Islamic Finance in the Era of Financial Technology: A Bibliometric Review of Future Trends

Abstract

1. Introduction

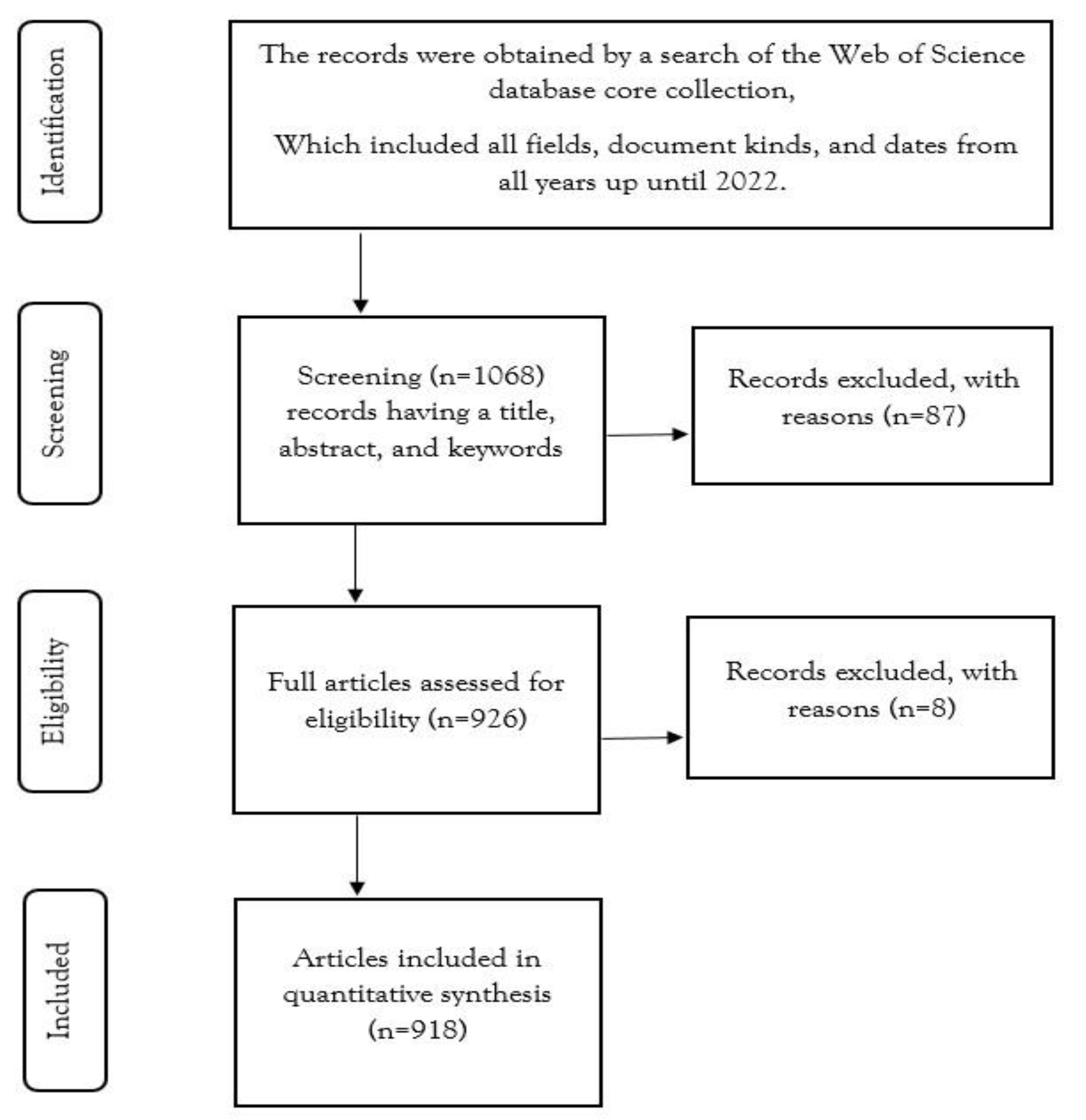

2. Methodology

2.1. Data Sourcing

2.2. Selection of Research Database

2.3. Finding Relevant Materials

2.4. Tool Selection for Science Mapping

2.5. Scientometric Techniques

3. Findings

3.1. Web of Science Database Analysis of Islamic Finance and Fintech Literature

3.2. Primary Research Interests in Islamic Finance and Fintech

3.3. Research Trends on Islamic Finance and Fintech

- Cluster 1: “Financial Inclusion and Corporate Governance in Islamic Fintech”

- Cluster 2: “Information Technology and Future Financial Islamic Services”

- Cluster 3: “The Transformation of Islamic Banking: How Fintech is changing the Game”

- Cluster 4: “Islamic Finance: A Growing Force in the Digital Age”

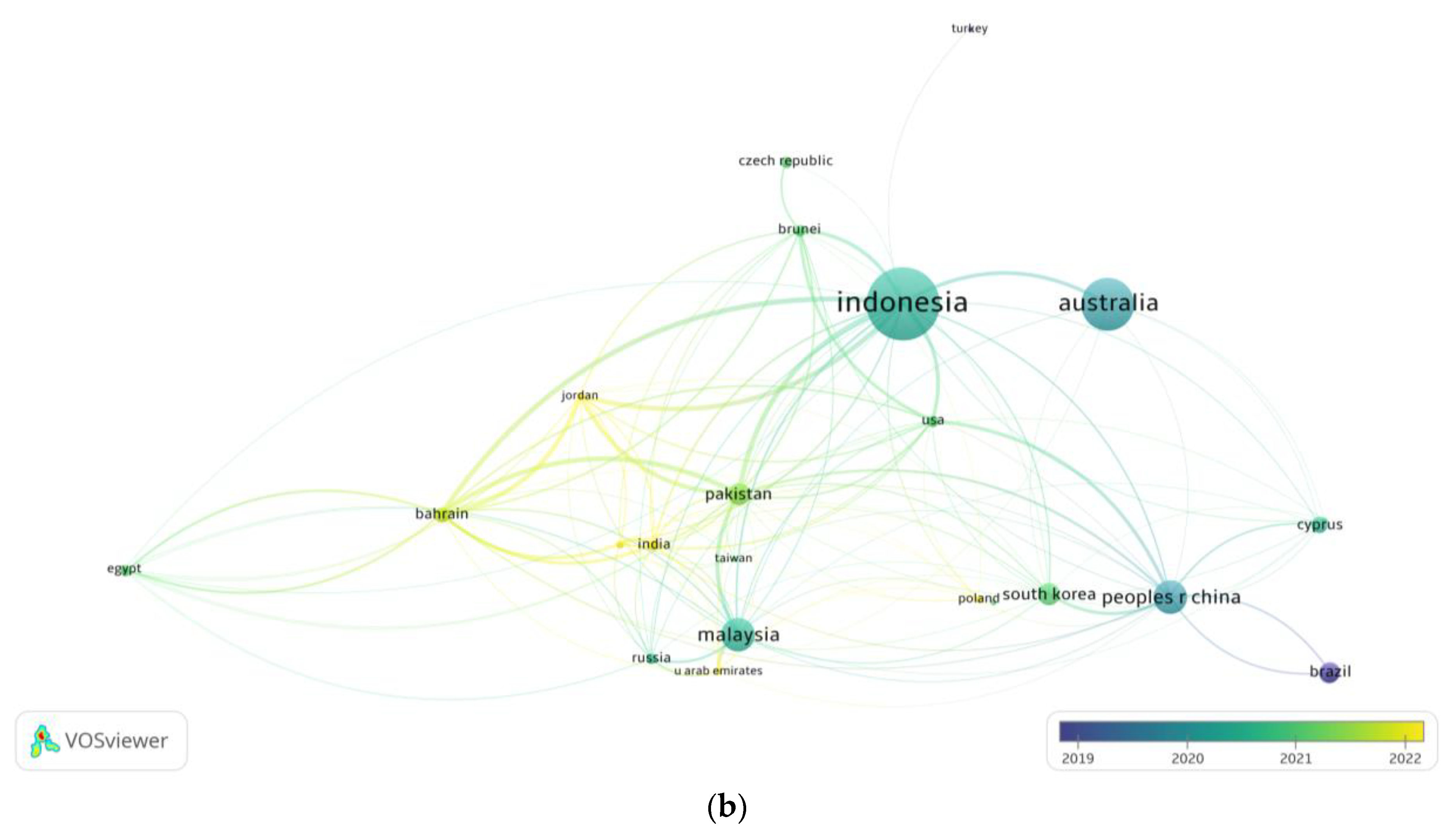

3.4. Mapping the Landscape of Islamic Finance and Fintech Literature

4. Discussion

5. Research Implications, Future Research Directions, Limitations and Conclusions

5.1. Practical and Theoretical Implications

5.2. Future Research Directions

5.3. Limitations

5.4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Article Title and Authors | Year | Journal | Main Focus | Number of Citations |

|---|---|---|---|---|

| The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application (Au and Kauffman 2008) | 2008 | Electronic Commerce Research and Applications | Mobile payments | 220 |

| The emergence of the global fintech market: Economic and technological determinants (Haddad and Hornuf 2019) | 2019 | Small Business Economics | Global fintech market | 176 |

| Fintech investments in European banks: a hybrid IT2 fuzzy multidimensional decision-making approach (Kou et al. 2021) | 2021 | Financial Innovation | Fintech investments in European banks | 148 |

| Artificial Intelligence in FinTech: understanding robo-advisors adoption among customers (Blanche et al. 2019) | 2019 | Industrial Management & Data Systems | Adoption of robo-advisors | 146 |

| Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities (Eyal 2017). | 2017 | Computer | Blockchain technology in finance and banking | 145 |

References

- Abdeljawad, Islam, Shatha Qamhieh Hashem, and Mamunur Rashid. 2022. Fintech and Islamic Financial Institutions: Applications and Challenges. In FinTech in Islamic Financial Institutions: Scope, Challenges, and Implications in Islamic Finance. Cham: Palgrave Macmillan, pp. 193–222. [Google Scholar] [CrossRef]

- Abedifar, Pejman, Shahid M. Ebrahim, Philip Molyneux, and Amine Tarazi. 2016. Islamic banking and finance: Recent empirical literature and directions for future research. In A Collection of Reviews on Savings and Wealth Accumulation. New York: Wiley, pp. 59–91. [Google Scholar] [CrossRef]

- Abojeib, Moutaz, and Farrukh Habib. 2021. Blockchain for Islamic social responsibility institutions. In Research Anthology on Blockchain Technology in Business, Healthcare, Education, and Government. Hershey: IGI Global, pp. 1114–28. [Google Scholar] [CrossRef]

- Ahmad, Syed Magfur, and Abdullah Al Mamun. 2020. Opportunities of Islamic FinTech: The Case of Bangladesh and Turkey. CenRaPS Journal of Social Sciences 2: 412–26. [Google Scholar] [CrossRef]

- Ahmed, Shamima, Muneer M. Alshater, Anis El Ammari, and Helmi Hammami. 2022. Artificial intelligence and machine learning in finance: A bibliometric review. Research in International Business and Finance 61: 101646. [Google Scholar] [CrossRef]

- Alaeddin, Omar, Mohanad Al Dakash, and Tawfik Azrak. 2021. Implementing the blockchain technology in islamic financial industry: Opportunities and challenges. Journal of Information Technology Management 13: 99–115. [Google Scholar] [CrossRef]

- Alam, Intekhab, and Pouya Seifzadeh. 2020. Marketing Islamic financial services: A review, critique, and agenda for future research. Journal of Risk and Financial Management 13: 12. [Google Scholar] [CrossRef]

- Ali, Hassnian, Rose Abdullah, and Muhd Zaki Zaini. 2019. Fintech and its potential impact on Islamic banking and finance industry: A case study of Brunei Darussalam and Malaysia. International Journal of Islamic Economics and Finance (IJIEF) 2: 73–108. [Google Scholar] [CrossRef]

- Al-Matari, Ebrahim Mohammed, Mahfoudh Hussein Mgammal, Mushari Hamdan Alosaimi, Talal Fawzi Alruwaili, and Sultan Al-Bogami. 2022. Fintech, board of directors and corporate performance in Saudi Arabia financial sector: Empirical study. Sustainability 14: 10750. [Google Scholar] [CrossRef]

- Alshater, Muneer Maher, Ashraf Khan, Mohammad Kabir Hassan, and Andrea Paltrinieri. 2023. Islamic Banking: Past, Present and Future. Journal of College of Sharia and Islamic Studies 41: 351. [Google Scholar] [CrossRef]

- Alshater, Muneer M., Irum Saba, Indri Supriani, and Mustafa Raza Rabbani. 2022. Fintech in islamic finance literature: A review. Heliyon 8: e10385. [Google Scholar] [CrossRef]

- Alshater, Muneer, Kabir Hassan, Ashraf Khan, and Irum Saba. 2021a. Influential and intellectual structure of Islamic finance: A bibliometric review. International Journal of Islamic and Middle Eastern Finance and Management 14: 339–65. [Google Scholar] [CrossRef]

- Alshater, Muneer, Ram Al Jaffri Saad, Norazlina Abd. Wahab, and Irum Saba. 2021b. What do we know about zakat literature? A bibliometric review. Journal of Islamic Accounting and Business Research 12: 544–63. [Google Scholar] [CrossRef]

- Altarturi, Basheer Hussein Motawe, Hamza H. M. Altarturi, and Anwar Hasan Abdullah Othman. 2021. Applications of financial technology in Islamic finance: A systematic bibliometric review. In Artificial Intelligence and Islamic Finance. London: Routledge, p. 138161. [Google Scholar]

- Antoniadi, Anna Markella, Yuhan Du, Yasmine Guendouz, Lan Wei, Claudia Mazo, Brett A. Becker, and Catherine Mooney. 2021. Current challenges and future opportunities for XAI in machine learning-based clinical decision support systems: A systematic review. Applied Sciences 11: 5088. [Google Scholar] [CrossRef]

- Asutay, Mehmet, Hakim Ahmad, and Abu Umar Faruq. 2021. Blockchain and Smart Contracts for Islamic Finance: A Critical Assessment. International Journal of Financial Studies 9: 62. [Google Scholar]

- Atif, Mohammad, M. Kabir Hassan, Mustafa Raza Rabbani, and Shahnawaz Khan. 2021. Islamic FinTech: The digital transformation bringing sustainability to Islamic finance. In COVID-19 and Islamic Social Finance. London: Routledge, pp. 91–103. [Google Scholar]

- Au, Yoris A., and Robert J. Kauffman. 2008. The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electronic Commerce Research and Applications 7: 141–64. [Google Scholar] [CrossRef]

- Barbu, Cătălin Mihail, Dorian Laurenţiu Florea, Dan-Cristian Dabija, and Mihai Constantin Răzvan Barbu. 2021. Customer experience in fintech. Journal of Theoretical and Applied Electronic Commerce Research 16: 1415–33. [Google Scholar] [CrossRef]

- Bashir, Usman, Abu Jafar Mohammad Sufian, and Zeshaan Rasheed. 2020. Fintech and Islamic Finance: Digitalization, Development, and Disruption. Journal of Risk and Financial Management 13: 15. [Google Scholar]

- Bautista-Bernal, Irene, Cristina Quintana-García, and Macarena Marchante-Lara. 2021. Research trends in occupational health and social responsibility: A bibliometric analysis. Safety Science 137: 105167. [Google Scholar] [CrossRef]

- Belal, Ataur Rahman, Mohammed Mehadi Masud Mazumder, and Mohobbot Ali. 2019. Intellectual capital reporting practices in an Islamic bank: A case study. Business Ethics: A European Review 28: 206–20. [Google Scholar] [CrossRef]

- Biancone, Paolo Pietro, Buerhan Saiti, Denisa Petricean, and Federico Chmet. 2020. The bibliometric analysis of Islamic banking and finance. Journal of Islamic Accounting and Business Research 11: 2069–86. [Google Scholar] [CrossRef]

- Belanche, Daniel, Luis V. Casaló, and Carlos Flavián. 2019. Artificial Intelligence in FinTech: Understanding robo-advisors adoption among customers. Industrial Management & Data Systems 119: 1411–30. [Google Scholar]

- Chhtrapati, Devang, Shanti P. Chaudhari, Dilip Mevada, Atul Bhatt, and Dharmendra Trivedi. 2021. Research productivity and network visualization on digital evidence: A bibliometric study. Science and Technology Libraries 40: 358–72. [Google Scholar] [CrossRef]

- Chong, Felicia Hui Ling. 2021. Enhancing trust through digital Islamic finance and blockchain technology. Qualitative Research in Financial Markets 13: 328341. [Google Scholar] [CrossRef]

- Chowdhury, Asad Iqbal, and Mohammad Shamsu Uddin. 2021. Artificial intelligence, financial risk management, and Islamic finance. In Artificial Intelligence and Islamic Finance. London: Routledge, pp. 181–92. [Google Scholar]

- De Anca, Celia. 2019. Fintech in Islamic Finance: From collaborative finance to community-based finance. In Fintech in Islamic Finance. London: Routledge, pp. 47–61. [Google Scholar]

- Dhamija, Pavitra, and Surajit Bag. 2020. Role of artificial intelligence in operations environment: A review and bibliometric analysis. The TQM Journal 32: 869–96. [Google Scholar] [CrossRef]

- Djeki, Essohanam, Jules Dégila, Carlyna Bondiombouy, and Muhtar Hanif Alhassan. 2022. E-learning bibliometric analysis from 2015 to 2020. Journal of Computers in Education 9: 727–54. [Google Scholar] [CrossRef]

- Eyal, Ittay. 2017. Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer 50: 38–49. [Google Scholar] [CrossRef]

- Goud, Blake, Tanvir A. Uddin, and Bayu A. Fianto. 2021. Islamic Fintech and ESG goals: Key considerations for fulfilling maqasid principles. In Islamic Fintech. London: Routledge, pp. 16–35. [Google Scholar]

- Haddad, Christian, and Lars Hornuf. 2019. The emergence of the global fintech market: Economic and technological determinants. Small Business Economics 53: 81–105. [Google Scholar] [CrossRef]

- Hasan, Rashedul, Mohammad Kabir Hassan, and Sirajo Aliyu. 2020. Fintech and Islamic finance: Literature review and research agenda. International Journal of Islamic Economics and Finance (IJIEF) 3: 75–94. [Google Scholar] [CrossRef]

- Hassan, Kabir, and Mustafa Raza Rabbani. 2022. Sharia governance standards and the role of AAOIFI: A comprehensive literature review and future research agenda. Journal of Islamic Accounting and Business Research 14: 677–98. [Google Scholar] [CrossRef]

- Hassan, M. Kabir, Muneer M. Alshater, Rashedul Hasan, and Abul Bashar Bhuiyan. 2021. Islamic microfinance: A bibliometric review. Global Finance Journal 49: 100651. [Google Scholar] [CrossRef]

- Hassan, Kabir, Mustafa Raza Rabbani, and Mahmood Asad Mohd Ali. 2020. Challenges for the Islamic Finance and banking in post COVID era and the role of Fintech. Journal of Economic Cooperation and Development 41: 93–116. [Google Scholar]

- Hassan, Kabir, Mustafa Raza Rabbani, Mamunur Rashid, and Irwan Trinugroho. 2022a. Islamic Fintech, Blockchain and Crowdfunding: Current Landscape and Path Forward. In FinTech in Islamic Financial Institutions: Scope, Challenges, and Implications in Islamic Finance. Cham: Springer International Publishing, pp. 307–40. [Google Scholar]

- Hassan, Kabir, Zehra Zulfikar, Mustafa Raza Rabbani, and Mohd Atif. 2022b. Fintech Trends: Industry 4.0, Islamic Fintech, and Its Digital Transformation. In FinTech in Islamic Financial Institutions: Scope, Challenges, and Implications in Islamic Finance. Cham: Springer International Publishing, pp. 113–30. [Google Scholar]

- Huang, Yuandong, Chong Xu, Xujiao Zhang, and Lei Li. 2022. Bibliometric analysis of landslide research based on the WOS database. Natural Hazards Research 2: 49–61. [Google Scholar] [CrossRef]

- Hudaefi, Fahmi Ali, M. Kabir Hassan, and Muhamad Abduh. 2023. Exploring the development of Islamic fintech ecosystem in Indonesial. a text analytics. Qualitative Research in Financial Markets 15: 514–33. [Google Scholar] [CrossRef]

- Igwaran, Aboi, and Chiedu Epiphany Edoamodu. 2021. Bibliometric analysis on tuberculosis and tuberculosis-related research trends in Africal. a decade-long study. Antibiotics 10: 423. [Google Scholar] [CrossRef]

- Karim, A. K. M. Rezaul, and Mohammad Hasan. 2019. Islamic Finance and Fintech: A Critical Review. Journal of Islamic Accounting and Business Research 10: 296–311. [Google Scholar] [CrossRef]

- Karim, Sitara, Muhammad Abubakr Naeem, and Emad Eddin Abaji. 2022a. Is Islamic FinTech coherent with Islamic banking? A stakeholder’s perspective during COVID-19. Heliyon 8: e10485. [Google Scholar] [CrossRef]

- Karim, Sitara, Mustafa Raza Rabbani, Mamunur Rashid, and Zaheer Anwer. 2022b. COVID-19 Challenges and the Role of Islamic Fintech. In FinTech in Islamic Financial Institutions: Scope, Challenges, and Implications in Islamic Finance. Cham: Springer International Publishing, pp. 341–56. [Google Scholar]

- Khan, Mohammad Shahfaraz, Mustafa Raza Rabbani, Iqbal Thonse Hawaldar, and Abu Bashar. 2022. Determinants of behavioral intentions to use Islamic financial technology: An empirical assessment. Risks 10: 114. [Google Scholar] [CrossRef]

- Kok, Seng Kiong, Cynthia Akwei, Gianluigi Giorgioni, and Stuart Farquhar. 2022. On the regulation of the intersection between religion and the provision of financial services: Conversations with market actors within the global Islamic financial services sector. Research in International Business and Finance 59: 101552. [Google Scholar] [CrossRef]

- Kou, Gang, Özlem Olgu Akdeniz, Hasan Dinçer, and Serhat Yüksel. 2021. Fintech investments in European banks: A hybrid IT2 fuzzy multidimensional decision-making approach. Financial Innovation 7: 39. [Google Scholar] [CrossRef]

- Kristiana, Yustisia, and Martinus Tukiran. 2021. A Systematic Review: Is Transformational Leadership Effective for Organizational Commitment? Journal of Industrial Engineering and Management Research 2: 266–73. [Google Scholar] [CrossRef]

- Kuanova, Laura Aibolovna, Rimma Sagiyeva, and Nasim Shah Shirazi. 2021. Islamic social finance: A literature review and future research directions. Journal of Islamic Accounting and Business Research 12: 707728. [Google Scholar] [CrossRef]

- Lada, Suddin, Brahim Chekima, Rudy Ansar, Mohamad Isa Abdul Jalil, Lim Ming Fook, Caroline Geetha, Mohamed Bouteraa, and Mohd Rahimie Abdul Karim. 2023. Islamic Economy and Sustainability: A Bibliometric Analysis Using R. Sustainability 15: 5174. [Google Scholar] [CrossRef]

- Li, Huajiao, Haizhong An, Yue Wang, Jiachen Huang, and Xiangyun Gao. 2016. Evolutionary features of academic articles cokeyword network and keywords co-occurrence network: Based on two-mode affiliation network. Physica AL. Statistical Mechanics and Its Applications 450: 657–69. [Google Scholar] [CrossRef]

- Mehdiabadi, Amir, Mariyeh Tabatabeinasab, Cristi Spulbar, Amir Karbassi Yazdi, and Ramona Birau. 2020. Are we ready for the challenge of Banks 4.0? Designing a roadmap for banking systems in Industry 4.0. International Journal of Financial Studies 8: 32. [Google Scholar] [CrossRef]

- Milana, Carlo, and Arvind Ashta. 2021. Artificial intelligence techniques in finance and financial markets: A survey of the literature. Strategic Change 30: 189–209. [Google Scholar] [CrossRef]

- Mohamed, Hazik. 2021. Managing Islamic financial risks and new technological risks. In Artificial Intelligence and Islamic Finance. London: Routledge, pp. 61–76. [Google Scholar]

- Moral-Muñoz, José, Enrique Herrera-Viedma, Antonio Santisteban-Espejo, and Manuel J. Cobo. 2020. Software tools for conducting bibliometric analysis in science: An up-to-date review. Profesional de la Información 29: e290103. [Google Scholar] [CrossRef]

- Mujahed, Hamed, Elsadig Musa Ahmed, and Siti Aida Samikon. 2022. Factors influencing Palestinian small and medium enterprises intention to adopt mobile banking. Journal of Science and Technology Policy Management 13: 561–84. [Google Scholar] [CrossRef]

- Nguyen, Quang Khai. 2021. Oversight of bank risk-taking by audit committees and Sharia committees: Conventional vs. Islamic banks. Heliyon 7: e07798. [Google Scholar] [CrossRef]

- Nguyen, Quang Khai. 2022a. Determinants of bank risk governance structure: A cross-country analysis. Research in International Business and Finance 60: 101575. [Google Scholar] [CrossRef]

- Nguyen, Quang Khai. 2022b. The Effect of FinTech Development on Financial Stability in an Emerging Market: The Role of Market Discipline. Research in Globalization 5: 100105. [Google Scholar] [CrossRef]

- Nurdin, Nurdin, and Khaeruddin Yusuf. 2020. Knowledge management lifecycle in Islamic bank: The case of syariah banks in Indonesia. International Journal of Knowledge Management Studies 11: 59–80. [Google Scholar] [CrossRef]

- Oladapo, Ibrahim Abiodun, Manal Mohammed Hamoudah, Md Mahmudul Alam, Olawale Rafiu Olaopa, and Ruhaini Muda. 2022. Customers’ perceptions of FinTech adaptability in the Islamic banking sector: Comparative study on Malaysia and Saudi Arabia. Journal of Modelling in Management 17: 1241–61. [Google Scholar] [CrossRef]

- Orlando, Giuseppe, and Roberta Pelosi. 2020. The Role of Islamic Finance and Fintech in Promoting Financial Inclusion in Malaysia. International Journal of Financial Studies 8: 68. [Google Scholar] [CrossRef]

- Oseni, Umar, and Nazim Ali. 2019. Fintech in Islamic finance. In Fintech in Islamic Finance. London: Routledge, pp. 3–14. ISBN 9781351025584. [Google Scholar]

- Özen Çınar, İlgun. 2020. Bibliometric analysis of breast cancer research in the period 2009–2018. International Journal of Nursing Practice 26: e12845. [Google Scholar] [CrossRef] [PubMed]

- Qudah, Hanan Ahmad, Khawla Kassed Abdo, Laith Akram Al-Qudah, Hussein Mohammad Aldmour, and Mohammad Zakaria AlQudah. 2021. Factors Affecting Credit Policy in Islamic Banks of Jordan. Academy of Accounting and Financial Studies 25: 307–21. [Google Scholar]

- Rabbani, Mustafa Raza. 2022. Fintech innovations, scope, challenges, and implications in Islamic Finance: A systematic analysis. International Journal of Computing and Digital Systems 11: 579–608. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Abu Bashar, Nishad Nawaz, Sitara Karim, Mahmood Asad Mohd Ali, Habeeb Ur Rahiman, and Md Shabbir Alam. 2021. Exploring the role of islamic fintech in combating the aftershocks of COVID-19: The open social innovation of the islamic financial system. Journal of Open Innovation: Technology, Market, and Complexity 7: 136. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Adel Sarea, Shahnawaz Khan, and Yomna Abdullah. 2022a. Ethical concerns in artificial intelligence (AI): The role of RegTech and Islamic finance. In Artificial Intelligence for Sustainable Finance and Sustainable Technology: Proceedings of ICGER 2021 1. Cham: Springer International Publishing, pp. 381–90. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, M. Kabir Hassan, and Mamunur Rashid. 2022b. Introduction to Islamic Fintech: A Challenge or an Opportunity? In FinTech in Islamic Financial Institutions: Scope, Challenges, and Implications in Islamic Finance. Cham: Springer International Publishing, pp. 1–27. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Shahnawaz Khan, and Eleftherios Thalassinos. 2020. FinTech, blockchain and Islamic finance: An extensive literature review. International Journal of Economics and Business Administration 8: 65–86. Available online: https://www.um.edu.mt/library/oar/handle/123456789/54860 (accessed on 1 June 2023).

- Rabbani, Mustafa Raza, Shahnawaz Khan, and Mohammad Atif. 2023. Machine learning-based P2P lending Islamic Fintech model for small and medium enterprises in Bahrain. International Journal of Business Innovation and Research 30: 565–79. [Google Scholar] [CrossRef]

- Razak, Dzuljastri Abdul, Syamsu Rizal Zulmi, and Qosdan Dawami. 2021. Customers’ perception on islamic crowdfunding as a possible financial solution for the pandemic COVID-19 crisis in Malaysia. Journal of Islamic Finance 10: 92–100. Available online: https://journals.iium.edu.my/iiibf-journal/index.php/jif/article/view/531 (accessed on 1 June 2023).

- Saba, Irum, Rehana Kouser, and Imran Sharif Chaudhry. 2019. FinTech and Islamic finance-challenges and opportunities. Review of Economics and Development Studies 5: 581–890. [Google Scholar] [CrossRef]

- Sedighi, Mehri. 2016. Application of word co-occurrence analysis method in mapping of the scientific fields (case study: The field of Informatics). Library Review 65: 52–64. [Google Scholar] [CrossRef]

- Sinkovics, Noemi. 2016. Enhancing the foundations for theorizing through bibliometric mapping. International Marketing Review 33: 327–50. [Google Scholar] [CrossRef]

- Tok, Yoke Wang, and Dyna Heng. 2022. Fintech: Financial Inclusion or Exclusion? Washington, DC: International Monetary Fund. [Google Scholar]

- Truby, Jon, and Otabek Ismailov. 2022. The role and potential of blockchain technology in Islamic finance. European Business Law Review 33: 175–92. [Google Scholar] [CrossRef]

- Unal, Ibrahim Musa, and Ahmet Faruk Aysan. 2022. Fintech, Digitalization, and Blockchain in Islamic Finance: Retrospective Investigation. FinTech 1: 388–98. [Google Scholar] [CrossRef]

- Wenner, Greg, Joshua Bram, Martin Marino, Eric Obeysekare, and Khanjan Mehta. 2018. Organizational models of mobile payment systems in low-resource environments. Information Technology for Development 24: 681–705. [Google Scholar] [CrossRef]

- World Bank. 2020. Leveraging Islamic Fintech to Improve Financial Inclusion. Washington, DC: World Bank. [Google Scholar] [CrossRef]

- Xie, Lin, Zhenhao Chen, Hongli Wang, Chaojun Zheng, and Jianyuan Jiang. 2020. Bibliometric and visualized analysis of scientific publications on atlantoaxial spine surgery based on Web of Science and VOSviewer. World Neurosurgery 137: 435–42. [Google Scholar] [CrossRef]

- Xu, Zeshui, Xindi Wang, Xinxin Wang, and Marinko Skare. 2021. A comprehensive bibliometric analysis of entrepreneurship and crisis literature published from 1984 to 2020. Journal of Business Research 135: 304–18. [Google Scholar] [CrossRef]

- Ye, Nan, Tung-Boon Kueh, Lisong Hou, Yongxin Liu, and Hang Yu. 2020. A bibliometric analysis of corporate social responsibility in sustainable development. Journal of Cleaner Production 272: 122679. [Google Scholar] [CrossRef]

- Zouari, Ghazi, and Marwa Abdelhedi. 2021. Customer satisfaction in the digital eral. evidence from Islamic banking. Journal of Innovation and Entrepreneurship 10: 9. [Google Scholar] [CrossRef]

- Zulkhibri, Muhamed. 2019. Fintech and the Future of Islamic Finance: Opportunities and Challenges. Journal of Islamic Monetary Economics and Finance 5: 629–52. [Google Scholar]

| No. | Research Filed | Contribute Number |

|---|---|---|

| 1 | Business Economics | 430 |

| 2 | Computer Science | 228 |

| 3 | Engineering | 136 |

| 4 | Science Technology Other Topics | 62 |

| 5 | Environmental Sciences Ecology | 54 |

| 6 | Government Law | 53 |

| 7 | Telecommunications | 48 |

| 8 | Operations Research Management Science | 33 |

| 9 | Social Sciences Other Topics | 33 |

| 10 | Information Science Library Science | 27 |

| Journals | Publications | H-Index | TC | Publishers | Publications | H-Index | TC |

|---|---|---|---|---|---|---|---|

| Sustainability | 24 | 10 | 263 | Elsevier | 141 | 28 | 2263 |

| Journal of Risk and Financial Management | 14 | 3 | 27 | IEEE | 92 | 13 | 656 |

| Technological Forecasting and Social Change | 13 | 6 | 293 | Springer Nature | 92 | 15 | 926 |

| Advances in Social Science Education and Humanities Research | 9 | 2 | 7 | Emerald Group Publishing | 81 | 14 | 603 |

| Cogent Economics Finance | 9 | 2 | 11 | Taylor and Francis | 76 | 13 | 603 |

| Journal of Asian Finance Economics and Business | 8 | 4 | 34 | MDPI | 71 | 13 | 627 |

| AEBMR Advances in Economics Business and Management Research | 7 | 1 | 1 | Wiley | 37 | 7 | 242 |

| Finance Research Letters | 7 | 5 | 151 | Sage | 21 | 11 | 413 |

| Financial Innovation | 7 | 5 | 225 | Atlantis Press | 18 | 2 | 8 |

| Pacific-Basin Finance Journal | 7 | 4 | 84 | Assoc. Computing Machinery | 17 | 5 | 110 |

| Technological Forecasting and Social Change | 13 | 6 | 293 | Springer Nature | 92 | 15 | 926 |

| Countries/Regions | Publications | Countries/Regions | Publications |

|---|---|---|---|

| China | 273 | Russia | 22 |

| USA | 129 | Pakistan | 20 |

| England | 93 | Spain | 19 |

| Indonesia | 85 | Canada | 18 |

| Taiwan | 72 | France | 17 |

| Australia | 47 | Japan | 17 |

| Malaysia | 44 | Saudi Arabia | 17 |

| India | 35 | Singapore | 17 |

| Germany | 25 | Vietnam | 17 |

| South Korea | 24 | Italy | 16 |

| Authors | Number of Publications | H-Index | TC | Affiliation |

|---|---|---|---|---|

| Huang SH | 16 | 5 | 113 | National Yang Ming Chiao Tung University |

| Chen CT | 8 | 3 | 30 | National Yang Ming Chiao Tung University |

| Wang J | 7 | 4 | 54 | Rutgers State University New Brunswick |

| Yang XH | 7 | 2 | 20 | Shihezi University |

| Grobys K | 6 | 5 | 83 | University of Vaasa |

| Ma F | 6 | 2 | 14 | Xi’an Jiaotong-Liverpool University |

| Zhang Q | 6 | 2 | 17 | Xinjiang Academy of Agricultural Sciences |

| Almunawar MN | 5 | 3 | 53 | University Brunei Darussalam |

| Geng ZH | 5 | 2 | 15 | Shihezi University |

| Affiliation | Number Publications | Country | Affiliation | Number Publications | Country |

|---|---|---|---|---|---|

| National Yang Ming Chiao Tung University | 21 | Taiwan | Tianjin University | 9 | China |

| University of Indonesia | 17 | Indonesia | City University of Hong Kong | 8 | Hong Kong |

| University of London | 14 | England | Ming Chuan University | 8 | Taiwan |

| University of Hong Kong | 13 | Hong Kong | Universities Bina Nusantara | 8 | Indonesia |

| Chinese Academy of Sciences | 12 | China | Universities Padjadjaran | 8 | Indonesia |

| Xi An Jiao Tong Liverpool University | 12 | China | University of California System | 8 | USA |

| Fudan University | 10 | China | University of New South Wales Sydney | 8 | Australia |

| Southwestern University of Finance Economics China | 10 | China | University of Sydney | 8 | Australia |

| Renmin University of China | 9 | China | Zhejiang University | 8 | China |

| Shihezi University | 9 | China | Central University of Finance Economics | 7 | China |

| Keywords (Cluster 1): | Links | Total Links Strength | Occurrences |

|---|---|---|---|

| Fintech | 36 | 65 | 17 |

| Islamic Fintech | 20 | 29 | 10 |

| Islamic Finance | 10 | 19 | 9 |

| Corporate Governance | 17 | 20 | 3 |

| Islamic Banking | 4 | 8 | 3 |

| Performance | 16 | 18 | 3 |

| Banks | 7 | 9 | 2 |

| COVID-19 | 10 | 10 | 2 |

| Digitalization | 4 | 5 | 2 |

| Financial Inclusion | 4 | 5 | 2 |

| Information | 14 | 14 | 2 |

| Islamic Finance Industry | 7 | 7 | 2 |

| Size | 10 | 11 | 2 |

| Keywords (Cluster 2): | Links | Total Links Strength | Occurrences |

|---|---|---|---|

| Adoption | 26 | 32 | 6 |

| Innovation | 17 | 24 | 5 |

| Intention | 19 | 24 | 5 |

| Information Technology | 15 | 19 | 3 |

| Model | 19 | 21 | 3 |

| Trust | 13 | 15 | 3 |

| Financial Institutions | 14 | 14 | 2 |

| Mobile Banking | 8 | 9 | 2 |

| Services | 13 | 13 | 2 |

| Technology Acceptance Model | 11 | 12 | 2 |

| Technology Adoption | 8 | 8 | 2 |

| User Acceptance | 10 | 12 | 2 |

| Utaut Model | 8 | 9 | 2 |

| Keywords (Cluster 3): | Links | Total Links Strength | Occurrences |

|---|---|---|---|

| Financial Technology | 33 | 70 | 30 |

| Banking | 23 | 21 | 6 |

| Industry | 15 | 21 | 4 |

| Impact | 13 | 15 | 3 |

| P2p Lending | 11 | 12 | 3 |

| Blockchain | 8 | 8 | 2 |

| Cryptocurrency | 8 | 8 | 2 |

| Disruption | 6 | 8 | 2 |

| Ecosystem | 11 | 13 | 2 |

| Payments | 12 | 12 | 2 |

| Revolution | 8 | 9 | 2 |

| Transformation | 9 | 11 | 2 |

| Keywords (Cluster 4): | Links | Total Links Strength | Occurrences |

|---|---|---|---|

| Growth | 17 | 21 | 5 |

| Competition | 16 | 24 | 4 |

| Determinants | 15 | 20 | 3 |

| Efficiency | 18 | 20 | 3 |

| Ownership | 17 | 19 | 3 |

| Risk | 22 | 24 | 3 |

| Bank Performance | 10 | 12 | 2 |

| Earnings | 10 | 14 | 2 |

| Profitability | 10 | 14 | 2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qudah, H.; Malahim, S.; Airout, R.; Alomari, M.; Hamour, A.A.; Alqudah, M. Islamic Finance in the Era of Financial Technology: A Bibliometric Review of Future Trends. Int. J. Financial Stud. 2023, 11, 76. https://doi.org/10.3390/ijfs11020076

Qudah H, Malahim S, Airout R, Alomari M, Hamour AA, Alqudah M. Islamic Finance in the Era of Financial Technology: A Bibliometric Review of Future Trends. International Journal of Financial Studies. 2023; 11(2):76. https://doi.org/10.3390/ijfs11020076

Chicago/Turabian StyleQudah, Hanan, Sari Malahim, Rula Airout, Mohammad Alomari, Aiman Abu Hamour, and Mohammad Alqudah. 2023. "Islamic Finance in the Era of Financial Technology: A Bibliometric Review of Future Trends" International Journal of Financial Studies 11, no. 2: 76. https://doi.org/10.3390/ijfs11020076

APA StyleQudah, H., Malahim, S., Airout, R., Alomari, M., Hamour, A. A., & Alqudah, M. (2023). Islamic Finance in the Era of Financial Technology: A Bibliometric Review of Future Trends. International Journal of Financial Studies, 11(2), 76. https://doi.org/10.3390/ijfs11020076