The NFT Hype: What Draws Attention to Non-Fungible Tokens?

Abstract

:1. Introduction

2. Materials and Methods

2.1. Methodology

2.2. Data

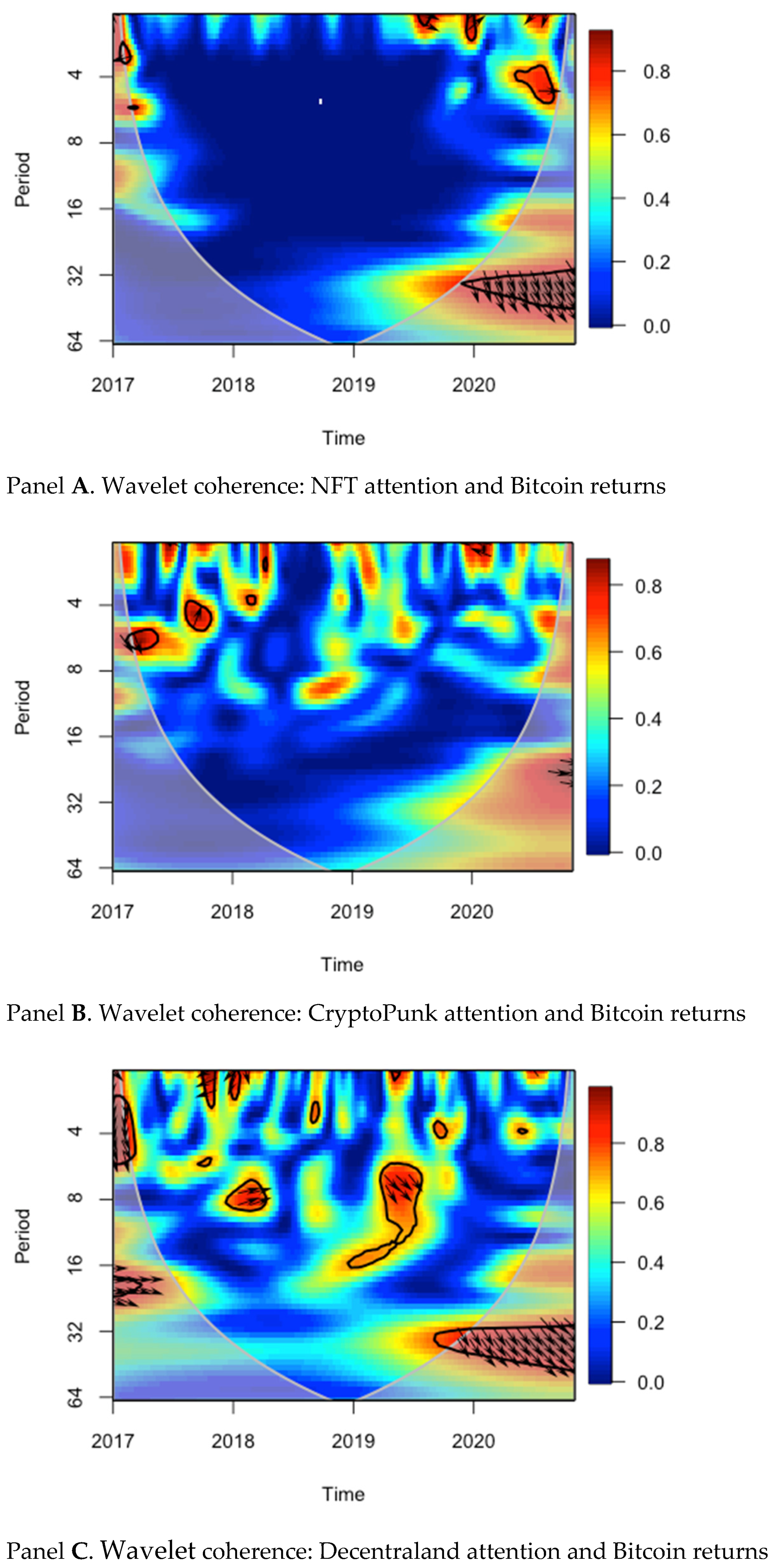

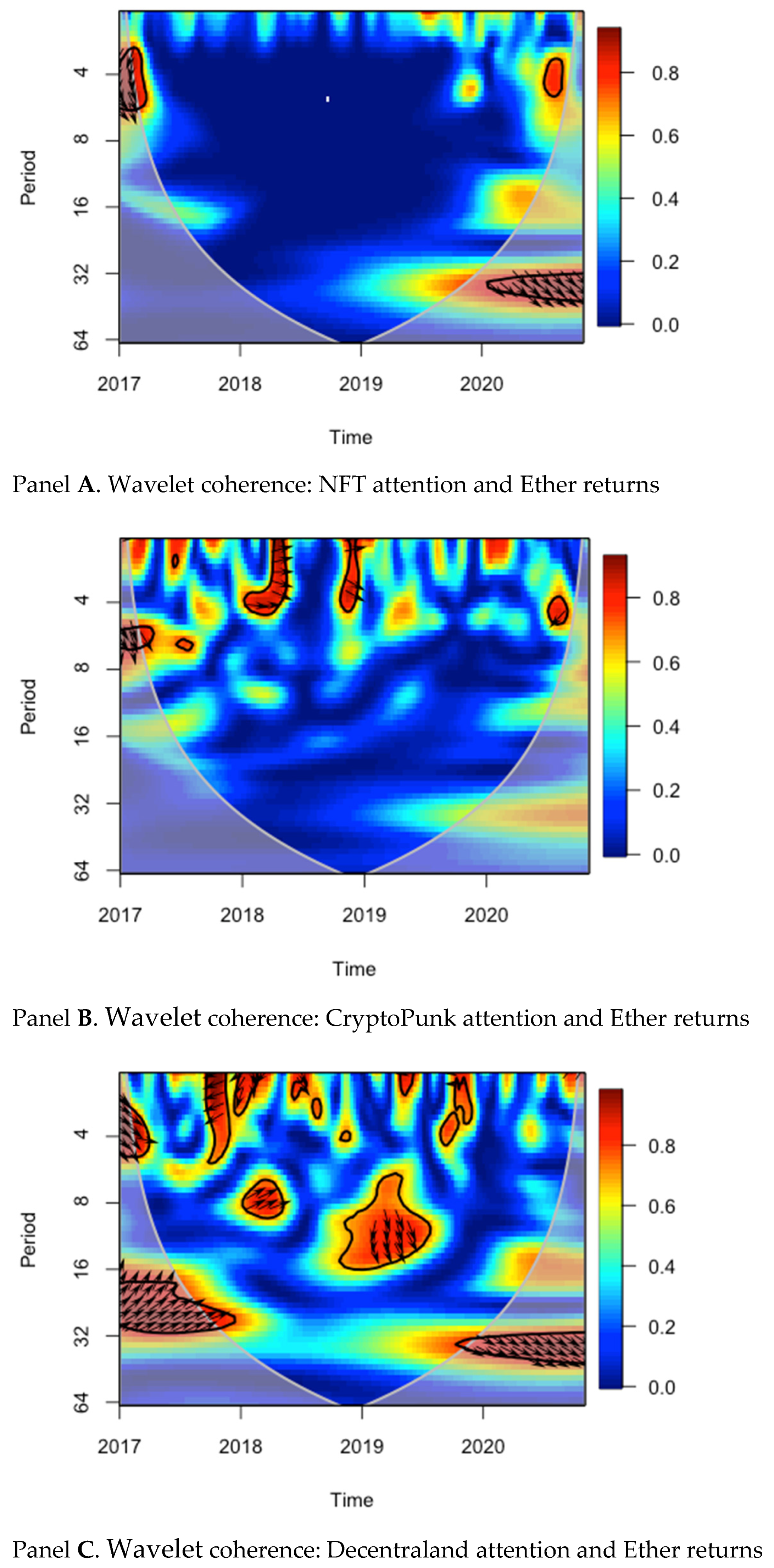

3. Results

4. Discussion and Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable Name | Definition |

|---|---|

| Bitcoin return (%) | Weekly Bitcoin return in percentage is defined as . Bitcoin price on week t is taken from coinmarketcap.com (accessed on 9 August 2021). |

| Ether return (%) | Weekly Ether return in percentage is defined as . Ether price on week t is taken from coinmarketcap.com (accessed on 9 August 2021). |

| VIX return (%) | Weekly VIX index return in percentage is defined as . VIX index on week t is taken from Yahoo Finance (accessed on 9 August 2021). |

| Gold return (%) | Weekly gold return in percentage is defined as . Gold price on week t is taken from Yahoo Finance (accessed on 9 August 2021). |

| S&P 500 return (%) | Weekly S&P 500 index return in percentage is defined as . S&P 500 index on week t is taken from Yahoo Finance (accessed on 9 August 2021). |

| NFT attention | Weekly time series measuring the frequency of Google search volumes for the topics “NFT” and “Non-Fungible Token” at the worldwide level. The Google search index ranges between 0 and 100. Data is taken from Google Trends (accessed on 9 August 2021). |

| CryptoPunk attention | Weekly time series measuring the frequency of Google search volumes for the topic “CryptoPunk” at the worldwide level. The Google search index ranges between 0 and 100. Data is taken from Google Trends (accessed on 9 August 2021). |

| Decentraland attention | Weekly time series measuring the frequency of Google search volumes for the topic “Decentraland” at the worldwide level. The Google search index ranges between 0 and 100. Data is taken from Google Trends (accessed on 9 August 2021). |

| NFT return (%) | Weekly NFT return in percentage is defined as . NFT price on week t is either the price of CryptoPunk or Decentraland, depending on the model. Prices are taken from nonfungible.com (accessed on 9 August 2021). |

| Bitcoin attention | Weekly time series measuring the frequency of Google search volumes for the topic “Bitcoin” at the worldwide level. The Google search index ranges between 0 and 100. Data is taken from Google Trends (accessed on 9 August 2021). |

| Ethereum attention | Weekly time series measuring the frequency of Google search volumes for the topic “Ethereum” at the worldwide level. The Google search index ranges between 0 and 100. Data is taken from Google Trends (accessed on 9 August 2021). |

References

- Wang, Q.; Li, R.; Wang, Q.; Chen, S. Non-Fungible Token (NFT): Overview, Evaluation, Opportunities and Challenges. arXiv 2021, arXiv:2105.07447. [Google Scholar]

- Dowling, M. Is non-fungible token pricing driven by cryptocurrencies? Financ. Res. Lett. 2021, 44, 102097. [Google Scholar] [CrossRef]

- Ante, L. The non-fungible token (NFT) market and its relationship with Bitcoin and Ethereum. 2021. [Google Scholar] [CrossRef]

- Dowling, M. Fertile LAND: Pricing non-fungible tokens. Financ. Res. Lett. 2021, 44, 102096. [Google Scholar] [CrossRef]

- Chohan, U.W. Non-Fungible Tokens: Blockchains, Scarcity, and Value. 2021. [Google Scholar] [CrossRef]

- Serada, A.; Sihvonen, T.; Harviainen, J.T. CryptoKitties and the New Ludic Economy: How Blockchain Introduces Value, Ownership, and Scarcity in Digital Gaming. Games Cult. 2020, 16, 457–480. [Google Scholar] [CrossRef]

- Nadini, M.; Alessandretti, L.; Di Giacinto, F.; Martino, M.; Aiello, L.M.; Baronchelli, A. Mapping the NFT revolution: Market trends, trade networks, and visual features. Sci. Rep. 2021, 11, 20902. [Google Scholar] [CrossRef] [PubMed]

- Urquhart, A. What causes the attention of Bitcoin? Econ. Lett. 2018, 166, 40–44. [Google Scholar] [CrossRef] [Green Version]

- Al Guindy, M. Cryptocurrency price volatility and investor attention. Int. Rev. Econ. Financ. 2021, 76, 556–570. [Google Scholar] [CrossRef]

- Lin, Z.-Y. Investor attention and cryptocurrency performance. Financ. Res. Lett. 2021, 40, 101702. [Google Scholar] [CrossRef]

- Sabah, N. Cryptocurrency accepting venues, investor attention, and volatility. Financ. Res. Lett. 2020, 36, 101339. [Google Scholar] [CrossRef]

- Zhu, P.; Zhang, X.; Wu, Y.; Zheng, H.; Zhang, Y. Investor attention and cryptocurrency: Evidence from the Bitcoin market. PLoS ONE 2021, 16, e0246331. [Google Scholar] [CrossRef] [PubMed]

- Goodell, J.W.; Goutte, S. Co-movement of COVID-19 and Bitcoin: Evidence from wavelet coherence analysis. Financ. Res. Lett. 2021, 38, 101625. [Google Scholar] [CrossRef]

- Qiao, X.; Zhu, H.; Hau, L. Time-frequency co-movement of cryptocurrency return and volatility: Evidence from wavelet coherence analysis. Int. Rev. Financ. Anal. 2020, 71, 101541. [Google Scholar] [CrossRef]

- Phillips, R.; Gorse, D. Cryptocurrency price drivers: Wavelet coherence analysis revisited. PLoS ONE 2018, 13, e0195200. [Google Scholar] [CrossRef]

- Kang, S.H.; McIver, R.P.; Hernandez, J.A. Co-movements between Bitcoin and Gold: A wavelet coherence analysis. Phys. A Stat. Mech. Its Appl. 2019, 536, 120888. [Google Scholar] [CrossRef]

- Choi, D.; Gao, Z.; Jiang, W. Attention to Global Warming. Rev. Financ. Stud. 2020, 33, 1112–1145. [Google Scholar] [CrossRef]

- Torrence, C.; Compo, G.P. A Practical Guide to Wavelet Analysis. Bull. Am. Meteorol. Soc. 1998, 79, 61–78. [Google Scholar] [CrossRef] [Green Version]

- Torrence, C.; Webster, P.J. Interdecadal Changes in the ENSO-Monsoon System. J. Clim. 1999, 12, 2679–2690. [Google Scholar] [CrossRef] [Green Version]

- Bouri, E.; Keung, C.; Lau, M.; Lucey, B.; Roubaud, D. Trading volume and the predictability of return and volatility in the cryptocurrency market. Financ. Res. Lett. 2019, 29, 340–346. [Google Scholar] [CrossRef] [Green Version]

- Bouri, E.; Shahzad, S.; Roubaud, D. Co-explosivity in the cryptocurrency market. Financ. Res. Lett. 2019, 29, 178–183. [Google Scholar] [CrossRef]

- Gandal, N.; Hamrick, J.T.; Moore, T.; Oberman, T. Price manipulation in the Bitcoin ecosystem. J. Monet. Econ. 2018, 95, 86–96. [Google Scholar] [CrossRef]

| Observations | Mean | Media | SD | Min | Max | Skewness | Kurtosis | ADF Test | |

|---|---|---|---|---|---|---|---|---|---|

| NFT attention | 193 | 7.93 | 1.00 | 19.81 | 0.00 | 100.00 | 3.18 | 12.66 | −1.52 |

| CryptoPunk attention | 193 | 3.93 | 0.00 | 11.38 | 0.00 | 100.00 | 4.78 | 32.69 | −0.43 |

| Decentraland attention | 193 | 7.63 | 3.00 | 13.66 | 0.00 | 100.00 | 3.63 | 19.53 | −3.95 *** |

| Bitcoin return | 193 | 0.76 | 0.75 | 11.91 | −53.94 | 31.51 | −0.53 | 5.17 | −13.98 *** |

| Ether return | 193 | 1.02 | 1.18 | 15.00 | −65.97 | 49.89 | −0.46 | 5.54 | −12.62 *** |

| VIX return | 193 | 0.16 | −1.68 | 17.00 | −46.09 | 85.37 | 0.96 | 6.41 | −15.43 *** |

| Gold return | 193 | 0.14 | 0.20 | 2.08 | −9.90 | 10.10 | −0.11 | 8.31 | −17.17 *** |

| S&P 500 return | 193 | 0.27 | 0.59 | 2.86 | −16.23 | 11.42 | −1.30 | 11.39 | −15.19 *** |

| Bitcoin attention | 193 | 16.27 | 10.00 | 14.04 | 6.00 | 83.00 | 2.16 | 7.85 | −3.58 *** |

| Ethereum attention | 193 | 14.03 | 6.00 | 17.92 | 2.00 | 100.00 | 2.38 | 9.37 | −2.24 |

| CryptoPunk return | 191 | 4.87 | 1.32 | 63.88 | −177.31 | 208.32 | 0.06 | 3.44 | −21.98 *** |

| Decentraland return | 179 | 2.76 | −0.97 | 67.62 | −227.13 | 207.45 | 0.06 | 4.65 | −18.97 *** |

| ∆NFT + Non-Fungible Tokens | Bitcoin Return | ∆CryptoPunk | Bitcoin Return | ∆Decentraland | Bitcoin Return | |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ∆NFT attention t-1 | 0.1341 * | 0.1829 | −0.2068 * | 0.0677 | −0.2799 *** | −0.0327 |

| (1.8302) | (0.8562) | (1.8806) | (0.3778) | (3.8149) | (0.2673) | |

| ∆NFT attention t-2 | 0.3235 *** | −0.1923 | −0.1756 | 0.0870 | −0.1820 ** | 0.0425 |

| (4.5670) | (0.9313) | (1.5079) | (0.4587) | (2.3972) | (0.3361) | |

| ∆NFT attention t-3 | −0.1944 *** | −0.1244 | 0.2142 * | 0.2004 | −0.1005 | 0.2011 |

| (2.6200) | (0.5749) | (1.8522) | (1.0642) | (1.3672) | (1.6426) | |

| ∆NFT attention t-4 | −0.1223 * | 0.3184 | −0.0509 | 0.0440 | −0.0467 | −0.1380 |

| (1.7283) | (1.5428) | (0.4595) | (0.2442) | (0.6327) | (1.1215) | |

| Bitcoin return t-1 | 0.0556 ** | 0.0069 | 0.0603 | 0.0128 | 0.1087 ** | 0.0432 |

| (2.1739) | (0.0930) | (1.3078) | (0.1709) | (2.3429) | (0.5586) | |

| Bitcoin return t-2 | −0.0286 | −0.0070 | 0.1322 *** | −0.0295 | 0.1045 ** | −0.0065 |

| (1.0645) | (0.0899) | (2.7199) | (0.3723) | (2.1046) | (0.0781) | |

| Bitcoin return t-3 | 0.0070 | 0.0938 | 0.0131 | 0.0823 | −0.0371 | 0.0807 |

| (0.2813) | (1.2892) | (0.2912) | (1.1219) | (0.7938) | (1.0368) | |

| Bitcoin return t-4 | 0.0637 ** | −0.0107 | 0.0026 | −0.0097 | 0.0518 | −0.0181 |

| (2.5245) | (0.1456) | (0.0577) | (0.1313) | (1.0692) | (0.2238) | |

| Exogenous Controls: | ||||||

| VIX return t-1 | 0.0011 | −0.0027 | 0.0008 | −0.0069 | −0.0668 | −0.0001 |

| (0.0417) | (0.0357) | (0.0172) | (0.0921) | (1.4132) | (0.0015) | |

| Gold return t-1 | −0.3016 ** | −0.8107 * | −0.3271 | −0.8532 * | 0.0857 | −0.6342 |

| (2.0328) | (1.8741) | (1.2189) | (1.9527) | (0.3402) | (1.5114) | |

| S&P 500 return t-1 | 0.0429 | 0.1559 | −0.1134 | 0.1776 | −0.3700 | 0.1548 |

| (0.2677) | (0.3339) | (0.3939) | (0.3789) | (1.3214) | (0.3319) | |

| ∆Bitcoin attention t-1 | −0.0325 | −0.0646 | 0.0112 | −0.0874 | −0.0083 | −0.2024 |

| (0.5749) | (0.3926) | (0.1166) | (0.5598) | (0.0869) | (1.2687) | |

| NFT return t-1 | 0.0038 | 0.0082 | −0.0073 | 0.0043 | ||

| (0.4614) | (0.6073) | (0.9768) | (0.3418) | |||

| Constant | 0.1017 | 0.6930 | 0.5000 | 0.6854 | 0.0071 | 1.0141 |

| (0.3600) | (0.8416) | (0.9770) | (0.8224) | (0.0147) | (1.2506) | |

| Observations | 189 | 189 | 187 | 187 | 178 | 178 |

| R2 | 0.212 | 0.0476 | 0.1244 | 0.0446 | 0.1495 | 0.0693 |

| H0: Bitcoin return does not Granger-cause NFT attention | 14.585 *** | 9.1201 * | 11.795 ** | |||

| Prob > chi2 | 0.006 | 0.058 | 0.019 | |||

| H0: NFT attention does not Granger-cause Bitcoin return | 2.9402 | 1.2094 | 5.777 | |||

| Prob > chi2 | 0.568 | 0.877 | 0.216 | |||

| ∆NFT + Non-Fungible Tokens | Ether Return | ∆CryptoPunk | Ether Return | ∆Decentraland | Ether Return | |

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| ∆NFT attention t-1 | 0.1768 ** | 0.2538 | −0.1129 | −0.1201 | −0.2507 *** | −0.0253 |

| (2.4669) | (0.9336) | (1.0393) | (0.4997) | (3.4229) | (0.1546) | |

| ∆NFT attention t-2 | 0.3163 *** | −0.5096 * | −0.1087 | 0.2110 | −0.1649 ** | −0.0143 |

| (4.4703) | (1.8990) | (0.9621) | (0.8440) | (2.1956) | (0.0849) | |

| ∆NFT attention t-3 | −0.1626 ** | −0.0936 | 0.3096 *** | 0.0424 | −0.0625 | 0.3265 ** |

| (2.3019) | (0.3495) | (2.7317) | (0.1692) | (0.8868) | (2.0698) | |

| ∆NFT attention t-4 | −0.1381 * | 0.5839 ** | 0.0021 | 0.0637 | −0.0343 | −0.1064 |

| (1.9423) | (2.1656) | (0.0190) | (0.2650) | (0.4703) | (0.6514) | |

| Ether return t-1 | 0.0341 | 0.1175 | 0.0086 | 0.1257 | 0.0536 | 0.1082 |

| (1.6196) | (1.4728) | (0.2341) | (1.5474) | (1.4360) | (1.2954) | |

| Ether return t-2 | −0.0317 | 0.0422 | 0.0484 | 0.0024 | 0.0485 | −0.0165 |

| (1.5223) | (0.5339) | (1.2928) | (0.0285) | (1.2779) | (0.1936) | |

| Ether return t-3 | −0.0050 | 0.0135 | −0.0072 | 0.0173 | −0.0281 | 0.0032 |

| (0.2593) | (0.1834) | (0.2081) | (0.2271) | (0.8033) | (0.0409) | |

| Ether return t-4 | 0.0287 | −0.0166 | −0.0192 | −0.0029 | −0.0267 | 0.0000 |

| (1.4527) | (0.2217) | (0.5486) | (0.0373) | (0.7481) | (0.0004) | |

| Exogenous Controls: | ||||||

| VIX return t-1 | 0.0037 | 0.0147 | 0.0092 | 0.0185 | −0.0433 | 0.0219 |

| (0.1427) | (0.1497) | (0.2017) | (0.1842) | (0.9078) | (0.2049) | |

| Gold return t-1 | −0.2884 ** | −0.6605 | −0.3151 | −0.7557 | 0.1009 | −0.3971 |

| (1.9685) | (1.1886) | (1.2265) | (1.3294) | (0.3981) | (0.7001) | |

| S&P 500 return t-1 | 0.0787 | 0.1536 | 0.0033 | 0.2078 | −0.1986 | 0.1819 |

| (0.4857) | (0.2498) | (0.0116) | (0.3313) | (0.7087) | (0.2900) | |

| ∆Ethereum attention t-1 | −0.1333 *** | −0.1152 | 0.3334 *** | −0.1137 | 0.0239 | −0.1033 |

| (2.6990) | (0.6149) | (3.8449) | (0.5923) | (0.2823) | (0.5457) | |

| NFT return t-1 | −0.1129 | −0.1201 | −0.0057 | 0.0130 | ||

| (1.0393) | (0.4997) | (0.7523) | (0.7693) | |||

| Constant | 0.1340 | 0.7301 | 0.5101 | 0.8031 | 0.0644 | 1.3120 |

| (0.4745) | (0.6818) | (1.0325) | (0.7345) | (0.1303) | (1.1872) | |

| Observations | 189 | 189 | 187 | 187 | 178 | 178 |

| R2 | 0.2095 | 0.0499 | 0.18 | 0.0273 | 0.1212 | 0.0477 |

| H0: Ether return does not Granger-cause NFT attention | 7.5409 | 2.1153 | 4.8831 | |||

| Prob > chi2 | 0.11 | 0.715 | 0.3 | |||

| H0: NFT attention does not Granger-cause Ether return | 6.5483 | 1.4026 | 6.1733 | |||

| Prob > chi2 | 0.162 | 0.844 | 0.187 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pinto-Gutiérrez, C.; Gaitán, S.; Jaramillo, D.; Velasquez, S. The NFT Hype: What Draws Attention to Non-Fungible Tokens? Mathematics 2022, 10, 335. https://doi.org/10.3390/math10030335

Pinto-Gutiérrez C, Gaitán S, Jaramillo D, Velasquez S. The NFT Hype: What Draws Attention to Non-Fungible Tokens? Mathematics. 2022; 10(3):335. https://doi.org/10.3390/math10030335

Chicago/Turabian StylePinto-Gutiérrez, Christian, Sandra Gaitán, Diego Jaramillo, and Simón Velasquez. 2022. "The NFT Hype: What Draws Attention to Non-Fungible Tokens?" Mathematics 10, no. 3: 335. https://doi.org/10.3390/math10030335

APA StylePinto-Gutiérrez, C., Gaitán, S., Jaramillo, D., & Velasquez, S. (2022). The NFT Hype: What Draws Attention to Non-Fungible Tokens? Mathematics, 10(3), 335. https://doi.org/10.3390/math10030335