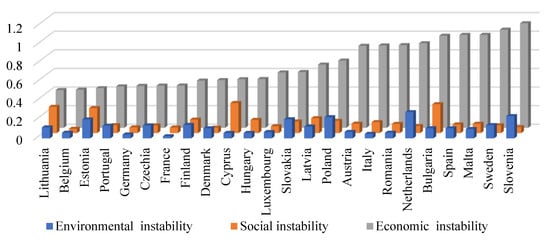

Summarizing the results of the analysis of economic, environmental, and social sustainability, we can conclude that Germany and France are the leaders of sustainable development among the EU countries (Figure 25).

Figure 25.

Economic, social, and environmental instability of EU countries.

The absolute leader is France, which social sustainability indicators is provided by protest potential of the society, as shown by the events of recent months. Instability of development can both be an indication of crisis phenomena in a country and a negative by-product of it.

5. Conclusions

- Currently, there is no single methodological math approach for sustainability assessment of countries and territorial entities. This is caused predominantly by the different in existing concepts, the applied mathematics indicators and them conceptual content, and variety of unit measurement. In addition, new types of sustainability are appearing now, making sustainable development a complex and multifaceted concept encompassing various dimensions.

- The barrier to practical usage of mathematical models to countries resilience and sustainability assessing is the complexity of the managerial usage of composite indicators, when determining the contribution of individual sustainability factors represents an ambiguity task. The problem of comparative analysis of sustainability is the lack of harmonized statistical data, due to the heterogeneity of countries development.

- To form the policy of sustainable development management, the core of approaches to assessing countries sustainability should be the principles of simultaneous consideration of social, environmental, and economic aspects, as well as possibility to identify meaningful variables in composite indices. In order to make sustainability a target variable in development strategies, it is necessary to use special methods combining mathematical tools and reasonable managerial content.

- A methodological approach consisting of seven successive stages to integrated assessment of social, economic, and environmental sustainability of countries has been created. It allows us to define position of European countries in sustainable development content relative to each other. An approach considers the requirements dictated by the multidimensionality of the studied economic, social, and environmental space and allows us to present the results of the comparative analysis visually, as well as to determine the direction of sustainability management for each country. The instrumental basis of methodological approach consists of multivariate comparisons, the Mahalanobis distances method, the correlation and regression analysis, analysis of variance, time series analysis and trends analysis.

- Composite indices of social, economic, and environmental sustainability of the EU countries, each of them including five indicators, were developed in this study. Developed indices considering multidimensionality features of used data allows us to identify countries dynamics in achieving sustainable development goals. For assessing economic sustainability, Real GDP per capita, House price index, Harmonized Index of Consumer Prices, Compensation of employees, and Gross fixed capital formation were chosen to create a composite index. For assessing environmental sustainability, primary energy consumption, average CO2 emissions per kilometer from new passenger cars, emissions intensity from industry, net greenhouse gas emissions, and recycling rate of municipal waste were chosen to create a composite index. For assessing social sustainability, unemployment rate, working poverty rate, average and median income by age and sex, fertility rates by age group, and Gini coefficient of equivalent disposable income were chosen to create a composite index.

- The sustainability of each indicator in each group (environmental, social, and economic) has been divided into two components: growth rate and fluctuations. The growth rate is a constant component and reflects a stable trend of the indicator change. Fluctuation, on the other hand, is a nonconstant component and reflects the variability of the indicator around the trend. This variability can be measured by volatility, i.e., fluctuations of the indicator around its average value. Thus, analyzing the stability of indicators allows us to divide the dynamics into a stable trend and the risk associated with fluctuations of the indicator around this trend.

- To create a common composite index for each group (environmental, social, and economic), Mahalanobis distances were calculated based on chosen indicators. The methodology is the finding of the average distance between the multivariate vector containing the values of all private indicators and the center of the multivariate distribution. This made it possible to assess how much each private indicator contributes to the overall sustainability score and to determine which indicators are most important.

- A linear time regression analysis has been conducted to identify four main parameters (deviation of the country from the countries mean, sustainable rate of development of the country, absolute level of the countries’ instability, and relative level of instability). This analysis assessed the relationship between various indicators such as the deviation of the country from the countries mean, the sustainable rate of development of the country, the absolute level, and the relative level of country’s instability.

- Based on the Eurostat’s 12-year period data, the levels of social, economic, and environmental sustainability of 24 EU countries were determined. Individual instability indicators of 15 chosen indicators were determined and analyzed. Mahalanobis distances, relative, and absolute instability levels of each composite indexes were calculated (social, economic, and environmental). The most and least sustainable countries for each component of sustainable development were identified. The case study results derived from spatial and temporal samples are consistent with the currently observed processes in the EU. Developed visual representation of the case study results were made.

- Hypotheses that there are positive relationships between instability and the level of country development, reflected in the values of socio-economic and environmental indicators, were proposed and tested. According to the analysis result of positive relationships were revealed for all five economic development indicators, for two environmental indicators. There were no significant positive relationships found for social indicators. As a result of the analysis, the role of economic factors as having more significant impact on the stability of a situation were confirmed.

- The study used several methods, including Mahalanobis distances analysis, time series, trends analysis, correlation and regression analysis, cluster analysis, and analysis of variance. The conducted cluster analysis made it possible to identify three groups of countries depending on Mahalanobis distance and the level of socio-ecological and economic instability. It has been revealed that there are countries with a high Machalanobis distance and a low level of environmental, social, and economic instability.

Author Contributions

Conceptualization, E.L. and K.G.; methodology, E.L.; validation, G.K. and E.L. formal analysis, E.L., G.K., and K.G.; investigation, E.L., G.K., and K.G.; resources, E.L., G.K. and K.G.; data collection, G.K. and K.G.; writing—original draft preparation, E.L.; writing—review and editing, E.L.; visualization, G.K.; supervision, E.L.; project administration, E.L.; funding acquisition, G.K. and E.L. All of the authors contributed significantly to the completion of this manuscript, conceiving and designing the research, writing and improving the paper. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data is available on demand.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Foster, K.A. A Case Study Approach to Understanding Regional Resilience; Working Paper 2007-08; Institute of Urban and Regional Development, University of California: Berkeley, CA, USA, 2007. [Google Scholar]

- Olawumi, T.O.; Chan, D.W.M. Identifying and prioritizing the benefits of integrating BIM and sustainability practices in construction projects: A Delphi survey of international experts. Sustain. Cities Soc. 2018, 40, 16–27. [Google Scholar] [CrossRef]

- Da Pimentel Silva, G.D.; Sherren, K.; Parkins, J.R. Using news coverage and community-based impact assessments to understand and track social effects using the perspectives of affected people and decision makers. J. Environ. Manag. 2021, 298, 113467. [Google Scholar] [CrossRef]

- Modica, M.; Reggiani, A. Spatial Economic Resilience: Overview and Perspectives. Netw. Spat. Econ. 2014, 15, 211–233. [Google Scholar] [CrossRef]

- Martin, R. Regional economic resilience, hysteresis and recessionary shocks. J. Econ. Geogr. 2012, 12, 1–32. [Google Scholar] [CrossRef]

- Van Bergeijk, P.A.G.; Brakman, S.; Van Marrewijk, C. Heterogeneous economic resilience and the great recession’s world trade collapse. Pap. Reg. Sci. 2017, 96, 3–12. [Google Scholar] [CrossRef]

- Giannakis, E.; Bruggeman, A. Regional disparities in economic resilience in the European Union across the urban-rural divide. Reg. Stud. 2019, 54, 1200–1213. [Google Scholar] [CrossRef]

- Volkov, A.; Žičkienė, A.; Morkunas, M.; Baležentis, T.; Ribašauskiene, E.; Streimikiene, D.A. Multi-Criteria Approach for Assessing the Economic Resilience of Agriculture: The Case of Lithuania. Sustainability 2021, 13, 2370. [Google Scholar] [CrossRef]

- Donkor, F.K.; Mitoulis, S.-A.; Argyroudis, S.; Aboelkhair, H.; Canovas, J.A.B.; Bashir, A.; Cuaton, G.P.; Diatta, S.; Habibi, M.; Hölbling, D.; et al. SDG Final Decade of Action: Resilient Pathways to Build Back Better from High-Impact Low-Probability (HILP) Events. Sustainability 2022, 14, 15401. [Google Scholar] [CrossRef]