1. Introduction

The phenomenon of the BRICS has gone through a series of consecutive stages, which finally led to what we know it as today. The group was conceived as an investment project by Goldman Sachs in 2001. At that time, Goldman Sachs recommended that fund managers, asset managers, and other interested parties take a special look at the corporate assets and shares from the four emerging nations included in the BRIC, as it was known at the time, as a combination of the four countries of Brazil, Russia, India, and China. Investment in the BRICs was supposed to lay the foundation for a new, better, and more prosperous world after 9/11 in the US and, later, after the global financial crisis of 2007–9. The BRICs provided hope for the world economy as drivers of GDP (Gross Domestic Product) growth and as a crucial part of global value-added chains.

The four countries greatly contributed to recovering global GDP after the dot-com bust of 2000–2001 and the sub-prime mortgage crisis a few years later. The four countries also helped both developing and developed nations obtain access to cheaper, competitive goods offered by the BRICs, because the four produced them with lower costs and decent quality. The markets of the BRICs were booming in the early 2000s. The boom drove up share prices of the BRICs corporations. Consequently, Goldman Sachs believed they were the next big thing in the world of finance. In fact, it strongly supported the idea that the four countries would overtake the combined GDP of G7 countries by 2050. The group was so successful that the bank had to revise its prognosis several times in the process, saying that it might actually happen a decade and a half earlier. In 2009, the leader of the BRICs first met at a summit in Russia. It was at this time that the BRICs started to see themselves as something more material in terms of politics and economic policy. Thus, out of an investment portfolio concept, the BRICs quickly transformed into an influential emerging market combination of countries that could have a say in global economic issues. In 2010, it became even more clear that the BRICs were determined to be a global economic driver and global reformer, when it added South Africa and became the BRICS, as we know it as today.

The BRICS started to claim more economic and political say in global issues. For example, the BRICS strongly supported the idea of international financial system reform after the global economy nearly collapsed due to the global financial crisis. The commodity boom of the early 2000s and its resurgence in early 2010s benefitted the BRICS, especially commodity-rich Brazil, Russia, and South Africa. China became part of the World Trade Organization and, by 2009, became the largest world exporter by merchandise. India became a global IT hub for the rest of the world. Thus, the assets and the currencies of the BRICS were quite interesting for foreign investors, even after Goldman Sachs reclaimed taking any part in the continuation of the BRICS dream as some kind of savior of the existing world economic order.

Economic success led the BRICS to strongly believe in their destiny as a new world economic center. The group started seriously thinking of internationalizing their currencies and replacing a certain share of the US dollar reserves in national currencies to diversify foreign exchange risks. The US Federal Reserve’s monetary tightening of 2013–2014 strengthened the dollar, raised capital costs, and reined in support for the existing world economic order and international monetary system, leaving it almost unchanged and unchallenged with the US as the ultimate leader. Despite a series of crises during the first two decades of the 21st century, the BRICS continued to be a sort of a global economic driver.

However, we must admit that the BRICS tried to pursue both an economic and political agenda, especially after the US started a trade war against China. Meanwhile, Russia met waves of economic and financial sanctions due to conflict in Ukraine and was as good as isolated from the rest of the world. Brazil was struggling to keep its democratic face during the government of a populist president Jair Bolsonaro. India also suffered reputational losses after the conservative Bharatiya Janata Party came to power with Prime Minister Narendra Modi at its helm. South Africa struggled greatly under the yoke of corruption and social unrest. The coronavirus crisis, as well as global financial and economic turbulence increased pressure on the BRICS, thus making them more divided as an entity of countries. The BRICS were never a common union. However, it was at this point when each member state had to look more to internal affairs than at more intra-group cooperation and development, due to many homegrown difficulties and strains.

Nevertheless, the BRICS did not come apart. They are still a very interesting economic, political, and social phenomenon that deserves research; especially today, the phenomenon really needs revisiting in terms of taking part in a new, less global world economy with a hostile economic and political environment. Part of the revisiting process can involve ways to conduct bilateral transactions through a sort of digital currency in an effort to de-dollarize their foreign currency reserves and reliance on the US. It is for this reason that this underlying research suggested a sort of digital currency project as a mechanism to cooperate and develop towards a better, communal, more prosperous, and secure future. A common digital currency project can be such an instrument and mechanism. Therefore, this hypothesis is to try to lay a foundation for a probable monetary system that may involve the BRICS and make it a sound concept or, at least, an initial discussion issue for ways of leading to that better cooperation, economic, and environmental sustainability, as well as technological sovereignty.

Since money is a conduit of economic activity, the hypothesis of this underlying article is that digital money can better address the problems of people in a contemporary turbulent world, i.e., it can create new ways and channels to help distant work in times of widespread disease as well as provide payments for people and whole nations under lockdowns. Digital money makes up a new seamless infrastructure to conduct cross-border transactions between nations for goods and services to support the resistance of supply chains and of value-added chains. Hence, the idea of this article is to lay a theoretical and methodological foundation for a digital currency to deepen the economic, financial, trade, and monetary integration of a group of emerging market economies—the BRICS—which produce over a quarter of global GDP and account for more than a quarter of global economic recovery after the coronavirus crisis and a period of turbulence in the financial markets.

Digital money today is split, however, into various types of currencies, tokens, coins, etc. It became so ubiquitous in global finance, indeed, that the government decided to also step in and try to regulate digital money (

Alsalmi et al. 2023). A number of countries in the world have launched initiatives or have prepared themselves to regulate digital money. A pilot scheme came into operation in China in 2020. Russia launches its version of a digital ruble in April 2023. Russia is in need of payment means and platforms due to international isolation. Thus, its project may assist it in its efforts to provide financial sustainability and a framework for exports and imports with countries that abstained from observing Western sanction regimes. Therefore, the author proposes and simulates a model with the same type of digital money in an effort to understand its dynamics after the launch.

A currency for a group of countries may have a name of a common currency, a shared currency, a collective currency, and a multilateral currency. For example, the euro is a common currency of the Eurozone nations, which are a group of the European Economic and Monetary Union (

Beetsma et al. 2016). Economists such as

Janková and Dostál (

2020) contributed to talking about the Eurozone as a union of countries sharing one currency. This is not a cryptocurrency, and it will not be one, even if a digital euro is introduced (

Johnson 2013). A shared object or system has become a sort of a cliché for everything, from cars to the economy in general, namely car sharing, property sharing, office sharing, etc. The idea of sharing things is about a mechanism people use to reduce the cost of living, production, and capital. It is as if the capitalist world has suddenly recognized the benefits of socialism, where people shared everything, including flats, land, inventory, factors of production, household items, etc. A shared economy has come into being as something formerly known as the economy of cooperation.

In this respect, money is also a shared good, because it is commonly used by everyone in an economy. It is a universal good accepted by every consumer and every producer. A shared good may also mean that it belongs to nobody in particular, such as property in the Soviet Union, wherein everything belonged to everyone and to no one in particular. However, in theory, a shared good can hardly sell on the market, because to sell any good in the marketplace, it must be private and exclusive. Economies and markets start where goods have specific owners. For example, a digital economy has not come into being yet, because governments, businesses, and the public in general have not answered the question as to whether data are private, exclusive goods or public goods. If they are public, they are not sellable on the market. Therefore, it is not clear who should provide them. Money today is still provided by state monetary authorities on behalf of governments. Hence, money is a shared good in a market economy. It buys goods and services and other currencies on the forex market.

Some authors, including

Cohen (

2012), used to say that the creation of a common currency or a transaction unit of account for a group of countries is a very comprehensive challenge, as well as a problem of regional economic integration and globalization, because it erases borders, national identity, national differences, cultures, and the language of finance. A currency, no matter if it is common or shared for a group of countries, always entails the power decentralization of a national central bank and the sovereignty of the state. In the Eurozone, this problem became especially acute after the world financial crisis and the euro crisis that was a result of transformations that took place in the international monetary system and international financial architecture since then. This idea was clearly stated, even before the pandemic, by contributors like

Boddin and Stähler (

2018) who viewed this process from the EU perspective. The world crisis (coronavirus crisis) that started in 2020 once again showed that having an independent currency shared with no other countries makes it easier to deal with government debt and budget deficit (

Hu et al. 2020). With this in mind,

Hou and Li (

2019) tried to present this numerically in a form of an indicator that could help explain the dynamics of selected assets. Hence, if countries share a currency, they will always have to look to their peers in the union and ask for a sort of permission to settle debt and budgetary problems (

Kim 2019), such as what they actually did during the pandemic, and we know that this took place from researchers including

Khan et al. (

2020), among others. During crises, emerging economies with no reserve currency status or freely convertible currencies tend to accumulate hard currency to sustain growth and prosperity in emergencies (

Sun et al. 2019). We saw this again during the pandemic and can find that outcome brilliantly stated in works such as

Salisu and Akanni (

2020). A few rapidly developing countries, very rich in natural resources, labor, liquidity, capital, and credit, which they can provide to the rest of the world, generally known as the BRICS, have recently started thinking about omitting currencies other than their own in foreign transactions (

Younsi and Bechtini 2018). They diversified their sovereign wealth funds and foreign exchange reserves by adding assets denominated in currencies other than the US dollar (

Yu 2014). They also started developing national digital currency projects. For example, China and Russia want to launch a digital yuan and a digital ruble, respectively (

Zou et al. 2019).

The economic crisis caused by the coronavirus pandemic in 2020 may accelerate that trend. In the short- and mid-term, there will perhaps be a setback in the BRICS’ penta-lateral currency use and a temporary return to the US dollar. However, in the long run, there is an expectation that the BRICS are going to settle more foreign deals and transactions in their local currencies after the pandemic (

Agrawal et al. 2020). The trend to diversify the foreign exchange reserves in the BRICS is likely to continue after economic activity will have restored again. Still, the local currencies of the BRICS by themselves will hardly challenge the US dollar or the euro, even in the super long run. A number of economists in the past, including

Galvão (

2010),

Johnson (

2013),

Kadayan (

2014), and

Kasekende et al. (

2010), already said that the BRICS may succeed only if they cooperate more closely in bringing about a currency agreement that would establish a new shared multilateral unit of transactions.

This underlying research continues the studies undertaken by previous scientists such as (

Brik et al. 2022) and supports their idea that stable digital currencies make a difference when discussing the issues of financial stability in the markets and the sustainability of economic growth in specific countries, especially when taking into account the plunge of cryptocurrencies after the US Federal Reserve turned to monetary tightening in the spring of 2022, as well as how rising interest rates have increased the value of stable currencies and depressed the value of the crypto ones (

Hou and Li 2019).

2. The Foundations of the Virtual Money Theory

The origins of virtual money are closely linked to the evolution of industry, manufacturing, and production forces. By the late 1990s, the evolution resulted in deindustrialization, which meant an increasing share of services in GDP. Money, as with all goods, also changed considerably due to deindustrialization in the later part of the 20th and early 21st centuries (

Alemany et al. 2020). Overtime, money became dematerialized in the same way that production processes became deindustrialized. This process helped spur the financialization of the reproduction process and the breakaway of the virtual financial sector from the real economy. The combination of these forces created an economy of virtual values

Zhou et al. (

2018).

Theoretically, each good has value on the market according to the value of inputs used to produce the good. However, that theory changed too, since financial services dominate the modern world market, and their value does not truly express the cost of their production. In the late 19th and early 20th centuries, a good’s value was meaningful for stimulating market competition (

Cao and Wang 2019). This allowed for the bankruptcy of poorly performing enterprises, no matter how big they were. Thus, no moral hazard occurred, and there was no too-big-to-fail dilemma. Market competition helped companies with average-performance become high-performing ones. If they failed, they became poorly performing companies and eventually went bankrupt and later exited the market. In the modern economy, a firm’s efficiency has taken a different meaning (

Tsai and Cheng 2019).

An efficient enterprise today is the one that has eliminated the working capital, inventories, and warehouses. It does not organize a conventional production process. As some researchers explain today, an entrepreneur takes a specific good called money to buy any form of capital, including securities, derivatives, bonds, foreign exchange, etc., and gains from trading them on the financial market. Thus, money itself started to produce surplus money (

Tripathi and Kaur 2020).

By the early 2000s, entrepreneurs have ultimately freed themselves not only of the necessity to employ a workforce and keep warehouses, inventory, and the means of production, but also of the obligation to pay wages, create amortization funds, modernize working capital, transfer funds for budget purposes, health care, training, and education. They do not have to pay taxes and various government charges, other than broker fees. This has resulted in individualizing the process of capital formation and accumulation.

Thus, money as a specific good has evolved parallel to deindustrialization, dematerialization, and financialization. It has increasingly taken the shape of a quasi-currency, a virtual currency and, finally, a digital currency, but has continued to remain under the control of the issuer or lender of last resort, which essentially is a central bank (

Dong et al. 2019).

This tendency further led to the creation of cryptocurrencies, a phenomenon which became part of deindustrialization, dematerialization, financialization, and a virtual economy. A principal distinction of cryptocurrencies from quasi-currencies is that the former is a financial product. It is the product of financial engineering and does not serve a legal tender function in an economy. There is no centralized issuer responsible for the issue and circulation of a cryptocurrency. There is no deposit insurance for funds denominated in cryptocurrencies, just like there is no deposit insurance for accounts used to trade financial products, derivatives, etc. Some financial products may have a credit rating of a certified credit rating agency. But there is no rating agency in existence to rate money (

Agrawal et al. 2020).

Cryptocurrencies are very volatile assets. For example, a daily exchange rate volatility of the currency pair Bitcoin/US dollar (or BTC/USD) may exceed 150,000 pips or more, which makes it impossible for any serious organization to hedge contracts expressed in BTC. Normal currency pair volatility on a particular day is 200–1000 pips. Even on the days of important economic and financial announcements, normal currency volatility rarely exceeds that. For example, on 2 June 2020, upon the Australian Reserve Bank announcement of the key interest rate, the currency pair of the Australian dollar/US dollar (or AUD/USD), moved 256 pips within an hour. At the same time, the BTC volatility in the currency pair BTC/USD amounted to almost 42,000 pips due to unknown reasons, and this change happened in just a little over six and a half hours. Hence, hedging a contract expressed in such a volatile currency will just lead to the bankruptcy of the insurer, if it were bold enough to do that in the first place (

Zou et al. 2019).

Another major aspect which proves the fact that a cryptocurrency such as BTC cannot be used as a regular unit of money circulation is the volume of trading (

Sagim and Reis 2020). For example, even on the days of the most significant economic and financial events, data releases, central bank announcements, etc., a five-minute volume of trading a normal currency pair is something like 500 lots, depending on the broker, and even this is a high volume. In the above example with the currency pair AUD/USD, this averaged 250 lots. A five-minute trading volume of the currency pair BTC/USD, on the other hand, may sky-rocket far beyond any imaginable level. In the same instance, this volume stood at 95,200 lots, which basically puts a currency such as BTC into the category of highly profitable assets like gold or palladium with regular five-minute transaction volumes of over 20,000 lots, and, even then, traders buy so much of these assets, usually during important events or existential press releases (

Salisu and Akanni 2020).

One more important fact which makes it impossible to speak of a cryptocurrency such as BTC as a regular normal currency is the amount of fees a broker charges a client wanting to trade in it (

Fu et al. 2020). Depending on the broker, a fee to trade in the currency pair BTC/USD may range from 4000 to 6000 USD a lot. In contrast, a brokerage fee to trade in the currency pair AUD/USD, for example, rarely exceeds 7 or 8 USD a lot. This means that, as a number of scientists think, only the traders who own large accounts with a broker can trade in the currency pair BTC/USD, and these accounts are far bigger than the usual accounts of an average trader on the market (

Gao et al. 2020).

Finally, a cryptocurrency such as BTC is open to trade 24/7, even on holidays, whereas regular currencies do this only on official working days.

Since a cryptocurrency has no links to any central monetary authority, some economists suggest that it may be a collective, common, or shared currency for a group of countries which cannot agree on a common central bank. However, due to the reasons described above, it is very unlikely that a group of sovereign countries could use such a highly volatile and speculative currency with a very unusual and strange trading regime. High volatility and a very speculative nature are particularly damaging for trade, current accounts, savings, investments, and many other things connected with the activities of individuals, business enterprises, and governments that need money as legal tender, a unit of account, and a means of transaction. A collective or a shared currency for a group of countries can be digital, but it is certainly cannot be as volatile and speculative as cryptocurrencies, and the foreign exchange market and the virtual financial market where cryptocurrencies circulate should not have the authority to make individuals and companies use it as a legal tender, because the population at large has no trust in a system which they are not able to control and which is unaccountable to anyone. Therefore, there must be a lender of last resort to issue a collective (or a shared) digital currency and a government authority to control it (

Wang et al. 2019).

The nationwide proliferation of a cryptocurrency that exists in short supply and launches into circulation as regular genuine money may provoke a liquidity crisis due to the fact that the mechanism of cryptocurrency supply works in a completely different and unconventional manner that is incomparable to the character and scope of a national currency. For example, BTC is short in supply due to restrictions put in place by cryptographic algorithms and computing power. Its total supply is going to reach its maximum by 2040 at 20 million units of BTC, which is hardly sufficient to satisfy the needs of the world economy. When Irwin Fisher thought about the sufficiency of currency supply in circulation, he understood it as an equation, which said that there must be enough money in an economy so that 100% of the money supply in circulation purchased 100% of the goods sold at current prices (

Fisher 1907). Hence, with a global GDP of, say, 85 trillion USD, the supply of cryptocurrency in worldwide use must amount to the quantity approximately equal to the velocity of a unit of money in circulation multiplied by the total quantity of the cryptocurrency in circulation. Nevertheless, it is difficult to find the components to put to the Fisher’s Formula, since there is no authority in existence to set interest rates and reserve requirements and, consequently, no way to determine the money multiplier. To have these characteristics, BTC will have to serve the functions money usually does in an economy, i.e., unit of account, means of payment, store of value, etc. Some scholars and professionals say BTC has all those features. However, the problem is that they just imagine that BTC wears these clothes. In fact, that does not mean that it will actually serve those functions if introduced. People will accept BTC as money only if they recognize it by the absolute majority as a currency one can use to pay for something, deposit with a bank account, transact with foreign countries, etc.

Still, in a hypothetical setting, if, at the end of the day, BTC really circulated in the world monetary system and had an institution responsible and accountable for its issue, then, with the official reserve requirements of, say, 10%, we will construct an equation in which the supply of the cryptocurrency multiplied by 10 equilibrates the entire world GDP, i.e., 20 million BTC multiplied by 10 must equal 85 trillion USD multiplied by the BTC/USD exchange rate, or 200 million BTC must equal 85 trillion USD multiplied by 0.0003 BTC, or 200 million BTC of currency supply must equal to 22,500 million BTC worth of goods and services (Formula (1)).

These simple calculations demonstrate that, by 2040, BTC will exist in an insufficient supply to satisfy the needs of society in goods and services, even in today’s prices and at the current BTC/USD exchange rate, and the world will need BTC in quantities at least 127.5 times as much as there is in existence, which makes it hardly realistic for use in circulation.

3. A Methodological Approach to Creating a BRICS Digital Currency

Thus, cryptocurrency is not a choice for either a monetary union such as the Eurozone, or an informal group of countries such as the BRICS. What they still can share is a digital virtual currency that is used as transactions tender. The creation of digital money starts with the name. The basic principle to choose a name for a shared digital currency for a group of countries is that there must be absolutely no indication in it to its national origin or reference for history, culture, and specific features referring to civilizations. So, name choices and acronyms for a digital unit of account for the BRICS may be as follows: the BRICS currency, such as the existing acronym; 5R—Five-R [faivɘ]—a name constructed from the initial letters from their international currency codes (Brazilian Reais—BRL, Russian Ruble—RUR, Indian Rupee—INR, Chinese Renminbi—RMB, South African Rand—ZAR); and Pentagral—a name created to account for the number of member countries of the group. A sign for it may be a star or a pentagram. The [-l] in the name instead of [-m] sounds better to think of a digital currency for the BRICS as an integral body and a sort of a unity.

The research already speculated above about the quantity of money needed to circulate a shared currency in the globe. If the BRICS currency goes global in the end, the formula to calculate the required quantity for circulation is going to be quite different from that of Fisher’s. This is explained by the fact that international needs will certainly exceed the money supply in domestic circulation and a nominal amount of world GDP.

In the world economy today, the real sector accounts for approximately 5–10% of GDP. Therefore, the formula to calculate the money supply for the international use of the BRICS currency should meet the following requirements: the quantity of money expressed in a certain unit of account is to meet the needs of foreign trade, foreign investment, trade in derivatives and foreign exchange on the world market, gold and foreign exchange reserves, international initial public offerings (or IPOs,), bank deposits, euro currency market operations, money transfers abroad, etc. This formula, which characterizes international circulation of the BRICS shared currency, is a simple arithmetic sum (Formula (2)):

In Formula (2), M is the quantity of money expressed in the BRICS digital currency required for international circulation. It is the sum of money needed to pay for world exports (ForT), foreign direct investment (FDI), portfolio investment (PI), world foreign exchange transactions (ForEx), gold and foreign exchange reserves (G&Ex), euro dollar accounts (ForDeposit), international securities (InterSec), derivatives (Der) and Eurobonds (EuroCurrency), as well as money transfers (MTransfer) and many other purposes (Etc.).

According to the approach accepted in this underlying paper, the quantity of money required for the international use of the shared digital currency for the BRICS has to be equal to the total sum of the components in Formula (2). Numerically,

Table 1 shows the actual figures. The bottom line shows the sum of the components with the introduction of the BRICS shared currency in 2021; for example, the bloc’s shared monetary authority would have to issue at least 4.6 trillion of new money in USD equivalent.

It is worth noticing that Formula (1) used here to calculate the quantity of money expressed in the shared currency of the BRICS for international use is a generalized view of the money supply and may not necessarily be limited to the components mentioned above, although they represent the overwhelming majority of international money transactions that usually happen in USD these days. There may be, of course, more ingredients to add to the formula, but, sometimes, they are minor and, therefore, viable to neglect.

So far, though, it is easier said than done. The existing currencies of the BRICS are very little used in international transactions. It is, therefore, very difficult to predict whether the BRICS digital currency will find a broader international use, not to mention its capacity to rival and outperform the USD in the international monetary system. A few currencies in the past several decades tried to do that and failed, including the German deutsche mark, the Japanese yen, and the euro (

Wu and Zhu 2018). Within the BRICS, only China’s yuan is representative enough to be visible in the international foreign exchange reserves of some countries. There are very few foreign countries in the world that are so bold as to keep the yuan apart from the USD, especially during financial and economic crises. The recent coronavirus crisis has shown that financial and economic tsunamis strengthen the USD’s role as the ultimate world reserve currency. Thus, it will take quite a long time for the BRICS digital currency to go global. Until that time, it may only be a means of shared BRICS intra-transactions and money settlements. The quantity of money supply expressed in the new currency of the BRICS for shared transactions depends on the numerical representation of the components in Formula (1), which are shown in

Table 2.

According to

Table 2, the potential quantity of money expressed in the BRICS digital currency needed for the bilateral or shared BRICS intra-use or circulation is equal to the sum of money there is today in the circulation among the BRICS themselves plus bilateral foreign trade deals, bilateral investment flows, bilateral trade in currency pairs of the local currencies, the amount of national currency kept in gold and foreign exchange reserves, as well as currency deposited in commercial bank accounts and money that crosses the nations’ borders as money transfers.

The data in

Table 2 also show that the quantity of money expressed in the new currency of the BRICS, if it were launched in 2019, would have had to have been equal to about 360 billion in USD equivalents to cover the shared needs of the BRICS to conduct foreign trade deals. Since foreign direct investment is a vulnerable, unstable and erratic value, which is quick to react to all kinds of financial shocks in the world financial market such as the coronavirus, it is impossible to precisely predict how much money expressed in the BRICS shared currency would be required to make all these things happen, especially foreign direct investment. Therefore, it is proposed here that its volume be omitted altogether when calculating the amount of money supply needed for the circulation. Also, in order to avoid a double count, it is worthwhile to put into the formula only the bilateral exports of the BRICS when considering the amount of the shared foreign trade deals.

If the BRICS digital currency had gone beyond the nations’ borders of the bloc, the quantity of money expressed in it would have to include the world exports of goods and services, financial capital flows, international reserves, loans, deposits, foreign exchange dealings in local currencies in the world market, and domestic needs in the money supply currently happening in the existing currencies of the BRICS.

Internationally, the money supply for non-residents may exceed the needs specified by Formula (1). In this case, there is a possibility of increasing demand for the digital currency of the BRICS, since the volume of foreign trade may also increase, as well as foreign direct investment, IPOs, bank deposits, etc. The money supply must vary depending on the market demand, because the lack or very tight money supply of an internationalized currency in the world market usually results in soaring interest rates and liquidity crises.

The limits to which the demand for an international currency may change depend on its growth in world GDP, world exports, world financial capital flows, international reserves, etc. During normal times, when the GDP grows adequately and as anticipated, monetary policy is fairly easy to conduct. The central monetary authority is comfortable about managing money circulation via short-term interest rates. The market reaction is predictable. There is no urgent need in liquid assets. Thus, the central monetary authority keeps supplying the currency on a scheduled basis. In extreme circumstances, such as today’s, the money supply must change and adjust to the market conditions on a repetitive basis, which usually takes place out of schedule. Therefore, determining the limits of the money supply is a very difficult issue, especially during global financial and economic crises.

An important challenge the BRICS are going to face while introducing the shared digital currency will be determining how much money should potentially be put into circulation. This is important, since this determines the demand for the BRICS currency. The demand for the BRICS currency must fulfil all the needs in this currency on the part of the public and private sectors and include the ingredients given in Formula (1).

4. Results

To understand whether the shared digital currency of the BRICS is going to work, it is worth calculating the correlation of the local currencies’ exchange rate dynamics. The correlation coefficients of the exchange rate dynamics of the BRICS local currencies in USD terms differ greatly. Surprisingly, the member states with which Russia has no borders and with which Russia trades less—Brazil and South Africa—have currency dynamics that correlate more closely with the Russian ruble than with the Indian rupee and Chinese yuan. It is also interesting to note that the Chinese yuan hardly correlates with any of the BRICS currencies, except for the Indian rupee. Of course, India is a very important trading partner for China and a neighbor (

Table 3).

The correlation coefficients of the BRICS’ currency exchange rate dynamics help to estimate the possibility for this group of countries to make an optimal currency area. The correlation coefficients in

Table 3 do not appear to make it possible. A number of researchers say that the BRICS will not be able to build the optimal currency area with a single currency. However, at least three countries of the bloc can do that, because they have currency dynamics that correlate quite closely, namely, Brazil, Russia, and South Africa.

The author’s calculations also find also quite tight correlations in

Table 3, which indicate that it may be possible to create a common currency for Brazil, Russia, and South Africa that makes up an optimal currency area. As for the rupee, it correlates with the real, ruble, and rand quite moderately. So, ceteris paribus, India may also join the optimal currency area of the BRICS. On the other hand, China is left behind due to poor correlation. However, if excluded from the potential monetary union, the whole plan for the digital currency will be absurd. China is the driving force of the BRICS, and to omit it would make the union unthinkable. The same argument was probably very important for the policymakers behind the euro plan when they created it and thought about including particular countries in the monetary union. That means that, in the BRICS, there must be also a sort of a consensus that would send a message to the rest to create the common currency.

To determine the exchange rate of the digital currency for the BRICS, one needs to use the five national currencies’ quotations. They change on every single trading day relative to the USD and include an open price, closing price, minimum price, and maximum price. The initial stage of the calculations is to determine the exchange rate of the digital currency relative to the USD. Then, it is possible to find the exchange rates of all other currencies in the world toward the BRICS shared currency.

If the BRICS can potentially make up an optimal currency area, then there might also be an optimal system of equations representing the BRICS’ existing currencies dynamics. If such an optimal system of equations exits, it must make a matrix of five functions that represent Formula (3), namely:

where n, m, p, q and x are proportionate exchange rate ratios for each of the BRICS’ existing currencies.

Next, it is necessary to represent these ratios in the form of equations which correspond to the dynamics of historic data of the BRICS currencies’ exchange rates relative to the USD. The USD equation dynamic is Y in the formula. The argument of the equation is a constant component chosen for the BRICS currency, which shows the inclination of the curve. The result is the system of five functions shown in

Table 4.

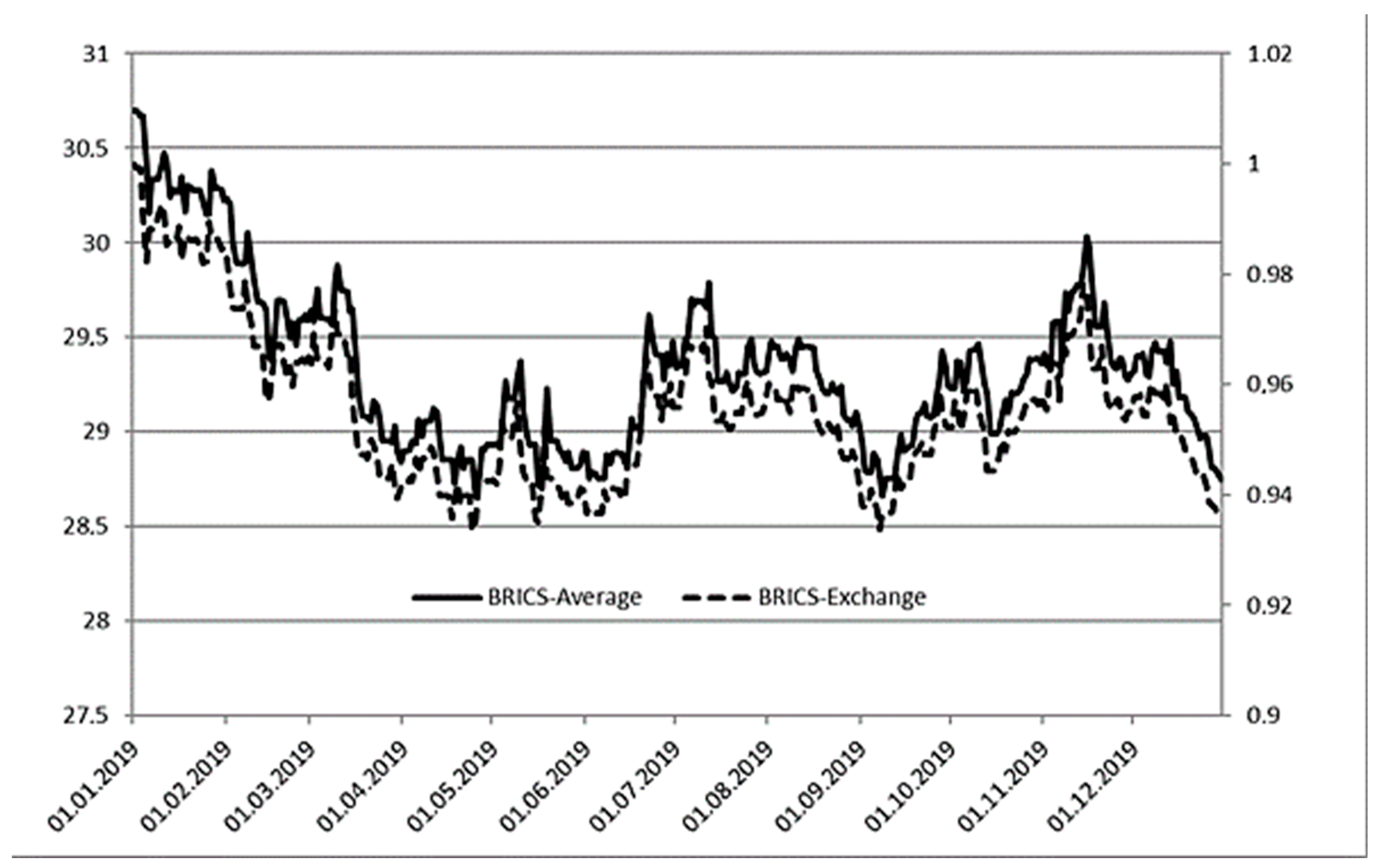

Figure 1 demonstrates the dynamics of the new digital shared currency for the BRICS. According to the author’s model, average annual exchange rate of the BRICS’s digital currency to the USD would be 31.2242. Assuming the GDP of the US and the BRICS were equal at the start of the period in question, the exchange rate of the BRICS digital currency (BRICS-Exchange on the chart) relative to the USD stood at 1:1. By the end of the period, the exchange rate changed to 0.9393 BRICS digital currency for 1 USD, meaning the shared digital currency for the BRICS appreciated during the period under consideration.

This underlying article contains only part of the simulation model developed for the common BRICS currency due to a lack of space. In particular,

Figure 1 represents a hypothetical dynamic of the currency under consideration. It represents simulated data of the probable movements in the currency’s fluctuation over the course of the last good year 2019 before the international financial and monetary system was shaken by the coronavirus crisis and other volatilities.

Figure 1 shows the movements of the hypothetical BRICS cryptocurrency in two representations. One of them depicts the currency as if it were a sort of index averaging the dynamics of the five regular currencies of the BRICS simulated and projected into the future based on the assumption and retrospective data starting in 2014 when the BRICS leaders met in Fortaleza, Brazil, agreed on the creation of the New Development Bank, and laid the foundation for the Pool of Contingency Reserve Currencies. The simulation approach made use of the actual data, projected it into the future, and got output in the form of a graph showing the average fluctuation of the BRICS’ currencies. Meanwhile, the other representation of the BRICS cryptocurrency provides a look at it as if it were a common currency for the BRICS. The cryptocurrency is weighted on the US dollar exchange rate, based on the assumption that, as soon as there is parity between the GDP of the G7 countries and that of the BRICS, hypothetically at the start of the year 2019, a unit of the BRICS currency cost a US dollar in January 2019. Later on in the process, the simulation model showed probable dynamics of the currency in question until the end of 2019. Once on the crypto money market, the result of the floatation delivers a new curve showing that the currency in question may get stronger than the US dollar by the end of 2019. The simulation shows that, if floated, the US-dollar-to-the-BRICS-currency-exchange-rate may take the value of approximately 0.935. Thus, if an investor considered buying into the BRICS currency in early 2019, he or she would have losses due to the BRICS currency getting stronger against the US dollar. In effect, the simulation model says that the hypothetical BRICS currency floatation would hurt the BRICS’ exporters and benefit their importers. Since the BRICS depend very much on foreign trade, the currency floatation may have significant consequences for both importers and exporters. The largest effect would be dealt on China’s foreign trade, where it is the largest actor in the world and among the BRICS.

With the exchange rate of the USD to the BRICS’ currency identified, it is possible to calculate its exchange rate toward the currencies of other countries.

Table 5 shows some of them.

5. Conclusions

The research comes close to analyzing the prospects of introducing a common currency for the BRICS when discussing whether it should be a private cryptocurrency such as Bitcoin or government-controlled digital money. Since the start of the pandemic in early 2020, a number of countries in the world addressed this issue, and some of them decided to introduce Bitcoin as legal tender. For instance, El Salvador really embraced the use of Bitcoin. However, lately, the country might have regretted it after Bitcoin lost more 60% of its value since the peak in November 2021. Some parts of Switzerland also joined the club of countries using Bitcoin as regular money. We think that part of the reason for them to do so is to make a sort of an offshore financial oasis there. In the past, they were not able to do that and lost in competition to other safe havens like the Cayman Islands, Bermuda, or Zurich; but now, with Bitcoin at their disposal, they thought they could make use of it as an instrument to build a financial pyramid that would attract much needed foreign capital to develop their economies and financial sectors in particular. However, due to high volatility and a lack of control, this financial innovation seems to have failed, at least by now, at the time of writing this article. The loss in market value of Bitcoin put pressure on state finances in El Salvador and some municipalities in Switzerland. Their budgets had to deal with deficits. Foreseeing it and seeing it now, other countries such as China or Russia responded to the challenge of a new financial digital revolution by adopting their own digital currencies that they can control. China launched a pilot digital yuan initiative. Russia joined China on 1 April 2023. Early stage results in China show that, in general, the majority of people have heard something of the pilot digital yuan, but they continue to mistrust it, and prefer regular currency. Also, the amount of money the Chinese can draw down on their digital yuan wallets is such that it makes it impossible to conduct some serious transactions, thus making the currency obsolete. Russia is still in the process of seeing its first encounter with the digital ruble. However, what is clear by now is that the population’s reaction to it may be the same as in China. Some people may think of profiting from it, while others neglect it, and when they understand the benefits of using the digital ruble in the end, it would be too late to gain benefits, since it is usually newcomers who take it all from such financial innovations. The reality, however, is clear, and the central bank digital currencies (or CBDCs) will find more use in the future for the international finance and the digital financial revolution, because they offer more control over finance, especially in countries with strong and strict central governments such as those of China and Russia. The CBDCs may also bring in order to financial chaos in countries with weaker financial regulation and more libertarian approaches to finance such as South Africa and India. Recent financial fraud cases and cases of corruption in finance in both countries visibly demonstrate the need to have some sort of a government-controlled digital currency that would allow them to interfere long before a financial shock strikes due to financial mishandling. It is on this basis and the basis of previous research on the issue that this underlying article tries to come up with an idea of a common digital currency for a group of emerging markets to collectively manage financial and monetary issues with digital money in hand (

Sabilla and Kurniasih 2020). The research suggests that the BRICS common digital unit of payment may indeed bring trust and security, especially for foreign trade partners of the BRICS who would like to hedge their currency risks and foreign exchange risks when exporting or importing important and valuable goods and services. This may improve cooperation and bring the BRICS to a new level of integration through common money.

The research identified the significance of the most important macroeconomic features that characterize the potential shared market of the BRICS digital currency, namely, a common interest rate, or the rate of refinancing, and the quantity of money in circulation needed for penta-lateral and international use. The exchange rate of the BRICS digital currency is going to heavily depend on the amount of the interest rate of the hypothetical, potential creditor of last resort. This problem is quite significant, since, for the international circulation, it is very important to know how much foreign currency the BRICS digital currency buys to trade with the rest of the world.

To be able to circulate a collective or shared digital currency, integrating nations must have complementary, interdependent and interacting economies, markets, and industries. The conditions of complementarity, interdependence, and interaction are very important, since independent economic entities have a vast potential to internationalize their own currency, i.e., some of them may do it alone and launch their currency for circulation in the world economy, just as in the case of the USD, without any need to make a collective or a shared currency. Within the BRICS, the most self-sustaining and self-sufficient economic entity is China. However, even China does not have all the qualities, competences, and qualifications required to achieve a currency internationalization similar to the USD.

Adopting a cryptocurrency as a collective or shared currency for a group of countries such as the BRICS, according to the idea expressed in this research, is not relevant due to a number of reasons.

First, a cryptocurrency’s value is vague, i.e., there is no definite, distinct, or standard mechanism to set its exchange rate. For example, there are cryptocurrencies that have exchange rates set up depending on the number of views or likes of a video or a commercial on YouTube. In addition to that, setting an exchange rate of a cryptocurrency is out of place and absurd, due to the fact that the general population and businesses need currencies to be able quote their relevant exchange rates towards the national and foreign currencies that circulate according to the rule of law by central monetary authorities or central banks.

Also, a national currency is one of the insignias of national sovereignty, whereas a cryptocurrency has absolutely no peg to any country. This means that a cryptocurrency has no sovereign characteristics and does not serve as a national unit of account. The more time goes by, the better people are going to see that cryptocurrency is just a veiled form of a product of financial engineering and financial innovation. Further delay to adopt it as a regular currency will reveal just more of its highly speculative nature. Basically, the market of cryptocurrencies was a sort of a replacement to the market of exotic derivatives that collapsed in 2007–2008.

During financial and economic crises, a national currency becomes an instrument to help an economy escape collapse when the government faces failure. Of course, genuine money is prone to inflation and devaluation, but it sometimes helps soften implications for the national economy. In 2014, for example, the US, the EU, and several other countries introduced anti-Russia sanctions. Many countries had to suspend foreign trade with Russia, and the Russian market faced supply shortages and dramatic price increases. The local currency devalued, which made it more expensive for the consumers to buy imported goods. The devaluation reduced the competitiveness of imported goods and switched consumers’ demand to the domestic products. Russian manufacturers gained from those sanctions. Many of them looked for means of import substitution, especially agricultural firms. This strategy was part of the protectionist policy. Cryptocurrency may also devalue and thus drive protectionism. However, its incredible fluctuations may lead to dramatic price changes that are big enough to cause hyperinflation and destabilize an economy. The economy would not be able to quickly adapt to such fluctuations, as well as hyperinflation. An economic crisis caused by hyperinflation, drastic currency devaluation, and depreciation could be very deep. The government debt and budget deficit expressed in cryptocurrency would also be too difficult to manage.

Moreover, a central monetary authority controls all money in circulation to avoid inflation, forgery, money laundering, etc. Therefore, for a cryptocurrency to work or function as a national unit of account, there must be an institution in existence responsible for its issue and setting of interest rates.

A cryptocurrency is comparable to something developed as a result of technological change, whereas genuine money is the result of socio-economic, cultural, civilizational, public, and political evolution. When Internet banking came into being, there were also hypotheses and speculations in circulation that it would expand and replace conventional banking. However, an Internet account still needs a commercial bank account, there is no alternative institution to underwrite the risk of keeping deposits, and there are no legal regulations that would insure deposits in cryptocurrencies. It is, therefore, very naïve to suppose that a cryptocurrency will someday go from just being a financial byproduct created to attract speculative capital to a vehicle on the financial and foreign exchange markets.

Cryptocurrencies attract investors by their shockingly high exchange rates to the USD. This makes them believe that cryptocurrencies are very valuable. However, they are so expensive only because they are artificially short is supply, which creates a feeling of exclusiveness by owning them.

Few countries in the world have a capacity to provide lender of last resort facilities when there is an urgent need for more currency. The last couple of decades of the 21st century have seen a few examples of when the world had an urgent need in a central-bank-for-the-world function.

Countries with weak governments only sometimes show that they want more independence from the great economic powers such as the US through more cooperation or integration with each other. However, they are very slow at negotiations and do not take decisive steps to create unions. A notable example is a would-be African Union. African countries negotiated the integration project for decades, but they always lacked the political will to take a final and decisive step that would actually lead to the establishment of the union. The BRICS are a different sort of a grouping. We hope that the BRICS at their twentieth year of inception will have a better chance for more cooperation in helping to reform the world economic order, the world financial architecture, and world monetary system.

The hope is that the BRICS at their twentieth year of inception after the crisis of 2020 will work more closely in digitizing economic activities. One of the ways to do that will be a shared digital currency of the BRICS.