Abstract

The digital transition is a challenge that developed countries are currently facing. The transition process is associated with different degrees of uncertainty, which are particularly relevant for changes that have to do with the provision of goods and services produced by public administrations. Our paper uses a partial equilibrium model to study the effects of uncertainty on the public provision of goods and services produced by bureaucratic agencies, including the incentive of the government to consolidate production. We assume that bureaucratic agencies may play either a cooperative game with each other and a non-cooperative game against the government (i.e., a consolidated bureaucracy) or a non-cooperative game with each other and against the government (i.e., competing bureaus). Both the government and the bureaus face tradeoffs between maximizing the electorate preferences and extracting some political and/or bureaucratic rents. We find that a cooperative (competitive) bureaucratic solution depends on the nature of the goods produced. We find that costs’ uncertainty affects the level of public production and the way the policymakers extract their rents.

1. Introduction

In 2021, in order to mitigate the socio-economic impact of the coronavirus pandemic and foster the green and digital transition of the member states, the European Union has launched the Recovery and Resilience Facility, worth €723.8 billion. About half (45%) of the facility takes the form of grants. In order to benefit from these funds, member states have to submit national plans detailing the actions to be implemented by the end of 2026. The plans need approval from the European authorities (the sponsor): the European Commission approves the plan and the European Council authorizes the disbursement. One of the flagship actions of the facility is the digitalization of the public administration (PA). To achieve this target, each member state must devote a fraction of the share of expenditure received to digital transition. (In turn, this share must be at least 20% of their total expenditure,([1]. The idea is that the digitalization of the PA will improve the productivity of bureaucratic agencies. If the goods and services supplied by these agencies have a positive impact on private sector activities, the digitalization of the PA will help enhance growth in the EU countries as well ([2,3]). It is worth noting that the issue of digital transition is an important concern for international organizations and governments worldwide (see([4,5]) and the references therein.) However, we shall refer here to an institutional framework typical of European countries, which is quite different from those of other OECD countries.

One important dimension of this action is the digitalization of local public administrations (LPAs). LPAs provide local goods and services such as business and construction permits, primary education and healthcare, whose levels may positively affect private business activities. However, although digitalization may be expected to boost the average productivity of LPAs, there is much uncertainty regarding its effects. The source of uncertainty may stem either from the economic sector or from the existing forms of organization of labor and the related labor productivity; alternatively, uncertainty might simply depend on the institutional context in which digitalization is implemented. For example, digitalization associated with different forms of organizing work (e.g., as regards the share of remote workers vs. in-person employees) can differently affect labor productivity. The productivity-enhancing effects of digitalization may differ according to the ability of bureau chiefs to reorganize activities in the office; or it may depend on the age distribution of the LAPs’ workforce, and hence on the workforce’s willingness to adapt to innovation rather than resisting it.

The aim of this paper is to present a stylized model analyzing the effects of introducing a technological innovation in bureaucratic agencies when there is uncertainty on its productivity-enhancing effects. A general result of the paper is that uncertainty on the productivity-enhancing effects of technological innovation will reduce the supply of the considered goods and services by LPAs, because uncertainty will induce politicians to appropriate a larger part of resources as political rents. The paper will suggest that a sponsor (e.g., the European authorities) would lessen inefficiencies if it succeeded in lowering the uncertainties associated with technological innovation.

2. Literature Review

We borrow from the standard approach to the economic theory of bureaucracy discussed by the traditional Public Choice literature ([6,7,8,9,10,11,12,13,14,15,16,17]) when governments deal with either competing or cooperating bureaus ([18,19,20]). One of the main propositions from the Public Choice literature is addressed to controlling politicians and bureaus so as to prevent the waste of public resources by allowing for a reduction of the bureaus’ discretionary profits and the government’s political rents. In this respect, the academic literature has also highlighted the importance of institutional bureaucratic reorganization ([13,20,21]). For example, governments interested in enhancing efficiency may consider different forms of consolidation or decentralization as a way of strengthening their control over the bureaucracy (see [22]).

In order to consider all of these issues, as a methodological approach, we refer to game theory, which analyzes the strategic interactions between the players within an economic context (e.g., [23]), where the concept of a sub-game perfect Nash equilibrium is of paramount importance. In particular, borrowing from [7,24,25,26], we shall present in Section 3 a dynamic game of complete/symmetric but imperfect information to model different institutional options of bureaucratic organization design for the public provision of differentiated goods and services. By extending a model of bureaucratic interaction [27] to the uncertainty regarding the cost of producing publicly provided goods and services, the considered approach will allow us to evaluate whether and how a productivity-enhancing innovation affects the bureaucratic institutional design, the amount of goods supplied, and the level of bureaucratic and political rents.

3. Methodology

We present a game of complete but imperfect information to model the public provision of differentiated goods and services by bureaucratic agencies. Applying game theory to analyze the strategic interaction between the government and the bureaucracy is a standard methodological approach in the Public Choice literature ([7,10,12,17]). We add to this literature the analysis of the determinants of bureaucratic organization (i.e., a consolidated bureaucracy vs. a decentralized bureaucracy) under the uncertainty regarding the production costs. Our interpretation of institutional design is twofold. On the one hand, consolidation can be seen as a government decision [12]. This fits well with the European experience (see below). On the other hand, consolidation can be interpreted as the outcome of a cooperative game between two bureaus, in which the bureaus are able to form a coalition and split equally the expected benefits of cooperation [28]. In the spirit of [25], we shall show that bureaucratic incentives to cooperate will depend on the nature of the goods produced.

3.1. The Basic Assumptions

We assume that a sponsor (e.g., the European Commission) allocates a fixed amount of resources (e.g., grants conditional on introducing digitalization in the LPAs) to a government (e.g., a member state, a regional/municipal government), which takes responsibility for the public provision of two goods/services to the community under its jurisdiction by means of bureaucratic agencies. The government can decide on how to organize bureaucratic activities by having either one consolidated bureaucracy producing the two goods or two competing bureaucracies, each producing one of the two goods. ([29,30]) propose alternative models of the political decision to consolidate bureaucratic agencies.) One may also think of the two bureaucracies playing either a cooperative game between each other and a non-cooperative game against the government (i.e., similarly to a consolidated bureaucracy in which the decision to integrate rests with the bureaus themselves); or playing a non-cooperative game between each other and against the government (i.e., the case of two competing bureaus).

It is interesting to notice that bureaucratic consolidation is usually a choice of government, especially in Europe (for the UK, see [31], on the “bureaucratic reshuffling” in central government agencies, [32], on the NHS hospital consolidation, [33], on the consolidation of job services, offender services and tax collection service agencies; for Italy, see [20], on the consolidation of local health authorities, [34], on the consolidation of regional agricultural service agencies; for the US, see [35], on the consolidation of federal and state government bureaus). However, in the US there are several instances of merging being promoted by the bureaus themselves (e.g., [36], on the school district consolidation in Iowa), although consolidation can be forced upon agencies (e.g., by state mandates for the minimum district size) or it can be overruled by a political decision (e.g., the lack of approval by voters).

Given the institutional design (or the cooperative vs. non-cooperative game between bureaus), the government will negotiate a budget with the bureaucratic agency(ies). It is assumed that both the government and the bureaucracy want to satisfy the community’s preferences for the considered goods, while being able to appropriate a share of resources as political and bureaucratic rents, respectively, at the same time.

This story is formalized as a three-stage game. In the first stage, a sponsor allocates a fixed amount of resources as grants to a government. The sponsor cannot interfere in the process of goods provision, but it evaluates its outcome. In the second stage, before allocating the resources to production, the government can choose whether to consolidate or keep two separate bureaus. In the third stage, for a given amount of public resources, while facing the uncertainty regarding the production costs, the government and the bureau(s) play a compliance game: the government and the bureau(s) choose simultaneously their compliance levels, i.e., the share of resources to be allocated to the bureaucratic budget and the share of the budget to be devoted to production. As a result of this interaction, bureaucratic production occurs, and political and bureaucratic rents are realized.

3.2. The Model

We consider an economy where two goods or services ( and ) are publicly provided by the government through bureaucratic agencies. The goods provide utility to a continuum of consumers of the same type with a separable and linear preference function in the numeraire good. Therefore, there are no income effects, and we can perform a partial equilibrium analysis.

Note that we distinguish here between the public provision of private goods, which are the focus of our analysis, and pure public goods in the sense of Samuelson, which deserve a different treatment as regards the optimal provision in equilibrium (see [37]).

The preferences of the sponsor are assumed to be the same as those of the representative consumer (electorate). Specifically, they are quadratic and strictly concave in the two goods. We borrow the utility from [38], formally.

and will determine the position and slope of the goods’ inverse demands, respectively, while indicates the relation between the two goods. For (), they are substitutes (complements). Regularity conditions require that (see [38]).

The above preferences imply a shadow price () for each good equal to

with and .

The government’s preferences account for the electoral constituency (representative consumer) and political rents obtained from the budgetary process. Political rents are equal to the difference between public resources assigned by the sponsor to produce each of the two goods and the budget the government allocates to the bureaucracy for producing good i ([7]).

Formally, the government’s preferences can be expressed as

The budget assigned to produce the good is , with being the share of resources that the government allocates to production (i.e., the government’s strategy or compliance level).

Once the resources are made available, the goods are produced either by multiple bureaus or by a single independent bureau, depending on the pre-determined design of the bureaucratic organization by part of the government or by the ability of bureaucracies to play cooperatively between them. Public agencies care about the bureaucratic revenue and evaluate their activities according to , namely their perception of the citizens’ marginal willingness to pay ([6]). Bureaus are also interested in slack (or bureaucratic rents), i.e., , where is the share of the public budget that the bureau allocates to production (i.e., the bureau’s strategy or compliance level).

The preferences of the bureau producing the good are:

If public production is centralized in a single bureau, or if the two bureaus are able to credibly commit to play in a cooperative way, Equation (4) is substituted by Equation (5):

The production for both of the goods has constant common marginal costs, . (Note that a solution requires ; otherwise, demand and supply do not intersect.) However, when the government and bureaus exploit their rents, choosing and , they both face uncertainty about the production cost. We can think of c as the effective marginal cost of producing one unit of bureaucratic output. The effective marginal cost can be seen as the ratio between the wage rate paid to civil servants and their labor productivity. The latter is taken to be a random variable, which is affected by technological innovation (e.g., digitalization), and we normalize the former to unity.

When the LPAs’ activities are highly labor-intensive, we can think of a simple linear-in-labor technology , where denotes the number of civil servants needed to produce units of output, and is a common labor productivity parameter. Civil servants are paid a wage rate w, which in several EU countries (e.g., France, Germany, Spain and, for some sectors, Italy) is set by national law or by a national negotiation ([39]). This means that we can consider wages () as an exogenous variable at the LPA level and set it equal to unity for simplicity. Hence, is the effective marginal cost of producing one unit of bureaucratic output. We assume that can be enhanced by the introduction of new technologies (e.g., digitalization) in the workplace, i.e., without digitalization, with digitalization. This way of modeling productivity-enhancing innovation is common in the labor economics literature ([40]). However, we assume that the effects of innovation on labor productivity ϕ are uncertain ex ante, according to the stated shock distribution.

The total cost of producing good i is equal to , which in turn is equal to the public resources used in production. Hence, yields: . We assume that, in the absence of technological innovation, the policy multiplier (i.e., labor productivity) would be a deterministic variable normalized to unity. However, with digitalization, the policy multiplier is unknown: government and bureaus are only informed about its distribution, which is , with .

4. Results: Solution of the Model by Backward Induction

Recall the timing of the story: In the first stage, a sponsor allocates a fixed amount of resources to a government. In the second stage, the government chooses whether to consolidate or keep two separate bureaus. In the third stage, the government and the bureau(s) play a compliance game: the government chooses the share of resources to be allocated as the bureaucratic budget and the bureau(s) the share of the budget to be devoted to production, while facing uncertainty about the production costs.

The model will be solved by backward induction, starting from the compliance game (third stage), when the uncertainty about effective marginal costs is not yet revealed, to determine a Subgame Perfect Nash equilibrium solution under symmetry.

4.1. Compliance Game: Third Stage

The government chooses by maximizing the expected value of Equation (3), taking as given the budgetary strategy of the bureaus. Optimal choices imply (see Appendix A):

It is worth noting that, other things being equal, uncertainty implies that the government aims to obtain more political rents from the budgetary process, as long as the uncertainty of the effective marginal cost lowers its optimal compliance level from Equation (6).

Similarly, each decentralized bureau chooses non-cooperatively to maximize the expected value of Equation (4) subject to Equation (2), taking as given the budgetary strategy of the government. The bureaus’ first-order conditions are (see Appendix A):

Alternatively, the consolidated bureau chooses simultaneously and to maximize the expected value of Equation (5) subject to Equation (2), taking as given the budgetary strategy of the government. This solution would also occur if the bureaus pre-commit themselves to play cooperatively against the government. Optimal choices require (see Appendix A):

In both decentralized and consolidated cases, uncertainty implies that the bureaus would like to achieve more rents from the provision of the considered goods: uncertainty on the effective marginal cost lowers the desired level of bureaucratic compliance from the second RHS term of Equations (7) and (8) (i.e., the bureaucratic best reply’s “intercept effect”). Moreover, notice that under centralization (namely, bureaus’ cooperation) each bureau, by internalizing a budget externality on the other bureau, will choose a lower level of compliance, other things being equal. This effect can be seen by comparing the first RHS terms of Equations (8) and (9) (i.e., the bureau’s best reply’s “slope effect”).

By solving Equations (6) and (7), we obtain the decentralized equilibrium of the compliance game, while by solving Equations (6)–(8) we get the centralized one. On this basis, we derive the goods provision in the different regimes.

As the game is symmetric at equilibrium: , , ; then the solution of the decentralized equilibrium can be written as:

The superscript denotes the decentralized solution of the compliance game. Under rational expectations, the realized (ex-post observed) value of productivity corresponds to the expected value of the cost multiplier, namely = () = . Looking at Equation (11), we can state that uncertainty, by increasing the room for political rents, determines a reduction of the quantities of goods provided, i.e., . Uncertainty makes the government more likely to absorb rents from Equation (9), reducing the budget available for bureaus. Notice that bureaucratic compliance is unaffected by uncertainty in the symmetric equilibrium from Equation (10). This means that each bureau’s desire to obtain more rents with uncertainty (from Equation (7)) is fully offset by the strategic interaction among the bureaus and the government.

The centralized solution implies:

Now denotes the centralized solution. From Equation (12), the government will choose a lower compliance level in equilibrium when facing uncertainty. In turn, this lowers the quantities of goods provided, namely . Bureaucratic compliance, as regards the decentralized solution, is unaffected by the uncertainty from Equation (13). This result stems again from the strategic interaction between the bureau and the government.

If we compare the compliance levels between regimes, it turns out that the degree of substitutability between goods affects the sign of the difference in the compliance levels of each agent. Comparing Equations (9) and (12) yields:

When the goods are complements (γ < 0), the government’s compliance level will be lower under the decentralized solution, namely for γ . When the goods are substitutes (γ > 0), the difference in compliance levels will depend on the value taken by the model’s parameters (i.e., α, β, γ, μ). A necessary and sufficient condition for when γ is > μ > 1, namely, the increase in average productivity following digitalization should be not too large.

Sharper results are obtained when comparing bureaucratic levels of compliance. Equations (10) and (13) yield:

Bureaucratic compliance is higher with decentralization when the goods are substitutes (γ ), whereas it is higher with centralization when the goods are complements (γ ). Hence, centralization maximizes bureaucratic slack when the agencies produce substitutes. On the contrary, agencies obtain a larger slack under decentralization when they produce complements. This and the previous result for government compliance both depend on how γ affects the nature of the strategic interaction between agents, as is clear from Equations (6)–(8), above.

By comparing outputs between regimes, Equations (11) and (14) yield:

The public provision of goods will be higher with consolidated (or cooperative) bureaus for γ (when the goods are complements), whereas it will be higher with decentralized (or competing) bureaus for γ (when the goods are substitutes), other things being equal. In either case, until the output is higher, the electorate’s utility from the public provision of the considered goods will be also higher. Hence, the institution financing the provision of goods is better off if bureaus compete with substitutes but consolidate with complements. Note, however, that the sponsor cannot directly instruct the agencies and must rely on the institutional design chosen by the government, to which we now turn.

4.2. Institutional Second Stage

At the institutional second stage, the government knows its own expected state-contingent payoffs at stage two. In the decentralized [centralized] regime, these can be used by combining Equation (3) with Equations (9) and (11) (with Equations (12) and (14)). Computing the government’s expected value function under the two regimes yields

The government chooses centralization as its Subgame Perfect Nash equilibrium strategy if and only if Equation (18) is positive (i.e., for γ ), meaning that bureaus produce complementary outputs. Similarly, the government chooses decentralization if and only if Equation (18) is negative, namely for γ , meaning that the bureaus produce substitutes.

4.3. First Stage

In this stage, the sponsor financing the provision of the goods evaluates the government use of its grant, by using the utility of the representative consumer, Equation (1) above, as a metric. Hence, for a given degree of uncertainty, the government’s incentives align with those of the sponsor. In other words, as long as the sponsor prefers centralization with complements and decentralization with substitutes (see above), the sponsor’s delegation of goods provision to the government (e.g., the European authorities financing a member state’s government to provide goods) is consistent with the efficient design of bureaucratic organization.

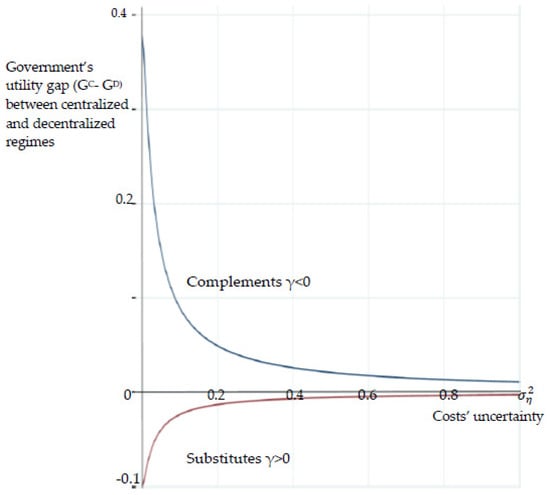

The effects of uncertainty on the government equilibrium utility gap, and hence on its choice of bureaucratic organization, are described in Figure 1, below, where we plot Equation (18) for different degrees of uncertainty () considering both complements (by fixing a value for γ ; see the upper graph) and substitutes (for a given value of γ ; see the lower graph).

Figure 1.

Government utility gap under substitutes (γ > 0) and complements (γ < 0). Note: The figure is for illustrative purposes only, as it assumes fixed values of the parameters: α = 2, β = 1, η = 1.2, and γ = ±0.5. However, the result is generalized for the set of parameters satisfying regularity conditions. The government prefers bureaucratic centralization for and decentralization for . Centralization is preferred with complements, γ < 0; decentralization with substitutes, γ > 0.

The impact of the nature of the goods (substitutes or complements) on the Subgame Perfect Nash equilibrium under symmetry is clear from the figure. If they are complements, the government always prefers consolidation (as ), while the opposite occurs for substitutes (when . However, uncertainty has monotone effects on the government utility gap. As uncertainty grows, the difference between the outcomes of the two regimes shrinks. When uncertainty tends to infinity, there is no difference between the two regimes from the government’s point of view.

The result occurs because the government has an increasing incentive to appropriate the sponsor’s entire grant as political rents, thus allocating no resource to the bureau(s), irrespective of the nature of the goods (see below). In other words, as uncertainty increases, the government becomes asymptotically indifferent to the choice of bureaucratic organization, given that in this case there is no provision of goods. For this same reason, the sponsor is worse off with increasing uncertainty: greater uncertainty always implies a lower provision of goods (see Equations (11) and (14)).

Our outcomes stem from different effects of uncertainty on the government and the bureaus’ equilibrium choices in the compliance game. Differentiating Equations (9), (10), (12) and (13), we can derive the following statements.

- The more pronounced the uncertainty, the higher the government’s political rents. Therefore, as uncertainty grows, the government lowers the share of resources allocated to the bureaus to produce the goods (i.e., and ). This result holds for both regimes (i.e., it is independent of the sign of ).

- The impact of uncertainty on the equilibrium choices of bureaus is zero. This result holds in both regimes, as implied by the equilibrium compliance levels Equations (10) and (13).

5. Discussion of the Results

From the previous analysis, we can draw some policy implications. The first policy implication is as follows. The sponsor, anticipating the government’s incentives to reduce its compliance when facing higher uncertainty- which, in turn, leads to both higher political rents and a lower provision of goods -may want to offset these incentives either ex ante, by enhancing its monitoring activities; or ex post, by punishing the government with a fine for poor performance (i.e., ex post withdrawal of funds.) However, the former policy option implies that the sponsor must incur in costly monitoring. The second policy option needs an optimal design of the fine to avoid it backfires and may be time inconsistent.

Alternatively, the sponsor may lessen inefficiencies if it succeeded in lowering uncertainties associated with technological innovation. This could be achieved by improving information flows from the sponsor to the government on the likely effects of innovation on bureaucratic productivity. The costs of providing information are likely to be lower than monitoring costs. If this is the case, information provision may be a more efficient policy for the sponsor than government monitoring.

Summing up, uncertainty in the production cost does not affect the consolidation choices of the government, but in a limiting case of very high uncertainty. These choices solely depend on the nature of the goods considered (substitutes or complements). The reason is that uncertainty, which raises the government political rents, always implies a reduction of the quantity of goods produced. This occurs in spite of the fact that bureaucratic agencies keep their compliance levels constant in equilibrium, hence put a limit to the output reduction associated with greater uncertainty, other things being equal.

6. Conclusions

The analysis of this paper has shown that the uncertainty regarding the effective marginal costs of producing two bureaucratic outputs might increase the government’s incentives to allocate a smaller fraction of the resources obtained from its sponsor to the bureaucratic budget(s). This, in turn, leads to a reduction in the amount of publicly provided goods and services. For low levels of uncertainty, there are no effects on the government decision on how to organize bureaucratic production, as long as this choice depends only on the degree of substitutability and complementarity between goods. This means that when the goods are complements, the government’s incentive will be to consolidate production of the two goods in a single bureau. Nevertheless, for a very high level of uncertainty, which always implies a sharp reduction of the quantity of goods produced and greatly raises the government’s political rents, although bureaucratic agencies keep their compliance levels constant in equilibrium, the result changes, and the incentive for government centralization with complements shrinks and might disappear.

Our model has some implications for the program of digitalization of the public administration in member states associated with the 2021–2026 Recovery and Resilience Facility of the European Union. In order to maximize the productivity-enhancing effects of digitalization in the PA, the model suggests the importance of reducing the uncertainty associated with technological innovation as perceived by local governments. This task may be enhanced if the European Commission (i.e., the sponsor) provides clear information and benchmarks on the likely effects of going digital in the PA. For example, a widespread diffusion among politicians of the results of the DESI reports (Digital Economy and Society Index) on digital public services and e-government ([41]) may be a step in the right direction.

A different view is that a sponsor may be willing to promote the introduction of a new technology only in so far as this is associated with a reduction in uncertainty. Specifically, the received view is that international organizations promote digitalization exactly because, by increasing transparency, digitalization raises the ability of governments to monitor the bureaucracy and the public provision of goods, thus lowering the uncertainty regarding bureaucratic costs.

For example, assume that the distribution of the cost multiplier is a mean-preserving spread of the cost multiplier distribution , associated with the introduction of an uncertainty-reducing technology. With < replacing in Equations (9)–(14), it turns out that government compliance and the public provision of goods will be higher after the introduction of the new technology, with no general effect on the consolidation choice of government. We think that whether digitalization will enhance or reduce uncertainty depends crucially on how it is introduced in the PA and on how it shapes organizational change.

This paper has modeled the relationship between the government and the bureaucracy as a compliance game under uncertainty. A further source of imperfect information in the bureaucratic context would be given by bureaucratic effort (often considered, in the principal agent literature, among the main sources of asymmetric information). The different information setting deserves a quite different technical treatment with respect to uncertainty considered here. We leave this task for future work.

Author Contributions

Conceptualization: G.D.B., S.F. and M.S.; Methodology: G.D.B., S.F. and M.S.; Formal analysis: G.D.B., S.F. and M.S.; Writing—original draft preparation: G.D.B., S.F. and M.S.; Writing—review and editing: G.D.B., S.F. and M.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

We thank the journal editor and three anonymous referees for their comments on previous versions. We are particularly grateful to one of the referees for suggesting some arguments discussed in the conclusions.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Derivation of Equation (6) in the main text. The government solves the following problem:

and , and where we made use of , with , and of R. The government treats bureaucratic compliance levels and as well as resources R, as given.

The first-order conditions are:

Solving for and simplifying yields:

As long as and , it follows that . Using and yields Equation (6) in the main text.

Derivation of Equation (7) in the main text. In the decentralized regime, each bureau i = 1, 2 solves the following program:

Each bureau i treats the other bureau’s compliance level and the government compliance, and as well as resources R, as given.

The first-order conditions are:

Solving for and simplifying yields:

Computing expectations yields Equation (7) in the main text.

Derivation of Equation (8) in the main text. In the centralized regime (equivalent to the case of a cooperative game between bureaus), the consolidated bureau solves:

The first-order conditions are:

Rearranging and simplifying yields Equation (8).

Derivation of Equation (16) in the main text. The government’s expected value function is:

In the symmetric equilibrium of the centralized (i.e., bureau-cooperative) regime, this is equivalent to:

And similarly for the equilibrium solution in the decentralized regime:

Note that, by the chain rule of expectations, we can now substitute Equations (9) and (11) and Equations (12) and (14) back into the previous equations and take the difference , yielding Equation (15) in the main text.

References

- European Commission. The Recovery and Resilience Facility. Available online: https://ec.europa.eu/info/business-economy-euro/recovery-coronavirus/recovery-and-resilience-facility_en (accessed on 24 November 2021).

- European Commission. The European Commission Takes Initiative to Reform Public Administration and Boost Economic Growth. Available online: https://ec.europa.eu/commission/presscorner/detail/en/MEMO_13_935 (accessed on 24 November 2021).

- European Commission. Proposal for a Decision Establishing a Policy Programme: The Path to the Digital Decade. Available online: https://digital-strategy.ec.europa.eu/en/library/proposal-decision-establishing-2030-policy-programme-path-digital-decade (accessed on 24 November 2021).

- De Mello, L.; Ter-Minassian, T. Digitalization Challenges and Opportunities for Subnational Governments; OECD Working Papers on Fiscal Federalism, No. 31; OECD Publishing: Paris, France, 2020. [Google Scholar]

- Van der Vlies, R. Digital Strategies in Education across OECD Countries: Exploring Education Policies on Digital Technologies; OECD Education Working Papers, No. 226; OECD Publishing: Paris, France, 2020. [Google Scholar]

- Niskanen, W. Bureaucracy and Representative Government; Aldine-Atherton: Chicago, IL, USA, 1971. [Google Scholar]

- Miller, G.J. Bureaucratic compliance as a game on the unit square. Public Choice 1977, 29, 37–51. [Google Scholar] [CrossRef]

- Orzechowski, W. Economic Models of Bureaucracy: Survey, Extensions, and Evidence. In Budget and Bureaucrats: The Source of Government Growth; Borcherding, T.E., Ed.; Duke University Press: Durham, NC, USA, 1977. [Google Scholar]

- Breton, A.; Wintrobe, R. The equilibrium size of a budget-maximizing bureau: A note on Niskanen’s theory of bureaucracy. J. Political Econ. 1975, 83, 195–207. [Google Scholar] [CrossRef]

- Mackay, R.J.; Weaver, C.L. Agenda control by budget maximizers in a multi-bureau setting. Public Choice 1981, 37, 447–472. [Google Scholar] [CrossRef]

- Breton, A.; Wintrobe, R. The Logic of Bureaucratic Conduct: An Economic Analysis of Competition, Change and Efficiency in Private and Public Organizations; Cambridge University Press: Cambridge, UK, 1982. [Google Scholar]

- Miller, G.J.; Moe, T.M. Bureaucrats, Legislators, and the Size of Government. Am. Political Sci. Rev. 1983, 77, 297–322. [Google Scholar] [CrossRef]

- Moe, T.M. The New Economics of Organization. Am. J. Political Sci. 1984, 28, 739. [Google Scholar] [CrossRef]

- Dunsire, A. Testing Theories: The Contribution of Bureaumetrics. In Bureaucracy and Public Choice; Lane, J.E., Ed.; Sage: London, UK, 1987. [Google Scholar]

- Shleifer, A.; Vishny, R.W. Corruption. Q. J. Econ. 1993, 108, 599–617. [Google Scholar] [CrossRef]

- Shleifer, A.; Vishny, R.W. Politicians and firms. Q. J. Econ. 1994, 109, 995–1025. [Google Scholar] [CrossRef]

- Forte, F.; Powers, C.H. Applying game theory to the protection of public funds: Some introductory notes. Eur. J. Law Econ. 1994, 1, 193–212. [Google Scholar] [CrossRef]

- Bagnoli, M.; McKee, M. Controlling the game: Political sponsors and bureaus. J. Law Econ. Organ. 1991, 7, 229–247. [Google Scholar]

- Fedeli, S.; Santoni, M. Endogenous institutions in bureaucratic compliance games. Econ. Gov. 2001, 2, 203–229. [Google Scholar] [CrossRef]

- Fedeli, S.; Leonida, L.; Santoni, M. Bureaucratic institutional design: The case of the Italian NHS. Public Choice 2018, 177, 265–285. [Google Scholar] [CrossRef]

- Moe, T.M. Delegation, control, and the study of public bureaucracy. Forum 2012, 10, 4. [Google Scholar] [CrossRef]

- Lester, J.P.; Franke, J.L.; O’M. Bowman, A.; Kramer, K.W. Hazardous wastes, politics and public policy: A comparative state analysis. West. Political Quart. 1983, 36, 257–285. [Google Scholar] [CrossRef]

- Gibbons, R. A Primer in Game Theory; Prenctice Hall: New York, NY, USA, 1992. [Google Scholar]

- Nikaidȏ, H.; Isoda, K. Note on noncooperative convex games. Pac. J. Math. 1955, 5, 807–815. [Google Scholar] [CrossRef]

- Horn, H.; Wolinsky, A. Bilateral monopolies and incentives to merge. Rand J. Econ. 1988, 19, 408–419. [Google Scholar] [CrossRef]

- Collard-Wexler, A.; Gowrisankaran, G.; Lee, R.S. Nash-in-Nash bargaining: A microfoundation for applied work. J. Political Econ. 2019, 127, 163–195. [Google Scholar] [CrossRef]

- Fedeli, S.; Santoni, M. The government choice of bureaucratic organization: An application to Italian state museums. J. Cult. Econ. 2006, 30, 41–72. [Google Scholar] [CrossRef]

- Bloch, F. Coalitions and networks in industrial organization. Manch. Sch. 2002, 70, 36–55. [Google Scholar] [CrossRef]

- Alesina, A.; Baqir, R.; Hoxby, C. Political jurisdictions in heterogeneous communities. J. Political Econ. 2019, 112, 348–396. [Google Scholar] [CrossRef]

- Ting, M.M. A theory of jurisdictional assignments in bureaucracies. Am. J. Political Sci. 2002, 46, 364–378. [Google Scholar] [CrossRef]

- Pollitt, C. Manipulating the Machine: Changing the Pattern of Ministerial Departments 1960–1983; George Allen and Unwin: London, UK, 1984. [Google Scholar]

- Gaynor, M.; Laudicella, M.; Propper, C. Can governments do it better? Merger mania and hospital outcomes in the English NHS. J. Health Econ. 2012, 31, 528–543. [Google Scholar] [CrossRef] [PubMed]

- Talbot, C.L.; Talbot, C.R. The Structure Solution? Public Sector Mergers in the United Kingdom, ch. 6. In Crossing Boundaries in Public Management and Policy; O’Flynn, J., Blackman, D., Halligan, J., Eds.; Routledge: London, UK, 2014. [Google Scholar]

- Asquer, A. Managing the process of decentralization: Transforming old public entities into new agencies in the agricultural sector. Int. Public Manag. J. 2012, 15, 207–229. [Google Scholar] [CrossRef]

- Hult, K.M. Agency Merger and Bureaucratic Redesign; University of Pittsburgh Press: Pittsburgh, PA, USA, 1987. [Google Scholar]

- Gordon, N.; Knight, B. A spatial merger estimator with an application to school district consolidation. J. Public Econ. 2009, 93, 752–765. [Google Scholar] [CrossRef]

- Samuelson, P.A. The pure theory of public expenditure. Rev. Econ. Stat. 1954, 37, 387–389. [Google Scholar] [CrossRef]

- Singh, N.; Vives, X. Price and quantity competition in a differentiated duopoly. RAND J. Econ. 1984, 15, 546–554. [Google Scholar] [CrossRef]

- Nomden, K.; Farnham, D.; Onnee-Abbruciati, M.L. Collective bargaining in public services: Some European comparisons. Int. J. Public Sect. Manag. 2003, 16, 412–423. [Google Scholar] [CrossRef]

- Haucap, J.; Wey, C. Unionisation structures and innovation incentives. Econ. J. 2004, 114, C149–C165. [Google Scholar] [CrossRef]

- European Commission. Digital Public Services in the Digital Economy and Society Index. DESI 2020 Report. 2021. Available online: https://digital-strategy.ec.europa.eu/en/policies/desi-digital-public-services (accessed on 24 November 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).