Abstract

The presence of board members with good governance attributes is value-relevant since it influences investors’ investment decisions. The value relevance is expected to improve with the newly introduced extended audit report to disclose key audit matters (KAMs). KAM disclosure provides information about issues faced by external auditors in the auditing of a company’s financial statement. Since the disclosure of KAM involves discussion and negotiation between the board and external auditor, it gives an indication that board value relevance can be affected by KAM disclosure. Using 931 firm-year observations from firms listed on the Bursa Malaysia between 2016 and 2019, this study re-examined the value relevance of the board and whether such value relevance improves with the disclosure of KAMs. The findings indicated that some board attributes influenced investors’ reactions negatively. The disclosure of KAM served as both an indirect mediator and a complementary mediator to increase the board’s value relevance. Investors reacted less negatively with KAM disclosure and companies’ values improved. The findings provide an insight into the role of KAM disclosure in reducing information asymmetry and assisting investors in making investment decisions. The findings support policymakers’ decisions to mandate the implementation of ISA 701, which requires the disclosure of KAMs.

1. Introduction

In the corporate world, the board of directors is responsible for establishing policies, providing direction, and monitoring the company performance to maximize shareholders’ value while considering the interests of other stakeholders. Prior research concurs that the board of directors is the pinnacle of internal corporate governance and plays a crucial role in overseeing business operations and management (Dang and Nguyen 2021; Nguyen 2022). An effective board limits managers’ opportunistic behavior, reduces the agency problem, and increases the demand for companies’ shares. An effective board also lowers the cost of enforcing contracts with customers and suppliers and reduces borrowing costs (Piot and Missonier-Piera 2009). A company with effective board members is more valued by investors and is expected to attract more investment. Past studies have demonstrated that an effective board measured by some board attributes is value-relevant since the board influences investors’ investment decisions (Amer Al-Jaifi et al. 2017; Shin and Kim 2018).

From the accounting and finance perspective, the board is also responsible for the integrity and accuracy of a company’s financial reporting, including the implementation of effective internal controls and appointment of independent external auditors (Tugman and Leka 2019). Agency theory postulates that information asymmetry and agency problems are lower in companies with effective corporate governance mechanisms (Fama and Jensen 1983). The existence of audit reports reduces agency problems and information asymmetry between management and shareholders. Effective corporate governance mechanisms and more detailed auditor reports will deter managers from acting opportunistically at the expense of shareholders’ interests (Jensen and Meckling 1976). Effective corporate governance mechanisms, represented by certain board attributes, protect shareholders’ interests by monitoring corporate activities and aligning the interests of management and shareholders.

The new international standards on auditing, ISA 701: Communicating Key Audit Matters (KAM) in the Independent Auditor’s Report, require auditors to provide an extended audit report that discusses key audit matters (IAASB 2018). KAMs provide additional information, citing the difficulties encountered by the auditor during the audit process. These include difficulties in obtaining sufficient audit evidence, significant modifications to the audit plan, and the identification of major deficiencies in the company’s internal controls. The framework for determining KAMs begins with matters communicated to the board of directors, or frequently referred to as those charged with governance (TCWG) (IAASB 2018). The board oversight functions are expected to influence the disclosure of KAMs because external auditors deal with the board on matters affecting a company’s financial and audit activities. A study in Malaysia confirmed the crucial role of TCWG in assisting the external auditors in the KAM selection process (Securities Commission Malaysia 2018). In Malaysia, following the recommendation of the Malaysian Institute of Accountants (MIA), ISA 701 was adopted in 2015 and applied for the audits of financial statements for periods ending on or after 15 December 2016.

Results from the majority of past studies show that the information disclosed in KAMs is value-relevant since investors use the information to make investment decisions (Fayad Altawalbeh and Alhajaya 2019; Reid et al. 2015; Suttipun 2020; Zhi and Kang 2021). In other words, the disclosure of KAMs causes the share price to change. Additionally, since the disclosure of KAMs depends on the discussion and negotiation between the board and external auditor (IAASB 2018), it gives an indication that KAM disclosure can be influenced by the characteristics of the board. Based on these chains of relationships (KAM and share price; board and KAM), it is expected that KAM disclosure can act as a mediator variable that enhances the value relevance of the board. However, to the authors’ knowledge, these associations have not been empirically tested before. Thus, this study fills in these research gaps. Specifically, the objective of the study is to re-examine the value relevance of boards by investigating its association with the share price. The study also investigates whether KAM can serve as a mediator variable to influence the value relevance of the board.

A study of KAM value relevance has never been carried out in Malaysia. The contradictory evidence globally about the effect of KAM disclosure (Altawalbeh and Alhajaya 2019; Reid et al. 2015; Suttipun 2020; Zhi and Kang 2021; Bédard et al. 2019; Boonyanet and Promsen 2019) raises the empirical question of whether investors in Malaysia value and appreciate KAM disclosure. The findings of this study in the Malaysian setting are expected to be generalized to all listed companies worldwide, since the requirement of KAM disclosure is mandated for all member countries of the International Federation of Accountants (IFAC).

Using a sample of 931 firm-year observations of Malaysian public listed companies from 2016 to 2019, this study found a significant negative association between several board attributes (board independence, female director, and board tenure) and the share price. The results also revealed that the additional information provided by KAM disclosure lessened the negative relationship between board attributes and the share price. In other words, the information content of KAMs improved the value relevance of the board and caused investors’ reactions. The findings add to the literature on the role of KAM disclosure in enhancing the value relevance of the board. The findings also support the decision by the International Auditing and Assurance Standards Board (IAASB) to mandate the disclosure of KAMs worldwide. Due to the informative value of KAM, we suggest that its implementation should also be extended to all audit reports of government agencies.

The rest of this paper is structured as follows: Section 2 examines previous research and develops the hypotheses. The research design is discussed in Section 3, and the descriptive statistics and empirical results are presented in Section 4. Finally, Section 5 summarizes the paper and discusses its limitations, followed by future research directions.

2. Corporate Governance in Malaysia

The importance of corporate governance in the Malaysian business environment is evidenced by a series of Malaysian Codes on Corporate Governance (MCCG), issued by the Securities Commission of Malaysia (SCM). The first version, released in March 2000, specified four broad principles of good corporate governance: appointment board of directors, director’s remuneration, shareholders, and accountability and audit. The second version, MCCG 2007, was updated to enhance the roles of the board of directors, audit committee, and internal controls, and to ensure that the board and the audit committee fulfill their duties and obligations properly. As a result, starting in 2007, Bursa Malaysia’s Listing Requirements specify that all audit committee members must be independent directors to guarantee the committee’s effectiveness (Securities Commission Malaysia 2009). The third version, MCCG 2012, redefined the roles and responsibilities of board members by making them accountable for ensuring the integrity of financial reporting, identifying and managing risks, ensuring timely and high-quality disclosures, and recognizing the relationship between the company and shareholders.

In 2017, SCM issued MCCG 2017, recommending that independent directors should make up at least half the number of the board members. Furthermore, MCCG 2017 tightened the restrictions on retaining independent directors for more than nine years, requiring the board to seek shareholders’ approval to retain them. Further, the retention of an independent director for more than 12 years required shareholders’ approval at the annual general meeting via a two-tier voting procedure. The latest reviewed and updated version of MCCG was released in 2021 to ensure its relevancy and alignment with globally recognized best practices and standards. Among the significant changes in MCCG 2021 are restrictions on the chairman of the board to serve on the audit, nomination, and remuneration committees. Furthermore, the reappointment of independent directors who have been on the board for more than nine years now requires approval via a two-tier voting procedure at the annual general meeting. Heads of state, heads of government, ministers, and active politicians are discouraged from joining the board. Further, the cooling period for former audit partners to become audit committee members has been increased from 2 to 3 years (Securities Commission Malaysia 2021).

3. Literature Review and Hypothesis Development

3.1. Board of Directors’ Attributes and Share Price

Agency theory is a predominant theory underpinning the role of effective governance in increasing a company’s value. The separation between management and ownership creates a potential conflict of interest between agents and principals, resulting in agency costs. The agency costs can be reduced with effective corporate governance mechanisms (Fama and Jensen 1983). Agency theory posits that managers are likely to act opportunistically by pursuing their personal gains at the expense of shareholders’ interests (Jensen and Meckling 1976). For example, they may be enticed to purchase lavish offices, company cars, and other extravagant items as long as the costs are borne by the owners. The effective corporate governance mechanism protects shareholders’ interests by monitoring these activities and aligning the interests of management and shareholders.

The presence of board members with good governance attributes signals to the capital market that the company has established a diligent monitoring process, and this can have an impact on investors’ perception towards the company’s value. Investors are attracted to invest in companies with good governance practices and are willing to pay a higher share price because good governance limits managers’ private benefits (Lombardo and Pagano 2000). Moreover, managers may find it more difficult to conceal their perquisite consumption and shirking behavior when they are closely monitored by effective board members. Good governance also increases a company’s negotiating power when dealing with various stakeholders, and this can reduce the cost of enforcing contracts between them (Lombardo and Pagano 2000). Other monitoring roles of the board include the appointment of independent external auditors, evaluating the rationale for management’s accounting policy choices, and assessing the quality of the company’s management. The extended audit report (KAM disclosure) by the external auditor is expected to reduce the agency costs and information asymmetry in financial reporting.

This study examines the effects of seven board attributes, namely board size, board independence, female board members, committed board, board tenure, board expertise, and board meeting, on companies’ share prices. These seven attributes have been discovered as representing good governance in previous studies (Agrawal and Chadha 2005; Akhtaruddin et al. 2009; Beasley 1996; Carcello et al. 2002; Kamardin et al. 2014; Srinidhi et al. 2011; Vafeas 1999).

Board size plays a crucial role in determining directors’ ability to monitor and control managers. A large board size is valuable for the extensiveness of members’ experiences, expertise, and potentially important connections (Fama and Jensen 1983). A large board size may also increase its supervisory capacity and remove ineffective management teams to ensure that the company is pursuing its shareholders’ interests and enhancing the company’s value (Dalton and Dalton 2005). In addition, board size, particularly the size of the audit committee, improves operational risk management, which in turn impacts bank performance (Nguyen and Dang 2022).

Board independence has also been considered to be highly effective in monitoring managers for shareholders’ interests. An independent board improves both the quality and the quantity of disclosure, thereby improving the transparency of accounting information and decreasing the information asymmetry between companies and investors (Bédard et al. 2008; Dang and Nguyen 2022; Higgins and Gulati 2006; Al-Sartawi et al. 2017). The financial statements of a company are considered more reliable if the company has a higher number of independent directors, as independent directors represent shareholders’ interests, thus ensuring high returns for investors (Beasley 1996; Rosenstein and Wyatt 1990). It has been discovered that the appointment of an independent director, particularly one from a financial institution, results in a positive market reaction and a reduction in the bid–ask spread, indicating that independent boards are more effective in monitoring management, resulting in greater control of agency problems and reduced information asymmetry (Rosenstein and Wyatt 1990).

Female board members promote more effective board communication with investors and increase the distribution of valuable information (Srinidhi et al. 2011). In comparison to male directors, female directors provide unique and different perspectives, experiences, and work styles (Giannarakis 2014). In pursuing the MCCG 2017 gender diversity agenda, Bursa Malaysia has amended its Listing Requirements, specifying that large companies must have at least 30 percent female board members (Bursa Malaysia 2017). Economically, female board members boost shareholder value since women are more likely than men to discover ethical judgment flaws and reduce the extent of earnings management (Gonçalves et al. 2022). In addition, investors feel that the inclusion of women on corporate boards increases the safety of their investments and deters corporate corruption and fraud. Boards with a higher proportion of women have a greater capacity for decision making, a more stringent monitoring structure, and greater alignment with shareholders’ interests (Adams and Ferreira 2009).

Additionally, directors who serve on several boards (multiple board directorships) have more experience and expertise (Fama and Jensen 1983). Usually, directors with superior performance receive more board appointments and companies with poor image appoint directors who can help to restore the company’s reputation (Helland 2006). However, according to Bursa Malaysia’s Listing Requirements, a director of a listed company must not hold more than five directorships in other listed companies (Bursa Malaysia 2017). This rule is the result of criticism against multiple directorships; the argument is that effective monitoring by directors requires the considerable commitment of time and resources. Busy directors might be less effective in monitoring management and might impose greater agency costs on the company (Srinivasan 2005; Volonté 2015). Several studies have also suggested that holding excessive multiple directorships is one of the factors preventing directors from contributing positively to company performance and performing their management oversight role or strategic role effectively (Kamardin et al. 2014).

The ability of board members to monitor and manage effectively corresponds with the number of years for which they serve on the board. Prior research has demonstrated a negative relation between board tenure and financial statement fraud and earnings management (Beasley 1996). In Malaysia, longer board member tenures are positively associated with earnings quality, since more experienced directors have a better understanding of the operation of the company, enabling them to have greater decision-making control to improve the company’s value (Hashim and Devi 2008).

Previous studies also suggest that companies with financially literate board members have a higher quality of financial reporting and fewer financial restatements (Agrawal and Chadha 2005). Indeed, board members who are financially literate are capable of comprehending and resolving the concerns raised by the auditor in preparing the financial reports. In addition to financial literacy, diverse knowledge and educational backgrounds are essential for accelerating strategic decision making (Katmon et al. 2019). In accordance with the Central Bank of Malaysia’s 2011 Guidelines on Corporate Governance, board members should have diverse qualifications and backgrounds in accounting, information technology (IT), finance, law, business, and public administration. Board members from diverse backgrounds offer valuable advice and knowledge that provide better oversight of the company’s management and improve the company’s performance.

Board meetings are a critical element of board operations and a barometer of directors’ effort. Active boards that meet frequently are more likely to carry out their responsibilities in the best interests of shareholders (Vafeas 1999). An increased frequency of board meetings reduces the likelihood of fraud by allowing directors to identify and resolve potential issues, particularly those related to the financial reporting quality (Chen et al. 2006). This study anticipates an effective board of directors’ attributes to have a positive relationship with a company’s market value. Hence, the following hypothesis is proposed to be tested.

Hypothesis 1 (H1).

There is a positive association between board attributes (board size, board independence, females on board, committed board, board tenure, board expertise, board meetings) and share price.

3.2. Board of Directors’ Attributes and KAM Disclosure and Share Price

Agency theory supports the role of KAM as an information environment that reduces agency problems (Goh et al. 2016). KAM disclosure is the outcome of negotiations and discussions between the board and the external auditor. KAM disclosure provides investors with an insight into the audit issues that the company is facing; thus, it is expected to reduce information asymmetry and may influence investors’ reactions. According to signaling theory, board members’ attributes provide signals to investors that help them to distinguish between good and bad companies (Ittonen 2012). By assisting investors in differentiating between these two types of companies, KAM disclosure allows them to make better investment decisions. Efficient market hypothesis (EMH) asserts that in a semi-strong market such as Malaysia, share prices always incorporate all available information, such as the auditors’ report, annual earnings, dividends, stock splits, and so on.

Hypothesis 1 predicts a positive association between board attributes and share price, implying that investors will consider the characteristics of the board before making investment decisions. Since KAM disclosure is the product of discussion and negotiation between auditors and TCWG, this study predicts that certain board attributes are expected to influence the KAM disclosure. Given the expected relationship between board attributes and share price (H1), as well as the relationship between board attributes and KAM disclosure, there is a chain of relationships between these three variables, with KAM disclosure serving as a possible mediator in these relationships. This is consistent with recent empirical evidence suggesting that the effect of an effective board of directors on share price is not only direct but also indirect, which occurs through the information environment (Goh et al. 2016; Latif et al. 2017).

In an earlier study, management forecast and analyst coverage were examined as an information environment (mediator) for the board of directors to influence investors’ reactions (Goh et al. 2016). Similarly, financial reporting quality, measured by earnings quality, served as a mediating variable through which corporate governance affected company value (Latif et al. 2017). In Bahrain’s Stock Exchange, a significant positive relationship was found between corporate governance frameworks and voluntary disclosure, resulting in a positive association with the market (Al Maskati and Hamdan 2017).

Based on the above statements, this study proposes that corporate governance mechanisms have an indirect influence on investors’ reactions through the disclosure of KAMs. A good corporate governance mechanism is expected to reduce information asymmetry through the KAMs’ disclosure, leading investors to react. The combination of agency and signaling theories provides the prediction of a mediating role of KAM disclosure between board attributes and investors’ reactions. Accordingly, this study proposes the following hypothesis to be tested.

Hypothesis 2 (H2).

KAM disclosure mediates the association between board attributes (board size, board independence, females on board, committed board, board tenure, board expertise, board meetings) and share price.

4. Data and Research Design

4.1. Sample and Data Collection

The population of this study comprises Malaysian public listed companies as of May 2020, excluding companies from the finance, real estate investment trust (REITs), and closed-end fund sectors. These companies were excluded because they have to adhere to different reporting regulations, such as the Financial Service Act 2013, required by the Central Bank of Malaysia. The policy document supplementing this Act requires finance-related companies to submit their audited financial statements to the Central Bank of Malaysia within three months after the end of its financial year (Bank Negara Malaysia 2019). The submission requirement is significantly earlier than the listing requirement of Bursa Malaysia. Consequently, financial institutions are excluded from the population total. We used the proportionate stratified random sampling method to obtain a more representative population. Table 1 reports the number of samples from each industry. The data on KAM disclosure and board attributes were collected from each company’s annual reports. Other financial data, such as share prices and control variables, were obtained from the Thomson Reuters DataStream Professional Database.

Table 1.

Sample selection.

4.2. Measurement of Variables

The dependent variable of this study is the company’s share price (PRICE), measured at 4 months after the end of each fiscal year. This measurement is consistent with Para 9.23 (1) of Bursa Malaysia’s Listing Requirements, requiring listed companies to issue their annual reports, audited financial statements, and other statutory-related documents within 4 months after the end of each fiscal year.

The independent variables are seven board attributes, namely board size (BDSIZE), board independence (BDIND), board gender (BDFEM), board commitment (BDCOMM), board tenure (BDTEN), board expertise (BDEXP), and board meeting frequency (BDMEET). Table 2 provides the detailed measurements of these attributes.

Table 2.

Measurement of variables.

The extended audit report, as the mediating variable, was measured based on KAM disclosure (KAMSCORE), encompassing two dimensions: the number of KAMs and the nature of issues disclosed as KAMs. The number of KAMs (NUM_KAM) indicates managerial opportunism and a company’s risks, which can influence investors to change their investment decisions (Lin et al. 2020). NUM_KAM may also affect users’ perceptions of the reliability of the audited financial statements (Abdullatif and Al-Rahahleh 2020). The four KAM issues are new KAMs (NEW_KAM), contingent liabilities (CL_KAM), fraud/litigation (LIT_KAM), and liquidity risk (LIQ_KAM). These four entity-specific risk disclosures pique the interest of investors more than common account-level risk disclosures (Gold et al. 2020).

New KAM issues (NEW_KAM) provide fresh audit issue information to the market (Bédard et al. 2019; Menon and Williams 2010). Contingent liabilities (CL_KAM) indicate uncertainty regarding future cash outflow estimates that can significantly affect market valuations and share price discounts (Lopes and Reis 2019). Liquidity risk (LIQ_KAM) affects stock returns, and investors prefer to invest in companies with a low bankruptcy risk (Dang and Nguyen 2020). Finally, the disclosure of fraud or litigation (LIT_KAM) can significantly reduce stock prices (Aggarwal et al. 2015; Eryigit 2019). Accordingly, this study focuses on these four KAM issues since they can affect a company’s value.

Five company financial attributes were included as the control variables, book value per share (BVS), earnings per share (EPS), company size (SIZE), profitability (ROA), and leverage (LEV), to assess their potentially confounding effects on share prices. BVS and EPS are two significant variables that influence share prices (Ohlson 1995). SIZE is also a significant determinant of the share price (Habib and Azim 2008; Lopes and Reis 2019; Sharif et al. 2015). In this context, larger companies are more likely to be profitable. Meanwhile, LEV is an essential determinant of the share price since investors attach more value to companies with less debt, as lower interest payments allow these companies to maximize stakeholders’ earnings (Habib and Azim 2008; Sharif et al. 2015). Table 2 summarizes the measurements of all variables in this study.

4.3. Empirical Model

To test H1, this study utilized multiple regression analysis to determine the relationship between the dependent variable and independent variables. The following regression model was used to test H1:

PRICEit = βο + β1BDSIZEit + β2BDINDit + β3BDFEMit + β4BDCOMMit + β5BDTENit +

β6BDEXPit + β7BDMEETit + β8BVSit + β9EPSit + β10SIZEit + β11ROAit + β12LEVit

+ δ1−n Fixed effects + εit

β6BDEXPit + β7BDMEETit + β8BVSit + β9EPSit + β10SIZEit + β11ROAit + β12LEVit

+ δ1−n Fixed effects + εit

The generalized structural equation modeling (GSEM) tool of STATA was used to test the mediation effect of KAM disclosure on the relationship between board attributes and share price. This study used the approach by Baron and Kenny (1986) and Zhao et al. (2010) to test the mediation role of KAM disclosure. According to Baron and Kenny (1986), three conditions must be present in order to test the mediation effect.

- There is a significant total effect of the independent variable (X) on the dependent variable (Y) without any effect from the mediator variable (M).PRICEit = βο + β1BDSIZEit + β2BDINDit + β3BDFEMit + β4BDCOMMit + β5BDTENit

+ β6BDEXPit + β7BDMEETit + β8BVSit + β9EPSit + β10SIZEit + β11ROAit + β12LEVit +

δ1−n Fixed effects + εit - There is a significant direct effect of the independent variable (X) and the mediator variable (M).KAMSCOREit = βο + β1BDSIZEit + β2BDINDit + β3BDFEMit + β4BDCOMMit + β5BDTENit + β6BDEXPit + β7BDMEETit + β8BVSit + β9EPSit + β10SIZEit + β11ROAit + β12LEVit + δ1−n Fixed effects + εit

- There is a significant direct effect of the independent variable (X) on the dependent variable (Y) while controlling the mediator variable (M).PRICEit = βο + β1BDSIZEit + β2BDINDit + β3BDFEMit + β4BDCOMMit + β5BDTENit + β6BDEXPit + β7BDMEETit + β8KAM_SCOREit + β9BVSit + β10EPSit + β11SIZEit + β12ROAit + β13LEVit + δ1−n Fixed effects + εit

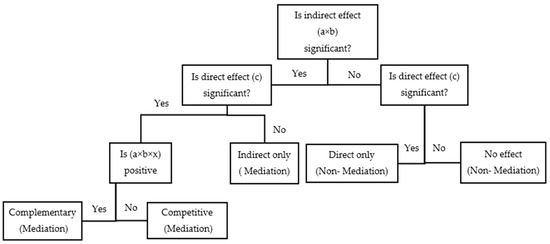

Even if the first requirement of Baron and Kenny’s technique is not satisfied, the researchers should not reject the mediation hypothesis (Zhao et al. 2010). Accordingly, even if there is no significant causal relationship between X and Y, an indirect effect can still be established. The indirect effect describes the pathway from the independent variable (X) to the outcome variable (Y) through the mediator (M). Three types of mediation have been proposed by Zhao et al. The first is complementary mediation, also referred to as “partial mediation” in Baron and Kenny’s method. This mediation occurs when both the direct and indirect effects of the independent variable on the dependent variable are significant and point in the same direction. The second is competitive mediation, in which the direct and indirect effects of the independent variable on the dependent variable are significant but point in the opposite direction. This mediation is not considered in Baron and Kenny’s method, because, if both the direct and indirect effects are significant but point in the opposite direction, the total effect can be close to zero, causing the independent–dependent variable test to fail. The final type of mediation is only indirect mediation, which is similar to the complete mediation proposed by Baron and Kenny. Figure 1 depicts Zhao et al. (2010)’s decision tree for establishing and understanding the three types of mediation.

Figure 1.

Decision tree for establishing and understanding types of mediation. Adapted from Zhao et al. (2010).

5. Results and Analysis

5.1. Descriptive Statistics

Table 3 reports the descriptive statistics of all the variables of this study. For PRICE, the average is 1.09, and the maximum and minimum are 5.36 and 0.07, respectively. On average, the board has seven members (BDSIZE), with a minimum of four and a maximum of 16. BDIND makes up 50 percent of the board, which is in line with MCCG 2017’s requirement that at least half of the board must comprise independent directors. Female directors (BDFEM) make up only 15 percent of the board on average, and some companies have no female representation. This is lower than MCCG 2017’s requirement for female directors to make up at least 30 percent of the board. Approximately 66.7 percent of the directors hold no more than three directorships (BDCOMM). This result is consistent with Kamardin et al. (2014), suggesting the insignificant prevalence of multiple directorships in Malaysia.

Table 3.

Descriptive statistics of variables.

Around 74.2 percent of the directors have served their respective companies for more than 3 years (BDTEN). A detailed analysis reveals that approximately 700 directors have served for more than 10 years. This finding is consistent with Kamardin et al. (2014), who reported an average board tenure of 9 years. Around 80 percent of the board members have a combination of expertise (BDEXP) in the accounting, finance, IT, legal, and business management fields. This finding is consistent with the Central Bank of Malaysia’s recommendation that board members should be knowledgeable in these areas. Furthermore, the average number of board meetings (BDMEET) is six, which is consistent with Bursa Malaysia’s Listing Requirements. The minimum and maximum BDMEET are two and 21, respectively.

KAMSCORE has a maximum value of 5.00, a median value of 2.00, and an average value of 1.87. Some companies have a zero KAMSCORE due to non-disclosure of KAMs. The mean and median value of NUM_KAM is 2.07, and the maximum value is 6.00. For KAMISSUE, some companies have a maximum of three issues arising from fraud, noncompliance, litigation, contingent liability, or liquidity. For the control variables, the average BVS and EPS are 1.20 and 0.06, respectively. SIZE has an average of 5.72 and ranges from 4.67 to 7.23, based on the natural logarithm of total assets. Meanwhile, the averages of LEV and ROA are 19.01 and 0.02, respectively. As all VIF values for independent variables are less than 3, there is no evidence of multicollinearity. According to Montgomery et al. (2021), VIFs larger than 10 suggest multicollinearity, and the problem becomes worse as the VIF values increase.

Table 4 presents the yearly KAM tabulation. In Malaysia, public listed companies are required to report KAMs effective from the fiscal year ending in December 2016. Thus, fewer KAMs were reported in 2016 than in the following years. On average, two KAMs were reported in the audit report each year. The Malaysian average of two KAMs for the first year of implementation is comparable to Singapore’s average but lower than the UK’s average of four KAMs per year (Securities Commission Malaysia 2018).

Table 4.

Number of KAMs according to years of study.

Table 5 presents the number of KAMs disclosed by industry. Companies in four industrial sectors (Industrial Products and Services; Consumer Products and Services; Technology, Telecommunications, and Media; and Property) reported a total of 100 KAMs or more during the study period. Furthermore, there were six observations with zero KAMs from the Technology, Telecommunications, and Media sector. During the study period, the majority of sample companies (70 percent) disclosed only one or two KAMs, 20 percent reported three KAMs, and the remaining 10 percent disclosed four or five KAMs.

Table 5.

Number of KAMs based on type of industry.

5.2. Endogeneity Issue

The issue of endogeneity between the board of directors’ attributes and share price was investigated using pooled two-stage least squares (pooled 2SLS). The lagged values of the variable can be used as an instrumental variable in the absence of suitable instruments (Ammann et al. 2011). Thus, the lag values of the board of directors’ attributes were used as an instrumental variable in this study. Sargan’s test results confirmed that endogeneity was not an issue in this study. The finding is consistent with that of Velte’s (2019) study, which discovered no evidence of endogeneity between corporate governance attributes and KAM disclosure.

5.3. Board Attributes and Share Price (H1)

The Hausman test results revealed that the fixed effect (FE) model is more appropriate for this panel data analysis. BDIND, BDFEM, and BDTEN were found to be negatively associated with PRICE, with coefficient values of −0.453, −0.994, and −0.298, respectively (see Table 6). Since the direction of association contradicts the developed hypothesis, H1 is not supported. This result from Malaysia contributes to the evidence that has been collected from emerging markets, where it has been discovered that the influence of independent directors on firm performance is positive in Korea, there is a negative association in Brazil, and there is no association in India (Salehi et al. 2022). The negative association between BDIND and PRICE indicates that board independence does not always create value (Rashid 2018). Underperforming companies tended to have high proportions of independent directors (Hermalin and Weisbach 1991). The appointment of independent directors is as a result of adhering to the recommendation of good governance, and the deviation from the optimal board composition has a negative impact on company value. In addition, the directors may not be truly independent and may lack the necessary expertise to perform their advisory duties.

Table 6.

Results of regression of board attributes on PRICE.

The presence of female board members was found to have a negative impact on investors. This finding is consistent with the finding of Abdullah et al. (2016) that the majority of Malaysian society views women in senior management positions negatively. Similarly, male investors in the United States are willing to invest three times as much in male-led firms than in female-led firms (Abdullah et al. 2016). According to Salehi and Zimon (2021), the appointment of male or female directors has no major impact on the value creation and growth of Tehran Stock Exchange-listed companies. Political connections and industrial leadership are the most influential factors in the growth of Tehran’s companies. Female directors are perceived to have fewer networks and to be less qualified in many areas (Kamardin et al. 2014; Fitzsimmons 2012). In Malaysia, companies with female directors were found to be less profitable than those without female directors (Zainal et al. 2013). The presence of female directors can have a beneficial effect on accounting performance but a detrimental effect on market performance (Abdullah et al. 2016). This scenario suggests that the market has a skewed view of female directors and undervalues their presence on boards.

The results also revealed a negative association between BDTEN and PRICE, implying that long-tenured directors may become complacent, jeopardizing their independence and monitoring role. They are also less critical of the financial report’s quality (Hashim and Devi 2008). These factors may explain why investors regard BDTEN negatively. Bursa Malaysia’s Listing Requirements also prevent large corporations from retaining the same independent directors for more than 12 years (Bursa Malaysia 2017).

Overall, what the study considered as good board attributes that are supposed to influence investor reactions positively have produced contradictory results. Board independence (BDIND), female board representation (BDFEM), and board tenure (BDTEN) have reacted negatively with PRICE. Although the MCCGs have provided numerous guidelines on various governance issues, the effectiveness of the implementation of these guidelines needs further investigation. In this study, the results are further analyzed with the presence of KAMs as the mediator variable.

5.4. KAM Disclosure as a Mediator between Board Attributes and Share Price (H2)

Table 7 shows the summary results of the mediation analysis to test H2. The results show that KAMSCORE can function both as an indirect-only mediator and a complementary mediator. Indirect-only mediation occurs when the direct effect is insignificant but the indirect effect is significant (Zhao et al. 2010). It is also known as complete or full mediation (Baron and Kenny 1986). The indirect effect coefficients for BDSIZE and BDEXP are −0.009 and −0.087, respectively, and significant at p ≤ 0.05. The insignificant direct effect and significant indirect effect indicate that X no longer affects Y when M is in the equation. In the absence of any influence from KAMSCORE, the total effect coefficients between BDSIZE, BDEXP, and PRICE are more negative (−0.020 and −0.375, respectively). This suggests that the detrimental effect of BDSIZE and BDEXP on PRICE is larger without KAM disclosure. When KAMs are disclosed, the values of both coefficients (BDSIZE and BDEXP) towards PRICE are less negative, implying that the information embedded in KAMs improves the value relevance of the board. The disclosure of KAMs by companies that have larger board sizes and board members with diverse expertise reduces information asymmetry and they are more valued by investors. KAM disclosure as reported in the extended audit report provides more information on a company’s financial affairs. Thus, KAM disclosure provides relevant information that influences investors’ trust and restores their confidence in the company’s management, leading to an increase in the company’s value.

Table 7.

Results of mediation between board attributes, KAMSCORE, and PRICE.

Table 7 also demonstrates the existence of complementary mediation between three board attributes (BDIND, BDFEM, and BDTEN) and PRICE. For all these board attributes, both the indirect and direct effects are negatively significant. Therefore, based on Zhao et al. 2010’s method of analysis, KAMSCORE plays a complementary mediation role in the relationships between BDIND, BDFEM, BDTEN, and PRICE. The complementary mediation effect is referred to as “positive confounding” or “consistent”, where the influence of variable X on variable Y is mediated by variable M, but variable X continues to explain a portion of Y independently of M. It is also called partial mediation by Baron and Kenny (1986).

The results show that the negative effects of BDIND, BDFEM, and BDTEN on PRICE are reduced after the inclusion of KAMSCORE. In other words, the value relevance of the board, represented by an independent board, female board members, and board tenure, improves when KAMs are disclosed. This is proven by the smaller coefficient of the direct effect compared to the coefficient of the total effect in the mediation analysis. For example, the coefficient of PRICE when regressed on BDIND and KAMSCORE (direct effect) is −0.376 (p ≤ 0.05), which is less negative than the coefficient of PRICE when regressed on BDIND alone (total effect) of −0.453 (p ≤ 0.05) (refer to the test result for H1). Hence, the inclusion of KAM reporting, which reduces investors’ negative perceptions, improves a company’s value. In other words, investors react less negatively when companies disclose KAM information. This is because such disclosure reduces information asymmetry, resulting in less negative reactions towards a company’s share price. The same explanation applies for the role of KAM disclosure in the relationships between BDFEM and BDTEN and PRICE, in which the market reacts less negatively when KAMs are disclosed. The significant mediation role of KAMs improves the value relevance of board independence, female representation on the board, and board tenure in increasing a company’s value. Since KAMSCORE mediates certain board attributes, H2 is therefore partially supported.

5.5. Additional Analysis

Table 8 shows the results of the yearly (2016–2019) regression analysis. The results show that the majority of board attribute variables do not have significant associations with the share price, except BDTEN and BDMEET for the year of 2017. The negative association of BDTEN is consistent with the earlier results (Table 6), suggesting that board monitoring roles may be affected if members have been on the board for longer than necessary. The results provide justification of Bursa Malaysia’s Listing Requirements that discourage large companies from retaining the same board members for more than 12 years, as directors may become complacent and jeopardize their independence.

Table 8.

Results of yearly regression of board attributes on PRICE.

BDMEET also showed a significant negative association with PRICE in 2017. The results also contradict the earlier results on the non-significant association between these variables (Table 6). The negative association between BDMEET and PRICE is supported by Vafeas (1999), who argue that companies with problems should hold more meetings to discuss and resolve the issues, thereby enhancing the company’s performance.

5.6. Robustness Test

A robustness test was performed to confirm the earlier findings of the association between board attributes and share price. In the robustness analysis, we used the board score (BDSCRE) as a total measure of the board attributes. This study suggests that the effectiveness of the board of directors could affect the share price. Table 9 summarizes the measurement of BDSCORE.

Table 9.

Measurement of board score (BDSCORE).

The results in Table 10 show that when the board of directors is measured collectively (BDSCORE), it does not explain the variations in PRICE. Consequently, the results reflect our earlier findings (Table 6) that individual board characteristics are more relevant to investors. Investors are not impressed with the majority of the characteristics that corporate governance guidelines identify as being essential for a board to possess.

Table 10.

Results of regression of board scores on PRICE.

6. Conclusions

This study examined the value relevance of the board toward a company’s value in the presence of an extended audit report provided by an independent external auditor. The extended audit report, known as KAM, increases the transparency of information about the issues faced by the external auditor in auditing a company’s financial statements. Since the disclosure of KAM necessitates some discussion and negotiation between the board and the external auditor, this study predicted KAM disclosure to create an information environment promoting more transparent and informative disclosure that enhances board value relevance by influencing investors’ investment decisions.

The results of this study showed that some board attributes influenced a company’s value negatively. As predicted, the presence of KAM disclosure improved the value relevance of board attributes when the market reacted less negatively. Specifically, the information in the KAM section of the external audit report functioned as both an indirect-only mediator and a complementary mediator. KAM disclosure functioned as an indirect-only mediator in companies with larger boards and more board expertise, reducing the negative effect of board attributes on the share price. On the other hand, KAM disclosure also functioned as a complementary mediator in companies with a more independent board, higher female board representation, and a long board tenure. The findings support the decision by the International Auditing and Assurance Standards Board (IAASB) worldwide to mandate the disclosure of KAMs. KAM disclosure provides more transparent information about the reliability of financial statements, reduces information asymmetry, and decreases the agency cost. Consequently, KAM disclosure improves the value relevance of the board in improving a company’s value. Due to the informative value of KAM and its link with the value relevance of the board, KAMs’ implementation should be extended to all audit reports of government agencies. The reports could highlight major financial issues faced by government bodies, enabling the users of the reports to make well-informed decisions.

This study has two limitations that can be addressed in future research. The first limitation is that this study used a value relevance model to gauge investors’ reactions. The presence of an effective board and KAMs affects investors’ investment decisions and the share price of a company. While share prices are an important indicator of investors’ reactions, many other measures can also be used to gauge investors’ reactions, such as stock returns, the bid–ask spread, and the trading volume. Thus, future research may investigate the impact of KAM disclosure, particularly the measurement of KAMs used in this study, on alternative measures of investors’ reactions. Short- and long-term windows may also be considered in determining how quickly investors process the additional information in the KAM section.

The second limitation is that this study evaluated board effectiveness through the lens of internal governance mechanisms, employing seven effective board attributes. Board effectiveness can also be measured from various other perspectives, both internally and externally, such as internal management ownership and remuneration, family ownership, internal audits, and external mechanisms, such as institutional investors, lenders, and external auditing. Future scholars should investigate the value relevance of additional internal and external governance mechanisms in relation to KAM disclosure.

Author Contributions

Conceptualization, R.J., N.A.A., M.S.H. and M.M.R.; methodology, R.J., N.A.A., M.S.H. and M.M.R.; validation, R.J., M.S.H. and M.M.R.; formal analysis, N.A.A.; investigation, N.A.A.; resources, R.J.; writing—original draft preparation, N.A.A.; writing—review and editing, R.J. and N.A.A.; supervision, R.J., M.S.H. and M.M.R.; project administration, R.J., M.S.H. and M.M.R.; funding acquisition, R.J. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Faculty of Economics and Management, Universiti Kebangsaan Malaysia, research grant EP-2020-066. The APC was funded by the Faculty of Economics and Management, Universiti Kebangsaan Malaysia: EP-2018-001 and Universiti Kebangsaan Malaysia, GP-2021-K005989.

Data Availability Statement

Raw data for auditors’ reports were collected from the Bursa Malaysia website at https://www.bursamalaysia.com (accessed on 10 September 2020) while the data for share prices and control variables were retrieved from Thomson Reuters DataStream Professional.

Conflicts of Interest

The authors declare no conflict of interest.

Note

| 1 | KAMSCORE consists of NUM_KAM and KAMISSUE. This study employed the weighted NUM_KAM, with a value of two if the number of KAMs was greater than the average score of the entire sample, a value of one if the number was less than or equal to the average score, and a value of zero if there was no KAM disclosure. |

References

- Abdullah, Shamsul Nahar, Ku Ismail, Ku Nor Izah, and Lilac Nachum. 2016. Does having women on boards create value? The impact of societal perceptions and corporate governance in emerging markets. Strategic Management Journal 37: 466–76. [Google Scholar] [CrossRef]

- Abdullatif, Modar, and Ayat S. Al-Rahahleh. 2020. Applying a new audit regulation: Reporting key audit matters in Jordan. International Journal of Auditing 24: 268–91. [Google Scholar] [CrossRef]

- Adams, Renée B., and Daniel Ferreira. 2009. Women in the boardroom and their impact on governance and performance. Journal of Financial Economics 94: 291–309. [Google Scholar] [CrossRef]

- Aggarwal, Reena, May Hu, and Jinjing Yang. 2015. Fraud, market reaction, and the role of institutional investors in Chinese listed firms. The Journal of Portfolio Management 41: 92–109. [Google Scholar] [CrossRef]

- Agrawal, Anup, and Sahiba Chadha. 2005. Corporate governance and accounting scandals. The Journal of Law and Economics 48: 371–406. [Google Scholar] [CrossRef]

- Akhtaruddin, Mohamed, Monirul Alam Hossain, Mahmud Hossain, and Lee Yao. 2009. Corporate governance and voluntary disclosure in corporate annual reports of Malaysian listed firms. Journal of Applied Management Accounting Research 7: 1–20. [Google Scholar]

- Al Maskati, Maram Muneer, and Allam Mohammed Mousa Hamdan. 2017. Corporate governance and voluntary disclosure: Evidence from Bahrain. International Journal of Economics and Accounting 8: 1–28. [Google Scholar] [CrossRef]

- Al-Sartawi, Abdalmuttaleb MA Musleh, Fatema Alrawahi, and Zakeya Sanad. 2017. Board characteristics and the level of compliance with IAS 1 in Bahrain. International Journal of Managerial and Financial Accounting 9: 303. [Google Scholar] [CrossRef]

- Altawalbeh, Mohammad Abdullah Fayad, and Mohammad Eid Sleem Alhajaya. 2019. The investors reaction to the disclosure of key audit matters: Empirical evidence from Jordan. International Business Research 12: 50–57. [Google Scholar] [CrossRef]

- Amer Al-Jaifi, Hamdan, Ahmed Hussein Al-Rassas, and Adel Ali Al-Qadasi. 2017. Corporate governance strength and stock market liquidity in Malaysia. International Journal of Managerial Finance 13: 592–610. [Google Scholar] [CrossRef]

- Ammann, Manuel, David Oesch, and Markus M. Schmid. 2011. Corporate governance and firm value: International evidence. Journal of Empirical Finance 18: 36–55. [Google Scholar] [CrossRef]

- Bank Negara Malaysia. 2019. Financial Reporting. Available online: https://www.bnm.gov.my/documents/20124/938039/Financial+Reporting.pdf/2acd5f99-c96e-d0d0-78b3-a68ee3bb6474?t=1592250524291 (accessed on 15 February 2023).

- Baron, Reuben M., and David A. Kenny. 1986. The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Journal of Personality and Social Psychology 51: 1173–82. [Google Scholar] [CrossRef] [PubMed]

- Beasley, Mark S. 1996. An empirical analysis of the relation between the board of director composition and financial statement fraud. Accounting Review 71: 443–65. [Google Scholar]

- Bédard, Jean, Danial Coulombe, and Lucie Courteau. 2008. Audit committee, underpricing of IPOs, and accuracy of management earnings forecasts. Corporate Governance: An International Review 16: 519–35. [Google Scholar] [CrossRef]

- Bédard, Jean, Nathalie Gonthier-Besacier, and Alain Schatt. 2019. Consequences of expanded audit reports: Evidence from the justifications of assessments in France. Auditing 38: 23–45. [Google Scholar] [CrossRef]

- Boonyanet, Wachira, and Waewdao Promsen. 2019. Key audit matters: Just little informative value to investors in emerging markets? Chulalongkorn Business Review 41: 153–83. [Google Scholar]

- Bursa Malaysia. 2017. Corporate Governance Guide—3rd Edition. Available online: https://bursa-malaysia.s3.amazonaws.com/reports/Consolidated_CG_Guide_3.PDF (accessed on 5 May 2021).

- Carcello, Joseph V., Dana R. Hermanson, Terry L. Neal, and Richard A. Riley, Jr. 2002. Board characteristics and audit fees. Contemporary Accounting Research 19: 365–84. [Google Scholar] [CrossRef]

- Chen, Gongmeng, Michael Firth, Danial N. Gao, and Oliver Rui. 2006. Ownership Structure, Corporate Governance, and Fraud: Evidence from China. Journal of Corporate Finance 12: 424–48. [Google Scholar] [CrossRef]

- Dalton, Catherine M., and Dan. R. Dalton. 2005. Boards of directors: Utilizing empirical evidence in developing practical prescriptions. British Journal of Management 16: S91–S97. [Google Scholar] [CrossRef]

- Dang, Tung Lam, and Thi Minh Hue Nguyen. 2020. Liquidity risk and stock performance during the financial crisis. Research in International Business and Finance 52: 101165. [Google Scholar] [CrossRef]

- Dang, Van Cuong, and Quang Khai Nguyen. 2021. Internal corporate governance and stock price crash risk: Evidence from Vietnam. Journal of Sustainable Finance & Investment, 1–18. [Google Scholar] [CrossRef]

- Dang, Van Cuong, and Quang Khai Nguyen. 2022. Audit committee characteristics and tax avoidance: Evidence from an emerging economy. Cogent Economics & Finance 10: 2023263. [Google Scholar] [CrossRef]

- Eryigit, Mehmet. 2019. Short-term performance of stocks after fraudulent financial reporting announcement. Journal of Financial Crime 26: 464–76. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Michael C. Jensen. 1983. Separation of ownership and control. The Journal of Law and Economics 26: 301–25. [Google Scholar] [CrossRef]

- Fitzsimmons, Stacey R. 2012. Women on boards of directors: Why skirts in seats aren’t enough. Business Horizons 55: 557–66. [Google Scholar] [CrossRef]

- Giannarakis, Grigoris. 2014. Corporate governance and financial characteristic effects on the extent of corporate social responsibility disclosure. Social Responsibility Journal 10: 569–90. [Google Scholar] [CrossRef]

- Goh, Beng Wee, Jimmy Lee, Jeffrey Ng, and Kevin Ow Yong. 2016. The effect of board independence on information asymmetry. European Accounting Review 25: 155–82. [Google Scholar] [CrossRef]

- Gold, Anna, Melina Heilmann, Christiane Pott, and Johanna Rematzki. 2020. Do key audit matters impact financial reporting behavior? International Journal of Auditing 24: 232–44. [Google Scholar] [CrossRef]

- Gonçalves, Tiago Cruz, Cristina Gaio, and Micaela Rodrigues. 2022. The impact of women power on firm values. Administrative Sciences 12: 93. [Google Scholar] [CrossRef]

- Habib, Ahsan, and Istiaq Azim. 2008. Corporate governance and the value-relevance of accounting information: Evidence from Australia. Accounting Research Journal 21: 167–94. [Google Scholar] [CrossRef]

- Hashim, Hafiza Aishah, and Susela Devi. 2008. Board characteristics, ownership structure and earnings quality: Malaysian evidence. Research in Accounting in Emerging Economies 8: 97–123. [Google Scholar]

- Helland, Eric. 2006. Reputational penalties and the merits of class-action securities litigation. Journal of Law and Economics 49: 365–95. [Google Scholar] [CrossRef]

- Hermalin, Benjamin E., and Michael S. Weisbach. 1991. The effects of board composition and direct incentives on firm performance. Financial Management 20: 101–12. [Google Scholar] [CrossRef]

- Higgins, Monica C., and Ranjay Gulati. 2006. Stacking the deck: The effects of top management backgrounds on investor decisions. Strategic Management Journal 27: 1–25. [Google Scholar] [CrossRef]

- IAASB. 2018. ISA 701: Communicating Key Audit Matters in The Independent Auditor’s Report. Available online: https://www.mia.org.my/v2/downloads/handbook/standards/ISA/2018/08/08/ISA_701.pdf (accessed on 5 May 2020).

- Ittonen. 2012. Market reactions to qualified audit reports: Research approaches. Accounting Research Journal 25: 8–24. [Google Scholar] [CrossRef]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Kamardin, Hasnah, Rohaida Abdul Latif, Kamarun Nisham Taufil Mohd, and Noriah Che Adam. 2014. Multiple Directorships and the Monitoring Role of the Board of Directors: Evidence from Malaysia. Jurnal Pengurusan 42: 51–62. [Google Scholar] [CrossRef]

- Katmon, Nooraisah, Zam Zuriyati Mohamad, Norlia Mat Norwani, and Omar Al Farooque. 2019. Comprehensive board diversity and quality of corporate social responsibility disclosure: Evidence from an emerging market. Journal of Business Ethics 157: 447–81. [Google Scholar] [CrossRef]

- Kitiwong, Weerapong, and Naruanard Sarapaivanich. 2020. Consequences of the implementation of expanded audit reports with key audit matters (KAMs) on audit quality. Managerial Auditing Journal 35: 1095–119. [Google Scholar] [CrossRef]

- Latif, Khalid, Arshad Ali Bhatti, and Abdul Raheman. 2017. Earnings quality: A missing link between corporate governance and firm value. Business & Economic Review 9: 255–79. [Google Scholar] [CrossRef]

- Lin, Chaohsin, Shuofen Hsu, Pai-Lung Chou, Ya-Yi Chao, and Chao-Wei Li. 2020. The Effects of Directors’ and Officers’ Liability Insurance on Key Auditing Matters. Emerging Markets Finance and Trade 56: 977–1002. [Google Scholar] [CrossRef]

- Lombardo, Davide, and Marco Pagano. 2000. Law and equity markets: A simple model. Available online: http://dx.doi.org/10.2139/ssrn.209312 (accessed on 10 September 2020).

- Lopes, Ana Isabel, and Laura Reis. 2019. Are provisions and contingent liabilities priced by the market? Meditari Accountancy Research 27: 228–57. [Google Scholar] [CrossRef]

- Menon, Krishnagopal, and David D. Williams. 2010. Investor reaction to going concern audit reports. The Accounting Review 85: 2075–105. [Google Scholar] [CrossRef]

- Montgomery, Douglas C., Elizabeth A. Peck, and G. Geoffrey Vining. 2021. Introduction to Linear Regression Analysis. Hoboken: John Wiley & Sons. [Google Scholar]

- Nguyen, Quang Khai. 2022. Audit committee effectiveness, bank efficiency and risk-taking: Evidence in ASEAN countries. Cogent Business & Management 9: 2080622. [Google Scholar] [CrossRef]

- Nguyen, Quang Khai, and Van Cuong Dang. 2022. The impact of risk governance structure on bank risk management effectiveness: Evidence from ASEAN countries. Heliyon 8: e11192. [Google Scholar] [CrossRef]

- Ohlson, James A. 1995. Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research 11: 661–87. [Google Scholar] [CrossRef]

- Piot, Charles, and Franck Missonier-Piera. 2009. Corporate Governance Reform and the Cost of Debt Financing of Listed French Companies. Available online: https://ssrn.com/abstract=960681 (accessed on 10 September 2020).

- Rashid, Afzalur. 2018. Board independence and firm performance: Evidence from Bangladesh. Future Business Journal 4: 34–49. [Google Scholar] [CrossRef]

- Reid, Lauren Carse, Joseph V. Carcello, Chan Li, and Terry L. Neal. 2015. Are auditor and audit committee report change useful to investors? Evidence from the United Kingdom. Available online: https://doi.org/10.2139/ssrn.2637880 (accessed on 20 September 2020).

- Rosenstein, Stuart, and Jeffrey G. Wyatt. 1990. Outside directors, board independence, and shareholder wealth. Journal of Financial Economics 26: 175–91. [Google Scholar] [CrossRef]

- Salehi, Mahdi, and Grzegorz Zimon. 2021. The effect of intellectual capital and board characteristics on value creation and growth. Sustainability 13: 7436. [Google Scholar] [CrossRef]

- Salehi, Mahdi, Grzegorz Zimon, Arash Arianpoor, and Fatemeh Eidi Gholezoo. 2022. The impact of investment efficiency on firm value and moderating role of institutional ownership and board independence. Journal of Risk and Financial Management 15: 170. [Google Scholar] [CrossRef]

- Securities Commission Malaysia. 2009. Corporate Governance Guide: Guidance on Effective Audit and Riskmanagement. Available online: https://www.bursamalaysia.com/sites/5bb54be15f36ca0af339077a/assets/5bb54d1a5f36ca0c341f0066/Pull-out_II.PDF (accessed on 9 April 2020).

- Securities Commission Malaysia. 2018. Enhanced Auditors’ Report—A Review of First-Year Implementation Experience in Malaysia. Available online: https://www.sc.com.my/api/documentms/download.ashx?id=450ac242-2fdd-4719-bda5-6e0adf128135 (accessed on 9 April 2020).

- Securities Commission Malaysia. 2021. Malaysian Code on Corporate Governance. Available online: https://www.sc.com.my/api/documentms/download.ashx?id=239e5ea1-a258-4db8-a9e2-41c215bdb776 (accessed on 9 April 2020).

- Sharif, Taimur, Harsh Purohit, and Rekha Pillai. 2015. Analysis of factors affecting share prices: The case of Bahrain stock exchange. International Journal of Economics and Finance 7: 207–16. [Google Scholar] [CrossRef]

- Shin, Hyejeong, and Su-In Kim. 2018. The Effect of corporate governance on earnings quality and market reaction to low quality earnings: Korean evidence. Sustainability 11: 102. [Google Scholar] [CrossRef]

- Srinidhi, Bin, Ferdinand A. Gul, and Judy Tsui. 2011. Female directors and earnings quality. Contemporary Accounting Research 28: 1610–44. [Google Scholar] [CrossRef]

- Srinivasan, Suraj. 2005. Consequences of Financial Reporting Failure for Outside Directors: Evidence from Accounting Restatements and Audit Committee Members. Journal of Accounting Research 43: 291–334. [Google Scholar] [CrossRef]

- Suttipun, Muttanachai. 2020. KAM reporting and common share price of listed companies in the market of alternative investment from Thailand. Academy of Accounting and Financial Studies Journal 24: 2635. [Google Scholar]

- Tugman, Laurie, and Laura Leka. 2019. 5 Key Factors to Enhance Audit Committee Effectiveness. IFAC. Available online: https://www.ifac.org/knowledge-gateway/supporting-international-standards/discussion/5-key-factors-enhance-audit (accessed on 10 September 2020).

- Vafeas, Nikos. 1999. Board meeting frequency and firm performance. Journal of Financial Economics 53: 113–42. [Google Scholar] [CrossRef]

- Velte, Patrick. 2019. Associations between the financial and industry expertise of audit committee members and key audit matters within related audit reports. Journal of Applied Accounting Research 21: 185–200. [Google Scholar] [CrossRef]

- Volonté, Christophe. 2015. Boards: Independent and Committed Directors? International Review of Law and Economics 41: 25–37. [Google Scholar] [CrossRef]

- Zainal, Dalilawati, Norhayah Zulkifli, and Zakiah Saleh. 2013. Corporate board diversity in Malaysia: A longitudinal analysis of gender and nationality diversity. International Journal of Academic Research in Accounting, Finance and Management Sciences 3: 136–48. [Google Scholar]

- Zhao, Xinshu, John G. Lynch, Jr., and Qimei Chen. 2010. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. Journal of Consumer Research 37: 197–206. [Google Scholar] [CrossRef]

- Zhi, Xiaoqiang, and Zuming Kang. 2021. Critical audit matters and stock price crash risk. Frontiers of Business Research in China 15: 1–25. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).