Analysis of a Personalized Provision of Service Level Agreement (SLA) Algorithm

Abstract

1. Introduction

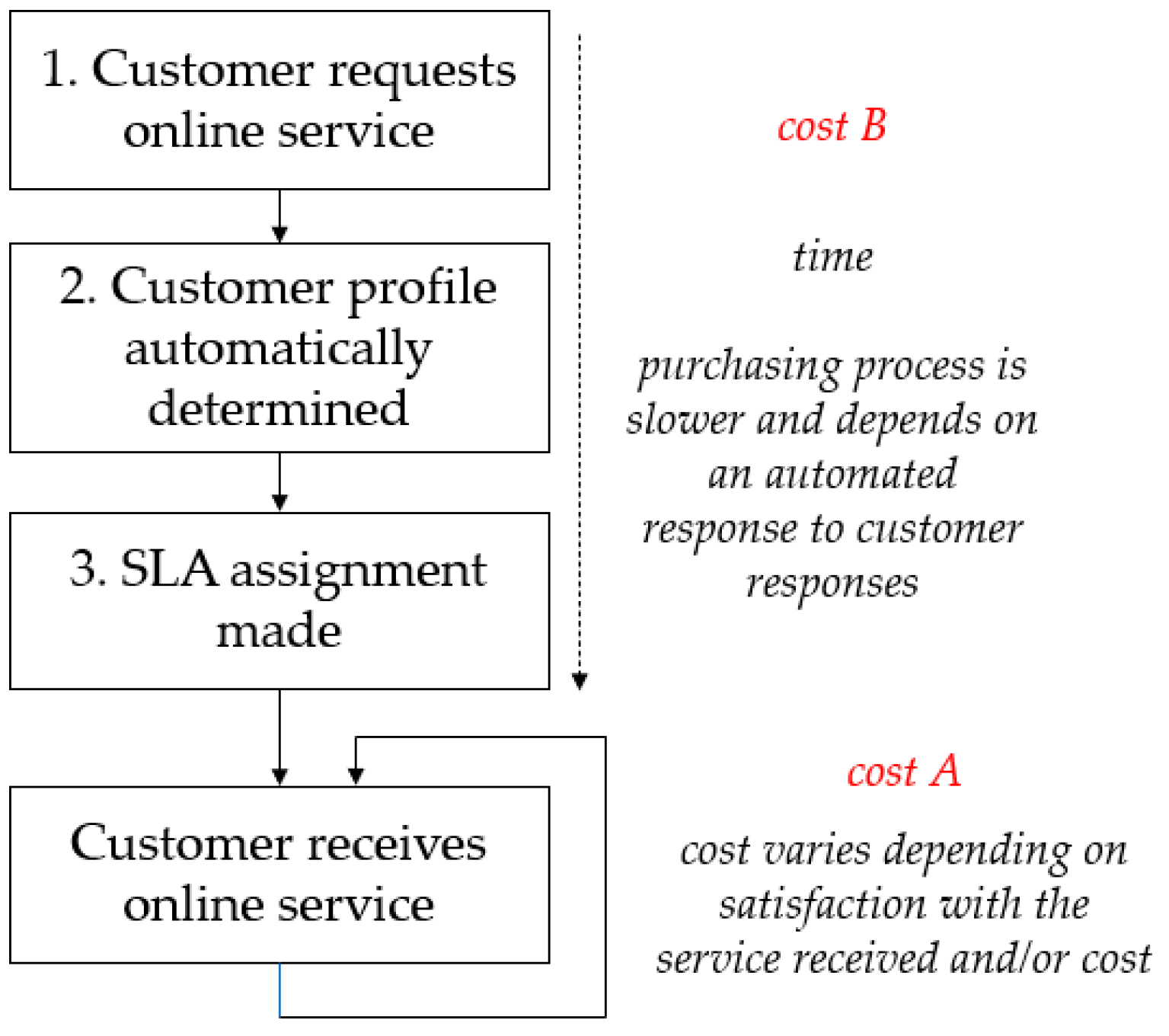

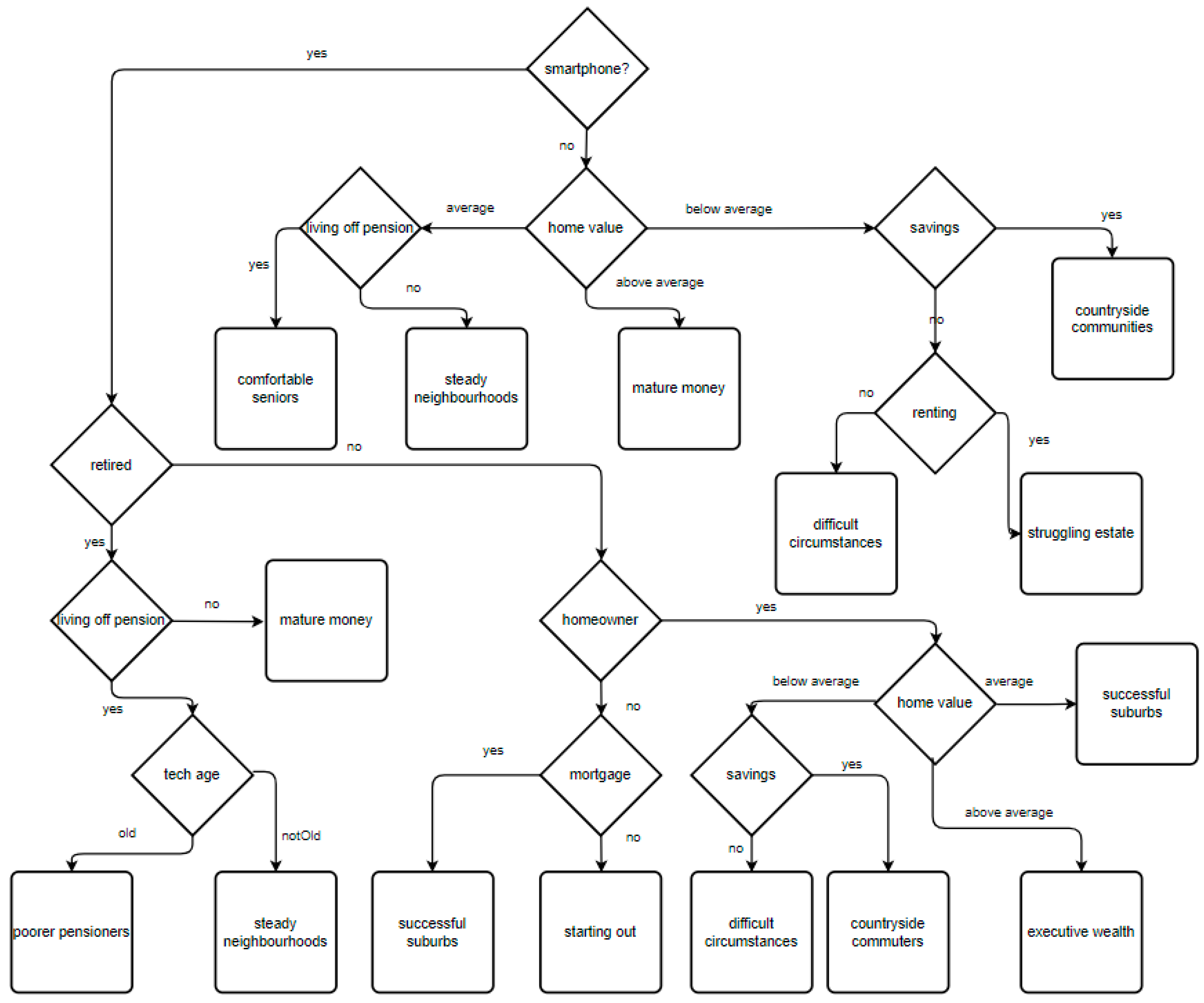

2. Materials and Methods

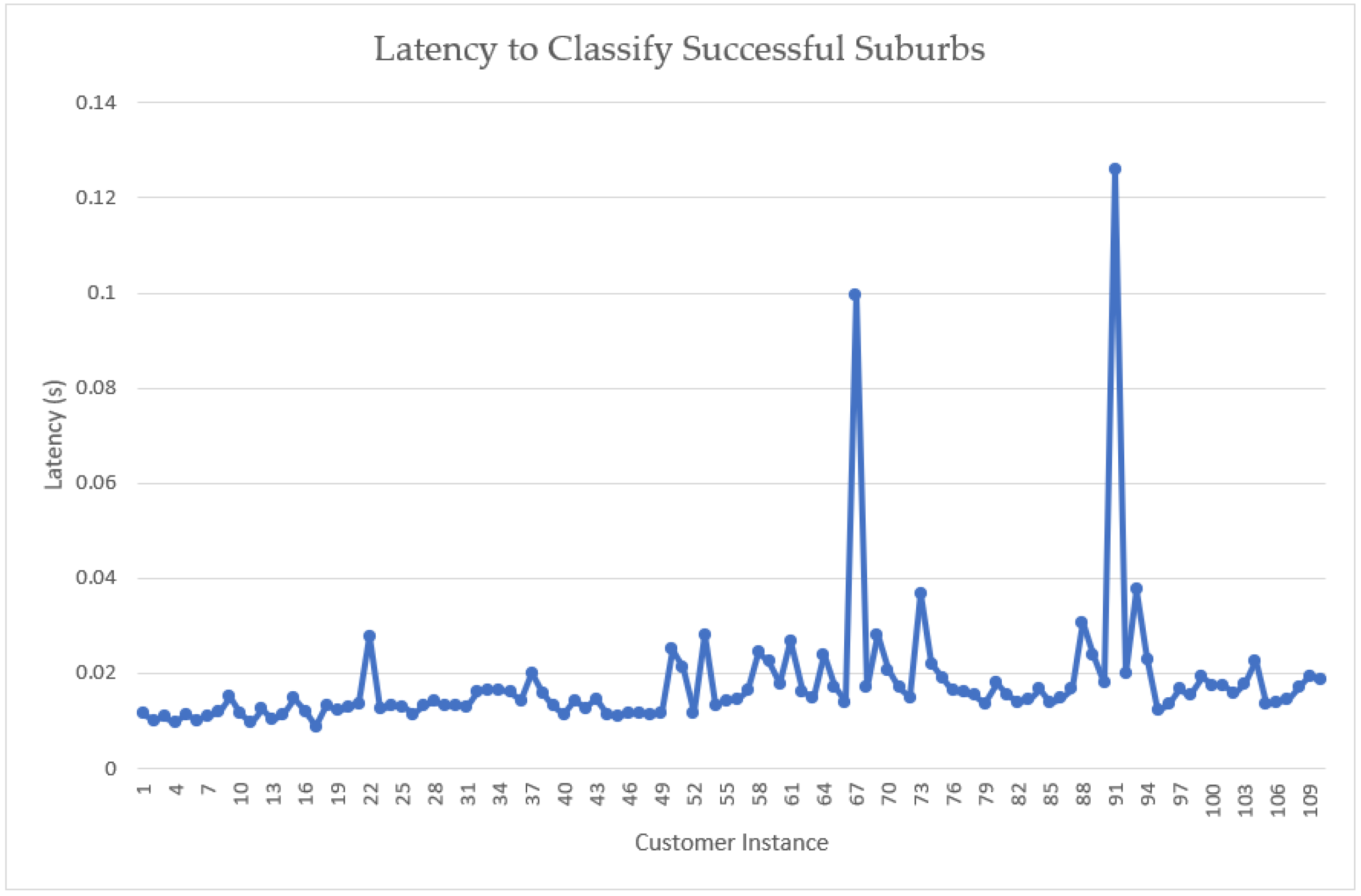

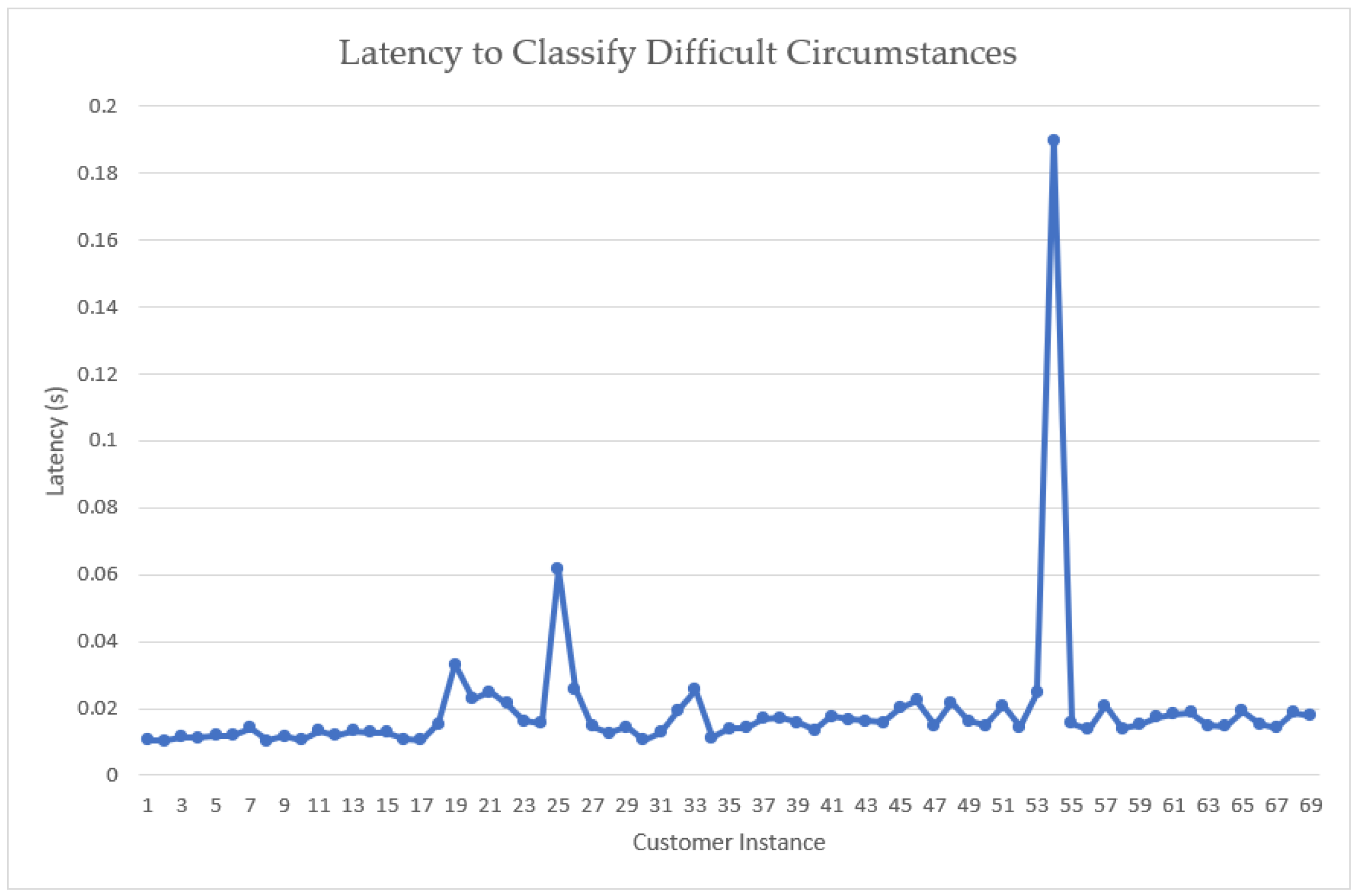

3. Results

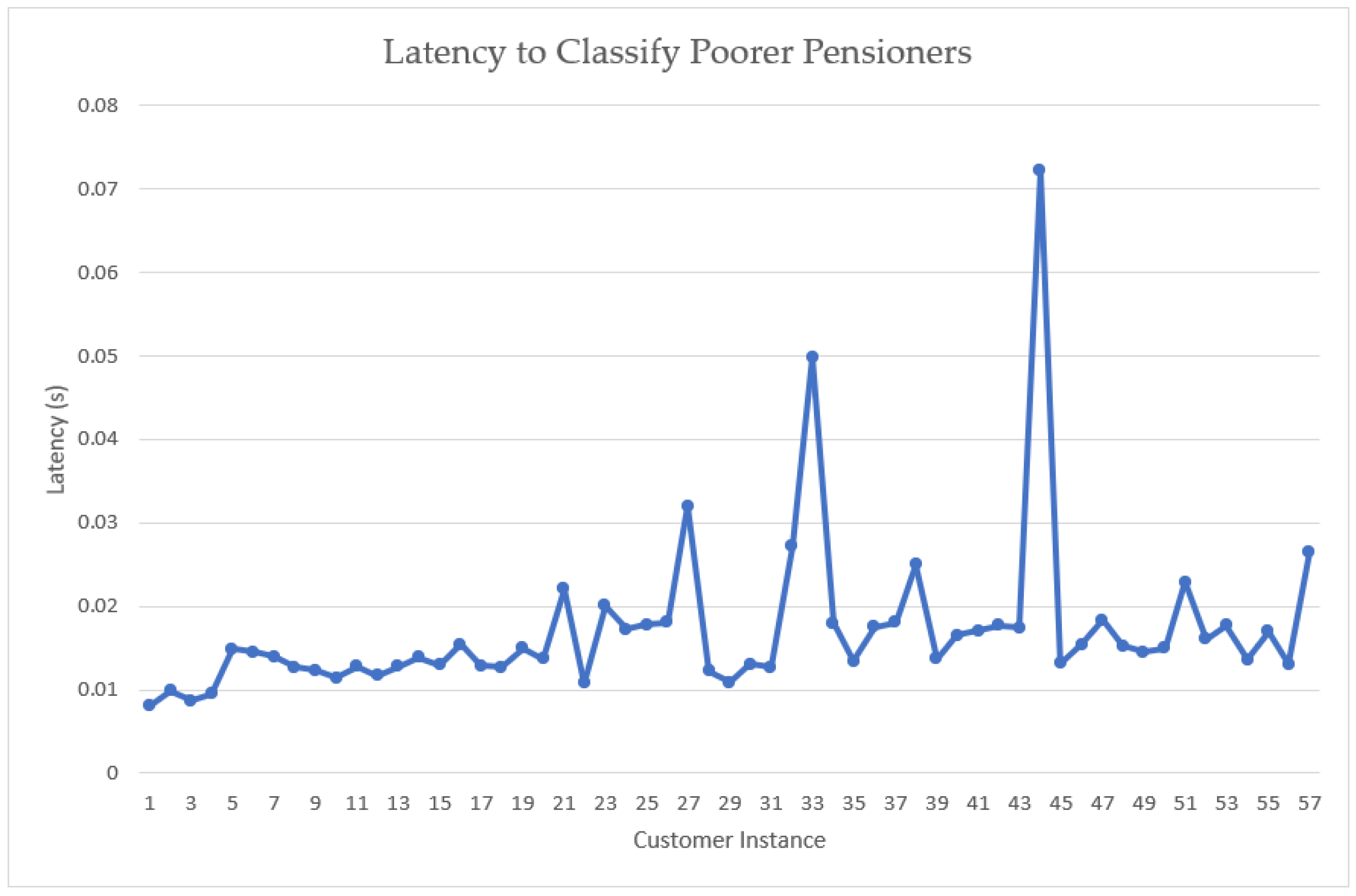

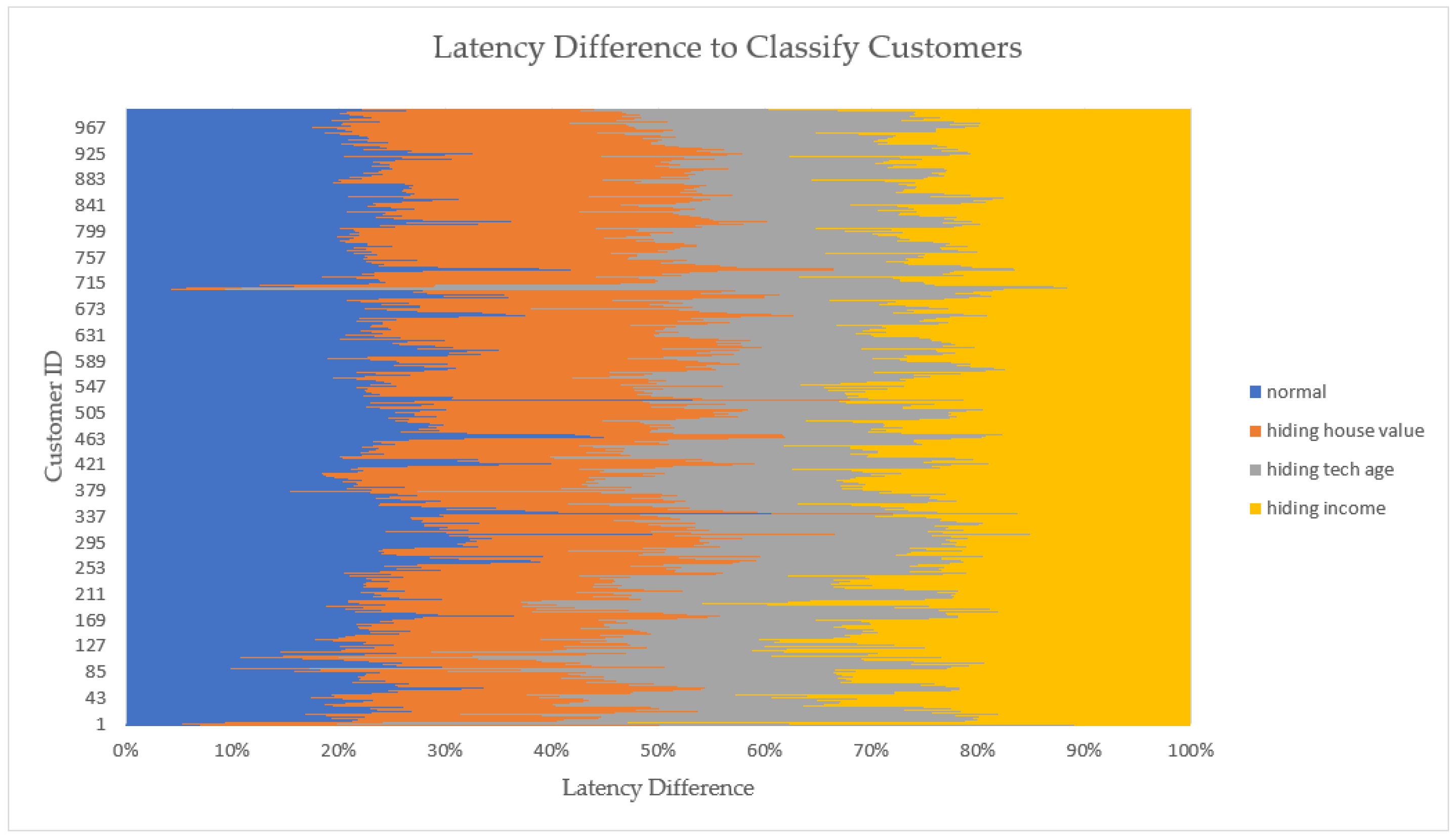

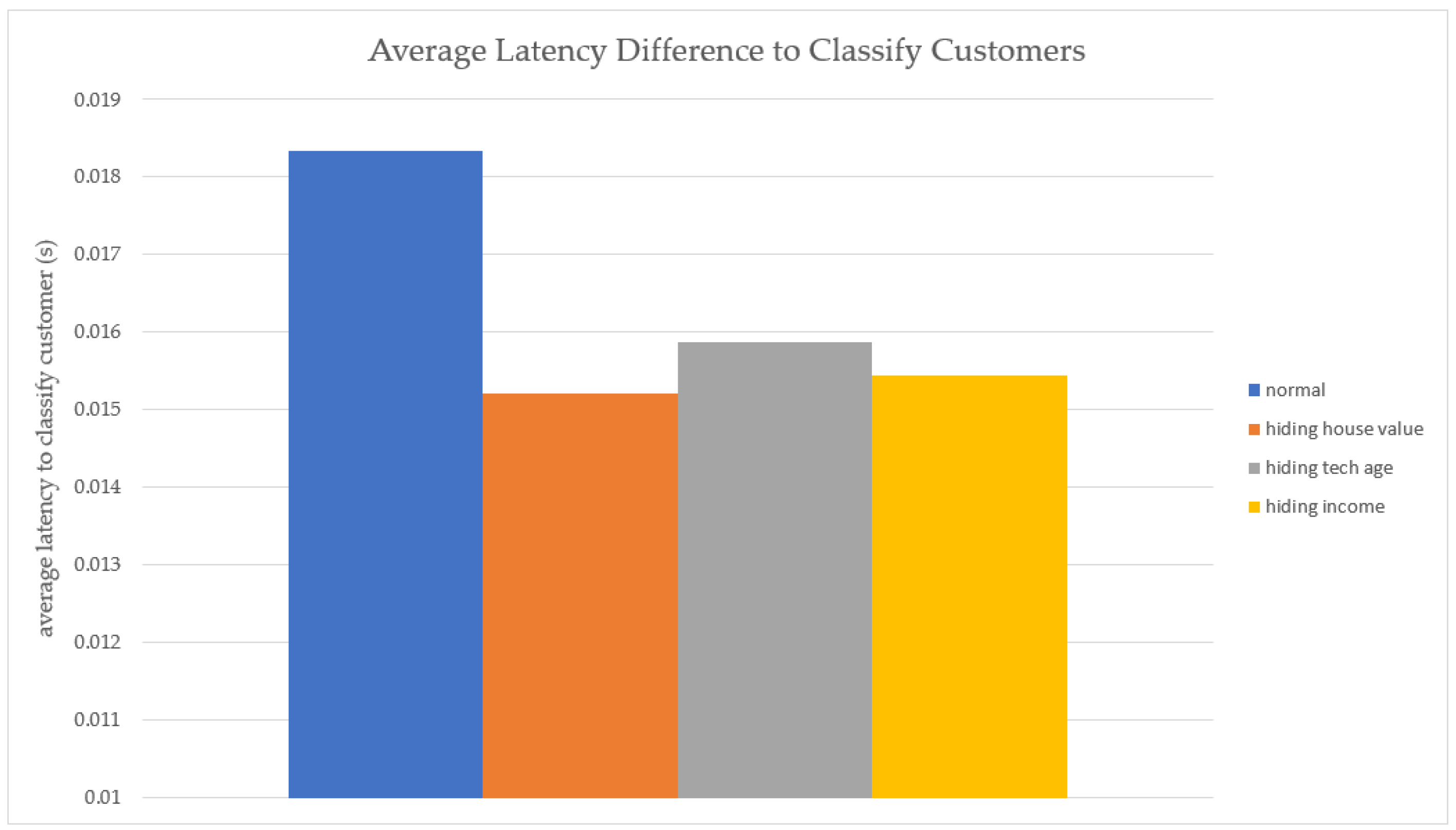

Examining the Impact of Inaccuracies in the Dataset on the Classification Process

4. Discussion

- -

- Location;

- -

- Number of people in household;

- -

- Age of oldest;

- -

- Age of youngest;

- -

- Any residents in the 10–20 age bracket;

- -

- Number of devices;

- -

- Service priority.

5. Conclusions, Limitations, and Further Work

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- EE. Broadband Deals Available in Your Area. Available online: https://broadband.ee.co.uk/select-your-speed (accessed on 22 February 2023).

- Sky. No Upfront Fees on Superfast Broadband. Switch Today. Available online: https://www.sky.com/broadband#Comparison-table-BB (accessed on 22 February 2023).

- TalkTalk. Fast Broadband for Every Home. Available online: https://new.talktalk.co.uk/broadband/ (accessed on 22 February 2023).

- Peoples, C.; Tariq, Z.; Moore, A.; Zoualfaghari, M.; Reeves, A. Using Process Mining to Formalise Service Level Agreement (SLA) Allocation. In Proceedings of the 2021 IEEE SmartWorld, Ubiquitous Intelligence & Computing, Advanced & Trusted Computing, Scalable Computing & Communications, Internet of People and Smart City Innovation (SmartWorld/SCALCOM/UIC/ATC/IOP/SCI), Atlanta, GA, USA, 18–21 October 2021; pp. 671–676. [Google Scholar] [CrossRef]

- Baek, J.W.; Park, J.-T.; Seo, D.-I. End-to-end Internet/intranet service management in multi-domain environment using SLA concept. In Proceedings of the NOMS 2000. 2000 IEEE/IFIP Network Operations and Management Symposium ’The Networked Planet: Management Beyond 2000’ (Cat. No.00CB37074), Honolulu, HI, USA, 10–14 April 2000; pp. 989–990. [Google Scholar] [CrossRef]

- Bagchi, A.; Caruso, F.; Mayer, A.; Roman, R.; Kumar, P.; Kowtha, S. Framework to achieve multi-domain service management. In Proceedings of the 2009 IFIP/IEEE International Symposium on Integrated Network Management, New York, NY, USA, 1–5 June 2009; pp. 287–290. [Google Scholar] [CrossRef]

- Alzubaidi, A.; Solaiman, E.; Patel, P.; Mitra, K. Blockchain-Based SLA Management in the Context of IoT. IT Prof. 2019, 21, 33–40. [Google Scholar] [CrossRef]

- Battula, S.K.; Garg, S.; Naha, R.; Amin, M.B.; Kang, B.; Aghasian, E. A blockchain-based framework for automatic SLA management in fog computing environments. J. Supercomput. 2022, 78, 16647–16677. [Google Scholar] [CrossRef]

- Sahoo, S.; Bigo, S.; Benzaoui, N. Introducing Best-in-Class Service Level Agreement for Time-Sensitive Edge Computing. In Proceedings of the 2021 European Conference on Optical Communication (ECOC), Bordeaux, France, 13–16 September 2021; pp. 1–4. [Google Scholar] [CrossRef]

- Li, X.; Chiasserini, C.F.; Mangues-Bafalluy, J.; Baranda, J.; Landi, G.; Martini, B.; Costa-Perez, X.; Puligheddu, C.; Valcarenghi, L. Automated Service Provisioning and Hierarchical SLA Management in 5G Systems. IEEE Trans. Netw. Serv. Manag. 2021, 18, 4669–4684. [Google Scholar] [CrossRef]

- CACI. Acorn Guide. 2014. Available online: https://acorn.caci.co.uk/downloads/Acorn-User-guide.pdf (accessed on 2 July 2022).

| Question | Value Range | Rationale for Question | Support for Rationale from [11] |

|---|---|---|---|

| 1. Do you have a smartphone? | Yes No | This question seeks to examine the extent to which a customer has more sophisticated technology available at their home. | Executive Wealth customers are “more likely” to own smartphones and are described as being “high income people”. Mature Money customers are “less likely than average to have a smartphone” and these “older, affluent people have the money and the time to enjoy life.” For Starting Out customers, “New technology including smartphones and tablet computers might be popular.” |

| 2. Are you retired? | Yes No | The volume of resource provision associated with a service is assumed to decline once customers can be characterized as being retired. | Executive Wealth customers include “empty nesters and better off retired couples.” Comfortable Communities include “comfortably off pensioners, living in retirement areas around the coast.” |

| 3. Do you have a mortgage? | Yes No | The fact of a customer having a mortgage can be used to influence understanding around a customer’s disposable income on the basis that those customers with a mortgage are more likely to have less disposable income than customers without. | A number of customers may be continuing to “be repaying a mortgage”; however, many may also own a second home. Many Mature Money customers will not have a mortgage. The majority of Comfortable Senior customers “will have paid off their mortgage.” |

| 4. Do you have debt? | Yes No | With a similar rationale to the consideration for customers with a mortgage (question 3), customers with debt are more likely to have less disposable income than customers without. While customers with debt may be more inclined to spend than customers without, this is not a trait that we wish to exploit. | One in ten customers who belong to the Difficult Circumstances category might have a level of debt greater than their annual income. More than double the average of customers belonging to the Struggling Estates classification will have difficulty with debts |

| 5. Age of your technology? | Old Not Old | With a similar rationale to the consideration for customers with a smartphone (question 1), customers with newer technology are more likely to be more prolific telecommunication service users than those with older technology. | Poorer Pensioners are not interested in new technology, and many will have never used the Internet. Mature Money customers own modern technologies, and those with children will own game consoles. |

| 6. Are you a homeowner? | Yes No | Customers who own their own homes are more likely to have higher purchasing power for an online service than those who do not. | In Countryside Communities, housing is largely owner-occupied. Successful Suburbs primarily have home-owning families. Steady Neighborhoods include home-owning families. |

| 7. What is your home value? | Below Average Average Above Average | As the value of a home increases, it is likely that purchasing power and usage of online services will similarly increase. | Homes for Steady Neighborhood customers are lower priced and have been occupied for many years. |

| 8. What is your average income? | Below Average Average Above Average | With a similar rationale as for Question 7, as average income increases, it is likely that purchasing power and usage of online services will similarly increase. | For Executive Wealth customers, “Incomes are good,” and they are “high income people”. Mature Money are also “high income households”. |

| 9. Are you living off a pension? | Yes No | When customers are living off a pension, we draw a conclusion that they are likely to have less intensive SLA requirements in comparison to customers who are not. | Executive Wealth customers are likely to have personal pensions. Many customers belonging to the Successful Suburbs category will “have pensions through their employer and others will have private pensions”. |

| 10. Do you have savings? | Yes No | With a similar rationale as for Question 9, customers with savings are assumed to have greater resource requirements from their SLA than customers without. | Many Executive Wealth customers have “significant levels of savings”. Poorer Pensioners are “unlikely to have much savings”. |

| 11. Are you renting accommodation? | Yes No | Similar to Question 9, customers renting their accommodation are assumed to have fewer resource requirements from their SLA than customers who own their homes. | Two-thirds of customers from Struggling Estates rent accommodation from the council. |

| Customer Classification | Income | Education | Technology | Internet | Employment | House Type | Average Tech. Age | Total |

|---|---|---|---|---|---|---|---|---|

| Mature Money | 5 | 5 | 3 | 2 | 1 | 5 | 4 | 25 |

| Steady Neighborhoods | 3 | 4 | 2 | 2 | 3 | 3 | 3 | 20 |

| Comfortable Seniors | 3 | 2 | 1 | 2 | 0 | 2 | 5 | 15 |

| Countryside Communities | 2 | 3 | 3 | 3 | 4 | 4 | 5 | 24 |

| Difficult Circumstances | 0 | 1 | 1 | 1 | 1 | 0 | 3 | 7 |

| Struggling Estate | 1 | 1 | 2 | 2 | 2 | 2 | 3 | 13 |

| Poorer Pensioners | 1 | 1 | 1 | 1 | 1 | 1 | 5 | 11 |

| Successful Suburbs | 4 | 4 | 3 | 3 | 4 | 4 | 3 | 25 |

| Executive Wealth | 5 | 5 | 5 | 5 | 5 | 5 | 4 | 34 |

| Starting Out | 4 | 4 | 5 | 5 | 4 | 3 | 3 | 28 |

| Attributes Used to Score a Customer Category | Attributes Used to Query a Customer about Their Service Needs |

|---|---|

| Income | average income, debt, savings, pension |

| Education | average income, savings |

| Technology | smartphone, technology age |

| Internet | smartphone, technology age |

| Employment | average income |

| House Type | homeowner, home value, renting |

| Average Technology Age | technology age |

| Customer ID | Smartphone | Retired | Mortgage | Debt | Technology Age | Homeowner | Home Value | Average Income | Living off Pension | Savings | Renting |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | no | yes | no | yes | notold | yes | belowaverage | average | no | no | no |

| 2 | no | no | yes | yes | old | yes | belowaverage | belowaverage | yes | yes | no |

| 3 | yes | no | yes | yes | notold | yes | aboveaverage | belowaverage | yes | yes | no |

| 4 | yes | yes | no | no | old | no | average | aboveaverage | no | yes | no |

| 5 | yes | no | yes | no | notold | yes | average | average | yes | no | yes |

| 6 | yes | no | yes | no | notold | no | belowaverage | aboveaverage | no | no | yes |

| 7 | yes | yes | no | no | notold | yes | average | belowaverage | yes | yes | no |

| 8 | no | no | no | yes | old | no | average | average | yes | yes | no |

| 9 | no | yes | yes | yes | old | no | average | belowaverage | no | yes | yes |

| 10 | no | no | yes | no | old | yes | average | aboveaverage | yes | no | no |

| 11 | yes | no | yes | yes | old | no | average | belowaverage | no | no | no |

| 12 | yes | yes | no | yes | old | yes | aboveaverage | belowaverage | no | no | yes |

| 13 | no | no | no | no | notold | no | aboveaverage | average | no | yes | no |

| 14 | yes | no | yes | yes | notold | yes | belowaverage | aboveaverage | no | no | yes |

| 15 | yes | no | yes | yes | notold | yes | average | aboveaverage | no | yes | no |

| 16 | yes | yes | yes | no | notold | no | belowaverage | average | yes | no | no |

| 17 | yes | yes | yes | no | old | no | aboveaverage | average | yes | no | no |

| 18 | yes | yes | yes | no | notold | yes | belowaverage | average | no | yes | no |

| 19 | yes | no | no | no | notold | no | belowaverage | average | no | yes | yes |

| 20 | yes | no | yes | yes | notold | yes | aboveaverage | average | yes | no | yes |

| 21 | yes | yes | no | yes | old | yes | aboveaverage | average | no | no | yes |

| 22 | no | yes | yes | no | notold | no | average | aboveaverage | yes | no | yes |

| 23 | yes | yes | no | no | notold | yes | belowaverage | aboveaverage | yes | yes | yes |

| Customer Classification [11] | Classification Description [11] |

|---|---|

| Countryside Communities | Areas of low population densities in farming areas. Agricultural employment, in addition to skilled occupations and professional people. An older demographic than the average. Sub-categories include:

|

| Difficult Circumstances | Streets with a high proportion of youth. Many single parents. Accommodation is mainly rented flats. Deprived neighborhoods. Sub-categories include:

|

| Executive Wealth | Wealthy families in large detached or semi-detached properties in family areas. Some empty nesters and retired couples. Incomes are good. Sub-categories include:

|

| Mature Money | Older empty nesters and retired couples. Live in detached or semi-detached properties. Many have two cars. High-income households. Sub-categories include:

|

| Starting Out | Younger couples in their first home. Early career professionals. Incomes above average. Spend more time online than average. Sub-categories include:

|

| Steady Neighborhood | Middle-aged home-owning families living in older, lower-priced homes. Some have degrees. Incomes around the national average. Use the Internet but not in an extensive way. Sub-categories include:

|

| Struggling Estate | Low-income families. Majority rent their homes from council. High proportion of children and single-parent households. Low incomes with a high proportion claiming benefits. Sub-categories include:

|

| Successful Suburbs | Home-owning families living comfortably in homes of average value for the area. Children may be young or include young adults who have not left home. Incomes of at least the national average. Sub-categories include:

|

| Comfortable Seniors | In two and three bedroom semi-detached houses and bungalows, typically below the average value for the area. Incomes are modest, with many living off their pension. Sub-categories include:

|

| Poorer Pensioners | Rent social housing, many without educational qualiications, with higher than the average claiming benefits. Sub-categories include:

|

| Customer ID | Customer Classification | Customer Score | Latency to Assign Classification | |

|---|---|---|---|---|

| 1 | Difficult | Circumstances | 7 | 0.018334034 |

| 2 | Countryside | Communities | 24 | 0.010890007 |

| 3 | Executive | Wealth | 34 | 0.010039806 |

| 4 | Mature | Money | 25 | 0.008650064 |

| 5 | Successful | Suburbs | 25 | 0.011470079 |

| 6 | Successful | Suburbs | 25 | 0.010050058 |

| 7 | Steady | Neighbourhoods | 20 | 0.009649992 |

| 8 | Steady | Neighbourhoods | 20 | 0.00951004 |

| 9 | Steady | Neighbourhoods | 20 | 0.011419773 |

| 10 | Steady | Neighbourhoods | 20 | 0.011350155 |

| 11 | Successful | Suburbs | 25 | 0.010799885 |

| 12 | Mature | Money | 25 | 0.009190083 |

| 13 | Mature | Money | 25 | 0.010370016 |

| 14 | Difficult | Circumstances | 7 | 0.010540009 |

| 15 | Successful | Suburbs | 25 | 0.009579897 |

| 16 | Steady | Neighbourhoods | 20 | 0.010859966 |

| 17 | Poorer | Pensioners | 11 | 0.008020163 |

| 18 | Mature | Money | 25 | 0.010799885 |

| 19 | Starting | Out | 28 | 0.010460138 |

| 20 | Executive | Wealth | 34 | 0.010509968 |

| 21 | Mature | Money | 25 | 0.010020018 |

| 22 | Steady | Neighbourhoods | 20 | 0.008859873 |

| 23 | Steady | Neighbourhoods | 20 | 0.011610031 |

| 24 | Steady | Neighbourhoods | 20 | 0.011650085 |

| Customer Category | Number of Cases |

|---|---|

| Difficult Circumstances | 70 |

| Countryside Communities | 113 |

| Executive Wealth | 35 |

| Mature Money | 278 |

| Successful Suburbs | 110 |

| Steady Neighbourhoods | 248 |

| Poorer Pensioners | 57 |

| Starting Out | 49 |

| Struggling Estate | 40 |

| 1000 |

| Unavailable Attributes | |||||

|---|---|---|---|---|---|

| Full Dataset | House Value | Tech Age | Income | ||

| Difficult Circumstances | 70 | 70 | 70 | 70 | |

| Countryside Communities | 113 | 113 | 113 | 113 | |

| Executive Wealth | 35 | 0 | 0 | 0 | |

| Mature Money | 278 | 103 | 103 | 103 | |

| Successful Suburbs | 110 | 145 | 145 | 145 | |

| Steady Neighbourhoods | 248 | 423 | 423 | 423 | |

| Poorer Pensioners | 57 | 57 | 57 | 57 | |

| Starting Out | 49 | 49 | 49 | 49 | |

| Struggling Estate | 40 | 40 | 40 | 40 | |

| Total | 1000 | 1000 | 1000 | 1000 | |

| Customer ID | Smartphone | Retired | Mortgage | Debt | Technology Age | Homeowner | Home Value | Average Income | Living off Pension | Savings | Renting |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 3 | yes | no | yes | yes | notold | yes | aboveaverage | belowaverage | yes | yes | no |

| 20 | yes | no | yes | yes | notold | yes | aboveaverage | average | yes | no | yes |

| 45 | yes | no | no | yes | notold | yes | aboveaverage | belowaverage | no | yes | no |

| 70 | yes | no | no | no | notold | yes | aboveaverage | aboveaverage | yes | yes | no |

| Customer ID | Smartphone | Retired | Mortgage | Debt | Technology Age | Homeowner | Home Value | Average Income | Living off Pension | Savings | Renting |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 31 | no | yes | no | no | old | no | aboveaverage | average | yes | no | yes |

| 32 | yes | yes | no | no | old | no | belowaverage | belowaverage | no | no | yes |

| Customer ID | Classification with Full Dataset | ex House Value | ex Tech Age | ex Income |

|---|---|---|---|---|

| 31 | Mature Money | Steady Neighbourhoods | Mature Money | Mature Money |

| 32 | Mature Money | Mature Money | Mature Money | Mature Money |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peoples, C.; Tariq, Z.; Georgalas, N.; Moore, A. Analysis of a Personalized Provision of Service Level Agreement (SLA) Algorithm. Electronics 2023, 12, 1231. https://doi.org/10.3390/electronics12051231

Peoples C, Tariq Z, Georgalas N, Moore A. Analysis of a Personalized Provision of Service Level Agreement (SLA) Algorithm. Electronics. 2023; 12(5):1231. https://doi.org/10.3390/electronics12051231

Chicago/Turabian StylePeoples, Cathryn, Zeeshan Tariq, Nektarios Georgalas, and Adrian Moore. 2023. "Analysis of a Personalized Provision of Service Level Agreement (SLA) Algorithm" Electronics 12, no. 5: 1231. https://doi.org/10.3390/electronics12051231

APA StylePeoples, C., Tariq, Z., Georgalas, N., & Moore, A. (2023). Analysis of a Personalized Provision of Service Level Agreement (SLA) Algorithm. Electronics, 12(5), 1231. https://doi.org/10.3390/electronics12051231