Abstract

This study provides a comprehensive assessment and synthesis of the literature on short-selling. It performs a lexicometric analysis, providing a quantitative review of 1093 peer-reviewed journal articles to identify and illustrate the main themes in short-selling research. Almost half the published literature on short-selling is thematically clustered around portfolio management techniques. Other key themes involve short-selling as it relates to risk management, strategic management, and market irregularities. Descending hierarchical classification examines the overall structure of the textual corpus of the short-selling literature and the relationships between its key terms. Similarity analysis reveals that the short-selling literature is highly concentrated, with most conceptual groups closely aligned and fitting into overlapping or conceptually similar areas. Some notable groups highlight prior short-selling studies of market dynamics, behavioral factors, technological advancements, and regulatory frameworks, which can serve as a foundation for market regulators to make more informed decisions that enhance overall market stability. Additionally, this study proposes a conceptual framework in which short-selling can be either a driver or an outcome by integrating the literature on its antecedents, consequences, explanatory variables, and boundary conditions. Finally, it suggests directions for future research.

1. Introduction

The role of short-selling in price discovery and market efficiency in the financial markets has attracted significant interest among researchers and market participants (Jank et al., 2021). Short-selling is a market activity wherein traders bet through borrowed securities, which they sell with the intention of buying them back at lower prices (Wang & Zhang, 2020). According to the Financial Industry Regulatory Authority (FINRA), the daily short-selling volume in the US market surpasses billions of shares. For instance, investors sold short a total of approximately 4.5 billion shares per month, according to the total short-selling volume reported to the FINRA Trade Reporting Facility and Alternative Display Facility in June 2023 (Financial Industry Regulation Authority, 2023). Short-selling helps with various aspects of the market, such as price discovery, through investors betting against overpriced stocks (Comerton-Forde et al., 2016); market sentiments, as high short-selling volumes can indicate negative outlooks (Fan & Gao, 2024); market efficiency, by correcting overvaluations and ensuring that stock prices better reflect actual value (Z. Jiang et al., 2024); and trading strategies for hedging and arbitrage (Y. Chen et al., 2019).

Several types of short-selling have been discussed in the literature. For example, naked or uncovered short-selling involves selling a security without first borrowing the shares or ensuring that they are available to borrow, which has led to efforts to regulate this practice. Covered short-selling, on the other hand, involves the seller arranging to borrow a security before the sale. Regulations also place some limits and reporting requirements on covered short-selling (e.g., Bernal et al., 2014; Galariotis et al., 2019; Moffett et al., 2012). Short sales can be combined with options (e.g., puts, calls, collars, spreads) or used as an alternative to option trading. Like short-selling, option trading can benefit market efficiency by reducing some constraints on short selling. Thus, research has shown that short interest tends to be higher among optionable stocks (Figlewski & Webb, 1993).

Existing studies on short-selling can be categorized from various perspectives due to its potential effects on price discovery and market efficiency. Some scholars describe short-sellers as informed market participants who promote efficiency in the market along with actual price discovery of assets (Bianchi & Drew, 2012; French et al., 2012; Watson & Funck, 2012). Conversely, other scholars argue that short-selling constitutes market manipulation (Bris et al., 2007; Möllers, 2020). Short-selling is also considered to enhance market liquidity, which plays a crucial role in the price discovery of stocks, allowing market participants to recognize overvalued stocks (Patel & Guidi, 2024). Recognition of overvalued stocks incorporates negative information into the asset price, which results in better market efficiency (Bushman & Pinto, 2024). Nevertheless, short-selling helps maintain market integrity and bolsters the confidence of investors (Liu et al., 2019). It also reduces the magnitude of anomalies following a shock, particularly ones that are news-driven (H. Chen, 2025). Prior studies have also explored the regulatory environment, such as short-sale bans and restrictions (Li et al., 2003), and how these macroeconomic factors impact the overall functioning of the market along with their impact on investors. Additionally, proponents of short-selling argue that the optimal scenario for short-sale investments occurs during high volatility, as there is often a negative correlation between volatility and stock index return (Hafner & Wallmeier, 2008). In such high volatility markets, proponents argue that short-selling provides a hedging tool to protect portfolios against potential losses in other investments. Thus, in times of high market volatility, investors can profit from short-selling activities. However, other researchers suggest that short-selling makes market volatility unsuitable, leading to panic and financial stress among investors (Apau et al., 2022).

Short-selling has evolved with changes in the investment landscape in terms of both asset classes and technological aspects. The introduction of innovations like algorithmic and high-frequency trading (HFT) has transformed the investing environment significantly in terms of technological advancements (Weller, 2018). A deeper understanding is needed to analyze their impact on short-sellers and their investment decisions. This is crucial because short-selling plays a vital role in maintaining market integrity and instilling investor confidence by mitigating over-pricing, facilitating price discovery, providing liquidity, and stabilizing the overall market (Yagi et al., 2010).

Scholarly opinions on the implications of technological trading for market volatility are mixed. Some researchers argue that HFT increases volatility due to the nature of market trading (Clapham et al., 2023). In contrast, others assert that HFT helps stabilize the market (Ersan et al., 2021). In general, these technological advancements enable rapid information processing, which may permit the early identification of overvalued securities, thereby helping to prevent the formation of price bubbles. However, greater understanding of how these technological advancements affect short-sellers is needed to provide valuable insights into market efficiency and volatility.

Furthermore, behavioral influences affect an investor’s decision-making (Cianciaruso et al., 2023). Given that short-sellers are often perceived as informed traders, their decisions can also influence the trading activities of the overall market (Watson & Funck, 2012). However, like all other retail and passive market participants, they remain prone to behavioral biases such as loss aversion (Chan et al., 2024), overconfidence bias (Abbes, 2013), anchoring bias (Bouteska & Regaieg, 2020), herd mentality (Spyrou, 2013), and confirmation bias (Duong et al., 2014). Because short-sellers’ decisions inform the trading activities in the market, when their decision-making is affected by behavioral biases, these biases can impact both their individual investment decisions and the dynamics of the market as a whole. Therefore, understanding these biases should provide valuable insights into short sellers’ behavior and their influence on broader market outcomes.

Consequently, to address these gaps in our understanding of the topic, this study provides a review of the extensive corpus of literature on short-selling. Previous literature reviews have focused on investigating short-selling with various determinants, such as regulatory developments in short-selling (Daniel & Lhabitant, 2012); short-selling bans in the financial markets (Alderighi & Gurrola-Perez, 2020); information gathering of short-sellers (H. Jiang et al., 2022); and constraints of short-selling on stock prices (Khan, 2024). However, this study represents the first attempt to comprehensively understand the interactions among the various studies in the short-selling literature. It addresses these gaps by evaluating the existing studies of short selling and employing the unique techniques of lexicometric analysis. By using quantitative approaches to analyze a large corpus of textual data, the study identifies patterns and relationships within that data (Chaney & Séraphin, 2023), uncovering hidden themes and interconnections, thereby providing a more comprehensive analysis. This review offers a solid foundation for better understanding the extensive literature on short-selling by critically evaluating key research areas and tracing which areas have been well-researched and which have been under-researched over the years. Thus, it highlights the significant advancements and emerging trends within the field. Furthermore, it contributes to the existing body of work by providing a well-defined conceptual framework that outlines distinct short-selling scenarios. This framework assists both academics and practitioners in navigating the complexities of short-selling, enhancing their ability to discern its multifaceted impacts on market dynamics, investor behavior, and regulatory considerations. Ultimately, this review serves as a valuable resource for those seeking to deepen their understanding of this dynamic financial strategy. To achieve these contributions, this investigation aims to address the following research questions:

RQ1:

What is the overall state of research in the corpus of the short-selling literature?

RQ2:

What are the key thematic clusters within the short-selling literature?

RQ3:

What are the emerging themes that highlight potential research areas in the field of short-selling?

2. Methodology

This review builds upon the work of Chaney and Séraphin (2023), who used lexicometric analysis to conduct a domain-based literature review. Lexicometric analysis is a powerful approach for examining textual data to identify latent meanings and make inferences from texts (Mandják et al., 2019). This approach was undertaken for this study due to its ability to efficiently process large volumes of textual data while automatically identifying keywords, recurring themes, and trends within the corpus (Chaney & Séraphin, 2023). To perform lexicometric analysis, we used the open-source software IRAMUTEQ (Ratinaud, 2014), which analyses the co-occurrence of words in a text, creates segments based on vocabulary similarity, and subsequently forms clusters of these segments. This tool was originally developed by Reinert (1990) to calculate the statistical distribution of various lexical elements, including nouns, verbs, adjectives, and adverbs. But it is emerging as a tool for better understanding the development of research domains, such as logistics (Fattam et al., 2023), travel and hospitality (Swain et al., 2024), and marketing (Chopra et al., 2023).

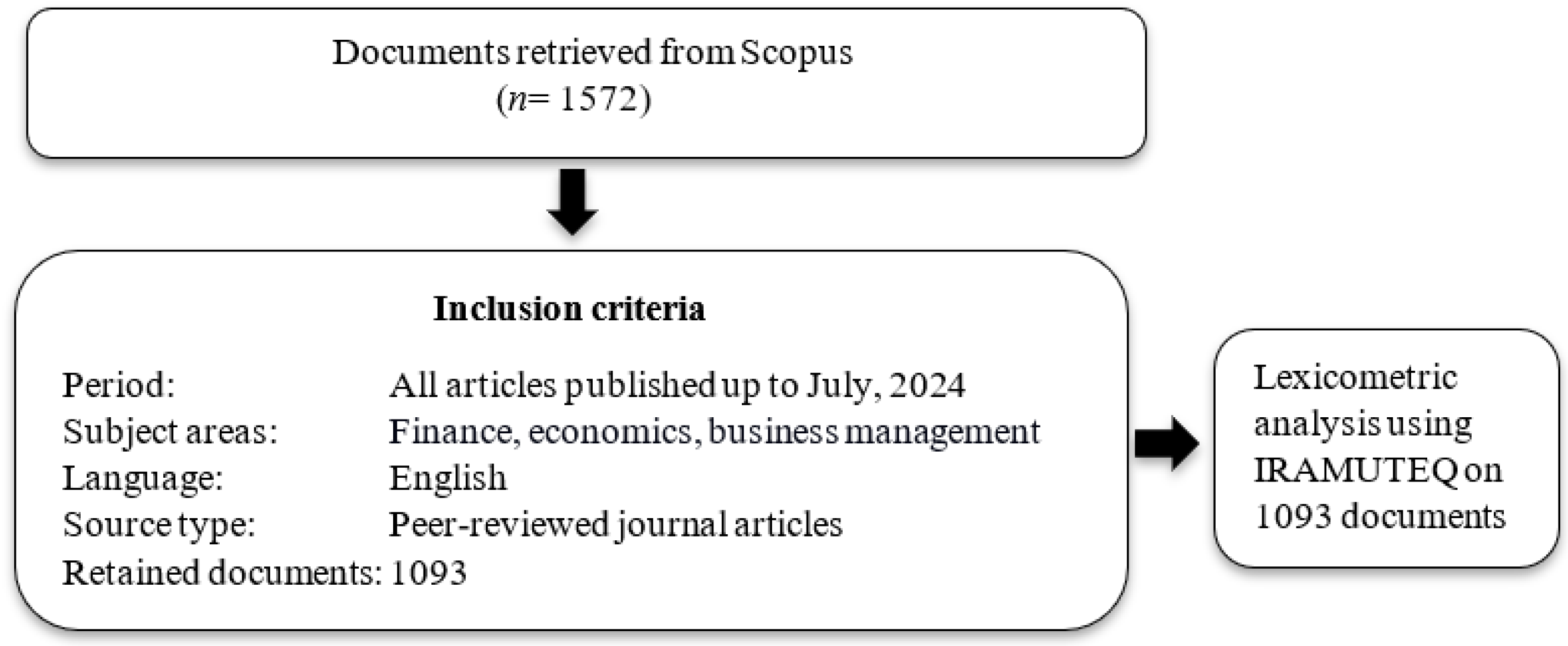

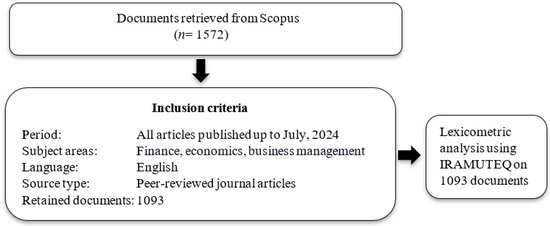

2.1. Database, Keywords, Inclusion/Exclusion Criteria and Data Extraction

To identify the literature relevant to this study, we searched the Scopus database, which provides a comprehensive collection of scholarly resources across various academic disciplines, including the sciences, humanities, and business and finance. Scopus is the largest abstract and citation database for the quality of content included in it (Schotten et al., 2017). The article search strategy is presented in Figure 1 below. The article search was conducted up to July 2024. We used search terms such as “short sell”, “short-selling”, and “shortselling” and Boolean operators to capture relevant literature on short-selling. The search resulted in the retrieval of 1572 documents after eliminating duplicates.

Figure 1.

Data retrieval and analysis process.

The source type was limited to peer-reviewed journal articles that aim to make key contributions to the literature, whereas book chapters are more explanatory and thus have been excluded from the study, as recommended by Paul et al. (2021). By limiting the source type to peer-reviewed journal articles, we ensured that the studies met high academic standards and contributed meaningfully to the field (Büyüközkan et al., 2024; Limbu & Huhmann, 2024). The subject areas encompassed in this study include Finance, Economics, and Business Management. Including multiple relevant subject areas allows for a more comprehensive interrogation of the research area.

Consistent with prior practice in review articles (e.g., Büyüközkan et al., 2024; Limbu & Huhmann, 2024), inclusion criteria were used to screen the identified articles and isolate only those relevant to the current study’s research objectives. Only documents written in English were included, as English is the primary language used in academic publishing for fields such as finance, economics, and business management. This criterion also helps minimize any complexities or time required for translation (Neimann Rasmussen & Montgomery, 2018).

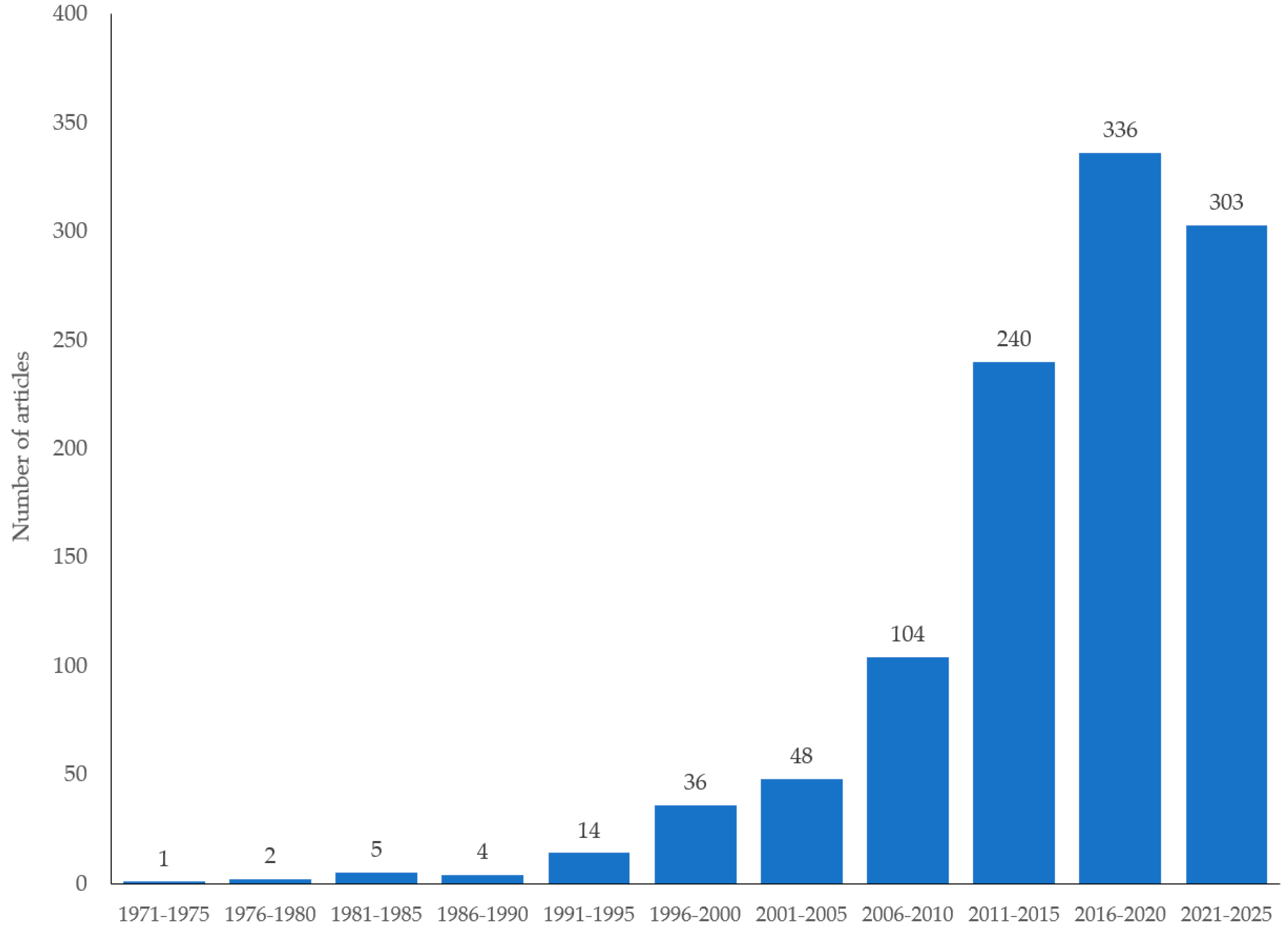

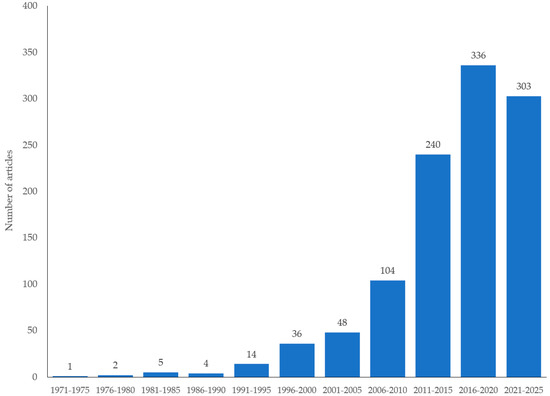

Filtration using these inclusion criteria narrowed the number of relevant articles down to 1093 for further analysis. The first article in our sample was published in 1971 (Lintner, 1971). Although this was the only article in the period from 1971 to 1975, the number of articles published on short-selling has been growing over time (see Figure 2). This topic saw a burst of strong interest following the 2007–2009 Global Financial Crisis and the subsequent introduction of additional regulations related to short-selling (e.g., Beber & Pagano, 2013; Bernal et al., 2014; Daniel & Lhabitant, 2012; Patel & Guidi, 2024).

Figure 2.

Number of articles published on short-selling by year of publication.

2.2. Analysis Process

For the 1093 articles in our sample, we gathered the titles, authors, publications, abstracts, and keywords. This collection allowed us to conduct a Lexicometric analysis using IRAMUTEQ. IRAMUTEQ provides a good software option for conducting analysis on a large corpus of textual data (Lahlou, 2001). We followed the steps outlined by Gourlay (2019): (a) structuring the file, (b) naming the variables, (c) creating the data input files, and (d) cleaning the data. Data cleaning involves standardizing variants of word usage in a corpus to a single form, such as spelling (e.g., standardize spelling of “color” and “colour” or “formalize” and “formalise”), sometimes hyphenated words (e.g., “short sale” and “short-sale”), and numbers (e.g., 19 and “nineteen”). Then, the data was imported into IRAMUTEQ for analysis. To cluster the data, descending hierarchical classification (DHC) was performed to ensure that the clusters formed were meaningful and significant. The DHC process begins by dividing the text corpus into smaller segments to analyze word frequencies and identify similar vocabularies. This clustering is refined using the chi-square test to determine the statistically significant associations between words and a cluster, enhancing the reliability of the results. As a result, the DHC algorithm further splits the clusters into sub-clusters, helping researchers to identify key themes and topics that are representative of the corpus of data. It is particularly useful for exploratory analysis, as it helps uncover hidden patterns to detect themes within the data.

Next, a similarity analysis was performed alongside DHC to explore relationships and patterns within the data by examining co-occurrence and proximity. This helps in understanding the connections between different clusters. Similarity analysis is a multivariate method that represents the entire corpus of textual data based on the interdependence of words (Chaney & Séraphin, 2023). The similarity analysis provides a visual representation of the relationships between words and the overall structure of the corpus of textual data. This dual approach of DHC and similarity analysis illustrates the interconnectedness between results, ensuring the reliability and validity of the findings, thereby enriching the overall analysis.

3. Data Analysis and Findings

3.1. Descriptive Statistics

First, descriptive statistics provide the number of texts, occurrences, forms, hapaxes, and the mean of occurrences. For this lexicometric analysis, each article is a text. An occurrence is a single instance of a specific linguistic unit. An occurrence can be a word, phrase (i.e., specific sequence of words), a lemma or a word’s base form (e.g., “sell”, “sale”, and “sold” all count as one lemma), or an N-gram, which is a sequence of n words. For example, N-grams include two-word bigrams (e.g., “stock market”) and three-word trigrams (e.g., “net operating income”). A hapax is a word that only occurs once within a corpus. A hapax may be a rare term or a context-dependent term. The number of hapaxes indicates the diversity of texts within a corpus. Descriptive analysis classifies occurrences into various forms. In contrast to the lemma, which is a word’s single base form, words can have multiple forms depending on how they are used, such as a word’s different verb tenses (e.g., “invest”, “invested”, or “investing”), number (i.e., singular or plural forms), person (i.e., first-person, second-person, or third-person forms), case (i.e., subject case such as “I” or “he”, object case such as “me” or “him”, and possessive case such as “my” or “his”), adjective and adverb degree (e.g., “small”, “smaller”, “smallest”), and voice (e.g., “take” and “taken” or “threw” and “thrown”).

Lemmas are divided into active forms and supplementary forms. Active forms are considered meaningful for analysis because they are distinct concepts that represent the primary semantic content (e.g., nouns, verbs, adjectives, and adverbs). Supplementary forms are typically grammatical connectors or function words (e.g., “the”, “a”, “is”, “and”, “of”, or “to”) and other common low-information lemmas. Supplementary forms tend to be high frequency words that do not meaningfully differentiate between classes. Eliminating supplementary forms in the statistical model produces more robust outcomes by reducing noise that obscures the underlying semantic structure.

The findings reveal that the corpus of relevant scholarly articles gathered for this lexicometric analysis includes 8546 occurrences and 1632 forms. The mean of occurrences by text is 9.30. Finally, the number of hapaxes (words appearing once within the entire corpus) is 863 (10.1% of occurrences and 52.9% of forms).

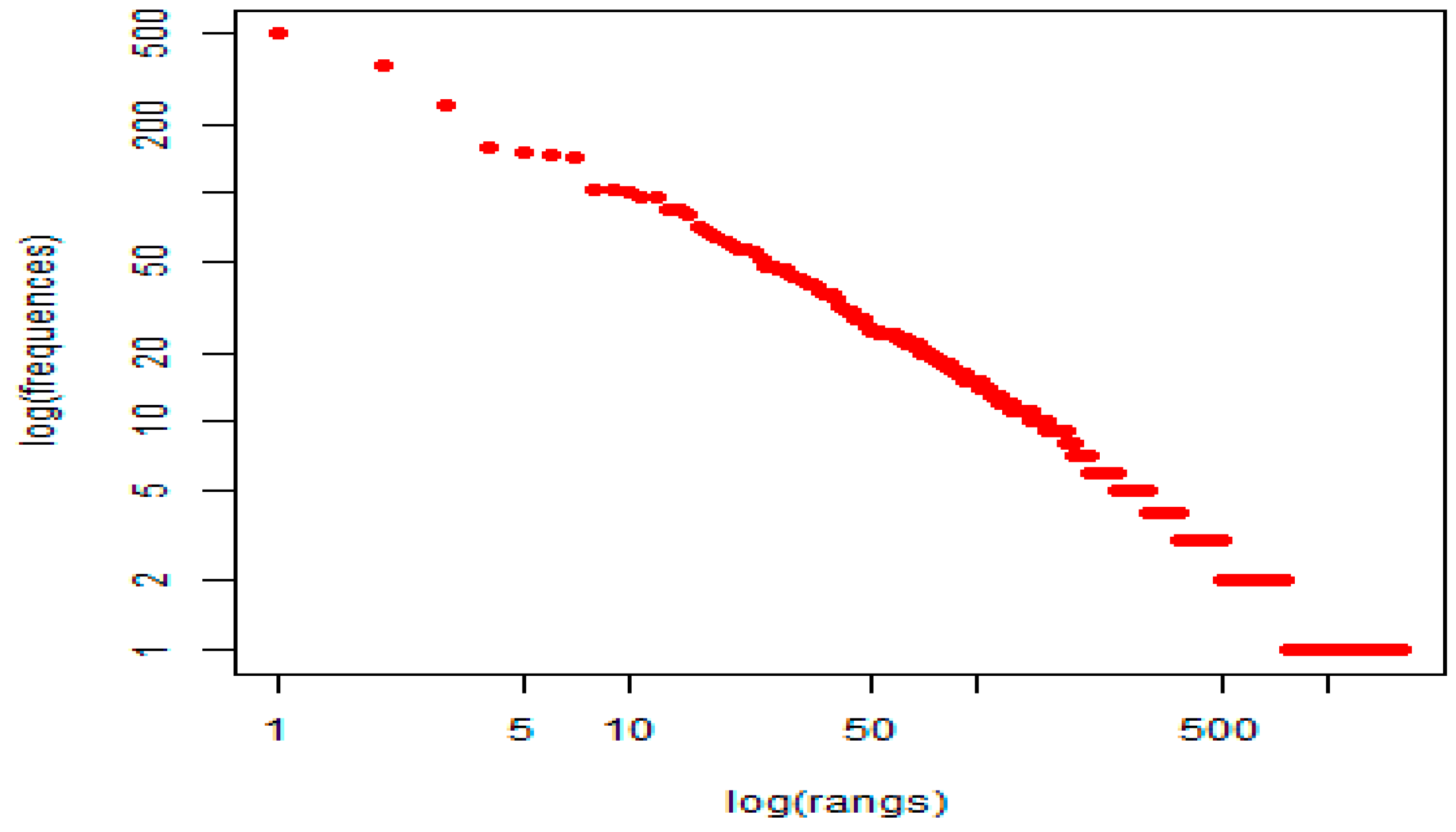

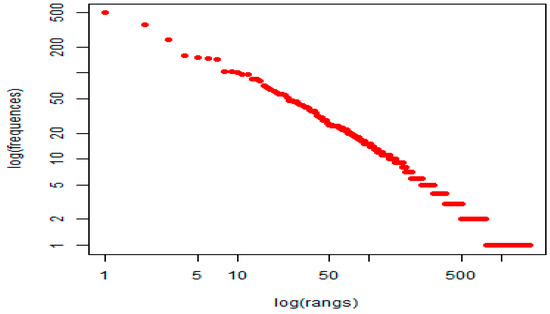

Figure 3 represents the Zipf diagram, which visualizes the frequency distribution of active forms or keywords within the corpus. The x-axis represents the keyword ranks based on frequency, whereas the y-axis shows the frequencies on a logarithmic scale. The downward slope of the plot indicates that a few keywords occur very often, whereas others are exceedingly rare. The long tail of the graph shows that many low-frequency keywords appear within the corpus, reflecting the texts’ linguistic diversity.

Figure 3.

Zipf diagram of the logarithmic forms of active forms in the corpus.

The most frequently appearing keywords are “short” (n = 494), “sell” (n = 354), “market” (n = 244), “trade” (n = 156), and “price” (n = 151). On the other hand, some keywords—such as “rationality” (n = 2), “inefficiency” (n = 2), “cryptocurrency” (n = 2), and “front-running” (n = 2 occurrences)—have very low frequency. This demonstrates the scarcity of research in the short-selling literature on topics related to these keywords.

3.2. Descending Hierarchical Classification

Table 1 represents a summary of our descending hierarchical classification (DHC). First, DHC analysis divided our entire text corpus into smaller, standardized units called text segments to create comparable units for statistical analysis. A total of 918 separate text segments were distinguished in our corpus. These text segments serve as the basis for the rest of the analysis. Next, DHC analysis resulted in 8546 occurrences across all text segments, out of which 1843 unique forms were identified. Before calculating the remaining statistics, IRAMUTEQ performs a lemmatization process, which reduces each form to its base lemma. A total of 1632 lemmas were identified. Thus, occurrences is the total count including duplicates, and forms is the raw frequency after combining duplicates, but the lemma count represents the number of distinct concepts.

Table 1.

Summary of Descending Hierarchical Classification (DHC).

Mean forms by segment was 9.309. This implies that each segment includes approximately 9 different words. Such a result is neither too scattered nor extremely dense, which indicates a moderately dense textual composition for our corpus. Finally, a total of 480 active forms with a frequency ≥ 3 appear in our corpus.

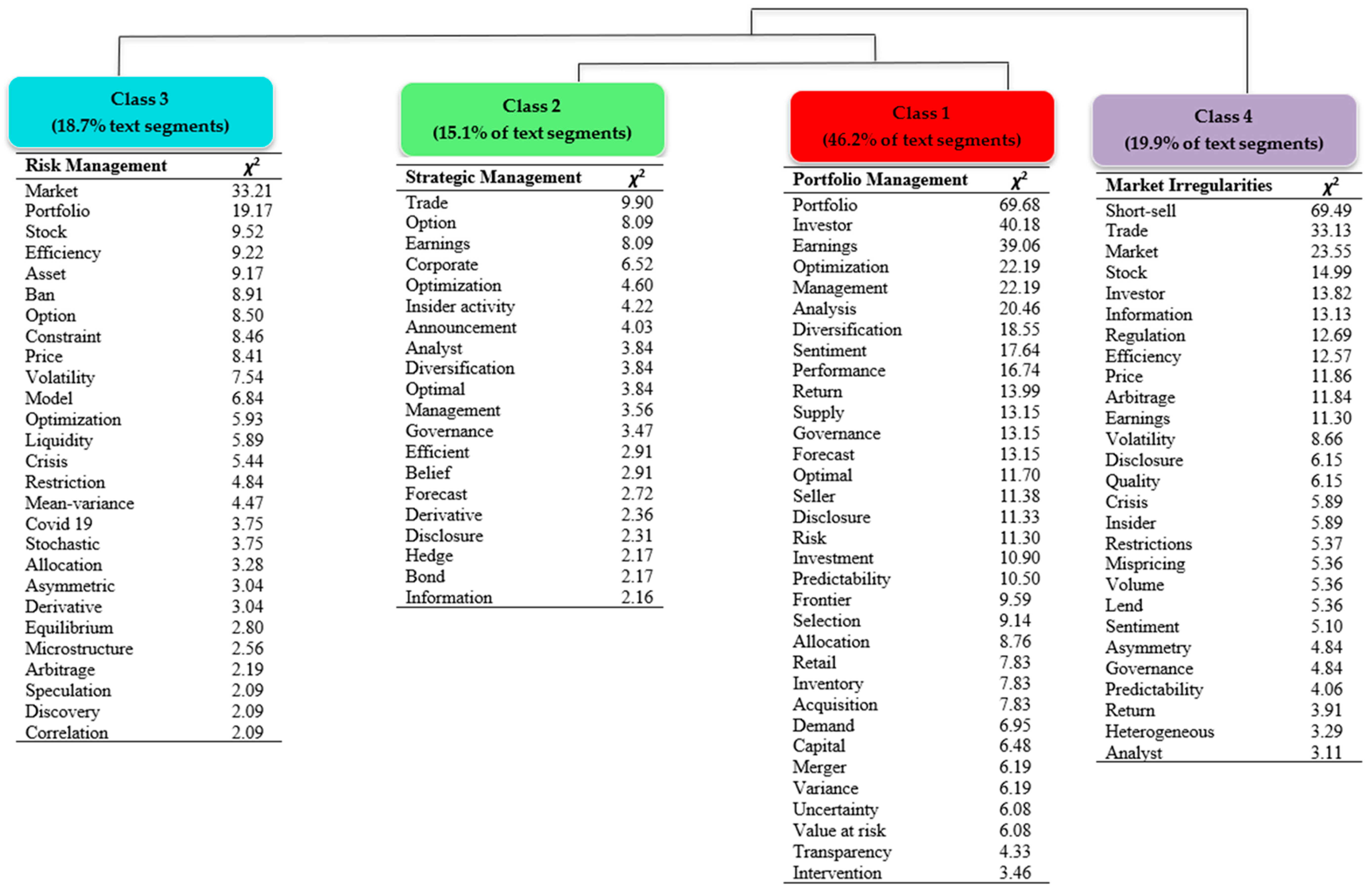

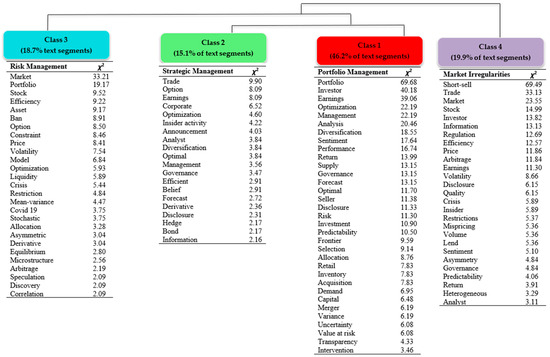

The DHC process hierarchically groups text segments into classes based on their shared vocabulary and the statistical association between occurrences and patterns of co-occurrence. A chi-square (χ2) test measures the associative strength between an occurrence and its class. Words that are highly characteristic of a particular class will have high chi-square values. For example, “portfolio” (χ2 = 69.68) is the most representative keyword for Class 1. Because Figure 4 only lists keywords with statistically significant χ2 values, the probability of their association with a particular class is highly likely not to be random. Thus, the keywords listed for a class should meaningfully define its thematic content.

Figure 4.

Dendrogram of thematic classes with characteristic keywords.

Then, divisive hierarchical clustering starts with the entire corpus and successively divides it into smaller, more homogeneous classes. This process revealed four classes or main groups of relationships within our corpus. Classes represent unique shared vocabularies within text segments based on the co-occurrence of keywords. Figure 4 visualizes the hierarchy of these classes in the form of a dendrogram (also known as a tree diagram). The leaves of the dendrogram represent the final most homogenous classes. The outermost leaves represent the most distinct classes identified by the analysis. The size of the leaves and the percentage labels on the leaves indicate the proportion of text segments falling within that class.

The branches of the dendrogram show the progressive division of the corpus. Starting from the initial primary division, each subsequent division splits the occurrences into a more specific, smaller classes until statistical stability is attained. This clustering process represents the broader concept of short-selling research, breaking down into more specific clusters of text segments within each class. The length of a branch between classes represents the degree of dissimilarity between those classes. As shown in Figure 4, Classes 1 and 2 are less dissimilar, whereas Class 4 is most dissimilar from the other classes in our corpus.

For each class, IRAMUTEQ provides a list of active forms (i.e., keywords) that are most characteristic of that class (p ≤ 0.0001) ordered by their chi-square value. These are the keywords that strongly differentiate one class from others and aid the interpretation of the theme or semantic content of that class. Whereas DHC groups text segments into classes based on their shared vocabulary, we chose the theme for each class based on our qualitative interpretation of the common topic of the text segments within that class informed by the keywords within that class. The names of the themes chosen to best represent the nature of the content of the text segments within a class appear above the keyword list for that class in Figure 4. Thus, these themes help define the different conceptual domains of these statistically derived classes.

Examining the most significant keywords for Class 1 Portfolio Management (376 out of 813 segments; 46.25%) reveals that text segments clustered within this class center around prominent keywords such as “portfolio”, “performance”, and “allocation”, indicating a primary focus of the short-selling literature on strategies for diversification and investment management. Diversification strategies are often adopted to reduce the volatility and standard deviation resulting in improved risk-adjusted returns (Switzer & Tahaoglu, 2015). Other key terms such as “uncertainty”, “predictability”, “variance”, and “value at risk” suggest discussions pertain to trading practices in the short-selling literature. Collectively, this clustering indicates that almost half of the short-selling literature revolves around the portfolio management strategies of investors to improve risk management and returns.

Class 2 Strategic Management (123 out of 813 segments; 15.13%), focuses on corporate decisions and market instruments. Many keywords relate to corporate activities, such as “earnings”, “announcement”, and “disclosure”. This class also lists investment instruments such as “options”, “hedge”, “bonds” and other concepts such as “diversification”, “governance” and “optimization” reflect investors’ strategic approaches to corporate actions and market movements. Overall, the literature that falls within Class 2 critically analyzes investor strategies and market interactions in the context of various macroeconomic conditions.

Class 3 Risk Management consists of 152 out of 813 text segments (18.7%). Class 3 primarily focuses on risk analytics and market theories. The short-selling literature that falls within this class delves into forecasting and analysis to shape market expectations. Predominant presence of quantitative finance and risk mitigation techniques such as, “optimization”, “mean variance”, and “stochastic” indicate a focus on optimizing strategies to minimize risk and enhance returns. It mostly emphasizes the broader market implications of regulatory and informational factors for financial modeling and risk assessment.

Finally, Class 4 Market Irregularities (162 out of 813 segments; 19.93%) revolves around the market inefficiencies and speculative behavior. The major focus of this class is on market conditions (“quality”, “volatility”, “heterogenous”, “earnings”), data availability (“information”, “price”, “predictability”), and market constraints (“short-sell”, “restrictions”, “sentiment”). Market conditions have an impact on the enabling or constraining of speculative behavior. This behavior becomes more common especially during financial stress or market disruptions.

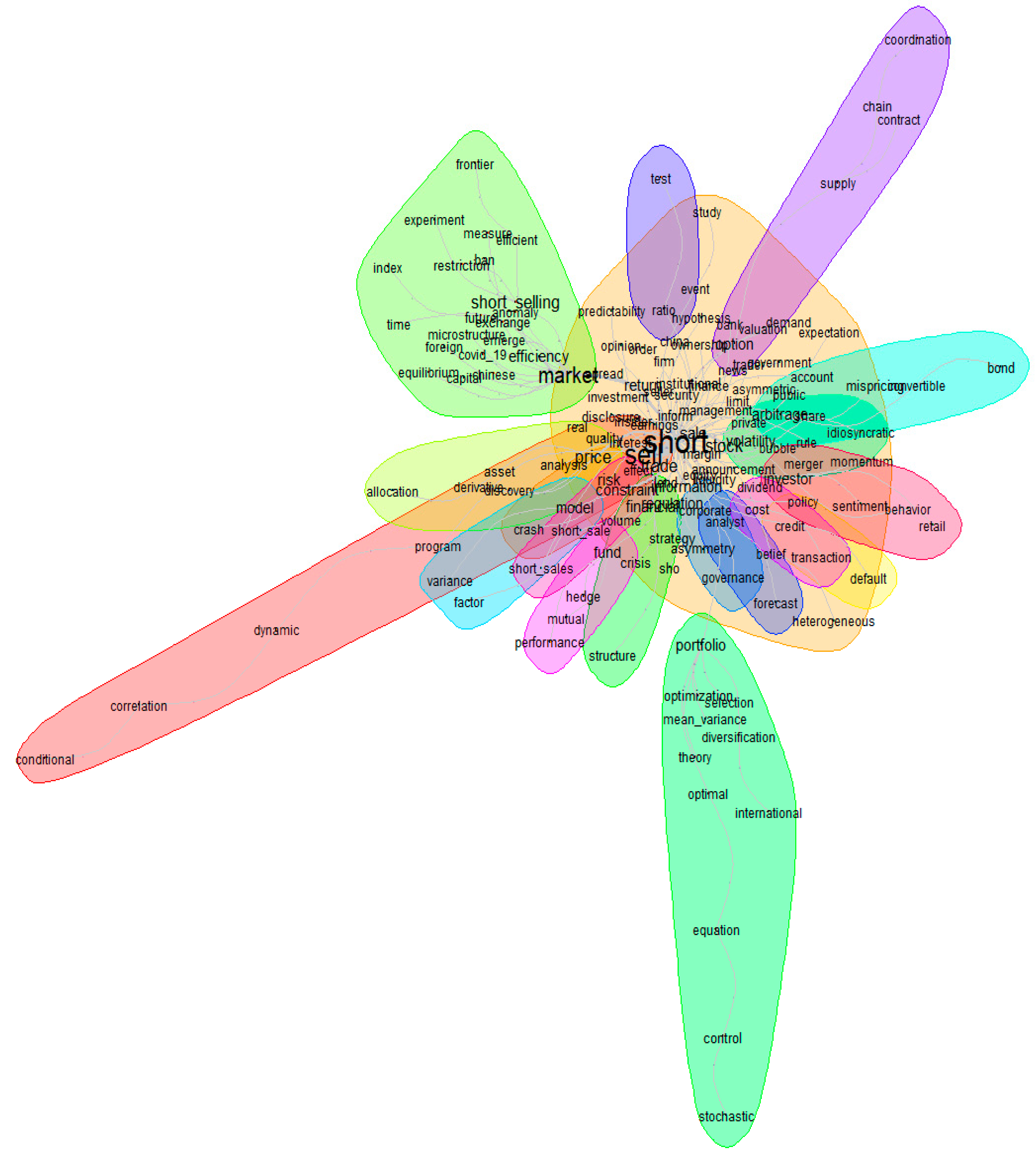

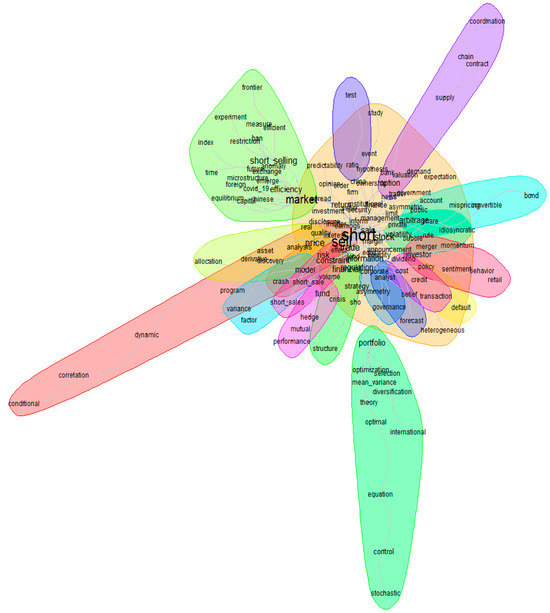

3.3. Similarity Analysis

In addition, we performed a similarity analysis (see Figure 5) to identify the major topics covered in the corpus of short-selling literature. Closer terms in the figure represent frequently associated words, which reflects a conceptual linkage between them. The thickness and shortness of the lines indicate the connection strength between words based on their co-occurrence. The blobs or different colored groups of concepts are the semantic communities formed of strongly interconnected words. While this similarity analysis indicates that many distinct conceptual groups appear strongly connected with relatively short lines connecting them, there are a few groups of active forms or keywords that are less integrated with the rest of the short-selling literature.

Figure 5.

Similarity analysis.

From the similarity analysis, it is evident that the literature primarily focuses on the influence of short-selling on market dynamics, including price discovery, market volatility, and liquidity. This is highlighted in studies (e.g., Allen et al., 2021; Blau et al., 2023; Ho et al., 2022) that debate whether short-selling contributes to market efficiency or not. Conceptual groups related to the behavioral aspects of short-selling as well as the impact of technological advancements and regulatory frameworks on short-selling are also evident in the similarity analysis. Furthermore, the literature appears to have explored portfolio optimization through short-selling, emphasizing strategies like diversification and asset allocation. For example, Switzer and Tahaoglu (2015) show how a diversified portfolio improves risk-adjusted-returns, whereas Dhingra et al. (2023) show how the inclusion of short-selling in portfolio diversification contributes to better asset allocation, reduces risk exposure, and increases overall optimized returns.

The similarity analysis also shows how the short-selling literature has examined behavior and sentiments in the context of informed market participants, specifically short-sellers. For example, the literature has found that their decisions influence market efficiency (French et al., 2012) as they make market prices more transparent and help in the actual price discovery of assets (Bianchi & Drew, 2012). The portion of the short-selling literature that addresses the impact of behavior on decisions indicates that market uncertainty and negative investor sentiments influence stock prices, which in turn affects overall market returns.

An additional portion of the short-selling literature involves understanding regulatory and governance issues surrounding short-selling and its implications for effective governance to eradicate its associated risks. This part of the literature has focused on insider trading and market manipulation as darker aspects of short-selling, where robust corporate governance is vital.

4. Discussion and Implications

This review applies lexicometric analysis tools to reveal the structure of the existing literature on short-selling and to offer valuable insights into its various aspects, including behavioral dynamics, market interactions, corporate governance, and regulatory considerations. We find that the literature comprehensively examines the mechanics and implications of short-selling within financial markets.

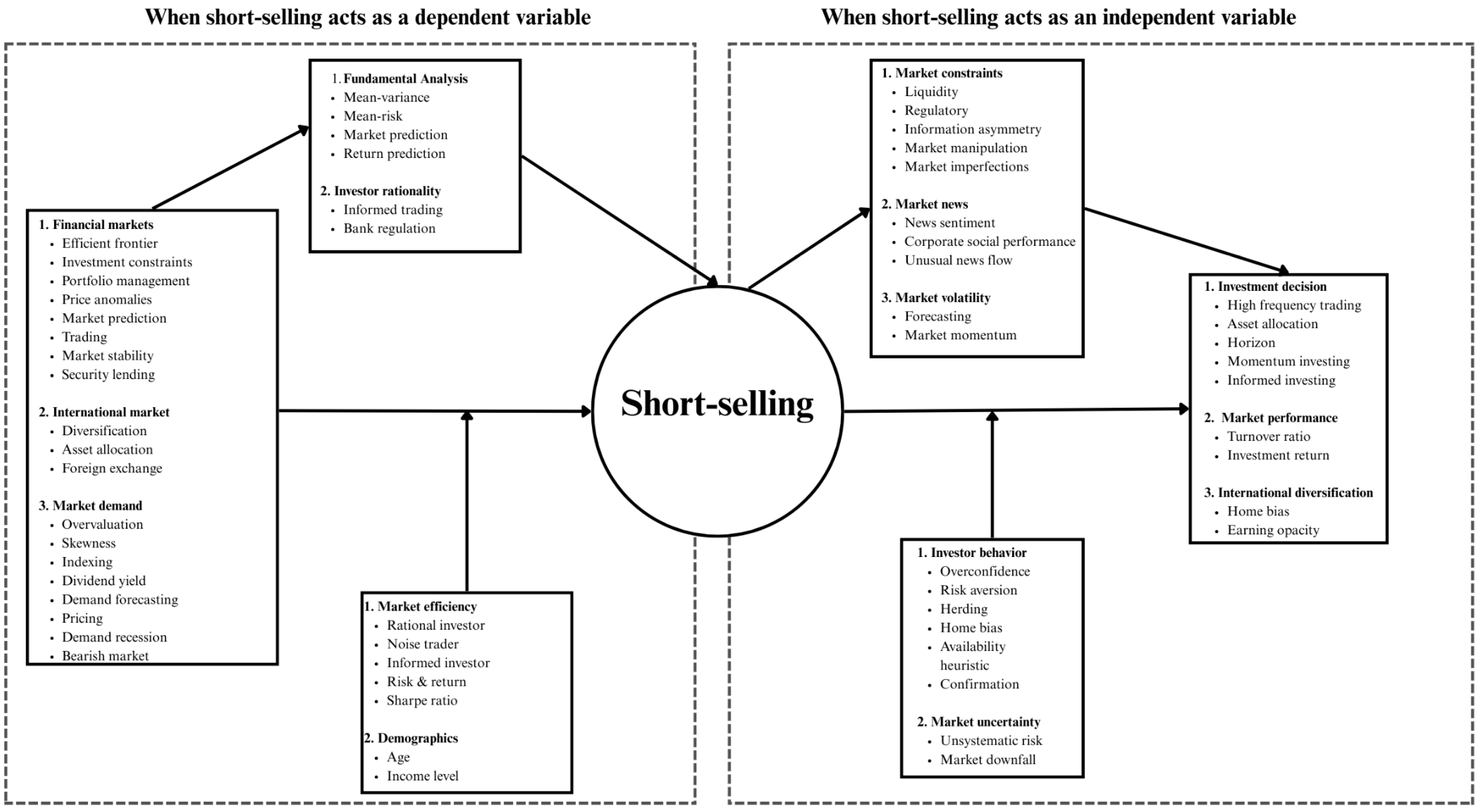

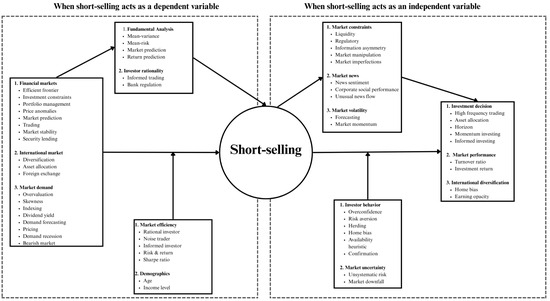

4.1. Conceptual Framework of the Drivers and Outcomes of Short-Selling

We develop a dual-role conceptual framework to explain how short sales function as both a dependent and independent variable in short-selling research. This conceptual framework is based on the results of this lexicometric analysis, our reading of the sampled articles, and our expertise in this area. This framework synthesizes our interpretation of the study results with the existing short-selling literature to help readers better visualize relationships in the research on this topic. This framework integrates the antecedents, mediators, moderators, and consequences of short-selling reported in the literature. Figure 6 illustrates these drivers and outcomes of short-selling as well as the previously investigated mediators and moderators of those relationships. This framework serves as a basis for a more comprehensive understanding of short-selling upon which future studies can expand. It provides a structured method to grasp the state of current research and to further investigate these dynamics to advance the field of financial market research.

Figure 6.

Conceptual framework of short-selling.

4.1.1. Drivers of Short-Selling

The first segment of the conceptual framework in Figure 6 lists the drivers or antecedents of short-selling, wherein it acts as the dependent variable. Financial markets, as well as international markets, have been shown to play a crucial role in short-selling activities. Financial market concepts (e.g., efficient frontier or investment constraints) reflect the broader mechanism of capital markets determining the viability of short-selling. The influence of international market aspects, such as diversification and asset allocation, have been investigated to assess how global structural changes affect short-selling decisions. Additionally, antecedents related to market demand have been shown to stimulate traders to initiate short-selling positions. The relationship between the drivers and short-selling has been shown to be mediated by fundamental analysis as well as the rationality of investors.

4.1.2. Outcomes of Short-Selling

The second segment of our conceptual framework summarizes the literature in which short-selling has been considered an influencing factor on various outcomes. The impact of short-selling on investment decisions has investigated changes in asset allocation, informed decision-making, and other factors. The performance matrix of portfolios and overall investment returns have also been shown to be important aspects affected by short-selling. Additionally, global portfolio choices in terms of earning opacity and home bias have been shown to be influenced by short-selling. These relationships have been shown to be mediated by market constraints, such as liquidity and market manipulation. Simultaneously, market news has been found to mediate short-selling’s impact on market outcomes.

4.1.3. Moderators

Next, the literature has identified conditional factors, also known as moderators, which can influence or alter the strength or direction of the relationship between antecedents and short-selling as well as between short-selling and its outcomes. For example, as shown in Figure 6, when short-selling acts as the outcome variable, market efficiency and investor demographics factors have been shown to interact with the antecedents in determining their effect on short-selling behavior. On the other hand, when short-selling acts as an independent variable, it has been shown to interact with several variables related to investor behavior or market uncertainty in shaping market outcomes.

4.2. Practical Implications

The findings of our lexicometric analysis provide some practical implications for investors, financial advisors, policymakers, and other market participants. First, short-selling’s role in portfolio management is most closely linked to investors’ strategic decisions and management rather than to its role in risk management. But our study clearly shows a very distinctive use of short-selling in the context of market irregularities. Our findings also shed light on the interplay between market dynamics, market efficiency, price discovery, and behavioral factors that contribute to market volatility and investor decision-making in relation to short-selling. A notable example that clearly illustrates these dynamics is the GameStop (GME) short squeeze in 2021, which highlights the critical role of information disclosure. Institutional investors engaged in extensive short-selling based on fundamental analysis, while retail investors executed coordinated buying strategies fueled by discussions on social media (GameStop short squeeze, 2025). This event underscores how both individual and institutional investors can influence the market through their perceptions of risk, social sentiment, and overall market behavior.

While practitioners have had substantial discussion of the regulatory governance of short-selling and its role in portfolio optimization, the study contributes to helping industry professionals both design policy and form investment strategies through identifying interconnections between short-selling and other concepts and through the development of a framework based on the literature of the drivers and outcomes of short-selling. For instance, understanding that short-selling influences market sentiment should help policymakers improve their risk modeling strategies. Overall, by better understanding short-selling, both short sellers and other market participants (e.g., retail investors and fund managers) should be able to build more stable portfolios that are better prepared to navigate the challenges of financial markets and achieve investment goals.

4.3. Theoretical Implications

The current study also contributes to theoretical implications. It has advanced the scope of studying the entire domain of the short-selling literature by applying lexicometric techniques, which provide a broad perspective on the state of research, along with offering a foundation for developing future meta-analyses.

The main contribution of our lexicometric analysis is to provide an overall picture of the prior research on short-selling. In particular, our findings identify four key themes or research streams related to short-selling: short-selling’s role in portfolio management, short-selling as an investment strategy for market participants, its role in risk management, and how market irregularities relate to short-selling behavior. Examining the strength of the relationship between keywords and these research themes provides an indication of the depth of empirical investigations in these research streams that should provide future researchers with an understanding of which topics have received considerable research focus.

Alternatively, an examination of the least studied concepts in the literature according to our analysis should provide future researchers with ideas to expand the boundaries of the short-selling literature into emerging research topics, such as cryptocurrency or the role of front-running short-sellers.

However, our similarity analysis shows that despite a considerable number of studies of short-selling, the literature has remained coalesced around a set of closely related concepts. Little of the literature appears to have branched out to investigate more unique aspects of short-selling. Some notable exceptions involve studies in the short-selling literature looking at financial analytics or stochastic portfolio theory/stochastic portfolio optimization.

5. Limitations and Future Research

While this study is the first to examine the entire corpus of short-selling literature, it has some limitations that necessarily constrain its ability to provide additional insights. First, it relies on the corpus of the short-selling literature that was subjected to lexicometric analysis. As a result, the findings are valid only for the literature published to date. Future research may expand the themes of the short-selling literature or conceptual groups of studies.

Second, to control the quality and consistency of the studies used to form the corpus of the short-selling literature for our study, we selected for analysis only those studies published in peer-reviewed journals in English. Hence, we may have missed relevant studies that remain unpublished, appear in other types of outlets (e.g., conference papers), or that are published in a different language.

However, by analyzing a substantial body of literature on short-selling, our lexicometric study has identified knowledge gaps in current research that offer clear directions for future research. Thus, despite the wealth of literature on short-selling, considerable potential for future investigations still remains in this area. The major themes for future exploration identified through this review are as follows:

5.1. Short-Selling and Technological Advancements

Rapid advancement of financial technology requires an exploration of its impact on short-selling and decisions related to it. High-frequency trading (HFT), artificial intelligence (AI), blockchain/cryptocurrency, and algorithmic trading have fundamentally transformed the landscape of financial markets, enabling both bulk and automatic trading activities (Zhou & Kalev, 2019). Sophisticated traders, however, rely heavily on market information flows and timing, but their direct competition lies with these automatic trading activities, which have become a dominant force in the financial markets (Tong, 2015). In fact, HFT accounted for approximately 52% of total equity trading in the US equity market in 2018 (Zaharudin et al., 2022). Nonetheless, the impact of HFT, AI, blockchain innovations, cryptocurrency investments, and algorithmic trading on short-selling remains relatively uninvestigated, despite being imperative to understand. Also, investigating financial technology innovations related to short-selling strategies could improve risk management and enhance returns, making it a valuable area for research. Thus, we propose that future investigations should address the following research questions:

FRQ1:

How do algorithmic and high-frequency trading influence the efficiency of short-selling?

FRQ2:

What role do AI and other technological advancements in the financial market play in mitigating the risks associated with short-selling?

5.2. Long-Term Effect of Market Crises on Short-Selling

Market crises, specifically uncontrollable ones, play a vital role in market disruptions. During these crises, uncertainty and volatility increase, leading to a substantial decline in market liquidity. For example, the lack of liquidity resulted in poor market performance during the COVID-19 crash in March 2020, primarily due to investor sentiment and behavior. During this phase, several countries, including the UK, China, and India, imposed restrictions on short-selling activities in their financial markets (Otani, 2020). Similarly, during the Global Financial Crisis, countries such as the US, Denmark, and Switzerland also restricted short-selling for certain shares (Beber & Pagano, 2013). The literature needs to expand its discussions on the long-run impact of such short-selling restrictions during market anomalies on creating inefficiencies, mispricing, and momentum.

During market crises, greater uncertainty and volatility force investors to reconsider their strategies and create panic within the market. Such crises can disrupt market dynamics, influence investor behavior, affect market efficiency, and impact the regulatory environment, all of which can affect short-selling activities in both the short and long term. While there has been considerable research on the short-term impact of crises, the long-term implications remain an area with limited research. Understanding the aftermath of crises and how short-selling interacts with market dynamics can provide valuable insights into the long-term impacts of market disruptions. To explore this further, the following research questions are proposed:

FRQ3:

How do market crises affect short-selling activities in the long run?

FRQ4:

How do different sectors respond in the long run to the restrictions on short-selling imposed during market crises?

Further, this study identifies several other potential areas for future research. For example, our conceptual framework, which illustrates short-selling’s dual-role in the literature, should help in formulating investigations in the future by allowing researchers to see how their study fits into the antecedents and consequences of short-selling. This framework should also help them see which variables have previously been investigated or identify novel antecedents, consequences, explanatory variables, or boundary conditions to empirically test in future studies.

The influence of social media platforms and finance influencers on market manipulation, investor sentiment, and short-selling activities is another emerging topic that warrants deeper exploration. Finally, exploring the influence of informed market participants in addressing market indifference through the lens of short-selling is another promising research opportunity.

6. Conclusions

Short-selling is an important investment activity that has the potential to influence overall market price fluctuations. This study is one of the first reviews to cover the entire body of research on short-selling rather than focusing on specific aspects. By automatically identifying keywords, recurring themes, and trends within a corpus, lexicometric analysis as applied in the current study reduces potential researcher bias that may be present in a narrative review. In addition to identifying relationships and commonly appearing concepts within the short-selling literature, the current study isolates some relatively under-investigated areas in relation to short-selling, which opens a wide area for research to explore emerging topics within this domain. Further, the current study puts forward a conceptual framework of short-selling’s dual role based on our understanding of the existing literature and the findings from our lexicometric analysis. This framework provides an integrative perspective on short-selling by structuring it as both a driver and outcome of other variables, as indicated in our analysis. Thus, the current study lays the groundwork for future investigations into the domain of short-selling by outlining a future research agenda to address gaps in the extensive literature surrounding short-selling.

Author Contributions

Conceptualization, N.S. and S.M.; methodology, N.S.; formal analysis, N.S.; data curation, N.S.; writing—original draft preparation, N.S., B.A.H. and Y.B.L.; writing—review and editing, B.A.H. and Y.B.L.; visualization, N.S. and B.A.H.; supervision, S.M.; project administration, Y.B.L.; funding acquisition, B.A.H. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded by the Department of Marketing, Virginia Commonwealth University.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available upon request from the first author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abbes, M. B. (2013). Does overconfidence bias explain volatility during the global financial crisis? Transition Studies Review, 19, 291–312. [Google Scholar] [CrossRef]

- Alderighi, S., & Gurrola-Perez, P. (2020). What does academic research say about short-selling bans? Available online: https://ssrn.com/abstract=3775704 (accessed on 18 July 2025). [CrossRef]

- Allen, F., Haas, M. D., Nowak, E., & Tengulov, A. (2021). Market efficiency and limits to arbitrage: Evidence from the Volkswagen short squeeze. Journal of Financial Economics, 142(1), 166–194. [Google Scholar] [CrossRef]

- Apau, R., Jeke, L., Moores-Pitt, P., & Muzindutsi, P. F. (2022). The effect of performance. Innovations, 19(3), 203–214. [Google Scholar] [CrossRef]

- Beber, A., & Pagano, M. (2013). Short-selling bans around the world: Evidence from the 2007–09 crisis. The Journal of Finance, 68(1), 343–381. [Google Scholar] [CrossRef]

- Bernal, O., Herinck, A., & Szafarz, A. (2014). Which short-selling regulation is the least damaging to market efficiency? Evidence from Europe. International Review of Law and Economics, 37, 244–256. [Google Scholar] [CrossRef][Green Version]

- Bianchi, R. J., & Drew, M. E. (2012). A positive economics view of short-selling. Banks & Bank Systems, 7(2), 63–71. [Google Scholar]

- Blau, B. M., Cox, J. S., Griffith, T. G., & Voges, R. (2023). Daily short-selling around reverse stock splits. Journal of Financial Markets, 65, 100832. [Google Scholar] [CrossRef]

- Bouteska, A., & Regaieg, B. (2020). Psychology and behavioral finance: Anchoring bias by financial analysts on the Tunisian stock market. EuroMed Journal of Business, 15(1), 39–64. [Google Scholar] [CrossRef]

- Bris, A., Goetzmann, W. N., & Zhu, N. (2007). Efficiency and the bear: Short sales and markets around the world. The Journal of Finance, 62(3), 1029–1079. [Google Scholar] [CrossRef]

- Bushman, R., & Pinto, J. (2024). The influence of short-selling on negative press coverage of firms. Management Science, 70(3), 1924–1942. [Google Scholar] [CrossRef]

- Büyüközkan, G., Uztürk, D., & Ilıcak, Ö. (2024). Fermatean fuzzy sets and its extensions: A systematic literature review. Artificial Intelligence Review, 57(6), 138. [Google Scholar] [CrossRef]

- Chan, T. H., Saqib, A., & Lean, H. H. (2024). Asymmetric effects of investor sentiment on Malaysian sectoral stocks: A nonlinear autoregressive distributed lag approach. Asian Academy of Management Journal of Accounting and Finance, 20(1), 189–215. [Google Scholar] [CrossRef]

- Chaney, D., & Séraphin, H. (2023). A systematic literature review and lexicometric analysis on overtourism: Towards an ambidextrous perspective. Journal of Environmental Management, 347, 119123. [Google Scholar] [CrossRef] [PubMed]

- Chen, H. (2025). Do short sales reduce post-shock anomalies in stock prices? Evidence from the Chinese stock market. International Journal of Financial Studies, 13(1), 7. [Google Scholar] [CrossRef]

- Chen, Y., Da, Z., & Huang, D. (2019). Arbitrage trading: The long and the short of it. The Review of Financial Studies, 32(4), 1608–1646. [Google Scholar] [CrossRef]

- Chopra, I. P., Jebarajakirthy, C., Acharyya, M., Saha, R., Maseeh, H. I., & Nahar, S. (2023). A systematic literature review on network marketing: What do we know and where should we be heading? Industrial Marketing Management, 113, 180–201. [Google Scholar] [CrossRef]

- Cianciaruso, D., Marinovic, I., & Smith, K. (2023). Asymmetric disclosure, noise trade, and firm valuation. The Accounting Review, 98(5), 215–240. [Google Scholar] [CrossRef]

- Clapham, B., Haferkorn, M., & Zimmermann, K. (2023). The impact of high-frequency trading on modern securities markets: An analysis based on a technical interruption. Business & Information Systems Engineering, 65(1), 7–24. [Google Scholar] [CrossRef]

- Comerton-Forde, C., Do, B. H., Gray, P., & Manton, T. (2016). Assessing the information content of short-selling metrics using daily disclosures. Journal of Banking & Finance, 64, 188–204. [Google Scholar] [CrossRef]

- Daniel, J., & Lhabitant, F. S. (2012). New regulatory developments for short-selling in Asia: A review. In Handbook of short-selling (pp. 303–313). Academic Press. [Google Scholar] [CrossRef]

- Dhingra, V., Gupta, S. K., & Sharma, A. (2023). Norm constrained minimum variance portfolios with short-selling. Computational Management Science, 20(1), 6. [Google Scholar] [CrossRef]

- Duong, C., Pescetto, G., & Santamaria, D. (2014). How value–glamour investors use financial information: UK evidence of investors’ confirmation bias. The European Journal of Finance, 20(6), 524–549. [Google Scholar] [CrossRef]

- Ersan, O., Dalgıç, N., Ekinci, C. E., & Bodur, M. (2021). High-frequency trading and its impact on market liquidity: A review of literature. Alanya Akademik Bakış, 5(1), 345–368. [Google Scholar] [CrossRef]

- Fan, Y., & Gao, Y. (2024). Short-selling, informational efficiency, and extreme stock price adjustment. International Review of Economics & Finance, 89, 1009–1028. [Google Scholar] [CrossRef]

- Fattam, N., Saikouk, T., Hamdi, A., Win, A., & Badraoui, I. (2023). A new taxonomy of fourth-party logistics: A lexicometric-based classification. International Journal of Logistics Management, 34(6), 1649–1674. [Google Scholar] [CrossRef]

- Figlewski, S., & Webb, G. P. (1993). Options, short sales, and market completeness. Journal of Finance, 48, 761–777. [Google Scholar] [CrossRef]

- Financial Industry Regulation Authority. (2023). Monthly short sale volume files. FINRA. Available online: https://www.finra.org/finra-data/browse-catalog/short-sale-volume-data/monthly-short-sale-volume-files (accessed on 18 July 2025).

- French, D. W., Lynch, A. A., & Yan, X. (2012). Are short sellers informed? Evidence from REITs. Financial Review, 47(1), 145–170. [Google Scholar] [CrossRef]

- Galariotis, E., Li, B., & Chai, D. (2019). Down but not out: Plenty of returns available for shorted down stocks. International Review of Financial Analysis, 63, 296–306. [Google Scholar] [CrossRef]

- GameStop short squeeze. (2025, February 7). Wikipedia. Available online: https://en.wikipedia.org/wiki/GameStop_short_squeeze (accessed on 27 May 2025).

- Gourlay, S. (2019, March 19). Preparing IRaMuTeQ input files. IRaMuTeQ. Available online: http://www.iramuteq.org/documentation/fichiers/preparing-iramuteq-input-files (accessed on 27 May 2025).

- Hafner, R., & Wallmeier, M. (2008). Optimal investments in volatility. Financial Markets and Portfolio Management, 22, 147–167. [Google Scholar] [CrossRef][Green Version]

- Ho, G. K. F., Treepongkaruna, S., Wee, M., & Padungsaksawasdi, C. (2022). The effect of short-selling on volatility and jumps. Australian Journal of Management, 47(1), 34–52. [Google Scholar] [CrossRef]

- Jank, S., Roling, C., & Smajlbegovic, E. (2021). Flying under the radar: The effects of short-sale disclosure rules on investor behavior and stock prices. Journal of Financial Economics, 139(1), 209–233. [Google Scholar] [CrossRef]

- Jiang, H., Habib, A., & Hasan, M. M. (2022). Short-selling: A review of the literature and implications for future research. European Accounting Review, 31(1), 1–31. [Google Scholar] [CrossRef]

- Jiang, Z., Liu, B., Schrowang, A., & Xu, W. (2024). Short Squeezes. Financial Analysts Journal, 80(2), 152–173. [Google Scholar] [CrossRef]

- Khan, M. S. R. (2024). Short-sale constraints and stock returns: A systematic review. Journal of Capital Markets Studies, 8(1), 43–66. [Google Scholar] [CrossRef]

- Lahlou, S. (2001). Text mining methods: An answer to Chartier and Meunier. Papers on Social Representations, 20(38), 1–7. [Google Scholar]

- Li, K., Sarkar, A., & Wang, Z. (2003). Diversification benefits of emerging markets subject to portfolio constraints. Journal of Empirical Finance, 10(1–2), 57–80. [Google Scholar] [CrossRef]

- Limbu, Y. B., & Huhmann, B. A. (2024). Message effectiveness of fear appeals in vaccination communication campaigns: A systematic review. Vaccines, 12(6), 653. [Google Scholar] [CrossRef] [PubMed]

- Lintner, J. (1971). The effect of short selling and margin requirements in perfect capital markets. Journal of Financial and Quantitative Analysis, 6(5), 1173–1195. [Google Scholar] [CrossRef]

- Liu, L., Luo, D., & Zhao, N. (2019). Short-selling activity and return predictability: Evidence from the Chinese stock market. Emerging Markets Finance and Trade, 56(14), 3445–3467. [Google Scholar] [CrossRef]

- Mandják, T., Lavissière, A., Hofmann, J., Bouchery, Y., Lavissière, M. C., Faury, O., & Sohier, R. (2019). Port marketing from a multidisciplinary perspective: A systematic literature review and lexicometric analysis. Transport Policy, 84, 50–72. [Google Scholar] [CrossRef]

- Moffett, C. M., Brooks, R., & Jeon, J. Q. (2012). The efficacy of Regulation SHO in resolving naked shorts. Journal of Financial Regulation & Compliance, 20(1), 72–98. [Google Scholar]

- Möllers, T. M. (2020). Market manipulation through short-selling attacks and misleading financial analyses. The International Lawyer, 53(1), 91–126. Available online: https://www.jstor.org/stable/27009680 (accessed on 27 May 2025).

- Neimann Rasmussen, L., & Montgomery, P. (2018). The prevalence of and factors associated with inclusion of non-English language studies in Campbell systematic reviews: A survey and meta-epidemiological study. Systematic Reviews, 7, 129. [Google Scholar] [CrossRef] [PubMed]

- Otani, A. (2020). Circuit breaker halts trading. The Wall Street Journal, B12. [Google Scholar]

- Patel, H., & Guidi, F. (2024). The effect of the 2008–2009 short-selling sales ban on UK security equities in relation to market metrics of volatility, liquidity, and price discovery. Research in International Business and Finance, 70, 102316. [Google Scholar] [CrossRef]

- Paul, J., Lim, W. M., O’Cass, A., Hao, A. W., & Bresciani, S. (2021). Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). International Journal of Consumer Studies, 45(4), O1–O16. [Google Scholar] [CrossRef]

- Ratinaud, P. (2014). IRaMuTeQ: Interface de R pour les analyses multidimensionnelles de textes et de questionnaires (Version 0.7 alpha 2). Available online: http://www.iramuteq.org (accessed on 8 January 2024).

- Reinert, M. (1990). Alceste une méthodologie d’analyse des données textuelles et une application: Aurelia De Gerard De Nerval. Bulletin of Sociological Methodology/Bulletin de Méthodologie Sociologique, 26(1), 24–54. [Google Scholar] [CrossRef]

- Schotten, M., El Aisati, M., Meester, W. J., Steiginga, S., & Ross, C. A. (2017). A brief history of Scopus: The world’s largest abstract and citation database of scientific literature. In Research Analytics (pp. 31–58). CRC Press. [Google Scholar] [CrossRef]

- Spyrou, S. (2013). Herding in financial markets: A review of the literature. Review of Behavioral Finance, 5(2), 175–194. [Google Scholar] [CrossRef]

- Swain, S., Jebarajakirthy, C., Sharma, B. K., Maseeh, H. I., Agrawal, A., Shah, J., & Saha, R. (2024). Place branding: A systematic literature review and future research agenda. Journal of Travel Research, 63(3), 535–564. [Google Scholar] [CrossRef]

- Switzer, L. N., & Tahaoglu, C. (2015). The benefits of international diversification: Market development, corporate governance, market cap, and structural change effects. International Review of Financial Analysis, 42, 76–97. [Google Scholar] [CrossRef]

- Tong, L. (2015). A blessing or a curse? The impact of high frequency trading on institutional investors. In European finance association annual meetings (pp. 1–51). S&P Global Market Intelligence. [Google Scholar] [CrossRef][Green Version]

- Wang, S., & Zhang, D. (2020). Short-selling restrictions and firms’ environment responsibility. Research in International Business and Finance, 54, 101295. [Google Scholar] [CrossRef]

- Watson, E., & Funck, M. C. (2012). A cloudy day in the market: Short-selling behavioural bias or trading strategy. International Journal of Managerial Finance, 8(3), 238–255. [Google Scholar] [CrossRef]

- Weller, B. M. (2018). Does algorithmic trading reduce information acquisition? The Review of Financial Studies, 31(6), 2184–2226. [Google Scholar] [CrossRef]

- Yagi, I., Mizuta, T., & Izumi, K. (2010). A study on the effectiveness of short-selling regulation using artificial markets. Evolutionary and Institutional Economics Review, 7, 113–132. [Google Scholar] [CrossRef]

- Zaharudin, K. Z., Young, M. R., & Hsu, W. H. (2022). High-frequency trading: Definition, implications, and controversies. Journal of Economic Surveys, 36(1), 75–107. [Google Scholar] [CrossRef]

- Zhou, H., & Kalev, P. S. (2019). Algorithmic and high frequency trading in Asia-Pacific, now and the future. Pacific-Basin Finance Journal, 53, 186–207. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).