The Transition of Samsung Electronics through Its M&A with Harman International

Abstract

:1. Introduction

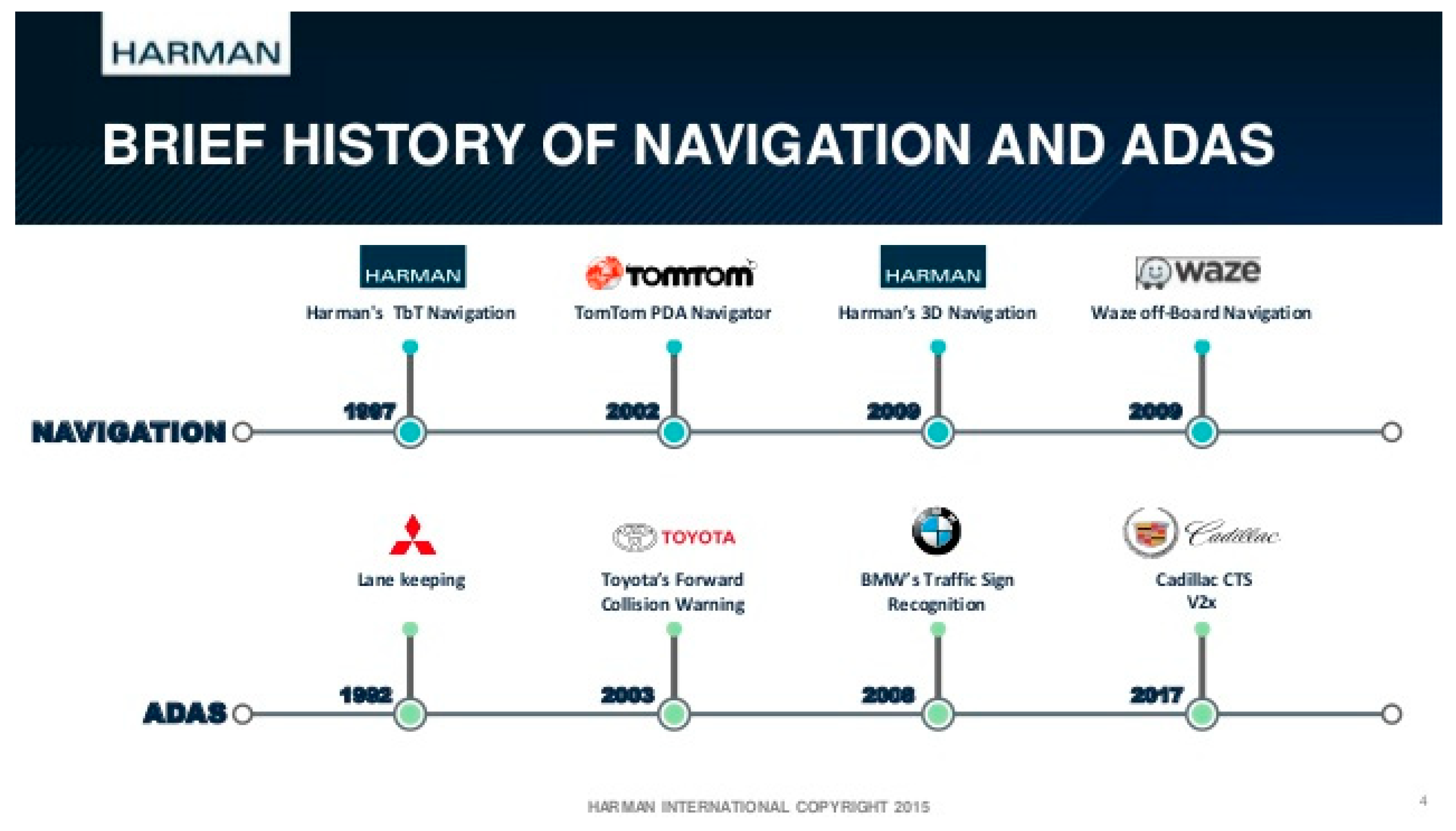

2. Changes in the Global Automobile Industry

The Era of Automotive Revolution

3. Innovation through M&As: Supply Sides Aspects

4. Innovation through M&As: The Rise of a New Contender—Samsung

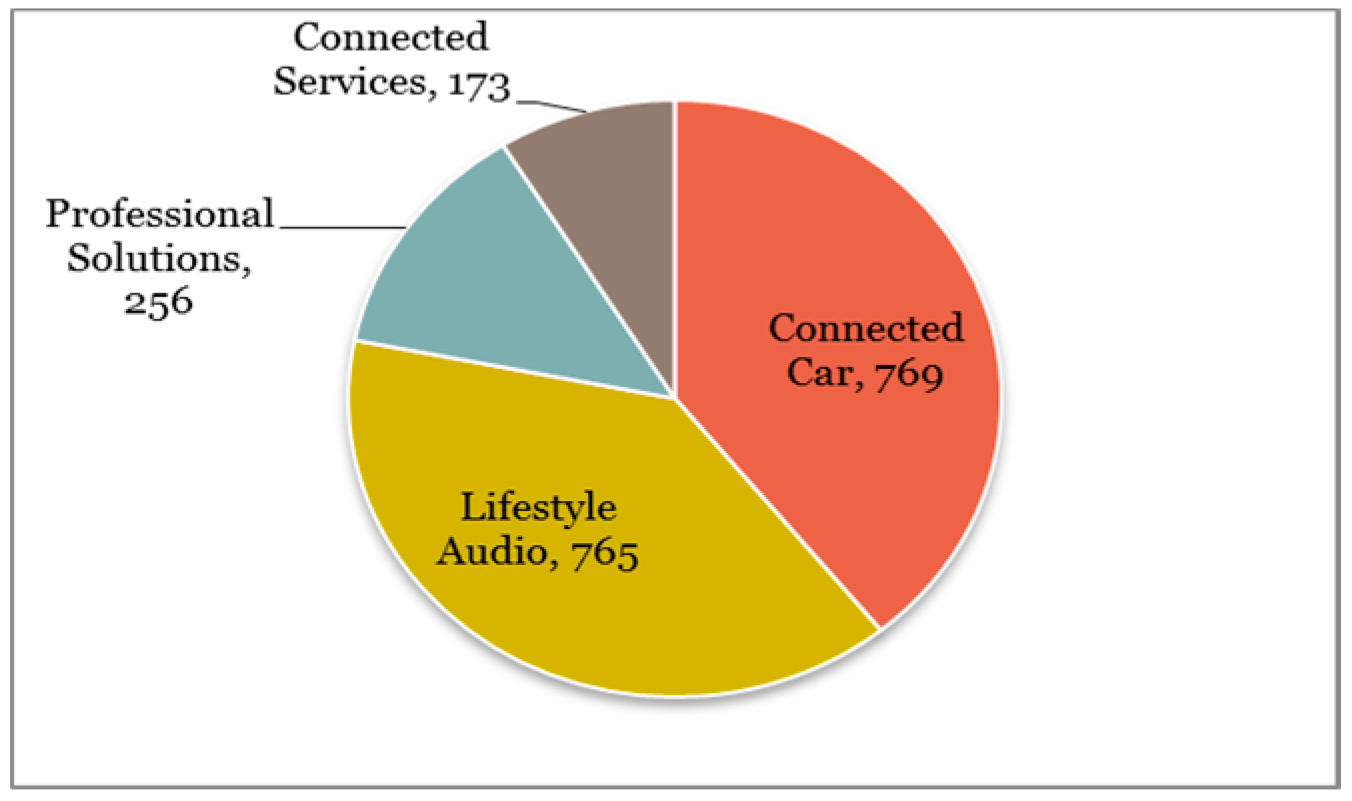

5. Harman International Incorporated

6. Samsung and the Automobile Industry

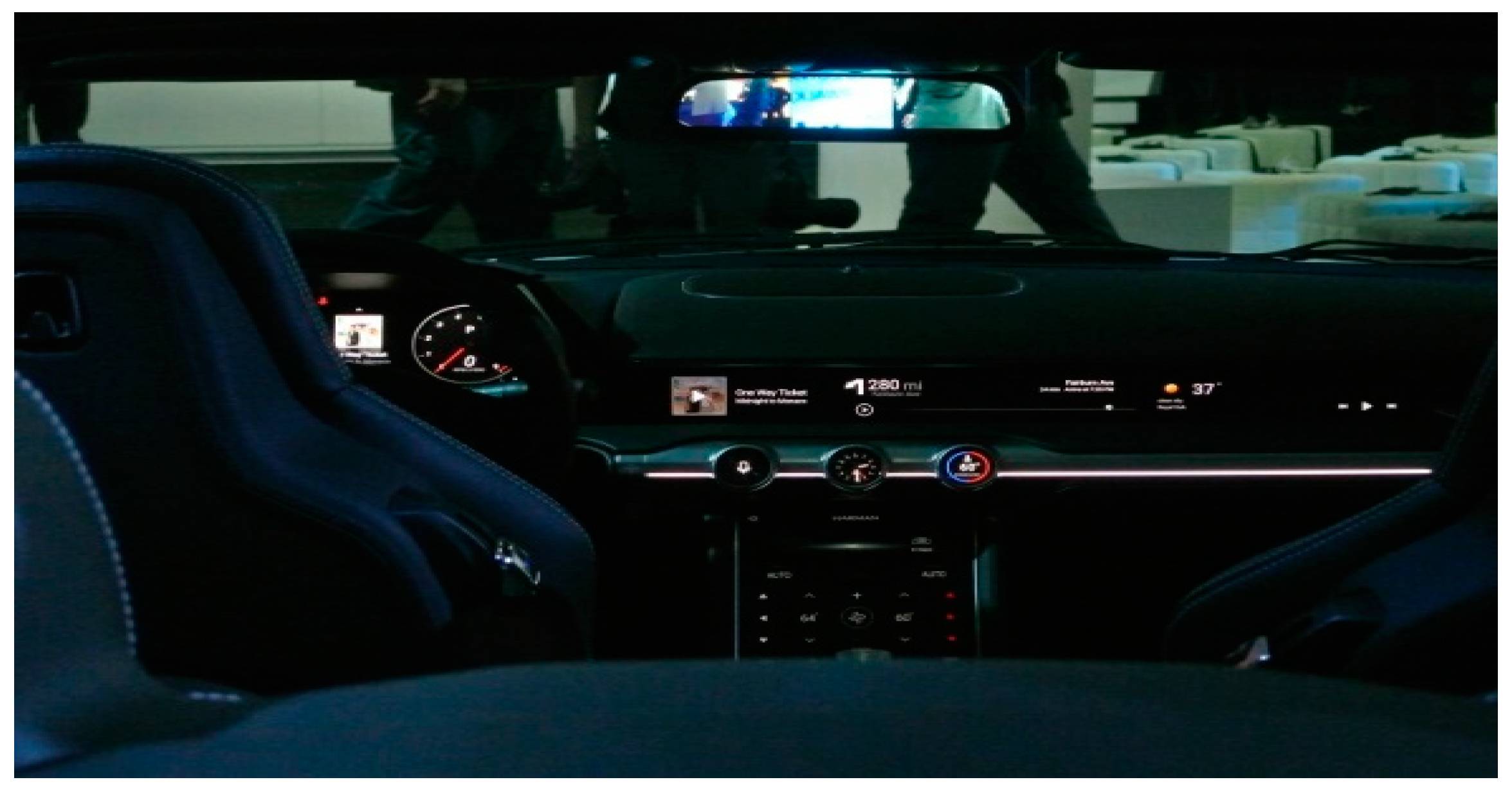

7. Samsung and Harman

Samsung’s M&A with Harman

8. The Post-Merger Integration Process

8.1. Governance Structure

8.2. Research and Development

9. Strategic Issues and the Road Ahead

Author Contributions

Funding

Conflicts of Interest

References

- Forbes. Why Samsung is Buying Harman. Available online: www.forbes.com (accessed on 13 June 2018).

- Shantanu, D.; Vinod, K. Mergers and Acquisitions (M&AS) by R&D intensive firms. J. Risk Financ. Manag. 2009, 2, 1–37. [Google Scholar]

- Akram, S.H.; Sanaz, S.; Mohammad, M. Competitive advantage and its impact on new product development strategy (Case Study: Toos Nirro Technical Firm). J. Open Innov. 2018, 4, 17. [Google Scholar]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Lu, Q.; Feng, W. Knowledge synergy and long-term value creation of M&A based on the dynamic capabilities perspective. In Proceedings of the 2010 International Conference on Management and Service Science, Wuhan, China, 24–26 August 2010; pp. 1–4. [Google Scholar]

- “Integration is Our Secret Weapon”: Samsung and HARMAN Executives Discuss the Next Chapter for Driving. Available online: www.news.harman.com (accessed on 20 October 2018).

- Cho, J. Harman Shareholders Withdraw from Class Action against Merger with Samsung. Available online: http://www.businesskorea.co.kr/news/articleView.html?idxno=18850 (accessed on 18 February 2019).

- Samsung. Harman and Samsung Unveil the Future of Connectivity and Autonomous Driving at CES 2018. Available online: www.news.samsung.com (accessed on 18 February 2019).

- Mobileye. Available online: https://mobileye.com/ (accessed on 20 February 2019).

- Argus Cyber Security, Argus Website. Available online: https://argus-sec.com/ (accessed on 20 February 2019).

- Prableen, B. What Samsung’s 10 Major Acquisitions Means for SSNLF. Available online: www.Nasdaq.com (accessed on 20 February 2019).

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Kogut, B.; Zander, U. Knowledge of the firm, combinative capabilities, and the replication of technology. Organ. Sci. 1992, 3, 383–397. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Čirjevskis, A. The role of dynamic capabilities as drivers of business model innovation in mergers and acquisitions of technology-advanced firms. J. Open Innov. Technol. Mark. Complex. 2019, 5, 12. [Google Scholar] [CrossRef]

- Jo, G.S.; Park, G.; Kang, J. Unravelling the link between technological M&A and innovation performance using the concept of relative absorptive capacity. Asian J. Technol. Innov. 2016, 24, 55–76. [Google Scholar]

- Mikalef, P.; Pateli, A. Information technology-enabled dynamic capabilities and their indirect effect on competitive performance: Findings from PLS-SEM and fsQCA. J. Bus. Res. 2017, 70, 1–16. [Google Scholar] [CrossRef]

- Tech Crunch. Samsung Laucnches $300M Autonomous Driving Fund, outs $90M into TTTech. Available online: https://www.techcrunch.com (accessed on 20 February 2019).

- HARMAN. Available online: https://www.harman.com/ (accessed on 5 March 2019).

- AMX by HARMAN. Available online: https://amx.com (accessed on 5 March 2019).

- Samsung News Room. Available online: https://news.samsung.com/global/ (accessed on 5 March 2019).

- Lee, W. Understanding Samsung’s diversification strategy: The case of Samsung Motors Inc. Long Range Plan. 2007, 40, 488–504. [Google Scholar] [CrossRef]

- Mckinsey. Mckinsey Connectivity and Autonomous Driving Consumer Survey. Available online: https://mckinsey.com (accessed on 5 March 2019).

- Ahuja, G.; Katila, R. Technological acquisitions and the innovation performance of acquiring firms: A longitudinal study. Strateg. Manag. J. 2001, 22, 197–220. [Google Scholar] [CrossRef]

- Cassiman, B.; Colombo, M.G.; Garrone, P.; Veugelers, R. The impact of M&A on the R&D process: An empirical analysis of the role of technological-and market-relatedness. Res. Policy 2005, 34, 195–220. [Google Scholar]

- Cloodt, M.; Hagedoorn, J.; Van Kranenburg, H. Mergers and acquisitions: Their effect on the innovative performance of companies in high-tech industries. Res. Policy 2006, 35, 642–654. [Google Scholar] [CrossRef]

- Haspeslagh, P.C.; Jemison, D.B. Managing Acquisitions: Creating Value Through Corporate Renewal; Free Press: New York, NY, USA, 1991; Volume 416. [Google Scholar]

- Cartwright, S.; Cooper, C.L. Mergers and Acquisitions: The Human Factor. Available online: https://econpapers.repec.org/bookchap/eeemonogr/9780750601443.htm (accessed on 5 March 2019).

- Larsson, R.; Finkelstein, S. Integrating strategic, organizational, and human resource perspectives on mergers and acquisitions: A case survey of synergy realization. Organ. Sci. 1991, 10, 1–26. [Google Scholar] [CrossRef]

- Gao, P.; Hensley, R.; Zielke, A. A Road Map to the Future for the Auto Industry. Available online: https://auto.economictimes.indiatimes.com/web/files/retail_files/reports/data_file-A-road-map-to-the-future-for-the-auto-industry-McKinsey-Quarterly-Report-1426754280.pdf (accessed on 5 March 2019).

- Adnan, F. Samsung Smartthings and Harman Team up to Advance the Internet of Things. Available online: www.sammobile.com (accessed on 20 May 2019).

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.h.; Chun, M.Y.-S.; Nhung, D.T.H.; Lee, J. The Transition of Samsung Electronics through Its M&A with Harman International. J. Open Innov. Technol. Mark. Complex. 2019, 5, 51. https://doi.org/10.3390/joitmc5030051

Kim Jh, Chun MY-S, Nhung DTH, Lee J. The Transition of Samsung Electronics through Its M&A with Harman International. Journal of Open Innovation: Technology, Market, and Complexity. 2019; 5(3):51. https://doi.org/10.3390/joitmc5030051

Chicago/Turabian StyleKim, Jung hyun, Monica Young-Shin Chun, Duong Thi Hong Nhung, and Jeonghwan Lee. 2019. "The Transition of Samsung Electronics through Its M&A with Harman International" Journal of Open Innovation: Technology, Market, and Complexity 5, no. 3: 51. https://doi.org/10.3390/joitmc5030051

APA StyleKim, J. h., Chun, M. Y.-S., Nhung, D. T. H., & Lee, J. (2019). The Transition of Samsung Electronics through Its M&A with Harman International. Journal of Open Innovation: Technology, Market, and Complexity, 5(3), 51. https://doi.org/10.3390/joitmc5030051