Abstract

This study investigates the relationship between capital structure and financial performance in South African firms, focusing on the potential non-linear, inverse U-shaped effect of leverage on profitability. Drawing on data from 1548 firm-year observations covering 183 publicly listed South African companies between 2013 and 2022, the analysis employs both Fixed Effects (FE) and System Generalized Method of Moments (System-GMM) models to address endogeneity and capture dynamic adjustments. The findings indicate that moderate levels of debt enhance profitability, but excessive leverage leads to diminishing returns, confirming an inverse U-shaped relationship. System-GMM results further reveal the persistence of past profitability and validate the dynamic nature of capital structure decisions. Larger firms appear more capable of sustaining higher leverage without adverse effects, while smaller firms benefit from maintaining lower debt levels. The study concludes that strategic debt management, tailored to firm size and economic context, is critical for optimizing financial performance in emerging markets like South Africa. The study identifies the optimal leverage ratio for South African firms and shows how firm size moderates the relationship between debt and profitability, offering tailored insights for firms of different sizes. These insights offer valuable guidance for managers, investors, and policymakers aiming to strengthen financial stability and efficiency through informed capital structure choices.

Keywords:

capital structure; financial performance; system-GMM; leverage; South African firms; optimal debt ratio JEL Classification:

G31; G32; G30; G39

1. Introduction

The optimal capital structure (CapStruct), the strategic mix of debt and equity used to finance firm operations, remains a cornerstone of corporate finance research, particularly in emerging markets. In these contexts, economic volatility, evolving regulatory frameworks, and limited access to external finance heighten the complexity of capital structure decisions. South Africa presents a compelling case study in this regard. With its expanding financial markets and socio-economic diversity, firms must navigate a financial landscape shaped by systemic constraints, investor sentiment, and access to credit.

Early theoretical work by Modigliani and Miller (1958) proposed the irrelevance of capital structure under perfect market conditions. However, subsequent theories like the Trade-Off Theory (Kraus & Litzenberger, 1973), the Agency Cost Theory (Jensen & Meckling, 2019), and the Pecking Order Theory (Myers & Majluf, 1984) recognized the frictions inherent in real-world markets. These models suggest that while debt offers tax advantages, excessive leverage exposes firms to financial distress and agency conflicts, especially in markets with institutional inefficiencies such as South Africa.

Recent literature has increasingly moved beyond linear models to uncover more nuanced dynamics between leverage and performance. Studies such as Prekazi et al. (2023) and Kathayat et al. (2024) identify a non-linear, inverse U-shaped relationship, where moderate debt enhances profitability, but beyond a critical threshold, the benefits diminish. These findings align with South Africa’s emerging economy status, where access to finance remains uneven and firm responses to debt levels are shaped by industry type, governance structures, and macroeconomic cycles.

Additionally, firm size emerges as a key moderating variable. Larger firms often enjoy better credit terms and can withstand higher debt levels due to diversified operations and more stable cash flows. In contrast, smaller firms are typically constrained by higher borrowing costs and greater sensitivity to market shocks (Zhang, 2024; Cooper et al., 2024). Despite this, empirical evidence exploring how firm size conditions the leverage–performance link remains sparse, particularly within the South African context.

This research seeks to fill that gap by empirically investigating the non-linear relationship between leverage and firm performance, while also examining the moderating effect of firm size. Drawing on a decade-long panel dataset of South African firms and employing the System-GMM methodology, the study offers new insights into the dynamic nature of CapStruct decisions. By identifying the “hidden peak” where leverage optimally boosts profitability before becoming detrimental, the study provides a data-driven benchmark for managers, investors, and policymakers in navigating financial decisions.

While the CapStruct performance link has been widely examined, few studies have explored the non-linear relationship in the context of South African firms, particularly with respect to an optimal leverage ratio (Tao, 2024) for different firm sizes. Despite extensive research on CapStruct determinants, the dynamic nature of CapStruct adjustments in South African firms remains largely unexplored. Prior studies have primarily relied on static models, overlooking how firms adjust their leverage in response to profitability fluctuations over time (Abor, 2005; Gwatidzo & Ojah, 2009). Given South Africa’s economic volatility, firms frequently modify their financial strategies, yet empirical evidence on these dynamic adjustments and limited research on firm characteristics and economic factors together are lacking. Additionally, while firm size is widely recognized as a moderating factor in CapStruct decisions, its influence within the South African context remains underexplored, despite larger firms benefiting from better access to financing and lower borrowing costs (Frank & Goyal, 2009; Rajan & Zingales, 1995). Furthermore, the literature does not sufficiently differentiate optimal CapStruct across industries, despite sectoral differences in financial constraints and risk exposure. Without these insights, firms lack tailored financial strategies, and policymakers struggle to develop industry-specific regulations that promote financial stability. This study addresses these gaps by employing a System-GMM model to capture dynamic CapStruct adjustments while investigating the moderating effect of firm size. By identifying industry-specific leverage thresholds, the research provides actionable insights for corporate managers and policymakers, enhancing financial resilience in South Africa’s evolving economic landscape.

This study aims to fill these gaps by determining the optimal leverage levels for South African firms, examining the inverse U-shaped relationship between leverage and profitability, and analyzing how firm size moderates this relationship. Specifically, the study addresses the following research questions:

RQ1:

Does capital structure significantly influence the financial performance of South African firms?

H1:

There is a significant impact of CapStruct on the financial performance of firms.

RQ2:

Is there an inverse U-shaped relationship between leverage and financial performance?

H2:

CapStruct exhibits an inverted U-shaped association with financial performance.

RQ3:

How does firm size moderate the relationship between leverage and profitability?

H3:

Large enterprises achieve their optimal CapStruct with a greater debt ratio than small firms.

This study uniquely contributes to the literature by applying the System-GMM model, which captures dynamic adjustments in CapStruct and addresses potential endogeneity issues. This approach is especially useful in South Africa, where economic volatility affects firms’ financing decisions. By examining the inverse U-shaped relationship, this research also offers insights into the precise leverage levels that maximize firm performance across different sizes, providing practical guidance for managers and policymakers.

The study’s findings offer valuable implications for multiple stakeholders. For corporate managers, understanding optimal debt–equity balance can lead to more strategic financial decision-making, enhancing profitability while mitigating risk. For policymakers, the results provide a basis for developing regulations that support economic stability and business growth. Additionally, this research enriches academic discourse by validating the applicability of CapStruct theories within an emerging market context and refining existing theories based on empirical evidence. Given South Africa’s volatile economic conditions and varied access to capital markets across firm sizes, this study aims to determine the optimal capital structure that maximizes firm profitability. It further investigates how the effect of leverage on performance varies between large and small firms. In doing so, the study addresses the critical question: What is the ideal capital structure for South African companies, and how does leverage influence profitability based on firm size?

The remainder of this paper is structured as follows. Section 2 reviews the theoretical and empirical literature on CapStruct dynamics and firm performance. Section 3 outlines the data sources, sample selection, and the methodological approach employed in the study. Section 4 presents and discusses the empirical results, highlighting key findings from the Fixed Effects and System-GMM models. Section 5 explores the theoretical contributions and practical implications for corporate managers, policymakers, and financial institutions. Finally, Section 6 provides the conclusion, summarizing the main findings and contributing recommendations for future research.

2. Related Research

2.1. Theoretical Perspective

The topic of CapStruct has been central to corporate finance research, with many theories explaining how corporations choose their optimal debt–equity combination. The Modigliani and Miller theorem proposed the irrelevance theory, which states that under ideal market conditions, CapStruct does not affect a firm’s value. This theory, while fundamental, presupposes the nonappearance of taxes, bankruptcy costs, and agency costs, which do not exist in real-world settings. (Khan et al., 2021) later referred to CapStruct as a “puzzle”, emphasizing the difficulties in applying these theories realistically. The Trade-off Theory evolved as a rebuttal to Modigliani and Miller’s model, integrating balancing debt’s tax benefits with bankruptcy costs (Synn & Williams, 2024). The endogenous and exogenous factors affecting CapStruct decisions include market conditions, firm-specific characteristics, and macroeconomic variables, which collectively influence a firm’s ability to balance risk, return, and growth potential (Darmono et al., 2024). Furthermore, the integration of environmental and social considerations into CapStruct analysis highlights the evolving nature of financial decision-making, where non-financial liabilities can increase the overall risk and cost of capital, necessitating a comprehensive understanding of both financial and non-financial elements (Schoenmaker & Schramade, 2023). Other important theories include the Agency Cost Theory, which emphasizes the impact of conflicts between managers and shareholders on shaping CapStruct decisions (Jensen & Meckling, 2019), and the Market Timing Theory, which suggests that firms issue equity when market conditions are advantageous and rely on debt when equity markets are unappealing (Mandasari & Rikumahu, 2024). These theories offer a framework for comprehending the complicated decisions that businesses make about their financial structures.

2.2. Empirical Evidence from Emerging Markets

CapStruct determinants in emerging markets such as South Africa might vary dramatically from those in nations with mature markets. Amelot et al. (2023) argue that real-world elements like tax concerns and insolvency costs render the Modigliani and Miller proposition’s basic assumptions less applicable. In such markets, the optimal CapStruct frequently differs by industry, with research pinpointing average debt-to-total-assets ratios of roughly 40% as best in various sectors. One study (Marcelle Amelot & Subadar Agathee, 2021) identifies idiosyncratic and macroeconomic risks as crucial in shaping CapStruct in South African firms; higher risks lead to reduced leverage and a preference for internal financing amid earnings volatility. Research in South Africa indicates a positive link between leverage, cash flow, and performance, supporting the trade-off and agency theories; profitable firms handle higher leverage comfortably, lowering financial risk. According to Aybar et al. (2023), the global financial crisis revealed that South African firms, like firms in other emerging markets, show unique CapStruct patterns, shifting between debt and equity under economic pressures. South Africa’s developmental risks demand evolving risk management, especially in sectors like construction (Oke et al., 2023). Overall, the interplay of these factors illustrates the complex relationship between risk and CapStruct adjustments in South Africa’s dynamic economic landscape.

2.3. Empirical Evidence on CapStruct Determinants

Empirical research has extensively examined the factors influencing CapStruct across different economies, including South Africa. (Boateng et al., 2022) discovered a positive correlation between leverage, cash flow, and profitability, supporting the trade-off and agency theories, with profitability linked to higher debt ratios, while liquidity negatively influences CapStruct choices. (Bibi & Akhtar, 2024) study shows that asset tangibility and liquidity reduce leverage, as firms with tangible assets rely less on debt, using them as collateral to lower lender risk. Firm size is another crucial determinant of CapStruct. Larger firms, with more stable cash flows, tend to use higher leverage due to their lower financial risks (Rahmawati et al., 2024) Research shows that larger firms have a higher capacity for debt, correlating positively with CapStruct decisions due to their stability and operational needs. These firms also have better access to external capital markets, allowing them to carry more debt. This demonstrates that size affects South African firms’ ability to reach their optimal CapStruct. Growth opportunities similarly influence CapStruct decisions. However, this preference for debt or equity varies with the firm’s life cycle and market conditions (Luo & Jiang, 2022), with South African firms favoring short-term loans during economic instability. Empirical studies suggest an optimal debt ratio of around 29% for firms, with benchmarks of 21% for manufacturing and 41% for wholesale trade (Demiraj et al., 2024). ROE is a key performance metric influenced by CapStruct decisions. While higher leverage can enhance ROE to a point, excessive debt increases financial risk. Some theories suggest that in perfect markets, CapStruct may not significantly impact firm value, indicating that the relationship between CapStruct and ROE can be context-dependent (Zhao et al., 2019; Suciati et al., 2021).

A firm’s optimal CapStruct significantly affects its Total Liabilities to Total Assets Ratio, impacting financial stability. An optimized CapStruct can improve performance and reduce risks from high debt levels. Excessive debt burdens can harm profitability and overall financial performance (Ombuh et al., 2024). A well-balanced CapStruct enables firms to navigate (Gornall & Strebulaev, 2018) financial distress and adapt to market changes more effectively, promoting long-term sustainability (Sajjad & Zakaria, 2018). Various factors such as firm size, growth opportunities, liquidity, and macroeconomic conditions shape a firm’s optimal CapStruct. Larger firms have better access to capital markets, allowing for a more favorable CapStruct (Wahyuni & Kristanti, 2024). High-growth firms may opt for equity to mitigate debt risks (Power et al., 2022). A strong liquidity position can reduce debt reliance and enhance stability (Frank & Sanati, 2021).

2.4. Impact of CapStruct on Financial Performance

The relationship between CapStruct and financial performance remains crucial. In South Africa, balancing debt and equity is vital for financial stability. (Lamichhane & Dhungel, 2024) suggest that high leverage beyond a certain point leads to diminishing returns due to increased financial risk. This supports an inverse U-shaped relationship, where moderate debt levels enhance profitability through tax benefits, but excessive debt raises the risk of financial distress.

Firm size plays a key role in CapStruct decisions. (Haque & Varghese, 2023) found that large firms have higher debt tolerance, while smaller firms reach optimal CapStruct at lower debt levels due to limited access to capital markets. This suggests that firm size moderates the leverage–performance relationship, and they noted that leverage increases during economic expansions, reflecting pro-cyclical conditions. In South Africa, inflation and interest rates significantly impact borrowing costs, prompting firms to adjust debt levels accordingly (Hussain et al., 2024). Balancing debt during different economic cycles is crucial for stability.

2.5. The Dynamics of Optimal CapStruct Adjustment

Research on CapStruct has been extensive. Instefjord and Nawosah (2023) proposed methods to estimate debt costs and identify the ideal leverage level for firms. (Amini et al., 2021) emphasized that the debt–equity ratio impacts firm value, highlighting the role of corporate financial management in optimizing value through appropriate debt selection and supporting the dynamic CapStruct model, showing that firms with volatile profits should use shorter debt maturities to balance tax shield benefits with bankruptcy risks. (Wang & Wang, 2022) examined optimal CapStruct in the presence of a moral hazard, finding that firms issue higher-coupon debt up front and default earlier in such cases. Palmowski et al. (2020) extended the Leland–Toft model, identifying optimal bankruptcy strategies and corresponding values for equity, debt, and the firm. Similarly, in (Adeoye et al., 2021), a new model suggests raising debt and lowering equity to reduce agency costs, addressing CapStruct and governance complexities. Studies on the speed of adjustment (SOA) show that Indian steel firms need about 2.13 years to reach optimal leverage, impacted by profitability and financial distress. Abdullah et al. (2023) found that firms with high debt adjust their leverage faster, while those with surplus funds do so more slowly, and found that South African firms adjust their CapStruct in response to macroeconomic conditions like interest rates and inflation. Amelot et al. (2023) used GMM regression to show that South African firms in low-risk settings adjust CapStruct more readily, offering reliable leverage determinant estimates by addressing endogeneity issues.

The pursuit of optimal CapStruct in South African firms is influenced by internal factors like profitability, asset structure, and firm size, along with external economic conditions such as inflation and interest rates. GMM regression enables a dynamic analysis of how firms adjust leverage in response to these factors. The unique economic and regulatory environment in South Africa demands a tailored understanding of CapStruct dynamics (Szczygielski & Chipeta, 2023). By accounting for these elements, firms can better manage financial complexities to achieve enhanced performance and sustainability. This review provides a foundation for future empirical studies on CapStruct adjustments in South African enterprises.

2.6. Hypothesis Development

Existing research on CapStruct and firm performance shows mixed results due to differences in study variables, periods, and methodologies, often overlooking firm size and life cycle stages. In (Can et al., 2023), assessing a company’s life cycle is critical for making CapStruct decisions that fit with financial demands and financing options. Our study examines a non-linear, inverse U-shaped CapStruct–performance relationship based on the Pecking Order Theory. This approach addresses limitations in prior studies, leading to our first hypothesis on optimal CapStruct, where excessive leverage negatively impacts performance.

H1:

There is a significant impact of CapStruct on the financial performance of firms.

Our study also aims to delve deeper into the nature of this relationship by examining the non-linear dynamics. Establishing that CapStruct influences financial performance is crucial, but identifying the inverse U-shaped pattern is even more valuable, as it indicates a point of diminishing returns from leverage. This can be likened to a firm navigating a complex financial landscape where it must adjust its CapStruct to optimize performance. Knowing where the optimal balance lies enables firms to tactically adjust their leverage for improved outcomes. Thus, the next hypothesis is as follows:

H2:

CapStruct exhibits an inverted U-shaped association with financial performance.

However, the study’s scope goes beyond merely confirming the existence of this relationship. Pinpointing the precise inflection point of the U-shaped relationship is critical for firms. This inflection point represents the optimal CapStruct where the benefits of increased leverage begin to be outweighed by the risks of financial distress. The optimal leverage ratio may differ based on firm size, with larger firms potentially having greater debt capacity due to their enhanced ability to manage financial risks, better access to capital markets, and generally more stable cash flows. Larger firms may require a higher debt threshold to reach their optimal CapStruct compared to smaller firms.

Thus, understanding how firm size affects the optimal CapStruct is a vital component of this research. Our investigation aims to identify how differences in firm size impact the optimal debt ratio, ensuring that each firm can effectively navigate its financial strategy. This brings us to the third hypothesis:

H3:

Large enterprises achieve their optimal CapStruct with a greater debt ratio than small firms.

This study, by focusing on a broad dataset and a comprehensive analysis framework, aims to provide more conclusive insights into how South African firms can achieve an optimal CapStruct that enhances their performance across different firm sizes and economic conditions.

3. Materials and Methods

3.1. Research Design

3.1.1. Sample and Data

This study utilizes a dataset comprising 1548 firm-year observations from 183 publicly listed South African companies between 2013 and 2022, sourced from Thomson Reuters. To reduce the impact of outliers, the dataset is winsorized at the 2% level. The unbalanced panel reflects market dynamics, including firm entries, exits, and mergers, capturing the evolving nature of South Africa’s corporate environment. Focusing solely on South African firms ensures regional consistency and minimizes the influence of varying economic policies. The dataset spans multiple industries, allowing for sector-wide insights while preserving statistical robustness through homogeneous sample selection, as recommended by Myers. This approach provides a comprehensive view of CapStruct decisions across sectors and over time, addressing key gaps in earlier studies. The final sample includes data from approximately 183 South African firms per year across various sectors, offering insights into CapStruct decisions by industry. The unbalanced panel structure captures annual fluctuations in firm count due to market conditions, ensuring that real-world dynamics are reflected. This variability allows for a detailed analysis of how CapStruct adjusts to changing economic cycles and conditions in South Africa.

Spanning 2013 to 2022, this study examines CapStruct trends in South African firms amid economic shifts. The 10-year dataset enables analysis of CapStruct impact on financial performance, exploring non-linear relationships and firm size effects, offering actionable insights for corporate leaders and policymakers to enhance financial stability in South Africa.

The selection of variables is informed by a thorough review of prior research. Table 1 summarizes the variables used, while Table 2 presents descriptive statistics for each.

Table 1.

Descriptions of variables. This table provides a summary of the chosen variables, including their calculation methods.

Table 2.

Descriptive statistics. This table presents descriptive statistics for the variables used in this study. The dependent variable in Panel A includes Return on Assets (ROA). The independent variable is Financial Leverage (Lev). Panel C consists of a comprehensive set of control variables. The sample consists of 1548 firm-year observations from 2013–2022.

3.1.2. Dependent Variable

Return on Assets: The dependent variable is financial performance, measured by Return on Assets (ROA), calculated as net income divided by total assets (Demiraj et al., 2022). ROA is commonly used in CapStruct–performance studies (Chandra et al., 2019; Habibniya et al., 2022) because it reflects how efficiently a firm utilizes its assets to generate profit. Unlike ROE, which is directly influenced by financing structure, ROA isolates operational efficiency, providing a clearer view of asset productivity without being skewed by leverage decisions (Gopane et al., 2023).

3.1.3. Independent Variable

Financial Leverage. In this study, the independent variable is the company’s CapStruct, measured by the total debt ratio (TD/TA). This ratio includes both short-term and long-term debt, offering a complete perspective on a firm’s total leverage (Banerjee, 2013; Jain et al., 2024). Using total debt to total assets helps in understanding a firm’s risk exposure and its reliance on borrowed capital (Putri et al., 2024; Kuchler, 2019), making it a suitable metric for evaluating the effect of leverage on a company’s performance by considering all liabilities. This measure offers a more holistic understanding of a firm’s debt obligations compared to a focus solely on long-term debt.

3.1.4. Moderating Variable

Firm Size. In this study, the moderating variable is firm size, which is measured using the natural logarithm of total assets. Firm size plays a key role in determining financial performance, as larger companies generally benefit from improved access to capital markets, reduced borrowing costs, and higher operational efficiencies driven by economies of scale (Matekenya & Moyo, 2022; Hegde et al., 2023; Dsouza & Krishnamoorthy, 2024). Using the logarithmic transformation of total assets reduces data skewness produced by big differences in firm sizes and offers a more accurate estimate of the relationship between size and performance.

3.1.5. Control Variables

To specifically identify the effect of financial leverage on company performance, a set of control variables that influence performance is included in the analysis:

Non-current assets to total assets ratio. This ratio is determined by dividing (Total Assets—Total Current Assets) by Total Assets. It indicates the share of a firm’s assets invested in long-term holdings, such as fixed assets. A higher ratio suggests a greater dependence on long-term investments, which can impact the firm’s borrowing capacity and risk profile, as fixed assets are often used as collateral (Ghani et al., 2023).

Current Ratio. The current ratio, determined by dividing Current Assets by Current Liabilities, reflects a company’s capacity to fulfil its short-term obligations. It is often used as a measure of liquidity risk, affecting a firm’s creditworthiness and borrowing costs. An optimal current ratio ensures a balance between liquidity and profitability, while excessive liquidity might indicate missed investment opportunities.

Asset Turnover. Asset turnover is determined by dividing net sales by total assets. It measures the efficiency with which a firm utilizes its assets to generate revenue (Mareta et al., 2022). As part of the DuPont model, asset turnover directly impacts ROA by indicating how effectively a firm is using its asset base to drive sales.

Asset Growth. Asset growth is calculated as the annual change in total assets. It represents a firm’s investment in growth opportunities and can have mixed effects on financial performance (Cooper et al., 2024; Savitri et al., 2024; Dsouza et al., 2024). While growth can enhance revenue potential, rapid expansion may strain resources and reduce overall efficiency if the newly acquired assets are underutilized.

Cash Ratio. The cash ratio is calculated as Cash/Total Assets. This ratio indicates the proportion of a firm’s assets held in cash and cash equivalents, providing a measure of its ability to cover short-term liabilities without needing to liquidate other assets (Odendo, 2023; Pedraza, 2021). A high cash ratio may be advantageous for liquidity but can signal that a firm is not effectively using its cash to generate returns.

The Market to Book Ratio. The market-to-book ratio is calculated as market capitalization/total book value. It reflects the investor perception of a firm’s value relative to its accounting value, providing insights into market expectations regarding a firm’s future performance and growth potential. A higher ratio often indicates that investors expect future growth, while a lower ratio may signal undervaluation or poor future prospects.

By incorporating these control variables, the study seeks to differentiate the impact of financial leverage on firm performance from other factors, offering a clearer understanding of how the CapStruct decisions influence ROA in South African firms. The inclusion of the moderating effect of firm size provides further insights into how the relationship between leverage and performance varies across the different firm sizes, helping to determine an optimal CapStruct.

3.2. Research Model

This study utilizes a dynamic System-GMM model to analyze the construction between CapStruct and financial performance in South African companies. The System-GMM is well-suited for analyzing panel data, effectively handling dynamic adjustments, and addressing endogeneity issues common in corporate finance. It captures time-varying influences and accounts for firm-specific effects, making it ideal for studying how firms alter their CapStruct over time.

The model reflects the inverted U-shaped relationship between leverage and financial performance, along with the moderating effect of firm size in identifying the optimal CapStruct. By using lagged values of ROA as instruments, it provides more accurate estimates of the impact of leverage on performance while reducing bias from reverse causality. The methodology aligns with recent research, demonstrating the effectiveness of System-GMM in understanding the dynamics between CapStruct and firm profitability (Solanki et al., 2022). The study offers insights into how South African firms can balance debt and equity for optimal profitability.

Model 1 Baseline Model

We start by modelling the impact of CapStruct (measured by financial leverage) on financial performance (measured by ROA). Based on the first hypothesis, the equation for the baseline model is

where ROAit is Return on Assets for firm i at time t, capturing financial performance. αi represents unobserved FEs of firm i, and δt represents time-fixed effects. Levit: Financial leverage (Total Debt/Total Assets), representing CapStruct, ROAit − 1: Lagged dependent variable to capture dynamic endogeneity and past performance effects. The matrix Xit′ Control variables (Non-current assets to total assets ratio, Current Ratio, Asset Turnover, Asset Growth, Cash Ratio, and Market-to-Book Ratio). eit: error term, assumed to be independently and identically distributed.

ROAit = αi + δt + β1 ROAit − 1 + β2 Levit + Xit′θ + ꞓit

Model 2 Testing the Inverse U-shaped Relationship

To test hypothesis 2, we may introduce the squared term of financial leverage (Lev2) to capture the non-linear relationship:

ROAit = αi + δt + β1 ROAit − 1 + β2 Levit + β3 Levit2 + Xit′θ + ꞓit

Model 3 Moderation Effect of Firm Size

We may incorporate the moderating effect of firm size by adding an interaction term between financial leverage and firm size by testing H3:

where ‘Levit * Largeit’ is the interaction term between leverage and firm size. This term allows us to explore how the relationship between leverage and financial performance changes with firm size.

ROAit = αi + δt + β1 ROAit − 1 + β2 Levit + β3 Levit2 + β4 (Levit * Largeit) + Xit′θ + eit

For large firms, the optimal leverage ratio can be computed as

Optimal LevLarge = −(β2 + β4)/2β3

For small firms, the optimal leverage ratio is calculated as

Optimal LevSmall = −β2/2β3

4. Results and Discussion

4.1. Descriptive Statistics

Table 2 provides summary data for the variables used in the study, which include ROA, leverage, firm size, and various control variables. With 1548 firm-year observations and 183 firms, with observations for each variable, the table captures the central tendency and dispersion of the data: ROA has a mean value of 0.049 and a standard deviation of 0.108, indicating that firms in the sample have an average return of 4.9% on their assets, with considerable variability in profitability across firms. Leverage (Lev) has a mean of 0.208, suggesting that the average firm finances approximately 20.8% of its assets through debt. The relatively low standard deviation (0.163) indicates moderate variation in leverage levels among firms. Size (natural log of total assets) has a mean of 19.822, reflecting the size distribution of firms in the sample. The standard deviation of 1.868 suggests varying scales of operations among the firms. The control variables, such as Non-current assets to total assets (Non CA/TA), Current Ratio (CR), Asset Turnover (AT), Assets growth (AG), Cash Ratio (C), and Market to book ratio (MB), display their respective mean and standard deviation values, helping to understand the variability in the financial health and operations of firms. Overall, these statistics provide a snapshot of the financial and operational characteristics of the sample firms, setting the context for subsequent regression analysis.

4.2. Correlation

Table 3 presents the pairwise correlations between the variables, offering insights into the relationships between them. Key observations include the following. ROA and Leverage have a significant negative correlation (−0.199 *), indicating that higher leverage is generally associated with lower returns on assets. This suggests that, in the sample, firms with higher debt levels tend to experience lower profitability. ROA and Size show a positive correlation (0.055), albeit weak, suggesting that larger firms might achieve slightly better returns on assets. Leverage and Size are positively correlated (0.222 *), indicating that larger firms tend to have higher leverage, possibly due to their greater ability to access debt markets. The correlation matrix also helps identify potential multicollinearity issues among the independent variables. The Variance Inflation Factor (VIF) values are all below 2, suggesting that multicollinearity is not a significant concern in this analysis. These correlations provide preliminary evidence of the relationships between CapStruct, firm size, and financial performance, supporting the hypotheses regarding the impact of leverage on ROA.

Table 3.

Pairwise correlation. This table presents the pairwise correlations between the variables, offering insights into the relationships between them. The correlation matrix also helps identify potential multicollinearity issues among the independent variables. The Variance Inflation Factor (VIF) values are all below 2, suggesting that multicollinearity is not a significant concern in this analysis. These correlations provide preliminary evidence of the relationships amongst all the variables.

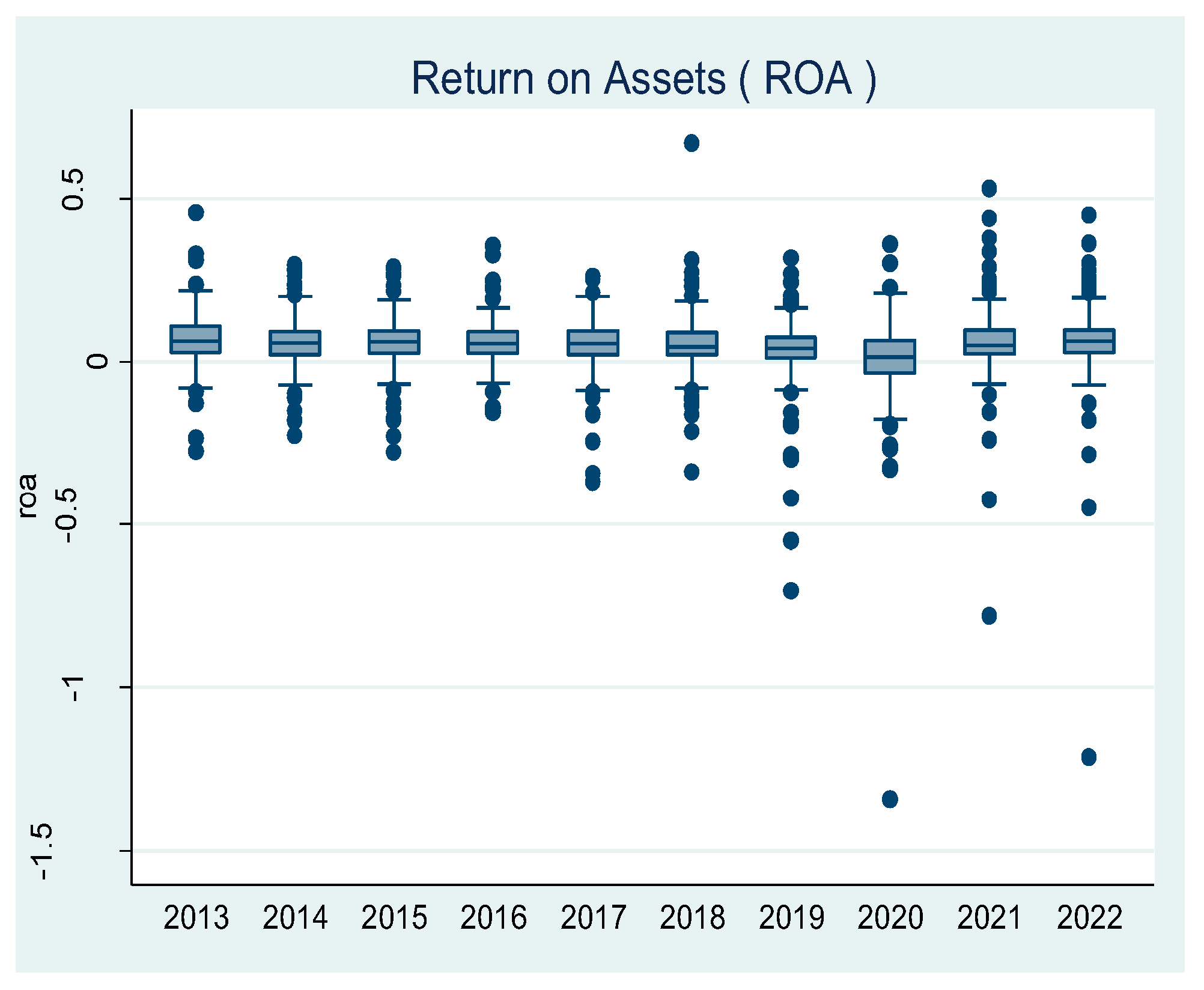

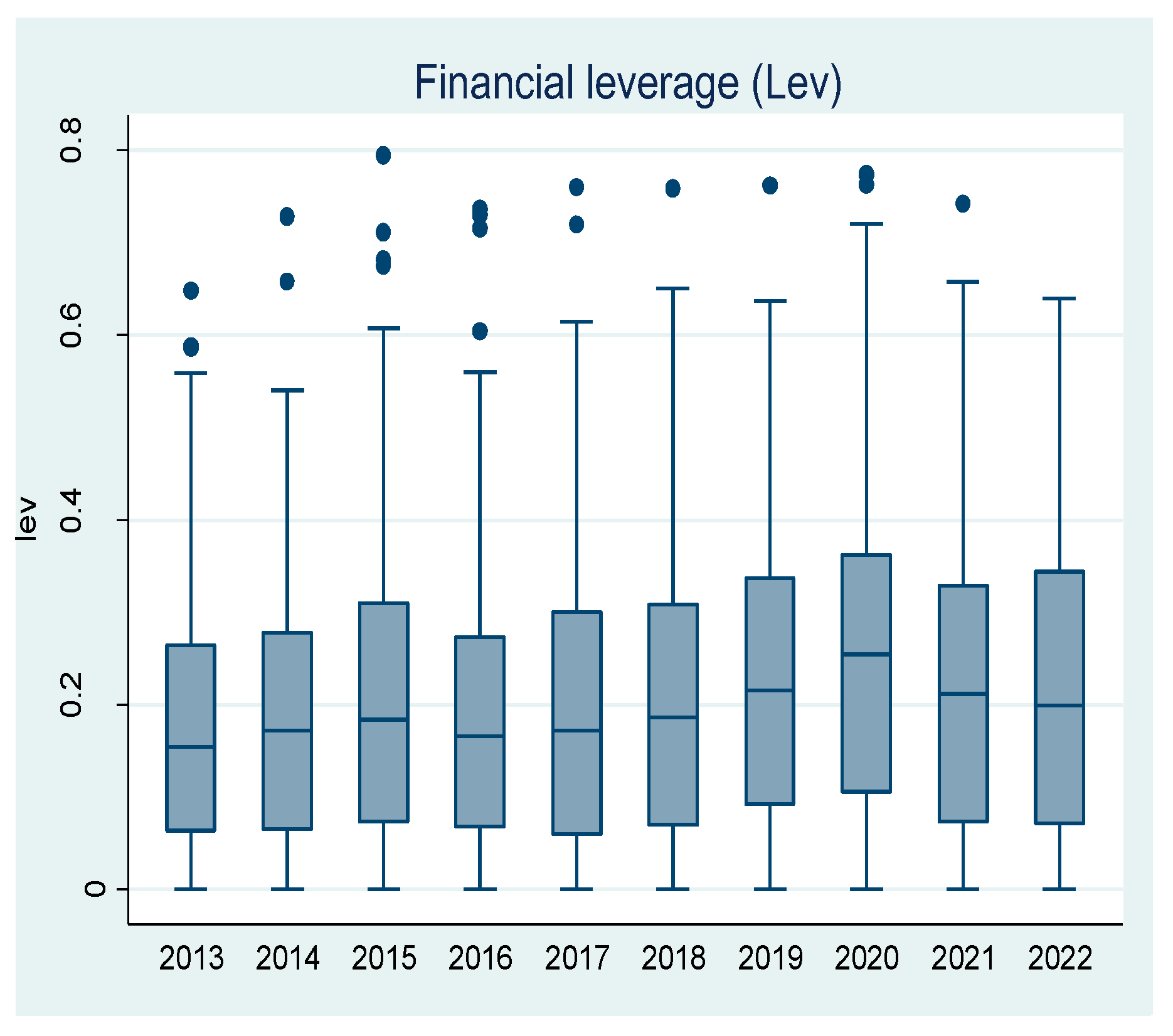

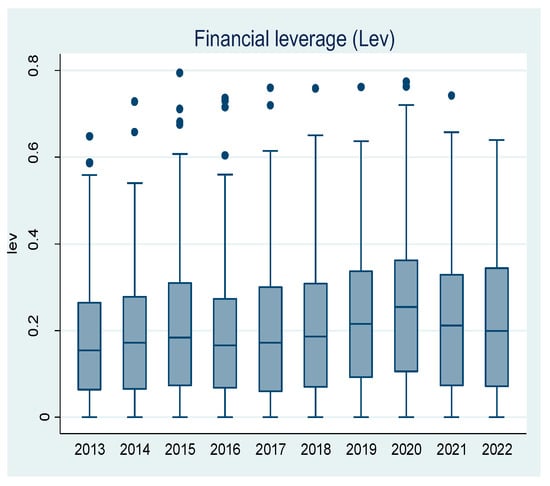

4.3. Distribution of Return on Assets and Financial Leverage (Box Plot Technique)

The aforementioned Figure 1 and Figure 2 illustrate the distribution of Return on Assets (ROA) and Financial Leverage (Lev) across the timeframe from 2013 to 2022, utilizing the Box plot methodology. The Box plot technique encapsulates the five-number summary within a central box, accompanied by whiskers that extend to encompass the non-outlier values. It is evident from all the figures that, for each individual year examined, the median is not approximately equidistant from the quartiles, and the whiskers exhibit unequal lengths; hence, we infer that the annual data distribution for ROA and Lev throughout the duration of the study is skewed.

Figure 1.

Distribution of Return on Assets (ROA).

Figure 2.

Distribution of Financial Leverage (Lev).

4.4. Univariate Analysis

Univariate analysis independently examined each individual variable within a given dataset. It delves into the characteristics of each variable individually. Table 4 shows the mean and median values of the independent variable and all control variables, with respect to the quartiles of the dependent variable (ROA). The mean difference was measured for each independent and control variable, followed by T-statistic results with a level of significance. The mean differences (Q1–Q4) of the independent variable and all control variables, except MB, were significantly closer to zero. Except for Lev, all others have a negative mean difference, indicating that the mean of the observations in Q4 is higher than the mean of the observations in Q1. The T-stat values in the table measure the statistical significance of the differences in mean values between the lowest (Q1) and highest (Q4) ROA quartiles. Large absolute T-stat values indicate stronger evidence that the differences are not due to random chance. Lev has a T-stat of 9.6823, highlighting a highly significant decrease from Q1 to Q4. Similarly, variables like Non CA/TA (−5.4652), CR (−6.4816), AT (−8.5303), and MB (−10.8499) show statistically significant differences at the 1% level (***). This suggests that these variables are closely associated with variations in ROA across firms.

Table 4.

Quartiles of ROA. This table reports the univariate analysis results. It shows the mean and median values of the independent variable and all control variables, with respect to the quartiles of the dependent variable (ROA) from 2013 to 2022, while columns (1) to (4) present the results for the quartiles Q1, Q2, Q3,and Q4. The p-values reported in T-stat, ***, **, and *, denote statistical significance at the 1%, 5%, and 10% levels, respectively.

4.5. Fixed Effects Regression Analysis

Table 5 displays the results of the Fixed Effects (FE) regression models used to analyze the impact of leverage on ROA. The three models vary in complexity, incorporating squared leverage terms and interaction terms with firm size: Model 1 shows that leverage has a significant negative impact on ROA (β = −0.085, p < 0.01), indicating that higher leverage is associated with reduced profitability. The lagged ROA term (β = 0.139, p < 0.01) suggests that past performance positively influences current performance. Model 2 introduces the squared term for leverage (Lev2), which is positive and significant (β = 0.289, p < 0.01), supporting the inverse U-shaped relationship hypothesis. This suggests that moderate levels of leverage improve profitability, but beyond a certain point, the negative impact of debt outweighs the benefits. Model 3 incorporates an interaction term between leverage and firm size, revealing that the negative impact of leverage is moderated for larger firms (β = −0.077, p < 0.1). This indicates that the leverage–profitability relationship varies with firm size, although the effect is weaker in this model. The R-squared values range from 0.288 to 0.294, indicating that the models explain around 29% of the variation in ROA. The significant Hausman test p-values suggest that the fixed effects model is appropriate for the analysis.

Table 5.

Impact of leverage on ROA: Fixed effects regression results. This table reports the fixed effects regression results for Model 1, Model 2, and Model 3. The impact of leverage on ROA, as well as the relationship with other control variables, is analyzed from 2013 to 2022, while columns (1) to (3) present the results for Model 1, Model 2, and Model 3. The p-values reported, ***, **, and *, denote statistical significance at the 1%, 5%, and 10% levels, respectively.

The negative coefficient for leverage in Model 1 (β = −0.085, p < 0.01) indicates that, in the South African context, higher levels of debt are associated with reduced profitability (ROA). Economically, this suggests that excessive reliance on debt financing can erode firm earnings due to rising interest obligations and heightened financial risk. In an emerging market like South Africa, where access to affordable credit may be uneven and macroeconomic volatility is common, firms with high leverage are particularly vulnerable to financial distress. This underscores the need for prudent debt management, especially among smaller firms with limited buffers against economic shocks. Hence, the findings reinforce the importance of maintaining moderate debt levels to preserve financial performance in such a dynamic economic environment.

The results of these models provide empirical support for the study’s hypotheses. The significant negative coefficient of leverage in Model 1 aligns with the hypothesis H1, which posits that CapStruct influences firm performance. The positive squared term in Model 2 confirms the hypothesis H2 of an inverse U-shaped relationship, indicating that moderate levels of debt are beneficial, but excessive leverage is detrimental. Finally, the interaction term in Model 3 supports H3, suggesting that larger firms that can reach their optimal CapStruct have a greater debt ratio than smaller enterprises, although this effect is less prominent in dynamic contexts. The findings directly respond to the central question of this study—what constitutes an ideal capital structure for South African firms. The results demonstrate that while moderate debt levels enhance profitability, excessive leverage erodes financial performance, confirming a non-linear (inverse U-shaped) relationship. Moreover, while larger firms can sustain relatively higher debt levels under fixed settings, the difference in optimal leverage between small and large firms becomes insignificant when accounting for dynamic adjustments. These insights highlight that capital structure strategies must be both size-sensitive and context-dependent, especially in emerging economies like South Africa.

4.6. System-GMM Regression Results

Table 6 presents the results of the System-GMM regression models, used to address potential endogeneity issues and better capture the dynamic nature of ROA. Model 1 confirms the negative impact of leverage on ROA (β = −0.315, p < 0.01), similarly to the FE model. The significant positive coefficient for lagged ROA (β = 0.237, p < 0.05) indicates a persistent effect of past profitability. Model 2, which includes the squared term (Lev2), shows a strong positive relationship (β = 2.047, p < 0.01), again confirming the inverse U-shaped relationship between leverage and ROA. Model 3 introduces the interaction between leverage and firm size but finds the coefficient (β = 0.0663) to be insignificant, suggesting that the effect of leverage does not differ significantly between large and small firms in the dynamic model. The diagnostic tests further validate the model. The significant AR1 p-values indicate the presence of first-order serial correlation, while the AR2 p-values are not significant, suggesting no second-order autocorrelation, thereby validating the use of the GMM approach. The Hansen test p-values are high (all > 0.49), confirming that the instruments used in the model are valid and not over-identifying the model. Additionally, the Sargan test p-values (ranging from 0.057 to 0.166) are within an acceptable range, further supporting the validity of the instruments in the analysis.

Table 6.

Impact of leverage on ROA: System-GMM regression results. This table reports the System-GMM regression results for Model 1, Model 2 and Model 3. The impact of leverage on ROA, as well as the relationship with other control variables, is analyzed from 2013 to 2022., while columns (1) to (3) present the results for Model 1, Model 2 and Model 3. The standard errors reported in parentheses are corrected for heteroscedasticity and clustering using the Windmeijer correction. ***, **, and * denote statistical significance at the 1%, 5%, and 10% levels, respectively.

This study uniquely contributes to the literature by applying the System-GMM model, which effectively captures dynamic adjustments in CapStruct and mitigates potential endogeneity concerns. The results from the System-GMM regression confirm a persistent effect of past profitability (β = 0.237, p < 0.05), supporting the notion that firms dynamically adjust their CapStruct in response to profitability fluctuations. This is particularly relevant in South Africa, where economic volatility influences firms’ financing decisions. Furthermore, the study validates that financial performance and leverage have an inverted U-shaped relationship (β = 2.047, p < 0.01 in the squared term for leverage), indicating that while moderate debt enhances profitability, excessive leverage leads to financial distress.

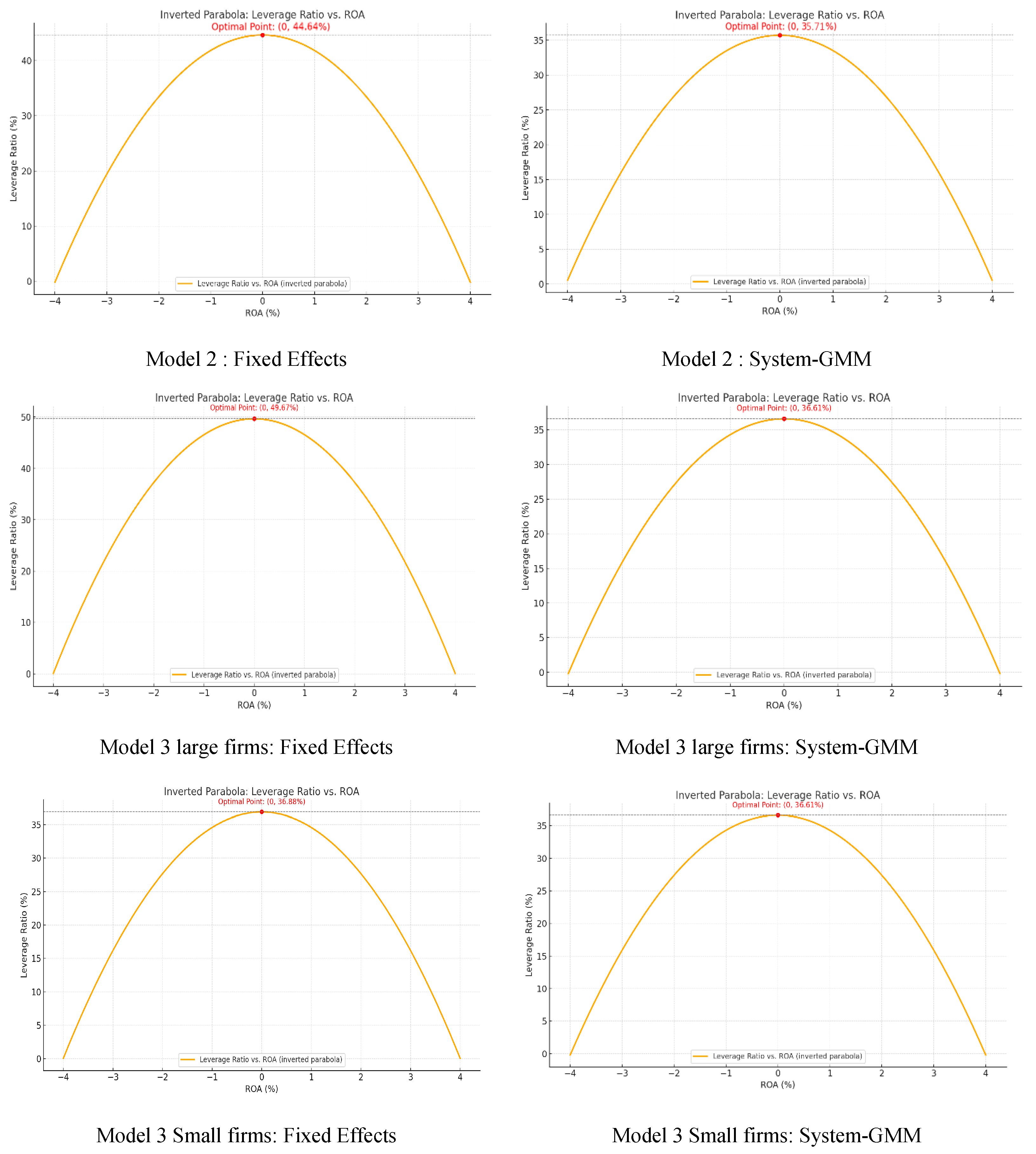

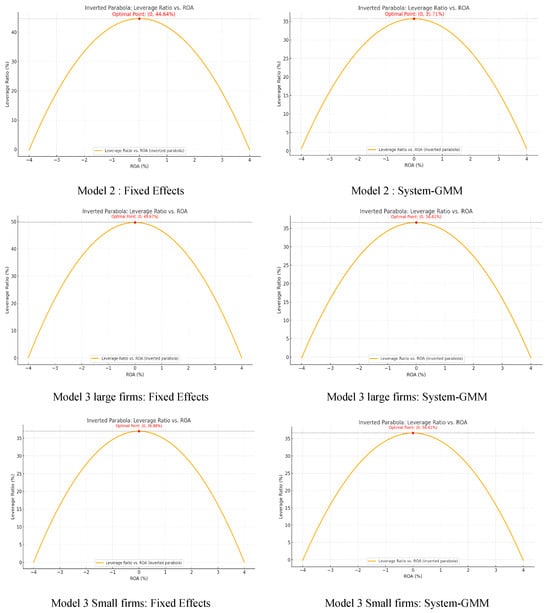

4.7. Comparison of Optimal Leverage Ratios: Fixed Effects vs. System-GMM Models

Table 7 and Figure 3 compares the optimal leverage ratios derived from the Fixed Effects and System-GMM models. Model 2 shows that the optimal leverage ratio is 44.64% in the FE model and 35.71% in the System-GMM model. This suggests that the debt level that maximizes profitability is slightly lower when accounting for the dynamic adjustments in leverage. Model 3 suggests that the optimal leverage ratio for large firms is 49.67% in the FE model, but it is lower (36.61%) in the System-GMM model, indicating that large firms might sustain higher leverage under static conditions compared to dynamic settings. For small firms, the optimal leverage ratio is 36.88% under the FE model, similar to that for large firms in the System-GMM analysis (36.61%). The lack of significance in the interaction term in the GMM model suggests no substantial difference in optimal leverage between large and small firms in the dynamic context. The results suggest that while moderate leverage can enhance firm profitability, firms must carefully manage their debt levels to avoid exceeding the optimal threshold. The differences between the FE and GMM models highlight the importance of considering dynamic adjustments when determining optimal leverage ratios. These interpretations provide an in-depth understanding of the relations between leverage, firm size, and financial performance, using a robust methodology that accounts for dynamic factors. Our findings demonstrate that the ideal leverage ratio varies between static and dynamic settings, with System-GMM estimating a lower optimal debt threshold. While large firms can sustain higher leverage in fixed settings, the moderating effect of firm size diminishes in dynamic contexts. This directly addresses our core question, revealing that optimal capital structure is both size-sensitive and context-dependent in South African enterprises. The results support the hypothesis of an inverse U-shaped connection between leverage and profitability and offer insights into how firms can achieve optimal CapStructs to maximize their returns.

Table 7.

Optimal CapStruct (Lev ratio). This table compares the optimal leverage ratios derived from the Fixed Effects and System-GMM, amongst all three models. Columns (1) to (2) present the results for Fixed Effects and System-GMM.

Figure 3.

Optimal CapStruct (Lev ratio).

The dynamic System Generalized Method of Moments (System-GMM) estimator was selected due to its ability to account for unobserved heterogeneity, endogeneity, and autocorrelation—common issues in capital structure–performance studies. Unlike static models such as OLS or Fixed Effects (FE), System-GMM leverages internal instruments (e.g., lagged dependent variables) to mitigate bias from simultaneity between leverage and profitability. This method is particularly effective in our unbalanced panel context, where firm behavior evolves over time and past performance influences current financing decisions. The inclusion of both lagged levels and differences enhances efficiency and consistency in estimation, making it superior for capturing dynamic financial behavior in emerging markets like South Africa.

5. Theoretical and Practical Implications

5.1. Theoretical Implications

This study adds to the growing body of literature by confirming the non-linear and inverse U-shaped association between CapStruct and business performance, as has been substantiated by a small number of previous studies. The findings challenge the traditional CapStruct irrelevance theory, proving that CapStruct decisions play a crucial role in influencing firm performance and must be carefully considered by financial managers. The evidence supports the Trade-off Theory, which suggests that there is an optimal balance between debt and equity where the benefits of debt peak before being offset by the costs of financial distress. This study’s discovery of an inflection point is consistent with the Pecking Order Theory, suggesting that firms with higher profitability are less inclined to rely on debt despite its theoretical benefits. Furthermore, the existence of this optimal structure implies a convergence of shareholder and management interests at specific debt levels, which helps to minimize agency costs and maximize firm performance. Beyond this point, however, the rising costs associated with increased debt reintroduce conflicts, leading to a decline in overall firm performance.

5.2. Practical Implications

The study’s conclusions hold significant significance for financial management, investors, lenders, and policymakers within South Africa’s unique economic landscape. For corporate managers, understanding the CapStruct–performance relationship is vital for optimizing financial health, especially in the context of South Africa’s evolving market and regulatory environment. Identifying an optimal leverage range offers a practical guide for financial decision-making, allowing firms to adjust their CapStruct to maximize shareholder value while minimizing financial risk. The inverted U-shaped link found across leverage and performance is especially important for strategic planning, enabling South African firms to align financing decisions with sustainable, long-term growth objectives. Furthermore, industry-specific insights allow firms to tailor their financial strategies to the distinct economic and financial dynamics of each sector, aiding them in benchmarking their CapStruct to maintain both competitiveness and resilience. For capital providers, including investors and lenders, this study provides valuable insights into evaluating a firm’s financial stability and risk profile in the South African context. Investors can use these findings to refine their portfolio management by focusing on firms within the optimal leverage range, effectively balancing risk and return in a market that can be volatile. Lenders can also use these data to determine the creditworthiness of borrowers, better customizing lending terms to align with firms that demonstrate stable financial performance and a sustainable CapStruct.

From a policy perspective, these insights are particularly relevant for South Africa. Policymakers can use this understanding of the CapStruct–performance relationship to design regulations that encourage firms to operate within optimal leverage levels, promoting overall economic stability. Additionally, these findings can guide policy initiatives aimed at enhancing financial resilience, particularly for firms in sectors facing structural challenges in achieving optimal leverage ratios. This method can promote a more robust and dynamic company environment, better equipped to navigate South Africa’s socio-economic complexities while supporting long-term growth.

This study highlights the need for sector-specific regulations, such as debt ceilings aligned with industry leverage capacities. Policymakers should offer incentives for firms maintaining optimal debt levels, especially during economic volatility. Supporting SMEs through alternative financing schemes and enhancing monitoring systems to track capital structure trends can promote financial resilience and sustainable growth in South Africa.

6. Conclusions

This study investigates the connection between CapStruct and financial performance among South African companies, focusing on identifying the optimal leverage levels that maximize profitability. Using both Fixed Effects (FE) and dynamic System-GMM models, the study found an inverse U-shaped link between leverage and company performance. This indicates that although moderate debt levels can boost profitability through tax advantages and other benefits, high levels of leverage may result in financial distress, negatively impacting returns. The analysis also highlights that larger firms tend to manage higher levels of debt more effectively than smaller firms, although the System-GMM results indicate that this difference is less significant when accounting for dynamic adjustments.

One of the main contributions of this research is the identification of optimal leverage ratios, which vary depending on the model used. The FE model suggests a higher optimal leverage ratio compared to the System-GMM model, which accounts for time-varying factors and firm-specific dynamics. This insight emphasizes the importance of considering dynamic adjustments in CapStruct decisions to better align with changes in profitability and market conditions. The study also confirms that firm size plays a moderating role, allowing larger firms to potentially sustain higher leverage under certain conditions. These findings, while grounded in the South African context, hold broader relevance for other emerging markets that face similar financial constraints, institutional gaps, and economic volatility. The evidence on optimal leverage and its performance implications can guide firms and policymakers in comparable settings to refine capital structure strategies that balance profitability with financial stability.

However, the study has several limitations. The focus on South African firms may limit the generalizability of the findings to other emerging markets with different regulatory and economic environments. Additionally, the analysis is constrained by the available data from 2013 to 2022 and may not capture longer-term trends or structural shifts in the South African economy. Future research could explore the influence of macroeconomic variables such as inflation and interest rates in greater depth, as these factors play a crucial role in shaping CapStruct decisions; also, industry-oriented variations in optimal leverage can be explored further.

The findings of this study have practical implications for both managers and policymakers. For corporate managers, understanding the optimal balance between debt and equity can guide strategic financial decisions, ensuring that firms leverage their financial structures for sustainable growth while minimizing risks. For policymakers, insights into the CapStruct dynamics of South African firms can inform the development of regulations that foster financial stability and support business growth. This research ultimately contributes to a more nuanced understanding of CapStruct optimization in the context of South Africa, providing a foundation for further studies and strategic financial planning.

Author Contributions

All authors have contributed equally. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data that support the findings of this study are available from the corresponding author, Suzan Dsouza, upon reasonable request.

Conflicts of Interest

The authors declare that they have no financial or personal relationships that may have inappropriately influenced them in writing this article.

References

- Abdullah, M., Gulzar, I., Chaudhary, A., Tabash, M. I., Rashid, U., Naaz, I., & Ali, A. (2023). Dynamics of speed of leverage adjustment and financial distress in the Indian steel industry. Journal of Open Innovation: Technology, Market, and Complexity, 9(4), 100152. [Google Scholar] [CrossRef]

- Abor, J. (2005). The effect of capital structure on profitability: An empirical analysis of listed firms in Ghana. The Journal of Risk Finance, 6(5), 438–445. [Google Scholar] [CrossRef]

- Adeoye, O. A., Islam, S. M. N., & Adekunle, A. I. (2021). Optimal capital structure and the debtholder-manager conflicts of interests: A management decision model. Journal of Modelling in Management, 16(4), 1070–1095. [Google Scholar] [CrossRef]

- Amelot, L. M. M., Subadar Agathee, U., & Seetanah, B. (2023). Impact of risk on capital structure adjustments: Evidence from the African markets. Journal of Corporate Accounting & Finance, 34(4), 122–142. [Google Scholar]

- Amini, S., Elmore, R., Öztekin, Ö., & Strauss, J. (2021). Can machines learn capital structure dynamics? Journal of Corporate Finance, 70, 102073. [Google Scholar] [CrossRef]

- Aybar, B., Deligonul, S., & An, B. (2023). Financial crises and capital structure decisions: Empirical evidence from emerging markets. Journal of Asia-Pacific Business, 24(1), 19–38. [Google Scholar] [CrossRef]

- Banerjee, A. (2013). Is profitability related to capital structure decisions in Indian cement industry? An empirical investigation through factor analysis approach. Available online: https://ssrn.com/abstract=3187966 (accessed on 1 May 2025).

- Bibi, T., & Akhtar, M. H. (2024). Determinants of capital structure: Evidence from securities companies. Bulletin of Business and Economics (BBE), 13(1). [Google Scholar] [CrossRef]

- Boateng, P. Y., Ahamed, B. I., Soku, M. G., Addo, S. O., & Tetteh, L. A. (2022). Influencing factors that determine capital structure decisions: A review from the past to present. Cogent Business & Management, 9(1), 2152647. [Google Scholar]

- Can, G., Demiraj, R., & Mersni, H. (2023). The effect of life cycle stages on capital expenditures: Evidence from an emerging market. EuroMed Journal of Business, 19(4), 898–921. [Google Scholar] [CrossRef]

- Chandra, T., Junaedi, A. T., Wijaya, E., Suharti, S., Mimelientesa, I., & Ng, M. (2019). The effect of capital structure on profitability and stock returns: Empirical analysis of firms listed in Kompas 100. Journal of Chinese Economic and Foreign Trade Studies, 12(2), 74–89. [Google Scholar] [CrossRef]

- Cooper, M., Gulen, H., & Ion, M. (2024). The use of asset growth in empirical asset pricing models. Journal of Financial Economics, 151, 103746. [Google Scholar] [CrossRef]

- Darmono, D., Su’un, M., Jillbert, J., Ikawijaya, N., & Mursyidin, M. (2024). Endogenous and exogenous factors affecting capital structure: A theoretical review. Atestasi: Jurnal Ilmiah Akuntansi, 7(1), 40–49. [Google Scholar] [CrossRef]

- Demiraj, R., Dsouza, S., & Abiad, M. (2022). Working capital management impact on profitability: Pre-pandemic and pandemic evidence from the european automotive industry. Risks, 10, 236. [Google Scholar] [CrossRef]

- Demiraj, R., Labadze, L., Dsouza, S., Demiraj, E., & Grigolia, M. (2024). The quest for an optimal capital structure: An empirical analysis of European firms using GMM regression analysis. EuroMed Journal of Business, 20, 529–551. [Google Scholar] [CrossRef]

- Dsouza, S., & Krishnamoorthy, K. (2024). Boosting corporate value through ESG excellence in oil and gas sector. International Journal of Energy Economics and Policy, 14(5), 335–346. [Google Scholar] [CrossRef]

- Dsouza, S., Momin, M., Habibniya, H., & Tripathy, N. (2024). Optimizing performance through sustainability: The mediating influence of firm liquidity on ESG efficacy in African enterprises. Cogent Business & Management, 11(1), 2423273. [Google Scholar]

- Frank, M. Z., & Goyal, V. K. (2009). Capital structure decisions: Which factors are reliably important? Financial Management, 38(1), 1–37. [Google Scholar] [CrossRef]

- Frank, M. Z., & Sanati, A. (2021). Financing corporate growth. The Review of Financial Studies, 34(10), 4926–4998. [Google Scholar] [CrossRef]

- Ghani, E. K., Rehan, R., Salahuddin, S., & Hye, Q. M. A. (2023). Discovering capital structure determinants for SAARC energy firms. International Journal of Energy Economics and Policy, 13(1), 135–143. [Google Scholar] [CrossRef]

- Gopane, T. J., Gandanhamo, T., & Mabejane, J. B. (2023). Technology firms and capital structure adjustment: Application of two-step system generalised method of moments. Applied Econometrics, 70, 34–54. [Google Scholar] [CrossRef]

- Gornall, W., & Strebulaev, I. A. (2018). Financing as a supply chain: The capital structure of banks and borrowers. Journal of Financial Economics, 129(3), 510–530. [Google Scholar] [CrossRef]

- Gwatidzo, T., & Ojah, K. (2009). Corporate capital structure determinants: Evidence from five African countries. African Finance Journal, 11(1), 1–23. [Google Scholar]

- Habibniya, H., Dsouza, S., Rabbani, M. R., Nawaz, N., & Demiraj, R. (2022). Impact of capital structure on profitability: Panel data evidence of the telecom industry in the United States. Risks, 10(8), 157. [Google Scholar] [CrossRef]

- Haque, S., & Varghese, R. (2023). Firms’ rollover risk, capital structure and unequal exposure to aggregate shocks. Journal of Corporate Finance, 80, 102416. [Google Scholar] [CrossRef]

- Hegde, A. A., Panda, A. K., & Masuna, V. (2023). Sectoral analysis of capital structure adjustment: Evidence from emerging market. Journal of Advances in Management Research, 20(5), 801–820. [Google Scholar] [CrossRef]

- Hussain, A., Shabbir, A., & Rehman, A. A. (2024). Impact of corporate capital structure on corporate performance: An empirical study of emerging market using GMM estimation technique. Journal of Asian Development Studies, 13(2), 595–605. [Google Scholar] [CrossRef]

- Instefjord, N., & Nawosah, V. (2023). Cost and Capital Structure. SSRN, 2, 368–383. [Google Scholar] [CrossRef]

- Jain, A. K., Dsouza, S., Kayani, U., Nawaz, F., Fahlevi, M., & Aziz, A. L. (2024). Nexus of firm specific variables and capital structure decisions: An evidence from Asia Pacific region amid COVID-19 crisis times. Cogent Social Sciences, 10(1), 2413619. [Google Scholar] [CrossRef]

- Jensen, M. C., & Meckling, W. H. (2019). Theory of the firm: Managerial behavior, agency costs and ownership structure. In Corporate governance (pp. 77–132). Gower. [Google Scholar]

- Kathayat, R., Khan, G. M. A., & Awan, F. (2024). Impact of corporate governance and capital structure on firm performance: A case of public listed companies. Contemporary Issues in Social Sciences and Management Practices, 3(2), 264–275. [Google Scholar] [CrossRef]

- Khan, K. I., Qadeer, F., Mata, M. N., Chavaglia Neto, J., Sabir, Q. U. A., Martins, J. N., & Filipe, J. A. (2021). Core predictors of debt specialization: A new insight to optimal capital structure. Mathematics, 9(9), 975. [Google Scholar] [CrossRef]

- Kraus, A., & Litzenberger, R. H. (1973). A state-preference model of optimal financial leverage. The Journal of Finance JSTOR, 28(4), 911–922. [Google Scholar]

- Kuchler, A. (2019). Leverage, investment, and recovery from a financial crisis: The role of debt overhang. Studies in Economics and Finance, 37(1), 143–159. [Google Scholar] [CrossRef]

- Lamichhane, P., & Dhungel, B. D. (2024). Capital structure and financial performance of manufacturing companies in Nepal. Journal of Mathematics Instruction, Social Research and Opinion, 3(2), 239–250. [Google Scholar] [CrossRef]

- Luo, Y., & Jiang, C. (2022). The impact of corporate capital structure on financial performance based on convolutional neural network. Computational Intelligence and Neuroscience, 2022(1), 5895560. [Google Scholar] [CrossRef]

- Mandasari, R., & Rikumahu, B. (2024). The impact of capital structure, investment growth, and liquidity on financial performance of automotive companies and its components on the Indonesia Stock Exchange (2018–2022). Review of Multidisciplinary Academic and Practice Studies, 1(2), 151–164. [Google Scholar] [CrossRef]

- Marcelle Amelot, L. M., & Subadar Agathee, U. (2021). Impact of idiosyncratic and macroeconomic risks on capital structure: Evidence from SADC countries. African Journal of Economic and Management Studies, 12(3), 400–422. [Google Scholar] [CrossRef]

- Mareta, F., Ulhaq, A., Resfitasari, E., Febriani, I., & Elisah, S. (2022). Effect of debt to equity ratio, current ratio, total assets turnover, earning per share, price earning-ratio, sales growth, and net profit margin on return on equity. In International conference on economics, management and accounting (ICEMAC 2021) (pp. 417–426). Atlantis Press. [Google Scholar]

- Matekenya, W., & Moyo, C. (2022). Innovation as a driver of SMME performance in South Africa: A quantile regression approach. African Journal of Economic and Management Studies, 13(3), 452–467. [Google Scholar] [CrossRef]

- Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261–297. [Google Scholar]

- Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Fnancial Economics, 13(2), 187–221. [Google Scholar] [CrossRef]

- Odendo, M. A., Akims, M. A., Nyachae, S. M., & Mbugua, L. (2023). Quick ratio and financial performance of agricultural firms listed at the Nairobi Securities Exchange, Kenya. Journal of Economics, 7(1), 64–76. [Google Scholar] [CrossRef]

- Oke, A. E., Adetoro, P. E., Stephen, S. S., Aigbavboa, C. O., Oyewobi, L. O., & Aghimien, D. O. (2023). Risk management practices in South Africa. In Risk management practices in construction: A global view (pp. 59–66). Springer. [Google Scholar]

- Ombuh, I. W., Opod, C. R., Mawitjere, P. S., & Ahmed, M. (2024). Impact of capital structure on firm performance of financial companies listed on the Indonesia stock exchange. Economy and Finance Enthusiastic, 2(1), 1–7. [Google Scholar] [CrossRef]

- Palmowski, Z., Pérez, J. L., Surya, B. A., & Yamazaki, K. (2020). The Leland–Toft optimal capital structure model under poisson observations. Finance and Stochastics, 24, 1035–1082. [Google Scholar] [CrossRef]

- Pedraza, J. M. (2021). The micro, small, and medium-sized enterprises and its role in the economic development of a country. Business and Management Research, Business and Management Research, 10(1), 33. [Google Scholar] [CrossRef]

- Power, J., Power, B., & Ryan, G. (2022). Determinants of equity financing: A demand-side analysis of Irish indigenous technology-based firms. The Irish Journal of Management, 41(1), 52–68. [Google Scholar] [CrossRef]

- Prekazi, Y., Bajrami, R., & Hoxha, A. (2023). The impact of capital structure on financial performance. International Journal of Applied Economics, Finance and Accounting, 17(1), 1–6. [Google Scholar] [CrossRef]

- Putri, I. P., Khairunisa, S., Silfhia, M., Pramudiani, J. P., & Leon, F. M. (2024). Determinants of sharia-compliant and non-compliant capital structure in the cyclical consumer sector. Jurnal Maksipreneur: Manajemen, Koperasi, Dan Entrepreneurship, 13(2), 563–580. [Google Scholar] [CrossRef]

- Rahmawati, I., Rifan, D. F., Suryanto, T., & Pramasha, R. R. (2024). The Effect of total asset turnover and return on assets on company profit growth (study of mining companies listed on the Indonesian Sharia Stock Index (ISSI) for the 2017–2022 Periode. Al-Kharaj: Journal of Islamic Economic and Business, 6(1), 37–55. [Google Scholar] [CrossRef]

- Rajan, R. G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The Journal of Finance, 50(5), 1421–1460. [Google Scholar] [CrossRef]

- Sajjad, F., & Zakaria, M. (2018). Credit rating as a mechanism for capital structure optimization: Empirical evidence from panel data analysis. International Journal of Financial Studies, 6, 13. [Google Scholar] [CrossRef]

- Savitri, R. J., Purwohedi, U., & Zakaria, A. (2024). 1. Pengaruh firm growth dan total asset turnover terhadap Kinerja Keuangan. Jurnal Akuntansi, Perpajakan dan Auditing, 4, 655–670. [Google Scholar] [CrossRef]

- Schoenmaker, D., & Schramade, W. (2023). Capital Structure. In Corporate finance for long-term value. Springer texts in business and economics. Springer. [Google Scholar] [CrossRef]

- Solanki, S., Singh, S., & Murthy, I. K. (2022). Agricultural exports and performance of agricultural firms in India: An empirical analysis using system GMM. Asian Economic and Financial Review, Asian Economic and Social Society, 12(2), 121–131. [Google Scholar] [CrossRef]

- Suciati, R., Marlina, M., Rialmi, Z., & Nastiti, H. (2021). Relationship analysis of capital structure and profitability ratio in trade sector companies in Indonesia. Journal of Accounting and Finance Management, 2(1), 9–29. [Google Scholar] [CrossRef]

- Synn, C., & Williams, C. D. (2024). Financial reporting quality and optimal capital structure. Journal of Business Finance & Accounting, 51(5–6), 885–910. [Google Scholar]

- Szczygielski, J. J., & Chipeta, C. (2023). Properties of returns and variance and the implications for time series modelling: Evidence from South Africa. Modern Finance, Fundacja Naukowa Instytut Współczesnych Finansów, 1(1), 35–55. [Google Scholar] [CrossRef]

- Tao, Y. (2024). A study on the impact of capital structure on the performance of listed companies. Advances in Economics, Management and Political Sciences, 102(3), 71–78. [Google Scholar] [CrossRef]

- Wahyuni, F. A., & Kristanti, F. T. (2024). The influence of profitability, firm size, growth, liquidity, asset tangibility, and non-debt tax shield on capital structure. Atestasi: Jurnal Ilmiah Akuntansi, 7(2), 986–999. [Google Scholar] [CrossRef]

- Wang, Z., & Wang, Q. (2022). Multiple large shareholders and leverage adjustment: New evidence from Chinese listed firms. Emerging Markets Finance and Trade, 58(12), 3487–3503. [Google Scholar] [CrossRef]

- Zhang, Z., & Chen, Y. (2024). Industry heterogeneity and the economic consequences of corporate ESG performance for good or bad: A firm value perspective. Sustainability, 16(15), 6506. [Google Scholar] [CrossRef]

- Zhao, X., Ma, H., & Hao, T. (2019). Acquirer size, political connections and mergers and acquisitions performance. Studies in Economics and Finance, 36(2), 311–332. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).