Effects of Insurance Adoption and Risk Aversion on Agricultural Production and Technical Efficiency: A Panel Analysis for Italian Grape Growers

Abstract

1. Introduction

2. Theoretical Background

3. Data and Methodology

3.1. Methods

3.2. Data

3.3. Empirical Strategies

4. Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

| 1 | This paper defines “quality grapevines” as those certified by the EU quality certification scheme. |

| 2 | Proofs and more technical details are provided in (Karakaplan and Kutlu 2017a, 2017b). |

| 3 | In the FADN the “standard output” (SO), of an agricultural product (crop or livestock) is the average monetary value of the agricultural output at farm-gate price. The SO excludes direct payments, value added tax and taxes on products. |

| 4 | In total, 27% of the observations for the total number of hours worked on grape growing were missing in the sample. Most of these missing values are related to some specific years and provinces. When the information of farm labour was available for a specific farm in at least one year, then the missing value has been replaced by the hours obtained based on the proportion between hours worked on grape growing and total hours worked on the farm. When hours worked on grape growing were missing in all years for one farm, we replaced them with an approximation based on year and location (province, region, and altimetry) specific mean. |

| 5 | A test similar to the Durbin–Wu–Hausman test has been used to assess the correlation between the instrumented variables and the two-side error term vit. This test examines the joint significance of the components of the bias correction terms (see Karakaplan and Kutlu 2017a, 2017b for more details). If the bias correction terms components are not jointly significant, one would conclude that correction for endogeneity is not necessary, and the variables can be estimated by the traditional frontier models. |

| 6 | Please note that being more efficient does not necessarily imply that farms are more productive. In fact, technical efficiency is a part of productivity, along with technical change and scale economies (Coelli et al. 2005). We find that smaller farms are more productive but less efficient than the medium-small farms. The explanation of such differences in the productivity and efficiency of different size classes deserves a specific study that is beyond the scope of our analysis. |

References

- Ahsan, Syed M., Ali A. G. Ali, and N. John Kurian. 1982. Toward a Theory of Agricultural Insurance. American Journal of Agricultural Economics 64: 510–29. [Google Scholar] [CrossRef]

- Aigner, Dennis, C. A. Knox Lovell, and Peter Schmidt. 1977. Formulation and estimation of stochastic frontier production function models. Journal of Econometrics 6: 21–37. [Google Scholar] [CrossRef]

- Aka, Joël, A. Alonso Ugaglia, and Jean-Marie Lescot. 2018. Pesticide Use and Risk Aversion in the French Wine Sector. Journal of Wine Economics 13: 409–18. [Google Scholar] [CrossRef]

- Amsler, Christine, Artem Prokhorov, and Peter Schmidt. 2016. Endogeneity in stochastic frontier models. Journal of Econometrics 190: 280–88. [Google Scholar] [CrossRef]

- Asplund, Nathan, D. Lynn Forster, and Thomas T. Stout. 1989. Farmers’ use of forward contracting and hedging. Review of Futures Markets 8: 24–37. [Google Scholar]

- Aubert, Magali, and Geoffroy Enjolras. 2014. The Determinants of Chemical Input Use in Agriculture: A Dynamic Analysis of the Wine Grape–Growing Sector in France. Journal of Wine Economics 9: 75–99. [Google Scholar] [CrossRef]

- Babcock, Bruce A., and David A. Hennessy. 1996. Input Demand under Yield and Revenue Insurance. American Journal of Agricultural Economics 78: 416–27. [Google Scholar] [CrossRef]

- Battese, George E. 1997. A note on the estimation of Cobb-Douglas production functions when some explanatory variables have zero values. Journal of Agricultural Economics 48: 250–52. [Google Scholar] [CrossRef]

- Battese, George E., and Timothy J. Coelli. 1995. A Model for Technical Inefficiency Effects in a Stochastic Frontier Production Function for Panel Data. Empirical Economics 20: 325–32. [Google Scholar]

- Bellon, Mauricio R., Bekele H. Kotu, Carlo Azzarri, and Francesco Caracciolo. 2020. To diversify or not to diversify, that is the question. Pursuing agricultural development for smallholder farmers in marginal areas of Ghana. World Development 125: 104682. [Google Scholar] [CrossRef]

- Bhakta, Ishita, Santanu Phadikar, and Koushik Majumder. 2019. State-of-the-art technologies in precision agriculture: A systematic review. Journal of the Science of Food and Agriculture 99: 4878–88. [Google Scholar] [CrossRef] [PubMed]

- Boehlje, Michael D., and Larry D. Trede. 1977. Risk Management in Agriculture. Journal of ASFMRA 41: 20–29. [Google Scholar]

- Chavas, Jean-Paul, and Kwansoo Kim. 2010. Economies of diversification: A generalization and decomposition of economies of scope. International Journal of Production Economics 126: 229–35. [Google Scholar] [CrossRef]

- Coelli, Timothy J., D. S. Prasada Rao, Christopher J. O’Donnell, and George E. Battese. 2005. An Introduction to Efficiency and Productivity Analysis. Berlin and Heidelberg: Springer Science & Business Media. [Google Scholar]

- Corsi, Alessandro, and Cristina Salvioni. 2012. Off- and on-farm labour participation in Italian farm households. Applied Economics 44: 2517–26. [Google Scholar] [CrossRef]

- Di Falco, Salvatore, and Jean-Paul Chavas. 2006. Crop genetic diversity, farm productivity and the management of environmental risk in rainfed agriculture. European Review of Agricultural Economics 33: 289–314. [Google Scholar] [CrossRef]

- Di Falco, Salvatore, and Marcella Veronesi. 2013. How can African agriculture adapt to climate change? A counterfactual analysis from Ethiopia. Land Economics 89: 743–66. [Google Scholar] [CrossRef]

- Di Falco, Salvatore, Felice Adinolfi, Martina Bozzola, and Fabian Capitanio. 2014. Crop Insurance as a Strategy for Adapting to Climate Change. Journal of Agricultural Economics 65: 485–504. [Google Scholar] [CrossRef]

- Diewert, W. Erwin. 1974. Functional Forms for Revenue and Factor Requirements Functions. International Economic Review 15: 119–30. [Google Scholar] [CrossRef]

- Enjolras, Geoffroy, and Magali Aubert. 2020. How Does Crop Insurance Influence Pesticide Use? Evidence from French Farms. Review of Agricultural, Food and Environmental Studies 101: 461–85. [Google Scholar] [CrossRef]

- Enjolras, Geoffroy, Fabian Capitanio, and Felice Adinolfi. 2012. The demand for crop insurance: Combined approaches for France and Italy. Agricultural Economics Review 13: 5–22. [Google Scholar] [CrossRef]

- Farrell, Michael J. 1957. The Measurement of Productive Efficiency. Journal of the Royal Statistical Society. Series A (General) 120: 253–90. [Google Scholar] [CrossRef]

- Foudi, Sébastien, and Katrin Erdlenbruch. 2012. The role of irrigation in farmers’ risk management strategies in France. European Review of Agricultural Economics 39: 439–57. [Google Scholar] [CrossRef]

- Goodwin, Barry K., Monte L. Vandeveer, and John L. Deal. 2004. An Empirical Analysis of Acreage Effects of Participation in the Federal Crop Insurance Program. American Journal of Agricultural Economics 86: 1058–77. [Google Scholar] [CrossRef]

- Gotor, Elisabetta, Muhammed A. Usman, Martina Occelli, Basazen Fantahun, Carlo Fadda, Yosef G. Kidane, Dejene Mengistu, Afewerki Y. Kiros, Jemal N. Mohammed, Mekonen Assefa, and et al. 2021. Wheat varietal diversification increases Ethiopian smallholders’ food security: Evidence from a participatory development initiative. Sustainability 13: 1029. [Google Scholar] [CrossRef]

- Hennessy, David A. 1996. Information Asymmetry as a Reason for Food Industry Vertical Integration. American Journal of Agricultural Economics 78: 1034–43. [Google Scholar] [CrossRef]

- Holland, Tara, and Barry Smit. 2010. Climate change and the wine industry: Current research themes and new directions. Journal of Wine Research 21: 125–36. [Google Scholar] [CrossRef]

- Horowitz, John K., and Erik Lichtenberg. 1993. Insurance, Moral Hazard, and Chemical Use in Agriculture. American Journal of Agricultural Economics 75: 926–35. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change (IPCC). 2013. Climate Change 2013: The Physical Science Basis. Contribution of Working Group I to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Cambridge and New York: Cambridge University Press. [Google Scholar]

- Istituto di Servizi per il Mercato Agricolo Alimentare (ISMEA). 2018. Rapporto sulla gestione del rischio in Italia 2018. Rome: Romana Editrice S.r.l. [Google Scholar]

- Just, Richard E., and Rulon D. Pope. 1979. Production Function Estimation and Related Risk Considerations. American Journal of Agricultural Economics 61: 276–84. [Google Scholar] [CrossRef]

- Just, Richard E., Linda Calvin, and John Quiggin. 1999. Adverse Selection in Crop Insurance: Actuarial and Asymmetric Information Incentives. American Journal of Agricultural Economics 81: 834–49. [Google Scholar] [CrossRef]

- Karakaplan, Mustafa U., and Levent Kutlu. 2017a. Endogeneity in panel stochastic frontier models: An application to the Japanese cotton spinning industry. Applied Economics 49: 5935–39. [Google Scholar] [CrossRef]

- Karakaplan, Mustafa U., and Levent Kutlu. 2017b. Handling endogeneity in stochastic frontier analysis. Economics Bulletin 37: 889–901. [Google Scholar] [CrossRef]

- Kim, Kwansoo, Jean-Paul Chavas, Bradford Barham, and Jeremy Foltz. 2012. Specialization, diversification, and productivity: A panel data analysis of rice farms in Korea. Agricultural Economics (United Kingdom) 43: 687–700. [Google Scholar] [CrossRef]

- Kirkley, James, Dale Squires, and Ivar E. Strand. 1998. Characterizing Managerial Skill and Technical Efficiency in a Fishery. Journal of Productivity Analysis 9: 145–60. [Google Scholar] [CrossRef]

- Lusk, Jayson L. 2017. Distributional effects of crop insurance subsidies. Applied Economic Perspectives and Policy 39: 1–15. [Google Scholar] [CrossRef]

- MacMinn, Richard D., and Alphonse G. Holtmann. 1983. Technological Uncertainty and the Theory of the Firm. Southern Economic Journal 50: 120–36. [Google Scholar] [CrossRef]

- Mailly, Florine, Laure Hossard, Jean-Marc Barbier, Marie Thiollet-Scholtus, and Christian Gary. 2017. Quantifying the impact of crop protection practices on pesticide use in wine-growing systems. European Journal of Agronomy 84: 23–34. [Google Scholar] [CrossRef]

- McConnell, Douglas J., and John L. Dillon. 1997. Farm Management for Asia: A Systems Approach. FAO Farm Systems Management Series; Rome: Food and Agriculture Organization, vol. 13. [Google Scholar]

- Meeusen, Wim, and Julien van Den Broeck. 1977. Efficiency Estimation from Cobb-Douglas Production Functions with Composed Error. International Economic Review 18: 435–44. [Google Scholar] [CrossRef]

- Mieno, Taro, Cory G. Walters, and Lilyan E. Fulginiti. 2018. Input use under crop insurance: The role of actual production history. American Journal of Agricultural Economics 100: 1469–85. [Google Scholar] [CrossRef]

- Möhring, Niklas, Martina Bozzola, Stefan Hirsch, and Robert Finger. 2020a. Are pesticides risk decreasing? The relevance of pesticide indicator choice in empirical analysis. Agricultural Economics (United Kingdom) 51: 429–44. [Google Scholar] [CrossRef]

- Möhring, Niklas, Tobias Dalhaus, Geoffroy Enjolras, and Robert Finger. 2020b. Crop insurance and pesticide use in European agriculture. Agricultural Systems 184: 102902. [Google Scholar] [CrossRef]

- Moschini, Giancarlo, and David A. Hennessy. 2001. Uncertainty, risk aversion, and risk management for agriculture producers. Handbook of Agricultural Economics 1: 88–153. [Google Scholar]

- Mozell, Michelle R., and Liz Thachn. 2014. The impact of climate change on the global wine industry: Challenges & solutions. Wine Economics and Policy 3: 81–89. [Google Scholar] [CrossRef]

- Nelson, Carl H., and Edna T. Loehman. 1987. Further Toward a Theory of Agricultural Insurance. American Journal of Agricultural Economics 69: 523–31. [Google Scholar] [CrossRef]

- Otsuka, Keijiro, Yuko Nakano, and Kazushi Takahashi. 2016. Contract farming in developed and developing countries. Annual Review of Resource Economics 8: 353–76. [Google Scholar] [CrossRef]

- Pagnani, Tiziana, Elisabetta Gotor, and Francesco Caracciolo. 2021. Adaptive strategies enhance smallholders’ livelihood resilience in Bihar, India. Food Security 13: 419–37. [Google Scholar] [CrossRef]

- Pope, Rulon D., and Randall A. Kramer. 1979. Production Uncertainty and Factor Demands for the Competitive Firm: An Extension. Southern Economic Journal 46: 489–501. [Google Scholar] [CrossRef][Green Version]

- Quiggin, John C., Giannis Karagiannis, and Julie Stanton. 1993. Crop Insurance and Crop Production: An Empirical Study of Moral Hazard and Adverse Selection. Australian Journal of Agricultural Economics 37: 95–113. [Google Scholar] [CrossRef]

- Raimondo, Maria, Concetta Nazzaro, Giuseppe Marotta, and Francesco Caracciolo. 2021. Land degradation and climate change: Global impact on wheat yields. Land Degradation and Development 32: 387–98. [Google Scholar] [CrossRef]

- Ramaswami, Bharat. 1992. Production Risk and Optimal Input Decisions. American Journal of Agricultural Economics 74: 860–69. [Google Scholar] [CrossRef]

- Ramaswami, Bharat. 1993. Supply Response to Agricultural Insurance: Risk Reduction and Moral Hazard Effects. American Journal of Agricultural Economics 75: 914–25. [Google Scholar] [CrossRef]

- Roll, Kristin H. 2019. Moral hazard: The effect of insurance on risk and efficiency. Agricultural Economics 50: 367–75. [Google Scholar] [CrossRef]

- Roosen, Jutta, and David A. Hennessy. 2003. Tests for the role of risk aversion on input use. American Journal of Agricultural Economics 85: 30–43. [Google Scholar] [CrossRef]

- Santeramo, Fabio G., Barry K. Goodwin, Felice Adinolfi, and Fabian Capitanio. 2016. Farmer Participation, Entry and Exit Decisions in the Italian Crop Insurance Programme. Journal of Agricultural Economics 67: 639–57. [Google Scholar] [CrossRef]

- Shee, Apurba, and Spiro E. Stefanou. 2014. Endogeneity corrected stochastic production frontier and technical efficiency. American Journal of Agricultural Economics 97: 939–52. [Google Scholar] [CrossRef]

- Skees, Jerry R., J. Roy Black, and Barry J. Barnett. 1997. Designing and Rating an Area Yield Crop Insurance Contract. American Journal of Agricultural Economics 79: 430–38. [Google Scholar] [CrossRef]

- Smith, Vincent H., and Barry K. Goodwin. 1996. Crop Insurance, Moral Hazard, and Agricultural Chemical Use. American Journal of Agricultural Economics 78: 428–38. [Google Scholar] [CrossRef]

- Urso, Arturo, Giuseppe Timpanaro, Francesco Caracciolo, and Luigi Cembalo. 2018. Efficiency analysis of Italian wine producers. Wine Economics and Policy 7: 3–12. [Google Scholar] [CrossRef]

- Vidoli, Francesco, Concetta Cardillo, Elisa Fusco, and Jacopo Canello. 2016. Spatial nonstationarity in the stochastic frontier model: An application to the Italian wine industry. Regional Science and Urban Economics 61: 153–64. [Google Scholar] [CrossRef]

- Vigani, Mauro, and Jonas Kathage. 2019. To Risk or Not to Risk? Risk Management and Farm Productivity. American Journal of Agricultural Economics 101: 1432–54. [Google Scholar] [CrossRef]

- Weber, Jeremy G., Nigel Key, and Erik. O’Donoghue. 2016. Does federal crop insurance make environmental externalities from agriculture worse? Journal of the Association of Environmental and Resource Economists 3: 707–42. [Google Scholar] [CrossRef]

- Wilson, Clevo, and Clem Tisdell. 2001. Why farmers continue to use pesticides despite environmental, health and sustainability costs. Ecological Economics 39: 449–62. [Google Scholar] [CrossRef]

- Wu, JunJie. 1999. Crop Insurance, Acreage Decisions, and Nonpoint-Source Pollution. American Journal of Agricultural Economics 81: 305–20. [Google Scholar] [CrossRef]

- Wu, JunJie, and Bruce A. Babcock. 1998. The Choice of Tillage, Rotation, and Soil Testing Practices: Economic and Environmental Implications. American Journal of Agricultural Economics 80: 494–511. [Google Scholar] [CrossRef]

| Variable and Abbreviation | Description | Mean | Standard Deviation | |

|---|---|---|---|---|

| Output and Inputs | ||||

| y | Production | Total Gross Production (EUR) | 57,338 | 136,247 |

| x1 | Land | Utilised Agricultural Area (ha) | 8.92 | 17.30 |

| x2 | Capital | Amount of Capital (EUR) | 472,696 | 1,446,921 |

| x3 | Intermediate Inputs | Intermediate Inputs Costs (EUR) | 11,908 | 37,635 |

| x4 | Labour | Total number of hours worked per year (h) | 2418 | 4511 |

| Risk Management Strategies | ||||

| ins | Insurance | Expenditure on crop insurance (EUR) | 891 | 5168 |

| dins | Insurance Dummy | One for insured farm, zero otherwise | 0.22 | 0.41 |

| irr | Irrigation | Percentage of irrigated land over total land (%) | 0.28 | 0.43 |

| dn | Non-agricultural Diversification | Dummy for services diversification | 0.11 | 0.32 |

| da | Agricultural Diversification | Dummy for crop or livestock diversification | 0.74 | 0.44 |

| Control Variables | ||||

| es1 | Economic Size (1) [base category] | One for small farms, zero otherwise | 0.13 | 0.33 |

| es2 | Economic Size (2) | One for medium-small farms, zero otherwise | 0.21 | 0.41 |

| es3 | Economic Size (3) | One for medium farms, zero otherwise | 0.28 | 0.45 |

| es4 | Economic Size (4) | One for medium-large farms, zero otherwise | 0.32 | 0.47 |

| es5 | Economic Size (5) | One for large farms, zero otherwise | 0.06 | 0.24 |

| alt1 | Altimetry (1) [base category] | One if located in the plain, zero otherwise | 0.24 | 0.42 |

| alt2 | Altimetry (2) | One if located in the hill, zero otherwise | 0.59 | 0.49 |

| alt3 | Altimetry (3) | One if located in the mountain, zero otherwise | 0.17 | 0.37 |

| loc1 | Location (1) [base category] | One for farms located in the South, zero otherwise | 0.12 | 0.33 |

| loc2 | Location (2) | One for farms located in the Central, zero otherwise | 0.25 | 0.43 |

| loc3 | Location (3) | One for farms located in the Northeast, zero otherwise | 0.32 | 0.47 |

| loc4 | Location (4) | One for farms located in the Northwest, zero otherwise | 0.31 | 0.46 |

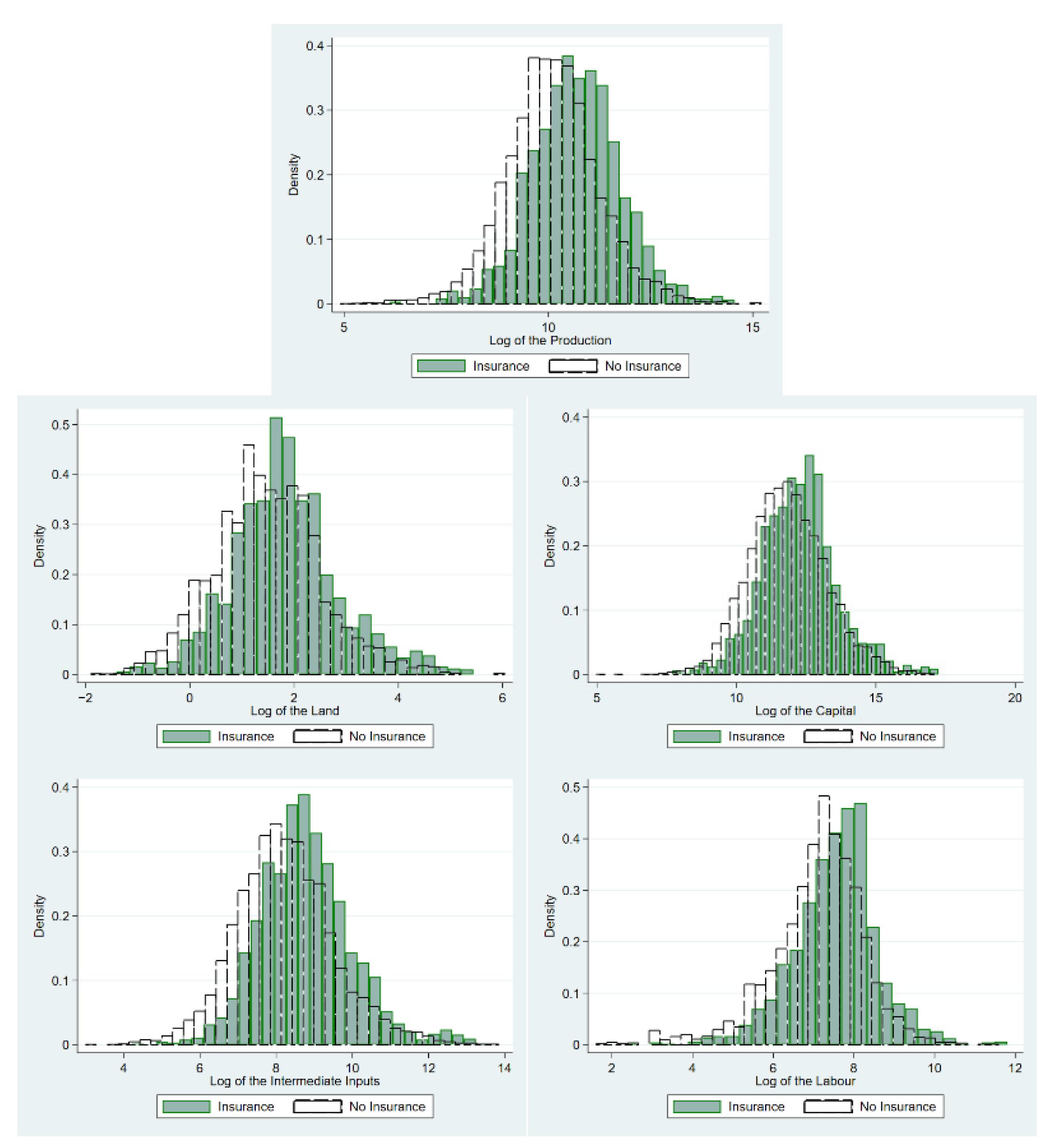

| Variable | No Insurance | Insurance | ||

|---|---|---|---|---|

| Mean | Standard Deviation | Mean | Standard Deviation | |

| Output and Inputs | ||||

| Production | 50,024 | 130,627 | 83,761 | 151,990 |

| Land | 8.07 | 16.03 | 11.98 | 20.99 |

| Capital | 410,406 | 1,116,236 | 697,727 | 2,256,782 |

| Intermediate Inputs | 10,439 | 33,155 | 17,215 | 47,099 |

| Labour | 2146 | 3462 | 3399 | 7025 |

| Risk Management Strategies | ||||

| Insurance | 0 | 0 | 4110 | 10,489 |

| Irrigation | 0.24 | 0.41 | 0.39 | 0.47 |

| Non-agricultural Diversification | 0.11 | 0.31 | 0.11 | 0.31 |

| Agricultural Diversification | 0.74 | 0.44 | 0.73 | 0.44 |

| Control Variables | ||||

| Economic Size (1) | 0.15 | 0.35 | 0.07 | 0.25 |

| Economic Size (2) | 0.23 | 0.42 | 0.15 | 0.35 |

| Economic Size (3) | 0.28 | 0.45 | 0.29 | 0.45 |

| Economic Size (4) | 0.29 | 0.46 | 0.40 | 0.49 |

| Economic Size (5) | 0.05 | 0.22 | 0.09 | 0.29 |

| Altimetry (1) | 0.23 | 0.42 | 0.26 | 0.44 |

| Altimetry (2) | 0.62 | 0.48 | 0.49 | 0.50 |

| Altimetry (3) | 0.15 | 0.35 | 0.25 | 0.43 |

| Location (1) | 0.15 | 0.35 | 0.06 | 0.24 |

| Location (2) | 0.24 | 0.43 | 0.28 | 0.45 |

| Location (3) | 0.28 | 0.45 | 0.46 | 0.50 |

| Location (4) | 0.33 | 0.47 | 0.20 | 0.40 |

| Variable | Parameter | Estimate | Standard Error | z | P > |z| |

|---|---|---|---|---|---|

| Inputs | |||||

| Land | β1 | 0.3457 | 0.1447 | 2.39 | 0.017 |

| Capital | β2 | 0.3934 | 0.0898 | 4.38 | 0.000 |

| Int. Inputs | β3 | 0.2889 | 0.0806 | 3.58 | 0.000 |

| Labour | β4 | −0.0158 | 0.0638 | −0.25 | 0.805 |

| Trend | βt | −0.0196 | 0.0251 | −0.78 | 0.437 |

| Land2 | β11 | −0.0560 | 0.0238 | −2.35 | 0.019 |

| Capital2 | β22 | −0.0018 | 0.0087 | −0.20 | 0.838 |

| Int. Inputs2 | β33 | 0.0124 | 0.0084 | 1.47 | 0.140 |

| Labour2 | β44 | 0.0031 | 0.0057 | 0.54 | 0.586 |

| Trend2 | βtt | 0.0038 | 0.0015 | 2.61 | 0.009 |

| Land ∗ Capital | β12 | 0.0216 | 0.0112 | 1.94 | 0.053 |

| Land ∗ Int. Inputs | β13 | 0.0227 | 0.0109 | 2.09 | 0.036 |

| Land ∗ Labour | β14 | −0.0075 | 0.0093 | −0.81 | 0.420 |

| Land ∗ Trend | β1t | −0.0084 | 0.0035 | −2.38 | 0.017 |

| Capital ∗ Int. Inputs | β23 | −0.0297 | 0.0080 | −3.72 | 0.000 |

| Capital ∗ Labour | β24 | 0.0072 | 0.0057 | 1.27 | 0.204 |

| Capital ∗ Trend | β2t | −0.0113 | 0.0021 | −5.27 | 0.000 |

| Int. Inputs ∗ Labour | β34 | −0.0026 | 0.0066 | −0.39 | 0.694 |

| Int. Inputs ∗ Trend | β3t | 0.0211 | 0.0026 | 8.14 | 0.000 |

| Labour ∗ Trend | β4t | −0.0015 | 0.0021 | −0.71 | 0.479 |

| Risk-Management Strategies | |||||

| Insurance | βins | 0.0640 | 0.0260 | 2.46 | 0.014 |

| Insurance2 | βins2 | 0.0076 | 0.0019 | 3.92 | 0.000 |

| Land ∗ Insurance | β1ins | −0.0018 | 0.0034 | −0.53 | 0.594 |

| Capital ∗ Insurance | β2ins | −0.0006 | 0.0020 | −0.33 | 0.745 |

| Int. Inputs ∗ Insurance | β3ins | −0.0056 | 0.0027 | −2.05 | 0.041 |

| Labour ∗ Insurance | β4ins | −0.0021 | 0.0020 | −1.04 | 0.300 |

| Trend ∗ Insurance | βtins | 0.0002 | 0.0007 | 0.32 | 0.750 |

| Irrigation | βirr | 0.0389 | 0.0301 | 1.29 | 0.196 |

| Non-Agr. Diversification | βdn | −0.0983 | 0.0350 | −2.81 | 0.005 |

| Agr. Diversification | βda | −0.0731 | 0.0253 | −2.89 | 0.004 |

| Control Variables | |||||

| Medium-Small | βes2 | −0.0782 | 0.0371 | −2.11 | 0.035 |

| Medium | βes3 | −0.0781 | 0.0445 | −1.75 | 0.079 |

| Medium-Large | βes4 | −0.0493 | 0.0529 | −0.93 | 0.352 |

| Large | βes5 | 0.0549 | 0.0792 | 0.69 | 0.488 |

| Hill | βalt2 | 0.1468 | 0.0288 | 5.10 | 0.000 |

| Mountain | βalt3 | 0.2830 | 0.0447 | 6.34 | 0.000 |

| Centre | βloc2 | −0.1345 | 0.0385 | −3.49 | 0.000 |

| Northeast | βloc3 | 0.1731 | 0.0388 | 4.46 | 0.000 |

| Northwest | βloc4 | 0.2391 | 0.0399 | 6.00 | 0.000 |

| Constant | β0 | 4.4803 | 0.6203 | 7.22 | 0.000 |

| Variable | Estimate | Standard Error | z | P > |z| |

|---|---|---|---|---|

| Land | 0.5926 | 0.0284 | 20.87 | 0.000 |

| Capital | 0.1427 | 0.0145 | 9.85 | 0.000 |

| Int. Inputs | 0.1312 | 0.0194 | 6.78 | 0.000 |

| Labour | 0.0358 | 0.0150 | 2.38 | 0.017 |

| Insurance | 0.1065 | 0.0156 | 6.85 | 0.000 |

| Trend | 0.0219 | 0.0056 | 3.98 | 0.000 |

| Variable | Parameter | Estimate | Standard Error | z | P > |z| |

|---|---|---|---|---|---|

| Insurance | δins | −0.0226 | 0.0111 | −2.03 | 0.042 |

| Irrigation | δirr | −0.2783 | 0.1188 | −2.34 | 0.019 |

| Non-Agr. Diversification | δdn | −0.0119 | 0.1168 | −0.10 | 0.919 |

| Agr. Diversification | δda | 0.0416 | 0.0931 | 0.45 | 0.655 |

| Trend | δt | 0.0617 | 0.0134 | 4.62 | 0.000 |

| Medium-Small | δes2 | −0.2647 | 0.1176 | −2.25 | 0.024 |

| Medium | δes3 | −0.1670 | 0.1212 | −1.38 | 0.168 |

| Medium-Large | δes4 | −0.0034 | 0.1260 | −0.03 | 0.978 |

| Large | δes5 | 0.0881 | 0.2024 | 0.44 | 0.663 |

| Hill | δalt2 | 0.4653 | 0.1271 | 3.66 | 0.000 |

| Mountain | δalt3 | −0.1931 | 0.1878 | −1.03 | 0.304 |

| Centre | δloc2 | −0.0439 | 0.1586 | −0.28 | 0.782 |

| Northeast | δloc3 | 0.4336 | 0.1553 | 2.79 | 0.005 |

| Northwest | δloc4 | 0.2443 | 0.1593 | 1.53 | 0.125 |

| Constant | δ0 | −1.6218 | 0.2227 | −7.28 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Russo, S.; Caracciolo, F.; Salvioni, C. Effects of Insurance Adoption and Risk Aversion on Agricultural Production and Technical Efficiency: A Panel Analysis for Italian Grape Growers. Economies 2022, 10, 20. https://doi.org/10.3390/economies10010020

Russo S, Caracciolo F, Salvioni C. Effects of Insurance Adoption and Risk Aversion on Agricultural Production and Technical Efficiency: A Panel Analysis for Italian Grape Growers. Economies. 2022; 10(1):20. https://doi.org/10.3390/economies10010020

Chicago/Turabian StyleRusso, Simone, Francesco Caracciolo, and Cristina Salvioni. 2022. "Effects of Insurance Adoption and Risk Aversion on Agricultural Production and Technical Efficiency: A Panel Analysis for Italian Grape Growers" Economies 10, no. 1: 20. https://doi.org/10.3390/economies10010020

APA StyleRusso, S., Caracciolo, F., & Salvioni, C. (2022). Effects of Insurance Adoption and Risk Aversion on Agricultural Production and Technical Efficiency: A Panel Analysis for Italian Grape Growers. Economies, 10(1), 20. https://doi.org/10.3390/economies10010020