1. Introduction

Dating back to the 1980s, in the seminal work of [

1] (Equations II.1–II.8), the excess return of a security, also known as its risk premium, has been prescribed as proportional to powers of the volatility. Specifically, three models were proposed, all presented in terms of the market price of risk (MPR) —that is, technically the ratio of the excess return and the volatility of the security. The first model, type I, assumed an MPR proportional to volatility (i.e., power

). This model implies that each risk factor earns a risk premium that is proportional to the variance of the factor’s return. The second and the third models (types II and III) postulate constant MPR (i.e., power 0 on variance) and constant excess return (i.e., power

on variance, inversely proportional to volatility), respectively. These models have been widely used in the literature; see [

2,

3,

4] for examples involving stochastic volatility (SV), stochastic interest, and jumps.

The specification of MPRs play a very important role in expected utility portfolio optimization. In this context, ref. [

5] solved the portfolio optimization problem for MPR of types I and II, in a setting of CRRA (power) utility, in an incomplete market with finite horizon for the Heston model (also known as the 1/2 model). Ref. [

6] considered the optimal investment and consumption problem in an incomplete market for the 3/2 model of [

7] with Epstein–Zin–Weil recursive utility and an infinite horizon, which implies a value function independent of time. In particular, the authors considered two forms of excess return —constant and linear in the variance (i.e., the MPRs of types I and III). Nevertheless, the exact solution is only available when the agent’s elasticity of intertemporal substitution is one with constant excess return (type III). For all other cases, the solutions are approximations.

Our paper presents the very first closed-form analysis for type I MPR on the recently proposed 4/2 model (see [

8]) with a finite horizon, consumption, and complete markets. This leads, as a by-product, to the first analysis of type I MPR on the 3/2 model. We incorporate several ingredients of interest to practitioners in an EUT setting: complete markets (incomplete market solutions follow trivially from our setting), consumption and terminal wealth, and ambiguity aversion.

Two recent studies have been conducted on the 4/2 model under MPRs outside of the settings in [

1], while excluding consumption in their analyses. First, ref. [

9] explored the optimal investment problem for a risk-averse investor in both incomplete and complete market in the absence of consumption. The authors employed the same MPR for the 1/2 and 3/2 components —proportional to

, the driver of variance. This means that the Heston component follows the type II MPR in [

5], whereas the 3/2 component follows type I MPR in [

6]. Second, the work of [

10] considered an investor that is not only risk-averse, but also ambiguity-averse.

Solving the optimal consumption and asset allocation with the advanced 4/2 model for a type I MPR is challenging. The fact that our closed-form solutions are non-affine is proof of this challenge and an important departure from the exiting literature. When the MPR is proportional to a 4/2-structured volatility, the risk premium/excess return is proportional to the variance, . This means that there are nonlinear elements in the drift of the equity, which jeopardizes affine solutions and the solvability of the implied partial differential equations (PDEs) in the corresponding Hamilton–Jacobi–Bellman (HJB) and HJB Isaacs (HJBI) equations.

The contributions of our work are as follows:

We conduct the first risk-averse, expected utility analysis in the presence of consumption for the non-affine class of SV models known as 4/2, under the preferable setting of MPR proportional to variance (type I). Our closed-form solutions, see Propositions 2, are of a non-affine nature, requiring confluent hypergeometric functions. As a by-product, we produce the very first closed-form portfolio analysis for the 3/2 model for finite horizons.

We extend the solutions described above to an ambiguity-averse investor, leading to the very first related analyses for the 4/2 and 3/2 models, see Proposition 3. In all cases, we consider complete markets, providing conditions for well-defined solutions under the assumption of existence, and proper changes of measure.

For a risk-averse investor, in a complete market, we illustrate the differences between the 4/2 model and the popular embedded cases of the 1/2 (Heston) and 3/2 models. On the one hand, the 4/2 and 1/2 models recommend similar levels of consumption and exposure. On the other hand, the 3/2 leads to 20% or higher levels of consumption and absolute exposures (see

Figure 1,

Figure 2,

Figure 3,

Figure 4,

Figure 5 and

Figure 6).

The difference in terms of exposures is exacerbated when considering an ambiguity-averse investor in a complete market. In such case, the 3/2 model performance could double absolute exposures compared to the 1/2 and 4/2 models (see

Section 5.1).

This paper contains five sections.

Section 2 describes the 4/2 model under consideration and the derivatives needed in the portfolio.

Section 3 presents and solves the consumption and terminal wealth expected utility problem for a risk-averse investor.

Section 3.1 focuses on the complete market case.

Section 4 then extends the problematic to an ambiguity-averse investor, with a section on complete markets (

Section 4.1).

Section 5 studies and implements the top three main cases numerically. First,

Section 5.1 analyses a risk-averse investor in a complete market with consumption. Second,

Section 5.2 studies an ambiguity-averse complete market investor with no consumption. Finally,

Section 6 provides conclusions. All proofs are provided with details in a complementary

Appendix A.

2. Description of the Model

The stochastic processes in the financial market are defined on a complete probability space

with a right-continuous filtration

. The price process

of the risky asset follows the 4/2 model described next:

where

drives the variance, and it follows a CIR with mean-reversion rate

. The long-run mean is captured by

, and the volatility of volatility is denoted

. The Feller condition (i.e.,

) is imposed to ensure the process

is strictly positive. The standard Brownian motions (BMs)

in dynamic of risky asset

and

in the dynamic of variance driver

are correlated with parameter

. Thus, we will write

, where

is another standard BM, independent of

. The variance, denoted by

is given as follows:

This setting implies market prices of risk with the following representation:

where

,

a and

b are positive constants,

and

are constant. The process

represents the market price of variance risk, and

is the market price of stock risk. Moreover,

can be understood as the market price of stock idiosyncratic risk (i.e., with respect to

). Note that in this form of market price of risk, the excess return of the risky asset is proportional to its variance, as recommended in the economics literature; see [

1] Equation (II.6), type I. As for the market price of variance risk

, we use Ito’s lemma to create the process of the variance:

Hence, our choice of market price of variance risk is

. That is, it is proportional to the volatility of the asset. This is similar to the proposal in [

2].

As pointed out by [

8], a risk-neutral measure may not exist in the 4/2 model. This is inherited from the embedded 3/2 model [

11]. This implies that the discounted asset price process may be a strict

-local martingale. Thus, we explore the topic of changing measures under the market price of risk introduced in Equation (

4).

In the next proposition, we find parametric conditions for the existence of a valid risk-neutral measure

, which follows [

9,

12]. These conditions will be assumed throughout this paper.

Proposition 1. The change of measure is well defined under the following conditions: Furthermore, we assume the investor can also allocate on a financial derivative on the underlying. Let

denote the price of the option. Using multivariate Ito’s lemma, it can be shown that the option price evolves with the stochastic differential equation (SDE):

where

, and

capture the partial derivatives of the option price,

m, with respect to

and

. Equations (

1), (

2), and (

7) are considered as the reference model.

3. Portfolio Optimization under EUT

We consider that the investor exhibits CRRA utility for both intermediate consumption and terminal wealth with the same risk-aversion level

. That is, we define the utility functions for consumption and for terminal wealth (abusing notation slightly):

where coefficients

and

are non-negative. The ratio

indicates the relative importance of intermediate consumption and terminal wealth, and it thus affects decision-making (optimal strategy). Without loss of generality, we can set

, and let

determine the relative importance ratio.

The objective of the investor is to maximize their utility from intermediate consumption

and terminal wealth

; therefore, the reward functional for the investor is defined as follows:

where

is a discount rate,

is a control variable to be clarified in the next section, and the goal is

where

is the value function and the space

of admissible controls

with

,

, is the set of feedback strategies that satisfy standard conditions (see [

13]).

3.1. Complete Market Analysis

Let

be the fraction of wealth invested in the stock,

be the fraction of wealth invested in the option that follows dynamic (

7),

be the portion of wealth invested in the money account, and

the consumption at time

t. The wealth

of the investor follows the SDE:

where we have assumed the money market account evolves as

, and

For simplicity of presentation, we will drop the subindex t in .

Under Bellman principle, the value function satisfies the HJB equation:

with boundary condition

. In our notation,

,

,

,

,

, and

represent first and second partial derivatives of

with respect to

t,

x, and

v.

We conjecture that our value function can be represented as follows:

where

for all

v. This conjecture leads to the following PDE for

h:

where

,

:

×

⟶

are measurable functions, and

Details of this calculation can be found in

Appendix A.2. Next, we provide the solution to the HJB equation.

Proposition 2 (4/2 model in complete market)

. Let us define

If the parameters satisfy the conditions in Proposition 1 and the following three conditions:then the candidate solution of the HJB Equation (13) is well defined and has the representation (14), withwhere ():where denotes the hypergeometric confluent (see [14]) function, with Moreover the optimal consumption–wealth ratio, and variance–stock exposures are given by It should be noted that, in case of no consumption, we can assume a simpler value function representation:

and solving the maximization problem in (

13), we obtain

Nonetheless as

, the nonlinear term

cannot be eliminated in the PDE for

, thus rendering a closed-form solution impossible under the 4/2 SV model. Moreover, a closed-form solution is available in [

15] (Example 1) for stock prices following the 1/2 SV model in a complete market without ambiguity.

4. Robust Consumption Portfolio Optimization under EUT

The investor, in our problem, is uncertain about the probability distribution for the reference model. He/She considers a set of plausible, alternative models when making investment decisions. In particular, the investor is uncertain about the distribution function of and .

Let

be an

-valued

-progressively measurable process. Let us define the Radon–Nikodym derivative process by

According to Girsanov’s theorem, the process

is a Wiener process under probability measure

. Here,

denotes the set of all

-progressively measurable processes. In this set, the process (

25) is a well-defined Radon–Nikodym derivative process. This representation of model uncertainty allows for uncertainty on the drift of diffusion risk factors of the stock and its variance’s driver (i.e.,

and

, respectively).

The alternative model follows:

The reward functional can be defined as in the previous section for a given probability measure

:

In the presence of a preference for robustness, the investor’s objective is to minimize the penalty term and maximize his utility from intermediate consumption

and terminal wealth

:

where

is the value function, and the last two terms serves as the penalty term for deviating too far from the reference model. The space

of

-adapted process

, is the set of perturbations; the space

of admissible controls

(i.e.,

,

) is the set of feedback-admissible strategies. The perturbations

and

are scaled by

and

, respectively. That is, the larger the values of

and

. One can notice that the smaller the penalties for deviating from the reference model, the more uncertain the investor is about the model. Following [

16], we assume

where

denotes the ambiguity-aversion parameters. In this specification, the optimal strategy is independent of the current wealth level for a CRRA utility investor, see [

16]. Furthermore,

can be interpreted as ambiguity aversion regarding the volatility driver, while

represents ambiguity about the stock process.

4.1. Complete Market Analysis

Let

be the fraction of wealth invested in the stock,

be the fraction of wealth invested in the option, and

be the remaining portion of wealth invested in the money account, while

is consumption at time

t. The wealth

follows the process

where

That is, if we can find wealth exposures

and

to the fundamental risk factors

and

, the corresponding wealth weights

and

can also be obtained. The value function satisfies the HJBI (robust) equation:

with boundary condition

. Similarly to

Section 3.1, after solving the first order conditions, we conjecture a value function as follows:

where

for all

v. This leads to the following PDE for

:

Details of this calculation can be found in

Appendix A.3. In order to find a solution we need to eliminate the term

, which means

By setting

, and rearranging terms, we obtain

where

Next, we present the main result of the section.

Proposition 3 (4/2 model in complete market, robustness)

. Letand (condition (

36)

). Assume , μ, and ν satisfy conditions (

18)

and Proposition 1. Then, the solution of the HJBI Equation (

33)

is , and solves the PDE in Equation (

37)

and admits the representationwhere , and follows from Equation (21) with associated m, D, β, and K. Moreover, the optimal consumption–wealth ratio, and variance–stock exposures are given by The worst case measure is determined by The previous result can be seen as a generalization of Proposition 2 by setting . It should be noted that the closed-form solution does not support ambiguity-aversion or uncertainty on the variance driver (i.e., must be zero). Conditions on the parametric space are provided next, to ensure that the optimal change of measure is well-defined in the complete market.

Proposition 4. The optimal Radon–Nikodym in the complete market is a well-defined density, under the following parameter conditions:where , and . Important solutions can be produced in the absence of consumption. In this case, the candidate for the solution of HJBI Equation (

33) is

, where

solves the PDE

with

The main result is reflected in the next proposition.

Proposition 5 (4/2 model in complete market, robustness, no consumption)

. Let

Assume correct , andwhile μ, and ν satisfy conditions (

18)

and Proposition 1. Then, , and has the representation where , and is the same as Equation (

21)

with associated m, D, β, and K. Moreover, correct the optimal variance–stock exposures are given by The correct worst case measure is determined by In contrast to a solution in the presence of consumption (Proposition 3), here we can entertain non-zero ambiguity-aversion on variance () and stock (), which provides a window into the impact of ambiguity-aversion in general.

5. Numerical Analysis

This section is divided into three subsections corresponding to the two most important contributions of this paper. First,

Section 5.1 presents the findings of closed-form solutions to a complete market with consumption (from

Section 3.1). Second,

Section 5.2 presents the solution to complete markets for ambiguity-averse investors (from

Section 4.1).

Note that we cannot use the estimation results of the “drift group” from [

9] due to the new choice of MPR for 4/2 and 3/2 models. To accommodate to our choice of MPR, we re-estimate the rate of market price of risk

for each model by fixing the excess return at

(long-term value), in line with [

9]. Then, we follow the procedure of [

9] and substitute

into the regression to update

for each model. The estimation results and the other baseline parameters are presented in

Table 1 and

Table 2, respectively. In this section, we set

, and solve for

for each model according to the relationship

.

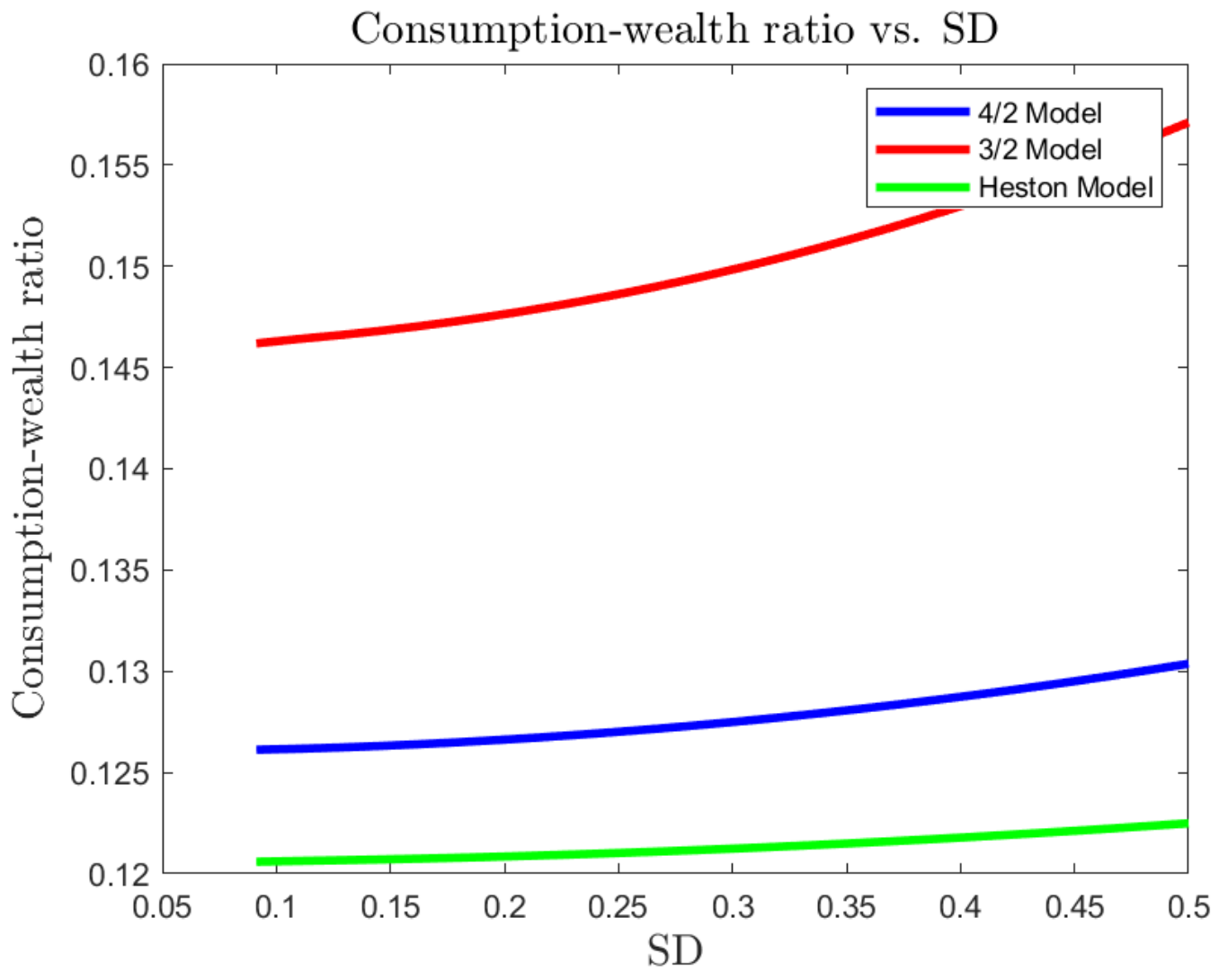

5.1. Complete Market Analysis with Consumption

Figure 1,

Figure 2 and

Figure 3 present the optimal consumption–wealth ratio

as a function of standard deviation (SD), investment horizon

T, and risk-averse level

, respectively. Intuitively, the optimal consumption–wealth ratio is related to the state of the economy. All models recommend an increase in consumption in a highly volatile economic state. In particular, the 4/2 model slightly recommends more consumption than the Heston model, while the 3/2 model suggests at least 20% more consumption. This behaviour of the 3/2 model may be explained by its excess return (i.e.,

), which decreases with the increase in

. That is, the more volatile the market, the less excess return the 3/2 investor may obtain from investing in a risky asset. As a result, the investor may allocate his wealth into consumption to obtain higher utility.

On correct the other hand, both the Heston and 4/2 models compensate the investor with higher excess return if the market becomes more risky. Hence, only a small portion of wealth is shifted from investing in risk assets into consumption. In general, the 3/2 model always implies the most wealth exposures, while the 4/2 model lies in between, closer to the conservative Heston model but with higher sensitivity to the changes in market conditions (SD), and risk-averse level .

Figure 3.

vs. the figures shall not be modified, it would take a few weeks more of work. .

Figure 3.

vs. the figures shall not be modified, it would take a few weeks more of work. .

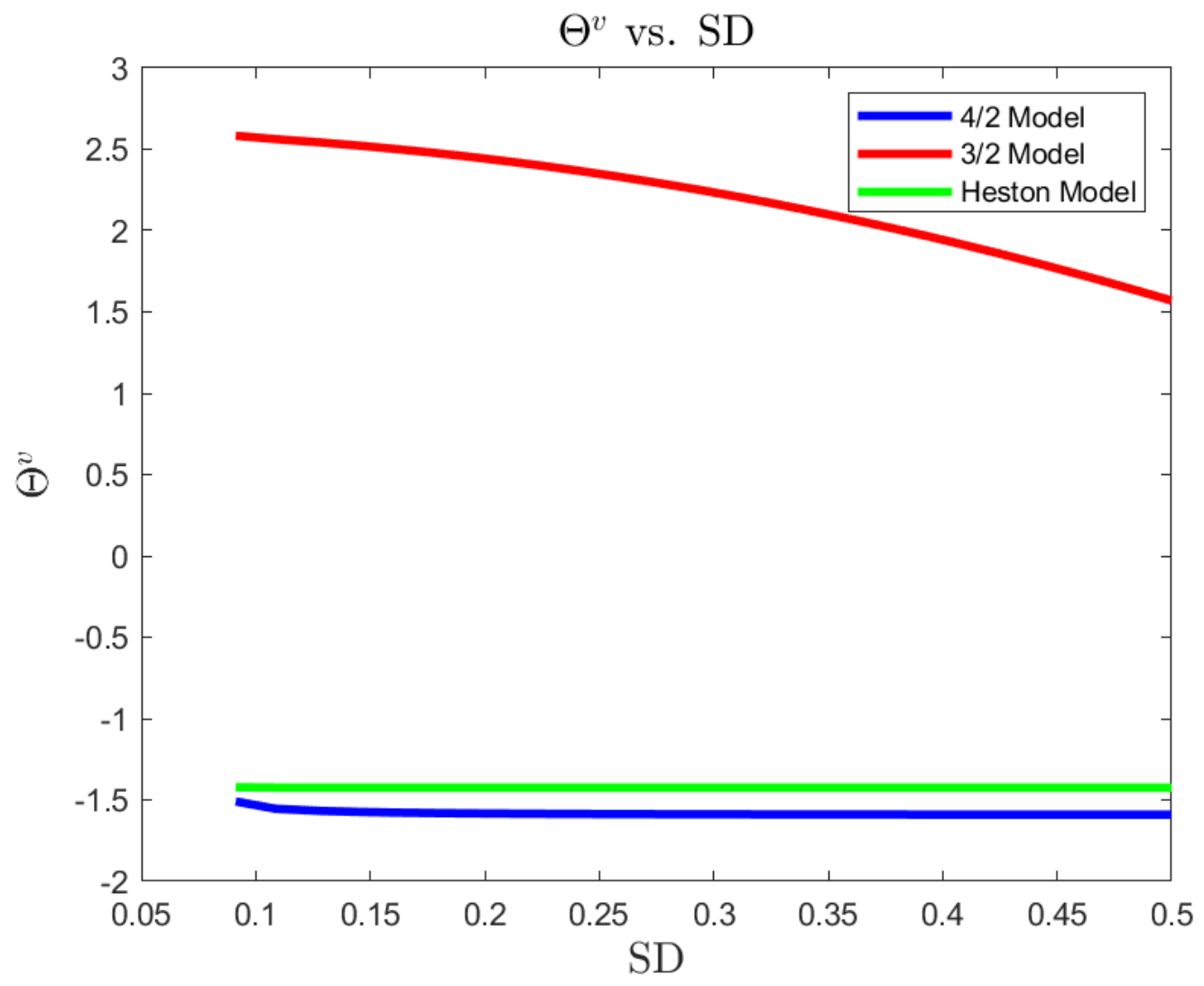

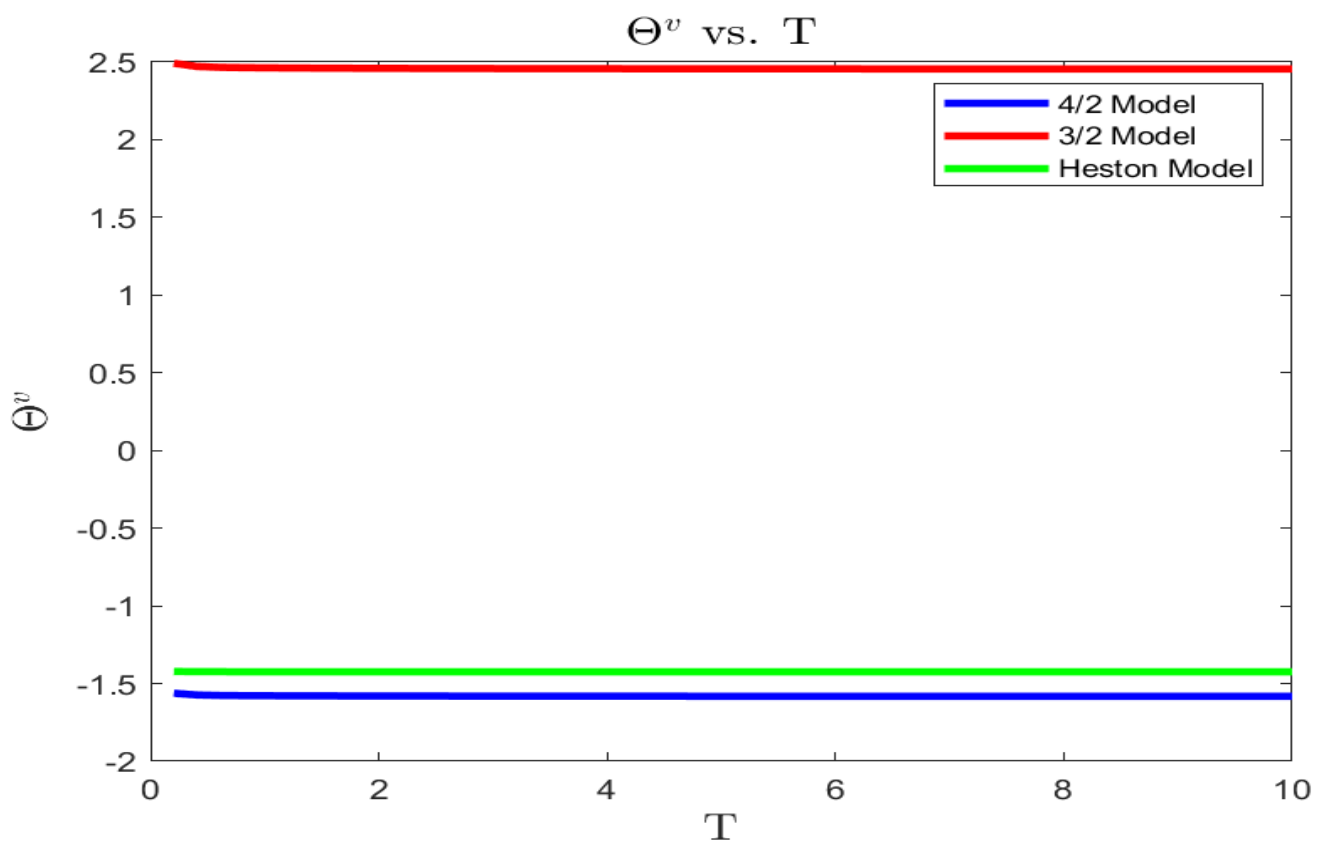

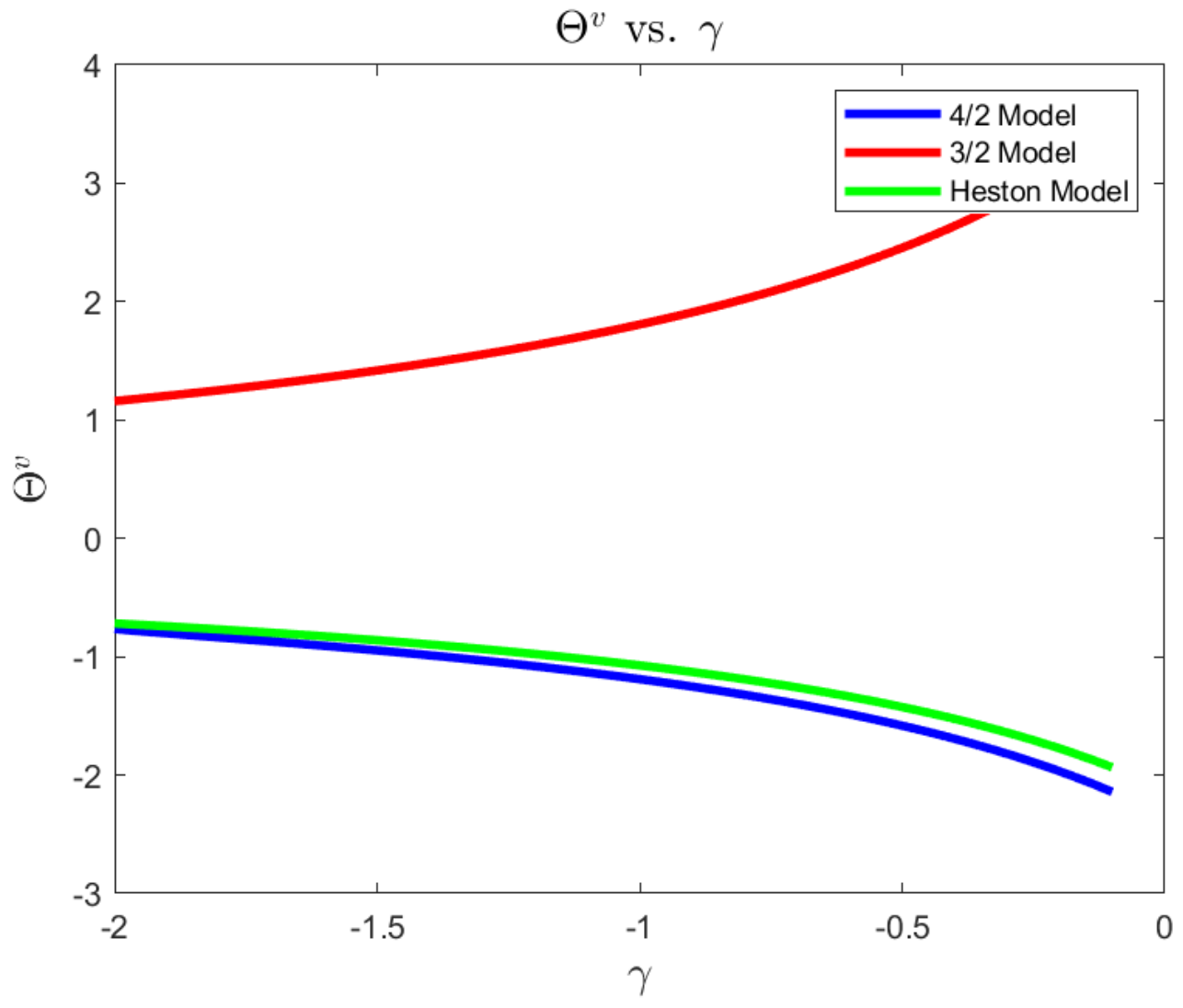

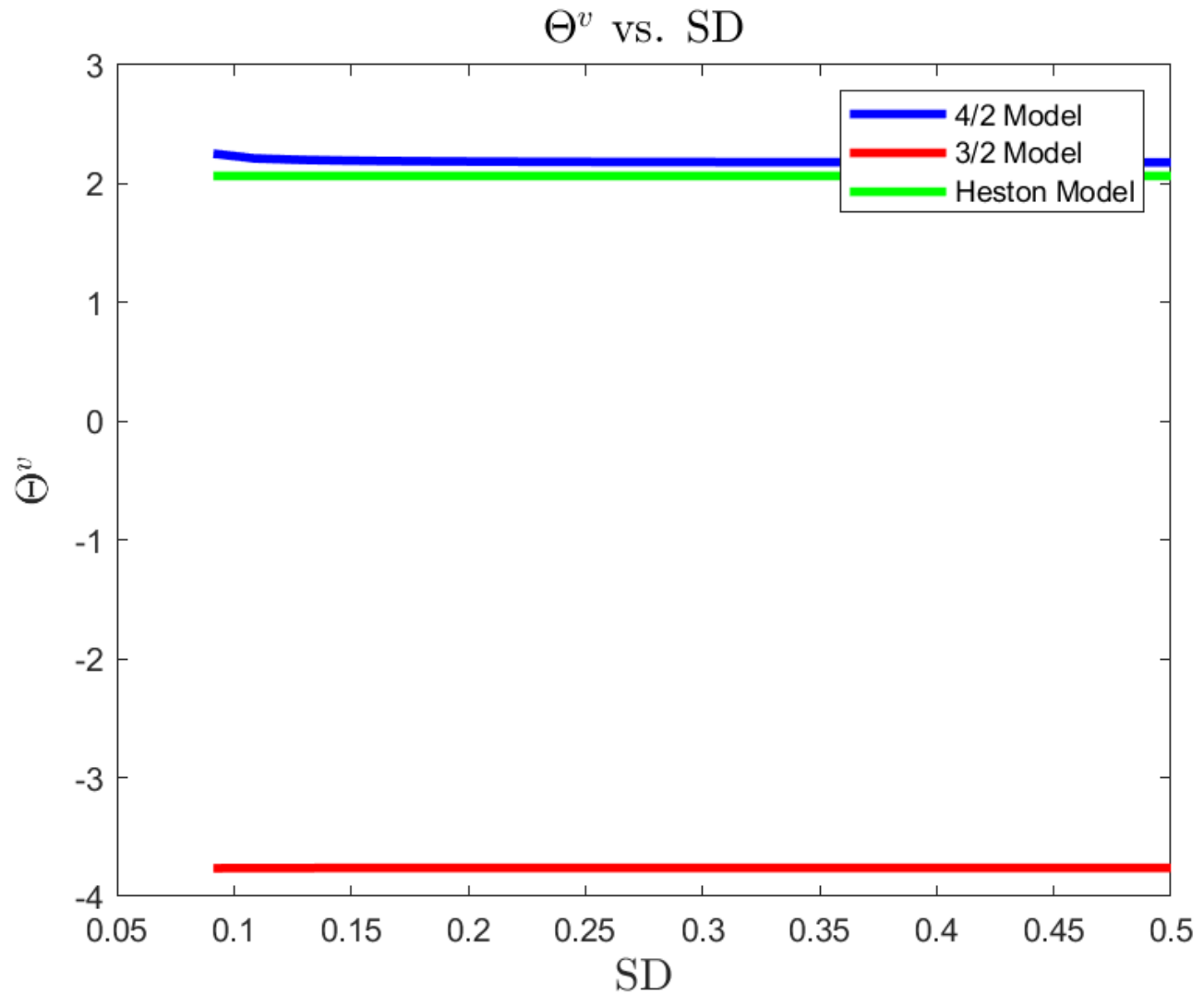

Figure 4,

Figure 5 and

Figure 6 present the plots of the optimal wealth exposure to variance driver’s risk

as a function of SD, investment horizon

T, and risk-averse level

, respectively. In contrast to the 3/2 model, the exposures to variance driver’s risk under the Heston and 4/2 models are insensitive to the changes in market conditions. That is, both the Heston and 4/2 models suggest a constant level of total wealth exposure to variance risk. However, the 3/2 model disinvests the risk of variance driver as the market gets into a highly volatile state, which can be understood as decreasing the holding on the asset associated with less excess return.

The correct positiveness of the wealth exposures among models may be explained by the correlation

between the risk factors of asset price and its variance driver for each model. Moreover, all three models recommend a constant level of wealth exposure in terms of investment horizon, as shown in

Figure 5. Furthermore, if the investor is less risk-averse, all the three models suggest more aggressive wealth exposure in the absolute sense.

The plot of optimal wealth exposure to stock’s risk

versus risk-averse level

is given in

Figure 7. As we expect, less risk-averse investors allocate more wealth to stocks.

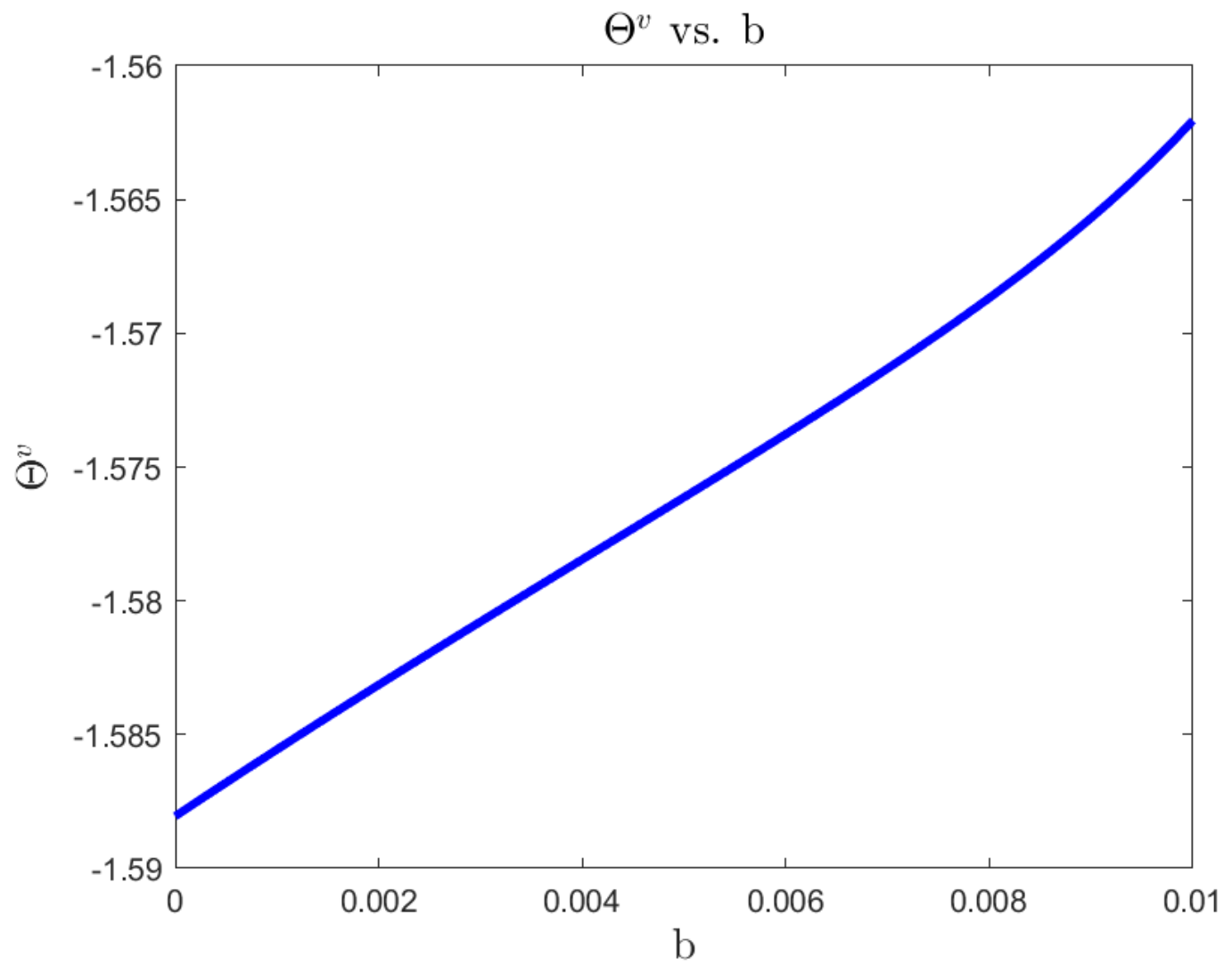

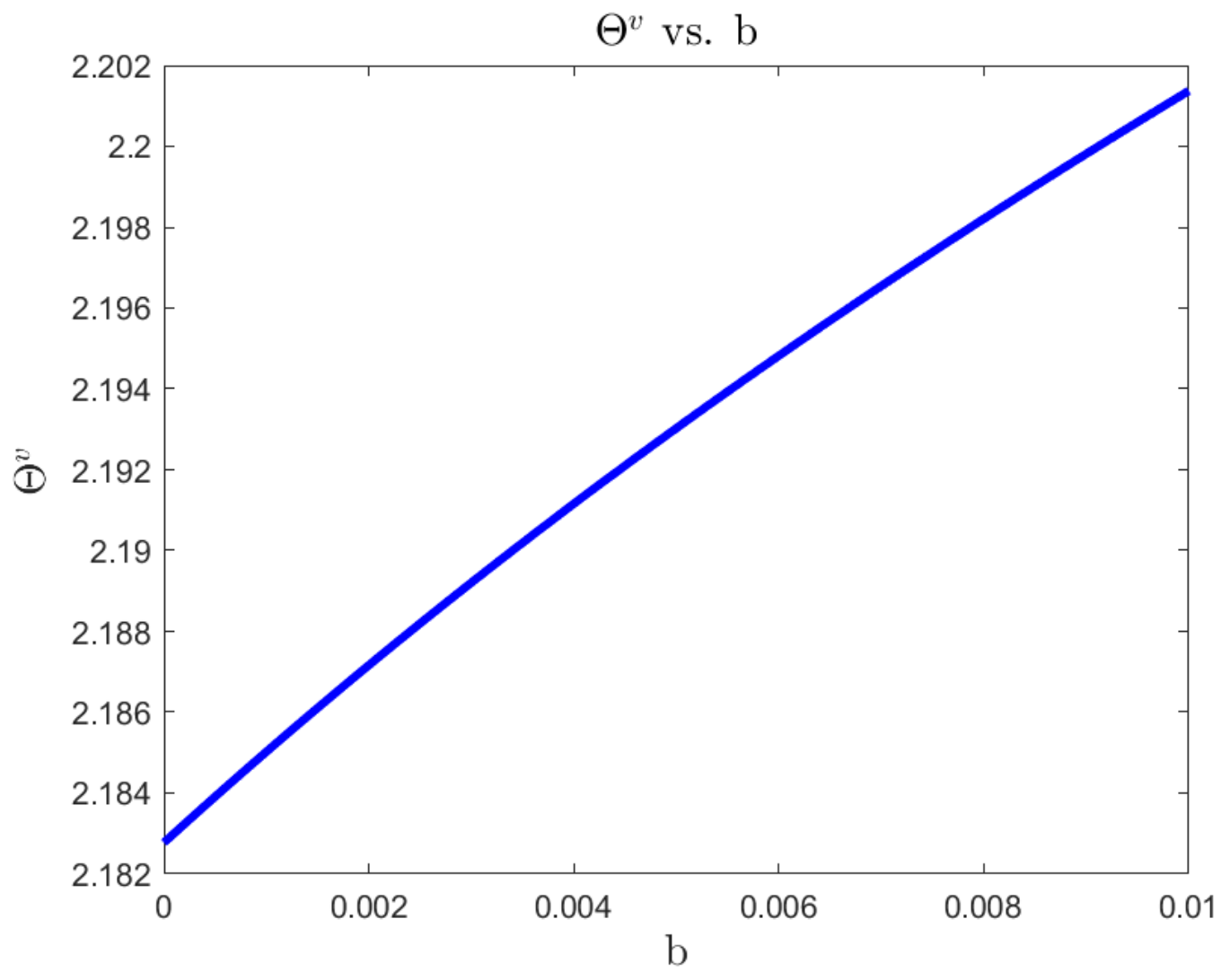

The correct sensitivity analysis of parameters

a,

b on the optimal consumption–wealth ratio

and optimal wealth exposure

with the 4/2 model are explored in

Figure 8,

Figure 9,

Figure 10 and

Figure 11, respectively. Although the 3/2 model behaves differently from the Heston model from our previous observation, the consumption–wealth ratio trends seem dominated by

b (i.e., more sensitivity to

b), while the wealth exposure

is dominated by the 1/2 component (i.e., more sensible to changes in

a).

5.2. Complete Market Analysis without Consumption for Ambiguity-Averse Investors

In this case, we have a constraint in the level of ambiguity-aversion and risk-aversion allowed to produce closed-form solutions, as seen in Equation (

48), which is

In correct this section, we continue using the baseline parameters,

with

, and we further set

in this section. The plots of optimal wealth exposures to variance driver’s risk

versus SD and investment horizon

T are displayed in

Figure 12 and

Figure 13. It can be seen that all the three models are rather insensitive to changes in the state of volatility and investment horizon, whereas the 3/2 model is apparently more aggressive than the Heston and 4/2 model by suggesting an almost double exposure to wealth.

The impact of parameters

a,

b on wealth exposure

with the 4/2 model can be found in

Figure 14 and

Figure 15, respectively. The marginal effect of the 1/2 component decreases dramatically when

a is greater than 0.5, while the 3/2 component

b suggests a slight increase in the exposure of wealth to variance driver’s risk.

6. Conclusions

In this paper, an optimal investment problem for a risk-averse investor under the 4/2 SV model and a 4/2-structured MPR is considered by combining with various elements of interest to scholars and practitioners. These elements include market completeness, terminal wealth with consumption, and ambiguity-aversion. By employing a corresponding derivative to complete the market, taking consumption into account, and allowing for different levels of uncertainty with respect to different risk factors, we orient our setting closer to the real world, which implies the importance in finding a closed-form solution. Although the non-affine nature of the 4/2 volatility and the 4/2-structured MPR is challenging, we found a closed-form solution for the case of complete market with consumption, and for all the other interesting cases under certain conditions.

In the numerical part, we present and compare the portfolio strategies recommended by the 4/2, 3/2, and 1/2 models for an investor who either cares about consumption or concerns about mis-specification of the model in a complete market using real-data parameters. The 4/2 and 1/2 models generally behave similarly in wealth exposures compared to that of 3/2 model. The 4/2 model behaves like an average by lying in-between the Heston and 3/2 models in consumption in a complete market.