1. Introduction

The COVID-19 pandemic intervened at a time when the global payments sector was in the midst of significant transformation. Banks, FinTechs and card associations were rolling out increasingly integrated, swift and contactless payment methods, leading to a reduction in the use of cash in all major economies. The world’s top central banks were already preparing for a cashless or less- cash future and collaborating on proposals to issue central bank digital currencies, while studying the opportunities and challenges emanating from privately managed crypto currencies. In emerging markets, governments eagerly adopted the digital transformation and cashless agendas as powerful tools to advance financial inclusion, shrink the informal economy and strengthen social safety nets. To the most optimistic observers, the end of cash and the cashless economy were both inevitable and desirable outcomes of these transformations. Yet Economics has told us otherwise.

In his 1919 book Currency and Credit, Ralph Hawtrey described an imaginary cashless economy where goods and services are bought and sold solely by drawing on bank-issued credit, denominated in an agreed unit of account. He demonstrated that the contractionary and expansionary nature of the credit cycle eventually destabilizes the value of the unit of account. Hawtrey emphasized that central bank money not only plays a stabilizing role vis-à-vis the unit of account, but also provides credibility in a credit-based system by ensuring that all credit and debt issued by banks can, as a last resort, be converted to a universally accepted means of payment—cash. These reflections could not be more relevant in the face of the disruption brought about by the pandemic on payment systems and preferences worldwide, the declining role of cash and its implications for regulators, banks and other financial intermediaries.

The objective of this paper is to assess the impact of the pandemic on payments systems and preferences worldwide, its implications for the digital payments and cashless agenda, and how these have influenced the priorities and decisions of regulators, banks and other financial intermediaries, particularly with regards to proposals for central bank digital currencies. It finds that while the pandemic has demonstrated the benefits associated with building an advanced, competitive and integrated digital payments eco-system, it has also brought to the forefront more fragmentation than convergence between payment systems in different regions of the world.

The paper draws on the data provided in the Global Payments Report (GPR), issued annually by FIS Global, one of the largest payments processing companies in the world. Underutilized in the academic literature, the GPR analyzes payment trends in over 40 countries year-by-year, covering all major digital payment instruments as well as cash. This delivers a level of detail not provided in the Red Book statistics of the Bank of International Settlements (BIS), which is limited to 26 countries, and which, notably, does not provide a specific breakdown of cash versus digital payment instruments in each country. The original contribution of this paper, in addition to the analysis, is in its compiling of individual country data from the GPR reports of 2020 to 2022 into a database. This allows for an assessment of how payment trends have evolved through the pandemic across countries and regions.

The paper is structured as follows.

Section 2 presents empirical data on the growth in digital payments in 38 developed and emerging economies in the context of the global pandemic.

Section 3 reviews the digital payments and cashless agenda pre-pandemic, focusing on how it developed in Sweden and Canada, as well as its distinct evolution in the wider Asia region and how these have influenced proposals for central bank digital currencies (CBDC).

Section 4 reviews the shifts in payment preferences as well as some of the challenges brought about by the pandemic, and the boost these have provided to Chinese and European CBDC proposals, even as the Federal Reserve has remained hesitant.

Section 5 draws some broad conclusions about an increasingly fragmented global payments landscape.

2. A Changing Payment Landscape

2.1. The Growth of e-Payments in Advanced Countries

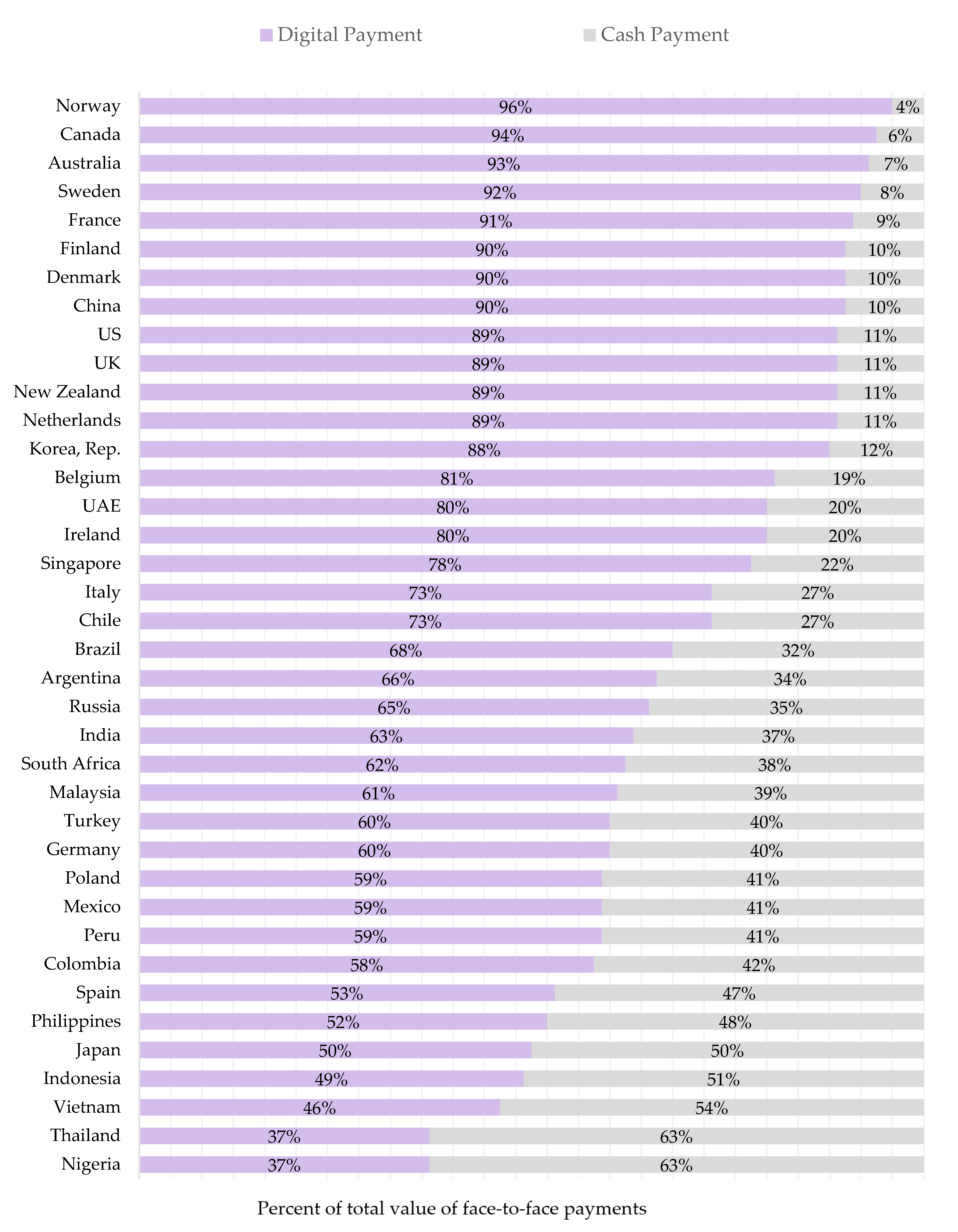

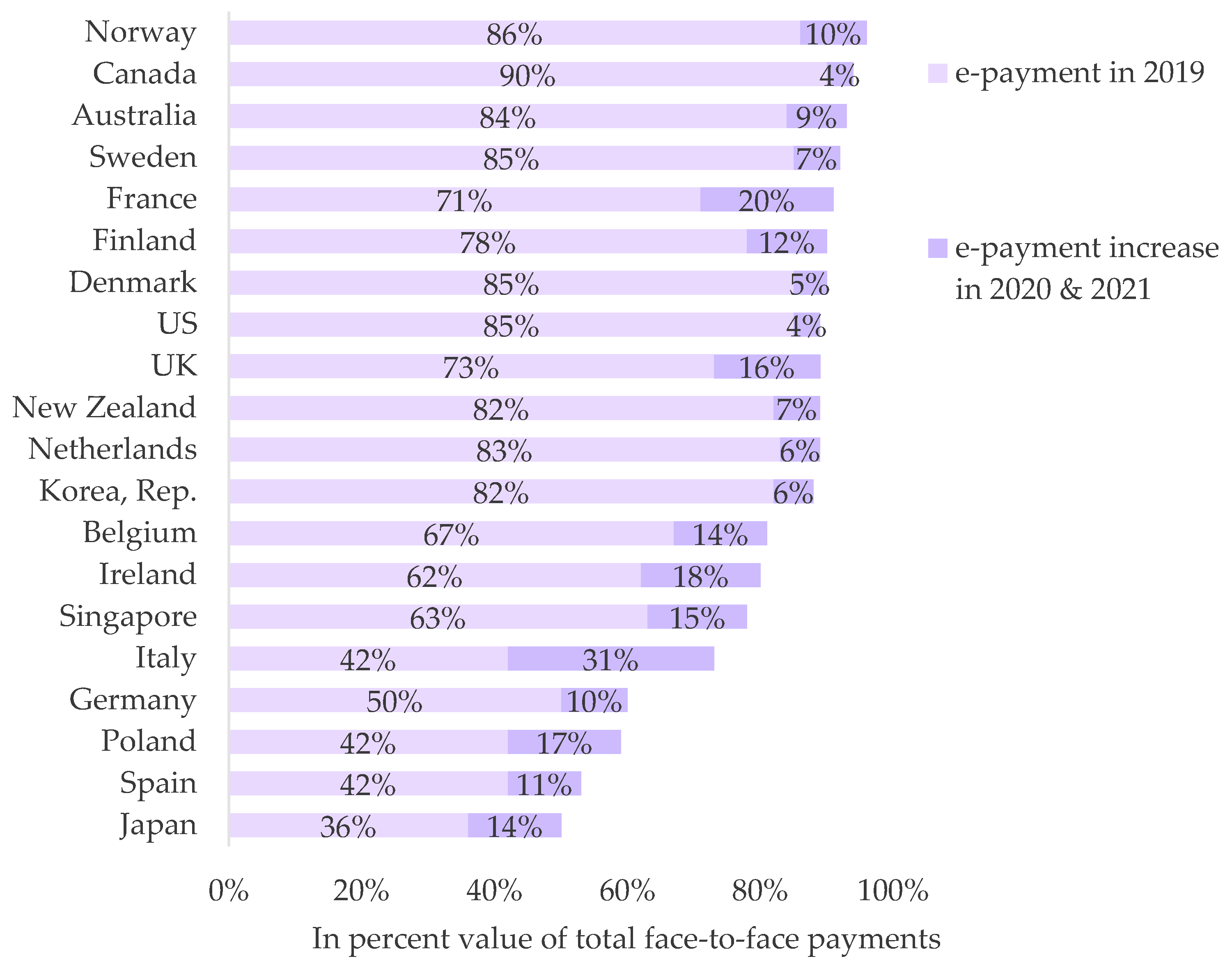

The global pandemic accelerated e-payments across the advanced countries. In the UK, France, Spain and Italy, the value of total payments settled by digital means

1 increased by between 11 and 31 percent in 2021, compared to 2019, as seen in

Figure 1. Overall, the advanced countries were able to leverage existing payment infrastructure to accommodate the rising demand for digital payments, whether by card or mobile. In France, banks and card associations raised the ceiling of contactless payments to EUR 50 in May 2020, estimating that this would cover some 70 percent of all in-store payments (

Douriez 2020), with a majority of EU countries adopting similar measures. Even in countries with a traditional preference for cash, such as Germany and Japan, e-payments advanced by at least 10 percent.

Within the European Union, the wider adoption of digital payments owes much to the efforts of the European Central Bank and the European Commission to establish a unified payments space across the continent, even if implementation has not always been easy. This includes the introduction of the Single European Payments Area (SEPA) in 2008, the launch of the Euro Retail Payments Board in 2013, as well as more recently, the second Payment Services Directive (PSD 2). The latter has sought to establish common licensing and regulatory framework for payment service providers, FinTechs and neo-banks, facilitating their operations across member states. Among the fruit of these efforts is the introduction of instant IBAN transfers, widely adopted in the peer-to-peer mobile payments space, as well as direct-debit facilities on euro-denominated accounts within the EU and neighboring SEPA-member countries such as Norway and Switzerland. The ECB has also sought through these measures to reduce, even if partially, the large footprint of US card associations Visa and Mastercard in the European payments sector (

Bloch 2019).

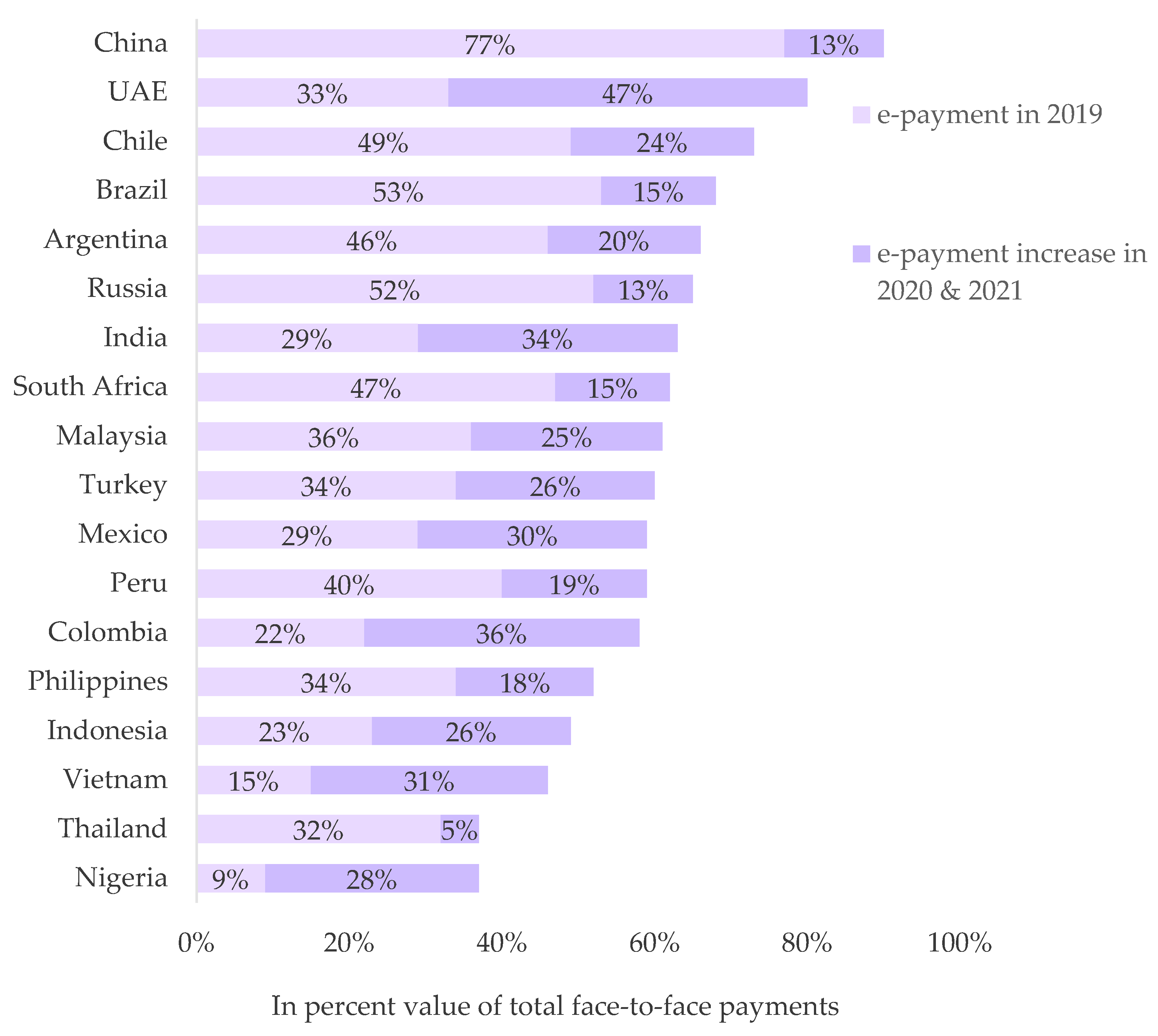

2.2. The Growth of e-Payments in Emerging Countries

It is in emerging markets that the impact of the global pandemic on digital payments is the most visible. Eleven countries witnessed a jump of more than 20 percent in e-payments between 2019 and 2021, as seen in

Figure 2. This shift can be attributed to a deep transformation of the payments eco-system in the past 10 years resulting from the adoption of financial inclusion and cashless economy initiatives, as well as the encouragement of greater collaboration between players across the payment value chain including regulators, banks, mobile operators, e-commerce payment gateways and third-party service providers. The full breakdown of digital payments by country in 2021, compiled from the GPR, is provided in

Figure A1 in

Appendix A.

In Chile, where legislation passed in 2007 guarantees all adults the right to a basic bank account and debit card, the shift to digital payments has been comparable to that in advanced countries (

Batiz-Lazo and Espinosa 2015;

BNamericas 2019). The same can be said of the UAE, which in 2017 authorized FinTechs to participate in the payments sector alongside banks, while announcing plans to transition to a cashless economy (

Srouji 2020). In other emerging economies however, weak infrastructure coverage and high levels of exclusion from formal banking systems left payment preferences largely unchanged throughout the pandemic. Such is the case of Mexico and Argentina, where despite significant improvements in debit card penetration in recent years, cash usage remains high. The same can be said for the Caribbean region (

Banco de Mexico 2020;

Gershenson et al. 2021) and large parts of Sub-Saharan Africa, where the cash-in, cash-out mobile money model continues to dominate (

Manjang and Naghavi 2021).

3. Digital Payments before the Pandemic

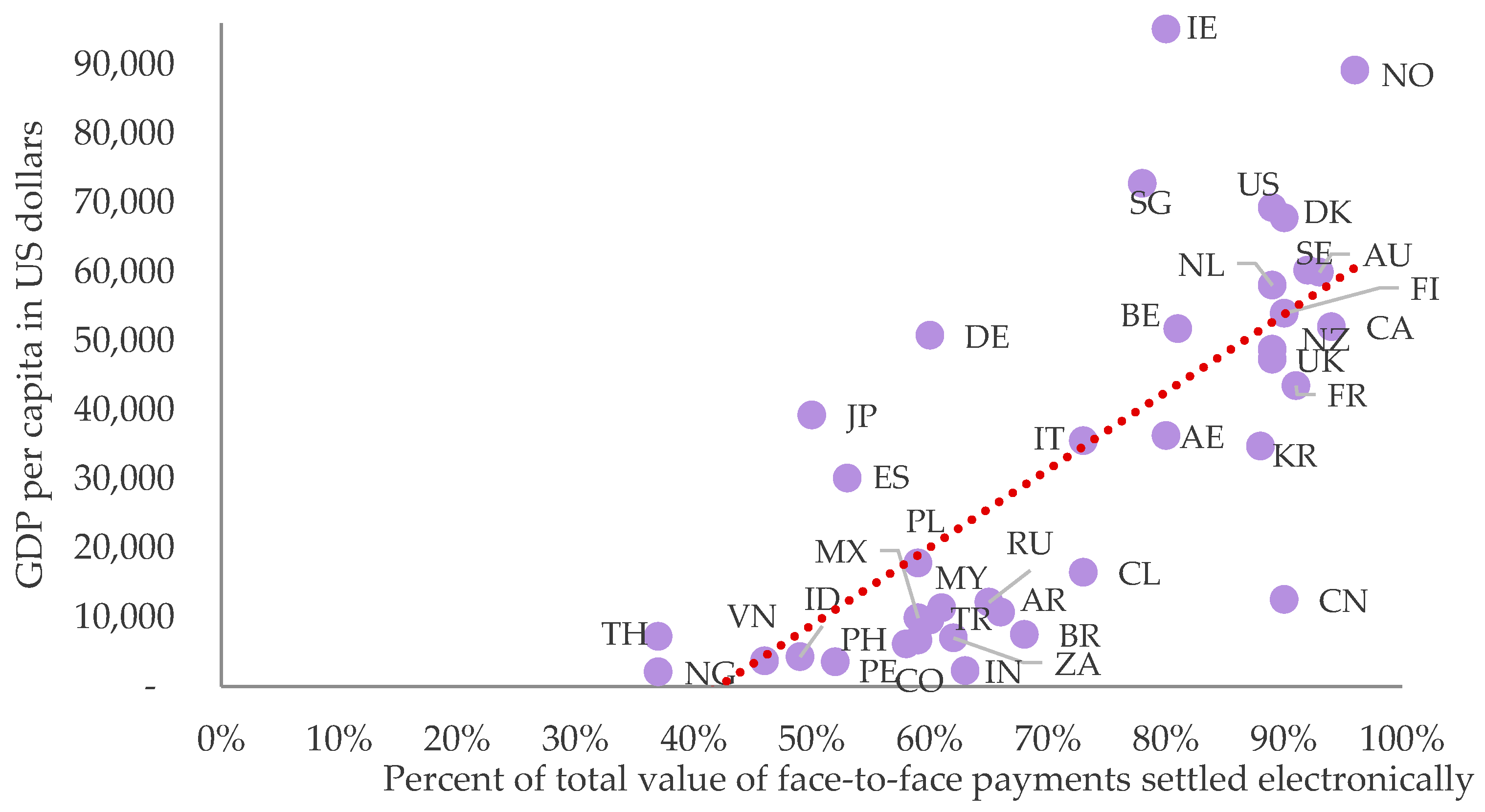

In both advanced and emerging economies, the relationship between digital payments and wealth level was well-established before the pandemic, as outlined in

Figure 3. Notable outliers included the UAE, where despite an advanced banking and payments infrastructure, transactions in cash were dominant. It was the same for Japan, well-known for its cash culture (

Kadoyama 2021), and Germany. By 2021, the jump in digital payments was particularly pronounced for the emerging economies group, while for some advanced economies, cash transactions declined to a trickle, as set out in

Figure 4.

3.1. The Nordic Group and Canada, Pioneers in Cashless Payments

The Nordic countries and Canada are often singled out as having progressed the most towards a cashless environment (

Bech et al. 2018;

Engert et al. 2019). These studies have also described a set of shared characteristics that have gradually reduced the reliance on cash in favor of digital payment methods in these countries. These include near-universal access to bank accounts and mobile internet, low levels of socio-economic inequality, as well as on the institutional side, a history of collaboration between regulators and financial intermediaries to gradually build a unified payments eco-system.

Since 2013, for example, Swedish banks operate a single shared ATM network across the country, optimizing operational and maintenance costs and providing greater convenience to customers (

Engert et al. 2019). Peer-to-peer payment application, Swish, is the fruit of this same collaboration and dominates the Swedish market in this area as well as in online payments, leaving little space for foreign players. Similarly in Canada, Interac, originally founded by the country’s main banks to manage the interbank network, has grown to dominate the online and peer-to-peer payments space, as well as handling a large proportion of in-store card payments. Given their relatively small populations, collaboration between banks in these countries is traditionally seen as the only way of achieving economies of scale, while ensuring end-users benefit from a secure, accessible and competitive payments network.

Other institutional factors have also contributed to this evolution. Contained within the Swedish tax system are incentives that encourage residents to declare transactions and services that in other countries would often remain within the informal sector, such as housekeeping, gardening or home improvements (

Engert et al. 2019). Merchants can also indicate that they do not accept cash by posting a sign on store fronts, whereby it is considered that upon entering a shop a customer has a contractual agreement with the merchant to not use cash (

Arvidsson 2019). Finally, the experience of the Nordic countries and Canada indicates that progress towards a near cashless eco-system is a gradual process that depends on a convergence of socio-economic, institutional and technological factors that are not easily replicated in other contexts.

3.2. The Specific Case of the Asian Economies

If banks have remained at the center of the payments eco-system evolution in Europe and North America, the trajectory has been very different in most of South and East Asia. Debit card penetration has remained low across the region, resulting from institutional and cultural factors, as well as in many cases, the prevalence of informal work. This context has favored the emergence of a competitive e-wallet and mobile payment landscape (

Xu 2022). In India, following the contested demonetization episode in 2016

2, the government continued its drive to bring more people into the formal economy and promote greater levels of financial inclusion. Overseeing these efforts is the Digital India Program, launched in 2015, and which seeks to digitalize the full range of governmental services available to citizens, as well as shift financial services, including payments, to digital channels. The proportion of banked adults in India subsequently grew from 54 percent in 2014 to 81 percent in 2018, a phenomenal leap among emerging economies and largely aided by the roll-out of national ID-card linked biometric authentication, enabling citizens to open mobile accounts virtually and to validate transactions in real-time (

Financial Inclusion Insights 2019). Despite the severe difficulties faced by India with the onset of the Delta variant in early 2021, these large investments into a digital services eco-system did contribute to both better social distancing and more efficient service delivery during the pandemic.

Another country that has made great strides in digital payments is China. Here, Tencent and Alibaba, two e-commerce giants, have rolled out smartphone payment solutions that are so popular, competitive and integrated with other digital services, that they have eliminated the prospects for any other competitor. These have also quickly outpaced UnionPay, the debit card scheme originally proposed by China’s financial sector as a counterweight to global card associations Visa and Mastercard (

Torre and Xu 2019). By 2019, close to 80 percent of all payments in China were transacted digitally, the bulk of which through smartphone, while in South Korea the figure was only slightly higher.

While India, China and South Korea have been the motor of digital payments transformation in the wider Asia region, other countries have followed suit with their own policies aimed at greater financial inclusion, wider adoption of digital payments and reduced reliance on cash. Improving tax collection by promoting traceable payment methods also features prominently in these plans. One can cite Malaysia’s Financial Sector Blueprint (2011), Indonesia’s National Non-Cash Movement (2014) and Vietnam’s No Cash Policy (2017). In all cases, the cashless agenda was well advanced across the region before the pandemic.

3.3. Central Banks and Their Digital Currency Proposals

The Basel-based Bank of International Settlements has for several years facilitated discussions between central banks and directed research efforts in relation to the subject of central bank digital currencies. The question has generated great interest both from the perspective of the future of central banking and payments systems as well as with regards to how banks and financial intermediaries position themselves within this new landscape. The risks associated with privately managed crypto currencies, seen as financial assets and not money by a majority of central banks, has added further momentum to these discussions. A BIS-sponsored study by

Boar et al. (

2020) involving 66 central banks found that 80 percent of institutions were engaged in CBDC research, while 40 percent were concept-testing either wholesale or general-purpose digital currencies. The study also noted that several emerging market central banks were planning to issue a digital currency within 3 years, while mature markets were targeting longer horizons.

While it is normal for central banks to keep pace with the evolution of payment systems, statements from central bankers before the pandemic provide additional insights into the motivations and concerns shaping CBDC initiatives. Sweden’s Riksbank, for example, has emphasized that cash transactions could disappear inadvertently as the result of the decentralized payment decisions of customers and merchants, leaving payment systems entirely in the hands of private entities. The e-krona project is seen as a necessary response to this scenario, which allows the central bank to ensure that the payment system is secure, efficient and accessible to all, while re-asserting the sovereignty of the state over the monetary system (

Riksbank 2018). In Japan, central bank vice governor Masayoshi Amamiya expressed similar concerns about the declining use of cash. As “technological innovation evolves rapidly, the retail payments market structure could suddenly change dramatically, pushing us toward a cashless society”, he writes. “In some cases, the need for CBDC issuance may suddenly increase. To be able to adapt to such a situation, central banks need to deepen their understanding on the latest developments in information technologies and their applicability to CDBC” (

Amamiya 2019).

Even as projects remained at different stages of development, discussions and research efforts converged on three alternative CBDC models (

Barontini and Holden 2019). The first concerns account-based CBDCs, also known as Central Banking for All, with the general public holding accounts at the central bank and with settlements taking place directly between accounts, bypassing commercial banks. The second concerns the issuance of central bank digital tokens, which then freely circulate as a digital money alternative to cash. The third model concerns wholesale CBDC, utilized only in interbank transactions. An example of the latter is Project Aber, trialed by the Saudi and UAE central banks for cross-border payments in 2020 (

SAMA 2020).

Globally, progress was altogether slow. In November 2018, Riksbank deputy governor Cecilia Skingsley highlighted that more time was needed for research, trialing different approaches and preparing the ground for a pilot project (

Skingsley 2018), suggesting that no major initiatives were on the horizon. Skingsley’s counterpart at the Bank of Canada, Timothy Lane, took a similar position in February 2020, stating that: “there is not a compelling case to issue a CBDC at this time. Canadians will continue to be well-served by the existing payment ecosystem, provided it is modernized and remains fit for purpose” (

Lane 2020). Even if the cautious and considered position of regulators with regard to CBDCs contrasted somewhat with the appetite of FinTech players for new and disruptive solutions, on the eve of the pandemic in the major economies, all industry players were aware of the need to prepare for a secure, accessible and less cash dependent payment eco-system.

4. The Pandemic Accelerates the Transition

4.1. The Boost to Digital Payments

In the United States, a survey conducted in mid-2021 across age groups found that on average 75 percent of respondents felt safer using digital payments during the pandemic, while 55 percent stated that post-pandemic they would continue to opt for digital payments (

Zelle 2021). In Europe, a 22-country survey by

Kotkowski and Polasik (

2021) conducted in the summer of 2020, following the first pandemic wave, found that 48 percent of respondents had moved towards increased cashless payments, while for 45 percent, payment preferences remained unchanged. Only seven percent of respondents declared using more cash. In the UK, a study by the Bank of England in November 2020 reported the counterintuitive finding that amid the digital payments increase, the total value of cash-in-circulation had also risen significantly. The “banknote paradox” was attributed to more people holding cash as contingency but not spending it, as well as the closure of cash-intensive businesses such as pubs and corner-stores (

Caswell et al. 2020).

Similar trends could be noted in other countries. In Australia, an additional AUD 1 billion in transactions were settled through digital wallets in March 2020, an increase of 21 percent compared to February (

Farr 2020). In Saudi Arabia, total in-store transactions settled by contactless payments grew from 74 percent in December 2019 to 94 percent in December 2020 (

Mada and Visa 2021). Sociologists have analyzed these changing payment preferences, confirming that for many the avoidance of cash was seen as contributing to limiting the spread of the virus (

Abu Daqar et al. 2021). The question that remained was whether the preference for digital payments would persist at the same level post-pandemic. Initial findings seemed to suggest so. A survey conducted by Germany’s Bundesbank in May 2020 found that 73 percent of respondents were unlikely to alter their payment preferences post-pandemic (

Balz 2020).

Not all countries, however, were at a level of readiness that permitted an easy transition away from cash. While India’s colossal efforts to expand the reach of digital services and e-payments paid dividends during the pandemic, in the Philippines, payment systems were largely unprepared. As lockdowns took hold in March 2020, the government announced the Social Amelioration Program to provide monthly cash allowances to all low-income and vulnerable households. The authorities were quickly faced with a distribution crisis, as citizens converged on community centers to register for their welfare payments, through in-person ID checks and paper-based applications. Overcrowding and long-queues made social distancing at these centers close to impossible, leading to major delays in addition to allegations of corruption (

Cho 2021;

Valente 2020). As problems persisted, the Manilla suburb of Pasig in collaboration with UNDP, trial tested the delivery of social welfare payments directly to the mobile wallet of beneficiaries, in partnership with mobile operators, assessing the feasibility of adopting such solutions nationwide (

UNDP 2021).

As in other emerging economies with high levels of unbanked adults, mobile wallets in the Philippines were for a long-time mainly used for peer-to-peer money transfers, based on the cash-in, cash-out method. The pandemic brought to the forefront the limitations of such hybrid payment models, pressuring the state, banks and mobile operators to reflect on how to better integrate payment platforms with digital services, going beyond the peer-to-peer model to enable government-to-person transfers, as well as in-store and online mobile payments. One of the first players to offer such integrated payment solutions, the GCash wallet, saw its user base in the Philippines grow from 20 to 46 million between 2020 and 2021, in a major boost to the country’s e-wallet eco-system (

Sazon 2021).

4.2. Central Banks Leapfrog Their CBDC Projects

Central banks could not remain indifferent to the increased demand for digital payments and the declining use of cash brought about by the pandemic. In July 2021, the People’s Bank of China (PBC) issued its progress report on launching a digital currency, following close to 7 years of research on the subject. The report provided insights into the concerns and the vision of the Chinese central bank with regard to the future shape of payment systems. It placed the matter of financial inclusion as one of its top priorities, highlighting that the project responded to the growing demand from the public for digital cash. Secondly, it stressed the need for a competitive, safe and stable payment system, which it contrasted to the volatility and limited traceability of crypto currencies, and underlined that the central bank would work to ensure its digital currency would complement existing electronic payment systems (

Working Group 2021). While the initiative was limited to retail payments within China, the report set as a third objective the desire to work with other central banks to explore the use of CBDCs in cross-border payments.

The report also stated that the right to issue a digital currency and oversee the e-wallet eco-system belonged to the state, while banks and other authorized intermediaries would be responsible for circulation. While there was nothing unusual in asserting the monetary sovereignty of the state, the matter was particularly stark in the light of China’s ban on all crypto currency transactions in September 2021, including via foreign exchanges (

Jennings 2021). The matter of complementing existing payment systems also left some room for interpretation. While the PBC stated it supported “fair competition” and the “coordinated development of various payment methods”, it was not clear whether it would seek to directly compete with e-payment giants, Alipay and WeChat Pay, or eventually integrate with them. As China expands the use of its new digital money, further insights will certainly be gained into its operations and successes.

Goodell and Nakib (

2021), in their study of e-yuan’s architecture, argue that while it is among the “most advanced CBDC design[s] in the world”, believe it does not go far enough in terms of guaranteeing end-user privacy.

In parallel to the PBC, both the Bank of England and the European Central Bank provided updates on their own CBDC plans. The Bank of England’s FinTech director, Tom Mutton, in a report published in June 2021, set out his view that a central bank digital currency would be “the safest form of money available” readily convertible into cash, and providing confidence and assurance of value (

Mutton 2021). He also outlined the results of broad consultations with technology companies, banks, academia, law firms and consumer interest groups with regards to their expectations for a CBDC. The consensus across stakeholder groups was that any CBDC design would need to have clear advantages over existing digital payment methods, including in terms of speed and transaction costs, suggesting that specific use cases should be developed. Second, respondents also stressed financial inclusion concerns, arguing that the digital currency should be accessible to those without smartphones as well as being compatible with offline payments, potentially through the use of low-cost technologies such as smartcards or connected devices. The issue of privacy was also raised, with respondents concerned that the central bank could monitor users’ transactions. For Mutton, while full anonymity was neither desirable nor realistic in digital payments, a plausible scenario was for compliance standards and monitoring to be delegated to wallet providers, with the regulator not having direct access to customer transaction data.

ECB executive board member, Fabio Panetta, in a note released in July 2021, stated that the shifts in payment preferences resulting from the pandemic made it a priority to work on a digital euro (

Panetta 2021). Panetta outlined the same concerns as Mutton in terms of the importance of financial inclusion, accessibility and user privacy, while also highlighting that a digital euro could serve as a powerful tool to shield Eurozone intermediaries from the entry of global tech giants into the payments space. In terms of timeline, he stated that the ECB had planned for a further two years of research, followed by three years of concept-testing. In December 2021, Swiss and French banks, in collaboration with the BIS, successfully tested the use of tokenized digital euro and Swiss franc in cross-border foreign exchange transactions between banks, drawing lessons on how future CBDC initiatives utilizing distributed ledger technologies could be deployed within Europe (

Revill 2021).

4.3. The Hesitancy of the Federal Reserve

In the midst of these discussions, a notable dissenting view was expressed by the Federal Reserve. In comments published in August 2021, Christopher Waller, a member of the Fed’s Board of Governors, described account-based CBDCs as “a solution in search of a problem”. While Waller did not comment on other general purpose or wholesale CBDC proposals seen in the Chinese and European examples, he was clearly skeptical of the reasoning put forward by his counterparts. “After careful consideration, I am not convinced as of yet that a CBDC would solve any existing problem that is not being addressed more promptly and efficiently by other initiatives” (

Waller 2021). Waller argued that US banks were already integrated with global banking networks, while domestically offering a secure, fast and competitive real-time payment network (RTP). The Federal Reserve, for its part, was developing its own instant payment platform, FedNow, which would enable instant settlement between commercial bank accounts domiciled across Federal Reserve branches. Neither the speed and security of payments, nor the matter of transaction costs, could be sufficient reasons to issue a CBDC, he stated.

Waller argued that margins on payments were already so low that it was unlikely a Federal Reserve-issued CBDC could credibly compete with the banking system or private payment providers. On the matter of financial inclusion, he stated that while 5.4 percent of US households were unbanked, survey data showed that the majority of these had no interest in holding a bank account, diminishing such justifications for a CBDC. He found that the only credible motive could be a rights-based one, providing citizens with an alternative to the retail banking system: “One could argue … that the general public has a fundamental right to hold a riskless digital payment instrument, and a CBDC would do this in a way no privately issued payment instrument can” (

Waller 2021). In its digital currency report issued in January 2022, the Federal Reserve committed to wider stakeholder discussions on the benefits and risks associated with launching a CBDC, while stressing that any proposed design would seek to protect the traditional division of labor between the Federal Reserve, commercial banks and payment service providers (

Federal Reserve 2022).

5. Conclusions: Towards an Increasingly Fragmented Global Payments Landscape

Even as the repercussions of the pandemic continue to be felt, it is clear that its consequences for the declining use of cash and the digitalization of payments have led to differentiated responses by agents and institutions across the world, bringing to the forefront more disparities than convergence in the evolution of payment systems. A few broad conclusions can be drawn. The first is that the road to a near cashless eco-system, as exemplified by Canada and Sweden, is more than a question of payment innovations and transaction costs, and requires a distinct set of socio-economic, institutional and technological pre-requisites that are not easily replicated. The second, and closely related to the first, is that faced with the declining use of cash, central banks in the major economies are unconvinced that private-led initiatives and innovations are able to guarantee a universally accessible, safe and inclusive payment system.

As discussed by

Hawtrey (

1919) a century ago, central bank money, whether cash, or in digital form as embodied in current CBDC proposals, plays a fundamental stabilizing role vis-à-vis commercial bank money (i.e., deposits and loans), as well as providing a guarantee that credit or debt-instruments are ultimately redeemable in a universally accepted means of payment. The debate, of course, revolves around what form this central bank digital money should take, its positioning within the existing division of labor between central banks and payments providers, and the extent of privacy offered to end-users. This provides for a third conclusion. The lead taken by China, India and other emerging market central banks in the domain of CBDCs in part reflects a lesser reliance on conventional retail banks, payment service providers and global card associations, given the very distinct evolution of their payment eco-systems. This is not the case in Europe, North America and many other advanced economies, where CBDC initiatives risk a larger collision with the interests of traditional financial intermediaries, leading to a greater need for concertation with stakeholders across the payment value chain.

Finally, it must be highlighted that large segments of the world remain outside of these trends, particularly in countries where low levels of financial inclusion and entrenched socio-economic inequalities have prevented any major shifts in payment methods and preferences. As European central banks diverge from the Federal Reserve on the need for a central bank digital currency, and as crypto currency players continue to operate largely opaque and under-regulated financial assets from the sidelines, global payment systems appear to be heading for increasing fragmentation in a post-pandemic world.