1. Introduction

CRM is an enterprise approach that understands and impacts customer behaviour through effective interactions with them for the purpose of enhancing customer attraction, retention, loyalty and, ultimately, customer profitability [

1,

2,

3]. CRM is important for top management to deliver the vision and CRM strategy to their employees [

4,

5].

This interaction between the organization and its employees is also important to ensure the CRM process can be successful in achieving the objectives and enhancing organizational performance [

1,

6]. The success of CRM implementation can increase customer satisfaction and the retaining ratio and also increase employee satisfaction and subsequently improve company performance [

7,

8].

In addition, several quantitative studies on CRM have explored its function and influence in specific sectors in developed countries. However, it remains to examine and confirm the applicability of the concept of CRM specifically in manufacturing industries and in developing countries [

9,

10]. Emerging markets may exhibit different characteristics.

In another scenario, SMEs are major participants in economic development in both advanced and developing countries and are at the centre of growth in both [

11,

12]. They encourage economic growth by providing employment opportunities for rural and urban people, enabling flexibility and enhancing innovative practices through entrepreneurship, and increasing international trade through diversification of economic activities. Their role in income generation and the economic growth of developing countries is especially important [

13,

14,

15,

16].

According to Al Montaser [

17], the Yemeni economy largely consists of small and medium enterprises, with SMEs accounting for 20.9% of the country’s manufacturing sector [

18]. Meanwhile, in Kuwait, 90% of the private employment is attributed to SMEs, and in Egypt SMEs constitute over 95% [

19]. Generally speaking, the data from the Arab countries show that SMEs account for 90% of the total firms. In fact, the majority of countries around the globe reported that SMEs provide 40–80% of employment. SMEs contribute significantly to GDP; for example, 59% in Palestine, 77% in Algeria, and 25% in Saudi Arabia [

20].

Yemen is one of the least-developed nations in the region, and the unemployment rate reached 12.81% in 2019 [

21]. It is important to note that SMEs perform a crucial function in the economies of all countries by making jobs available and acting as suppliers for larger enterprises. From a survey conducted in 2018, SMEs in Yemen were considered as the solution to economic problems such as worsening unemployment and poverty among the population [

22,

23].

In addition, there is little literature on integrated models for the performance of Yemeni manufacturing SMEs [

18,

24,

25,

26,

27] found that existing studies do not provide adequate inputs into the development of a common global understanding of CRM outcomes [

28,

29,

30,

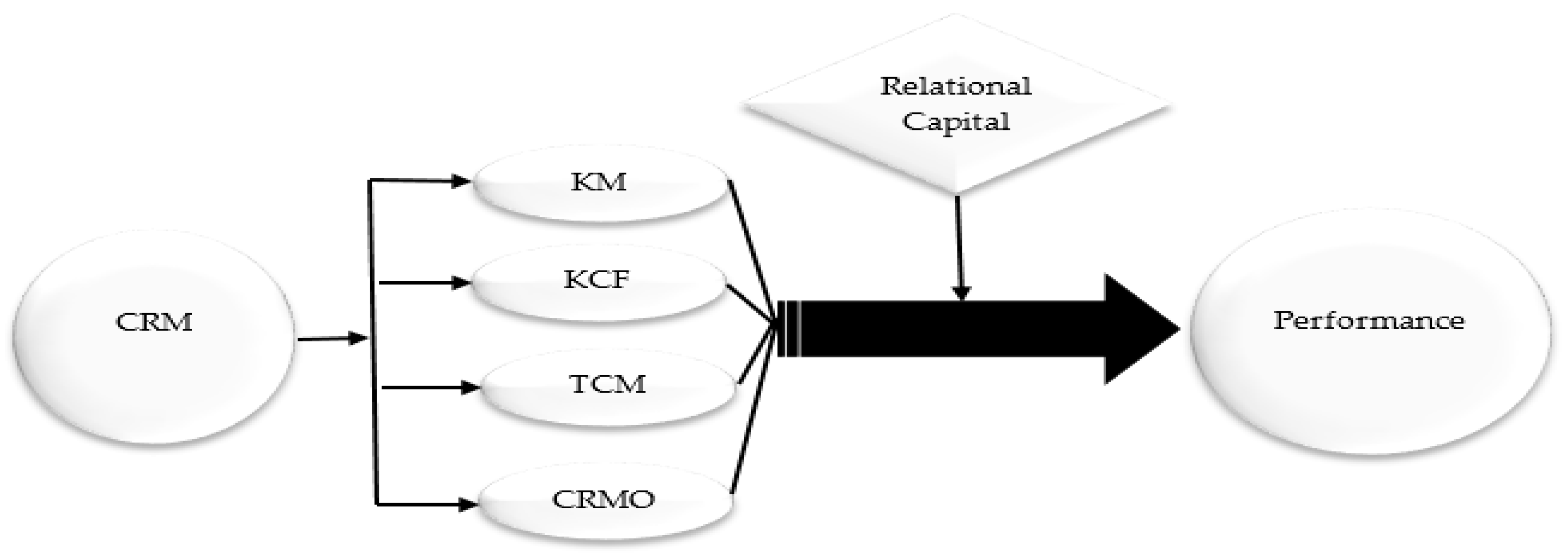

31] argued that a well-integrated framework for developing a CRM model through empirical studies and research is still needed, and four dimensions of CRM have been identified: CRM organization (CRMO), key customer focus (KCF), technology-based CRM (TCM), and CRM knowledge management (KM). However, an integrated mechanism to show how CRM leads to performance outcomes remains an unresolved problem, and further studies are required. According to meta-analyses conducted by Madhovi and Dhliwayo, [

32] and Nam, Lee and Lee [

33] the relationship between CRM and performance is robust, although others have found only negative implications [

27,

34,

35,

36]. Results suggest that additional moderators should be assessed in future studies.

A few studies on relational capital in Yemeni and Arab manufacturing industries do exist; for example, Sharabati, Jawad and Bontis [

37] explored a broad domain of firm- or industry-specific processes pertinent to RC, although their findings remain disconnected [

38]. In the field of human resources, various suggestions for creating and validating a new theoretical model have been proposed [

39,

40]. Meanwhile, several authors remain sceptical about the function, nature, and role of the RC concept [

39].

However, there is limited evidence on how the impact of CRM dimensions on SMEs’ performance is affected by relational capital in Middle Eastern countries. This study aims to examine the joint influence of CRM dimensions and relational capital on SEMs’ performance in Yemen. It concentrates on two questions:

Research Question 1. How do CRM dimensions impact SMEs’ performance?

Research Question 2. How does RC moderate these relationships?

Finally, the findings of this study will be useful to policymakers, researchers, and managers. In particular, they provide current knowledge of the effect of CRM dimensions, RC and SMEs’ performance, contributing to the literature on performance and the firm-based view.

5. Discussions: Innovative CRM, Performance and Relational Capital

The CRM process is used to explore the relationship between organizations and their customers; one tangible outcome is to increase organizations’ profit by enhancing customers’ purchasing behaviour in the future. For instance, it trains and guides employees in delivering high-quality products/services that are important for promoting good customer relationships [

87,

88].

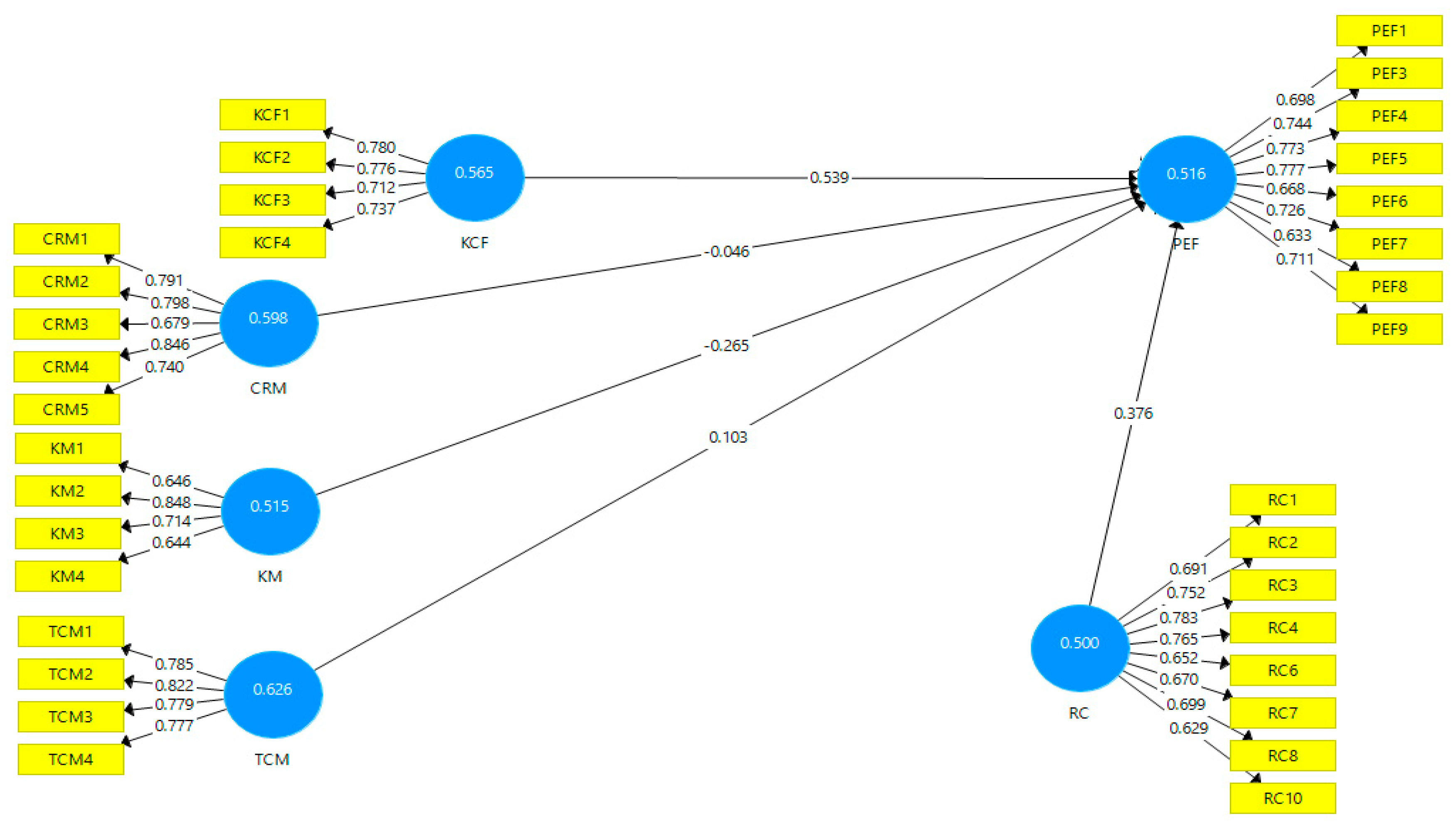

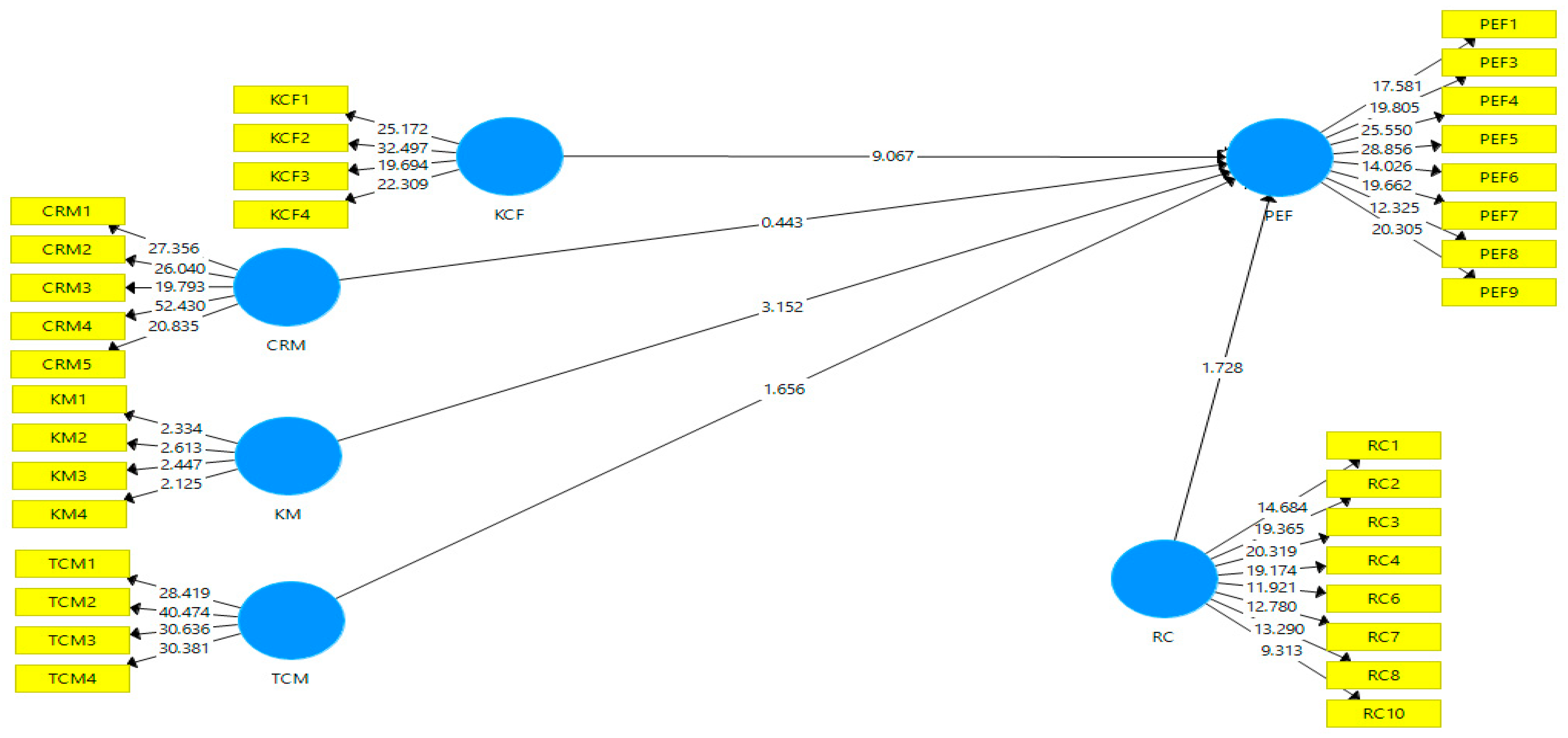

This study used Yemeni manufacturing SMEs as the population to investigate the effect of investigating CRM on performance. Results indicate that only three dimensions of CRM (KCF, TCM and KM) have a significant effect on SMEs’ performance [

43,

89], and that the fourth dimension (CRMO) does not [

36]. The findings obviously presented the major effect paths and CRM’s strength for firm performance, thus offering complete and helpful information

The study has high value for both researchers and practitioners. The findings indicate that the key factors of organizations in practising customer knowledge, effective customer performance, and customer loyalty affect CRM in SMEs in Yemen. Based on these findings, the study concludes that it is important to meet customers’ needs and expectations in terms of calling, or communication via modern Internet communication. SMEs in Yemen need to provide adequate customer service to increase their performance.

Unfortunately, previous studies in Yemen, the Middle East, and the Arab world have not investigated the impact of CRM on the performance of this very important sector of the country’s economy, and the relationship between CRM and manufacturing SMEs’ performance had yet to be investigated. The present study has made an important contribution to the literature by investigating this important construct in line with one of the objectives of the study.

In line with the second research question, the study investigated the moderating effect of relational capital on the relationship between CRM and SMEs’ performance. RC is a complex construct which can be classified as the relation between firms and customers [

37]. This concerned the direct relationship between CRM dimensions and SME performance in Yemen. However, based on the findings, this direct relationship may be influenced significantly or not significantly and may be improved or reduced depending on the relational capital of the firm. In other words, relational capital moderates the relationship between CRM and manufacturing firm performance. The implication of this finding is that organizations with a higher level of relational capital perform better. This moderating effect is an important contribution to the literature, as previous studies have only focused on the direct relationship [

51,

90,

91].

The literature review found mixed results from studies of CRM and performance; these include studies by [

35,

36]. Based on these inconsistent findings, this study found it appropriate to introduce a moderating variable in the relationship between CRM and SME performance; it contributes by examining RC’s moderating role in the CRM dimensions relationship with the performance of SMEs in Yemen.

Indeed, to answer the research questions, we formulated the hypotheses. The result of the moderation test for the effect of relational capital on the relationship between CRM dimensions and performance indicated that relational capital significantly moderates the relationship between two CRM dimensions and performance: TCM and CRMO; it does not moderate the relationship between key customer focus and CRM knowledge management and SMEs’ performance. This is in line with previous studies; Akroush et al., [

27] argued that key customer focus has an insignificant and negative relationship with organizational performance. Others studies have found mixed results [

36]. Reinartz, Krafft and Hoyer [

35] concluded that the CRM process-performance link is not strong. Vishnu and Kumar Gupta reported a weak and negative relationship between intellectual capital and performance [

47,

92,

93]. The findings showed that RC did not significantly influence the key customer focus and knowledge management relationships, but did significantly influence technology-based CRM and CRM-organization relationships with performance. This result may be attributed to the lack of absorptive capacity of manufacturing firms for knowledge and technologies through RC. Moreover, the cognitive gap between effective CRM dimensions and the owners of organizations when it comes to RC capabilities may also have negative effects as this gap reflects basic perceptions, interpretation, and evaluation systems that are integrated within the culture of the organization. In other words, cognitive skills and knowledge distances were not sufficient to maximize the CRM dimensions and bring about an understanding of opportunities via RC.

Finally, to sustain and survive in the rapidly changing market, SMEs have to focus on their relationships with customers and suppliers to renew their team skills to innovate radically high competences. Foltean et al., [

44] explained that the exploitation of the relationship with customers emphasizes the need for employee training and resources. Agnihotri et al., [

45] showed that as markets become increasingly hyper-competitive, CRM is needed as an immediate measure to create sustainable advantage. Hence, continuous organizational offers for their customers are the only effective technique for advantage-structure.

Organizations need to pay attention to innovative CRM processes, which help optimize the deployment of more tangible services, to match the quality of foreign services. Of the combined RC enable firms to proactively develop market strategies and enable innovative capabilities using a knowledge-based approach when in doubt.

7. Implications

The findings of this study have implications for government policy as well as managerial implications for managers and owners of SMEs in Yemen. The implications are not necessarily limited to Yemen, as owners/managers and government policy-makers in other developing countries may also learn from these findings.

The policy implication of the study consists of advice for the government, the Yemeni Ministry of Industry and Trade and the Yemeni Ministry of Technical Education and Vocational Training. Given the large number of manufacturing firms in Yemen, the government should pay very close attention to this sector. It a surprise that Yemeni manufacturing SMEs do not contribute much to the country’s GDP. The World Bank [

94] critically appraised the performance of the Yemeni economy in recent years and concluded that it has been very poor, with the manufacturing sector being especially weak. The World Bank put the blame for the low performance of the manufacturing sector on insufficient CRM to enhance the market share and revenue of SMEs in Yemen.

Therefore, the government should intervene in SME operations in Yemen so as to improve CRM and improve the relationship with the suppliers and customers in local and international markets by providing modern technology to SMEs to help them acquire modern industrial equipment and train their employees. However, based on our findings, the problem of low performance cannot be resolved without skilled human capital, which implies the need for training.

Finally, owners and managers of SMEs should reduce their emphasis on classical ways of managing organizational processes [

95,

96,

97]. For example, they need to adopt new creative ideas and technologies to enhance their products, service, and operations. In addition, RC needs to be adopted in operational activities in order to achieve high performance. Owners and managers must also increase their investment in CRM activities to build good relationships with their customers and suppliers and achieve trust locally and internationally.

8. Limitations and Future Research

Since the population of the study was limited to manufacturing SMEs in Yemen, it is recommended that other sectors of the Yemeni economy be investigated, for example, performance among service businesses like banks, hospitals, airports, etc. Additionally, the respondents for this study were owners, and the analysis concentrated only on the organizational level. Therefore, a detailed analysis of study variables cannot be comprehensive at other levels such as group and individual levels. Also, the current study used a quantitative approach to achieve the study objectives, but future studies might investigate the extent of the study variables by using qualitative techniques, to provide in-depth knowledge of the issues. Finally, the moderating effect of relational capital variables was not previously recognized in the literature. Hence, this study has successfully advanced theory and understanding of the effect of CRM and performance, emphasizing the important moderating role of relational capital variables. Future researchers can use other dimensions of intellectual capital such as innovation capital or human capital.