Bilateral Trading Strategy for the Wind–Thermal Storage System Considering Peak Shaving

Abstract

1. Introduction

- Pathways for TES participation in peak shaving are delineated from a prosumer perspective. Devices are classified as independent or coupled based on voltage level, point of interconnection, and installed capacity.

- A bilateral-trading peak shaving model is established for wind power and an independent TES. The Stackelberg (leader–follower) framework is employed to maximize the economic benefits for both parties. A multi-round process, consisting of quantity bids by TES and price offers by wind farms, is used to determine the final accommodated wind energy and the equilibrium trading price. This approach reflects cooperative intent and improves resource allocation.

- Case studies using operational data from a real wind farm demonstrate the effectiveness and practicality of the proposed framework. Results show that it increases wind energy accommodation, enhances the system’s down-regulation capability, and improves the economic outcomes for market participants.

2. Analysis of Electrical Supply and Thermal Pathways of Thermal Energy Storage Units

3. Bilateral Trading Model for Independent Thermal Energy Storage in Grid Peak Shaving

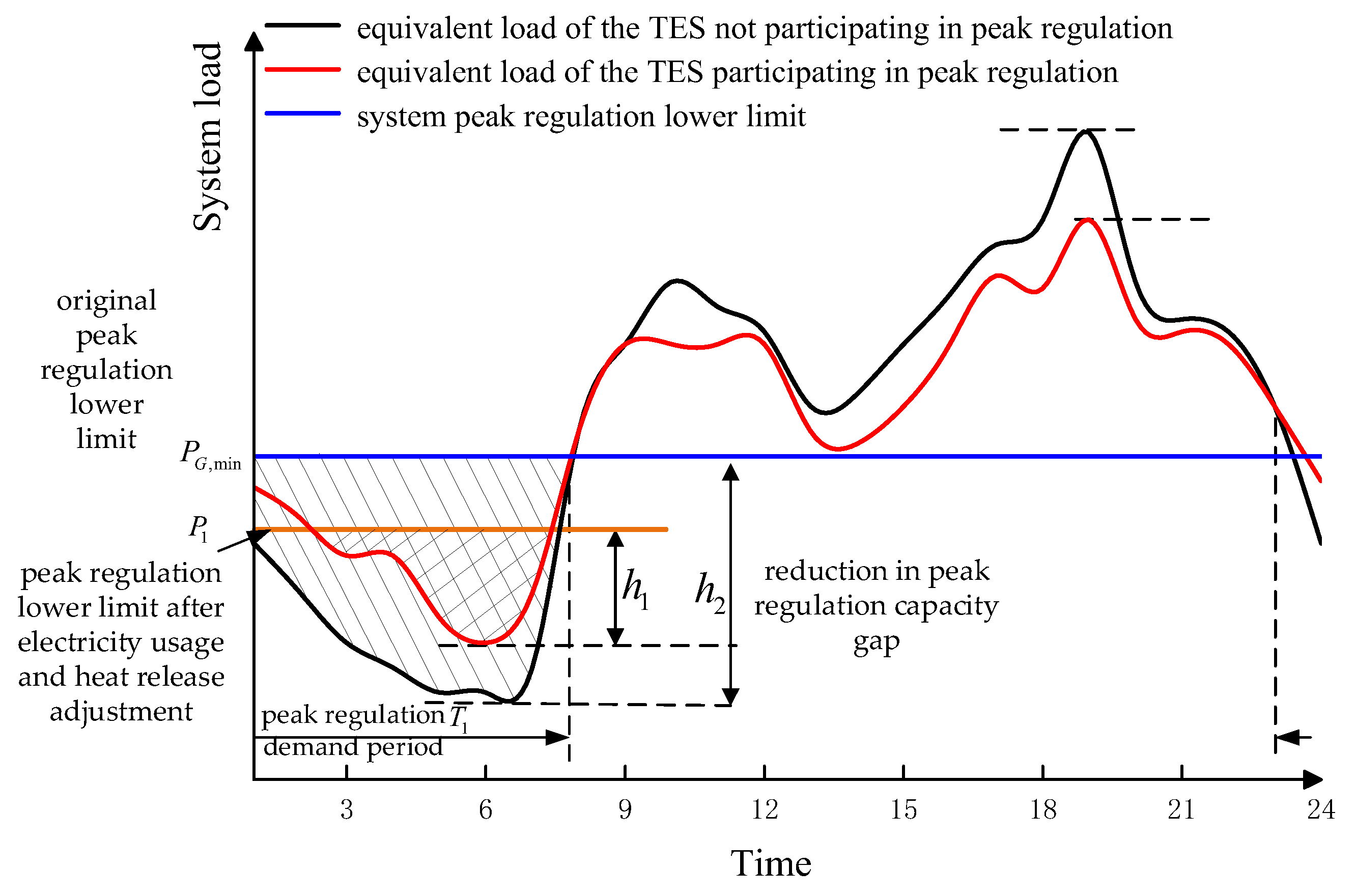

3.1. Mechanism of Joint Peak-Shaving Participation by Independent TES and Wind Power

3.2. Design of the Bilateral Trading Mechanism for Wind Power and TES in Peak Shaving

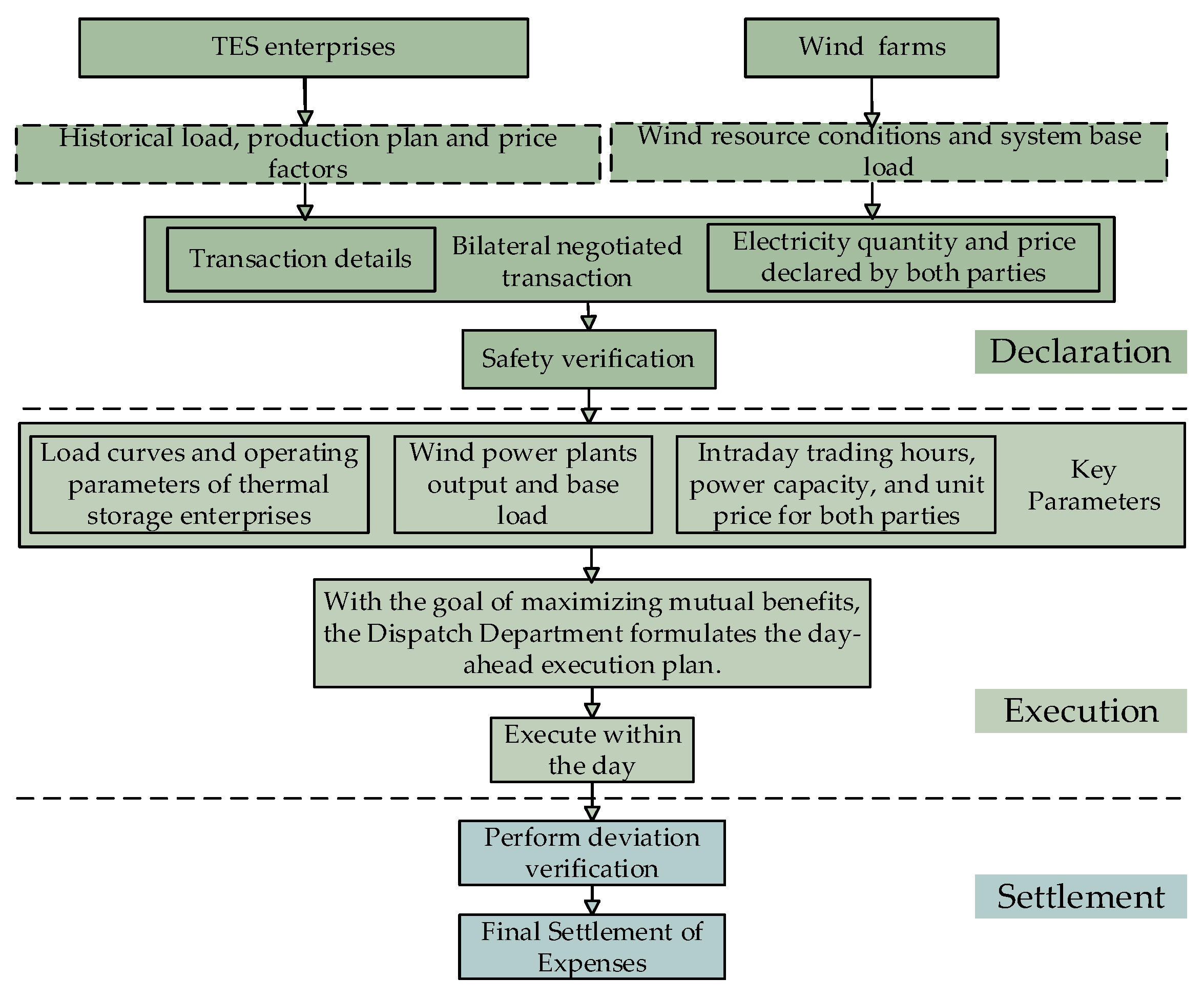

3.3. Execution Workflow for Bilateral Trading Between Wind Power and TES in Peak Shaving

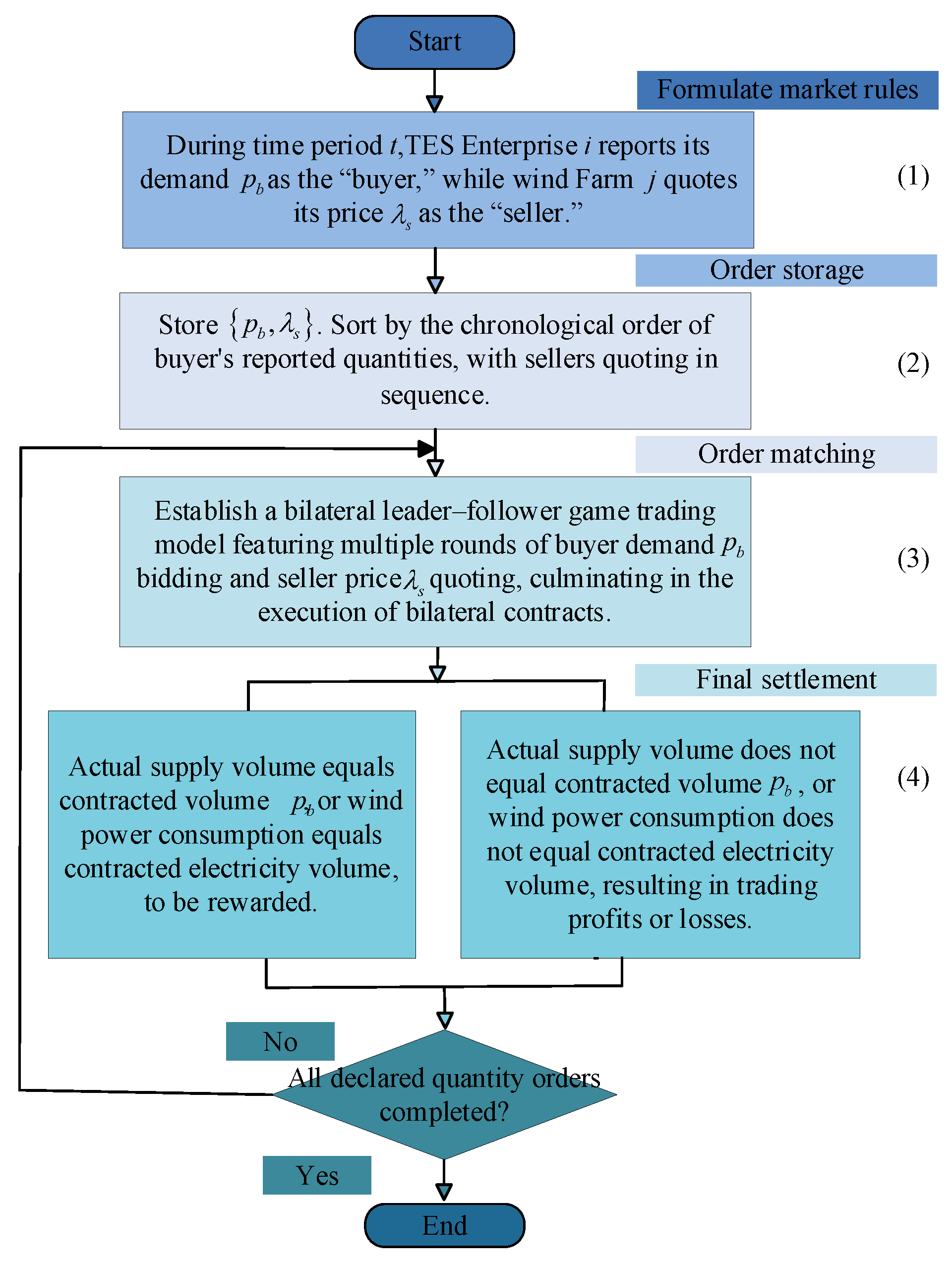

- (1)

- Rule setting. Counterparties are chosen autonomously. The TES enterprise i acts as the buyer and, according to its operational needs, first submits the intended purchase of constrained wind energy (MWh). The wind farm j, as the seller, submits the offer price (CNY/MWh) based on its declared constrained energy.

- (2)

- Order-booking. A trusted trading center serves as the third party and records all TES quantity submissions for that time in an order book to ensure transparency. Submissions are time-stamped and sorted by arrival time; matching then proceeds sequentially in that order.

- (3)

- Matching rule. A quantity-based pricing bilateral model is employed. Using the first-round quantity declarations from both sides, the buyer submits a second-round price bid; the seller then adjusts its quantity offer accordingly. This bargaining iterates over multiple rounds until the equilibrium price and traded quantity are determined. The matching process continues in the order book until all executable orders are cleared.

- (4)

- Clearing and settlement. After security verification by the dispatch center, the TES enterprises and the wind farms settle the transaction [27]. Operational deviations may create energy imbalances; therefore, a deviation-settlement scheme is applied. Parties whose actual transacted energy equals the contracted quantity receive an additional incentive via a bonus mechanism. When discrepancies arise between actual and contracted quantities, the surplus or shortfall is bought from or sold to the third party at the on-grid tariff.

3.4. Stackelberg Game-Based Decision Method for Bilateral Trading

3.4.1. Payoff Model for the Wind Plants

3.4.2. Payoff Model for the TES Enterprises

3.4.3. Solution of the Stackelberg Game Model

- (1)

- Players:

- (2)

- Strategy sets:

- (3)

- Payoff functions:

- (4)

- Stackelberg–Nash equilibrium:

- (1)

- Initialization: Prepare basic data for the wind farms and the TES enterprises participating in the game, and set the COA parameters.

- (2)

- Candidate generation: For each curtailed interval , the TES enterprises use COA to generate a set of candidate absorption quantities . For each candidate , the wind farms compute the profit-maximizing price offer from their payoff function.

- (3)

- Fitness evaluation: Given , the TES enterprises evaluate the profit (fitness) associated with each candidate . The feasible traded quantity iswhere is the maximum available curtailed energy.

- (4)

- COA update: Apply COA’s update mechanism to produce a new round of candidates ; repeat Steps (2)–(4) until the best price offer is obtained.

- (5)

- Payoff calculation: Substitute and into (2) and (9) to compute the wind farm’s and the TES enterprise’s profits, respectively.

- (6)

- Equilibrium check: Compare the current round’s profits with those of the previous round. If the changes for both parties remain below a preset threshold over several consecutive iterations, an approximate Stackelberg–Nash equilibrium is deemed reached. Otherwise, adjust the COA parameters and return to Step (2); if satisfied, proceed to Step (7).

- (7)

- Next interval: Set and repeat Steps (1)–(6) to obtain the equilibrium for the next trading interval.

- (8)

- Output: Return the final trading price and traded quantity for all curtailed intervals, yielding the optimal decision schedule.

4. Case Study

4.1. Simulation Setup

4.2. Simulation Results and Analysis

5. Conclusions

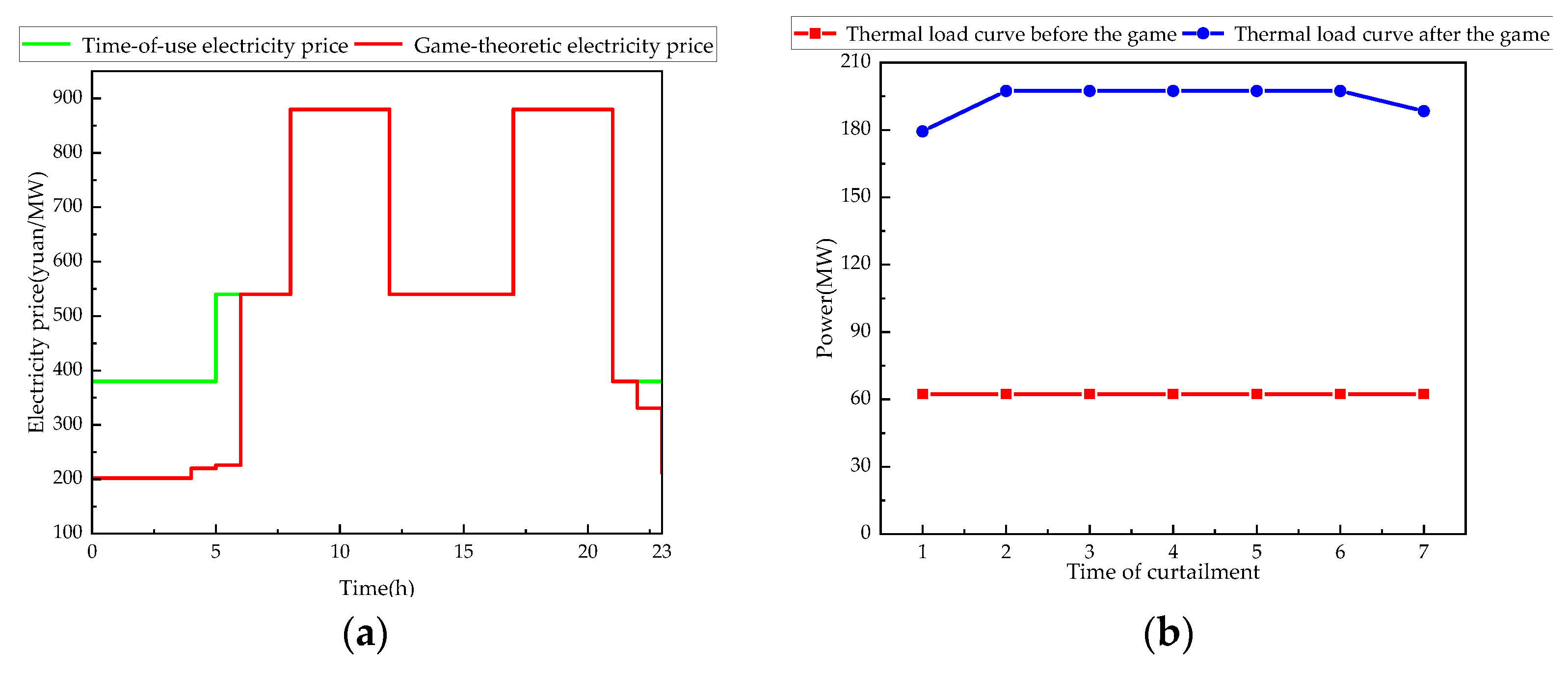

- In this study, the thermal and electrical pathways of TES were delineated, and a role classification was proposed based on the point of interconnection, voltage level, and installed capacity. From a prosumer perspective, independent TES enterprises coordinated with wind farms act as a flexible consumer. Furthermore, by reducing wind curtailment, the proposed model enhances the ability of independent TES enterprises to participate in peak shaving and increases the power load capacity by 131.6 MW during off-peak hours.

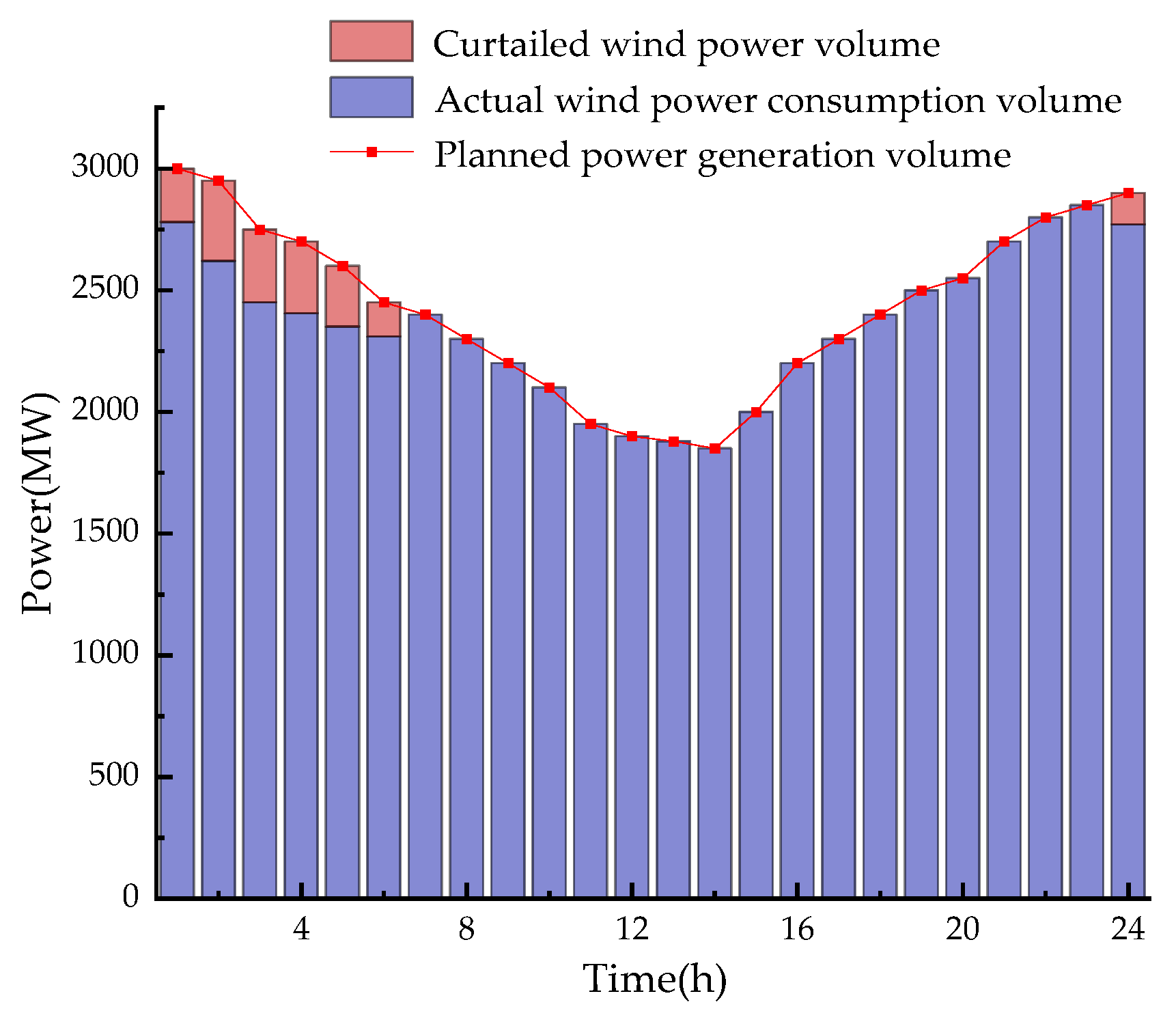

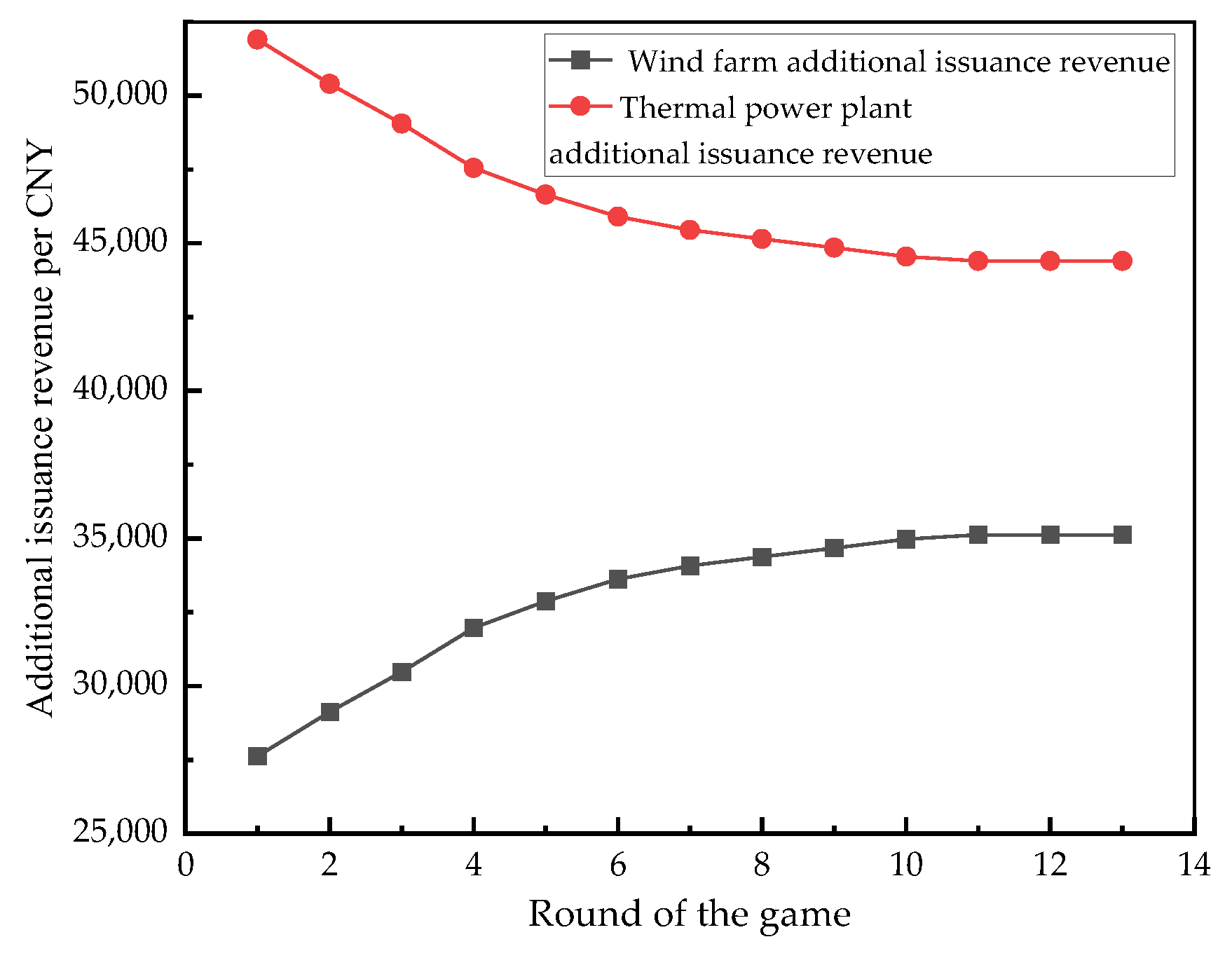

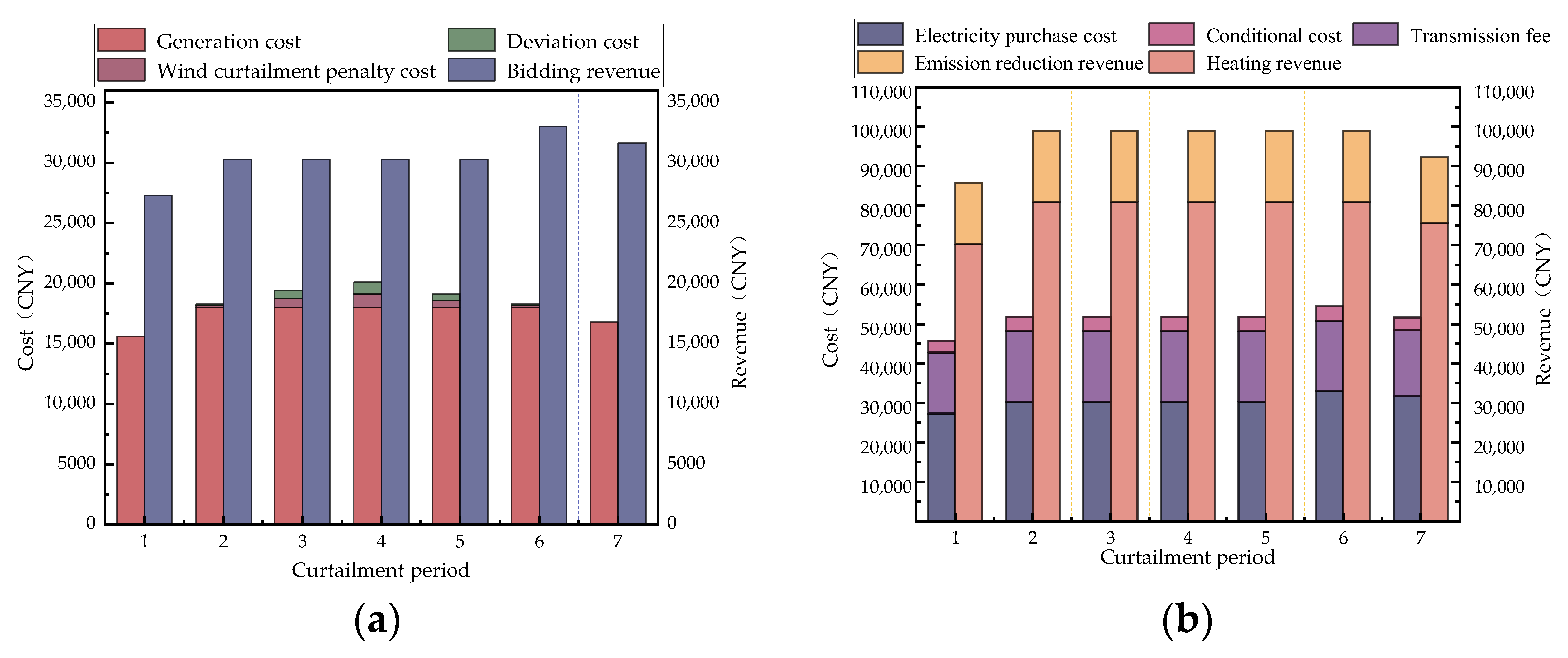

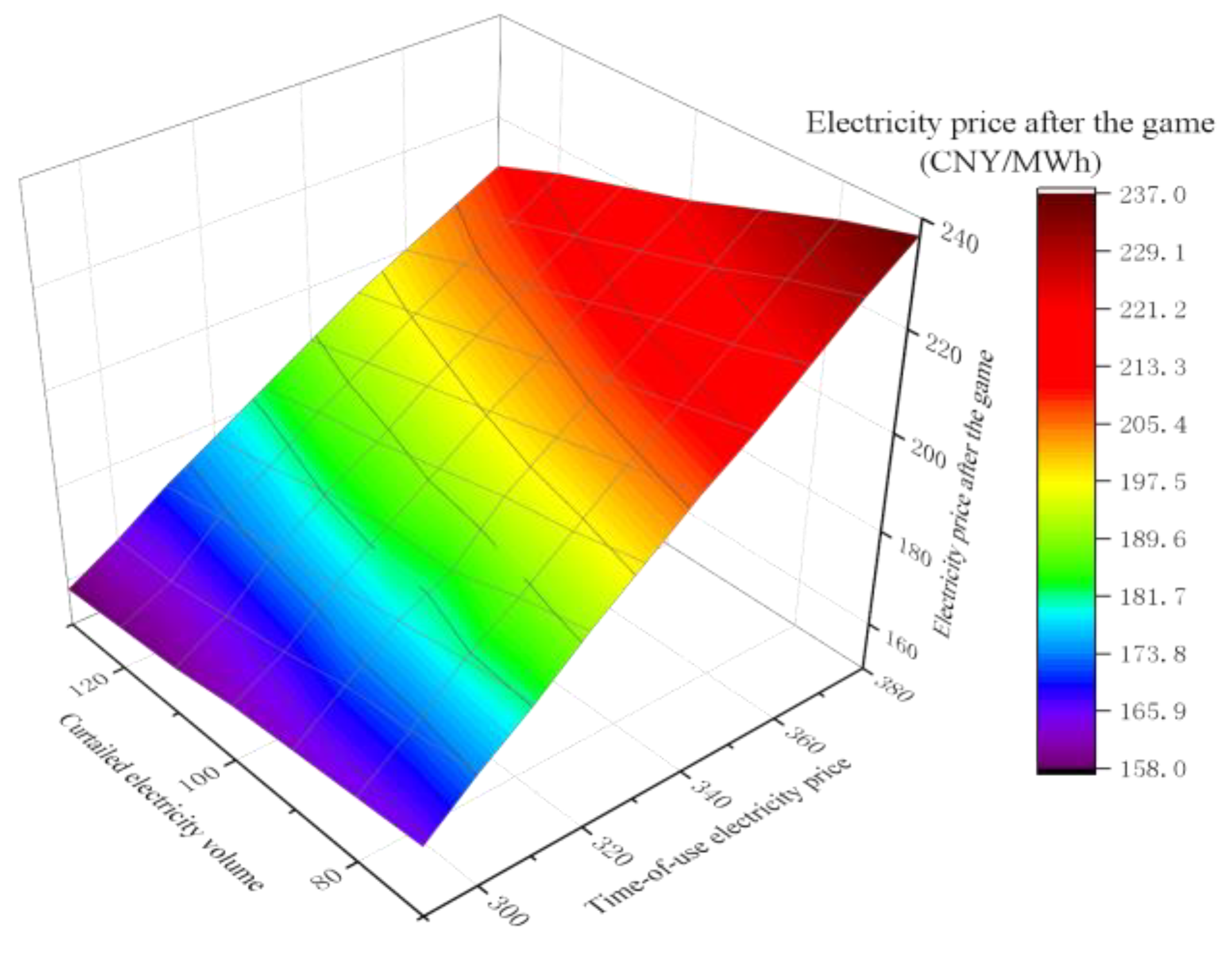

- A Stackelberg leader–follower framework with TES-quantity bids and wind-price offers was established, which mitigates ambiguity in benefit allocation across multiple stakeholders. By leveraging the TES enterprise’s load-shifting capability, the scheme enhances nighttime wind power absorption. Under typical daily conditions where obstructed wind power reaches 1665 MWh, the proposed method can achieve an additional absorption rate of 61.26% for obstructed wind power.

- A bilateral trading mechanism for peak shaving between the wind farms and the TES enterprise was proposed, which effectively promotes participation on both sides. These results indicate that the prosumer framework enhances wind–TES coordination, mitigates information asymmetry, significantly reduces the profit margin gap between TES and wind farms from an initial 24,275.4 to 9275.4 CNY, and leverages market signals to incentivize peak-shaving behaviors.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| TES | Thermal energy storage | Unit O&M cost | |

| CHP | Combined heat and power | Unit curtailment-penalty rate | |

| TOU | Time-of-use | Cumulative energy sold through the bilateral trade | |

| COA | Coati Optimization Algorithm | Wind power output at time t | |

| Set of curtailment hours | Unit penalty for deviations from the contracted quantity | ||

| System load at time t (MW) | Ratio of volatility-related energy to the forecast energy | ||

| Minimum stable output of the thermal unit at time t (MW) | Wind farm’s planned on-grid electricity price (CNY/MWh) | ||

| Total revenue from bilateral trades | Heating-equivalent electricity price | ||

| Generation and O&M cost | Carbon price | ||

| Curtailment penalty | Difference in emission factors between the reference supply and wind-based electrified heat | ||

| Penalty for deviations from the contracted quantity | Standard transmission–distribution (wheeling) tariff | ||

| Electricity sold by the wind farms at time t in the bilateral trade | Initial stored heat | ||

| Agreed bilateral price at time t | Leader (TES enterprises) | ||

| Total traded energy over curtailment hours | Follower (wind farms) | ||

| Unit generation cost | Maximum available curtailed energy |

References

- Yao, S.; Gu, W.; Zhou, S.; Lu, S.; Wu, C.; Pan, G. Hybrid Timescale Dispatch Hierarchy for Combined Heat and Power System Considering the Thermal Inertia of Heat Sector. IEEE Access 2018, 6, 63033–63044. [Google Scholar] [CrossRef]

- Li, J.; Ma, Y.; Mu, G.; Feng, X.; Yan, G.; Guo, G.; Zhang, T. Optimal configuration of energy storage system coordinating wind turbine to participate power system primary frequency regulation. Energies 2018, 11, 1396. [Google Scholar] [CrossRef]

- Chen, X. Increasing the flexibility of combined heat and power for wind power integration in China: Modeling and implications. IEEE Trans. Power Syst. 2015, 30, 1848–1857. [Google Scholar] [CrossRef]

- Zhang, D.; Hu, Y.; Gao, Y. Flexibility improvement of CHP unit for wind power accommodation. J. Mod. Power Syst. Clean Energy 2022, 10, 731–742. [Google Scholar] [CrossRef]

- Liu, M.; Wang, S.; Zhao, Y.; Tang, H.; Yan, J. Heat–power decoupling technologies for coal-fired CHP plants: Operation flexibility and thermodynamic performance. Energy 2019, 188, 116074. [Google Scholar] [CrossRef]

- Cao, L.; Wang, Z.; Pan, T.; Dong, E.; Hu, P.; Liu, M.; Ma, T. Analysis on wind power accommodation ability and coal consumption of heat–power decoupling technologies for CHP units. Energy 2021, 231, 120833. [Google Scholar] [CrossRef]

- You, L.; Jin, X.; Liu, Y. A Unit Commitment Model Considering the Flexibility Retrofit of Combined Heat and Power Units for Wind Integration. IEEE Access 2024, 12, 122199–122212. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, X.; Shen, S.; Ren, C.; Zang, H.; Sun, G. Distributed multi-market product trading of prosumers based on information-gap decision theory. Autom. Electr. Power Syst. 2023, 47, 122–130. [Google Scholar]

- Yang, G.; Li, X.; Liu, J.; Lin, S. Prosumer-alliance power trading strategy based on a distributed branch-and-bound algorithm. Smart Power 2023, 51, 9–16. [Google Scholar]

- Cui, S.; Wang, Y.-W.; Xiao, J.-W.; Liu, N. A Two-Stage Robust Energy Sharing Management for Prosumer Microgrid. IEEE Trans. Ind. Inform. 2019, 15, 2741–2752. [Google Scholar] [CrossRef]

- Peng, W.; Yi, Y.; Yihan, Z.; Li, X.; Haili, W. Market optimization strategy for photovoltaic prosumers and shared energy storage based on Nash bargaining. Power Syst. Technol. 2025, 49, 642–652. [Google Scholar]

- Ma, L.; Liu, W.; Sun, H. Trading strategies for prosumers in frequency-regulation markets based on contract theory. Power Syst. Technol. 2021, 45, 1347–1356. [Google Scholar]

- Chen, H.; Qiao, N.; Zhang, C.; Zhang, J.; Shen, S. Trading strategies for prosumers participating in the peak-shaving ancillary-service market. Power Demand Side Manag. 2024, 26, 101–106. [Google Scholar]

- Gao, X.; Ye, C.; Wang, J.; Xu, S.; Yao, Y.; Wang, D.; Wang, X.; Li, J. Joint Clearing Mechanism and Economic Evaluation of Energy Storage Participation in Spot-Frequency Regulation Market Based on Two Stages of SCUC-SCED. In Proceedings of the 2025 International Conference of Clean Energy and Electrical Engineering (ICCEEE), Changchun, China, 18–21 July 2025; pp. 1–6. [Google Scholar]

- Luo, H.; Wang, H.; Ge, W.; Liu, C.; Wang, Y. Design of a dynamic peak-shaving ancillary-service market bidding mechanism considering bid supervision. Trans. China Electrotech. Soc. 2021, 36, 1935–1947. [Google Scholar]

- Sun, J.; Jiang, Q.; Cheng, Z.; Luo, H.; Ge, W. Optimization model for capacity and price intervals of large-scale electric thermal storage participating in bilateral trading for peak-shaving ancillary services. Power Syst. Technol. 2019, 43, 1995–2001. [Google Scholar]

- Bompard, E.; Tao, H.; Li, Y. Market equilibrium under incomplete and imperfect information in bilateral electricity markets. IEEE Trans. Power Syst. 2011, 26, 1231–1240. [Google Scholar] [CrossRef]

- Zhu, X.; Zhao, G.; Li, J.; Liu, H.; Zhao, Z.; Li, C.; Li, Z.; Zhou, H. Stackelberg Game for Bilateral Transactions between Energy Storage and Wind Farms Considering the Day-Ahead Electricity Market. Energy Eng. 2025, 122, 1645–1668. [Google Scholar] [CrossRef]

- Yu, X.; Pan, D.; Zhou, Y. A Stackelberg game-based peer-to-peer energy trading market with energy management and pricing mechanism: A case study in Guangzhou. Sol. Energy 2024, 270, 112388. [Google Scholar] [CrossRef]

- Pan, H.; Wu, Q.; Guo, H.; Bai, J. Low-Carbon Optimization Scheduling of Integrated Energy Systems Based on Bilateral Demand Response and Two-Level Stackelberg Game. Energies 2024, 17, 5491. [Google Scholar] [CrossRef]

- Wang, M.; Li, X.; Han, X.; Wang, W.; Liu, W. Leader–follower game-based transaction decision method for heat-storage electric-boiler loads in curtailed wind power consumption. Glob. Energy Interconnect. 2022, 5, 496–504. [Google Scholar]

- Wu, J.; Bi, Y.; Lu, Y. Research status and prospects of solid electric-heat storage technology. Power Demand Side Manag. 2022, 24, 65–71. [Google Scholar]

- Wang, Y.; Lou, S.; Wu, Y.; Wang, S. Flexible Operation of Retrofitted Coal-Fired Power Plants to Reduce Wind Curtailment Considering Thermal Energy Storage. IEEE Trans. Power Syst. 2020, 35, 1178–1187. [Google Scholar] [CrossRef]

- Li, J.; Fu, Y.; Xing, Z.; Zhang, X.; Zhang, Z.; Fan, X. Coordination Scheduling Model of Multi-Type Flexible Load for Increasing Wind Power Utilization. IEEE Access 2019, 7, 105840–105850. [Google Scholar] [CrossRef]

- Zhang, M.; Wang, J.; Wang, X.; Cao, X.; Chen, Y. Bilateral trading mechanism and model for the peak-shaving ancillary-service market oriented to renewable-energy accommodation. Electr. Power Autom. Equip. 2021, 41, 84–91. [Google Scholar]

- Zhou, M.; Yan, Y.; Ding, Q.; Wu, Z.; He, Y.; Long, S. Trading and settlement mechanisms in typical foreign electricity markets and implications for China. Autom. Electr. Power Syst. 2017, 41, 1–8. [Google Scholar]

- Zhou, J.; Cai, G.; Liu, C.; Wang, Y.; Zhao, X.; Bian, G. Dynamic pricing strategy for bilateral trading between energy-intensive industrial parks and wind-power enterprises in the ancillary-services market. Proc. CSEE Early Access 2025, 1–13. Available online: https://link.cnki.net/urlid/11.2107.tm.20250324.1136.004 (accessed on 13 November 2025).

- Camacho-Vallejo, J.-F.; Corpus, C.; Villegas, J.G. Metaheuristics for bilevel optimization: A comprehensive review. Comput. Oper. Res. 2024, 161, 106410. [Google Scholar] [CrossRef]

| Parameter (Unit) | Value | Parameter (Unit) | Value |

|---|---|---|---|

| /(CNY·MWh−1) | 90 | /(CNY·MWh−1) | 150 |

| /(CNY·MWh−1) | 308 | a | 0.1 |

| /(CNY·MWh−1) | 119 | b | 10 |

| /(CNY·MWh−1) | 11 | c | 0.2 |

| /(CNY·MWh−1) | 15 | (g CO2·MWh−1) | 800 |

| /(CNY·MWh−1) | 90 |

| Time Interval | Game-Clearing Price (CNY/MWh) | Curtailed Wind Power (MWh) | Traded Energy (MWh) | Incremental Revenue—Wind Farms (104 CNY) | Incremental Revenue—TES Enterprises (104 CNY) |

|---|---|---|---|---|---|

| 23:00–0:00 | 210 | 130 | 130 | 2.925 | 1.924 |

| 0:00–1:00 | 202 | 160 | 150 | 3.242 | 2.310 |

| 1:00–2:00 | 202 | 200 | 150 | 3.189 | 2.310 |

| 2:00–3:00 | 202 | 225 | 150 | 3.158 | 2.310 |

| 3:00–4:00 | 202 | 190 | 150 | 3.203 | 2.310 |

| 4:00–5:00 | 220 | 160 | 150 | 3.512 | 4.440 |

| 5:00–6:00 | 226 | 140 | 140 | 3.374 | 4.074 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huan, J.; Guo, W.; Zhang, W.; Jiang, J.; Huang, Y.; Xu, A. Bilateral Trading Strategy for the Wind–Thermal Storage System Considering Peak Shaving. Electronics 2025, 14, 4493. https://doi.org/10.3390/electronics14224493

Huan J, Guo W, Zhang W, Jiang J, Huang Y, Xu A. Bilateral Trading Strategy for the Wind–Thermal Storage System Considering Peak Shaving. Electronics. 2025; 14(22):4493. https://doi.org/10.3390/electronics14224493

Chicago/Turabian StyleHuan, Jiafei, Wanshu Guo, Weitao Zhang, Jixuan Jiang, Yuan Huang, and Ang Xu. 2025. "Bilateral Trading Strategy for the Wind–Thermal Storage System Considering Peak Shaving" Electronics 14, no. 22: 4493. https://doi.org/10.3390/electronics14224493

APA StyleHuan, J., Guo, W., Zhang, W., Jiang, J., Huang, Y., & Xu, A. (2025). Bilateral Trading Strategy for the Wind–Thermal Storage System Considering Peak Shaving. Electronics, 14(22), 4493. https://doi.org/10.3390/electronics14224493