Latin American Agri-Food Exports, 1994–2019: A Gravity Model Approach

Abstract

1. Introduction

2. Materials and Methods

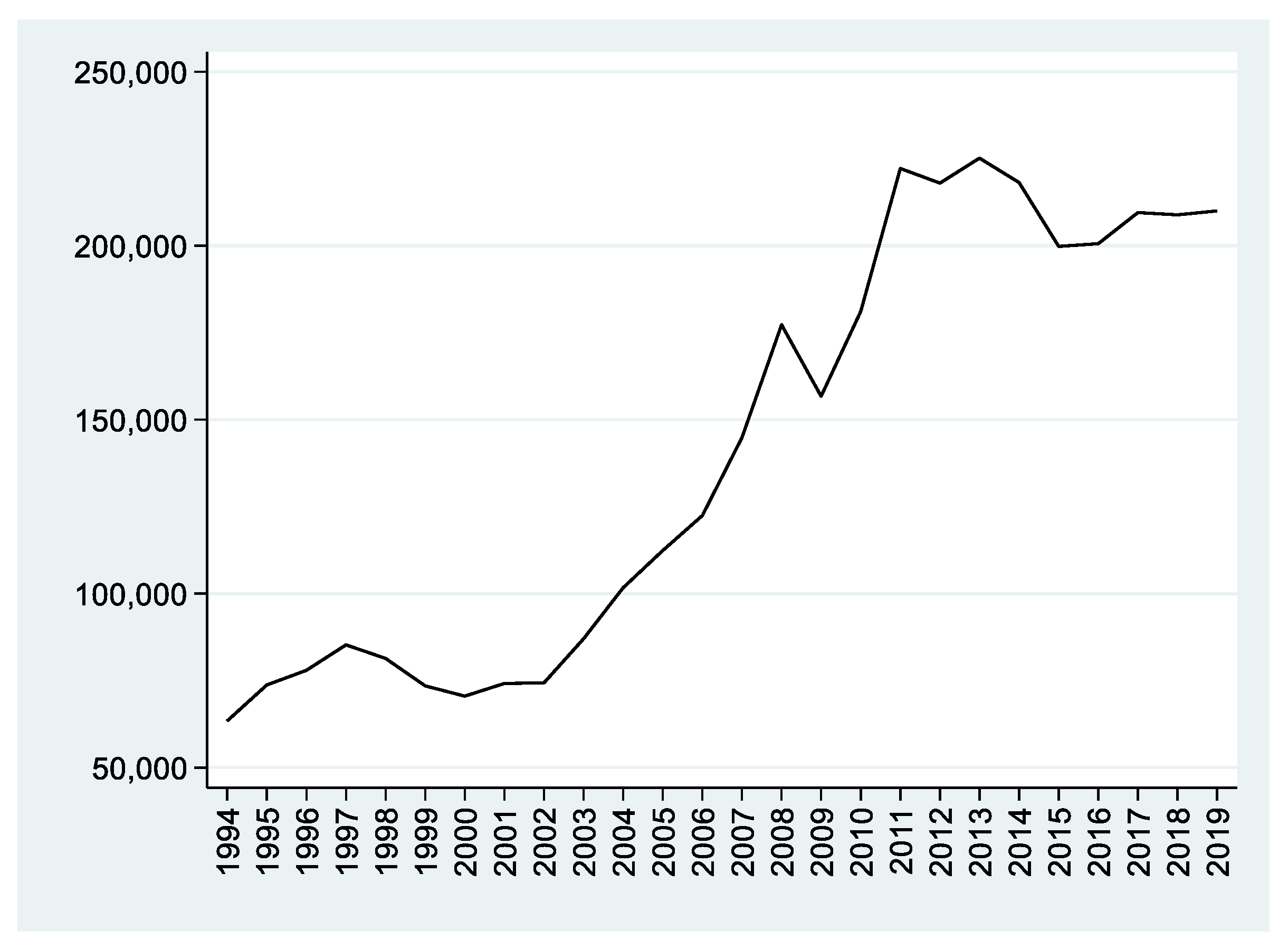

2.1. The Evolution of Agri-Food Exports from Latin America, 1994–2019

2.2. Theoretical Framework: Gravity Models and the Determinants of International Trade

2.3. Methods of Estimation

2.4. Empirical Model and Data

3. Results and Discussion

4. Sensitivity Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Findlay, R.; O’Rourke, K.H. Power and Plenty: Trade, War, and the World Economy in the Second Millennium; Princeton University Press: Princeton, NJ, USA, 2007. [Google Scholar]

- Serrano, R.; Pinilla, V. The long-run decline in the share of agricultural and food products in international trade: A gravity equation approach to its causes. Appl. Econ. 2012, 44, 4199–4210. [Google Scholar] [CrossRef]

- Serrano, R.; Pinilla, V. The declining role of Latin America in global agricultural trade, 1963–2000. J. Lat. Am. Stud. 2016, 48, 115–146. [Google Scholar] [CrossRef][Green Version]

- Serrano, R.; Pinilla, V. New directions of trade for the agri-food industry: A disaggregated approach for different income countries, 1963–2000. Lat. Am. Econ. Rev. 2014, 23, 10. [Google Scholar] [CrossRef][Green Version]

- Chaherli, N.; Nash, J. Agricultural Exports from Latin America and the Caribbean: Harnessing Trade to Feed the World and Promote Development; World Bank: Washington, DC, USA, 2013. [Google Scholar]

- Dingemans, A.; Ross, C. Los Acuerdos de Libre Comercio en América Latina Desde 1990: Una Evaluación de la Diversificación de Exportaciones. Revista CEPAL No. 108. 2012, pp. 27–50. Available online: https://repositorio.cepal.org/handle/11362/11558 (accessed on 2 July 2021).

- Rayes, A.; Rayes, M. La eficacia de la política pública para estimular las ventas externas. El programa de aumento y diversificación de las exportaciones (PADEX) en Argentina, 2014–2015. POSTData 2020, 25, 163–198. [Google Scholar]

- Bordo, M.D.; Taylor, A.M.; Williamson, J.G. Globalization in Historical Perspective; University of Chicago Press: Chicago, IL, USA, 2003. [Google Scholar]

- Martín-Retortillo, M.; Pinilla, V.; Velazco, J.; Willebald, H. The goose that laid the golden eggs? Agricultural development in Latin America in the 20th century. In Agricultural Development in the World Periphery; Palgrave Studies in Economic History; Pinilla, V., Willebald, H., Eds.; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Aparicio, G.; González-Esteban, A.L.; Pinilla, V.; Serrano, R. The World Periphery in Global Agricultural and Food Trade, 1900–2000. In Agricultural Development in the World Periphery; Palgrave Studies in Economic History; Pinilla, V., Willebald, H., Eds.; Palgrave Macmillan: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Bulmer-Thomas, V. The Economic History of Latin America since Independence; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Pinilla, V.; Aparicio, G. Navigating in troubled waters: South American exports of food and agricultural products, 1900–1950. Rev. Hist. Econ. J. Iber. Lat. Am. 2015, 33, 223–255. [Google Scholar] [CrossRef]

- Bertola, L.; Ocampo, J.A. El Desarrollo Económico en América Latina desde su Independencia; Fondo de Cultura Económica: Mexico City, Mexico, 2013. [Google Scholar]

- Martín-Retortillo, M.; Pinilla, V.; Velazco, J.; Willebald, H. The dynamics of Latin American agricultural production growth, 1950–2008. J. Lat. Am. Stud. 2019, 51, 573–605. [Google Scholar] [CrossRef]

- Martín-Retortillo, M.; Pinilla, V.; Velazco, J.; Willebald, H. Is There a Latin American Agricultural Growth Pattern? Factor Endowments and Productivity in the Second Half of the 20th Century; Cambridge University Press: Cambridge, UK, 2021. [Google Scholar] [CrossRef]

- Badia-Miró, M.; Pinilla, V.; Willebald, H. (Eds.) Natural Resources and Economic Growth Learning from History; Routledge: London, UK, 2015. [Google Scholar]

- Ducoing, C.; Pérez-Cajías, J. Natural Resources and Divergence A Comparison of Andean and Nordic Trajectories; Palgrave Mcmillan: Cham, Switzerland, 2021. [Google Scholar]

- Duarte, R.; Pinilla, V.; Serrano, A. Understanding agricultural virtual water flows in the world from an economic perspective: A long term study. Ecol. Indic. 2016, 61, 980–990. [Google Scholar] [CrossRef]

- Olmos, X. Sostenibilidad Ambiental en las Exportaciones Agroalimentarias. Un Panorama de América Latina; CEPAL: Santiago, Chile, 2017. [Google Scholar]

- Popescu, C.R.G.; Popescu, G.N. An Exploratory Study Based on a Questionnaire Concerning Green and Sustainable Finance, Corporate Social Responsibility, and Performance: Evidence from the Romanian Business Environment. J. Risk Financ. Manag. 2019, 12, 162. [Google Scholar] [CrossRef]

- Yotov, Y.V.; Piermartini, R.; Monteiro, J.A.; Larch, M. An Advanced Guide to Trade Policy Analysis: The Structural Gravity Model; World Trade Organization: Geneva, Switzerland, 2016. [Google Scholar] [CrossRef]

- Anderson, J.E. A Theoretical foundation for the gravity equation. Am. Econ. Rev. 1979, 69, 106–116. [Google Scholar]

- Helpman, E.; Krugman, P.R. Market Structure and Foreign Trade: Increasing Returns, Imperfect Competition, and the International Economy; MIT Press: Cambridge, MA, USA, 1985. [Google Scholar]

- Bergstrand, J.H. The generalized gravity equation, monopolistic competition, and the factor-proportions theory in international trade. Rev. Econ. Stat. 1989, 71, 143–153. [Google Scholar] [CrossRef]

- Deardoff, A. Determinants of bilateral trade: Does gravity work in a neoclassical world? In The Regionalization of the World Economy; Frankel, J.A., Ed.; University of Chicago Press: Chicago, IL, USA, 1998. [Google Scholar]

- Bergstrand, J.H. The gravity equation in international trade: Some microeconomic foundations and empirical evidence. Rev. Econ. Stat. 1985, 67, 474–481. [Google Scholar] [CrossRef]

- Baier, S.; Standaert, S. Gravity models and empirical trade. In Oxford Research Encyclopedia of Economics and Finance; Oxford University Press: Oxford, UK, 2020. [Google Scholar] [CrossRef]

- Krugman, P.R. Increasing returns, monopolistic competition, and international trade. J. Int. Econ. 1979, 9, 469–479. [Google Scholar] [CrossRef]

- Krugman, P. Scale economies, product differentiation, and the pattern of trade. Am. Econ. Rev. 1980, 70, 950–959. [Google Scholar]

- Helpman, E.; Krugman, P.R. Trade Policy and Market Structure; MIT Press: Cambridge, MA, USA, 1989. [Google Scholar]

- Arkolakis, C.; Costinot, A.; Rodriguez-Claire, A. New Trade Models, Same Old Gains? Am. Econ. Rev. 2012, 102, 94–130. [Google Scholar] [CrossRef]

- Anderson, J.E.; Van Wincoop, E. Gravity with gravitas: A solution to the border puzzle. Am. Econ. Rev. 2003, 93, 170–192. [Google Scholar] [CrossRef]

- Baldwin, R.E.; Taglioni, D. Gravity for Dummies and Dummies for Gravity Equations; NBER Work. Paper No. 12516; National Bureau of Economic Research: Cambridge, MA, USA, 2006. [Google Scholar] [CrossRef]

- Feenstra, R.E. Border effects and the gravity equation: Consistent methods for estimation. Scott. J. Political Econ. 2002, 49, 491–506. [Google Scholar] [CrossRef]

- Feenstra, R.E. Advanced International Trade. Theory and Evidence; Princeton University Press: Princeton, NJ, USA, 2004. [Google Scholar]

- Novy, D. International trade without CES: Estimating translog gravity. J. Int. Econ. 2013, 89, 271–282. [Google Scholar] [CrossRef]

- Eaton, J.; Kortum, S. Technology, geography and trade. Econometrica 2002, 70, 1741–1779. [Google Scholar] [CrossRef]

- Redding, S.; Venables, A.J. Economic geography and international inequality. J. Int. Econ. 2004, 6, 53–82. [Google Scholar] [CrossRef]

- Anderson, J.E.; Yotov, Y.V. Terms of trade and global efficiency effects of free trade agreements, 1990–2002. J. Int. Econ. 2016, 99, 279–298. [Google Scholar] [CrossRef]

- Redding, S.; Weinstein, D. Aggregation and the gravity equation. Am. Econ. Rev. Pap. Proc. 2019, 109, 450–455. [Google Scholar] [CrossRef]

- Flowerdew, R.; Aitkin, M. A method of fitting the gravity model based on the Poisson distribution. J. Reg. Sci. 1982, 22, 191–202. [Google Scholar] [CrossRef] [PubMed]

- Eichengreen, B.; Irwin, D.A. The role of history in bilateral trade flows. In The Regionalization of the World Economy; Frankel, J.A., Ed.; University of Chicago Press: Chicago, IL, USA, 1998. [Google Scholar]

- Linders, G.J.; De Groot, H.L.F. Estimation of the Gravity Equation in the Presence of Zero Flows; Tinbergen Institution Discussion Paper. 06-072/3; SSRN: Rochester, NY, USA, 2006. [Google Scholar]

- Burger, M.J.; van Oort, F.G.; Linders, G.M. On the specification of the gravity model of trade: Zeros, excess zeros and zero-inflated estimations. Spat. Econ. Anal. 2009, 4, 167–190. [Google Scholar] [CrossRef]

- Westerlund, J.; Wilhelmsson, F. Estimating the gravity model without gravity using panel data. Appl. Econ. 2009, 43, 641–649. [Google Scholar] [CrossRef]

- Gómez-Herrera, E. Comparing alternative methods to estimate gravity models of bilateral trade. Empir. Econ. 2013, 44, 1087–1111. [Google Scholar] [CrossRef]

- Heckman, J.J. Sample selection bias as a specification error. Econometrica 1979, 47, 153–161. [Google Scholar] [CrossRef]

- Helpman, E.; Melitz, M.; Rubinstein, Y. Estimating trade flows: Trading partners and trading volumes. Q. J. Econ. 2008, 123, 441–487. [Google Scholar] [CrossRef]

- Martin, W.; Pham, C.S. Estimating the Gravity Model When Zero Trade Flows Are Frequent; Policy Research Working Paper No. 7308; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Santos-Silva, J.M.C.; Tenreyro, S. Trading partners and trading volumes: Implementing the Helpman–Melitz–Rubinstein model empirically. Oxf. Bull. Econ. Stat. 2015, 77, 93–105. [Google Scholar] [CrossRef]

- Santos-Silva, J.M.C.; Tenreyro, S. The log of gravity. Rev. Econ. Stat. 2006, 88, 641–658. [Google Scholar] [CrossRef]

- Staub, K.E.; Winkelmann, R. Consistent estimation of zero-inflated count models. Health Econ. 2013, 22, 673–686. [Google Scholar] [CrossRef]

- Eaton, J.; Tamura, A. Bilateralism and regionalism in Japanese and U.S. trade and direct foreign investment patterns. J. Jpn. Int. Econ. 1994, 8, 478–510. [Google Scholar] [CrossRef]

- Eaton, J.; Kortum, S.; Sotelo, S. International Trade: Linking Micro and Macro; Technical Report; National Bureau of Economic Research (NBER): Cambridge, MA, USA, 2012. [Google Scholar] [CrossRef]

- Head, K.; Mayer, T. Gravity Equations: Workhorse, Toolkit, and Cookbook. In The Handbook of International Economics; Gopinath, G., Helpman, E., Rogoff, K., Eds.; Elsevier: Amsterdam, The Netherlands, 2014; Volume 4. [Google Scholar] [CrossRef]

- Martínez-Zarzoso, I. The log of Gravity Revisited. Appl. Econ. 2013, 45, 311–327. [Google Scholar] [CrossRef]

- Manning, W.G.; Mulahy, J. Estimating log models: To transform or not to transform? J. Health Econ. 2001, 20, 461–494. [Google Scholar] [CrossRef]

- Sören, P.; Bruemmer, B. Bimodality & the Performance of PPML; Institute for Agrieconomics Discussion Paper, 1202; Department für Agrarökonomie und Rurale Entwicklung: Göttingen, Germany, 2012. [Google Scholar]

- Dorakh, A. A gravity model analysis of FDI across EU member states. J. Econ. Integr. 2020, 35, 426–456. [Google Scholar] [CrossRef]

- Nguyen, T.N.A.; Haug, A.A.; Owen, P.D.; Gene, M. What drives bilateral foreign direct investment among Asian economies? Econ. Model. 2020, 93, 125–141. [Google Scholar] [CrossRef]

- UN-Comtrade. UN Statistical Division’s Commodity Trade Statistics Database, New York. Available online: https://comtrade.un.org/db/ (accessed on 2 July 2021).

- Jacobo, A.D. Incrementando la presencia comercial de América Latina: ¿Qué tienen los modelos gravitacionales para decir? Actual. Econ. 2005, 15, 15–20. [Google Scholar]

- Conte, M.; Cotterlaz, P.; Mayer, T. “The CEPII Gravity Database”; CEPII: Paris, France, 2021; Available online: http://www.cepii.fr/cepii/en/bdd_modele/bdd.asp (accessed on 2 July 2021).

- World Development Indicators (WDI). 2021. Available online: https://databank.bancomundial.org/source/world-development-indicators (accessed on 2 July 2021).

- Renjini, V.R.; Kar, A.; Jha, G.K.; Kumar, P.; Burman, R.R.; Praveen, K.V. Agricultural trade potential between India and ASEAN: An application of gravity model. Agric. Econ. Res. Rev. 2017, 30, 105–112. [Google Scholar] [CrossRef]

- Head, K.; Mayer, T. Non-Europe: The magnitude and causes of market fragmentation in the EU. Rev. World Econ. 2000, 136, 284–314. [Google Scholar] [CrossRef]

- Head, K.; Mayer, T. Illusory Border Effects: Distance Mismeasurement Inflates Estimates of Home Bias in Trade; CEPII: Paris, France, 2002; Volume 1. [Google Scholar]

- Mayer, T.; Zignago, S. Notes on CEPII’s Distances Measures: The GeoDist Database; CEPII Working Paper No. 2011-25; SSRN: Rochester, NY, USA, 2011. [Google Scholar]

- University of Pennsylvania Wharton. The Political Constraint Index (POLCON) Dataset. Available online: https://mgmt.wharton.upenn.edu/faculty/heniszpolcon/polcondataset/ (accessed on 2 July 2021).

- FAOSTAT-Agriculture-Database, FAO. Available online: https://www.fao.org/faostat/es/#data/QV (accessed on 2 July 2021).

- Rose, A.K. Do we really know that the WTO increases trade? Am. Econ. Rev. 2004, 94, 98–114. [Google Scholar] [CrossRef]

- Fiankor, D.D.; Curzi, D.; Olper, A. Trade, price and quality upgrading effects of agri-food standards. Eur. Rev. Agric. Econ. 2021, 48, 835–877. [Google Scholar] [CrossRef]

- Feenstra, R.C.; Markusen, J.A.; Rose, A.K. Understanding the Home Market Effect and the Gravity Equation: The Role of Differentiating Goods; NBER Working Paper No. 6804; National Bureau of Economic Research: Cambridge, MA, USA, 1998. [Google Scholar]

- Feenstra, R.E.; Markusen, J.R.; Rose, A.K. Using the gravity equation to differentiate among alternative theories of trade. Can. J. Econ. 2001, 34, 430–447. [Google Scholar] [CrossRef]

- Santos-Silva, J.M.C.; Tenreyro, S. On the existence of the maximum likelihood estimates in Poisson regression. Econ. Lett. 2010, 107, 310–312. [Google Scholar] [CrossRef]

- François, J.; Manchin, M. Institutions, infrastructure, and trade. World Dev. 2013, 46, 165–175. [Google Scholar] [CrossRef]

- Cameron, A.C.; Gelbach, J.B.; Miller, D.L. Robust inference with multiway clustering. J. Bus. Econ. Stat. 2011, 29, 238–249. [Google Scholar] [CrossRef]

- Ramsey, J.B. Tests for specification errors in classical linear least-squares regression analysis. J. R. Stat. Soc. Ser. B 1969, 31, 350–371. [Google Scholar] [CrossRef]

- Fidrmuc, J. The core and periphery of the world economy. J. Int. Trade Econ. Dev. 2004, 13, 89–106. [Google Scholar] [CrossRef]

- Jensen, P.E. Trade, entry barriers, and home market effects. Rev. Int. Econ. 2006, 14, 104–118. [Google Scholar] [CrossRef]

- Siliverstovs, B.; Schumacher, D. Home-market and factor-endowment effects in a gravity approach. Rev. World Econ. 2006, 142, 330–353. [Google Scholar] [CrossRef]

- Siliverstovs, B.; Schumacher, D. Using the gravity equation to differentiate among alternative theories of trade: Another look. Appl. Econ. Lett. 2007, 14, 1065–1073. [Google Scholar] [CrossRef]

- Serrano, R.; Pinilla, V. Changes in the structure of world trade in the agri-food industry: The impact of the home market effect and regional liberalization from a long-term perspective, 1963–2010. Agribusiness 2014, 30, 165–183. [Google Scholar] [CrossRef]

- Abula, K.; Abula, B. An analysis of gravity model based on the impact of China’s agricultural exports—A case study of western and Central Asia along the economic corridor. Acta Agric. Scand. B Soil Plant Sci. 2021, 71, 432–442. [Google Scholar] [CrossRef]

- Shahriar, S.; Qian, L.; Kea, S. Determinants of Exports in China’s Meat Industry: A Gravity Model Analysis. Emerg. Mark. Financ. Trade 2019, 55, 2544–2565. [Google Scholar] [CrossRef]

- Disdier, A.C.; Head, K. The puzzling persistence of the distance effect on bilateral trade. Rev. Econ. Stat. 2008, 90, 37–48. [Google Scholar] [CrossRef]

- Cipollina, M.; Salvatici, L. Reciprocal trade agreements in gravity models: A meta-analysis. Rev. Int. Econ. 2010, 18, 63–80. [Google Scholar] [CrossRef]

- Baier, S.L.; Bergstrand, J.H. Do free trade agreements actually increase member’s international trade? J. Int. Econ. 2007, 71, 72–95. [Google Scholar] [CrossRef]

- Grant, J.H.; Lambert, D.M. Do regional trade agreements increase members’ agricultural trade? Am. J. Agric. Econ. 2008, 90, 765–782. [Google Scholar] [CrossRef]

- Rauch, J. Networks versus markets in international trade. J. Int. Econ. 1999, 48, 7–35. [Google Scholar] [CrossRef]

- Disdier, A.C.; Marette, S. The combination of gravity and welfare approaches for evaluating nontariff measures. Am. J. Agric. Econ. 2010, 92, 713–726. [Google Scholar] [CrossRef]

- Cho, G.; Sheldon, I.M.; McCorriston, S. Exchange rate uncertainty and agricultural trade. Am. J. Agric. Econ. 2002, 84, 931–942. [Google Scholar] [CrossRef]

- Rose, A.K. One money, one market: The effect of common currencies on trade. Econ. Policy 2000, 15, 7–46. [Google Scholar] [CrossRef]

- Gil-Pareja, S.; Llorca-Vivero, R.; Martínez-Serrano, J.A. Do nonreciprocal preferential trade agreements increase beneficiaries’ exports? J. Dev. Econ. 2014, 107, 291–304. [Google Scholar] [CrossRef]

- Carrère, C. Revisiting the effects of regional trade agreements on trade flows with proper specification of the gravity model. Eur. Econ. Rev. 2006, 50, 223–247. [Google Scholar] [CrossRef]

- Romalis, J. NAFTA’s and CUSFTA’s impact on international trade. Rev. Econ. Stat. 2007, 89, 416–435. [Google Scholar] [CrossRef]

- Fratianni, M.; Oh, C.H. Expanding RTAs, trade flows, and the multinational enterprise. J. Int. Bus. Stud. 2009, 40, 1206–1227. [Google Scholar] [CrossRef]

- Geldi, H.K. Trade effects of regional integration: A panel cointegration analysis. Econ. Model. 2012, 29, 1566–1570. [Google Scholar] [CrossRef]

- Caliendo, L.; Parro, F. Estimates of the trade and welfare effects of NAFTA. Rev. Econ. Stud. 2015, 82, 1–44. [Google Scholar] [CrossRef]

| Variables | Obs. | Mean | Std. Dev. | Minimum | Maximum |

|---|---|---|---|---|---|

| Xij,t | 72,150 | 53,800,000 | 475,000,000 | 0 | 3.19 × 1010 |

| Distij | 71,595 | 10,242 | 4321 | 181.113 | 19,812.040 |

| Yi,t | 72,150 | 223,000,000 | 423,000,000 | 3,432,357 | 2.48 × 109 |

| Yj,t | 71,340 | 293,000,000 | 1.27 × 109 | 10,887 | 2.14 × 1010 |

| GAPi,t | 68,265 | 20,200,000 | 38,200,000 | 133,753 | 2.5 × 108 |

| Excvolij,t | 61,790 | 0.412 | 0.673 | 0 | 4.504 |

| Polconvi,t | 72,150 | 0.480 | 0.206 | 0 | 0.782 |

| Langij | 71,595 | 0.109 | 0.312 | 0 | 1 |

| Comreligij,t | 69,810 | 0.282 | 0.320 | 0 | 0.940 |

| Landlockedi | 72,150 | 0.133 | 0.340 | 0 | 1 |

| RTAij,t | 71,595 | 0.126 | 0.320 | 0 | 1 |

| WTOij,t | 71,595 | 0.751 | 0.432 | 0 | 1 |

| NAFTAij,t | 72,150 | 0.001 | 0.027 | 0 | 1 |

| MERCOSURij,t | 72,150 | 0.004 | 0.066 | 0 | 1 |

| CACMij,t | 72,150 | 0.007 | 0.084 | 0 | 1 |

| CANij,t | 72,150 | 0.004 | 0.068 | 0 | 1 |

| APECij,t | 72,150 | 0.018 | 0.133 | 0 | 1 |

| ALADIij,t | 72,150 | 0.028 | 0.165 | 0 | 1 |

| G-3ij,t | 72,150 | 0.001 | 0.025 | 0 | 1 |

| APij,t | 72,150 | 0.001 | 0.026 | 0 | 1 |

| P4ij,t | 72,150 | 0 | 0.020 | 0 | 1 |

| TPPij,t | 72,150 | 0.001 | 0.043 | 0 | 1 |

| 1 | |||||||

| 0.2889 * | 1 | ||||||

| 0.3025 * | 0.9336 * | 1 | |||||

| 0.4996 * | 0.0658 * | 0.0580 * | 1 | ||||

| −0.1504 * | 0.0279 * | 0.0228 * | 0.0889 * | 1 | |||

| 0.0499 * | −0.0006 | 0.0187 * | −0.0331 * | 0.0268 * | 1 | ||

| 0.0983 * | 0.1314 * | 0.1791 * | −0.0396 * | 0.0176 * | −0.0470 * | 1 |

| VARIABLES | VIF |

|---|---|

| Log of Exporter GDP (ln Yi,t) | 13.67 |

| Log of Exporter GAP (ln GAPi,t) | 12.35 |

| Log of Distance (ln Distij) | 2.60 |

| Common Language (Langij) | 1.90 |

| ALADI | 1.62 |

| RTA | 1.62 |

| Exporter Landlocked (Landlockedi) | 1.51 |

| Log of Common Religion Index (ln Comreligij,t) | 1.41 |

| Log of Importer GDP (ln Yj,t) | 1.36 |

| CACM | 1.29 |

| APEC | 1.26 |

| TPP | 1.24 |

| CAN | 1.16 |

| MERCOSUR | 1.16 |

| AP | 1.13 |

| WTO | 1.09 |

| Log of Exporter Polconv (ln Polconvi,t) | 1.08 |

| Log of Excvol (ln Excvolij,t) | 1.08 |

| NAFTA | 1.08 |

| G-3 | 1.03 |

| P4 | 1.03 |

| Dependent Variable: Latin American Agricultural Exports | ||||

|---|---|---|---|---|

| Explanatory Variables | (Model 1) | (Model 2) | (Model 3) | (Model 4) |

| ln Yi,t | 0.0144 | 0.1201 | ||

| (0.092) | (0.081) | |||

| ln GAPi,t | 0.2474 *** | 0.1906 ** | ||

| (0.094) | (0.093) | |||

| ln Yj,t | 0.9223 *** | 0.9182 *** | 0.8934 *** | 0.8989 *** |

| (0.137) | (0.135) | (0.141) | (0.138) | |

| ln Distij | −1.6904 *** | −1.7167 *** | −1.1110 *** | −1.0531 *** |

| (0.238) | (0.255) | (0.176) | (0.185) | |

| RTAij,t | 0.7024 *** | 0.7136 *** | ||

| (0.153) | (0.157) | |||

| WTOij,t | 0.1269 | 0.1085 | 0.1271 | 0.1146 |

| (0.167) | (0.164) | (0.162) | (0.161) | |

| Langij | 0.4314 * | 0.4229 * | 0.7414 *** | 0.7661 *** |

| (0.232) | (0.233) | (0.163) | (0.160) | |

| Landlockedi | 0.0550 | −0.0123 | 0.0790 | −0.0487 |

| (0.317) | (0.316) | (0.268) | (0.256) | |

| ln Excvolij,t | −0.0658 ** | −0.0657 ** | −0.0652 *** | −0.0600 *** |

| (0.028) | (0.029) | (0.022) | (0.023) | |

| ln Polconvi,t | 0.0560 | 0.0642 | 0.0318 | 0.0415 |

| (0.049) | (0.058) | (0.029) | (0.030) | |

| NAFTAij,t | 2.2986 *** | 2.3699 *** | ||

| (0.367) | (0.378) | |||

| MERCOSURij,t | 0.6643 *** | 0.6631 *** | ||

| (0.190) | (0.190) | |||

| CACMij,t | 1.0730 ** | 1.2089 ** | ||

| (0.481) | (0.511) | |||

| CANij,t | 0.3270 | 0.3542 | ||

| (0.369) | (0.373) | |||

| APECij,t | 0.5255 ** | 0.5466 ** | ||

| (0.233) | (0.238) | |||

| ALADIij,t | 0.0802 | 0.0639 | ||

| (0.207) | (0.212) | |||

| G-3ij,t | 0.1925 | 0.1689 | ||

| (0.334) | (0.335) | |||

| APij,t | −0.0319 | −0.0641 | ||

| (0.222) | (0.222) | |||

| P4ij,t | −0.4451 | −0.4033 | ||

| (0.332) | (0.343) | |||

| TPPij,t | 0.4731 *** | 0.4584 *** | ||

| (0.080) | (0.081) | |||

| Constant | 8.9303 *** | 8.8902 *** | 3.3598 * | 3.0362 |

| (2.577) | (2.648) | (1.805) | (1.859) | |

| Observations | 60,971 | 57,434 | 60,971 | 57,434 |

| R-squared | 0.743 | 0.746 | 0.86 | 0.867 |

| RESET test (statistic) | 5.28 ** | 4.77 ** | 0.02 | 0.02 |

| OLS Model | Heckman Model | |||||

|---|---|---|---|---|---|---|

| Probit | Probit | |||||

| Explanatory Variables | (1) | (2) | (3) | (4) | (5) | (6) |

| ln GAPi,t | 0.2861 *** | 0.5988 *** | 0.1841 *** | 0.2903 *** | 0.1695 *** | 0.2657 *** |

| (0.056) | (0.099) | (0.039) | (0.056) | (0.039) | (0.056) | |

| ln Yj,t | 0.5229 *** | 1.2419 *** | 0.3112 *** | 0.5406 *** | 0.3185 *** | 0.5245 *** |

| (0.065) | (0.127) | (0.048) | (0.065) | (0.050) | (0.067) | |

| ln Distij | −1.8679 *** | −3.4592 *** | −1.1297 *** | −1.8971 *** | −1.1395 *** | −1.9018 *** |

| (0.134) | (0.235) | (0.083) | (0.137) | (0.083) | (0.137) | |

| WTOij,t | 0.0947 | 0.0268 | −0.0039 | 0.0940 | −0.0219 | 0.1176 |

| (0.101) | (0.170) | (0.063) | (0.101) | (0.067) | (0.107) | |

| Langij | 0.8656 *** | 2.1703 *** | 0.5723 *** | 0.8902 *** | 0.5606 *** | 0.8773 *** |

| (0.199) | (0.428) | (0.212) | (0.199) | (0.211) | (0.198) | |

| Landlockedi | −2.8294 *** | −6.1035 *** | −0.8553 *** | −0.8290 *** | −0.9470 *** | −0.7986 *** |

| (0.239) | (0.429) | (0.083) | (0.170) | (0.093) | (0.175) | |

| ln Excolij,t | −0.0536 *** | −0.0698 ** | −0.0301 ** | −0.0558 *** | −0.0269 ** | −0.0425 ** |

| (0.019) | (0.033) | (0.013) | (0.019) | (0.013) | (0.019) | |

| ln Polconvi,t | 0.0214 | −0.0125 | −0.0310 | −0.0258 | 0.0142 | |

| (0.028) | (0.055) | (0.023) | (0.024) | (0.027) | ||

| ln Comreligij,t | 0.1532 ** | |||||

| (0.069) | ||||||

| NAFTAij,t | 0.3189 | −0.1126 | 2.2255 *** | 0.3068 | 2.1658 *** | 0.2879 |

| (0.426) | (0.555) | (0.447) | (0.425) | (0.447) | (0.423) | |

| MERCOSURij,t | 0.5039 | −1.2989 | −1.0291 *** | 0.4645 | −1.0060 *** | 0.4820 |

| (0.535) | (1.056) | (0.379) | (0.539) | (0.379) | (0.540) | |

| CACMij,t | 1.6248 *** | 0.9879 | −0.6554 * | 1.6131 *** | −0.6836 * | 1.5648 *** |

| (0.383) | (0.680) | (0.377) | (0.386) | (0.375) | (0.385) | |

| CANij,t | 1.0573 ** | 1.2618 | 5.1982 *** | 1.0617 ** | 5.1955 *** | 1.0756 *** |

| (0.414) | (0.799) | (0.416) | (0.418) | (0.413) | (0.413) | |

| APECij,t | 0.9222 *** | 0.8703 *** | 0.4607 * | 0.9187 *** | 0.4176 * | 0.8699 *** |

| (0.143) | (0.294) | (0.242) | (0.143) | (0.244) | (0.140) | |

| ALADIij,t | 1.1758 *** | 1.1064 * | 0.7494 *** | 1.1694 *** | 0.7638 *** | 1.1911 *** |

| (0.207) | (0.400) | (0.249) | (0.208) | (0.248) | (0.208) | |

| G-3ij,t | −0.4509 | −0.0218 | 4.5014 *** | −0.4504 | 4.3874 *** | −0.4961 |

| (0.406) | (1.007) | (0.443) | (0.411) | (0.445) | (0.409) | |

| APij,t | 0.0196 | −0.6304 | 2.8839 *** | 0.0123 | 2.7866 *** | −0.0019 |

| (0.231) | (0.504) | (0.376) | (0.233) | (0.386) | (0.231) | |

| P4ij,t | −0.5512 | −2.7721 *** | −1.1329 *** | −0.5789 | −1.1259 *** | −0.5459 |

| (0.405) | (0.859) | (0.244) | (0.406) | (0.247) | (0.405) | |

| TPPij,t | 0.0409 | −0.6407 ** | −0.6413 ** | 0.0312 | −0.6307 ** | 0.0660 |

| (0.137) | (0.287) | (0.308) | (0.137) | (0.309) | (0.131) | |

| Constant | 9.0099 *** | 37.3730 *** | 8.9673 *** | 12.0044 *** | 9.3722 *** | 12.1274 *** |

| (1.354) | (2.477) | (0.822) | (1.483) | (0.838) | (1.477) | |

| Observations | 35,493 | 57,434 | 57,434 | 57,434 | 54,595 | 54,595 |

| R-squared | 0.708 | 0.693 | ||||

| WALD test | 13.04 *** | 7.73 *** | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ayuda, M.-I.; Belloc, I.; Pinilla, V. Latin American Agri-Food Exports, 1994–2019: A Gravity Model Approach. Mathematics 2022, 10, 333. https://doi.org/10.3390/math10030333

Ayuda M-I, Belloc I, Pinilla V. Latin American Agri-Food Exports, 1994–2019: A Gravity Model Approach. Mathematics. 2022; 10(3):333. https://doi.org/10.3390/math10030333

Chicago/Turabian StyleAyuda, María-Isabel, Ignacio Belloc, and Vicente Pinilla. 2022. "Latin American Agri-Food Exports, 1994–2019: A Gravity Model Approach" Mathematics 10, no. 3: 333. https://doi.org/10.3390/math10030333

APA StyleAyuda, M.-I., Belloc, I., & Pinilla, V. (2022). Latin American Agri-Food Exports, 1994–2019: A Gravity Model Approach. Mathematics, 10(3), 333. https://doi.org/10.3390/math10030333