Abstract

This paper examines the multi-dimensional efficiency of the Islamic banking sector and its determinants, including the impacts of the COVID-19 pandemic. To do that, we use a novel approach of two-stage data envelopment analysis (DEA) double frontiers to evaluate the overall efficiency of 79 Islamic banks across 16 countries (2005–2020). In the first-stage analysis, we found that the Islamic banking sector experienced an increasing trend in its efficiency and performance, even during the recent pandemic, although it varied across banks and countries. Our empirical results of the second-stage analysis further showed that economic development can help countries both withstand the recent pandemic and improve the efficiency and performance of their (Islamic) banking system. This, in turn, could help speed up the recovery process of the global economy. Since there is evidence that the Islamic banking sector is resilient to the COVID-19 pandemic, it is expected that this sector will be a driving force of such recovery.

1. Introduction

The ongoing COVID-19 pandemic has been affecting many countries, regions, and sectors such as (public) healthcare, capital and financial markets, tourism, and banking (Boubaker et al. 2022b; Elnahass et al. 2021; International Monetary Fund 2021). According to Demirgüç-Kunt et al. (2021), it is thus important to examine the impacts of such events on the efficiency and performance of the global banking sector. Boubaker et al. (2022b) further argued that by analysing Islamic banks (IBs), which are arguably more resilient than conventional banks during crisis times (Alqahtani et al. 2017; Ashraf et al. 2022; Farooq and Zaheer 2015), one can understand the supportive role of the IBs and the global banking sector in the recovery process of the World economy (International Monetary Fund 2021). This paper, therefore, aims to examine the efficiency of the IBs and its determinants, including the impacts of the COVID-19 pandemic.

Measuring bank efficiency and performance is an important task for not only policymakers and bank managers, but also for researchers. For instance, a simple search on Google Scholar using the keywords of “bank efficiency” AND “determinants” resulted in about 16,000 articles; many of them using the multi-dimensional frontier analysis approach of data envelopment analysis (DEA) and stochastic frontier analysis (SFA) (Ben Mohamed et al. 2021; Boubaker et al. 2022b; Le et al. 2022b; Lu et al. 2018). Both DEA and SFA have their own pros and cons; however, DEA is more popularly used in the bank efficiency literature, thanks to its flexibility (Boubaker et al. 2020; Boubaker et al. 2022a; Ho et al. 2021; P. H. Nguyen and Pham 2020; Vidal-García et al. 2018).

Originally introduced by Charnes et al. (1978) to measure the relative efficiency of a set of homogenous decision-making units (DMUs) using multiple inputs to produce multiple outputs, DEA has been extended to various settings, including the variable returns to scale assumption (Banker et al. 1984), slack-based optimization (Tone 2001), common weights (Hammami et al. 2022), worst-frontier measurement (Paradi et al. 2004), the inverse model (Boubaker et al. 2022b), and so on. Since DEA is sensitive to the characteristics of the sampled DMUs (e.g., outliers, input/output selection, and the specific DEA methods) (Hughes and Yaisawarng 2004; Tortosa-Ausina et al. 2008), it is argued that the relevant interpretations or conclusions would benefit from multiple DEA results, rather than from a single one (Wang et al. 2007). Particularly, Wang et al. (2007) and Azizi (2014), among others, pointed out that while one can assess the efficiency of a DMU based on an optimistic (i.e., ‘best practice’) frontier, one can also use a pessimistic (i.e., ‘worst practice’) frontier for the same evaluation purposes. Accordingly, the overall efficiency of such a DMU should account for both frontiers under a DEA double frontiers approach. This approach was developed to measure the overall efficiency of DMUs operating in the manufacturing sector (Wang and Chin 2009), supply chains (Badiezadeh et al. 2018), aviation (Cui et al. 2022), and so on. However, it is worth mentioning that none of those studies has examined the determinants of such DEA double frontiers efficiency scores.

The application of DEA double frontiers in the banking sector, however, is also scanty. To the best of our knowledge, there was only a single study by Gölcükcü (2015) on 20 Turkish banks. Due to data limitations, however, Gölcükcü (2015) could only examine the single-dimension efficiency of the banks (i.e., the relationship between deposit rates and loan rates) but not the multi-dimensional perspective of DEA (Charnes et al. 1978). Accordingly, the contributions of this paper to the literature are as follows.

- It is the first cross-country study on the efficiency of Islamic banks using DEA double frontiers to evaluate the overall efficiency, including both the optimistic and pessimistic aspects, of the examined IBs. It, therefore, can provide more robust insight into the performance of the IBs.

- For the first time, the determinants of such double frontier efficiency, including the recent COVID-19 pandemic, are investigated under a two-stage DEA framework.

- It extends the applications of DEA double frontier in the banking efficiency literature.

2. Literature Review

In this section, we first review the relevant literature on banking efficiency and performance. It is noted that financial ratios, such as net interest margin, returns over assets, or nonperforming loan ratios, are commonly used for this purpose (Ramalho and Silva 2013; Salmi and Martikainen 1994; Tran and Ngo 2014). Because a single ratio can only reflect a single aspect of the bank’s efficiency and performance, in recent decades, a multi-dimensional approach of efficiency evaluation has become more popular (see, for example, the surveys of Berger and Humphrey 1997; Emrouznejad and Yang 2018; Fethi and Pasiouras 2010). For instance, Liu et al. 2013 found that the banking sector accounts for the highest number of studies and applications in the DEA literature. The basic idea of DEA in banks is to measure the aggregated technical efficiency of a bank in combining all inputs to produce all outputs (Charnes et al. 1978; Tran and Ngo 2014), without too much concern about the specific technology of how these combinations occur, i.e., a bank is treated as a ‘black box’. Although there are several approaches to unboxing this ‘black box’ using network DEA, fuzzy DEA, or stochastic DEA (Avkiran 2015; Cui et al. 2022; Fukuyama and Matousek 2017; Matthews 2013; Ngo and Tsui 2022; Tsionas 2021; Yang and Liu 2012), our study is more focused on the sensitivity issue of DEA, and, thus, we only employ the basic DEA model of Charnes et al. 1978 in our analysis.

Although Islamic banking is still an emerging industry, compared to the CBs, the performance of IBs, especially during economic turmoil such as the Asian Financial Crisis 1997 (AFC) and the Global Financial Crisis 2007 (GFC), has attracted increasing attention from researchers. Studies on the efficiency of the IBs under COVID-19, although on an increasing trend, are still limited (Ashraf et al. 2022; Boubaker et al. 2022b; Le et al. 2022a; Mirzaei et al. 2022). According to Majeed and Zainab (2021), there is a mixed result on the performance comparison between IBs and CBs using a single-dimensional perspective (Ansari and Rehman 2011; Hassoune 2002; Iqbal 2001; Ramlan and Adnan 2016) and a multi-dimensional one (Abdul-Majid et al. 2017; Bader et al. 2008; Ben Mohamed et al. 2021; Kamaruddin et al. 2008; Kamarudin et al. 2014). One reason for this inconclusive finding is that, according to Miah and Uddin (2017) and Boubaker et al. (2022b), the IBs and CBs are operating under different principles (e.g., the Islamic laws of Shari’ah for the IBs). One may argue that it is not a fair comparison between the IBs and CBs, for example, in terms of a profitability evaluation, because the CBs are trying to maximize their profits, while the IBs are not. Consequently, to have a better view of the Islamic banking sector, this study focuses on the efficiency of the IBs within their own group, avoiding any comparisons between the IBs and CBs. It could provide a more insightful view into the operations and efficiency of the IBs themselves within their “Islamic world” (Khan 2010; Mastrosimone 2013). We consider it as filling a gap in the literature.

The second strand of literature that we also look at is the methodological aspect of those studies. Except for single-dimension studies where a ratio (e.g., net profit margin or return on assets) or several ratios were used to evaluate the IBs, multi-dimension studies often use DEA for their investigations (Alexakis et al. 2019; Bahrini 2017; Belanès et al. 2015; Viverita and Skully 2007; Yudistira 2004). A recent study by Boubaker et al. (2022b) examines the global Islamic banking sector (consisting of 49 IBs for the 2019–2020 period) amid the effects of COVID-19 but under an inverse DEA model. Particularly, this study argues that the IBs, under COVID-19, faced difficulties in increasing or retaining their outputs, such as operating incomes and earning assets. As such, to maintain the pre-COVID-19 levels of efficiency, those IBs needed to accordingly reduce their inputs (e.g., total deposits and, especially, operating expenses). Another study by Mirzaei et al. (2022) used DEA to examine the IBs and CBs together (and, thus, faces the previously discussed problem) and also found that the IBs have evidently higher efficiency levels than their counterparts during the COVID-19 crisis. Focusing on Indonesian IBs, Lantara et al. 2022 found that the sampled banks improved their overall technical efficiency in the 2020–2021 period in three out of four models. The resiliency of the IBs during the recent COVID-19 pandemic was also observed in some other studies (Abdulla and Ebrahim 2022; Alabbad and Schertler 2022; Ashraf et al. 2022; Boubaker et al. 2022b; Rizwan et al. 2022). However, DEA studies on the efficiency of the IBs amid COVID-19 are still limited (Boubaker et al. 2022b; Lantara et al. 2022; Mirzaei et al. 2022); none of them has applied the double frontier approach, which is more robust against the DEA sensitivity issue, and none has also examined the determinants of the double frontier efficiency. We consider it as a methodological gap in the literature.

Given these two research gaps, in this paper, we develop a two-stage DEA double frontier framework to examine the efficiency and its determinants of the global Islamic banking sector (see Table 1). Generally, our first stage involves the use of DEA double frontier to estimate the overall efficiency of a set of global IBs only; no comparison with the CBs is needed. In the second stage, such overall efficiency is regressed on a set of determinants, including the COVID-19 variable, to measure the impacts of those factors on the IBs. The next section will present more details on our method and data.

Table 1.

The characteristics of our study.

3. Data and Methodologies

3.1. Data

We follow Lozano-Vivas et al. (2002), Fujii et al. (2014), and Boubaker et al. (2022b), among others, to select operating expenses (x1) and total deposits (x2) as the two inputs, while operating income (y1) and other earning assets (y2) are the two outputs of our DEA double frontiers model. In this sense, the IBs are treated as intermediaries between savers and borrowers, whereas their objective is to use the least inputs to produce the most outputs (Sealey and Lindley 1977). Such input/output variables are popularly used in the banking efficiency literature (Alqahtani et al. 2017; Ben Mohamed et al. 2021; Berger et al. 1993; Bonin et al. 2005; Dincer et al. 2019); the readers are encouraged to seek more information on those variables therein. The data were consequently gathered from the Thomson Reuters Eikon (2022) database.

To examine the determinants of the DEA double frontier efficiency scores, we further collected macroeconomic data, such as GDP growth rate, inflation index (consumer price index, base year 2010, as 100 points), and income levels (e.g., low-income or advanced countries) from the World Economic Outlook (International Monetary Fund 2021). This resulted in unbalanced panel data of 79 IBs in 16 countries for the 2005–2020 period, ranging from a low of 42 banks in 2005 to a high of 64 banks in 2019, yielding a total of 783 bank-year observations (see also the Appendix A). These countries include Bangladesh (BGD), Bahrain (BHR), Egypt (EGY), Indonesia (IDN), Jordan (JOR), Kuwait (KWT), Malaysia (MYS), Nigeria (NGA), Oman (OMN), Pakistan (PAK), Qatar (QAT), Saudi Arabia (SAU), Sri Lanka (LKA), Sudan (SDN), the United Arab Emirates (ARE), and the United Kingdom (GBR). While it is suggested that one should focus more on the IBs in countries where the Islamic principles are more practiced (such as PAK, LKA, and GBR), our data limitations prevent us from doing so. More importantly, since we would like to provide an examination of the global Islamic banking sector, and how it can contribute to the recovery of the world economy (International Monetary Fund 2021), a cross-country sample is more suitable for our analysis. The descriptive statistics of our data are presented in Table 2 below.

Table 2.

Descriptive statistics.

3.2. The Overall Efficiency of IBs: The DEA Double Frontiers

DEA is a popular tool for efficiency and performance evaluation in the banking sector (Liu et al. 2013). The major reason is that DEA is more flexible with multiple inputs/outputs and small sample situations, which is a common setting for many banking studies (Avkiran 2011; Ngo and Le 2019; Reinhard et al. 2000). Initially, DEA optimizes the weights of the multiple inputs/outputs of the examined banks so that the banks can be closest to the best-practice frontier, i.e., the so-called ‘optimistic DEA frontier’ (Charnes et al. 1978; Schaffnit et al. 1997). Following Ngo and Le (2019) and Hammami et al. (2022), among others, we formulate our optimistic DEA model as follows.

Subject to

where u and v are the vectors of weight of the j0-th bank’s outputs (y) and inputs (x), respectively; and j runs from 1 to n, with n as the total number of IBs being examined (in a certain year). It is noted that the higher the value of , the better the performance of the IB, with indicating the most efficient.

On the other hand, one can also use DEA to measure the ‘pessimistic’ efficiency of the IBs. In particular, an inefficient (or ‘worst practice’) frontier can be estimated; and the banks further from this inefficient frontier are considered to be more efficient (Wang and Chin 2009). In this sense, the higher the value of , the better the performance of the IB, with indicating the less efficient. Following Azizi (2014), Badiezadeh et al. (2018), and Cui et al. (2022), the pessimistic DEA model can be expressed as:

Subject to

Once both the optimistic and pessimistic DEA efficiency scores are estimated, one can follow Wang et al. (2007) to compute the overall efficiency () of bank j in year t as the geometric mean of and using Equation (3), with the higher the value of OEF, the better the performance of the IB:

where j denotes the bank, and t denotes the year.

3.3. The Determinants of the Overall Efficiency of IBs

To further examine the determinants of the overall efficiency of the IBs, we follow the rich literature on the two-stage DEA approach (Boubaker et al. 2020; Boubaker et al. 2021; Casu and Molyneux 2003; Hoff 2007; K. M. Nguyen et al. 2012) and regress the OEF against a set of macro-economic factors that can affect the performance of the IBs (see Table 2B). For instance, (Heffernan and Fu 2010; Fang et al. 2019; Le and Ngo 2020) showed that the economic status of the country, such as GDP growth (GDPGR) and inflation (INF), can influence bank performance, where a higher GDPGR reflects an increase, and a higher INF indicates a reduction in demand for banking services. To better capture the other factors of economic status that were not reflected in GDPGR and INF, we also use a dummy variable (ADVANCE) to distinguish between advanced and (under)developed countries, since there is evidence that banks in advanced countries are more profitable than their counterparts (Ngo and Le 2019; Yin et al. 2020). Furthermore, (Yudistira 2004; Viverita and Skully 2007; Bahrini 2017) all found that the IBs performed differently across regions. Consequently, Equation (4) estimates the relationship between the OEF of the IB j, from country I, in year t (), and a set of control variables, including the economic development of the country that the IB operates in (i.e., GDPGR, INF, and ADVANCE); the regional effect (MIDDLEEAST), in which IBs outside the Middle East and Central Asia region tend to outperform IBs from that region (Alexakis et al. 2019; Boubaker et al. 2022b; Viverita and Skully 2007; Yudistira 2004); and also the 2008 global financial crisis (GFC) and the recent coronavirus pandemic (COVID-19) effects. Because the is not restricted to be bounded between 0 and 1, and due to the existence of dummy variables (e.g., ADVANCE or COVID) that prevents us from performing a fixed-effect estimation, we instead employed a generalized least squares (GLS) random-effect panel regression in the estimation of Equation (4).

where j denotes the bank; i denotes the country; and t denotes the year.

4. Empirical Results and Discussion

4.1. DEA Double Frontiers Efficiency of the IBs (2005–2020)

We first report the average DEA efficiency scores of the sampled IBs in Table 3. As observed from that table, the efficiency scores and ranks of the IBs are different under the optimistic and pessimistic approaches, and, thus, it is justified to evaluate the IBs using the double frontiers approach. By analysing the DEA double frontier’s OEF scores and rankings, one can see that the top-three performer banks (for the whole 2005–2020 period) include Bahrain Islamic Bank BSC (BISB.BH), Al Salam Bank Bahrain BSC (SALAM.BH), and Sterling Bank PLC (STERLNB.LG), while the bottom three are Abu Dhabi Islamic Bank PJSC (ADIB.AD), Al Baraka Bank Egypt SAE (SAUD.CA), and Bank of Punjab (BOPU.PSX).

Table 3.

Average efficiency of the examined IBs.

All in all, Table 3 suggests that there are some significant differences in the efficiency and performance of the examined IBs. For instance, Bahrain Islamic Bank BSC (top performer) has an OEF of 3.248, more than six-times higher than the efficiency of Abu Dhabi Islamic Bank PJSC (worst-performer, OEF = 0.524). We, therefore, continue to look for the country-wise picture of the DEA double frontiers efficiency, as reported in Table 4. Again, we observed that IBs operating in different countries also perform differently. For example, the six IBs in Egypt had the lowest (average) OEF scores, which may be due to the fact that Egypt is one of the few Muslim countries where the government tends to support the CBs, which puts more pressure on the Egyptian IBs (Galal Abdullah Mouawad 2009; Tammam 2019). It is, therefore, arguable that one should further examine which factors could lead to the differences in the performance of the IBs, e.g., the macroeconomic environments or the impacts of COVID-19. This question will be addressed in the next section.

Table 4.

Country-wise performance of the IBs.

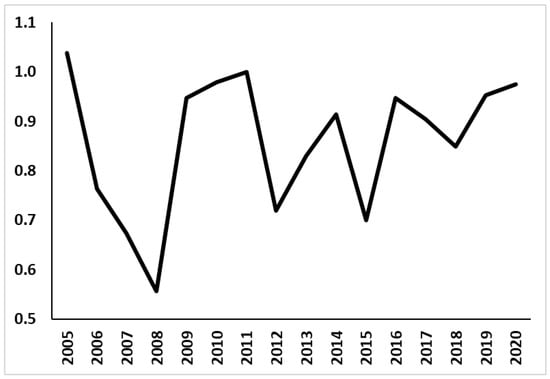

We further illustrate the changes in the OEF over time in Figure 1. It shows the significant impact of the GFC when the OEF dropped to its lowermost value of 0.557 in 2008. This finding is consistent with the studies of Beck et al. (2013); Ftiti et al. (2013); Belanès et al. (2015); and Miah and Uddin (2017) on the negative impacts of the GFC on the IBs. The Islamic banking system has since recovered, with some struggles during the 2012–2018 period, similar to what was found by Alqahtani et al. (2017), and also experienced an increase in the OEF in 2019 and 2020, despite the recent pandemic. One may thus argue that the IBs were more resilient during the COVID-19 outbreak (Ashraf et al. 2022; Boubaker et al. 2022b; Mirzaei et al. 2022). Such effects of the GFC and COVID-19 will be empirically examined in the following section.

Figure 1.

The overall efficiency of the Islamic banking sector over time.

4.2. The Determinants of Islamic Banks’ Efficiency

It is noted that our model in Equation (4) is justified, since the Ramsey Regression Equation Specification Error Test (RESET) results of our random-effects panel data regression (DeBenedictis and Giles 1998) cannot reject the null hypothesis of a good specification (see Table 5). Table 6 consequently presents the regression results for the determinants of the IBs’ efficiency. Several conclusions can be drawn from this table, as follows. First, the economic growth (i.e., GDPGR) of the country can positively improve the performance of the IBs operating within its territory (at a 1% level of significance). Second, the global financial crisis in 2008 (i.e., GFC = 1) did have a negative impact on the performance of the Islamic banking sector (as illustrated in Figure 1). Third, the efficiency of the IBs during the COVID-19 pandemic (i.e., COVID-19 = 1) was higher than that of the previous years. Lastly, we could not find any statistical evidence of the (positive) impact of inflation (i.e., INF), the (negative) impact of higher income levels (i.e., ADVANCE), and the geographical characteristics (i.e., MIDDLEEAST) on the performance of the examined IBs.

Table 5.

DeBenedictis and Giles (1998) Specification RESET Tests.

Table 6.

Regression results.

We accordingly argue that maintaining good economic development not only helps countries to withstand crises and pandemics (Acemoglu 2009), but it also helps improve the efficiency and performance of the Islamic banking system. This, in turn, could help speed up the recovery process of the global economy (Elnahass et al. 2021; International Monetary Fund 2021). For instance, the International Monetary Fund (2021) projected a 4.9 percent growth rate for the world economy in 2022, subject to the stability conditions of the banking and financial sectors. We also expect that the Islamic banking sector will be a driving force of such recovery, as the sector is more resilient to the COVID-19 pandemic and even improved its efficiency and performance in recent years (Ashraf et al. 2022; Boubaker et al. 2022b; Mirzaei et al. 2022). It is thanks to the nature of the Islamic banking model (Elnahass et al. 2021), the lessons that the IBs have learnt from the GFC (Rehman et al. 2021), and the diversification approach of the IBs (Alabbad and Schertler 2022; Le et al. 2022a). The Islamic banking sector, in the near future, therefore, will be a talking point for researchers, policymakers, managers, and investors.

5. Conclusions

Measuring the efficiency of the banking sector, including Islamic banks, and its determinants is always an important task. The current literature, however, reveals two research gaps: (1) the lack of studies on the IBs only, especially under COVID-19, and not in a comparison with the CBs, as the two groups operate under different principles; and (2) the nonexistence of a two-stage double DEA frontier for the IBs. We, therefore, have contributed to the banking efficiency literature by empirically investigating the determinants of the DEA double frontiers efficiency scores of the Islamic banking sector, given the utilization of their inputs (i.e., operating expenses and total deposits) to produce the outputs (i.e., operating incomes and other earning assets), and the impacts of several macroeconomic conditions, such as GDP growth rates, inflation, and the recent COVID-19 pandemic. In this sense, this study extended the applications of the DEA double frontier approach (i) for the Islamic banking sector and (ii) for a two-stage DEA of efficiency determinants, especially to investigate the impacts of the recent COVID-19 pandemic on the efficiency of the examined Islamic banks.

Our empirical results showed that economic development can help countries to both withstand such crises as the recent pandemic and improve the efficiency and performance of the (Islamic) banking system. This, in turn, could help speed up the recovery process of the global economy. Given that the Islamic banking sector is more resilient to the COVID-19 pandemic, it is expected that this sector will be a driving force of such recovery, and, thus, will soon be a talking point for researchers, policymakers, managers, and investors.

This study is not without limitations. Firstly, due to data limitations, we could not examine IBs in more details at the country-level, especially for countries where the Islamic principles are more practiced. It is also noted that this study only focused on the determinants of efficiency at a macro-level (e.g., GDPGR or COVID-19) but not at the bank- or country-level; we leave this task for future research. Secondly, it would also be interesting to apply different DEA techniques, such as inverse DEA, network DEA, fuzzy DEA, or stochastic DEA (Boubaker et al. 2022b; Ngo and Tsui 2022; Tsionas 2021; J. Zhu 2020), in the first stage of the double frontier estimation. Thirdly, for the second-stage regression, future studies may extend the sample and overcome the data limitations to perform richer analyses with different settings of sub-sampling, variables selecting, and robustness testing to confirm and improve our findings. Newer estimation techniques such as random forest, artificial neuron network, or lasso regression (Chen et al. 2021; Thaker et al. 2021; N. Zhu et al. 2020) should also be employed.

Author Contributions

Conceptualization, X.T.T.M. and T.N.; methodology and software, T.D.Q.L. and T.N.; validation, H.T.N.N. and L.P.N.; formal analysis, T.N.; investigation, T.D.Q.L. and L.P.N.; resources, T.D.Q.L.; data curation, T.D.Q.L. and T.N.; writing—original draft preparation, T.N.; writing—review and editing, X.T.T.M. and H.T.N.N.; visualization and supervision, X.T.T.M.; project administration, H.T.N.N. and L.P.N. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study, in the collection, analyses, or interpretation of the data, in the writing of the manuscript, or in the decision to publish the results.

Appendix A. List of Islamic Banks

| No. | Name | Code | No. | Name | Code |

| 1 | Riyad Bank SJSC | 1010.SE | 41 | Hatton National Bank PLC | HNB.CM |

| 2 | AB Bank Ltd. | ABBK.DH | 42 | Islami Bank Bangladesh Ltd. | ISLB.DH |

| 3 | Arab Banking Corporation BSC | ABCB.BH | 43 | Ithmaar Holding BSC | ITHMR.BH |

| 4 | Arab Banking Corporation Jordan PSC | ABCO.AM | 44 | Jamuna Bank Ltd. | JMNB.DH |

| 5 | Abu Dhabi Commercial Bank PJSC | ADCB.AD | 45 | Jordan Islamic Bank Co PLC | JOIB.AM |

| 6 | Abu Dhabi Islamic Bank PJSC | ADIB.AD | 46 | KUWAIT FINANCE HOUSE K S C P | KFH.KW |

| 7 | Abu Dhabi Islamic Bank Egypt SAE | ADIB.CA | 47 | Khaleeji Commercial Bank BSC | KHCB.BH |

| 8 | Affin Bank BHD | AFIN.KL | 48 | Kuwait International Bank KSCP | KIBK.KW |

| 9 | Ajman Bank PJSC | AJBNK.DU | 49 | Masraf Al Rayan QPSC | MARK.QA |

| 10 | Amlak Finance PJSC | AMLK.DU | 50 | Mashreqbank PSC | MASB.DU |

| 11 | AMMB Holdings BHD | AMMB.KL | 51 | National Bank of Bahrain BSC | NATB.BH |

| 12 | Meezan Bank Ltd. | AMZN.PSX | 52 | National Bank of Kuwait Egypt SAE | NBKE.CA |

| 13 | Arab Bank PLC | ARBK.AM | 53 | National Bank of Kuwait SAKP | NBKK.KW |

| 14 | Ahli United Bank BSC | AUBB.BH | 54 | National Bank of Oman SAOG | NBOB.OM |

| 15 | Bank Alfalah Ltd. | BAFL.PSX | 55 | Pubali Bank Ltd. | PBBK.DH |

| 16 | Al Baraka Banking Group BSC | BARKA.BH | 56 | Prime Bank Ltd. | PRBK.DH |

| 17 | Bank Islami Pakistan Ltd. | BIPL.PSX | 57 | Premier Bank Ltd. | PRBN.DH |

| 18 | Bahrain Islamic Bank BSC | BISB.BH | 58 | Qatar International Islamic Bank QPSC | QIIB.QA |

| 19 | Bank Asia Ltd. | BKAL.DH | 59 | Qatar Islamic Bank QPSC | QISB.QA |

| 20 | Bank Dhofar SAOG | BKDB.OM | 60 | Qatar National Bank QPSC | QNBK.QA |

| 21 | Bank Muscat SAOG | BKMB.OM | 61 | RHB Bank BHD | RHBC.KL |

| 22 | Ahli United Bank KSCP | BKME.KW | 62 | Societe Arabe International De Banque SAE | SAIB.CA |

| 23 | Bank Nizwa SAOG | BKNZ.OM | 63 | Al Salam Bank Bahrain BSC | SALAM.BH |

| 24 | Sohar International Bank SAOG | BKSB.OM | 64 | Al Baraka Bank Egypt SAE | SAUD.CA |

| 25 | Bank of Punjab | BOPU.PSX | 65 | Southeast Bank Ltd. | SEBK.DH |

| 26 | Boubyan Bank KSCP | BOUK.KW | 66 | Sharjah Islamic Bank PJSC | SIB.AD |

| 27 | Bank Syariah Indonesia Tbk PT | BRIS.JK | 67 | Safwa Islamic Bank PSC | SIBK.AM |

| 28 | Suez Canal Bank SAE | CANA.CA | 68 | Silkbank Ltd. | SILK.PSX |

| 29 | Commercial Bank of Kuwait KPSC | CBKK.KW | 69 | Summit Bank Ltd. | SMBL.PSX |

| 30 | CIMB Group Holdings BHD | CIMB.KL | 70 | Social Islami Bank Ltd. | SOCI.DH |

| 31 | Commercial Bank of Ceylon PLC | COMB.CM | 71 | Soneri Bank Ltd. | SONA.PSX |

| 32 | City Bank Ltd. | CTBK.DH | 72 | Al Salam Bank Sudan PLC | SSUD.DU |

| 33 | Dhaka Bank Ltd. | DHBK.DH | 73 | Standard Chartered PLC | STAN.L |

| 34 | Dubai Islamic Bank PJSC | DISB.DU | 74 | Standard Bank Ltd. | STBL.DH |

| 35 | Emirates NBD Bank PJSC | ENBD.DU | 75 | Sterling Bank PLC | STERLNB.LG |

| 36 | Export Import Bank of Bangladesh Ltd. | EXPT.DH | 76 | Trust Bank Ltd. | TRBK.DH |

| 37 | First Abu Dhabi Bank PJSC | FAB.AD | 77 | United Arab Bank PJSC | UAB.AD |

| 38 | Faisal Islamic Bank of Egypt SAE | FAITA.CA | 78 | United Bank Ltd. | UBL.PSX |

| 39 | Hong Leong Financial Group BHD | HLCB.KL | 79 | Warba Bank KSCP | WARB.KW |

| 40 | Habib Metropolitan Bank Ltd. | HMB.PSX |

References

- Abdulla, Yomna, and Yousif Ebrahim. 2022. Effect of COVID-19 on the performance of Islamic and conventional GCC banks. Review of Financial Economics 40: 239–58. [Google Scholar] [CrossRef]

- Abdul-Majid, Mariani, Manizheh Falahaty, and Mansor Jusoh. 2017. Performance of Islamic and conventional banks: A meta-frontier approach. Research in International Business and Finance 42: 1327–35. [Google Scholar] [CrossRef]

- Acemoglu, Daron. 2009. The crisis of 2008: Structural lessons for and from economics. Globalization and Growth 2: 37. [Google Scholar]

- Alabbad, Amal, and Andrea Schertler. 2022. COVID-19 and bank performance in dual-banking countries: An empirical analysis. Journal of Business Economics 92: 1511–57. [Google Scholar] [CrossRef]

- Alexakis, Christos, Marwan Izzeldin, Jill Johnes, and Vasileios Pappas. 2019. Performance and productivity in Islamic and conventional banks: Evidence from the global financial crisis. Economic Modelling 79: 1–14. [Google Scholar] [CrossRef]

- Alqahtani, Faisal, David G. Mayes, and Kym Brown. 2017. Islamic bank efficiency compared to conventional banks during the global crisis in the GCC region. Journal of International Financial Markets, Institutions and Money 51: 58–74. [Google Scholar] [CrossRef]

- Ansari, Sanaullah, and Atiq Ur Rehman. 2011. Financial Performance of Islamic and Conventional Banks in Pakistan: A Comparative Study. Paper presented at the 8th International Conference on Islamic Economics and Finance, Doha, Qatar, December 19–21. [Google Scholar]

- Ashraf, Badar Nadeem, Mosab I. Tabash, and M. Kabir Hassan. 2022. Are Islamic banks more resilient to the crises vis-à-vis conventional banks? Evidence from the COVID-19 shock using stock market data. Pacific-Basin Finance Journal 73: 101774. [Google Scholar] [CrossRef]

- Avkiran, Necmi K. 2011. Association of DEA super-efficiency estimates with financial ratios: Investigating the case for Chinese banks. OMEGA 39: 323–34. [Google Scholar] [CrossRef]

- Avkiran, Necmi Kemal. 2015. An illustration of dynamic network DEA in commercial banking including robustness tests. OMEGA 55: 141–50. [Google Scholar] [CrossRef]

- Azizi, Hossein. 2014. DEA efficiency analysis: A DEA approach with double frontiers. International Journal of Systems Science 45: 2289–300. [Google Scholar] [CrossRef]

- Bader, Mohammed Khaled I., Shamsher Mohamad, Mohamed Ariff, and Taufiq Hassan. 2008. Cost, Revenue, And Profit Efficiency Of Islamic Versus Conventional Banks: International Evidence Using Data Envelopment Analysis. Islamic Economic Studies 15: 24–76. [Google Scholar]

- Badiezadeh, Taliva, Reza Farzipoor Saen, and Tahmoures Samavati. 2018. Assessing sustainability of supply chains by double frontier network DEA: A big data approach. Computers & Operations Research 98: 284–90. [Google Scholar] [CrossRef]

- Bahrini, Raéf. 2017. Efficiency Analysis of Islamic Banks in the Middle East and North Africa Region: A Bootstrap DEA Approach. International Journal of Financial Studies 5: 7. [Google Scholar] [CrossRef]

- Banker, Rajiv D., Abraham Charnes, and William Wager Cooper. 1984. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science 30: 1078–92. [Google Scholar] [CrossRef]

- Beck, Thorsten, Asli Demirgüç-Kunt, and Ouarda Merrouche. 2013. Islamic vs. conventional banking: Business model, efficiency and stability. Journal of Banking & Finance 37: 433–47. [Google Scholar] [CrossRef]

- Belanès, Amel, Zied Ftiti, and Rym Regaïeg. 2015. What can we learn about Islamic banks efficiency under the subprime crisis? Evidence from GCC Region. Pacific-Basin Finance Journal 33: 81–92. [Google Scholar] [CrossRef]

- Ben Mohamed, Ezzeddine, Neama Meshabet, and Bilel Jarraya. 2021. Determinants of technical efficiency of Islamic banks in GCC countries. Journal of Islamic Accounting and Business Research 12: 218–38. [Google Scholar] [CrossRef]

- Berger, Allen N., and David B. Humphrey. 1997. Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research 98: 175–212. [Google Scholar] [CrossRef]

- Berger, Allen N., William C. Hunter, and Stephen G. Timme. 1993. The efficiency of financial institution: A review and preview of research past, present, and future. Journal of Banking & Finance 17: 221–49. [Google Scholar]

- Bonin, John P., Iftekhar Hasan, and Paul Wachtel. 2005. Bank performance, efficiency and ownership in transition countries. Journal of Banking & Finance 29: 31–53. [Google Scholar]

- Boubaker, Sabri, Duc Trung Do, Helmi Hammami, and Kim Cuong Ly. 2020. The role of bank affiliation in bank efficiency: A fuzzy multi-objective data envelopment analysis approach. Annals of Operations Research 311: 611–39. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Riadh Manita, and Wael Rouatbi. 2021. Large shareholders, control contestability and firm productive efficiency. Annals of Operations Research 296: 591–614. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Riadh Manita, and Salma Mefteh-Wali. 2022a. Foreign currency hedging and firm productive efficiency. Annals of Operations Research 313: 833–54. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Tu D. Q. Le, and Thanh Ngo. 2022b. Managing bank performance under COVID-19: A novel inverse DEA efficiency approach (Online first). International Transactions in Operational Research. [Google Scholar] [CrossRef]

- Casu, Barbara, and Philip Molyneux. 2003. A comparative study of efficiency in European banking. Applied Economics 35: 1865–76. [Google Scholar] [CrossRef]

- Charnes, Abraham, William W. Cooper, and Edwardo Rhodes. 1978. Measuring the efficiency of decision making units. European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Chen, Ya, Mike G. Tsionas, and Valentin Zelenyuk. 2021. LASSO+DEA for small and big wide data. OMEGA 102: 102419. [Google Scholar] [CrossRef]

- Cui, Qiang, Yi-lin Lei, Jing-ling Lin, and Li-ting Yu. 2022. Airline efficiency measures considering undesirable outputs: An application of a network slack-based measures with double frontiers. Journal of Environmental Planning and Management 66: 191–220. [Google Scholar] [CrossRef]

- DeBenedictis, Linda F., and David E. A. Giles. 1998. Diagnostic Testing in Econometrics: Variable Addition, RESET and Fourier Approximations. In Handbook of Applied Economic Statistics. Edited by Aman Ullah and David E. Giles. New York: Marcel Dekker, pp. 383–417. [Google Scholar]

- Demirgüç-Kunt, Asli, Alvaro Pedraza, and Claudia Ruiz-Ortega. 2021. Banking sector performance during the COVID-19 crisis. Journal of Banking & Finance 133: 106305. [Google Scholar] [CrossRef]

- Dincer, Hasan, Umit Hacioglu, Ekrem Tatoglu, and Dursun Delen. 2019. Developing a hybrid analytics approach to measure the efficiency of deposit banks. Journal of Business Research 104: 131–45. [Google Scholar] [CrossRef]

- Elnahass, Marwa, Vu Quang Trinh, and Teng Li. 2021. Global banking stability in the shadow of Covid-19 outbreak. Journal of International Financial Markets, Institutions and Money 72: 101322. [Google Scholar] [CrossRef]

- Emrouznejad, Ali, and Guo-liang Yang. 2018. A survey and analysis of the first 40 years of scholarly literature in DEA: 1978--2016. Socio-Economic Planning Sciences 61: 4–8. [Google Scholar] [CrossRef]

- Fang, Jianchun, Chi-Keung Marco Lau, Zhou Lu, Yong Tan, and Hua Zhang. 2019. Bank performance in China: A Perspective from Bank efficiency, risk-taking and market competition. Pacific-Basin Finance Journal 56: 290–309. [Google Scholar] [CrossRef]

- Farooq, Moazzam, and Sajjad Zaheer. 2015. Are Islamic Banks More Resilient During Financial Panics? Pacific Economic Review 20: 101–24. [Google Scholar] [CrossRef]

- Fethi, Meryem Duygun, and Fotios Pasiouras. 2010. Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey. European Journal of Operational Research 204: 189–98. [Google Scholar] [CrossRef]

- Ftiti, Zied, Olfa Nafti, and Safa Sreiri. 2013. Efficiency Of Islamic Banks During Subprime Crisis: Evidence of GCC Countries. Journal of Applied Business Research 29: 285–304. [Google Scholar] [CrossRef]

- Fujii, Hidemichi, Shunsuke Managi, and Roman Matousek. 2014. Indian bank efficiency and productivity changes with undesirable outputs: A disaggregated approach. Journal of Banking & Finance 38: 41–50. [Google Scholar]

- Fukuyama, Hirofumi, and Roman Matousek. 2017. Modelling bank performance: A network DEA approach. European Journal of Operational Research 259: 721–32. [Google Scholar] [CrossRef]

- Galal Abdullah Mouawad, Sherin. 2009. The development of Islamic finance: Egypt as a case study. Journal of Money Laundering Control 12: 74–87. [Google Scholar] [CrossRef]

- Gölcükcü, Ayhan. 2015. Investigation of Optimist and Pessimist Situations via DEA with Fuzzified Data: Banking Example. Gazi University Journal of Science 28: 561–69. [Google Scholar]

- Hammami, Helmi, Thanh Ngo, David Tripe, and Dinh-Tri Vo. 2022. Ranking with a Euclidean common set of weights in data envelopment analysis: With application to the Eurozone banking sector. Annals of Operations Research 311: 675–94. [Google Scholar] [CrossRef]

- Hasan, Md Bokhtiar, M. Kabir Hassan, Md Mamunur Rashid, and Yasser Alhenawi. 2021. Are safe haven assets really safe during the 2008 global financial crisis and COVID-19 pandemic? Global Finance Journal 50: 10068. [Google Scholar] [CrossRef]

- Hassoune, Anouar. 2002. Islamic banks’ profitability in an interest rate cycle. International Journal of Islamic Financial Services 4: 1–13. [Google Scholar]

- Heffernan, Shelagh A., and Xiaoqing Fu. 2010. Determinants of financial performance in Chinese banking. Applied Financial Economics 20: 1585–600. [Google Scholar] [CrossRef]

- Ho, Tin H., Dat T. Nguyen, Thanh Ngo, and Tu D. Q. Le. 2021. Efficiency in Vietnamese Banking: A Meta-Regression Analysis Approach. International Journal of Financial Studies 9: 41. [Google Scholar] [CrossRef]

- Hoff, Ayoe. 2007. Second stage DEA: Comparison of approaches for modelling the DEA score. European Journal of Operational Research 181: 425–35. [Google Scholar] [CrossRef]

- Hughes, Andrew, and Suthathip Yaisawarng. 2004. Sensitivity and dimensionality tests of DEA efficiency scores. European Journal of Operational Research 154: 410–22. [Google Scholar] [CrossRef]

- International Monetary Fund. 2021. World Economic Outlook, October 2021: Recovery during a Pandemic. Washington, DC: International Monetary Fund (IMF). [Google Scholar]

- Iqbal, Munawar. 2001. Islamic and Conventional Banking in the Nineties: A Comparative Study. Islamic Economic Studies 8: 1–27. [Google Scholar]

- Kamaruddin, Badrul Hisham, Mohammad Samaun Safa, and Rohani Mohd. 2008. Assessing production efficiency of Islamic banks and conventional bank Islamic windows in Malaysia. International Journal of Management and Business Research 1: 31–48. [Google Scholar]

- Kamarudin, Fakarudin, Bany Ariffin Amin Nordin, Junaina Muhammad, and Mohamad Ali Abdul Hamid. 2014. Cost, Revenue and Profit Efficiency of Islamic and Conventional Banking Sector: Empirical Evidence from Gulf Cooperative Council Countries. Global Business Review 15: 1–24. [Google Scholar] [CrossRef]

- Khan, Feisal. 2010. How ‘Islamic’ is Islamic Banking? Journal of Economic Behavior & Organization 76: 805–20. [Google Scholar] [CrossRef]

- Lantara, Dirgahayu, Junaidi Junaidi, Nurhayati Rauf, A. Pawennari, and Ratu Noorita Achmad. 2022. Indonesian Islamic banks: A review of the financial state before and after the COVID-19 pandemic. Banks and Bank Systems 17: 12–24. [Google Scholar] [CrossRef]

- Le, Tu D. Q., and Thanh Ngo. 2020. The determinants of bank profitability: A cross-country analysis. Central Bank Review 20: 65–73. [Google Scholar] [CrossRef]

- Le, Tu D. Q., Thanh Ngo, Tin H. Ho, and Dat T. Nguyen. 2022a. ICT as a Key Determinant of Efficiency: A Bootstrap-Censored Quantile Regression (BCQR) Analysis for Vietnamese Banks. International Journal of Financial Studies 10: 44. [Google Scholar] [CrossRef]

- Le, Tu D. Q., Tin H. Ho, Dat T. Nguyen, and Thanh Ngo. 2022b. A cross-country analysis on diversification, Sukuk investment, and the performance of Islamic banking systems under the COVID-19 pandemic. Heliyon 8: e09106. [Google Scholar] [CrossRef]

- Liu, John S., Louis Y. Y. Lu, Wen-Min Lu, and Bruce J. Y. Lin. 2013. A survey of DEA applications. OMEGA 41: 893–902. [Google Scholar] [CrossRef]

- Lozano-Vivas, Ana, Jesús T. Pastor, and José M. Pastor. 2002. An efficiency comparison of European banking systems operating under different environmental conditions. Journal of Productivity Analysis 18: 59–77. [Google Scholar] [CrossRef]

- Lu, Ying Fang, Christopher Gan, Baiding Hu, Moau Yong Toh, and David A. Cohen. 2018. Bank efficiency in New Zealand: A stochastic frontier approach. New Zealand Economic Papers 53: 166–83. [Google Scholar] [CrossRef]

- Majeed, Muhammad Tariq, and Abida Zainab. 2021. A comparative analysis of financial performance of Islamic banks vis-à-vis conventional banks: Evidence from Pakistan (online first). ISRA International Journal of Islamic Finance 13: 331–46. [Google Scholar] [CrossRef]

- Mastrosimone, Carlo. 2013. Introduction to the Practices and Institutions of Islamic Finance Between the Islamic World and the West. Journal of Global Policy and Governance 2: 121–32. [Google Scholar] [CrossRef]

- Matthews, Kent. 2013. Risk management and managerial efficiency in Chinese banks: A network DEA framework. OMEGA 41: 207–15. [Google Scholar] [CrossRef]

- Miah, Mohammad Dulal, and Helal Uddin. 2017. Efficiency and stability: A comparative study between islamic and conventional banks in GCC countries. Future Business Journal 3: 172–85. [Google Scholar] [CrossRef]

- Mirzaei, Ali, Mohsen Saad, and Ali Emrouznejad. 2022. Bank stock performance during the COVID-19 crisis: Does efficiency explain why Islamic banks fared relatively better? Annals of Operations Research. [Google Scholar] [CrossRef] [PubMed]

- Ngo, Thanh, and Kan Wai Hong Tsui. 2022. Estimating the confidence intervals for DEA efficiency scores of Asia-Pacific airlines. Operational Research 22: 3411–34. [Google Scholar] [CrossRef]

- Ngo, Thanh, and Tu Le. 2019. Capital market development and bank efficiency: A cross-country analysis. International Journal of Managerial Finance 15: 478–91. [Google Scholar] [CrossRef]

- Nguyen, Khac Minh, Thanh Long Giang, and Viet Hung Nguyen. 2012. Efficiency and super-efficiency of commercial banks in Vietnam: Performances and determinants. Asia-Pacific Journal of Operational Research 30: 1250047. [Google Scholar]

- Nguyen, Phong Hoang, and Duyen Thi Bich Pham. 2020. The cost efficiency of Vietnamese banks—The difference between DEA and SFA. Journal of Economics and Development 22: 209–27. [Google Scholar] [CrossRef]

- Paradi, Joseph C., Mette Asmild, and Paul C Simak. 2004. Using DEA and worst practice DEA in credit risk evaluation. Journal of Productivity Analysis 21: 153–65. [Google Scholar] [CrossRef]

- Ramalho, JoaquimJ S., and J. Vidigal Silva. 2013. Functional form issues in the regression analysis of financial leverage ratios. Empirical economics 44: 799–831. [Google Scholar] [CrossRef]

- Ramlan, Hamidah, and Mohd Sharrizat Adnan. 2016. The Profitability of Islamic and Conventional Bank: Case Study in Malaysia. Procedia Economics and Finance 35: 359–67. [Google Scholar] [CrossRef]

- Rehman, Shakeel Ul, Yasser Saleh A. Almonifi, and Rafia Gulzar. 2021. Impact of the COVID-19 pandemic on Islamic Bank indices of the GCC countries. International Journal of Islamic Banking and Finance Research 7: 1–17. [Google Scholar] [CrossRef]

- Reinhard, Stijn, C. A. Knox Lovell, and Geert J. Thijssen. 2000. Environmental efficiency with multiple environmentally detrimental variables; estimated with SFA and DEA. European Journal of Operational Research 121: 287–303. [Google Scholar] [CrossRef]

- Rizwan, Muhammad Suhail, Ghufran Ahmad, and Dawood Ashraf. 2022. Systemic risk, Islamic banks, and the COVID-19 pandemic: An empirical investigation. Emerging Markets Review 51: 100890. [Google Scholar] [CrossRef]

- Salmi, Timo, and Teppo Martikainen. 1994. A review of the theoretical and empirical basis of financial ratio analysis. The Finnish Journal of Business Economics 43: 426–48. [Google Scholar]

- Schaffnit, Claire, Dan Rosen, and Joseph C. Paradi. 1997. Best practice analysis of bank branches: An application of DEA in a large Canadian bank. European Journal of Operational Research 98: 269–89. [Google Scholar] [CrossRef]

- Sealey, C. Williams, and James T. Lindley. 1977. Inputs, outputs, and a theory of production and cost at depository financial institutions. Journal of Finance 32: 1251–66. [Google Scholar] [CrossRef]

- Tammam, Aliaa Abdallah. 2019. The Role of Central Bank Regulations in Enhancing Islamic Bank Performance in Egypt. Cardiff: Cardiff Metropolitan University. [Google Scholar]

- Thaker, Keyur, Vincent Charles, Abhay Pant, and Tatiana Gherman. 2021. A DEA and random forest regression approach to studying bank efficiency and corporate governance. Journal of the Operational Research Society 73: 1258–77. [Google Scholar] [CrossRef]

- Thomson Reuters Eikon. 2022. Refinitiv. Edited by Thomson Reuters. London: Thomson Reuters Eikon. [Google Scholar]

- Tone, Kaoru. 2001. A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research 130: 498–509. [Google Scholar] [CrossRef]

- Tortosa-Ausina, Emili, Emili Grifell-Tatje, and Carmen Armero. 2008. Sensitivity analysis of efficiency and Malmquist productivity indices: An application to Spanish savings banks. European Journal of Operational Research 184: 1062–84. [Google Scholar] [CrossRef]

- Tran, Duc Hiep, and Thanh Ngo. 2014. Performance of the Vietnamese automobile industry: A measurement using DEA. Asian Journal of Business and Management 2: 184–91. [Google Scholar]

- Tsionas, Mike G. 2021. Optimal combinations of stochastic frontier and data envelopment analysis models. European Journal of Operational Research 294: 790–800. [Google Scholar] [CrossRef]

- Vidal-García, Javier, Marta Vidal, Sabri Boubaker, and Majdi Hassan. 2018. The efficiency of mutual funds. Annals of Operations Research 267: 555–84. [Google Scholar] [CrossRef]

- Viverita, Kym Brown, and Michael Skully. 2007. Efficiency analysis of Islamic banks in Africa, Asia and the Middle East. Review of Islamic Economics 11: 5–16. [Google Scholar]

- Wang, Ying-Ming, and Kwai-Sang Chin. 2009. A new approach for the selection of advanced manufacturing technologies: DEA with double frontiers. International Journal of Production Research 47: 6663–79. [Google Scholar] [CrossRef]

- Wang, Ying-Ming, Kwai-Sang Chin, and Jian-Bo Yang. 2007. Measuring the performances of decision-making units using geometric average efficiency. Journal of the Operational Research Society 58: 929–37. [Google Scholar] [CrossRef]

- Yang, Chyan, and Hsian-Ming Liu. 2012. Managerial efficiency in Taiwan bank branches: A network DEA. Economic Modelling 29: 450–61. [Google Scholar] [CrossRef]

- Yin, Haiyan, Jiawen Yang, and Xing Lu. 2020. Bank globalization and efficiency: Host- and home-country effects. Res Int Bus Finance 54: 101305. [Google Scholar] [CrossRef]

- Yudistira, Donsyah. 2004. Efficiency in Islamic banking: An empirical analysis of eighteen banks. Islamic Economic Studies 12: 1–19. [Google Scholar]

- Zhu, Joe. 2020. DEA under big data: Data enabled analytics and network data envelopment analysis. Annals of Operations Research 309: 761–83. [Google Scholar] [CrossRef]

- Zhu, Nan, Chuanjin Zhu, and Ali Emrouznejad. 2020. A combined machine learning algorithms and DEA method for measuring and predicting the efficiency of Chinese manufacturing listed companies. Journal of Management Science and Engineering 6: 435–48. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).