1. Introduction

The COVID-19 pandemic generated a great deal of uncertainty in all areas of human activity and brought about many serious social and economic effects. The latter included effects on employment, economic growth, physical investment, and, naturally, the stock and credit markets [

1,

2,

3,

4]. The pandemic environment shared some similarities with other historical market turmoil periods, but in contrast to recent global financial crises (the

dot.com crisis in 2001 or the subprime mortgages crisis in 2008) or the economic recessions in recent decades, the recent crisis was detonated by the worst sanitary catastrophe in a century.

Its strong impact affected both the real economy and the financial markets [

5,

6]. Diseased and convalescent individuals, sanitary measures including quarantines, curfews, and others reduced the supply of labor and created serious bottlenecks and logistics problems in many industries. As the economy suffered the terrible consequences of the pandemic, turbulence surged across all the world’s financial markets. In numerous countries, important government and central bank initiatives were implemented, including financial support for large and small enterprises, employees and consumers, reduced taxes, exceptional monetary stimulus, and many more, although there were also exceptional omissions [

7].

Risk in financial markets is usually measured in terms of asset price volatility. Its dynamic nature determines the existence of a time-changing risk premium in asset valuation, usually interpreted as an expected excess return paid by the market to those investors who are willing to include risky assets in their portfolio. The theoretical importance as well as its significant implications for practitioners have made the study of assets’ return volatility and risk premium a preferred topic in the literature. The remarkable seminal contribution to the modeling of risk premium by Engle, Lilien, and Robins [

8] introduced the ARCH-M model that allows the conditional variance to be factored in as an explanatory variable of the mean return equation and its estimated coefficient to be a measure of an asset return risk premium. That work detonated a vast effort to understand and measure volatility (for a detailed exposition on the subject see, for example, Francq and Zakoian [

9]. More recently, Yong et al. [

10] studied volatility during the COVID-19 pandemic for two Asian stock markets, the Bursa Malaysia and the Singapore Exchange, for a period that went from 1 July 2019 to 31 August 2020. These authors split their observation period into a pre-COVID-19 and a COVID-19 subperiod and estimated five different models of the GARCH family to choose the one with the lowest Schwarz information criterion value under six different statistical distributions. The GARCH(1,1), GARCH-M(1,1), and EGARCH(1,1) models performed satisfactorily for both Asian market returns, and the latter also revealed the presence of a leverage effect (market returns that were negatively correlated to their volatility). Following a similar approach, Duttilo et al. [

11] examined the impact of two waves of COVID-19 on the volatility of the stock market indexes of the euro area countries. They employed a Threshold GARCH(1,1)-in-Mean model with exogenous dummy variables and concluded that “euro-area members with small financial centers appear to be more resilient to COVID-19 compared to euro-area members with middle-large financial centers”. A key aspect of this work was its finding of a time-varying risk premium for several euro area main capital market indexes (AEX from the Netherlands, ATX from Austria, BEL 20 from Belgium, DAX from Germany, ISEQ 20 from Ireland, and OMXH 25 from Finland). The reported results suggest that these market investors “require a higher risk premium due to uncertainty surrounding the COVID-19 pandemic”.

The present study contributes to the same line of research initiated by Yong et al. [

10] and Duttilo et al. [

11], which is interested in studying market volatility and its association to the market’s risk premium during the COVID-19 pandemic period. Our main contribution consists of estimating market volatility and the market’s risk premium of a sample of nine countries from three different geographical regions and different degrees of economic development, thus increasing the representativeness of the sample with respect to the above references. Moreover, we further innovate by estimating an MS GARCH model that allows us to lean out into the sample microstructure workings of the stock markets and detect the existence of regime changes in the data. These two contributions do not compete among themselves to identify which approach is best for modeling the stock market volatility, but they are complementary as the GARCH-M model focuses on the estimation of conditional volatility, and its mean equation contains the parameter of our interest since it clearly measures risk premium, while the MS GARCH model, from a different perspective, reveals the existence of states of the data generating process and measures their respective probability.

Our investigation models volatility and its effects on the capital markets’ risk premium in the context of the COVID-19 pandemic with the GARCH-M(1,1) model of Engle, Lilien, and Robins [

8]. We further delve into the market’s microstructure to investigate the presence of changing regimes in volatility, this time with an MS GARCH(1,1) model, capable of identifying the presence of two possible regimes for each market in the sample. The analysis performed with the GARCH-M(1,1) model was divided in two periods: the pre-COVID period from 1 January 2015 to 31 December 2019 and the COVID period from 1 January 2020 to 31 December 2021. The conditional mean estimated coefficient represented the market risk premium, and we used the Normal Inverse Gaussian (NIG) distribution as a strategy to deal with the problem of data distributions with heavy tails. The MS GARCH(1,1) estimation included the whole observation period.

The observation sample included nine national markets distributed in three geographical regions: the North American region (the IPC for Mexico; the S&P 500 for the USA; and, the TSX for Canada); the Asian region, (the KOSPI for South Korea; the NIKKEI for Japan; the HANG SENG for Hong Kong; and the STI for Singapore); and, the South American region (the IBOVESPA for Brazil; and the MERVAL for Argentina).

The rest of the paper is structured as follows:

Section 2 presents a brief literature review;

Section 3 explains the methodology;

Section 4 presents the empirical results and their interpretation; and, finally,

Section 5 contains the main conclusions of the study.

2. Literature Review

In a world with highly integrated financial markets, risk measures are an essential tool for market participants (investors, regulators, and managers); indeed, financial risk, usually measured in terms of asset return volatility, is one of the most important variables for decision makers. This section briefly reviews some seminal and recent works that frame the analysis offered by this paper in the context of volatility modeling, risk premium estimation, and regime-changing volatility estimation.

The most widely used models to study financial markets risk and to capture the clustering of financial data volatility are the Autoregressive Conditional Heteroskedasticity (ARCH) Model [

12] and the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) Model [

13,

14]. Refinements of the former model capture additional characteristics of the data, namely, asymmetry [

15] and exponential trends [

16]. An important development in volatility modeling was the introduction of component models of which some examples include Ding and Granger [

17], Adrian and Rosenberg [

18], and Engle and Rangel [

19]. The influential paper of Engle, Ghysels, and Sohn [

20] proposed several new component model specifications that incorporated direct links to economic variables and followed the Mixed Data Sampling (or MIDAS) approach to develop a new class of models that they called GARCH–MIDAS models. Their approach extracted two components of volatility, one corresponding to short-term returns and the other one to long-run returns, in order to study the relationship between stock market volatility and economic activity. Further developments of MIDAS-type models include the GARCH–MIDAS-X model that was tested in Amendola et al. [

21] and Conrad et al. [

22]. Both of these studies emphasized the forecasting ability and performance of their models and concluded that they compete with the MS GARCH specification in volatility forecasting.

The classical ARCH and GARCH models were developed to capture volatility clustering but cannot explain the data generation process when the variable return distribution has heavy tails. Alternative conditional distributions frequently used to deal with the heavy tails issue include the

t-distribution [

13], the General Error Distribution (GED) [

16], the alpha stable distributions [

23], and the Normal Inverse Gaussian Distribution (NIG) [

24]. Another important model is the GARCH–NIG [

25] based on a mix of distributions, i.e., returns are assumed normal with a latent stochastic variance; this is the one that we used to perform the risk premium estimation analysis of the present contribution, as detailed in the methodological section.

The dynamics of volatility in financial markets can change in a structural sense because of important events that affect financial markets. Consequently, the forecasting of volatility with classical GARCH models may be subject to a bias due to the assumption of a constant mean and variance (see, for example, Lamoureux and Lastrapes [

26]). An effective proposal that deals with this problem is the Switching Regime Model introduced by Hamilton in his seminal paper [

27]. Some years later, Cai [

28] combined Hamilton’s model and the ARCH structure of Engle [

12] to study the volatility persistence in monthly three-month treasury bill returns, and Hamilton and Susmel [

29] combined the concept of structural changes and the GARCH structure. From that moment onward, many studies of stock market volatility with a direct application of Markov-Switching GARCH models has proliferated.

The robustness and versatility of the MS GARCH model has supported multiple studies developed in many different markets. A short list of examples includes, for example, Ataurima and Rodríguez [

30], who illustrated the modeling of stock market volatility with an application of Markov-Switching GARCH models for the stock market and the foreign exchange market of several developed (Canada, the USA, Denmark, Norway, Australia, Switzerland, the UK, Japan, and Europe) and emerging Latin American countries (Argentina, Brazil, Chile, Colombia, Mexico, and Peru). Ataurima and Rodriguez used the algorithms proposed by Augustyniak [

31] and Ardia et al. [

32] to develop a multidimensional exhaustive analysis of their sample of developed and emerging market countries using specifications of the single regime GARCH(1,1) and contrasting them with MS GARCH(1,1) models (with normal, skewed normal,

t-student, and skewed t-student distributions). The best adjustment model for the case of high-income country indexes, as well as for emerging market indexes, except in the cases of Colombia, Peru, and Chile, is the GJR model with a skewed

t distribution. The best models are estimated using R and the program developed in Ardia et al. [

32].

Not considering the skewness, asymmetry and the possible regime changes cause problems in the estimation of Value at Risk (VaR), as demonstrated in Sajjad et al. [

33], where an empirical analysis on the FTSE and S&P indexes was developed for short and long positions. Using back testing to compare MS GARCH models with single-regime GARCH VaR estimations, they found that the former specification clearly outperforms other models in estimating the VaR for long and short FTSE positions (and performs very well for S&P positions). Su et al. [

34] proved the usefulness of the MS GARCH model to predict the out of the sample VaR of stock and currency-stock portfolios’ returns. Braione et. al. [

35] suggested that forecasts of Value-at-Risk (VaR) must account for non-normally distributed, fat-tailed, and often skewed financial asset returns, so they look at the effects that different distributional assumptions have on the accuracy of both univariate and multivariate GARCH models in out-of-sample VaR predictions. Their results indicate that allowing for heavy-tails and skewness in the distributional assumption is important, and they report that the skew-Student’s distribution outperforms the others across all tests and confidence levels. Al Rahahleh and Kao [

36] evaluated the forecasting ability of linear and nonlinear generalized GARCH models forecasting accuracy using the TASI and TIPISI indexes of the Saudi market. Their finding was that the Asymmetric Power of ARCH (APARCH) model is the most accurate for forecasting the volatility of both indexes.

Another application of this type of model, this time to the returns from gold, platinum, palladium, and silver prices can be found in Naeem et al. [

37]. The findings of these authors were that the in-sample estimations with MS GARCH models with two and three states were better than the single-regime GARCH’s findings. However, for prediction purposes (and, therefore, the estimation of the VaR), MS GARCH models dominate only in the case of gold and platinum. Similarly, Shiferaw [

38] demonstrated that MS GARCH is better for forecasting VaR for the prices of agricultural products, oil, gas, coal, and the exchange rate of South Africa currency (USD/Rand). De la Torre-Torres [

39], using weekly data for oil futures, demonstrated the ability of the MS GARCH Gaussian model for trading purposes. In a similar study, Xiao [

40] demonstrated that the MS GARCH model is suitable for the prediction of risk in oil market (WTI) and concluded that a model with switching regimes better captures dynamic structures than the single-regime model. Lopez-Herrera and Mota-Aragón [

41] reported that the asymmetric MS GARCH model is suitable for the estimation of volatility in the Mexican stock and exchange rate markets. In Zhang et al. [

42], the modeling of in-sample volatility of the Brent and WTI oil prices was best performed with an MS GARCH model, using weekly data; however, for the out-of-sample forecasting, the single regime models were shown to be very solid for different time horizons, from one day to four weeks.

An increasing interest in cryptocurrency studies is manifested in Balcombe and Fraser [

43], who found evidence of structural changes in the dynamics of bitcoin price volatility in the presence of bubbles, or Thies and Molnar [

44], who also found structural changes in the average returns and volatility for the same market. Ardia et al. [

45] studied the bitcoin market and compared GARCH versus MS GARCH model forecasting of VaR performance. In the one-day-ahead comparison, the MS GARCH was the best model, and again, for in-sample estimations a two-regime MS GARCH proved better than the single regime specification. Still another application of the MS GARCH to the analysis of cryptocurrencies market can be found in Caporale and Zekokh [

46] who compare a two-regime model with a one-regime model using bitcoin, ethereum, ripple and litecoin and concluded that VaR forecasting with the MS–GARCH and back testing gave better than simpler models.

Some other studies that have used the MS GARCH to model market volatility have dealt with several markets simultaneously, with spillovers and with VaR projections. For example, Ghorbel and Jeribi [

47] analyzed the volatilities of WTI oil prices, the Chinese stock exchange market index (SSE), bitcoin and gold prices, and the stock market indexes of the G7 countries and concluded that in bitcoin, gold, and all the indexes there is a change of volatility regime. Urom et al. [

48] applied a dynamic CAPM based on MS GARCH to study 81 markets (commodities, energy, and financial) and demonstrated that a one-day forecasting of VaR is better performed when a change of regime is considered. Mohammadi et al. [

49] used ARCH and GARCH models to find empirical evidence of unidirectional return spillovers from the US to the stock markets of Hong Kong and mainland China (Shanghai and Shenzhen) but no spillover in the opposite direction.

The COVID-19 pandemic motivated the elaboration of several studies on the impact of the uncertainty created by COVID-19 over securities returns of different stock markets. For example, Akhtaruzzaman et al. [

50] analyzed how financial contagion occurred through financial and nonfinancial firms between China and G7 countries during the COVID emergency. The results reported suggest that both financial and nonfinancial firms experienced a significant increase in the conditional correlations of their stock returns, but the magnitude of increases is considerably higher for financial firms, confirming the importance of their role in financial contagion transmission. Demir et al. [

51] acknowledged the volatility increase associated with COVID-19 and discussed the potential effect of the vaccine to recover the stability in the energy sector. This study documented that vaccination programs effectively decreased volatility, both in statistical and economic terms, for energy stocks at a global level (58 countries). Alexakis et al. [

52] investigated the impact of government social distancing measures to reduce the COVID-19 spread, as reflected on 45 major stock market indexes. The authors reported evidence of negative direct and spillover effects during the containment measures period. Scherf et al. [

53] analyzed how national stock market indexes reacted to the news of national lockdown restrictions (from January to May of 2020) and reported that lockdown restrictions produced different reactions in their sample of OECD and BRICS. The general effect at the onset was the outcome of rapidly increasing lockdown provisions. Relaxing the provisions had positive effects on stock markets during the second half of the period. Fernandez-Perez et al. [

54] addressed the effect of national culture on stock market responses to a global health disaster such as the COVID-19 pandemic and found that in their sample ranging from emerging to highly industrialized economies, there were larger declines and greater volatility for stock markets in countries with lower individualism and higher uncertainty avoidance during the first three weeks after a country’s first COVID-19 case announcement. Haldar and Sethi [

55] investigated whether the coronavirus (COVID-19) pandemic negatively affected the stock market through contagion. With data from the 10 most affected stock markets over the period from December 2019 to May 2020 and with the statistical support of an EGARCH model, they showed that “market speculations lead to negative stock returns and higher stock market volatility”. These authors reported that the stock market returns for most of the countries in their sample experienced “low to negative returns and higher volatility” during the first months of the pandemic. During the second phase, “returns improved but volatility remained high”, probably explained by a reduction in the uncertainty associated with the virus. Ozkan [

56] studied the impact of the COVID-19 pandemic on stock market efficiency in six developed countries—the US, Spain, the United Kingdom (UK), Italy, France, and Germany from 29 July 2019 to 25 January 2021 using a wild bootstrap automatic variance ratio (WBAVR). According to the author, the WBAVR test was chosen because it offers robust and precise results in the presence of non-normality and conditional heteroskedasticity. Their tests suggest that the COVID-19 pandemic affected market efficiency of the stock markets in all of the countries in the sample for some time. Most deviations from market efficiency were observed in the US and UK stock markets. Szczygielski et al. [

57] explored the impact of COVID-19 on the returns and volatility of the stock market of regional market groups using ARCH/GARCH models. The authors measured uncertainty by searches for information as reflected by Google search trends. They discovered that Asian and Latin American markets were the least and most affected in terms of volatility. With information obtained from wavelet coherence and phase difference, Nian et al. [

58] described the response of China and the US stock market indexes to the COVID-19 outbreak in a long-term band roughly divided into three phases. During the first phase, the reason for the extreme volatility of the stock market was mainly attributed to the pessimistic expectations of investors; the Chinese and US stock markets had a strong negative correlation with the growing number of COVID-19 cases. During the second phase, the recovery of the stock market exhibited opposite responses; the former retained a significant negative correlation, while the latter turned to a positive correlation. During the third phase, vaccines and economic stimulus diminished both of the markets’ vulnerability to COVID-19, and investor sentiment indexes recovered.

Many studies have used GARCH models to study market volatility during the COVID-19 outbreak. Some examples include Duttilo et al. [

11], who studied the way the first two waves of COVID-19 affected the return and volatility of the euro area country stock market indexes. Chiang [

59] based on the estimation results of a Generalized Error Distribution GARCH, proved that the uncertainty present in the United States contributed strongly to the spillover on many financial markets. Setiawan et al. [

60] used a GARCH(1,1) model to show that the impact of the COVID crisis was greater than the impact of the subprime mortgage crisis on the return and volatility of Indonesia and Hungary’s stock markets; complementing their analysis with a Threshold GARCH-M(1,1) for the eurozone’s 16 stock markets, they studied the impact on volatility of the two first waves of the COVID-19 contagion. Yousaf et al. [

61] examined the hedging role of gold against 13 Asian stock markets during the COVID-19 outbreak using a DCC–GARCH model and reported that gold was a strong hedge for the stock market in China, Indonesia, Singapore, and Vietnam but only a weak safe haven for the Pakistan and Thailand markets. Manuj [

62] studied whether gold is a good hedge in the US and Indian stock markets. Using a GARCH(1,1) model and linear regression with monthly data for the American (S&P 500) and Indian (BSE Sensex) stock market indexes, during the period from 1980 to 2020, they concluded that gold was not a satisfactory haven during that period.

The difficult environment created by the COVID-19 pandemic had severe consequences at many different levels of the world’s economy, and important research efforts were devoted to better understand its nature and implications. A subject of special interest in the analysis of the implications of the pandemic on the functioning of the financial markets is: how did country risk premiums evolved through the pandemic?

Our bibliographic search found only two papers that had aimed to answer that question. The first one was the work of Nieto and Rubio [

63], whose focus was “to analyze the performance of systematic risk factors across international stock markets during the COVID-19 crisis”. These authors also made a detailed comparison of the risk factors present during the subprime mortgages crisis (2008–2009) with respect to those observed during the COVID-19 crisis and evaluated the expected market risk premium through the implied volatility of the one-month and 12-month maturity options on selected stock market indexes worldwide. The second was the work of Bizuneh and Geremew [

64] who focused on the COVID-19 pandemic’s impact on 12 Emerging Market Countries’ sovereign bond risk premium and fiscal solvency. Their analysis was based on the results of a Dynamic Panel model, and they found that the pandemic impacted the sovereign risk premium mainly through GDP growth and political stability indicators; the real exchange rate and the ratio of net exports to GDP were also statistically significant determinants of sovereign bond risk premia.

3. Methodology

As mentioned, the objective of this paper is to determine whether the COVID crisis influenced the volatility of returns and the market risk premium of a sample of stock markets in developed and emerging countries.

We postulate that a GARCH-M(1,1) model is adequate to capture the risk premium of an asset, because in the model’s specification, an asset’s return is partially determined by the previous period’s volatility. The original idea came from Engle et al. [

8] in which they present the ARCH-M model to capture the time-varying risk premium of the yields of holding a bond position. However, GARCH models have proven to produce better results, so under this specification, the variance is presented as the explanatory variable in the mean process. The traditional model to estimate is:

In Equation (1), represents the risk premium or excess return, given previous conditional volatility. If the value is positive and statistically significant, then the interpretation is that an increase in conditional variance leads to an increment in the expected return, i.e., the risk premium.

An issue with the traditional approaches is that the complete shape and dynamics of the mean and the volatility (proxied by the squared returns), although conditional with respect to time, are not fully captured under the normal distribution assumption.

More advanced models use distributions different from the normal to capture the dynamics that cause the skewness and excess kurtosis observed in empirical data (see, for example, Ngunyi et al. [

65] and Cerqueti [

66]). In such cases, the conditional behavior of the innovations may be described as a density function with parameters

, with the mean and standard deviation used to standardize the innovations:

The

denotes the remaining parameters of the distribution, which may include the shape and skewness parameters. One laudable property of the semi-heavy tail distribution discussed in Jensen and Lunde [

67] is that they can be incorporated in the GARCH equation as the distribution explaining the residuals of the model. The Generalized Hyperbolic Family is a set of distributions; they are defined with five parameters, which, according to Cont [

68], need at least four parameters that allow for enough flexibility to capture the stylized facts of asset returns. The NIG distribution was defined in the seminal paper of Barndorff-Nielsen [

69], as follows:

where

is the modified Bessel function of second kind, order

. For the domain

and parameters

and

and

.

Extensions of this model are presented in Anderson [

70] and Barndorff-Nielsen and Shepard [

71], where the authors describe the incorporation of time-dependent equations to model return volatility (stochastic volatility modeling). In this case, the results have the property to capture skew and leptokurtic behavior, allowing for an estimation of the parameters. Further developments of NIG non-normal processes and the computational benefits are extensively discussed in Albrecher and Predota [

72]. To compute the GARCH model, the conditional distribution of the process must be self-decomposable and possess the linear transformation property, in order to center the mean and obtain a unitary variance. For the moment, generating function of the Generalized Hyperbolic distribution, expected moments depend on all parameters [

69]. Nevertheless, the existence of location and invariant parametrization helps to avoid this issue and construct a likelihood function to estimate the model. Namely, the parametrization to use is

defined as:

With this reparameterization, the interpretation is direct: represents the shape and stands for the skewness. However, for the Generalized Hyperbolic distribution, there is another parameter to consider: , which helps control the shape of the distribution. From a computational perspective, this coefficient may cause several problems, as it is part of the Bessel function. To address this issue, the Normal Inverse Gaussian (NIG) distribution may be used instead, as is the case when the value of lambda is set .

Deploying this model over the two data partitions, namely pre-COVID and COVID, it was possible to represent not only the stylized facts of the data but also a better estimation of the evolution of the risk premium. Given the model’s properties, changes in the coefficient, in the sign, or the loss of significance of the risk premium parameter, reflect the presence of a change of regime. These results are valuable by themselves as they describe the different market behavior during the pandemic; however, further analysis is required to elucidate the phenomenon behind.

To identify possible influences originated in the structure of the market (possible regime changes in the series), we ran a Markov-Switching GARCH (MS GARCH) model. As mentioned, traditional GARCH models tend to fail in the computation of volatility when a time series experiences regime changes. The specification of a more modern model is due to the work of Haas et al. [

73], who presented a

state GARCH model, with each regime transition following a Markov Chain.

With a continuous return series, it is possible to define the filtration up to

with the traditional

. Then the specification is:

where

is the continuous distribution with mean

,

is the conditional variance in time

and state

,

is a vector of additional parameters of the distribution, and

is defined in the space

of possible regimes. With these parameters, we can build a

Markov Chain transition probability matrix with

denoting the probability of transition from

to

. In the specification presented by Hass et al. (2004), the conditional variance becomes:

that is, an

measurable function, dependent on past returns, variance, and additional parameters of the

regime. For the current analysis, the simple GARCH specification was implemented and tested with a different number of regimes. The selection criteria of the best model were chosen to be the Akaike Information Criterion (AIC) and the Bayes Information Criterion (BIC) (see [

74]). These models were run with the nine country stock market indexes to determine whether the MS GARCH models detect the state transition of the returns.

5. Conclusions

This paper analyzed the effects of the COVID-19 pandemic on the world’s capital markets volatility from two different perspectives. In first place, we estimated the stock market index volatility and risk premium of a sample of nine countries from three different geographical regions and different degrees of economic development increasing the representativeness of the sample with respect Duttilo et al. [

11], who focused only on the euro area countries and Yong et al. [

10] who focused exclusively on Malaysia and Singapore. In second place, we innovated by estimating how an MS GARCH(1,1) model reveals the microstructure workings of the stock markets by identifying the existence of regime changes in the data and their state probability. These two contributions do not compete among themselves to identify which approach is best for modeling stock market volatility, but are complementary as the GARCH-M(1,1) model focuses on the estimation of conditional volatility, and its mean equation contains the parameter of our interest since it clearly measures risk premium, while the MS GARCH(1,1) model, from a different perspective, reveals the existence of states of the data generating process and measures their respective probability.

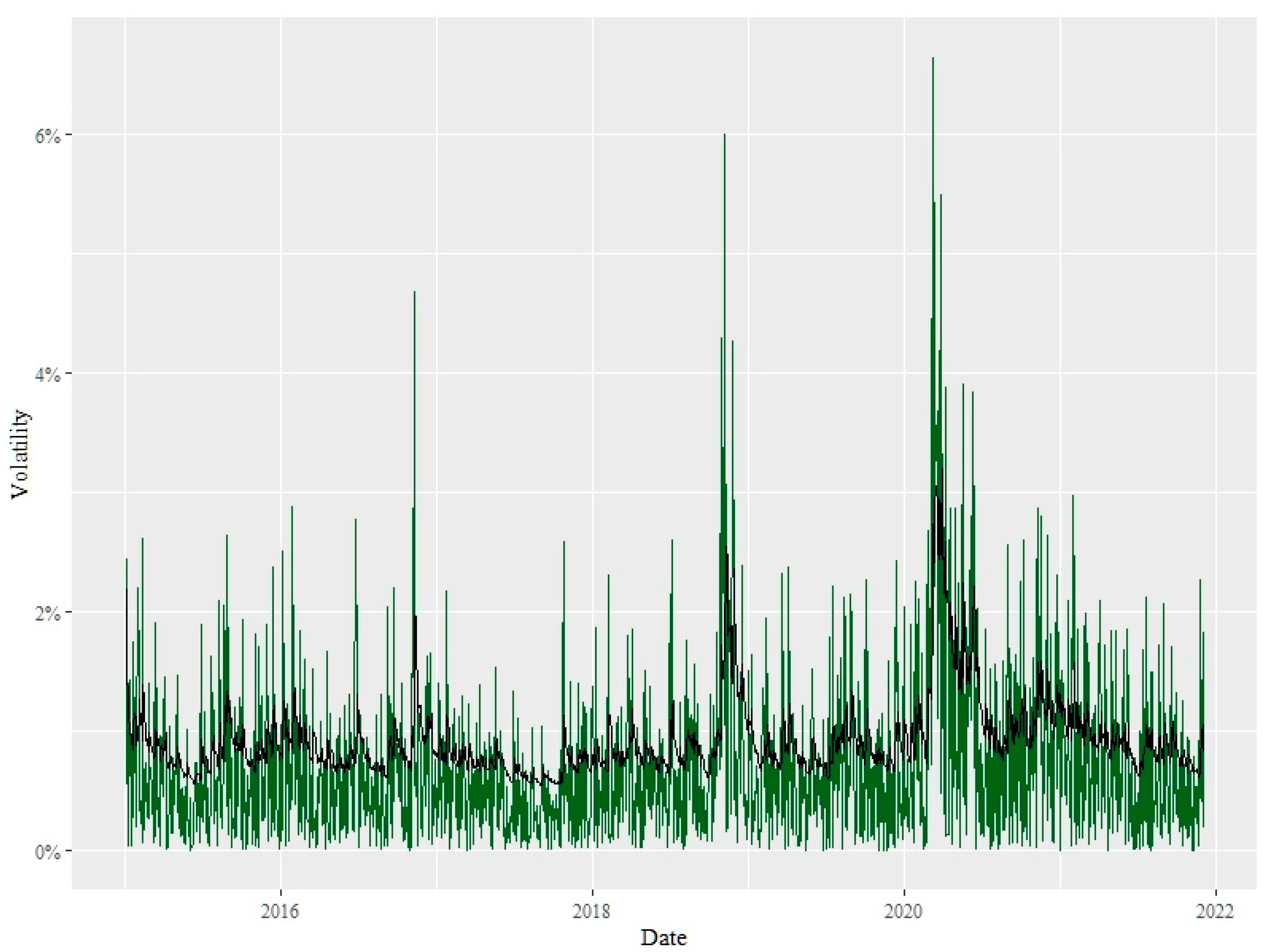

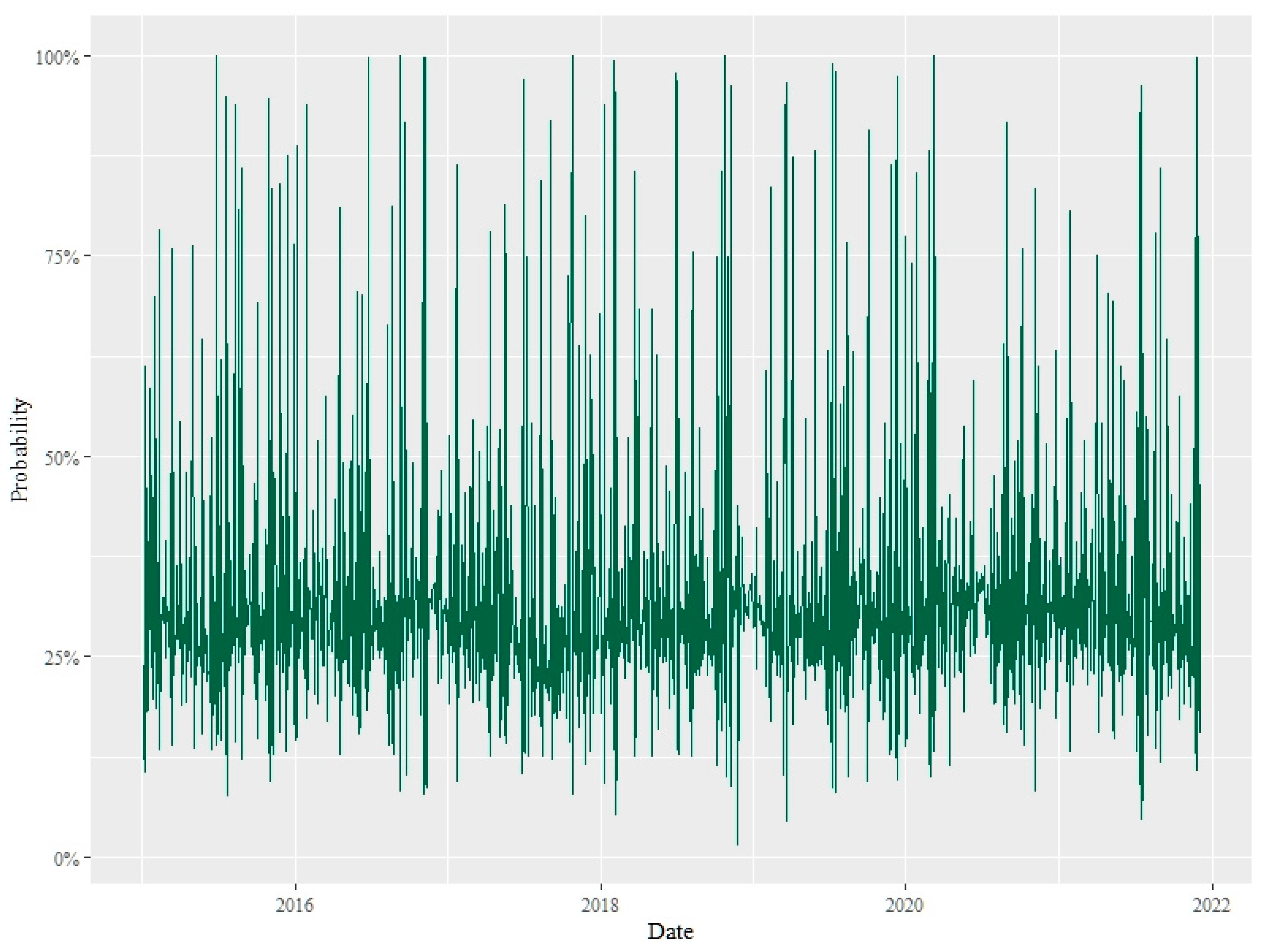

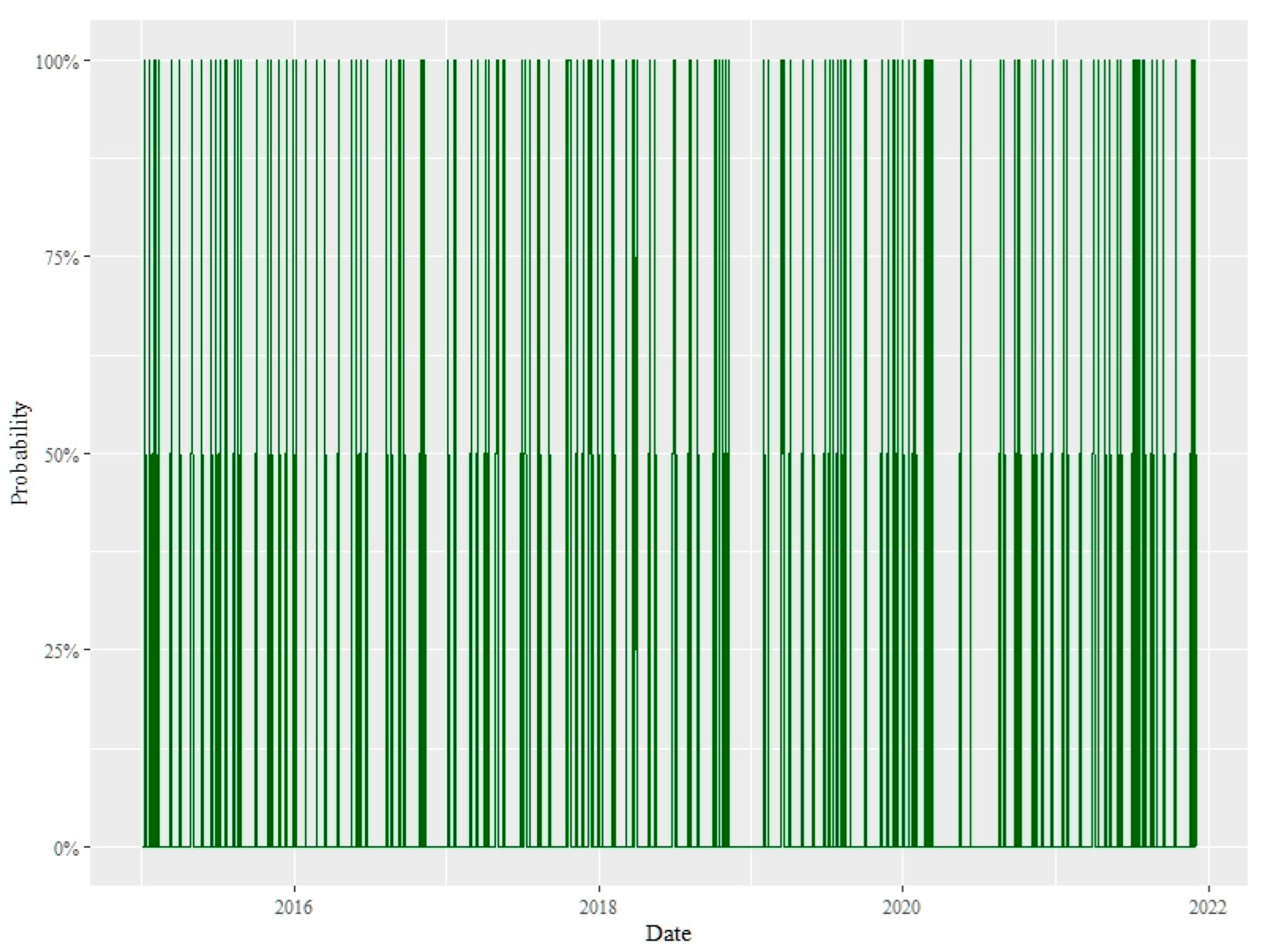

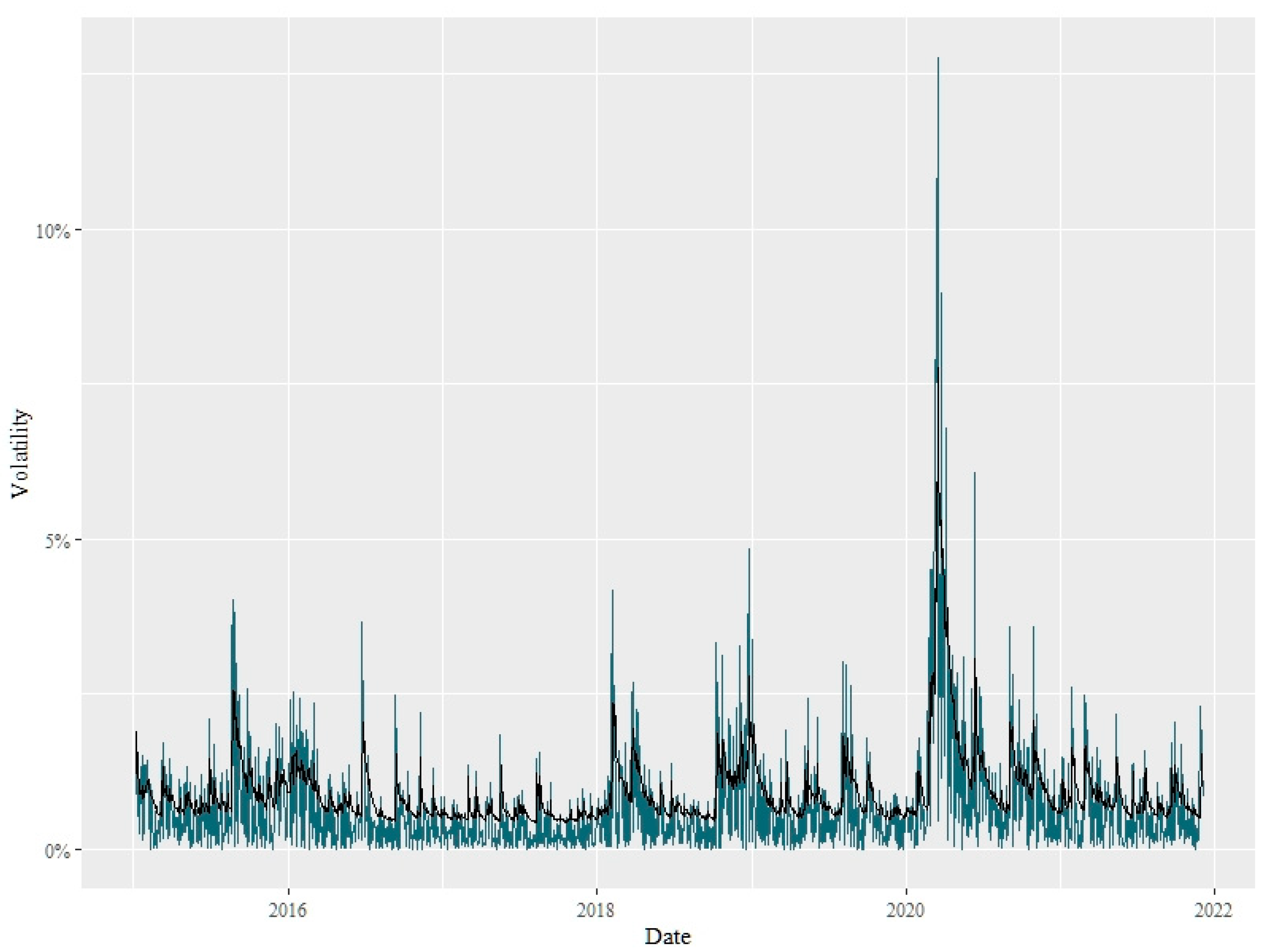

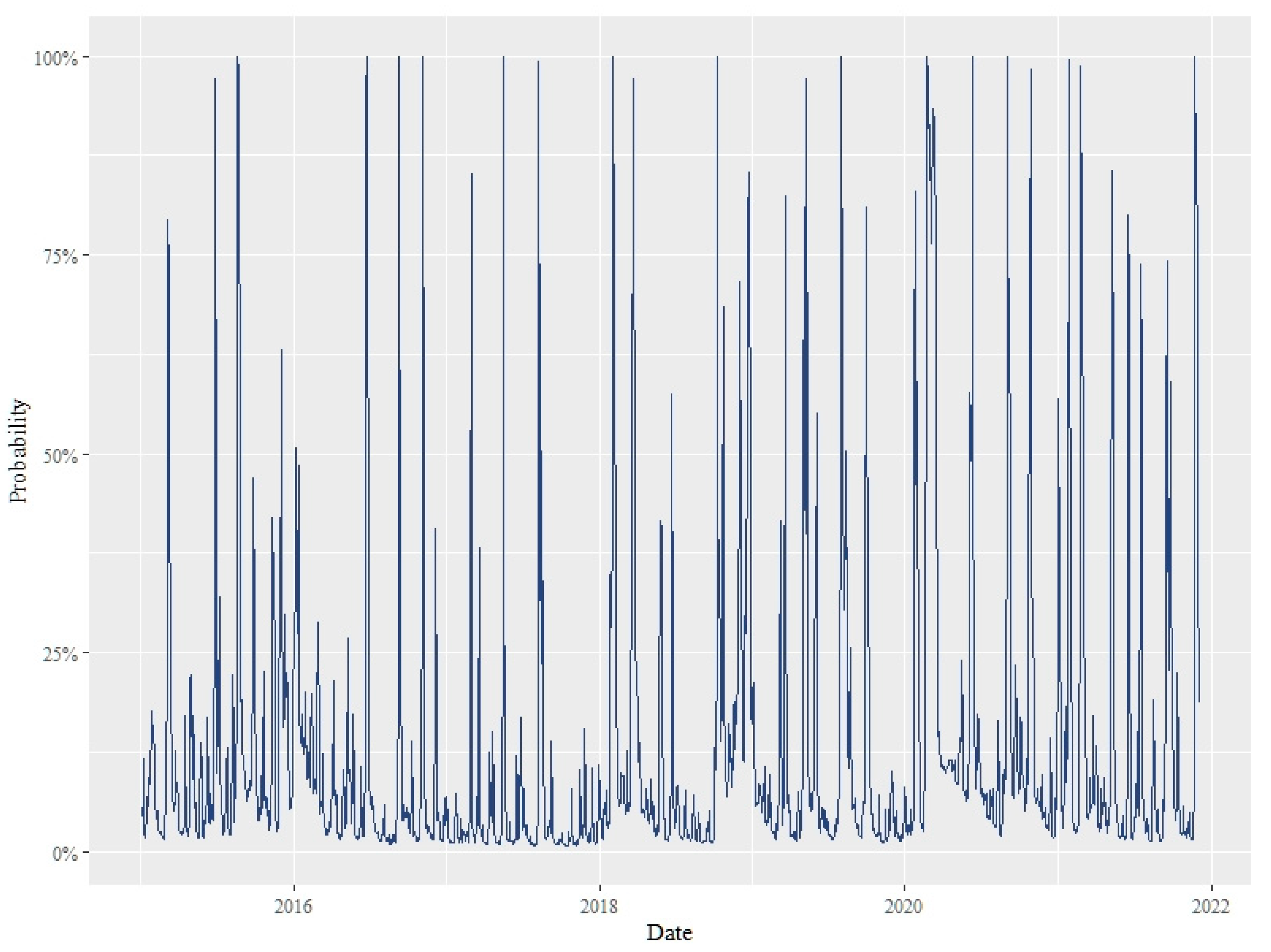

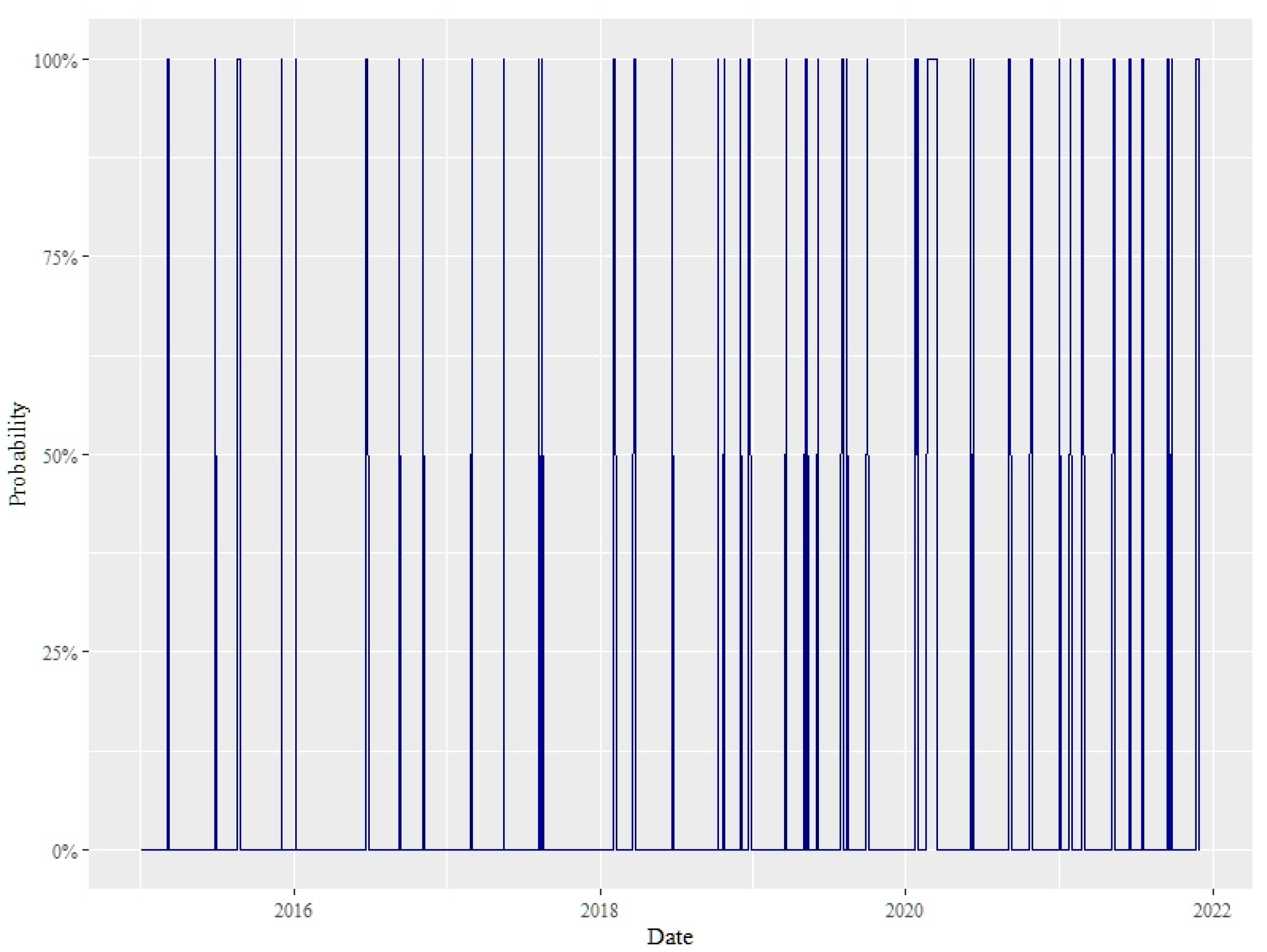

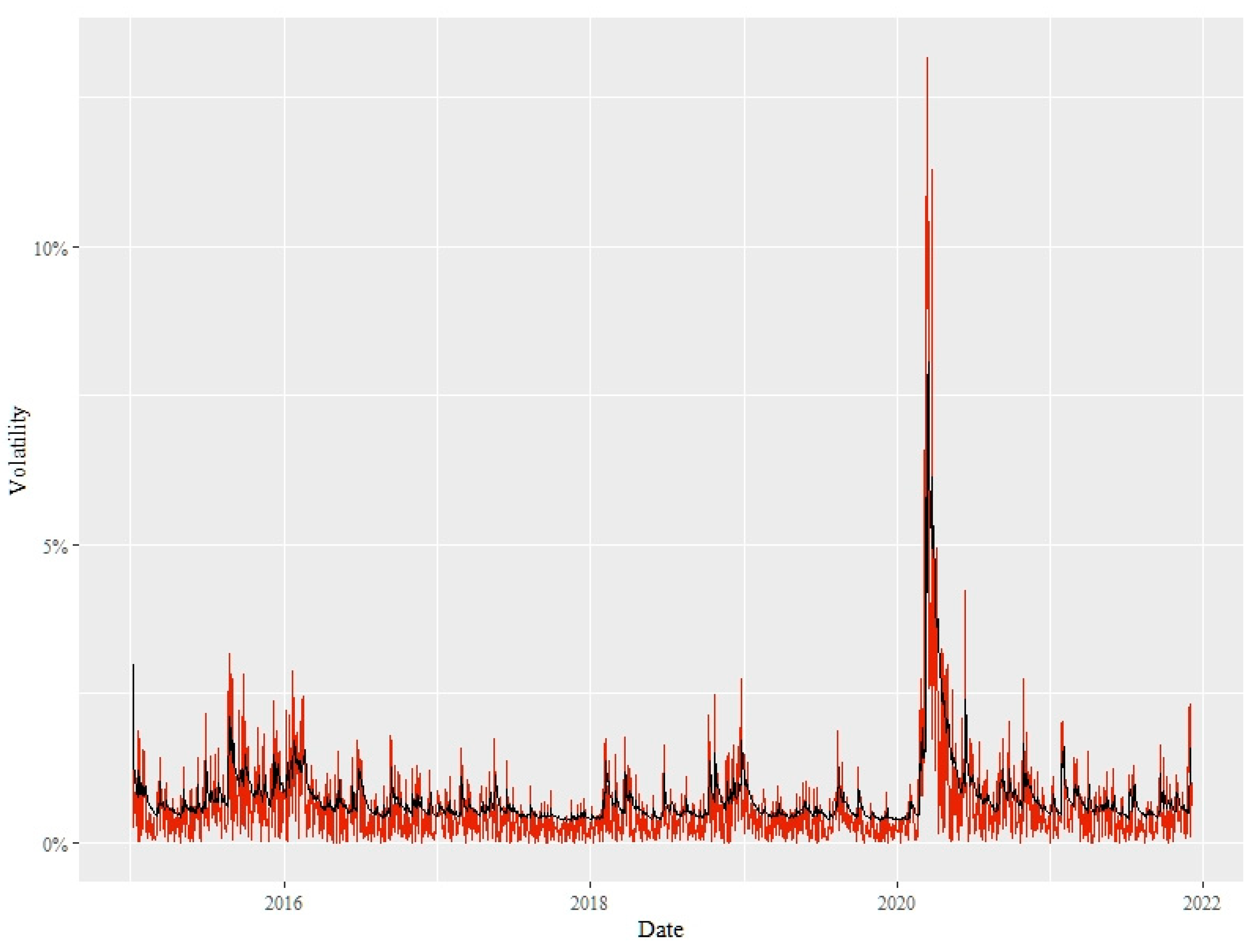

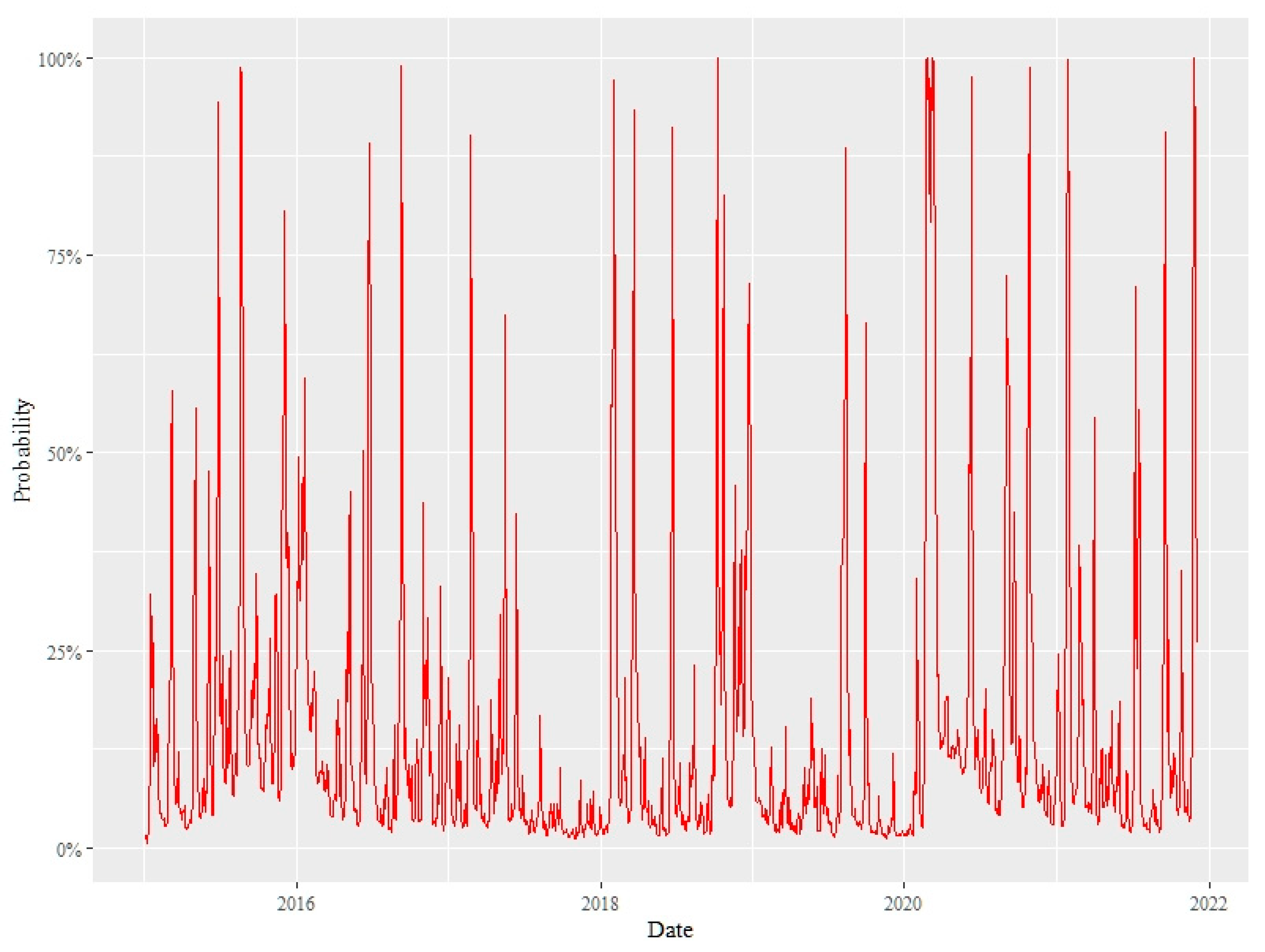

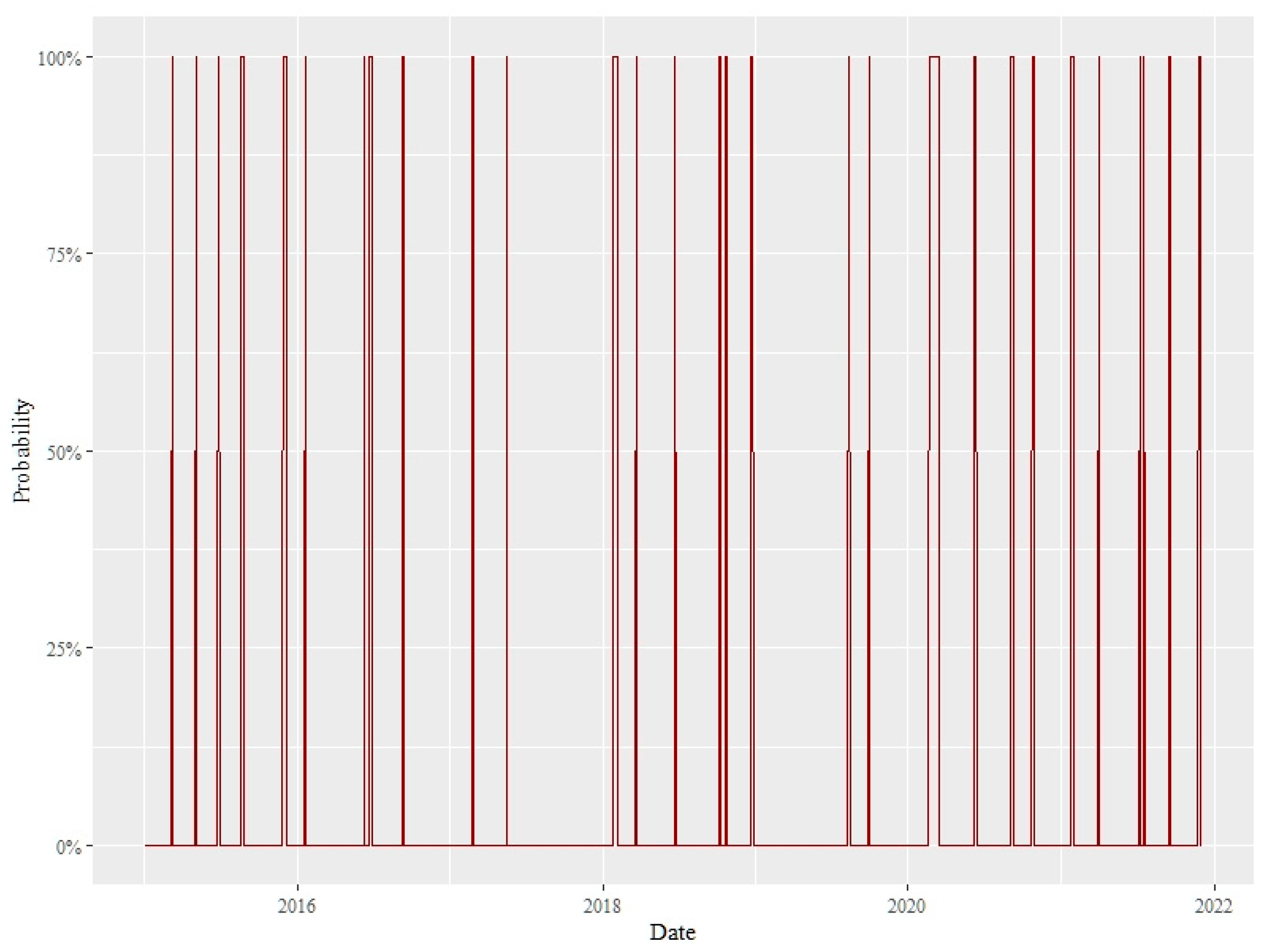

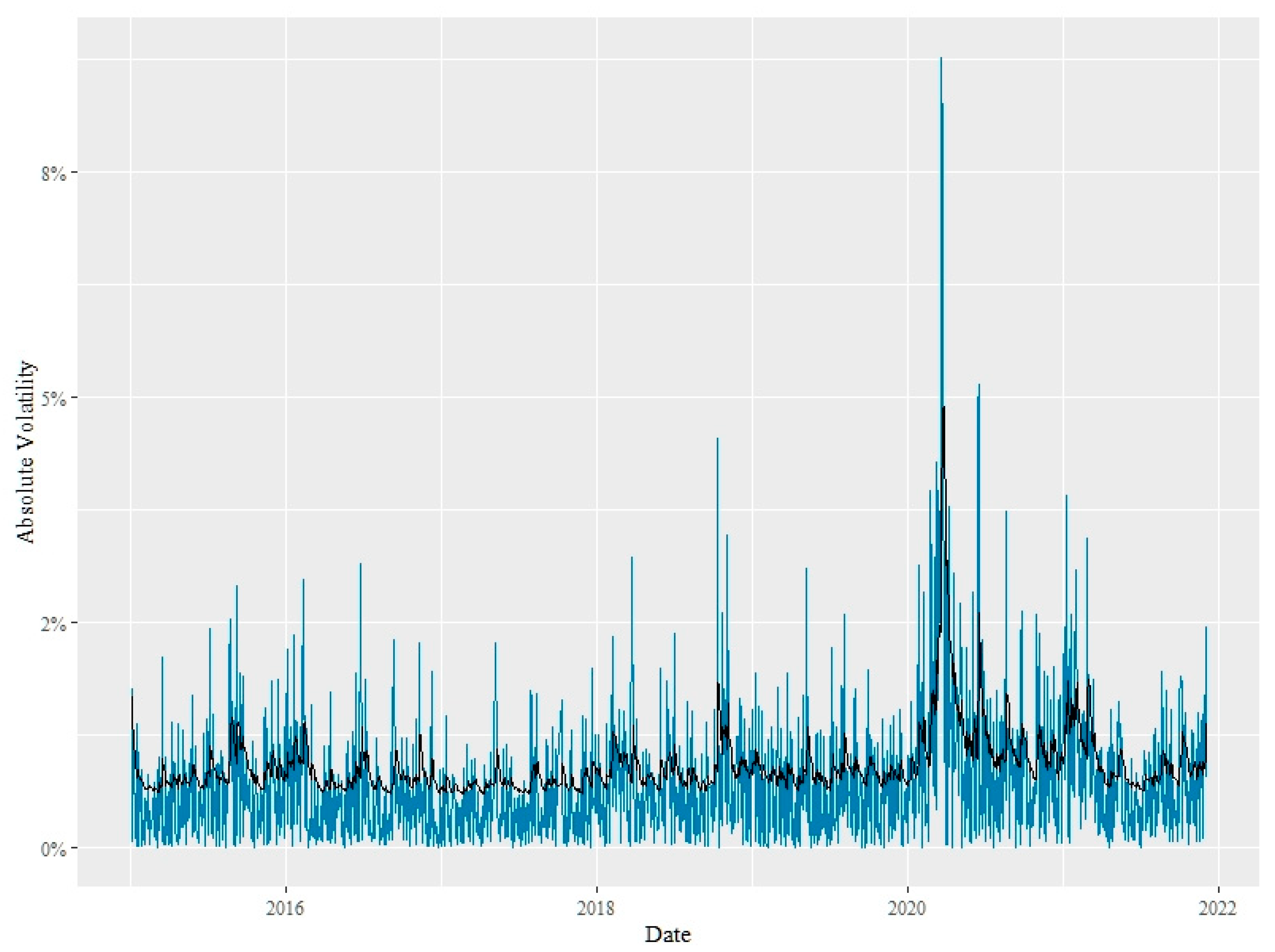

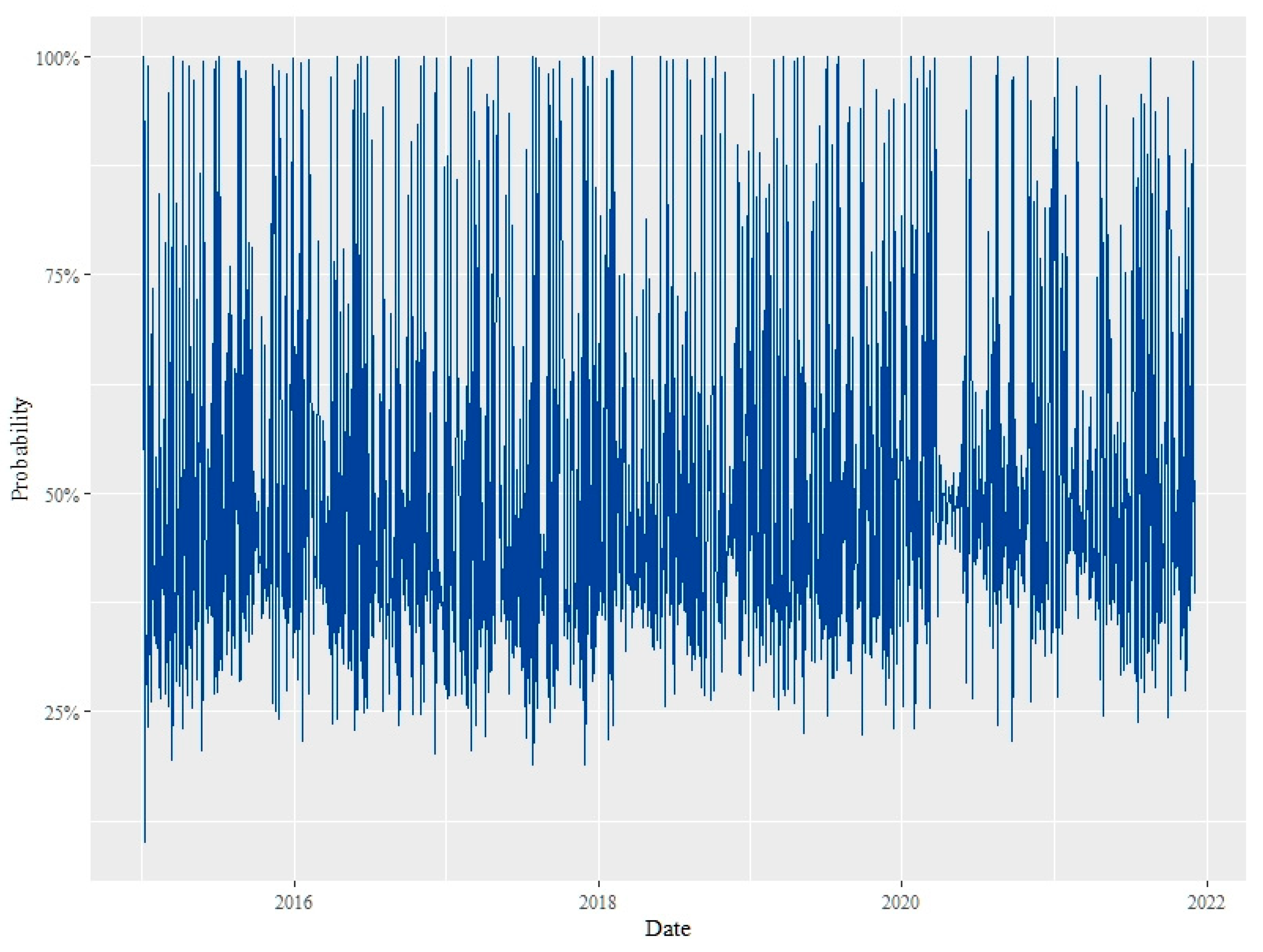

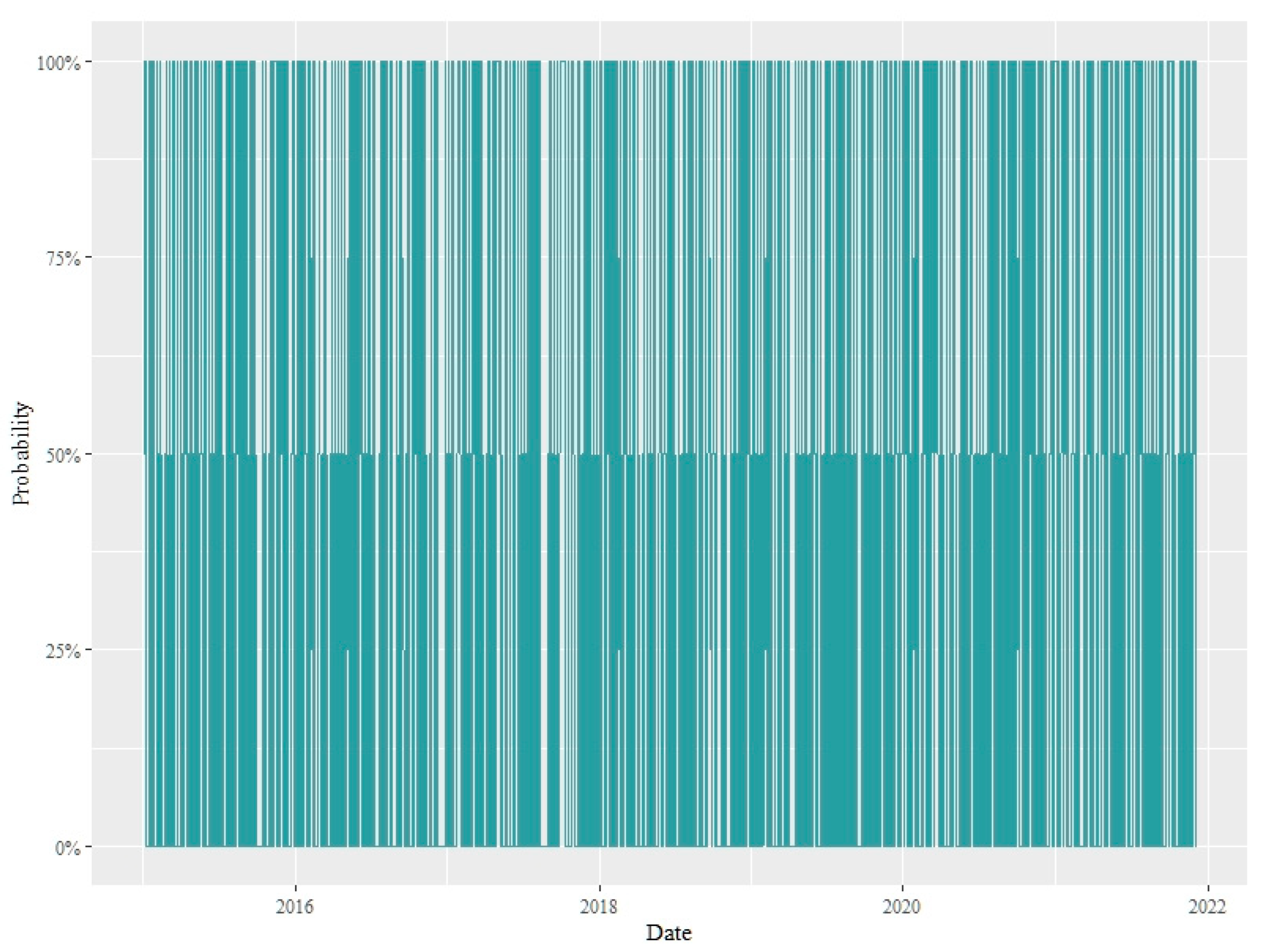

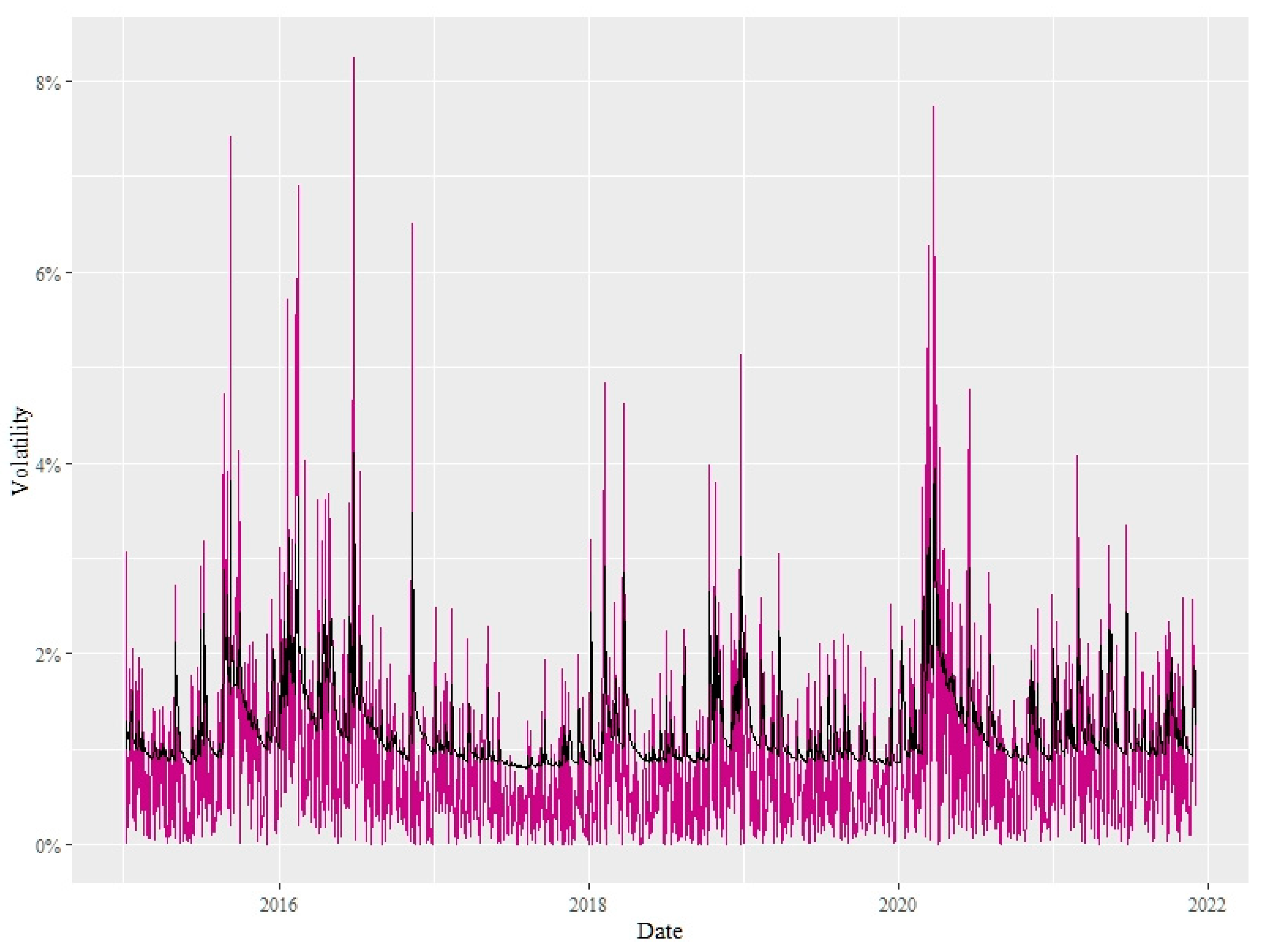

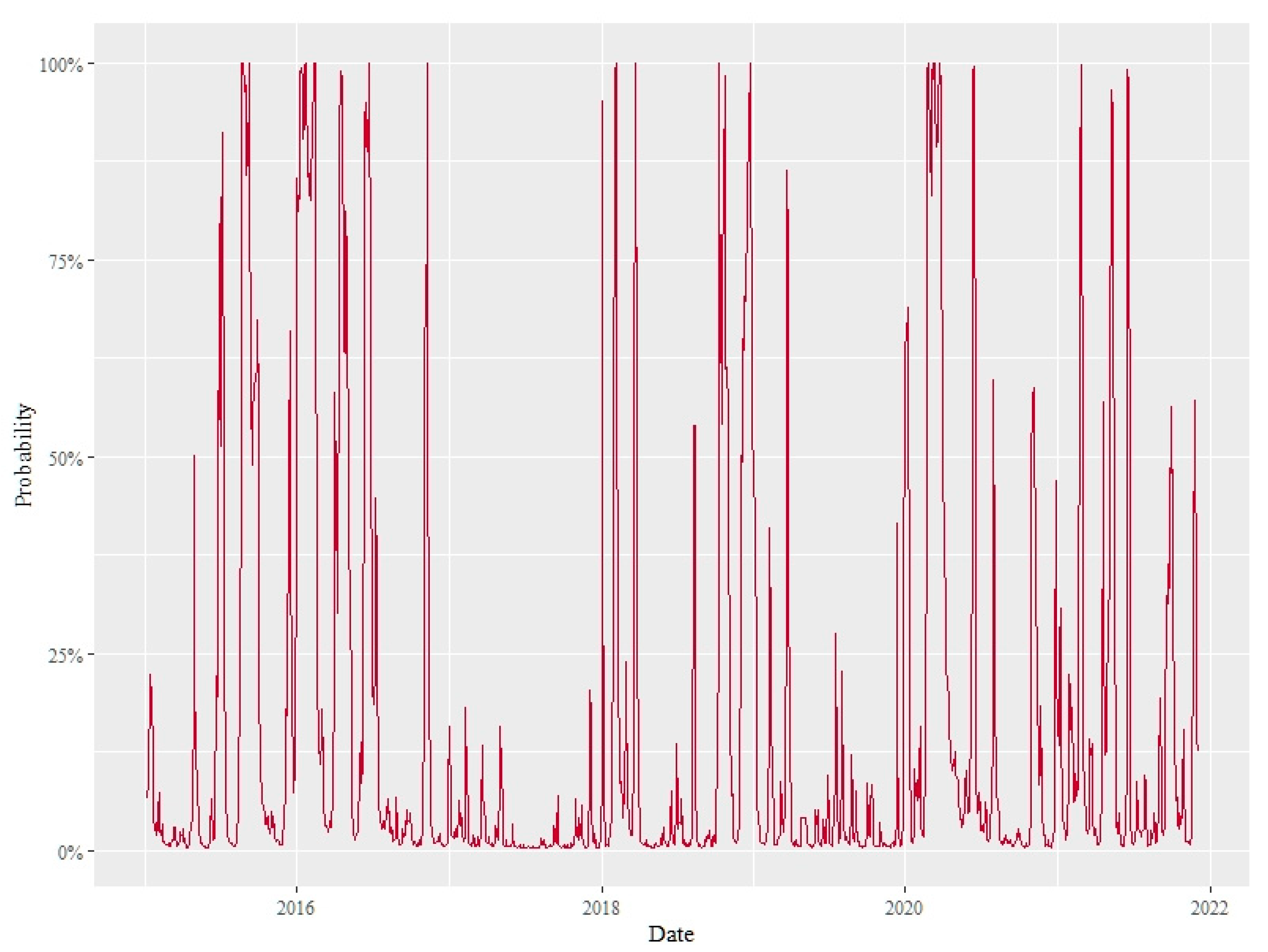

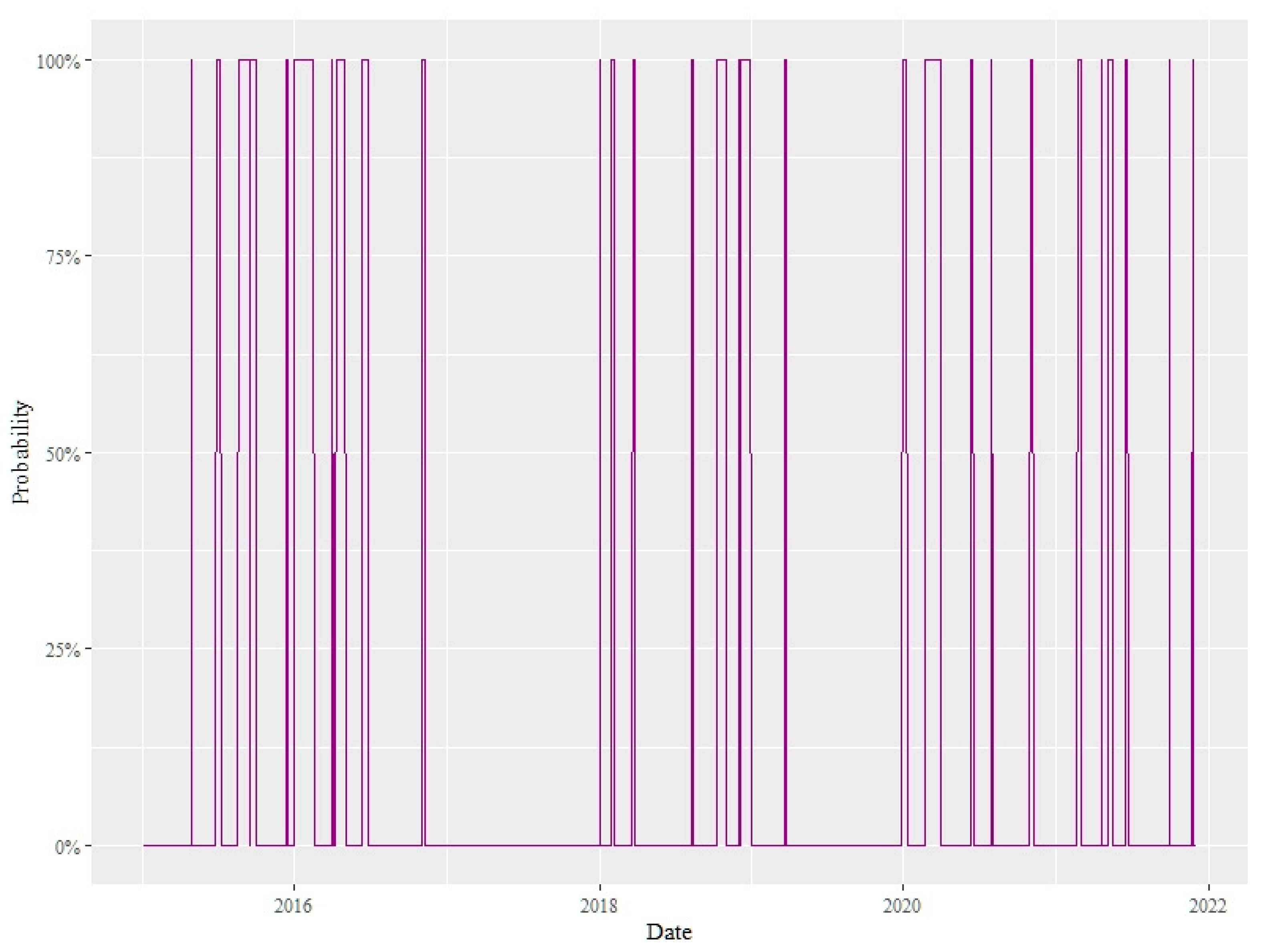

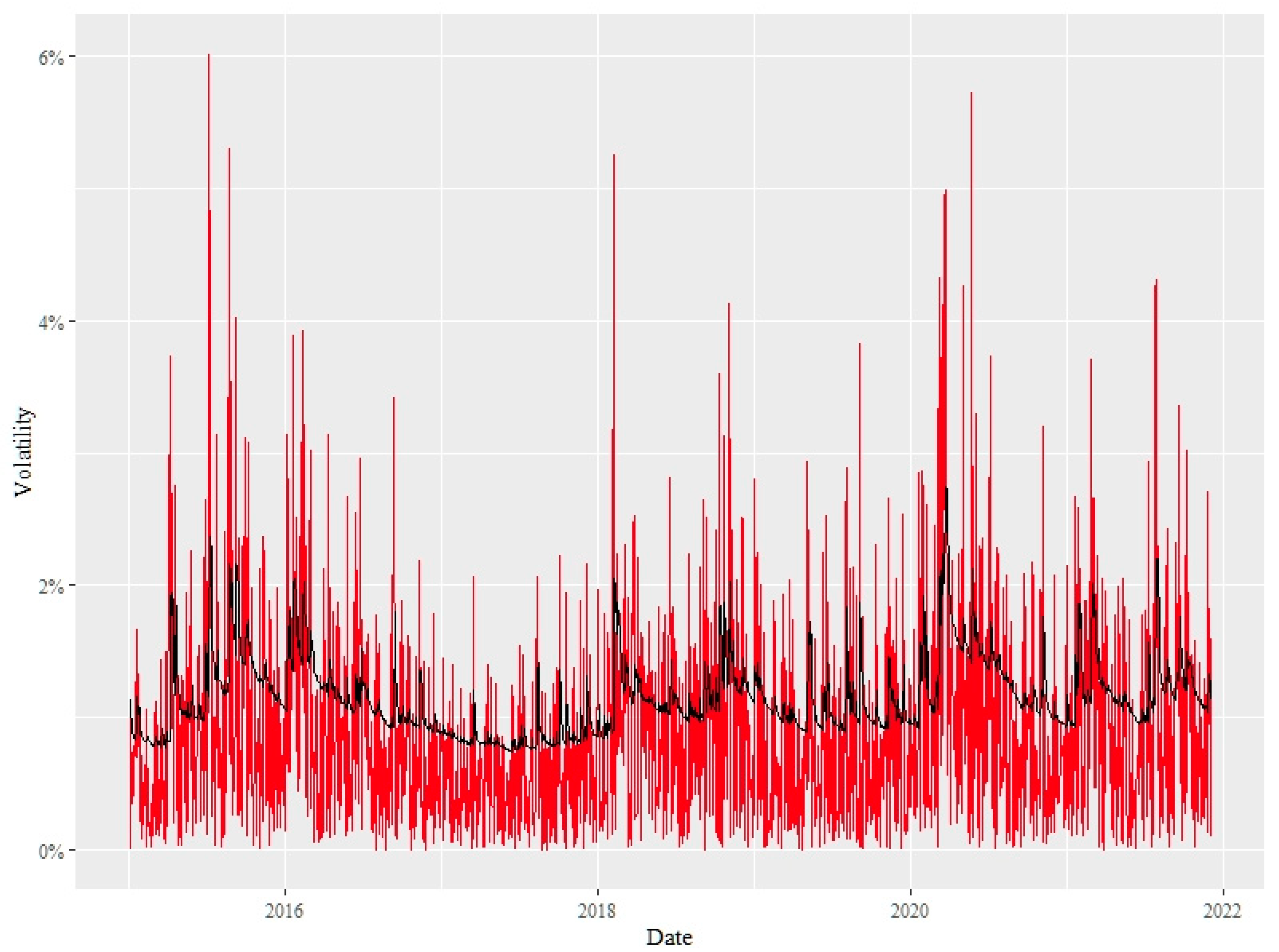

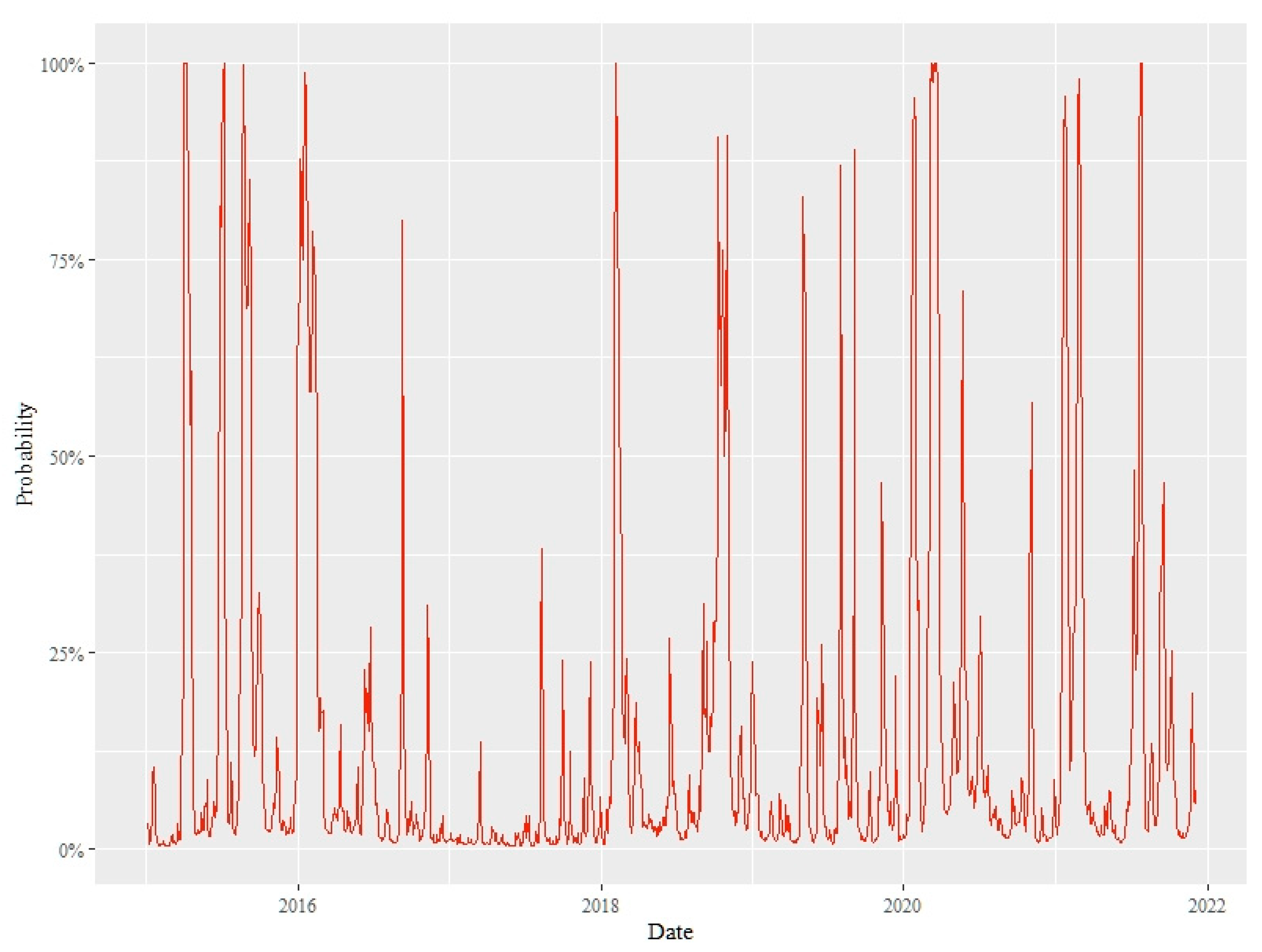

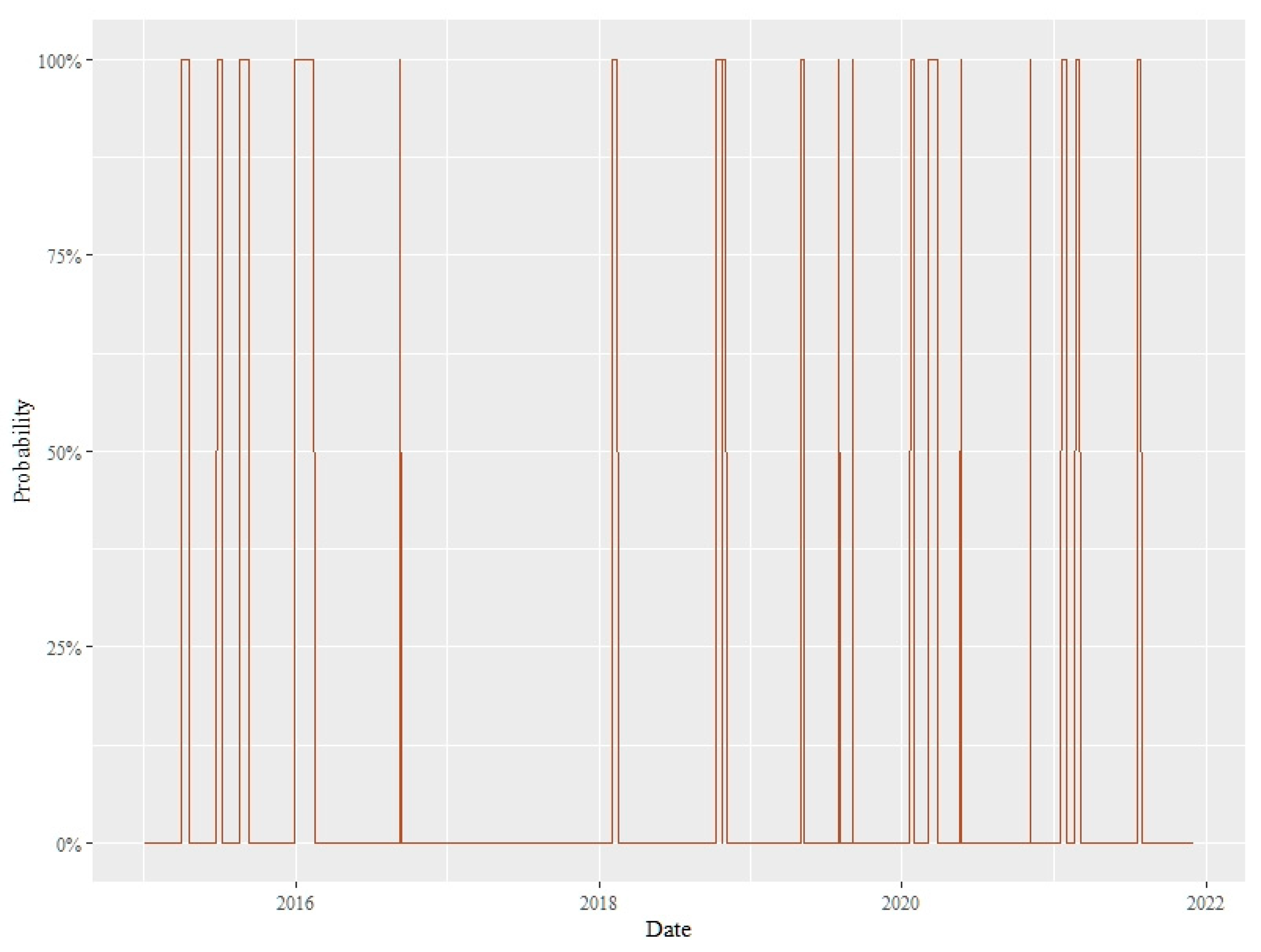

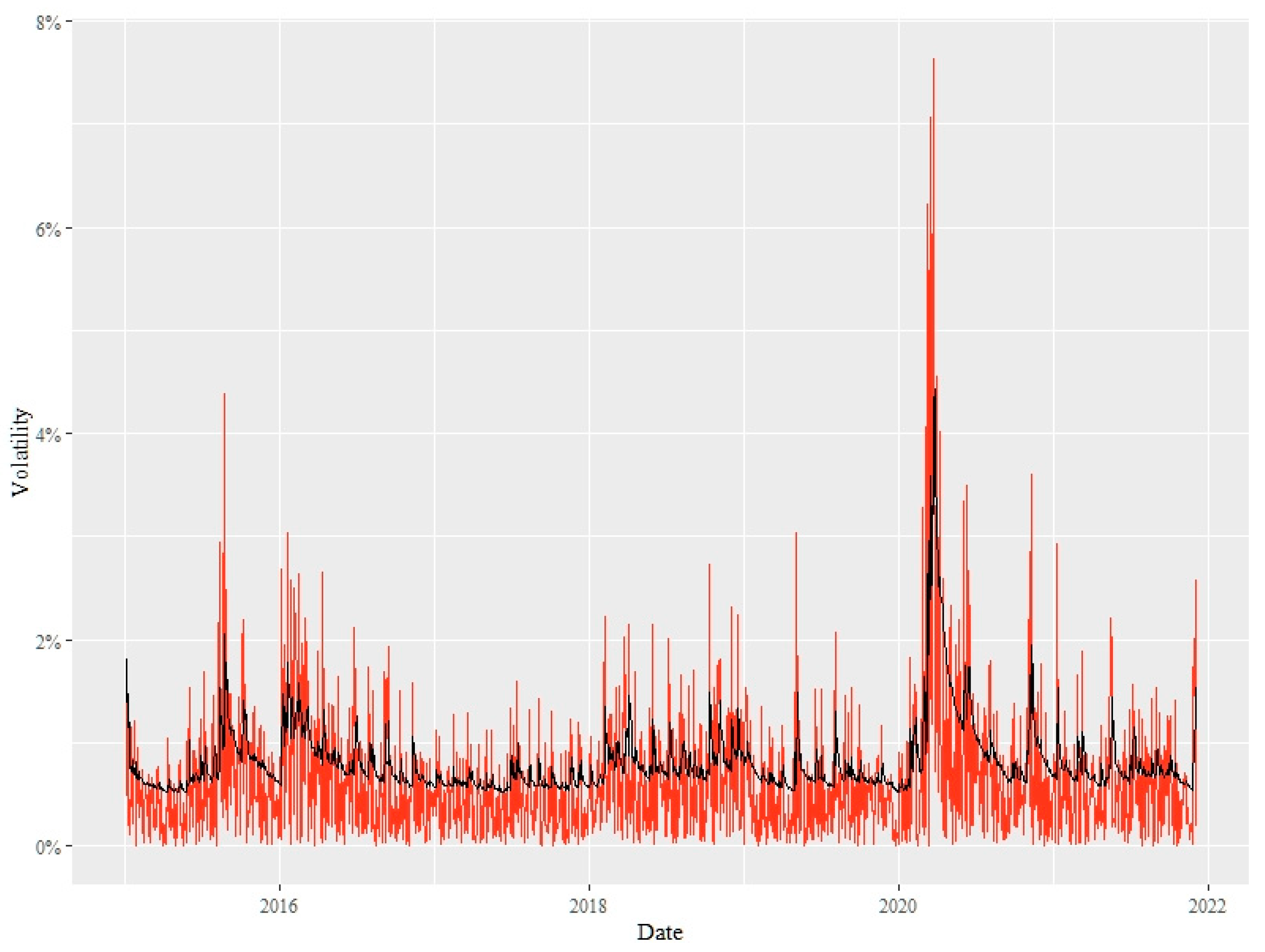

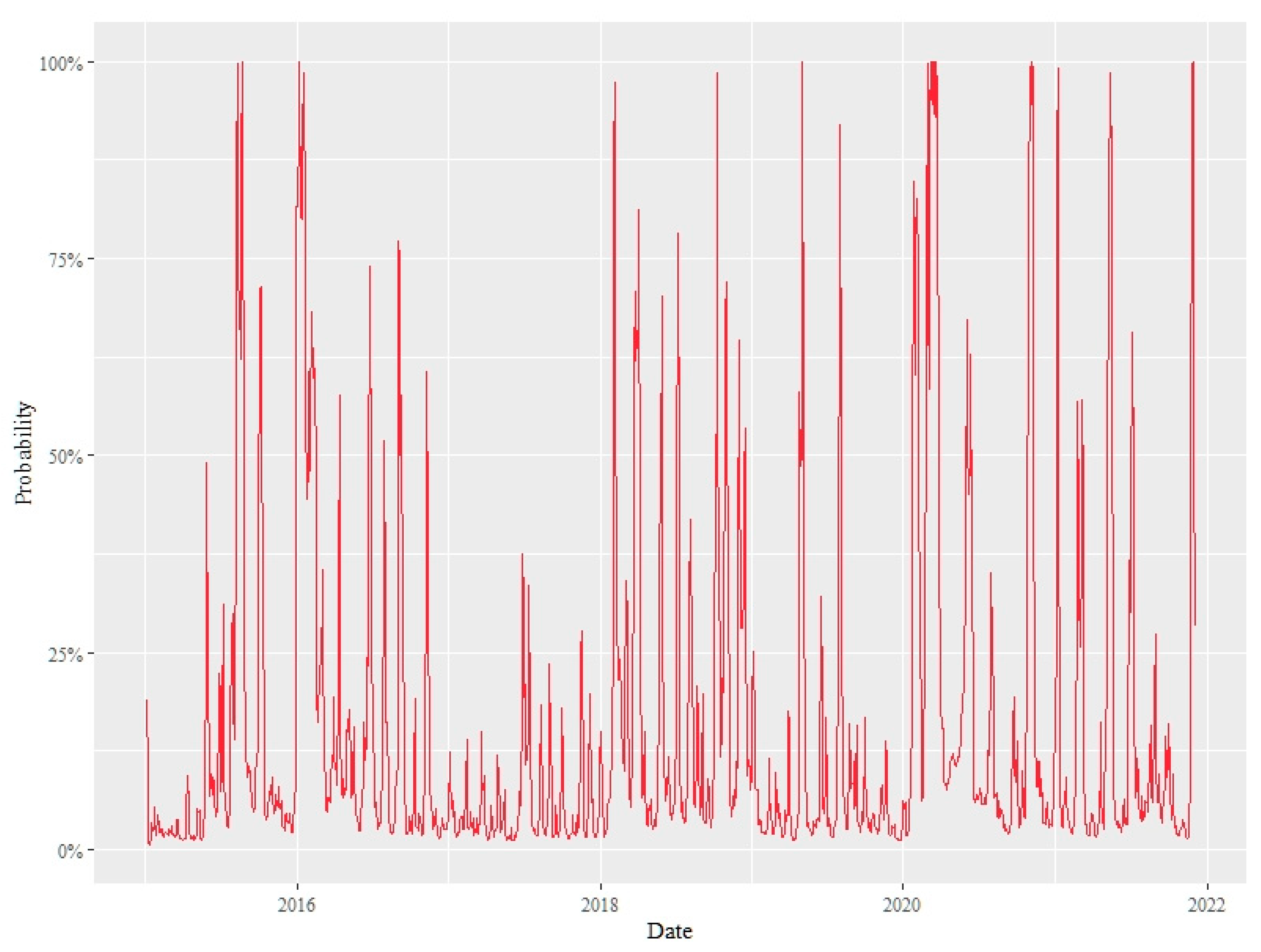

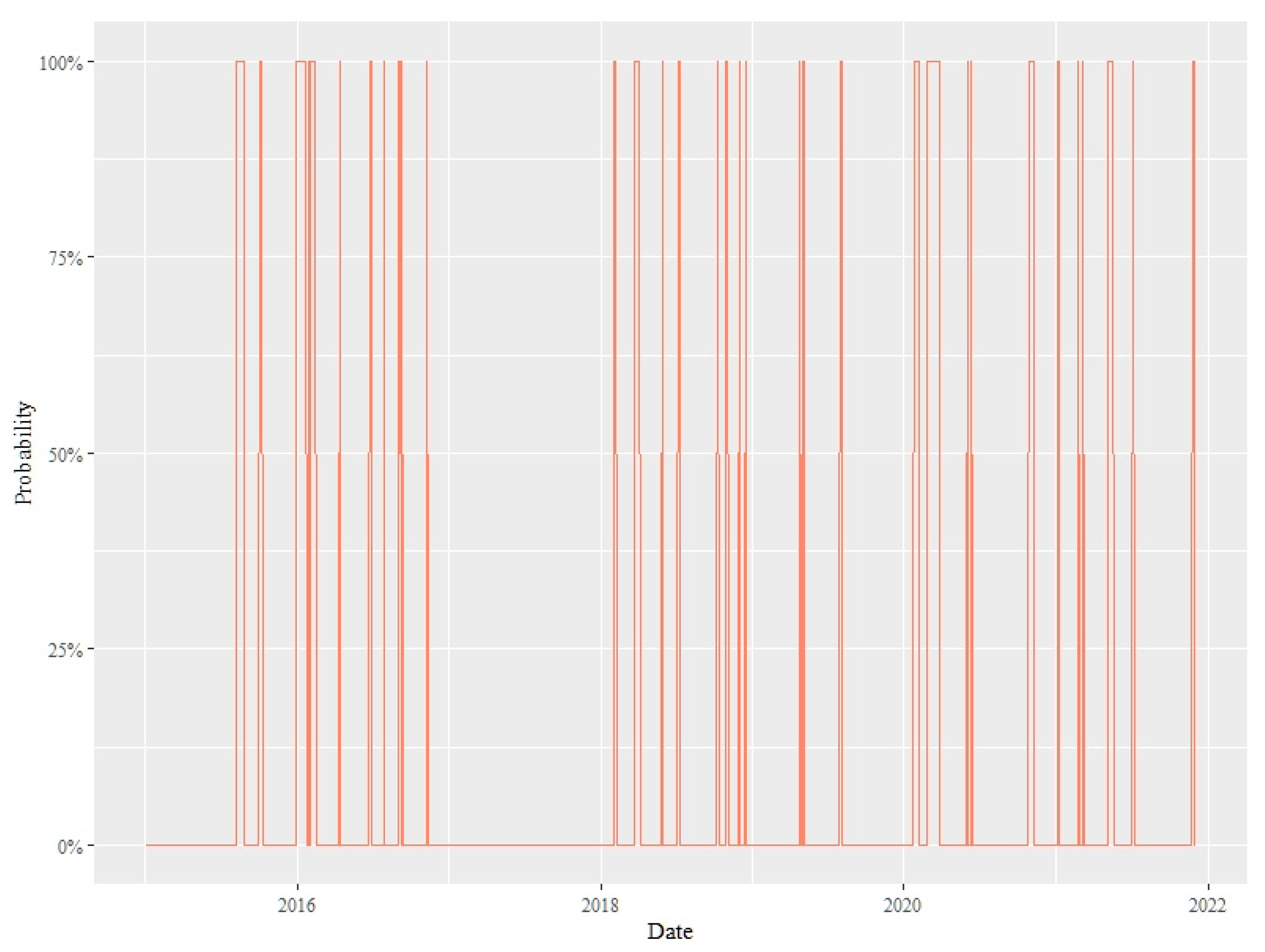

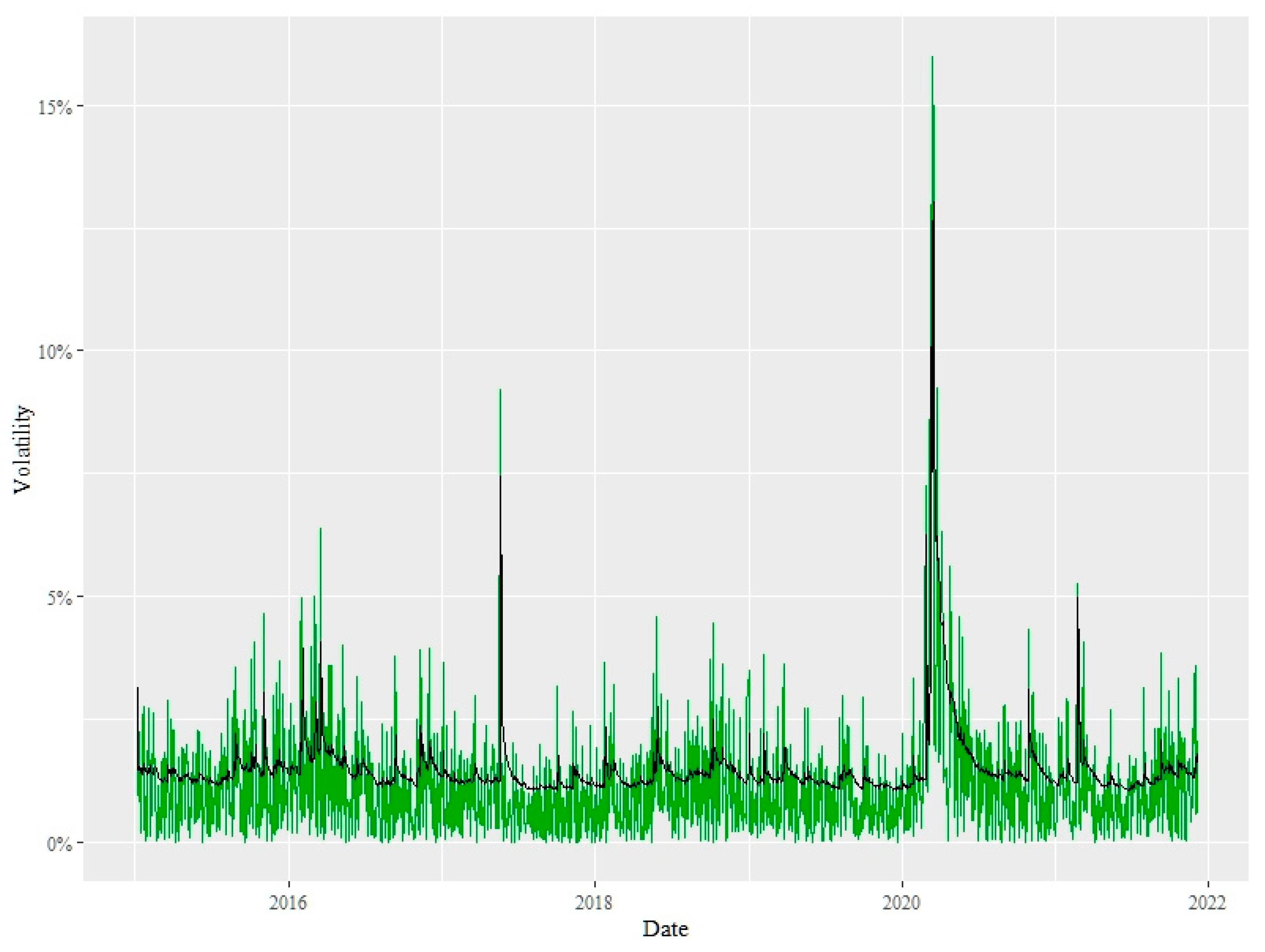

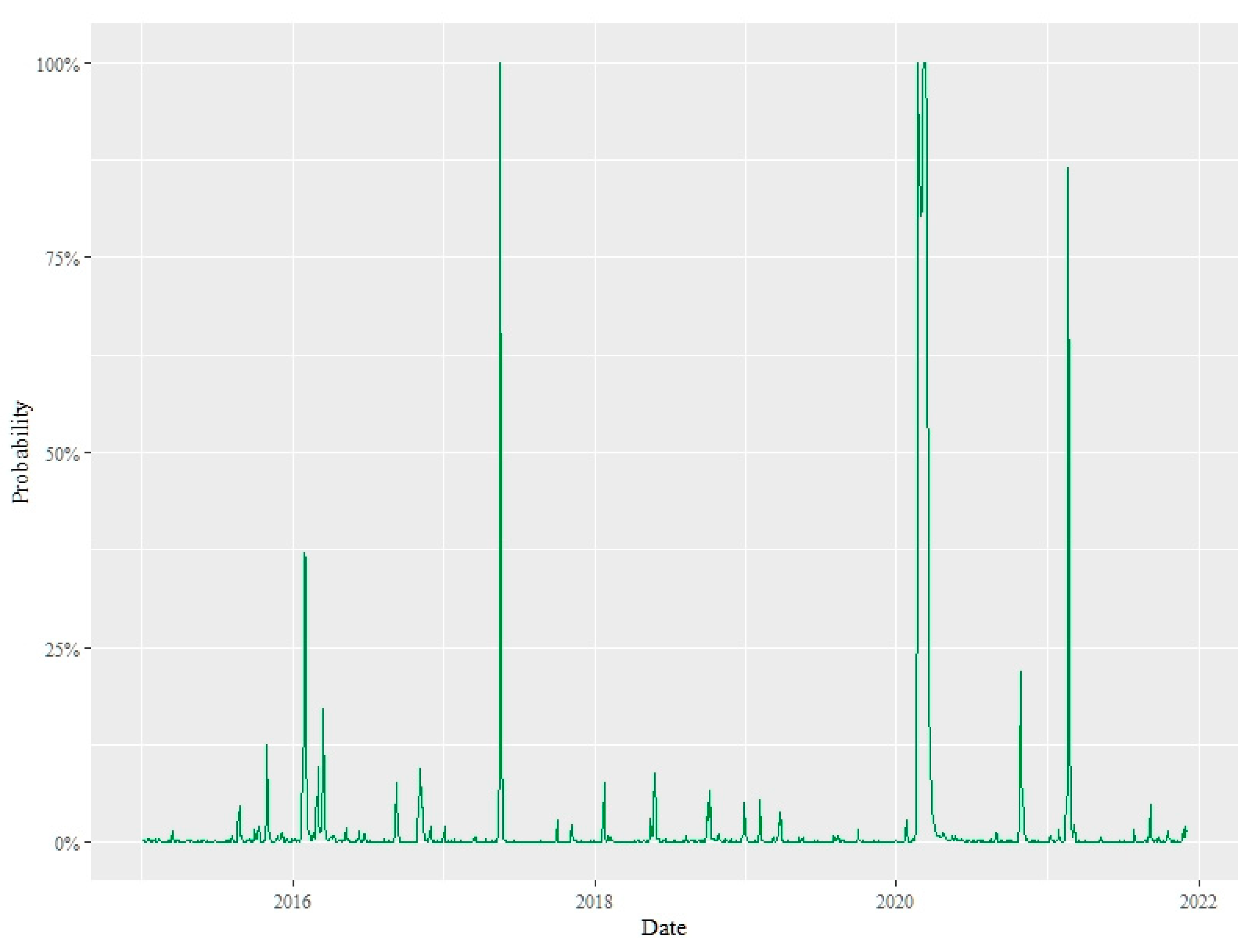

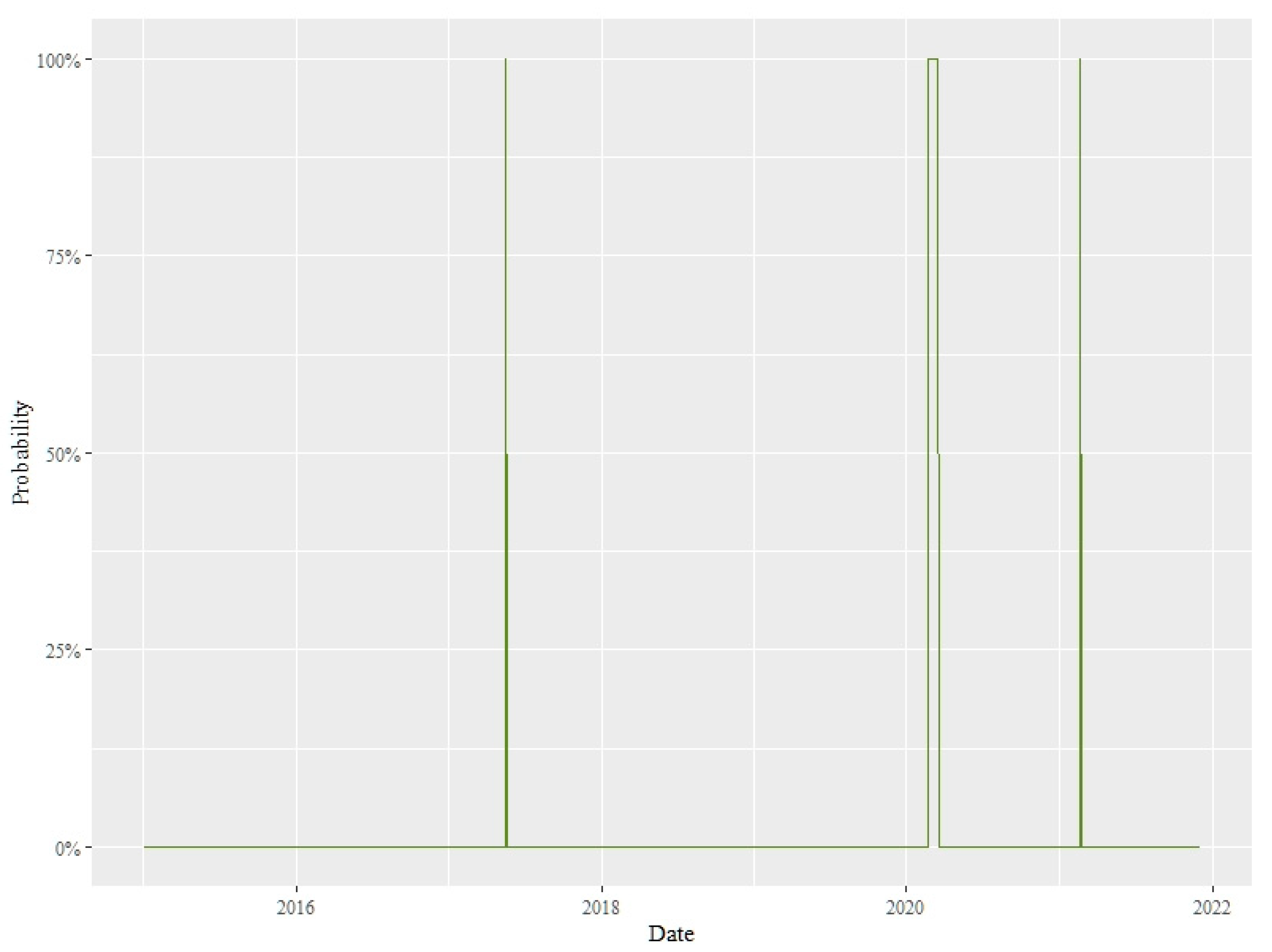

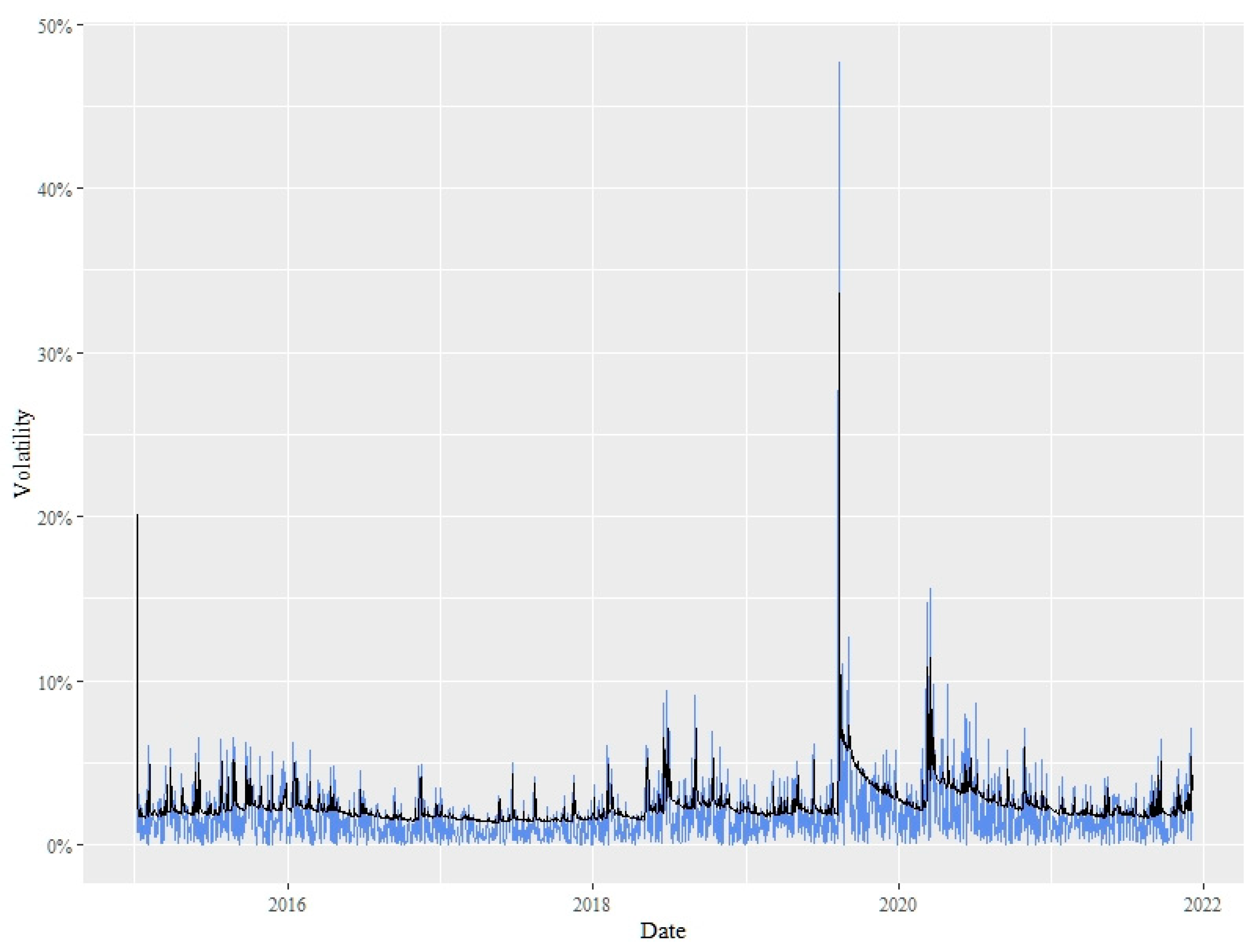

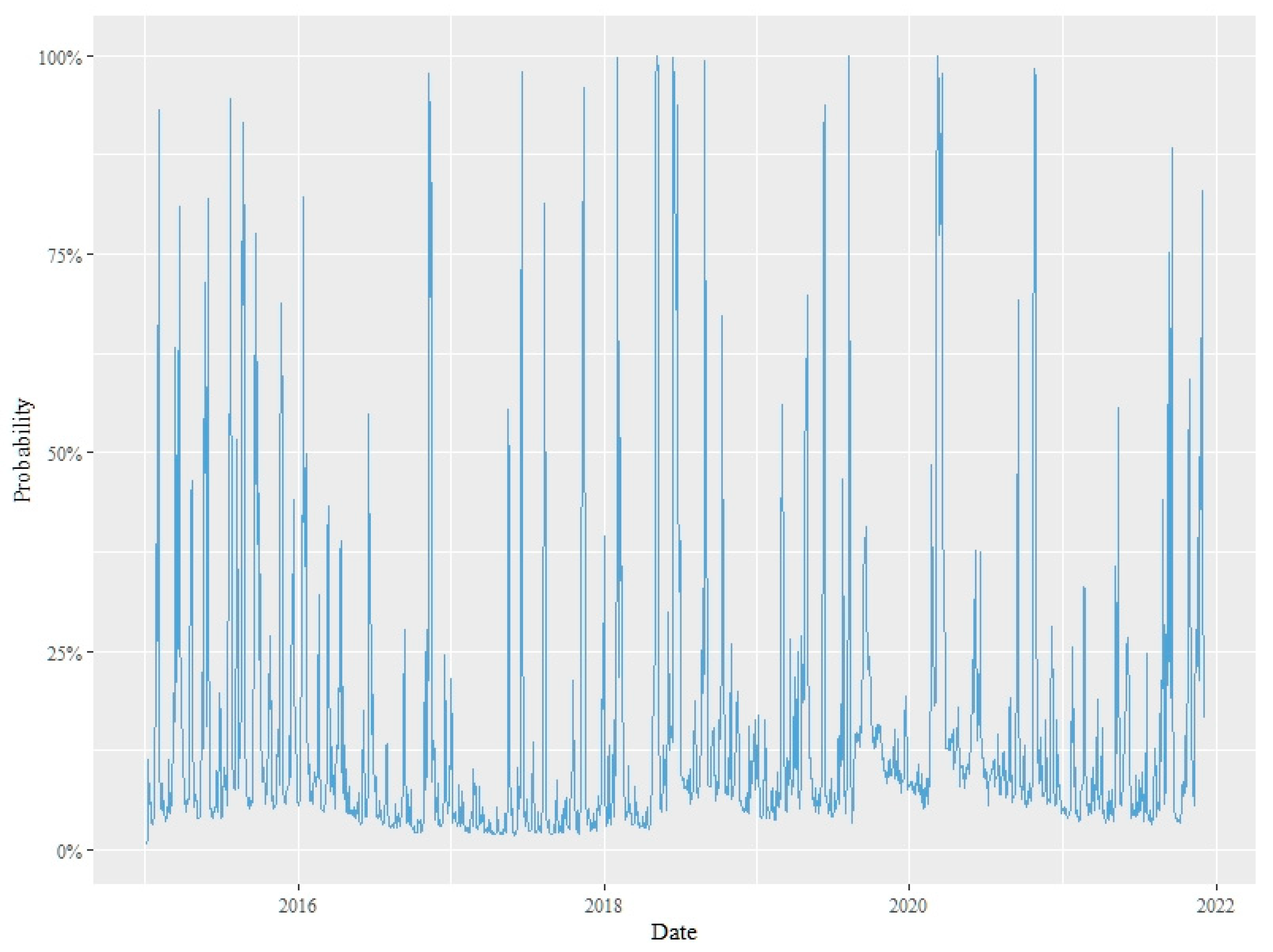

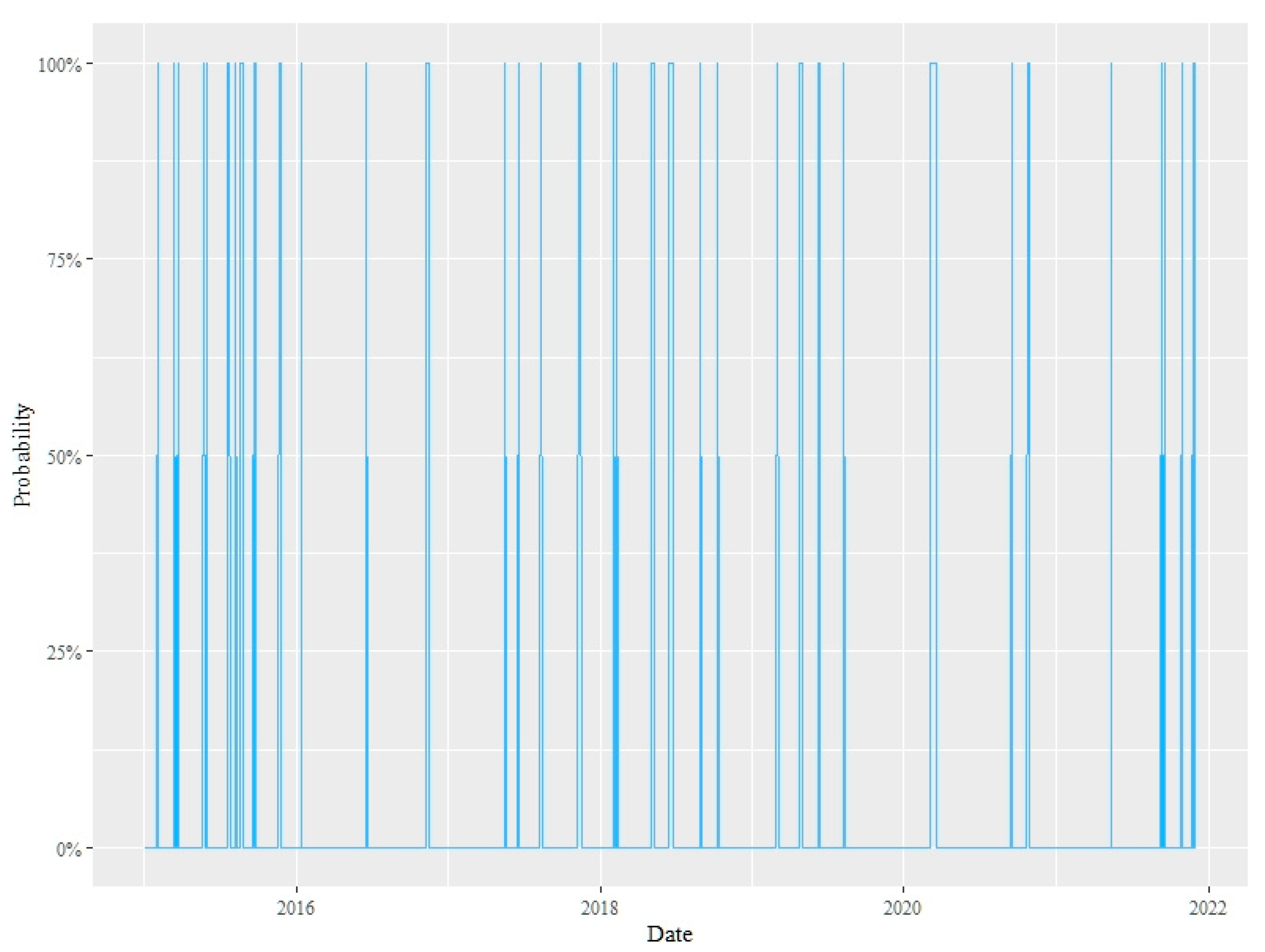

Daily data for the main stock market indexes of a sample of nine countries (three North American: Canada, the United States and Mexico; four Asian: Japan, Korea, Hong Kong and Singapore; and two South American: Brazil and Argentina) were retrieved from

yahoo.finance.com (accessed on 10 December 2021). The data were first processed using a GARCH-M(1,1) model that captured the risk premium effect in two time periods (pre-COVID and COVID). To improve the flexibility of the model as well as the estimation of the coefficients, the residual generation process was assumed to have a NIG distribution, resulting in a skewed and leptokurtic version of the original specification. Furthermore, an MS GARCH(1,1) model with two regimes was estimated for the whole period.

The results from the different models indicate that the stock markets from more developed countries experienced an important increase in their risk premium during the COVID period, likely attributable to the massive anticyclical economic government policies implemented. By contrast, developing countries, particularly those in Latin America, experienced a reduction and in some cases even a total loss of risk premium in their stock market indexes. This may be explained by a disproportional increase in volatility that could not be matched with the recovery of stock prices. However, the MS GARCH(1,1) results reveal that there was a double cause of that disproportional increase in volatility: the probability of transition from low and high volatility regimes was not large, and the unconditional probability to remain in the low volatility state was high. However, while the risk of a high volatility regime was modest, the volatility in either one of the two states was the highest in the sample.

Finally, the superiority of the MS GARCH(1,1) two-regime model over the simple GARCH and the three-regime models was confirmed based on the Akaike and Bayes Information Criteria (AIC and BIS), for all the national stock market results in our sample.

From the perspective of investors and portfolio risk managers, the identification of high and low volatility periods and their estimated probability of occurrence is useful for the characterization of stress scenarios and the design of emerging strategies. For governments and central bankers, the implementation of different policies should respond to the more likely scenarios but should also be prepared to respond to other less likely scenarios. Institutional preparedness to respond to as many different scenarios as may be identified with the use of MS GARCH models can make their interventions more successful. The COVID-19 pandemic experience has represented a laboratory to improve the understanding policy makers have of the role they are expected to play under extraordinary conditions. Although the approach presented in this work refers only to the stock market volatility and risk premium modeling, financial market stability is crucial to maintain high employment, economic growth, and productive chain functionality.