1. Introduction

According to the statistics of the China Association of Automobile Manufacturers, China’s NEV sales have shown an increasing trend year by year from 2015 to 2022, and sales in 2022 reached 6.887 million units, with a year-on-year growth of 93.4%. Simultaneously, the market penetration rate of NEVs reached 25.6%, which is a significant increase compared with 13.4% in 2021 [

1,

2]. However, from the perspective of the market share, there is still a big gap between the market penetrate rate of NEVs and that of fuel vehicles. The main reason is that high battery prices keep the prices of NEVs high. In addition, consumers remain concerned about battery performance, including endurance and residual value anxiety caused by battery decay [

3].

To eliminate consumers’ concerns about purchasing NEVs, the NEV industry has taken measures toward two aspects [

4,

5,

6]. On the one hand, to better solve the problems of high battery price, battery decay and residual value anxiety, the battery leasing service has begun to be developed in the NEV market [

7]. Such a service includes NIO’s “Battery as a Service”, BAIC’s “Vehicle and Electrical Value Separation Business Model”, Geometry Auto’s “Battery Leasing Program” and SAIC’s “Battery Bank”. The battery leasing service means that for NEVs, battery swapping vehicle manufacturers (vehicle manufacturers for short) have changed the traditional sales mode of the whole vehicle by selling the vehicle body without the battery (vehicle body for short) and the power battery (battery for short) separately. In this mode, vehicle manufacturers only sell the vehicle body to consumers while providing the battery leasing service to consumers by themselves or third-party enterprises where consumers only have the usage right but not ownership of the battery [

8]. In this way, the initial purchase cost of consumers is greatly reduced, which completely solves the problem of battery decay and residual value anxiety caused by the purchase of batteries [

9]. On the other hand, for the issue of mileage anxiety, the battery swapping service has become another important choice for consumers to shorten the refueling time [

10]. Generally speaking, battery charging and battery swapping are the two energy replenishment methods of NEVs. Compared with the battery charging mode, battery swapping not only greatly shortens the energy replenishment time, but is also advantageous in alleviating mileage anxiety and improving battery safety level [

11,

12]. With the rapid growth of the NEV market, the market size of the battery swapping service amounts to 100 billion RMB YUAN, which is attracting many enterprises to join in. For example, in China, battery manufacturers headed by CATL, vehicle manufacturers headed by NIO and Geely Automobile, and third-party operators headed by Aulton New Energy Automotive Technology Company (Aulton Technology for short) and Botan Technology Engineering Company (Botan Technology for short) have entered the battery swapping market.

The battery leasing service and battery swapping service have become a significant business model to solve the pain points of NEVs. However, the choice of operation mode has become an urgent issue for the vehicle supply chain members. Currently, there are three operation modes in the market:

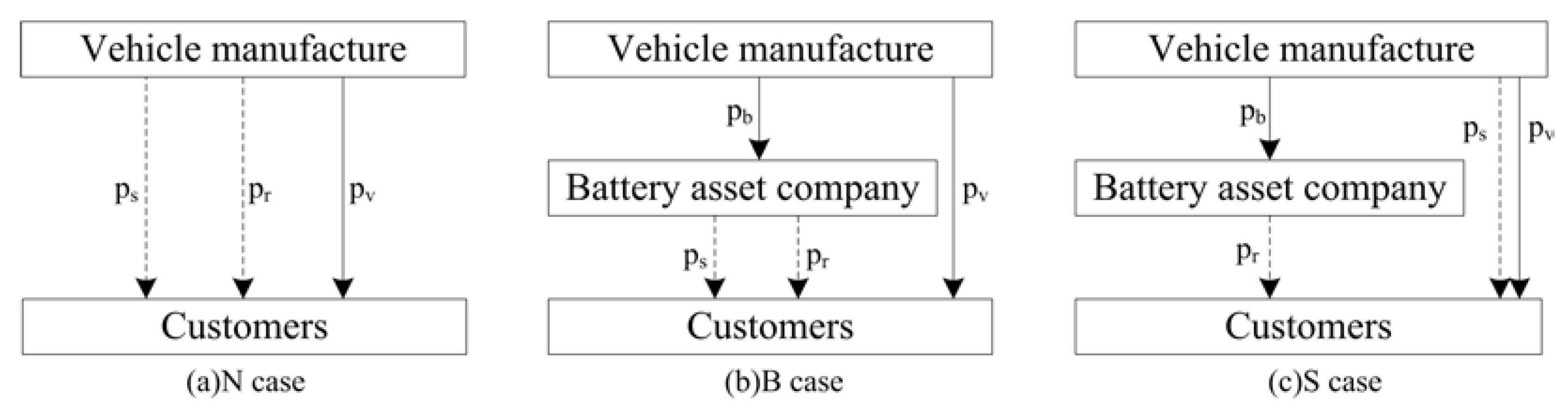

Vehicle manufacturers provide the battery leasing service and battery swapping service. In this mode, vehicle manufacturers sell the vehicle body to consumers while taking advantage of its OEM to provide the battery leasing service and battery swapping service for battery swapping vehicles. For example, NIO and Geely Automobile provide the battery leasing service and battery swapping service for their battery swapping vehicle through self-built battery swapping systems.

Vehicle manufacturers provide the battery swapping service and battery asset management companies (battery asset companies for short) provide the battery leasing service. To address the high battery cost pressure in the first mode, vehicle manufacturers transfer the ownership of the battery to the battery asset companies. In this mode, vehicle manufacturers sell the vehicle body and provide the battery swapping service to consumers while selling the battery to the battery asset companies; additionally, the battery asset companies obtain battery ownership and carry out battery life cycle management while providing the battery leasing service. For example, the NEV brand of SAIC MOTOR such as RISING AUTO provides the battery swapping service to customers and transfers the battery ownership of its battery swapping model R7 to a third-party company that provides the battery leasing service.

Battery asset companies provide the battery leasing service and battery swapping service, which means that they enter the battery swapping market with a scale of hundreds of billion RMB YUAN by virtue of the advantage of battery ownership. In this mode, vehicle manufacturers sell the vehicle body to consumers and the battery to the battery asset companies. For example, Aulton Technology owns the battery ownership of BAIC’s EU5 battery swapping vehicles. As the battery asset company, Aulton Technology provides the battery leasing service and battery swapping service for EU5 battery swapping vehicles.

As for the fact that the battery leasing service involves the battery leasing time and that the battery swapping service extends the battery leasing time through battery maintenance, this paper constructs three operation modes of the battery leasing service and battery swapping service, i.e., the two services are provided by vehicle manufacturers and battery asset companies, respectively, and the battery swapping service is provided by the vehicle manufacturers while the battery leasing service is provided by the battery asset companies. Then, it analyzes the optimal decisions of supply chain members under the three operation modes and gives relevant managerial insight through a comparative analysis. All in all, we desire to answer the following questions:

Regarding the three operation modes of battery leasing and battery swapping services, which mode is best for consumers? Which mode provides the lowest price for the battery leasing service and battery swapping service?

Which mode is more favorable to the development of the NEV industry?

Which mode should vehicle manufacturers and battery asset companies choose?

The main conclusions are as follows:

First, by comparing the three operation modes, the mode where the vehicle manufacturer provides the battery leasing and battery swapping services is the best. Second, the battery swapping service can increase the battery asset company’s profit. However, the impact of the battery leasing and battery swapping services on the vehicle manufacturer’s profit depends on the battery leasing increasing time cost coefficient. In addition, the battery asset company extending the battery leasing time can increase the vehicle manufacturer’s profit. Finally, the NEV industry should positively extend the battery leasing increasing time to increase the demand for NEVs.

The rest of this paper is organized as follows.

Section 2 briefly reviews the related literature.

Section 3 is the problem description and case assumptions.

Section 4 develops three operation modes and gives their equilibrium solutions.

Section 5 analyzes and compares the equilibrium solutions.

Section 6 conducts a numerical example.

Section 7 presents the conclusions and future research opportunities. All the proofs are detailed in

Appendix A,

Appendix B,

Appendix C and

Appendix D.

5. Model Analysis and Comparison

5.1. The Impact of Battery Leasing Increasing Time in N Case

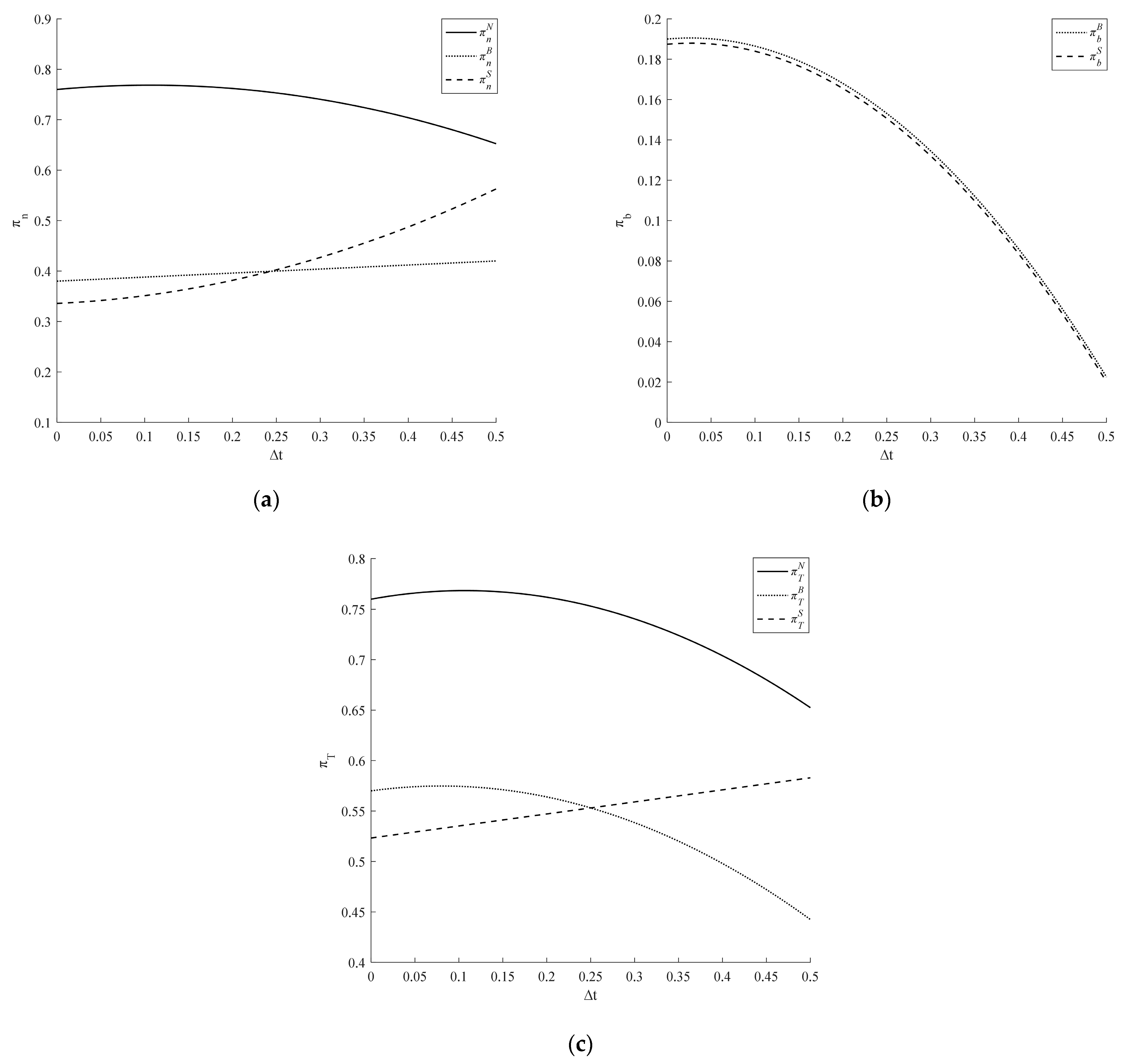

Corollary 1. (1) If , , , , ; otherwise, , , , ; (2) If , or and , ; if and , .

Where , , , , , .

From Corollary 1, the impact of the battery leasing increasing time on the service price and demand is affected by the vehicle production cost . The impact of the battery leasing increasing time on the vehicle manufacturer profit depends on the vehicle production cost and the battery leasing increasing time cost coefficient . When is larger or and are smaller, the vehicle manufacturer is more advantageous in extending the battery leasing increasing time.

Specifically, when the vehicle production cost is lower (), with the increase in , the battery leasing price increases and the battery swapping price, battery swapping vehicle demand and battery swapping service demand gradually decrease. In this case, the vehicle manufacturer can set a lower vehicle body price so that the demand for battery swapping vehicles becomes larger. Consequently, the vehicle manufacturer will raise the battery leasing price to increase revenue with the increase in , thus reducing the demand for the battery swapping service. Clearly, to increase the demand for the battery swapping service, the price of the battery swapping service should be reduced. However, the increase in demand for a battery swapping vehicle caused by the reduction in the battery swapping price is less than the decrease in demand for the battery swapping service caused by the demand for a battery swapping vehicle, which reduces the demand for the battery swapping service.

When the vehicle production cost is higher (), with the increase in , the battery leasing price decreases and the battery swapping price, battery swapping vehicle demand and battery swapping service demand gradually increase. Obviously, a higher vehicle production cost will prompt the vehicle manufacturer to raise the vehicle body price, thereby reducing the demand for vehicles. Therefore, to increase the demand for a battery swapping vehicle, the vehicle manufacturer will lower battery leasing price with the increase in . In addition, the longer the , the higher the cost of the battery swapping service, hence raising the battery swapping price. However, the demand for the battery swapping service increases because the decline in demand for the battery swapping service caused by the increase in the battery swapping price is less than the increase in demand for the battery swapping service caused by the demand for battery swapping vehicles.

The variation in profit with is related to the vehicle production cost and the battery leasing increasing time cost coefficient . When the vehicle production cost is larger () or both the vehicle production cost and the cost of battery leasing increasing time are smaller ( and ), extending the battery leasing increasing time is equivalent to extending the battery leasing time on the basis of the same basic battery leasing time . As a result, the vehicle manufacturer’s battery leasing service revenue increases, thereby increasing their profits. However, if the battery leasing increasing time cost is higher (), then extending the battery leasing increasing time will reduce the vehicle manufacturer profit even though the vehicle production cost is smaller.

5.2. The Impact of Battery Leasing Increasing Time in B Case

Corollary 2. (1) ; (2) If , , , , ; otherwise, , , , ;

(3) (a) ; (b) if or and , ; if and , ; (c) if or and , ; if and , .

Where , , , .

Proof .

The proof process is similar to Corollary 1; omitted. □

From Corollary 2, the impact of on the service price, demand and profits is the same as Corollary 1, which indicates that the impact of on supply chain members’ decisions in the B case is similar to that in the N case. In addition, the longer the in the B case, the higher the battery price is. Namely, if the battery leasing increasing time is longer, then the unit battery leasing service income is higher based on the same battery leasing price, which encourages the vehicle manufacturer to increase the battery price when selling the battery to the battery asset company.

In terms of profit, for the vehicle manufacturer, the longer the battery leasing time, the higher the battery price, which is more conductive to improving its profit. For the battery asset company and the supply chain, the impact of on profit depends on the vehicle production cost and the battery leasing increasing time cost coefficient . If the vehicle production cost is larger () or both the vehicle production cost and the cost of battery leasing increasing time are smaller ( and ), then increasing the battery leasing increasing time will raise the profits of the battery asset company and system. However, when the cost of the battery leasing increasing time is larger based on the smaller vehicle production cost, extending the battery leasing increasing time can reduce the battery leasing service revenue, thus reducing the profits of the battery asset company and system.

5.3. The Impact of Battery Leasing Increasing Time in S Case

Corollary 3. (1) ; (2) If , , , , ; otherwise, , , , ;

(3) (a) ; (b) if and , or , and , ; if , or , and , ; (c) if or and , , if and , .

Where, , , , , , , , .

Proof .

The proof process is similar to Corollary 1; omitted. □

From Corollary 3, the impact of on battery price, service price and demand is the same as Corollary 1, which indicates that the impact of on supply chain members’ decisions in the S case is similar to that in the N case. With regard to profits, for the vehicle manufacturer, the longer the , the more battery maintenance fees the vehicle manufacturer can gain from the battery asset company, which is more favorable to increasing its profit. For the battery asset company, the , and all affect the impact of on profit. Furthermore, when customers are not sensitive to battery swapping, extending the battery leasing increasing time will reduce the battery asset company profit. For the supply chain, only in the two case, i.e., the battery leasing time is longer (), the battery leasing time is shorter and the vehicle production cost is larger ( and ), the longer the battery leasing increasing time, the more the battery leasing service revenue, and the greater the system profit.

From Corollaries 1–3, despite the vehicle production cost being higher, the provider of the battery leasing service, whether it be the vehicle manufacturer in the N case or the battery asset company in the B and S cases, will choose to reduce the battery leasing price with the increase in to further expand the market demand for electric vehicles. At the same time, although the unit profit space of the battery leasing service is reduced, both the supply chain members and system profit can be increased. Because the battery swapping price increases, and the demand for battery swapping vehicles and the battery swapping service increases. This case is in line with the current situation of the development stage of battery swapping vehicles. To promote the expansion of battery swapping vehicles and the battery swapping service, and to make more profits, both the vehicle manufacturer and the battery asset company strive to maintain a lower battery leasing price with the increase in the battery leasing increasing time in the background of high vehicle production cost. Nevertheless, the battery price remains high.

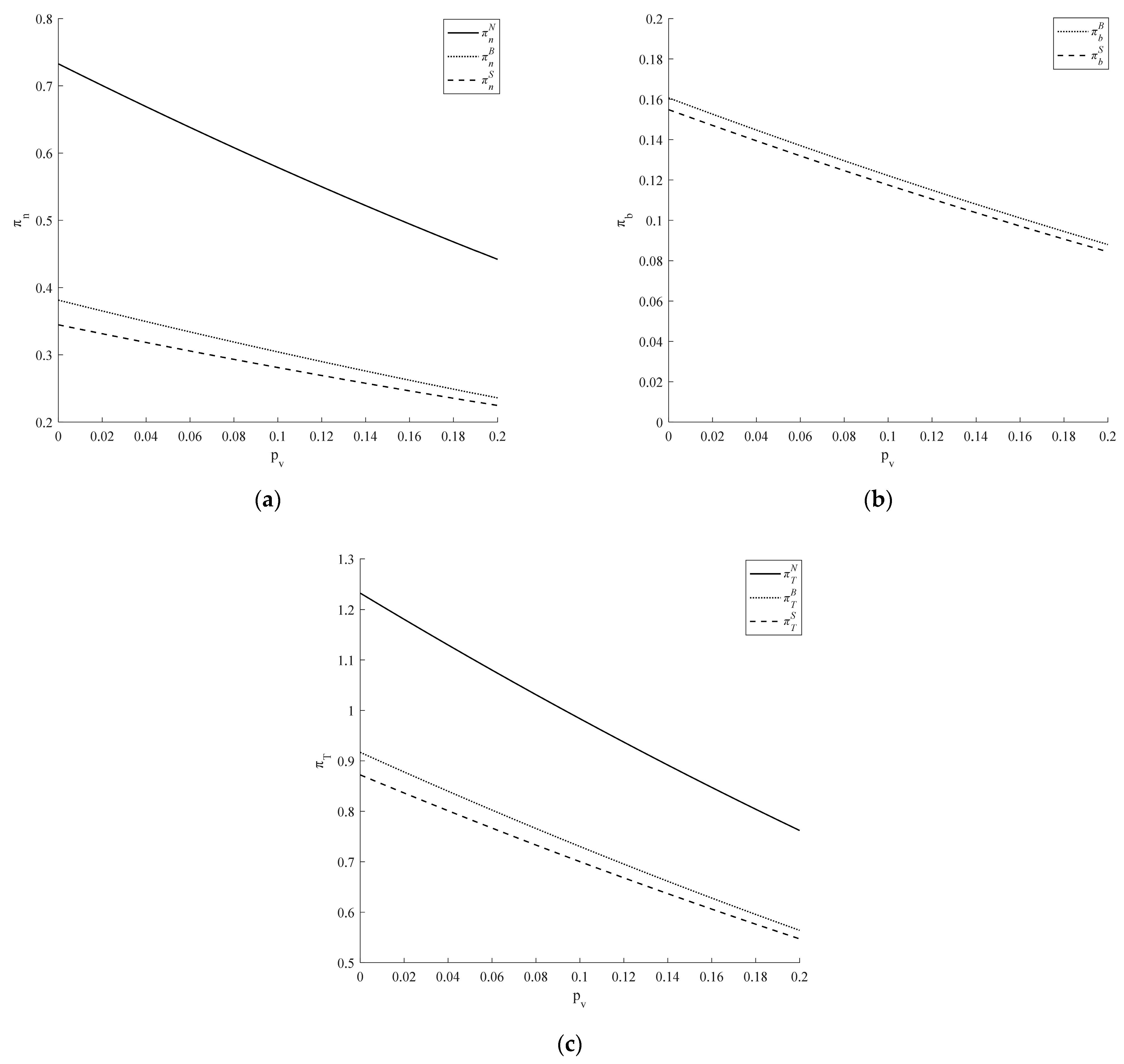

5.4. The Impact of Vehicle Body Price

Corollary 4. (1) , ; (2) (a) If and , ; if , or and , ; (b) if and , , if , or and , ; (c) ;

(3) , , , , , , , , , , , , , , , .

From Corollary 4, with the increase in , the battery price decreases. This means that a higher vehicle body price will reduce the demand for battery swapping vehicles, so that the vehicle manufacturer will reduce the battery price to increase profit. Furthermore, the impact of on battery leasing prices is different. More specifically, with the increase in , the battery leasing price declines in the S case. The reason is that the battery leasing price and vehicle body price simultaneously affect the demand for battery swapping vehicles as well as the battery leasing service provided by the battery asset company in the S case. Thus, the battery asset company will lower the battery leasing price to slow down the decline in battery swapping vehicle demand when the increase in reduces the demand for battery swapping vehicles. What is more, the impact of on the battery leasing price depends on the vehicle production cost and the sensitivity of the battery swapping price in the N case and B case. In both cases, the two services are provided by the same supply chain member. If the battery swapping price sensitivity is higher based on the larger vehicle production cost, then battery leasing price falls with the increase in . Otherwise, the battery leasing price rises. That is to say, if consumers are more sensitive to the battery swapping price and the vehicle production cost is high, then the battery leasing price can be reduced to expand the potential market of the battery swapping service; otherwise, the battery leasing price can be raised.

With the increase in , the battery swapping price, the demand for electric vehicles, the demand for battery swapping service and profit all decrease. This is because the increase in vehicle body price reduces the demand for battery swapping vehicles, thereby indirectly reducing the demand for the battery swapping service. Therefore, the service providers in the three cases will reduce the battery swapping price to promote the increase in demand. Additionally, even if the battery leasing price increases when the consumer is not sensitive to the battery swapping price, its impact on profit is less than the impact of the demand for electric vehicles and the profit reduction of the battery swapping service, thereby reducing the profits of the supply chain members and the system.

Corollary 4 shows that the lower the vehicle body price is, the more favorable it is to increase demand, supply chain members and system profit.

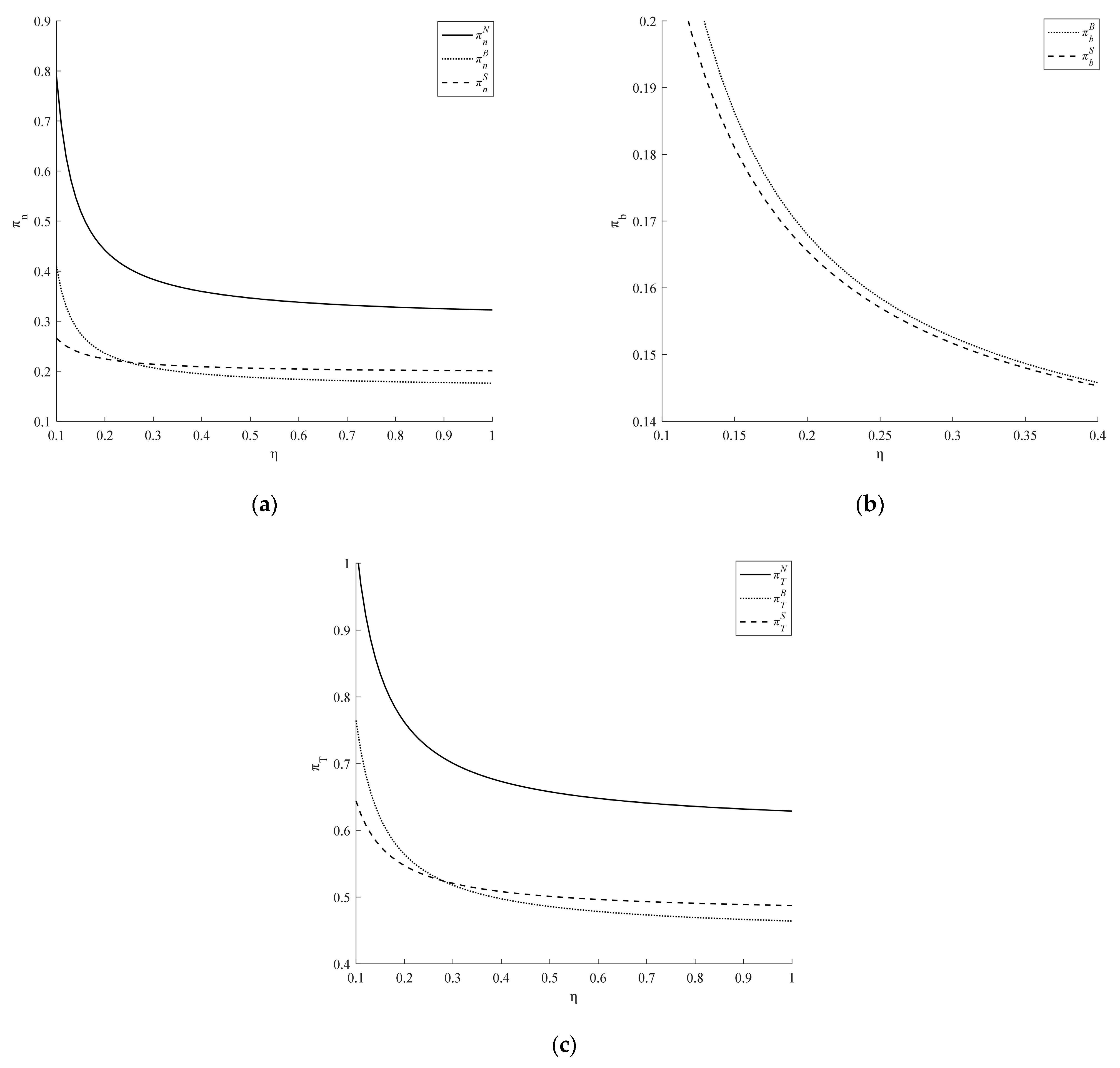

5.5. The Impact of Battery Swapping Price Sensitive Coefficient

Corollary 5. (1) , , , , ; (2) , , , , , , ;

(3) , , , , , , , .

Proof .

Corollary 5 can be obtained by the partial derivative of decision variables, demand and profit in the three cases. The proof process is omitted. □

From Corollary 5, with the increase in , the battery leasing price rises, and thebattery swapping price, battery swapping vehicle demand, battery swapping service demand and profit all decrease. The reasons for the increase in battery leasing price and the decrease in battery swapping price are different in the three cases. The two services are provided by the same supply chain members in the N case and B case. With the increase in , supply chain members who provide both services will choose to reduce the price of the battery swapping service and increase the battery leasing price. However, the battery swapping service is provided by the vehicle manufacturer while the battery leasing service is provided by the battery asset company in the S case. When consumers are sensitive to the battery swapping price, the vehicle manufacturer will reduce the battery swapping price to increase the battery swapping demand. In turn, the battery asset company will increase the battery leasing price to increase the battery leasing service income while the demand for battery swapping vehicles is reduced. However, the decline in demand for battery swapping vehicles is greater than the increase in demand caused by the decline in the battery swapping price, thereby reducing the demand for the battery swapping service. Furthermore, the profit increase brought by the increase in the battery leasing price is less than the decrease brought by the decrease in battery swapping vehicle demand, so the profits of the supply chain members are reduced. This shows that the more sensitive consumers are to the battery swapping price, the more the demand, supply chain members and system profit are reduced, although it is beneficial to reducing the battery swapping price. In conclusion, the above conclusions are in agreement with the current development status of the battery swapping vehicle. In this instance, consumers are more sensitive to the battery swapping price, the battery leasing price is higher, and the demand for battery swapping vehicles and the battery swapping service is smaller while the supply chain members and system do not achieve significant profits.

5.6. Comparative Analysis of the Three Cases

Corollary 6. (1) , , , , ; (2) If , ; otherwise, ; if , ; otherwise, ; if , ; otherwise, ;

(3) ;

(4) ; ; if , ; otherwise, .

Where , , , , .

Corollary 6 shows that in the N case, the battery leasing price is the lowest and the demand for battery swapping vehicles and the battery swapping service is the largest. This shows that when the vehicle manufacturer provides battery leasing and battery swapping services, the lower battery leasing price is helpful to promote the growth of demand for battery swapping vehicles and the battery swapping service. In addition, the battery price is the highest in the B case. Given that in the B case, the revenue of the vehicle manufacturer only includes vehicle body sales revenue and battery sales revenue, the vehicle manufacturer will adopt a higher battery price strategy to increase profit since it has more service revenue from the battery swapping service in the S case compared with the B case.

The comparison of the vehicle manufacturer and system profit in the three cases depends on the battery leasing increasing time cost coefficient , and the battery asset company profit is higher in the B case, which indicates that providing the battery swapping service can increase profit. Specifically, if is smaller, then the vehicle manufacturer profit in the N case is larger; otherwise, that in the S case is larger. This shows that only when the cost of the battery leasing increasing time is smaller, namely, the battery maintenance cost is smaller, is providing the battery leasing service conducive to improving the vehicle manufacturer profit. Conversely, providing the battery swapping service will reduce profit. Thus, the impact of the battery leasing service is greater than that of the battery swapping service. In addition, it is more advantageous for the supply chain that the vehicle manufacturer provides centralized battery leasing and battery swapping services.

Overall, the battery asset company should actively provide the battery swapping service. For the vehicle manufacturer, if the battery leasing increasing time cost coefficient is smaller, then it is best to provide two types of services; otherwise, providing the battery swapping service is a better choose. For the supply chain, the vehicle manufacturer providing two types of service is optimal.

7. Summary and Discussions

The battery leasing service and battery swapping service have emerged as significant solutions to overcome the challenges in the development of NEVs. Therefore, it is crucial and necessary to study the operation mode of the two services in the new energy vehicle supply chain. Based on the battery leasing service and battery swapping service, this paper proposes three operation modes of the battery leasing service and battery swapping service for the battery swapping vehicle supply chain composed of the vehicle manufacturer, the battery asset company and consumers: (1) the vehicle manufacturer provides the battery leasing and battery swapping services (N case), (2) the battery asset company provides the battery leasing and battery swapping services (B case) and (3) the vehicle manufacturer provides the battery swapping service while the battery asset company provides the battery leasing service (S case). According to the characteristics of the two services, the decision models under the three modes are constructed individually, and the relevant optimal decisions are obtained by backward induction. The decision results under the different modes are compared and analyzed. Finally, numerical examples are given to verify the results. This study finds that:

The N case is the optimal. In addition, for the comparison of the B case and the S case, when the battery leasing increasing time cost coefficient is smaller, the B case is the best. Otherwise, the S case is.

For supply chain members, when the battery leasing increasing time cost coefficient is smaller, the vehicle manufacturer should provide two services for the maximum profit. In the meantime, the battery leasing price is the lowest, and the vehicle demand and battery swapping service demand are the largest. In addition, the battery asset company should provide the battery swapping service to gain the maximum profit.

When the battery asset company provides the battery leasing service, the longer the battery leasing time and the greater the vehicle manufacturer profit.

For price and demand, the longer battery leasing time is not better. Only when the vehicle production cost is higher is increasing the battery leasing time conducive to reducing the battery leasing price, which is more beneficial to consumers, thus promoting demand growth.

Compared with the related literature on the pricing and strategy selection of energy replenishment methods for NEVs (Hu et al. [

4]; Yang et al. [

21]), this paper provides some new insights. Different from the above two literature studies from the perspective of consumer utility, this paper focuses on battery leasing and battery swapping services in the vehicle supply chain from the perspective of businesses and systematically considers the business mode in terms of the three aspects of battery leasing service, battery swapping service and vehicle body. Specifically, this paper considers that battery maintenance during battery swapping can increase the battery leasing time and discusses the boundaries of different operation modes for battery leasing and battery swapping services.

The battery leasing service and battery swapping service are of great significance to promoting NEVs. Based on the above research, the following managerial insight can be obtained:

The mode of the vehicle manufacturer providing two services to the supply chain is the optimal.

The vehicle manufacturer should decide on the service mode according to the battery leasing increasing time cost coefficient, while the battery asset company should actively provide the battery swapping service.

When the battery asset company provides battery leasing service, the vehicle manufacturer can “free ride” to enjoy the benefits of extending the battery leasing time.

With the high cost of NEVs limiting their development in China, extending the battery leasing increasing time is an effective measure to facilitate the diffusion of NEVs.

The limitation of this paper is that it does not consider the impact of the network externalities of the battery swapping station layout on the battery leasing and battery swapping services. This paper only considers the impact of the battery swapping service on the basis of the battery leasing service. In fact, as the operation place of battery swapping service, the network layout of the battery swapping station has a great influence on battery swapping vehicles and the battery swapping service. Therefore, further study is needed to consider the impact of the battery swapping station network layout on the basis of battery leasing and battery swapping services.