An Exploration of Overconfidence and the Disposition Effect in the Stock Market

Abstract

1. Introduction

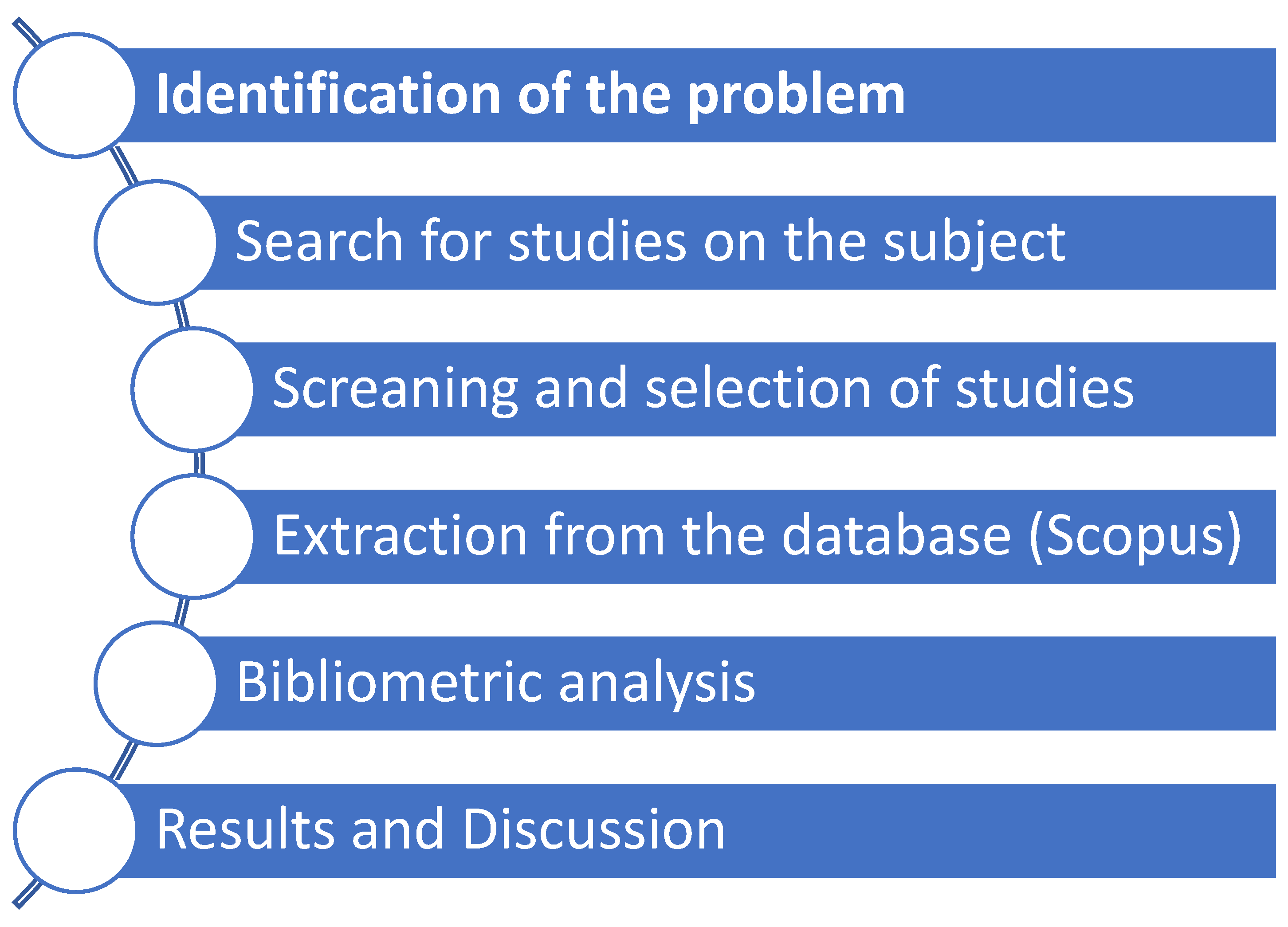

2. Research Methodology

3. Results

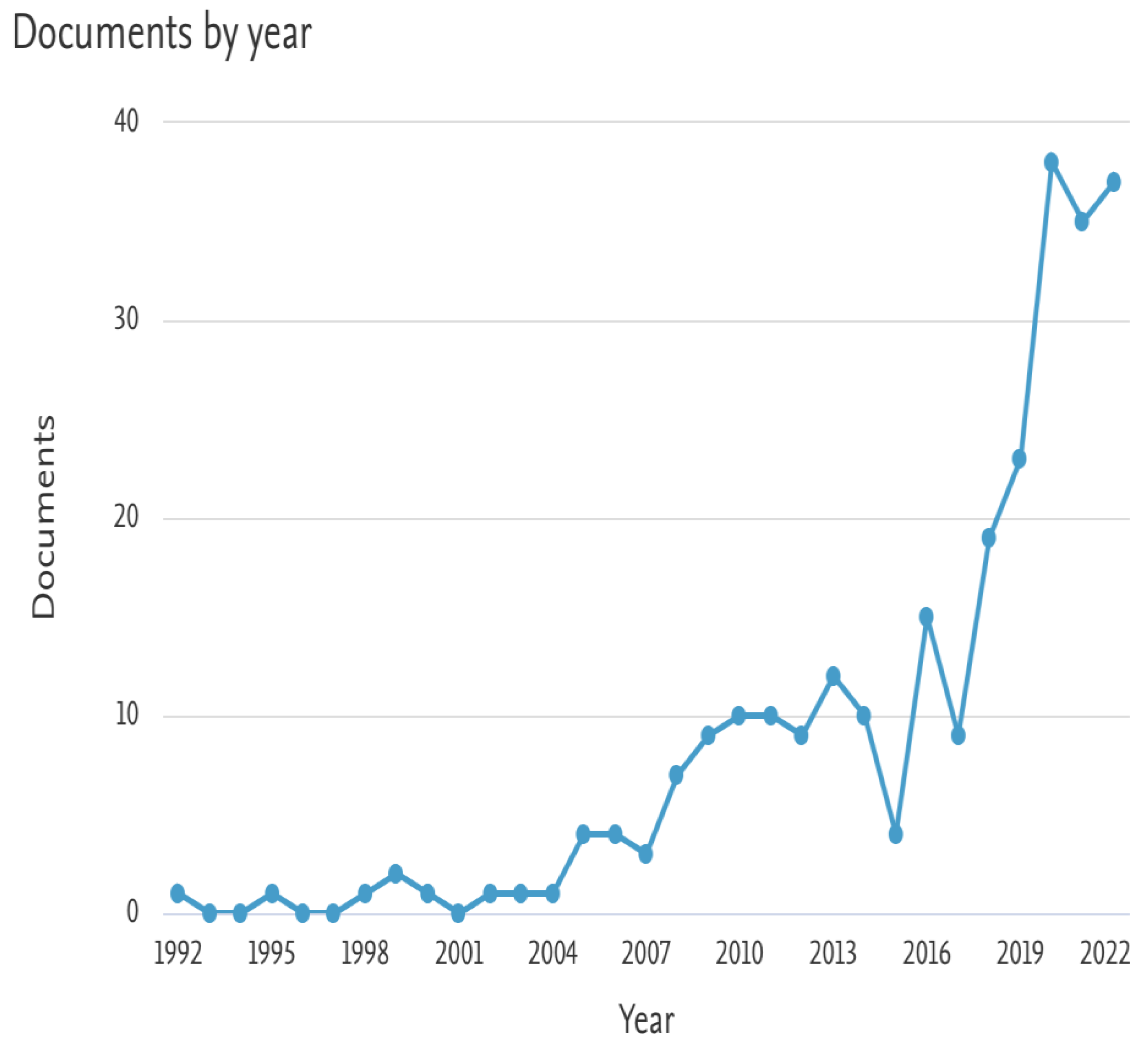

3.1. Current Status of the Field

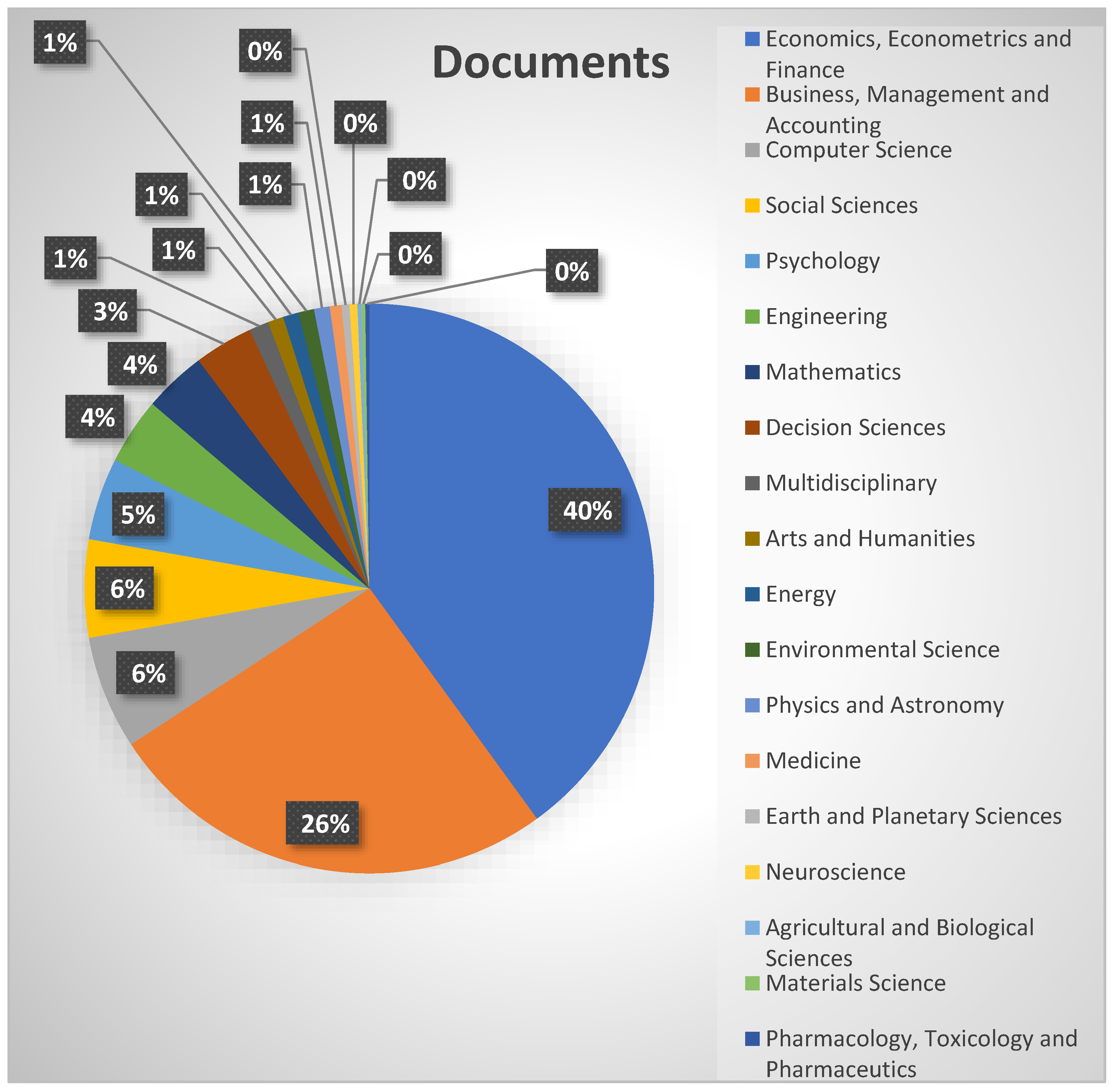

3.2. Documents by Subject Area

3.3. Scientific Production by Country

3.4. Most Relevant Contributions

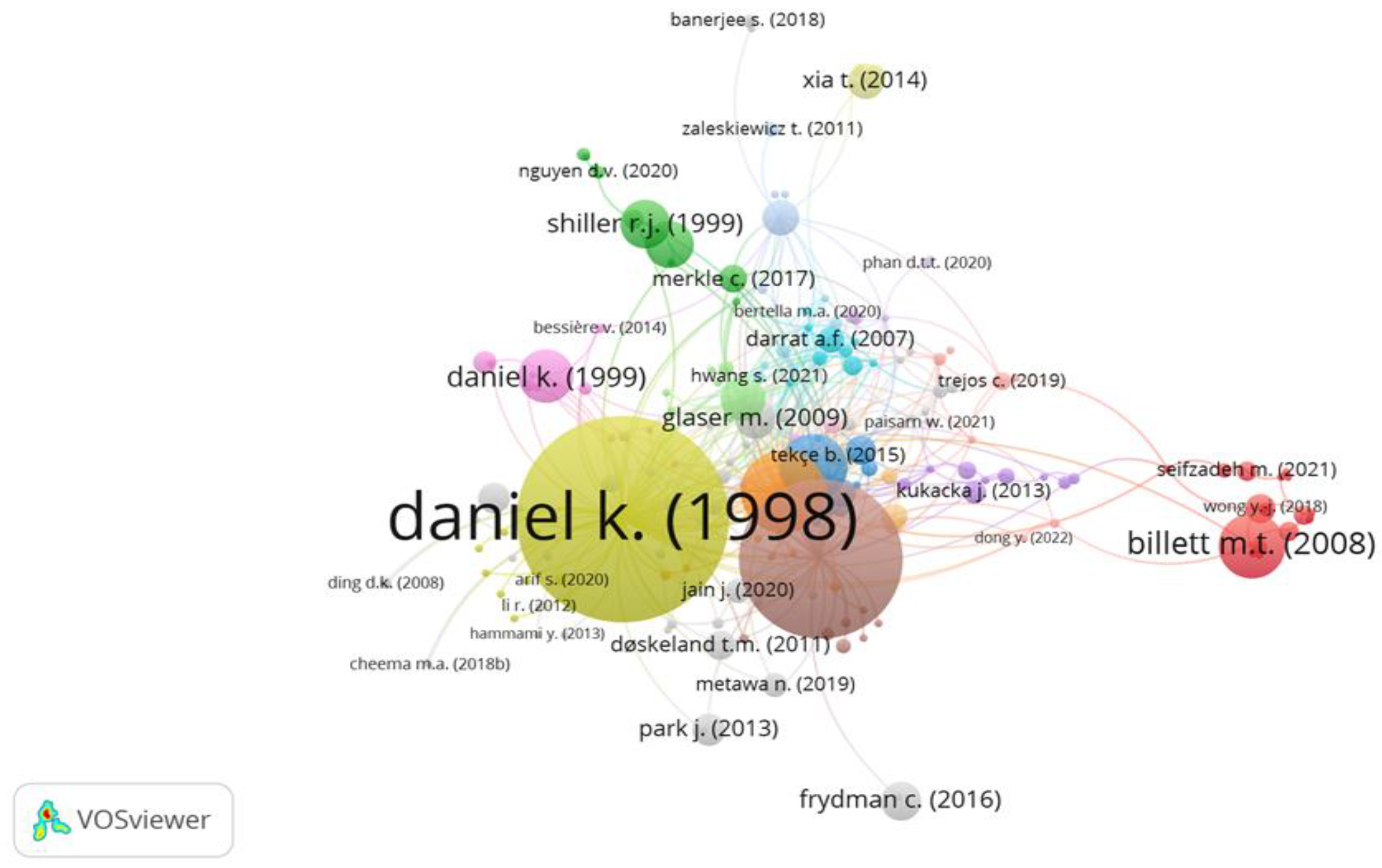

3.5. Citation Network Analysis

3.6. Contribution by Journals

3.7. Analyzing Research Trends on Overconfidence in the Stock Market

- Cluster analysis:

- Cluster 1:

- Cluster 2:

- Cluster 3:

- Cluster 4:

- Cluster 5:

- Cluster 6:

4. Discussion of Findings and Future Research Directions

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aljifri, R. 2023. Investor psychology in the stock market: An empirical study of the impact of overconfidence on firm valuation. Borsa Istanbul Review 23: 93–112. [Google Scholar] [CrossRef]

- Aspara, J., and A. O. Hoffmann. 2015. Cut your losses and let your profits run: How shifting feelings of personal responsibility reverses the disposition effect. Journal of Behavioral and Experimental Finance 8: 18–24. [Google Scholar] [CrossRef]

- Baker, M. 2009. Capital market-driven corporate finance. The Annual Review of Financial Economics 1: 181–205. [Google Scholar] [CrossRef]

- Baker, M., and J. Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21: 129–51. [Google Scholar] [CrossRef]

- Barber, B. M., and T. Odean. 2000. Trading is hazardous to your wealth: The common stock investment performance of individual investors. The Journal of Finance 55: 773–806. [Google Scholar] [CrossRef]

- Best, M. J., and R. R. Grauer. 2016. Prospect theory and portfolio selection. Journal of Behavioral and Experimental Finance 11: 13–17. [Google Scholar] [CrossRef]

- Daniel, K., D. Hirshleifer, and A. Subrahmanyam. 1998. Investor Psychology and Security Market Under- and Overreactions. The Journal of Finance 53: 1839–85. [Google Scholar] [CrossRef]

- De Bondt, F. M., and R. H. Thaler. 1995. Financial decision making in markets and firms: A behavioral perspective. Handbooks in Operations Research and Management Science 9: 385–410. [Google Scholar]

- Deaves, R., E. Luders, and G. Y. Luo. 2008. An experimental test of overconfidence and gender on trading activity. Review of Finance 13: 555–75. [Google Scholar] [CrossRef]

- Donthu, N., S. Kumar, D. Mukherjee, N. Pandey, and W. M. Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–96. [Google Scholar] [CrossRef]

- Ellegaard, O., and J. A. Wallin. 2015. The bibliometric analysis of scholarly production: How great is the impact? Scientometrics 105: 1809–31. [Google Scholar] [CrossRef] [PubMed]

- Fama, E. F. 1970. Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fama, E. F., and K. R. French. 1988. Permanent and temporary components of stock prices. Journal of Political Economy 96: 246–73. [Google Scholar] [CrossRef]

- French, Kenneth R., and James M. Poterba. 1990. Japanese and US cross-border common stock investments. Journal of the Japanese and International Economies 4: 476–93. [Google Scholar] [CrossRef]

- Gervais, S., and T. Odean. 2001. Learning to be overconfident. The Review of Financial Studies 14: 411–35. [Google Scholar] [CrossRef]

- Haidich, A. B. 2010. Meta-analysis in medical research. Hippokratia 14 Suppl. 1: 29. [Google Scholar]

- Hoffmann, A. O., and T. Post. 2016. How does investor confidence lead to trading? Linking investor return experiences, confidence, and investment beliefs. Journal of Behavioral and Experimental Finance 12: 65–78. [Google Scholar] [CrossRef]

- Keren, G. 1991. On the calibration and probability judgments: Conceptual and methodological issues. Acta Psychologica 77: 217–73. [Google Scholar] [CrossRef]

- Kumar, S., and N. Goyal. 2016. Evidence on rationality and behavioural biases in investment decision making. Qualitative Research in Financial Markets 8: 270–87. [Google Scholar] [CrossRef]

- Langer, E. J. 1975. The illusion of control. Journal of Personality and Social Psychology 32: 311–28. [Google Scholar] [CrossRef]

- Lichtenstein, S., B. Fishhoff, and L. D. Phillips. 1980. Calibration of probabilities: The state of the art to 1980. In Judgement under Uncertainty: Heuristics and Biases. Edited by Daniel Kahnemen, Paul Solvic and Amos Tversky. Cambridge: Cambridge University Press, pp. 306–34. [Google Scholar]

- Malkiel, B. G. 1973. A Random Walk down Wall Street [by] Burton G. Malkiel. Mountain View: Norton. [Google Scholar]

- Markowitz, H. 1952. The utility of wealth. Journal of political Economy 60: 151–58. [Google Scholar] [CrossRef]

- McClelland, A., and F. Bolger. 1994. Self-serving bias in attribution of causality: Fact or fiction? Psychological Bulletin 82: 213–25. [Google Scholar]

- Ngene, G. M., and A. N. Mungai. 2022. Stock returns, trading volume, and volatility: The case of African stock markets. International Review of Financial Analysis 82: 102176. [Google Scholar] [CrossRef]

- Nofsinger, J. R. 2010. Household behavior and boom/bust cycles. Journal of Financial Stability 8: 161–73. [Google Scholar] [CrossRef]

- Odean, T. 1998a. Are investors reluctant to realize their losses? The Journal of Finance 53: 1775–98. [Google Scholar] [CrossRef]

- Odean, T. 1998b. Volume, volatility, price and profit when all traders are above average. The Journal of Finance 53: 1887–934. [Google Scholar] [CrossRef]

- Odean, T. 1999. Do Investors Trade Too Much? American Economic Review 89: 1279–98. [Google Scholar] [CrossRef]

- Parmentola, A., A. Petrillo, I. Tutore, and F. De Felice. 2022. Is blockchain able to enhance environmental sustainability? A systematic review and research agenda from the perspective of Sustainable Development Goals (SDGs). Business Strategy and the Environment 31: 194–217. [Google Scholar] [CrossRef]

- Presson, P., and V. A. Benassi. 1996. Illusion of control: A meta- analytic review. Social Behavior and Personality 11: 493–510. [Google Scholar]

- Sabir, S. A., H. B. Mohammad, and H. B. K. Shahar. 2019. The role of overconfidence and past investment experience in herding behaviour with a moderating effect of financial literacy: Evidence from Pakistan stock exchange. Asian Economic and Financial Review 9: 480–90. [Google Scholar] [CrossRef]

- Shefrin, H. 2001. Behavioral corporate finance. Journal of Applied Corporate Finance 14: 113–26. [Google Scholar] [CrossRef]

- Shefrin, H. 2002. Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing. Oxford: Oxford University Press on Demand. [Google Scholar]

- Shrotryia, V. K., and H. Kalra. 2023. COVID-19 and overconfidence bias: The case of developed, emerging and frontier markets. International Journal of Emerging Markets 18: 633–65. [Google Scholar] [CrossRef]

- Svenson, O. 1981. Are we all less risky and more skilful than our fellow drivers? Acta Psychologica 47: 143–48. [Google Scholar] [CrossRef]

- Talpsepp, T., M. Vlcek, and M. Wang. 2014. Speculating in gains, waiting in losses: A closer look at the disposition effect. Journal of Behavioral and Experimental Finance 2: 31–43. [Google Scholar] [CrossRef]

- Taylor, S., and J. D. Brown. 1988. Illusion and well-being: A social psychology perspective and mental health. Psychological Bulletin 103: 193–210. [Google Scholar] [CrossRef]

- Tekçe, B., and N. Yılmaz. 2015. Are individual stock investors overconfident? Evidence from an emerging market. Journal of Behavioral and Experimental Finance 5: 35–45. [Google Scholar] [CrossRef]

- Thaler, R. H., and L. J. Ganser. 2015. Misbehaving: The Making of Behavioral Economics. New York: W. W. Norton & Company. [Google Scholar]

- Weinstein, N. D. 1980. Unrealistic optimism about future life events. Journal of Personality and Social Psychology 39: 806–20. [Google Scholar] [CrossRef]

- Yate, J. F. 1990. Judgment and Decision Making. Englewood Cliffs: Prentice-Hall. [Google Scholar]

| Rank | Document | Years | Citations | Links | The Most Cited Article (Reference) | Journal |

|---|---|---|---|---|---|---|

| 1 | Daniel K. | 1998 | 2457 | 94 | Investor psychology and security market under- and overreactions. | Journal of Finance |

| 2 | Barber B. M. | 2000 | 1463 | 55 | Trading is hazardous to your wealth: the common stock investment performance of individual investors. | Journal of Finance |

| 3 | Dunning D. | 2004 | 1187 | 1 | Flawed self-assessment implications for health, education, and the workplace. | Psychological science in the public interest, supplement |

| 4 | Lorenz J. | 2011 | 571 | 0 | How social influence can undermine the wisdom of crowd effect. | Proceedings of the National Academy of science of the United States of America |

| 5 | Statman M. | 2006 | 409 | 59 | Investor overconfidence and trading volume. | Review of Financial Studies |

| 6 | Chen G. | 2007 | 258 | 17 | Trading performance, disposition effect, overconfidence, representatives bias, and experience of emerging market investors. | Journal of behavioral decision-making |

| 7 | Billett M. T. | 2008 | 253 | 7 | Are overconfident CEOs born or made? Evidence of self-attribution bias from frequent acquirers. | Management Science |

| 8 | Daniel K. | 1999 | 168 | 8 | Market efficiency in an irrational world. | Financial Analysts Journal |

| 9 | Shiller R. J. | 1999 | 140 | 2 | Chapter 20: Human behavior and the efficiency of the financial system. | Handbook of Macroeconomics |

| 10 | Nosi’c A. | 2010 | 132 | 3 | How riskily do I invest? The role of risk attitudes, risk perceptions, and overconfidence. | Decision Analysis |

| Source | Publisher | TP * | TC ** | SJR *** | SNIP **** | Cite Score |

|---|---|---|---|---|---|---|

| Journal of Finance | American Finance Association (AFA) | 5.829 (2020) | 50,844 (2020) | 3.827 (2020) | 2.977 (2020) | 6.7 (2019) |

| Psychological science in the public interest, supplement | Association for Psychological Science (APS) | 3.838 (2019) | 5087 (2019) | 0.813 (2019) | 1.936 (2019) | 3.7 (2019) |

| Proceedings of the National Academy of science of the United States of America | National Academy of Sciences (NAS) | 9.58 (2020) | 891,906 (2020) | 10.637 (2020) | 8.986 (2020) | 14.5 (2019) |

| Review of Financial Studies | Society for Financial Studies (SFS) | 7.936 (2020) | 45,919 (2020) | 7.988 (2020) | 6.852 (2020) | 9.9 (2019) |

| Journal of behavioral decision-making | John Wiley & Sons | 2.648 (2020) | 4928 (2020) | 1.924 (2020) | 1.954 (2020) | 3.1 (2019) |

| Management Science | INFORMS (Institute for Operations Research and the Management Sciences) | 7.098 (2020) | 57,938 (2020) | 4.841 (2020) | 4.948 (2020) | 6.5 (2019) |

| Financial Analysts Journal | CFA Institute | 2.726 (2020) | 7865 (2020) | 0.959 (2020) | 2.066 (2020) | 3.3 (2019) |

| Decision Analysis | INFORMS (Institute for Operations Research and the Management Sciences) | 3.096 (2020) | 7973 (2020) | 2.634 (2020) | 2.744 (2020) | 3.8 (2019) |

| Cluster | Color | 62 Items | Main Items |

|---|---|---|---|

| 1 | Red | 13 Items | CEO overconfidence, China, Chinese stock market, corporate governance, COVID-19, financial markets, investor overconfidence, managerial overconfidence, managers, stock price, stock price crash risk. |

| 2 | Green | 12 Items | Anchoring, behavioral finance, disposition effect, EGARCH, market efficiency, overconfidence, overreaction, prospect theory, trading volume, underreaction, volatility. |

| 3 | Blue | 11 Items | Financial market, herding, investment, momentum, price dynamics, return predictability, risk taking, stock market. |

| 4 | Yellow | 11 Items | Behavioral biases, behavioral finance, emerging markets, financial literacy, herding behavior, individual investors, investor behavior, overconfidence bias, psychology, self-attribution bias. |

| 5 | Purple | 9 Items | Behavioral biases, behavioral research, commerce, financial crisis, financial data processing, investment decisions, investor psychology, investor sentiment, loss aversion. |

| 6 | White | 6 Items | Self-attribution, stock return. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ikram, B.; Fouad, B.E.H.; Sara, C. An Exploration of Overconfidence and the Disposition Effect in the Stock Market. Int. J. Financial Stud. 2023, 11, 78. https://doi.org/10.3390/ijfs11020078

Ikram B, Fouad BEH, Sara C. An Exploration of Overconfidence and the Disposition Effect in the Stock Market. International Journal of Financial Studies. 2023; 11(2):78. https://doi.org/10.3390/ijfs11020078

Chicago/Turabian StyleIkram, Benomar, Ben El Haj Fouad, and Chelh Sara. 2023. "An Exploration of Overconfidence and the Disposition Effect in the Stock Market" International Journal of Financial Studies 11, no. 2: 78. https://doi.org/10.3390/ijfs11020078

APA StyleIkram, B., Fouad, B. E. H., & Sara, C. (2023). An Exploration of Overconfidence and the Disposition Effect in the Stock Market. International Journal of Financial Studies, 11(2), 78. https://doi.org/10.3390/ijfs11020078