Abstract

This research examines the impact of financial knowledge on risky investment intention via the lens of the theory of planned behavior (TPB). The research developed a comprehensive model to test the mediation effect of the three TPB antecedents on the link between financial knowledge and risky investment intention. The research investigates the moderating effect of risk-taking on the link between three TPB constructs and risky investment intention. For these purposes, we used a pre-tested survey, was directed to senior university students in public universities in Saudi Arabia. The findings of SmartPLS showed a significant positive influence of financial knowledge on attitudes towards risky investment, subjective norms (SNs), and perceived behavioral control (PBC). Both SNs and PBC have a significant positive influence on risky investment intention. Nonetheless, the personal attitude of students failed to have a significant direct or mediating influence on risky investment intention. Additionally, risk-taking did not have a moderating effect on the link between personal attitude and risky investment intention. Students belong to a risk-adverse culture, which could justify the insignificant impact of their personal attitudes on risky investment intention. On the other side, SNs and PBC have a mediating effect on the link between financial knowledge and risky investment intention. Risk-taking has a moderating effect on the link between SNs, PBC, and risky investment intention. The research extends the use of TPB by validating its assumptions about driving the investment intention of university graduates.

Keywords:

risk taking; financial knowledge; risky investment intention; theory of planned behavior; attitudes towards investment; SEM analysis MSC:

91C99

1. Introduction

Risky investment refers to financial instruments other than those having a constant rate of return, such as bank deposits and bonds [1]. To illustrate, in risky investment investor does not know how much money s/he will gain with this type of investment, with the possibility that s/he could lose the money invested. Individual engagement in investment activities has increased sharply in recent years [2]. Defiantly, the risky investment required adequate financial knowledge, particularly among young people [3]. On the other side, Lusardi and Mitchel [4] indicated that the majority of university students do not have adequate knowledge regarding money management and the basics of economic principles needed to engage in investment activities. Alleyne and Broome [5] found that attitude towards behavior, subjective norms, perceived behavioral control, and risk propensity has a significant impact on the behavioral investment intention of future investors, which ultimately impacts their actual investment behavior.

The variables that impact on investment intention of university students, such as financial knowledge, financial literacy, and risk-taking, have gained the attention of policymakers, investment advisors, financial planners, and academics [6]. In this sense, Robb [7] found a positive correlation between financial knowledge and credit card behavior of college students, which indicated that students with sufficient knowledge engaged in more responsible credit card use. It is confirmed that behavioral investment intention predicts actual investment behavior [8]. Earlier studies [9,10] have emphasized that financial knowledge positively influences students’ investment intentions. Financial knowledge is highly required to enable students to understand their rights, evaluate risk-taking, enhance their intention and successfully make investment decisions that maximize profit [6]. Therefore, Halim [11] argued that risky investment requires an adequate level of financial knowledge in order to make an investment decision that can maximize profit. Mawadah and Ratno [12] confirmed that students with high levels of financial knowledge positively intend to engage in a risky investment.

This research investigates the influence of risk-taking and financial knowledge on risky investment intention by applying the theory of planned behavior (TPB) [13]. TPB is appreciated as one of the strongest and most effective research theories for understanding individuals’ intentions in general [13] and investment intentions in particular [5]. TPB has been employed in several studies to understand investment behavior [5,8,14]. However, such studies focused on individuals more likely to be in an investment environment, such as investors and professionals in private business [15]. However, to the authors’ knowledge, the current research is one of the first attempts to demonstrate how TPB could be applied to predict risky investment intention among university graduates in the KSA context and consider risk-taking as a moderator. Intention can be described as self-instruction to conduct a certain behavior [16]; hence, it directly influences behavior [13]. Earlier studies [17,18,19] have consistently indicated a positive, meaningful correlation between individual intentions and behavior. According to TPB, three antecedents influence intention: attitude towards behavior, perceived behavioral control (PBC), and subjective norms (SNs). Ajzen and Fishbein [20] defined attitude as the degree to which an individual feels favorably or negatively about a certain psychological object. At the same time, subjective norms are described as a person’s perception of whether a group or other people, who serve as a reference, support or disagree with a certain action that they want to engage in [13]. PBC can be described as the proposition one has self-assurance in his or her capability to conduct a certain practice [13].

Nga et al. [21] revealed that young people lack knowledge regarding financial services, planning, and products. Additionally, Sedais and Al shahb [22] indicated that the level of financial knowledge among young Saudi Arabian individuals is low. The Organization for Economic Cooperation and Development (OECD) estimates that just 9.6 out of 21 young Saudis are financially knowledgeable, which is the lowest level in comparison to G20 countries [23]. By the same token, Alyahya [24] demonstrated that the majority of higher education students lack financial knowledge and consequently have less intention toward risky investment. However, The Saudi Vision 2030 works to promote investment activities among Saudi people by enhancing financial knowledge and investment cultures in the Saudi market (https://www.vision2030.gov.sa/thekingdom/invest/; accessed on 1 November 2022). Therefore, financial knowledge has gained great attention from policymakers in Saudi Arabia, particularly from the Ministry of Education. To clarify, the Saudi Arabian Ministry of Education added a specialized course related to financial knowledge into the current curricula of the second stage starting from the academic year 2022–2023. The Ministry also added the course “Principles of Entrepreneurship” in most universities to stimulate their entrepreneurial and investment intention.

The purpose of this research are to test the impact of students’ financial knowledge on their risky investment intention via the influence of SNs, PBC, and personal attitude. The current study aims to add to TPB by validating its assumptions about investment intention among university graduates. The research developed a comprehensive model which investigates the influence of financial knowledge on the students’ risky investment intention via the three constructs of TPB. Furthermore, the study examines the moderating effect of risk-taking on the link between TPB antecedents and intention to risky investment. There is a lack of published literature on the moderating effect of risk-taking on the link between financial knowledge and risky investment intention, as well as the mediating role of TPB antecedents. The study addresses three objectives. Firstly, it tests the effect of financial knowledge on risky investment intention via the effect of TPB constructs. Secondly, it investigates the impact of TPB dimensions on students’ risky investment intentions. Thirdly, this is the first attempt to investigate the moderating influence of risk-taking on the relationship between TPB variables and risky investment intention. As a result, this research provides a unique perspective on such mediating and moderating influences and addresses gaps in the current literature on an emergent country such as Saudi Arabia. The research questions are (1) what is the impact of financial knowledge on the three constructs of TPB? (2) What is the impact of TPB constructs on students’ risky investment intention? (3) How does students’ subjective norms, attitude, and PBC intermediate the link between financial knowledge and risky investment intention? (4) How does risk-taking moderate the relationship between TPB constructs and the intention to engage in risky investment?

Following a discussion of the research problem concerning the impact of financial knowledge on investment intention through the effect of TPB, a series of research hypotheses are proposed. They are presented in part 2 with the study’s conceptual framework. Part 3 explains the research design. Part 4 presents the study findings. Part 5 discusses the findings and compares the results with previous related literature. Part 6 suggests the implications for policy-makers and academics.

2. Hypothesis Development

2.1. The Impact of Financial Knowledge on TPB Constructs

Financial knowledge relates to a person’s comprehension of key financial concepts [25]. Financial knowledge is attained through organizing, learning, and storing financial information in memory [26]. Financial knowledge includes two aspects: objective and subjective knowledge [27,28]. Objective knowledge is the actual financial understanding as determined by the respondent’s overall score on financial concepts such as interest, inflation, the stock market, rates, savings, insurance, and credit. Nevertheless, subjective knowledge relates to the amount of each individual’s self-rated level of knowledge of the financial subject. Therefore, Hamza and Arif [29] indicated that financial knowledge affects an investment decision. Likewise, earlier studies [30,31,32] have confirmed that both dimensions of financial knowledge had a positive impact on investment intention.

Several theories were adopted to examine investment intentions, such as the social exchange theory, the theory of reasonable action, and TPB [33,34]. Out of them, TPB is the most effective and commonly utilized theory to describe how financial knowledge influences investment intention [13,35]. TBP claims that personal attitudes toward the behavior, subjective norms (SNs), and (PBC) perceived behavioral control influence a person’s intentions [13]. According to Ajzen [36], attitude towards behavior refers to how positively or negatively a person evaluates or appraises the behavior in concern. In the context of the relationship between financial knowledge and attitude toward behavior, Krosnick and Petty [37] argued that continuous knowledge has a significant impact on forming attitudes as well as affecting the matching values or engagements. Therefore, attitude and behavior are influenced by operational knowledge. Similarly, Jorgensen and Savla [38] and Sang [39] indicated that financial knowledge positively influences financial attitude and consequently promotes awareness of sound financial behavior. Furthermore, Mueller [40] found that attitude toward behavior is influenced by different variables such as experience, knowledge, education, personal value, personality, etc. Thus, it has been argued financial knowledge positively affects the university student’s attitude toward entrepreneurship because financial knowledge raises the advantages of engaging in investment activities [41]. Financial knowledge might also assist individuals in developing stronger money management abilities and attitudes [42].

Ajzen [43] defined subjective norms as pressure from the social network. A study finding by Agarwalla et al. [44] emphasized that individuals are affected by the surrounding environment’s financial knowledge. Furthermore, money management and saving behavior might be one of the behaviors shaped by social norms because of financial knowledge [45]. In this sense, Ajzen and Fishbein [46] asserted that normative beliefs influence social norms. If students feel that their environment supports them with adequate financial knowledge, they are more likely to engage in risky investments [45]. Under societal pressure, a person may decide to engage in a specific behavior even when they do not actually want to [47,48]. Some individuals also might motivate other individuals based on their perceived knowledge and competence in particular types of risky investments [49]. Recently, the 2030 Saudi Vision aimed to promote financial knowledge among Saudi people through the Capital Market Authority and other associated entities. As a result, Saudi families and individuals grew more conscious of the necessity of investing, and consequently, students’ intentions may be influenced by the surrounding environment, such as parental guidance and university education.

Perceived behavioral control relates to how easy or difficult an activity is considered to be, and it is believed to be a reflection of both previous experience and predicted obstructions and challenges [50]. University students do not have prior experience. Therefore, financial knowledge can enhance students’ skills, knowledge, and abilities [51]. The PBC can also be considered to include non-motivating elements such as aptitude, resource availability, other people’s cooperation, environmental variables, etc. [51]. Investment decisions often involve access to finances, financial understanding, and financial knowledge [8,52,53]. The variable financial well-being has been used to operationalize the adequateness of wealth or financial resources. Based on these discussions, the following hypotheses were proposed:

H1.

Financial knowledge has a positive impact on student attitude toward behavior.

H2.

Financial knowledge has a positive impact on student subjective norms.

H3.

Financial knowledge has a positive impact on student perceived behavior control.

2.2. The Impact of TPB Constructs on Risky Investment Intention

To the best of the researcher team’s knowledge, there have been limited studies that utilized TPB to predict students’ intention to engage in risky investment, particularly in emergent countries such as Saudi Arabia. TPB was originally proposed by Ajzen [54] based on the Reasoned Action Theory [46]. Ajzen [13], p. 188 stated that “as a general rule, the more favorable the attitude and subjective norms with respect to a behavior, and the greater the perceived behavior control, the stronger should be an individual’s intention to perform the behavior under consideration.” There are two broad aspects that describe attitude, first, as a tool to assess if a behavior is significant, harmful, or valuable. Second, to assess whether the behavior is enjoyable [43,55]. If a person has a good attitude toward a certain behavior, they are more likely to develop a positive intention to engage in that behavior [56]. Earlier studies (e.g., [8,14,57,58]) have confirmed that attitude towards behavior has a significant and positive impact on intention. In the context of risky investment, students’ attitudes towards risky investment could play an essential role in enhancing an intention to invest to obtain the appropriate degree of monetary stability [5,59].

A key element of TPB is SNs [13]. SNs are described as the pressure that individuals sense from others in their daily social lives to carry out or not perform any behavior [13]. In this sense, numerous studies [14,60,61,62] have demonstrated that SNs have been found to be an essential predictor of behavioral intention. Similarly, Adam and Shauki [63] emphasized that SNs were found to be a key antecedent in understanding individual investors’ intents and behavior toward investment. SNs are a stimulus of investment intention impacted by networks near individuals [62,64]. As a result, social norms propose a technique to alter personal investor behavior to relationships; hence, it was found that SNs are correlated with investment intention [65]. Nevertheless, Reyhanloo et al. [61] argued that SNs are a weak factor in determining investment intention. Likewise, Raut et al. [62] have indicated that SNs have a non-significant impact on investment intention. To conclude, it is evident from the prior literature that SNs are significant predicators of investors’ behavioral intention [5].

PBC has always been considered a key influence in intention creation [13]. Behavior of a people is manageable when the individual has the skills required, confidence, and capability to conduct a certain behavior [62]. Individuals with higher PBC are more likely to perform a certain behavior [66]; however, behaviors that are free of extrinsic constraints can be simply executed [66]. The perception of comfort and the individual ability to perform and conduct are positively correlated with the intention to behave. It indicates that when individuals believe that they can complete a task easily, their intent to conduct it will be higher [12,66,67]. To that end, earlier studies (e.g., [14,62,63,64,68]) have suggested that PBC is a crucial component in predicting an investor’s intention to invest while making financial decisions. Hence, Mahastanti and Hariady [69] presented a contextual suggestion that the only important predictor of an investor’s propensity to invest in a risky investment is PBC. Hence, we propose the following:

H4.

Attitude has a positive impact on student intention toward risky investment.

H5.

Social norms has a positive impact on student intention toward risky investment.

H6.

Perceived behavior has control has a positive impact student intention toward risky investment.

2.3. TPB Constructs as a Mediator between Finacial Knowledge and Risky Investment Intention

According to TPB, individuals acts in compliance with their intentions and intentions are influenced by personal attitudes, SNs, and PBC [13]. Additionally, gaining financial knowledge may help individuals to develop stronger money management techniques and attitudes and consequently promotes his/her investment intention [70]. Thus, Jorgensen and Savla [38] and Sang [39] revealed an indirect link between knowledge and intention, with attitude towards behavior acting as a mediator. This suggests that financial knowledge has a favorable impact on financial attitude and raises awareness of appropriate financial behavior. Khan et al. [70] revealed that more financial knowledge results in a more positive attitude toward financial investment, which might further increase financial behavioral intention to invest. Furthermore, Mulyono [71] has argued that attitude mediates the link between financial literacy and investment intention.

Earlier studies such as Reyhanloo et al. [61] and Raut et al. [62] have confirmed that social norms consider an important antecedent to determining investment intention. Similarly, Ammer and Aldhyani [6] emphasized that financial knowledge has a positive impact on student’s intentions, while social norms have an important role in promoting investment intention as well [71]. Whereas, Lajuni et al. [72] argued that financial knowledge determines the capabilities, awareness and skills required to engage in a risky investment. Students will gain adequate financial knowledge through their surrounding environment, such as friends, colleagues, peers, and parents, which in turn are considered as pressure to perform or not perform a certain behavior [73,74]. Parents and peers with sufficient financial knowledge will guide university students toward money management and saving behavior. Consequently, students will have a higher intent towards risky investment [4]. In that sense, Ali et al. [45] argued that social influence mediates the link between investment awareness and risky investment.

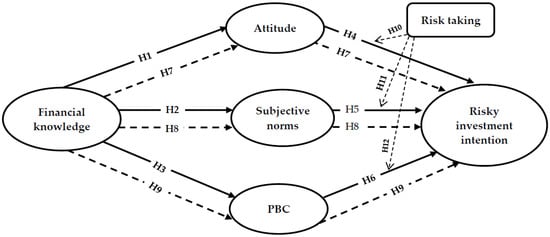

In the context of mediating role of PBC, students often participate in certain activities with high intent when they consider themselves to have the required capabilities to undertake them. Students will have self-efficacy and determine the required skills through financial knowledge [75]. Adequate or inadequate financial knowledge will affect students’ perception regarding the ease or difficulty of engaging in risky investments [76]. Additionally, individuals with a low level of PBC in money management frequently encounter income-related difficulties, resulting in additional financial risks [77]. On the other hand, an individual with a high level of PBC may handle their money, fulfill their monetary objectives, and consistently expand their funds [74] (See Figure 1). Thus, we propose the following:

Figure 1.

The research framework.

H7.

Students personal attitude have a mediation effect in the link between financial knowledge and risky investment intention.

H8.

Students subjective norms have a mediation effect in the link between financial knowledge and risky investment intention.

H9.

Students perceived behavior control have a mediation effect in the link between financial knowledge and risky investment intention.

2.4. Risk Taking as a Moderator in the Relationship between TPB and Risky Investment Intention

The level of risk is increased in risky investments than the traditional investments. A high level of risk is linked to a high level of returns in investment [78]. A study conducted by Akhtar and Das [65] showed that individuals with risk-taking have a higher intention to invest. Several studies regarding behavioral finance have revealed that investors’ risk-taking behavior affects their desire to select investment ideas [65]. The perceptions of risk were adopted to assess investors’ readiness or aversion to risky investment alternatives [79]. Ainia and Lutfi [80] assert that a person’s probability of making an investment decrease as their risk perception increases, and the opposite is also true. The higher the person’s risk perception, the more likely they are to engage in risky investment, and vice versa [80].

From reviewing the earlier studies, research teams observed no study had examined the moderation effect of taking a risk on the link between TPB variables and risky investment intention. Thus, this research can be considered the first study attempt to investigate the moderation effect of risk-taking on the link between TPB variables and intention toward risky investment. The research team proposed this relationship based on some potential evidence. First, the TPB confirms that attitudes, subjective norms, and PBC have an impact on the likelihood of risky conduct occurrence [13]. Second, risk-taking is linked to potential investor attitude [80]. In other meaning, the student may be a positive attitude toward risky investment, but taking a high risk could impact the students’ intention to invest. Third, social norms, according to Raut et al. [64], positively affect investment intention. Social circles such as peers, friends, and family are very important to form the intention to invest. Hence, the surrounding environment might motivate individuals to take a high risk or to refrain from the risk. Fourth, PBC is associated with risk-taking [81]. Fifth, risk-taking was found to, directly and indirectly, affect entrepreneurial and investment intention [82]. To illustrate, students with a high level of PBC are more intent toward risky investment. Furthermore, they are more confident to take a high level of risk because they have the resource and the skills to conduct a risky investment. Based on these debates, we propose the following:

H10.

Risk-taking moderates the relationship between attitude toward behavior and intention to invest in risky investment.

H11.

Risk-taking moderates the relationship between subjective norms and the intention to invest in risky investment.

H12.

Risk-taking moderates the relationship between PBC and the intention to invest in risky investment.

3. Methods

3.1. Data Collection Process

The study aims to examine the link between financial knowledge among university students and risky investment intention through the mediating role of the theory of planned behavior and the moderating role of risk-taking as a personality trait. The research was conducted and implemented at three top-ranked public universities in KSA (King Abdelaziz, Umm Al Qura, and Imam Abdulrahman Bin Faisal University). An online questionnaire was created on Google Forms Platform and distributed to senior higher education students. We have targeted senior students who successfully completed modules in areas such as principles of management and entrepreneurship basics. These modules are compulsory in the targeted KSA universities, and their content provides the necessary skills to help students run future projects. The employed measures were derived from English sources. Therefore, we translated the questionnaire into Arabic so that the targeted Arabic students could comprehend it. We utilized a sample of senior students in public universities. We emailed the questionnaire link to students’ standard email systems and WhatsApp groups and asked those senior students (about to graduate in their final year) to complete the survey. A total of 590 valid replies were collected after making the link available to students in October 2022. Because privacy is a significant concern, we made sure to begin the survey with an introduction explaining the study’s purpose and the strict secrecy that would be maintained with any information gathered.

3.2. The Study Scale

The measures were taken from previous scales that had psychometric properties and were related to our topic. All dimensions and their sources, with all reflective variables that measured every dimension, are presented in Table 1.

Table 1.

The Scale Psychometric Properties Results.

3.3. Employed Data Analysis Methods

SEM analysis with PLS was used so that the hypothesized relationships with the moderating and mediating effects could be explored and tested. According to Leguina’s two-step approach [86], the suggested conceptual model was examined following the assessment of the outer measurement model’s validity and adequacy. To test the validity of the outer measurement model, we followed the recommended criteria that were suggested by Hair et al. [87]. These criteria include several threshold indices such as the “standardized factor loading” (higher than 0.7); the “composite reliability, CR” (higher than 0.7); the “average variance extracted, AVE” (higher than 0.5); the “normed fit index” (higher than 0.90); the “Standardized root mean square Residual, SRMR” (lower than 0.08). the R2 (higher than 0.1); and the Stone-Geisser Q2 (higher than 0.0).

Multiple steps were done to address and evaluate the likelihood of common method variance in the data (CMV) because the data were collected utilizing a self-reporting questionnaire. For example, the identity and confidentiality of respondents were maintained. In addition, Harman’s single-factor technique was utilized, and all indicators were assessed with SPSS software for exploratory factor analysis (EFA), with no more than one factor retrieved without rotation. The results of our investigation demonstrated that CMV was not a problem, as only one variable explained 35% of the variance [87].

4. Results

4.1. The Evaluation of the Outer Model (Measurement Model)

As proposed by the previous literature [87], we have checked for variables’ loadings, data validity, reliability, consistency, average variance extracted (AVE), discriminant validity with cross-loadings (Table 2), Heterotrait-Monotrait Criterion (Table 3), and Fornell-Larcker (Table 4). As all the suggested minimum and/or maximum thresholds are fulfilled [88,89], so the outer measurement model is correct, and the scale depicts proper convergent validity [88]. Regarding investigations of discriminant validity, both the Fornell-Larcker) and Heterotrait-Monotrait indices fulfilled the suggested thresholds [88,89], so the scale demonstrated proper discriminant validity.

Table 2.

Cross-loadings.

Table 3.

Heterotrait-monotrait ratio (HTMT)—Matrix.

Table 4.

Fornell-Larcker criterion-Matrix.

As Sarstedt et al. [90] recommended, evaluating the measurement model’s collinearity was required in the following stage of the data analysis process. Regarding this, we checked the VIF values for each variable, which must be below the value of 10 [87]; the results showed that all items have VIF below 10. Thus, the data did not suffer from multicollinearity. A bootstrap analysis was then performed. This lets us evaluate the study hypotheses with their related t-statistics and p-value.

4.2. The Inner Structural Model (Hypotheses Testing)

PLS-SEM was utilized to examine the inner model for hypotheses assessment once the outer measurement model had been satisfactorily evaluated and confirmed. The model GoF was evaluated using a series of criteria drawn from those proposed by Hair et al. [87], Chin [89], and Henseler et al. [88]. Table 5 shows that the model meets all the requirements necessary to demonstrate its data fit and prediction ability. The scores of R2, Q2, SRMR, and NFI were all higher than the cutoffs, allowing us to test the hypotheses underlying the study. Smart PLS4 was used to conduct a bootstrapping analysis, which analyzed the regression weights, t-value, and significance level of the direct, mediating, and moderating effects. As seen in Table 5, we tested a total of twelve hypotheses in the current investigation, six direct, three mediating, and three moderating.

Table 5.

The inner model’s findings.

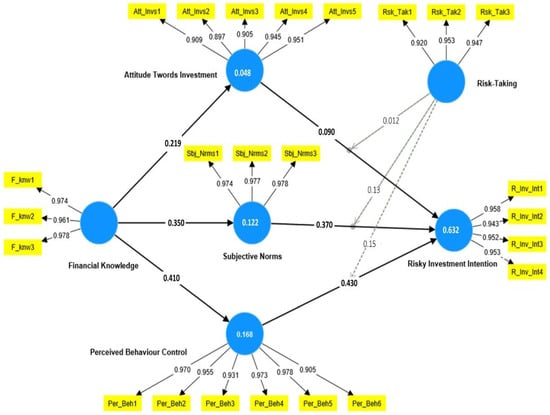

The findings, as shown in Figure 2 and Table 5, revealed that financial knowledge succeeded in having a significant positive influence on attitude towards risky investment (β = 0.219, t-value = 4.854, and p < 0.001), subjective norms (β = 0.350, t-value = 7.982, and p < 0.01), and perceived behavior control (β = 0.41, t-value=8.792, and p < 0.001), therefore, we can agree to H1, H2, and H3. However, students’ attitudes toward investment failed to significantly affect risky investment intention ((β = 0.09, t-value=0.921, and p = 0.883), which rejects H4. Conversely, risky investment intention was found to be positively and significantly impacted by subjective norms (β = 0.37, t-value = 8.857, and p < 0.001) and perceived behavior control (β = 0.43, t-value = 9.620, and p < 0.001), which validate H5 and H6.

Figure 2.

Inner and Outer model.

For the mediating effects, the specific indirect effects in SmartPls 4 output report were checked, in which students’ attitudes towards investment failed to mediate the link between financial knowledge and risky investment intention(β = 0.007, t-value = 0.990, and p = 0.184). Thus, we were unable to support H7. On the other hand, subjective norms succeeded in mediating the relationships between financial knowledge and risky investment intention (β = 0.129, t-value = 1.999, and p ≤ 0.05). Similarly, perceived behavior control was found to have a significant positive mediating effect in the relationship between (β = 0.150, t-value = 2.789, and p ≤ 0.05), allowing us to support H8 and H9.

For the moderating analysis, the SmartPls output showed that risk-taking as a personality trait failed to significantly improve the insignificant impact of students’ attitude towards behavior and risky investment intention (β = 0.012, t-value = 837, and p = 0.403), which means that we cannot accept H10. However, risk-taking was found to have a positive significant moderating impact on the link between subjective norms and risky investment intention (β = 0.13, t-value = 2.445, and p < 0.01) and on the association between perceived behavior control and risky investment intention ((β = 0.150, t-value = 2.789, and p < 0.01), therefore, allowing us to accept H11, and H12.

5. Discussions

This research creates an innovative approach to test a comprehensive mediating-moderating model, which has been drawn from the related literature review (Figure 1). The research tests the link between financial knowledge and risky investment intention through the lens of TPB. Precisely, it tests the mediating effect of TPB constructs on the aforementioned relationship. The research also tests the moderating effect of risk-taking on the link between TBP constructs, i.e., attitude towards behavior, SNs and PBC, and risky investment intention. The findings showed financial knowledge succeeded in having a significant positive influence on attitudes towards risky investment, SNs, and PBC. The findings confirm that financial knowledge stimulates university students’ attitudes towards investment [5,41]. When students have financial knowledge, they are more likely to develop better money management and positive attitudes toward investment [42]. The results confirm that when students feel that their network, e.g., family and colleagues support them with adequate financial knowledge, they are more likely to engage in a risky investment. Additionally, a member of a network might motivate other members based on their perceived knowledge [49]. Furthermore, adequate financial knowledge could lead to improve student confidence in their skills and competencies. Hence, it significantly affects students’ PBC.

Unlike previous research (e.g., [5,8,14,57,58]), which confirmed that attitudes towards investment have a significant impact on a risky investment, the current research showed that students’ attitudes toward investment failed to have a significant direct effect on risky investment intention. Additionally, the finding did not support the TBP framework [13] that attitudes towards behavior are a predicator of behavioral intention. Moreover, students’ attitudes towards investment failed to mediate the link between financial knowledge and risky investment intention. Although financial knowledge stimulating students’ attitudes toward investment, the results of current research showed that this was not enough to have a significant effect on their risky investment intention. Students’ attitudes towards investment did not significantly affect their intention to engage in a risky investment.

The findings confirmed that risky investment intention was found to be positively and significantly affected by SNs and PBC. The findings confirmed that both SNs and PBC are the stimulus of investment intention and are affected by information provided by networks of students, which supports the previous literature review [5]. They both succeeded in mediating the link between financial knowledge and risky investment intention. Parents and peers with sufficient financial knowledge will guide their friends toward money management and saving behavior. Consequently, students have a higher intent toward risky investment [4]. The findings support the work of Mulyono [71], who argued that PBC significantly mediates the relationship between financial literacy (in this research, financial knowledge) and investment intention.

For the moderating analysis, the findings showed that risk-taking as a personality trait of university students failed to improve the insignificant impact of students’ attitudes towards investment on their risky investment intention. This finding is not in line with Ainia and Lutfi [80] that risk-is associated with potential investors’ attitude and affect their intention to involve in a risky investment. This could be because students are more risk-averse due to the culture of this society [91]. Because students’ attitude is risk-averse, their attitude toward investment do not positively affect their risky investment intention, nor does their low-level risk-taking traits fail to do this. However, risk-taking was found to have a positive significant moderating impact on the link between SNs and risky investment intention and on the association between PBC and risky investment intention. Family and friends can encourage students to engage in a risky investment. Moreover, when students are able to control themselves and manage their capacities, they become more ready for risky investments.

6. Implications of the Study

The current findings have theoretical and practical implications. First, the current study extends the use of TBP in predicting risky investment among university graduates in Saudi Arabia through the mediating effect of TPB constructs in the link between financial knowledge and risky investment intention. Second, the findings confirmed for the first time the role of risk-taking as a personality trait on the effects of TBP constructs on risky investment intention, except for their attitude towards investment. This is because Saudi students are more likely to be risk-averse; hence, their attitude towards risky investment has an insignificant impact on their risky investment intention. Third, there is a need for more studies on how to stimulate university students’ attitudes toward risky investment. Factors that affect positive students’ attitudes towards investment also need more attention from academics.

The results of the current study also have implications for policymakers, especially at Saudi universities. They have to spend all their endeavors to create a positive attitude towards investment among university students. Moreover, universities have to play a major role in encouraging students to engage in risk-taking activities. This could be done through training and development programs [92]. Business incubators at universities can play this role by developing students’ capabilities, enhancing their skills and self-confidence, and stimulating their attitude towards investment, which would affect their entrepreneurial and investment intention [93]. Further research could replicate the current study model with a larger sample size to validate or falsify our results.

Author Contributions

Conceptualization, A.E.E.S. and I.A.E.; methodology, A.E.E.S. and I.A.E.; software, I.A.E.; validation, A.E.E.S. and I.A.E.; formal analysis, A.E.E.S. and I.A.E.; investigation, A.E.E.S. and I.A.E.; resources, I.A.E.; data curation, A.E.E.S. and I.A.E.; writing—original draft preparation, A.E.E.S. and I.A.E.; writing—review and editing, A.E.E.S. and I.A.E.; visualization, A.E.E.S. and I.A.E.; supervision, A.E.E.S. and I.A.E.; project administration, I A.E.E.S. and I.A.E.; funding acquisition, A.E.E.S. and I.A.E. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Deanship of Scientific Research, Vice Presidency for Graduate Studies and Scientific Research, King Faisal University, Saudi Arabia (Grant No. GRANT2630).

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki and approved by the deanship of scientific research ethical committee, King Faisal University (project number: GRANT2630, date of approval: 1 June 2022).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data is available upon request from researchers who meet the eligibility criteria. Kindly contact the first author privately through e-mail.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aydemir, S.D.; Aren, S. Do the effects of individual factors on financial risk-taking behaviour diversify with financial literacy? Kybernetes 2017, 46, 1706–1734. [Google Scholar] [CrossRef]

- Calvet, L.; Célérier, C.; Sodini, P.; Vallée, B. Financial Innovation and Stock Market Participation; Finanzinnovation und Aktienmarktbeteiligung; Canadian Derivatives Institute: Montréal, QC, Canada, 2016; Volume 16, pp. 1–35. [Google Scholar]

- Shehata, S.M.; Abdeljawad, A.M.; Mazouz, L.A.; Aldossary, L.Y.K.; AlSaeed, M.Y.; Sayed, M.N. The Moderating Role of Perceived Risks in the Relationship between Financial Knowledge and the Intention to Invest in the Saudi Arabian Stock Market. Int. J. Financ. Stud. 2021, 9, 9. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. The economic importance of financial literacy: Theory Evid. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef] [PubMed]

- Alleyne, P.; Broome, T. Using the theory of planned behaviour and risk propensity to measure investment intentions among future investors. J. East. Caribb. Stud. 2011, 36, 1–21. [Google Scholar]

- Ammer, M.A.; Aldhyani, T.H. An Investigation into the Determinants of Investment Awareness: Evidence from the Young Saudi Generation. Sustainability 2022, 14, 13454. [Google Scholar] [CrossRef]

- Robb, C.A. Financial knowledge and credit card behaviour of college students. J. Fam. Econ. Issues 2011, 32, 690–698. [Google Scholar] [CrossRef]

- East, R. Investment decisions and the theory of planned behaviour. J. Econ. Psychol. 1993, 14, 337–375. [Google Scholar] [CrossRef]

- Marcolin, S.; Abraham, A. Financial Literacy Research: Current Literature and Future Opportunities. Faculty of Commerce-papers, University of Wollongong Research Online, Hong Kong, China. 2006. Available online: https://ro.uow.edu.au/commpapers/223/ (accessed on 6 November 2022).

- Binswanger, J.; Carman, K.G. How real people make long-term decisions: The case of retirement preparation. J. Econ. Behav. Organ. 2012, 81, 39–60. [Google Scholar] [CrossRef]

- Halim, A. Analisis Investasi, Penerbit PT; Salemba Emban Patria: Jakarta, Indonesia, 2005. [Google Scholar]

- Mawadah, S.; Ratno, F.A. Faktor-Faktor yang Mempengaruhi Minat Mahasiswa Menjadi Anggota KSPM UIN Walisongo Semarang dalam Perspektif Islam. J. Ekon. Dan Perbank. Syariah 2017, 8, 141–153. [Google Scholar] [CrossRef]

- Ajzen, I. The theory of planned behaviour. Organ. Behav. Hum. Decis. Proc. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Gopi, M.; Ramayah, T. Applicability of theory of planned behaviour in predicting intention to trade online: Some evidence from a developing country. Int. J. Emerg. Mark 2007, 2, 348–360. [Google Scholar] [CrossRef]

- Sondari, C.M.; Sudarsono, R. Using Theory of Planned Behaviour in Predicting Intention to Invest: Case of Indonesia. Int. Acad. Res. J. Bus. Technol. 2015, 1, 137–141. [Google Scholar]

- Triandis, H.C. Reflections on trends in cross-cultural research. J. Cross Cult. Psychol. 1980, 11, 35–58. [Google Scholar] [CrossRef]

- Armitage, C.J.; Conner, M. Efficacy of the theory of planned behaviour: A meta-analytic review. Br. J. Soc. Psychol. 2001, 40, 471–499. [Google Scholar] [CrossRef]

- Floyd, D.L.; Prentice-Dunn, S.; Rogers, R.W. A meta-analysis of research on protection motivation theory. J. Appl. Soc. Psychol. 2000, 30, 407–429. [Google Scholar] [CrossRef]

- Tornikoski, E.; Maalaoui, A. Critical reflections–The Theory of Planned Behaviour: An interview with Icek Ajzen with implications for entrepreneurship research. Int. Small Bus. J. 2019, 37, 536–550. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. The prediction of behavioural intentions in a choice situation. J. Exp. Soc. Psychol. 1969, 5, 400–416. [Google Scholar] [CrossRef]

- Nga, J.K.H.; Yong, L.H.L.; Sellappan, R.D. A study of financial awareness among youths. Young Consum. Insights Ideas Responsible Mark 2010, 11, 277–290. [Google Scholar]

- Sedais, K.I.; Al Shahab, O. The Impact of COVID-19 on the Banking Sector of Saudi Arabia. 2020. Available online: https://assets.kpmg/content/dam/kpmg/sa/pdf/2020/the-impact-of-covid-19-on-the-banking-sector-of-saudi-arabia.pdf (accessed on 1 November 2022).

- OECD. G20/OECD INFE Report on Adult Financial Literacy in G20 Countries. 2017. Available online: https://www.oecd.org/daf/fin/financial-education/G20-OECD-INFE-report-adult-financial-literacy-in-G20-countries.pdf (accessed on 8 September 2022).

- Alyahya, R.Y. Financial Literacy among College Students in Saudi Arabia. Master’s Thesis, The University of Queensland, Brisbane, Australia, 2017. [Google Scholar]

- Robb, A.; Sharpe, D.L. Effect of Personal Financial Knowledge on College Students’ Credit Card Behaviour. J. Financ. Couns. Plan. 2009, 40, 25–43. [Google Scholar]

- Wang, A. Interplay of investors’ financial knowledge and risk taking. J. Behav. Financ. 2009, 10, 204–213. [Google Scholar] [CrossRef]

- Khan, S. Impact of Financial Literacy, Financial Knowledge, Moderating Role of Risk Perception on Investment Decision. 2016. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2727890 (accessed on 1 November 2022).

- Lee, J.M.; Park, N.; Heo, W. Importance of subjective financial knowledge and perceived credit score in payday loan use. Int. J. Financ. Stud. 2019, 7, 53. [Google Scholar] [CrossRef]

- Hamza, N.; Arif, I. Impact of financial literacy on investment decisions: The mediating effect of big-five personality traits model. Mark. Forces. 2019, 14, 43–60. [Google Scholar]

- Fedorova, E.A.; Nekhaenko, V.V.; Dovzhenko, S.E. Impact of financial literacy of the population of the Russian Federation on behaviour on financial market: Empirical evaluation. Stud. Russ. Econ. Dev. 2015, 26, 394–402. [Google Scholar] [CrossRef]

- Sivaramakrishnan, S.; Srivastava, M.; Rastogi, A. Attitudinal factors, financial literacy, and stock market participation. Int. J. Bank Mark. 2017, 35, 818–841. [Google Scholar] [CrossRef]

- Rahies, M.K.; Khan, M.A.; Askari, M.; Ali, Q.; Shoukat, R. Evaluation of the Impact of Risk Tolerance and Financial Literacy on Investment Intentions of Securities Investors in Pakistan using the Theory of Planned Behaviour (TBP). Empir. Econ. Rev. 2022, 5, 104–137. [Google Scholar]

- Kautonen, T.; Van Gelderen, M.; Tornikoski, E.T. Predicting entrepreneurial behaviour: A test of the theory of planned behaviour. Appl. Econ. 2013, 45, 697–707. [Google Scholar] [CrossRef]

- Shapero, A.; Sokol, L. The social dimensions of entrepreneurship. In Encyclopedia of Entrepreneurship; Prentice-Hall: Englewood Cliffs, NJ, USA, 1982; pp. 72–90. [Google Scholar]

- Ferreira, A.D.S.M.; Loiola, E.; Gondim, S.M.G.; Pereira, C.R. Efects of entrepreneurial competence and planning guidance on the relation between university students’ attitude and entrepreneurial intention. J. Entrep. 2022, 31, 7–29. [Google Scholar] [CrossRef]

- Ajzen, I. Attitudes, Personnality and Behaviour, 2nd ed.; Open University Press: New York, NY, USA, 2005. [Google Scholar]

- Krosnick, J.A.; Petty, R.E. Attitude strength: An overview. In Attitude Strength: Antecede and Consequences; Psychology Press: London, UK, 1995; Volume 1, pp. 1–24. [Google Scholar]

- Jorgensen, B.L.; Savla, J. Financial literacy of young adults: The importance of parental socialization. Fam. Relat. 2010, 59, 465–478. [Google Scholar] [CrossRef]

- Sang, L.T. An Investigation of the Level and Determinants of Financial Literacy among Different Groups in Sabah; Universiti Malaysia Sabah: Kota Kinabalu, Malaysia, 2014. [Google Scholar]

- Mueller, S.L. Gender gaps in potential for entrepreneurship acrosss countries and cultures. J. Dev. Entrep. 2004, 9, 199–220. [Google Scholar]

- Gelderen, M.V.; Brand, M.; Praag, M.V.; Bodewes, W.; Poutsma, E.; Gils, A.V. Explaining Entrepreneurial Intentions by Means of the Theory of Planned Behaviour. Career Dev. Int. 2008, 13, 538–559. [Google Scholar] [CrossRef]

- Al-Tamimi, H.A.H. Financial literacy and investment decisions of UAE investors. J. Risk Finan. 2009, 10, 500–516. [Google Scholar] [CrossRef]

- Ajzen, I. Behavioural Interventions Based on the Theory of Planned Behaviour. 2006. Available online: http://people.umass.edu/aizen/pdf/tpb.intervention.pdf (accessed on 1 November 2022).

- Agarwalla, S.K.; Barua, S.K.; Jacob, J.; Varma, J.R. Financial Literacy among Working Young in Urban India; Indian Institute of Management Ahmedabad: Gujarat, India, 2013. [Google Scholar]

- Ali, M.A.S.; Ammer, M.A.; Elshaer, I.A. Determinants of Investment Awareness: A Moderating Structural Equation Modeling-Based Model in the Saudi Arabian Context. Mathematics 2022, 10, 3829. [Google Scholar] [CrossRef]

- Ajzen, I.; Fishbein, M. Understanding Attitudes and Predicting Social Behaviour; Prentice-Hall: Englewood Cliffs, NJ, USA, 1980. [Google Scholar]

- Venkatesh, V.; Davis, F.D. A theoretical extension of the technology acceptance model: Four longitudinal field studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef]

- Fu, J.-R.; Farn, C.-K.; Chao, W.-P. Acceptance of electronic tax filing: A study of taxpayer intentions. Inf. Manag. 2006, 43, 109–126. [Google Scholar] [CrossRef]

- Hapsari, S.A. The Theory of Planned Behaviour and Financial Literacy to Analyze Intention in Mutual Fund Product Investment. In Proceedings of the 5th Global Conference on Business, Management and Entrepreneurship (GCBME 2020), Bandung, Indonesia, 8 August 2020; Atlantis Press: Amsterdam, The Netherlands, 2020; Volume 187. [Google Scholar]

- Ajzen, I. Constructing a Theory of Planned Behaviour Questionnaire. 2006. Available online: http://people.umass.edu/aizen/pdf/tpb.measurement.pdf (accessed on 1 November 2022).

- Henderson, R.; Robertson, M. Who wants to be an Entrepreneur? Young Adult Attitudes to Entrepreneurship as a Career. Career Dev. Int. 2000, 5, 279–287. [Google Scholar]

- Sahni, A. Incorporating perceptions of financial control in purchase prediction: An empirical examination of the theory of planned behaviour. Adva. Cons. Res. 1994, 21, 442–448. [Google Scholar]

- Rutherford, L.; DeVaney, S.A. Utilizing the theory of planned behaviour to understand convenience use of credit cards. J. Financ. Couns. Plan. 2009, 20, 48–63. [Google Scholar]

- Ajzen, I. From intentions to actions: A theory of planned behaviour. In Action Control; SSSP Springer Series in Social Psychology; Kuhl, J., Beckmann, J., Eds.; Springer: Berlin/Heidelberg, Germany, 1985; pp. 11–39. [Google Scholar]

- Schmidt, N. What Drives Investments into Mutual Funds? Applying the Theory of Planned Behaviour to Individual’s Willingness and and Intention to Purchase Mutua Funds; Otto Beinsheim School of Management: Vallendar, Germany, 2010. [Google Scholar]

- O’Connor, E.L.; White, K.M. Willingness to trial functional foods and vitamin supplements: The role of attitudes, subjective norms, and dread of risks. Food Qual. Prefer. 2010, 21, 75–81. [Google Scholar] [CrossRef]

- Ramayah, T.; Yusoff, Y.M.; Jamaludin, N.; Ibrahim, A. Applying the theory of planned behaviour (TPB) to predict internet tax filing intentions. Int. J. Manag. Rev. 2009, 26, 272–284. [Google Scholar]

- Phan, C.K.; Zhou, J. Vietnamese individual investors’ behaviour in the stock market: An exploratory study. Int. J. Soc. Sci. Manag. 2014, 3, 46–54. [Google Scholar]

- Ali, A. Predicting individual investors’ intention to invest: An experimental analysis of attitude as a mediator. Int. J. Humanit. Soc. Sci. 2011, 6, 876–883. [Google Scholar]

- Sheeran, P.; Taylor, S. Predicting intentions to use condoms: A meta-analysis and comparison of the theories of reasoned action and planned behaviour. J. Appl. Soc. Psychol. 1999, 29, 1624–1675. [Google Scholar] [CrossRef]

- Reyhanloo, T.; Baumgartner, S.; Haeni, M.; Quatrini, S.; Saner, P.; Lindern, E.V. Private-sector investors’ intention and motivation to invest in land degradation neutrality. PLoS ONE 2018, 13, e0208813. [Google Scholar] [CrossRef] [PubMed]

- Raut, R.K.; Das, N.; Kumar, R. Individual investors’ intention towards SRI in India: An implementation of the theory of reasoned action. Soc. Responsib. J. 2020, 17, 877–896. [Google Scholar] [CrossRef]

- Adam, A.A.; Shauki, E.R. Socially responsible investment in Malaysia: Behavioural framework in evaluating investors’ decision-making process. J. Clean. Prod. 2014, 80, 224–240. [Google Scholar] [CrossRef]

- Raut, R.K.; Das, N.; Kumar, R. Extending the theory of planned behaviour: Impact of past behavioural biases on the investment decision of Indian investors. Asian J. Bus. Account. 2018, 11, 265–291. [Google Scholar] [CrossRef]

- Akhtar, F.; Das, N. Predictors of investment intention in Indian stock markets: Extending the theory of planned behaviour. Int. J. Bank Mark. 2018, 37, 97–119. [Google Scholar] [CrossRef]

- Kidwell, B.; Jewell, R.D. The motivational impact of perceived control on behavioural intentions. J. Appl. Soc. Psychol. 2010, 40, 2407–2433. [Google Scholar] [CrossRef]

- Ibrahim, Y.; Arshad, I. Examining the impact of product involvement, subjective norm and perceived behavioural control on investment intentions of individual investors in Pakistan. Investig. Manag. Financ. Innov. 2018, 14, 181–193. [Google Scholar] [CrossRef]

- Wang, W.T.; Ou, W.M.; Chen, W.Y. The impact of inertia and user satisfaction on the continuance intentions to use mobile communication applications: A mobile service quality perspective. Int. J. Inf. Manag. 2019, 44, 178–193. [Google Scholar] [CrossRef]

- Mahastanti, L.A.; Hariady, E. Determining the factors which affect the stock investment decisions of potential female investors in Indonesia. Int. J. Process. Manag. Benchmarking 2014, 4, 186–197. [Google Scholar] [CrossRef]

- Khan, M.A.; Shah, N.H.; Hussain, A.; Hussain, J.; Khan, M.; Khan, A. The Effect of Financial Knowledge on Financial Behavioural Intention to Invest: Mediating Role of Risk Perception and Attitude. Linguist. Antverp. 2021, 43, 1212–1224. [Google Scholar]

- Mulyono, K.B. Decision Model for Saving Stocks Based on TPB and Financial Literacy. J. Dinamika Manaj. Pendidik. 2021, 16, 94–102. [Google Scholar] [CrossRef]

- Lajuni, N.; Bujang, I.; Karia, A.A.; Yacob, Y. The role of educators and the influence of financial behaviour on personal financial distress among undergrad students of public universities in Sabah, Malaysia. IJEPC 2017, 2, 121–130. [Google Scholar]

- Putri, D.N.; Wijaya, C. Analysis of Parental Influence, Peer Influence, and Media Influence Towards Financial Literacy at University of Indonesia Students. SSRG Int. J. Humanit. Soc. Sci. 2020, 7, 66–73. [Google Scholar]

- Mpaata, E.; Koskei, N.; Saina, E. Financial literacy and saving behaviour among micro and small enterprise owners in Kampala, Uganda: The moderating role of social influence. JEFAS 2020, 2, 22–34. [Google Scholar]

- Zhao, H.; Seibert, S.E.; Hills, G.E. The mediating role of self-efficacy in the development of entrepreneurial intentions. J. Appl. Psychol. 2005, 90, 1265–1272. [Google Scholar] [CrossRef]

- Lu, X.; Xiao, J.; Wu, Y. Financial literacy and household asset allocation: Evidence from micro-data in China. J. Consum. Aff. 2021, 55, 1464–1488. [Google Scholar] [CrossRef]

- Biljanovska, N.; Palligkinis, S. Control thyself: Self-control failure and household wealth. J. Bank Financ. 2018, 92, 280–294. [Google Scholar] [CrossRef]

- Yitzhaki, S.; Lambert, P.J. Is higher variance necessarily bad for investment? Rev. Quant. Financ. Acc. 2014, 43, 855–860. [Google Scholar] [CrossRef]

- Roundy, P.; Holzhauer, H.; Dai, Y. Finance or philanthropy? Exploring the motivations and criteria of impact investors. Soc. Responsib. J. 2017, 13, 491–512. [Google Scholar] [CrossRef]

- Ainia, N.S.N.; Lutfi, L. The influence of risk perception, risk tolerance, overconfidence, and loss aversion towards investment decision making. J. Econ. Bus. Account. Ventur. 2019, 21, 401–413. [Google Scholar] [CrossRef]

- Krueger, N., Jr.; Dickson, P.R. How believing in ourselves increases risk taking: Perceived self-efficacy and opportunity recognition. Decis. Sci. 1994, 25, 385–400. [Google Scholar] [CrossRef]

- Elshaer, I.A.; Sobaih, A.E.E. I Think I Can, I Think I Can: Effects of Entrepreneurship Orientation on Entrepreneurship Intention of Saudi Agriculture and Food Sciences Graduates. Agriculture 2022, 12, 1454. [Google Scholar] [CrossRef]

- Azhar, Z.; Azilah, N.; Syafiq, A. Investment awareness among young generation. In International Conference on Business and Management Research; Atlantis Press: Amsterdam, The Netherlands, 2017; pp. 126–135. [Google Scholar]

- Ajzen, I. The theory of planned behaviour: Frequently asked questions. Hum. Behav. Emerg. Technol. 2020, 2, 314–324. [Google Scholar] [CrossRef]

- Hyrsky, K.; Tuunanen, M. Innovativeness and risk-taking prospensity: A cross-cultural study of Finnish and US entrepreneurs and small business owners. Liiketal. Aikakauskirja 1999, 43, 238–256. [Google Scholar]

- Leguina, A. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Int. J. Res. Method Educ. 2015, 38, 220–221. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage: Thousand Oaks, CA, USA, 2016. [Google Scholar]

- Henseler, J.; Ringle, C.M.; Sinkovics, R.R. The Use of Partial Least Squares Path Modeling in International Marketing. In Advances in International Marketing; Sinkovics, R.R., Ghauri, P.N., Eds.; Emerald Group Publishing Limited: Bingley, UK, 2009; Volume 20, pp. 277–319. [Google Scholar] [CrossRef]

- Chin, W.W. The Partial Least Squares Approach for Structural Equation Modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial Least Squares Structural Equation Modeling. In Handbook of Market Research; Homburg, C., Klarmann, M., Vomberg, A., Eds.; Springer: Cham, Switzerland, 2017. [Google Scholar] [CrossRef]

- Cassell, M.A.; Blake, R.J. Analysis of Hofstedes 5-D model: The implications of conducting business in Saudi Arabia. Int. J. Manag. Inf. Syst. (IJMIS) 2012, 16, 151–160. [Google Scholar] [CrossRef]

- Aliedan, M.M.; Elshaer, I.A.; Alyahya, M.A.; Sobaih, A.E.E. Influences of University Education Support on Entrepreneurship Orientation and Entrepreneurship Intention: Application of Theory of Planned Behaviour. Sustainability 2022, 14, 13097. [Google Scholar] [CrossRef]

- Ayad, T.; Sobaih, A.E.E.; Elshaer, I.A. University Incubator Support and Entrepreneurial Intention among Tourism Graduates: Mediating Role of Personal Attitude. Sustainability 2022, 14, 16045. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).