Degradation Cost Analysis of Li-Ion Batteries in the Capacity Market with Different Degradation Models

Abstract

1. Introduction

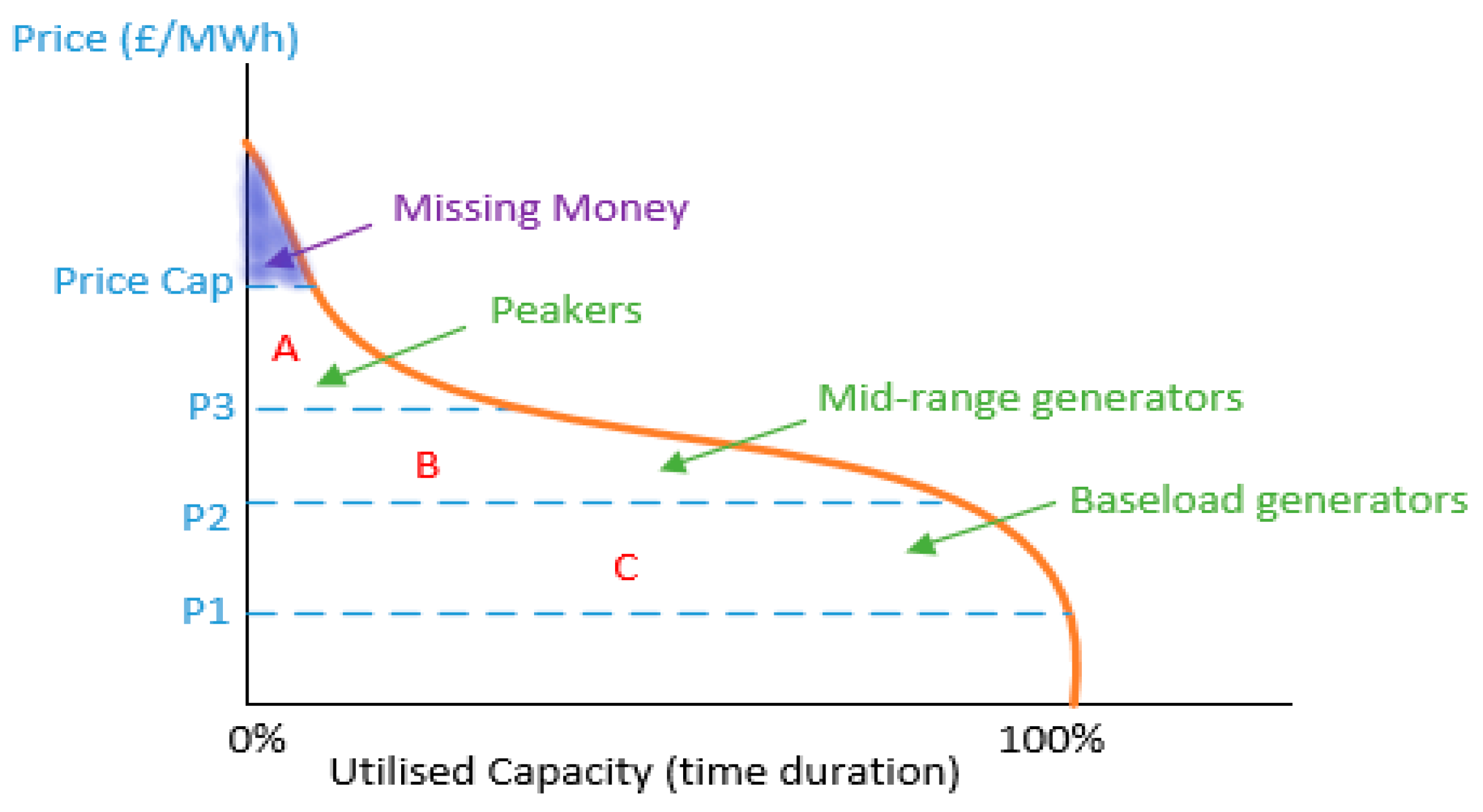

2. The Necessity for a Capacity Market

3. Methods

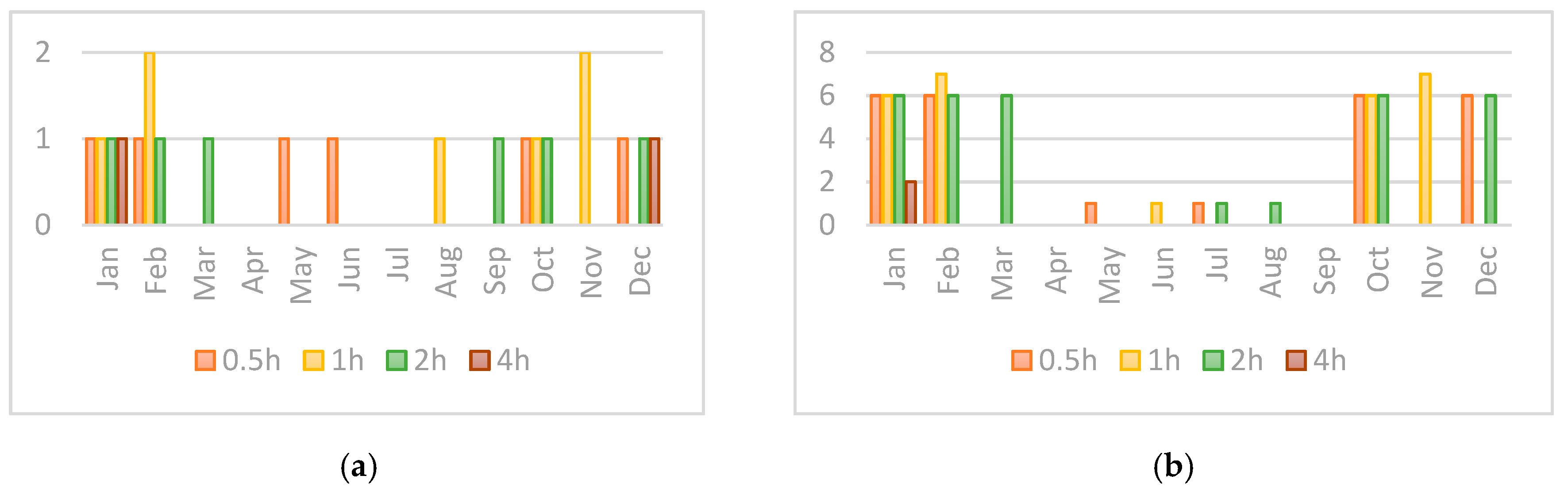

3.1. Problem Setup

- is the de-rated capacity and is the de-rating factor

- and are the CM auction clearing price and the battery degradation cost respectively

- is a factor used to reward slightly more payment in peak demand months

- is the CM overpayment as a result of battery discharging more than its obligation

- is the CM penalty

- is the battery connection capacity which is function of the battery current, voltage and the number of cells ()

- and are the undelivered and over delivered capacity of the obligation during settlement period (i)

- is the capacity lost as a result of battery degradation for model j

- is the peak electricity demand during the SSE () divided by the total CM contracted capacity through the CM auction ()

- Equation (1) calculates the total revenue for a battery in the CM including any overpayment and penalties

- Equation (2) obtain the de-rating capacity based on the battery output power in Equation (3) and the chosen de-rating strategy (i.e., 0.5 h, 1 h etc.)

- Equation (4) calculates the penalty of the battery by multiplying any undelivered capacity obligation by the CM’s auction clearing price. The amount of undelivered capacity is calculated based on the battery’s State of Charge (SoC) at the end of any SSE.

- Equation (5) calculates the overpayment similar to (4)

- Equation (6) calculates the battery capacity degradation cost by multiplying the cell degradation by the cost of degradation along with the number of cells

- Equation (7) calculates the capacity obligation that must be delivered by the battery considering the duration of the SSE(i) and peak demand in Equation (8) minus any delivered balancing services capacity

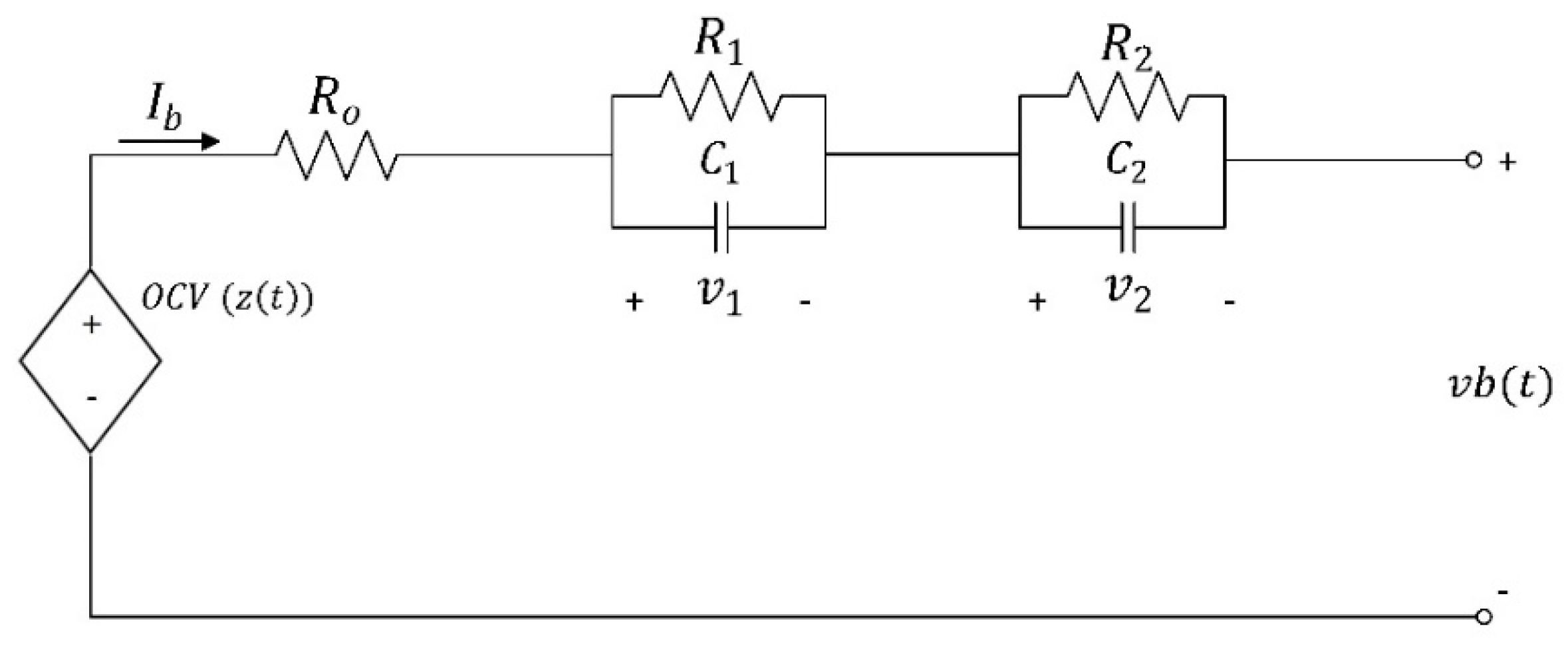

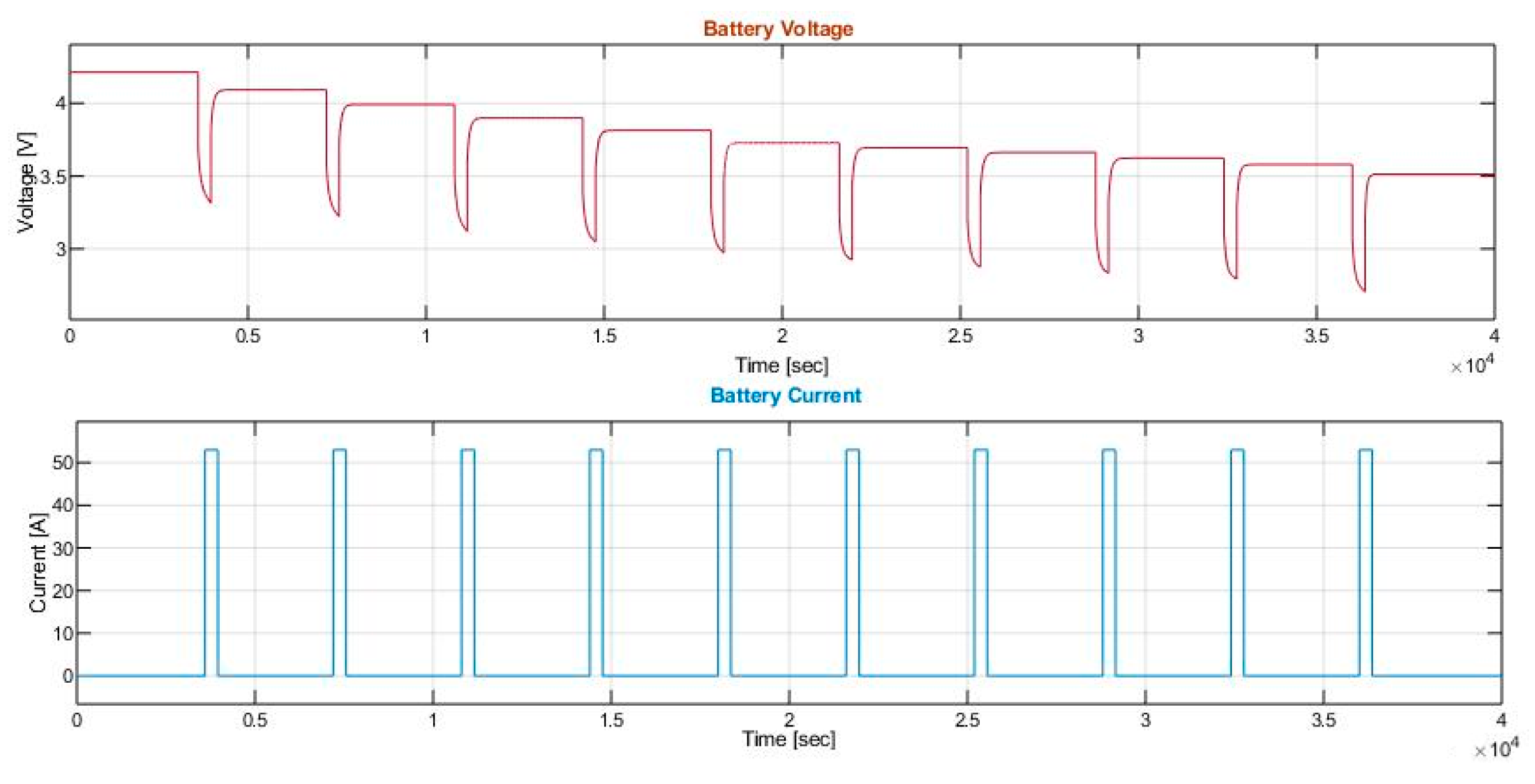

3.2. Equivalent Circuit Battery Model

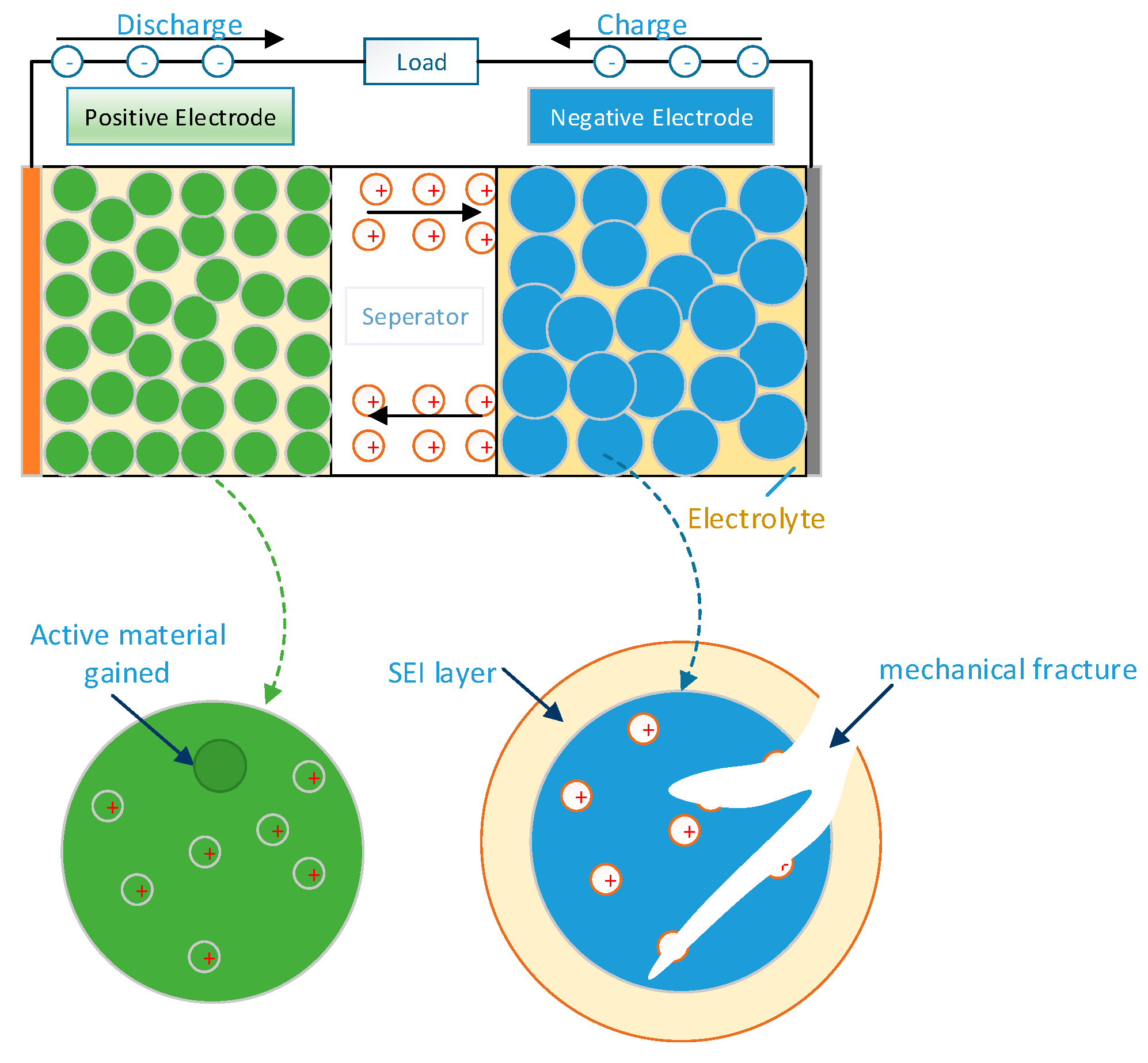

3.3. Degradation Models

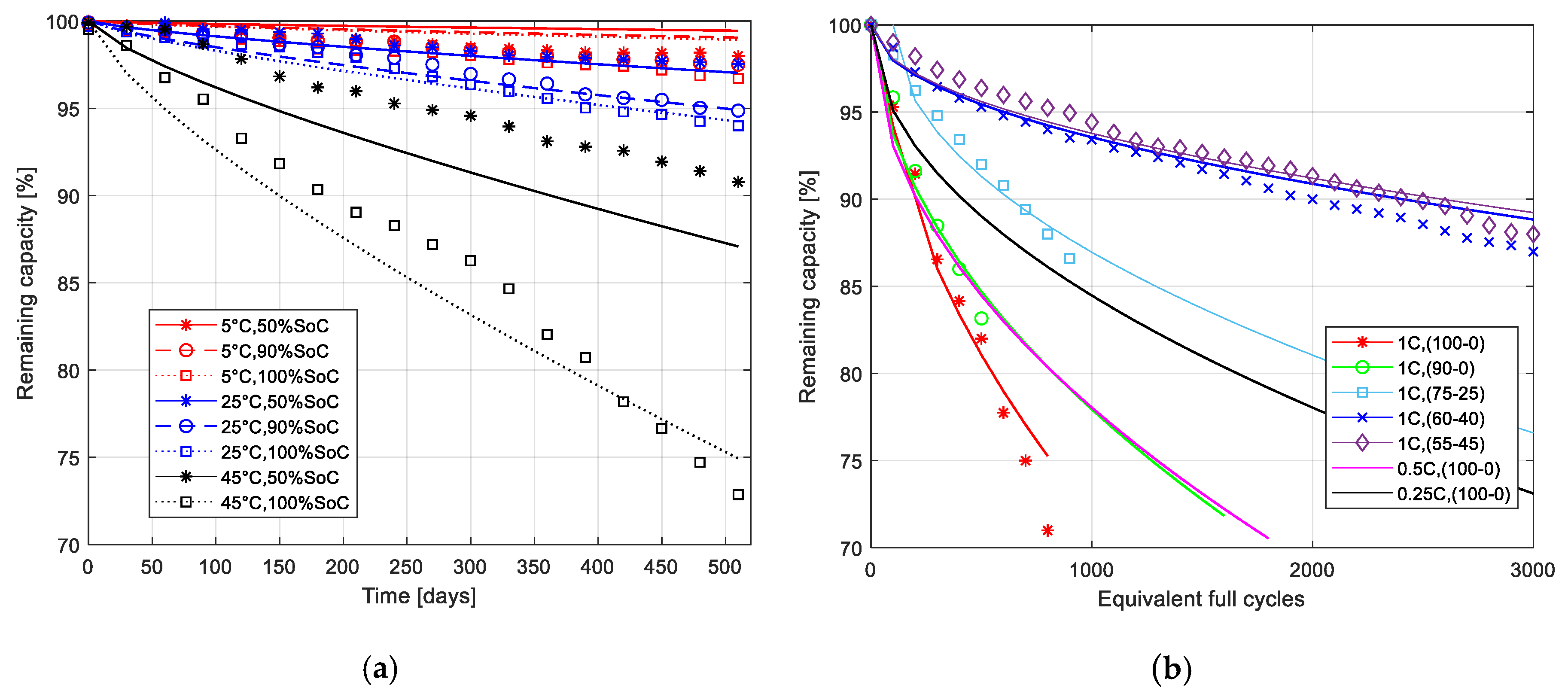

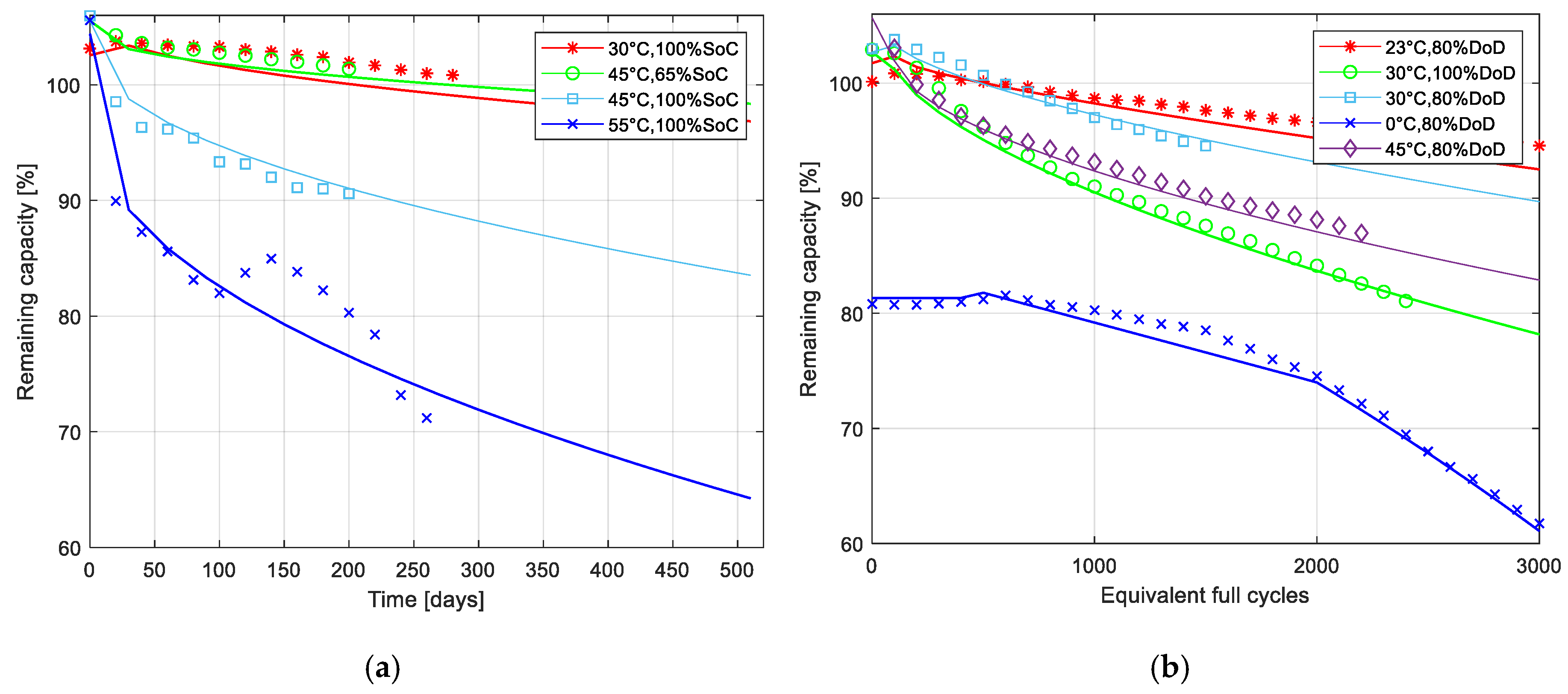

3.3.1. Empirical Model

3.3.2. Semi-Empirical Model

3.4. Degradation Cost

4. Results

4.1. Accuracy of Battery Degradation Models

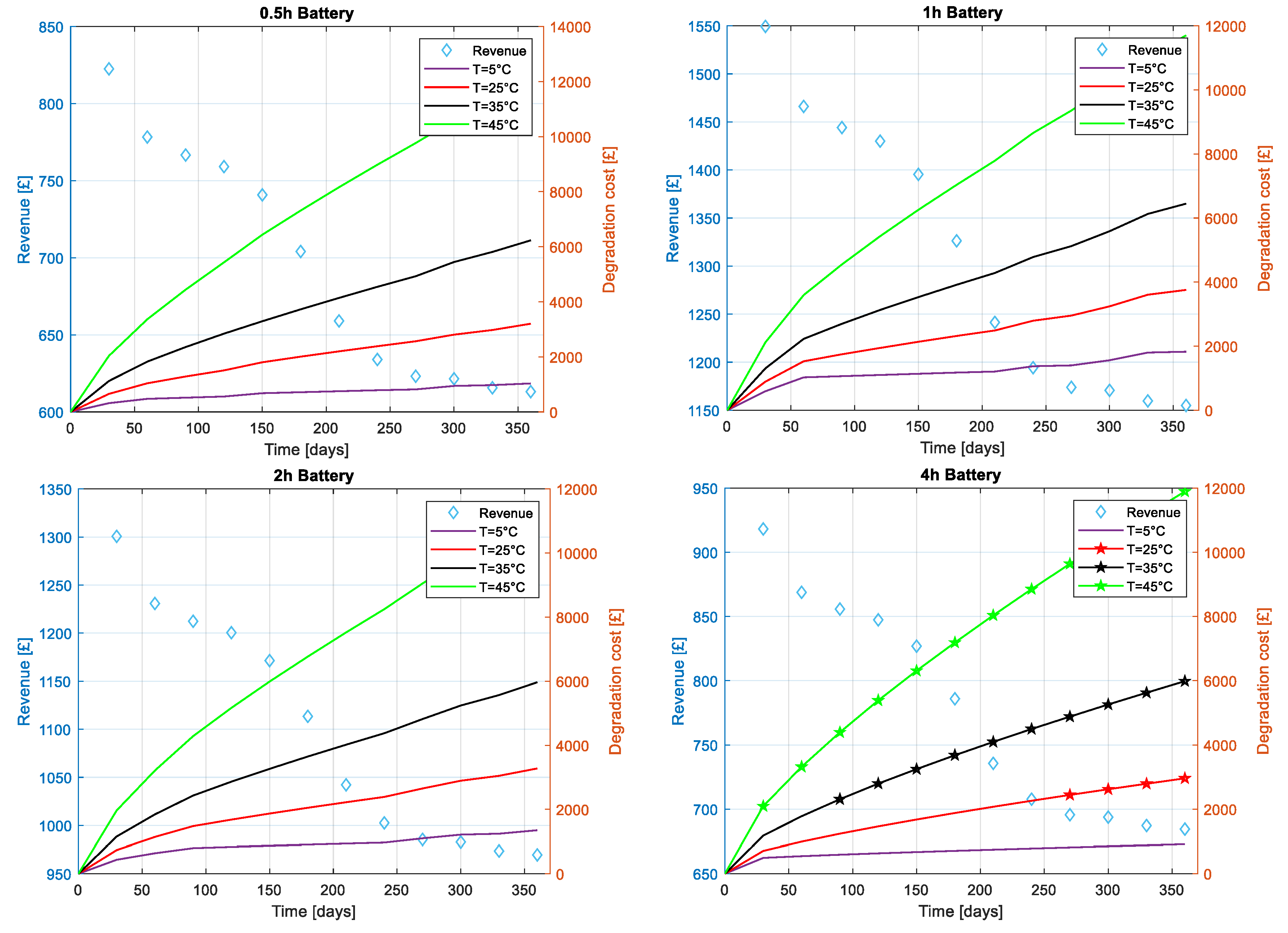

4.2. Revenue and Degradation Cost in the Capacity Market

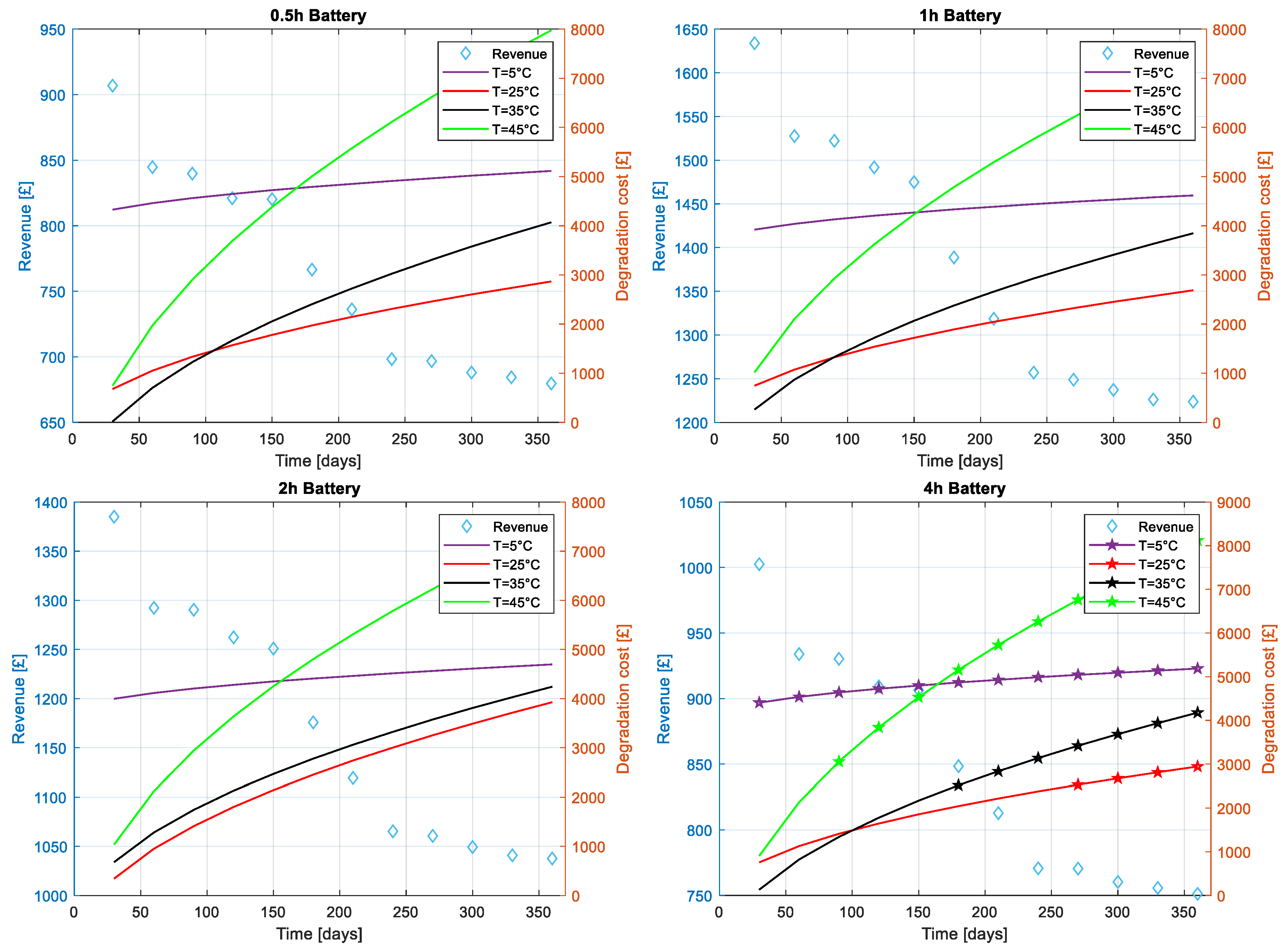

4.2.1. Revenue and Degradation Cost for Different Temperatures

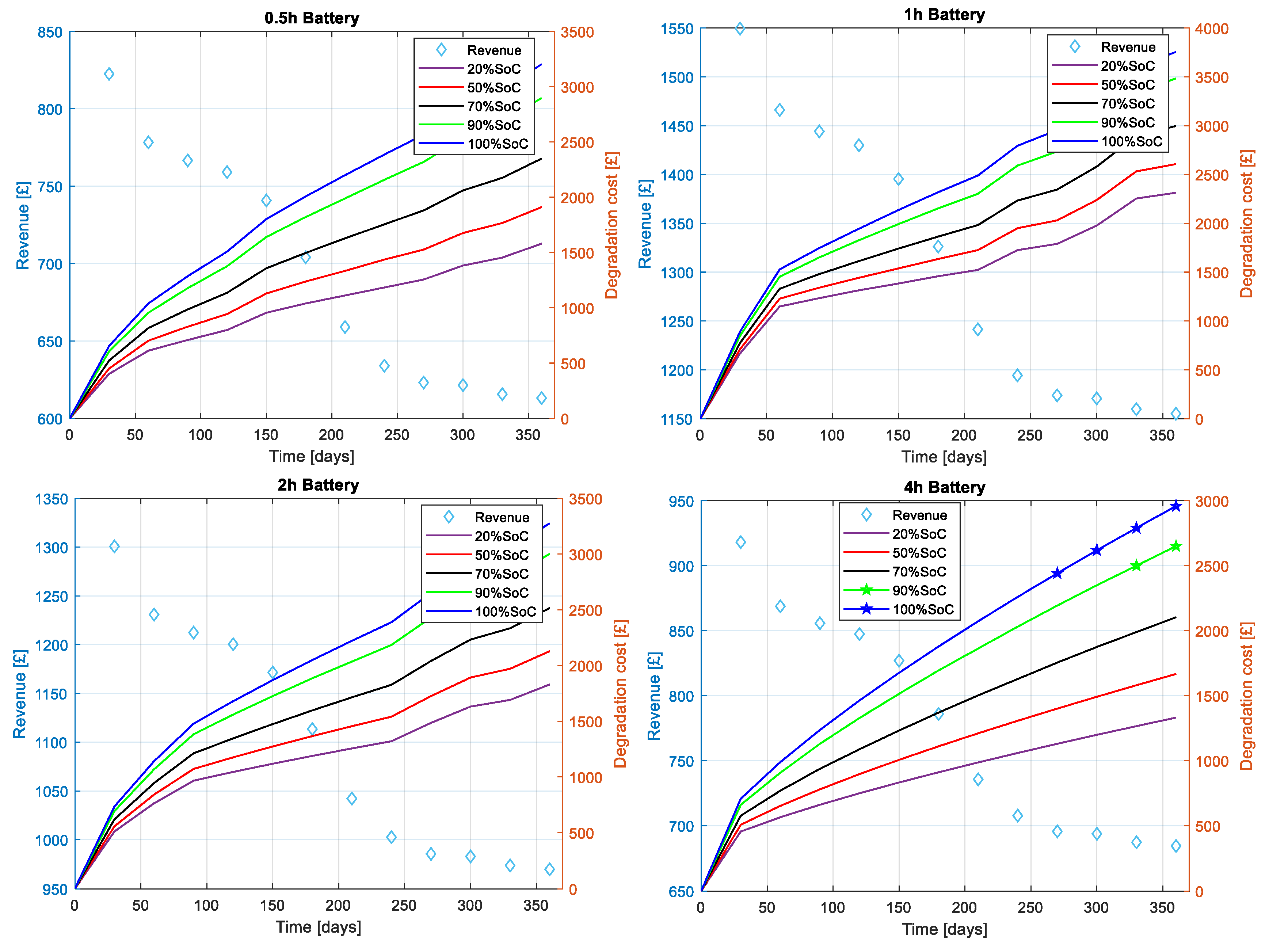

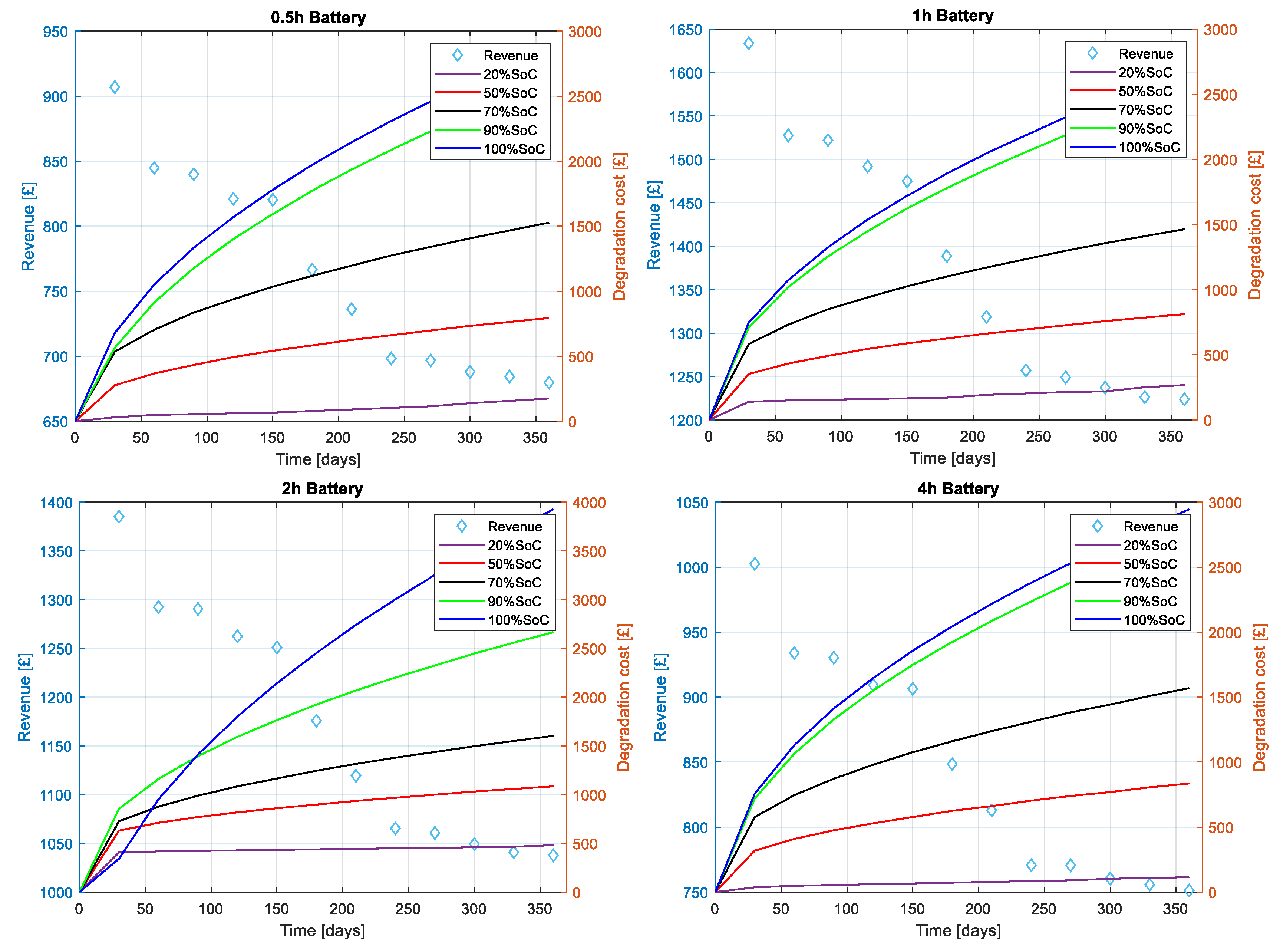

4.2.2. Revenue and Degradation Cost for Different SoCs

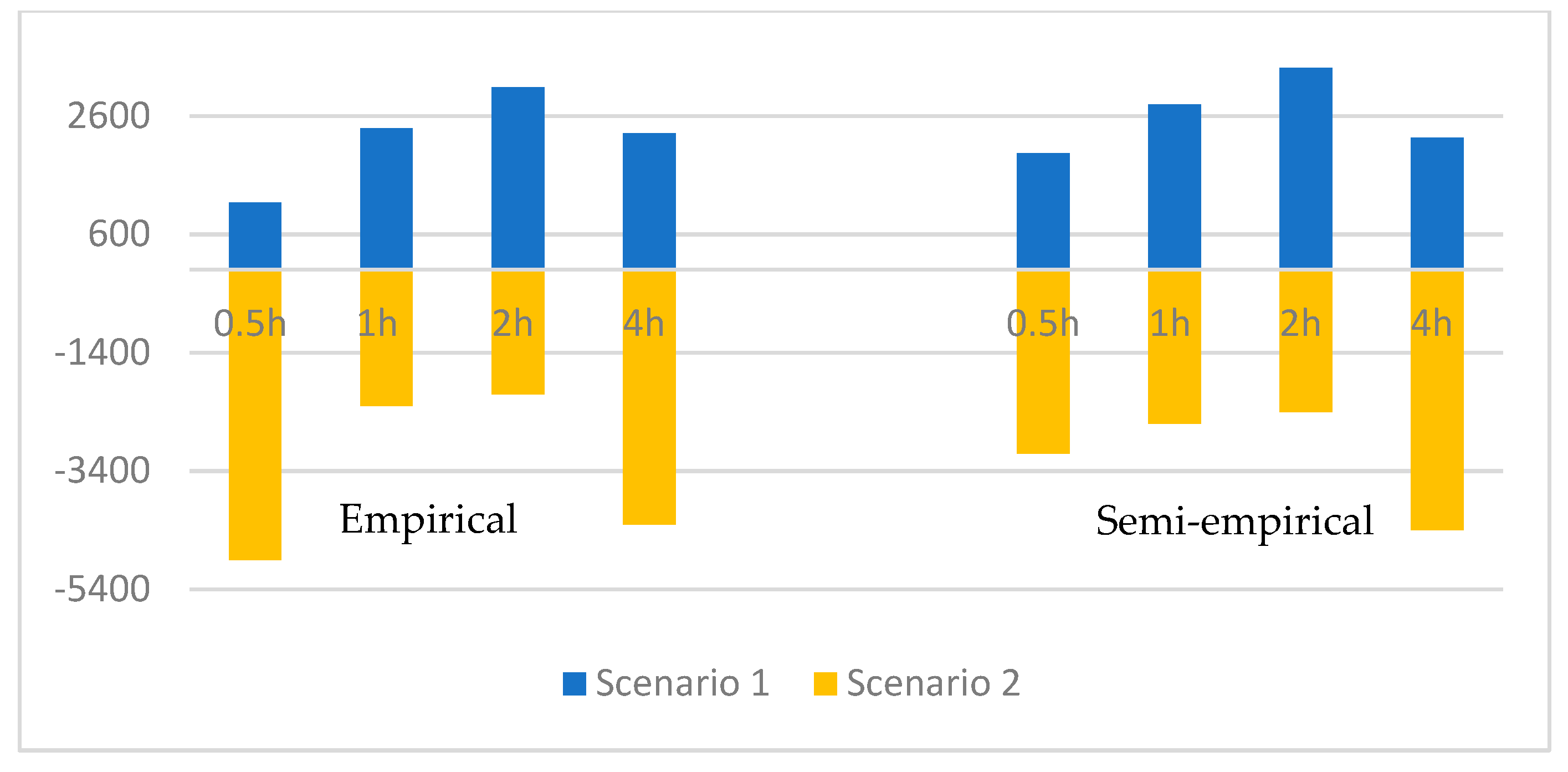

4.3. Increased Battery Cycling Effects

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

References

- IRENA. Renewable Capacity Highlights; International Renewable Energy Agency: Abu Dhabi, UAE, 2019; Available online: https://bit.ly/2IaRs78 (accessed on 10 October 2019).

- BEIS. UK Renewable Electricity Capacity and Generation; Department for Business Energy & Industrial Strategy: London, UK, 2019. Available online: https://bit.ly/31y7gXz (accessed on 2 September 2019).

- Kerdphol, T.; Watanabe, M.; Mitani, Y.; Phunpeng, V. Applying Virtual Inertia Control Topology to SMES System for Frequency Stability Improvement of Low-Inertia Microgrids Driven by High Renewables. Energies 2019, 12, 3902. [Google Scholar] [CrossRef]

- Sandelic, M.; Sangwongwanich, A.; Blaabjerg, F. Reliability Evaluation of PV Systems with Integrated Battery Energy Storage Systems: DC-Coupled and AC-Coupled Configurations. Electronics 2019, 8, 1059. [Google Scholar] [CrossRef]

- Williams, S.; Short, M.; Crosbie, T. On the use of thermal inertia in building stock to leverage decentralised demand side frequency regulation services. Appl. Therm. Eng. 2018, 133, 97–106. [Google Scholar] [CrossRef]

- Hossain, M.S.; Madlool, N.A.; Rahim, N.A.; Selvaraj, J.; Pandey, A.K.; Khan, A.F. Role of smart grid in renewable energy: An overview. Renew. Sustain. Energy Rev. 2016, 60, 1168–1184. [Google Scholar] [CrossRef]

- Yoon, M.; Lee, J.; Song, S.; Yoo, Y.; Jang, G.; Jung, S.; Hwang, S. Utilization of Energy Storage System for Frequency Regulation in Large-Scale Transmission System. Energies 2019, 12, 3898. [Google Scholar] [CrossRef]

- Chattopadhyay, D.; Alpcan, T. Capacity and Energy-Only Markets under High Renewable Penetration. IEEE Trans. Power Syst. 2016, 31, 1692–1702. [Google Scholar] [CrossRef]

- UK Government. 2010 to 2015 Government Policy: UK Energy Security; Department of Energy & Climate Change: London, UK, 2014.

- Spees, K.; Newell, S.A.; Pfeifenberger, J.P. Capacity Markets—Lessons Learned from the First Decade. Econ. Energy Environ. Policy 2013, 2, 1–26. [Google Scholar] [CrossRef]

- Federal Ministry for Economic Affairs and Energy. System Adequacy for Germany and its Neighbouring Countries: Transnational Monitoring and Assessment; Consentec: Berlin, Germany, 2015. [Google Scholar]

- Bublitz, A.; Keles, D.; Zimmermann, F.; Fraunholz, C.; Fichtner, W. A survey on electricity market design: Insights from theory and real-world implementations of capacity remuneration mechanisms. Energy Econ. 2019, 80, 1059–1078. [Google Scholar] [CrossRef]

- Mastropietro, P.; Rodilla, P.; Batlle, C. National capacity mechanisms in the European internal energy market: Opening the doors to neighbours. Energy Policy 2015, 82, 38–47. [Google Scholar] [CrossRef]

- Bhagwat, P.C.; Marcheselli, A.; Richstein, J.C.; Chappin, E.J.L.; De Vries, L.J. An analysis of a forward capacity market with long-term contracts. Energy Policy 2017, 111, 255–267. [Google Scholar] [CrossRef]

- Forrester, S.P.; Zaman, A.; Mathieu, J.L.; Johnson, J.X. Policy and market barriers to energy storage providing multiple services. Electr. J. 2017, 30, 50–56. [Google Scholar] [CrossRef]

- Ibrahim, H.; Ilinca, A.; Perron, J. Energy storage systems—Characteristics and comparisons. Renew. Sustain. Energy Rev. 2008, 12, 1221–1250. [Google Scholar] [CrossRef]

- Pandžić, H.; Wang, Y.; Qiu, T.; Dvorkin, Y.; Kirschen, D.S. Near-Optimal Method for Siting and Sizing of Distributed Storage in a Transmission Network. IEEE Trans. Power Syst. 2015, 30, 2288–2300. [Google Scholar] [CrossRef]

- Wang, L.; Liang, D.H.; Crossland, A.F.; Taylor, P.C.; Jones, D.; Wade, N.S. Coordination of Multiple Energy Storage Units in a Low-Voltage Distribution Network. IEEE Trans. Smart Grid 2015, 6, 2906–2918. [Google Scholar] [CrossRef]

- Gayme, D.; Topcu, U. Optimal power flow with large-scale storage integration. IEEE Trans. Power Syst. 2013, 28, 709–717. [Google Scholar] [CrossRef]

- Engels, J.; Claessens, B.; Deconinck, G. Techno-economic analysis and optimal control of battery storage for frequency control services, applied to the German market. Appl. Energy 2019, 242, 1036–1049. [Google Scholar] [CrossRef]

- Hesse, C.H.; Schimpe, M.; Kucevic, D.; Jossen, A. Lithium-Ion Battery Storage for the Grid—A Review of Stationary Battery Storage System Design Tailored for Applications in Modern Power Grids. Energies 2017, 10, 2107. [Google Scholar] [CrossRef]

- Goebel, C.; Hesse, H.; Schimpe, M.; Jossen, A.; Jacobsen, H. Model-Based Dispatch Strategies for Lithium-Ion Battery Energy Storage Applied to Pay-as-Bid Markets for Secondary Reserve. IEEE Trans. Power Syst. 2017, 32, 2724–2734. [Google Scholar] [CrossRef]

- Khan, A.S.M.; Verzijlbergh, R.A.; Sakinci, O.C.; De Vries, L.J. How do demand response and electrical energy storage affect (the need for) a capacity market? Appl. Energy 2018, 214, 39–62. [Google Scholar] [CrossRef]

- Staffell, I.; Rustomji, M. Maximising the value of electricity storage. J. Energy Storage 2016, 8, 212–225. [Google Scholar] [CrossRef]

- Castagneto Gissey, G.; Dodds, P.E.; Radcliffe, J. Market and regulatory barriers to electrical energy storage innovation. Renew. Sustain. Energy Rev. 2018, 82, 781–790. [Google Scholar] [CrossRef]

- Rappaport, R.D.; Miles, J. Cloud energy storage for grid scale applications in the UK. Energy Policy 2017, 109, 609–622. [Google Scholar] [CrossRef]

- Perez, A.; Moreno, R.; Moreira, R.; Orchard, M.; Strbac, G. Effect of Battery Degradation on Multi-Service Portfolios of Energy Storage. IEEE Trans. Sustain. Energy 2016, 7, 1718–1729. [Google Scholar] [CrossRef]

- Reniers, J.M.; Mulder, G.; Ober-Blöbaum, S.; Howey, D.A. Improving optimal control of grid-connected lithium-ion batteries through more accurate battery and degradation modelling. J. Power Sources 2018, 379, 91–102. [Google Scholar] [CrossRef]

- Xu, B.; Oudalov, A.; Ulbig, A.; Andersson, G.; Kirschen, D.S. Modeling of Lithium-Ion Battery Degradation for Cell Life Assessment. IEEE Trans. Smart Grid 2018, 9, 1131–1140. [Google Scholar] [CrossRef]

- National Grid. Duration-Limited Storage De-Rating Factor Assessment—Final Report; National Grid: London, UK, 2017. Available online: https://bit.ly/2pFRw7K (accessed on 3 February 2019).

- Koller, M.; Borsche, T.; Ulbig, A.; Andersson, G. Defining a degradation cost function for optimal control of a battery energy storage system. In Proceedings of the 2013 IEEE Grenoble Conference, Grenoble, France, 16–20 June 2013; pp. 1–6. [Google Scholar]

- Wang, J.; Liu, P.; Hicks-Garner, J.; Sherman, E.; Soukiazian, S.; Verbrugge, M.; Tataria, H.; Musser, J.; Finamore, P. Cycle-life model for graphite-LiFePO4 cells. J. Power Sources 2011, 196, 3942–3948. [Google Scholar] [CrossRef]

- Thompson, A.W. Economic implications of lithium ion battery degradation for Vehicle-to-Grid (V2X) services. J. Power Sources 2018, 396, 691–709. [Google Scholar] [CrossRef]

- Purewal, J.; Wang, J.; Graetz, J.; Soukiazian, S.; Tataria, H.; Verbrugge, M.W. Degradation of lithium ion batteries employing graphite negatives and nickel-cobalt-manganese oxide + spinel manganese oxide positives: Part 2, chemical-mechanical degradation model. J. Power Sources 2014, 272, 1154–1161. [Google Scholar] [CrossRef]

- Smith, K.; Earleywine, M.; Wood, E.; Neubauer, J.; Pesaran, A. Comparison of Plug-In Hybrid Electric Vehicle Battery Life across Geographies and Drive Cycles; SAE International: Warrendale, PA, USA, 2012. [Google Scholar]

- Vetter, J.; Novák, P.; Wagner, M.R.; Veit, C.; Möller, K.C.; Besenhard, J.O.; Winter, M.; Wohlfahrt-Mehrens, M.; Vogler, C.; Hammouche, A. Ageing mechanisms in lithium-ion batteries. J. Power Sources 2005, 147, 269–281. [Google Scholar] [CrossRef]

- Sankarasubramanian, S.; Krishnamurthy, B. A capacity fade model for lithium-ion batteries including diffusion and kinetics. Electrochim. Acta 2012, 70, 248–254. [Google Scholar] [CrossRef]

- Safari, M.; Morcrette, M.; Teyssot, A.; Delacourt, C. Multimodal Physics-Based Aging Model for Life Prediction of Li-Ion Batteries. J. Electrochem. Soc. 2009, 156, A145–A153. [Google Scholar] [CrossRef]

- Ploehn, H.J.; Ramadass, P.; White, R.E. Solvent Diffusion Model for Aging of Lithium-Ion Battery Cells. J. Electrochem. Soc. 2004, 151, A456–A462. [Google Scholar] [CrossRef]

- Reniers, J.M.; Mulder, G.; Howey, D.A. Review and Performance Comparison of Mechanical-Chemical Degradation Models for Lithium-Ion Batteries. J. Electrochem. Soc. 2019, 166, A3189–A3200. [Google Scholar] [CrossRef]

- Chao, H.; Lawrence, D.J. How capacity markets address resource adequacy. In Proceedings of the 2009 IEEE Power & Energy Society General Meeting, Calgary, AB, Canada, 26–30 July 2009; pp. 1–4. [Google Scholar]

- Hogan, M. Follow the missing money: Ensuring reliability at least cost to consumers in the transition to a low-carbon power system. Electr. J. 2017, 30, 55–61. [Google Scholar] [CrossRef]

- Hogan, W.W. Electricity Scarcity Pricing Through Operating Reserves. Econ. Energy Environ. Policy 2013, 2, 65–86. Available online: https://ideas.repec.org/a/aen/eeepjl/2_2_a04.html (accessed on 1 September 2019).

- Cramton, P.; Ockenfels, A.; Stoft, S. Capacity Market Fundamentals. Econ. Energy Environ. Policy 2013, 2, 27–46. [Google Scholar] [CrossRef]

- Billimoria, F.; Poudineh, R. Market design for resource adequacy: A reliability insurance overlay on energy-only electricity markets. Util. Policy 2019, 60, 100935. [Google Scholar] [CrossRef]

- Peter Cramton, S.S. The Convergence of Market Designs for Adequate Generating Capacity with Special Attention to the CAISO’s Resource Adequacy Problem; University of Maryland: College Park, MD, USA, 2006; Available online: https://drum.lib.umd.edu/handle/1903/7056 (accessed on 13 September 2019).

- Hogan, W.W. Virtual bidding and electricity market design. Electr. J. 2016, 29, 33–47. [Google Scholar] [CrossRef]

- THEMA Consulting Group. Capacity Adequacy in the Nordic Electricity Market; Norden: Oslo, Norway, 2015; Available online: https://www.nordicenergy.org/wp-content/uploads/2015/08/capacity_adequacy_THEMA_2015-1.pdf (accessed on 12 August 2019).

- Bhagwat, P.C.; Iychettira, K.K.; Richstein, J.C.; Chappin, E.J.L.; De Vries, L.J. The effectiveness of capacity markets in the presence of a high portfolio share of renewable energy sources. Util. Policy 2017, 48, 76–91. [Google Scholar] [CrossRef]

- BEIS. Supply and Consumption of Electricity; UK Government: London, UK, 2019. Available online: https://www.gov.uk/government/statistics/electricity-section-5-energy-trends (accessed on 3 October 2019).

- National Grid. Capacity Market Registers. 2019. Available online: https://www.emrdeliverybody.com/CM/Registers.aspx (accessed on 6 June 2019).

- Ma, Z.; Zou, S.; Liu, X. A Distributed Charging Coordination for Large-Scale Plug-In Electric Vehicles Considering Battery Degradation Cost. IEEE Trans. Control Syst. Technol. 2015, 23, 2044–2052. [Google Scholar] [CrossRef]

- Frost, D.F.; Howey, D.A. Completely Decentralized Active Balancing Battery Management System. IEEE Trans. Power Electron. 2018, 33, 729–738. [Google Scholar] [CrossRef]

- Lai, X.; Zheng, Y.; Sun, T. A comparative study of different equivalent circuit models for estimating state-of-charge of lithium-ion batteries. Electrochim. Acta 2018, 259, 566–577. [Google Scholar] [CrossRef]

- Plett, G. Battery Management Systems, Volume I: Battery Modeling; Artech House: London, UK, 2015. [Google Scholar]

- Xu, Y.; Hu, M.; Fu, C.; Cao, K.; Su, Z.; Yang, Z. State of Charge Estimation for Lithium-Ion Batteries Based on Temperature-Dependent Second-Order RC Model. Electronics 2019, 8, 1012. [Google Scholar] [CrossRef]

- Petit, M.; Prada, E.; Sauvant-Moynot, V. Development of an empirical aging model for Li-ion batteries and application to assess the impact of Vehicle-to-Grid strategies on battery lifetime. Appl. Energy 2016, 172, 398–407. [Google Scholar] [CrossRef]

- Huria, T.; Ceraolo, M.; Gazzarri, J.; Jackey, R. High fidelity electrical model with thermal dependence for characterization and simulation of high power lithium battery cells. In Proceedings of the 2012 IEEE International Electric Vehicle Conference, Greenville, SC, USA, 4–8 March 2012; pp. 1–8. [Google Scholar]

- Barré, A.; Deguilhem, B.; Grolleau, S.; Gérard, M.; Suard, F.; Riu, D. A review on lithium-ion battery ageing mechanisms and estimations for automotive applications. J. Power Sources 2013, 241, 680–689. [Google Scholar] [CrossRef]

- Hahn, S.L.; Storch, M.; Swaminathan, R.; Obry, B.; Bandlow, J.; Birke, K.P. Quantitative validation of calendar aging models for lithium-ion batteries. J. Power Sources 2018, 400, 402–414. [Google Scholar] [CrossRef]

- Schmalstieg, J.; Käbitz, S.; Ecker, M.; Sauer, D.U. A holistic aging model for Li(NiMnCo)O2 based 18650 lithium-ion batteries. J. Power Sources 2014, 257, 325–334. [Google Scholar] [CrossRef]

- Park, J.; Appiah, W.A.; Byun, S.; Jin, D.; Ryou, M.-H.; Lee, Y.M. Semi-empirical long-term cycle life model coupled with an electrolyte depletion function for large-format graphite/LiFePO4 lithium-ion batteries. J. Power Sources 2017, 365, 257–265. [Google Scholar] [CrossRef]

- Smith, K.; Saxon, A.; Keyser, M.; Lundstrom, B.; Ziwei, C.; Roc, A. Life prediction model for grid-connected Li-ion battery energy storage system. In Proceedings of the 2017 American Control Conference (ACC), Seattle, WA, USA, 24–26 May 2017; pp. 4062–4068. [Google Scholar]

- Safoutin, J.M.; McDonald, J.; Ellies, B. Predicting the Future Manufacturing Cost of Batteries for Plug-In Vehicles for the U.S. Environmental Protection Agency (EPA) 2017–2025 Light-Duty Greenhouse Gas Standards. World Electr. Veh. J. 2018, 9, 42. [Google Scholar] [CrossRef]

- Chu, S.; Cui, Y.; Liu, N. The path towards sustainable energy. Nat. Mater. 2016, 16, 16. [Google Scholar] [CrossRef]

- Ioannis, T.; Dalius, T.; Natalia, L. Li-Ion Batteries for Mobility and Stationary Storage Applications; Publications Office of the European Union: Brussels, Belgium, 2018; Available online: https://bit.ly/2Nbc6WZ (accessed on 20 September 2019).

- Bloomberg. A Behind the Scenes Take on Lithium-Ion Battery Prices; Bloomberg: New York, NY, USA, 2019; Available online: https://bit.ly/32bjNAH (accessed on 23 July 2019).

- Dane, S. MAT4BAT Advanced Materials for Batteries Project. 2017. Available online: https://cordis.europa.eu/project/rcn/109052/reporting/en (accessed on 20 July 2019).

- Bloom, I.; Cole, B.W.; Sohn, J.J.; Jones, S.A.; Polzin, E.G.; Battaglia, V.S.; Henriksen, G.L.; Motloch, C.; Richardson, R.; Unkelhaeuser, T.; et al. An accelerated calendar and cycle life study of Li-ion cells. J. Power Sources 2001, 101, 238–247. [Google Scholar] [CrossRef]

- Ouyang, D.; He, Y.; Weng, J.; Liu, J.; Chen, M.; Wang, J. Influence of low temperature conditions on lithium-ion batteries and the application of an insulation material. RSC Adv. 2019, 9, 9053–9066. [Google Scholar] [CrossRef]

- Moretti, A.; Carvalho, V.D.; Ehteshami, N.; Paillard, E.; Porcher, W.; Brun-Buisson, D.; Ducros, J.-B.; de Meatza, I.; Eguia-Barrio, A.; Trad, K.; et al. A Post-Mortem Study of Stacked 16 Ah Graphite//LiFePO4 Pouch Cells Cycled at 5 °C. Batteries 2019, 5, 45. [Google Scholar] [CrossRef]

- García-Quismondo, E.; Almonacid, I.; Cabañero Martínez, Á.M.; Miroslavov, V.; Serrano, E.; Palma, J.; Alonso Salmerón, P.J. Operational Experience of 5 kW/5 kWh All-Vanadium Flow Batteries in Photovoltaic Grid Applications. Batteries 2019, 5, 52. [Google Scholar] [CrossRef]

- Mays, J.; Morton, D.P.; O’Neill, R.P. Asymmetric risk and fuel neutrality in electricity capacity markets. Nat. Energy 2019, 4, 948–956. [Google Scholar] [CrossRef]

- Harlow, J.E.; Ma, X.; Li, J.; Logan, E.; Liu, Y.; Zhang, N.; Ma, L.; Glazier, S.L.; Cormier, M.M.E.; Genovese, M.; et al. A Wide Range of Testing Results on an Excellent Lithium-Ion Cell Chemistry to be used as Benchmarks for New Battery Technologies. J. Electrochem. Soc. 2019, 166, A3031–A3044. [Google Scholar] [CrossRef]

- Northrop, P.W.C.; Suthar, B.; Ramadesigan, V.; Santhanagopalan, S.; Braatz, R.D.; Subramanian, V.R. Efficient Simulation and Reformulation of Lithium-Ion Battery Models for Enabling Electric Transportation. J. Electrochem. Soc. 2014, 161, E3149–E3157. [Google Scholar] [CrossRef]

- National Grid. Final Auction Results T-4 Capacity Market Auction. 2014. Available online: https://bit.ly/32BpxUu (accessed on 23 March 2019).

| Battery Capacity (MWh) | Connection Capacity (MW) | Duration (h) |

|---|---|---|

| 2 | 2 | 0.5 |

| 2 | 2 | 1 |

| 2 | 1 | 2 |

| 2 | 0.5 | 4 |

| SoC | OCV (V) | R0 (mΩ) | R1 (mΩ) | C1 (kF) | R2 (mΩ) | C2 (kF) |

|---|---|---|---|---|---|---|

| 0 | 3.5136 | 9.6145 | 4.944 | 9.792 | 0.746 | 27.958 |

| 0.1 | 3.579 | 9.3483 | 4.928 | 12.621 | 0.572 | 38.512 |

| 0.2 | 3.623 | 9.5188 | 4.925 | 14.635 | 0.507 | 37.631 |

| 0.3 | 3.662 | 9.4834 | 4.90 | 15.301 | 0.498 | 26.237 |

| 0.4 | 3.694 | 9.4206 | 4.878 | 13.912 | 0.270 | 20.286 |

| 0.5 | 3.727 | 9.3673 | 4.899 | 11.905 | 0.0032 | 18.975 |

| 0.6 | 3.813 | 9.356 | 4.890 | 14.256 | 0.2385 | 15.288 |

| 0.7 | 3.899 | 9.3326 | 4.889 | 14.488 | 0.556 | 16 |

| 0.8 | 3.991 | 9.3847 | 4.884 | 13.775 | 0.288 | 18.763 |

| 0.9 | 4.092 | 9.240 | 4.822 | 15.166 | 0.659 | 18.454 |

| 1 | 4.21 | 9.351 | 4.885 | 12.889 | 0.490 | 12.412 |

| Degradation Type | Empirical RMSE [%] | Semi-Empirical RMSE [%] |

|---|---|---|

| Calendar | 3.4 | 4.9 |

| Cycle | 1.7 | 1.1 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gailani, A.; Al-Greer, M.; Short, M.; Crosbie, T. Degradation Cost Analysis of Li-Ion Batteries in the Capacity Market with Different Degradation Models. Electronics 2020, 9, 90. https://doi.org/10.3390/electronics9010090

Gailani A, Al-Greer M, Short M, Crosbie T. Degradation Cost Analysis of Li-Ion Batteries in the Capacity Market with Different Degradation Models. Electronics. 2020; 9(1):90. https://doi.org/10.3390/electronics9010090

Chicago/Turabian StyleGailani, Ahmed, Maher Al-Greer, Michael Short, and Tracey Crosbie. 2020. "Degradation Cost Analysis of Li-Ion Batteries in the Capacity Market with Different Degradation Models" Electronics 9, no. 1: 90. https://doi.org/10.3390/electronics9010090

APA StyleGailani, A., Al-Greer, M., Short, M., & Crosbie, T. (2020). Degradation Cost Analysis of Li-Ion Batteries in the Capacity Market with Different Degradation Models. Electronics, 9(1), 90. https://doi.org/10.3390/electronics9010090