4. Results and Discussion

Our objectives are to decode the relationship between accounting variables and profitability, to validate the predictive power of neural networks, and to provide actionable insights that enhance strategic decision making in the field of accounting, because financial projections are not just based on past trends or rules of thumb, but are dynamically shaped by the complex, real-time interplays within our financial data [

7].

We set out to explore and quantify the relationship between specific financial metrics and corporate profitability and demonstrate the applicability of neural networks in financial forecasting. By using a neural network model, we seek to identify how variables like profit margins, return on assets, debt-to-equity ratios, and cash flow contribute to a company’s profitability in ways that traditional linear models may overlook.

Beyond simply predicting profitability, we want to understand which financial levers, such as asset allocation, cost management, or revenue growth, have the most significant impact on profitability, thus guiding management on where to focus their efforts. In doing so, we hope to bridge the gap between data analysis and actionable insights, offering accountants and financial professionals a tool for more informed, strategic planning.

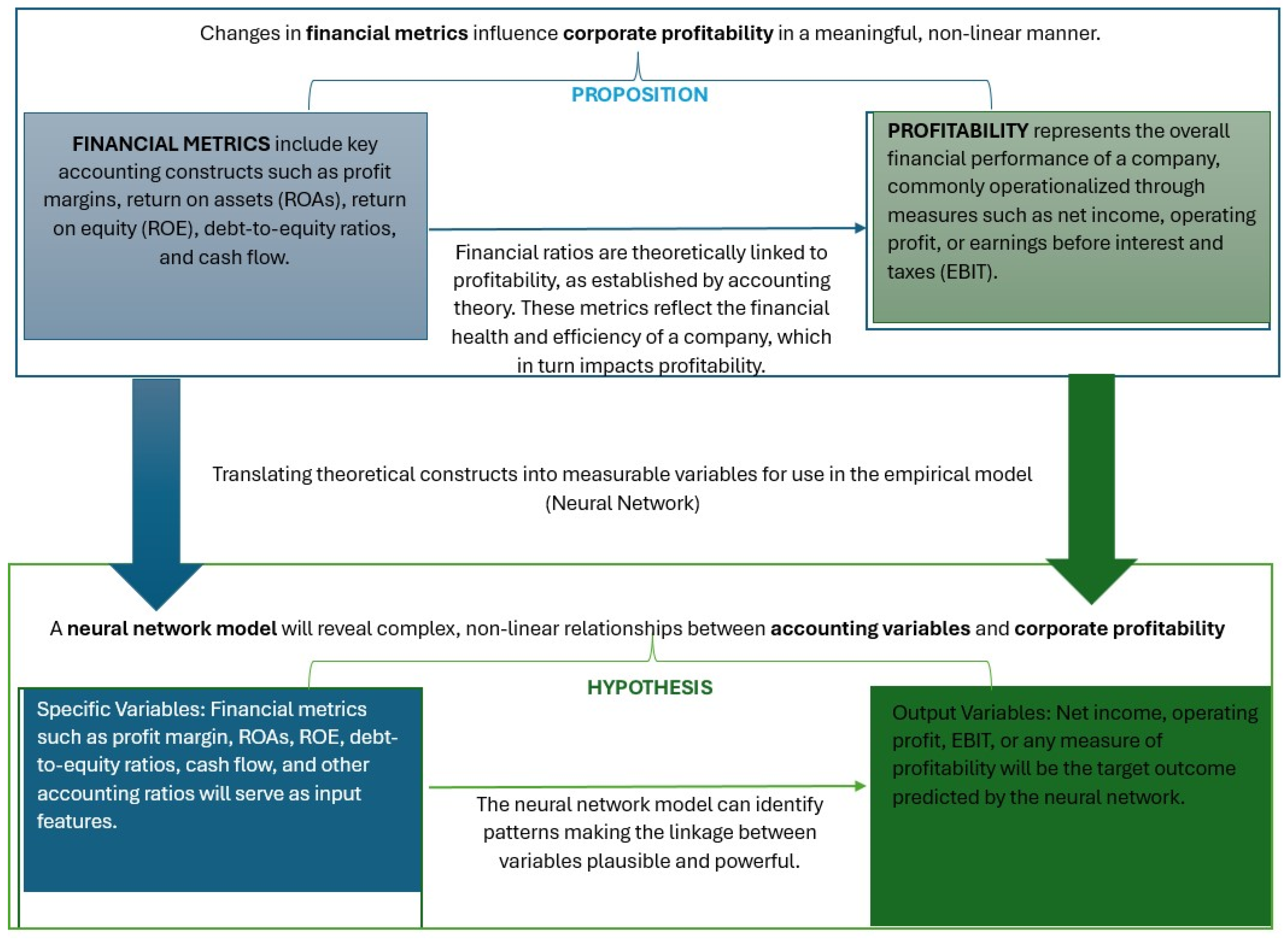

The most prominent variables in our study can be divided into two main categories as seen in

Figure 1, namely input variables and output variables, each chosen to capture critical aspects of a company’s financial health and performance.

The input variables represent key financial metrics that have traditionally been linked to profitability and represent the key financial constructs that our neural network model uses to predict profitability, providing a different lens through which to view a company’s operational and financial efficiency.

On the output side, our primary output variable is profitability, which allows us to measure different dimensions of profitability, each relevant to various strategic decisions within the business. By analyzing the interaction between these input and output variables, our study aims to reveal patterns and insights that are crucial for financial forecasting and strategic decision making [

8].

The integration of neural networks into accounting practices has garnered significant attention in recent years, reflecting a broader trend towards leveraging artificial intelligence for financial forecasting and decision making.

Various international studies, highlighting the theoretical foundations, practical applications, and socio-economic implications of employing neural networks in accounting, show that neural networks have been employed to predict financial metrics, such as earnings, cash flows, and stock prices. Their ability to learn from historical data enables them to provide forecasts that adapt to changing market conditions.

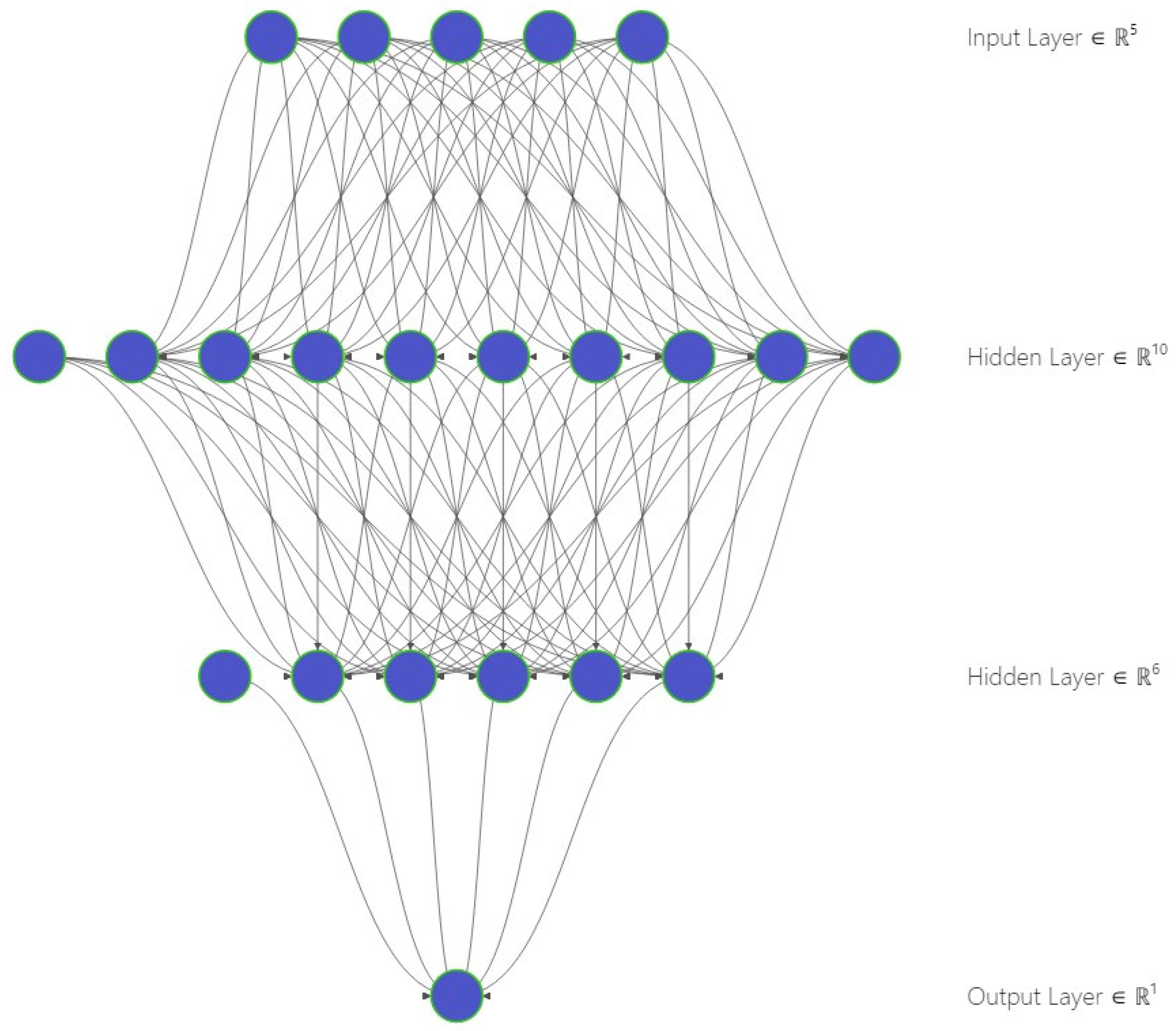

In accounting, we are constantly evaluating key financial indicators, like profit margins, return on assets, debt-to-equity ratios, and cash flow, that represent a company’s health, efficiency, and risk levels. When creating this neural network, all these metrics enter the model through the input layer, which has five nodes, one for each of these core metrics, and each node is like a doorway into the neural network, where we feed in financial signals [

25].

Our neural network model is set up to accomplish this by incorporating pivotal accounting ratios and profit margins, like return on assets, return on equity, debt-to-equity ratios, and cash flow, according to which we can uncover complex interdependencies that traditional linear models tend to miss. We can express the architectural structure of our model using mathematical notation, where:

representing the multi-dimensional input layer, capturing a company’s “financial DNA”.

Each hidden layer refines the information, allowing the model to learn nonlinear interdependencies that simple linear regressions might overlook. For instance, partial derivatives of the output with respect to each pair of inputs can be nonzero, indicating that changes in the debt-to-equity ratio can alter how cash flow impacts profitability. This can capture real-world complexities, such as liquidity constraints exacerbating debt costs or synergy effects between efficient asset utilization and return on equity:

The first hidden layer serves as a broad sweep of financial metrics, similar to a team of accountants each bringing a unique perspective on profitability factors, and allowing for the initial discovery of nuanced interactions, like the interplay of debt load and ROAs. Each node in the first hidden layer is like a miniature economic analysis that tries to find connections or correlations or trends or patterns among the five-input metrics. One node might learn how variations in the debt-to-equity ratio affect profitability in different cash flow scenarios, another might pick up on how the return on assets correlates with the return on equity over time, and so on and so forth, and can be expressed as follows:

Nonlinear Transformation

where

is an activation function like the ReLU, tanh, or sigmoid.

The second hidden layer focuses on deeper relationships uncovered by the first layer that revealed how subtle variations in cash flow or asset returns might ripple through the company’s financial structure and distills the most salient patterns before the final prediction, taking the insights from layer one, like how various metrics interact, and rethinking them, thus combining them into more nuanced, second-level perspectives.

The output layer aggregates the refined insights from the second hidden layer to predict overall profitability, reflecting the final metric of interest in strategic decision making.

As well as the formula for profitability predictions:

The input layer provides the model with the core ingredients it needs to understand a company’s financial DNA.

Our motivation for this design is to balance model complexity and interpretability in line with longstanding practice in regard to neural network architecture and to reflect on the nuanced reality of financial data arising from different regulatory frameworks, such as the IFRS and US GAAP.

A strictly minimal architecture might overlook these cross-standard interactions and misrepresent relationships that only emerge when processing the data during intermediate stages, because a single hidden layer might not capture the variety of subtle, nonlinear relationships we encounter in modern financial metrics. Even something as fundamental as net income can be reported differently across regions, especially when companies adhere to distinct accounting standards [

26].

Our two-layer approach reflects a compromise between these extremes. Empirically, we have seen that one hidden layer may be insufficient to tease out the layered intricacies in financial statements [

27], for instance, the interplay between standardized elements like revenue recognition policies in the IFRS and more nuanced items like stock-based compensation under the US GAAP. By devoting one layer to learning universal patterns, such as fundamental ratios or cash flow structure, and a second layer to refining those representations, we can better adapt to varying disclosures and classification practices. While this is not an entirely novel insight, two-layer networks are well-documented in the literature, the design choice remains meaningful for corporate accounting data, which rarely conform to a single, uniform standard [

26].

We have two hidden layers in this network, with 10 nodes in the first and 6 nodes in the second. Each hidden layer analyzes and reanalyzes the financial metrics, refining, and combining them in new ways. In the first hidden layer, we start with a broader, more comprehensive sweep across the data similar to a group of skilled auditors, each taking a different slice of the financials, identifying the relationships and nuances in regard to each metric, because it is one thing to know a company’s profit margin and another to understand how that margin interacts with debt levels or asset efficiency. This first layer, with 10 nodes, allows us to start seeing these nonlinear relationships. The second hidden layer, with six nodes, focuses on understanding how subtle changes in cash flow, for example, or asset returns, can ripple out across the business’s entire profitability picture and lead to deeper insights, zeroing in on what really impacts profitability.

The output layer has a single node dedicated to profitability prediction, based on what is observed in the financial metrics.

In

Figure 2, we outlined our proposed architecture to build a clear theoretical network framework, using the NN-SVG to explain each layer’s purpose [

23], how it corresponds to the accounting variables, and why this specific structure was chosen. The next step is to set up a similar architecture in the TensorFlow Playground to experiment with different learning dynamics, adding a practical dimension to the theoretical framework. The TensorFlow Playground shows visualizations of how well the network’s predictions match the data distribution. If the pattern aligns closely with the data, the model is learning effectively.

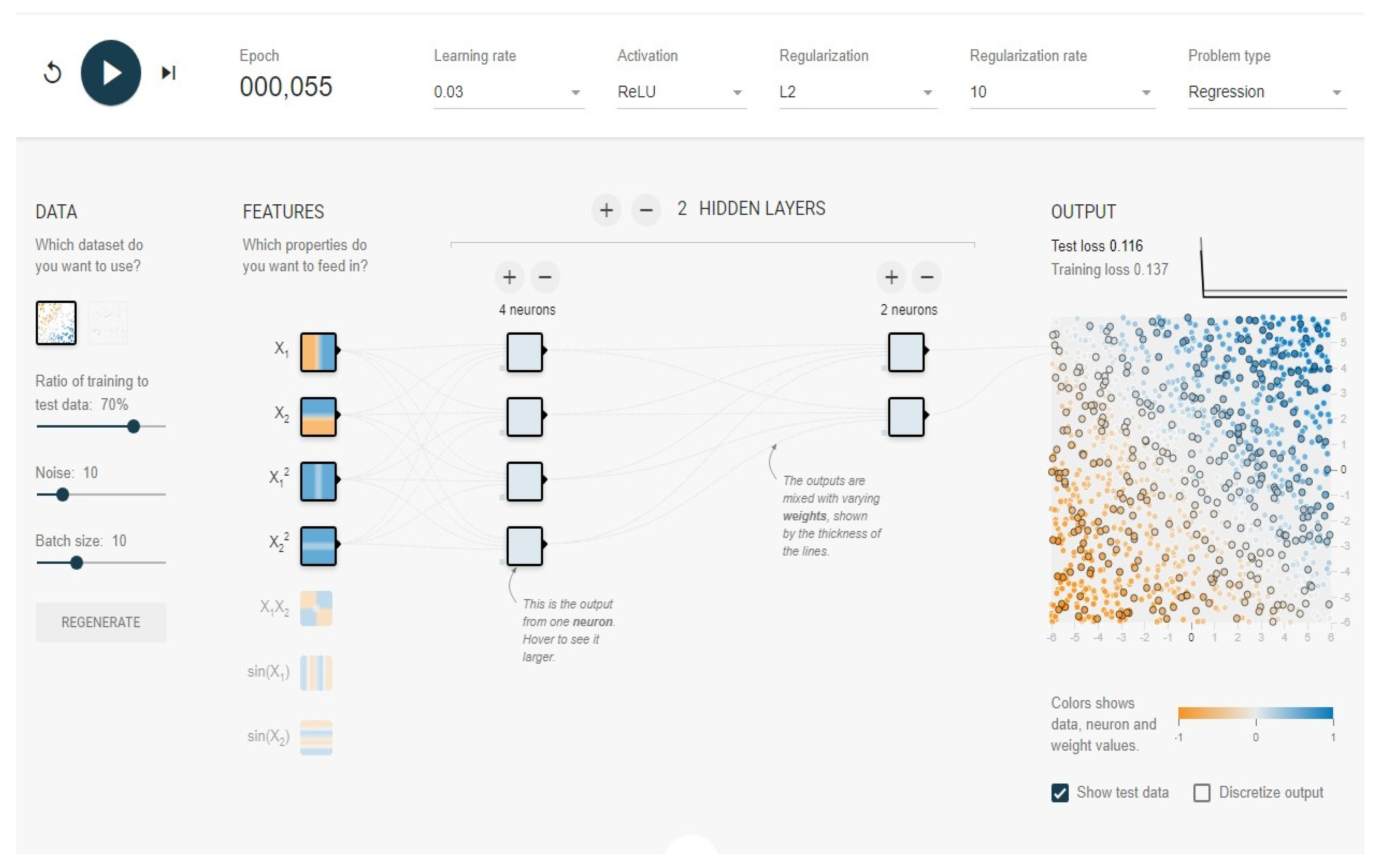

First, we start with a dataset that is input into the TensorFlow Playground, which represents simple data patterns, choosing the plane dataset to approximate a regression problem like predicting profitability. In our model, the plane dataset is made up of the profit margin, return on assets (ROAs), return on equity (ROE), debt-to-equity ratio, and cash flow. These metrics feed into the network to help predict the target like, for example, net income or EBIT (earnings before interest and taxes). For this to function, we also must set the ratio of training to test data.

The ratio of training to test data represents the historical accounting records that teach the network patterns and test data that act as new records that challenge the network to make accurate predictions. In this case, we set it up as 70% for training and 30% for testing, allowing the model to learn effectively from past data and then evaluate its predictive power on fresh, unseen data. We started with zero noise to keep things simple, but, in a full model, adding noise helps make the network robust, able to handle real-world variability through adding randomness to the data, simulating unpredictable fluctuations, like economic events or market volatility, that introduce uncertainty.

In the TensorFlow Playground, we have options to include X1, X2, X12, X22, X1X2, sin(X1), and sin(X2), which represent various data transformations. In our case, X1 and X2 represent simple financial metrics like the ROAs and profit margin, and X12 and X22 are used to capture the nonlinear relationships of the ROAs and profit margin to profitability.

The hidden layers are the core of the accounting neural network. Each layer represents a stage in the decision-making process, much like an accountant analyzing data, layer by layer. In a real-world financial model, more nodes and layers might be necessary, but this simplified structure helped us to grasp the basics. Each layer has an activation function, and we chose the ReLU (Rectified Linear Unit), helping the network to handle nonlinear data that can curve, peak, and plateau. Use of the ReLU helps us to make sense of complex patterns and understand that, for example, the ROAs does not increase net income endlessly and there are diminishing returns. For our accounting neural network, the learning rate is crucial for the speed at which AI learns from new data, and we set it to 0.03, while keeping the batch size at 10, making learning efficient, while allowing the model to adjust gradually. If we set a higher value, the model might learn too quickly without depth, but if we set it too low, the model learns too slowly. For our financial model, we believe a learning rate of 0.001 to 0.01 is acceptable for balancing accuracy and efficiency. We also must be careful to prevent the network from focusing too closely on one year’s data trends and failing to generalize for future years. Because ours is a theoretical model, we did not set up regularization to keep things simple, but in a full model, we suggest using Dropout (randomly ignoring nodes) or L2 Regularization (penalizing large weights) to ensure the network generalizes well.

Based on the input data, as shown in

Figure 3, we started with a test loss of 0.808 and a training loss of 0.840, letting the model train for at least 50 epochs initially, while observing how both the test loss and training loss change. For most models, if both losses stabilize within a low range after 100–200 epochs, this is often a good place to stop [

22].

After 50 epochs, both the test loss and training loss were at exactly 0.000, indicating a red flag in neural network training, indicating overfitting. Our model has overfit the data, indicating that our model has learned to predict the training data perfectly, which is unusual in real-world applications and suggests it has “memorized” the data rather than learning generalizable patterns. At the same time, a test loss of 0.000 suggests that the model is also perfectly predicting the test set due to a lack of complexity in the data or having excessive capacity, like too many nodes/parameters, relative to the complexity of the financial data.

In our financial forecasting and most real-world accounting applications, achieving a perfect fit in regard to both the training and test data is unrealistic, because real financial data tends to be noisy and complex.

To counter overfitting, we applied some adjustments. We increased the regularization rate to 10, preventing overfitting by adding a penalty for overly complex models, we reduced the number of nodes in the hidden layers from eight layers to six layers and from four additional layer to 2 layers, respectively, and we also increased the amount of noise to a value of 10 to increase the dataset’s complexity.

Regarding this setup, we let it run to about 50 epochs to see whether the losses stabilized, and then we interpreted the results based on the final values and behavior of the losses. The new setup can be seen in

Figure 4, starting with a test loss of 0.272 and a training loss of 0.316.

Based on the new input data, we started with a test loss of 0.272 and a training loss of 0.316, letting the model train for at least 50 epochs initially, while again observing how both the test loss and training loss changed [

24].

With the test loss and training loss at 0.116 and 0.137, respectively, the model is no longer showing signs of extreme overfitting. These losses are low and close to each other, which suggests that the model has learned generalizable patterns rather than just memorizing the training data and introducing regularizations, and the introduction of noise likely helped the model become more robust, enabling it to handle variability in the data better.

As presented in

Figure 5, starting at a test loss of 0.272 and a training loss of 0.316 and ending with a test loss of 0.116 and a training loss of 0.137 shows steady progress in regard to learning. This gradual reduction in losses over 55 epochs indicates that the model is effectively learning from the data and converging without overfitting, and is now better suited to predicting financial metrics, as it is more likely to generalize well to new data, which is crucial in real-world financial forecasting.

To ensure a more stable outcome, we ran a few more epochs to confirm its stability and ensure the losses did not start diverging. After an additional 25 epochs, the test loss was 0.116 and the training loss was 0.137, suggesting optimal parameters.

The next logical step would be to train our network and test it with new unseen data, confirming that our model can generalize well beyond the initial sample, but this being a theoretical model we stopped here.

Given our current results, we concluded that the model has strong stability and convergence. Both losses have reached a steady point, low and close to each other, which is a great indicator of effective learning, revealing that the model has picked up on real patterns in the data without overfitting to the specifics of the training set and finding a balance that is likely to make it reliable for future predictions based on similar data.

The robustness and regularization adjustments, adding a bit of noise, and reducing the complexity of the hidden layers resulted in visible improvements, showing us that the model can handle the kind of variability we expect in real-world financial data and that it was not just memorizing details, but understanding broader trends that will make it adaptable in practical applications.

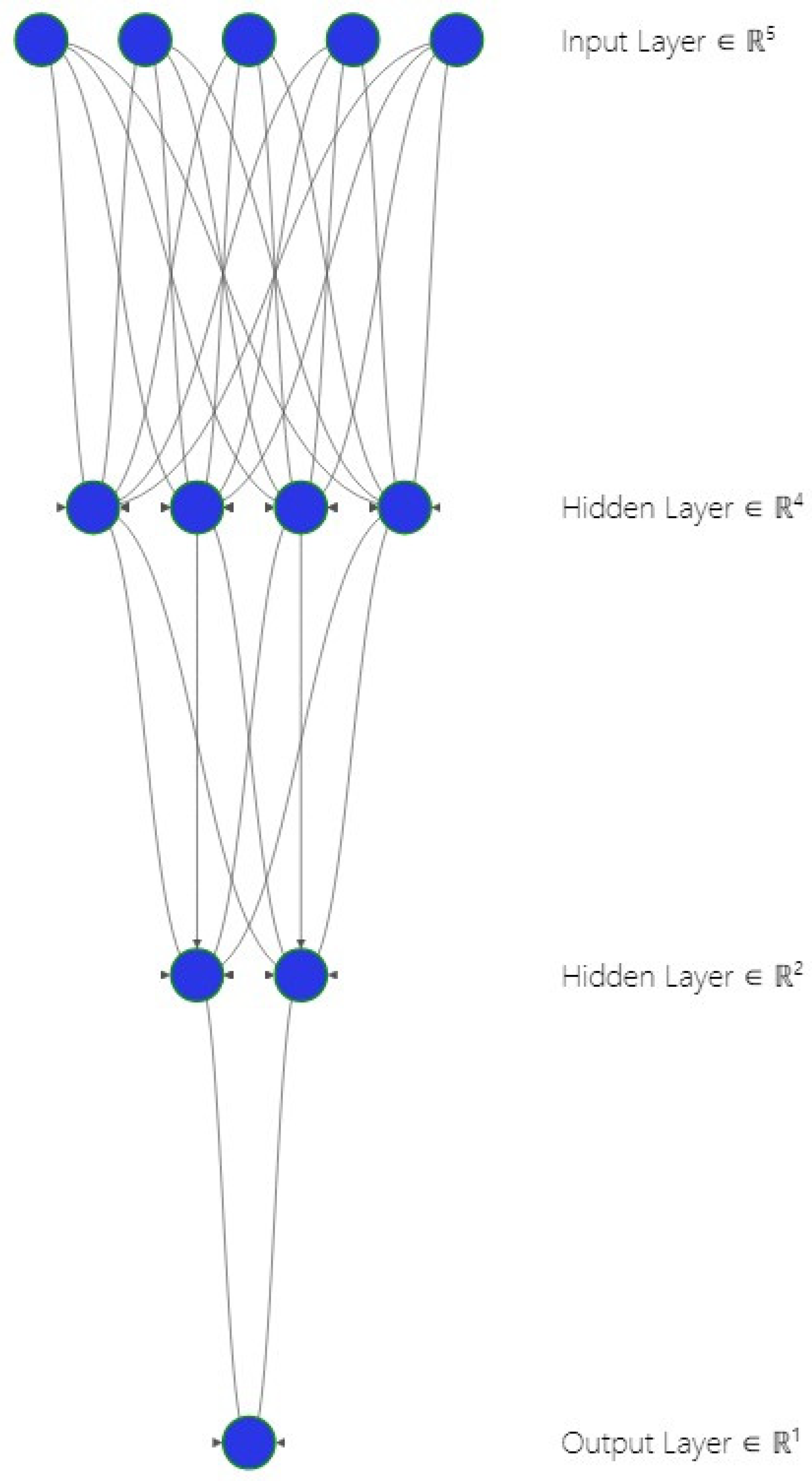

Based on our findings, we redesigned the neural network diagram, using the NN-SVG, to reflect our findings in the TensorFlow Playground. The new conceptual diagram for our accounting neural network is presented in

Figure 6.

Adapting the new conceptual NN-SVG diagram, we can state that the new structure 4–2–1 is better aligned with our empirical findings in the TensorFlow Playground that include improved generalization and reduced overfitting when dealing with real-world financial data.

We can express the new architectural structure of out model using a mathematical notation, where:

by using fewer nodes (four in the first layer, two in the second), the model is less prone to overfitting based on smaller datasets and is easier to regularize.

As with the previous model, any second derivative of the output with respect to two different inputs can be nonzero, indicating that changes in one metric can amplify or dampen the influence of another on overall profitability:

The first hidden layer captures general relationships among key accounting ratios and begins to reveal the relationships and nonlinear interactions among the five key accounting metrics.

Learned Weights and Bias

is the weight matrix, and is the bias vector.

Nonlinear Transformation

where

is an activation function like the ReLU, tanh, or sigmoid.

The second hidden layer focuses on subtler variations, when changes in cash flow or asset performance might ripple through the firm’s overall profitability dynamics.

Learned Weights and Bias

is the weight matrix, and is the bias vector.

The output layer aggregates the refined insights from the second hidden layer to predict overall profitability and has just one node:

Learned Weights and Bias

(or ) and .

As well as the formula for profitability predictions:

where

is the single output node predicting profitability, and, depending on whether we expect positive/negative or unbounded values,

might be linear or nonlinear.

Regarding the theoretical model’s predictive performance, we see acceptable outputs for a forecasting model in finance. With a test loss of around 0.116 and a training loss close behind at 0.137, we achieve a level of accuracy that provides a solid basis for reliable insights. In accounting, we know perfect predictions are rare, but this model’s performance provides us with a strong foundation for making meaningful, data-driven forecasts.

The effectiveness of this model hinges on the quality and representativeness of the financial data used and, without a clear understanding of the data sources, it is challenging to assess whether the model generalizes well across different industries, economic conditions, and timeframes. Also, the financial metrics selected, such as profit margin, ROAs, and debt-to-equity ratio, should also be justified as the most relevant for forecasting profitability, ensuring they offer consistent value across varied financial scenarios.

Of course, interpretability is another critical area of concern for us in terms of the empirical development of the theoretical model. Neural networks in the accounting field can have limited usefulness for strategic decision making, and the choices made regarding the regularization rate, noise levels, and hidden layer complexity need careful justification. While regularization and noise were introduced into our theoretical model proposal to improve its robustness, it is essential for future real-life scenarios to know whether these adjustments were systematically validated or whether they were based on empirical evidence from validation data.

To ensure that these findings can be validated beyond just one training set, we incorporated a form of cross-validation, even though we are dealing with synthetic data. We rotate different parts of the dataset in and out of the training and testing phase, so that every input is analyzed, reducing the chance that the projection of a robust model can be generated when, in fact, it might only excel based on one subset of observations.

One straightforward way to gauge how much the predicted values deviate from the true outcomes is to compute error metrics that summarize the differences across all the data points measuring the average of the squared differences between the predicted and actual values to heavily penalize larger errors, since the differences are squared. Equally important is the interpretation of these metrics in the context of accounting and finance. A tiny difference in the mean squared error between two models might, in practical terms, translate into a huge disparity in profit forecasts. Through the use of our theoretical framework, we must suggest and incorporate in future empirical real-life models, not just the numerical performance measures, but also how they translate in regard to decisions made, and whether a company might decide to alter its capital structure or allocate resources differently based on our model’s profitability predictions. By linking those statistical figures back to strategic accounting implications, we can install a richness into the empirical model that pure numbers alone cannot convey.

Traditional models often fall short when the data is highly interconnected and do not follow predictable patterns. But with neural networks, we can dig deeper, finding patterns that would otherwise go unnoticed and delivering forecasts that hold up in the real world [

22,

23].

While our research presents a theoretical framework and proof of concept using synthetic data, we recognize the importance of demonstrating real-world applicability and, by incorporating empirical steps, we aim to strengthen the credibility and applicability of the proposed neural network framework.

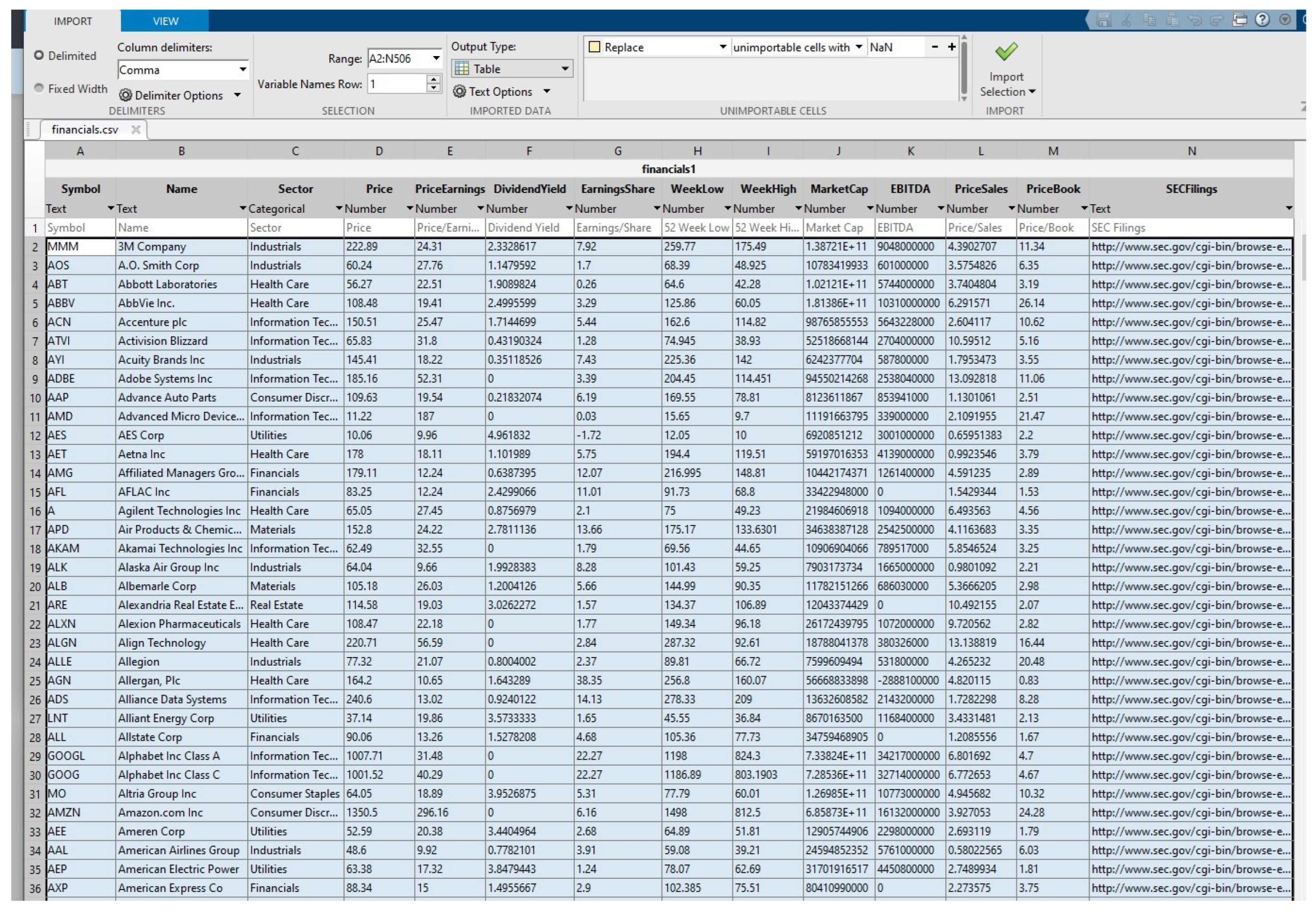

We introduced a targeted empirical exercise to assess the practical viability of our neural network framework, retrieving a publicly available dataset from Kaggle, containing financial indicators for S&P 500 companies as seen in

Figure 7, such as price, earnings per share (EPS), and market capitalization, and used MATLAB2024b to predict each firm’s share price, using actual financial data in MATLAB2024b to see whether our neural network could indeed capture the real dynamics that underlie corporate metrics. Our intention was to see how these fundamental inputs might predict a company’s share price, thereby giving us a first taste of how well our model’s architecture translates to the real world, because raw data almost always comes with missing fields, outliers, and uneven distributions.

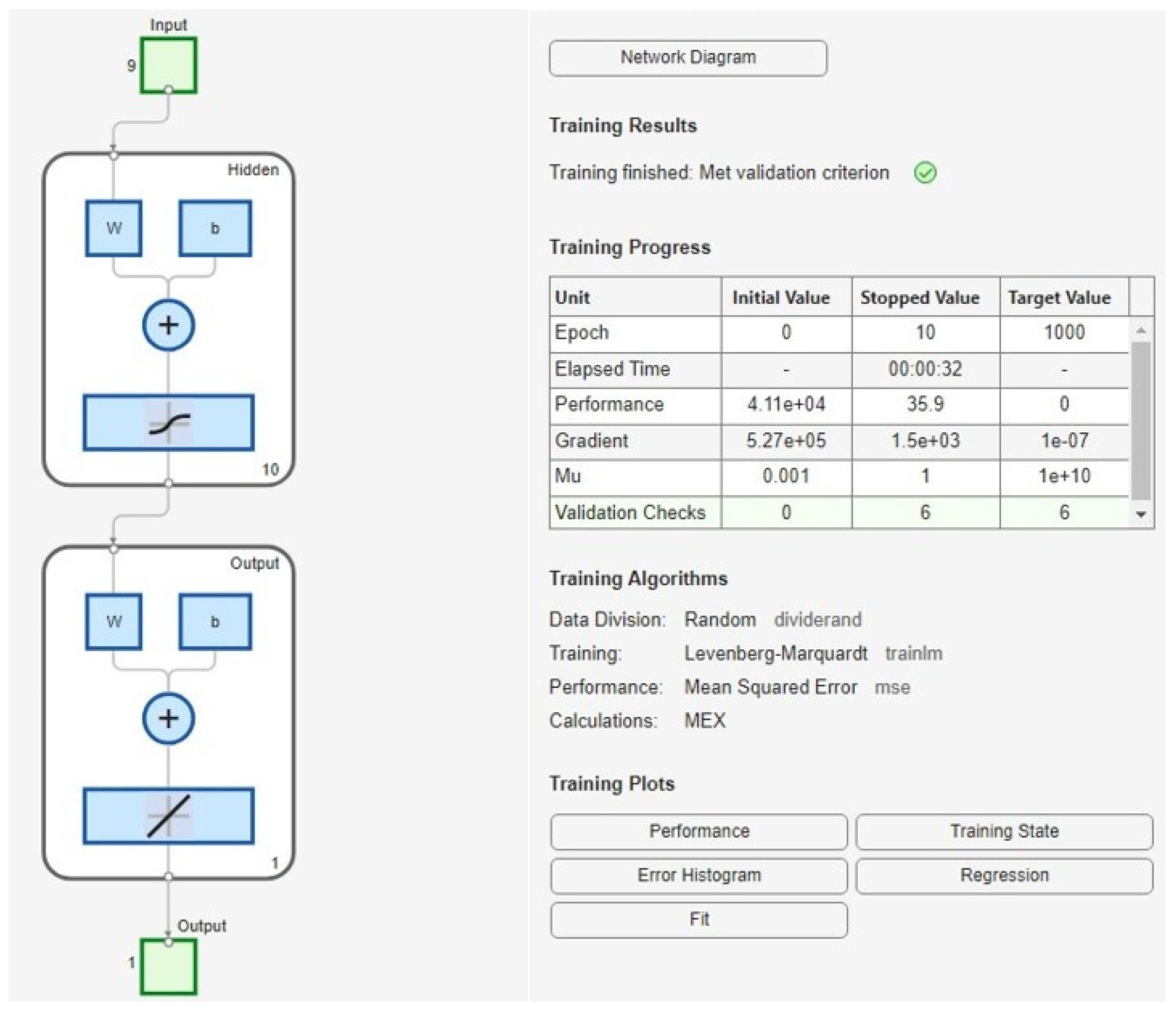

Using the Deep Learning Toolbox R2024b, once we had a reliable subset, we fed it into MATLAB, split the data into a training portion and a smaller test portion, and then applied a modest, single-hidden-layer neural network.

Figure 8 illustrates that our neural architecture could learn meaningful relationships from real figures, without relying exclusively on synthetic distributions or curated test settings, and the empirical text reveals that even this minimal model captured noticeable patterns in pricing, albeit with the sort of error margin one would expect when using only a handful of basic metrics to predict something as complex as share price.

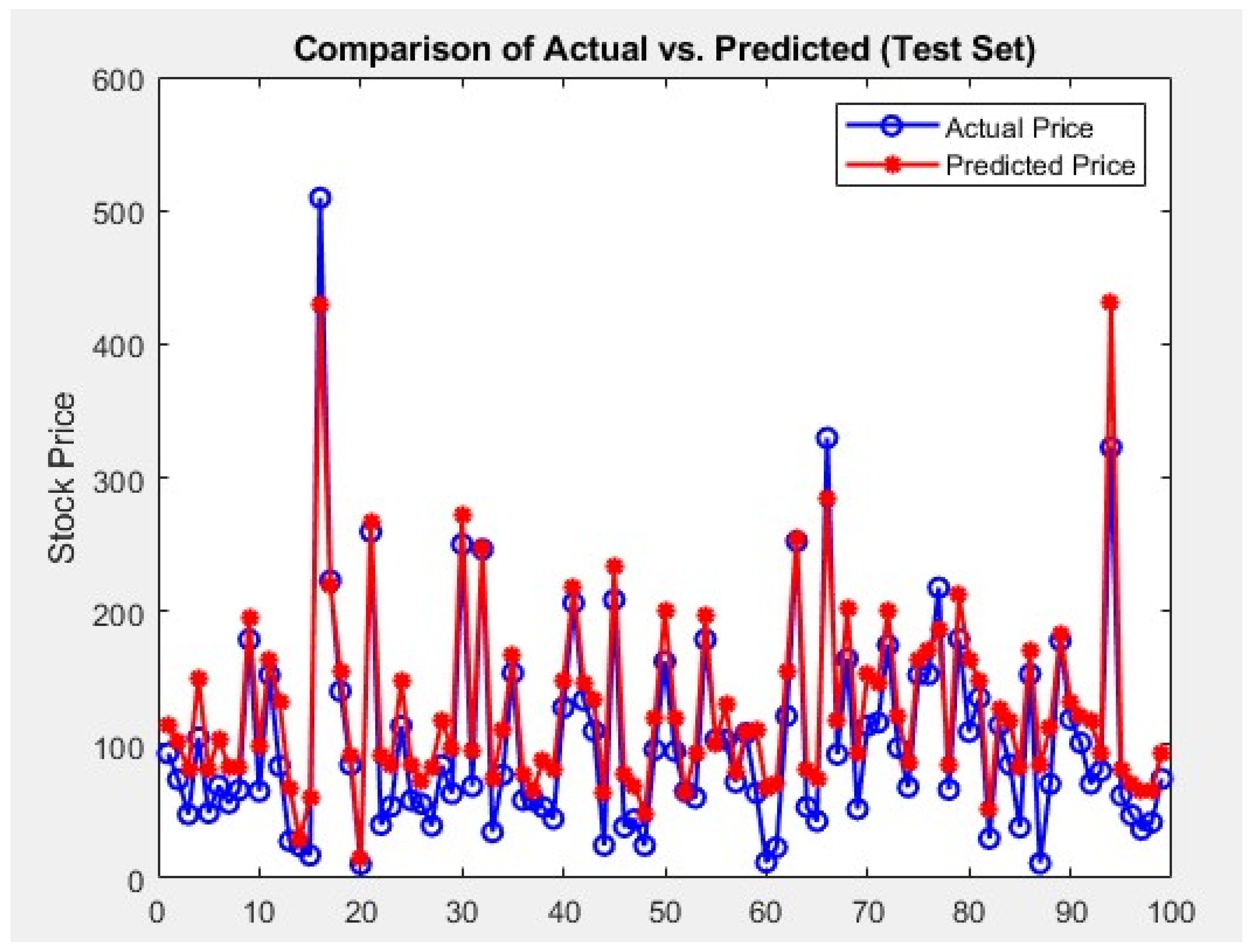

After cleaning and preprocessing the data, we employed an 80/20 train–test split, using a single-hidden-layer neural network to capture potential nonlinear relationships among variables like the P/E ratio, dividend yield, and EBITDA. Our aim was not to create a production-grade forecasting system, but rather to showcase that the proposed architecture indeed learns meaningful patterns from real-world financial data. We then measured its performance via the mean squared error (MSE) and root mean squared error (RMSE). In terms of our test set, the model demonstrated an RMSE of approximately 32.48, suggesting a moderate level of predictive accuracy for a first pass. While certain outliers and sector-specific nuances inevitably reduced the precision, this finding indicates that even a lean implementation of our proposed framework can extract informative signals from fundamental stock data.

We acknowledge that share prices hinge on far more than a handful of numerical ratios, with market sentiment, macroeconomic shifts, and competitive landscapes all playing substantial roles. Yet, the results demonstrate that our theoretical model can be adapted to real-world data, validating its core premise. For a future, more robust iteration, we plan to expand the feature space and refine the neural network hyperparameters, aiming for an even tighter fit.

The final model obtained an MSE of 1054.68 and an RMSE of 32.48 based on the test set, implying an average deviation of about 32 USD from the actual stock price.

Figure 8 compares actual vs. predicted prices, given that several stocks in our sample have prices ranging from 50 USD to more than 300 USD, an average deviation of 32 USD is a good starting point, but can likely be improved with more features and/or hyperparameter tuning.

Figure 9 shows that, while the predicted prices generally track the actual prices, there is noticeable divergence in regard to certain samples. This indicates that the network captures some core relationships, but lacks complete accuracy, likely due to omitted factors, such as market sentiment or macroeconomic data.

Because of the potential impact of this model on strategic financial decisions, ethical and regulatory considerations must be addressed. Predictive models in accounting carry significant responsibility, as they influence key decisions that affect various stakeholders [

28]. Thus, any concerns around transparency, accountability, and the responsible use of AI in financial forecasting should be directly addressed to ensure the model supports informed, ethical decision making [

21].