1. Introduction

Prompted by the development of the Internet and logistics technology, e-commerce platforms have flourished over the past decade, which has also promoted the development of fresh agricultural product modules on e-commerce platforms [

1]. The COVID-19 pandemic restricted the outdoor activities of the public, which made the daily purchasing of fresh agricultural products more difficult [

2]. However, e-commerce platforms, especially the fresh agricultural product modules, have succeeded in maintaining their supply of daily necessities. Hence, the purchasing of fresh agricultural products online instead of offline (via traditional routes) has been widely adopted by consumers [

3]. Thus, e-commerce pertaining to fresh agricultural products has experienced remarkable growth and development. For example, the total transaction of JD’s fresh agricultural products during the 618-activities period of 2021 increased by 156% compared with the previous year [

4]. Meanwhile, the increased demand for fresh agricultural products has increased the amount of effort required to maintain the freshness of these products. For example, Amazon added extra packaging to 500,000 fresh agricultural products to ensure their safe transportation and consumption in 2020 [

5]. In addition, although consumers are often willing to pay for fresh agricultural products, such products are perishable, possessing a short shelf life and sensitivity to temperature, humidity, and light—factors that pose great challenges for the transportation and storage of fresh agricultural products [

6,

7,

8]. According the research conducted by the National Supermarket Research Group, waste resulting from the deterioration of fresh agricultural products costs a grocery chain with 300 stores about USD 34 billion per year. With regard to the whole fresh agricultural product industry, spoilage and shrinkage can translate into USD 32 billion worth of chilled meat, seafood, and cheese and USD 34 billion worth of produce [

9]. Consequently, such exorbitant spoilage and shrinkage lead to a great deal of inefficiency in the logistics process and encourage the fresh agricultural products industry to focus on the deterioration of logistics to a greater extent.

The prosperity of e-commerce in the fresh agricultural produce sector gives rise to not only opportunities but also challenges in terms of logistics. Since freshness-keeping measures are crucial but expensive, e-tailers of fresh agricultural products often rely on a third-party logistics service provider (LSP) to deliver their products to their consumers [

10,

11]. According to a report conducted by iiMedia Research, in 2020, the cold chain logistics industry maintained its growth trend, with an estimated market size of CNY 485 billion in China. At this time, the number of cold chain logistics enterprises was continuously growing, but their regional distribution was uneven, with 32.3% concentrated in East China. At present, the cold chain logistics industry is mainly used in food and medicine. In 2020, the scale of fresh e-commerce transactions exceeded CNY 260 billion, and the pharmaceutical logistics market scale is expected to reach CNY 3.8 trillion [

12]. Due to the distribution demand caused by the outbreak of COVID-19, cold chain logistics enterprises are expanding the transport network, reserving storage resources, and deepening the application of information technology [

12]. To ensure that agricultural products are being delivered at a considerable freshness level, retailers are required to take continuous freshness-keeping measures throughout the process of delivering fresh agricultural products [

13]. Cold chain freshness-keeping activities require investments in controlling temperature, humidity, and light conditions, such as advanced freshness-keeping technology, refrigeration trucks, and so on. For example, to transport fresh berries, VX Logistic Properties established a cold chain system for a local supermarket in Jiangsu, China [

14]. However, in order to extract additional revenue, a third-party LSP is always inclined to be overconfident [

15,

16]. LSPs may overestimate their freshness-keeping measures such that their investment in freshness keeping may be misallocated to expanding their delivery capacity instead. For instance, in May 2019, Cainiao Network joined forces with LSPs to install 30,000 green recycling bins in express delivery outlets. Meanwhile, the market demand for green recycling services was lower than expected. Thus, the extra investment in recycling bins eventually became a wasted investment caused by overconfidence [

17]. In response, blockchain technology has been widely utilized in the cold chain logistics industry to deal with overconfidence and track the variation in freshness during delivery [

18].

Blockchain technology, also known as a distributed database, maintains a sprouting list of data records that are safe and cannot be tampered with or modified [

19,

20,

21,

22,

23]. Due to the transparency of blockchain technology, all users can scrutinize the exhaustive history of their delivery activities and obtain real-time freshness and delivery information [

24,

25]. Thus, the freshness of products can be better controlled during delivery. The traceability and robustness of blockchain technology allows for the effective tracking of historical information on freshness keeping measures with timestamps or monitors. Moreover, it can also transmit exceptional changes in temperature in a cold chain in real time and enhance the effectiveness of freshness keeping measures [

26]. Blockchains have been wildly adopted. For example, the results of a food safety traceability protocol test conducted by the USA and China in 2017 showed that blockchains reduced the time required to track food from a few days to a few minutes. Carrefour adopted blockchain technology to track fresh agricultural products like chicken, eggs, and tomatoes, and Anchor collaborates with Provence, a blockchain e-commerce supply chain service platform, to track the quality of milk products [

27]. However, according to some scholars, blockchain technology is not always successful in the fresh agricultural product industry [

6,

28]. In fact, blockchain technology can fail to enhance the terminal freshness of products if it is adopted inappropriately. For instance, Meituan uses punctual insurance, a basic blockchain technology, to compensate consumers when their products are delivered late and fine their couriers to ensure that they deliver fresh products on schedule. However, in order to avoid penalties, couriers fudge their declarations of delivery, which eventually reduces the terminal freshness of products. Thus, for the fresh agricultural products industry to effectively standardize member behaviors, blockchain technology must be investigated in a suitable way.

There has been extensive research on the relationship between blockchains and overconfidence in the fresh agricultural product industry. Although blockchain technology is implemented in consideration of the types and degrees of overconfidence behavior, the interplay between these two aspects is rarely investigated. Less complex models use blockchain technology to combat the asymmetric information brought on by the overconfident behaviors of LSPs. Moreover, although overconfidence may result in sub-optimal decision making, warehouse imbalances, and low investment efficiency, mild overconfidence can positively influence decision-making behavior, including via reducing the conservatism of risk-averse managers [

29], stimulating managers to participate in risky but profitable projects [

30], and encouraging the innovative behavior of company members [

31]. In the fresh product industry, overconfidence does not always result in losses, but it sometimes leads to increased orders or business prospects. For instance, some autonomous order-receiving businesses, including Meituan, Eleme, and Didi Globe, earn more profits when franchisees exhibit overconfidence and thus place more orders. Thus, overconfidence is commonly observed when it comes to the delivery of fresh agricultural products. The effects of overconfidence vary depending on how a given supply chain system is operated. Less complex models use blockchain technology to contend with the overconfidence of LSPs. Additionally, fresh agricultural products can deteriorate over time, thereby reducing their usefulness or quantity compared to the original products. In order to prevent losses due to deterioration, freshness keeping measures and blockchain technology should be exerted and implemented dynamically to monitor and modify real-time preservation measures. For instance, in cold chain logistics, refrigerated cars should maintain their temperatures and transmit real-time information during delivery. As a result, freshness keeping measures and blockchain technology should both be considered dynamically as the degree of freshness changes.

Motivated by the above discussions, this paper investigates the optimal freshness-keeping strategy for combatting the overconfidence of LSPs in the fresh agricultural product industry with respect to blockchain technology. We are interested in the following research questions (RQs):

RQ 1: What effect does LSPs’ overconfidence have on the freshness keeping measures of retailers in the fresh agricultural product industry?

RQ 2: How does blockchain technology impact the freshness-keeping strategies of retailers and the optimal freshness variation of products?

RQ 3: What is the optimal strategy for retailers to apply to blockchain technology considering the overconfidence behavior of LSP?

To theoretically answer the above research questions, an optimal control model [

32] is adopted to deal with the dynamic freshness-keeping efforts and blockchain adoption strategies resulting from the deterioration of fresh agricultural products. The performance index represents the total surplus of members of the system, including the retailer, the LSP, and consumers. The LSP has a tendency to exaggerate the true effect of freshness keeping measures on delivery. Moreover, retailers also need to decide on an optimal freshness keeping strategy that combines freight and freshness-keeping because LSPs tend to be overconfident. Furthermore, after assessing the influence of blockchain technology on the surplus of the overall system, this technology is discussed both as a countermeasure adopted to correct overconfidence behaviors of LSPs and as an initial-established system with freshness keeping measures, and these considerations are contrasted with former models to illustrate the interaction between overconfidence and blockchain technology.

The conclusions obtained in this paper are as follows. Firstly, freshness-keeping efforts vary with the price and initial freshness of products regardless of whether the members of the system are rational. Secondly, overconfidence cannot improve the performance of freshness keeping measures. However, through interactions with retailers, who are motivated to increase their freshness-keeping investments, the real freshness of products is significantly increased when such efforts are accepted by consumers. Thirdly, blockchain technology fails to coordinate the imbalance of overconfidence when it is adopted as a countermeasure. Meanwhile, when it is established in tandem with the corresponding freshness-keeping strategy, blockchain technology improves the performance of freshness keeping.

Different from the existing blockchain literature, our article is the first to investigate the overconfidence behavior of LSPs in fresh agricultural product supply chains. Our findings contribute to the literature in several ways. Firstly, the effect of blockchain technology is discussed in consideration of an irrational member in a fresh agricultural product supply chain system, which has not been investigated in the existing literature. A third-party LSP is designed to overestimate the effect of freshness-keeping measures. Blockchain technology is considered in this scenario as an initial-established tracing system and a countermeasure. These unique characteristics make our article more practical than ideal models concerning rational behavior. Moreover, instead of focusing on the effect of blockchain technology as is the case in current research, our article concentrates to a greater degree on the interaction role of blockchain and the behavior of members. The comparison of blockchain application patterns is first carried out in relation to blockchain technology adoption. Although both blockchain technology and overconfidence behavior improve the performance of fresh agricultural product supply chains with respect to terminal freshness, when these factors are combined, blockchain technology fails when it is adopted as a countermeasure against the overconfidence behavior of a third-party LSP. Moreover, interestingly, the situation in which blockchain fails to coordinate the overconfidence of the third-party LSP is discussed further in terms of the relationships between members. Similar results have not been found in prior studies. When blockchain technology fails to coordinate the overconfidence behavior of a third-party LSP, it performs inappropriately with respect to the interaction between the retailer and the third-party LSP. According to our conclusions, it is wise to adopt blockchain technology as an initial-established tracing system rather than as a countermeasure. This finding also indicates that third-party LSPs and retailers earn more profits when blockchain technology is designed to encourage their cooperation.

This paper provides the following managerial implications. Firstly, managers should modify their freshness-keeping strategies once the corresponding third-party LSP is prone to overconfidence. Secondly, instead of adopting blockchain technology as a countermeasure, it is more sensible for managers to establish a system employing freshness keeping measures initially. Thirdly, it is more crucial for managers to take pricing, initial freshness, natural deterioration rates, and freshness keeping costs into consideration in the logistics service system of the fresh agricultural product industry in order to increase their performance on behalf of consumers. These factors influence the freshness of products perpetually regardless of whether the members of the system are rational. Sometimes, the variance the factors generate is even more significant than the decision-making behavior.

The rest of this research is organized as follows.

Section 2 presents a literature review.

Section 3 provides a description and the notations for the problem investigated in the model. In

Section 4,

Section 5 and

Section 6, the three models that are investigated are introduced, that is, the benchmark mode, the centralized decision-making mode with overconfidence, and the decentralized decision-making mode with blockchain and overconfidence. The results of simulation experiments and sensitivity analyses are investigated in

Section 7.

Section 8 presents the conclusions and managerial implications of this paper and proposes some future research directions. The proofs of all propositions are shown in the

Appendix A,

Appendix B,

Appendix C,

Appendix D,

Appendix E and

Appendix F.

5. Centralized Decision-Making Mode with Overconfidence

In centralized decision-making mode with overconfidence (ODM), the actions of the couriers are distinct from those of the retailers in that the retailers provide products and oversee the initial freshness, while the couriers are responsible for ensuring freshness during delivery. Couriers overestimate the effect of their freshness keeping measures with the degree

and evaluate their profits based on their own expectations. Moreover, they still need to ensure the freshness of the products when received by the consumers; therefore, the variation in freshness is a limitation on the overconfident expectations of the couriers. Moreover, no matter how much the freshness-keeping effect is overestimated, the freshness of the products cannot surpass the initial degree of freshness. Thus, the expected revenue of the third-party LSP is illustrated as follows:

Proposition 2. In ODM, the optimal freshness keeping scheme and the relevant optimal freshness is shown as follows.

- (1)

When , the retailer does not modify their freshness-keeping strategy, and the freshness keeping scheme decreases with distance. The optimal freshness keeping scheme and relevant optimal freshness are shown as follows: - (2)

When , the retailer invests their freshness keeping schemes in two stages. The first stage is in a relatively closed area, in which the freshness keeping level remains constant. In the posterior stage, the freshness keeping scheme begins to decrease with distance. The optimal freshness keeping scheme and relevant optimal freshness are shown as follows: - (3)

When moving away from the retailer, the freshness keeping scheme is zero, and the optimal freshness keeping scheme deteriorates naturally.

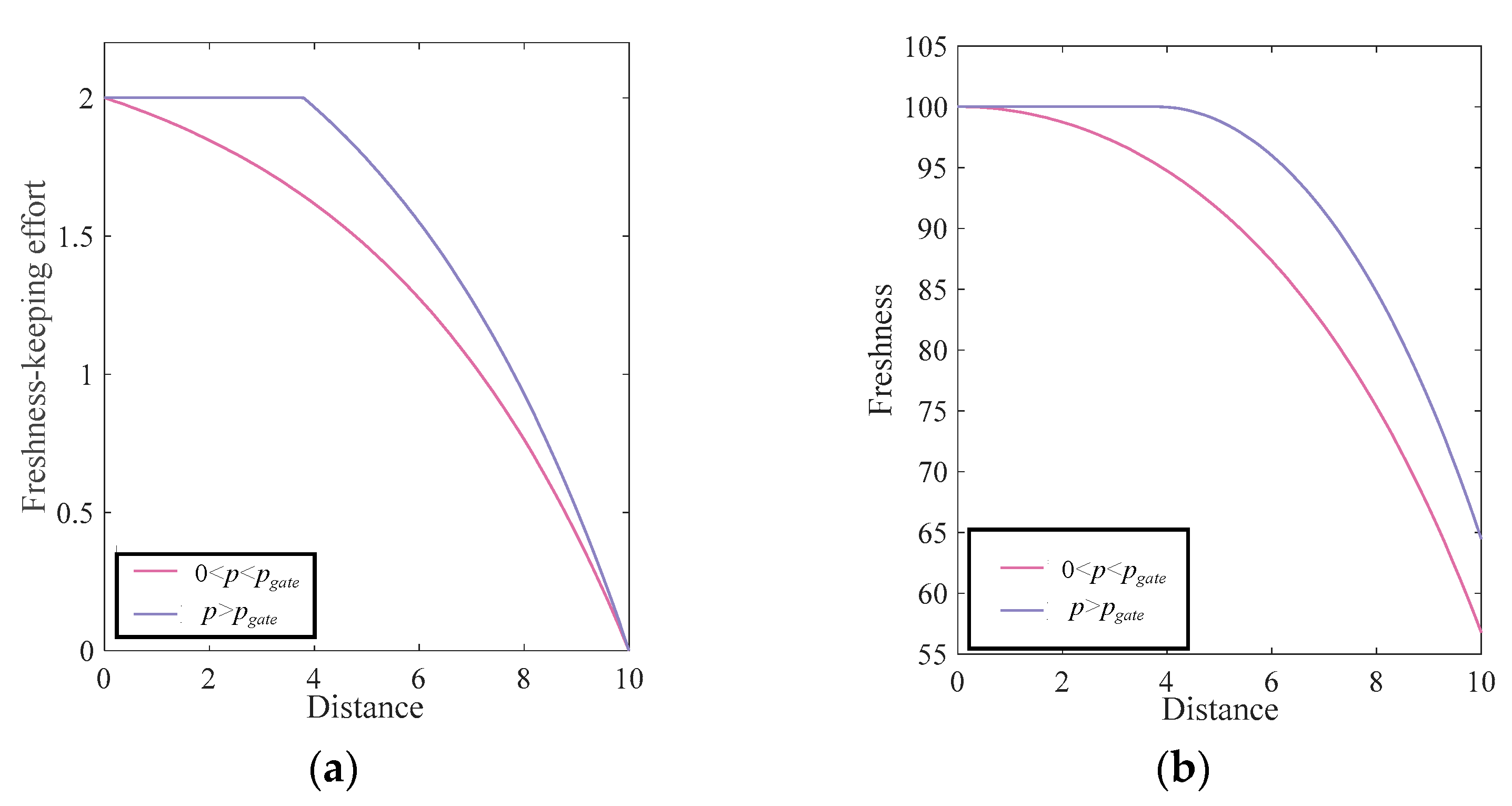

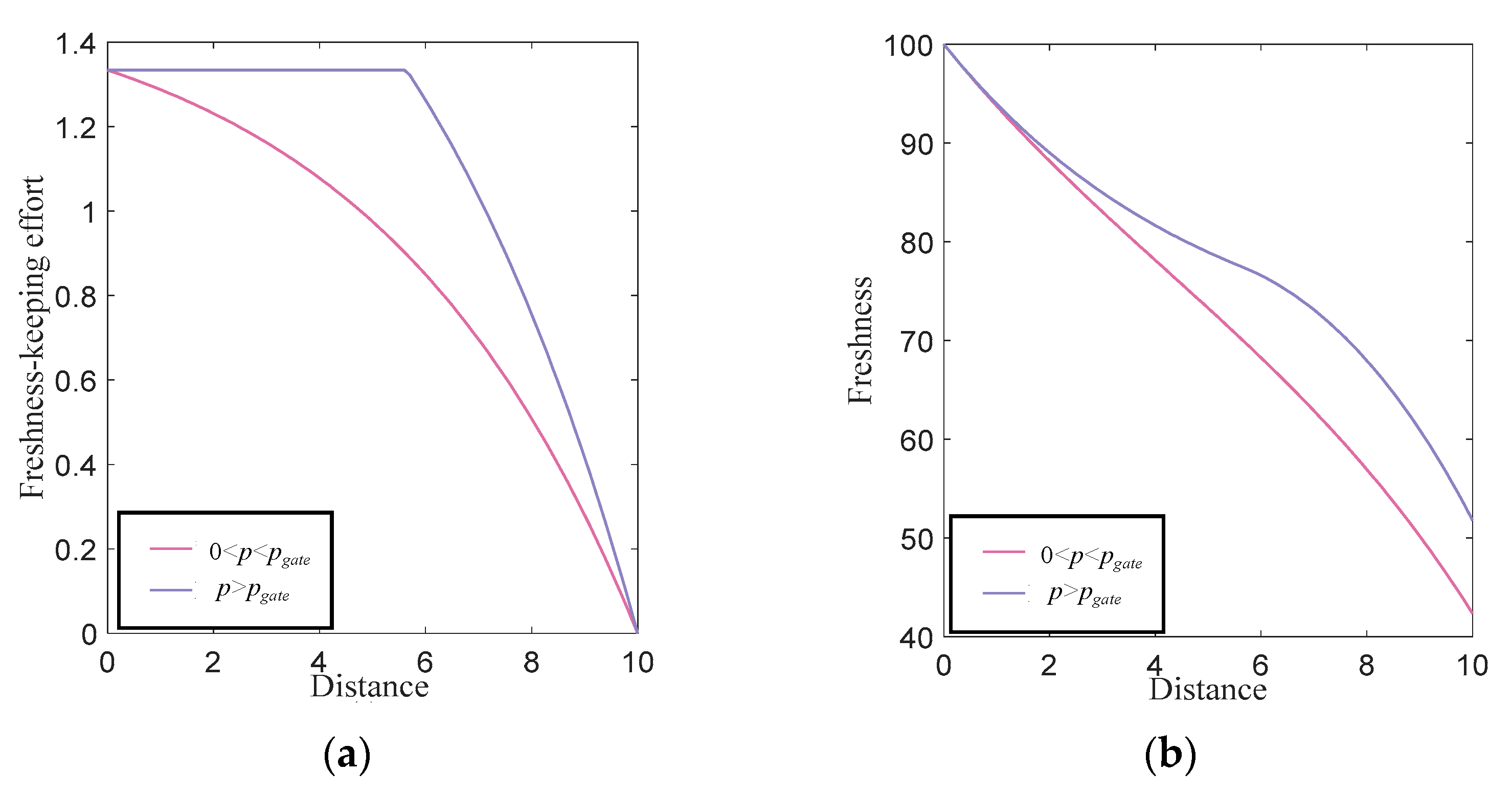

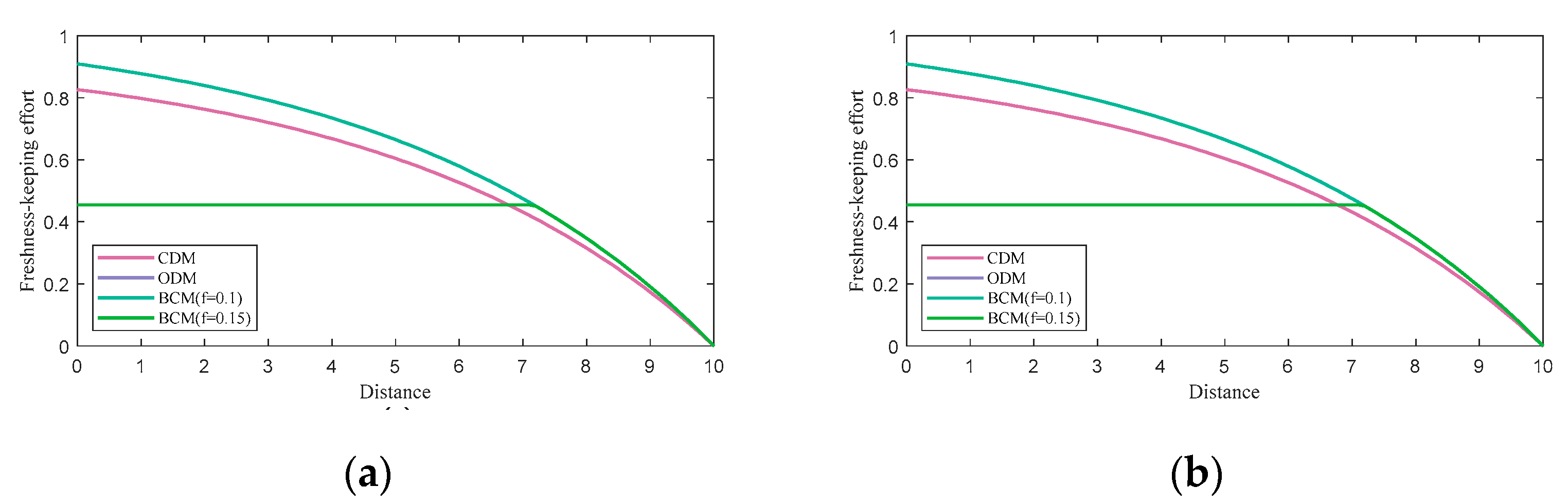

The situation of Proposition 2 can be summarized in

Figure 2. The strategy with overconfidence generally does not change the fact that the freshness-keeping strategy initially decreases with a low price and remains invariable with a high price. However, when the retailer is influenced by the overconfidence of the LSP, the initial freshness-keeping level decreases such that the freshness of the high-price products cannot remain at the initial freshness level and deteriorates slowly. In the posterior stage, the freshness-keeping effort diminishes faster, decreasing the terminal freshness-keeping effort to zero. Regarding the freshness of products, when the retailer changes their freshness-keeping strategy, the deterioration rate notably changes from gently concave to steeply convex.

From Proposition 2, the strategy that the retailers employ to ensure freshness in two stages is unaffected by the overconfidence of the third-party LSP. However, the third-party LSP makes an irrational decision such that the effect of the freshness-keeping measures is overestimated. Thus, the variations are caused by the differences in the freshness-keeping strategies. Eventually, the bias in decision-making results in the variation in the products’ freshness during delivery.

Proposition 3. Overconfidence of the third-party LSP causes retailers to change their freshness-keeping strategy, which eventually increases the terminal freshness of the product.

According to Proposition 3, although overconfidence, an irrational behavior of the third-party LSP, provides inaccurate logistics information to the system and burdens retailers with the need to employ extra freshness keeping measures, the terminal freshness of the products is not always diminished when consumers receive them. However, overconfidence itself does not directly increase terminal freshness. Instead, despite the assumption that the third-party LSP is overconfident, retailers are forced to input additional investments to improve their freshness keeping measures. Otherwise, the result is the loss of consumers and profit of the retailer; thus, the overconfidence of the third-party LSP has lowered the terminal freshness of the products such that they have become stale.

For instance, overconfident couriers often reopen the seals of packages and overestimate the freshness-keeping effect of backpacks; these actions not only exceed their delivery remit but also detrimentally affect food safety. In order to improve its logistics service, Meituan required retailers to adopt unrecoverable seals or disposable sealed backpacking bags for their take-out service in their signature stipulation promulgated in 2022. According to statistics from the Beijing News website and iiMedia Research, such additional procedures, such as seal sticking and seal binding, increase the packaging costs of retailers by CNY 4 each bill. In fact, retailers had already taken measures to seal products before this stipulation was published, and the network chain delivery business was prompted to increase 19.8% [

12]. Moreover, for some special products, such as ramen noodles, unlike spaghetti or other pasta, ramen noodles are usually cooked with soup; thus, if they are delivered over the maximum distance that retailers can serve, these noodles will clump together and become too sticky to eat. To maintain the terminal freshness of noodles, retailers are compelled to pack noodles and soup separately, which burdens retailers with additional packaging costs. However, when the packing method becomes normal, the freshness of the noodles eventually improves.

Therefore, overconfidence prompts retailers to invest more heavily in freshness keeping measures, which eventually increases the freshness of the products the consumers receive. The following two aspects encourage retailers to maintain their freshness-keeping efforts. Firstly, the third-party LSP is motivated to expect the adopted freshness keeping measures to be more effective and durable, which incurs extra waste due to natural deterioration. Secondly, in the following period, products with deteriorated secondary freshness require greater investment in order to ensure their terminal freshness when received by consumers. With the increase in the degree of overconfidence, the deviation from the above two aspects increases, and the extra freshness keeping measures of retailers also increase.

6. Decentralized Decision-Making Mode with Blockchain and Overconfidence

According to the research conducted by Li et al. [

4], the effect of blockchain technology is considered to be an increment to freshness with the degree of

. The cost of blockchain technology depends on the adoption degree. The freshness variation as influenced by overconfidence behavior and blockchain technology is shown as follows:

Moreover, when blockchain technology is adopted, the decisions of retailers and the third-party LSP also change. Meituan has already adopted location tracking in delivery, which can be considered an embryonic form of blockchain utilized by Meituan. When blockchain technology is adopted as a countermeasure for the overconfidence of the third-party LSP, freshness keeping measures are adopted by the retailers, and the third-party LSP incurs the cost of blockchain technology. Based on the policies of Meituan, retailers offer incubators and food containers, and couriers deliver in a timely manner to avoid penalties due to delays (as reported via location-tracking technology).

Thus, when the third-party LSP is overconfident, the retailer adopts blockchain technology, as follows:

Proposition 4. When blockchain technology is employed to coordinate the overconfidence of the third-party LSP, in the practical range of freshness keeping measures, the optimal blockchain adoption degree is as follows.

- (1)

If and , or if and , then the optimal blockchain adoption degree is as follows: - (2)

If and , or if and , then the optimal blockchain adoption degree is as follows: - (3)

If and , then the optimal blockchain adoption degree is as follows.

Proposition 4 illustrates that the adoption of blockchain technology depends on the performance of the third-party LSP, which includes freight, the cost of technology, and the effect of blockchain technology on freshness-keeping. Moreover, the case is significantly different depending on whether a freshness-keeping strategy has been implemented. Once the freshness-keeping strategy limits the maximum freshness of products, blockchain technology is subject to the optimal freshness keeping measures.

Proposition 5. When blockchain technology is employed to coordinate the overconfidence of the third-party LSP, in the practical range of the blockchain adoption degree, the optimal freshness keeping measures are as follows.

- (1)

If and , or if and , then the optimal freshness keeping scheme is as follows: - (2)

If and , then the optimal freshness-keeping scheme is as follows: - (3)

If , , and , or if , , and , then the optimal freshness-keeping scheme is as follows:

According to Proposition 5, the optimal freshness-keeping effort varies depending on whether blockchain technology has been adopted. The situation is different when the blockchain technology adoption strategy is deemed to be an initial-established system, which is considered along with the freshness-keeping measure or a as countermeasure for overconfidence limited by the optimal freshness. Thus, the adoption of blockchain technology and freshness keeping measures influence each other. The interaction of these two factors in the context of overconfidence is discussed as follows.

Proposition 6. In the following cases, blockchain technology is adopted with an explicit scheme. The freshness keeping scheme, the adoption degree, and the optimal freshness are shown as follows.

- (1)

If and , then the optimal freshness keeping scheme, optimal degree of blockchain adoption, and relevant optimal freshness are as follows:in which .

- (2)

If

and , then the optimal freshness keeping scheme, optimal degree of blockchain adoption, and relevant optimal freshness are as follows: - (3)

If

and , then the optimal freshness keeping scheme, optimal degree of blockchain adoption, and relevant optimal freshness are as follows: - (4)

If and , then the optimal degree of blockchain adoption and optimal freshness-keeping strategy are as follows: - (i)

When

, the optimal freshness is as follows:in which

.

- (ii)

When

, the optimal freshness is as follows:

- (5)

The blockchain technology is not adopted or formulated in an explicit execution, especially when price and freight are bounded by one another.

- (i)

If , , and , the freshness-keeping strategy differs when blockchain technology is adopted. Moreover, blockchain technology adoption is also impacted by the employed freshness keeping measures. Thus, neither of them can be explicitly executed. The optimal freshness keeping scheme and optimal blockchain adoption degree are shown as follows: In , an explicit execution of the strategy of blockchain technology adoption and freshness-keeping strategy cannot be conducted because of the interdependence of and .

- (ii)

If

and and or , , the optimal degree of blockchain technology adoption can be deduced as , i.e., blockchain technology is not adopted.

As expressed in Proposition 6, the freshness of products increases when blockchain technology is adopted as an initial-established system with freshness-keeping strategies. When freshness-keeping strategies have not yet been established, adopting blockchain technology initially without the limitation of a freshness-keeping measure can increase the freshness of products during delivery and eventually maintain a greater terminal freshness with an explicit execution.

Interestingly, blockchain technology fails to account for overconfidence behavior when it is adopted as a countermeasure for the overconfidence of the third-party LSP. Since blockchain technology’s effect on freshness keeping cannot raise the level of freshness over the initial level, the degree to which blockchain is adopted is also limited by the freshness-keeping efforts. Adoption without a limitation, which precipitates an illogical situation, is considered as an impossible solution with an expensive cost that must be avoided. Therefore, when overconfidence has already been exhibited, the established freshness keeping measures should be taken into consideration as a limitation for blockchain technology adoption. However, an explicit execution for blockchain adoption cannot be inferred and its adoption can even be refused when managers are required to implement an adoption strategy with the limitation of freshness-keeping efforts. Thus, blockchain technology cannot be adopted as a countermeasure for the overconfidence of third-party LSPs.

In practice, punctual insurance, a delivery delay insurance product insured by Meituan for consumers, is a combination of freshness keeping measures and blockchain delivery tracing technology. To avoid compensation, retailers need to ensure their products are not stale when the consumer receives them, and couriers must deliver the products before the deadline. This requires the platform to formulate the compensation details, taking freshness and delivery tracing into consideration. Meanwhile, because this compensation burdens couriers, they often confirm completion of an order on the system before delivering the product to the consumers, which invalidates the delivery-tracing technology and eventually diminishes the freshness of the products and wastes the insurance premium.

7. Numerical Analysis

Based on the above theoretical research, in this section, we used mathematical derivation and numerical simulation to illustrate the influence of overconfidence and blockchain technology on the delivery of fresh agricultural products. The simulation experiment was designed based on the Meituan express model, which has already adopted blockchain for use in fresh product logistics. In the Meituan express model, fresh products are packed with freshness keeping measures and delivered by self-operating couriers with punctual insurance. However, this punctual insurance, as a blockchain adoption measure, eventually fails to improve the products’ terminal freshness and causes the couriers to lie on the delivery confirmation receipt. Due to the variation of the freshness keeping strategy and the adoption of blockchain technology, the price, freight, degree of overconfidence, and effect of blockchain are set as variable parameters. Other parameters, according to the research conducted by Li et al. [

4], Liu et al. [

56], and Liu et al. [

35], are set as permanent, and they are shown in

Table 3.

7.1. The Influence of Overconfidence

In this section, the influence of overconfidence is discussed in three scenarios: (I), (II), and (III). The influence of overconfidence mainly manifests in the optimal freshness keeping measures of the retailer and the variation in optimal freshness. The freshness keeping measures represent the retailer’s investment into freshness-keeping facilities and evaluate the quality awareness of the retailer. The freshness variation stimulates the deterioration of the products during delivery. Supposing that the retailer serves a fixed area with a maximum service distance, we analyze the above three situations in

Figure 1 and

Figure 2.

Table 4 shows the concrete price adopted in this paper under different scenarios.

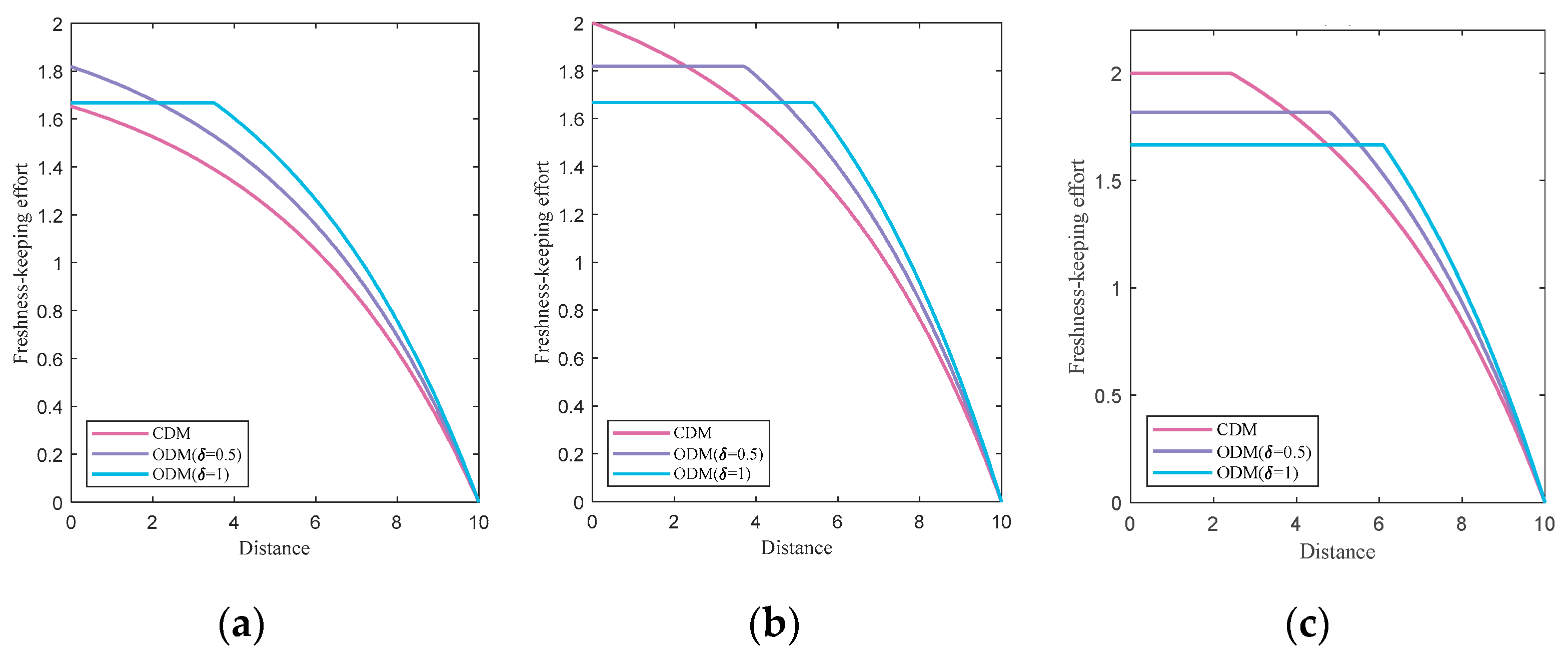

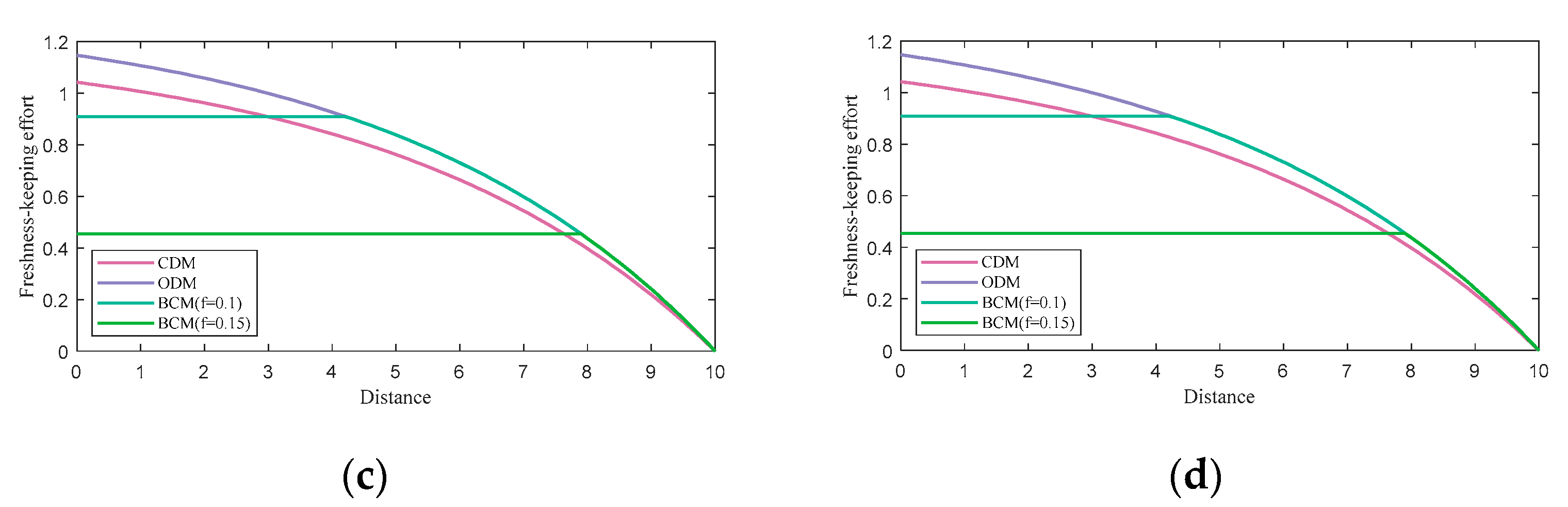

Figure 3 and

Figure 4 compare the optimal freshness-keeping measure and the optimal freshness of different decision-making modes. CDM represents the freshness keeping measures of the benchmark mode, while ODM (

δ = 0.5) and ODM (

δ = 1) represent the freshness keeping measures of the overconfidence-influenced decision-making mode with different overconfidence degrees. The exogenous prices are different in situations (I), (II), and (III), as shown in

Table 4.

Figure 3 reveals the following three characteristics. Firstly, overconfidence prompts retailers to change their strategy of freshness-keeping. The retailer maintains a relatively lower freshness keeping level over longer distances in order to offset the extra investment following delivery. Secondly, the threshold of the distance at which the retailer decides to adjust their strategy rises with the overconfidence degree. A retailer who faces an overconfident third-party LSP retains their initial freshness-keeping efforts. Thirdly, since the price threshold is reduced by overconfidence behavior, the strategy under ODM performs more steadily while, the exogenous price changes. Thus, overconfidence makes the logistics system more economical, while the market demand declines with distance.

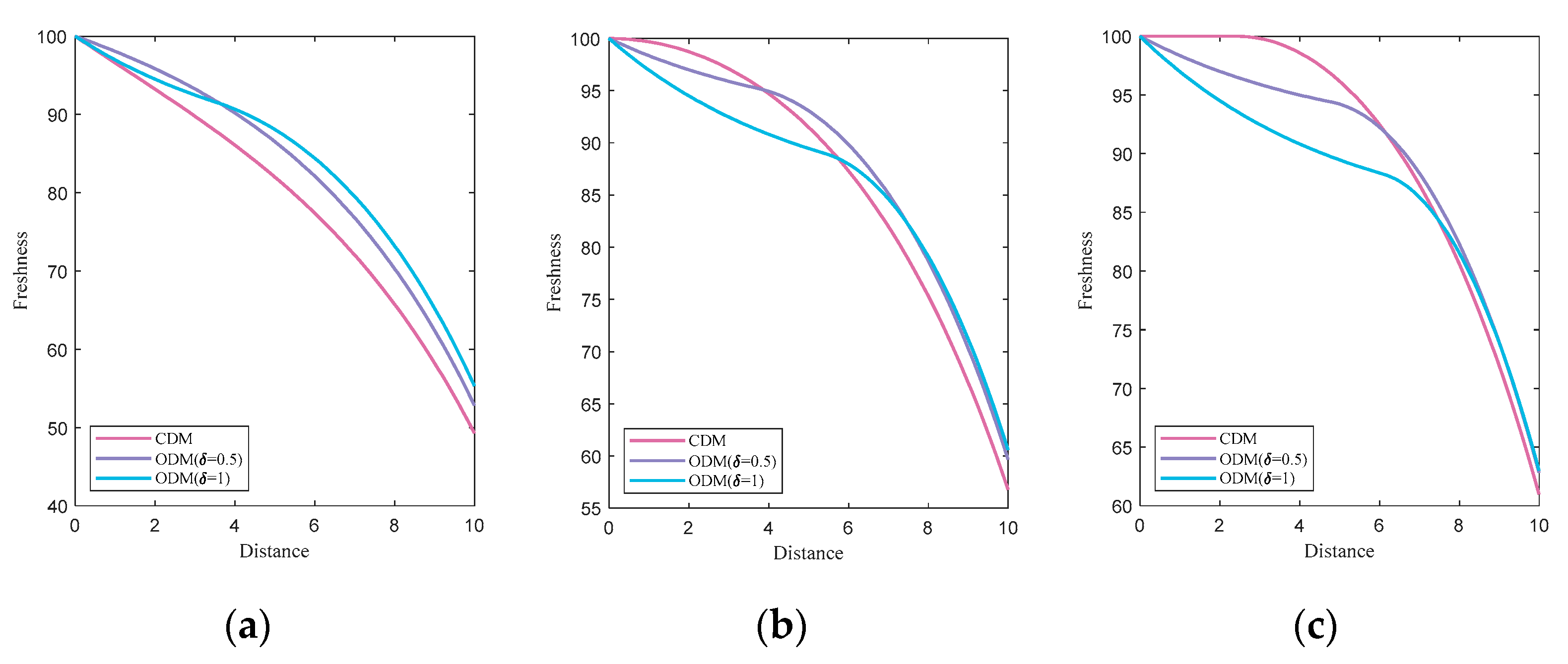

Figure 4 illustrates the freshness of the products when the optimal freshness keeping strategies shown in

Figure 3 are adopted. When the price remains low, as in situation (I), overconfidence improves the performance of the logistics system in freshness keeping because the retailer is induced to invest in extra freshness keeping measures. Furthermore, when the price rises, the freshness of the products varies as well. In the initial stage, the freshness of products in ODM deteriorates more rapidly than that in CDM because of the insufficient initial freshness keeping measures. However, when products are delivered over a certain distance to ensure terminal freshness when the products are received by the consumers, some extra freshness keeping measures are employed in order to compensate for the excessive deterioration. Eventually, the terminal freshness is close to that under CDM or even performs with greater freshness.

From

Figure 3 and

Figure 4, the following conclusions regarding the influence of overconfidence on optimal freshness keeping measures and optimal freshness can be drawn.

Firstly, while the prices of products rise, retailers invest more into freshness keeping. However, the freshness keeping measures eventually decrease to zero despite the initial freshness keeping measures and the overconfidence exhibited. The strategies that the retailer utilizes aim to ensure that the freshness of the products is not deteriorated to the point that the consumers refuse to accept them. Therefore, when the retailer adopts a subjective threshold of terminal freshness for the consumers, the freshness keeping measures are usually economized such that they just satisfy the minimum level to avoid additional freshness keeping costs.

Moreover, the total freshness keeping measures are increased by overconfidence when prices are low. Meanwhile, the gap of freshness keeping measures is narrowed between different degrees of overconfidence when prices rise. The overconfidence degree drops the threshold of the alteration in the price of the freshness-keeping strategy, which implies that the third-party LSP deems the freshness-keeping measures to be more enduring. Moreover, this also means that retailers invest more resources to evade the damage caused by this irrational behavior. Thus, ODM performs better with respect to the terminal freshness of the products when received by consumers.

Additionally, freshness keeping measures are more stable when products become expensive in the overconfidence-affected decision-making mode. Due to the reduction in the price threshold, the retailer adjusts the strategies of freshness keeping earlier with lower initial freshness keeping measures. Differing from the CDM, which is initiated with higher freshness keeping measures and attenuates rapidly, ODM is more likely to follow a strategy wherein products are maintained under relatively lower initial freshness keeping measures and remain longer. Moreover, overconfidence also raises the threshold of distance when the retailer changes their strategies, which lowers the cost of freshness-keeping posterior to delivery.

7.2. The influence of Blockchain Technology

In this section, the interaction between overconfidence and blockchain technology adoption is discussed in relation to four situations: (I)

,

; (II)

,

; (III)

,

; (IV)

,

. The influence of blockchain technology being adopted as a countermeasure for overconfidence is shown in

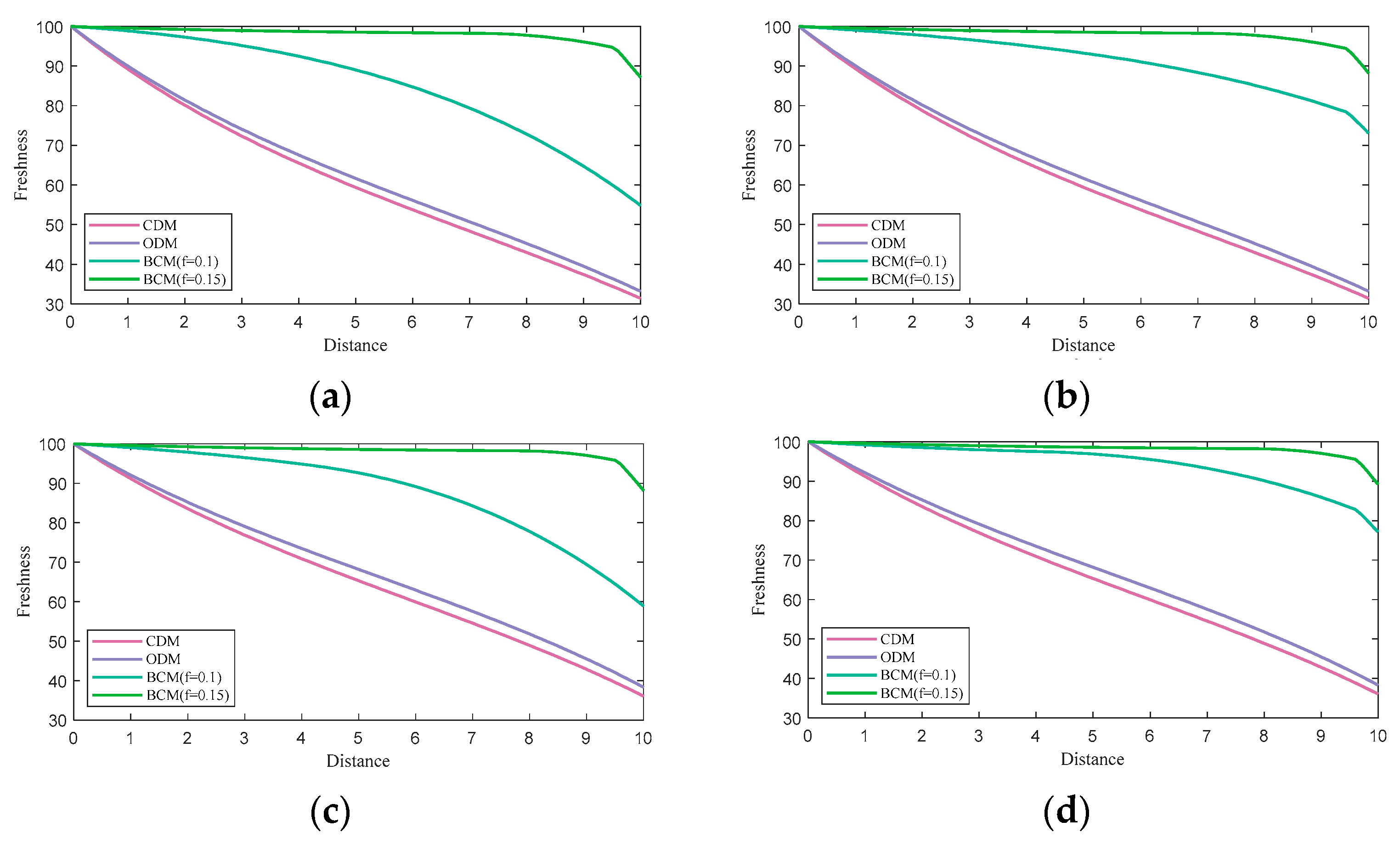

Figure 5 and

Figure 6, which reveal the impact on the optimal freshness keeping measures and optimal freshness, respectively. Despite the situation in which blockchain is not adopted or explicitly executed, the above four valid situations are discussed as follows.

Figure 5 and

Figure 6 compare the optimal freshness keeping measures and optimal freshness in different decision-making modes. BCM (

= 0.1) and BCM (

= 0.15) represent the freshness keeping measures under decentralized decision-making modes with blockchain technology and overconfidence under different effects of blockchain technology. The prices and freights vary in different situations, i.e., (I), (II), (III), and (IV), which are shown in

Table 5.

The influence of blockchain technology is described in the following. Firstly,

Figure 5 suggests that the performance of the logistics system is determined by freight, which is gated by the factors of blockchain technology, including cost, effect, and adoption degree. Secondly, when BCM and ODM coincide, the subsequent freshness keeping measures are in accordance with ODM. Both BCM and ODM execute the strategy where freshness keeping measures remain at the initial level and are compensated for in the post-delivery stage. Particularly, blockchain technology enhances the delays and transfers of freshness-keeping efforts from the initial to post-delivery phases. The initial freshness keeping level of BCM requires less investment but remains more enduring than ODM.

Figure 6 illustrates the freshness of products when the optimal freshness keeping strategies shown in

Figure 5 are adopted. Due to refrainment from overconfidence behavior, logistics systems in a low-price market lead to fresher products when blockchain technology is adopted. The effect of blockchain technology increases the extra freshness of products. Moreover, differing from the freshness keeping measures, the optimal freshness fluctuates with the prices of products; this refers to the expense and effect of freshness keeping measures. In particular, the less-efficient BCM performs more sensitively with variation in prices. When in a relatively low-price market, BCM with a weak effect of blockchain technology generates low terminal freshness.

From

Figure 5 and

Figure 6, the following conclusions can be drawn about the influence of blockchain technology on optimal freshness keeping measures and optimal freshness.

Firstly, the overall investment in freshness keeping is decreased by blockchain technology, while the freshness of products during delivery increases. When the overconfidence behavior of the third-party LSP is corrected by blockchain technology, retailers invest less in freshness keeping measures and postpone the freshness keeping measures until after delivery. The third-party LSP is motivated to execute the strategies of the retailer via supervision and compensation. Thus, the retailer economizes the freshness keeping measures with the prospect of considerable terminal freshness.

Nevertheless, the adoption of blockchain technology burdens the third-party LSP. The increase without additional freshness-keeping efforts occurs because of the cost of the third-party LSP. Supervision weakens the LSP’s decision-making functions and downgrades their identity to an executor in the system. The compensation puts them in in danger of facing uncertain costs during delivery. The relationship between the retailer and the third-party LSP varies from cooperation to subordination.

Additionally, blockchain technology is not suitable for every situation. When the retailer and platform aim to establish an initial system with freshness-keeping efforts and blockchain technology as a tracking system, it is not a sensible decision to adopt the blockchain technology instead of adopting it as a countermeasure for irrational behavior. This is because this technology needs to be employed while simultaneously considering freshness-keeping efforts, thereby precipitating mutual restrictions and eventually generating a strategy with an ambiguous plan or without blockchain technology.

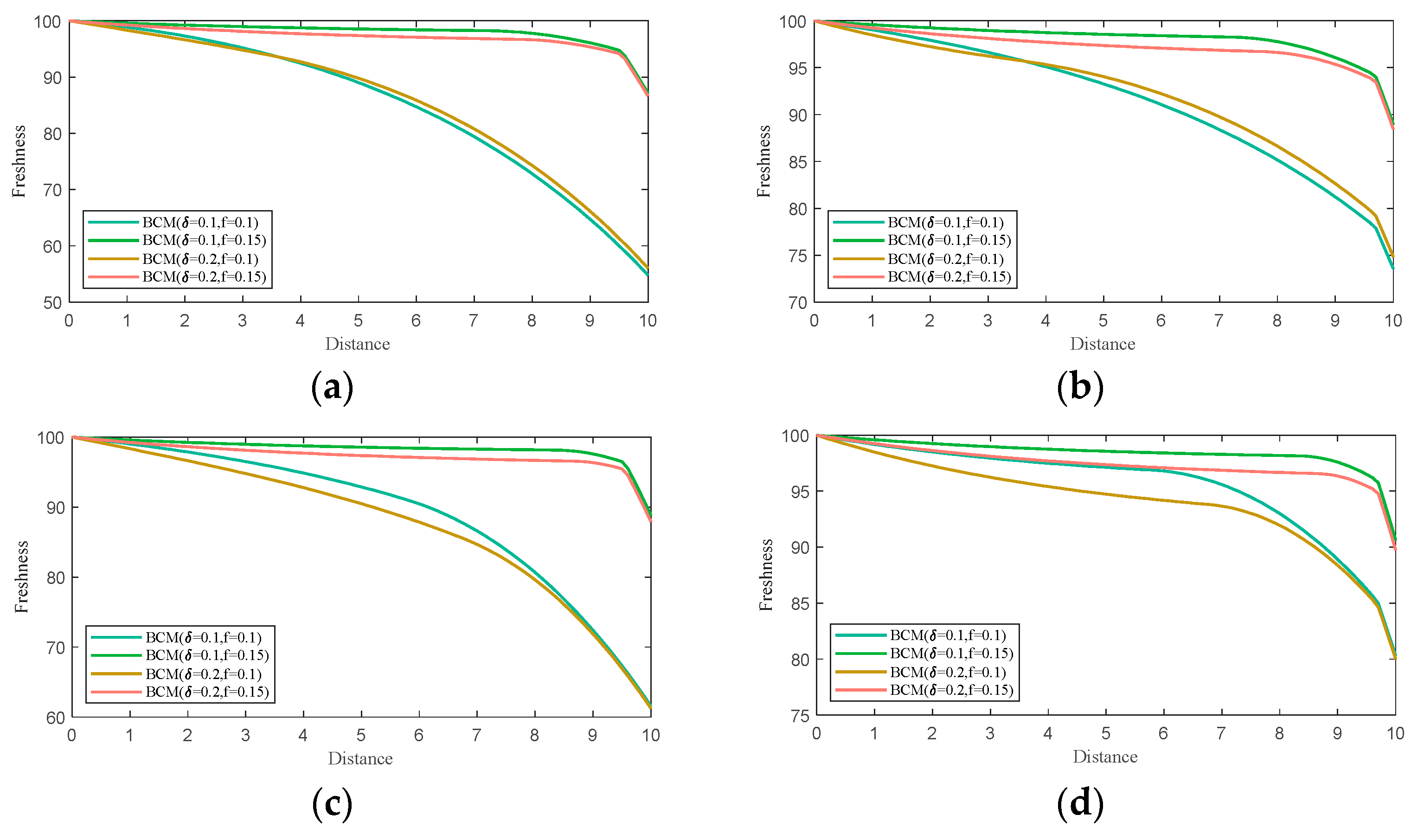

7.3. The Interaction between Overconfidence and Blockchain Adoption

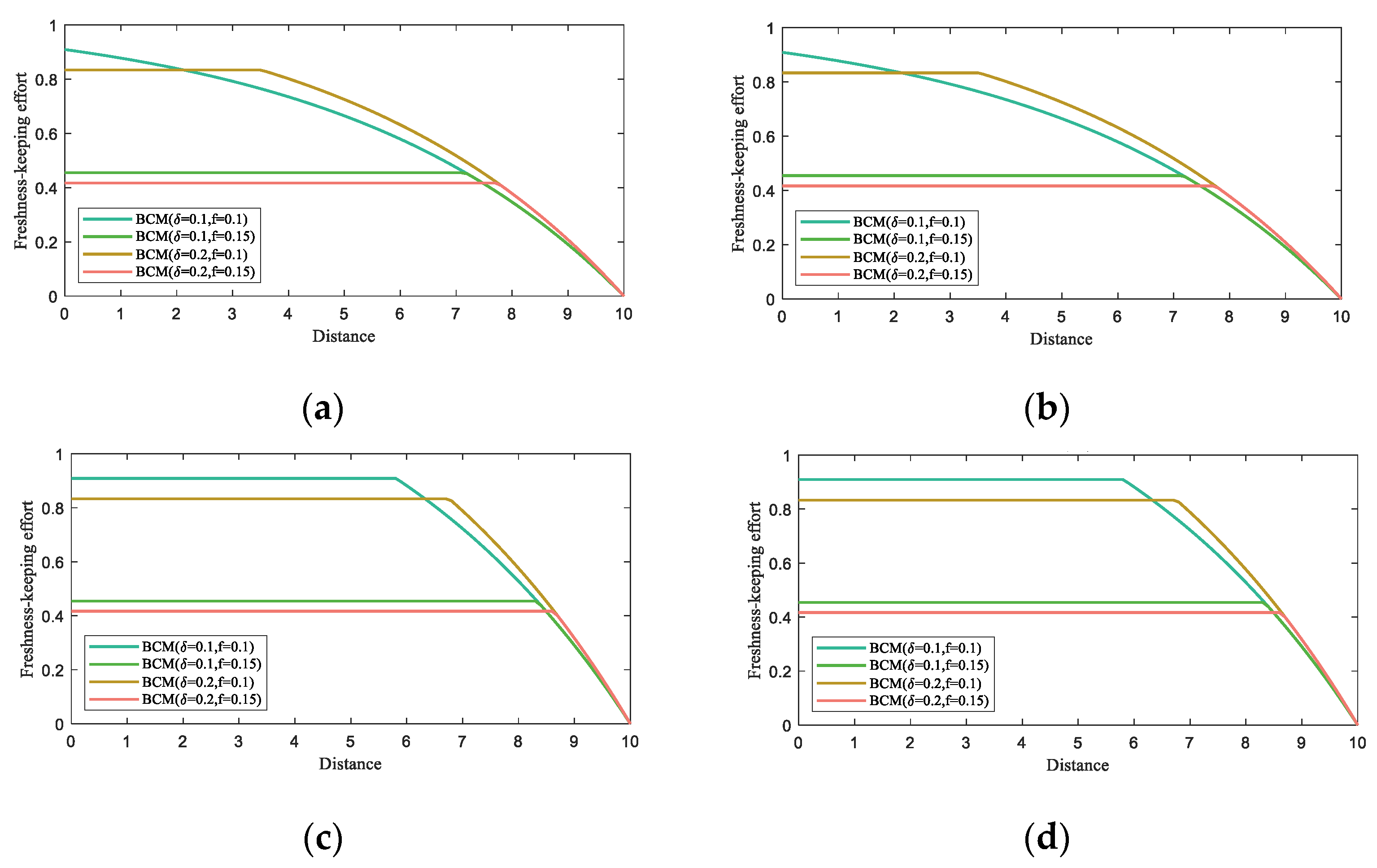

Figure 7 and

Figure 8 illustrate four BCMs with different overconfidence degrees and the effects of blockchain. The interaction between overconfidence and blockchain technology is discussed as follows.

The optimal freshness keeping measures in four different situations are illustrated in

Figure 7. Generally, BCM with a lower overconfidence degree is more likely to employ the strategy of retaining a lower initial degree of implementing freshness-keeping efforts for longer and compensating for this in the post-delivery stage. However, BCM with a higher level of blockchain technology adoption reduces the initial freshness keeping measures. The freshness keeping measures rely on the effect of blockchain technology, and the overconfidence degree reacts as a disruption of the terminal strategy for the initial freshness level and the threshold of distance.

Figure 8 illustrates the optimal freshness in the above four situations. BCMs that adopt blockchain technology more effectively yield fresher products upon delivery. Moreover, the prices influence the performance of each BCM more significantly when comparing situations (I) and (III) and situations (II) and (IV). The gap of freshness is also narrowed when the price rises, especially for terminal freshness. BCMs with the same blockchain adoption level perform approximately equally; however, the influence of overconfidence still serves as a disturbance during delivery. When blockchain technology is effective, the influence of overconfidence on terminal freshness can be ignored.

According to

Figure 7 and

Figure 8, the interaction between blockchain technology and overconfidence behavior can be summarized as follows.

Firstly, the effect of blockchain technology governs the strategies of freshness keeping. The optimal freshness keeping measures decrease with the initial freshness level, while the optimal freshness is also increased via the use of more effective blockchain technology. Moreover, the degree of overconfidence disrupts possible solutions. BCM with a higher overconfidence degree enhances the delay of freshness-keeping efforts, causing the initial freshness to drop much lower and delaying the threshold of distance as well. However, the freshness keeping measures eventually attenuate to zero regardless of the degree of blockchain technology adoption and overconfidence degree. The freshness also differs little with different overconfidence degrees.

Moreover, the exogenous price and freight influence the strategy of freshness keeping and blockchain adoption, regardless of the effect of blockchain technology and overconfidence degrees. The freshness keeping strategy varies with the price and freight area based on the overconfidence degree and the effect of blockchain technology. Meanwhile, strategies effectively employing blockchain technology are less sensitive to the variation in exogenous price and freight.

8. Conclusions

8.1. Summary

This paper investigated the optimal freshness keeping measures in conjunction with the overconfidence of third-party LSPs in the fresh agricultural product industry. Moreover, blockchain technology was adopted as a countermeasure against this irrational behavior. Based on the optimal control model, some of the main findings are summarized as follows.

Firstly, as an irrational behavior, the overconfidence of the third-party LSP does not damage the logistics system. When the third-party LSP overestimates the effect of the freshness keeping measures of the retailer, the retailer is prompted to invest more resources in freshness keeping measures and modify their strategy of freshness keeping. The retailer takes measures to ensure that the execution of freshness keeping procedures remains at a relatively low level and compensates for this in the post-delivery stage. Eventually, due to the decrease in the number of consumers with greater distance, the extra cost of the retailers can be recouped. The terminal freshness upon the consumers’ reception of the products can be preserved at a considered level.

Secondly, it is not always a wise decision for managers to employ blockchain technology to counter overconfidence. However, it performs more effectively with respect to freshness-keeping when adoption strategies of blockchain technology are designed independently. When the adoption strategy of blockchain technology is designed based on established freshness keeping measures, blockchain cannot carry out an explicit execution and can even decrease the performance of the logistics system with respect to freshness-keeping. Moreover, adopting blockchain technology as a tracking system results in higher freshness with equivalent freshness keeping measures of the retailer; however, some additional costs, such as the compensation and demotion of decision-making statuses, constituting a burden on the third-party LSP, which is not conducive to cooperation between members.

Thirdly, compared to overconfidence, the impact of blockchain technology appears to have a greater effect on freshness keeping. When blockchain technology is adopted as a countermeasure for overconfidence behavior, the effect of blockchain technology eventually causes a trend where the freshness of products deteriorates during delivery, while the degree of overconfidence influences other aspects related to freshness. Moreover, in the same logic, the exogenous price and freight also hasten or delay freshness deterioration. The effect of blockchain technology also influences overconfidence.

8.2. Theoretical Contributions

This paper contributes to the existing literature on countermeasures for overconfidence behavior and blockchain technology adoption in the fresh agricultural product industry. Compared with the existing literature, three important theoretical contributions have been highlighted, which are listed as follows.

First, the overconfidence behavior of a third-party LSP was investigated in the fresh agricultural product industry. Although blockchain technology has been designed as a tracking system in the fresh agricultural product industry [

4,

25,

47,

55], the overconfidence behavior of third-party LSPs has been neglected in the literature. Overconfidence behaviors violate the rational behavior hypothesis, which eventually distorts the effect of blockchain. The rare research on the irrational behaviors exhibited by third-party LSP focuses on overestimating the effect of freshness keeping measures. In this paper, the retailer is responsible for maintaining the freshness of products, and the third-party LSP decides on their delivery capacity. When the third-party LSP overestimates the effect of freshness keeping measures, the retailer is urged to improve their freshness-keeping measures to avoid losses caused by this irrational behavior and eventually increase the terminal freshness. However, when blockchain technology is adopted as a countermeasure, the retailer is liberated from the losses caused by overconfidence, but the third-party LSP needs to compensate for the losses, which induces more serious irrational behavior. No prior study has investigated the effect of blockchain when a member of the supply chain is irrational. These unique characteristics make this paper different from the existing literature.

Second, the influence of blockchain technology and overconfidence behavior is discussed in the fresh agricultural product industry, constituting an unresolved topic in the literature. In current research, blockchain technology and overconfidence behavior in the fresh agricultural product industry act differently in some specific situations [

4,

43,

54,

57]. However, previous studies have not considered the interaction between these two factors when they opearate simultaneously in a system. The influence of blockchain technology as a countermeasure for overconfidence behavior is a unique research setting wherein the adoption of blockchain technology can cause a third-party LSP to change their decision-making mode. In the current research, it was not definitively determined whether blockchain technology and overconfidence benefit or harm the system. When blockchain technology is adopted as a countermeasure, the positive effect of overconfidence behavior increasing the terminal freshness is weakened, and the optimal blockchain adoption strategy is disturbed by the overconfidence. Meanwhile, when blockchain technology is adopted as an initial-established tracking system with freshness keeping measures, information on freshness can be shared to all of the members in order to eliminate the overconfidence behavior and maintain a satisfactory level of terminal freshness. No similar results have been found in the prior literature. Hence, this paper is an important contribution to the literature on multiple pricing policies for fresh agricultural products.

Third, this paper focuses on the applicable conditions of blockchain technology. Instead of investigating the performance of blockchain technology in the logistics systems investigated in recent studies [

17,

43,

49,

54,

57], the adoption degree, which can be used to evaluate the degree of blockchain technology adoption, is employed to discuss the concrete situation wherein blockchain technology improves the performance. Moreover, differing with some research incorporating a dynamic adoption degree [

27], situations that cannot be determined with optimal solutions are offered. When blockchain technology is adopted as a countermeasure, the third-party LSP and retailer take on adversarial roles in the supply chain system. Although the unfairness wherein the retailer bear the brunt of the losses incurred by the third-party LSP is eliminated, the degree of terminal freshness is decreased, which is not conductive to the whole system and even harms the surplus of consumers. When blockchain technology is adopted as an initial-established tracking system, freshness, logistics, and freshness keeping information is shared with both the retailer and the third-party LSP. These two sectors play cooperative roles, with the side effect being that overconfidence behavior is replaced by the division of labor with execution. Eventually, the performance of the whole system gains better returns. This discussion is strikingly different from the evaluation in the existing literature. This paper offers a specific and comprehensive solution to deal with the problem of blockchain technology adoption.

8.3. Managerial Implications

The theoretical results of this paper provide critical guidelines for greengrocer retailers who adopt blockchain technology, especially those affected by the overconfidence of third-party LSPs.

Firstly, managers should adjust their freshness keeping strategy once the third-party LSP is overconfident. Although overconfidence can eventually increase the terminal freshness, this increase is based on the extra freshness keeping measures instead of overconfidence. Otherwise, the continual unfair situation wherein the retailer is burdened with the losses caused by the overconfidence of the third-party LSP and invests in extra freshness-keeping efforts unbalances the collaboration of the supply chain system and eventually disrupts the normal behaviors in the industry.

Moreover, instead of adopting blockchain technology as a countermeasure, it is more sensible for managers to establish the system with freshness keeping measures initially. When blockchain technology is adopted as a countermeasure, it cannot implement an explicit execution, and it also burdens the third-party LSP, which is not favorable for member cooperation. The adoption pattern of blockchain technology is not only a tracking system for freshness information sharing, but it also builds the relationship between the third-party LSP and the retailer. Adopting it as a countermeasure is more likely to intensify the conflict between members.

Moreover, it is more useful for managers to pay attention to the exogenous price and freight. The exogenous price and freight induce a change in freshness keeping and blockchain technology adoption despite the overconfidence degree and the effect of blockchain technology. Instead of focusing on the improvement of transparent freshness keeping measures and freshness information with blockchain [

4,

17,

43,

49,

54], our article places emphasis on the role of the LSP in the supply chain system when blockchain is adopted as an initial-established tracking system or a countermeasure.

These findings are consistent with our observations. Meituan declared that they would open their logistics platform for couriers, and they employ a delivery-tracking system. The retailer in the platform should offer related freshness keeping measures, including disposable food containers and disposable food bags, while couriers in this mode should take orders on their own and be motivated to be overconfident for extra profit. Retailers usually take extra freshness keeping measures, such as using dry ice to stop ice cream from melting over long distance deliveries due to couriers overestimating the effect of freshness keeping measures. Moreover, when a tracking system is employed, couriers are under supervision, which should guarantee the terminal freshness. However, couriers during delivery who carry a bill obtained with overconfidence give false information on advance delivery confirmation.

8.4. Future Research Directions

There are numerous directions for future research. First, the logistics system was investigated with a single member in this paper. However, in practice, it is usually the case that several couriers provide logistics service for several retailers. With competition among homogeneous members, the price and freight should also be taken into consideration, especially for some products that deteriorate rapidly. Therefore, blockchain technology adoption should be investigated in consideration of multi-agent game behavior [

58]. Second, the demand and deterioration of a product are considered fixed factors in this paper. However, in practice, the germinal mechanism of market demand and deterioration is a stochastic process. Therefore, it should be taken into consideration with stochastic utility in future research.