Can International Market Indices Estimate TASI’s Movements? The ARIMA Model

Abstract

1. Introduction

2. Innovations of Tadawul and International Markets

3. Tadawul Index (TASI) and International Indices

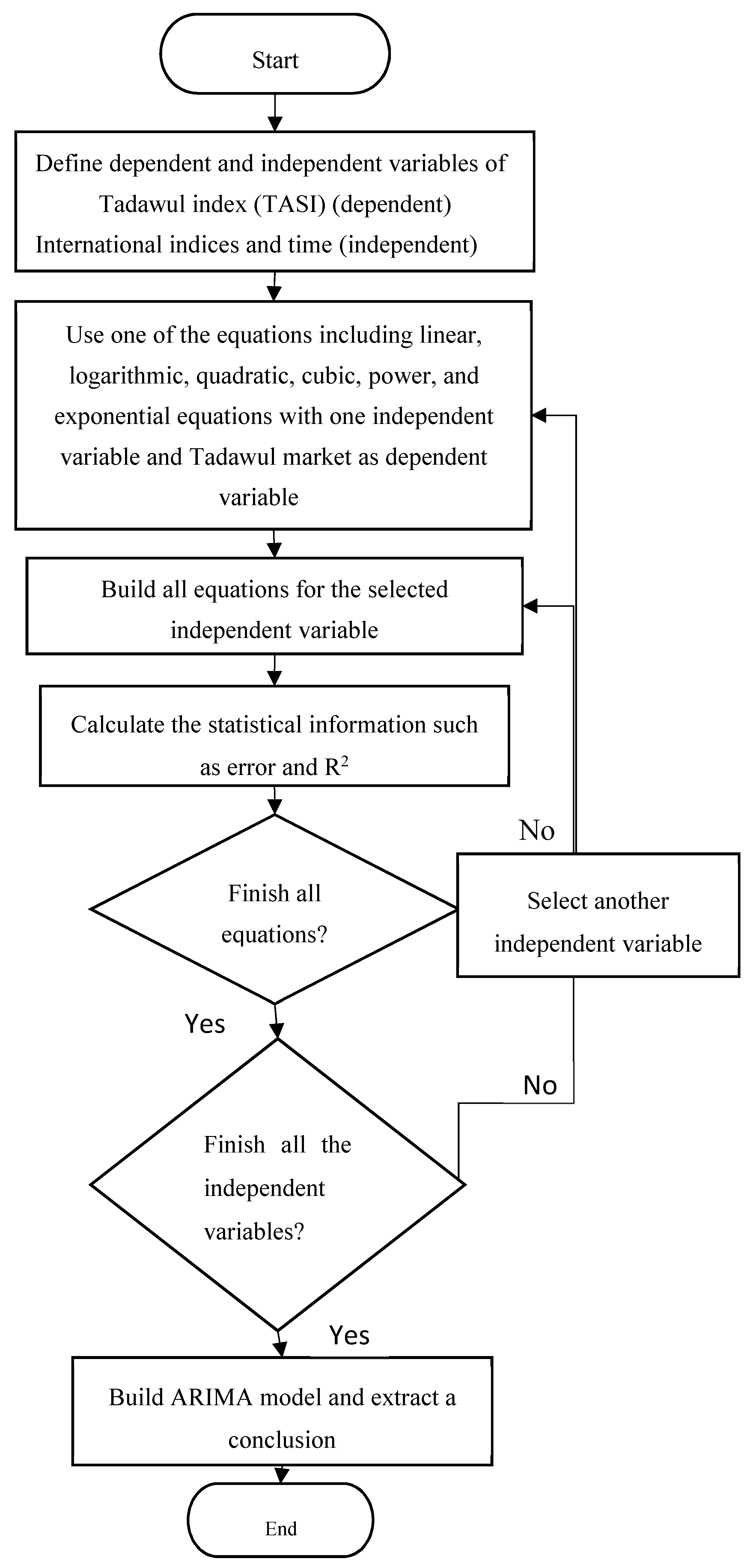

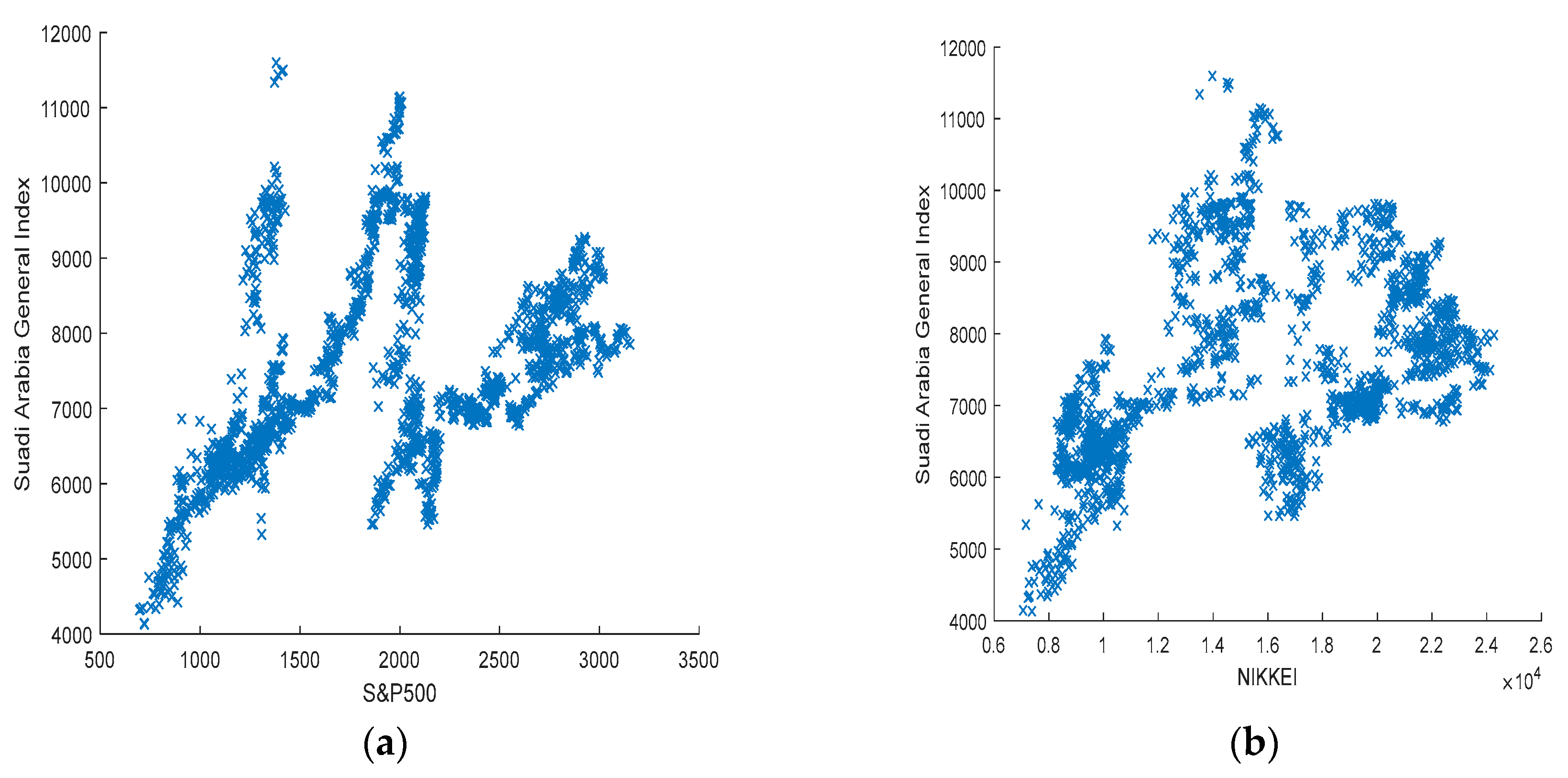

4. Research Methodology

4.1. Data Collection and Analysis

4.2. Equations

4.2.1. Linear Equation

4.2.2. Quadratic Equation

4.2.3. Power Equation

4.2.4. Cubic Equation

4.2.5. Exponential Equation

4.2.6. Logarithmic Equation

4.3. Estimate Methodology of Tadawul Index (TASI)

4.4. ARIMA model and Open Innovation

5. Results, Analysis and Discussion

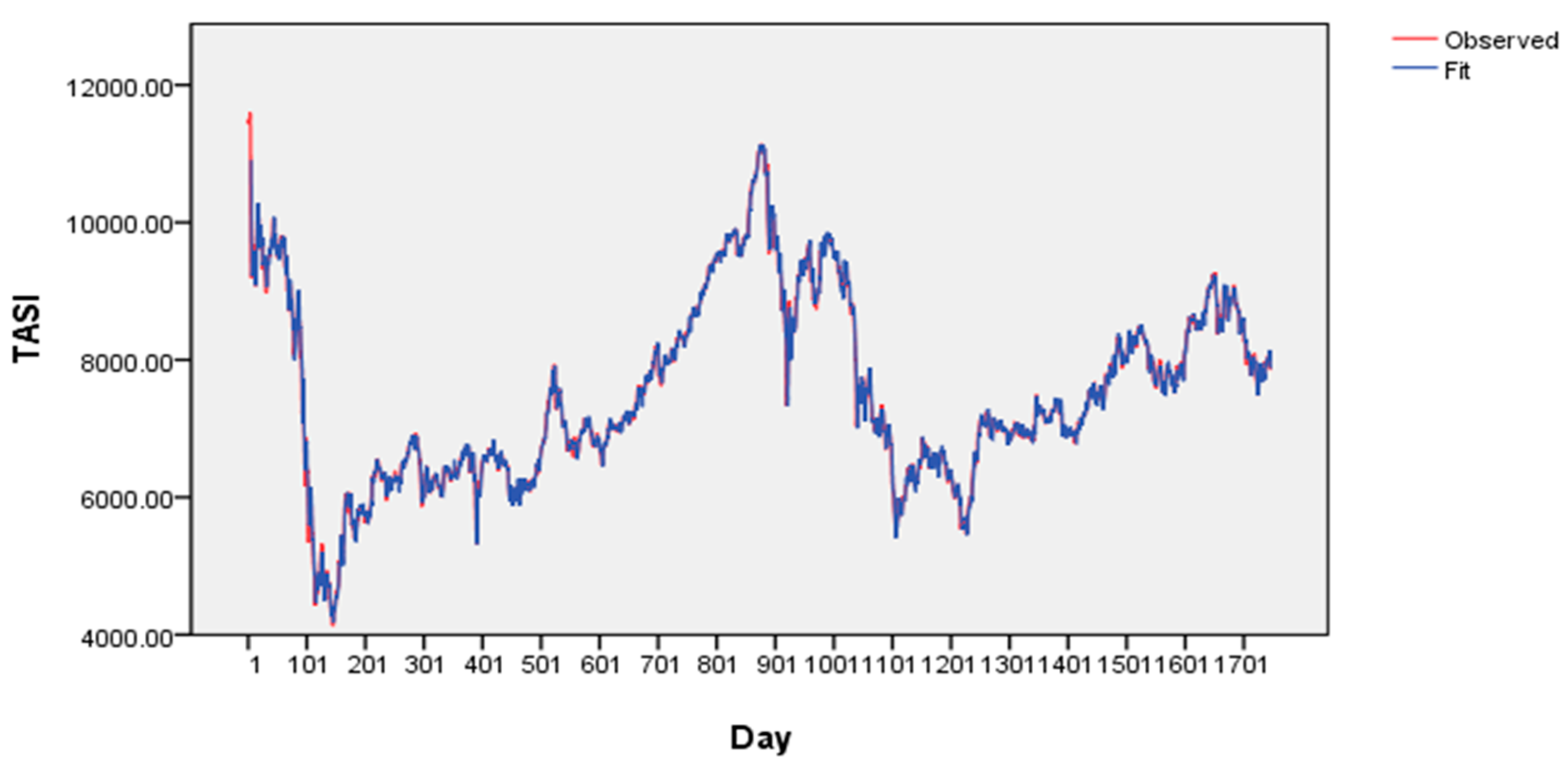

ARIMA Model

6. Conclusions

7. Limitations and Further Studies

8. Practical Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Yun, J.J.; Liu, Z. Micro-and Macro-Dynamics of Open Innovation with a Quadruple-Helix Model. Sustainability 2019, 11, 3301. [Google Scholar] [CrossRef]

- Chesbrough, H. Managing open innovation. Res.-Technol. Manag. 2004, 47, 23–26. [Google Scholar] [CrossRef]

- Noh, Y. Financial effects of open innovation in the manufacturing industry. Manag. Decis. 2015, 53, 1527–1544. [Google Scholar] [CrossRef]

- Ballestra, L.; Fontana, S.; Scuotto, V.; Solimene, S. A multidisciplinary approach for assessing open innovation model impact on stock return dynamics. Manag. Decis. 2018, 56, 1430–1444. [Google Scholar] [CrossRef]

- Hung, K.P.; Chou, C. The impact of open innovation on firm performance: The moderating effects of internal R&D and environmental turbulence. Technovation 2013, 33, 368–380. [Google Scholar]

- Szutowski, D. Market reaction to open innovation announcements. Eur. J. Innov. Manag. 2018, 21, 368–380. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Dynamics from open innovation to evolutionary change. J. Open Innov. Technol. Mark. Complex 2016, 2, 7. [Google Scholar] [CrossRef]

- Yun, J.J. How do we conquer the growth limits of capitalism? Schumpeterian Dynamics of Open Innovation. J. Open Innov. Technol. Mark. Complex 2015, 1, 17. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Cooke, P. World Turned Upside Down: Entrepreneurial Decline, Its Reluctant Myths and Troubling Realities. J. Open Innov. Technol. Mark. Complex. 2019, 5, 22. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Campbell, D.F.J. Open Innovation Diplomacy and a 21st Century Fractal Research, Education and Innovation (FREIE) Ecosystem: Building on the Quadruple and Quintuple Helix Innovation Concepts and the “Mode 3” Knowledge Production System. J. Knowl. Econ. 2011, 2, 327. [Google Scholar] [CrossRef]

- AlAmro, R.; McCarren, A.; Al-Rasheed, A. Predicting Saudi Stock Market Index by Incorporating GDELT Using Multivariate Time Series Modelling. In International Conference on Computing; Springer: Cham, Switzerland, 2019; pp. 317–328. [Google Scholar]

- Hauser, S.; Kamara, A.; Shurki, I. The effects of randomizing the opening time on the performance of a stock market under stress. J. Financial Mark. 2012, 15, 392–415. [Google Scholar] [CrossRef]

- Gholamiangonabadi, D.; Taheri, S.D.M.; Mohammadi, A.; Menhaj, M.B. Investigating the performance of technical indicators in electrical industry in Tehran’s Stock Exchange using hybrid methods of SRA, PCA and Neural Networks. In Proceedings of the 2014 5th Conference on Thermal Power Plants (CTPP), Tehran, Iran, 10–11 June 2014; IEEE: Piscataway, NJ, USA, 2015; pp. 75–82. [Google Scholar]

- Qiu, M.; Song, Y. Predicting the direction of stock market index movement using an optimized artificial neural network model. PLoS ONE 2016, 11, e0155133. [Google Scholar] [CrossRef] [PubMed]

- Hollstein, F.; Prokopczuk, M.; Simen, C.W. Estimating beta: Forecast adjustments and the impact of stock characteristics for a broad cross-section. J. Financ. Mark. 2019, 44, 91–118. [Google Scholar] [CrossRef]

- Chen, X.; Shangguan, W.; Liu, Y.; Wang, S. Can Network Structure Predict Cross-Sectional Stock Returns? Evidence from Co-attention Networks in Chin. Finance Res. Lett. 2019. [Google Scholar] [CrossRef]

- Sutthichaimethee, P.; Chatchorfa, A.; Suyaprom, S. A Forecasting Model for Economic Growth and CO2 Emission Based on Industry 4.0 Political Policy under the Government Power: Adapting a Second-Order Autoregressive-SEM. J. Open Innov. Technol. Mark. Complex. 2019, 5, 69. [Google Scholar] [CrossRef]

- Moghaddam, A.H.; Moghaddam, M.H.; Esfandyari, M. Stock market index prediction using artificial neural network. J. Econ. Finance Adm. Sci. 2016, 21, 89–93. [Google Scholar] [CrossRef]

- Selvamuthu, D.; Kumar, V.; Mishra, A. Indian stock market prediction using artificial neural networks on tick data. Financial Innov. 2019, 5, 16. [Google Scholar] [CrossRef]

- Khan, M.A.; Hernandez, J.A.; Shahzad, S.J.H. Time and frequency relationship between household investors’ sentiment index and US industry stock returns. Finance Res. Lett. 2019, 101318. [Google Scholar] [CrossRef]

- Jiang, M.; Liu, J.; Zhang, L.; Liu, C. An improved Stacking framework for stock index prediction by leveraging tree-based ensemble models and deep learning algorithms. Phys. A: Stat. Mech. its Appl. 2020, 541, 122272. [Google Scholar] [CrossRef]

- Anik, M.M.; Arefin, M.S.; Dewan, M.A.A. An Intelligent Technique for Stock Market Prediction. In Proceedings of the International Joint Conference on Computational Intelligence, Vienna, Australia, 17–19 September 2019; Springer: Singapore, 2020; pp. 721–733. [Google Scholar]

- Chandrasekara, V.; Tilakaratne, C.; Mammadov, M. An Improved Probabilistic Neural Network Model for Directional Prediction of a Stock Market Index. Appl. Sci. 2019, 9, 5334. [Google Scholar] [CrossRef]

- Tsai, M.-C.; Cheng, C.-H.; Tsai, M.-I. A Multifactor Fuzzy Time-Series Fitting Model for Forecasting the Stock Index. Symmetry 2019, 11, 1474. [Google Scholar] [CrossRef]

- Ryu, D. The US–Korea free trade agreement as a shock to product market competition: Evidence from the Korean stock market. Finance Res. Lett. 2019. [Google Scholar] [CrossRef]

- Dichtl, H.; Drobetz, W. Are stock markets really so inefficient? The case of the “Halloween Indicator”. Finance Res. Lett. 2014, 11, 112–121. [Google Scholar] [CrossRef]

- Fang, J.; Gozgor, G.; Lau, C.K.M.; Lu, Z. The impact of Baidu Index sentiment on the volatility of China’s stock markets. Finance Res. Lett. 2019, 32, 101099. [Google Scholar] [CrossRef]

- Heston, S.L.; Sinha, N.R. News vs. Sentiment: Predicting Stock Returns from News Stories. Financial Anal. J. 2017, 73, 67–83. [Google Scholar] [CrossRef]

- Zhang, X.; Fuehres, H.; Gloor, P. Predicting stock market indicators through twitter “I hope it is not as bad as I fear”. Procedia-Soc. Behav. Sci. 2011, 26, 55–62. [Google Scholar] [CrossRef]

- Bollen, J.; Mao, H.; Zeng, X.-J. Twitter mood predicts the stock market. J. Comput. Sci. 2011, 2, 1–8. [Google Scholar] [CrossRef]

- Hirshleifer, D.; Shumway, T. Good Day Sunshine: Stock Returns and the Weather. J. Finance 2003, 58, 1009–1032. [Google Scholar] [CrossRef]

- Corby, P.; Machado, R.; Fox, F. U.S. Patent Application No. 11/159,252; USPTO: Alexandria, VA, USA, 2006.

- Mohammed, S.; Abdalhafid, M.; Ahmed, B. Examining Causal Relationship between Saudi Stock Market (TASI) and US Stock Markets Indices. Asian J. Econ. Finance Manag. 2020, 2, 1–9. [Google Scholar]

- Kapar, B.; Olmo, J.; Ghalayini, R. Financial Integration in the United Arab Emirates Stock Markets. Finance Res. Lett. 2019. [Google Scholar] [CrossRef]

- Tissaoui, K.; Azibi, J. International implied volatility risk indexes and Saudi stock return-volatility predictabilities. N. Am. J. Econ. Finance 2019, 47, 65–84. [Google Scholar] [CrossRef]

- Dai, Z.; Zhou, H. Prediction of Stock Returns: Sum-of-the-Parts Method and Economic Constraint Method. Sustainability 2020, 12, 541. [Google Scholar] [CrossRef]

- Meng, T.L.; Khushi, M. Reinforcement Learning in Financial Markets. Data 2019, 4, 110. [Google Scholar] [CrossRef]

- Chung, H.; Shin, K.-S. Genetic Algorithm-Optimized Long Short-Term Memory Network for Stock Market Prediction. Sustainability 2018, 10, 3765. [Google Scholar] [CrossRef]

- Shah, H.; Tairan, N.; Garg, H.; Ghazali, R. A Quick Gbest Guided Artificial Bee Colony Algorithm for Stock Market Prices Prediction. Symmetry 2018, 10, 292. [Google Scholar] [CrossRef]

- Dinh, T.A.; Kwon, Y.K. An empirical study on importance of modeling parameters and trading volume-based features in daily stock trading using neural networks. Informatics 2018, 5, 36. [Google Scholar] [CrossRef]

- Rundo, F.; Trenta, F.; Di Stallo, A.L.; Battiato, S. Advanced Markov-Based Machine Learning Framework for Making Adaptive Trading System. Computation 2019, 7, 4. [Google Scholar] [CrossRef]

- Shah, D.; Isah, H.; Zulkernine, F. Stock Market Analysis: A Review and Taxonomy of Prediction Techniques. Int. J. Financial Stud. 2019, 7, 26. [Google Scholar] [CrossRef]

- Khorsheed, M.S. Saudi Arabia: From Oil Kingdom to Knowledge-Based Economy. Middle East Policy 2015, 22, 147–157. [Google Scholar] [CrossRef]

- Al Rahahleh, N.; Kao, R. Forecasting Volatility: Evidence from the Saudi Stock Market. J. Risk Financial Manag. 2018, 11, 84. [Google Scholar] [CrossRef]

- Kumar, A. A Statistical Analysis of the Stochastic Drift between MICEX and TASI-an in-Depth Study. Asian J. Manag. 2018, 9, 413. [Google Scholar] [CrossRef]

- Jarrah, M.; Salim, N. A Recurrent Neural Network and a Discrete Wavelet Transform to Predict the Saudi Stock Price Trends. Int. J. Adv. Comput. Sci. Appl. 2019, 10, 155–162. [Google Scholar] [CrossRef]

- Alsufyani, M.; Sarmidi, T. The Inter-Relationship Between Commodity Energy Prices and Stock Market Volatility in Saudi-Arabia. J. Nusant. Stud. (JONUS) 2020, 5, 270–293. [Google Scholar] [CrossRef]

- Ferreira, P.; Loures, L. An Econophysics Study of the S&P Global Clean Energy Index. Sustainability 2020, 12, 662. [Google Scholar]

- Bai, Y.; Guo, A. An Empirical Investigation to the “Skew” Phenomenon in Stock Index Markets: Evidence from the Nikkei 225 and Others. Sustainability 2019, 11, 7219. [Google Scholar] [CrossRef]

- Goode, S.W.; Annin, S.A. Differential Equations and Linear Algebra; Pearson Higher Ed.: London, UK, 2007. [Google Scholar]

- Sterling, M.J. Algebra I Workbook For Dummies; John Wiley & Sons: Hoboken, NJ, USA, 2017. [Google Scholar]

- Stroud, A.H. Numerical Quadrature and Solution of Ordinary Differential Equations: A Textbook for A Beginning Course in Numerical Analysis; Springer Science & Business Media: New York, NY, USA, 1974; Volume 10. [Google Scholar]

- Croucher, J. Mathematics Toolbox 300589: Introductory Mathematics and Statistics for Business; McGraw Hill: New York, NY, USA, 2009. [Google Scholar]

- Dempsey, R. Determining the Alignment of Math 105-Intermediate Algebra at the University of Wisconsin--Milwaukee to the Goals of the Common Core State Standards. Master’s Thesis, University of Wisconsin, Madison, WI, USA, 2013. [Google Scholar]

- Arifin, A.S.; Habibie, M.I. The prediction of mobile data traffic based on the ARIMA model and disruptive formula in industry 4.0: A case study in Jakarta, Indonesia. Telkomnika 2020, 18, 907–918. [Google Scholar] [CrossRef]

- Kim, S.; Heo, J.-M. Time series regression-based pairs trading in the Korean equities market. J. Exp. Theor. Artif. Intell. 2017, 29, 755–768. [Google Scholar] [CrossRef]

- Somboonsak, P. Development Innovation to Predict Dengue Affected Area and Alert People with Smartphones. Int. J. Online Biomed. Eng. (iJOE) 2020, 16, 62–79. [Google Scholar] [CrossRef]

- Jiang, X.-Q.; Zhang, L.-C. Stock price fluctuation prediction method based on time series analysis. Discret. Contin. Dyn. Syst.-S 2019, 12, 915–927. [Google Scholar] [CrossRef]

- Abu Bakar, S.R.N. Autoregressive Integrated Moving Average (ARIMA) Model for Forecasting Cryptocurrency Exchange Rate in High Volatility Environment: A New Insight of Bitcoin Transaction. Int. J. Adv. Eng. Res. Sci. 2017, 4, 130–137. [Google Scholar] [CrossRef]

| Index | Acronym | Stock Market Exchange | Country |

|---|---|---|---|

| CAC40 | Cotation Assistée en Continu | Euronext Paris Exchange | France |

| DAX | Deutscher Aktienindex | Frankfurt Stock Exchange | Germany |

| NASDAQ | National Association of Securities Dealers Automated Quotations | New York Stock Exchange | USA |

| SP 500 | Standard & Poor’s 500 Index | Chicago Mercantile Exchange | USA |

| NIKKEI 225 | Nihon Keizai Shimbun | Tokyo Stock Exchange | Japan |

| HSI | Hang Seng Index | Hong Kong Stock Exchange | Hong Kong |

| TASI | Tadawul All Share Index | Tadawul | Saudi Arabia |

| Minimum | Maximum | Mean | Std. Deviation | |

|---|---|---|---|---|

| Day | 1.00 | 31.00 | 16.08 | 8.54 |

| Month | 1.00 | 12.00 | 6.46 | 3.39 |

| Year | 2008.00 | 2019.00 | 2013.89 | 3.37 |

| NASDAQ | 1321.01 | 8705.18 | 4500.91 | 1971.25 |

| SP500 | 696.33 | 3153.63 | 1887.41 | 622.38 |

| NIKKEI | 7054.98 | 24,270.62 | 15,559.14 | 4868.32 |

| CAC40 | 2554.55 | 5929.79 | 4401.88 | 760.67 |

| DAX | 3690.72 | 13,559.60 | 9226.40 | 2605.94 |

| HSI | 11,015.84 | 32,966.89 | 23,365.03 | 3697.91 |

| TASI | 4130.15 | 11,597.01 | 7523.90 | 1341.63 |

| Day | Month | Year | NASDAQ | SP500 | NIKKEI | CAC40 | DAX | HSI | TASI | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Day | Coeff. | 1 | −0.023 | 0.012 | 0.016 | 0.014 | 0.005 | 0.005 | 0.007 | 0.003 | −0.001 |

| Sig. (2-tailed) | 0.344 | 0.628 | 0.516 | 0.545 | 0.833 | 0.840 | 0.778 | 0.895 | 0.958 | ||

| Month | Coeff. | −0.023 | 1 | −0.015 | 0.053 * | 0.044 | 0.032 | −0.021 | 0.017 | −0.031 | −0.094 ** |

| Sig. (2-tailed) | 0.344 | 0.529 | 0.027 | 0.067 | 0.181 | 0.369 | 0.466 | 0.197 | 0.000 | ||

| Year | Coeff. | 0.012 | −0.015 | 1 | 0.962 ** | 0.961 ** | 0.888 ** | 0.769 ** | 0.934 ** | 0.702 ** | 0.260 ** |

| Sig. (2-tailed) | 0.628 | 0.529 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| NASDAQ | Coeff. | 0.016 | 0.053 * | 0.962 ** | 1 | 0.994 ** | 0.940 ** | 0.871 ** | 0.943 ** | 0.801 ** | 0.342 ** |

| Sig. (2-tailed) | 0.516 | 0.027 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| SP500 | Coeff. | 0.014 | 0.044 | 0.961 ** | 0.994 ** | 1 | 0.954 ** | 0.892 ** | 0.961 ** | 0.808 ** | 0.402 ** |

| Sig. (2-tailed) | 0.545 | 0.067 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| NIKKEI | Coeff. | 0.005 | 0.032 | 0.888 ** | 0.940 ** | 0.954 ** | 1 | 0.935 ** | 0.957 ** | 0.801 ** | 0.436 ** |

| Sig. (2-tailed) | 0.833 | 0.181 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| CAC40 | Coeff. | 0.005 | −0.021 | 0.769 ** | 0.871 ** | 0.892 ** | 0.935 ** | 1 | 0.906 ** | 0.856 ** | 0.515 ** |

| Sig. (2-tailed) | 0.840 | 0.369 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| DAX | Coeff. | 0.007 | 0.017 | 0.934 ** | 0.943 ** | 0.961 ** | 0.957 ** | 0.906 ** | 1 | 0.808 ** | 0.408 ** |

| Sig. (2-tailed) | 0.778 | 0.466 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| HSI | Coeff | 0.003 | −0.031 | 0.702 ** | 0.801 ** | 0.808 ** | 0.801 ** | 0.856 ** | 0.808 ** | 1 | 0.525 ** |

| Sig. (2-tailed) | 0.895 | 0.197 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| TASI | Coeff | −0.001 | −0.094 ** | 0.260 ** | 0.342 ** | 0.402 ** | 0.436 ** | 0.515 ** | 0.408 ** | 0.525 ** | 1 |

| Sig. (2-tailed) | 0.958 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Equation | Model Summary | Parameter Estimates | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| R2 | Err. | F | df1 | df2 | Sig. | b1 | b2 | b3 | ||

| NASAQ | Linear | 0.86 | 2888 | 10,491 | 1 | 1746 | 0.000 | 1.440 | ||

| Logarithmic | 0.97 | 1233 | 65,345 | 1 | 1746 | 0.000 | 906.404 | |||

| Quadratic | 0.96 | 1442 | 23,664 | 2 | 1745 | 0.000 | 3.198 | 0.000 | ||

| Cubic | 0.98 | 1141 | 25,534 | 3 | 1744 | 0.000 | 4.861 | −0.001 | 5.938 × 10−8 | |

| Power | 1.00 | 0 | 680,741 | 1 | 1746 | 0.000 | 1.070 | |||

| Exponential | 0.84 | 4 | 9481 | 1 | 1746 | 0.000 | 0.002 | |||

| SP500 | Linear | 0.92 | 2215 | 19,048 | 1 | 1746 | 0.000 | 3.681 | ||

| Logarithmic | 0.97 | 1220 | 66,830 | 1 | 1746 | 0.000 | 1006.990 | |||

| Quadratic | 0.98 | 1164 | 36,795 | 2 | 1745 | 0.000 | 7.549 | −0.002 | ||

| Cubic | 0.98 | 1122 | 26,455 | 3 | 1744 | 0.000 | 9.571 | −0.004 | 4.845 × 10−7 | |

| Power | 1.00 | 0 | 1,050,867 | 1 | 1746 | 0.000 | 1.188 | |||

| Exponential | 0.91 | 3 | 17,014 | 1 | 1746 | 0.000 | 0.004 | |||

| NIKKEI | Linear | 0.93 | 2076 | 21,935 | 1 | 1746 | 0.000 | 0.451 | ||

| Logarithmic | 0.97 | 1236 | 65,063 | 1 | 1746 | 0.000 | 785.258 | |||

| Quadratic | 0.98 | 1104 | 40,980 | 2 | 1745 | 0.000 | 0.932 | −2.627 × 10−5 | ||

| Cubic | 0.98 | 1102 | 27,442 | 3 | 1744 | 0.000 | 1.003 | −3.542 × 10−5 | 2.760 × 10−10 | |

| Power | 1.00 | 0 | 1,937,714 | 1 | 1746 | 0.000 | 0.927 | |||

| Exponential | 0.92 | 3 | 19,017 | 1 | 1746 | 0.000 | 0.001 | |||

| CAC40 | Linear | 0.97 | 1298 | 58,854 | 1 | 1746 | 0.000 | 1.686 | ||

| Logarithmic | 0.97 | 1262 | 62,295 | 1 | 1746 | 0.000 | 899.907 | |||

| Quadratic | 0.98 | 1121 | 39736 | 2 | 1745 | 0.000 | 2.649 | 0.000 | ||

| Cubic | 0.98 | 1097 | 27,690 | 3 | 1744 | 0.000 | 0.762 | 0.001 | −9.648 × 10−8 | |

| Power | 1.00 | 0 | 4,713,935 | 1 | 1746 | 0.000 | 1.064 | |||

| Exponential | 0.97 | 1 | 66,270 | 1 | 1746 | 0.000 | 0.002 | |||

| DAX | Linear | 0.94 | 1950 | 25,084 | 1 | 1746 | 0.000 | 0.771 | ||

| Logarithmic | 0.97 | 1246 | 64,022 | 1 | 1746 | 0.000 | 829.492 | |||

| Quadratic | 0.98 | 1118 | 39,961 | 2 | 1745 | 0.000 | 1.577 | −7.64 × 10−5 | ||

| Cubic | 0.98 | 1117 | 26,656 | 3 | 1744 | 0.000 | 1.508 | −6.10 × 10−5 | −8.01 × 10−10 | |

| Power | 1.00 | 0 | 2,013,683 | 1 | 1746 | 0.000 | 0.98 | |||

| Exponential | 0.93 | 2 | 23,387 | 1 | 1746 | 0.000 | 0.001 | |||

| HSI | Linear | 0.97 | 1238 | 64,797 | 1 | 1746 | 0.000 | 0.319 | ||

| Logarithmic | 0.97 | 1277 | 60,859 | 1 | 1746 | 0.000 | 749.991 | |||

| Quadratic | 0.98 | 1108 | 40,690 | 2 | 1745 | 0.000 | 0.479 | −6.552 × 10−6 | ||

| Cubic | 0.98 | 1075 | 28,850 | 3 | 1744 | 0.000 | 0.098 | 2.513 × 10−5 | −6.451 × 10−10 | |

| Power | 1.00 | 0 | 6,358,601 | 1 | 1746 | 0.000 | 0.887 | |||

| Exponential | 0.98 | 1 | 80,323 | 1 | 1746 | 0.000 | 0.000 | |||

| Time | Linear | 0.76 | 3718 | 5637 | 1 | 1746 | 0.000 | 6.618 | ||

| Logarithmic | 0.95 | 1680 | 34,424 | 1 | 1746 | 0.000 | 1139.390 | |||

| Quadratic | 0.88 | 2612 | 6608 | 2 | 1745 | 0.000 | 16.773 | −0.008 | ||

| Cubic | 0.92 | 2180 | 6576 | 3 | 1744 | 0.000 | 29.835 | −0.033 | 1.069 × 10−5 | |

| Power | 0.98 | 1 | 76,075 | 1 | 1746 | 0.000 | 1.347 | |||

| Exponential | 0.75 | 4 | 5377 | 1 | 1746 | 0.000 | 0.008 | |||

| Model | Number Predictors | Model Fit Statistics | Ljung–Box Q(18) | ||||

|---|---|---|---|---|---|---|---|

| Stationary R2 | R2 | RMSE | Statistics | DF | Sig. | ||

| TASI | 4 | 0.270 | 0.993 | 113.064 | 15.634 | 15 | 0.407 |

| Estimate | SE | t | Sig. | |||

|---|---|---|---|---|---|---|

| TASI | MA | Lag 4 | 0.075 | 0.024 | 3.130 | 0.002 |

| SP500 | Lag 0 | 0.366 | 0.157 | 2.329 | 0.020 | |

| NIKKEI | Lag 0 | 0.050 | 0.013 | 3.932 | 0.000 | |

| CAC40 | Lag 0 | 0.287 | 0.056 | 5.094 | 0.000 | |

| HSI | Lag 0 | 0.094 | 0.009 | 10.877 | 0.000 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Assous, H.F.; Al-Rousan, N.; AL-Najjar, D.; AL-Najjar, H. Can International Market Indices Estimate TASI’s Movements? The ARIMA Model. J. Open Innov. Technol. Mark. Complex. 2020, 6, 27. https://doi.org/10.3390/joitmc6020027

Assous HF, Al-Rousan N, AL-Najjar D, AL-Najjar H. Can International Market Indices Estimate TASI’s Movements? The ARIMA Model. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(2):27. https://doi.org/10.3390/joitmc6020027

Chicago/Turabian StyleAssous, Hamzeh F., Nadia Al-Rousan, Dania AL-Najjar, and Hazem AL-Najjar. 2020. "Can International Market Indices Estimate TASI’s Movements? The ARIMA Model" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 2: 27. https://doi.org/10.3390/joitmc6020027

APA StyleAssous, H. F., Al-Rousan, N., AL-Najjar, D., & AL-Najjar, H. (2020). Can International Market Indices Estimate TASI’s Movements? The ARIMA Model. Journal of Open Innovation: Technology, Market, and Complexity, 6(2), 27. https://doi.org/10.3390/joitmc6020027