Cryptocurrency Market Analysis from the Open Innovation Perspective

Abstract

1. Introduction

- the study of digital currencies’ theoretical basis.

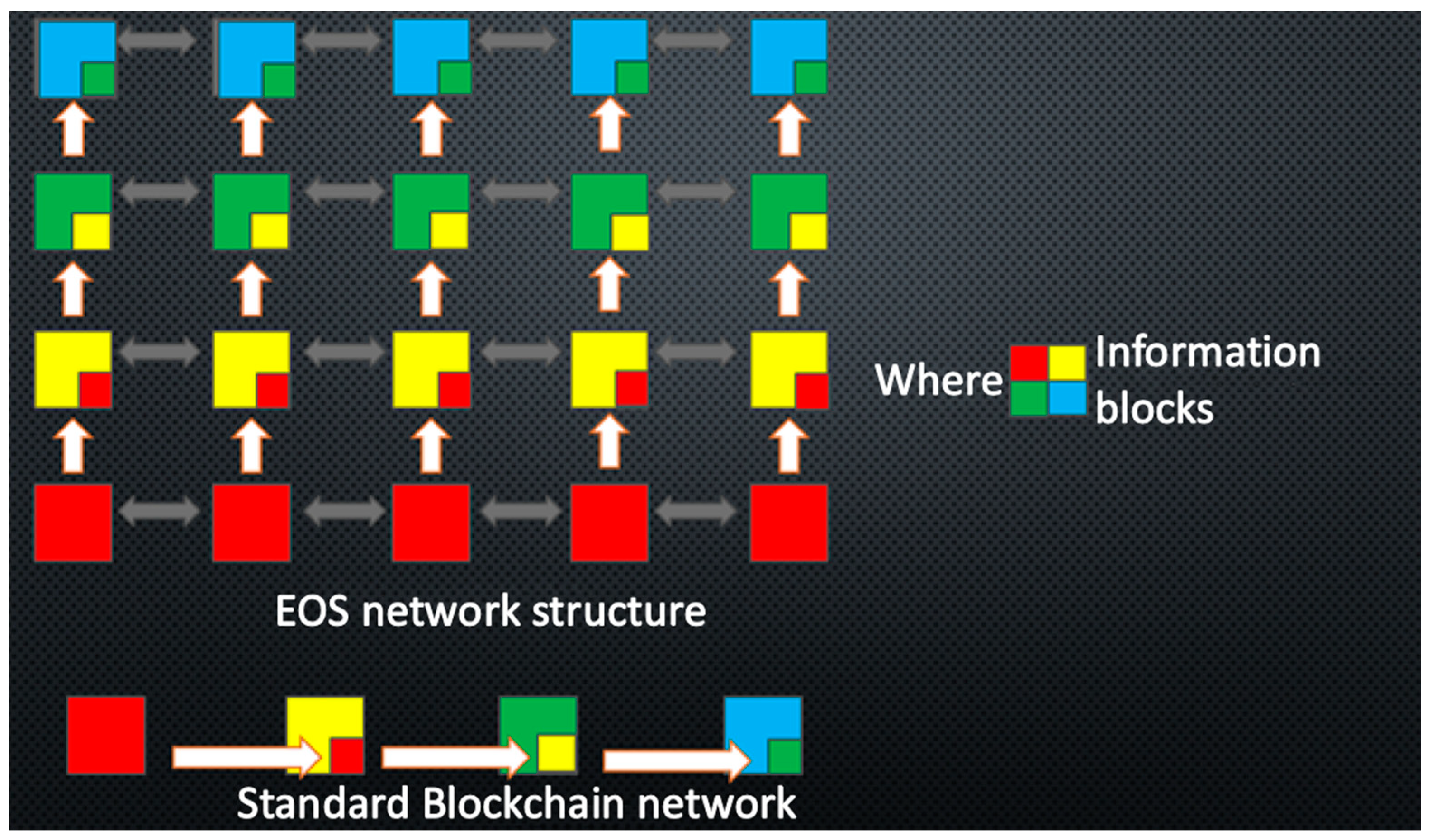

- consideration of the chronology of blockchain technology and cryptocurrency development.

- analysis of the current state of the market and comparation of cryptocurrencies.

- evaluating the possible threats and prospects for the development of cryptocurrencies within the global financial system.

2. Literature Review

2.1. The Innovation in Cryptocurrency Market

2.2. The Emergence of Cryptocurrency and the Chronology of Its Development

- Telephone and SMS fraud. The criminal introduces himself as a bank representative and, having won the client’s trust, learns his personal data.

- Mobile banking. If the owner loses their phone, an attacker can use the program to perform transactions.

2.3. Forms of Cryptocurrency

- Target cryptocurrencies, the nature of origin of which is a specific intention of the developers. These digital currencies have an original purpose.

- Non-targeted—the creation of such cryptocurrencies most often occurs involuntarily, as a result of software failure and a branch of the development scheme of the indigenous digital currency. This rebuilding of the system is called a fork.

- Original digital currencies—the process of their creation began with a completely new system and code, different from the previously used cryptocurrencies.

- Independent mining: the principle is the same as that of an individual entrepreneur: one participant of the system works and receives full profit from the work done.

- mining pools or joint mining: there are more than one participant. The computing power of technology is added up and accumulated into a more powerful single system, where each member receives a share of the profit equal to the share of the contribution to the computing power of the pool.

- cloud mining is the use of remote computing power under a lease or lease agreement, where operations are performed on behalf of the client.

2.4. Open Innovation with Cryptocurrency

- The lack of interesting research programs that universities would be ready to sell or show sponsors in order to attract means.

- The high initial maintenance costs in effective management team.

- High business standards culture.

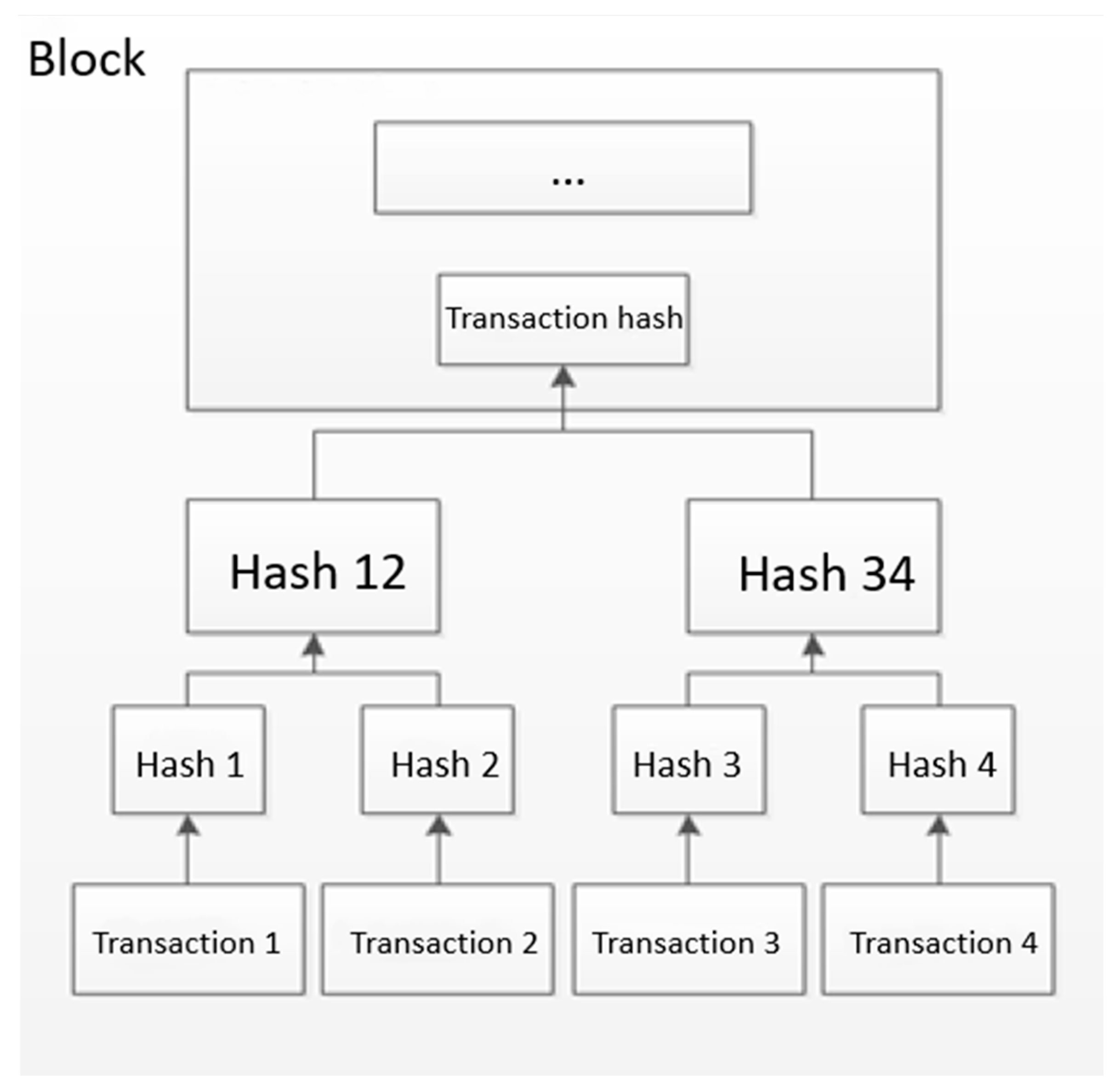

3. Data

- D is the pool’s complexity;

- DIF1(target) is the number of symbols in the hash;

- CUR(target) is a standard 256-bit number.

4. Analysis

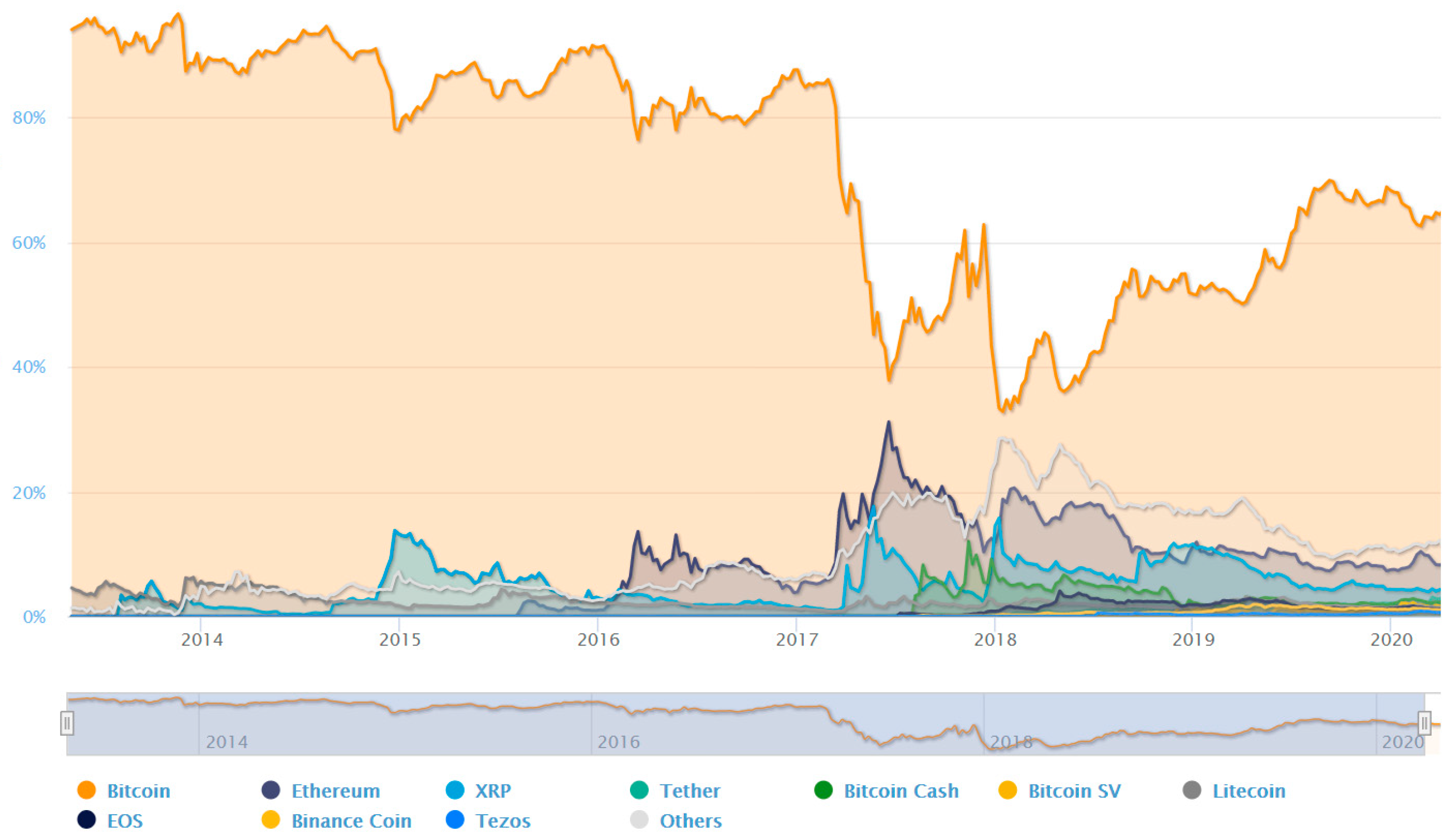

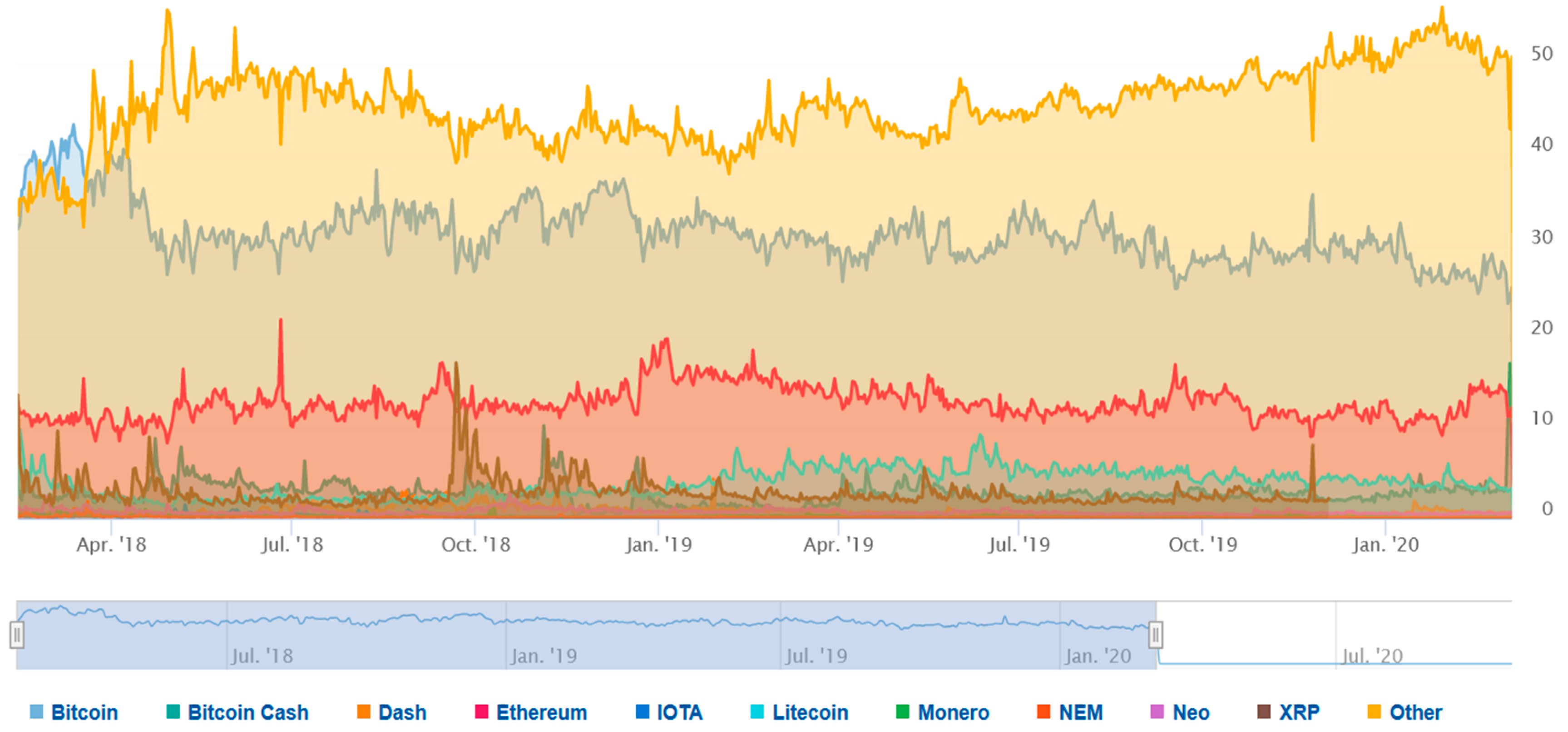

4.1. Price Stability

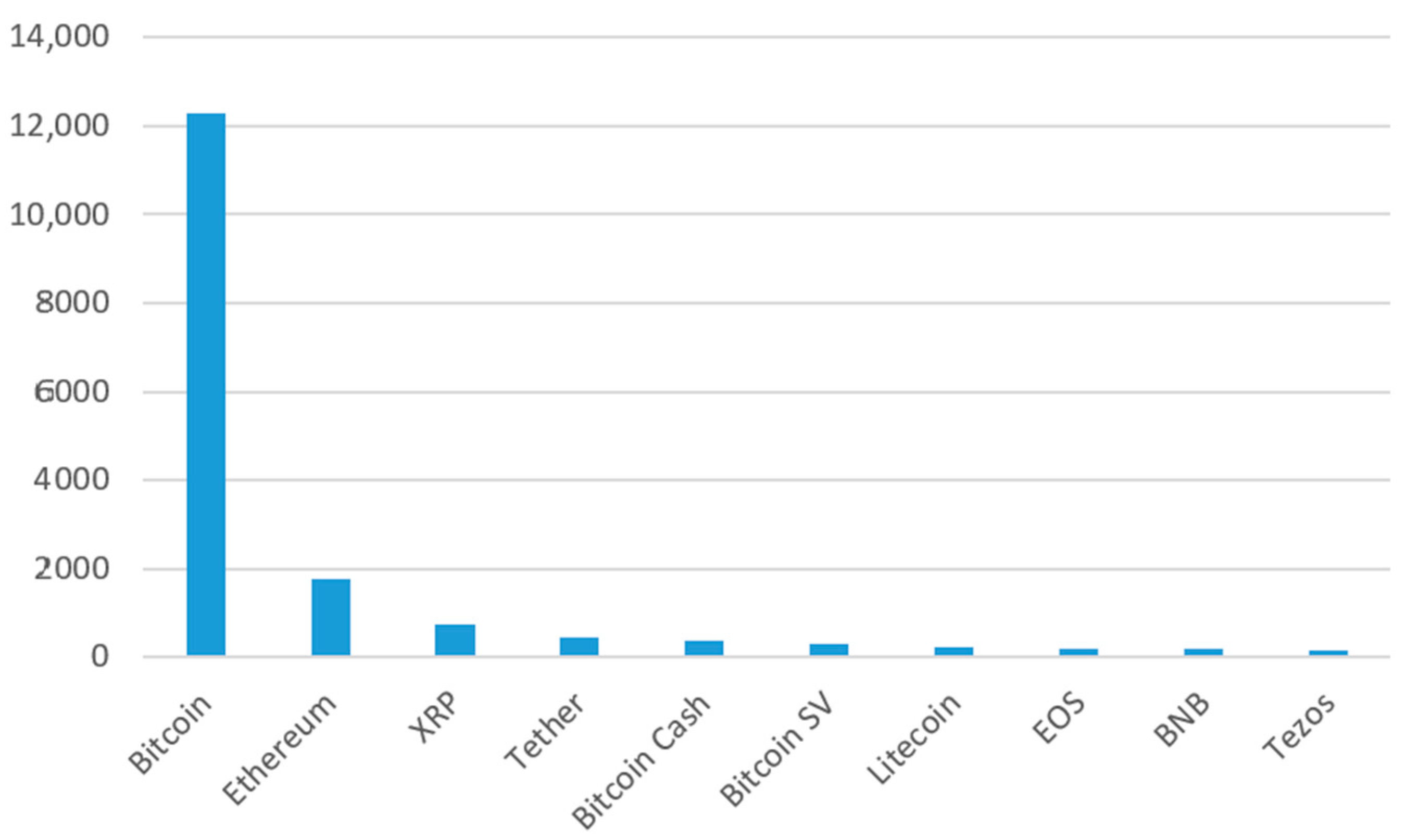

4.2. Cryptocurrency Comparative Analysis

4.3. Competition on the Cryptocurrency Market

5. Discussion: Cryptocurrency and Open Innovation

- Similarity with the most popular large-scale currency—Bitcoin. This characteristic is due to the high credit of investor confidence in the Bitcoin platform and all its hard forks.

- Support for smart contracts. This property is new on the market, but it is this concept and open innovation that can fully reveal the potential of using cryptocurrencies in the modern world. Accordingly, investors believe in this technology and invest in the corresponding coins and digital assets.

- Availability of open source for application development. This property of cryptocurrencies makes it possible to expand the range of use of blockchain protocols and enables third-party developers to create programs that are integrated into sectors of the economy and social activities in general.

- State cryptocurrencies—this digital currency is controlled by an authorized government body. This scheme does not maintain the main advantage of cryptocurrency—decentralization and data confidentiality. In this type of cryptocurrency, the interests of the state about full awareness of operations carried out in the system collide with the interests of network users in complete security and privacy of data.

- Cryptocurrency systems founded by private organizations. The main purpose of their creation is to generate profit in the form of commissions from network users. For this, the tasks of maximum satisfaction of consumer interests were set: the more extensive the use of cryptocurrency, the more money the organizers receive for it [86].

- Bitcoin and altcoins. This group of digital currencies includes the first cryptocurrency is Bitcoin, which is still the most recognized cryptocurrency and its counterparts are altcoins. These are cryptocurrencies built on a platform related to Bitcoin’s and have a similar set of characteristics and properties. These cryptocurrencies are most often used as a financial asset and traded on exchanges.

- Stablecoins are a cryptocurrency backed by a third-party asset, which is the basis for pricing for this type of currency. The issuer of such a cryptocurrency stores an asset that provides the value of a stablecoin in bank accounts. Traditional currencies are most often used as such an asset. These cryptocurrencies are intended for making payment transactions, since their volatility is much lower and comparable to the volatility of the underlying asset. Such coins differ significantly in characteristics from altcoins.

- Tokens are both a unit of value and a unit of calculation that is used within one project. Accordingly, ICOs are carried out to attract investments in the issuing company. The cost of such coins may increase depending on the performance indicators of the issuer, and after that the tokens can be traded on the exchange. This type of coins can be compared to venture investments, since they have a minimum intrinsic value at the start, and the risk of not receiving income is very high [87].

- Cryptocurrencies with limited and cyclical emission, for which an upper level of release is determined at the launch of the system, which may be artificially or technically limited. This classification feature is extremely important because it determines the cryptocurrency’s ability to be used as a ubiquitous payment method. With an increase in the emission of such a digital currency, its cost often grows, as well as the complexity of computing processes and requirements to the technology.

- Cryptocurrencies without emission but with cyclical restrictions. The issuance of such coins is not limited by the actions of the administration or the bandwidth of the system. Such cryptocurrency systems are innovative and often have the ability to scale freely or have high technological resources. If we consider digital currency as a potential replacement for existing fiat money, then cryptocurrency systems of this type are the most promising.

6. Conclusions

Funding

Conflicts of Interest

References

- Zhang, H.; Ho, T.B.; Lin, M.S. A Non-Parametric Wavelet Feature Extractor for Time Series Classification. In Advances in Knowledge Discovery and Data Mining; Springer: Berlin/Heidelberg, Germany, 2004; pp. 595–603. [Google Scholar]

- Yan, R.J.; Ling, C.X. Machine Learning for Stock Selection. In Proceedings of the KDD07: The 13th ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, San Jose, CA, USA, 12–15 August 2007; pp. 1038–1042. [Google Scholar]

- Wei, L.; Keogh, E. Semi-supervised time series classification. In Proceedings of the KDD06: 12th ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, Philadelphia, PA, USA, 20–23 August 2006; Association Computer Machinery: New York, NY, USA, 2014. Available online: https://dl.acm.org/doi/proceedings/10.1145/1150402 (accessed on 2 March 2020).

- Vejačka, M. Basic Aspects of Cryptocurrencies. J. Econ. Bus. Financ. 2014, 2, 75–83. [Google Scholar]

- Uematsu, Y.; Tanaka, S. High-dimensional macroeconomic forecasting and variable selection via penalized regression. Econ. J. 2019, 22, 34–56. [Google Scholar] [CrossRef]

- Tinbergen, J. Shaping the World Economy; Suggestions for an International Economic Policy; Twentieth Century Fund: New York, NY, USA, 1962; p. 113. [Google Scholar]

- Tasca, P.; Liu, S.; Hayes, A. The Evolution of the Bitcoin Economy: Extracting and Analyzing the Network of Payment Relationships. SSRN Electron. J. 2018, 19, 94–126. [Google Scholar] [CrossRef]

- Portmann, E. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Newton, MA, USA, 2015; p. 23. [Google Scholar]

- Maini, S.S.; Govinda, K. Stock Market Prediction using Data Mining Techniques. In Proceedings of the ICISS 2017: IEEE International Conference on Intelligent Sustainable Systems (ICISS) 2017, Tirupur, India, 7–8 December 2017. [Google Scholar]

- Silva, J.S.; Tenreyro, S. The log of gravity. Rev. Econ. Stat. 2006, 88, 641–658. [Google Scholar] [CrossRef]

- Shahrivari, S. Beyond Batch Processing: Towards Real-Time and Streaming Big Data. Computer 2014, 3, 117–129. [Google Scholar] [CrossRef]

- Remy, C.; Rym, B.; Matthieu, L. Tracking Bitcoin Users Activity Using Community Detection on a Network of Weak Signals. In Proceedings of the International Conference on Complex Networks and Their Applications, Lyon, France, 29 November–1 December 2017; Springer: Cham, Switzerland, 2017; pp. 166–177. [Google Scholar]

- Reid, F.; Harrigan, M. An Analysis of Anonymity in the Bitcoin System. In Security and Privacy in Social Networks; Springer: New York, NY, USA, 2013; pp. 197–223. [Google Scholar]

- Puri, V. Decrypting Bitcoin Prices and Adoption Rates Using Google Search. Bachelor’s Thesis, Claremont McKenna College, Claremont, CA, USA, April 2016. Available online: http://scholarship.claremont.edu/cmc_theses/1418 (accessed on 2 March 2020).

- Nyangarika, A.; Mikhaylov, A.; Richter, U. Oil Price Factors: Forecasting on the Base of Modified Auto-regressive Integrated Moving Average Model. Int. J. Energy Econ. Policy 2019, 1, 149–160. [Google Scholar]

- Meynkhard, A. Long-Term Prospects for the Development Energy Complex of Russia. Int. J. Energy Econ. Policy 2020, 10, 224–232. [Google Scholar] [CrossRef]

- DeStefano, M. Stock Returns and the Business Cycle. Financ. Rev. 2004, 39, 527–547. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic co-movements of stock market returns, implied volatility and policy uncertainty. Econ. Lett. 2013, 120, 87–92. [Google Scholar] [CrossRef]

- Ko, J.-H.; Lee, C.-M. International economic policy uncertainty and stock prices: Wavelet approach. Econ. Lett. 2015, 134, 118–122. [Google Scholar] [CrossRef]

- Li, T.; Ma, F.; Zhang, X.; Zhang, Y. Economic policy uncertainty and the Chinese stock market volatility: Novel evidence. Econ. Model. 2020, 87, 24–33. [Google Scholar] [CrossRef]

- Christou, C.; Cunado, J.; Gupta, R.; Hassapis, C. Economic policy uncertainty and stock market returns in PacificRim countries: Evidence based on a Bayesian panel VAR model. J. Multinatl. Financ. Manag. 2017, 40, 92–102. [Google Scholar] [CrossRef]

- Kühnhausen, F. Financial Innovation and Financial Fragility; Munich Discussion Paper No. 2014-37; Taylor & Francis, Ltd.: Abingdon, UK, 2014; Available online: https://epub.ub.uni-muenchen.de/21173/ (accessed on 10 March 2020).

- Orlowski, L. Stages of the 2007/2008 Global Financail Crisis Is There a Wandering Asset-Price Bubble? Economics Discussion Papers No. 2008-43; SSRN: Rochester, NY, USA, 2008; Available online: https://www.econstor.eu/handle/10419/27479 (accessed on 2 March 2020).

- Julio, B.; Yook, Y. Corporate Financial Policy under Political Uncertainty: International Evidence from National Elections. J. Financ. 2012, 7, 121. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Arouri, M.; Estay, C.; Rault, C.; Roubaud, D. Economic policy uncertainty and stock markets: Long-run evidence from the US. Financ. Res. Lett. 2016, 18, 136–141. [Google Scholar] [CrossRef]

- Pastor, L.; Veronesi, P. Political Uncertainty and Risk Premia. J. Financ. Econ. 2013, 110, 520–545. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A. Oil shocks, policy uncertainty and stock marketreturn. J. Intent. Financ. Mark. Inst. Money 2013, 26, 305–318. [Google Scholar] [CrossRef]

- Backus, D.K.; Routledge, B.R.; Zin, S.E. Asset Prices in Business Cycle Analysis; Paper 414; Tepper School of Business: Pittsburgh, PA, USA, 2007; Available online: http://repository.cmu.edu/tepper/414 (accessed on 15 February 2020).

- Campa, J.M.; Fernandes, N. Sources of gains from international portfolio diversification. J. Empir. Financ. 2006, 13, 417–443. [Google Scholar] [CrossRef]

- An, J.; Dorofeev, M.; Zhu, S. Development of energy cooperation between Russia and China. Int. J. Energy Econ. Policy 2020, 10, 134–139. [Google Scholar] [CrossRef]

- Meynkhard, A. Fair market value of bitcoin: Halving effect. Investig. Manag. Financ. Innov. 2019, 16, 72–85. [Google Scholar] [CrossRef]

- Graham, M.; Peltomäki, J.; Piljak, V. Global economic activity as an explicator of emerging market equity returns. Res. Int. Bus. Financ. 2016, 36, 424–435. [Google Scholar] [CrossRef]

- Bartman, S.; Brown, G.; Stulz, R.M. Why do Foreign Firms have Less Idiosyncratic Risk than U.S. Firms? 2009. Available online: https://www.nber.org/papers/w14931 (accessed on 26 August 2020).

- Mehl, A. Large Global Volatility Shocks, Equity Markets and Globalisation: 1885-2011. Fed. Reserv. Bank Dallas Glob. Monet. Policy Inst. Work. Pap. 2013, 2013. [Google Scholar] [CrossRef]

- Das, D.; Kumar, S.B. International economic policy uncertainty and stock prices revisited: Multiple and Partial wavelet approach. Econ. Lett. 2018, 164, 100–108. [Google Scholar] [CrossRef]

- Sugimoto, K.; Matsuki, T.; Yoshida, Y. The global financial crisis: An analysis of the spillover effects on African stock markets. Emerg. Mark. Rev. 2014, 21, 201–233. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Schreiber, T. Measuring Information Transfer. Phys. Rev. Lett. 2000, 85, 461–464. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Labs Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Marschinski, R.; Kantz, H. Analysing the information flow between financial time series. Eur. Phys. J. B 2002, 30, 275–281. [Google Scholar] [CrossRef]

- Sensoy, A.; Sobaci, C.; Sensoy, S.; Alali, F. Effective transfer entropy approach to information flow between exchange rates and stock markets. Chaos Solitons Fractals 2014, 68, 180–185. [Google Scholar] [CrossRef]

- Chunxia, Y.; Xueshuai, Z.; Luoluo, J.; Sen, H.; He, L. Study on the contagion among American industries. Phys. A Stat. Mech. Appl. 2016, 444, 601–612. [Google Scholar] [CrossRef]

- Behrendt, S.; Dimpfl, T.; Peter, F.J.; Zimmermann, D.J. RTransferEntropy—Quantifying information flow between different time series using effective transfer entropy. SoftwareX 2019, 10, 100265. [Google Scholar] [CrossRef]

- Dimpfl, T.; Peter, F.J. The impact of the financial crisis on transatlantic information flows: An intraday analysis. J. Int. Financ. Mark. Inst. Money 2014, 31, 1–13. [Google Scholar] [CrossRef]

- Hartley, R.V. Transmission of information. Bell Labs Tech. J. 1928, 7, 535–563. [Google Scholar] [CrossRef]

- Jizba, P.; Kleinert, H.; Shefaat, M. Renyi’s information transfer between financial time series. Phys. A Stat. Mech. Appl. 2012, 391, 2971–2989. [Google Scholar] [CrossRef]

- Rényi, A. Probability Theory; Dover Publications: New York, NY, USA, 1970. [Google Scholar]

- Beck, C.; Schögl, F. Thermodynamics of chaotic systems: An introduction. In Cambridge Nonlinear Science Series; Cambridge University Press: Cambridge, UK, 1993; Volume 4. [Google Scholar]

- Alqahtani, A.; Martinez, M. US Economic Policy Uncertainty and GCC Stock Market. Asia-Pac. Financ. Mark. 2020, 27, 415–425. [Google Scholar] [CrossRef]

- Istiak, K.; Alam, M.R. US economic policy uncertainty spillover on the stock markets of the GCC countries. J. Econ. Stud. 2020, 47, 36–50. [Google Scholar] [CrossRef]

- Sum, V. How Do Stock Markets in China and Japan Respond to Economic Policy Uncertainty in the United States? 2012. Available online: https://ssrn.com/abstract=2092346 (accessed on 26 August 2020).

- Sum, V. The ASEAN stock market performance and economic policy uncertainty in the United States. Econ. Pap. J. Appl. Econ. Policy 2013, 32, 512. [Google Scholar] [CrossRef]

- Yin, L.; Han, L. Spillovers of macroeconomic uncertainty among major economies. Appl. Econ. Lett. 2014, 21, 938–944. [Google Scholar] [CrossRef]

- Finger, M.; Stucki, A. Open Innovation as an Option for Reacting to Reform and Crisis: What Factors Influence the Adoption of Open Innovation. In Proceedings of the 2nd ISPIM Innovation Symposium, New York, NY, USA, 6–9 December 2009. [Google Scholar]

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R.J. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2019, 4, 226–233. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jung, K.; Yigitcanlar, T. The Culture for Open Innovation Dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Yigitcanlar, T.; Lee, D.; Ahn, H. Architectural Design and Open Innovation Symbiosis: Insights from Research Campuses, Manufacturing Systems, and Innovation Districts. Sustainability 2018, 10, 4495. [Google Scholar] [CrossRef]

- Yun, J.J.; Lee, M.; Park, K.; Zhao, X. Open Innovation and Serial Entrepreneurs. Sustainability 2019, 11, 5055. [Google Scholar] [CrossRef]

- Chen, W.; Xu, H.; Jia, L.; Gao, Y. Machine learning model for Bitcoin exchange rate prediction using economic and technology determinants. Int. J. Forecast. 2020, 37, 28–43. [Google Scholar] [CrossRef]

- Chen, Z.; Li, C.; Sun, W. Bitcoin price prediction using machine learning: An approach to sample dimension engineering. J. Comput. Appl. Math. 2020, 365, 112395. [Google Scholar] [CrossRef]

- Abualigah, L.M.; Khader, A.T. Unsupervised text feature selection technique based on hybrid particle swarm optimization algorithm with genetic operators for the text clustering. J. Supercomput. 2017, 73, 4773–4795. [Google Scholar] [CrossRef]

- Abualigah, L.M.; Khader, A.T.; Hanandeh, E.S. A new feature selection method to improve the document clustering using particle swarm optimization algorithm. J. Comput. Sci. 2018, 25, 456–466. [Google Scholar] [CrossRef]

- Abualigah, L.; Khader, A.T.; Hanandeh, E.S. Hybrid clustering analysis using improved krill herd algorithm. Appl. Intell. 2018, 48, 4047–4071. [Google Scholar] [CrossRef]

- Meynkhard, A. Priorities of Russian Energy Policy in Russian-Chinese Relations. Int. J. Energy Econ. Policy 2020, 10, 65–71. [Google Scholar] [CrossRef]

- Meynkhard, A. Energy Efficient Development Model for Regions of the Russian Federation: Evidence of Crypto Mining. Int. J. Energy Econ. Policy 2019, 9, 16–21. [Google Scholar] [CrossRef]

- An, J.; Dorofeev, M. Short-term FX forecasting: Decision making on the base of expert polls. Investig. Manag. Financ. Innov. 2019, 16, 72–85. [Google Scholar] [CrossRef]

- Nyangarika, A.M.; Tang, B.-J. Influence Oil Price towards Economic Indicators in Russia. IOP Conf. Series Earth Environ. Sci. 2018, 192, 012066. [Google Scholar] [CrossRef]

- Neudecker, T.; Hartenstein, H. Could Network Information Facilitate Address Clustering in Bitcoin? In Proceedings of the FC2017: International Conference on Financial Cryptography and Data Security, Sliema, Malta, 3–7 April 2017; Springer: Cham, Switzerland, 2017; pp. 155–169. [Google Scholar]

- Mikhaylov, A. Volatility Spillover Effect between Stock and Exchange Rate in Oil Exporting Countries. Int. J. Energy Econ. Policy 2018, 8, 321–326. [Google Scholar]

- Hegde, M.S.; Krishna, G.; Srinath, R. An Ensemble Stock Predictor and Recommender System. In Proceedings of the 2018 International Conference on Advances in Computing, Communications and Informatics (ICACCI), Bangalore, India, 19–22 September 2018. [Google Scholar]

- Manning, C.D.; Raghavan, P.; Schütze, H. Introduction to Information Retrieval; Cambridge University Press: New York, NY, USA, 2008; p. 123. [Google Scholar]

- Lukashin, Y.P. Adaptive methods for short-term forecasting. Finansy i Statistika 2003. Available online: https://www.imemo.ru/en/publications/info/adaptive-methods-of-short-term-forecasting-of-temporal-rows-moscow-finansy-i-statistika-publishers-2003 (accessed on 26 August 2020).

- Louppe, G. Understanding Random Forests: From Theory to Practice; University of Liège: Liège, Belgium, 2015; pp. 25–53. [Google Scholar]

- Lohrmann, C.; Luukka, P. Classification of intraday S&P500 returns with a Random Forest. Int. J. Forecast. 2019, 35, 390–407. [Google Scholar] [CrossRef]

- Lischke, M.; Fabian, B. Analyzing the Bitcoin Network: The First Four Years. Futur. Internet 2016, 8, 7. [Google Scholar] [CrossRef]

- Lewer, J.J.; Van den Berg, H. A gravity model of immigration. Econ. Lett. 2008, 99, 164–167. [Google Scholar] [CrossRef]

- Lahmiri, S.; Bekiros, S. Cryptocurrency forecasting with deep learning chaotic neural networks. Chaos Solitons Fractals 2019, 118, 35–40. [Google Scholar] [CrossRef]

- Kroll, J.A.; Davey, I.C.; Felten, E.W. The economics of Bitcoin mining, or Bitcoin in the presence of adversaries. In Proceedings of the WEIS, Washington, DC, USA, 11–12 June 2013; p. 11. [Google Scholar]

- Kristoufek, L. What Are the Main Drivers of the Bitcoin Price? Evidence from Wavelet Coherence Analysis. PLoS ONE 2015, 10, e0123923. [Google Scholar] [CrossRef]

- Kristoufek, L. BitCoin meets Google Trends and Wikipedia: Quantifying the relationship between phenomena of the Internet era. Sci. Rep. 2013, 3, 3415. [Google Scholar] [CrossRef]

- Koshy, P.; Koshy, D.; McDaniel, P. An Analysis of Anonymity in Bitcoin Using P2P Network Traffic. In Proceedings of the FC 2014: International Conference on Financial Cryptography and Data Security, Christ Church, Barbados, 3–7 March 2014; Springer: Berlin, Germany, 2014; pp. 469–485. [Google Scholar]

- Kohavi, R.; John, G. Wrappers for feature selection. Artif. Intell. 1997, 97, 273–324. [Google Scholar] [CrossRef]

- Kira, K.; Rendell, L.A. A practical approach to feature selection. In Machine Learning Proceedings 1992; Sleeman, D., Edwards, P., Eds.; Morgan Kaufmann: San Francisco, CA, USA, 1992; pp. 368–377. [Google Scholar] [CrossRef]

- Kenda, K.; Kazic, B.; Novak, E.; Mladenić, D. Streaming Data Fusion for the Internet of Things. Sensors 2019, 19, 1955. [Google Scholar] [CrossRef]

- Kang, Q.; Zhou, H.; Kang, Y. An Asynchronous Advantage Actor-Critic Reinforcement Learning Method for Stock Selection and Portfolio Management. In Proceedings of the ICBDR 2018: 2nd International Conference on Big Data Research, Weihai, China, 27–29 October 2018; pp. 141–145. [Google Scholar]

| Characteristic | Fiat Money | Assets | Financial Assets | Cryptocurrency |

|---|---|---|---|---|

| Store of value | Yes | Yes | Yes | Heт |

| Medium of exchange | Yes | No | No | Partially |

| Unit of account | Yes | No | No | No |

| Property right | No | Yes | Yes | Possible |

| Economic benefits from ownership | Possible | Yes | Yes | Possible |

| Is a liability from a third-party | Yes | No | Yes | No |

| Information transfer and storage function | No | No | No | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mikhaylov, A. Cryptocurrency Market Analysis from the Open Innovation Perspective. J. Open Innov. Technol. Mark. Complex. 2020, 6, 197. https://doi.org/10.3390/joitmc6040197

Mikhaylov A. Cryptocurrency Market Analysis from the Open Innovation Perspective. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):197. https://doi.org/10.3390/joitmc6040197

Chicago/Turabian StyleMikhaylov, Alexey. 2020. "Cryptocurrency Market Analysis from the Open Innovation Perspective" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 197. https://doi.org/10.3390/joitmc6040197

APA StyleMikhaylov, A. (2020). Cryptocurrency Market Analysis from the Open Innovation Perspective. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 197. https://doi.org/10.3390/joitmc6040197