Beyond GDP: COVID-19’s Effects on Macroeconomic Efficiency and Productivity Dynamics in OECD Countries

Abstract

1. Introduction

- How did macroeconomic efficiency and productivity evolve before, during, and after the pandemic?

- What role did technological change versus efficiency change play in shaping productivity dynamics?

- How did government stringency measures influence post-pandemic productivity outcomes?

2. Literature Review

3. Methodology

3.1. Measuring Macroeconomic Efficiency: NO-SBM-DEA with Undesirable Outputs

- is the SBM efficiency score for DMU , ranging from 0 to 1. A score of indicates that DMU is fully efficient on the frontier, implying all slack variables () are zero.

- and are the observed inputs, desirable outputs, and undesirable outputs of DMU .

- The constraint imposes the VRS assumption, appropriate for comparing national economies of potentially different scales.

- are the slack variables representing input excess, desirable output shortfall, and undesirable output excess, respectively.

- are the intensity vectors representing the contribution of DMU j to the frontier.

3.2. Measuring Productivity Dynamics: Malmquist Productivity Index (MPI)

3.3. Analyzing the Impact of Government Stringency

- represents the cumulative MPI, cumulative Efficiency Change, or cumulative Technological Change for country over the 2023Q1–2024Q1 period (depending on the specific regression).

- is the measure of government stringency for country . In Model I, this term is replaced by separate independent variables representing the average annual stringency in 2020, 2021, and 2022. In Model II, this is represented by a series of dummy variables indicating the average quarterly stringency for each quarter from 2020Q1 to 2022Q4.

- is the intercept, represents the coefficients of interest, estimating the impact of government stringency during the specified period on the cumulative productivity change in 2023Q1–2024Q1, and is the error term.

4. Data

4.1. Input Variables

4.2. Output Variables

5. Results and Discussion

5.1. MPI Results

5.2. Efficiency Changes (Catch-Up Effect)

5.3. Technological Changes (Frontier-Shift)

- The pandemic dramatically accelerated digital adoption: Firms and households rapidly embraced remote work tools, e-commerce platforms, cloud computing, and automation technologies to maintain operations amid stringent lockdowns and mobility restrictions (Bloom et al., 2025). Digital-intensive economies such as Ireland and Estonia experienced notable surges in ICT services exports, reflecting how digital transformation supported productivity and technological advancements even during the height of the crisis.

- The reorganization of production processes played a critical role: In response to global supply chain disruptions, many firms adopted leaner and more automated systems to reduce reliance on labor-intensive operations. For instance, Germany and Japan leveraged robotics, digital supply chain management, and Industry 4.0 technologies to enhance flexibility and efficiency, driving a forward shift in the production frontier.

- Specific industries experienced innovation surges that contributed disproportionately to TC: The pharmaceutical sector underwent unprecedented R&D acceleration, particularly in the development and deployment of mRNA vaccines. Similarly, ICT, logistics, and healthcare sectors introduced breakthrough innovations to meet the demands of the crisis, which strengthened technological progress at the macroeconomic level.

- Sectoral resource reallocation contributed to the observed advancements: Labor, capital, and research efforts shifted away from low-productivity sectors such as tourism and hospitality towards high-productivity sectors like digital services, healthcare, and technology-intensive manufacturing. This reallocation supported structural adjustments that sustained technological gains.

- The adaptive policy measures of 2021 appear to have reinforced these trends: As shown in our regression robustness checks (Section 5.5), 2021 stringency measures were positively associated with TC, suggesting that more targeted and flexible interventions not only minimized economic disruptions but also encouraged firms to invest in digital transformation and process innovations. This pattern highlights the dual role of policy in both mitigating immediate public health challenges and indirectly fostering long-term technological resilience.

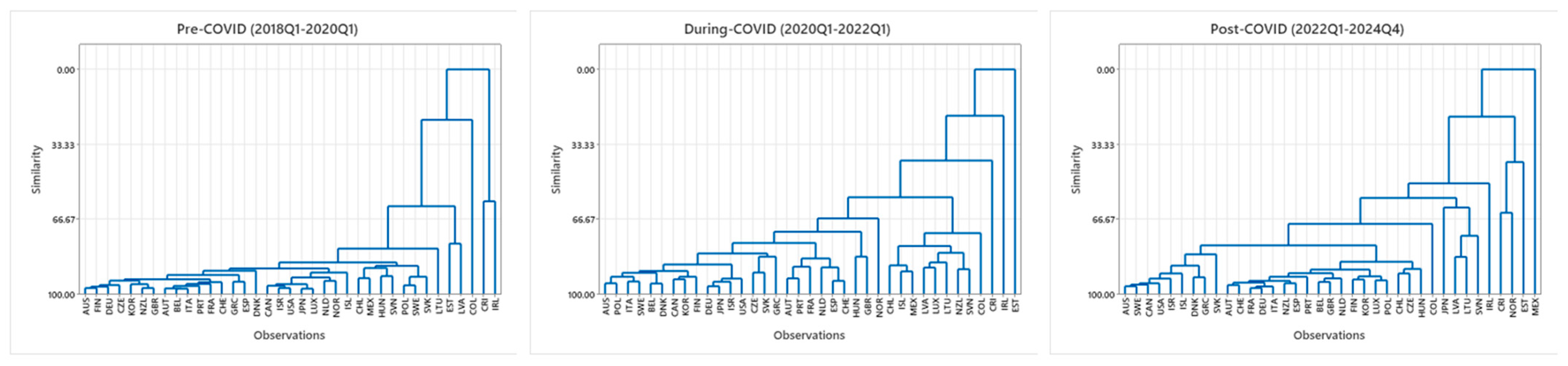

- High-Productivity Cluster: This cluster consists of countries that consistently outperform others in terms of MPI and TC, particularly Ireland, South Korea, the United States, and the Nordic countries (Denmark, Sweden, and Finland). These economies benefitted from robust digital infrastructure, significant investment in R&D, and advanced technological capabilities. For example, Ireland’s strong ICT sector and South Korea’s rapid digital transformation allowed them to weather the pandemic with minimal productivity losses and even record gains in TC. These countries also implemented targeted fiscal measures and flexible labor market policies that enabled quick adaptation to shifting economic conditions.

- Medium-Productivity Cluster: The second cluster includes economies such as France, Germany, Canada, and Italy, which experienced moderate productivity improvements during the post-COVID period. While these countries implemented effective pandemic responses, they faced constraints in fully leveraging technological change. In Germany, for instance, the automotive and manufacturing sectors rebounded slowly due to global supply chain disruptions, despite strong pre-pandemic industrial bases. These countries demonstrate steady, if slower, recovery trajectories compared to the high-productivity group.

- Low-Productivity Cluster: The third cluster primarily consists of countries with persistent efficiency and technological challenges, including Spain, Greece, Portugal, and some Central European economies. These countries are characterized by heavy reliance on tourism and traditional services, sectors that were severely impacted by prolonged restrictions. Higher unemployment and inflation rates in these economies contributed to lower MPI scores, and technological improvements have been slower due to structural rigidities and weaker digital infrastructure.

- Temporal Dynamics: The cluster differentiation became more pronounced during the pandemic (2020Q1–2022Q1) and persisted into the post-COVID recovery (2022Q1–2024Q4). Countries in the high-productivity cluster not only maintained their lead but also widened the gap due to accelerated adoption of digital technologies and proactive policy interventions. In contrast, countries in the low-productivity cluster struggled to recover lost efficiency and lagged in implementing structural reforms.

5.4. Impact of Government Stringency

5.5. Robustness and Endogeneity

6. Conclusions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Year | Quarter | Population1 | GFCF | Employment | GDP | Consumer Price Index2 | Unemployment | House Price Index3 | Short-Term Interest Rate4 |

|---|---|---|---|---|---|---|---|---|---|

| 2018 | Quarter 1 | 34,288.61 | 79,034.11 | 16,048.39 | 1,576,646.84 | 103.77 | 906.11 | 111.75 | 1.70 |

| 2018 | Quarter 2 | 34,338.66 | 78,988.35 | 16,136.32 | 1,596,324.61 | 104.70 | 889.52 | 112.61 | 1.72 |

| 2018 | Quarter 3 | 34,393.18 | 78,127.25 | 16,167.64 | 1,611,335.79 | 105.14 | 872.20 | 113.13 | 1.74 |

| 2018 | Quarter 4 | 34,447.21 | 78,568.07 | 16,211.96 | 1,627,762.60 | 105.55 | 876.85 | 114.27 | 1.80 |

| 2019 | Quarter 1 | 34,493.91 | 79,096.43 | 16,275.16 | 1,649,237.32 | 105.63 | 877.40 | 115.21 | 1.84 |

| 2019 | Quarter 2 | 34,542.05 | 80,937.65 | 16,347.66 | 1,675,689.36 | 106.75 | 853.48 | 115.86 | 1.80 |

| 2019 | Quarter 3 | 34,565.67 | 80,266.79 | 16,375.60 | 1,699,761.89 | 106.90 | 849.61 | 117.10 | 1.67 |

| 2019 | Quarter 4 | 34,641.41 | 82,048.22 | 16,443.67 | 1,715,390.58 | 107.25 | 847.24 | 118.29 | 1.62 |

| 2020 | Quarter 1 | 34,660.81 | 80,560.05 | 16,378.32 | 1,702,561.03 | 107.49 | 870.79 | 119.97 | 1.56 |

| 2020 | Quarter 2 | 34,684.33 | 72,134.54 | 15,142.24 | 1,530,888.04 | 107.45 | 1367.71 | 120.41 | 1.27 |

| 2020 | Quarter 3 | 34,707.91 | 79,612.57 | 15,663.77 | 1,684,013.95 | 107.80 | 1253.70 | 121.85 | 1.05 |

| 2020 | Quarter 4 | 34,729.36 | 83,873.17 | 15,930.22 | 1,711,125.09 | 107.99 | 1131.76 | 124.44 | 0.96 |

| 2021 | Quarter 1 | 34,738.08 | 85,855.36 | 15,904.02 | 1,740,155.79 | 108.80 | 1095.79 | 127.33 | 0.93 |

| 2021 | Quarter 2 | 34,767.94 | 87,965.93 | 16,071.46 | 1,792,894.14 | 110.14 | 1060.84 | 129.80 | 0.93 |

| 2021 | Quarter 3 | 34,801.18 | 88,028.18 | 16,236.31 | 1,836,878.64 | 111.31 | 965.18 | 132.42 | 1.01 |

| 2021 | Quarter 4 | 34,842.38 | 89,361.99 | 16,354.18 | 1,900,407.88 | 113.23 | 895.78 | 134.55 | 1.28 |

| 2022 | Quarter 1 | 34,898.09 | 90,946.69 | 16,510.10 | 1,951,090.11 | 115.93 | 849.50 | 135.22 | 1.68 |

| 2022 | Quarter 2 | 34,972.31 | 90,418.41 | 16,630.60 | 2,009,591.63 | 120.03 | 820.60 | 134.93 | 2.29 |

| 2022 | Quarter 3 | 35,031.82 | 89,414.68 | 16,655.19 | 2,044,101.15 | 123.06 | 813.09 | 133.57 | 3.48 |

| 2022 | Quarter 4 | 35,092.59 | 90,131.96 | 16,704.46 | 2,059,488.18 | 125.26 | 812.99 | 130.56 | 4.66 |

| 2023 | Quarter 1 | 35,154.26 | 94,421.64 | 16,833.70 | 2,080,094.16 | 127.17 | 807.14 | 128.44 | 5.31 |

| 2023 | Quarter 2 | 35,208.98 | 95,952.73 | 16,890.10 | 2,090,217.15 | 128.86 | 807.64 | 128.00 | 5.76 |

| 2023 | Quarter 3 | 35,270.71 | 96,493.16 | 16,930.03 | 2,111,493.60 | 129.72 | 816.07 | 127.66 | 5.93 |

| 2023 | Quarter 4 | 35,334.05 | 97,042.64 | 16,950.64 | 2,124,346.85 | 130.21 | 827.33 | 128.25 | 5.86 |

| 2024 | Quarter 1 | 35,384.06 | 98,076.29 | 16,989.04 | 2,149,108.21 | 131.17 | 838.64 | 128.90 | 5.67 |

| 2024 | Quarter 2 | 35,438.94 | 97,598.43 | 17,018.02 | 2,173,948.11 | 132.51 | 842.49 | 129.84 | 5.49 |

| 2024 | Quarter 3 | 35,488.58 | 100,057.74 | 17,053.15 | 2,195,558.98 | 133.11 | 846.03 | 130.88 | 5.24 |

| 2024 | Quarter 4 | 35,529.84 | 99,291.72 | 17,062.51 | 2,218,422.12 | 130.90 | 840.23 | 132.21 | 4.79 |

| Year | Variable | Population5 | GFCF | Employment | GDP | Consumer Price Index6 | Unemployment | House Price Index7 | Short-Term Interest Rate8 |

|---|---|---|---|---|---|---|---|---|---|

| 2018 | Mean | 34,367 | 78,679 | 16,141 | 1,603,017 | 104.79 | 886 | 112.94 | 1.74 |

| 2018 | Stan. Dev. | 59,451 | 185,148 | 28,260 | 3,477,137 | 3.24 | 1279 | 9.43 | 2.02 |

| 2018 | Minimum | 354 | 1440 | 198 | 20,177 | 100.52 | 6 | 95.54 | 0.04 |

| 2018 | Median | 10,335 | 26,117 | 4755 | 478,026 | 104.15 | 301 | 112.77 | 0.53 |

| 2018 | Maximum | 328,795 | 1,099,753 | 155,763 | 20,656,516 | 115.79 | 6315 | 137.73 | 8.91 |

| 2019 | Mean | 34,561 | 80,587 | 16,361 | 1,685,020 | 106.63 | 857 | 116.62 | 1.73 |

| 2019 | Stan. Dev. | 59,740 | 192,693 | 28,605 | 3,623,402 | 4.11 | 1228 | 11.78 | 2.00 |

| 2019 | Minimum | 362 | 1285 | 201 | 21,822 | 101.17 | 7 | 94.59 | 0.08 |

| 2019 | Median | 10,354 | 27,191 | 4832 | 491,175 | 106.07 | 290 | 116.70 | 0.49 |

| 2019 | Maximum | 330,513 | 1,148,680 | 157,537 | 21,539,982 | 119.87 | 5999 | 150.96 | 9.12 |

| 2020 | Mean | 34,696 | 79,045 | 15,779 | 1,657,147 | 107.68 | 1156 | 121.67 | 1.21 |

| 2020 | Stan. Dev. | 59,976 | 193,121 | 27,103 | 3,586,995 | 5.19 | 2228 | 13.47 | 1.37 |

| 2020 | Minimum | 367 | 1149 | 195 | 20,451 | 99.91 | 11 | 96.14 | 0.15 |

| 2020 | Median | 10,385 | 25,280 | 4802 | 493,960 | 107.65 | 351 | 122.26 | 0.61 |

| 2020 | Maximum | 331,840 | 1,152,467 | 147,813 | 21,354,105 | 122.89 | 12,950 | 154.04 | 6.52 |

| 2021 | Mean | 34,787 | 87,803 | 16,141 | 1,817,584 | 110.87 | 1004 | 131.02 | 1.04 |

| 2021 | Stan. Dev. | 60,111 | 210,400 | 27,897 | 3,957,897 | 6.54 | 1598 | 17.73 | 1.12 |

| 2021 | Minimum | 373 | 1474 | 197 | 22,953 | 101.13 | 13 | 97.17 | 0.11 |

| 2021 | Median | 10,419 | 29,027 | 4783 | 565,004 | 110.91 | 344 | 130.23 | 0.62 |

| 2021 | Maximum | 332,505 | 1,259,944 | 152,584 | 23,681,171 | 129.53 | 8630 | 169.46 | 5.51 |

| 2022 | Mean | 34,999 | 90,228 | 16,625 | 2,016,068 | 121.07 | 824 | 133.57 | 3.03 |

| 2022 | Stan. Dev. | 60,401 | 229,334 | 28,799 | 4,339,218 | 10.02 | 1201 | 20.95 | 2.91 |

| 2022 | Minimum | 383 | 1740 | 210 | 28,058 | 103.93 | 8 | 94.51 | 0.67 |

| 2022 | Median | 10,527 | 28,624 | 4940 | 674,001 | 119.50 | 300 | 130.73 | 1.19 |

| 2022 | Maximum | 334,373 | 1,389,702 | 158,295 | 26,006,893 | 140.13 | 5993 | 180.72 | 10.82 |

| 2023 | Mean | 35,242 | 95,978 | 16,901 | 2,101,538 | 128.99 | 815 | 128.09 | 5.72 |

| 2023 | Stan. Dev. | 60,812 | 244,098 | 29,274 | 4,616,391 | 13.87 | 1188 | 20.34 | 2.99 |

| 2023 | Minimum | 395 | 1954 | 220 | 30,158 | 106.34 | 8 | 89.39 | 0.85 |

| 2023 | Median | 10,578 | 31,256 | 5028 | 644,550 | 126.09 | 294 | 127.73 | 4.28 |

| 2023 | Maximum | 337,141 | 1,482,408 | 161,041 | 27,720,710 | 159.22 | 6077 | 172.18 | 14.49 |

| 2024 | Mean | 35,460 | 98,756 | 17,031 | 2,184,259 | 131.92 | 842 | 130.46 | 5.30 |

| 2024 | Stan. Dev. | 61,258 | 258,362 | 29,362 | 4,850,266 | 16.73 | 1266 | 23.30 | 2.13 |

| 2024 | Minimum | 407 | 2208 | 230 | 31,045 | 85.26 | 8 | 84.46 | 1.04 |

| 2024 | Median | 10,631 | 26,428 | 5065 | 676,222 | 130.31 | 306 | 130.81 | 4.42 |

| 2024 | Maximum | 340,212 | 1,573,491 | 161,349 | 29,184,890 | 166.93 | 6761 | 181.05 | 12.12 |

| Pre-COVID (2018Q1–2020Q1) | During-COVID (2020Q1–2022Q1) | POST-COVID (2022Q1–2024Q4) | TOTAL (2018Q1–2024Q4) | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | AVG. | CUM. | MIN. | MED. | MAX. | S.D. | AVG. | CUM. | MIN. | MED. | MAX. | S.D. | AVG. | CUM. | MIN. | MED. | MAX. | S.D. | AVG. | CUM. | MIN. | Q1 | Q2 | Q3 | MAX. | S.D. |

| AUS | 1.019 | 1.162 | 1.010 | 1.019 | 1.028 | 0.006 | 1.016 | 1.136 | 0.965 | 1.019 | 1.060 | 0.027 | 1.007 | 1.084 | 0.979 | 1.003 | 1.040 | 0.018 | 1.014 | 1.430 | 0.965 | 1.003 | 1.018 | 1.025 | 1.060 | 0.018 |

| AUT | 1.018 | 1.151 | 0.997 | 1.019 | 1.030 | 0.011 | 1.006 | 1.035 | 0.886 | 1.024 | 1.076 | 0.061 | 1.003 | 1.032 | 0.964 | 0.999 | 1.073 | 0.027 | 1.008 | 1.229 | 0.886 | 0.992 | 1.011 | 1.029 | 1.076 | 0.036 |

| BEL | 1.020 | 1.170 | 0.996 | 1.024 | 1.028 | 0.010 | 1.011 | 1.082 | 0.940 | 1.018 | 1.060 | 0.042 | 1.008 | 1.090 | 0.964 | 0.998 | 1.076 | 0.032 | 1.012 | 1.380 | 0.940 | 0.992 | 1.018 | 1.028 | 1.076 | 0.030 |

| CAN | 1.005 | 1.039 | 0.987 | 1.006 | 1.019 | 0.012 | 1.014 | 1.120 | 0.987 | 1.012 | 1.058 | 0.021 | 1.011 | 1.128 | 0.979 | 1.011 | 1.040 | 0.016 | 1.010 | 1.311 | 0.979 | 1.000 | 1.010 | 1.019 | 1.058 | 0.016 |

| CHL | 1.014 | 1.116 | 0.983 | 1.012 | 1.064 | 0.024 | 1.006 | 1.049 | 0.961 | 1.007 | 1.055 | 0.032 | 1.016 | 1.182 | 0.958 | 1.024 | 1.059 | 0.030 | 1.012 | 1.384 | 0.958 | 0.992 | 1.014 | 1.030 | 1.064 | 0.028 |

| COL | 1.130 | 2.384 | 0.998 | 1.040 | 1.616 | 0.219 | 1.010 | 1.065 | 0.924 | 0.999 | 1.118 | 0.072 | 1.038 | 1.461 | 0.956 | 1.024 | 1.251 | 0.082 | 1.057 | 3.710 | 0.924 | 0.998 | 1.017 | 1.076 | 1.616 | 0.137 |

| CRI | 1.092 | 1.803 | 0.751 | 1.074 | 1.362 | 0.192 | 0.980 | 0.796 | 0.740 | 1.031 | 1.136 | 0.130 | 0.982 | 0.766 | 0.776 | 0.966 | 1.157 | 0.114 | 1.014 | 1.099 | 0.740 | 0.904 | 1.027 | 1.090 | 1.362 | 0.146 |

| CZE | 1.018 | 1.157 | 1.005 | 1.016 | 1.042 | 0.012 | 0.986 | 0.883 | 0.935 | 0.976 | 1.042 | 0.047 | 1.014 | 1.159 | 0.928 | 1.019 | 1.072 | 0.046 | 1.007 | 1.185 | 0.928 | 0.989 | 1.013 | 1.041 | 1.072 | 0.040 |

| DNK | 1.019 | 1.163 | 0.980 | 1.019 | 1.076 | 0.029 | 1.010 | 1.081 | 0.961 | 1.013 | 1.059 | 0.035 | 1.003 | 1.026 | 0.915 | 1.014 | 1.046 | 0.038 | 1.010 | 1.289 | 0.915 | 0.992 | 1.014 | 1.036 | 1.076 | 0.033 |

| EST | 1.005 | 0.991 | 0.819 | 1.006 | 1.130 | 0.115 | 1.066 | 1.413 | 0.764 | 1.069 | 1.549 | 0.239 | 1.003 | 0.821 | 0.672 | 1.015 | 1.315 | 0.210 | 1.022 | 1.149 | 0.672 | 0.874 | 1.055 | 1.130 | 1.549 | 0.188 |

| FIN | 1.017 | 1.142 | 1.012 | 1.015 | 1.030 | 0.006 | 1.007 | 1.057 | 0.952 | 1.011 | 1.046 | 0.028 | 1.014 | 1.155 | 0.975 | 1.005 | 1.053 | 0.028 | 1.013 | 1.395 | 0.952 | 1.000 | 1.014 | 1.030 | 1.053 | 0.023 |

| FRA | 1.021 | 1.177 | 0.976 | 1.028 | 1.034 | 0.020 | 1.003 | 1.011 | 0.918 | 1.004 | 1.070 | 0.054 | 1.009 | 1.107 | 0.979 | 1.009 | 1.044 | 0.018 | 1.011 | 1.317 | 0.918 | 0.997 | 1.014 | 1.031 | 1.070 | 0.032 |

| DEU | 1.011 | 1.095 | 1.001 | 1.014 | 1.021 | 0.007 | 1.008 | 1.058 | 0.934 | 1.017 | 1.059 | 0.037 | 1.004 | 1.043 | 0.972 | 1.007 | 1.029 | 0.017 | 1.007 | 1.208 | 0.934 | 0.997 | 1.012 | 1.019 | 1.059 | 0.022 |

| GRC | 1.012 | 1.097 | 0.984 | 1.014 | 1.051 | 0.024 | 0.999 | 0.978 | 0.886 | 1.002 | 1.071 | 0.054 | 1.004 | 1.038 | 0.942 | 1.003 | 1.091 | 0.038 | 1.005 | 1.113 | 0.886 | 0.985 | 1.003 | 1.029 | 1.091 | 0.038 |

| HUN | 1.021 | 1.175 | 0.987 | 1.018 | 1.070 | 0.025 | 1.002 | 0.999 | 0.864 | 1.000 | 1.113 | 0.075 | 1.015 | 1.170 | 0.905 | 1.033 | 1.062 | 0.045 | 1.013 | 1.374 | 0.864 | 0.988 | 1.016 | 1.045 | 1.113 | 0.049 |

| ISL | 1.004 | 1.034 | 0.963 | 1.006 | 1.034 | 0.023 | 0.991 | 0.928 | 0.966 | 0.992 | 1.013 | 0.016 | 0.990 | 0.897 | 0.957 | 0.994 | 1.004 | 0.013 | 0.995 | 0.861 | 0.957 | 0.982 | 0.996 | 1.004 | 1.034 | 0.018 |

| IRL | 1.042 | 1.312 | 0.916 | 0.995 | 1.257 | 0.137 | 1.068 | 1.547 | 0.839 | 1.029 | 1.376 | 0.174 | 1.008 | 0.998 | 0.788 | 0.979 | 1.247 | 0.136 | 1.036 | 2.025 | 0.788 | 0.929 | 1.011 | 1.092 | 1.376 | 0.142 |

| ISR | 1.006 | 1.048 | 0.997 | 1.006 | 1.014 | 0.006 | 1.011 | 1.089 | 0.947 | 1.023 | 1.069 | 0.039 | 1.009 | 1.098 | 0.984 | 1.005 | 1.044 | 0.021 | 1.009 | 1.254 | 0.947 | 0.997 | 1.006 | 1.020 | 1.069 | 0.024 |

| ITA | 1.015 | 1.130 | 0.996 | 1.017 | 1.025 | 0.009 | 1.000 | 1.000 | 0.933 | 1.003 | 1.036 | 0.032 | 1.006 | 1.061 | 0.960 | 1.001 | 1.046 | 0.024 | 1.007 | 1.199 | 0.933 | 0.997 | 1.013 | 1.020 | 1.046 | 0.023 |

| JPN | 1.003 | 1.022 | 0.990 | 1.001 | 1.016 | 0.009 | 1.010 | 1.082 | 0.938 | 1.012 | 1.061 | 0.035 | 1.066 | 1.946 | 0.919 | 1.038 | 1.276 | 0.094 | 1.031 | 2.153 | 0.919 | 0.999 | 1.016 | 1.038 | 1.276 | 0.067 |

| KOR | 1.013 | 1.107 | 0.996 | 1.009 | 1.033 | 0.013 | 1.011 | 1.088 | 0.992 | 1.015 | 1.024 | 0.013 | 1.013 | 1.148 | 0.970 | 1.016 | 1.040 | 0.020 | 1.012 | 1.382 | 0.970 | 0.999 | 1.015 | 1.023 | 1.040 | 0.016 |

| LVA | 1.035 | 1.285 | 0.917 | 1.047 | 1.133 | 0.079 | 0.999 | 0.985 | 0.952 | 0.992 | 1.059 | 0.045 | 1.006 | 1.016 | 0.734 | 1.030 | 1.086 | 0.097 | 1.013 | 1.287 | 0.734 | 0.971 | 1.026 | 1.052 | 1.133 | 0.076 |

| LTU | 1.030 | 1.260 | 0.947 | 1.030 | 1.091 | 0.048 | 1.001 | 1.000 | 0.931 | 1.004 | 1.097 | 0.050 | 0.988 | 0.855 | 0.819 | 0.993 | 1.047 | 0.060 | 1.004 | 1.077 | 0.819 | 0.981 | 1.004 | 1.030 | 1.097 | 0.054 |

| LUX | 1.006 | 1.051 | 0.988 | 1.008 | 1.022 | 0.011 | 1.014 | 1.109 | 0.976 | 1.000 | 1.094 | 0.040 | 1.005 | 1.048 | 0.971 | 1.005 | 1.061 | 0.024 | 1.008 | 1.223 | 0.971 | 0.996 | 1.005 | 1.015 | 1.094 | 0.026 |

| MEX | 1.018 | 1.151 | 0.978 | 1.011 | 1.061 | 0.029 | 1.000 | 0.999 | 0.971 | 0.992 | 1.076 | 0.035 | 1.010 | 0.787 | 0.627 | 0.995 | 1.624 | 0.276 | 1.010 | 0.905 | 0.627 | 0.971 | 1.002 | 1.053 | 1.624 | 0.170 |

| NLD | 1.018 | 1.152 | 0.994 | 1.011 | 1.061 | 0.021 | 1.021 | 1.171 | 0.948 | 1.027 | 1.088 | 0.046 | 1.012 | 1.133 | 0.953 | 1.005 | 1.098 | 0.042 | 1.016 | 1.527 | 0.948 | 0.998 | 1.011 | 1.039 | 1.098 | 0.037 |

| NZL | 1.018 | 1.151 | 1.007 | 1.015 | 1.030 | 0.008 | 0.989 | 0.916 | 0.957 | 0.983 | 1.034 | 0.026 | 1.014 | 1.157 | 0.964 | 1.010 | 1.069 | 0.025 | 1.008 | 1.220 | 0.957 | 0.998 | 1.011 | 1.021 | 1.069 | 0.024 |

| NOR | 1.005 | 1.041 | 0.976 | 0.998 | 1.051 | 0.026 | 1.061 | 1.577 | 0.911 | 1.067 | 1.163 | 0.077 | 1.001 | 0.947 | 0.767 | 1.024 | 1.220 | 0.110 | 1.020 | 1.554 | 0.767 | 0.976 | 1.026 | 1.066 | 1.220 | 0.083 |

| POL | 1.021 | 1.181 | 0.999 | 1.023 | 1.033 | 0.011 | 1.020 | 1.170 | 0.972 | 1.024 | 1.048 | 0.024 | 1.001 | 1.007 | 0.958 | 1.005 | 1.040 | 0.027 | 1.013 | 1.392 | 0.958 | 0.999 | 1.020 | 1.029 | 1.048 | 0.024 |

| PRT | 1.015 | 1.123 | 0.972 | 1.021 | 1.029 | 0.018 | 1.007 | 1.039 | 0.866 | 1.030 | 1.088 | 0.074 | 1.016 | 1.180 | 0.978 | 1.003 | 1.084 | 0.033 | 1.013 | 1.376 | 0.866 | 0.995 | 1.021 | 1.031 | 1.088 | 0.044 |

| SVK | 1.028 | 1.244 | 0.990 | 1.038 | 1.056 | 0.023 | 1.006 | 1.042 | 0.965 | 1.005 | 1.057 | 0.034 | 1.009 | 1.083 | 0.908 | 1.007 | 1.102 | 0.054 | 1.013 | 1.403 | 0.908 | 0.979 | 1.021 | 1.042 | 1.102 | 0.040 |

| SVN | 1.033 | 1.292 | 0.996 | 1.035 | 1.058 | 0.019 | 0.988 | 0.907 | 0.922 | 1.003 | 1.024 | 0.038 | 1.015 | 1.124 | 0.821 | 1.019 | 1.115 | 0.094 | 1.012 | 1.317 | 0.821 | 0.963 | 1.020 | 1.049 | 1.115 | 0.063 |

| ESP | 1.007 | 1.057 | 0.954 | 1.013 | 1.029 | 0.024 | 1.015 | 1.118 | 0.892 | 1.030 | 1.059 | 0.052 | 1.011 | 1.130 | 0.979 | 1.006 | 1.067 | 0.024 | 1.011 | 1.336 | 0.892 | 0.998 | 1.014 | 1.029 | 1.067 | 0.033 |

| SWE | 1.026 | 1.225 | 0.982 | 1.029 | 1.047 | 0.019 | 1.009 | 1.069 | 0.930 | 1.015 | 1.050 | 0.034 | 1.012 | 1.133 | 0.990 | 1.007 | 1.034 | 0.014 | 1.015 | 1.485 | 0.930 | 1.005 | 1.018 | 1.029 | 1.050 | 0.023 |

| CHE | 1.013 | 1.109 | 0.982 | 1.009 | 1.039 | 0.018 | 1.024 | 1.191 | 0.884 | 1.043 | 1.065 | 0.060 | 1.008 | 1.084 | 0.966 | 1.007 | 1.068 | 0.026 | 1.014 | 1.431 | 0.884 | 1.005 | 1.009 | 1.033 | 1.068 | 0.036 |

| GBR | 1.018 | 1.156 | 0.998 | 1.019 | 1.038 | 0.012 | 1.002 | 0.988 | 0.880 | 1.024 | 1.121 | 0.084 | 1.006 | 1.055 | 0.946 | 1.002 | 1.093 | 0.042 | 1.008 | 1.205 | 0.880 | 0.976 | 1.014 | 1.038 | 1.121 | 0.050 |

| USA | 1.005 | 1.041 | 0.991 | 1.006 | 1.011 | 0.006 | 1.017 | 1.145 | 0.966 | 1.021 | 1.067 | 0.028 | 1.010 | 1.113 | 1.004 | 1.011 | 1.016 | 0.005 | 1.011 | 1.327 | 0.966 | 1.005 | 1.009 | 1.015 | 1.067 | 0.016 |

| AVG. | 1.022 | 1.189 | 0.973 | 1.018 | 1.075 | 0.035 | 1.011 | 1.079 | 0.923 | 1.014 | 1.090 | 0.054 | 1.009 | 1.088 | 0.914 | 1.008 | 1.105 | 0.055 | 1.013 | 1.392 | 0.889 | 0.984 | 1.015 | 1.039 | 1.143 | 0.052 |

| S.D. | 0.024 | 0.239 | 0.050 | 0.015 | 0.112 | 0.049 | 0.019 | 0.154 | 0.055 | 0.019 | 0.096 | 0.043 | 0.013 | 0.190 | 0.094 | 0.014 | 0.114 | 0.056 | 0.010 | 0.452 | 0.086 | 0.027 | 0.009 | 0.024 | 0.156 | 0.045 |

| Pre-COVID (2018Q1–2020Q1) | During-COVID (2020Q1–2022Q1) | POST-COVID (2022Q1–2024Q4) | TOTAL (2018Q1–2024Q4) | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | AVG. | CUM. | MIN. | MED. | MAX | S.D. | AVG. | CUM. | MIN. | MED. | MAX | S.D. | AVG. | CUM. | MIN. | MED. | MAX. | S.D. | AVG. | CUM. | MIN. | Q1 | Q2 | Q3 | MAX | S.D. |

| AUS | 1.021 | 1.173 | 0.960 | 1.025 | 1.074 | 0.041 | 0.990 | 0.901 | 0.883 | 0.985 | 1.109 | 0.078 | 1.002 | 1.010 | 0.934 | 1.004 | 1.061 | 0.045 | 1.004 | 1.067 | 0.883 | 0.961 | 1.004 | 1.056 | 1.109 | 0.054 |

| AUT | 1.033 | 1.247 | 0.861 | 1.037 | 1.174 | 0.112 | 0.972 | 0.657 | 0.674 | 1.028 | 1.258 | 0.219 | 1.019 | 1.051 | 0.740 | 1.024 | 1.389 | 0.180 | 1.009 | 0.861 | 0.674 | 0.901 | 1.025 | 1.120 | 1.389 | 0.168 |

| BEL | 1.031 | 1.239 | 0.895 | 1.032 | 1.153 | 0.091 | 0.973 | 0.713 | 0.754 | 0.996 | 1.266 | 0.177 | 1.014 | 1.054 | 0.810 | 1.015 | 1.251 | 0.146 | 1.007 | 0.931 | 0.754 | 0.895 | 1.015 | 1.100 | 1.266 | 0.137 |

| CAN | 1.003 | 1.018 | 0.953 | 1.018 | 1.041 | 0.033 | 0.995 | 0.951 | 0.930 | 0.980 | 1.056 | 0.046 | 1.008 | 1.076 | 0.928 | 1.000 | 1.101 | 0.046 | 1.002 | 1.042 | 0.928 | 0.974 | 1.000 | 1.034 | 1.101 | 0.040 |

| CHL | 0.998 | 0.983 | 0.969 | 0.996 | 1.048 | 0.025 | 0.986 | 0.874 | 0.869 | 1.003 | 1.085 | 0.083 | 1.059 | 1.194 | 0.515 | 1.009 | 1.904 | 0.329 | 1.019 | 1.026 | 0.515 | 0.969 | 1.001 | 1.065 | 1.904 | 0.208 |

| COL | 1.076 | 1.606 | 0.976 | 1.007 | 1.612 | 0.217 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.023 | 1.606 | 0.976 | 1.000 | 1.000 | 1.000 | 1.612 | 0.116 |

| CRI | 1.053 | 1.341 | 0.742 | 1.025 | 1.347 | 0.196 | 1.008 | 1.000 | 0.779 | 1.000 | 1.283 | 0.135 | 1.023 | 0.777 | 0.546 | 1.000 | 1.898 | 0.344 | 1.027 | 1.042 | 0.546 | 0.965 | 1.000 | 1.095 | 1.898 | 0.243 |

| CZE | 1.002 | 1.016 | 0.975 | 1.006 | 1.022 | 0.016 | 0.965 | 0.662 | 0.723 | 0.965 | 1.275 | 0.183 | 1.050 | 1.206 | 0.613 | 1.017 | 1.744 | 0.288 | 1.011 | 0.812 | 0.613 | 0.911 | 1.002 | 1.058 | 1.744 | 0.202 |

| DNK | 1.042 | 1.301 | 0.824 | 1.053 | 1.233 | 0.141 | 0.975 | 0.707 | 0.717 | 1.013 | 1.264 | 0.197 | 1.015 | 1.030 | 0.772 | 1.004 | 1.366 | 0.169 | 1.011 | 0.947 | 0.717 | 0.886 | 1.009 | 1.148 | 1.366 | 0.162 |

| EST | 0.977 | 0.727 | 0.690 | 1.040 | 1.125 | 0.180 | 1.074 | 1.514 | 0.697 | 1.094 | 1.394 | 0.219 | 1.005 | 0.790 | 0.710 | 1.024 | 1.458 | 0.242 | 1.017 | 0.870 | 0.690 | 0.847 | 1.040 | 1.132 | 1.458 | 0.210 |

| FIN | 1.037 | 1.274 | 0.864 | 1.026 | 1.202 | 0.123 | 0.972 | 0.693 | 0.712 | 1.008 | 1.194 | 0.188 | 1.027 | 1.155 | 0.778 | 1.019 | 1.439 | 0.181 | 1.014 | 1.019 | 0.712 | 0.880 | 1.019 | 1.138 | 1.439 | 0.161 |

| FRA | 1.015 | 1.125 | 0.999 | 1.017 | 1.027 | 0.011 | 0.988 | 0.902 | 0.934 | 0.978 | 1.033 | 0.036 | 1.005 | 1.051 | 0.964 | 1.007 | 1.033 | 0.018 | 1.003 | 1.066 | 0.934 | 0.990 | 1.007 | 1.021 | 1.033 | 0.025 |

| DEU | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 |

| GRC | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 0.987 | 0.898 | 0.926 | 1.000 | 1.003 | 0.027 | 1.046 | 0.983 | 0.496 | 1.000 | 2.016 | 0.360 | 1.015 | 0.883 | 0.496 | 1.000 | 1.000 | 1.000 | 2.016 | 0.221 |

| HUN | 1.004 | 1.027 | 0.972 | 1.003 | 1.053 | 0.025 | 0.983 | 0.832 | 0.878 | 0.943 | 1.162 | 0.117 | 1.052 | 1.158 | 0.555 | 1.039 | 1.894 | 0.320 | 1.017 | 0.989 | 0.555 | 0.945 | 0.998 | 1.048 | 1.894 | 0.206 |

| ISL | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 |

| IRL | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 |

| ISR | 1.027 | 1.177 | 0.844 | 1.032 | 1.181 | 0.123 | 0.977 | 0.712 | 0.703 | 1.008 | 1.234 | 0.199 | 1.025 | 1.112 | 0.738 | 1.032 | 1.412 | 0.191 | 1.012 | 0.932 | 0.703 | 0.868 | 1.032 | 1.141 | 1.412 | 0.168 |

| ITA | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 |

| JPN | 0.999 | 0.988 | 0.977 | 1.000 | 1.015 | 0.014 | 0.998 | 0.983 | 0.962 | 1.002 | 1.031 | 0.026 | 1.036 | 1.444 | 0.993 | 1.000 | 1.264 | 0.080 | 1.014 | 1.402 | 0.962 | 0.994 | 1.000 | 1.019 | 1.264 | 0.054 |

| KOR | 1.010 | 1.080 | 0.966 | 1.013 | 1.042 | 0.025 | 0.993 | 0.941 | 0.926 | 0.995 | 1.041 | 0.034 | 1.008 | 1.090 | 0.961 | 1.008 | 1.077 | 0.035 | 1.004 | 1.108 | 0.926 | 0.983 | 1.001 | 1.025 | 1.077 | 0.031 |

| LVA | 0.981 | 0.814 | 0.814 | 1.000 | 1.101 | 0.114 | 1.027 | 1.229 | 0.975 | 1.013 | 1.112 | 0.045 | 1.003 | 1.000 | 0.827 | 1.000 | 1.209 | 0.086 | 1.004 | 1.000 | 0.814 | 1.000 | 1.000 | 1.027 | 1.209 | 0.083 |

| LTU | 0.991 | 0.915 | 0.882 | 1.000 | 1.089 | 0.065 | 1.000 | 0.988 | 0.918 | 1.009 | 1.093 | 0.055 | 0.989 | 0.751 | 0.705 | 0.989 | 1.418 | 0.184 | 0.993 | 0.678 | 0.705 | 0.931 | 1.000 | 1.025 | 1.418 | 0.120 |

| LUX | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 |

| MEX | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.021 | 1.000 | 0.633 | 1.000 | 1.616 | 0.226 | 1.008 | 1.000 | 0.633 | 1.000 | 1.000 | 1.000 | 1.616 | 0.138 |

| NLD | 1.012 | 1.087 | 0.932 | 1.012 | 1.063 | 0.051 | 0.988 | 0.876 | 0.828 | 1.012 | 1.131 | 0.100 | 1.011 | 1.079 | 0.858 | 1.018 | 1.217 | 0.094 | 1.004 | 1.027 | 0.828 | 0.945 | 1.017 | 1.061 | 1.217 | 0.082 |

| NZL | 1.030 | 1.228 | 0.870 | 1.029 | 1.175 | 0.102 | 0.962 | 0.669 | 0.724 | 0.979 | 1.154 | 0.151 | 1.026 | 1.150 | 0.735 | 1.038 | 1.430 | 0.179 | 1.008 | 0.944 | 0.724 | 0.921 | 1.023 | 1.108 | 1.430 | 0.146 |

| NOR | 1.036 | 1.208 | 0.780 | 1.049 | 1.215 | 0.166 | 1.023 | 0.985 | 0.716 | 1.052 | 1.394 | 0.238 | 1.006 | 0.957 | 0.813 | 0.991 | 1.272 | 0.154 | 1.020 | 1.138 | 0.716 | 0.856 | 1.032 | 1.187 | 1.394 | 0.175 |

| POL | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 |

| PRT | 0.998 | 0.981 | 0.954 | 1.001 | 1.029 | 0.023 | 0.985 | 0.845 | 0.823 | 0.986 | 1.134 | 0.112 | 1.052 | 1.161 | 0.525 | 0.999 | 1.866 | 0.313 | 1.016 | 0.963 | 0.525 | 0.967 | 0.995 | 1.061 | 1.866 | 0.201 |

| SVK | 1.010 | 1.083 | 0.984 | 1.004 | 1.038 | 0.021 | 0.994 | 0.938 | 0.904 | 0.990 | 1.122 | 0.063 | 1.033 | 1.040 | 0.598 | 0.995 | 1.776 | 0.278 | 1.015 | 1.056 | 0.598 | 0.979 | 0.998 | 1.026 | 1.776 | 0.174 |

| SVN | 1.003 | 0.999 | 0.830 | 1.010 | 1.085 | 0.083 | 0.995 | 0.944 | 0.903 | 1.024 | 1.075 | 0.067 | 0.991 | 0.778 | 0.768 | 0.970 | 1.384 | 0.177 | 0.996 | 0.734 | 0.768 | 0.920 | 1.009 | 1.075 | 1.384 | 0.121 |

| ESP | 0.992 | 0.934 | 0.966 | 0.993 | 1.016 | 0.015 | 1.005 | 1.038 | 0.944 | 1.007 | 1.039 | 0.031 | 1.007 | 1.076 | 0.983 | 1.000 | 1.043 | 0.018 | 1.002 | 1.043 | 0.944 | 0.990 | 1.000 | 1.016 | 1.043 | 0.022 |

| SWE | 1.040 | 1.326 | 0.896 | 1.044 | 1.174 | 0.096 | 0.963 | 0.642 | 0.728 | 0.978 | 1.258 | 0.196 | 1.022 | 1.133 | 0.786 | 1.011 | 1.328 | 0.156 | 1.010 | 0.964 | 0.728 | 0.917 | 1.011 | 1.128 | 1.328 | 0.150 |

| CHE | 1.050 | 1.323 | 0.792 | 1.021 | 1.296 | 0.182 | 0.967 | 0.671 | 0.702 | 1.014 | 1.197 | 0.181 | 1.009 | 1.043 | 0.863 | 1.008 | 1.172 | 0.108 | 1.009 | 0.926 | 0.702 | 0.887 | 1.013 | 1.153 | 1.296 | 0.149 |

| GBR | 1.005 | 1.044 | 0.981 | 1.006 | 1.026 | 0.014 | 0.999 | 0.978 | 0.900 | 1.009 | 1.089 | 0.058 | 0.999 | 0.989 | 0.948 | 1.000 | 1.060 | 0.025 | 1.001 | 1.010 | 0.900 | 0.991 | 1.000 | 1.018 | 1.089 | 0.034 |

| USA | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 1.000 | 0.000 |

| AVG. | 1.013 | 1.088 | 0.923 | 1.013 | 1.099 | 0.062 | 0.993 | 0.912 | 0.868 | 1.002 | 1.121 | 0.088 | 1.015 | 1.036 | 0.813 | 1.006 | 1.327 | 0.134 | 1.008 | 1.002 | 0.788 | 0.953 | 1.007 | 1.056 | 1.353 | 0.108 |

| S.D. | 0.022 | 0.167 | 0.085 | 0.017 | 0.126 | 0.066 | 0.020 | 0.173 | 0.116 | 0.024 | 0.117 | 0.080 | 0.019 | 0.129 | 0.168 | 0.013 | 0.317 | 0.117 | 0.008 | 0.155 | 0.166 | 0.049 | 0.011 | 0.056 | 0.312 | 0.079 |

| Pre-COVID (2018Q1–2020Q1) | During-COVID (2020Q1–2022Q1) | POST-COVID (2022Q1–2024Q4) | TOTAL (2018Q1–2024Q4) | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Code | AVG. | CUM. | MIN. | MED. | MAX | S.D. | AVG. | CUM. | MIN. | MED. | MAX | S.D. | AVG. | CUM. | MIN. | MED. | MAX. | S.D. | AVG. | CUM. | MIN. | Q1 | Q2 | Q3 | MAX | S.D. |

| AUS | 1.000 | 0.991 | 0.954 | 0.997 | 1.060 | 0.039 | 1.031 | 1.260 | 0.938 | 1.028 | 1.139 | 0.065 | 1.007 | 1.073 | 0.938 | 1.000 | 1.073 | 0.046 | 1.012 | 1.340 | 0.938 | 0.966 | 1.002 | 1.053 | 1.139 | 0.050 |

| AUT | 0.995 | 0.923 | 0.864 | 0.989 | 1.174 | 0.113 | 1.079 | 1.576 | 0.822 | 1.018 | 1.451 | 0.226 | 1.013 | 0.982 | 0.715 | 1.000 | 1.350 | 0.179 | 1.027 | 1.428 | 0.715 | 0.896 | 1.000 | 1.143 | 1.451 | 0.172 |

| BEL | 0.996 | 0.944 | 0.888 | 0.991 | 1.139 | 0.089 | 1.068 | 1.518 | 0.837 | 1.036 | 1.355 | 0.192 | 1.012 | 1.034 | 0.806 | 0.980 | 1.231 | 0.142 | 1.024 | 1.482 | 0.806 | 0.920 | 0.997 | 1.139 | 1.355 | 0.141 |

| CAN | 1.003 | 1.021 | 0.973 | 1.001 | 1.041 | 0.024 | 1.021 | 1.177 | 0.956 | 1.023 | 1.099 | 0.044 | 1.005 | 1.048 | 0.914 | 1.003 | 1.090 | 0.046 | 1.009 | 1.258 | 0.914 | 0.982 | 1.003 | 1.035 | 1.099 | 0.039 |

| CHL | 1.016 | 1.135 | 0.999 | 1.015 | 1.031 | 0.009 | 1.024 | 1.200 | 0.962 | 1.004 | 1.113 | 0.057 | 1.039 | 0.990 | 0.534 | 0.997 | 1.888 | 0.323 | 1.028 | 1.348 | 0.534 | 0.988 | 1.014 | 1.032 | 1.888 | 0.199 |

| COL | 1.054 | 1.484 | 1.003 | 1.023 | 1.293 | 0.097 | 1.010 | 1.065 | 0.924 | 0.999 | 1.118 | 0.072 | 1.038 | 1.461 | 0.956 | 1.024 | 1.251 | 0.082 | 1.034 | 2.310 | 0.924 | 0.998 | 1.020 | 1.030 | 1.293 | 0.081 |

| CRI | 1.040 | 1.345 | 0.963 | 1.011 | 1.194 | 0.079 | 0.975 | 0.796 | 0.876 | 0.981 | 1.067 | 0.081 | 1.034 | 0.985 | 0.565 | 1.024 | 1.768 | 0.296 | 1.018 | 1.055 | 0.565 | 0.949 | 1.012 | 1.056 | 1.768 | 0.191 |

| CZE | 1.016 | 1.138 | 0.997 | 1.019 | 1.040 | 0.014 | 1.049 | 1.333 | 0.817 | 1.001 | 1.333 | 0.172 | 1.028 | 0.961 | 0.571 | 0.983 | 1.621 | 0.269 | 1.031 | 1.459 | 0.571 | 0.960 | 1.016 | 1.091 | 1.621 | 0.187 |

| DNK | 0.993 | 0.894 | 0.840 | 0.986 | 1.204 | 0.129 | 1.074 | 1.529 | 0.825 | 1.019 | 1.425 | 0.220 | 1.011 | 0.996 | 0.742 | 0.995 | 1.314 | 0.161 | 1.024 | 1.361 | 0.742 | 0.887 | 0.995 | 1.154 | 1.425 | 0.166 |

| EST | 1.048 | 1.362 | 0.880 | 1.001 | 1.319 | 0.147 | 1.003 | 0.934 | 0.782 | 0.985 | 1.295 | 0.166 | 1.007 | 1.039 | 0.831 | 1.004 | 1.174 | 0.083 | 1.018 | 1.321 | 0.782 | 0.939 | 1.004 | 1.097 | 1.319 | 0.125 |

| FIN | 0.993 | 0.896 | 0.848 | 0.988 | 1.192 | 0.125 | 1.070 | 1.526 | 0.846 | 1.020 | 1.387 | 0.200 | 1.014 | 1.001 | 0.699 | 1.003 | 1.354 | 0.174 | 1.024 | 1.369 | 0.699 | 0.891 | 0.994 | 1.154 | 1.387 | 0.163 |

| FRA | 1.006 | 1.047 | 0.976 | 1.005 | 1.027 | 0.015 | 1.015 | 1.120 | 0.954 | 1.027 | 1.048 | 0.034 | 1.005 | 1.053 | 0.965 | 1.002 | 1.048 | 0.026 | 1.008 | 1.235 | 0.954 | 0.990 | 1.006 | 1.027 | 1.048 | 0.025 |

| DEU | 1.011 | 1.095 | 1.001 | 1.014 | 1.021 | 0.007 | 1.008 | 1.058 | 0.934 | 1.017 | 1.059 | 0.037 | 1.004 | 1.043 | 0.972 | 1.007 | 1.029 | 0.017 | 1.007 | 1.208 | 0.934 | 0.997 | 1.012 | 1.019 | 1.059 | 0.022 |

| GRC | 1.012 | 1.097 | 0.984 | 1.014 | 1.051 | 0.024 | 1.013 | 1.089 | 0.886 | 1.015 | 1.106 | 0.068 | 1.054 | 1.056 | 0.488 | 1.007 | 2.023 | 0.363 | 1.029 | 1.261 | 0.488 | 0.982 | 1.008 | 1.040 | 2.023 | 0.225 |

| HUN | 1.017 | 1.145 | 0.993 | 1.017 | 1.039 | 0.013 | 1.026 | 1.201 | 0.913 | 0.994 | 1.165 | 0.088 | 1.040 | 1.010 | 0.529 | 1.011 | 1.861 | 0.315 | 1.029 | 1.389 | 0.529 | 0.976 | 1.015 | 1.071 | 1.861 | 0.197 |

| ISL | 1.004 | 1.034 | 0.963 | 1.006 | 1.034 | 0.023 | 0.991 | 0.928 | 0.966 | 0.992 | 1.013 | 0.016 | 0.990 | 0.897 | 0.957 | 0.994 | 1.004 | 0.013 | 0.995 | 0.861 | 0.957 | 0.982 | 0.996 | 1.004 | 1.034 | 0.018 |

| IRL | 1.042 | 1.312 | 0.916 | 0.995 | 1.257 | 0.137 | 1.068 | 1.547 | 0.839 | 1.029 | 1.376 | 0.174 | 1.008 | 0.998 | 0.788 | 0.979 | 1.247 | 0.136 | 1.036 | 2.025 | 0.788 | 0.929 | 1.011 | 1.092 | 1.376 | 0.142 |

| ISR | 0.992 | 0.891 | 0.845 | 0.982 | 1.196 | 0.126 | 1.073 | 1.529 | 0.832 | 1.017 | 1.419 | 0.216 | 1.013 | 0.987 | 0.703 | 0.998 | 1.371 | 0.180 | 1.025 | 1.345 | 0.703 | 0.898 | 0.997 | 1.153 | 1.419 | 0.171 |

| ITA | 1.015 | 1.130 | 0.996 | 1.017 | 1.025 | 0.009 | 1.000 | 1.000 | 0.933 | 1.003 | 1.036 | 0.032 | 1.006 | 1.061 | 0.960 | 1.001 | 1.046 | 0.024 | 1.007 | 1.199 | 0.933 | 0.997 | 1.013 | 1.020 | 1.046 | 0.023 |

| JPN | 1.004 | 1.035 | 0.995 | 1.004 | 1.015 | 0.007 | 1.012 | 1.101 | 0.975 | 1.017 | 1.041 | 0.024 | 1.029 | 1.348 | 0.919 | 1.015 | 1.124 | 0.065 | 1.017 | 1.536 | 0.919 | 0.995 | 1.009 | 1.028 | 1.124 | 0.043 |

| KOR | 1.003 | 1.025 | 0.979 | 1.002 | 1.031 | 0.018 | 1.019 | 1.155 | 0.967 | 1.022 | 1.077 | 0.035 | 1.005 | 1.053 | 0.924 | 1.005 | 1.076 | 0.040 | 1.009 | 1.247 | 0.924 | 0.986 | 1.003 | 1.031 | 1.077 | 0.033 |

| LVA | 1.061 | 1.579 | 0.924 | 1.050 | 1.133 | 0.068 | 0.974 | 0.802 | 0.877 | 0.966 | 1.059 | 0.061 | 1.003 | 1.016 | 0.888 | 1.025 | 1.081 | 0.062 | 1.012 | 1.287 | 0.877 | 0.955 | 1.030 | 1.052 | 1.133 | 0.069 |

| LTU | 1.042 | 1.378 | 0.986 | 1.037 | 1.138 | 0.049 | 1.003 | 1.012 | 0.913 | 0.992 | 1.115 | 0.067 | 1.028 | 1.139 | 0.700 | 1.009 | 1.457 | 0.195 | 1.025 | 1.587 | 0.700 | 0.968 | 1.009 | 1.072 | 1.457 | 0.127 |

| LUX | 1.006 | 1.051 | 0.988 | 1.008 | 1.022 | 0.011 | 1.014 | 1.109 | 0.976 | 1.000 | 1.094 | 0.040 | 1.005 | 1.048 | 0.971 | 1.005 | 1.061 | 0.024 | 1.008 | 1.223 | 0.971 | 0.996 | 1.005 | 1.015 | 1.094 | 0.026 |

| MEX | 1.018 | 1.151 | 0.978 | 1.011 | 1.061 | 0.029 | 1.000 | 0.999 | 0.971 | 0.992 | 1.076 | 0.035 | 0.990 | 0.787 | 0.785 | 1.002 | 1.295 | 0.156 | 1.001 | 0.905 | 0.785 | 0.978 | 1.002 | 1.035 | 1.295 | 0.098 |

| NLD | 1.008 | 1.060 | 0.953 | 1.002 | 1.082 | 0.045 | 1.041 | 1.337 | 0.913 | 1.027 | 1.206 | 0.103 | 1.009 | 1.049 | 0.825 | 0.991 | 1.206 | 0.105 | 1.018 | 1.487 | 0.825 | 0.968 | 1.006 | 1.064 | 1.206 | 0.087 |

| NZL | 0.996 | 0.937 | 0.869 | 0.989 | 1.162 | 0.102 | 1.052 | 1.369 | 0.871 | 1.022 | 1.337 | 0.175 | 1.014 | 1.007 | 0.703 | 1.006 | 1.368 | 0.173 | 1.020 | 1.292 | 0.703 | 0.901 | 0.996 | 1.118 | 1.368 | 0.149 |

| NOR | 0.993 | 0.862 | 0.820 | 0.990 | 1.256 | 0.165 | 1.080 | 1.600 | 0.814 | 1.020 | 1.423 | 0.220 | 1.010 | 0.989 | 0.749 | 0.989 | 1.275 | 0.158 | 1.026 | 1.365 | 0.749 | 0.844 | 0.994 | 1.206 | 1.423 | 0.174 |

| POL | 1.021 | 1.181 | 0.999 | 1.023 | 1.033 | 0.011 | 1.020 | 1.170 | 0.972 | 1.024 | 1.048 | 0.024 | 1.001 | 1.007 | 0.958 | 1.005 | 1.040 | 0.027 | 1.013 | 1.392 | 0.958 | 0.999 | 1.020 | 1.029 | 1.048 | 0.024 |

| PRT | 1.017 | 1.144 | 0.992 | 1.018 | 1.039 | 0.013 | 1.029 | 1.229 | 0.938 | 0.990 | 1.155 | 0.085 | 1.043 | 1.017 | 0.524 | 1.006 | 1.912 | 0.328 | 1.031 | 1.430 | 0.524 | 0.975 | 1.016 | 1.051 | 1.912 | 0.205 |

| SVK | 1.018 | 1.149 | 1.000 | 1.014 | 1.047 | 0.017 | 1.015 | 1.110 | 0.942 | 1.006 | 1.129 | 0.061 | 1.033 | 1.041 | 0.581 | 1.005 | 1.732 | 0.270 | 1.023 | 1.328 | 0.581 | 0.977 | 1.012 | 1.047 | 1.732 | 0.168 |

| SVN | 1.035 | 1.294 | 0.954 | 1.030 | 1.200 | 0.080 | 0.997 | 0.960 | 0.921 | 0.979 | 1.124 | 0.073 | 1.055 | 1.445 | 0.736 | 1.024 | 1.384 | 0.223 | 1.032 | 1.795 | 0.736 | 0.954 | 1.003 | 1.088 | 1.384 | 0.149 |

| ESP | 1.016 | 1.132 | 0.987 | 1.021 | 1.025 | 0.013 | 1.010 | 1.077 | 0.945 | 1.022 | 1.042 | 0.033 | 1.005 | 1.050 | 0.951 | 1.006 | 1.049 | 0.028 | 1.010 | 1.281 | 0.945 | 0.996 | 1.013 | 1.025 | 1.049 | 0.025 |

| SWE | 0.995 | 0.924 | 0.877 | 0.992 | 1.158 | 0.102 | 1.082 | 1.666 | 0.835 | 1.039 | 1.395 | 0.203 | 1.011 | 1.000 | 0.757 | 0.986 | 1.300 | 0.159 | 1.027 | 1.540 | 0.757 | 0.904 | 0.997 | 1.125 | 1.395 | 0.155 |

| CHE | 0.991 | 0.838 | 0.799 | 0.989 | 1.273 | 0.172 | 1.088 | 1.775 | 0.859 | 1.048 | 1.336 | 0.181 | 1.009 | 1.039 | 0.859 | 0.976 | 1.169 | 0.115 | 1.027 | 1.545 | 0.799 | 0.879 | 1.001 | 1.155 | 1.336 | 0.150 |

| GBR | 1.013 | 1.107 | 0.991 | 1.016 | 1.019 | 0.009 | 1.002 | 1.010 | 0.924 | 1.023 | 1.034 | 0.041 | 1.006 | 1.067 | 0.946 | 1.002 | 1.067 | 0.036 | 1.007 | 1.193 | 0.924 | 0.991 | 1.016 | 1.028 | 1.067 | 0.031 |

| USA | 1.005 | 1.041 | 0.991 | 1.006 | 1.011 | 0.006 | 1.017 | 1.145 | 0.966 | 1.021 | 1.067 | 0.028 | 1.010 | 1.113 | 1.004 | 1.011 | 1.016 | 0.005 | 1.011 | 1.327 | 0.966 | 1.005 | 1.009 | 1.015 | 1.067 | 0.016 |

| AVG. | 1.013 | 1.102 | 0.945 | 1.007 | 1.109 | 0.058 | 1.029 | 1.217 | 0.903 | 1.011 | 1.183 | 0.099 | 1.016 | 1.051 | 0.795 | 1.002 | 1.307 | 0.136 | 1.019 | 1.379 | 0.787 | 0.957 | 1.007 | 1.070 | 1.345 | 0.110 |

| S.D. | 0.018 | 0.172 | 0.061 | 0.015 | 0.093 | 0.052 | 0.031 | 0.246 | 0.057 | 0.018 | 0.143 | 0.071 | 0.016 | 0.124 | 0.154 | 0.012 | 0.285 | 0.104 | 0.010 | 0.257 | 0.148 | 0.042 | 0.008 | 0.052 | 0.277 | 0.068 |

| 1 | Missing data for 2024Q4 for Australia and Belgium and 2024Q2–2024Q4 for Iceland and South Korea is calculated by the average growth rate of the last 10 quarters of these countries. |

| 2 | |

| 3 | |

| 4 | 0.85 is added to all the observations to make the data values positive. |

| 5 | See Note 1. |

| 6 | See Note 2. |

| 7 | See Note 3. |

| 8 | See Note 4. |

References

- Adams-Prassl, A., Boneva, T., Golin, M., & Rauh, C. (2020). Inequality in the impact of the coronavirus shock: Evidence from real time surveys. Journal of Public Economics, 189, 104245. [Google Scholar] [CrossRef]

- Alon, T., Doepke, M., Olmstead-Rumsey, J., & Tertilt, M. (2020). The impact of COVID-19 on gender equality. NBER Working Paper No. 26947. National Bureau of Economic Research. [Google Scholar]

- Andrews, D., Charlton, A., & Moore, A. (2021). COVID-19, productivity and reallocation: Timely evidence from three OECD countries. OECD Economics Department Working Paper No. 1676. OECD Publishing. [Google Scholar]

- Apergis, N., Aye, G. C., Barros, C. P., Gupta, R., & Wanke, P. (2015). Energy efficiency of selected OECD countries: A slacks-based measure with bootstrapped quasi-likelihood estimation. Energy Economics, 47, 1–10. [Google Scholar]

- Azadi, M., Moghaddas, Z., Saen, R. F., Gunasekaran, A., Mangla, S. K., & Ishizaka, A. (2023). Using network data envelopment analysis to assess the sustainability and resilience of healthcare supply chains in response to the COVID-19 pandemic. Annals of Operations Research, 328(1), 107–150. [Google Scholar] [CrossRef]

- Banker, R. D., Charnes, A., & Cooper, W. W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science, 30(9), 1078–1092. [Google Scholar] [CrossRef]

- Baqaee, D. R., & Farhi, E. (2022). Supply and Demand in Disaggregated Keynesian Economies with an Application to the COVID-19 Crisis. American Economic Review, 112(5), 1397–1436. [Google Scholar] [CrossRef]

- Bloom, N., Bunn, P., Mizen, P., Smietanka, P., & Thwaites, G. (2025). The impact of COVID-19 on productivity. Review of Economics and Statistics, 107(1), 28–41. [Google Scholar] [CrossRef]

- Bloom, N., Davis, S. J., & Zhestkova, Y. (2021). COVID-19 shifted patent applications toward technologies that support working from home. AEA Papers and Proceedings, 111, 263–266. [Google Scholar]

- Brockett, P. L., Golany, B., & Li, S. (1999). Analysis of intertemporal efficiency trends using rank statistics with an application evaluating the macro economic performance of OECD nations. Journal of Productivity Analysis, 11(2), 169–182. [Google Scholar] [CrossRef]

- Calligaris, S., Ciminelli, G., Costa, H., Criscuolo, C., Demmou, L., Desnoyers-James, I., Franco, G., & Verlhac, R. (2023). Employment dynamics across firms during COVID-19: The role of job retention schemes. OECD Economics Department Working Paper No. 1788. OECD Publishing. [Google Scholar]

- Camanho, A. S., Silva, M. C., Piran, F. S., & Lacerda, D. P. (2024). A literature review of economic efficiency assessments using Data Envelopment Analysis. European Journal of Operational Research, 315(1), 1–18. [Google Scholar] [CrossRef]

- Caves, D. W., Christensen, L. R., & Diewert, W. E. (1982). The economic theory of index numbers and the measurement of input, output, and productivity. Econometrica: Journal of the Econometric Society, 50(6), 1393–1414. [Google Scholar] [CrossRef]

- CBS. (2025). Existing own homes; purchase prices, price indices 2020=100. Available online: https://www.cbs.nl/en-gb/figures/detail/85773ENG (accessed on 15 March 2025).

- Central Bank of Costa Rica. (2025). Consumer price index. Available online: https://gee.bccr.fi.cr/indicadoreseconomicos/Cuadros/frmVerCatCuadro.aspx?idioma=2&CodCuadro=%202732 (accessed on 15 March 2025).

- Chang, T. P., & Hu, J. L. (2010). Total-factor energy productivity growth, technical progress, and efficiency change: An empirical study of China. Applied Energy, 87(10), 3262–3270. [Google Scholar] [CrossRef]

- Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429–444. [Google Scholar] [CrossRef]

- Chien, T., & Hu, J. L. (2007). Renewable energy and macroeconomic efficiency of OECD and non-OECD economies. Energy Policy, 35(7), 3606–3615. [Google Scholar] [CrossRef]

- Chile National Statistics Institute (INE). (2025). Consumer price index. Available online: https://www.ine.gob.cl/statistics/economic/price-indices-and-inflation/consumer-price-index (accessed on 15 March 2025).

- Choi, Y., Zhang, N., & Zhou, P. (2012). Efficiency and abatement costs of energy-related CO2 emissions in China: A slacks-based efficiency measure. Applied Energy, 98, 198–208. [Google Scholar] [CrossRef]

- Deliktas, E., & Balcilar, M. (2005). A comparative analysis of productivity growth, catch-up, and convergence in transition economies. Emerging Markets Finance and Trade, 41(1), 6–28. [Google Scholar] [CrossRef]

- del Rio-Chanona, R. M., Mealy, P., Pichler, A., Lafond, F., & Farmer, J. D. (2020). Supply and demand shocks in the COVID-19 pandemic: An industry and occupation perspective. Oxford Review of Economic Policy, 36, S94–S137. [Google Scholar] [CrossRef] [PubMed]

- Demiral, E. E., & Sağlam, Ü. (2021). Eco-efficiency and eco-productivity assessments of the states in the United States: A two-stage non-parametric analysis. Applied Energy, 303, 117649. [Google Scholar] [CrossRef]

- Demiral, E. E., & Sağlam, Ü. (2023). Sustainable production assessment of the 50 US states. Journal of Cleaner Production, 419, 138086. [Google Scholar] [CrossRef]

- Doğan, M. İ., Özsoy, V. S., & Örkcü, H. H. (2021). Performance management of OECD countries on Covid-19 pandemic: A criticism using data envelopment analysis models. Journal of Facilities Management, 19(4), 479–499. [Google Scholar] [CrossRef]

- Dorville, Y., Luu, N., Mourougane, A., & Schmidt, J. (2025). Towards more timely measures of labour productivity growth (No. 2025/01). OECD Publishing. [Google Scholar]

- Ersoy, Y., & Aktaş, A. (2022). Health system efficiency of OECD countries with data envelopment analysis. Management Issues/Problemy Zarządzania, 20(4), 98–117. [Google Scholar] [CrossRef]

- Farrell, M. J. (1957). The measurement of productive efficiency. Journal of the Royal Statistical Society: Series A (General), 120(3), 253–281. [Google Scholar] [CrossRef]

- Färe, R., Grosskopf, S., Norris, M., & Zhang, Z. (1994). Productivity growth, technical progress, and efficiency change in industrialized countries. The American Economic Review, 84(1), 66–83. [Google Scholar]

- Forstner, H., & Isaksson, A. (2002). Productivity, technology, and efficiency: An analysis of the world technology frontier; when memory is infinite. Statistics and Information Networks Branch of UNIDO. [Google Scholar]

- Gössling, S., Scott, D., & Hall, C. M. (2020). Pandemics, tourism and global change: A rapid assessment of COVID-19. Journal of Sustainable Tourism, 29(1), 1–20. [Google Scholar] [CrossRef]

- Haskel, J., & Westlake, S. (2021). Restarting the future: How to fix the intangible economy. Princeton University Press. [Google Scholar]

- Hu, J. L., & Kao, C. H. (2007). Efficient energy-saving targets for APEC economies. Energy Policy, 35(1), 373–382. [Google Scholar] [CrossRef]

- Hu, J. L., & Wang, S. C. (2006). Total-factor energy efficiency of regions in China. Energy Policy, 34(17), 3206–3217. [Google Scholar] [CrossRef]

- Husseiny, I. A. E., & Badawy, M. M. (2022). Evaluating the efficiency of fiscal responses to COVID-19 pandemic in the OECD countries: A two-stage data envelopment analysis approach. International Journal of Computational Economics and Econometrics, 12(4), 459–485. [Google Scholar] [CrossRef]

- Iftikhar, Y., He, W., & Wang, Z. (2016). Energy and CO2 emissions efficiency of major economies: A non-parametric analysis. Journal of Cleaner Production, 139, 779–787. [Google Scholar] [CrossRef]

- International Monetary Fund (IMF). (2021). Policy responses to COVID-19. Available online: https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19 (accessed on 15 April 2025).

- International Monetary Fund (IMF). (2025). International financial statistics and data files. consumer price index (2010 = 100)—Mexico. Available online: https://data.worldbank.org/indicator/FP.CPI.TOTL?locations=MX (accessed on 15 March 2025).

- Ivanov, D., & Dolgui, A. (2021). A digital supply chain twin for managing the disruption risks and resilience in the era of Industry 4.0. Production Planning & Control, 32(9), 775–788. [Google Scholar]

- Kaüger, J. J., Cantner, U., & Hanusch, H. (2000). Total factor productivity, the East Asian miracle, and the world production frontier. Weltwirtschaftliches Archiv, 136(1), 111–136. [Google Scholar] [CrossRef]

- Klumpp, M., Loske, D., & Bicciato, S. (2022). COVID-19 health policy evaluation: Integrating health and economic perspectives with a data envelopment analysis approach. The European Journal of Health Economics, 23(8), 1263–1285. [Google Scholar] [CrossRef]

- Malmquist, S. (1953). Index numbers and indifference surfaces. Trabajos de estadística, 4(2), 209–242. [Google Scholar] [CrossRef]

- Martins, A., & Sousa, D. (2024). Assessing the efficiency of contagion control and medical treatment for COVID-19 in OECD countries using data envelopment analysis. In Handbook on data envelopment analysis in business, finance, and sustainability: Recent trends and developments (pp. 147–192). Springer. [Google Scholar]

- Min, H., Lee, C. C., & Joo, S. J. (2022). Assessing the efficiency of the Covid-19 control measures and public health policy in OECD countries from cultural perspectives. Benchmarking: An International Journal, 29(6), 1781–1796. [Google Scholar] [CrossRef]

- OECD (Organisation for Economic Co-operation and Development). (2021). OECD employment outlook 2021: Navigating the COVID-19 crisis and recovery. OECD Publishing. [Google Scholar]

- OECD Data Explorer. (2025). Main economic indicators-complete database. main economic indicators (database). Available online: https://data-explorer.oecd.org/ (accessed on 15 March 2025).

- Our World in Data. (2024). COVID-19 pandemic. Available online: https://ourworldindata.org/coronavirus (accessed on 15 April 2025).

- Park, Y. S., Lim, S. H., Egilmez, G., & Szmerekovsky, J. (2018). Environmental efficiency assessment of US transport sector: A slack-based data envelopment analysis approach. Transportation Research Part D: Transport and Environment, 61, 152–164. [Google Scholar] [CrossRef]

- Pereira, M. A., Dinis, D. C., Ferreira, D. C., Figueira, J. R., & Marques, R. C. (2022). A network data envelopment analysis to estimate nations’ efficiency in the fight against SARS-CoV-2. Expert Systems with Applications, 210, 118362. [Google Scholar] [CrossRef]

- Pujawan, I. N., & Bah, A. U. (2022). Supply chains under COVID-19 disruptions: Literature review and research agenda. Supply Chain Forum: An International Journal, 23(1), 81–95. [Google Scholar] [CrossRef]

- QV. (2025). QV house price index. Available online: https://www.qv.co.nz/price-index/ (accessed on 15 March 2025).

- Selamzade, F., Ersoy, Y., Ozdemir, Y., & Celik, M. Y. (2023). Health efficiency measurement of OECD countries against the COVID-19 pandemic by using DEA and MCDM methods. Arabian Journal for Science and Engineering, 48(11), 15695–15712. [Google Scholar] [CrossRef]

- Statista (Japan). (2025). Monthly consumer price index (CPI) of all items in Japan from January 2019 to March 2025. Statista Inc. Available online: https://www.statista.com/statistics/1413990/japan-monthly-consumer-price-index/ (accessed on 15 March 2025).

- Taherinezhad, A., & Alinezhad, A. (2023). Nations performance evaluation during SARS-CoV-2 outbreak handling via data envelopment analysis and machine learning methods. International Journal of Systems Science: Operations & Logistics, 10(1), 2022243. [Google Scholar]

- Tone, K. (2001). A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research, 130(3), 498–509. [Google Scholar] [CrossRef]

- Tone, K. (2010). Variations on the theme of slacks-based measure of efficiency in DEA. European Journal of Operational Research, 200(3), 901–907. [Google Scholar] [CrossRef]

- Wang, C. N., Hsu, H. P., Wang, Y. H., & Nguyen, T. T. (2020). Eco-efficiency assessment for some European countries using slacks-based measure data envelopment analysis. Applied Sciences, 10(5), 1760. [Google Scholar] [CrossRef]

- Wang, C. N., Nguyen, T. T. T., Dang, T. T., & Hsu, H. P. (2023). Exploring economic and environmental efficiency in renewable energy utilization: A case study in the Organization for Economic Cooperation and Development countries. Environmental Science and Pollution Research, 30(28), 72949–72965. [Google Scholar] [CrossRef]

- World Bank. (2020). The inequality virus: Bringing together a world torn apart by coronavirus through a fair, just and sustainable economy. World Bank. [Google Scholar]

- World Health Organization (WHO). (2025). WHO Coronavirus (COVID-19) dashboard. Available online: https://data.who.int/dashboards/covid19/cases?n=o (accessed on 15 April 2025).

- Yeh, T. L., Chen, T. Y., & Lai, P. Y. (2010). A comparative study of energy utilization efficiency between Taiwan and China. Energy Policy, 38(5), 2386–2394. [Google Scholar] [CrossRef]

- Yu, Y., Liao, J., Ma, D., & Zhu, W. (2024). Measuring the COVID-19 treatment efficiency in OECD countries: A multiplicative network DEA approach. INFOR: Information Systems and Operational Research, 62(3), 419–448. [Google Scholar] [CrossRef]

- Zhou, P., & Ang, B. W. (2008). Linear programming models for measuring economy-wide energy efficiency performance. Energy Policy, 36(8), 2911–2916. [Google Scholar] [CrossRef]

- Zhou, P., Ang, B. W., & Han, J. Y. (2010). Total factor carbon emission performance: A Malmquist index analysis. Energy Economics, 32(1), 194–201. [Google Scholar] [CrossRef]

| Pre-COVID (2018Q1–2020Q1) | During-COVID (2020Q1–2022Q1) | Post-COVID (2022Q1–2024Q4) | |

|---|---|---|---|

| Malmquist Productivity Index (MPI) | Most OECD countries experienced steady productivity growth (MPI > 1.00), especially advanced economies like Belgium, Austria, and Australia with low variability (SD < 0.01). Volatile high performers included Colombia (MPI = 1.130, SD = 0.219) and Costa Rica. | Productivity trends diverged: Australia, Canada, and US maintained MPI > 1.01. Ireland (MPI = 1.068, SD = 0.174) and Estonia (MPI = 1.066, SD = 0.239) were volatile. Costa Rica and Czechia declined below MPI = 1.00, reflecting pandemic impacts. | Japan (avg MPI = 1.066) and Colombia (1.038) led recovery, with substantial gains. Czechia, Finland, and New Zealand showed balanced performance (avg MPI ~1.014). Costa Rica (0.982) and Lithuania (0.988) lagged, indicating structural challenges. |

| Efficiency Change (EC) | Countries like Colombia (EC = 1.606), Sweden, and Switzerland showed strong efficiency gains. Moderate performers included France and Netherlands. Some countries, like Germany, Ireland, and Mexico, recorded no change (EC = 1.000). | Efficiency declined across many countries. Estonia (EC = 1.514), Czechia (1.275), and Latvia (1.229) showed resilience. Others like Sweden (0.642), Austria (0.657), and Finland (0.693) experienced steep drops. Several maintained flat EC = 1.000. | Japan (EC = 1.444), Czechia (1.206), Chile (1.194), and Portugal (1.161) were among the top efficiency improvers. Estonia and Slovenia regressed (EC < 0.80), while Germany, Ireland, and Mexico showed flat growth (EC = 1.000). |

| Technological Change (TC) | Technological progress was led by Latvia, Colombia, and Estonia (TC > 1.05). Ireland and Lithuania showed consistent gains. Many advanced economies had stable but modest frontier shifts, indicating early divergence in innovation capacity. | Countries like Switzerland, Sweden, and Norway had strong frontier shifts (TC > 1.08), driven by digital transformation. Austria and Denmark showed rebound patterns. Others, like Belgium and Canada, had mid-period declines before partial recovery. | Slovenia, Greece, and Portugal exceeded TC > 1.04 but with high volatility. Greece’s TC ranged from 0.49 to 1.2. Canada and Australia achieved steady TC gains. Divergence widened between innovation leaders and structurally lagging countries. |

| Model I | MPI | Efficiency Change (Catch-Up Effect) | Technological Change (Frontier-Shift) | ||||||||||||

| Term | Coef | SE Coef | T-Value | p-Value | VIF | Coef | SE Coef | T-Value | p-Value | VIF | Coef | SE Coef | T-Value | p-Value | VIF |

| Constant | 1.0970 | 0.1570 | 6.99 | 0.000 | 1.1640 | 0.1190 | 9.79 | 0.000 | 0.9298 | 0.0774 | 12.01 | 0.000 | |||

| 2020 | −0.0110 | 0.0040 | −2.76 | 0.009 | 2.15 | −0.0074 | 0.0030 | −2.45 | 0.020 | 2.15 | −0.00474 | 0.00196 | −2.42 | 0.021 | 2.15 |

| 2021 | 0.0073 | 0.0044 | 1.66 | 0.106 | 2.53 | 0.0045 | 0.0033 | 1.36 | 0.184 | 2.53 | 0.00454 | 0.00217 | 2.09 | 0.044 | 2.53 |

| 2022 | 0.0029 | 0.0037 | 0.78 | 0.439 | 1.27 | 0.0001 | 0.0028 | 0.05 | 0.962 | 1.27 | 0.00102 | 0.00181 | 0.56 | 0.578 | 1.27 |

| Model II | MPI | Efficiency Change (Catch-Up Effect) | Technological Change (Frontier-Shift) | ||||||||||||

| Term | Coef | SE Coef | T-Value | p-Value | VIF | Coef | SE Coef | T-Value | p-Value | VIF | Coef | SE Coef | T-Value | p-Value | VIF |

| Constant | 1.0390 | 0.1750 | 5.93 | 0.000 | 1.1380 | 0.1410 | 8.05 | 0.000 | 0.8688 | 0.0869 | 9.99 | 0.000 | |||

| 2020 Q1 | 0.0077 | 0.0039 | 1.97 | 0.060 | 1.30 | 0.0041 | 0.0032 | 1.29 | 0.210 | 1.30 | 0.0046 | 0.0019 | 2.36 | 0.027 | 1.30 |

| 2020 Q2 | −0.0069 | 0.0031 | −2.20 | 0.038 | 2.87 | −0.0048 | 0.0025 | −1.89 | 0.070 | 2.87 | −0.0025 | 0.0016 | −1.63 | 0.116 | 2.87 |

| 2020 Q3 | 0.0022 | 0.0027 | 0.83 | 0.417 | 4.08 | 0.0022 | 0.0022 | 1.01 | 0.322 | 4.08 | 0.0005 | 0.0013 | 0.36 | 0.725 | 4.08 |

| 2020 Q4 | −0.0065 | 0.0035 | −1.85 | 0.076 | 4.93 | −0.0053 | 0.0028 | −1.89 | 0.071 | 4.93 | −0.0015 | 0.0017 | −0.88 | 0.388 | 4.93 |

| 2021 Q1 | −0.0002 | 0.0042 | −0.05 | 0.961 | 7.75 | −0.0001 | 0.0034 | −0.03 | 0.973 | 7.75 | −0.0010 | 0.0021 | −0.49 | 0.630 | 7.75 |

| 2021 Q2 | 0.0100 | 0.0040 | 2.49 | 0.020 | 5.61 | 0.0074 | 0.0032 | 2.28 | 0.032 | 5.61 | 0.0053 | 0.0020 | 2.63 | 0.015 | 5.61 |

| 2021 Q3 | −0.0052 | 0.0041 | −1.28 | 0.212 | 5.14 | −0.0041 | 0.0033 | −1.27 | 0.218 | 5.14 | −0.0028 | 0.0020 | −1.40 | 0.174 | 5.14 |

| 2021 Q4 | 0.0099 | 0.0040 | 2.45 | 0.022 | 6.19 | 0.0067 | 0.0032 | 2.07 | 0.050 | 6.19 | 0.0054 | 0.0020 | 2.71 | 0.012 | 6.19 |

| 2022 Q1 | −0.0090 | 0.0040 | −2.26 | 0.033 | 4.60 | −0.0063 | 0.0032 | −1.97 | 0.060 | 4.60 | −0.0041 | 0.0020 | −2.07 | 0.050 | 4.60 |

| 2022 Q2 | 0.0017 | 0.0051 | 0.33 | 0.742 | 5.13 | −0.0001 | 0.0041 | −0.01 | 0.990 | 5.13 | 0.0016 | 0.0025 | 0.65 | 0.524 | 5.13 |

| 2022 Q3 | 0.0069 | 0.0070 | 0.99 | 0.332 | 6.50 | 0.0050 | 0.0056 | 0.89 | 0.381 | 6.50 | 0.0003 | 0.0035 | 0.09 | 0.927 | 6.50 |

| 2022 Q4 | −0.0008 | 0.0061 | −0.13 | 0.901 | 4.36 | −0.0008 | 0.0049 | −0.15 | 0.880 | 4.36 | 0.0009 | 0.0030 | 0.30 | 0.768 | 4.36 |

| Model | Coefficient (β) | SE | T-Value | p-Value | R-sq (%) |

|---|---|---|---|---|---|

| Lagged Stringency (2020Q2) | −0.00633 | 0.00210 | −3.02 | 0.005 | 20.7 |

| 2020 Stringency (Year Average) | −0.01174 | 0.00382 | −3.07 | 0.004 | |

| 2021 Stringency (Year Average) | 0.00886 | 0.00391 | 2.27 | 0.030 | 21.8 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sağlam, Ü. Beyond GDP: COVID-19’s Effects on Macroeconomic Efficiency and Productivity Dynamics in OECD Countries. Econometrics 2025, 13, 29. https://doi.org/10.3390/econometrics13030029

Sağlam Ü. Beyond GDP: COVID-19’s Effects on Macroeconomic Efficiency and Productivity Dynamics in OECD Countries. Econometrics. 2025; 13(3):29. https://doi.org/10.3390/econometrics13030029

Chicago/Turabian StyleSağlam, Ümit. 2025. "Beyond GDP: COVID-19’s Effects on Macroeconomic Efficiency and Productivity Dynamics in OECD Countries" Econometrics 13, no. 3: 29. https://doi.org/10.3390/econometrics13030029

APA StyleSağlam, Ü. (2025). Beyond GDP: COVID-19’s Effects on Macroeconomic Efficiency and Productivity Dynamics in OECD Countries. Econometrics, 13(3), 29. https://doi.org/10.3390/econometrics13030029