A Study on Storm and Flood Insurance Management Mapping: Case Study of Incheon Metropolitan City

Abstract

:1. Introduction

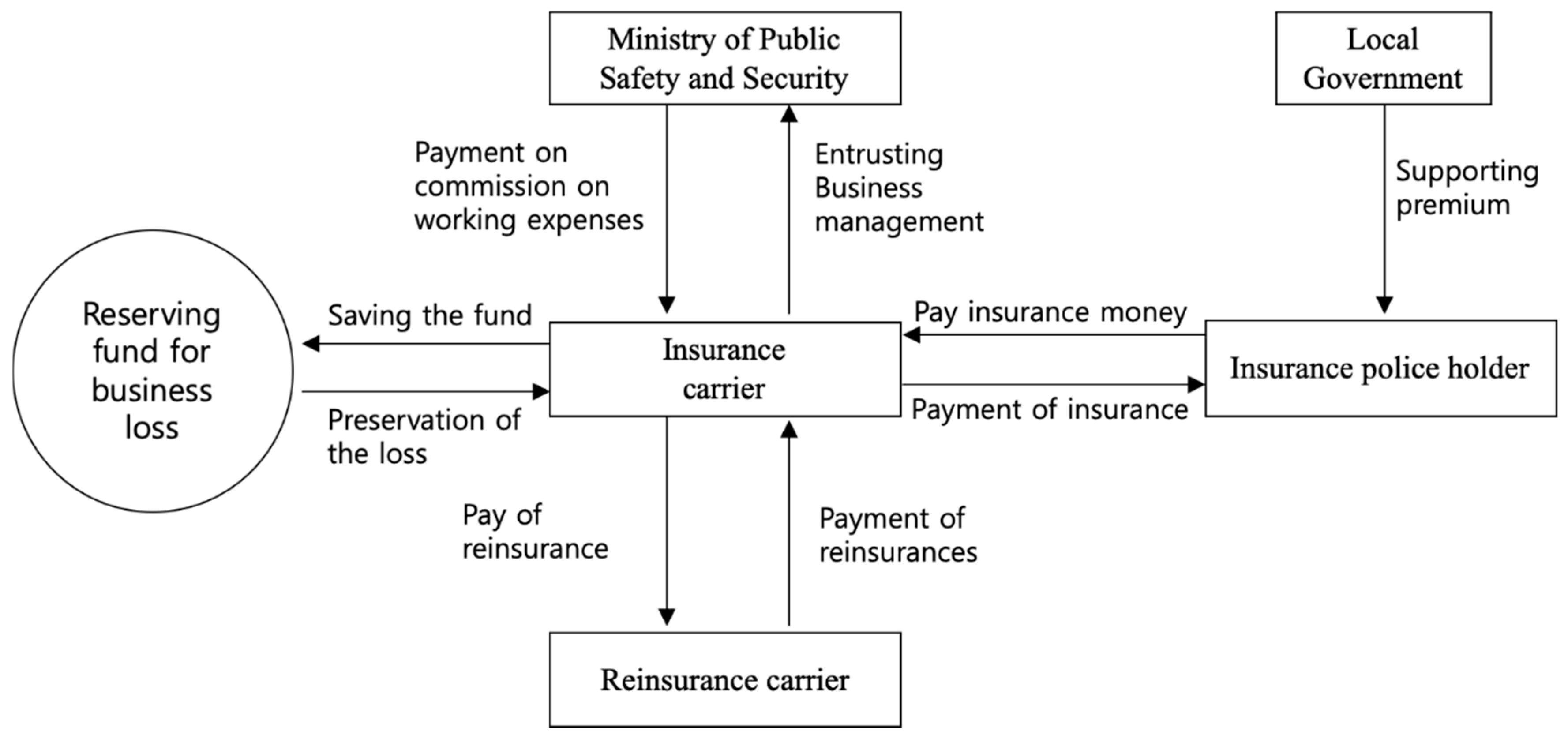

2. Overview of Storm and Flood Insurance

3. Test Data Acquisition and Analysis

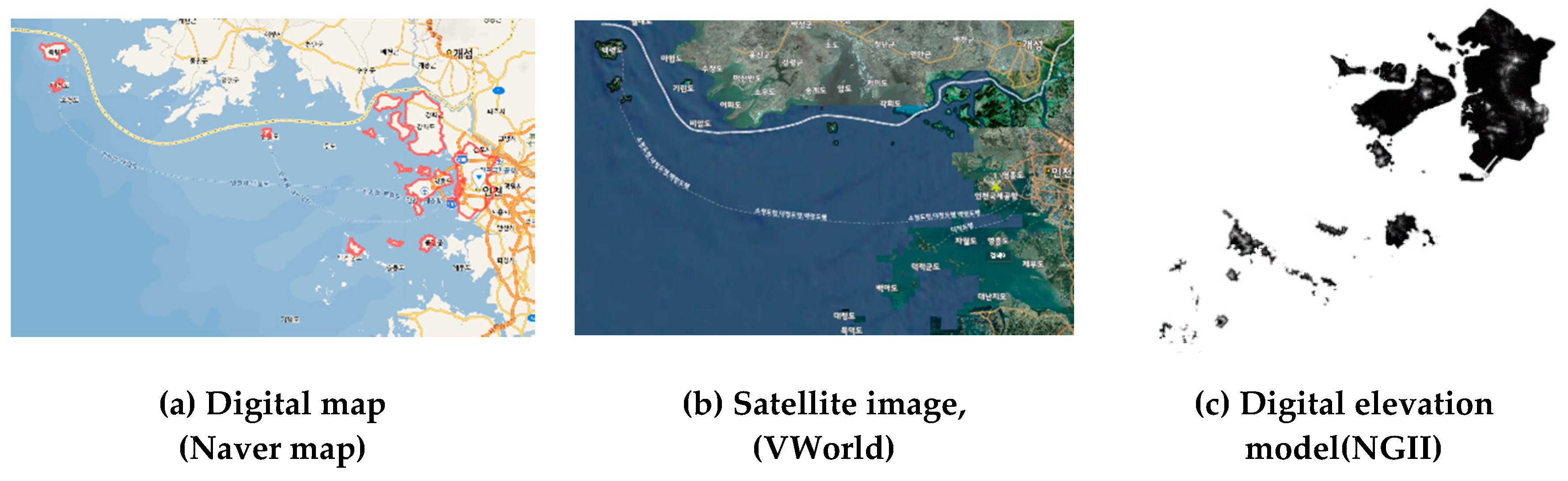

3.1. Study Area

3.2. Data classification

3.3. Risk

3.4. Premium Rate

4. The Storm, Flood, and Snow Insurance Management Map

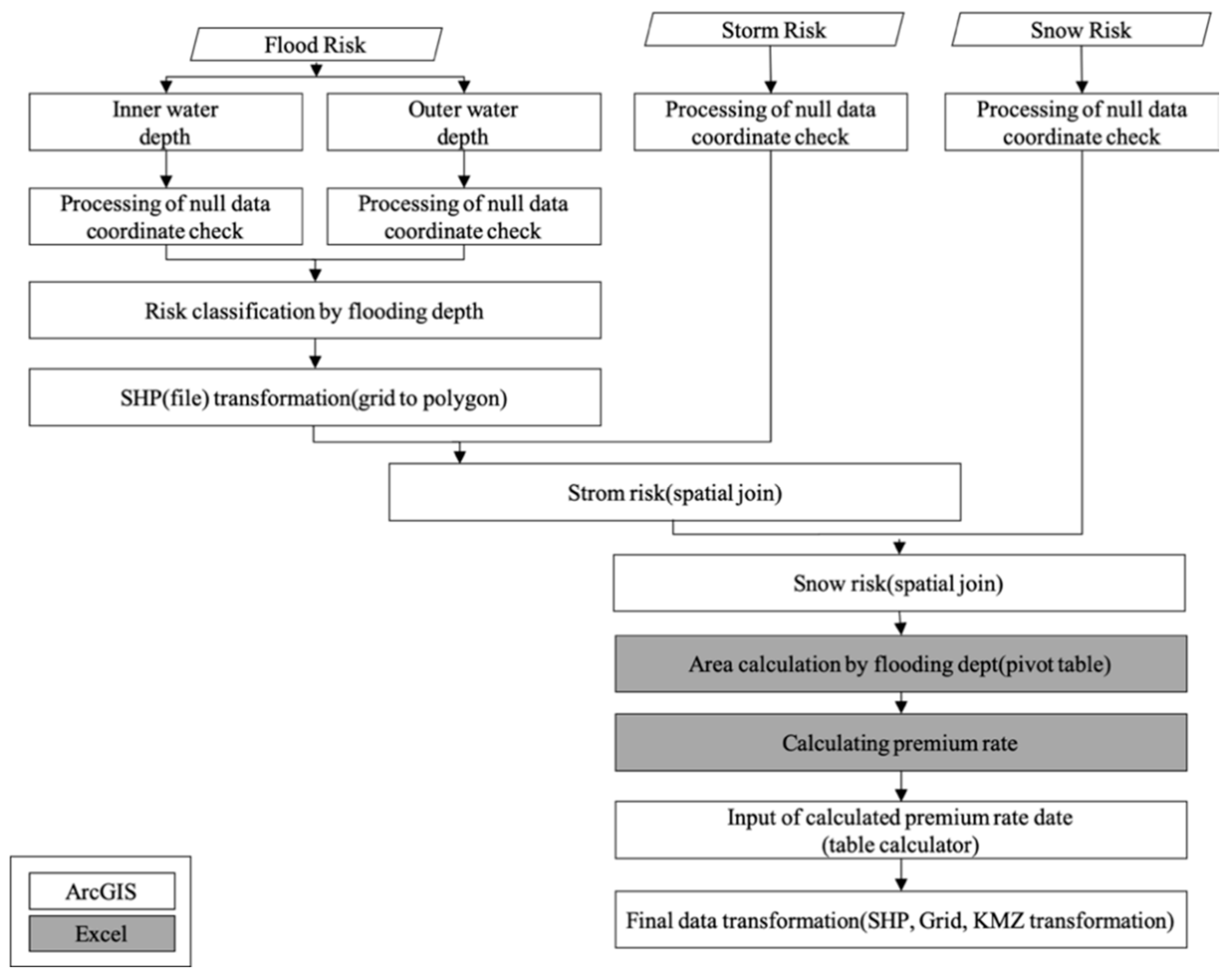

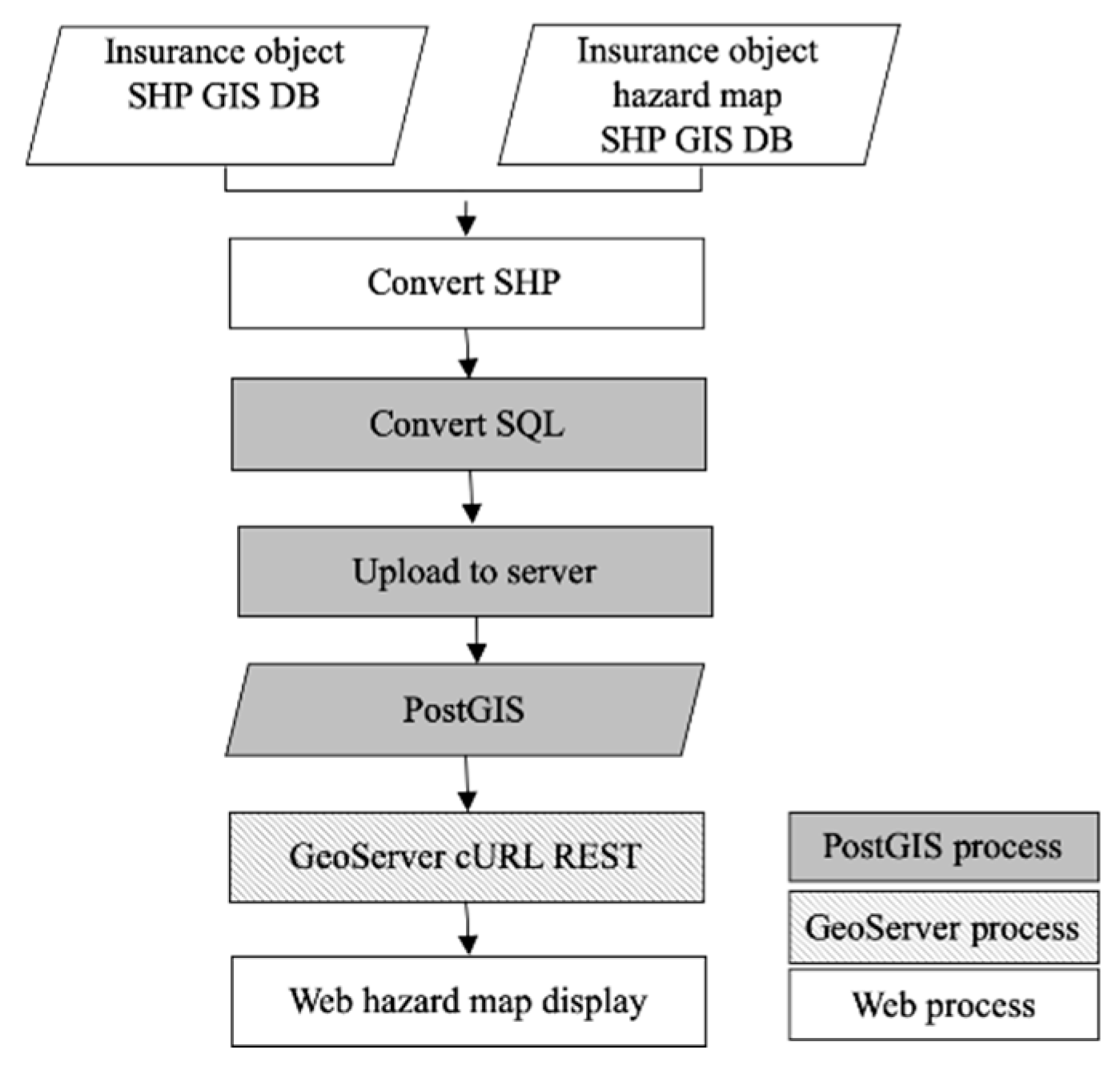

4.1. Integration of Risk and Premium Rate Analysis Process

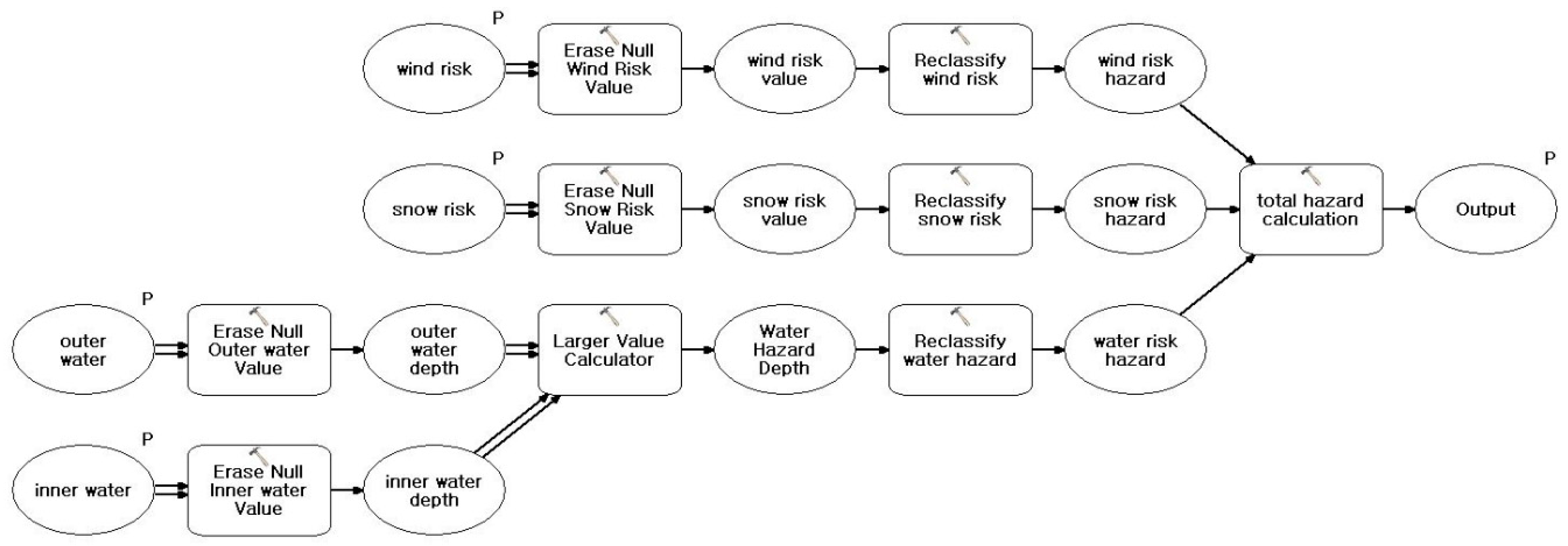

4.2. Automatic Risk Analysis Method

4.3. Risk Data and Premium Rate Results

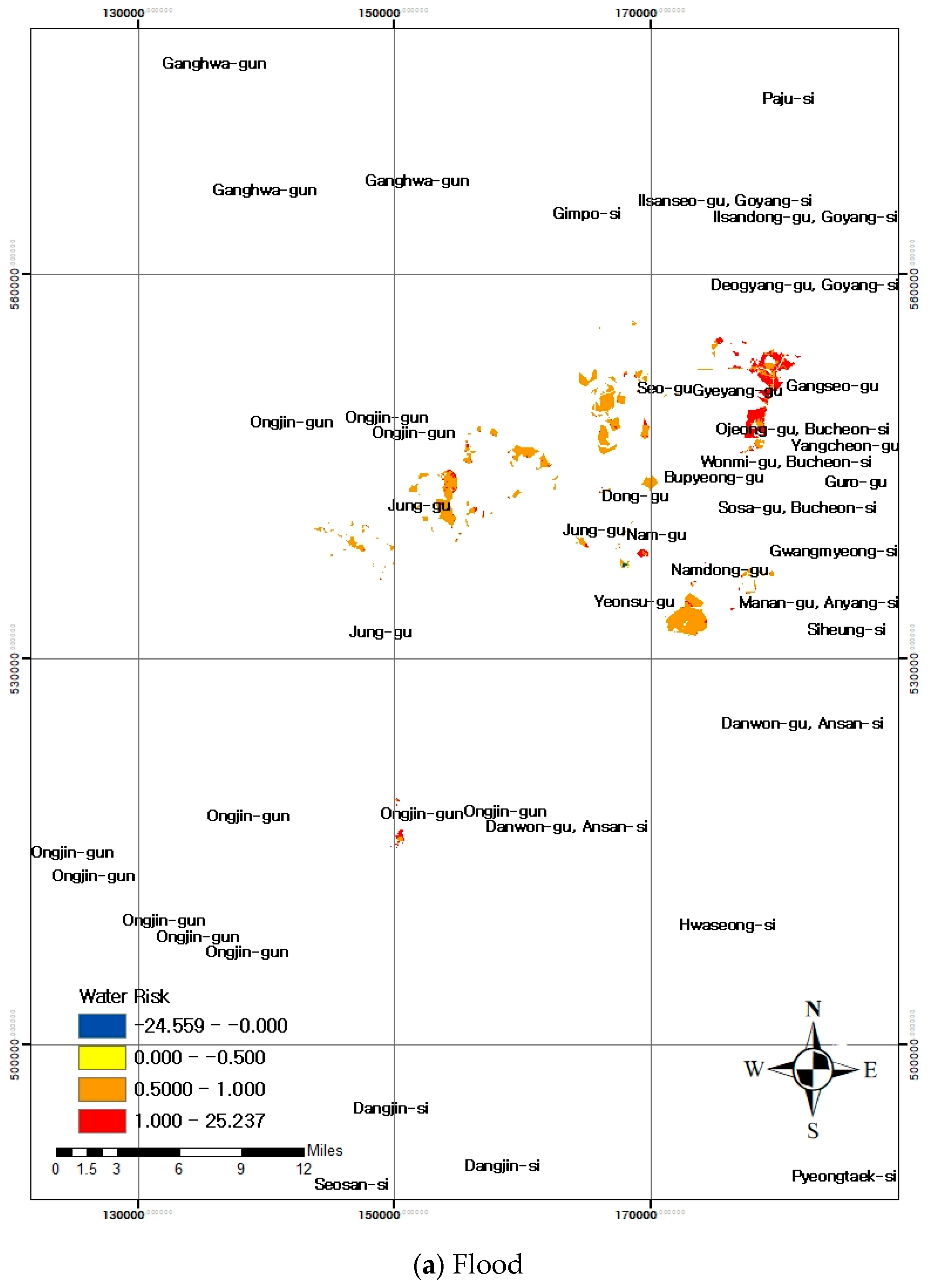

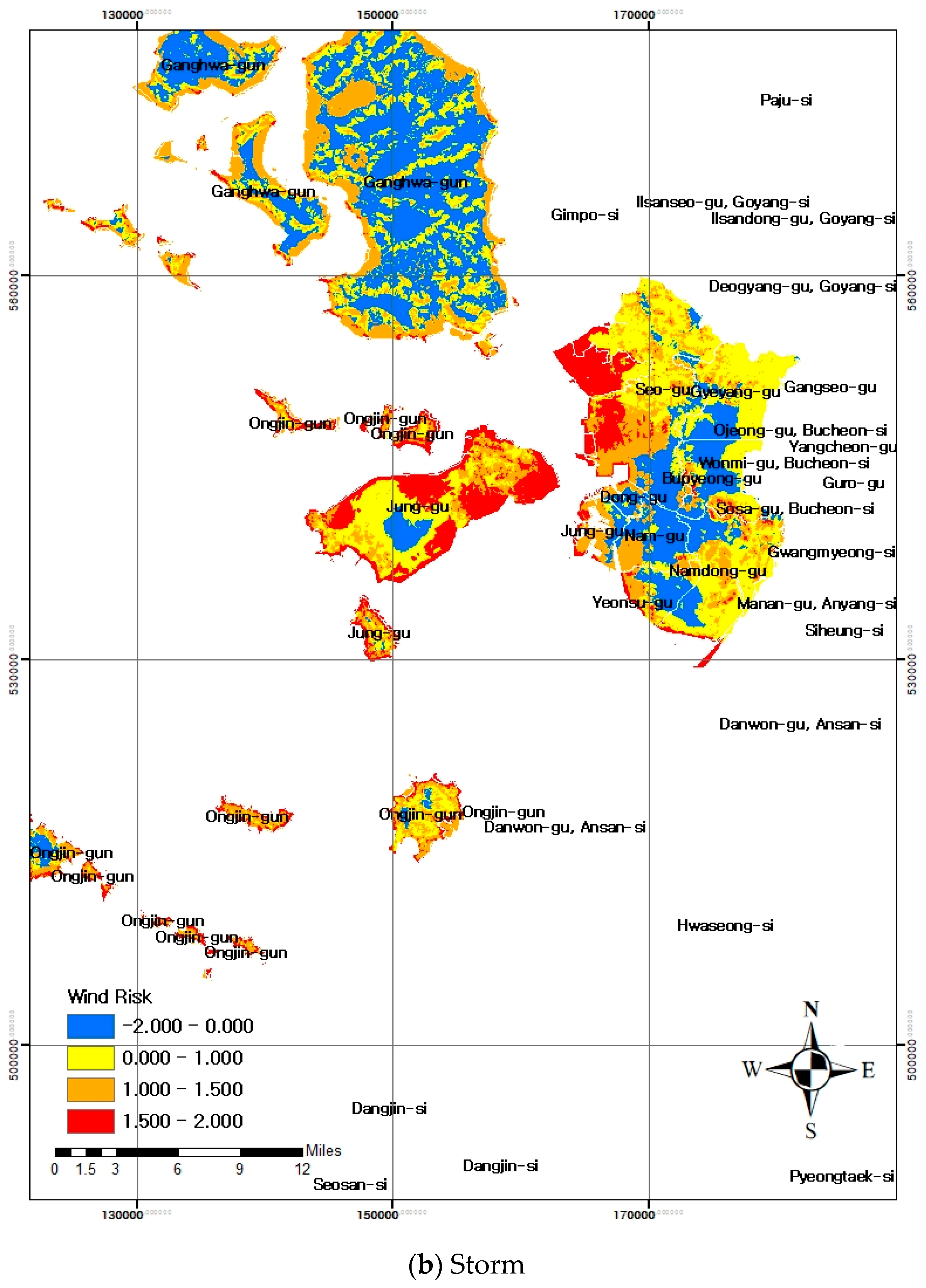

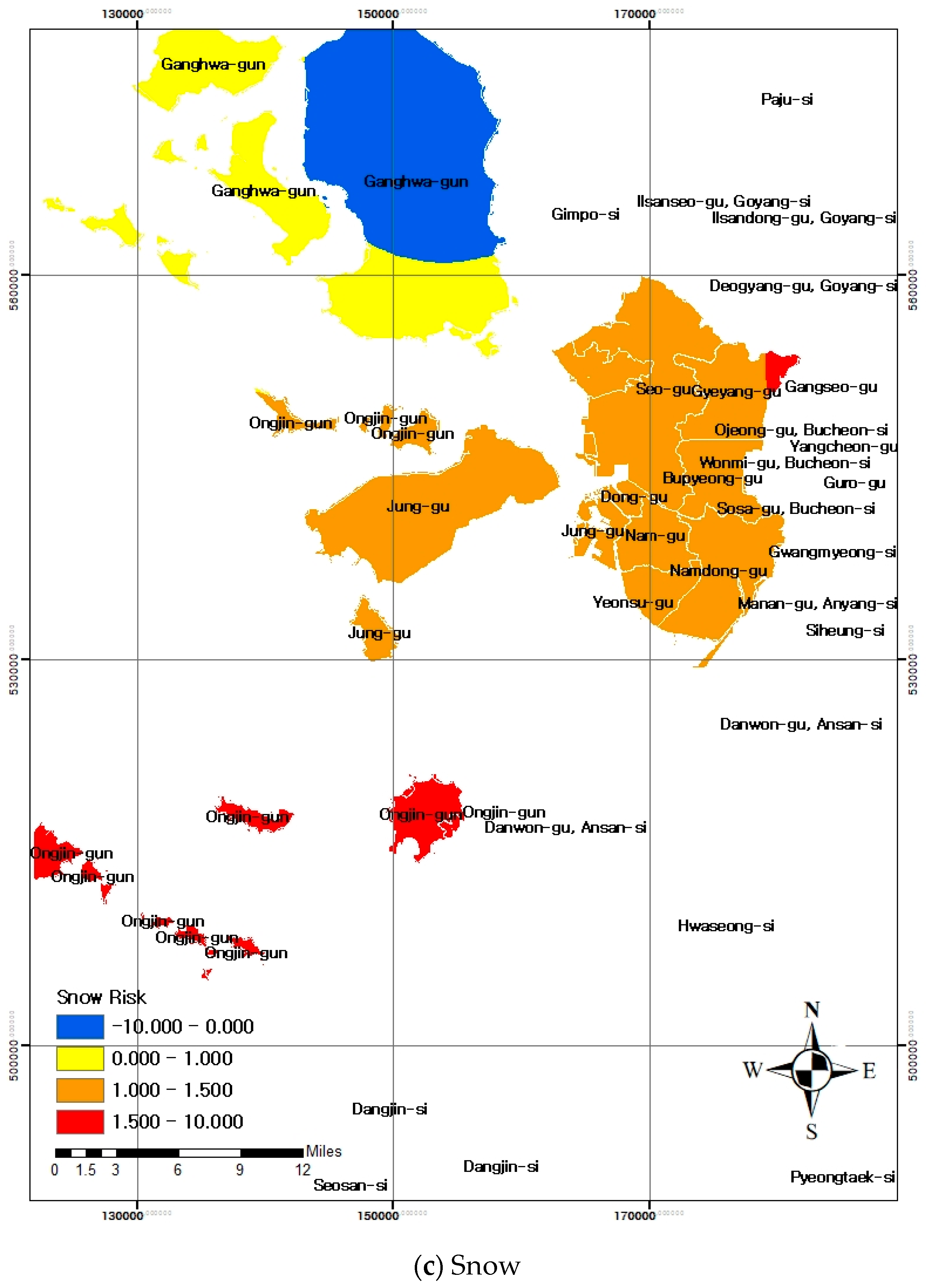

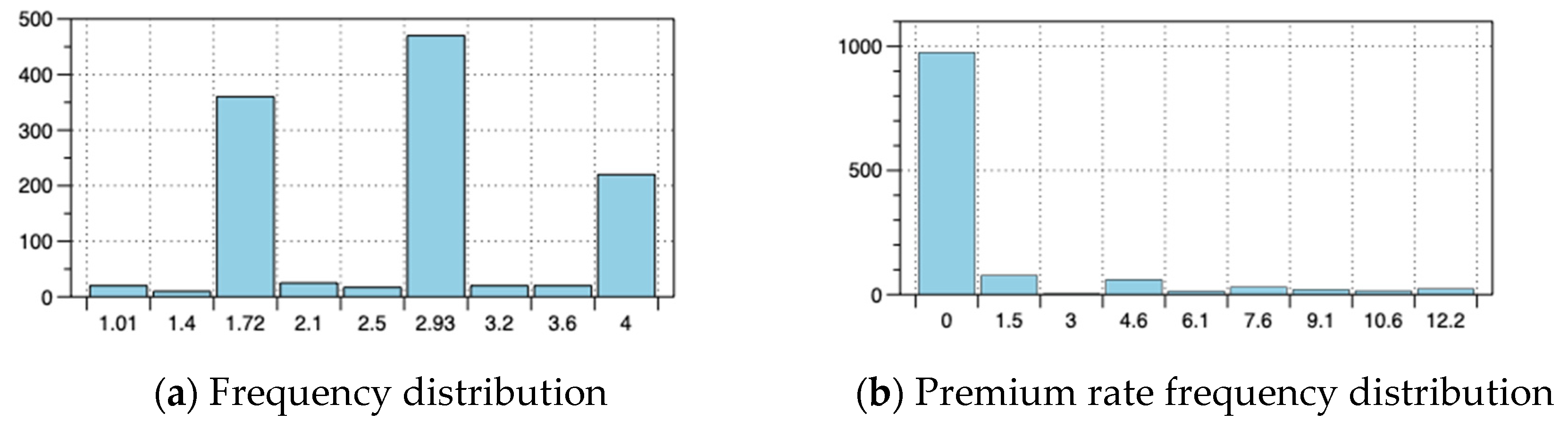

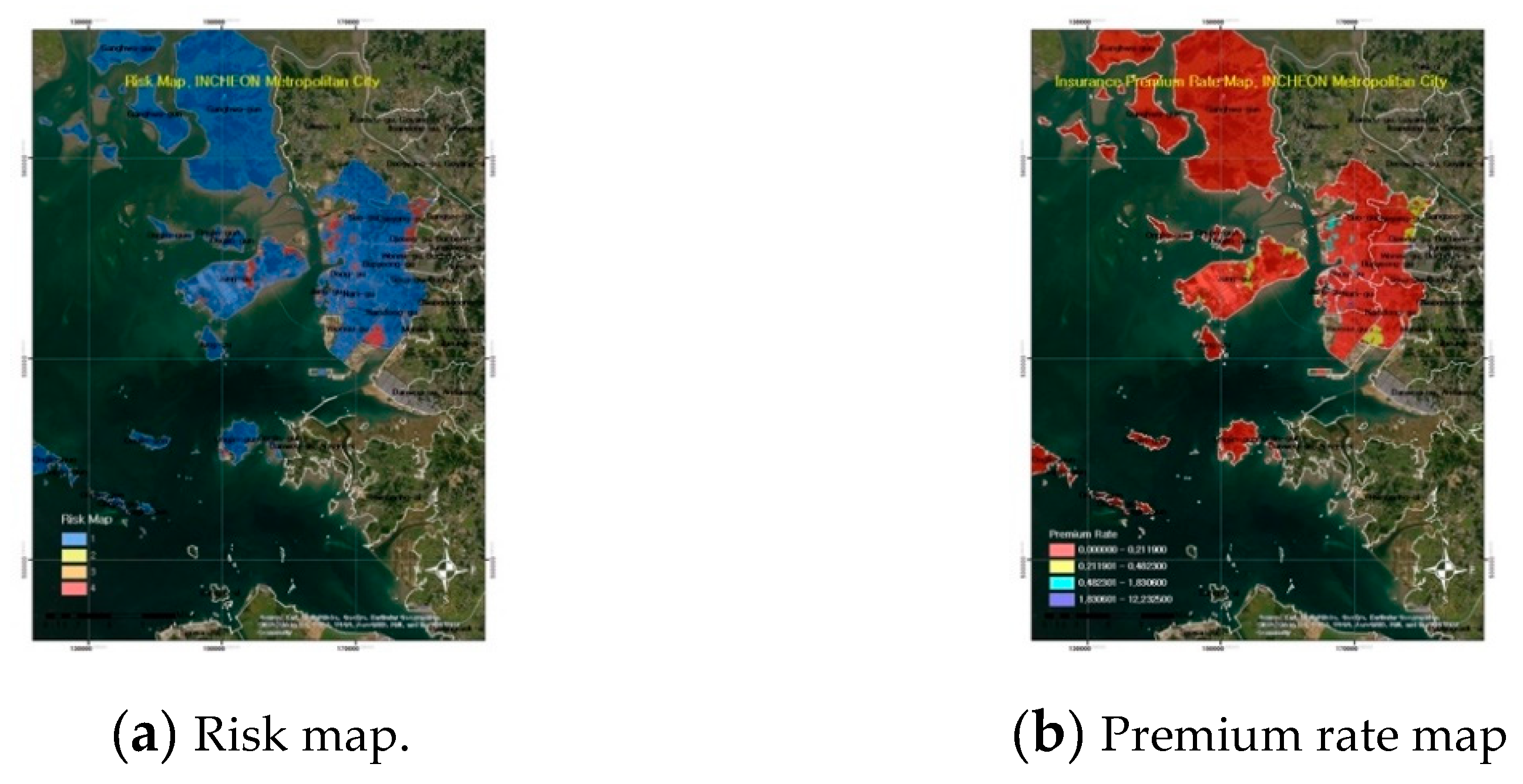

4.3.1. Risk Data

4.3.2. Premium Rate

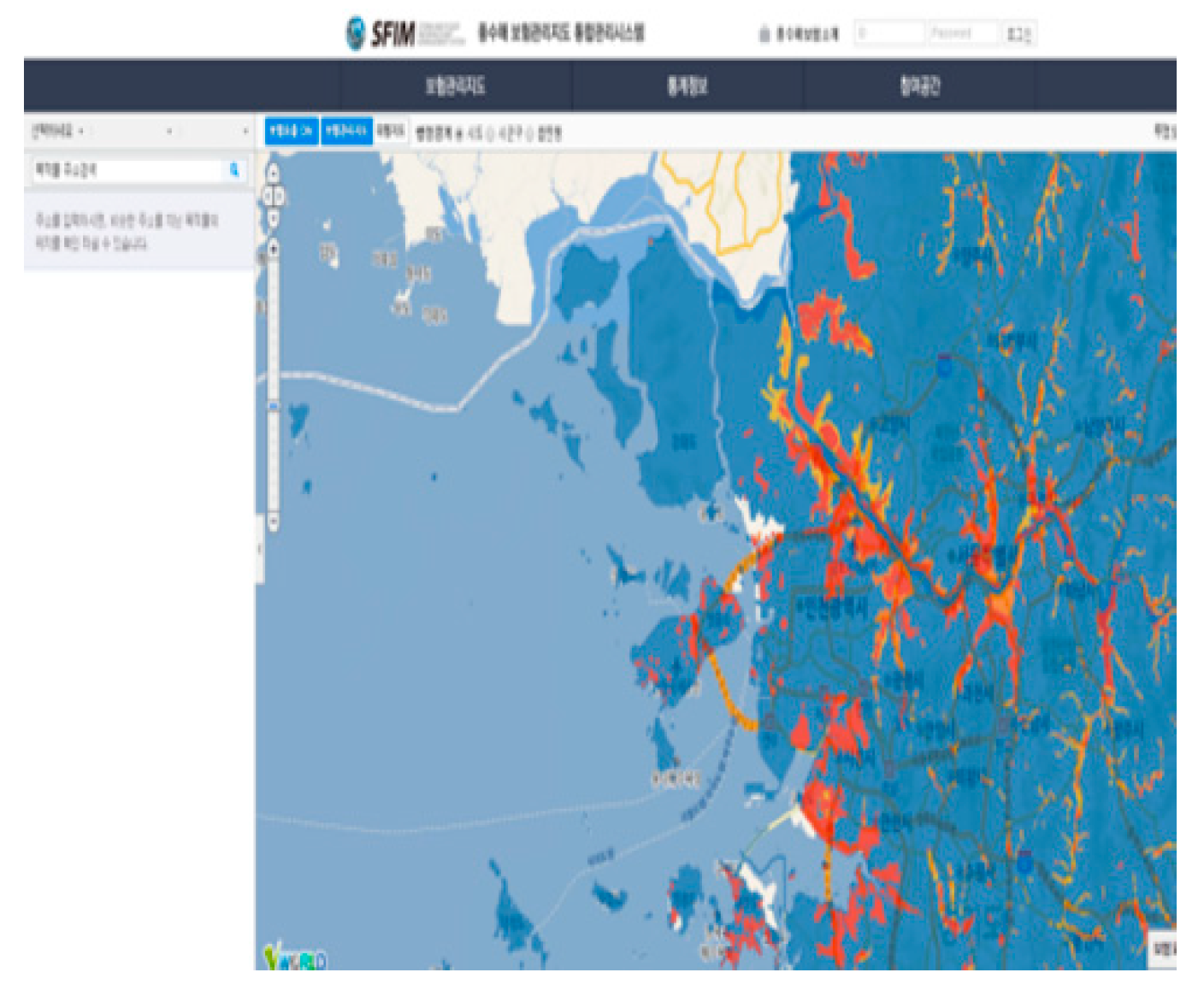

4.4. Mapping of Storm and Flood Insurance Management (SFIM)

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Korea Ministry of Government Legislation. Countermeasures Against Natural Disasters Act; Korea Ministry of Government: Sejong teukbyeol jachisi, Korea, 2018.

- Korea Ministry of Government Legislation. Storm and Flood Insurance Act; Korea Ministry of Government Legislation: Sejong teukbyeol jachisi, Korea, 2017.

- Shin, D.H. A study on the risk distribution of natural hazards and the role of government. J. Insur. Stud. 2005, 45, 49–75. [Google Scholar]

- Lee, H.-C.; Park, S.-Y.; Lee, C.-H.; Kim, Y.-S. The point at issue and improvement of natural disaster insurance rate system. J. Korean Soc. Hazard Mitig. 2014, 14, 223–232. [Google Scholar] [CrossRef]

- National Emergency Management Agency. Disaster Report; National Emergency Management Agency: Seoul, Korea, 2006. [Google Scholar]

- National Emergency Management Agency. Disaster Report; National Emergency Management Agency: Seoul, Korea, 2008. [Google Scholar]

- National Emergency Management Agency. Disaster Report; National Emergency Management Agency: Seoul, Korea, 2010. [Google Scholar]

- Lee, H.; Lim, H.; Shin, D.; Lee, J.; Lee, J.; Kim, Y. A Study on Calculation and Verification Method of Natural Disaster Insurance Rate. J. Korean Soc. Hazard Mitig. 2017, 17, 101–115. [Google Scholar] [CrossRef]

- Frederique, M.; Loat, R. Handbook on Good Practices for Flood Mapping in Europe Handbook on Good Practices for flood Mapping in Europe; European Exchange Circle on Flood Mapping (EXCIIMAP): Emmeloord, The Netherlands, 2007. [Google Scholar]

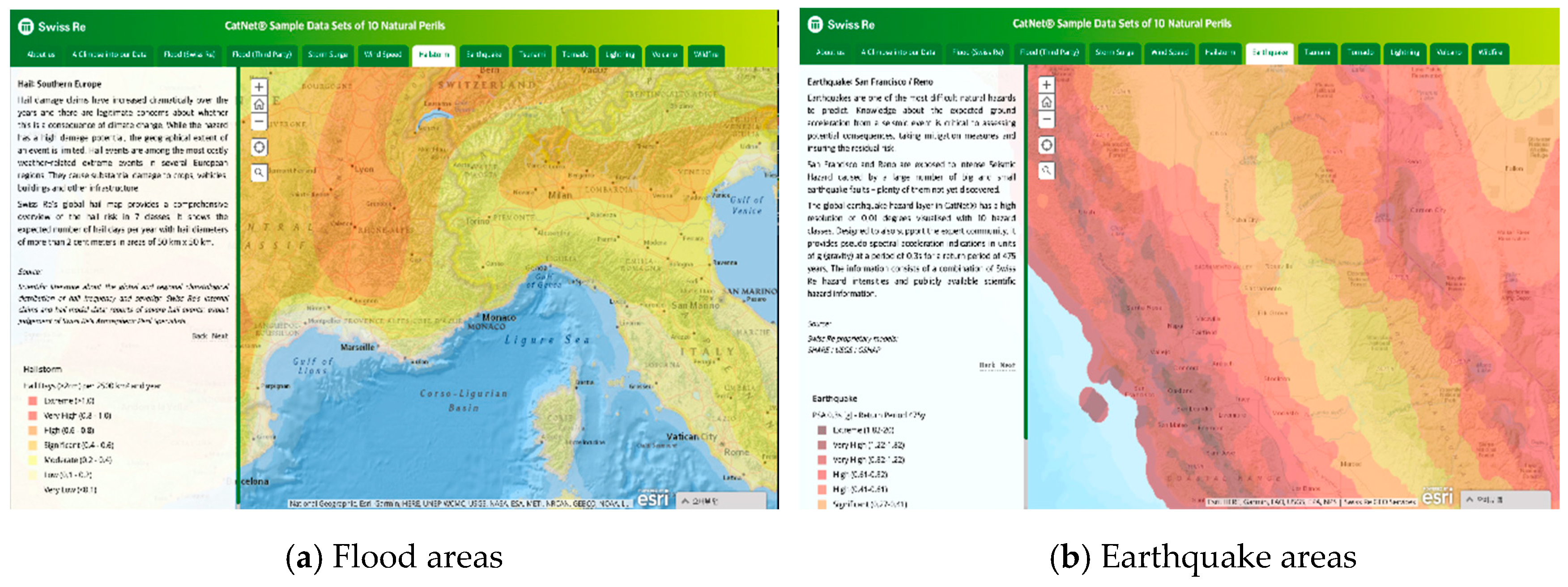

- Swiss Re Cat Net. Available online: https://www.swissre.com/reinsurance/property-and-casualty/solutions/property-specialty-solutions/catnet.html (accessed on 10 March 2019).

- de Moel, H.; van Alphen, J.; Aerts, J. Flood maps in Europe-methods, availability and use. Natural Hazards and Earth System Sciences. 2009, 9, 289–301. [Google Scholar] [CrossRef]

- Hsu, W.-K.; Huang, P.-C.; Chang, C.-C.; Chen, C.-W.; Hung, D.-M.; Chiang, W.-L. An integrated flood risk assessment model for property insurance industry in Taiwan. Nat. Hazards 2011, 58, 1295–1309. [Google Scholar] [CrossRef]

- FEMA Flood Insurance Rate Map (FIRM). Available online: https://www.fema.gov/flood-insurance-rate-map-firm (accessed on 10 March 2019).

- Shinjuku City Shinjuku Flood Hazard Map. Available online: http://www.city.shinjuku.lg.jp/anzen/htdocs/index.html (accessed on 10 March 2019).

- Park, S.; Jang, D.; Seo, B. Measures to Activate Storm and Flood Insurance Considering Comprehensive Reduction Measures. J. Korean Soc. Soc. Secur. 2009, 2, 3–7. [Google Scholar]

| Data | Provider | Data Format |

|---|---|---|

| Flood risk | Dongbu Engineering | GRID, Shape |

| Storm risk | Quber, Inc. | GRID, Shape |

| Snow risk | Kongju National University | GRID, Shape |

| Premium rate | Kangwon National University | Table |

| Other data (digital maps, DEM, hydrological analysis data) | Korea Land and Geospatial Informatix Corp. | GRID, Shape, Table |

| Type | Definition | ||||

|---|---|---|---|---|---|

| Mean damage ratio | MDR (%) - Insurance money/Insurance amount (ex: experiential approach, vulnerability function modeling) | ||||

| Premium rate calculation variables by risk grade | Grade | I | II | III | IV |

| Flood depth (h) | h < 0 m | 0 m ≤ h < 0.5 m | 0.5 m ≤ h < 1 m | 1 m ≤ h | |

| Damage history data by risk grade | 37 data (I: 23, II: 3, III: 3, IV: 8) | ||||

| Weight of disaster causes | Calculating average weight by disaster causes - Amount of damage (Annual disaster report) - Number of insurance accidents and Insurance money * Weight of disaster causes of City, County, District | ||||

| RisksnFID | Water | Storm | Snow |

|---|---|---|---|

| 1 | 1 | 0.11 | 0.04 |

| 2 | 1 | 0.08 | 0.04 |

| 3 | 1 | 0.10 | 0.04 |

| 4 | 1 | 0.09 | 0.04 |

| 5 | 1 | 0.08 | 0.04 |

| 6 | 1 | 0.09 | 0.03 |

| 7 | 1 | 0.10 | 0.04 |

| 8 | 1 | 0.10 | 0.04 |

| 9 | 1 | 0.08 | 0.04 |

| 10 | 3 | 0.10 | 0.04 |

| 11 | 3 | 0.10 | 0.04 |

| 12 | 4 | 0.10 | 0.04 |

| 13 | 4 | 0.10 | 0.04 |

| FID | Join Code | Risks | Premium Rate |

|---|---|---|---|

| 1 | Namdong-gu1 | 1 | 0.05 |

| 2 | Bupyeong-gu1 | 1 | 0.11 |

| 3 | Jung-gu1 | 1 | 0.04 |

| 4 | Dong-gu1 | 1 | 0.08 |

| 5 | Gyeyang-gu1 | 1 | 0.12 |

| 6 | Ganghwa-gun1 | 1 | 0.07 |

| 7 | Seo-gu1 | 1 | 0.12 |

| 8 | Yeonsu-gu1 | 1 | 0.03 |

| 9 | Ganghwa-gun2 | 2 | 0.07 |

| 10 | Seo-gu4 | 4 | 1.83 |

| 11 | Seo-gu2 | 2 | 1.08 |

| 12 | Seo-gu3 | 3 | 1.24 |

| 13 | Seo-gu4 | 4 | 1.83 |

| 14 | Gyeyang-gu4 | 4 | 0.47 |

| Category | Main Contents | Notes |

|---|---|---|

| Content | Administrative district, risk rating (risk), rate, rate grade | - |

| Basic spatial information | Topographical map DEM (10 m × 10 m grid) | 1/5000 digital topographic map |

| Risk (risk rating) Premium rate grade | four ratings (I, II, III, IV) | Based on flood depth |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lee, I.; Lee, J.; Ham, S. A Study on Storm and Flood Insurance Management Mapping: Case Study of Incheon Metropolitan City. ISPRS Int. J. Geo-Inf. 2019, 8, 485. https://doi.org/10.3390/ijgi8110485

Lee I, Lee J, Ham S. A Study on Storm and Flood Insurance Management Mapping: Case Study of Incheon Metropolitan City. ISPRS International Journal of Geo-Information. 2019; 8(11):485. https://doi.org/10.3390/ijgi8110485

Chicago/Turabian StyleLee, Insu, Junseok Lee, and Sungil Ham. 2019. "A Study on Storm and Flood Insurance Management Mapping: Case Study of Incheon Metropolitan City" ISPRS International Journal of Geo-Information 8, no. 11: 485. https://doi.org/10.3390/ijgi8110485

APA StyleLee, I., Lee, J., & Ham, S. (2019). A Study on Storm and Flood Insurance Management Mapping: Case Study of Incheon Metropolitan City. ISPRS International Journal of Geo-Information, 8(11), 485. https://doi.org/10.3390/ijgi8110485