1. Introduction

The domain of international trade is pivotal in shaping the global economic landscape, fostering advancements in technology, and facilitating cultural exchange amongst nations. Nonetheless, this exchange carries significant environmental implications, particularly concerning carbon emissions. The European Union (EU), a central figure in global commerce, maintains intricate trade relations with diverse nations, including economic giants such as China and the United States of America (USA). The trade balance, specifically net exports (the difference between total export and import values), serves as a critical indicator of these relationships’ economic and environmental footprints. For instance, the EU’s substantial trade deficit with China, which amounted to EUR 180 billion in 2020, underscores the vast scale of goods exchange and its potential environmental repercussions (

European Commission, 2021). Additionally, the trade balance with the USA is of paramount importance, reflecting the depth of transatlantic economic relations’ depth and its concomitant environmental considerations.

As the EU intensifies its efforts to combat climate change, carbon mitigation has become an integral part of its trade policy. Central to this strategy is the carbon border adjustment mechanism (CBAM) (

European Commission, 2023), a tool designed to prevent carbon leakage and incentivize both EU and non-EU industries to adopt greener production methods. Carbon leakage occurs when industries relocate production to countries with less stringent environmental regulations, thereby undermining the EU’s climate goals. The CBAM aims to counteract this by imposing a carbon price on imports of certain goods from countries with weaker carbon regulations, thereby leveling the playing field between domestic and foreign producers (

Clora et al., 2023). By linking environmental costs to imported goods, the CBAM functions as a non-tariff measure that aligns trade policy with the EU’s Green Deal. The ideal impact of this policy is twofold: reducing EU carbon emissions and encouraging trade partners to adopt stronger environmental standards. This shift toward integrating carbon mitigation in trade policy has far-reaching consequences for industries that export goods to the EU, especially those in high-carbon sectors such as steel, cement, and aluminum. A study by

Branger and Quirion (

2014) and the

International Energy Agency (IEA) (

2021) found that border carbon adjustments could reduce the competitiveness of industries in emerging economies, exacerbating existing economic inequalities.

Given the potential impact of the CBAM on global trade, it is essential to investigate how this policy affects the trade dynamics between the EU and its key partners, particularly in terms of import goods form the US and China. Understanding this relationship is vital, as it provides insight into whether and how international trade contributes—directly or indirectly—to the EU’s carbon footprint. We hypothesize that, if a significant link between specific imported goods and EU carbon emissions exists, it could reveal broader systemic interactions between trade flows and domestic environmental performance. In particular, two scenarios are considered: (1) a positive relationship, where increased imports of certain goods are associated with higher carbon emissions in the EU, potentially due to complementary domestic production or logistics-related emissions; and (2) a negative relationship, indicating that imports might substitute more carbon-intensive domestic activities, thereby reducing overall emissions.

This research focuses on identifying the specific types of goods most affected by the CBAM, which is crucial for informing policymakers in partner countries about how they can adapt to this new regulatory landscape. To this end, we plan to analyze the impact of the CBAM on 15 key import goods which are highly carbon-intensive and most likely to be impacted by this policy.

This study employs a two-part methodology to address the research question. First, a Bayesian variable selection process will be applied using the BART and BASAD models to identify the most relevant variables from a pool of potential predictors. This step ensures that only the significant factors influencing the EU’s trade are included. Second, the Time-Varying Structural Vector Autoregressions (TV-SVAR) model will be used to estimate the time-varying coefficients of the selected variables. The TV-SVAR model will allow us to observe how the effects of carbon mitigation policies on trade patterns evolve over time. Additionally, it is vital for policymakers to not only assess the current impact but also to predict how these measures might influence future trade patterns. Predicting the coefficients of these relationships allows for a clearer understanding of how carbon mitigation policies could shape the Eurozone’s trade dynamics over time in the future. This foresight is essential for policymakers, as it enables the development of proactive strategies to mitigate potential economic disruptions, support affected industries, and maintain competitive trade advantages in an increasingly sustainability-focused global economy.

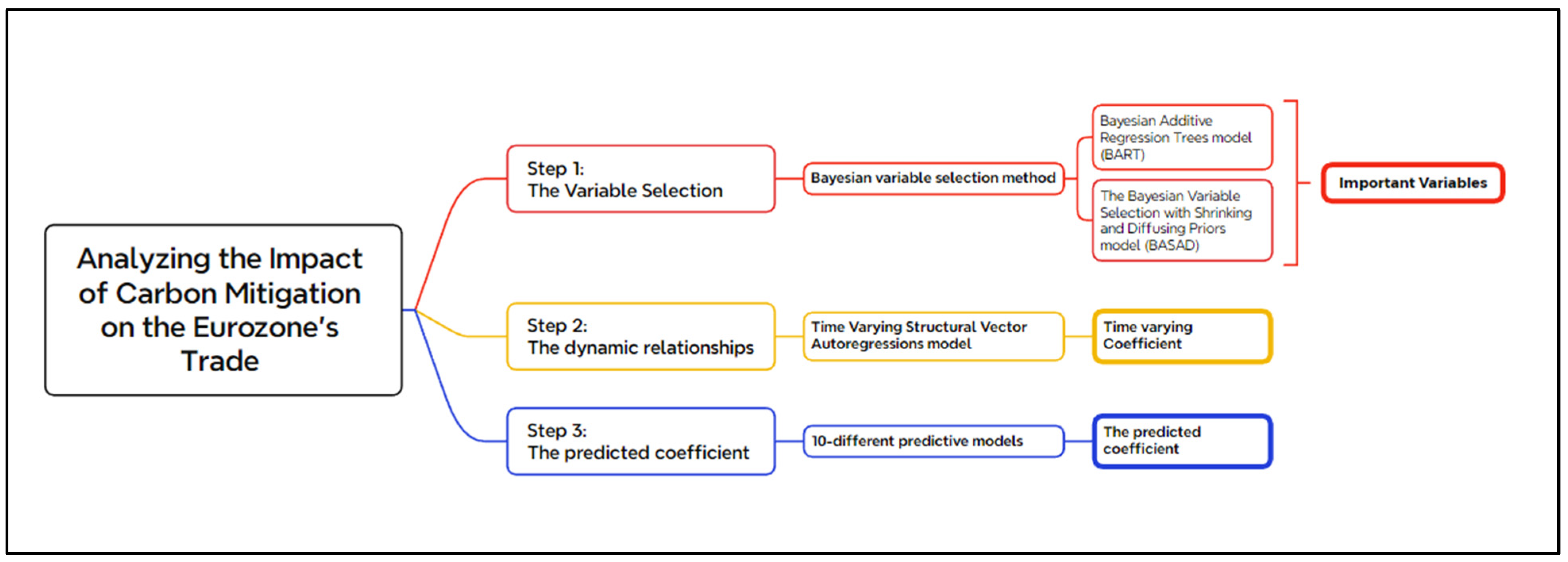

This study adopts a three-step methodological framework, variable selection, dynamic relationship modeling, and coefficient prediction, as presented in

Figure 1. First, Bayesian variable selection methods (BART and BASAD) identify the key factors influencing trade under carbon mitigation policies. Next, the Time-Varying Structural Vector Autoregressions (TV-SVAR) model incorporates time-varying coefficients to capture evolving economic relationships and shifting trade dynamics. Finally, ten predictive models estimate the forecasted coefficient, ensuring a robust and reliable quantification of carbon mitigation’s future impact on trade.

In addition to identifying the dynamic effects of carbon mitigation policies on trade, this study extends its analysis to forecasting future impacts. Accurately predicting how key trade variables influence carbon emissions is critical for policymaking in a time of rapidly evolving environmental regulations. By estimating the future trajectories of time-varying coefficients, we provide a forward-looking perspective on how the carbon border adjustment mechanism (CBAM) may reshape trade relations. This predictive insight is particularly valuable for EU policymakers seeking to preemptively design adaptive trade measures and support industries likely to face environmental compliance challenges. It also equips trade partners—such as the US and China—with evidence to guide their production and export strategies in alignment with emerging EU sustainability benchmarks. In this way, forecasting becomes not only an analytical tool but also a strategic asset for achieving long-term climate and economic objectives.

4. Results

4.1. Variable Selection

The variable selection is crucial due to the presence of 52 potential explanatory variables for EU carbon emissions, which makes it necessary to identify the most relevant ones to avoid overfitting and improve model interpretability. To address this, we employ two Bayesian variable selection methods, specifically the Bayesian Additive Regression Trees (BART) and Bayesian Shrinkage Additive Decomposition (BASAD) models by integrating their results for variable selection which offers a balanced strategy that leverages the strengths of both methods. Ultimately, this integrated approach balances predictive complexity with parsimony, yielding models that are not only accurate but also interpretable and thus more reliable for informed decision making.

- (1)

For the BART model, we set the split point () at the quantile criterion at the 2nd quantile which helps in determining the splitting rules within the sum-of-trees approach, focusing on identifying variables that significantly contribute to reducing prediction error.

- (2)

For the BASAD model, covariates were selected based on their marginal posterior probabilities, with a chosen threshold of 0.5, indicating that only variables with a probability above this threshold are retained as significant predictors. By cross-referencing the results from both methods, we were able to identify the key variables that consistently emerged as significant across both approaches, ensuring a more robust and comprehensive selection of predictors for the subsequent analysis.

After applying the Bayesian variable selection methods, the integrated results from BART and BASAD models highlighted three key variables that consistently emerged as significant (

Table 2): US_x9 (manufactured products from the US), US_x12 (manufactured goods from the US), and CH_x7 (petroleum products from China). These variables indicate the importance of manufactured and petroleum products in understanding the effects of carbon mitigation policies on trade patterns between the EU and its major trade partners, specifically, the United States and China. The prominence of these variables suggests that shifts in the trade of these product categories may have a substantial impact on the carbon footprint and trade dynamics of the Eurozone.

4.2. The Model Selection

We begin by selecting the most appropriate panel regression model for our dataset through comparative analysis. This method is based on the understanding that different economic phenomena can exhibit diverse behaviors and relationships within the data. To identify the most suitable estimation model, we use the Akaike information criterion (AIC) and Bayesian information criterion (BIC) as selection criteria.

This makes it necessary to identify the most relevant variables to avoid overfitting and improve model interpretability. To address this, we employ two Bayesian variable selection methods, specifically the Bayesian Additive Regression Trees (BART) and Bayesian Shrinkage Additive Decomposition (BASAD) models, by integrating their result for variable selection which offers a balanced strategy that leverages the strengths of both methods. Ultimately, this integrated approach balances predictive complexity with parsimony, yielding models that are not only accurate but also interpretable and thus more reliable for informed decision making.

Our analysis compares the Time-Varying Structural Vector Autoregressions (TV-SVAR) model and the State Space model, alongside static regression methods like Ordinary Least Squares (OLS) Regression and Lasso Regression. This comparison aims to determine whether our proposed model offers a better fit than traditional models.

Table 3 presents the AIC and BIC values used for model selection, indicating that the Time-Varying Structural Vector Autoregressions (TV-SVAR) model outperforms both dynamic and static regression models, as reflected in its lower AIC and BIC scores. These results suggest that the TV-SVAR model provides a greater understanding of the data compared to the alternative models.

4.3. The Estimated Result

The Time-Varying Structural Vector Autoregressions (TV-SVAR) model allows us to examine how the impact of these selected predictors on EU carbon emissions evolves over time. The TV-SVAR model is particularly well-suited for this analysis, as it captures the dynamic nature of economic relationships, revealing how changes in trade patterns and policies affect carbon emissions across different time periods. By utilizing this model, we can gain insights into the fluctuating effects of each predictor on the EU’s carbon footprint, thereby providing a clearer understanding of the interplay between trade dynamics and environmental outcomes.

We present the dynamic patterns of how EU import goods influence carbon emissions within the EU, as revealed through the Time-Varying Structural Vector Autoregressions (TV-SVAR) model, in

Table 4 and

Figure 2. This model enables us to trace how the effects of key variables shift over time, and these patterns are visualized in the accompanying figures. Through this approach, we highlight how the strength and direction of each variable’s influence fluctuate across the sample period, offering a more detailed view of their dynamic behavior. This temporal resolution is especially helpful in pinpointing intervals during which certain variables exert stronger or weaker effects.

Firstly, the estimated coefficients for manufactured products from the US (US_x9) range from −0.006 to 0.009, with a mean of 0.004, indicating a small but positive time-varying effect on EU carbon emissions. This suggests that increased imports of these products slightly raise carbon emissions, likely due to the carbon-intensive nature of US manufacturing processes and the emissions associated with transportation logistics (

Hertwich & Peters, 2009;

Mayor & Tol, 2008). However, the graph reveals a gradual downtrend in this impact over time, suggesting that the carbon footprint of these imports has diminished as production methods in the US become more energy-efficient and aligned with cleaner technologies. This trend presents an opportunity for the EU to promote imports of lower-carbon goods through targeted trade agreements, aligning with its carbon reduction goals while maintaining strong trade relations with the US.

Manufactured goods (US_x12) from the US range from −3.460 to −0.034, with a mean of −1.863, indicating that increased imports of these goods tend to reduce EU carbon emissions over time. This negative relationship suggests that the shift in production to the US, where stricter emission standards and more energy-efficient practices prevail, has allowed the EU to benefit from reduced local emissions while still accessing necessary goods (

Sauvage, 2014). However, the trend shows a notable uptrend over time, meaning that the negative impact of these imports on emissions has lessened, with the coefficients becoming closer to zero. This change implies that the initial environmental benefits of shifting production are diminishing, potentially due to changes in production practices or increased import volumes.

Finally, petroleum products from China (CH_x7) range from 2.261 to 4.948, with a mean value of 3.727, indicating a strong positive relationship between these imports and EU carbon emissions. This suggests that increased imports of petroleum products from China correlate with reduced carbon emissions in the EU, likely due to a substitution effect where the EU decreases its carbon-intensive domestic petroleum production and relies more on imports (

Khan et al., 2020). This trend aligns with the EU’s growing emphasis on renewable energy, which has lessened the need for locally produced fossil fuels. However, the graph reveals a slight upward trend, indicating that the initial negative impact of these imports on EU emissions is diminishing over time. This change may reflect shifts in the global energy market or the EU’s continued investment in renewables, which reduces the comparative benefits of imported petroleum.

The TV-SVAR analysis sheds light on the evolving effects of different imports on EU carbon emissions. Manufactured products from the US (US_x9) display a slight positive effect, reflecting the ongoing carbon intensity of US-manufactured products. US_x12 shows a negative effect, suggesting that importing these goods may reduce emissions through shifts in production. Meanwhile, petroleum products from China (CH_x7) demonstrate a significant positive impact. Together, these insights emphasize the complex interactions between trade dynamics and carbon emissions, highlighting the importance of trade patterns in shaping the Eurozone’s environmental outcomes.

4.4. The Predicted Coefficient Result

This step of the analysis is to predict the time-varying coefficients obtained from the Time-Varying Structural Vector Autoregressions (TV-SVAR) model to provide a future perspective on how key trade variables will impact EU carbon emissions. This future view is essential for policymakers, as it can inform decisions on trade and environmental policies by highlighting anticipated changes in the carbon impact of imports over time.

To accomplish this, the predictive models were trained and evaluated using the full in-sample dataset consisting of 149 monthly observations from May 2011 to September 2023. A total of ten forecasting models were tested to identify the most suitable one for predicting the time-varying effects of trade on EU carbon emissions. Although out-of-sample validation was not conducted, model robustness was assessed through comparative performance across multiple algorithms. The evaluation was based on two key metrics: mean absolute percentage error (MAPE) and mean absolute deviation (MAD), both of which measure the accuracy and precision of the predictions. Lower values of MAPE and MAD indicate better model performance in terms of minimizing error and deviation from actual data (

Table 5). Among the models tested, the Arima model was identified as the most suitable predictive model, as it had the lowest MAPE and MAD values across all key variables: manufactured products from the US, manufactured goods from the US, and petroleum products from China. This model will be used for further prediction analysis, providing a robust framework for understanding future carbon emissions impacts from trade with these countries.

The results of the predicted time-varying coefficients over the next 24 months provide critical insights into the future impact of key imports on EU carbon emissions (

Figure 3). The predicted time-varying coefficients for manufactured products from the US (US_x9) indicate a decreasing impact on EU carbon emissions (

Figure 3a). This trend suggests that these products may have a reduced carbon footprint in the future, potentially exempting them from stricter environmental regulations. In contrast, the forecast for manufactured goods from the US (US_x12) reveals an upward trend (

Figure 3b), indicating that these imports will contribute more significantly to EU carbon emissions over time, necessitating stronger regulatory measures to mitigate their environmental impact. US policymakers should encourage cleaner, energy-efficient production for manufactured goods (US_x12) to reduce their growing carbon footprint and avoid stricter EU trade regulations. Meanwhile, the decreasing impact of manufactured products (US_x9) presents an opportunity to further promote sustainable manufacturing, strengthening trade ties with the EU and supporting global climate goals.

Similarly, petroleum products from China (CH_x7) show a projected increase in their contribution to EU carbon emissions, highlighting the need for more aggressive environmental policies (

Figure 3c). As the carbon intensity of these imports rises, policymakers will need to consider implementing stricter trade barriers or carbon pricing mechanisms to align these imports with the EU’s sustainability goals. Chinese policymakers should focus on reducing the carbon intensity of petroleum products (CH_x7), which are projected to increase EU carbon emissions. By promoting cleaner energy sources and improving production efficiency, China can mitigate the risk of facing stricter EU trade barriers or carbon pricing. Implementing such measures will not only help maintain access to EU markets but also support global efforts to reduce carbon emissions.

5. Discussion and Limitations

5.1. The Discussion

The findings of this study reveal significant implications for international trade dynamics in the context of carbon mitigation, particularly for the Eurozone and its major trading partners—the US and China. The analysis highlights the evolving relationship between carbon emissions and trade, underscoring the need for adaptive policy responses to align with global environmental objectives. The results suggest that manufactured products from the US currently have a small but positive time-varying effect on the Eurozone’s carbon emissions. However, the observed downward trend over time indicates a decline in their environmental impact. This finding reflects potential improvements in production efficiency or stricter environmental regulations being adopted by US manufacturers. From a policy perspective, this trend is encouraging, as it suggests that certain US-manufactured goods could eventually contribute to reducing the EU’s carbon footprint. As these products continue to exhibit diminishing emissions effects, they may become less susceptible to future non-tariff environmental barriers within the EU, potentially maintaining their competitive advantage in European markets.

In contrast, the analysis reveals a concerning trend for manufactured goods from the US and petroleum products from China, both of which exhibit a positive trajectory in their contribution to the EU’s carbon emissions. This suggests a growing environmental impact over time, likely due to increasing trade volumes, reliance on carbon-intensive production processes, or insufficient implementation of cleaner technologies. As the EU continues to strengthen its commitment to climate change mitigation, these goods could become prime targets for stricter measures, such as carbon tariffs or import restrictions. Such actions would align with the EU’s broader carbon mitigation strategies and its goal of incentivizing cleaner production practices among its trading partners.

Overall, these findings emphasize the importance of adaptive and forward-looking trade policies in response to evolving environmental challenges. The EU’s potential implementation of non-tariff measures on high-carbon imports highlights the growing intersection between trade and environmental governance. For trading partners like the US and China, aligning production processes with global environmental standards will not only help mitigate climate change but also ensure continued access to the increasingly environmentally conscious European market. Additionally, the study’s implications are aligned with broader Sustainable Development Goals (SDGs). This study contributes to supporting SDG 13 (Climate Action) by highlighting the importance of carbon-conscious trade and SDG 17 (Partnerships for the Goals) by underscoring the need for cooperative trade and climate strategies between advanced and developing economies and to a deeper understanding of how carbon mitigation policies influence international trade flows and underscores the importance of integrating sustainability considerations into future trade strategies.

5.2. Limitations and Future Directions

This study provides important insights into the relationship between carbon mitigation and trade, while several limitations should be acknowledged. First, there remains the possibility of omitted variable bias or reverse causality, particularly where carbon emissions may indirectly influence trade patterns or policy responses. Although the Bayesian variable selection method reduces this risk, the presence of unobserved feedback mechanisms cannot be entirely ruled out. In addition, the use of monthly data and the dynamic changes may not fully reflect long-term or lagged environmental effects, especially in industries with slower adjustment cycles. Second, the classification of imports into broad product categories such as “manufactured goods” and “petroleum products” may mask underlying variations in carbon intensity across sub-sectors.

Future research could benefit from more detailed trade data or firm-level carbon emission profiles to increase accuracy. It is also recommended that future studies expand the analysis to include exports and bilateral trade flows. Furthermore, developing countries beyond China and the US—such as those in Southeast Asia, Africa, or Latin America—should be considered, as they may face higher adjustment costs under the CBAM framework. These extensions would help improve the policy relevance of the findings and align with global sustainability goals, particularly SDG 13 (Climate Action) and SDG 17 (Partnerships for the Goals).

6. Conclusions

This study has provided a comparative assessment of the effectiveness of carbon mitigation strategies, particularly carbon pricing mechanisms for international trade, in influencing trade dynamics between the Eurozone and key trading partners, namely, the USA and China. The research employed advanced Bayesian variable selection methods and a Time-Varying Structural Vector Autoregressions (TV-SVAR) model to identify and analyze the variables most significantly affecting carbon emissions within this trade context. This methodological approach allowed us to capture the evolving impact of trade-related imports on EU carbon emissions, shedding light on how these effects vary over time and differ between trade partners.

The findings provide critical insights for EU policymakers and trade partners. Manufactured products from the US (US_x9) currently have a minor positive impact on EU carbon emissions, but this effect is decreasing over time, suggesting they may be exempt from future environmental regulations. Conversely, manufactured goods from the US (US_x12) and petroleum products from China (CH_x7) are expected to contribute more to EU emissions over time, indicating the need for stricter trade regulations.