A Concept Tree of Accounting Theory: (Re)Design for the Curriculum Development

Abstract

:1. Introduction

2. Concept Map in Accounting Education and a Critique of the Old Curriculum Map

- Hierarchical structure refers to knowledge as part of an inclusive and systematic framework.

- Progressive differentiation is defined as engendering new concepts and ideas as knowledge deepens.

- Integrative reconciliation elucidates interrelationships between concepts.

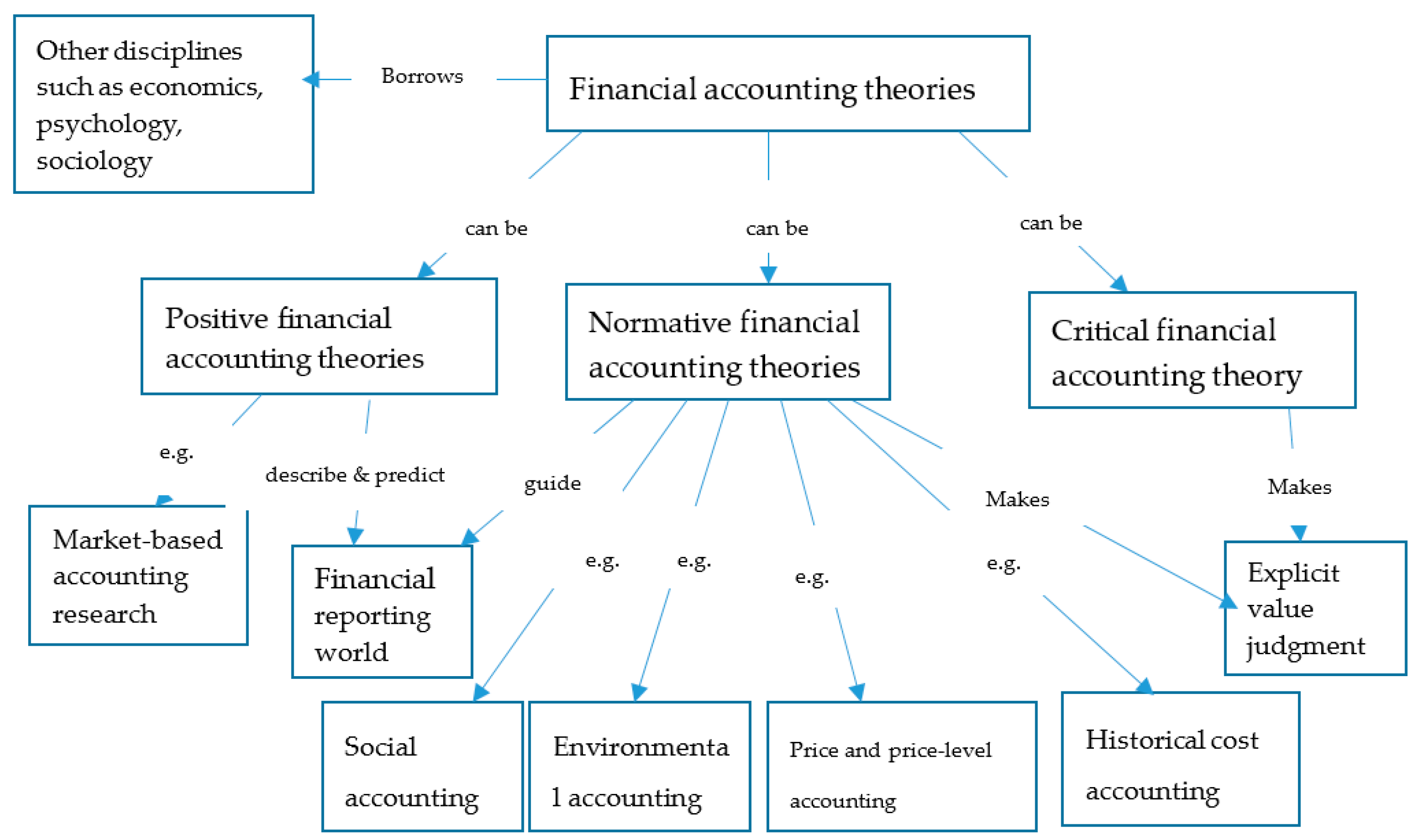

3. Design of the Concept Tree for the Curriculum of Accounting Theory

3.1. The Tree Concept Map and Accounting Theory Knowledge

3.2. The Sketch of the Concept Tree

3.3. Bifurcations

3.4. Linking Phrases

3.5. Colors and Their Implications

3.6. The Curriculum Concept Tree of Accounting Theory

3.7. A Comparison between the Two Curriculum Concept Maps

4. Educational Insights

4.1. Feeling the Pulses of Accountancy Development

4.2. Addressing Accounting Evolution

4.3. Understanding Accounting Research Methodology in Contexts

4.4. Enhancing Understanding of Sector-Specific Accounting Practices

5. Notes to the Curriculum Design

5.1. Sequence of Lecture Topics

5.2. Cohesion of Topics

5.3. A Meaningful Learning Mode of Exam Design

- (1)

- Calculate the amount of value for this asset shown in the financial report at the year-end 20X7.

- (2)

- Calculate the market value, the net realizable value, and the economic value at the end of 20X7. At that time, the company had three options to deal with the machine: to sell the machine directly, to sell it after maintenance, and to keep it. What would be the best option from an economic view?

- (3)

- Use this case to discuss the advantages and the disadvantages of the historical cost method to value a fixed asset.Suppose you try to write a research paper using this case in which you maintain a stance of advocating alternative costing and critiquing the traditional historical cost method. Is your research classified to positive or normative accounting theory?

6. Conclusions

Funding

Conflicts of Interest

References

- Novak, J.D.; Gowin, D.B. Learning How to Learn; Cambridge University Press: New York, NY, USA, 1984. [Google Scholar]

- Canas, A.J. A Summary of Literature Pertaining to the Use of Concept Mapping Techniques and Technologies for Education and Performance Support; The Institute for Human and Machine Cognition: Pensacola, FL, USA, 2003. [Google Scholar]

- Schwendimann, B. Concept mapping. In Encyclopedia of Science Education; Gunstone, R., Ed.; Springer: Amsterdam, The Netherlands, 2015. [Google Scholar]

- Wise, A.M. Map It: How Concept Mapping Affects Understanding of Evolutionary Processes. Ph.D. Thesis, University of California, Davis, CA, USA, 2009. [Google Scholar]

- Schwendimann, B.A. Concept maps as versatile tools to integrate complex ideas: From kindergarten to higher and professional education. Knowl. Manag. E-Learn. 2015, 7, 73–99. [Google Scholar]

- Bridges, S.M.; Corbet, E.F.; Chan, L.K. Designing problem-based curricula: The role of concept mapping in scaffolding learning for the health sciences. Knowl. Manag. E-Learn. 2015, 7, 119–133. [Google Scholar]

- Hay, D.B.; Proctor, M. Concept maps which visualise the artifice of teaching sequence: Cognition, linguistic and problem-based views on a common teaching problem. Knowl. Manag. E-Learn. 2015, 7, 36–55. [Google Scholar]

- Cañas, A.J.; Novak, J.D.; Reiska, P. How good is my concept map? Am I a good Cmapper? Knowl. Manag. E-Learn. 2015, 7, 6–19. [Google Scholar]

- Kinchin, I.M. Concept Mapping as a Learning Tool in Higher Education: A Critical Analysis of Recent Reviews. J. Contin. High. Educ. 2014, 62, 39–49. [Google Scholar] [CrossRef] [Green Version]

- Simon, J. Concept mapping in a financial accounting theory course. Acc. Educ. 2007, 16, 273–308. [Google Scholar] [CrossRef]

- Leauby, B.A.; Szabat, K.; Mass, J.D. Concept mapping—An empirical study in introductory financial accounting. Acc. Educ. 2010, 19, 279–300. [Google Scholar] [CrossRef]

- Lamberton, G. Sustainability accounting—A brief history and a conceptual framework. Acc. Forum 2005, 29, 7–26. [Google Scholar] [CrossRef]

- Roberts, J. No one is perfect: The limits of transparency and an ethic for ‘intelligent’ accountability. Acc. Organ. Soc. 2009, 34, 957–970. [Google Scholar] [CrossRef]

- Schaltegger, S.; Burritt, R.L. Sustainability accounting for companies: catchphrase or decision support for business leaders? J. World Bus. 2010, 45, 375–384. [Google Scholar] [CrossRef]

- Shearer, T. Ethics and accountability: from the for-itself to the for-the-other. Acc. Organ. Soc. 2002, 27, 541–573. [Google Scholar] [CrossRef]

- Simon, J. Curriculum changes using concept maps. Acc. Educ. 2010, 19, 301–307. [Google Scholar] [CrossRef]

- Vanides, J.; Yin, Y.; Tomita, M.; Ruiz-Primo, M.A. Using concept maps in the science classroom. Sci. Soc. 2005, 28, 27–31. [Google Scholar]

- Solvie, P.A.; Sungur, E. Concept maps/graphs/trees/vines in education. Presented at the 5th WSEAS International Conference on E-ACTIVITIES, Venice, Italy, 20 November 2006. [Google Scholar]

- Gilmour, S.J. Daz Sint Noch Ungelogenius Wort: A Literary Linguistic Commentary on Gurnemanz, Episode. In Book III of Wolfram’s Parzival; Universitatsverlag Winter: Heidelberg, Germany, 2000. [Google Scholar]

- Alexandre, F. Trees, waves and linkages: models of language diversification. In The Routledge Handbook of Historical Linguistics; Bowern, B., Evans, C., Eds.; Routledge: New York, NY, USA, 2014; pp. 161–189. [Google Scholar]

- Ausubel, D. The Psychology of Meaningful Verbal Learning; Grune & Stratton: Oxford, UK, 1963. [Google Scholar]

- Ausubel, D. The Acquisition and Retention of Knowledge: A Cognitive View; Springer: Amsterdam, The Netherlands, 2012. [Google Scholar]

- Ausubel, D. The use of advance organizers in the learning and retention of meaningful verbal material. J. Educ. Psychol. 1960, 5, 267–272. [Google Scholar] [CrossRef]

- Mayer, R.E. Can advance organizers influence meaningful learning? Rev. Educ. Res. 1979, 49, 371–383. [Google Scholar] [CrossRef]

- Ausubel, D. Educational Psychology: A Cognitive View; Holt, Rinehart and Winston: New York, NY, USA, 1968. [Google Scholar]

- Rovira, C. Theoretical foundation and literature review of the study of concept maps using eye tracking methodology. Prof. Inf. 2016, 25, 59–73. [Google Scholar] [CrossRef]

- Handy, S.A.; Polimeni, R.S. Concept mapping—A graphical tool to enhance learning in an introductory cost or managerial accounting course. J. Acad. Bus. Educ. 2017, 18, 161–174. [Google Scholar]

- Mass, J.D.; Leauby, B.A. Active learning and assessment: A student guide to using concept mapping in financial accounting. Glob. Perspect. Acc. Educ. 2014, 11, 41–63. [Google Scholar]

- Shimerda, T.A. Concept mapping: A technique to aid meaningful learning in business and accounting education. Indian J. Econ. Bus. 2007, 6, 117–124. [Google Scholar]

- Mass, J.D.; Leauby, B.A. Concept mapping—Exploring its value as a meaningful learning tool in accounting education. Glob. Perspect. Acc. Educ. 2005, 2, 75–98. [Google Scholar]

- Cañas, A.J.; Novak, J.D. Concept mapping using cmap tools to enhance meaningful learning. In Knowledge Cartography: Software Tools and Mapping Techniques; Okada, A., Shum, S.B., Sherborne, T., Eds.; Springer-Verlag: London, UK, 2008; pp. 25–46. [Google Scholar]

- Kinchin, I.M. Pedagogic frailty: A concept analysis. Knowl. Manag. E-Learn. 2017, 9, 295–310. [Google Scholar]

- Gray, R.; Adams, C.; Owen, D. Accountability, Social Responsibility and Sustainability: Accounting for Society and the Environment; Pearson Education Limited: London, UK, 2014. [Google Scholar]

- Goetz, A.; Jenkins, R. Voice, Accountability and Human Development: The Emergence of a New Agenda; United Nations Development Programme: New York, NY, USA, 2002. [Google Scholar]

- Mashaw, J. Accountability and institutional design: Some thoughts on the grammar of governance. In Public Accountability: Designs, Dilemmas and Experiences; Dowdle, M.W., Ed.; Cambridge University Press: Cambridge, UK, 2006; pp. 115–156. [Google Scholar]

- Schedler, A. Conceptualizing accountability. In The Self-Restraining State: Power and Accountability in New Democracies; Schedler, A., Diamond, L., Plattner, M., Eds.; Lynne Rienner Publishers: London, UK, 1999; pp. 13–28. [Google Scholar]

- Bovens, M. Analysing and assessing accountability: A conceptual framework. Eur. Law J. 2007, 13, 447–468. [Google Scholar] [CrossRef]

- Australia Auditing Standard Board. Materiality and Audit Adjustments AUS 306; Australian Accounting Research Foundation: Melbourne, Australia, 2001. [Google Scholar]

- Global Reporting Initiative. G4 Sustainability Reporting Guidelines (GRI G4); GRI: Amsterdam, The Netherlands, 2013. [Google Scholar]

- AccountAbility. AA1000 AccountAbility Principles Standard 2008 (AA1000APS 2008); AccountAbility: London, UK, 2008. [Google Scholar]

- Murninghan, M. Redefining Materiality II: Why it Matters, Who’s Involved, and What it Means for Corporate Leaders and Boards; AccountAbility: London, UK, 2013. [Google Scholar]

- Zhou, Y. Materiality in Sustainability Accounting: A Critical Realist Perspective. Ph.D. Thesis, Southern Cross University, Lismore, Australia, 2017. [Google Scholar]

- Anon. IFAC Public Sector Meets in New Zealand. Acc. J. 1993, 72, 34–37. [Google Scholar]

- Barton, A. Professional accounting standards and the public sector—A mismatch. Abacus 2005, 41, 138–158. [Google Scholar] [CrossRef]

- Meyer, J.; Land, R. Threshold Concepts and Troublesome Knowledge: Linkages to Ways of Thinking and Practising within the Disciplines; University of Edinburgh: Edinburgh, UK, 2003; pp. 412–424. [Google Scholar]

- Christensen, M.; Newberry, S.; Potter, B. Enabling global accounting change: Epistemic communities and the creation of a ‘more business-like’ public sector. Crit. Perspect. Acc. 2019, 58, 53–76. [Google Scholar] [CrossRef]

- Herath, G. Sustainable development and environmental accounting: the challenge to the economics and accounting profession. Int. J. Soc. Econ. 2005, 32, 1035–1050. [Google Scholar] [CrossRef]

- Hardy, L.; Ballis, H. Accountability and giving accounts. Acc. Audit. Acc. J. 2013, 26, 539–566. [Google Scholar] [CrossRef]

- Ball, R.; Brown, P. An empirical evaluation of accounting income numbers. J. Acc. Res. 1968, 6, 159–178. [Google Scholar] [CrossRef]

- Watts, R.L.; Zimmerman, J.L. Towards a positive theory of the determination of accounting standards. Acc. Rev. 1978, 53, 112–134. [Google Scholar]

- Modell, S. In defence of triangulation: A critical realist approach to mixed methods research in management accounting. Manag. Acc. Res. 2009, 20, 208–221. [Google Scholar] [CrossRef]

- Modell, S. Critical realist accounting: In search of its emancipatory potential. Crit. Pers. Acc. 2017, 42, 20–35. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhou, G. Establishing judgement about materiality in government audits: Experience from Chinese local government auditors. Int. J. Gov. Audit. 2011, 38, 9–14. [Google Scholar]

- Raman, K.; Van Daniker, R. Materiality in government auditing. J. Acc. 1994, 177, 71–76. [Google Scholar]

- DeZoort, T.; Harrison, P.; Taylor, M. Accountability and auditors’ materiality judgments: the effects of differential pressure strength on conservatism, variability, and effect. Acc. Organ. Soc. 2006, 31, 373–390. [Google Scholar] [CrossRef]

- Novak, J.D. Learning, Creating, and Using Knowledge: Concept Maps as Facilitative Tools in Schools and Corporations; Lawrence Erlbaum Association: Mahwah, NJ, USA, 1998. [Google Scholar]

- Edmondson, K.M. Concept maps as reflectors of conceptual understanding. J. Res. Sci. Teach. 1983, 13, 19–26. [Google Scholar]

| Research Schemes | Articles |

|---|---|

| Making instructor-prepared concept maps to enhance learning | Simon (2007) designs a curriculum concept map for Accounting Theory [10]; Handy and Polimeni (2017) propose six concept maps that correspond to six topics of the Introductory Managerial Accounting curriculum [27]; Mass and Leauby (2014) introduce a concept map for the topic of financial reporting standards in the financial accounting curriculum [28]. |

| Teaching accounting students to produce concept maps | After informing students about the steps of concept mapping, Shimerda (2007) presents student-prepared concept maps for the accounting equation topic, then indicates usefulness of concept mapping in accounting education [29]. Simon (2007) shows some instructor-prepared maps as the guidance for accounting students to create their own concept maps [25]. |

| Assessing effectiveness of concept maps in accounting | Mass and Leauby (2005) compare two groups of students undertaking two accounting topics of income statement and cash flow statement. Its finding claims that the group using concept maps had a better understating of the two topics than the other group taught under the traditional instruction method [30]. Leauby et al. (2010) appraise concept maps as a valuable learning tool as a result from the survey response from students who used the concept map method in the introductory accounting courses [11]. |

| Accounting Contexts/Sectors | Accountor | Accountee | Account |

|---|---|---|---|

| Corporate financial accounting | Corporation /business entity | Shareholders | General-purpose financial reports |

| Sustainability accounting | Corporation /business entity | Stakeholders | Formal and informal environmental and social reports |

| Public sector accounting | Government | The public | The government fiscal reports and audit reports |

| Twig notes | Abbreviation | Examples |

|---|---|---|

| Consist(s) of | C | Accounting principles consist of materiality. |

| Be derived from | D | Capital market research is derived from market efficiency hypothesis. |

| Be in the form of | F | Creative accounting can be in the form of “window dressing”. |

| Be to guide | G | Financial reporting standards are to guide “recognition” of financial items. |

| Be operationalized as | O | Alternative costs can be operationalized as deprival value. |

| Regulates | R | Accountabiltiy regulates the “corporation–stakeholder relationship” in the domain of sustainability accounting. |

| Be to study | S | Agency theory is to study information asymmetry. |

| Be underpinned by | U | “New school” (of sustainability accounting) is underpinned by stakeholder primacy. |

| Objects | Color | Implications |

|---|---|---|

| Bifurcations | Deep blue | Deep blue represents wisdom. It implies potential to generate new sophisticated theoretical perspectives or philosophies. |

| Accountability | Brown | Brown is the color of soil, referring to accountability as the root for the whole accounting system. |

| Financial accounting (trunk) | Gold | The gold color denotes the for-profit assumption of (traditional corporate) financial accounting. |

| Sustainability accounting (branch) | Green + Gold | The new school is colored with green, aiming at improving environmental and social performance. The old school adopts the same color of gold as financial accounting. This is in accordance with the view that old school holds a “for-profit” (shareholder primacy) element, and it is part of financial accounting. |

| Public-sector accounting (branch) | Sky blue | Sky blue stands for harmony and trustworthiness, associated with the “for the public” assumption of public-sector accounting. |

| Alternative measurement (twig) | Yellow | Yellow refers to opportunity and awareness, highlighting alternative measurement methods as “alternatives” to the traditional historical costing in making managerial decisions. |

| Capital market research (sub-twig) | Red | Red implies good signs or prosperousness in capital markets. |

| Creative accounting (sub-twig) | Grey | Creative accounting is a “grey zone” in financial reporting, exploiting loopholes in financial reporting regulation to gain advantages. It is not illegal but deviates from the spirit of accounting. |

| Comparative Themes | The Old Concept Map (Simon 2007) [4] | The Concept Tree (Developed in this Paper) | Comments on the Redesign |

|---|---|---|---|

| Accountability | Not included. | Highlighted as the foundation of accounting practices. | Addressing the exceptionally important accountability perspective to accounting. |

| Public sector accounting | Not covered. | Public-sector accounting is diverged from traditional (corporate) financial accounting. | Addressing public-sector accounting that is not for profit and not applied in the business environment. |

| Environmental and social perspectives of accounting | Taken as part of financial accounting. | Sustainability (environmental and social) accounting is diversified from financial accounting and encompasses two streams. | The old school having a shareholder-primacy orientation is closely related to financial accounting, intimating the traditional view presented in Simon’s map. The new school holding non-financial and stakeholder-based elements has become mainstream in sustainability accounting. The new school is beyond the scope of Simon’s map. |

| Comparison and contrast | It fails to recognize the alternative perspectives and lacks comparisons and contrasts between them. | Comparisons between concepts are used to indicate how accounting contexts/sectors and streams are diversified. | Addressing accounting evolution; justifying how new accounting systems and streams/schools were developed from the traditional venue. |

| Linking phrases | Focuses on only two simple terms, “can be” and “e.g.”, to describe the relationships. | Uses multiple technical terms to indicate the relationships. | Elucidating the complex relationships between accounting concepts. |

| Accounting research methodology | Presented as individual streams. | Consolidated in accounting contexts/sectors. | Providing a concrete understanding on accounting research methodology. |

| Examined Knowledge Pieces | Reference to the Concept Tree |

|---|---|

| Financial reporting of a fixed asset | A lower-level sub-twig in the financial accounting standards twig |

| Calculation models of alternative values | Sub-twigs of alternative costs twig |

| Applications of the alternative values in decision-making | The twig of alternative costs |

| The historical cost assumption | The bifurcation signpost between twigs of financial accounting and alternative measurements |

| The positive and the normative accounting theory | In-context normative accounting theory associated to the twig of alternative measurement |

© 2019 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, Y. A Concept Tree of Accounting Theory: (Re)Design for the Curriculum Development. Educ. Sci. 2019, 9, 111. https://doi.org/10.3390/educsci9020111

Zhou Y. A Concept Tree of Accounting Theory: (Re)Design for the Curriculum Development. Education Sciences. 2019; 9(2):111. https://doi.org/10.3390/educsci9020111

Chicago/Turabian StyleZhou, Yining. 2019. "A Concept Tree of Accounting Theory: (Re)Design for the Curriculum Development" Education Sciences 9, no. 2: 111. https://doi.org/10.3390/educsci9020111

APA StyleZhou, Y. (2019). A Concept Tree of Accounting Theory: (Re)Design for the Curriculum Development. Education Sciences, 9(2), 111. https://doi.org/10.3390/educsci9020111