2. Literature Review

Stock prices are very important for investors, companies, banks, and governments for a gainful investment. One of the vital sector indexes is the banking sector index, which has the highest volume and drives the financial market index. The banking sector index affects both the economy and financial markets (

Assous and Al-Najjar 2021). A stock is a certificate of ownership issued by a joint-stock company to raise funds, which allows the shareholder to receive dividends and bonuses. The stock market is a very complex and sizeable financial system, with economic and political factors influencing the changes in the stock market at every moment (

Cao 2021). As the market provides investment channels for institutions and individuals, companies have an incentive to follow changes in their stock prices and push them to improve their performance and increase their profitability, which leads to improved stock prices (

Menaje 2012). However, stock market price index prediction is a very challenging process due to its nonlinearity, volatility, and noise (

Peng et al. 2021).

Uras et al. (

2020) forecasted six daily closing price series of Bitcoin, Litecoin, and Ethereum cryptocurrencies, using data on prices and volumes of prior days. They used the simple linear regression model for univariate series forecast using only closing prices, the MLR model for multivariate series using both price and volume data, and two artificial neural networks methods, multilayer perceptron and long short-term memory. Another example of similar forecasting was completed by

Kurek (

2014), who investigated the information content of equity block trade transactions for companies constituting the WIG20 index from the Stock Exchange in Poland. The investigation used two approaches, including simple linear regression and multivariate adaptive regression splines. From the conducted research, it can be concluded that equity block trade transactions carry an important signal for investors acting on a stock exchange: significantly abnormal positive (negative) returns follow the execution of the equity block trade, the price of which is higher than the closing price two days before the execution of the transaction.

As an example of accounting for breaks between recession periods,

Fuquene et al. (

2015) used robust Bayesian dynamic models (RBDMs) in order to account for possible outliers and structural breaks in Latin-American economic time series. They used a random walk model to show how RBDMs can be applied for detecting historic changes in the economic inflation of Mexico. Additionally, they modeled the Consumer Price Index, the Economic Activity Index, and the total number of employments economic time series in Puerto Rico using local linear trend and seasonal RBDMs with observational and state variances. The results illustrate how the model accounts for the structural breaks for the historic recession periods in Puerto Rico.

Lim and Hooy (

2012) reexamined the persistence and source of nonlinear predictability in the stock markets of G7 countries. Applying the Brock–Dechert–Scheinkman (BDS) test on autoregression (AR)-filtered returns in rolling estimation windows, they found evidence of local nonlinear predictability in all the sampled stock markets. To identify the source, they applied the BDS test on AR-generalized autoregressive conditional heteroskedasticity (GARCH)-filtered returns in rolling windows. After accounting for conditional heteroskedasticity, they found brief time periods with nonlinear predictability in all markets, contradicting the weak-form efficient markets hypothesis.

To examine the causal relationships between the changes in commodity prices and the US inflation periods,

Mahadevan and Suard (

2013) used both linear and nonlinear causality tests. Using the asymmetric generalized autoregressive conditional heteroskedasticity model, they found evidence of significant nonlinear causality from raw industrial and metal indexes to inflation, with most of this detected as a nonlinear relationship. This implied that the observed nonlinear Granger causality was largely driven by unanticipated shocks and volatility spillovers in the run-up of commodity prices in late 2000.

Liang (

2020) used MLR to establish the certain impacts of COVID-19 on the domestic economy and the consumer price index (CPI) in China during the pandemic. MLR was used to establish and analyze the model. On the other hand,

Banerjee (

2020) analyzed the impact of the S&P500 returns along with the influence of S&P500 Information Technology stocks (S&P500-lT) on Apple Inc. daily returns at the beginning of 2018 by complex MLR and Chow analysis. The index of S&P500-lT and S&P500-C in the complex regression model exhibited a negative effect on the daily returns of Apple Inc., due to the multicollinearity of the daily returns with S&PS00-lT stocks. The structural breaks were insignificant in the improved regression model.

Alvarez-Dfaz and Gupta (

2016) used a variety of linear random walk (RW), autoregressive (AR), seasonal autoregressive integrated moving average (SARIMA), nonlinear artificial neural network (ANN), and genetic programming (GP) univariate models to predict the consumer price index of the US economy based on monthly data. They found that while the SARIMA model is superior relative to other linear and nonlinear models, as it tends to produce smaller forecast errors; statistically, these forecasting gains are not significant relative to higher-order AR and nonlinear models, though simple benchmarks such as the RW and AR(l) models were statistically outperformed.

Ballings et al. (

2015) used the multiple classifier technique to predict the stock prices.

Additionally, some scholars have analyzed the companies’ financial performance using dynamic factor modeling.

Bujosa et al. (

2013) proposed a new framework for building composite leading indicators for the Spanish economy using monthly targeted predictors and small-scale dynamic factor models. Based on the low-frequency components of four monthly economic variables, the leading indicator index could predict the onset of the Spanish recessions as well as the gross domestic product (GDP) growth cycles and classical industrial production cycles, both historically and in real time.

Shammout (

2020) studied the impact of characteristics on market price in the 13 commercial banks in Jordan during the period from 2005 to 2018 by using MLR. It was found that there was a significant impact of stock characteristics on the market price at the Jordanian commercial banks.

Fletcher (

2019) used the sequential approach to build linear factor models in UK stock returns among a set of 13 candidate factors using individual stocks and 3 groups of test portfolios between July 1983 and December 2017. It was found that the market factor is the dominant factor in reducing mispricing in individual stocks and test portfolios, regardless of the pricing error metric used.

During the pandemic crisis,

Assous and Al-Najjar (

2021) examined the effect of COVID-19 indicators and policy response on the Saudi banking index. COVID-19 variables that were applied were: new confirmed and fatal COVID-19 cases in Saudi Arabia, lockdowns, first and second decreases in interest rates, regulations, and oil prices. They used MLR and then built an artificial neural network (ANN) model.

Abedifar et al. (

2022) examined whether environmental and social (ES) activities had an impact on the resilience of firms during the COVID-19 crisis, studied in 300 firms operating in 5 developed countries: Canada, France, Japan, the UK, and the US. They found that with a low ES ranking, Japanese and UK stock prices with a high ES ranking suffered more during and after the market rundown, whereas for the other countries there were no significant differences in stock prices based on ES ratings.

In the literature, there is a lack of research to compare index prices in different crisis periods. One study focused on the consumer price index, monetary aggregates, discount rate, and exchange rate to see their effects on inflation (

Cogoljevic et al. 2018), while another used the construction production index, industrial production index, fuel consumptions, consumptions of goods’ availability, and the consumer confidence index to determine the lead indicator for the Spanish economy during the 2008 crisis (

Bujosa et al. 2013). Another one used past stock market data, such as the Bank of America Corporation (BAC), Exxon Mobil Corporation (XOM), S&P500 Index (INX), Microsoft Corporation (MSFT), Dow Jones Industrial Average (DJIA INDEX), CarMax, Inc. (KMX), Tata Steel Limited (TATASTEEL), and HCL Technologies Ltd. (HCLTECH), to learn and then estimate the direction of stock movement via the machine learning method (

Ampomah et al. 2020).

This paper aims to find the answer to the research question: “is there any pattern of price indexes during crisis periods?”, and to determine the most efficient price indexes that have an impact on the stock market closing price during the crisis periods. For these purposes, five crisis periods were selected from the five banks’ data and multiple linear regression (MLR) was utilized for the data analysis, using SPSS (version 26) and Excel software.

The rest of the paper is structured as follows:

Section 3 describes the data and methodology,

Section 4 presents the results,

Section 5 discusses the findings, and

Section 6 presents the conclusions.

3. Data and Methodology

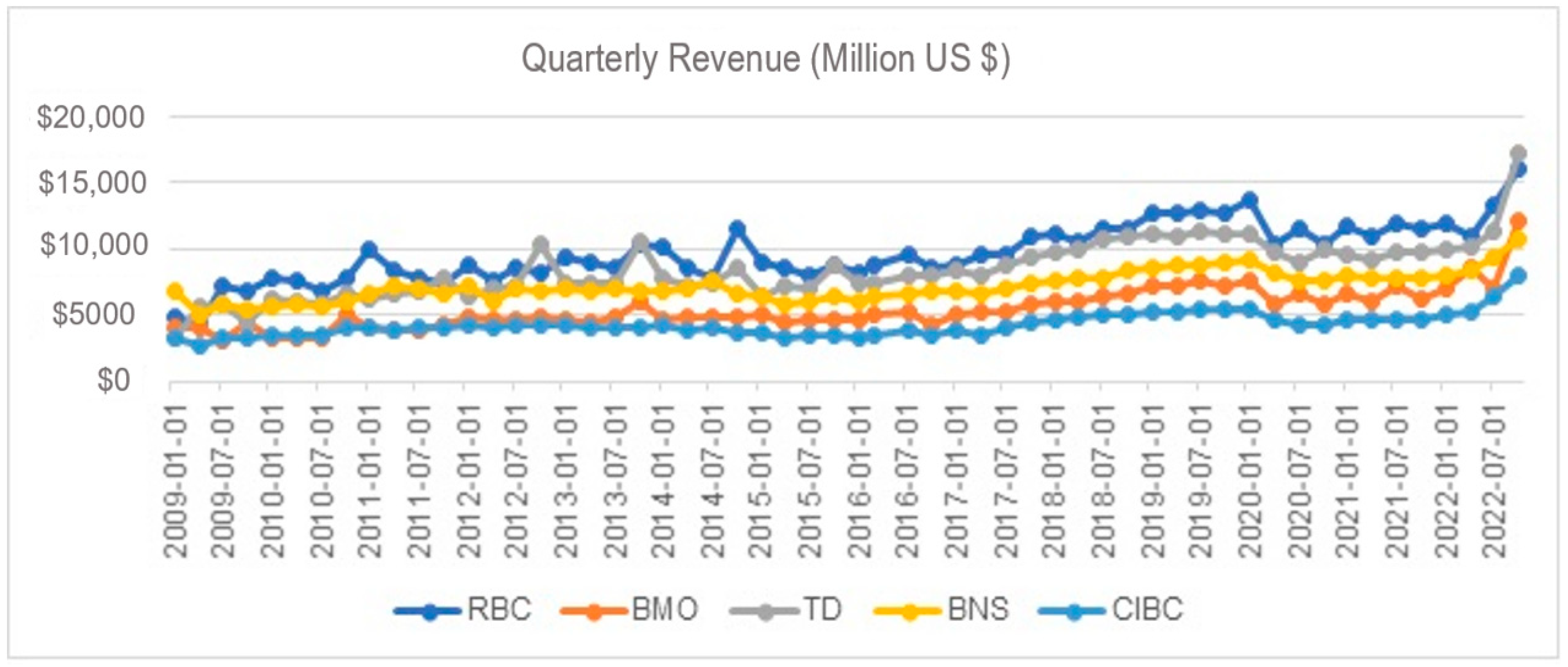

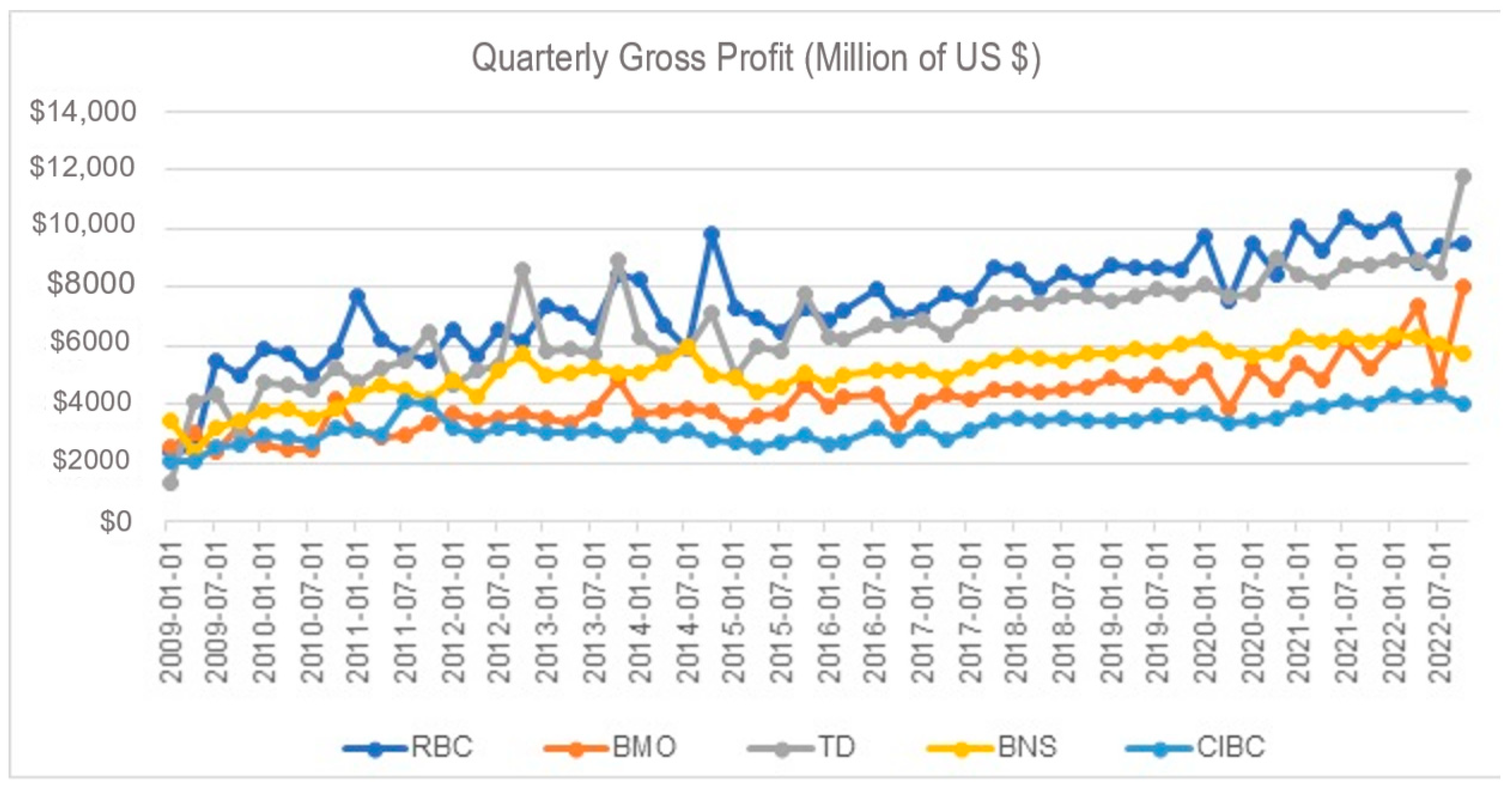

Daily common stock market prices and indexes from 1/1/1975 to 31/12/2020 of five banks: /BMO, BNS, CIBC, RBC, and TD, were collected from (

Data 1 n.d. http://clouddc.chass.utoronto.ca.ezproxy.lib.ryerson.ca/ds/cfmrc/displayTSX.do?ed=2018&t=ts&f=daily&lang=en#v2, accessed on 5 May 2021). In this paper, the daily closing price (DCP) was considered as the dependent variable, and fifteen daily price indexes, equal weighted indexes, value weighted indexes, the call loan interest rate, and the foreign exchange rate were considered as the independent variables. Odd numbers of indexes are the daily price indexes (ind1-ind29) (DPI), while even numbers of indexes are the daily total return indexes (ind2-ind30) (DTRI). Return indexes were not included in this study because there is a high correlation between the closing price and returns. Among the remaining indexes, three (ind33, ind35, and ind37) were daily equal weighted indexes (DEWI), three (ind34, ind36, and ind38) were value weighted indexes (VWI), ind31 is the call loan interest rate, and ind32 is the daily foreign exchange rate. Some of the indexes differed in their start time points, such as the indexes, 3–22 are from 1/2/1975 to 12/30/1987, and indexes 23–30 are from 1/2/1975 to 5/31/2002. The missing periods within each index were removed from the assessments if they fell into the studied crisis periods. The model was based on the independent variables shown in

Table 1 (

Supplementary Materials Table S1).

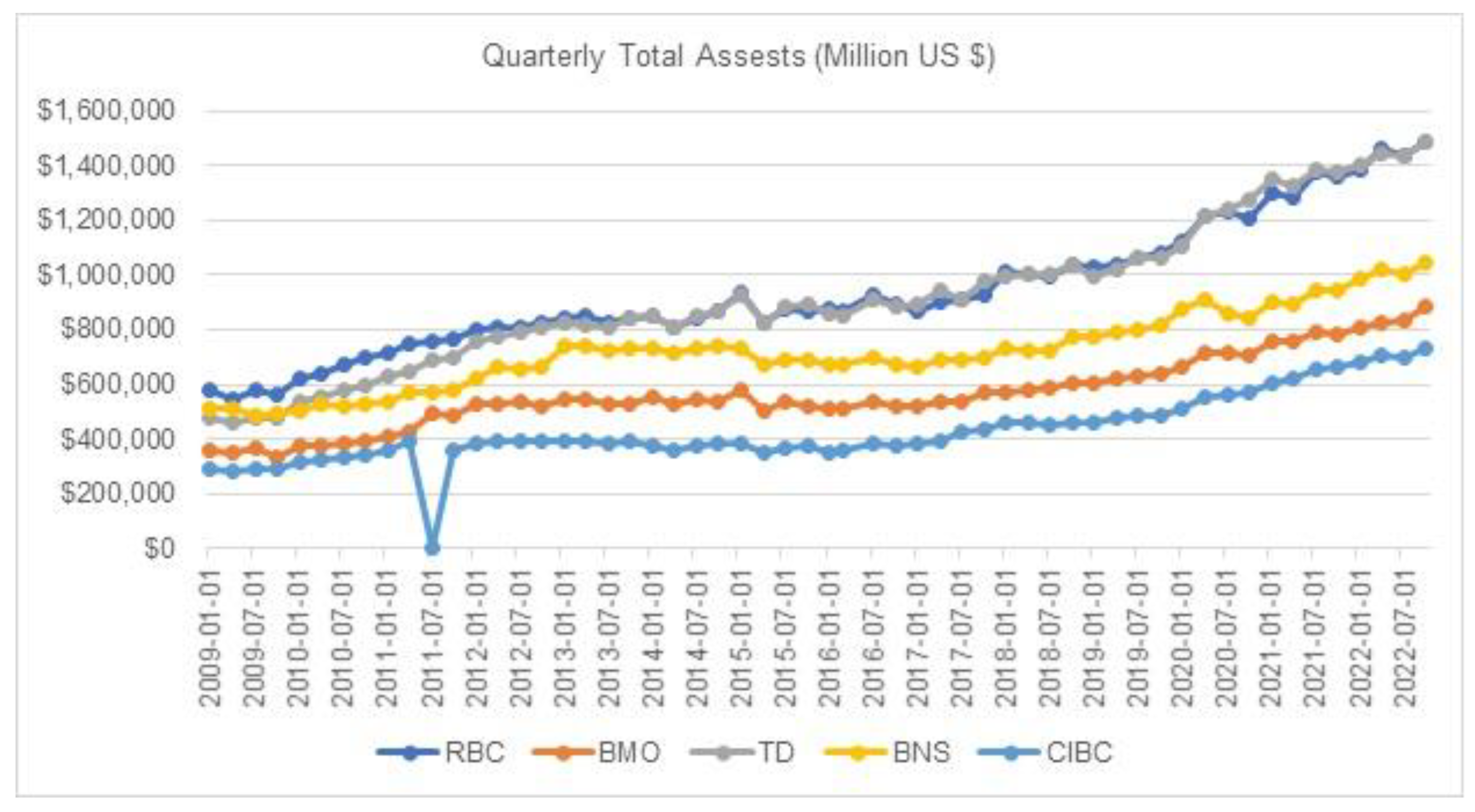

Figure 1 depicts the graphs of the DCP of the five banks. In general, the DCP of the five banks dramatically decreased in crisis periods. To select the crisis periods, graphs of the five banks were drawn and the common DCP decrease periods were determined. Then, from the graph in

Figure 1 (

Supplementary Materials Figure S1) and in the view of the Canadian economic crises from the literature, five economic crisis periods: I: 1/1/1992–30/4/1993, II: 1/7/1998–30/10/1998, III: 1/5/2007–30/3/2009, IV: 1/9/2014–30/2/2016, and V:1/2/2020–30/3/2020, were determined. SPSS (version 26) and Excel software were used to analyze the prospective data of the five crisis periods for each bank. SPSS was used for each MLR model and Excel was used for sketching the graphs.

Daily price indexes are formed from the daily stock prices (DCP) in the stock market, but this paper considered the price indexes in the reverse manner in search for a significant impact on the DCP in different crisis periods as well as the price index differences among the crisis periods in conjunction with the recession or depression. MLR models were constructed to evaluate the impact of index prices on the DCP during the crisis periods. In all models, DCP is the dependent variable and the twenty-three index prices are the independent variables. Equation (1) below is the general MLR model for the assessments:

where,

are the impact values of indexes, and

is a random error.

The stepwise regression was used to analyze the data collected from the five banks in crisis periods. The stepwise method includes the variable which has the highest t-statistic values in each step, regardless of collinearity. When the different models were compared, the highest adjusted R-squared model was generally selected as the best model. In this work, preliminary tests were performed in order to select the proper estimators, as well as regression pitfalls, linearity, multicollinearity, normality, and heteroscedasticity, and the regression diagnostics for the model assessments were verified. All MLR models satisfied the remedying violations of the required conditions. The models had high adjusted R-squared values and the smallest standard error values. The variation inflation factor (VIF) values were less than 10, so there was no collinearity. Outliers were detected by Cook‘s distance and a small number of outliers were removed from the evaluations. F statistics of the ANOVA table were also tested to determine whether the model can be used for prediction. p-values of ANOVA tables were all smaller than 0.001, which means that all models can be used for prediction. R-square changes were checked to find the best model. The MLR model outputs for each bank during the five crisis periods are discussed in the following section.

4. Results

In the stock market, the index prices change according to current conditions, where some of them increase and some of them decrease on a daily basis. Investors use different investment instruments in their portfolios, such as bonds, information technology, telecommunication services, healthcare, etc. The stock prices are formed by the prices of instruments and their percentage amounts in their portfolio. In this paper, the studied banks also have different investment instruments in their stock portfolios. In this section, how the indexes changed through the five crises will be discussed individually for each bank.

4.1. Indexes in the Multiple Linear Regression Models of the Bank of Montreal

The Bank of Montreal (BMO) is one of the oldest and the fourth largest bank in Canada (

Appendix A.2).

Table 2 (

Supplementary Materials Table S2) shows the MLR models of BMO in the five crisis periods. The indexes included by the MLR models are different in the five crisis periods, except ind15 (Financials). During the crisis period I, ind3 (Energy), ind15 (Financials), ind17 (Information Technology), ind21 (Utilities), and ind31 (Call Loan Interest Rate) had a negative impact on the DCP of BMO, while ind15 (Financials), ind32 (Daily Foreign Exchange Rate), and ind36 (CFMRC Under

$2 Value Weighted Index) had positive impacts on the DCP of BMO.

In crisis period II, ind15 (Financials), ind21 (Utilities), and ind31 (Call Loan Interest Rate) had a positive impact on the DCP, whereas only ind9 (Consumer Discretionary) had a negative impact on the DCP. Ind31 (Call Loan Interest Rate) had a negative impact in crisis period I, but it had a positive impact in crisis period II.

In crisis period III, the indexes in the MLR model were completely different from crisis period II, except ind15, but were similar to the crisis period I, with additional indexes. Ind15 (Financials), ind19 (Telecommunications Services), ind29 (Venture DPI), ind32 (Daily Foreign Exchange Rate), and ind36 (CFMRC Under $2 Value Weighted Index) had a positive impact on the DCP, and ind17 (Information Technology) and ind23 (60 DPI) had negative impacts on the DCP of BMO.

In crisis period IV, two new indexes, ind11 and ind13, were included in the MLR. While ind11 (Consumer Staples), ind15 (Financials), and ind31 (Call Loan Interest Rate) had a positive impact on the DCP, ind9 (Consumer Discretionary), ind13 (Healthcare) and ind19 (Telecommunications Services) had negative impacts on the DCP. It is interesting that ind31 (Call Loan Interest Rate) had a negative impact during the crisis period I, but during the crisis periods II and IV, it had a positive impact.

In the pandemic crisis period V, the indexes were similar to the indexes in crisis period III, but they had opposite impacts on the DCP in crisis period IV. In this period, ind13 (Healthcare), ind15 (Financials), and ind23 (60 DPI) had positive impacts, and ind29 (Venture DPI) and ind32 (Daily Foreign Exchange Rate) had negative impacts on the DCP of BMO.

Ind15 was the common index in all crisis periods for BMO.

4.2. Indexes in the Multiple Linear Regression Models of the Bank of Nova Scotia

In the crisis period I, ind11 (Consumer Staples), ind13 (Healthcare), ind15 (Financials), ind19 (Telecommunications Services), and ind21 (Utilities) had a positive impact on the DCP, whereas ind7 (Industrials) and ind37 (CFMRC Over $2 Equal Weighted Index) had negative impacts on the DCP of BNS.

In crisis period II, the indexes in crisis period I, ind7, ind11, and ind19, disappeared, and ind31 and ind32 were included in the MLR model. Impacts of ind13 and ind37 were opposite to in crisis period I. While ind15 (Financials), ind21 (Utilities), ind32 (Daily foreign Exchange Rate), and ind37 (CFMRC Over $2 Equal Weighted Index) had a positive impact on the DCP, ind13 (Healthcare) and ind31 (Call Loan Interest Rate) had negative impacts on the DCP of BNS.

In crisis period III, ind15 (Financials) and ind17 (Information Technology) had positive impacts, and ind9 (Consumer Discretionary) and ind13 (Healthcare) had negative impacts on the DCP of BNS.

The MLR model of the crisis period IV included different indexes compared to the other crisis periods. Ind1 (S&P/TSX Composite), ind3 (Energy), and ind23 (S&P/TSX 60) had positive impacts on the DCP, but only ind17 (Information Technology) had a negative impact on the DCP of BNS.

In the pandemic crisis period V, there were five indexes included in the MLR model. While ind15 (Financials), ind21 (Utilities), and ind27 (S&P/TSX Small Cap DPI) had a positive impact on the DCP, ind5 (Materials) and ind7 (Industrials) had negative impacts on the DCP. Ind15 was the common index for all the crisis periods, except crisis period IV.

4.3. Indexes in the Multiple Linear Regression Models of the Canadian Imperial Bank of Commerce

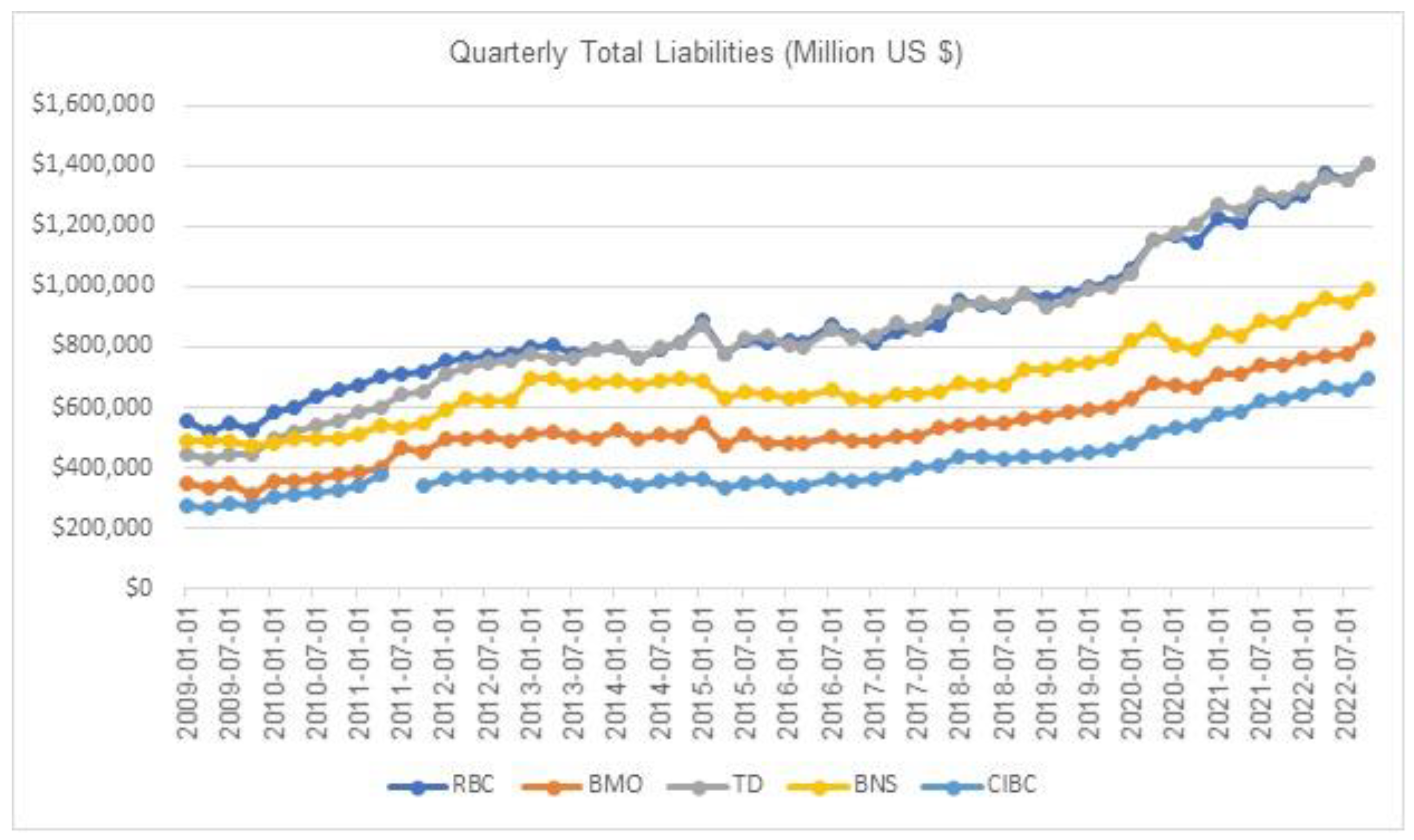

The Canadian Imperial Bank of Commerce (CIBC) is the fifth largest bank in terms of total assets (

Appendix A.2).

Table 4 (

Supplementary Materials Table S4) shows the outputs of MLR models during the five crisis periods of CIBC. As was expected, ind15 (Financials) was included in all MLR models. In addition, ind13 (Healthcare) was included in almost all MLR models of CIBC, except the crisis period I, and similarly ind21 (Utilities) was also included in almost all MLR models, except the crisis period IV. The following indexes were not included in the MLR models: ind1 (Composite), ind17 (Information Technology), ind23 (TSX 60), ind25 (Mid Cap), ind27 (Small Cap), ind29 (Venture), ind33 (Daily Equal Weighted Index (DEWI)), ind35 (DEWI Under

$2), ind36 (VWI Under

$2), and ind38 (VWI Over

$2).

In the crisis period I, ind5 (Materials), ind15 (Financials), and ind19 (Telecommunications Services) had a positive impact on the DCP, but ind3 (Energy), ind7 (Industrials), ind9 (Consumer Discretionary), and ind21 (Utilities) had negative impacts on the DCP of CIBC.

In crisis period II, ind11 (Consumer Staples), ind13 (Healthcare), ind15 (Financials), ind31 (Call Loan Interest Rate), and ind34 (VWI) had positive impacts on the DCP, but ind21 (Utilities) and ind37 (DEWI Over $2) had a negative impact on the DCP of CIBC. Ind34 had the highest positive impact on the DCP, whereas ind37 had the highest negative impact on the DCP.

In crisis period III, while ind9 (Consumer Discretionary), ind11 (Consumer Staples), ind13 (Healthcare), and ind15 (Financials) had positive impacts DCP, ind5 (Materials), ind21 (Utilities), ind31 (Call Loan Interest Rate), and ind32 (Daily Foreign Exchange rate) had negative impacts on the DCP. Among those indexes, ind32 (Daily Foreign Exchange Rate) had the highest negative impact on the DCP.

In crisis period IV, however, the indexes were the same as in crisis period III, except the indexes ind9, ind11, and ind21. While only ind15 (Financials) had a positive impact on the DCP, ind5 (Materials), ind13 (Healthcare), ind31 (Call Loan Interest Rate), and ind32 (Daily Foreign Exchange rate) had negative impacts on the DCP of CIBC. Ind32 (Daily Foreign Exchange rate) and ind31 (Call Loan Interest Rate) had the highest negative impacts on the DCP, respectively.

In the pandemic crisis period V, ind7 (Industrials) and ind15 (Financials) had positive impacts on the DCP, whereas ind3 (Energy), ind13 (Healthcare), ind21 (Utilities), and ind32 (Daily Foreign Exchange rate) had negative impacts on the DCP of CIBC. Ind32 (Daily Foreign Exchange Rate) had the highest negative impact on the DCP.

4.4. Indexes in the Multiple Linear Regression Models of the Royal Bank of Canada

The RBC (Royal Bank of Canada) is considered the largest bank in Canada (

Appendix A.2).

Table 5 (

Supplementary Materials Table S5) shows the outputs of MLR models during the five crisis periods. Compared to the other banks’ findings, the indexes in the MLR models of RBC in the five crisis periods did not show any pattern. Only ind15 was found in all five models. The following indexes were not in the MLR models: ind5 (Materials), ind23 (TSX 60), ind27 (Small Cap), ind29 (Venture), ind31 (Call Loan Interest Rate), ind35 (DEWI Under

$2), ind36 (VWI Under

$2), ind37 (DEWI Over

$2), and ind38 (VWI Over

$2).

In crisis period I, ind1 (Composite), ind3 (Energy), ind13 (Healthcare), ind15 (Financials), ind33 (Daily Equal Weighted Index (DEWI)), and ind34 (Value Weighted Index (VWI)) had positive impacts on the DCP, and ind9 (Consumer Discretionary) and ind21 (Utilities) had negative impacts on the DCP of RBC. Ind33 and ind34 had high positive impacts on the DCP of RBC.

In crisis period II, ind1 (Composite), ind3 (Energy), ind9 (Consumer Discretionary), ind13 (Healthcare), ind33 (DEWI), and ind34 (VWI) were not found in the MLR model. Instead, Ind7 (Industrials), ind15 (Financials), ind17 (Information Technology), ind19 (Telecommunications Services), ind21 (Utilities), and ind25 (Mid Cap) were in the MLR model. Ind15 (Financials), ind19 (Telecommunications Services), and ind21 (Utilities) had positive impacts on the DCP, whereas ind7 (Industrials), ind17 (Information Technology), and ind25 (Mid Cap) had negative impacts.

In crisis period III, ind3 (Energy), ind15 (Financials), ind19 (Telecommunications Services), and ind32 (Daily Foreign Exchange Rate) had positive impacts on the DCP, whereas ind11 (Consumer Staples), ind17 (Information Technology), and ind25 (Mid Cap) had negative impacts on the DCP of RBC.

In crisis period IV, however, the indexes showed different combinations. Ind13 (Healthcare) and ind15 (Financials) had positive impacts on the DCP, whereas ind3 (Energy), ind9 (Consumer Discretionary), ind11 (Consumer Staples), ind19 (Telecommunications Services), and ind32 (Daily Foreign Exchange Rate) had negative impacts on the DCP of RBC.

In the pandemic crisis period V, only two indexes were in the MLR model: ind15 (Financials), which had a positive impact on the DCP, and ind9 (Consumer Discretionary), which had a negative impact on the DCP of RBC.

4.5. Indexes in the Multiple Linear Regression Models of Toronto-Dominion Bank

Toronto-Dominion Bank (TD) is the second largest bank in Canada (

Appendix A.2).

Table 6 (

Supplementary Materials Table S6) shows the outputs of MLR models of TD during the five crisis periods. Compared to the other MLR models of BMO, BNS, CIBC, and RBC, MLR models of TD had less indexes and they were generally different from the others, except ind15 (Financials), which was in all MLR models. According to the crisis periods, indexes in the MLR models showed different distributions. Ind13 (Healthcare) was in all MLR models, except the crisis period I. Similarly, ind21 (Utilities) was in all MLR models, except the crisis period IV. The following indexes: ind1 (Composite), ind17 (Information Technology), ind23 (TSX 60), ind25 (Mid Cap), ind27 (Small Cap), ind29 (Venture), ind33 (Daily Equal Weighted Index (DEWI)), ind35 (DEWI Under

$2), ind36 (VWI Under

$2), and ind38 (VWI Over

$2), were not in the MLR models of TD.

In crisis period I, while only ind15 (Financials) had a positive impact on the DCP, ind7 (Industrials), ind13 (Healthcare), and ind17 (Information Technology) had negative impacts on the DCP of TD.

In crisis period II, like the crisis period I, only ind15 (Financials) had a positive impact on the DCP, whereas ind9 (Consumer Discretionary), ind11 (Consumer Staples), ind17 (Information Technology), and ind32 (Daily Foreign Exchange Rate) had negative impacts on the DCP of TD.

In crisis period III, while ind15 (Financials) and ind19 (Telecommunications Services) had positive impacts on the DCP, ind11 (Consumer Staples), ind13 (Healthcare), and ind31 (Call Loan Interest Rate) had negative impacts on the DCP of TD. Among those indexes, ind31 (Call Loan Interest Rate) had the highest negative impact on the DCP of TD.

In crisis period IV, ind15 (Financials), ind17 (Information Technology), and ind33 (DEWI) had positive impacts on the DCP, whereas ind9 (Consumer Discretionary), ind21 (Utilities), and ind31 (Call Loan Interest Rate) had negative impacts the DCP of TD. Ind33 (DEWI) had the highest positive impact on the DCP.

In the pandemic crisis period V, ind15 (Financials) and ind29 (Venture) had positive impacts on the DCP, but only ind25 (Mid Cap) had a negative impact the DCP of TD.

The R-squares of the five banks’ models during the five crisis periods were very high, which shows that over 90% of the variation on the DCP was explained by the independent variables (index prices) in the model. It also shows that the model fit the data well. The F-test was used for testing the utility of the models. The MLR models of the banks produced large F-test statistics, which rejected the null hypothesis (

p = 0.000):

at a significance level of 5%; therefore, the overall models are statistically useful for predicting DCP. The

t-tests on the individual parameter coefficients at a significance level of 5% were highly significant (

p < 0.05) for all banks.

According to the values of the estimated coefficients, individual parameters increased or decreased the DCP when the other parameters remained constant. All MLR equations satisfied the diagnostic residual tests. VIF values were all smaller than 10, which shows that there was no serious collinearity. Hence, the overall models are statistically useful for predicting DCP.

5. Discussion

It was hypothesized that in different crisis periods, there is a set of common indexes affecting the DCP of the banks in Canada, positively or negatively. Knowing them will help the banks to predict the stock market collapse in advance and learn how to invest, as well as know how to change their investment instruments in light of the future crises. For this purpose, the data of the five largest banks in Canada for five crisis periods were collected and analyzed by running a stepwise MLR with SPSS. Crisis periods were selected from the literature and the graphs of the five banks were charted. Results showed that ind15 (Financials) was the most effective index and was included in all MLR models for the five crisis periods. Other than ind15 (Financials), no specific common indexes were found to reduce or increase the DCP of the banks during all crisis periods. This was expected because each bank has different investment portfolios. Moreover, the characteristics of crises are other reason for not being able to determine the specific common indexes in all crisis periods. For example, oil price decreases were the reason for the crisis period IV, and the COVID-19 pandemic was the reason for the crisis period V. For this reason, the efficiency of the indexes will be discussed based on the individual crisis periods below.

5.1. Crisis Period I

Canada experienced a recession from the second quarter of 1990 to the first quarter of 1991, during which real GDP dropped by 3.6 percent (

Department of Finance Canada 1993). Primary factors that have led to the recession include the following: inflation and the resulting monetary policy of the Bank of Canada, several tax increases instituted by the federal government between 1989 and 1991, the high value of the Canadian dollar, a high unemployment rate, the lowest level of short-term interest rates, and a deficit increase (

Wilson et al. 2019) (

Appendix A.1).

In this period, the most effective common index on the DCP of the five banks after ind15 (Financials) was ind21 (Utilities), followed by ind3 (Energy), ind7 (Industrials), and ind13 (Healthcare). These indexes for some of the banks had positive impacts on their DCPs, and the others had negative impacts due to the fact that each bank has different investment tools with different percentage amounts in their portfolio. From the crisis perspective, the high value of the Canadian dollar, the high unemployment rate, and the deficit increase in this crisis period (

Wilson et al. 2019) dramatically affected not only the financial structure of Canada, but also industry, production, the energy sector, and healthcare in Canada.

In the overall comparison of the five banks, indexes that had positive or negative impacts on the DCP of the TD bank were moderately different from the other banks. There were some similarities in the indexes of BNS and CIBC, but BMO and RBC had mostly different indexes in their MLR models. Having different investment tools in their portfolios and managing different amounts of assets are the main reasons for these differences.

In the most common case for this crisis period I, none of the following indexes: ind23 (TSX 60), ind25 (Mid Cap), ind27 (Small Cap), ind29 (Venture), ind35 (DEWI Under $2), and ind38 (VWI Over $2), had any positive or negative impacts of the DCP of the banks.

5.2. Crisis Period II

The 1997–1998 Asian financial crisis began in Thailand, then spread to other Asian countries, including Malaysia, Indonesia, The Philippines, South Korea, Hong Kong, and China. It became a global crisis when it spread to the Russian and Brazilian economies. Canada was also affected by the Asian crisis. Primary factors that have led to the crisis include the following: international trade with Asian countries dramatically decreased, because their currencies significantly dropped, and Canada’s share of the East Asian import markets declined. By making imports much more expensive, these depreciations of currencies have made it increasingly difficult for Canadian firms to continue to be competitive in Asian markets (

Murray et al. 2022). Demand for Canadian products would naturally decline as incomes from the importing countries dropped. Another point to highlight is that the Canadian bank exposure is largely concentrated in Japan, Hong Kong, and Taiwan, and they possess substantial financial resources to deal with their current financial difficulties. It would take a serious implosion of these extremely wealthy countries to severely affect the Canadian banks (

Murray et al. 2022). Moreover, if such a cataclysmic event were to occur now, the entire global economy would be seriously eroded. In addition, Canada’s tourism industry is being adversely affected by the loss of wealth in Asia and the lower purchasing power of Asian currencies (

Appendix A.1).

In this period, ind15 (Financials) had a positive impact of all banks. The other important index was ind21 (Utilities). It had a negative impact on the DCP of CIBC, however, a positive impact on the DCP of BMO, BNS, and RBC. Another common index in the three MLR models was ind31 (Call Loan Interest Rate), and it had a positive impact on the DCP of BMO and CIBC, but a negative impact on BNS. The other indexes, ind7 (Industrials), ind9 (Consumer Discretionary), ind11 Consumer Staples), ind17 (Information Technology), ind19 (Telecommunication Services), ind25 (Mid Cap), ind32 (Daily Foreign Exchange Rate), ind34 (Daily VWI), and ind37 (DEWI Over $2), had more or less positive and negative impacts on the DCPs. In crisis period II, the drastically affected trade in Canada yielded negative changes in Utilities, Industry, Loan Interest Rate, Foreign Exchange Rate, Information Technology, Telecommunication, and Consumer Discretionary indexes. Due to the nature of the crisis period II, the following indexes did not have any positive or negative impacts on the DCP of the banks: ind1 (Composite), ind3 (Energy), ind5 (Materials), ind23 (TSX 60), ind27 (Small Cap), ind29 (Venture), ind33 (DEWI), ind35 (DEWI Under $2), ind36 (VWI Under $2), and ind38 (VEI Over $2).

5.3. Crisis Period III

The financial crisis of 2007–2008 started in the USA, then spread to Europe. It is also known as the subprime mortgage crisis. It was a liquidity crisis in the global financial markets, then turned into a solvency crisis. It threatened to destroy the international financial system, caused the failure (or near-failure) of several major investment and commercial banks, such as the 168-year-old investment bank Lehman Brothers, mortgage lenders, insurance companies, and savings and loan associations, and precipitated the Great Recession. Stock markets registered their greatest drops in more than 75 years. In the decade following a financial crisis, growth of the annual GDP is usually one percentage point lower, while the unemployment rate is generally five percentage points higher (

Reinhart and Reinhart 2010) (

Appendix A.1).

In this period, ind15 (Financials) had a positive impact on the DCP of all banks, but the other indexes had very different impacts on the DCP of the banks compared to the other crisis periods. The indexes found in all models that were important in predicting the DCP were ind11 (Consumer Staples), ind13 (Healthcare), ind17 (Information Technology), ind19 (Telecommunications Services), and ind32 (Daily Foreign Exchange Rate). The following indexes that showed inconsistent directions of positive and negative impacts on the DCP were: ind3 (Energy), ind5 (Materials), ind9 (Consumer Discretionary), ind21 (Utilities), ind23 (TSX 60), ind25 (Mid Cap), ind29 (Venture), and ind31 (Call Loan Interest Rate). The reason for the specified indexes above in the MLR models during this period is not only through international trade, but also by weakening financial markets of Canada in light of the high level of uncertainty (

Bank of Canada 2010). On the other hand, ind1 (Composite), ind7 (Industrials), ind27 (Small Cap), ind33 (DEWI), ind34 (Daily VWI), ind35 (DEWI Under

$2), and ind38 (VEI Over

$2) were not included in the MLR models to predict the DCP.

5.4. Crisis Period IV

Between mid-2014 and early 2016, the global economy faced one of the largest oil price declines in modern history. The 70 percent price drop during that period was one of the three biggest declines since World War II, and the longest lasting since the supply-driven collapse of 1986 (

Stocker et al. 2018). The oil price plunge was accompanied by a slowdown in 2015 and 2016. Oil producers in Alberta in 2015 were the most impacted. The recession gripping Alberta is likely to go down in history as one of the most severe the province has ever endured (

Burleton 2016; economist report) (

Appendix A.1).

In this period, surprisingly, ind15 was not in MLR model of BNS, but it was included by the other banks’ MLR models and had a positive impact on their DCP. The indexes that had a significant impact on the DCP of all banks were: ind9 (Consumer Discretionary), ind13 (Healthcare), and ind31 (Call Loan Interest Rate). In addition, the other important indexes were: ind1 (Composite), ind3 (Energy), ind11 (Consumer Staples), ind17 (Information Technology), ind19 (Telecommunication Services), ind21 (Utilities), ind23 (TSX 60), ind32 (Daily Foreign Exchange Rate), and ind33 (DEWI). Canada is a net oil exporter, and the price of oil affects the country’s terms of trade, its gross domestic income, and the value of its currency. Furthermore, while oil and gas extraction account for only 6 percent of Canadian gross domestic product (GDP), they made up roughly 30 percent of the total business investment in 2014 (

Ellwanger et al. 2017). Since the main reason for this crisis period was the drop-in oil prices, the main oil producers in Alberta were seriously affected (

Burleton 2016; economist report), whereas the other provinces were not affected that much. That is why the above indexes were included in the MLR models, and therefore the indexes: ind5 (Materials), ind7 (Industrials), ind25 (Mid Cap), ind27 (Small Cap), ind29 (Venture), ind34 (Daily VWI), ind35 (DEWI Under

$2), ind36 (VWI Under

$2), ind37 (DEWI Over

$2), and ind38 (VEI Over

$2), were not included in MLR models to predict the DCP.

5.5. Crisis Period V

The world faced many challenges in 2020, starting with the new coronavirus (COVID-19) pandemic, moving to the oil price crash, and ending with new variants of the coronavirus. Since the declaration of COVID-19 as a global pandemic on 11 March 2020, followed by the announcement of worldwide lockdowns, all financial and non-financial sectors have been in shock (

Assous et al. 2020). The collaboration between economic and non-economic factors leads to a strong fluctuation in the stock market index (

Assous et al. 2020) (

Appendix A.1).

During this pandemic crisis, ind15 (Financials) again had a positive impact on the DCP of all banks. However, the importance of the indexes, whether having positive or negative impacts on the DCP, was found to be very different for individual banks. The indexes that had a negative impact on the DCPs of individual banks were the following: ind3 (Energy) on CIBC, ind5 (Energy) on BNS, ind9 (Consumer Discretionary) on RBC, and ind25 (Mid Cap) on TD. On the other hand, the indexes that had a positive impact on the DCP of individual banks were as follows: ind23 (TSX 60) on BMO and ind27 (Small Cap) on BNS. Moreover, there were some indexes found to have a positive impact on some banks, but a negative impact on other banks. For example, the ind7 (Industrials) had a positive impact on the DCP of CIBC, but a negative impact on the DCP of BNS, ind13 (Healthcare) had a positive impact on the DCP of BMO, but a negative impact on the DCP of CIBC, ind21 (Utilities) had a positive impact on the DCP of BNS, but a negative impact on the DCP of CIBC, and ind29 (Venture) had a positive impact on the DCP of TD, but a negative impact on the DCP of BMO. The ind32 (Daily Foreign Exchange Rate) had a negative impact on the DCP for both BMO and CIBC. The reason for the positive and negative impact differences is that each bank has a different investment portfolio and different amounts of assets.

Demirgüç-Kunt et al. (

2021) provided strong evidence that, in the global banking sector, the COVID-19 outbreak has had a detrimental effect on financial performance across many indicators of financial performance and financial stability. They stated that although financial sector policy announcements (i.e., liquidity support, monetary easing, and borrower assistance programs) moderated the negative impact of the pandemic, this impact has significantly varied across banks and countries. The following indexes that did not have any impact on the DCP of the banks in this period: ind1 (Composite), ind11 (Consumer Staples), ind17 (Information Technology), ind19 (Telecommunication Services), ind31 (Call Loan Interest Rate), ind33 (DEWI), ind34 (Daily VWI), ind35 (DEWI Under

$2), ind36 (VWI Under

$2), ind37 (DEWI Over

$2), and ind38 (VEI Over

$2). These indexes can be called the main resiliency transmitters, as

Zhang et al. (

2022) discussed in their research.

There are some limitations of this work that need to be discussed. The main limitation of this study is not knowing the investment portfolio and the percentage of the investment tools the banks utilized. The second limitation is that the defined starting and ending dates defined in the literature did not exactly coincide with the years of the crises shown in the line graphs of the five banks. Perhaps there was a bit of lagging in the shock to the banking system due to the crises. The third limitation is that the missing values were eliminated from the data analysis. The last limitation is that only the price indexes were included in this study. The volatilities and return indexes were not included in this study due to the fact that the return and price indexes are highly correlated.

6. Conclusions

The financial crises and recessions drastically vary by cause and severity, and may cause changes to the economic condition, currency values, or to external factors such as oil prices (

Asteriou et al. 2019). As financial markets respond quickly to unexpected shocks, the effects of the crises are often felt almost immediately in the markets and persist longitudinally (

Spyrou 2011;

Asteriou et al. 2019). The stock market is a vehicle that provides investors with opportunities to trade in a variety of financial assets and receive returns on them. Investors consider the behavior of the stock market when making investment decisions. One of the vital sector indexes is the banking sector index, which has the highest volume (

Assous and Al-Najjar 2021).

Any weakness in the banking sector negatively affects the economy. The banks’ approaches to monitoring financial stability take a broad view. Canada’s financial system is made up of a complex network of institutions, including banks and credit unions, pension funds, and other asset managers. In order to avoid weakness problems in the future and provide useful information to the banks, in this study, stock prices of the five largest Canadian banks during the five crisis periods were analyzed by MLR using SPSS software.

The results will provide a better insight into the structure of the stock market and highlight which indexes play an important role on the stock prices during the crisis periods. According to the results, ind15 (Financials) always had a positive impact on the DCP, which contributes the findings of

Zhang et al. (

2022). The indexes were not consistently significant in predicting the DCP in each crisis period because of the different causes of the crises. The indexes in the MLR models changed based on the causes of the crises. Although the findings showed that there was no pattern, i.e., no common indexes in all five crisis periods due to the nature of the crises, this work delivered promising results for the banks to adjust their portfolios quickly when facing the crisis described in each crisis period, as described below.

Crisis Period I: Canada experienced economic crises and recession in the early 1990s. This led to massive government deficits, high unemployment, and general disaffection (

Economic Concepts, Recessions n.d.). This also led to high inflation and low purchasing power (

Appendix A.1). MLR results for this crisis period showed that Financials (contributing the findings of Zhang et al.), Daily Foreign Exchange Rate, Healthcare (except TD bank), and Telecommunications indexes had positive impacts on the DCPs, and Consumer Discretionary, Energy (except RBC bank), Industrials, Call Loan Interest Rate, Utilities, and Technology, which contributes the findings of

Banerjee (

2020), indexes had negative impacts. CFMRC S&P/TSX 60 DPI, S&P/TSX Mid Cap DPI, S&P/TSX Small Cap DPI, S&P/TSX Venture DPI, CFMRC (DEWI) Under

$2, and CFMRC (VWI) Over

$2 were not included in the MLR models so they can be referred to here as the main resiliency transmitters (

Zhang et al. 2022). During this type of economic crisis and recession, it is suggested that the banks change their investment profiles based on the indexes according to those having positive and negative impacts on their GDP to increase their assets.

Crisis Period II: This global crisis and the collapse in the world commodity prices affected the Canadian economy. Currency values, stock markets, and other asset values of the countries collapsed, the oil prices fell, and trade demand in the countries collapsed due to high value of the Canadian dollar. Banks that are heavily exposed to the oil sector are more susceptible to losses due to the likelihood of defaults in this industry. To the extent that markets internalize that the profitability of these banks will be lower, interest rate cuts would have small effects. On the other hand, banks with short-term liquidity constraints, but with less exposed portfolios, stand to benefit more from the ease in funding conditions (

Demirgüç-Kunt et al. 2021) (

Appendix A.1). MLR results showed that Financials, Telecommunications, and CFMRC Daily (VWI) indexes had positive impacts on the DCPs, and Industrials, Consumer Discretionary, and S&P/TSX Mid Cap DPI indexes had negative impacts on the DCPs. Although, the indexes Consumer Staples, Healthcare, Utilities, Call Loan Interest Rate, Daily Foreign Exchange Rate, and CFMRC (DEWI) Over

$2 had positive impacts on some banks’ DCPs and negative impacts on the others’ DCPs. This depends on the characteristics of the investment tools that the banks use. The indexes: Energy, Materials, S&P/TSX 60, S&P/TSX Small Cap, S&P/TSX Venture, CFMRC (DEWI), CFMRC (DEWI) Under

$2, CFMRC (VWI) Under

$2, and CFMRC (VWI) Over

$2, did not have significance impacts on the DCPs, so they can be referred to here as the main resiliency transmitters (

Zhang et al. 2022). For this type of economic crisis, it is suggested that the banks change their investment profiles based on the indexes according to those having positive and negative impacts on their GDPs to increase their assets.

Crisis Period III: The global financial crisis of 2008 caused a major recession, which led to a significant rise in unemployment in Canada (

Sturgeon 2009). The collapse of the prices of oil and other Canadian commodity exports compounded the effects of the financial crisis. During this recession, GDP declined by 3.3 percent over three quarters (nine months) because of a sharp decline of 16 percent in exports (

Gordon 2017). Therefore, any oil price fluctuation negatively (positively) affects stock market performance. Since a higher (lower) oil price represents higher (lower) input costs, oil price changes are likely to directly affect the earnings of an organization (

Jebran et al. 2017) (

Appendix A.1). MLR results showed that the indexes Energy, Financials, Telecommunications, S&P/TSX Venture, and CFMRC (VWI) Under

$2 had positive impacts on the DCPs. The indexes Materials, Industrials, Utilities, S&P/TSX 60, S&P/TSX Mid Cap, and Call Loan Interest Rate had negative impacts on the DCPs. On the other hand, the indexes Consumer Discretionary, Consumer Staples, Healthcare, Information Technology, and Daily Foreign Exchange Rate had negative impacts on the DCP of some banks and positive impacts on the DCP of the others. These unbalanced impacts depend on the characteristics of the investments of the banks. As

Zhang et al. (

2022) defined, the indexes Industrials, S&P/TSX Small Cap, CFMRC (DEWI), CFMRC Daily (VWI), CFMRC (DEWI) Under

$2, CFMRC (DEWI) Over

$2, and CFMRC (VWI) Over

$2 are the main resiliency transmitters. For this type of economic crisis, it is suggested that the banks change their investment profiles based on the indexes according to those having positive and negative impacts on their GDPs to increase their assets.

Crisis Period IV: The cause of this crisis was a commodity price shock and a sharp deceleration in oil-exporting economies. Economic policymakers should consider the oil price as an important factor that could boost the economic performance of the financial market. Thus, investors might consider the oil price as an important determinant of their stock returns while constructing their portfolios (

Jebran et al. 2017). Canada has major export markets in oil, gas, wheat, lumber, diamonds, and other commodities. Canada has a major manufacturing sector of the car industry that is linked to the US and Japanese manufacturers, with major exports to the US (

Milne 2012) (

Appendix A.1). MLR results showed that the indexes S&P/TSX Composite, Financials, S&P/TSX 60, and CFMRC (DEWI) had a positive impact on the DCPs, whereas the indexes Materials, Consumer Discretionary, Healthcare, Telecommunications, Utilities, and Daily Foreign Exchange Rate had negative impacts on DCPs. The following indexes, however, had positive impacts on some DCPs and negative impacts on other DCPs: Energy, Consumer Staples, Information Technology, and Call Loan Interest. The indexes Industrials, S&P/TSX Mid Cap DPI, S&P/TSX Small Cap DPI, S&P/TSX Venture DPI, CFMRC Daily (VWI), CFMRC (DEWI) Under

$2, CFMRC (VWI) Under

$2, CFMRC (DEWI) Over

$2, and CFMRC (VWI) Over

$2 did not have any significance on the DCPs of the banks. During this type of economic crisis and recession, it is suggested that the banks change their investment profiles based on the indexes according to those having positive and negative impacts on their DCPs to increase their assets.

Crisis Period V: After the declaration of the COVID-19 pandemic in March 2020, most countries, including Canada, went into lockdown. The unemployment rate increased, and oil prices and interest rates dropped. Construction, transportation, tourism, and industrial productions were drastically affected by this lockdown. The government increased liquidity to support companies, which increased the inflation rate. Approximately three quarters of small businesses have taken on debt in this period (

Brewin 2021). The stock market dropped, too. During days of policy rate cuts, banks with lower liquidity experienced higher abnormal returns than other more liquid banks (

Statistics Canada 2022). The significant relative increase in abnormal stock returns among banks with lower liquidity ratios may have reflected the markets’ expectation that lower interest rates would increase liquidity in the financial system, thereby benefiting banks with larger funding risks (

Demirgüç-Kunt et al. 2021) (

Appendix A.1). According to MLR results, only the index Financials had a positive impact on DCPs. The indexes Energy, Materials, Consumer Discretionary, S&P/TSX Mid Cap, and Daily Foreign Exchange Rate had negative impacts. Since the banks have different investment portfolios, the indexes Industrials, Healthcare, Utilities, S&P/TSX Small Cap, and S&P/TSX Venture had positive impacts on some DCPs and negative impacts on the other DCPs, which contributes the findings of

Demirgüç-Kunt et al. (

2021). In this crisis period, the indexes S&P/TSX Composite, Consumer Staples, Information Technology, Telecommunications, Call Loan Interest Rate, CFMRC (DEWI), CFMRC Daily (VWI), CFMRC (DEWI) Under

$2, CFMRC (VWI) Under

$2, CFMRC (DEWI) Over

$2, and CFMRC (VWI) Over

$2 did not have any significant impact on the DCPs of the banks. During this type of pandemic crisis, it is suggested that the banks change their investment profiles based on the indexes according to those having positive and negative impacts on their GDPs to increase their assets.

Overall, the comparisons reveal that the MLR model of TD showed a different set of indexes when compared with the other banks’ MLR models. TD bank is the one of the largest banks in Canada and has the largest assets, this may mean that it has a different portfolio comparing to the other banks. The other main conclusion is that the indexes having a positive or negative impact on the DCP depend on the characteristics of banks’ investment instruments and the nature of the crisis. For future crises, in the light of the indexes which were found in different crisis periods having positive and negative impacts on the DCPs, banks must check the signals of the coming crises and adjust their investments accordingly.

For further studies, different methods, such as logistic regression (LR), the partial least square method (PLS), the structural equation model (SEM), machine learning methods, or data mining methods, including data on daily volume and transactions, open price, bid price, and daily call changes, can be used to verify the findings. A comparative study can also provide reliability of the results. On the other hand, with data mining techniques, not only index prices, but also index returns, together or separately, could be studied. The last important fact is that data sets about the amount and assets of instruments in banks’ portfolios should be included in the models to see their effects on DCPs and these models should be assessed with different methods.