Research on Spatial Patterns and Mechanisms of Live Streaming Commerce in China Based on Geolocation Data

Abstract

1. Introduction

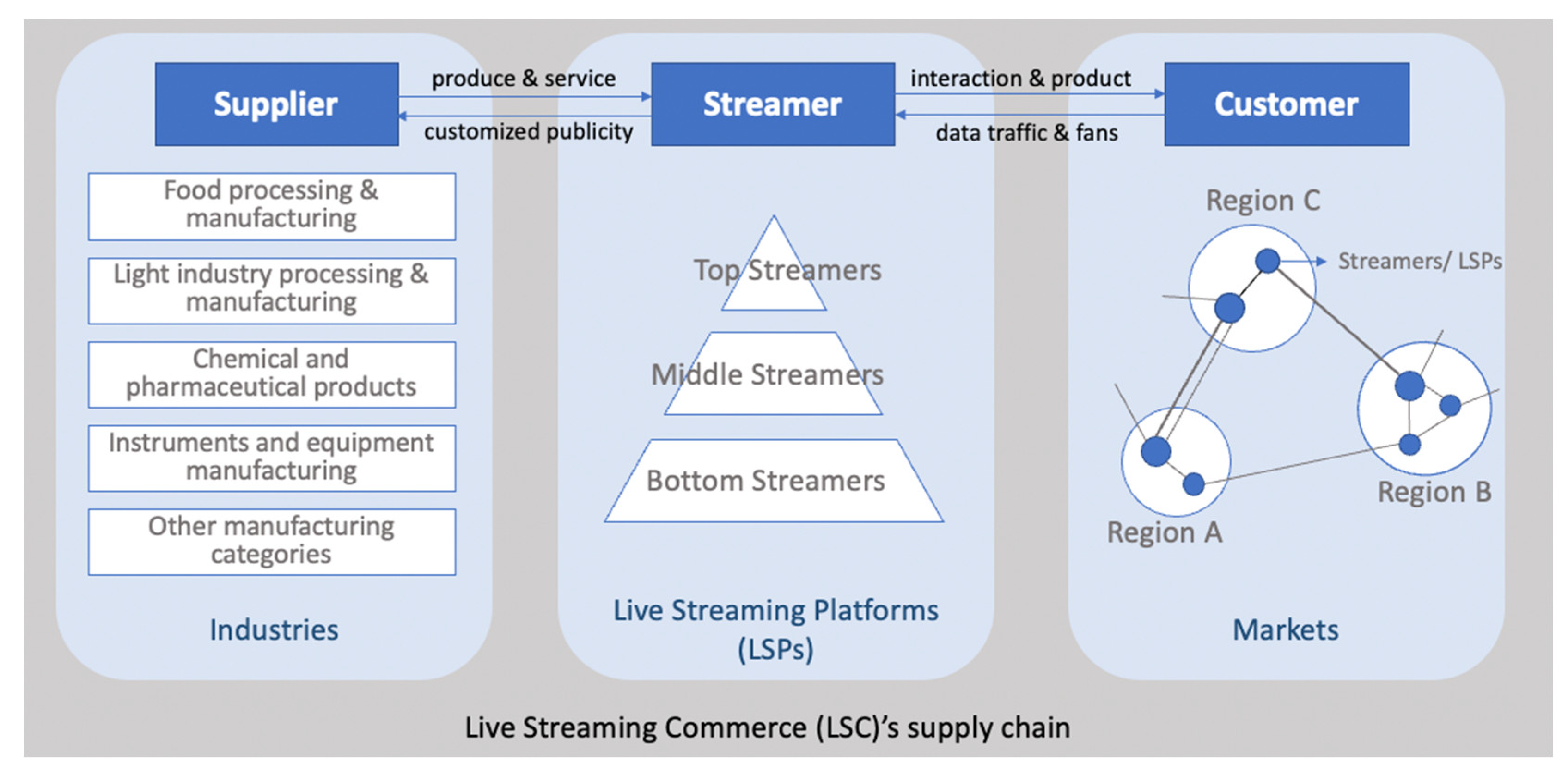

2. Conception and Research Framework

2.1. Emerging Live Streaming Commerce in China

2.2. Intermediary Role of Live Streamers in Live Streaming Commerce

2.3. Distributions and Connection of Live Streaming Commerce

3. Methodology

3.1. Data Collection

3.2. Research Method

4. Results

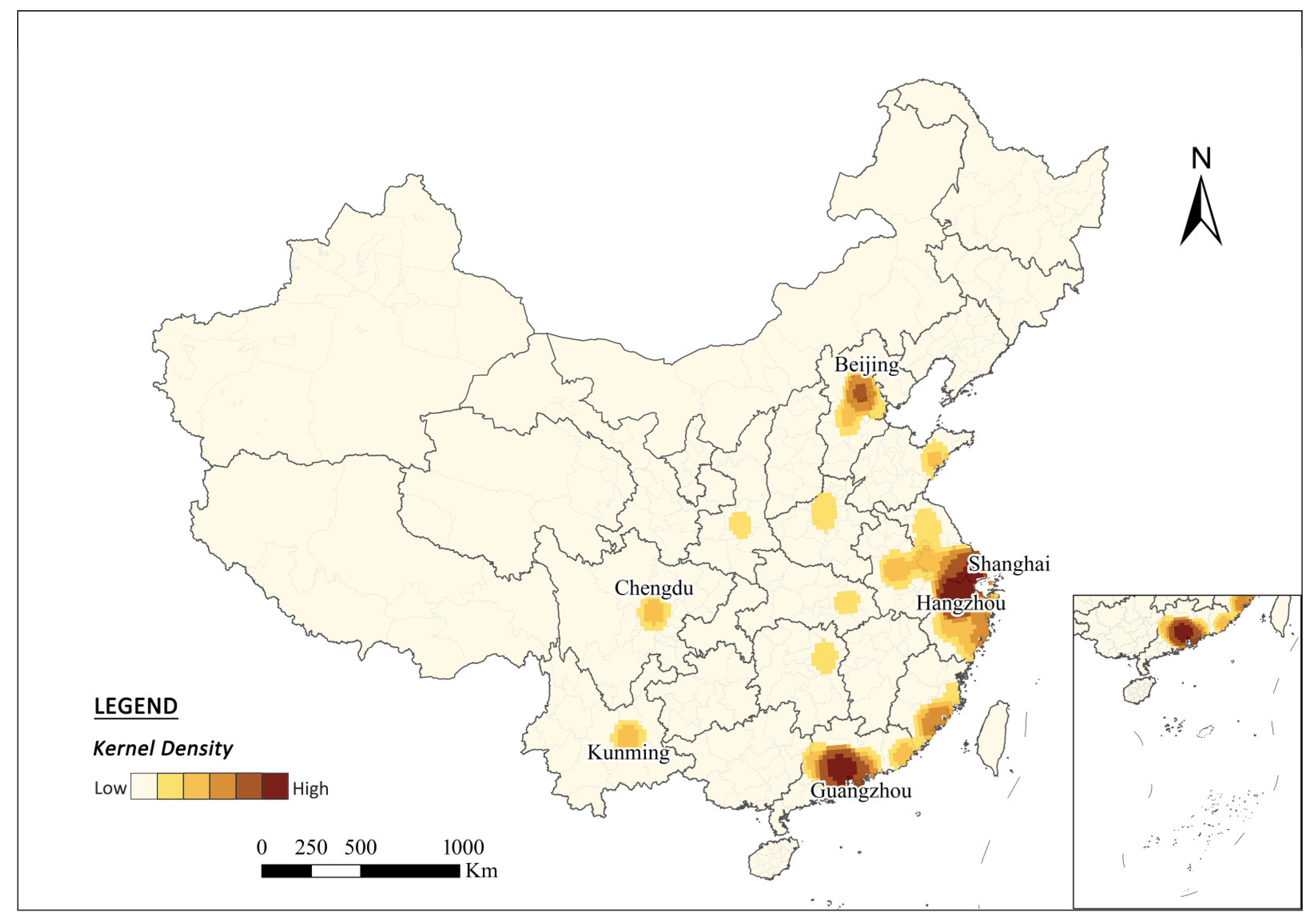

4.1. Spatial Distribution Characteristics of Suppliers, Streamers and Consumers

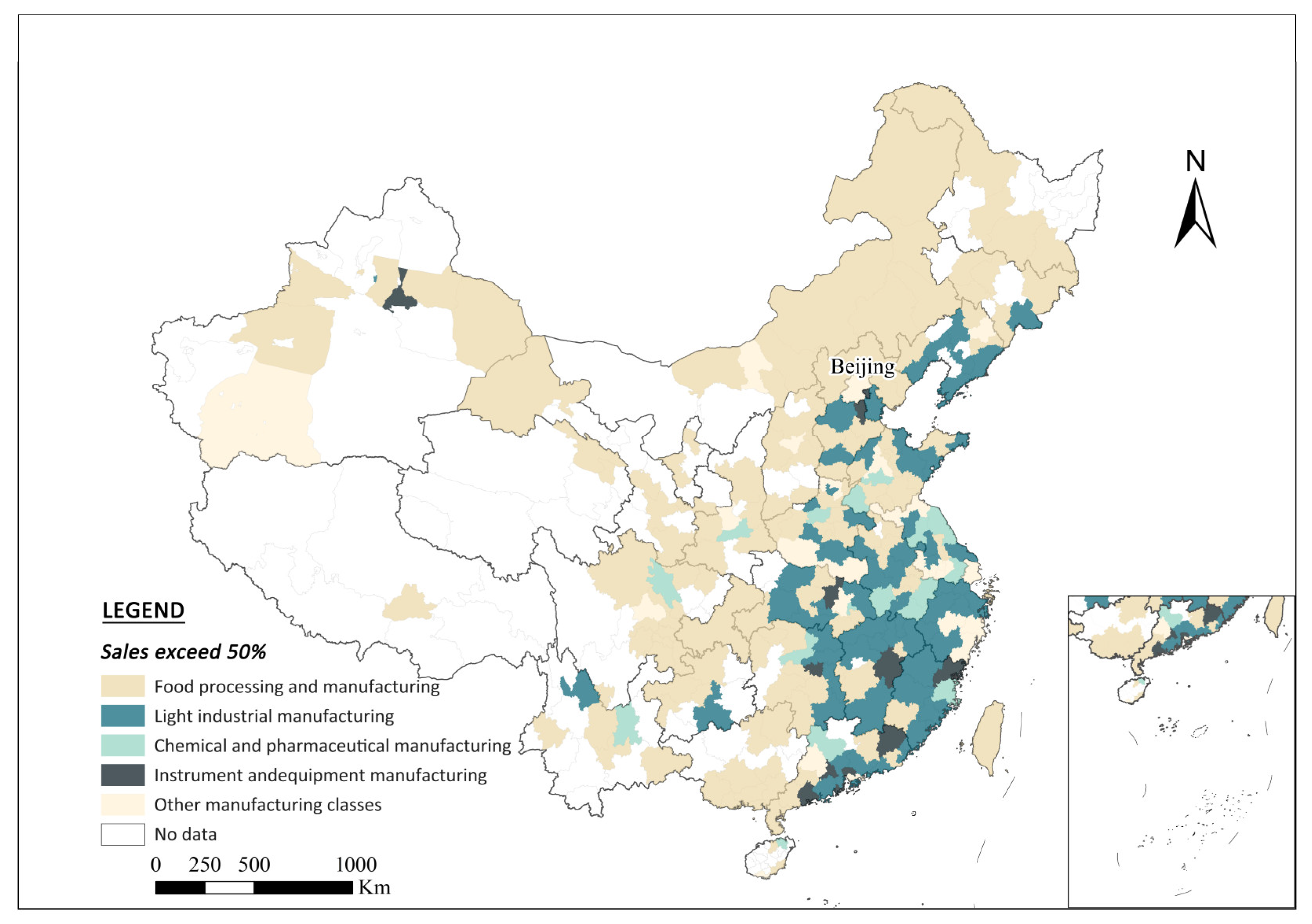

4.2. The Role of LSC in Different Types of Industries

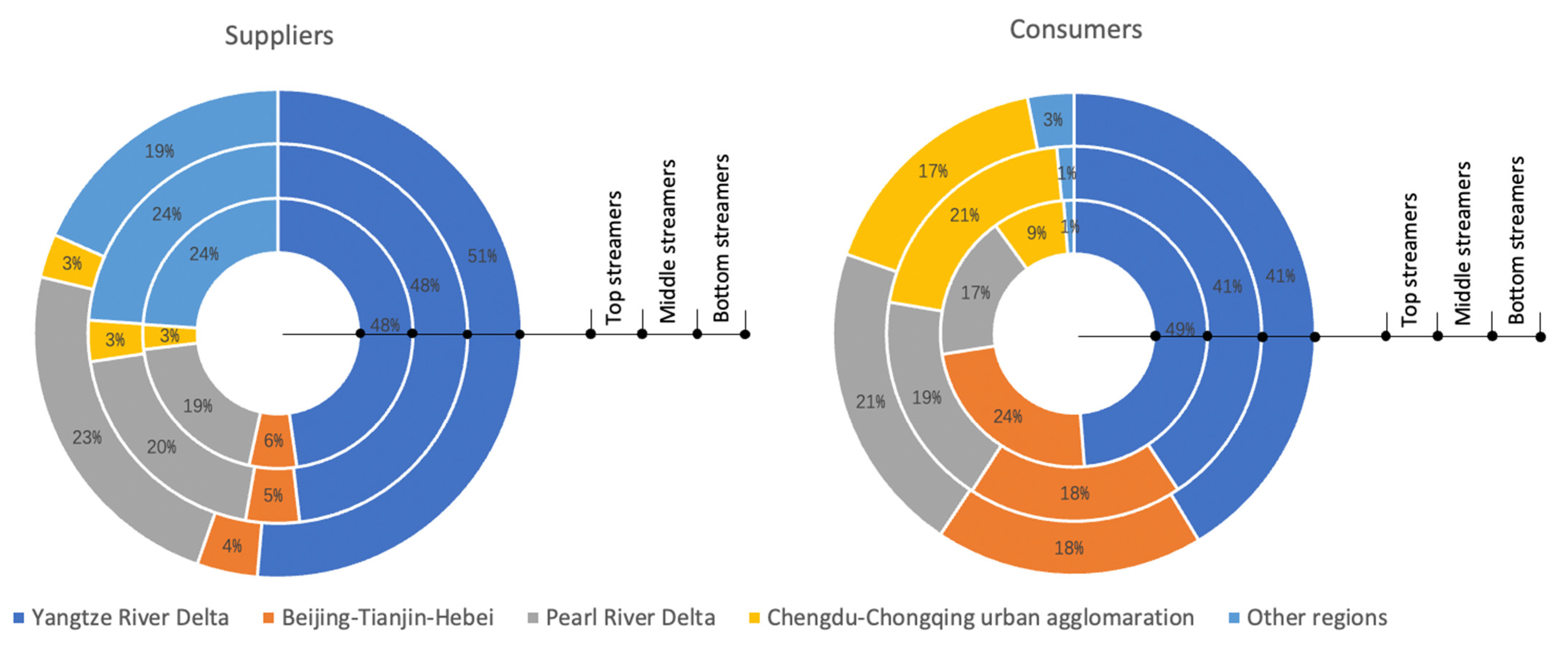

4.3. The Role of Different Types of Live Streamers on the Regional-Local Supply Chain

5. Conclusions and Discussion

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| (No.) Industry Categories | (No.) Specific Industries |

|---|---|

| (1) Food processing and manufacturing | (13) Agricultural by-product processing industry |

| (14) Food manufacturing | |

| (15) Wine, beverage, and refined tea manufacturing | |

| (16) Tobacco manufacturing industry | |

| (2) Light industrial manufacturing | (17) Textile industry |

| (18) Clothing and apparel industry | |

| (19) Leather, fur, feathers, and their associated products and footwear | |

| (20) Wood processing and wood, bamboo, rattan, palm, and grass products industry | |

| (21) Furniture manufacturing | |

| (22) Paper and paper products industry | |

| (23) Printing and recording media reproduction industry | |

| (24) Education, arts and crafts, sports, and recreational goods manufacturing | |

| (28) Chemical fiber manufacturing | |

| (29) Rubber and plastic manufacturing | |

| (3) Chemical and pharmaceutical manufacturing | (26) Chemical raw materials and products manufacturing |

| (27) Pharmaceutical manufacturing | |

| (4) Instrument and equipment manufacturing | (34) General equipment manufacturing |

| (35) Special equipment manufacturing (36) Automotive manufacturing | |

| (37) Railroad, ship, aerospace, and other transportation equipment manufacturing | |

| (38) Electrical machinery and equipment manufacturing | |

| (39) Computer, communications, and other electronic equipment manufacturing | |

| (40) Instrumentation manufacturing data processing | |

| (5) Other manufacturing classes | (25) Petroleum, coal, and other fuel processing industry |

| (30) Non-metallic mineral products industry | |

| (31) Ferrous metal smelting and rolling processing industry | |

| (32) Non-ferrous metal smelting and rolling processing industry | |

| (33) Metal products industry | |

| (41) Other manufacturing industries | |

| (42) Comprehensive utilization of waste resources industry | |

| (43) Metal products, machinery, and equipment repair industry |

Appendix B

| Food Processing and Manufacturing | Supplier No. (%) | Light Industrial Manufacturing | Supplier No. (%) | Other Manufacturing | Supplier No. (%) |

|---|---|---|---|---|---|

| Shanghai | 361 (10.90%) | Hangzhou | 1077 (18.89%) | Shanghai | 217 (14.23%) |

| Hangzhou | 178 (5.38%) | Guangzhou | 810 (14.20%) | Hangzhou | 177 (11.61%) |

| Guangzhou | 150 (4.53) | Shanghai | 506 (8.87%) | Guangzhou | 155 (10.16%) |

| Ningbo | 135 (4.08%) | Jiaxing | 314 (5.51%) | Shenzhen | 105 (6.89%) |

| Beijing | 124 (3.75%) | Jinhua | 296 (5.19%) | Jinhua | 95 (6.23%) |

| Chengdu | 124 (3.75%) | Shenzhen | 255 (4.47%) | Suzhou | 63 (4.13%) |

| Changsha | 88(2.66%) | Suzhou | 195 (3.42%) | Jiaxing | 46 (3.02%) |

| Chongqing | 84 (2.54%) | Nantong | 135 (2.37%) | Foshan | 42 (2.75%) |

| Suzhou | 64 (1.93%) | Shantou | 134 (2.35%) | Ningbo | 35 (2.30%) |

| Jinhua/Shenzhen | 58 (1.75%) | Ningbo | 133 (2.33%) | Beijing | 32 (1.51%) |

| Chemical and pharmaceutical manufacturing | Supplier No. (%) | Instrument and equipment manufacturing | Supplier No. (%) | ||

| Guangzhou | 387 (24.54%) | Shenzhen | 117 (11.55%) | ||

| Shanghai | 233 (14.77%) | Shanghai | 101 (9.97%) | ||

| Hangzhou | 178 (11.29%) | Guangzhou | 98 (9.67%) | ||

| Ningbo | 102 (6.47%) | Hangzhou | 89 (8.79%) | ||

| Suzhou | 72 (4.57%) | Foshan | 75 (7.40%) | ||

| Zhengzhou | 58 (3.68%) | Jinhua | 65 (6.42%) | ||

| Jinhua | 54 (3.42%) | Ningbo | 55 (5.43%) | ||

| Shenzhen | 42 (2.66%) | Beijing | 41 (4.05%) | ||

| Beijing | 38 (2.41%) | Suzhou | 31 (3.06%) | ||

| Jiaxing | 36 (2.28%) | Zhongshan | 31 (3.06%) |

References

- Wongkitrungrueng, A.; Dehouche, N.; Assarut, N. Live Streaming Commerce from the Sellers’ Perspective: Implications for Online Relationship Marketing. J. Mark. Manag. 2020, 36, 488–518. [Google Scholar] [CrossRef]

- CNNIC. The 48th Statistical Report on Internet Development in China; China Internet Network Information Center: Beijing, China, 2021. [Google Scholar]

- Guo, Y.; Zhang, K.; Wang, C. Way to Success: Understanding Top Streamer’s Popularity and Influence from the Perspective of Source Characteristics. J. Retail. Consum. Serv. 2022, 64, 102786. [Google Scholar] [CrossRef]

- Nguyen, L.V.; Jung, J.J.; Hwang, M. OurPlaces: Cross-Cultural Crowdsourcing Platform for Location Recommendation Services. ISPRS Int. J. Geo-Inf. 2020, 9, 711. [Google Scholar] [CrossRef]

- Prahalad, C.K.; Ramaswamy, V. Co-Opting Customer Competence. Harv. Bus. Rev. 2000, 78, 79–90. [Google Scholar]

- Bratton, B.H. The Stack: On Software and Sovereignty; MIT Press: Cambridge, MA, USA, 2016. [Google Scholar]

- Rochet, J.-C.; Tirole, J. Two-Sided Markets: A Progress Report. RAND J. Econ. 2006, 37, 645–667. [Google Scholar] [CrossRef]

- Srnicek, N. Platform Capitalism; John Wiley & Sons: Hoboken, NJ, USA, 2017. [Google Scholar]

- Elwood, S.; Leszczynski, A. Privacy, Reconsidered: New Representations, Data Practices, and the Geoweb. Geoforum 2011, 42, 6–15. [Google Scholar] [CrossRef]

- Langley, P.; Leyshon, A. Platform Capitalism: The Intermediation and Capitalization of Digital Economic Circulation. Financ. Soc. 2017, 3, 11–31. [Google Scholar] [CrossRef]

- Pasquale, F. Two Narratives of Platform Capitalism. Yale Law Policy Rev. 2016, 35, 309. [Google Scholar]

- Lu, Z.; Xia, H.; Heo, S.; Wigdor, D. You Watch, You Give, and You Engage: A Study of Live Streaming Practices in China. In Proceedings of the 2018 CHI Conference on Human Factors in Computing Systems, Montreal, QC, Canada, 21–26 April 2018; pp. 1–13. [Google Scholar]

- Zhang, Y.; Wang, M.; Wang, F. Spatial Differences in the Development of Livestreaming E-Commerce and Influence in China. Sci. Geogr. Sin. 2022, 42, 1555–1565. (In Chinese) [Google Scholar]

- Wang, F.; Wang, M. Spatial Aggregation Characteristics and Influencing Factors of Taobao Village Based on Grid in China. Sci. Geogr. Sin. 2020, 40, 229–237. (In Chinese) [Google Scholar] [CrossRef]

- Ma, F.; Ding, Z. Spatial Differentiation and Influencing Factors of the Development of China’s Tiktok Live Broadcast Cargo Industryw. Econ. Geogr. 2021, 41, 22–32. (In Chinese) [Google Scholar]

- Peng, J.; He, J. Spatial differentiation and influencing factors of fan economy in China: Taking TikTok livestreaming commerce host as an example. Prog. Geogr. 2021, 40, 1098–1112. (In Chinese) [Google Scholar] [CrossRef]

- Zou, L.; Lyu, G.; Zhu, Y.; Yan, S.; Zhang, X. Spatializing the Emerging Geography of Urban System in China: Based on Live Streaming E-Commerce. Cent. Mod. Chin. City Stud. East China Norm. Univ. Shanghai China 2023. submitted. [Google Scholar]

- Luo, Z. Research on Countermeasures for the Development of China’s Live Broadcast Economy under the New Development Pattern. Econ. Forum 2021, 9, 83–91. [Google Scholar]

- Liu, Y.; Li, Z. Taobao Live 2021 Annual Report; Taobao Live: Beijing, China, 2021. [Google Scholar]

- Guo, J.; Wang, L. Scientifically Understand the Technical-Economic Characteristics and Market Attributes of Data Elements. Theory Pract. 2021, 05, 12–14+26. [Google Scholar]

- Su, X.; Li, X.; Liu, L.; Zhou, X. Analysis of Regional Distribution and Influence Characteristics of Live Broadcast Economy in the Era of New Media: Taking Taobao Live Broadcast as an Example. In Proceedings of the 2021 Annual China Urban Planning Conference, Chengdu, China, 25–30 September 2021. [Google Scholar]

- Chavez, R.; Yu, W.; Jacobs, M.A.; Feng, M. Data-Driven Supply Chains, Manufacturing Capability and Customer Satisfaction. Prod. Plan. Control 2017, 28, 906–918. [Google Scholar] [CrossRef]

- CASS. Live Commerce White Book; Taobao Live, National Academy of Economic Strategy (CASS): Beijing, China, 2022. [Google Scholar]

- Li, F.; Frederick, S.; Gereffi, G. E-Commerce and Industrial Upgrading in the Chinese Apparel Value Chain. J. Contemp. Asia 2019, 49, 24–53. [Google Scholar] [CrossRef]

- Cai, J.; Wohn, D.Y. Live Streaming Commerce: Uses and Gratifications Approach to Understanding Consumers’ Motivations. In Proceedings of the 52nd Hawaii International Conference on System Sciences, Maui, HI, USA, 8–11 January 2019. [Google Scholar]

- Deshpande, S.G.; Hwang, J.-N. A Real-Time Interactive Virtual Classroom Multimedia Distance Learning System. IEEE Trans. Multimed. 2001, 3, 432–444. [Google Scholar] [CrossRef]

- Bründl, S.; Matt, C.; Hess, T. Consumer Use of Social Live Streaming Services: The Influence of Co-Experience and Effectance on Enjoyment. In Proceedings of the 25th European Conference on Information Systems (ECIS), Guimarães, Portugal, 5 June 2017; pp. 1775–1791. [Google Scholar]

- Haimson, O.L.; Tang, J.C. What Makes Live Events Engaging on Facebook Live, Periscope, and Snapchat. In Proceedings of the 2017 CHI Conference on Human Factors in Computing Systems, Denver, CO, USA, 6–11 May 2017; pp. 48–60. [Google Scholar]

- Meyrowitz, J. No Sense of Place: The Impact of Electronic Media on Social Behavior; Oxford University Press: Oxford, UK, 1986. [Google Scholar]

- Collins, R. Interaction Ritual Chains. In Interaction Ritual Chains; Princeton University Press: Princeton, NJ, USA, 2014. [Google Scholar]

- Jenkins, H. Textual Poachers: Television Fans and Participatory Culture; Routledge: New York, NY, USA, 2012. [Google Scholar]

- Kang, K.; Lu, J.; Guo, L.; Li, W. The Dynamic Effect of Interactivity on Customer Engagement Behavior through Tie Strength: Evidence from Live Streaming Commerce Platforms. Int. J. Inf. Manag. 2021, 56, 102251. [Google Scholar] [CrossRef]

- iiMedia Researc 2020 H1 China Live E-Commerce Industry Streamer Career Development Status and Trends Research Report. Available online: https://www.iimedia.cn/c400/71682.html (accessed on 20 March 2023).

- Massey, D. Regionalism: Some Current Issues. Cap. Cl. 1978, 2, 106–125. [Google Scholar] [CrossRef]

- Zhang, F.; Wu, F. “Fostering Indigenous Innovation Capacities”: The Development of Biotechnology in Shanghai’s Zhangjiang High-Tech Park. Urban Geogr. 2012, 33, 728–755. [Google Scholar] [CrossRef]

- Krugman, P. First Nature, Second Nature, and Metropolitan Location. J. Reg. Sci. 1993, 33, 129–144. [Google Scholar] [CrossRef]

- Glaeser, E.L.; Rosenthal, S.S.; Strange, W.C. Urban Economics and Entrepreneurship. J. Urban Econ. 2010, 67, 1–14. [Google Scholar] [CrossRef]

- Marshall, A. Principles of Economics, 8th ed.; Macmillan & Co., Ltd.: London, UK, 1920. [Google Scholar]

- World Bank; Development Research Center of the State Council, the People’s Republic of China. Urban China: Toward Efficient, Inclusive and Sustainable Urbanization; World Bank Publications: Washington, DC, USA, 2014. [Google Scholar]

- Wu, A.; Sun, T.; Li, G. Spatial Agglomeration and Regional Shift of Textile and Garment Industry in China. Acta Geogr. Sin. 2013, 68, 775–790. [Google Scholar]

- Lin, Y. E-Urbanism: E-Commerce, Migration, and the Transformation of Taobao Villages in Urban China. Cities 2019, 91, 202–212. [Google Scholar] [CrossRef]

- Wang, C.C.; Miao, J.T.; Phelps, N.A.; Zhang, J. E-Commerce and the Transformation of the Rural: The Taobao Village Phenomenon in Zhejiang Province, China. J. Rural Stud. 2021, 81, 159–169. [Google Scholar] [CrossRef]

- Castells, M.; Blackwell, C. The Information Age: Economy, Society and Culture. Volume 1. The Rise of the Network Society. Environ. Plan. B Plan. Des. 1998, 25, 631–636. [Google Scholar]

- Graham, M. Time Machines and Virtual Portals: The Spatialities of the Digital Divide. Prog. Dev. Stud. 2011, 11, 211–227. [Google Scholar] [CrossRef]

- Zheng, N. Influencing Factors of the Layout of the ICT Industry—Based on Empirical Research from 30 Provinces and Municipalities in China. Econ. Forum 2016, 10, 72–79. [Google Scholar]

- Ash, J.; Kitchin, R.; Leszczynski, A. Digital Turn, Digital Geographies? Prog. Hum. Geogr. 2018, 42, 25–43. [Google Scholar] [CrossRef]

- Forman, C.; Goldfarb, A.; Greenstein, S. How Geography Shapes—And Is Shaped by—The Internet. In The New Oxford Handbook of Economic Geography; Oxford University Press: Oxford, UK, 2018; pp. 269–285. [Google Scholar]

- Qian, Q.; Chen, Y.; Liu, S.; Zhang, J.; Chen, C. Development Characteristics and Formation Mechanism of Taobao Town: Taking Xintang Town in Guangzhou as an Example. Sci. Geogr. Sin. 2017, 37, 1040–1048. (In Chinese) [Google Scholar]

- Zhang, Y.N.; Long, H.L.; Tu, S.S.; Li, Y.R.; Ma, L.; Ge, D.Z. A Multidimensional Analysis of Rural Restructuring Driven by E-Commerce: A Case of Xiaying Village in Central China. Sci. Geogr. Sin. 2019, 39, 947–956. (In Chinese) [Google Scholar]

- Caputo, A.; Pizzi, S.; Pellegrini, M.M.; Dabić, M. Digitalization and Business Models: Where Are We Going? A Science Map of the Field. J. Bus. Res. 2021, 123, 489–501. [Google Scholar] [CrossRef]

- Sadowski, J. Cyberspace and Cityscapes: On the Emergence of Platform Urbanism. Urban Geogr. 2020, 41, 448–452. [Google Scholar] [CrossRef]

- Nooren, P.; van Gorp, N.; van Eijk, N.; Fathaigh, R.Ó. Should We Regulate Digital Platforms? A New Framework for Evaluating Policy Options. Policy Internet 2018, 10, 264–301. [Google Scholar] [CrossRef]

- Caprotti, F.; Chang, I.-C.C.; Joss, S. Beyond the Smart City: A Typology of Platform Urbanism. Urban Transform. 2022, 4, 4. [Google Scholar] [CrossRef]

- Barns, S. Smart Cities and Urban Data Platforms: Designing Interfaces for Smart Governance. City Cult. Soc. 2018, 12, 5–12. [Google Scholar] [CrossRef]

- Kitchin, R.M. Towards Geographies of Cyberspace. Prog. Hum. Geogr. 1998, 22, 385–406. [Google Scholar] [CrossRef]

- Castells, M. The Internet Galaxy: Reflections on the Internet, Business, and Society; Oxford University Press: New York, NY, USA, 2002. [Google Scholar]

- Dodge, M.; Kitchin, R. Atlas of Cyberspace; Addison-Wesley: London, UK, 2001. [Google Scholar]

- Townsend, A.M. Network Cities and the Global Structure of the Internet. Am. Behav. Sci. 2001, 44, 1697–1716. [Google Scholar] [CrossRef]

- Zook, M.A. The Web of Production: The Economic Geography of Commercial Internet Content Production in the United States. Environ. Plan. A 2000, 32, 411–426. [Google Scholar] [CrossRef]

- Brunn, S.D.; Dodge, M. Mapping the “Worlds” of the World Wide Web: (Re) Structuring Global Commerce through Hyperlinks. Am. Behav. Sci. 2001, 44, 1717–1739. [Google Scholar] [CrossRef]

- Zook, M. The Geographies of the Internet. Annu. Rev. Inf. Sci. Technol. 2006, 40, 53–78. [Google Scholar] [CrossRef]

- World Bank. The Taobao Villages as an Instrument for Poverty Reduction and Shared Prosperity. Available online: https://www.worldbank.org/en/news/speech/2016/10/29/the-taobao-villages-as-an-instrument-for-poverty-reduction-and-shared-prosperity (accessed on 7 October 2022).

- Zhou, J.; Yu, L.; Choguill, C.L. Co-Evolution of Technology and Rural Society: The Blossoming of Taobao Villages in the Information Era, China. J. Rural Stud. 2021, 83, 81–87. [Google Scholar] [CrossRef]

- Berke, O. Exploratory Disease Mapping: Kriging the Spatial Risk Function from Regional Count Data. Int. J. Health Geogr. 2004, 3, 18. [Google Scholar] [CrossRef] [PubMed]

- Wang, T.; Wang, L.; Ning, Z.-Z. Spatial Pattern of Tourist Attractions and Its Influencing Factors in China. J. Spat. Sci. 2020, 65, 327–344. [Google Scholar] [CrossRef]

- Chen, D.; He, Z.; Hong, X.; Ni, X.; Ma, R. Green and Low-Carbon Commuting Evaluation and Optimization of a Cross-Border Metropolitan Region by the Subway Network: The Case of Shenzhen and Hong Kong, China. Land 2022, 11, 1127. [Google Scholar] [CrossRef]

- Zhang, X.; Huang, X.; Li, J. The Evolution of Green Development, Spatial Differentiation Pattern and Its Influencing Factors in Characteristic Chinese Towns. Sustainability 2023, 15, 5079. [Google Scholar] [CrossRef]

- Silverman, B.W. Density Estimation for Statistics and Data Analysis; CRC Press: Boca Raton, FL, USA, 1986; Volume 26. [Google Scholar]

- Arribas-Bel, D. Accidental, Open and Everywhere: Emerging Data Sources for the Understanding of Cities. Appl. Geogr. 2014, 49, 45–53. [Google Scholar] [CrossRef]

- Derudder, B.; Taylor, P.J.; Hoyler, M.; Ni, P.; Liu, X.; Zhao, M.; Shen, W.; Witlox, F. Measurement and Interpretation of Connectivity of Chinese Cities in World City Network, 2010. Chin. Geogr. Sci. 2013, 23, 261–273. [Google Scholar] [CrossRef]

- Taylor, P.J.; Derudder, B.; Faulconbridge, J.; Hoyler, M.; Ni, P. Advanced Producer Service Firms as Strategic Networks, Global Cities as Strategic Places. Econ. Geogr. 2014, 90, 267–291. [Google Scholar] [CrossRef]

| Actors | Indicators | Explanation/Number |

|---|---|---|

| Supplier | No. | 11,713 |

| Cities no. | 266 | |

| Supplier–streamer ties | 2102 | |

| Streamer | No. | 999 |

| Cities no. | 77 | |

| Streamer type | Top/middle/bottom; | |

| Production type | Food processing and manufacturing (2%) Light industrial manufacturing (78%) Chemical and pharmaceutical manufacturing (5%) Instrument and equipment manufacturing (3%) Other manufacturing classes (12%) | |

| Customer | No. | 623,218,349 |

| Streamer–customer ties | 539 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, Y.; Zhang, X.; Yan, S.; Zou, L. Research on Spatial Patterns and Mechanisms of Live Streaming Commerce in China Based on Geolocation Data. ISPRS Int. J. Geo-Inf. 2023, 12, 229. https://doi.org/10.3390/ijgi12060229

Zhu Y, Zhang X, Yan S, Zou L. Research on Spatial Patterns and Mechanisms of Live Streaming Commerce in China Based on Geolocation Data. ISPRS International Journal of Geo-Information. 2023; 12(6):229. https://doi.org/10.3390/ijgi12060229

Chicago/Turabian StyleZhu, Yiwen, Xumin Zhang, Simin Yan, and Lin Zou. 2023. "Research on Spatial Patterns and Mechanisms of Live Streaming Commerce in China Based on Geolocation Data" ISPRS International Journal of Geo-Information 12, no. 6: 229. https://doi.org/10.3390/ijgi12060229

APA StyleZhu, Y., Zhang, X., Yan, S., & Zou, L. (2023). Research on Spatial Patterns and Mechanisms of Live Streaming Commerce in China Based on Geolocation Data. ISPRS International Journal of Geo-Information, 12(6), 229. https://doi.org/10.3390/ijgi12060229