A Bibliometric Analysis of Fintech Trends: An Empirical Investigation

Abstract

1. Introduction

2. Literature Review

3. Objectives

- To find the most influential authors in the Fintech field in banking and insurance.

- To find out which country does the most research in the Fintech domain in banking and insurance?

- To find out the gaps in Fintech Domain in banking and insurance.

4. Research Methodology

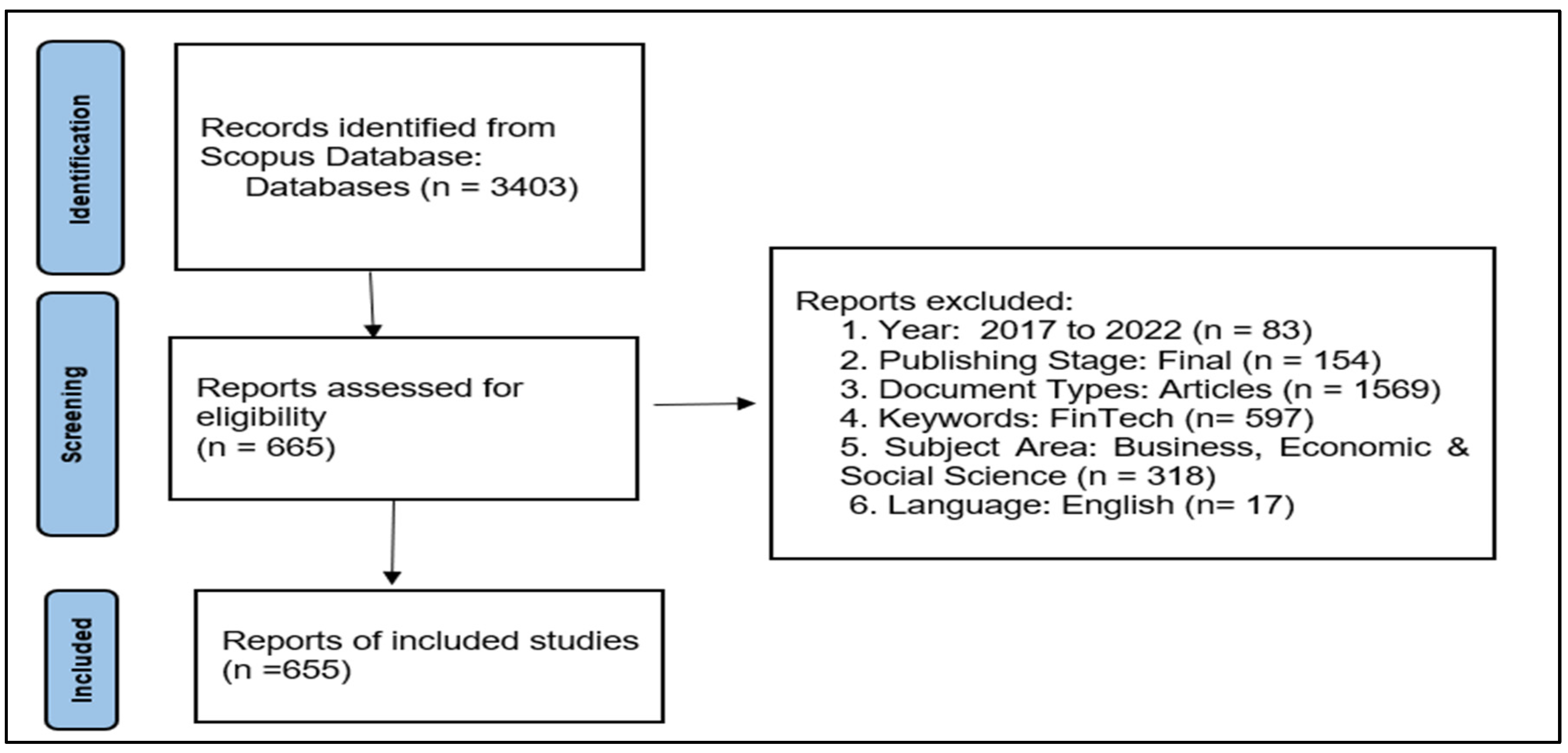

4.1. Data Collection

4.2. Methodology

5. Result Analysis and Interpretation

5.1. Descriptive Statistics

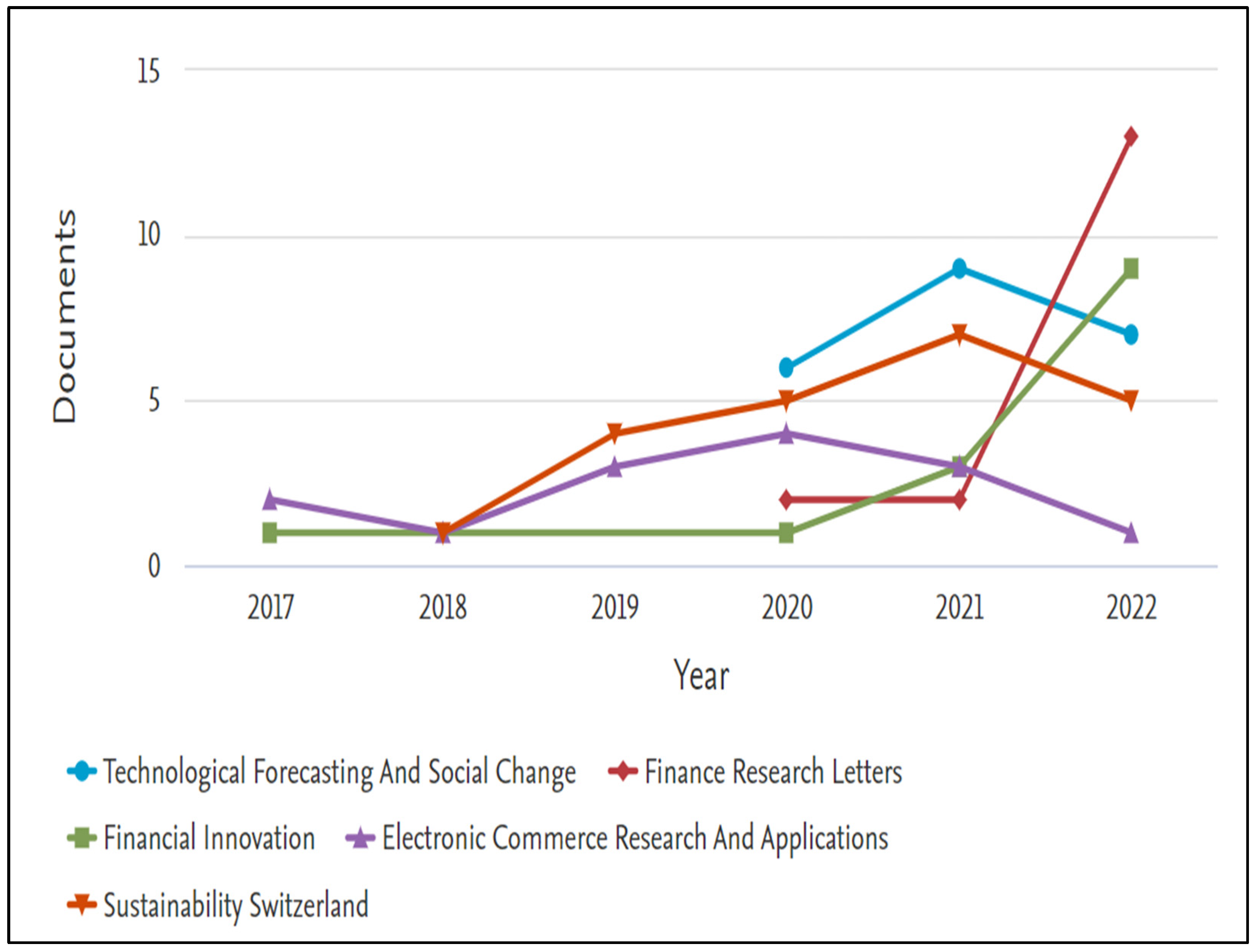

5.2. Documents Per Year by Source

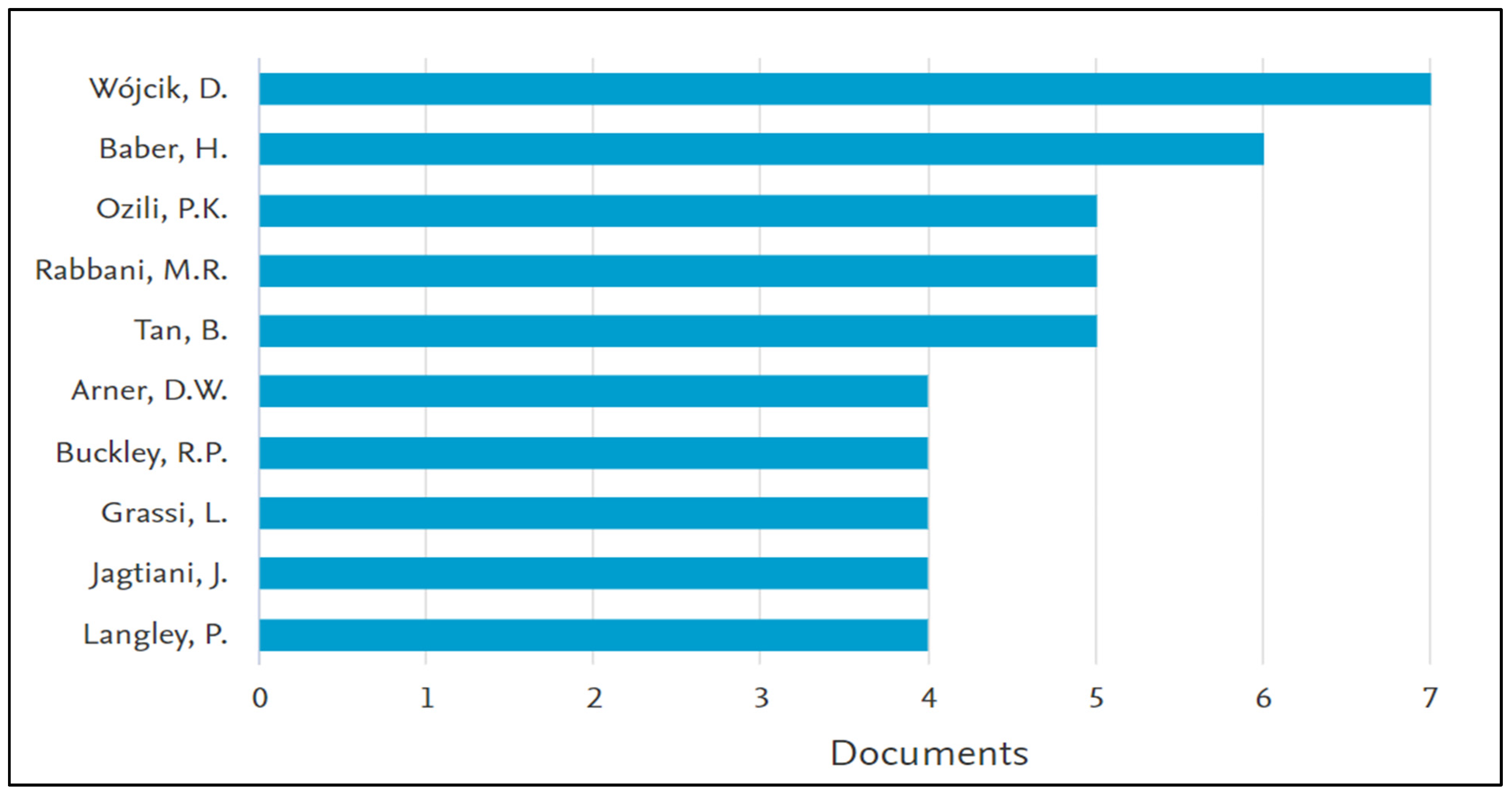

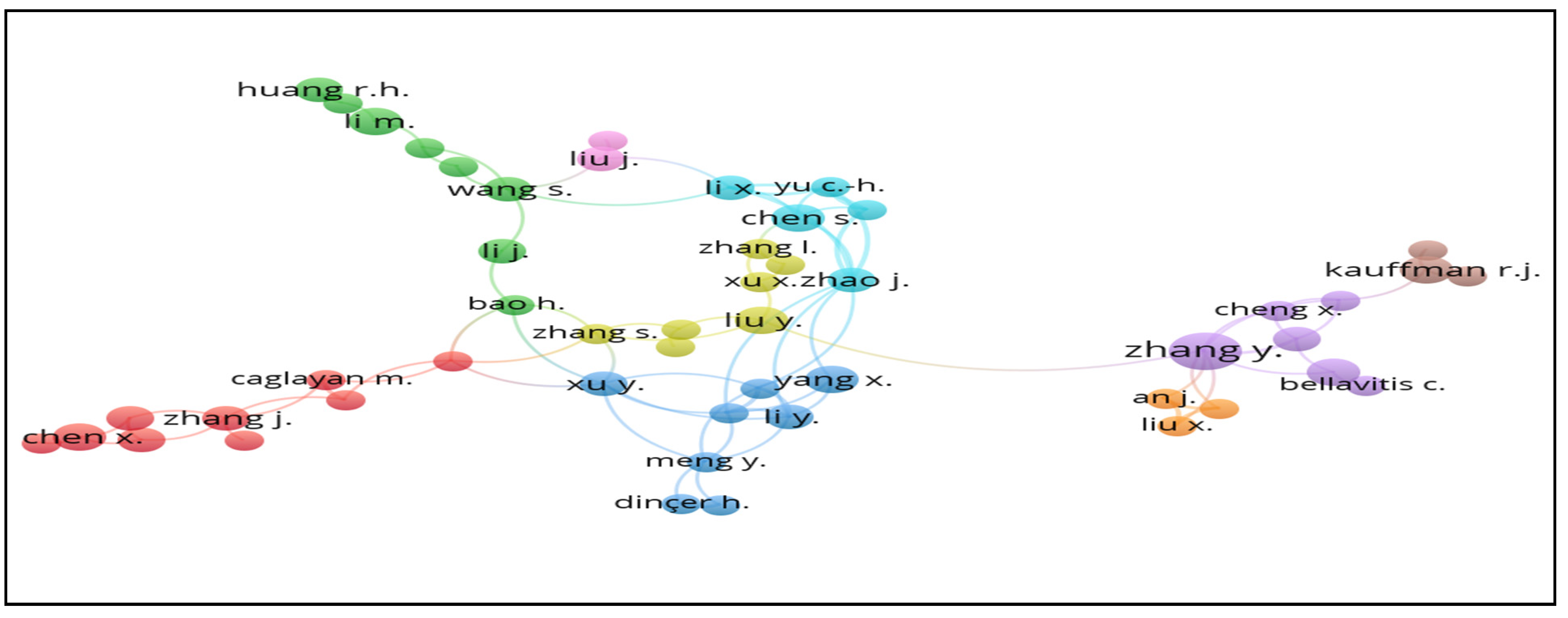

5.3. Author Wise Publication and Author Network

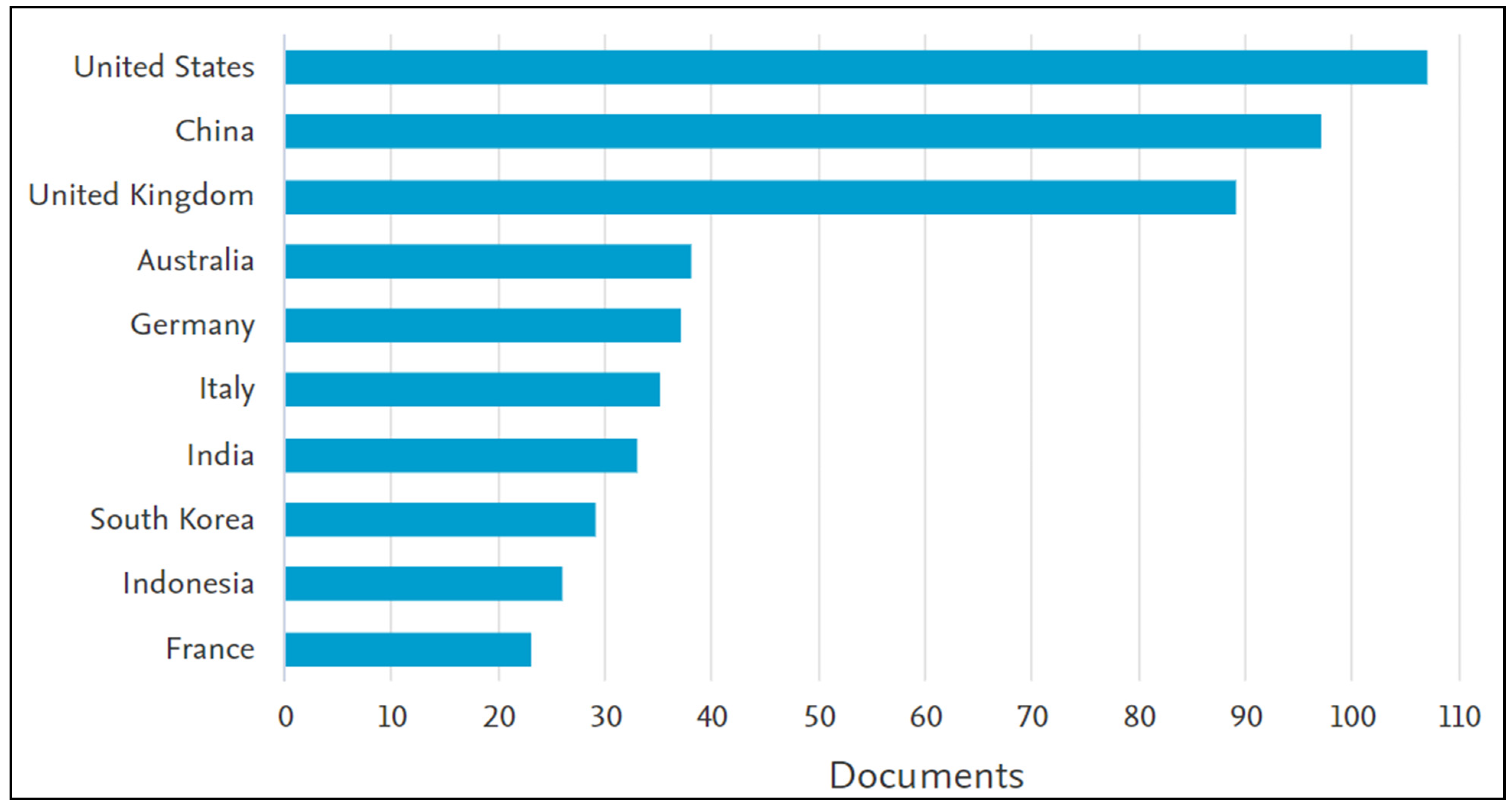

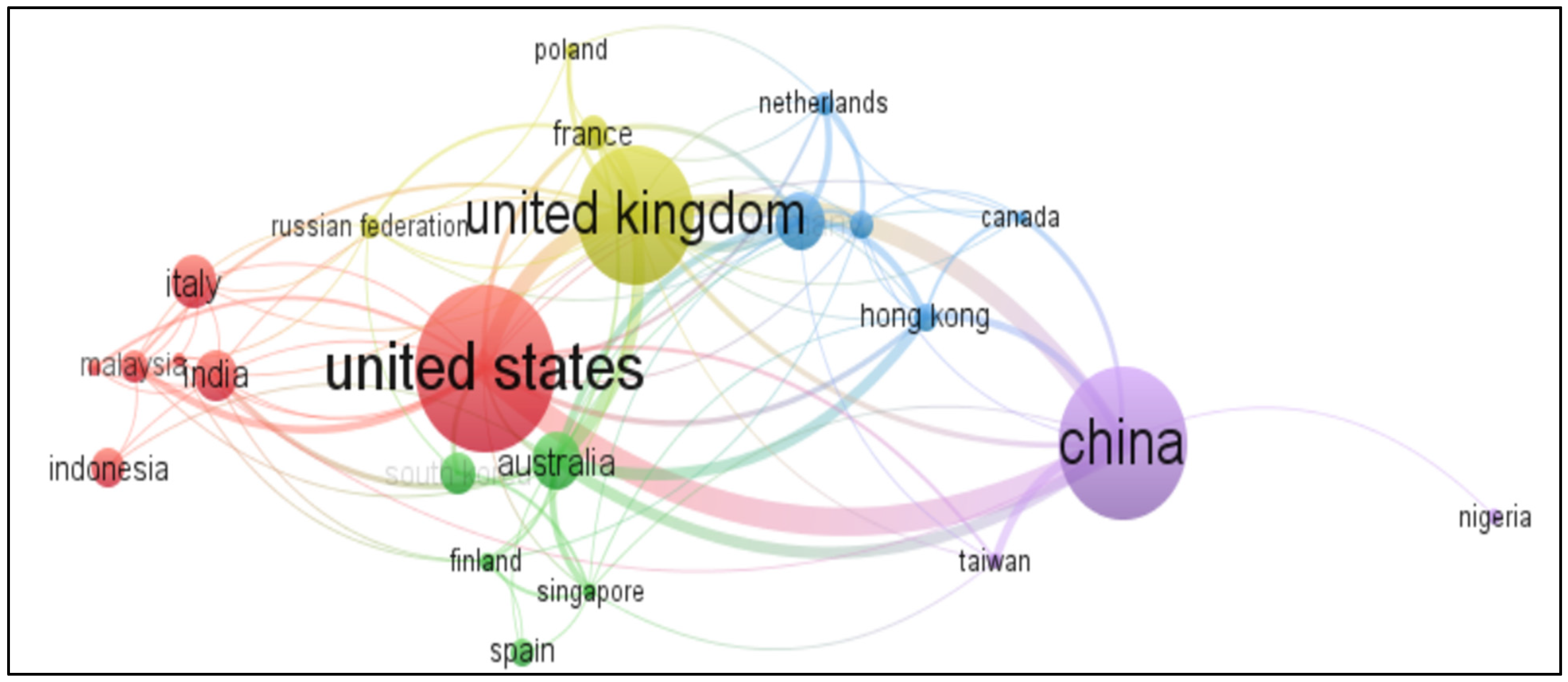

5.4. Country Wise Publication

5.5. Citation

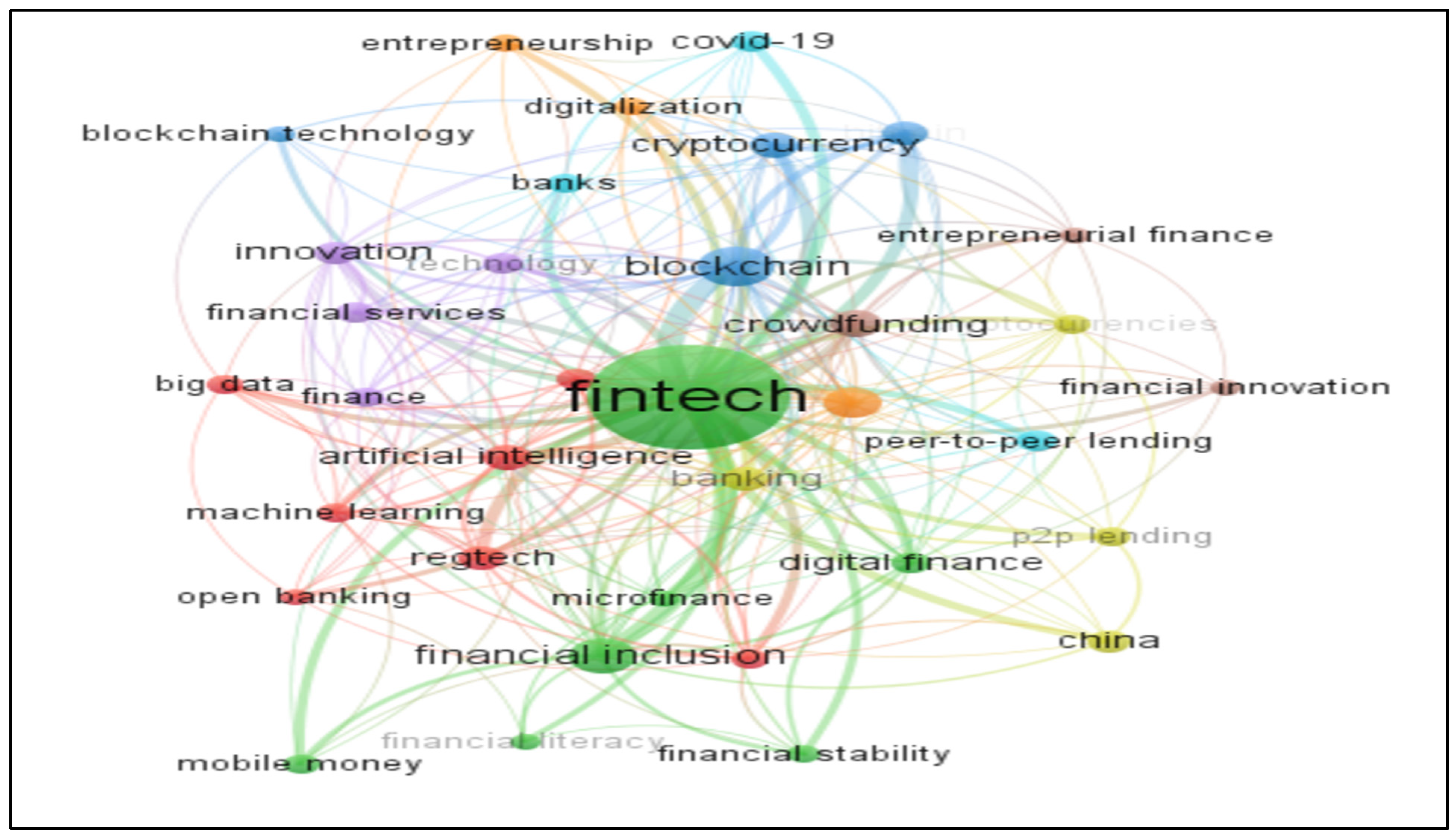

5.6. Keywords

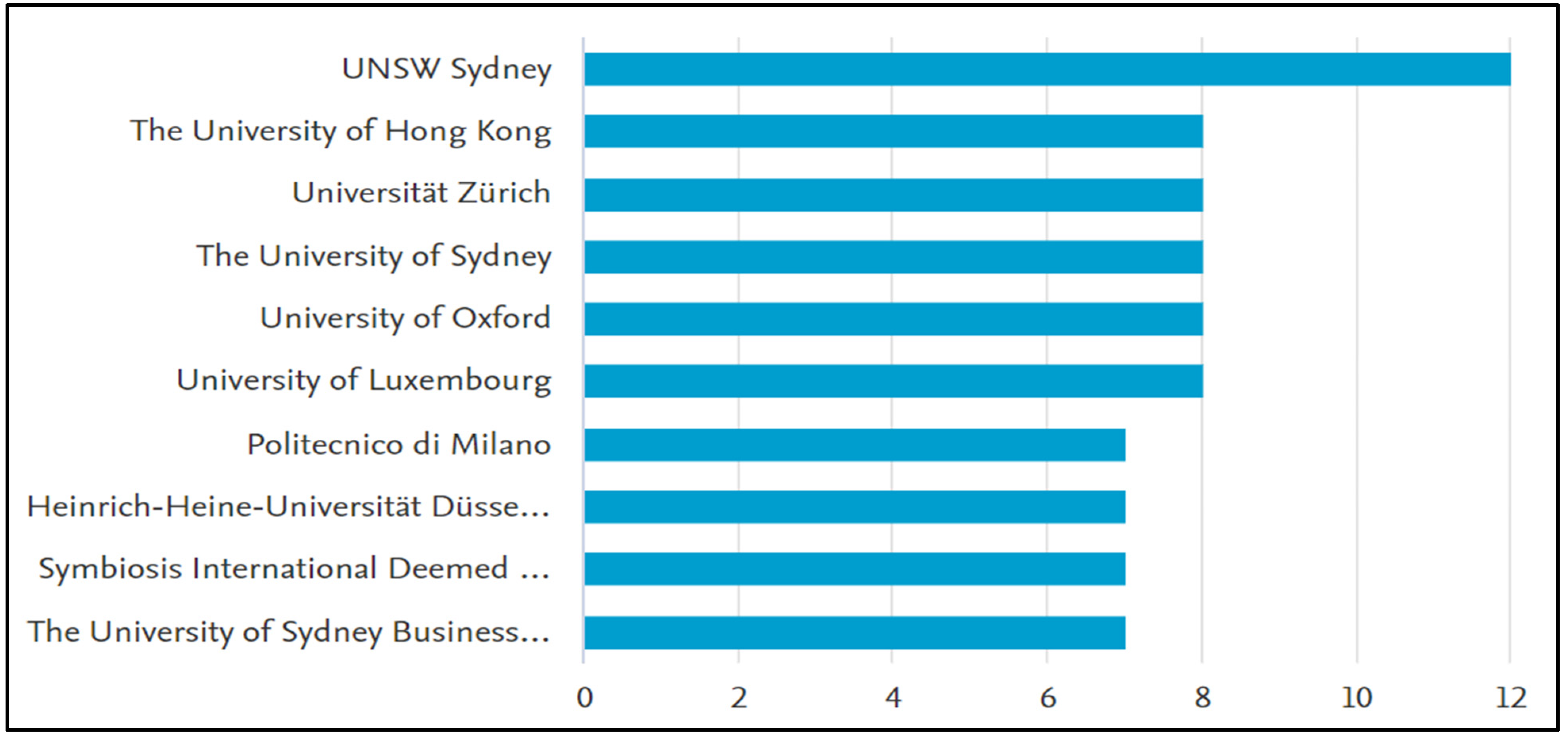

5.7. Affiliation

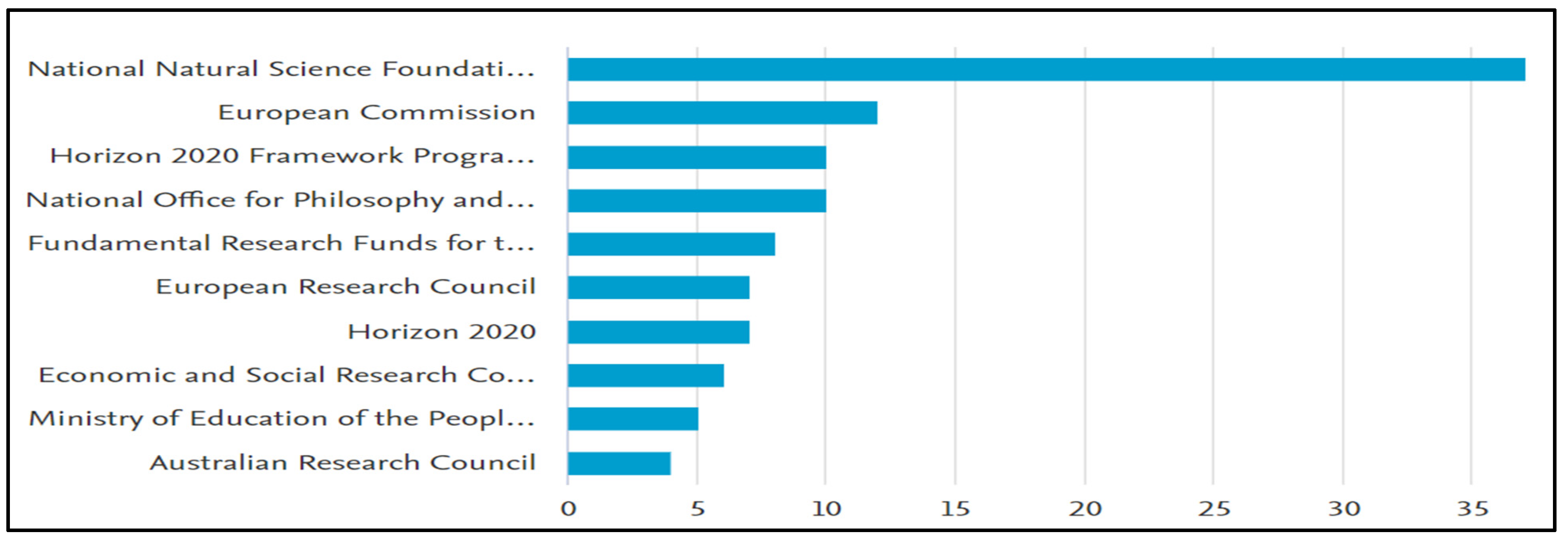

5.8. Documents by Funding Sponsor

5.9. Different Types of Indexes

5.10. Bradford’s Law

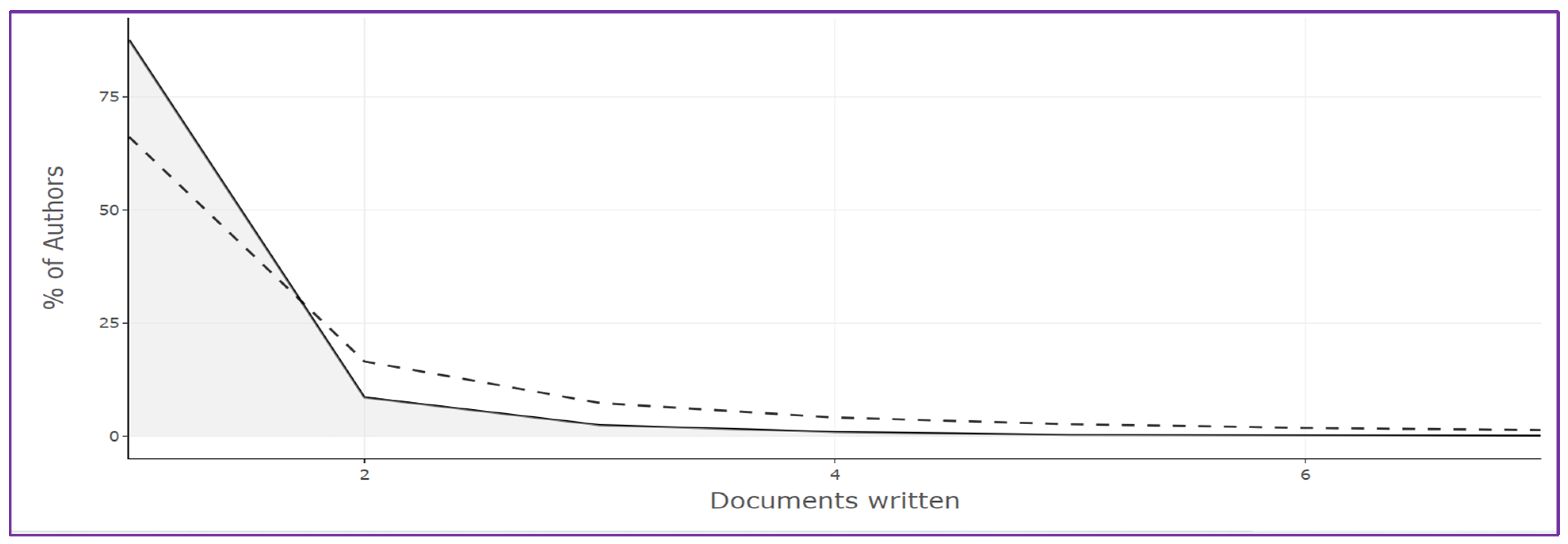

5.11. Lotka’s Law

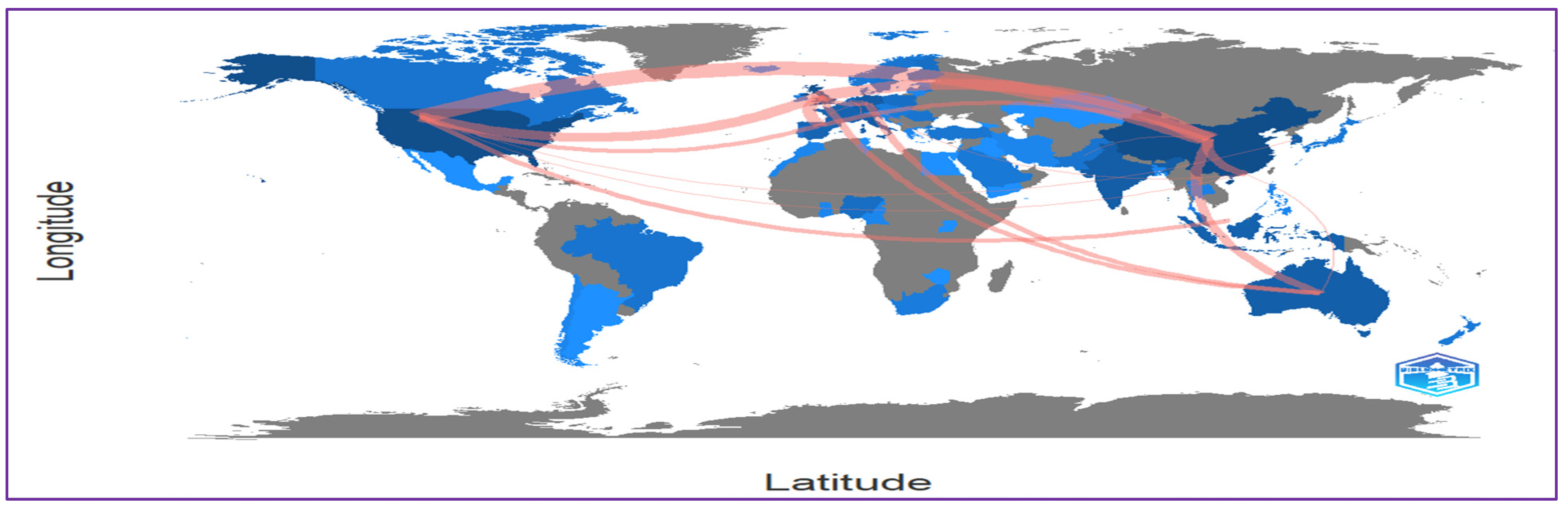

5.12. World Map

6. Conclusions

7. Limitations

8. Implications

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Anjum, Muhammad Naeem, Xiuchun Bi, Jaffar Abbas, and Shuguang Zhang. 2017. Analyzing predictors of customer satisfaction and assessment of retail banking problems in Pakistan. Cogent Business & Management 4: 1338842. [Google Scholar] [CrossRef]

- Aria, Massimo, and Corrado Cuccurullo. 2017. Bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics 11: 959–75. [Google Scholar] [CrossRef]

- Arner, Douglas W., Janos Nathan Barberis, and Ross P. Buckley. 2015. The Evolution of Fintech: A New Post-Crisis Paradigm? SSRN Electronic Journal 47: 1271. [Google Scholar] [CrossRef]

- Azizi, Mohammad Reza, Rasha Atlasi, Arash Ziapour, Jaffar Abbas, and Roya Naemi. 2021. Innovative Human Resource Management Strategies during the COVID-19 Pandemic: A Systematic Narrative Review Approach. Heliyon 7: e07233. [Google Scholar] [CrossRef]

- Berger, Allen N. 2002. The Economic Effects of Technological Progress: Evidence from the Banking Industry. SSRN Electronic Journal 35: 141–76. [Google Scholar] [CrossRef]

- Bradford, S. C. 1934. Sources of Information on Specific Subjects. Engineering 137: 85–86. [Google Scholar]

- Brandl, Barbara, and Lars Hornuf. 2020. Where Did FinTechs Come From, and Where Do They Go? The Transformation of the Financial Industry in Germany After Digitalization. Frontiers in Artificial Intelligence 3: 8. [Google Scholar] [CrossRef]

- Chen, You-Shyang, Chien-Ku Lin, Yu-Sheng Lin, Su-Fen Chen, and Huei-Hua Tsao. 2022. Identification of Potential Valid Clients for a Sustainable Insurance Policy Using an Advanced Mixed Classification Model. Sustainability 14: 3964. [Google Scholar] [CrossRef]

- Fairthorne, Robert A. 1969. Empirical Hyperbolic Distributions (Bradford-Zipf-Mandelbrot) for Bibliometric Description and Prediction. Journal of Documentation 25: 319–43. [Google Scholar] [CrossRef]

- Frame, W. Scott, and Lawrence J. White. 2004. Empirical Studies of Financial Innovation: Lots of Talk, Little Action? Journal of Economic Literature 42: 116–44. [Google Scholar] [CrossRef]

- Gill, Asif, Deborah Bunker, and Philip Seltsikas. 2015. Moving Forward: Emerging Themes in Financial Services Technologies’ Adoption. Communications of the Association for Information Systems 36: 12. [Google Scholar] [CrossRef]

- Gomber, Peter, Jascha-Alexander Koch, and Michael Siering. 2017. Digital Finance and FinTech: Current research and future research directions. Journal of Business Economics 87: 537–80. [Google Scholar] [CrossRef]

- Hood, William W., and Concepción S. Wilson. 2001. The Literature of Bibliometrics, Scientometrics, and Informetrics. Scientometrics. Scientometrics 52: 291–314. [Google Scholar] [CrossRef]

- Joshi, Vasant Chintaman. 2020. Digital Finance, Bits and Bytes. Singapore: Springer. [Google Scholar]

- Kanungo, Rama Prasad, and Suraksha Gupta. 2021. Financial inclusion through digitalisation of services for well-being. Technological Forecasting and Social Change 167: 120721. [Google Scholar] [CrossRef]

- Karagiannaki, Angeliki, Georgios Vergados, and Konstantinos Fouskas. 2017. The Impact of Digital Transformation in the Financial Services Industry: Insights from an Open Innovation Initiative in Fintech in Greece. Paper presented at the Mediterranean Conference on Information Proceedings 2. (MICS), Genoa, Italy, September 4–5; Available online: http://aisel.aisnet.org/mcis2017/2 (accessed on 15 February 2023).

- Lai, K. P. Y. 2020. FinTech. In The Routledge Handbook of Financial Geography. Abingdon-on-Thames: Routledge, pp. 440–57. [Google Scholar] [CrossRef]

- Leong, Kelvin, and and Anna Sung. 2018. FinTech (Financial Technology): What is It and How to Use Technologies to Create Business Value in Fintech Way? International Journal of Innovation, Management and Technology 9: 74–78. [Google Scholar] [CrossRef]

- Li, Bo, and Zeshui Xu. 2021. Insights into financial technology (FinTech): A bibliometric and visual study. Financial Innovation 7: 69. [Google Scholar] [CrossRef]

- Lotka, Alfred J. 1926. The Frequency Distribution of Scientific Productivity. Journal of Washington Academic and Science 16: 317–23. [Google Scholar]

- Nicoletti, Bernardo. 2017. Future of FinTech. Basingstoke: Palgrave Macmillan. [Google Scholar]

- Osareh, Farideh. 1996a. Bibliometrics, Citation Analysis and Co-Citation Analysis: A Review of Literature I. Libri 46: 149–58. [Google Scholar] [CrossRef]

- Osareh, Farideh. 1996b. Bibliometrics, Citation Anatysis and Co-Citation Analysis: A Review of Literature II. Libri 46: 217–25. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2018. Impact of digital finance on financial inclusion and stability. Borsa Istanbul Review 18: 329–40. [Google Scholar] [CrossRef]

- Pritchard, A. 1969. Statistical Bibliography or Bibliometrics. Journal of Documentation 25: 348–49. [Google Scholar]

- Puschmann, Thomas. 2017. Fintech. Business & Information Systems Engineering 59: 69–76. [Google Scholar] [CrossRef]

- Shao, Min, Wenxin Jiang, and Chao Ma. 2022. Research on Internet Use and Family Commercial Health Insurance Purchase Behavior: Evidence from China. Paper presented at the ICMSSE 2022, AHCS 12, Chongqing, China, December 12; pp. 374–80. [Google Scholar] [CrossRef]

- Suprun, Anatoly, Tetiana Petrishina, and Iryna Vasylchuk. 2020. Competition and cooperation between fintech companies and traditional financial institutions. E3S Web of Conferences 166: 13028. [Google Scholar] [CrossRef]

- Tepe, Gencay, Umut Burak Geyikci, and Fatih Mehmet Sancak. 2021. FinTech Companies: A Bibliometric Analysis. International Journal of Financial Studies 10: 2. [Google Scholar] [CrossRef]

- Tsay, R. S. 2005. Analysis of Financial Time Series, 3rd ed. Hoboken: John Wiley and Sons. [Google Scholar]

- Vučinić, Milena. 2020. Fintech and Financial Stability Potential Influence of FinTech on Financial Stability, Risks and Benefits. Journal of Central Banking Theory and Practice 9: 43–66. [Google Scholar] [CrossRef]

- Wang, Chunlei, Dake Wang, Jaffar Abbas, Kaifeng Duan, and Riaqa Mubeen. 2021. Global Financial Crisis, Smart Lockdown Strategies, and the COVID-19 Spillover Impacts: A Global Perspective Implications from Southeast Asia. Frontiers in Psychiatry 12: 643783. [Google Scholar] [CrossRef]

- Zarifis, Alex, and Xusen Cheng. 2021. Evaluating the new AI and data driven insurance business models for incumbents and disruptors: Is there convergence? Paper presented at the 24th International Conference on Business Information Systems (BIS 2021), Hannover, Germany, June 15–17; pp. 199–208. [Google Scholar]

- Zarifis, Alex, Peter Kawalek, and Aida Azadegan. 2021. Evaluating if trust and personal information privacy concerns are barriers to using health insurance that explicitly utilizes AI. Journal of Internet Commerce 20: 66–83. [Google Scholar] [CrossRef]

- Zipf, George Kingsley. 1949. Human Behavior and the Principle of Least Effort. Boston: Addison-Wesley Press. [Google Scholar]

- Zou, Zongsen, Xindi Liu, Meng Wang, and Xinze Yang. 2023. Insight into digital finance and fintech: A bibliometric and content analysis. Technology in Society 73: 102221. [Google Scholar] [CrossRef]

| Author | Documents | Citations | Total Link Strength |

|---|---|---|---|

| Gomber P. | 2 | 547 | 75 |

| Kauffman R.J. | 4 | 357 | 42 |

| Shin Y.J. | 2 | 303 | 58 |

| Ozili P.K. | 5 | 212 | 18 |

| Giudici G. | 2 | 208 | 26 |

| Martinazzi S. | 2 | 208 | 26 |

| Brooks’ S. | 2 | 200 | 23 |

| Hornuf L. | 2 | 154 | 35 |

| Tan B. | 5 | 139 | 52 |

| Sun Y. | 4 | 130 | 48 |

| Leong C. | 3 | 126 | 42 |

| Tan F.T.C. | 2 | 126 | 36 |

| Jagtiani J. | 5 | 124 | 53 |

| Lemieux C. | 2 | 113 | 47 |

| Langley P. | 2 | 108 | 15 |

| Leyshon A. | 2 | 108 | 15 |

| Rabbani M.R. | 6 | 107 | 18 |

| Chang V. | 3 | 106 | 4 |

| Belanche D. | 2 | 103 | 6 |

| Casaló L.V. | 2 | 103 | 6 |

| Keyword | Occurrences | Total Link Strength |

|---|---|---|

| Fintech | 506 | 1783 |

| Blockchain | 84 | 382 |

| Financial Inclusion | 63 | 260 |

| Financial Technology | 58 | 201 |

| Finance | 51 | 301 |

| Financial Services | 47 | 269 |

| Banking | 46 | 265 |

| Innovation | 45 | 279 |

| Artificial Intelligence | 40 | 193 |

| China | 37 | 180 |

| Cryptocurrency | 37 | 161 |

| Bitcoin | 32 | 135 |

| Crowdfunding | 32 | 127 |

| Financial Market | 27 | 182 |

| Big Data | 24 | 99 |

| Financial System | 22 | 174 |

| Regtech | 22 | 93 |

| Peer-to-Peer Lending | 21 | 81 |

| Technology | 20 | 109 |

| COVID-19 | 18 | 67 |

| Element | H-Index | G-Index |

|---|---|---|

| TECHNOLOGICAL FORECASTING AND SOCIAL CHANGE | 12 | 21 |

| SUSTAINABILITY (SWITZERLAND) | 10 | 14 |

| ELECTRONIC COMMERCE RESEARCH AND APPLICATIONS | 9 | 13 |

| JOURNAL OF OPEN INNOVATION: TECHNOLOGY, MARKET, AND COMPLEXITY | 7 | 8 |

| ENVIRONMENT AND PLANNING A | 6 | 6 |

| EUROPEAN BUSINESS ORGANIZATION LAW REVIEW | 6 | 9 |

| FINANCIAL INNOVATION | 6 | 10 |

| INDUSTRIAL MANAGEMENT AND DATA SYSTEMS | 6 | 8 |

| FINANCE RESEARCH LETTERS | 5 | 9 |

| ELECTRONIC MARKETS | 4 | 4 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Garg, G.; Shamshad, M.; Gauhar, N.; Tabash, M.I.; Hamouri, B.; Daniel, L.N. A Bibliometric Analysis of Fintech Trends: An Empirical Investigation. Int. J. Financial Stud. 2023, 11, 79. https://doi.org/10.3390/ijfs11020079

Garg G, Shamshad M, Gauhar N, Tabash MI, Hamouri B, Daniel LN. A Bibliometric Analysis of Fintech Trends: An Empirical Investigation. International Journal of Financial Studies. 2023; 11(2):79. https://doi.org/10.3390/ijfs11020079

Chicago/Turabian StyleGarg, Girish, Mohd Shamshad, Nikita Gauhar, Mosab I. Tabash, Basem Hamouri, and Linda Nalini Daniel. 2023. "A Bibliometric Analysis of Fintech Trends: An Empirical Investigation" International Journal of Financial Studies 11, no. 2: 79. https://doi.org/10.3390/ijfs11020079

APA StyleGarg, G., Shamshad, M., Gauhar, N., Tabash, M. I., Hamouri, B., & Daniel, L. N. (2023). A Bibliometric Analysis of Fintech Trends: An Empirical Investigation. International Journal of Financial Studies, 11(2), 79. https://doi.org/10.3390/ijfs11020079