Abstract

This paper examines the stability of the Bilson–Fama regression for a panel of 55 developed and developing countries. We find multiple break points for nearly every country in our panel. Subperiod estimates of the slope coefficient show a negative bias during some time periods and a positive bias during other time periods in nearly every country. The subperiod biases display two key patterns that shed light on the literature’s linear regression findings. The results point toward the importance of risk in currency markets. We find that risk is greater for developed country markets. The evidence undercuts the widespread view that currency returns are predictable or that developed country markets are less rational.

1. Introduction

The forward rate anomaly is a long-standing puzzle in International Macroeconomics. The anomaly is based on a linear regression of the future change of the spot exchange rate on the forward premium. The assumptions of risk neutral investors, no capital controls, and the rational expectations hypothesis (REH) imply that the slope coefficient (hereafter ) should be unity. However, Bilson (1981) and Fama (1984) (BF) and many subsequent studies report that is less than unity and negative in the major currency markets.1 The negative bias from unity “suggests that one can make predictable profits by betting against the forward rate” Obstfeld et al. (1996), p. 589.

Macroeconomists have explored two main explanations for the predictable excess returns: a time-varying risk premium or systematic forecasting errors. REH risk premium models have encountered considerable difficulty in explaining the negative bias, which has given support to models in which market participants are less than fully rational.2

The cointegrated VAR (CVAR) studies of (Juselius 2017a, 2017b; Juselius and Assenmacher 2017; Juselius and Stillwagon 2018) provide evidence that the forward rate anomaly may originate from another source. These studies find that the process underpinning currency returns is not only unstable, but the instability is triggered by novel historical developments such as German reunification and the 1985 Plaza Accord. The instability implies that market participants must cope with imperfect knowledge about the future and that returns are less predictable than widely reported. The CVAR findings also provide evidence of a time-varying risk premium, but one based on imperfect knowledge economics (IKE).3 In the IKE model, the market’s risk premium compensates participants for their loss aversion and downside risk. The model relates downside risk to the gap between the exchange rate and its benchmark value, rather than to the volatility of returns as with standard REH models. Juselius, Assenmacher, and Stillwagon use purchasing power parity (PPP) to define benchmark values. They find that excess returns are positively related to the gap from PPP at high significance levels as predicted by the IKE model.4 Taken as a whole, the CVAR findings suggest that forward rate biasedness may be better understood as a consequence of imperfect knowledge and risk, rather than a lack of rationality.

In this paper, we present additional evidence of this view. Our analysis examines a key finding in the literature: forward rate biasedness is less negative for developing countries than for developed countries. Most studies report that , although less than unity, is positive for developing countries.5 However, these countries are generally thought to be riskier for investors than developed countries. They are characterized by greater political and macroeconomic instability, less liquid and more volatile financial markets, and greater vulnerability to commodity price and other terms of trade shocks. These countries’ currency markets should thus be characterized by larger and more volatile risk premiums and thus greater forward rate biasedness. The finding that they are not is taken by Frankel and Poonawala (2010) and others to imply a striking conclusion: currency markets in developed countries are less rational than those in developing countries.6

We argue, however, that this conclusion, and the broader claim of predictable excess returns, misses what is arguably the key problem facing currency forecasters: instability in the process underpinning outcomes (Clements and Hendry (1999)).7 We go further than (Juselius 2017a, 2017b); Juselius and Assenmacher (2017), and Juselius and Stillwagon (2018), and others in documenting this structural change. Our structural change analysis is comprehensive; we examine the BF regression’s instability for a large panel of 20 developed and 35 developing countries. Our sample of monthly observations runs from the mid 1980s through January 2016 for most developed countries and the late 1990s (due to data availability) through January 2016 for many developing countries.

We find that the BF regression is characterized by multiple structural breaks for nearly all countries in the full sample. The breakpoints for each country, in turn, imply multiple subperiods or “regimes” that are characterized by a distinct . In roughly half of all the subperiods for both groups of countries, cannot be rejected. In the other subperiods, we find regimes in which and other regimes in which (and sometimes negative) for nearly all countries. The results show that there are prolonged time periods in which one would have earned profits on average by betting against the forward rate () and other time periods in which one would have either earned profits by betting with the forward rate () or earned no profits at all ().8

These results undercut the widespread view that currency returns are predictable on the basis of the linear BF regression. To predict returns, one would need to predict the structural change that underpins outcomes in these markets. As such, the literature’s linear-regression estimates provide little evidence, one way or the other that currency markets in developed countries are less rational than those in developing countries.

Nonetheless, the sharp difference in the linear-regression estimates for the two groups of countries is intriguing and raises two sets of questions. First, do the subperiod estimates of display patterns that shed light on why the linear estimates show a greater negative bias for developed countries? In addition, second, are the patterns informative of the importance of imperfect knowledge and risk in currency markets? We find affirmative answers to both questions. A key result is that the size of the subperiod biases, negative and positive, are roughly two times larger for developed countries than for developing countries. As such, the structural changes that occur in developed-country markets are considerably larger and thus lead to greater capital losses when structural change occurs.

The remainder of the paper is structured as follows: Section 2 extends Frankel and Poonawala (2010)’s linear-regression analysis by updating the sample period and enlarging the panel to 55 countries. We find that Frankel and Poonawala’s main result of a smaller bias for developing countries is weakened in the extended panel. In Section 3, we test for instability in the BF regression for the countries in our panel. We rely on recursive procedures that leave open the timing, magnitude, and number of structural breaks in the data. The section reports two key patterns in the subperiod biases. Section 4 and Section 5 discuss how these patterns point toward the importance of imperfect knowledge and risk in currency markets. Section 6 offers concluding remarks.

2. Updating the Linear Estimates: Evidence of Instability

The forward rate anomaly is based on the BF regression:

where denotes the log of the spot exchange rate at time (the domestic currency price of foreign exchange), is the forward premium on foreign exchange (the log of the forward rate minus the log of the spot rate), is an error term, and is a first-difference operator.

Frankel and Poonawala (2010) consider the BF regression for a panel of 20 developed and 14 developing countries and a sample period that begins in December 1996 for most countries and runs through April 2004. We first reproduce their main results. We then consider a larger panel of 55 countries, consisting of the original 34 countries plus 21 additional developing economies. We also update the sample period so that it begins before December 1996 for most of the developed countries and some of the developing countries and runs through January 2016.9 We use monthly data on spot and one-month forward rates for nearly all countries, which we obtain from Thompson DataStream’s World Market Reuters (WMR). The one exception is New Zealand, for which WMR does not provide a consistent forward rate series. For this country, we input one-month eurocurrency interest rates and the spot exchange rate into covered interest parity (CIP) to derive a one-month forward exchange rate.10

There is clearly dependence in the data. Many of the countries in the original and extended panels had some type of pegged or managed exchange rate regime over most or all of the sample period. The panels include countries that were in the European Exchange Rate Mechanism (ERM) until 1998, members of the euro area starting in 1999 and later, and non-European countries, such as Hong Kong and Saudi Arabia, which maintained tight U.S. dollar pegs. However, even for floating-rate regimes, we would expect U.S. macro news to impact all of the U.S. dollar exchange rates in our panel, often in the same direction.

Frankel and Poonawala include pegged-rate and managed-floating regimes in their analysis. They first present OLS results for all developed and developing countries, including the 11 individual euro countries. To account for the dependence in the data, they employ balanced seemingly unrelated regressions (SUR). The data for the euro countries is largely overlapping (from 1999–2004). Frankel and Poonawala thus drop individual euro countries in the SUR analysis and use single euro-area spot and forward rate series for the region. However, they continue to include other tightly pegged developed- and developing-country regimes in the SUR estimation (for example, Denmark, Hong Kong, and Saudi Arabia).

We reproduce Frankel and Poonawala’s OLS and main SUR results for their original panel of countries and sample periods. In order to fully exploit our extended data set, we also estimate an unbalanced SUR model that includes all developed and developing countries.11 We use single euro-area spot and forward rate series for the 11 developed euro countries in our panel, but, unlike Frankel and Poonawala, we treat Denmark as in the euro-area.12,13 Our extended panel includes five developing euro countries that joined after the single currency’s inception (Estonia, Latvia, Lithuania, Slovenia, and Slovakia). The samples for the first four of these countries begin in April 2004. By that date, their currencies were (or soon to be) tied to the euro in an ERM. We thus treat these countries like the other euro-area countries and drop their individual exchange rate series from the SUR analysis. Slovakia’s sample, however, begins in March 2002. The country had a floating currency until the end of November 2005, after which it tied its koruna to the euro as part of an ERM. We thus include Slovakia as an additional country in our SUR analysis, ending its sample in November 2005.

Frankel and Poonawala’s rationale for including some tightly pegged regimes, but not others in their analysis is unclear. Including them either makes sense economically or not.

Pegged rate regimes are characterized by exchange rate fluctuations, albeit in a much more narrow range than managed floating rate regimes. Although small, the fluctuations should be consistent with forward rate unbiasedness under the assumptions of risk neutrality and REH, thereby providing economic rationale for including them. Any incipient deviation from unbiasedness would lead to large expected profits and massive capital flows that would quickly push rates back into line. Moreover, pegged and managed-rate regimes are characterized, on the whole, by smaller PPP deviations than their floating-rate counterparts. According to the IKE model, these regimes should be less prone to downside risk. The question is whether the many developing countries that have them are characterized by lower forward rate biasedness. Excluding these countries, therefore, may bias the analysis against such a finding, hindering attempts to uncover whether risk considerations or irrationality underpinned the pattern of forward rate biasedness across developed and developing countries.

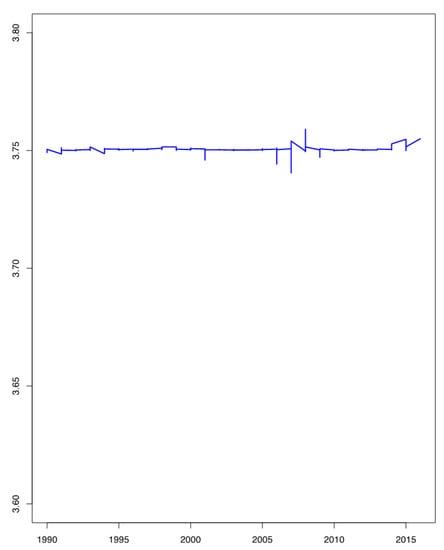

However, the range of fluctuations in pegged rate regimes may be so narrow, and the expected exchange rate changes so small that the expected profits from exploiting deviations may be smaller than the transactions costs (given by bid-asked spreads) and cost of capital. In this case, deviations from unbiasedness would not result in capital flows and thus not be a reflection of the importance of risk or irrationality.14 The Saudi Arabian riyal (SAR) is a case in point. Except for a few brief periods, the riyal was tightly pegged to the U.S. dollar (USD) at 3.7502 for nearly the entire sample (see Figure 1). The coefficient of variation of the spot rate over our sample is 0.0003, which is lower than the currency’s average bid-asked spread (0.0004) over the sample.15 Deviations from unbiasedness in the SAR market (and other tightly pegged regimes), therefore, may not be economically meaningful, thereby weakening the strength of the empirical results.

Figure 1.

SAR-USD Spot Exchange Rate 1990:06–2016:01.

In order to be conservative, we conduct the SUR analysis for a panel that also excludes the other tightly pegged regimes, which involve USD pegs. The group entails the following countries/time periods: Saudi Arabia, Hong Kong, Bahrain, China and Malaysia prior to August 2005, and Thailand before August 1997.16

2.1. Frankel and Poonawala’s Panel

Table 1 and Table 2 (columns 3 and 4) report OLS results for Frankel and Poonawala’s original panel of countries and sample periods.17 The results suggest that forward rate biasedness is much greater for developed countries. The estimates (denoted by ) for developed countries are all negative (save for Greece). In total, 17 of the 20 economies are characterized by negative biasedness at the level (that is, ), which we indicate by bold figures in the table. By contrast, only four of the 14 original developing countries are characterized by a negative , and only seven of the countries in this group have a negative bias at the level. The average for the group of developed and developing countries is and , respectively.

Table 1.

Linear individual country BF regressions for developed countries.

Table 2.

Linear individual country BF regressions for developed countries.

The balanced SUR results in columns 2 and 3 of Table 3 also show greater negative biasedness for developed countries, although less so compared with the OLS estimates.18 Nine of the 10 developed country s are negative, whereas negative estimates are found for eight of the 13 developing countries.19 However, the percentage of developed countries that are characterized by a significant negative bias (again shown in bold in the tables) drops to 60 percent after accounting for data dependence, and we observe a similar percentage for developing countries. A pooled unbalanced SUR model shows that both groups of countries are characterized by negative forward rate bias (see Table 4, column 4).20 However, the results in Table 4 (column 3) also show, like Frankel and Poonawala, greater biasedness for developed countries: for the group of developed countries is significantly less than zero, whereas the zero null cannot be rejected for the developing country group.

Table 3.

Seemingly unrelated regression estimates.

Table 4.

Pooled regressions via unbalanced SUR.

2.2. The Extended Panel

The regression results reported in Table 1, Table 2, Table 3 and Table 4, and those in most of the literature more broadly, should be viewed as descriptive at best. This is because the research disregards the problem of structural change.

The problem can already be seen in the results for the extended panel of countries and sample periods. When based on OLS regressions, we find that is considerably less negative in the extended samples for every developed country examined (see the last two columns in Table 1). Four of these countries now have positive estimates and the number of countries that are characterized by negative biasedness at the level drops from 17 to 12. The average OLS estimate for the developed country group falls in magnitude from to .

The OLS results for developing countries shows less evidence of structural change (see Table 2, last three columns). Frankel and Poonawala’s countries continue to be characterized largely by positive s (although the number falls from ten to eight) in the extended sample periods, with an average estimate for the group that is little changed at . The added 21 countries are also characterized by largely positive s (14 in total) with an average estimate for the added group that is little different than the original group at .

The unbalanced SUR results are suggestive of structural change for both groups of countries (see Table 3, the last two columns). Most developed and developing countries witness higher s compared with the original sample (seven of nine and nine of 11, respectively). All of the developing countries that remain from the original sample (recall that we drop Hong Kong and Saudi Arabia) are characterized by a positive full-sample . A Wald test of the null that the original and extended sample results are the same is rejected at the level (see the bottom of Table 3).21,22

Full-sample slope estimates for the added 17 developing countries (recall that we also dropped four developing euro-area countries and Bahrain and added Indonesia) are similar in character to those for Frankel and Poonawala’s original group of countries; the s are largely positive (13 of 17 and 11 of 11, respectively). The added countries’ s are also mostly less than unity at the level (10 of , although this is the case for only five of the original countries. The extended-panel results continue to show a greater number of negative slope estimates for developed countries. However, Frankel and Poonawala’s main finding—that developed countries are characterized by greater negative biasedness—is considerably weakened. The results are reported in the last three columns of Table 4. They show that both developed and developing countries are still characterized by a negative forward rate bias. However, the difference between the two country groups is much smaller in the extended panel than in the original panel. Indeed, the developing-country slope estimate is no longer significantly less than zero.

Taken as a whole, the original and extended panel results suggest that the BF regression’s results depend on the time period examined.

3. The Changing Nature of Forward Rate Biasedness

We now investigate systematically the BF regression’s instability across developed and developing countries. Other studies examine this instability, but mostly for a sample of either developed or developing countries. Many studies test for one or more exogenously imposed breaks in a sample of developed countries and report strong evidence of structural change.23 Researchers have also used ad hoc procedures to identify subperiods in the data that are characterized by high or low volatility of returns (Clarida et al. (2009)) or money growth (Moore and Roche (2012)). They report estimates that are negative during low volatility regimes and positive during high volatility regimes. Moore and Roche (2012) is one of the few studies that examines the instability for both developed and developing countries. They find that varies with the volatility regime for both groups of countries.

Several studies employ endogenous structural change tests that allow for multiple break points at unknown dates. Bekaert and Hodrick (1993) and MacDonald and Nagayasu (2015) estimate a two-state Markov-switching model for the largest developed countries. They find that varies with the volatility regime. Bai and Mollick (2010) and Baillie and Cho (2014) employ Bai and Perron’s (1998, 2003a, 2003b) sequential test procedure, the former for a sample of developing countries and the latter for a sample of developed countries. They find that financial crisis triggers shifts in from negative to positive values.24 All of these studies find evidence of multiple break points.

In order to examine the instability of the BF regression, we make use of Bai and Perron’s (1998, 2003a, 2003b) sequential test approach.25 The test procedure has several advantages for our purposes over the Markov-switching approach. Bekaert and Hodrick’s (1993) and MacDonald and Nagayasu’s (2015) Markov-switching models assume that any structural change involves a switch between only two possible states, thereby assuming that all structural changes are of the same size. This model also assumes that the timing of these changes is governed by a fixed probability distribution. By contrast, the Bai and Perron procedure leaves open the timing and magnitude of the structural changes in the BF regression.

One limitation of Bai and Perron’s test is that its sequential procedure tends to stop too early in the search for breaks (Perron (2006)). To address this problem, we combine the sequential procedure with the double maximum tests proposed by Bai and Perron (1998), following the recommendations of Perron (2006) and Bai and Perron (2003b). We first employ the double maximum test. If the test indicates a break, we continue with the sequential procedure to look for additional break points, conditional on the break point found by the double maximum test.26 If neither of the two tests indicate a break for a country, we conclude with no breaks (this was the case only for Bahrain).27

The estimated break points, in turn, give rise to multiple subperiods with distinct s. The unbalanced SUR model that we estimate below implies a system in which the number of equations equals the number of countries times the number of distinct subperiods. Small subperiods decrease the accuracy of our estimates, while increasing the variance-covariance matrix’s size and thus the model’s computational demands. To address these problems, we restrict the size of a subperiod to twelve months or longer (with exceptions for the first and the last subperiods). As such, we drop any break point that falls within this minimum bound.28,29

In carrying out the structural change analysis, we augment the BF regression with lags of both the left- and right-hand side variables via an ADL(2,2) specification. The dynamic specification accounts for autocorrelated errors, which are typical with persistent variables like the forward premium.30

3.1. More Frequent Structural Change

Our structural change analysis examines the BF regression’s stability for nine developed countries (including the euro area) and 28 developing countries (Estonia, Latvia, Lithuania, and Slovenia are treated as part of the euro area), including Slovakia, whose sample period runs from March 2002 through November 2005 (recall that we dropped Hong Kong, Saudi Arabia, and Bahrain). Table 5a,b report summary results on the frequency of structural change in our panel. Column 2 of the tables shows the number of break points identified for each country. The full set of change dates is reported in Table A1 in the Appendix A. We find that the frequency of structural change in the BF regression is higher for both developed and developing countries than previously reported. The number of break points for both groups of countries varies considerably, in part because of variation in sample sizes. The number of break points ranges from a low of four to a high of 10 for developed countries and from a low of one to a high of 10 for developing countries. The average number of breaks is and for the developed and developing groups, respectively.

Table 5.

Linear individual country BF regressions for developed countries.

In order to account for differences in sample sizes, we compute the average number of break points per decade for each country (column 3 in the tables). We would have expected that developing countries would be characterized by considerably more structural change, given their greater vulnerability to macroeconomic and political instability. However, the average number of break points per decade for developed countries is not so different than the number for developing countries, at and , respectively. Table 6 reports a difference in means test for these averages (column 2). The test compares the average number of breaks per decade for developed and developing countries via a two-sample t-test. Hence, this is a descriptive result. The test is suggestive that the difference is significant, with a p-value equal to .

Table 6.

Difference in means tests.

3.2. Is Not Always Less Than Unity

The break points reported in Table A1 imply multiple subperiods or regimes for which the hypothesis of no structural change cannot be rejected. We use these results and estimate the BF regression in the distinct regimes for each country in our panel. In order to correct for correlation in the data, we make use of an unbalanced SUR model, which is estimated by the approach described by McDowell (2004). The regression estimates the subperiod s for all developed and developing countries as a system, thereby accounting for correlations across countries and making the model temporally nonlinear.

The subperiod estimates give rise to a piecewise linear specification of returns for each country. If the subperiod s were uniformly less than unity, betting against the forward rate would continue to yield predictable profits despite the slope coefficient’s instability (assuming ). Bekaert and Hodrick’s (1993) and MacDonald and Nagayasu’s (2015) Markov-switching results suggest that this is the case; they find a for both states of nature.

However, test procedures that leave open the number, timing, and magnitude of the structural changes show that is not always less than unity. The full set of subsample estimates for each country are reported in Table A1. We summarize the results in the last six columns of Table 5a,b. Columns 4 and 5 report the number of regimes for which the estimated bias is found to be less than and greater than unity, respectively. Columns 6 and 7 show the number of estimated biases that are significantly negative and positive (at the level), respectively, while columns 8 and 9 report the number of negative and positive biases per decade.

We find that cannot be rejected in roughly half of the regimes for most countries in both groups. This finding is not surprising given the much shorter subperiod samples. We also find that nearly all countries are characterized by multiple regimes in which and other regimes in which .31

The pronounced instability vitiates the view that forward rate biasedness is more negative for developed than developing countries. Moreover, assuming away the instability misses revealing patterns in the biasedness across the two groups of countries. These patterns shed light on the literature’s linear regression estimates. They also point towards the importance of risk in driving currency markets.

3.3. Two Key Patterns

Two key patterns emerge from the subperiod slope estimates. One pattern is shared by both developed and developing countries: regimes with a negative bias occur more frequently than those with a positive bias. The other pattern reveals an important difference across the two country groups: the size of the subperiod biases, both negative and positive, is much larger for developed countries.

3.3.1. Negative-Bias Subperiods Are More Frequent

Table 5a,b, columns 4 and 5, show that the regimes in which occur roughly twice as often in our sample on average as those in which for both country groups: and , respectively, for developed countries and and , respectively, for developing countries. Difference in means tests (which are reported at the bottom of the tables and again should be treated as descriptive) indicate that the number of negative biases is significantly higher than the number of positive biases for both groups of countries. Moreover, the average of the ratios of positive to negative estimated biases for developed countries is little different than that for developing countries, at and , respectively. These averages are reported in Table 6, column 3, along with a difference in means test, which suggests a small difference. Again, the tests in Table 6 should be viewed only as descriptive since they do not account for the dependence across countries.

The greater number of negative estimated biases for both groups of countries could be a result of sample sizes. To check this possibility, we examine the number of positive and negative biases per decade for each country (columns 8 and 9 in the tables). We find that the scaled figures deliver a similar result: the number of negative biases on average is roughly twice the number of positive biases for developed and developing countries, respectively. We also examine the ratio of positive to negative estimated biases for each country per decade. Table 6 (column 4) reports the average ratio for developed and developing countries, along with a difference in means test. The test is suggestive that the difference is not large.

The higher frequency of negative-bias subperiods is suggestive that carry trade strategies, which bet against the forward rate, are profitable over prolonged stretches of time in both developed and developing countries. Burnside et al. (2007, 2011b), and others report such profitability. However, our structural change results imply that carry trade returns are time dependent and risky.32 Time periods that are characterized by a and carry trade profits are eventually followed by a time period with a and carry trade losses.

3.3.2. Developed Countries Have Larger Biases

Table 7 and Table 8 (columns 2 and 3) report the average size of the estimated negative and positive subperiod biases for the two country groups. We find that the negative and positive biases for developed countries— and , respectively—are roughly and 4 times larger on average, respectively, than the negative and positive biases for developing countries— and , respectively. We see similar patterns when we compute averages of only the significant s (columns 4 and 5 in the tables) or consider a weighted average of the s using as weights the number of observations in a subperiod (columns 6 and 7 in the tables). Statistical tests reported in Table 9 (columns 2–5) show that the size differences in both the negative and positive biases across developed and developing countries are largely significant. The tests take into account the variance–covariance matrix of the unbalanced nonlinear SUR regression.33

Table 7.

Average forward rate bias across regimes: developed countries.

Table 8.

Average forward rate bias across regimes: developed countries.

Table 9.

Difference in means tests.

3.3.3. Origins of Linear Regression Results

The two key patterns show the origins of the literature’s linear regression findings. The negative biasedness found for both developed and developing countries arises from the greater frequency of regimes for which . The larger negative bias that Frankel and Poonawala (2010) and others report for developed countries stems from the much larger subperiod biases for this group.

The results for the developed countries stem in part from the behavior of the 1980s, which were characterized by large swings in dollar exchange rates. The developing-country samples miss this period, which may underpin the larger biases for developed countries.34 In order to check this possibility, we analyze the biases of the developed countries for truncated samples that start in the 1990s.35

Table 10 reports these results. We find that the size of the estimated biases for developed countries is, for the most part, even greater than when the 1980s are omitted from the sample. They continue to show that the size of both negative and positive biases is larger for developed than developing countries. The last four columns of Table 9 show that the differences continue to be significant for this time period.

Table 10.

Average forward rate bias across regimes: developed countries.

4. Unpredictability and Imperfect Knowledge

The pronounced instability of forward rate biasedness implies that currency returns are not predictable on the basis of the linear BF model. However, currency returns may nonetheless be predictable. The question turns on whether the instability can be modeled ex ante with a probability rule. Goldberg et al. (Forthcoming) examine this question for six developed-country markets. They consider the out-of-sample predictive performance of Markov-switching and other nonlinear regression models. They find that the nonlinear models have little or no predictive power.36

This finding is supportive of the main premise of imperfect knowledge economics: the process underpinning economic outcomes undergoes change at points in time and in ways that cannot be characterized ex ante with the same probability rule at all points in time. Frydman and Goldberg (2013a, 2013b); Frydman et al. (2015) argue that this Knightian uncertainty arises because structural change in financial markets and the broader economy is triggered in part by historical developments that are to some extent novel. Examples include the appointment of a new central bank governor or Treasury Secretary, shifts in exchange rate policy, German reunification, and financial crises. The novelty of these events implies that they are to some extent non-repetitive and that their impact on returns “deal[s] with situations which are far too unique...[to rely solely on] statistical tabulations” Knight (1921), p. 198.

Consequently, the structural shifts that they trigger are unlikely to be characterized by a stable probability rule.

The corpus of Johansen and Juselius’s empirical work on currency markets provides considerable evidence of a connection between structural change and novel historical developments. In nearly all of their CVAR studies, they have had to include equilibrium mean shifts, broken trends, and a series of various dummies to account for the impact of major policy changes and other novel historical developments. Juselius (2017b) is a case in point. The study estimates a CVAR for the German mark-U.S. dollar exchange rate. It finds that a well specified unrestricted model requires: (1) a broken trend and step dummy in January 1991 to control for German reunification; (2) an impulse dummy to account for three new German excise taxes to pay for reunification; and (3) intervention dummies to account for large shocks to U.S. goods and bond prices in the aftermath of the 1985 Plaza Accord.

There is also considerable evidence in the broader literature that structural change in financial markets is triggered by novel historical developments.37 These developments are not mere repetitions of events in the past. As such, no probabilistic rule that was estimated on ex post data are likely to enable one to predict their timing or character, let alone their quantitative impact on the process underpinning asset returns.

Our structural change results provide additional evidence of a connection between structural change and novel historical developments. The full set of break points for developed and developing countries (see Table A1) show that breaks are proximate to major historical developments. For example, one or more break points that are proximate to the 2008 global financial crisis are found for nearly all countries. In many cases, the instability involved a change in the sign of the forward rate bias. Not surprisingly, Baillie and Cho (2014) and Daniel et al. (2017) find that carry trade strategies produced large losses after 2008. Few economists or market participants predicted the financial crisis, let alone its impact on currency markets and forward rate bias.

5. Developed Countries Are More Risky Not Less Rational

The BF regression’s instability implies that conclusions based on the linear model about the rationality or irrationality of currency markets in general, or developed countries’ relative irrationality in particular, are unfounded. Moreover, the structural change results in Table 5, Table 6, Table 7, Table 8 and Table 9 point instead to the importance of risk in driving currency returns and in understanding forward rate biasedness across developed and developing countries.

A common measure of risk in financial markets is the volatility of returns. However, volatility measures suffer from the problem of structural change: the basic properties of market data are not the same during crisis and noncrisis periods (e.g., see Jorion (2009)). Indeed, market volatility tends to fall during large price upswings away from benchmark values. However, it is precisely during these periods that risk rises, as markets become more vulnerable to sudden structural change that is accompanied by large and sustained price reversals. This behavior lends support to IKE’s alternative risk premium model, which implies that growing departures from benchmark values lead to greater risk for investors who bet on even larger departures from benchmark values. The findings of Juselius and Assenmacher (2017), Juselius and Stillwagon (2018), Cavusoglu et al. (2020), and others provide strong support for this alternative measure of risk.

This research suggests that the frequency and magnitude of the instability in the BF regression provide useful additional measures of market risk.38 In terms of the forward rate puzzle, the carry trade’s ability to generate profits or losses depends on the sign and size of the bias. A negative bias implies profits on average, whereas a positive bias implies losses. In addition, the larger the size of the bias, the greater are the positive or negative returns. Consequently, a greater frequency or magnitude of structural change in the BF regression implies greater risk in betting against (or with) the forward rate.

The instability results reported in Table 5a,b show that currency markets and carry trade strategies are riskier than what is suggested by the literature’s linear regression results. In terms of the prevalence of structural change, and the frequency with which negative- and positive-bias regimes occur, developed and developing countries are comparably risky.

However, as we saw in Table 7, Table 8, Table 9 and Table 10, the size of both the negative and positive biases is larger for developed countries than developing countries. This finding implies greater profits to carry trade strategies in developed countries during regimes with a negative bias, but also greater losses during regimes with a positive bias. It also suggests that the magnitude of the structural changes that occur in developed-country markets is on average much greater than in developing-country markets.

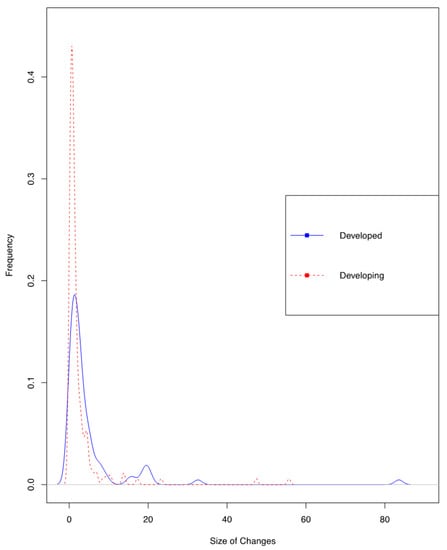

We find that this is the case. The size difference is easy to spot in Figure 2, which provides frequency distributions of the absolute value of the changes in that occurred across the distinct subperiods for each country, one for the developed countries (the solid blue line), and the other for developing countries (the dashed red line). We find that the mean of the structural changes for the group of developed countries () is roughly twice the mean change for the group of developing countries (). A descriptive difference in means test is suggestive that the difference is large. We also employ an ks-test, which is suggestive that the distributions for the two country groups are different.

Figure 2.

Absolute changes in across subperiods.

The results imply that betting against (with) the forward rate in developed-country markets delivers higher profits than in developing-country markets during subperiods in which the forward rate bias is negative (positive). However, they also imply that speculation in the major markets is much more risky relative to developing-country markets than previously thought.

6. Conclusions

The structural change results reported in this paper indicate that the literature’s linear-regression findings lead to spurious conclusions about the importance of rationality and risk in developed- and developing-country currency markets. The BF regression’s instability and lack of predictive power imply that the widespread claims of currency markets’ irrationality are premature at best. The connection between structural change and novel historical developments suggests that imperfect knowledge and not irrationally is key to understanding these markets. The instability findings also indicate that developed-country markets are riskier than those in developing countries.

An open question is whether any of the risk factors considered in the literature can explain (1) why subperiods with a negative forward rate bias occur nearly twice as often as subperiods with a positive bias; and (2) why the subperiod biases (both negative and positive) are on average much larger for developed countries. The findings of Juselius (1992, 1995, 2014, 2017a, 2017b); Johansen and Juselius (1992); Juselius and MacDonald (2004); Juselius and Assenmacher (2017); Johansen et al. (2010) and Juselius and Stillwagon (2018) suggest that the IKE gap measure of risk is a good place to start.

Author Contributions

Conceptualization and methodology, M.D.G. and O.K.; empirical analysis, O.K. and D.O.; writing, M.D.G., O.K., D.O.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received funding from the Institute for New Economic Thinking and the University of New Hampshire.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Subperiod coefficients and corresponding break dates.

Table A1.

Subperiod coefficients and corresponding break dates.

| Country/Subperiod | Total # of Observations | Coefficient | Std. Error | Break Dates | Number of Months per Subperiod |

|---|---|---|---|---|---|

| Developed | |||||

| Australia | 373 | −0.3082 | 0.5984 | 1999-06 | 175 |

| −8.6771 | 13.7382 | 2001-02 | 20 | ||

| −0.6493 | 1.1689 | 2008-06 | 88 | ||

| −0.7285 | 2.8214 | 2010-1 | 19 | ||

| 0.4062 | 0.9101 | 71 | |||

| Canada | 373 | −0.2389 | 0.9779 | 1987-04 | 29 |

| −1.4654 | 1.0122 | 1989-11 | 31 | ||

| 0.2372 | 0.6406 | 1993-08 | 45 | ||

| −2.6832 | 2.1780 | 1995-04 | 20 | ||

| −1.2089 | 1.5584 | 2001-10 | 78 | ||

| −9.5507 | 5.0584 | 2003-04 | 18 | ||

| 1.0208 | 3.9075 | 2006-02 | 34 | ||

| 7.5901 | 4.6161 | 2007-09 | 19 | ||

| −19.5800 | 9.8565 | 2009-03 | 18 | ||

| 2.8892 | 2.4325 | 2014-06 | 63 | ||

| 19.6943 | 7.9364 | 18 | |||

| Euro Area | 478 | 0.4528 | 0.7482 | 1978-11 | 33 |

| 0.0321 | 0.9964 | 1981-09 | 34 | ||

| −2.1309 | 0.9799 | 1984-05 | 32 | ||

| 2.8425 | 1.1327 | 1988-1 | 44 | ||

| 0.0923 | 0.8849 | 1991-07 | 42 | ||

| 3.2566 | 4.2712 | 1995-04 | 45 | ||

| −2.4436 | 1.1624 | 2000-12 | 68 | ||

| −5.2466 | 2.1608 | 2005-1 | 49 | ||

| 0.4328 | 1.5662 | 2008-12 | 47 | ||

| −1.8837 | 5.8379 | 2014-03 | 63 | ||

| −7.3366 | 8.4644 | 21 | |||

| Japan | 386 | 0.1118 | 1.0256 | 1990-09 | 83 |

| 1.8287 | 2.5877 | 1995-03 | 54 | ||

| −1.9918 | 1.1511 | 1998-07 | 40 | ||

| 2.7793 | 1.8288 | 2000-02 | 19 | ||

| −1.4243 | 0.6852 | 2007-05 | 87 | ||

| 5.6131 | 2.6862 | 2012-10 | 65 | ||

| 83.5468 | 30.6330 | 2014-05 | 19 | ||

| −5.2268 | 9.2788 | 19 | |||

| New Zealand | 492 | −2.2846 | 1.3259 | 1978-02 | 39 |

| 4.8323 | 1.8153 | 1980-09 | 31 | ||

| −1.0799 | 1.8461 | 1984-10 | 49 | ||

| 2.7421 | 6.3360 | 1986-10 | 24 | ||

| −0.6085 | 2.6035 | 1989-07 | 33 | ||

| 0.5230 | 0.6438 | 1996-05 | 82 | ||

| −3.7483 | 2.4294 | 1998-05 | 24 | ||

| −4.4428 | 1.6941 | 2006-06 | 97 | ||

| 6.6367 | 3.2458 | 2009-02 | 32 | ||

| -20.5526 | 24.2922 | 2011-03 | 25 | ||

| −1.7211 | 5.4291 | 56 | |||

| Norway | 373 | −0.9166 | 1.0722 | 1986-11 | 24 |

| −0.7687 | 0.6134 | 1989-12 | 37 | ||

| 0.0000 | NA | 1991-06 | 18 | ||

| 0.5360 | 1.0065 | 1993-04 | 22 | ||

| 2.7532 | 2.9482 | 1995-02 | 22 | ||

| −1.7781 | 1.5888 | 2001-06 | 76 | ||

| −1.0843 | 0.8722 | 2008-06 | 84 | ||

| 5.1275 | 3.4849 | 2009-12 | 18 | ||

| 1.6363 | 2.7222 | 2011-11 | 23 | ||

| 1.8358 | 2.6974 | 2014-05 | 30 | ||

| 15.1781 | 6.6951 | 19 | |||

| Sweden | 373 | −2.4596 | 0.7969 | 1987-11 | 36 |

| 0.7971 | 2.1823 | 1989-08 | 21 | ||

| 0.1666 | 0.9902 | 1991-07 | 23 | ||

| 2.5192 | 1.6961 | 1993-1 | 18 | ||

| −1.0084 | 1.2543 | 1998-12 | 71 | ||

| −2.9010 | 1.8458 | 2001-05 | 29 | ||

| −5.2160 | 1.5676 | 2005-10 | 53 | ||

| 2.6345 | 1.4783 | 2008-06 | 32 | ||

| 19.3950 | 5.7027 | 2010-04 | 22 | ||

| 0.8363 | 2.2597 | 2014-02 | 46 | ||

| 1.8842 | 7.1255 | 22 | |||

| Switzerland | 386 | −0.4233 | 0.9348 | 1986-08 | 34 |

| −0.6516 | 1.2321 | 1990-07 | 47 | ||

| 3.2036 | 3.0870 | 1992-03 | 20 | ||

| −0.8667 | 0.7235 | 2007-05 | 182 | ||

| 4.2475 | 4.1783 | 2009-03 | 22 | ||

| 16.3319 | 12.9444 | 2010-12 | 21 | ||

| −32.6304 | 27.5562 | 2012-07 | 19 | ||

| −2.8336 | 6.4644 | 41 | |||

| UK | 386 | −7.5512 | 2.8635 | 1985-06 | 20 |

| −1.8967 | 1.3367 | 1987-05 | 23 | ||

| −2.8908 | 2.3169 | 1988-12 | 19 | ||

| −1.8905 | 1.2130 | 1990-09 | 21 | ||

| 1.1869 | 1.2998 | 1992-07 | 22 | ||

| 4.5790 | 1.5620 | 1994-06 | 23 | ||

| −2.2244 | 1.3260 | 2003-04 | 106 | ||

| −0.8953 | 2.4753 | 2004-11 | 19 | ||

| 4.4470 | 2.3033 | 2008-06 | 43 | ||

| 18.4322 | 10.6962 | 2010-1 | 19 | ||

| −3.8585 | 6.7086 | 71 | |||

| Developing | |||||

| Argentina | 141 | −0.0958 | 0.5646 | 2004-11 | 8 |

| 0.7673 | 0.3107 | 2007-12 | 37 | ||

| 0.2887 | 0.0363 | 2008-12 | 12 | ||

| 0.4860 | 0.1059 | 2012-06 | 42 | ||

| 1.1154 | 0.2744 | 2013-12 | 18 | ||

| 0.3883 | 0.0672 | 2015-06 | 18 | ||

| 0.9347 | 0.0776 | 6 | |||

| Brazil | 186 | 0.9088 | 0.0403 | 2002-12 | 30 |

| 0.9866 | 0.1477 | 2004-06 | 18 | ||

| 0.0000 | NA | 2006-05 | 23 | ||

| 0.0000 | NA | 2014-06 | 97 | ||

| −0.0648 | 0.0248 | 18 | |||

| Bulgaria | 141 | -3.5688 | 2.9220 | 2004-11 | 8 |

| 0.4379 | 1.4784 | 2008-06 | 43 | ||

| 0.4148 | 2.4357 | 2009-11 | 17 | ||

| 4.5024 | 5.9976 | 2011-05 | 18 | ||

| 13.7375 | 7.3284 | 2014-04 | 35 | ||

| −55.6967 | 30.6570 | 20 | |||

| Chile | 141 | −13.8590 | 17.0886 | 2005-06 | 15 |

| −10.0127 | 17.1859 | 2007-1 | 19 | ||

| −17.2676 | 7.8673 | 2008-02 | 13 | ||

| 0.7853 | 4.4646 | 2009-02 | 12 | ||

| −2.5543 | 7.6903 | 2010-02 | 12 | ||

| 1.5528 | 2.8893 | 2011-09 | 19 | ||

| 1.3136 | 0.6464 | 51 | |||

| China | 125 | 0.5924 | 0.1354 | 2007-08 | 25 |

| 0.7590 | 0.1756 | 2010-08 | 36 | ||

| 1.6309 | 0.5411 | 2012-1 | 17 | ||

| −1.1263 | 0.3327 | 2013-12 | 23 | ||

| 0.1817 | 0.4695 | 2015-04 | 16 | ||

| 2.8581 | 1.6522 | 8 | |||

| Colombia | 202 | 1.3873 | 0.3123 | 2006-07 | 89 |

| −1.0140 | 0.4726 | 2008-06 | 23 | ||

| 1.8736 | 0.5124 | 2014-02 | 68 | ||

| 5.6470 | 2.7517 | 22 | |||

| Czech Rep. | 228 | 0.8126 | 0.7866 | 1998-11 | 23 |

| 5.4488 | 4.3751 | 2001-05 | 30 | ||

| −4.9186 | 1.9831 | 2005-10 | 53 | ||

| 2.7161 | 1.5110 | 2008-02 | 28 | ||

| 4.3070 | 10.2054 | 2010-03 | 25 | ||

| −23.3166 | 29.1053 | 2011-05 | 14 | ||

| −4.5362 | 4.3501 | 55 | |||

| Hungary | 218 | 1.0809 | 0.2567 | 2000-09 | 35 |

| −1.4584 | 0.6682 | 2003-04 | 31 | ||

| −0.7277 | 0.4705 | 2005-10 | 30 | ||

| −6.9917 | 3.8187 | 2006-11 | 13 | ||

| −2.8764 | 2.3553 | 2008-06 | 19 | ||

| 1.6251 | 1.6403 | 2010-04 | 22 | ||

| 0.2695 | 1.9366 | 2011-12 | 20 | ||

| 0.4686 | 1.1248 | 48 | |||

| India | 218 | 0.4456 | 0.1802 | 2002-05 | 55 |

| −1.7245 | 0.4493 | 2004-03 | 22 | ||

| −0.1465 | 0.9981 | 2006-06 | 27 | ||

| −2.5408 | 0.9615 | 2008-03 | 21 | ||

| 0.5489 | 1.3950 | 2009-03 | 12 | ||

| 0.1722 | 2.2994 | 2010-03 | 12 | ||

| −0.1679 | 0.7296 | 2011-03 | 12 | ||

| 1.2974 | 0.7176 | 2013-02 | 23 | ||

| 0.5237 | 0.5032 | 34 | |||

| Indonesia | 228 | 3.8981 | 1.9813 | 1998-05 | 17 |

| 0.1566 | 0.1551 | 211 | |||

| Israel | 210 | −0.4982 | 0.3219 | 2008-04 | 118 |

| 0.4819 | 0.7938 | 92 | |||

| Kuwait | 307 | 1.7744 | 0.8420 | 1993 | 32 |

| −0.3105 | 0.3083 | 2006-04 | 159 | ||

| 4.3963 | 1.7924 | 2007-11 | 19 | ||

| 3.7145 | 1.0172 | 2009-02 | 15 | ||

| −0.5747 | 1.1904 | 2011-07 | 29 | ||

| 1.6385 | 0.6491 | 53 | |||

| Malaysia | 125 | -4.2645 | 8.0502 | 2008-11 | 40 |

| −0.0281 | 0.0172 | 85 | |||

| Mexico | 228 | 0.6822 | 0.4218 | 1998-08 | 20 |

| −0.1806 | 0.2565 | 2001-02 | 30 | ||

| 0.3187 | 0.7664 | 2003-02 | 24 | ||

| −0.1820 | 0.4709 | 2006-05 | 39 | ||

| 1.5004 | 1.0725 | 2009-1 | 32 | ||

| −1.0894 | 1.3735 | 2011-06 | 29 | ||

| 0.5518 | 1.1641 | 2014-08 | 38 | ||

| 6.8058 | 2.3260 | 16 | |||

| Morocco | 141 | −0.1280 | 1.0689 | 2005-02 | 11 |

| 0.1180 | 0.4491 | 2008-05 | 39 | ||

| −0.1794 | 0.5143 | 2009-11 | 18 | ||

| 1.8136 | 0.8844 | 2011-05 | 18 | ||

| 1.6589 | 0.8872 | 2012-07 | 14 | ||

| −0.8132 | 0.6044 | 2014-07 | 24 | ||

| 1.1329 | 0.5115 | 17 | |||

| Pakistan | 212 | 0.0638 | 0.0573 | 1999-04 | 12 |

| 1.3060 | 0.4875 | 2000-07 | 15 | ||

| 0.4743 | 0.2151 | 2008-02 | 91 | ||

| 0.5902 | 0.1446 | 94 | |||

| Peru | 141 | 0.0831 | 0.4122 | 2005-07 | 16 |

| −2.2890 | 1.7241 | 2007-08 | 25 | ||

| 2.4383 | 1.5624 | 2008-08 | 12 | ||

| −0.8687 | 1.5976 | 2009-09 | 13 | ||

| −2.1029 | 0.5409 | 2013 | 40 | ||

| 0.5476 | 0.3679 | 2014-07 | 18 | ||

| 1.5442 | 0.4653 | 17 | |||

| Philippines | 228 | 2.5033 | 0.8389 | 1998-08 | 20 |

| −0.9631 | 0.8221 | 2000-04 | 20 | ||

| 1.4522 | 0.8622 | 2001-06 | 14 | ||

| 0.3668 | 0.3465 | 2004-11 | 41 | ||

| −2.0437 | 0.9682 | 2006-05 | 18 | ||

| −6.1869 | 3.1264 | 2008-1 | 20 | ||

| 1.6098 | 1.1308 | 2009-07 | 18 | ||

| −1.1853 | 0.6464 | 77 | |||

| Poland | 232 | 0.6382 | 0.2803 | 2000-09 | 49 |

| −0.5078 | 0.5407 | 2004-04 | 43 | ||

| −3.4396 | 1.9701 | 2005-06 | 14 | ||

| −1.2795 | 3.8595 | 2008-06 | 36 | ||

| 4.6760 | 2.9489 | 2010-11 | 29 | ||

| 2.8072 | 3.2026 | 2011-12 | 13 | ||

| 0.1432 | 1.4978 | 2014-06 | 30 | ||

| 9.3328 | 3.6071 | 18 | |||

| Romania | 141 | −1.0197 | 0.5550 | 2005 | 10 |

| −0.4703 | 1.7485 | 2007-10 | 33 | ||

| 1.6233 | 1.2055 | 2009-02 | 16 | ||

| −0.1026 | 0.7470 | 2010-08 | 18 | ||

| 1.4124 | 1.5923 | 2012-07 | 23 | ||

| −1.1989 | 1.2713 | 2014-06 | 23 | ||

| 10.5916 | 3.2499 | 18 | |||

| Russia | 141 | 0.8047 | 0.4158 | 2005-06 | 15 |

| −1.2353 | 1.1216 | 2006-10 | 16 | ||

| −2.1772 | 1.7489 | 2008-06 | 20 | ||

| 2.0998 | 0.5678 | 2009-07 | 13 | ||

| −1.2113 | 1.9413 | 2010-08 | 13 | ||

| 0.2709 | 3.1239 | 2011-09 | 13 | ||

| 0.6228 | 1.4569 | 2012-10 | 13 | ||

| 3.6984 | 1.4420 | 2014-10 | 24 | ||

| 1.7015 | 1.5434 | 14 | |||

| South Africa | 307 | 0.8543 | 0.2783 | 1995-12 | 67 |

| 0.8414 | 0.7293 | 1997-03 | 15 | ||

| 2.8378 | 1.2608 | 1998-06 | 15 | ||

| 0.8760 | 0.7424 | 2001-08 | 38 | ||

| −0.8895 | 1.2953 | 2003-04 | 20 | ||

| −2.1292 | 1.5756 | 2004-11 | 19 | ||

| 1.1902 | 3.2008 | 2006-04 | 17 | ||

| 0.7352 | 2.2410 | 2007-11 | 19 | ||

| 0.7370 | 1.8149 | 2009-02 | 15 | ||

| 0.6433 | 0.7325 | 2013-08 | 54 | ||

| 0.0000 | NA | 28 | |||

| South Korea | 213 | 1.2408 | 1.0681 | 1999-03 | 12 |

| −8.5410 | 2.2965 | 2000-10 | 19 | ||

| −0.3671 | 0.5255 | 2004-09 | 47 | ||

| −0.4782 | 0.8521 | 2006-05 | 20 | ||

| 0.8593 | 0.4506 | 2008-1 | 20 | ||

| 0.6694 | 1.0405 | 2009-12 | 23 | ||

| 2.9395 | 0.4449 | 2011-04 | 16 | ||

| 0.4545 | 2.2550 | 2013-04 | 24 | ||

| −1.0332 | 1.9164 | 32 | |||

| Slovakia | 45 | −2.8608 | 1.1622 | 2004-1 | 23 |

| −3.1858 | 2.0160 | 2005-02 | 22 | ||

| 0 | NA | ||||

| Singapore | 373 | 0.5831 | 0.3100 | 1995-05 | 126 |

| 0.7140 | 1.3990 | 1997-12 | 31 | ||

| 0.9378 | 0.8768 | 2005-09 | 93 | ||

| 0.4908 | 0.6365 | 2008-11 | 38 | ||

| 2.0443 | 0.8051 | 2014-06 | 67 | ||

| 4.4078 | 3.8367 | 18 | |||

| Taiwan | 228 | 4.3931 | 1.4556 | 1998-08 | 20 |

| 1.0372 | 0.9006 | 2000-08 | 24 | ||

| 0.5288 | 0.9851 | 2002-06 | 22 | ||

| 0.8003 | 0.4580 | 2008-02 | 68 | ||

| −0.3337 | 0.6425 | 2010-12 | 34 | ||

| −1.5819 | 2.7336 | 2014-08 | 44 | ||

| −47.4316 | 15.4424 | 16 | |||

| Thailand | 221 | −0.2435 | 0.7765 | 1998-12 | 17 |

| −1.1262 | 1.1897 | 2001-06 | 30 | ||

| −3.2605 | 2.2530 | 2002-06 | 12 | ||

| −0.9522 | 0.4665 | 2007-06 | 60 | ||

| 0.8642 | 1.1569 | 2008-10 | 16 | ||

| −0.9202 | 0.4696 | 2013-03 | 53 | ||

| 0.6895 | 0.6123 | 33 | |||

| Turkey | 228 | 0.7387 | 0.0382 | 2001-1 | 49 |

| −0.0219 | 0.0426 | 2002-1 | 12 | ||

| 0.0671 | 0.0286 | 2010-1 | 96 | ||

| 0.0322 | 0.0124 | 2014-1 | 48 | ||

| 0.0269 | 0.0244 | 23 |

Values in bold denote negative and significant biases (at a 0.05 level).

References

- Ahmad, Rubi, Ghon Rhee, and Yuen Meng Wong. 2012. Foreign exchange market efficiency under recent crises: Asia-pacific focus. Journal of International Money and Finance 31: 1574–92. [Google Scholar] [CrossRef]

- Ang, Andrew, Joseph Chen, and Yuhang Xing. 2012. Downside risk. Review of Financial Studies 31: 1574–92. [Google Scholar]

- Ang, Andrew, and Alan Timmermann. 2012. Regime changes and financial markets. Annual Review of Financial Economics 4: 313–37. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 1998. Estimating and testing linear models with multiple structural changes. Econometrica 66: 47–78. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 2003a. Critical values for multiple structural change tests. The Econometrics Journal 6: 72–78. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 2003b. Computation and analysis of multiple structural change models. Journal of Applied Econometrics 18: 1–22. [Google Scholar] [CrossRef]

- Bai, Shuming, and Andre Varella Mollick. 2010. Currency crisis and the forward discount bias: Evidence from emerging economies under breaks. Journal of International Financial Markets, Institutions and Money 20: 556–74. [Google Scholar] [CrossRef]

- Baillie, Richard T., and Tim Bollerslev. 2000. The forward premium anomaly is not as bad as you think. Journal of International Money and Finance 19: 471–88. [Google Scholar] [CrossRef]

- Baillie, Richard T., and Dooyeon Cho. 2014. When carry trades in currency markets are not profitable. Review of Development Economics 18: 794–803. [Google Scholar] [CrossRef]

- Bansal, Ravi. 1997. An exploration of the forward premium puzzle in currency markets. Review of Financial Studies 10: 369–403. [Google Scholar] [CrossRef]

- Bansal, Ravi, and Magnus Dahlquist. 2000. The forward premium puzzle: Different tales from developed and emerging economies. Journal of International Economics 51: 115–44. [Google Scholar] [CrossRef]

- Beckmann, Joscha, Ansgar Belke, and Michael Kühl. 2006. The dollar-euro exchange rate and macroeconomic fundamentals: A time-varying coefficient approach. Review of World Economics 147: 11–40. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Robert J. Hodrick. 1993. On biases in the measurement of foreign exchange risk premiums. Journal of International Money and Finance 12: 115–38. [Google Scholar] [CrossRef]

- Bilson, John F. O. 1981. The speculative efficiency hypothesis. Journal of Business 54: 435–51. [Google Scholar] [CrossRef]

- Brunnermeier, Markus K., Stefan Nagel, and Lasse H. Pedersen. 2008. Carry trades and currency crashes. NBER Macroeconomics Annual 23: 313–47. [Google Scholar] [CrossRef]

- Burnside, Craig, Han Bing Hirshleifer David, and Tracy Yue Wang. 2011a. Investor overconfidence and the forward premium puzzle. Review of Economic Studies 78: 523–58. [Google Scholar] [CrossRef]

- Burnside, Craig, Martin S. Eichenbaum, and Sergio Rebelo. 2007. The returns to currency speculation in emerging markets. American Economic Review 97: 333–38. [Google Scholar] [CrossRef]

- Burnside, Craig, Martin S. Eichenbaum, and Sergio Rebelo. 2009. Understanding the forward premium puzzle: A microstructure approach. American Economic Journal: Macroeconomics 2: 127–54. [Google Scholar] [CrossRef]

- Burnside, Craig, Martin S. Eichenbaum, and Sergio Rebelo. 2011b. Carry trade and momentum in currency markets. NBER Working Paper, 16942. [Google Scholar]

- Cavusoglu, Nevin, Michael D. Goldberg, and Josh Stillwagon. 2020. Currency Returns and Downside risk: Debt, Volatility, and the Gap from Benchmark Values. Working Paper. Available online: https://www.ineteconomics.org/research/research-papers/new-evidence-on-the-portfolio-balance-approach-to-currency-returns (accessed on 30 October 2020).

- Chinn, Menzie D. 2006. The (partial) rehabilitation of interest rate parity in the floating rate era: Longer horizons, alternative expectations, and emerging markets. Journal of International Money and Finance 25: 7–21. [Google Scholar] [CrossRef]

- Clarida, Richard, Josh Davis, and Niels Pedersen. 2009. Currency carry trade regimes: Beyond the fama regression. Journal of International Money and Finance 28: 1373–89. [Google Scholar] [CrossRef]

- Clements, Michael P., and David F. Hendry. 1999. Forecasting Non- Stationary Economic Time Series. Cambridge: The MIT Press. [Google Scholar]

- Daniel, Kent, Robert J. Hodrick, and Zhongjin Lu. 2017. The Carry Trade: Risks and Drawdowns. Critical Finance Review 6: 211–262. [Google Scholar] [CrossRef]

- Deng, Ai, and Pierre Perron. 2008. A non-local perspective on the power properties of the cusum and cusum of squares tests for structural change. Journal of Econometrics 42: 212–40. [Google Scholar] [CrossRef]

- Engel, Charles A. 1996. The forward discount anomaly and the risk premium: A survey of recent evidence. Journal of Empirical Finance 3: 123–91. [Google Scholar] [CrossRef]

- Engel, Charles A. 2014. Exchange rates and interest parity. In Handbook of International Economics. Edited by Gita Gopinath, Elhanan Helpman and Kenneth Rogoff. Amsterdam: North-Holland, vol. IV, pp. 453–522. [Google Scholar]

- Fama, Eugene F. 1984. Forward and spot exchange rates. Journal of Monetary Economics 14: 319–38. [Google Scholar] [CrossRef]

- Flood, Robert P., and Andrew K. Rose. 2002. Uncovered Interest Parity in Crisis. International Monetary Fund Staff Papers 49: 252–66. [Google Scholar]

- Frankel, Jeffrey, and Jumana Poonawala. 2010. The forward market in emerging currencies: Less biased than in major currencies. Journal of International Money and Finance 29: 585–98. [Google Scholar] [CrossRef]

- Froot, Kenneth A., and Richard H. Thaler. 1990. Anomalies: Foreign exchange. Journal of Economic Perspectives 4: 179–92. [Google Scholar] [CrossRef]

- Frydman, Roman, Michael D. Goldberg, and Nicholas Mangee. 2015. Knightian uncertainty and stock-price movements: Why the reh present-value model failed empirically? Economics: The Open-Access, Open-Assessment E-Journal 9: 1–50. [Google Scholar] [CrossRef]

- Frydman, Roman, and Michael D. Goldberg. 2007. Imperfect Knowledge Economics: Exchange Rates and Risk. Princeton: Princeton University Press. [Google Scholar]

- Frydman, Roman, and Michael D. Goldberg. 2011. Beyond Mechanical Markets: Asset Price Swings, Risk, and the Role of the State. Princeton: Princeton University Press. [Google Scholar]

- Frydman, Roman, and Michael D. Goldberg. 2013a. Opening models of asset prices and risk to non-routine change. In Rethinking Expectations: The Way Forward for Macroeconomics. Edited by Roman Frydman and Edmund S. Phelps. Princeton: Princeton University Press, pp. 207–50. [Google Scholar]

- Frydman, Roman, and Michael D. Goldberg. 2013b. The imperfect knowledge imperative in modern macroeconomics and finance theory. In Rethinking Expectations: The Way Forward for Macroeconomics. Edited by Roman Frydman and Edmund S. Phelps. Princeton: Princeton University Press, pp. 130–65. [Google Scholar]

- Goldberg, Michael D., and Roman Frydman. 1996a. Imperfect knowledge and behavior in the foreign exchange market. Economic Journal 106: 869–93. [Google Scholar] [CrossRef]

- Goldberg, Michael D., and Roman Frydman. 1996b. Empirical exchange rate models and shifts in the co-integrating vector. Journal of Structural Change and Economic Dynamics 7: 55–78. [Google Scholar] [CrossRef]

- Goldberg, Michael, Olesia Kozlova, and Peter Sullivan. Forthcoming. Are currency returns really predictable?: Novel structural change and the forward rate anomaly. SSRN, forthcoming.

- Gourinchas, Pierre-Olivier, and Aaron Tornell. 2004. Exchange rate puzzles and distorted beliefs. Journal of International Economics 64: 303–33. [Google Scholar] [CrossRef]

- Goyal, Amit, and Ivo Welch. 2008. A comprehensive look at the empirical performance of equity premium prediction. The Review of Financial Studies 21: 1455–508. [Google Scholar]

- Hoover, Kevin D., Katarina Juselius, and Søren Johansen. 2008. Allowing the data to speak freely: The macroeconometrics of the cointegrated vector autoregression. American Economic Review 98: 251–55. [Google Scholar] [CrossRef]

- Ito, Hiro, and Menzie Chinn. 2007. Price-based measurement of financial globalization: A cross-country study of interest rate parity. Pacific Economic Review 12: 419–44. [Google Scholar] [CrossRef]

- Johansen, Sø ren, Katarina Juselius Roman Frydman, and Michael D. Goldberg. 2010. Testing hypotheses in an i(2) model with piece-wise linear trends. an analysis of the persistent long swings in the dmk/$ rate. Journal of Econometrics 158: 117–29. [Google Scholar] [CrossRef]

- Johansen, Sø ren, and Katarina Juselius. 1992. Testing structural hypotheses in a multivariate cointegration analysis of the ppp and the uip for uk. Journal of Econometrics 53: 211–44. [Google Scholar] [CrossRef]

- Jorion, Phillippe. 2009. Risk management lessons from the credit crisis. European Financial Management 15: 923–33. [Google Scholar] [CrossRef]

- Juselius, Katarina. 1992. Domestic and foreign effects on prices in an open economy: The case of denmark. Journal of Policy Modeling 14: 401–28. [Google Scholar] [CrossRef]

- Juselius, Katarina. 1995. Do the purchasing power parity and the uncovered interest rate parity hold in the long run?—an application of likelihood inference in a multivariate time series model. Journal of Econometrics 69: 211–40. [Google Scholar] [CrossRef]

- Juselius, Katarina. 2014. Testing for near i(2) trends when the signal-to-noise ratio is small. Economics—The Open-Access, Open-Assessment E-Journal 8: 1–30. [Google Scholar] [CrossRef]

- Juselius, Katarina. 2017a. A Cvar Scenario for a Standard Monetary Model Using Theory-Consistent Expectations. Discussion Papers 17-08. Copenhagen: Department of Economics, University of Copenhagen. [Google Scholar]

- Juselius, Katarina. 2017b. Using a theory-consistent cvar scenario to test an exchange rate model based on imperfect knowledge. Econometrics, MDPI, Open Access Journal 5: 1–20. [Google Scholar]

- Juselius, Katarina, and Katrin Assenmacher. 2017. Real exchange rate persistence and the excess return puzzle: The case of switzerland versus the us. Journal of Applied Econometrics 32: 1145–55. [Google Scholar] [CrossRef]

- Juselius, Katarina, and Ronald MacDonald. 2004. International parity relationships between the usa and japan. Japan and the World Economy 16: 17–34. [Google Scholar] [CrossRef]

- Juselius, Katarina, and Joshua Stillwagon. 2018. Are outcomes driving expectations or the other way around? an i(2) cvar analysis of interest rate expectations in the dollar/pound market. Journal of International Money and Finance 83: 93–105. [Google Scholar] [CrossRef]

- Knight, Frank Hyneman. 1921. Risk, Uncertainty and Profit. Boston: Houghton Mifflin, vol. 31. [Google Scholar]

- Lee, Byung-Joo. 2013. Uncovered interest parity puzzle: Asymmetric responses. International Review of Economics and Finance 27: 238–49. [Google Scholar] [CrossRef]

- Levich, Richard M. 1985. Empirical studies of exchange rates: Price behavior, rate determination and market efficiency. In Handbook of International Economics. Edited by Ronald W. Jones and Peter B. Kenen. Amsterdam: Elsevier, vol. 2, pp. 979–1040. [Google Scholar]

- Lewis, Karen K. 1995. Puzzles in international financial markets. In Handbook of International Economics. Edited by Gene M. Grossman and Kenneth Rogoff. Amsterdam: Elsevier, vol. 3, pp. 1913–17. [Google Scholar]

- Liu, Wei, and Alex Maynard. 2005. Testing forward rate unbiasedness allowing for persistent regressors. Journal of Empirical Finance 12: 613–28. [Google Scholar] [CrossRef]

- Lothian, James R., and Liuren Wu. 2011. Uncovered Interest- Rate Parity Over the Past Two Centuries. Journal of International Money and Finance 30: 448–73. [Google Scholar] [CrossRef]

- MacDonald, Ronald, and Jun Nagayasu. 2015. Currency Forecast Errors and Carry Trades at Times of Low Interest Rates: Evidence From Survey Data on the Yen/Dollar Exchange Rate. Journal of International Money and Finance 53: 1–19. [Google Scholar] [CrossRef]

- Mark, Nelson C., and Yangru Wu. 1998. Rethinking deviations from uncovered interest parity: The role of covariance risk and noise. Economic Journal 108: 1686–786. [Google Scholar] [CrossRef]

- Maynard, Alex. 2003. Testing for forward-rate unbiasedness: On regression in levels and in returns. Review of Economics and Statistics 85: 313–27. [Google Scholar] [CrossRef]

- McDowell, Allen. 2004. From the help desk: Seemingly unrelated regression with unbalanced equations. The Stata Journal 4: 442–48. [Google Scholar] [CrossRef]

- Melvin, Michael, and Mark P. Taylor. 2009. The crisis in the foreign exchange market. Journal of International Money and Finance 28: 1317–30. [Google Scholar] [CrossRef]

- Menkhoff, Lukas, Lucio Sarno Maik Schmeling, and Andreas Schrimpf. 2012. Carry trades and global foreign exchange volatility. Journal of Finance 67: 681–718. [Google Scholar] [CrossRef]

- Moore, Michael J., and Maurice J. Roche. 2012. When does uncovered interest parity hold? Journal of International Money and Finance 31: 865–79. [Google Scholar] [CrossRef]

- Nelson, Charles R., and Myung J. Kim. 1993. Predictable stock returns: The role of small sample bias. Journal of Finance 48: 641–61. [Google Scholar] [CrossRef]

- Obstfeld, Maurice, Rogoff Kenneth S., and Wren-Lewis Simon. 1996. Foundations of International Macroeconomics. Cambridge: MIT Press, vol. 30. [Google Scholar]

- Olmo, Jose, and Keith Pilbeam. 2011. Uncovered interest parity and the efficiency of the foreign exchange market: A re-examination. International Journal of Economics and Finance 16: 189–204. [Google Scholar] [CrossRef]

- Perron, Pierre. 2006. Dealing with structural breaks. In Palgrave Handbook of Econometrics, Vol. 1: Econometric Theory. Edited by Kerry Patterson and Terence C. Mills. London: Palgrave Macmillan, pp. 278–352. [Google Scholar]

- Pettenuzzo, Davide, and Alan Timmermann. 2011. Predictability of stock returns and asset allocation under structural breaks. Journal of Econometrics 164: 60–78. [Google Scholar] [CrossRef]

- Phillip, Bacchetta, and Eric van Wincoop. 2010. Infrequent portfolio decisions: A solution to the forward discount puzzle. American Economic Review 3: 870–904. [Google Scholar]

- Sarno, Lucio. 2005. Towards a solution to the puzzles in exchange rate economics: Where do we stand? Canadian Journal of Economics 38: 673–708. [Google Scholar] [CrossRef]

- Stambaugh, Robert F. 2006. Predictive regressions. Journal of Financial Economics 54: 375–421. [Google Scholar] [CrossRef]

- Zhu, Zhen. 2002. Time-varying forward bias and the expected excess return. Journal of International Financial Markets, Institutions and Money 12: 119–37. [Google Scholar] [CrossRef]

| 1. | For review articles, see Froot and Thaler (1990); Lewis (1995); Chinn (2006); Engel (1996, 2014); Sarno (2005). |

| 2. | See Burnside et al. (2011a); Gourinchas and Tornell (2004); Mark and Wu (1998); Phillip and van Wincoop (2010). |

| 3. | An IKE risk premium model is developed in (Frydman and Goldberg 2007, 2013a). |

| 4. | Juselius (1995) was the first to present evidence of this positive equilibrium relationship. See also (Juselius 1992, 2014, 2017a, 2017b); Cavusoglu et al. (2020); Frydman and Goldberg (2007); Hoover et al. (2008); Johansen and Juselius (1992); Johansen et al. (2010); Juselius and MacDonald (2004). See Brunnermeier et al. (2008), and Menkhoff et al. (2012) for additional evidence of downside risk in currency markets. In stock markets, see Ang et al. (2012). |

| 5. | For example, see Bansal and Dahlquist (2000); Chinn (2006); Flood and Rose (2002); Frankel and Poonawala (2010); Ito and Chinn (2007); Lee (2013). |

| 6. | To account for greater irrationality, Burnside et al. (2009) develop a model in which informed speculators’ access to private information matters more in developed countries. Burnside et al. (2011a) assumes that market participants systematically overreact to information about future inflation. Phillip and van Wincoop (2010) develop a model of rational inattention. |

| 7. | The BF regression also suffers from bias due to the much greater persistence in the forward premium compared with exchange rate changes. See Baillie and Bollerslev (2000); Liu and Maynard (2005); Maynard (2003); Nelson and Kim (1993); Olmo and Pilbeam (2011); Stambaugh (2006). |

| 8. | Goldberg et al. (Forthcoming) also find this kind of pronounced instability in for three developed countries. See also Bansal (1997); Clarida et al. (2009); Frydman and Goldberg (2007); Lothian and Wu (2011); Zhu (2002), and Baillie and Cho (2014). |

| 9. | The sample sizes are limited by the availability of forward rate data, which is more difficult to obtain. |

| 10. | Covered interest parity provides a very close proxy of the forward rate for economies without capital controls when eurocurrency interest rates are used. See Levich (1985). |

| 11. | The estimation procedure follows McDowell (2004) and accounts for the unbalanced data by creating a block diagonal matrix of all the countries. |

| 12. | Six of the developed euro-area countries’ samples extend farther back in time than in Frankel and Poonawala’s dataset. We could include the individual spot and forward rate series in the unbalanced SUR model, ending the samples in December 1998. However, the individual European currencies were bound together in an ERM before 1999, which involved monetary policy cooperation among countries. These countries are thus best viewed as a single region for the developed country group. Denmark was tied to the ECU/euro in an informal ERM over the entire sample and so we treat it like a euro-area country. |

| 13. | In general, the exchange rate series for any of the ERM/euro countries could be used as our euro-area series. We chose the Austrian spot and forward rate series since this country’s sample period is the longest among the euro countries (extending back to 1976). |

| 14. | We are indebted to the editors for this argument and the SAR example that follows. |

| 15. | SAR bid-asked prices were taken from a Bloomberg terminal. Bid-asked spreads are larger in the forward market. |

| 16. | An earlier version of the paper included the tightly pegged USD regimes in the SUR analysis. The results of this analysis (which are available on request) are slightly more favorable to our main arguments. |

| 17. | The WMR forward rate data that we use for a few of the developed countries and many of Frankel and Poonawala’s developing countries start one or more observations after their sample begins in December 1996. The full sample dates for each country in our panel are reported in column 2 of Table 1 and Table 2. |

| 18. | As in Frankel and Poonawala (2010), the balanced sample starts in October 1997. |

| 19. | Frankel and Poonawala drop Indonesia from the SUR analysis because their sample ends in February 2002. In order to facilitate a direct comparison, we also drop Indonesia from the analysis. |

| 20. | We estimate the pooled model as unbalanced, unlike Frankel and Poonawala. This enables us to keep all developing countries in the analysis. The unbalanced SUR’s time period is the same as in Frankel and Poonawala (2010). |

| 21. | The Wald test has finite sample limitations. However, it is a sensible choice here given that we do not have to estimate multiple models unlike other commonly employed multiple restriction tests. This is particularly advantageous because the unbalanced SUR model is computationally expensive compared to a balanced SUR model. The computational demands increase considerably in the model with subperiods as discussed below. |

| 22. | To carry out the test, we create a dummy variable for the Frankel and Poonawala sample period. We add this dummy, and interaction terms with the remaining regressors, and estimate another unbalanced SUR model. The Wald statistic provides a test of the joint significance of these terms. In order to distinguish the effects of the extended sample period and list of countries, we repeat the same procedure, but limit it to the Frankel and Poonawala (2010) countries only. We find a significant difference between the two samples. These results are available upon request. |

| 23. | For example, see Engel (1996); Frydman and Goldberg (2007); Lewis (1995); Mark and Wu (1998). |

| 24. | See also Ahmad et al. (2012), who finds that the Asian financial crisis triggered structural change in a panel of Asian-Pacific countries. |

| 25. | The testing procedure proceeds equation by equation and thus ignores cross-country correlations in the data. |

| 26. | We set the trimming level of the tests to 5%, as opposed to the commonly employed 15%. This decision allows for a wider portion of the sample to be considered in the test and relaxes the limit on the maximum number of allowed breaks. Relaxing this limit is important because we would expect many breaks for countries with the longest time series. |

| 27. | We also perform supF tests, which confirm our break number and dating results. |

| 28. | We also estimate an unbalanced SUR model without the one-year subperiod restriction for the full panel. A few slope estimates become very large. However, the estimates for the common/comparable subperiods are close in magnitude. These results are available upon request. |

| 29. | Alternative solutions to this problem include increasing the trimming parameter and/or imposing restrictions on the estimated coefficients, neither of which is suitable for our economic application. The former would limit the number of breaks, whereas there is no obvious bound to impose with the latter. |

| 30. | Johansen et al. (2010) and Juselius (2014) find that interest rate differentials (and thus the forward premium) are near I(2). Bai and Perron (1998) suggest modeling a dynamic context by either adding lagged values to the regression or employing a nonparametric correction. Deng and Perron (2008) show in the context of other structural change tests that a dynamic specification helps address the autorrelated-errors problem. |

| 31. | Bansal (1997); Clarida et al. (2009); Frydman and Goldberg (2007); Lothian and Wu (2011); Moore and Roche (2012); Zhu (2002), and Baillie and Cho (2014) also report negative and positive estimates of subperiod biases. |

| 32. | See Baillie and Cho (2014); Brunnermeier et al. (2008); Melvin and Taylor (2009), and Daniel et al. (2017) for additional evidence of this time dependency and riskiness. |

| 33. | The Wald tests in Table 9 consider the inidividual subsample biases, negative and positive, for developed and developing countries. The test is conducted under the null that the negative and positive biases for the two country groups are equal at mean. |

| 34. | Bekaert and Hodrick (1993) report that the large negative biases found for developing countries stem largely from behavior in the 1980s. |

| 35. | Each country’s sample begins with the observation right after the first break date in the 1990s. For example, the first break date in the 1990s for Australia is September 1993 (see Table A1). The truncated sample for this country therefore begins in October 1993. |

| 36. | Goyal and Welch (2008) report similar results for linear models of stock returns. |

| 37. | In currency markets, see Goldberg and Frydman (1996a, 1996b); Ahmad et al. (2012); Beckmann et al. (2006); Melvin and Taylor (2009), and Goldberg et al. (Forthcoming). In stock markets, see Pettenuzzo and Timmermann (2011); Frydman and Goldberg (2011); Ang and Timmermann (2012), and Frydman et al. (2015). |

| 38. | Brunnermeier et al. (2008), Daniel et al. (2017) and others find that carry trade returns are highly negatively skewed, which gives a measure of what they call âcrash or downside ârisk. These studies examine only developed-country markets. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |