Blockchain and Double Auction-Based Trustful EVs Energy Trading Scheme for Optimum Pricing

Abstract

:1. Introduction

- Most conventional energy trading schemes have focused on the security aspect of the EVs while neglecting the optimal payoff between them;

- As per the literature, researchers have addressed the security and privacy issues of EVs energy trading schemes. As a result, authors in [12,24,25,26] investigated the blockchain-based energy trading scheme to strengthen the security and transparency of the EVs communication. However, they have ignored the price optimality aspect of EVs along with other factors such as profit for consumers, computation time, and data storage computation. Moreover, authors of [27] have adopted a double auction mechanism for optimality, but they did not consider the truthfulness and individual rationality of the EVs;

- Therefore, a blockchain and IPFS-enabled energy trading scheme is a plausible solution to overcome the price optimality and trust issues of the EVs based on the trustful double auction mechanism. Furthermore, the IPFS and 5G wireless technology ensures the highly reliable, scalable, and efficient data communication between EVs in energy trading.

- We propose a blockchain-based secure and truthful energy trading scheme for optimal payoff between EVs, i.e., prosumers and consumers;

- We employ a P2P IPFS protocol with the blockchain to provide a low cost data storage for EV energy trading;

- We formulate a truthful double auction mechanism to enable the optimized payoff for EVs in energy trading due to its truthfulness and individual rationality;

- Finally, the simulation of the proposed energy trading scheme has been presented in terms of various aspects such as convergence, profit for consumers, computation time, and data storage cost computation.

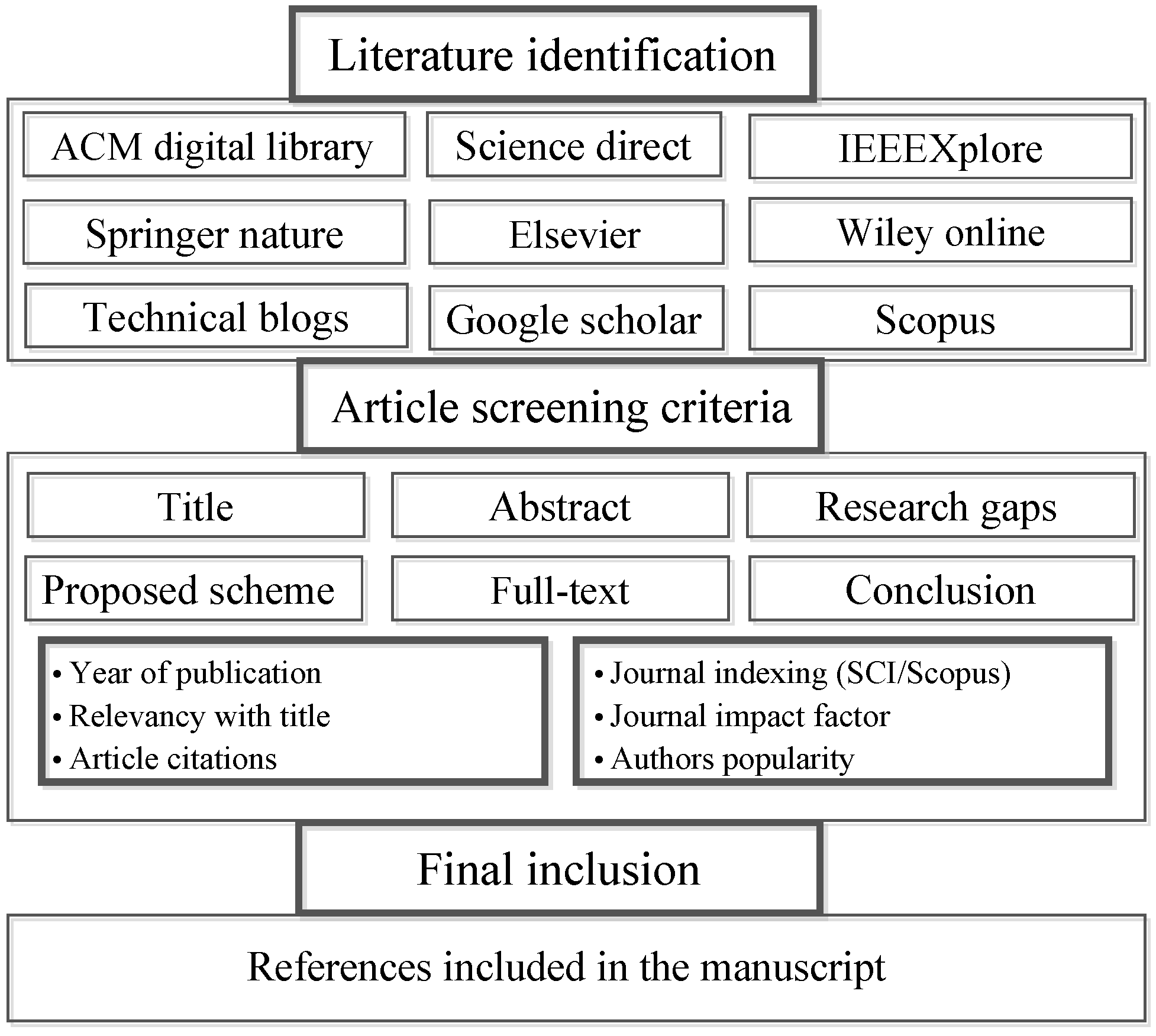

2. Materials and Methods

3. Related Works

4. System Model and Problem Formulation

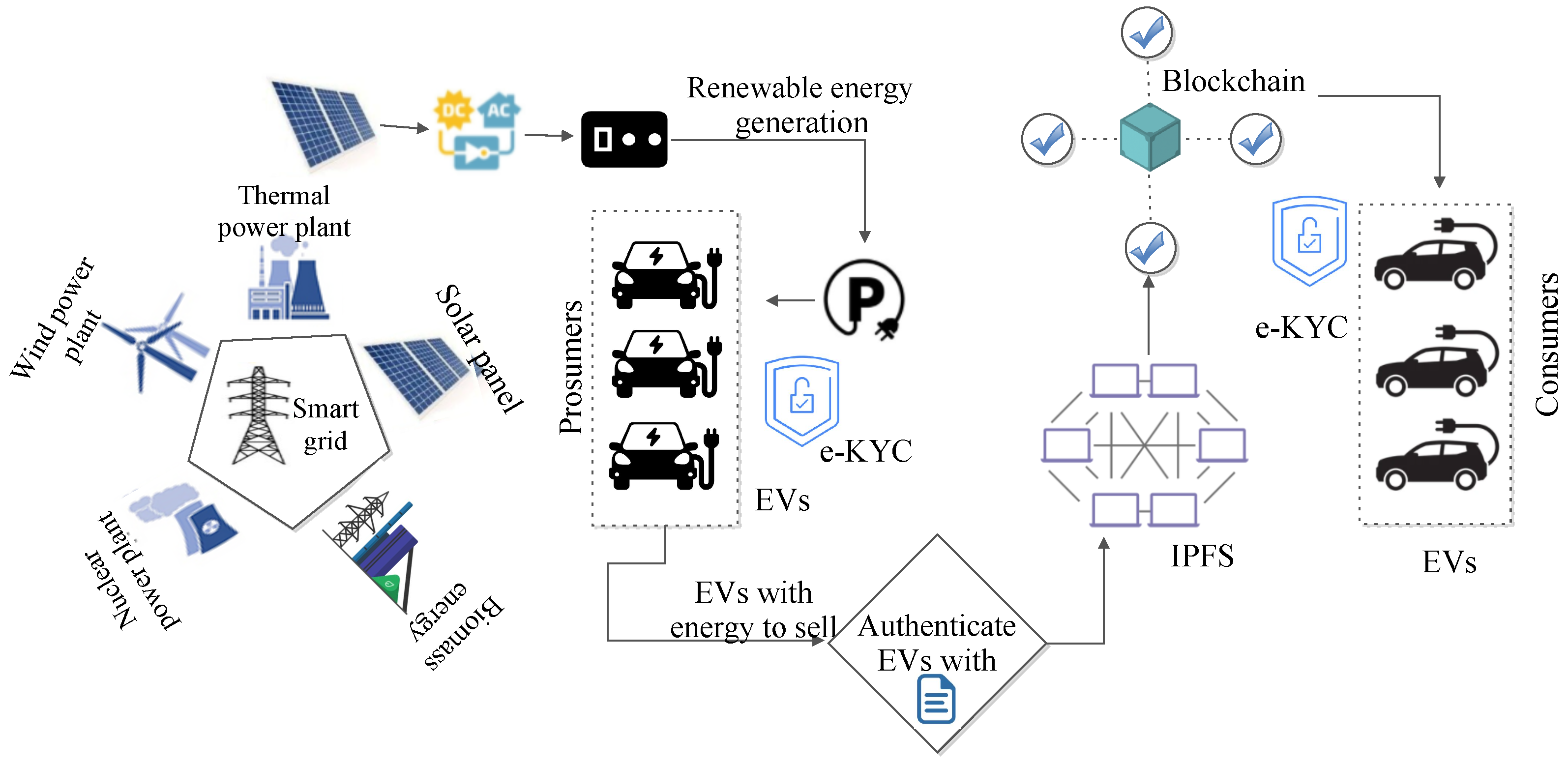

4.1. System Model

4.1.1. Prosumer Layer

4.1.2. Blockchain and Auction Layer

- Blockchain-based secure data storage algorithmIn Algorithm 1, the two entities, i.e., prosumer and consumer , are considered along with their data and needed to be stored in the IPFS beforehand certified by the registering authority . After obtaining the legitimate certificate from , EVs can store their energy trading data in the IPFS that further generates the corresponding hash keys for them. Furthermore, public key cryptography associated with the public-private key pair for the EVs can be used to ensure authenticity and transparency in the energy trading based on the blockchain network [38]. The complete procedure of blockchain-based secure data storage for p and q number of EVs, i.e., prosumer and consumer, can be computed in terms of the time complexity of O(p) and O(q).

| Algorithm 1 Blockchain-based algorithm to perform secure data transactions for EVs |

Input: Output: Add data transactions to the blockchain

|

4.1.3. Consumer Layer

4.2. Problem Formulation

5. The Proposed Scheme: Truthful Double Auction

5.1. Truthful and Individual Rationality Characteristics of the Double Auction Mechanism

- If < , then prosumers trade energy with the bid value less than its true value. However, prosumers bidding with the energy price less than their true value can deviate them from the energy trading due to the incurred loss;

- If > , then prosumers trade energy with the bid value greater than its true value, which seems to be a beneficial choice for them. However, consumers may not be willing to participate in the energy trading due to the high energy prices for EVs.

- Similarly, if < and > , then, based on the first case, consumers trade energy with the bid value less than its true value and, in the second case, consumers trade energy with the bid value greater than its true value. However, the first case is not beneficial for prosumers due to the willingness of consumer to trade energy with less number of Volt coins. Alternatively, the second case is not favorable for consumers due to the higher bidding value (more number of Volt coins) in the energy trading scheme.

5.2. Truthful Double Auction Mechanism Algorithm for EVs Optimal Payoff

| Algorithm 2 The truthful double auction mechanism between EVs for optimal payoff |

Input: Output:

|

6. Performance Evaluation

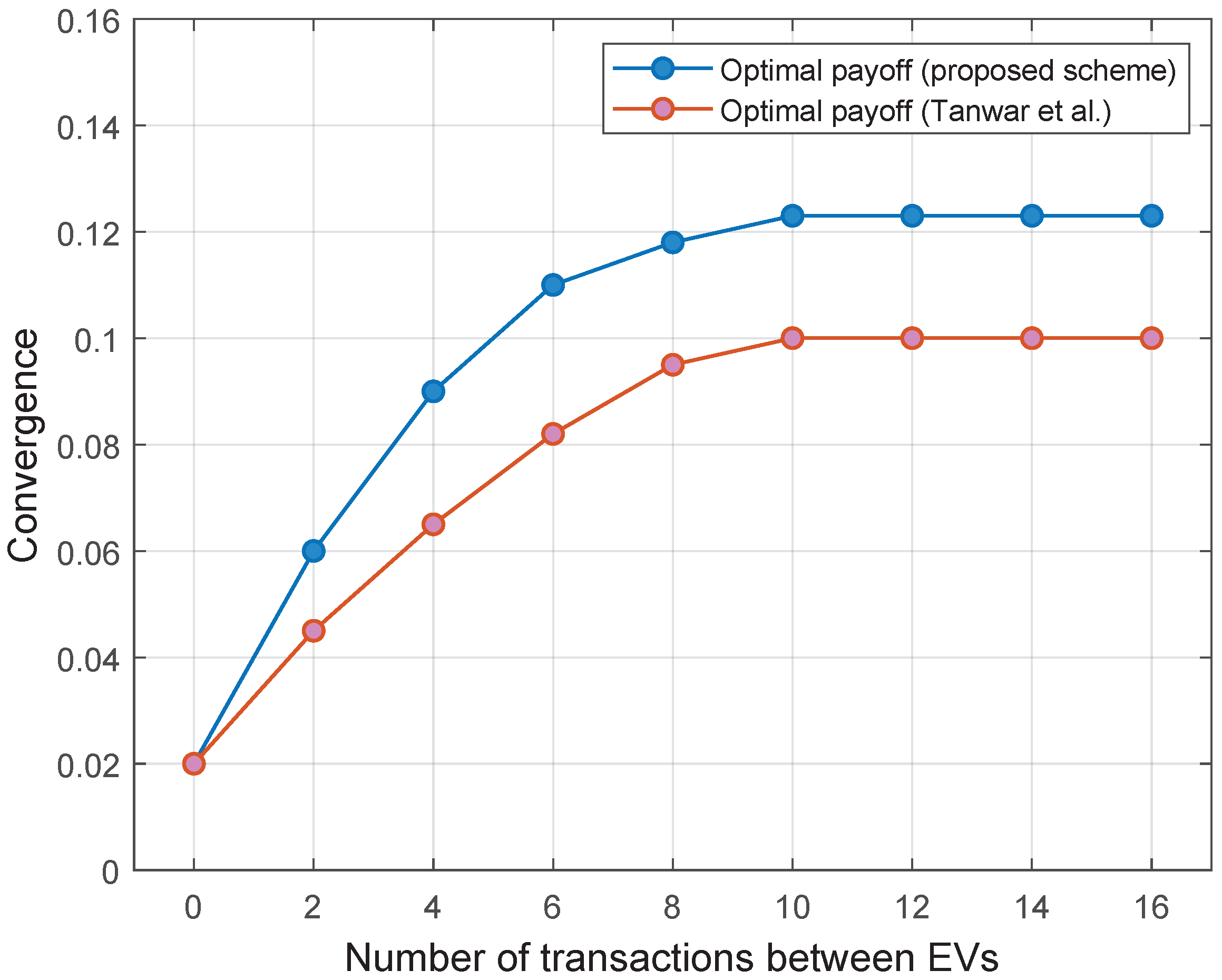

6.1. Convergence

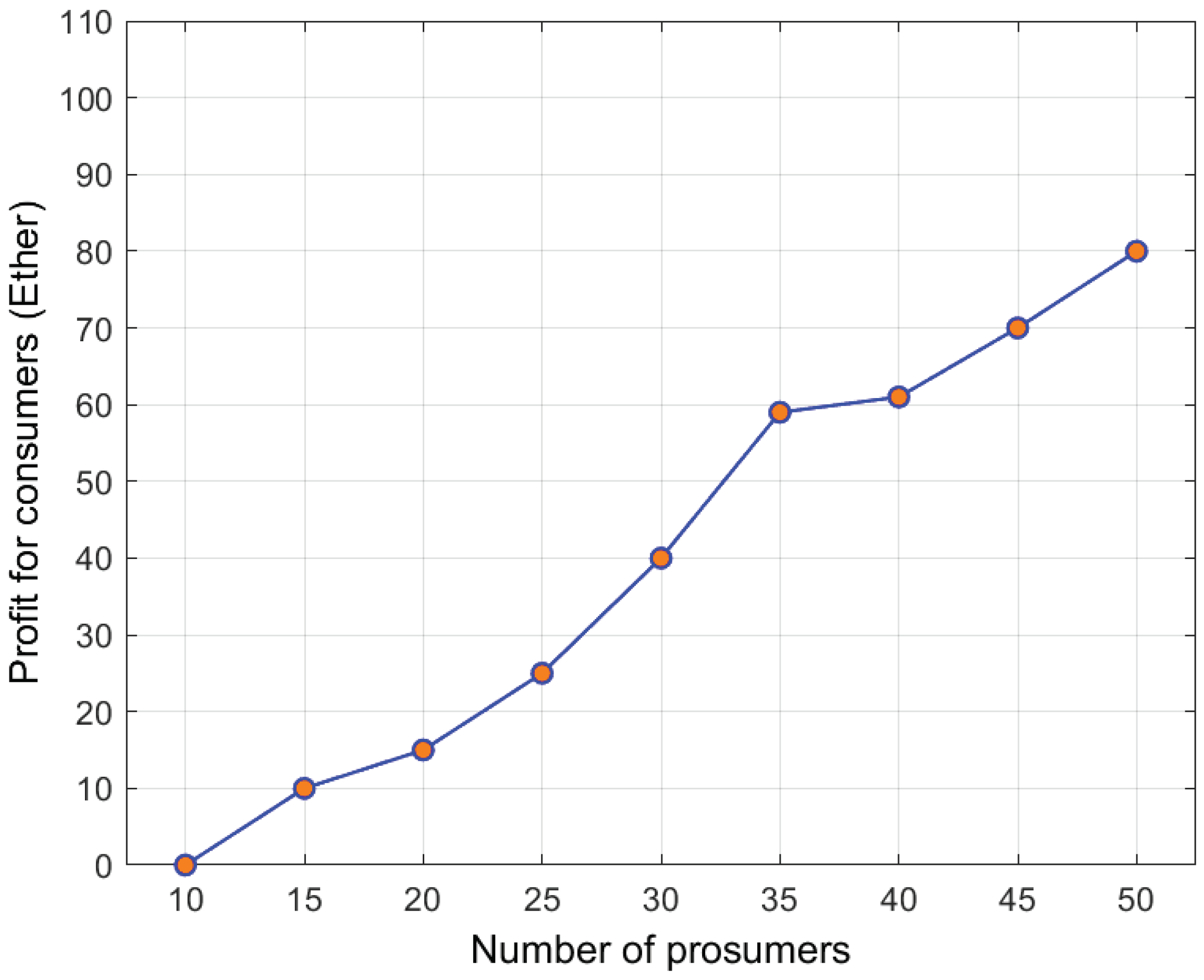

6.2. Profit for Consumers

6.3. Computation Time

6.4. Blockchain Analysis

- Node Commit Latency—In this subsection, we discuss an important metric, the node commit latency of the proposed scheme. The node commit latency is the elapsed time when a transaction is proposed, and it is finalized in the block with the consensus validation. Figure 6 presents the results. Thus, the node commit latency is directly proportional to the consensus mechanism employed in the system, and the value of miner difficulty . We compare the results with Kumari et al., which uses a Proof-of-Stake (PoS) consensus. Let us consider that q EV transactions are finalized, with a difficulty . Thus, in the PoS consensus, the finalized blocks satisfy the condition as follows:where denotes the time elapsed for finalizing a block by any miner, and presents the stake of the miner. Thus, the product is the coin-age, and is the overall stake of the miner. Once a miner is selected, we set as 0 to ensure fairness in the system. As we have a large number of transactions to be finalized, is generally large. In our proposed approach, we consider a sharded PoS approach, where the entire blockchain network is divided into w shards. Thus, the finalizing time of each shard is . Once the payoffs are finalized by an auction, we consider the load of transactions proposed to a shard. In this case, if is sufficiently high, we reduce the election time of the miner by reducing the value of , which reduces the latency. In overall, the node commit latency in a shard is proportional to times of , which improves the commit latency. In the figure, we consider the load as percentage of processed blocks, which is , where is the finalized blocks, and is the total blocks. Thus, at , means 1/4 of total blocks are finalized, the commit latency in the non-shared (Kumari et al.) approach is 1150 seconds (s). With shards, the commit time reduces to ≈125 s. Similarly, at (one-half of total blocks are finalized), the commit time is 2500 s in a non-sharded approach, which becomes 250 s in our approach.

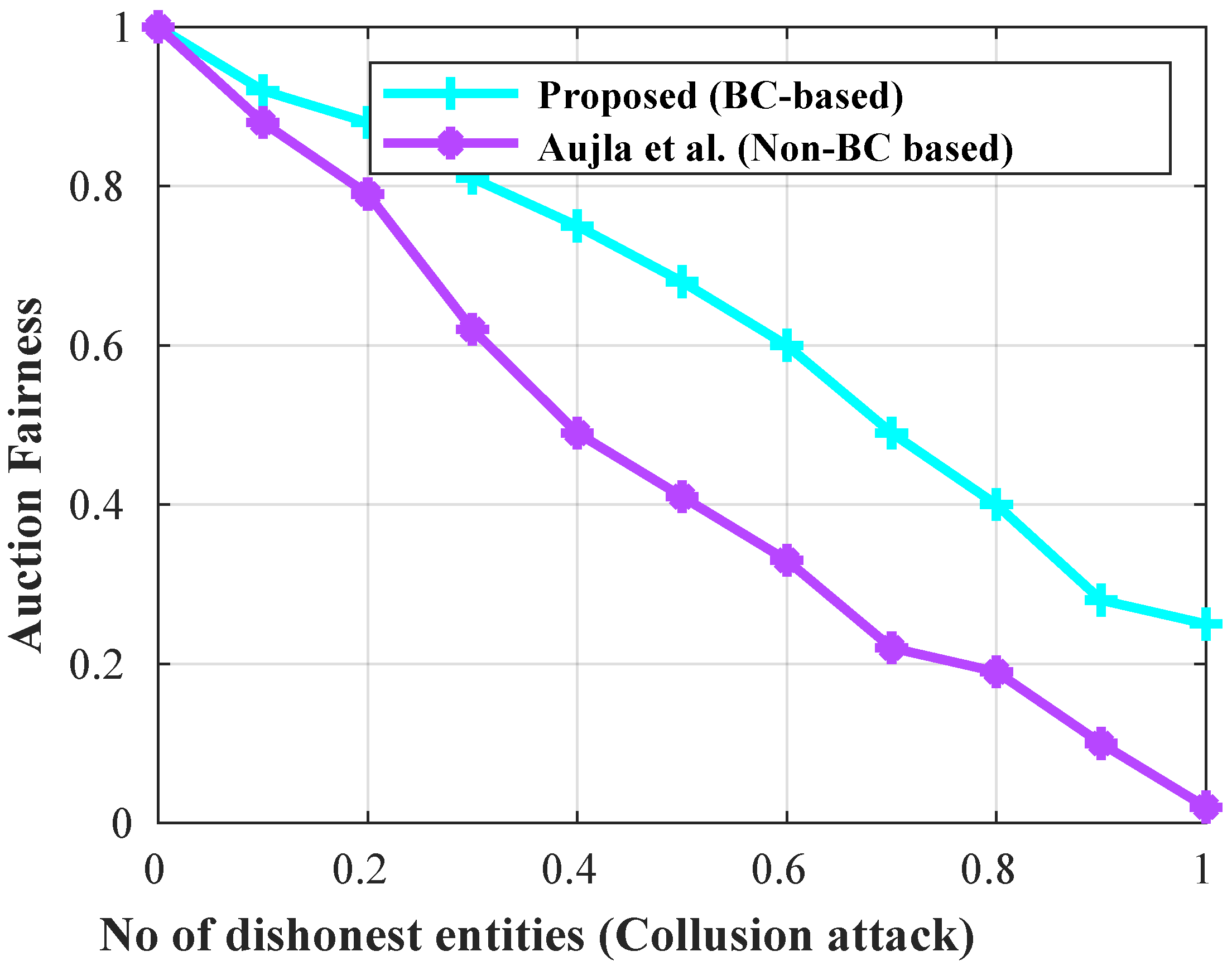

- Collusion Attack Scenario—Next, we present the importance of blockchain in mitigating the collusion attacks. Figure 7 presents the results. In the scheme, we discuss a truthful double auction between p prosumers and c consumers. We consider a scenario where the k among the p prosumers can collude to decrease the energy level , which would lead to price inflation for consumers. This situation would not be solved by an auction pricing mechanism as it would only determine a faulty optimal payoff condition. Instead, once the energy units are fixed by p, the details of energy price per unit are also fixed, and then the auction starts. As the details are stored in the blockchain, the colluding parties’ higher bids would not be considered by other nodes during validation.Intuitively, auction fairness in the real sense is defined as the trading condition where no payoff condition brings a price loss to the buyer and seller nodes. In the proposed double auction mechanism, considering n nodes in the network, we assume that, if the offered price to a particular seller node s is less than a designated base (nodal price) , then an additional compensation amount c is also paid to s. Thus, the seller node’s auction fairness (selling price) condition is depicted as follows:where denotes the final price to seller node. In the case of collusions, the bidding price is lowered by buyer nodes to lower the profit of the seller. In such a case, the auction designer increases the nodal (base) price to cover the loss. On the other hand, if the seller node is collusive, then also fairness is guaranteed as the base price is stored in the blockchain. Thus, all buyer nodes are aware of the , and the bidding starts with a price just higher than . For the buyer nodes, the fairness condition is presented as follows:where denotes the final price of buyer node, and denotes the cost price of the traded energy. The auction fairness condition is dynamic and depends on the underlying auction conditions [46]. The details of auction fairness are presented on similar lines.We compare our approach to Aujla et al. [47], which proposes a Stackelberg game formation for energy trading among EVs and CS. In the figure, a collusion indicator of indicates that, out of the total participating entities (p prosumers and c consumers), we assume that 30% of the population is not fair, or have made parties with others. In the consensus formation, we consider a sharded PoS, which elects a miner based on a reputation score R.In any event E, out of total users, we consider the R value for each node between 0 and 1, i.e., , and is defined as , where is the final verified blocks, and is the total number of blocks. As increases during the auction phase, the fair energy allocation decreases in a non-BC approach, whereas, in the proposed scheme, we see a gradual drop in auction fairness. At collusion scenario (50% dishonest entities), the fairness indicator is in our scheme, which means that still 68% of the traded transactions are fair, compared to in the non-BC approach. The reason is trivial: once the prices are stored, they cannot be altered, and the sharded PoS elects a miner based on a high value of R, and, thus, there are less chances for the miner to be biased. This leads to fair block proposals in most auction events.

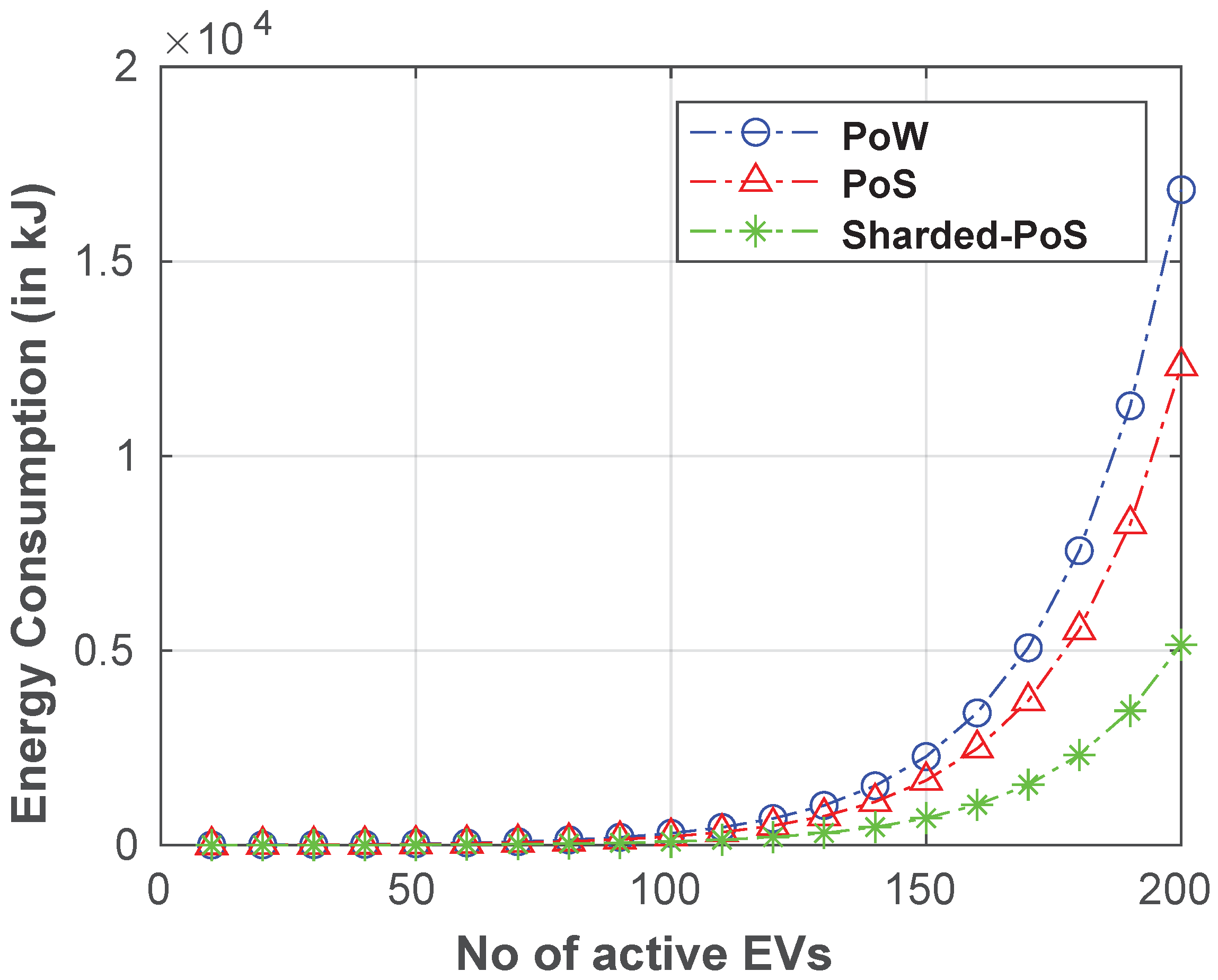

- Energy consumption by EVs- Lastly, we simulate the energy consumption by EVs against consensus approaches like Proof-of-Work (PoW), and PoS. Figure 8 depicts the results. As shared PoS has a low transactional finality time, thus less time is required to form the collective voting decision to add the next block. However, in both PoW and PoS, the network requires multiple message confirmations to finalize the block. In PoW, we consider t miners in the ecosystem; then, the average expected time to finalize a block is presented as follows [48]:where is the computational power of node, and is the target difficulty. In PoS, the expected time for t-miner ecosystem is as follows [49]:where denotes the stake of miner, and is the lifetime value of based on last win chance. In both PoW and PoS, the time to add a block is further delayed by , and is presented as follows:where is the communication delay for propagation of node updates. Both PoW and PoS thus have a low transactional throughput. However, with a sharded approach, the overall network is divided into k shards, and thus each shard only has number of transactions to validate. Most communications are managed through a shard manager, and thus reduces drastically. Thus, the expected time also reduces, and less energy is required to communicate in the network. On these discussions, we model the energy consumption of energy trading between active EVs, and compare our scheme with PoS and PoW blockchains. As an example, for 150 active EVs, PoW has a high energy dissipation of kiloJoule (kJ), PoS has kJ energy dissipation, and the energy dissipation in our scheme is KJ, respectively.

6.5. Data Storage Cost Computation

7. Conclusions and Future Scope

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abishu, H.N.; Seid, A.M.; Yacob, Y.H.; Ayall, T.; Sun, G.; Liu, G. Consensus Mechanism for Blockchain-Enabled Vehicle-to-Vehicle Energy Trading in the Internet of Electric Vehicles. IEEE Trans. Veh. Technol. 2022, 71, 946–960. [Google Scholar] [CrossRef]

- Tanwar, S.; Popat, A.; Bhattacharya, P.; Gupta, R.; Kumar, N. A taxonomy of energy optimization techniques for smart cities: Architecture and future directions. Expert Syst. 2022, 39, e12703. [Google Scholar] [CrossRef]

- Austmann, L.M. Drivers of the electric vehicle market: A systematic literature review of empirical studies. Financ. Res. Lett. 2021, 41, 101846. [Google Scholar] [CrossRef]

- Alshaeri, A.; Younis, M. A Blockchain-based Energy Trading Scheme for Dynamic Charging of Electric Vehicles. In Proceedings of the 2021 IEEE Global Communications Conference (GLOBECOM), Madrid, Spain, 7–11 December 2021; pp. 1–6. [Google Scholar] [CrossRef]

- Secinaro, S.; Calandra, D.; Lanzalonga, F.; Ferraris, A. Electric vehicles’ consumer behaviours: Mapping the field and providing a research agenda. J. Bus. Res. 2022, 150, 399–416. [Google Scholar] [CrossRef]

- Secinaro, S.; Brescia, V.; Calandra, D.; Biancone, P. Employing bibliometric analysis to identify suitable business models for electric cars. J. Clean. Prod. 2020, 264, 121503. [Google Scholar] [CrossRef]

- Adil, M.; Mahmud, M.P.; Kouzani, A.Z.; Khoo, S. Energy trading among electric vehicles based on Stackelberg approaches: A review. Sustain. Cities Soc. 2021, 75, 103199. [Google Scholar] [CrossRef]

- Bayram, I.S.; Devetsikiotis, M.; Jovanovic, R. Optimal design of electric vehicle charging stations for commercial premises. Int. J. Energy Res. 2022, 46, 10040–10051. [Google Scholar] [CrossRef]

- Ray, P.; Bhattacharjee, C.; Dhenuvakonda, K.R. Swarm intelligence-based energy management of electric vehicle charging station integrated with renewable energy sources. Int. J. Energy Res. 2021, 1–21. [Google Scholar] [CrossRef]

- Thi Kim, O.T.; Le, T.H.T.; Shin, M.J.; Nguyen, V.; Han, Z.; Hong, C.S. Distributed Auction-Based Incentive Mechanism for Energy Trading Between Electric Vehicles and Mobile Charging Stations. IEEE Access 2022, 10, 56331–56347. [Google Scholar] [CrossRef]

- Alphonse, A.R.A.; Raj, A.P.P.G.; Arumugam, M. Simultaneously allocating electric vehicle charging stations (EVCS) and photovoltaic (PV) energy resources in smart grid considering uncertainties: A hybrid technique. Int. J. Energy Res. 2022, 1–22. [Google Scholar] [CrossRef]

- Bhattacharya, P.; Tanwar, S.; Bodkhe, U.; Kumar, A.; Kumar, N. EVBlocks: A blockchain-based secure energy trading scheme for electric vehicles underlying 5G-V2X ecosystems. Wirel. Pers. Commun. 2021, 1–41. [Google Scholar] [CrossRef]

- Zhou, X.; Wang, F.; Qi, R.; Cao, R.; Wang, L.; Zheng, Y. Optimal Scheduling of Hierarchical Energy Systems with Controllable Load Demand Response. In Proceedings of the 2022 5th International Conference on Energy, Electrical and Power Engineering (CEEPE), Chongqing, China, 22–24 April 2022; pp. 1178–1183. [Google Scholar] [CrossRef]

- Chung, H.M.; Maharjan, S.; Zhang, Y.; Eliassen, F.; Strunz, K. Optimal Energy Trading With Demand Responses in Cloud Computing Enabled Virtual Power Plant in Smart Grids. IEEE Trans. Cloud Comput. 2022, 10, 17–30. [Google Scholar] [CrossRef]

- Abad-Segura, E.; Infante-Moro, A.; González-Zamar, M.D.; López-Meneses, E. Blockchain Technology for Secure Accounting Management: Research Trends Analysis. Mathematics 2021, 9, 1631. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Deliu, D. Big Data’s Disruptive Effect on Job Profiles: Management Accountants’ Case Study. J. Risk Financ. Manag. 2021, 14, 376. [Google Scholar] [CrossRef]

- Kumari, D.A.; Gupta, R.; Tanwar, S. Amalgamation of Blockchain and IoT for Smart Cities underlying 6G Communication: A Comprehensive Review. Comput. Commun. 2021, 172, 102–118. [Google Scholar] [CrossRef]

- Saberi, S.; Kouhizadeh, M.; Sarkis, J.; Shen, L. Blockchain technology and its relationships to sustainable supply chain management. Int. J. Prod. Res. 2019, 57, 2117–2135. [Google Scholar] [CrossRef] [Green Version]

- Calandra, D.; Secinaro, S.; Massaro, M.; Dal Mas, F.; Bagnoli, C. The link between sustainable business models and Blockchain: A multiple case study approach. Bus. Strategy Environ. 2022, 1–15. [Google Scholar] [CrossRef]

- Andoni, M.; Robu, V.; Flynn, D.; Abram, S.; Geach, D.; Jenkins, D.; McCallum, P.; Peacock, A. Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 2019, 100, 143–174. [Google Scholar] [CrossRef]

- Gupta, R.; Shukla, A.; Mehta, P.; Bhattacharya, P.; Tanwar, S.; Tyagi, S.; Kumar, N. VAHAK: A Blockchain-based Outdoor Delivery Scheme using UAV for Healthcare 4.0 Services. In Proceedings of the IEEE INFOCOM 2020—IEEE Conference on Computer Communications Workshops (INFOCOM WKSHPS), Toronto, ON, Canada, 6–9 July 2020; pp. 255–260. [Google Scholar] [CrossRef]

- Hasselgren, A.; Kralevska, K.; Gligoroski, D.; Pedersen, S.A.; Faxvaag, A. Blockchain in healthcare and health sciences—A scoping review. Int. J. Med. Inform. 2020, 134, 104040. [Google Scholar] [CrossRef] [PubMed]

- Mirabelli, G.; Solina, V. Blockchain-based solutions for agri-food supply chains: A survey. Int. J. Simul. Process Model. 2021, 17, 1–15. [Google Scholar] [CrossRef]

- Kakkar, R.; Gupta, R.; Obaidiat, M.S.; Tanwar, S. Blockchain and Multiple Linear Regression-based Energy Trading Scheme for Electric Vehicles. In Proceedings of the 2021 International Conference on Computer, Information and Telecommunication Systems (CITS), Istanbul, Turkey, 11–13 November 2021; pp. 1–5. [Google Scholar] [CrossRef]

- Baza, M.; Sherif, A.; Mahmoud, M.M.E.A.; Bakiras, S.; Alasmary, W.; Abdallah, M.; Lin, X. Privacy-Preserving Blockchain-Based Energy Trading Schemes for Electric Vehicles. IEEE Trans. Veh. Technol. 2021, 70, 9369–9384. [Google Scholar] [CrossRef]

- Alshaeri, A.; Younis, M. Lightweight Authentication and Authorization Protocol for Dynamic Charging of Electric Vehicles. In Proceedings of the 2022 IEEE 19th Annual Consumer Communications & Networking Conference (CCNC), Las Vegas, NV, USA, 8–11 January 2022; pp. 550–556. [Google Scholar] [CrossRef]

- Tanwar, S.; Kakkar, R.; Gupta, R.; Raboaca, M.S.; Sharma, R.; Alqahtani, F.; Tolba, A. Blockchain-based electric vehicle charging reservation scheme for optimum pricing. Int. J. Energy Res. 2022, 1–14. [Google Scholar] [CrossRef]

- Kaur, M.; Gupta, S.; Kumar, D.; Verma, C.; Neagu, B.C.; Raboaca, M.S. Delegated Proof of Accessibility (DPoAC): A Novel Consensus Protocol for Blockchain Systems. Mathematics 2022, 10, 2336. [Google Scholar] [CrossRef]

- Gao, J.; Wong, T.; Wang, C.; Yu, J.Y. A Price-Based Iterative Double Auction for Charger Sharing Markets. IEEE Trans. Intell. Transp. Syst. 2022, 23, 5116–5127. [Google Scholar] [CrossRef]

- Kakkar, R.; Gupta, R.; Tanwar, S.; Rodrigues, J.J.P.C. Coalition Game and Blockchain-Based Optimal Data Pricing Scheme for Ride Sharing Beyond 5G. IEEE Syst. J. 2021, 10, 1–10. [Google Scholar] [CrossRef]

- Neagu, B.C.; Ivanov, O.; Grigoras, G.; Gavrilas, M. A New Vision on the Prosumers Energy Surplus Trading Considering Smart Peer-to-Peer Contracts. Mathematics 2020, 8, 235. [Google Scholar] [CrossRef] [Green Version]

- Ashfaq, T.; Javaid, N.; Javed, M.U.; Imran, M.; Haider, N.; Nasser, N. Secure Energy Trading for Electric Vehicles using Consortium Blockchain and k-Nearest Neighbor. In Proceedings of the 2020 International Wireless Communications and Mobile Computing (IWCMC), Limassol, Cyprus, 15–19 June 2020; pp. 2235–2239. [Google Scholar] [CrossRef]

- Kumari, A.; Shukla, A.; Gupta, R.; Tanwar, S.; Tyagi, S.; Kumar, N. ET-DeaL: A P2P Smart Contract-based Secure Energy Trading Scheme for Smart Grid Systems. In Proceedings of the IEEE INFOCOM 2020—IEEE Conference on Computer Communications Workshops (INFOCOM WKSHPS), Toronto, ON, Canada, 6–9 July 2020; pp. 1051–1056. [Google Scholar] [CrossRef]

- Chen, S.; Shen, Z.; Zhang, L.; Yan, Z.; Li, C.; Zhang, N.; Wu, J. A trusted energy trading framework by marrying blockchain and optimization. Adv. Appl. Energy 2021, 2, 100029. [Google Scholar] [CrossRef]

- Chen, S.; Mi, H.; Ping, J.; Yan, Z.; Shen, Z.; Liu, X.; Zhang, N.; Xia, Q.; Kang, C. A blockchain consensus mechanism that uses Proof of Solution to optimize energy dispatch and trading. Nat. Energy 2022, 7, 495–502. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, L.; Yan, Z.; Shen, Z. A Distributed and Robust Security-Constrained Economic Dispatch Algorithm Based on Blockchain. IEEE Trans. Power Syst. 2022, 37, 691–700. [Google Scholar] [CrossRef]

- Lazaroiu, C.; Roscia, M.; Saatmandi, S. Blockchain strategies and policies for sustainable electric mobility into Smart City. In Proceedings of the 2020 International Symposium on Power Electronics, Electrical Drives, Automation and Motion (SPEEDAM), Sorrento, Italy, 24–26 June 2020; pp. 363–368. [Google Scholar] [CrossRef]

- Zhang, P.; Hong, Y.; Kumar, N.; Alazab, M.; Alshehri, M.; Jiang, C. BC-EdgeFL: Defensive Transmission Model Based on Blockchain Assisted Reinforced Federated Learning in IIoT Environment. IEEE Trans. Ind. Inform. 2021, 18, 3551–3561. [Google Scholar] [CrossRef]

- Doan, H.T.; Cho, J.; Kim, D. Peer-to-Peer Energy Trading in Smart Grid Through Blockchain: A Double Auction-Based Game Theoretic Approach. IEEE Access 2021, 9, 49206–49218. [Google Scholar] [CrossRef]

- Zhai, X.; Zhou, T.; Zhu, C.; Chen, B.; Fang, W.; Zhu, K. Truthful Double Auction for Joint Internet of Energy and Profit Optimization in Cognitive Radio Networks. IEEE Access 2018, 6, 23180–23190. [Google Scholar] [CrossRef]

- Patel, Y.S.; Malwi, Z.; Nighojkar, A.; Misra, R. Truthful online double auction based dynamic resource provisioning for multi-objective trade-offs in IaaS clouds. Clust. Comput. 2021, 24, 1855–1879. [Google Scholar] [CrossRef] [PubMed]

- Zhang, J. Influence of individual rationality on continuous double auction markets with networked traders. Phys. A Stat. Mech. Appl. 2018, 495, 353–392. [Google Scholar] [CrossRef]

- Eisenring, L. Performance Analysis of Blockchain Off-Chain Data Storage Tools. Bachelor’s Thesis, University of Zurich Department of Informatics (IFI), Zürich, Switzerland, 2018. [Google Scholar]

- Nyaletey, E.; Parizi, R.M.; Zhang, Q.; Choo, K.K.R. BlockIPFS-Blockchain-Enabled Interplanetary File System for Forensic and Trusted Data Traceability. In Proceedings of the 2019 IEEE International Conference on Blockchain (Blockchain), Atlanta, GA, USA, 14–17 July 2019; pp. 18–25. [Google Scholar] [CrossRef]

- Shrimali, B.; Patel, H.B. Blockchain State-of-the-Art: Architecture, Use Cases, Consensus, Challenges and Opportunities. J. King Saud Univ. Comput. Inf. Sci. 2021, 1319–1578. [Google Scholar] [CrossRef]

- Kaleta, M. Price of fairness on networked auctions. J. Appl. Math. 2014, 2014, 860747. [Google Scholar] [CrossRef] [Green Version]

- Aujla, G.S.; Kumar, N.; Singh, M.; Zomaya, A.Y. Energy trading with dynamic pricing for electric vehicles in a smart city environment. J. Parallel Distrib. Comput. 2019, 127, 169–183. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A peer-to-peer electronic cash system. Decentralized Bus. Rev. 2008, 21260. Available online: https://www.debr.io/article/21260-bitcoin-a-peer-to-peer-electronic-cash-system (accessed on 31 October 2008.).

- Wood, G. Ethereum: A secure decentralised generalised transaction ledger. Ethereum Proj. Yellow Pap. 2014, 151, 1–32. [Google Scholar]

- Gupta, R.; Nair, A.; Tanwar, S.; Kumar, N. Blockchain-assisted secure UAV communication in 6G environment: Architecture, opportunities, and challenges. IET Commun. 2021, 15, 1352–1367. [Google Scholar] [CrossRef]

| Author | Year | Objective | Blockchain Platform | Pros | Cons |

|---|---|---|---|---|---|

| Ashfaq et al. [32] | 2020 | Presented a consortium blockchain-based secure energy trading for EVs | Yes | Optimized charging and execution cost, resource efficient | Ignorance of price optimality and data storage cost |

| Kumari et al. [33] | 2020 | Designed a smart contract-based energy trading scheme for smart grid | Yes | Improved storage cost, low latency | No consideration of optimal pricing |

| Chen et al. [34] | 2021 | Discussed a blockchain-based trusted energy trading by adopting an optimization scheme | Yes | Enhanced scalability and computation time | Need to focus on security against cyber, data spoofing, and DoS attacks |

| Chung et al. [14] | 2021 | Designed a energy trading and demand response framework for EVs using smart grid | No | Reduced charging cost, optimized revenue | Should focus on security and privacy issues |

| Bhattacharya et al. [12] | 2021 | Presented a blockchain-based EVs energy trading platform for vehicle-to-anything system | Yes | Improved optimized, communication, and computation costs | Need to provide security against malicious attacks |

| Chen et al. [36] | 2022 | Investigated a robust blockchain-based dispatch framework | Yes | Highly robust | Security issues against malicious attack, no discussion on optimality |

| Chen et al. [35] | 2022 | Proposed a blockchain-based energy trading framework for an optimal solution | Yes | Optimum solution, less complex | Optimal payoff and computation time is ignored |

| Thim Kim et al. [10] | 2022 | Discussed an energy trading incentive mechanism between EVs and mobile CSs | No | Enhanced computational efficiency | Need to focus on optimality and computation time |

| The proposed system | 2022 | Proposed a blockchain and double auction-based trustful EV energy trading scheme for optimum pricing | Yes | Highly secure, efficient, and optimized payoff | - |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kakkar, R.; Gupta, R.; Agrawal, S.; Bhattacharya, P.; Tanwar, S.; Raboaca, M.S.; Alqahtani, F.; Tolba, A. Blockchain and Double Auction-Based Trustful EVs Energy Trading Scheme for Optimum Pricing. Mathematics 2022, 10, 2748. https://doi.org/10.3390/math10152748

Kakkar R, Gupta R, Agrawal S, Bhattacharya P, Tanwar S, Raboaca MS, Alqahtani F, Tolba A. Blockchain and Double Auction-Based Trustful EVs Energy Trading Scheme for Optimum Pricing. Mathematics. 2022; 10(15):2748. https://doi.org/10.3390/math10152748

Chicago/Turabian StyleKakkar, Riya, Rajesh Gupta, Smita Agrawal, Pronaya Bhattacharya, Sudeep Tanwar, Maria Simona Raboaca, Fayez Alqahtani, and Amr Tolba. 2022. "Blockchain and Double Auction-Based Trustful EVs Energy Trading Scheme for Optimum Pricing" Mathematics 10, no. 15: 2748. https://doi.org/10.3390/math10152748

APA StyleKakkar, R., Gupta, R., Agrawal, S., Bhattacharya, P., Tanwar, S., Raboaca, M. S., Alqahtani, F., & Tolba, A. (2022). Blockchain and Double Auction-Based Trustful EVs Energy Trading Scheme for Optimum Pricing. Mathematics, 10(15), 2748. https://doi.org/10.3390/math10152748