Abstract

Digitalization becomes a key strategy for the success of businesses, which in today’s critical times, are under remarkable pressures and diffused uncertainty. The rapid pace of digitization is forcing deep changes in the modus operandi of organizations. This phenomenon is even more so true for accounting organizations considering that, by implementing blockchain, RPA, cloud, big data, cybersecurity, and AI, accountants might have the most digitized workplace of all. The purpose of this paper is to explore how these emergent technologies are contributing to the digital transformation of accounting firms. Based on a qualitative approach, the methodology consists of a thematic analysis of the academic literature to reveal the synergic effect of the most disruptive emergent technologies for accountancy firms. In addition to the topic of research, the originality of this study is ensured by the fact that it presents both technical and conceptual information, easily digestible for academicians and practitioners skilled in the ICT field, or not. The paper is intended to be a building brick for the literature related to this topic.

1. Introduction

Deep changes in management structures, choices, and tactics are mandated by digital resilience for organizations. Along with how new organizational forms are impacted by technology, businesses are also changing how they produce and convert information from one kind to another [1,2,3]. The World Economic Forum’s founder and president, Klaus Schwab, talked of a technological revolution that would drastically change the way we live, work, and interact with one another, while the magnitude, breadth, and complexity of the transition will be unprecedented in human history [4]. Therefore, although the previous technological revolution shaped the accounting field throughout the years, we can consider the fourth industrial revolution as the undergoing process having vast consequences on accountancy and our lives as well [1].

“Industry 4.0” aims to integrate cyber–physical systems. This evolutionary stage is characterized by a merging of multiple technologies that include big data, artificial intelligence, the Internet of Things and Systems, nanotechnology, and 3D printing. All these technologies are deeply interconnecting the physical and digital worlds [3,5] and this could have a significant impact on the foundations of society through the power of digitalization and information technology [5,6].

Accounting researchers have recently indicated rising interest in the accounting profession in the use of numerous individual technologies [1,7]. Furthermore, professional accounting organizations (for example, ACCA, CIMA, IFAC, and IMA) are quickly responding to the expectations of the business community by making recommendations and conducting research on the digitalization of accounting organizations [8].

The current research aims to explore how emerging technologies such as artificial intelligence (AI), blockchain technology (BCT), cloud, big data, and cybersecurity, are digitalizing accounting organizations. Based on a qualitative approach, the methodology consists of a thematic analysis of the academic literature with the aim to reveal the synergic effect of the most disruptive emergent technologies for accountancy firms.

As a result, it was discovered that the expected disruptions in the future digitized accounting ecosystem may lead to new roles, tasks, and opportunities for professionals and companies involved, who must learn how to implement and use emergent technologies efficiently and ethically. Therefore, the paper is aligned with current trends of research, and it brings its contribution by having an original approach, offering technical and conceptual information not only for those familiar with a digitalized accounting ecosystem but also for those who are just starting to explore it. This study is intended to be a building brick for the literature review related to this topic.

2. Literature Review

The degree of application of digital technologies is largely determined by the external environment of companies’ activities and by the practices in the field in which a company operates. The latest digital developments are causing both dilemmas and opportunities for companies. The challenges might appear in regard to “information literacy” while new possibilities may rise for the information and data providers [2].

Due to the use of technologies such as artificial intelligence, blockchain, and big data, it is becoming more of a certainty that in the upcoming years the financial reporting process, the audition process, and the accounting profession overall, will have to face the challenges of automation and digital transformation. The accounting profession has more to gain than to fear from keeping up with technological advancements (e.g., coded accounting entries, improved accuracy of rules-based approaches, revenues estimated with forecasting models based on predictive learning, and misconduct cases better identified) [9].

The fact that large CPA firms are highly migrating towards advisory services, could indicate their attempt to protect themselves against the disruptive changes threatening to impact the profession. Unclear regulation and practitioners’ out-of-date set of skills, can slow down the implementation of digital transformation, leading to a market in disharmony. Heading towards a bright future starts with accountants gaining a deep understanding of how these technologies can solve or automate some of their accounting problems, what their technical threats are, and developing new skills while working with them [9].

The “core” roles will continue to exist but, in the next decade, most of the accounting tasks and skills will undergo some changes in one form or another. Due to the disruptive technologies, accounting professionals will have to learn new skills, especially in IT, data analysis, and statistics [10]. Such a workforce will be highly demanded and will most probably replace the one dealing with traditional assurance work, where most of the repetitive tasks can be automated.

While the new roles predicted appear to imply human-robot collaboration, some tasks will not even be performed by humans at all, but by digital technologies [11]. A scenario in which most of the decision-making is robotic, predictive, and dynamically optimized and the data flow is continuous even without human intervention, could be expected [12].

In order to create an equilibrium between the current accounting knowledge and the profession’s nowadays relevant IT-related skills, major changes are called in the accounting curriculum too. When designing an accounting curriculum, academia should take into account the adoption of new technologies in the industry, to make sure that future graduates are prepared for the market and easily employable [13,14].

However, the degree of acceptance or adoption of new technologies seems to be majorly affected by the perceived usefulness and the perceived ease of use [15]. This issue, together with lack of proper regulation and scarce human resources ICT skilled or digitally competent, are all problems encountered not only by the accounting and auditing firms, but by companies from other fields too, with similar activities as financial services for instance.

Having this awareness, universities can help students in becoming familiar with the latest technological developments preparing them for the realities of accounting practice, while accounting firms can support their employed practitioners throughout the process of digital transformation by providing training from the start.

For this reason and not only, the collaboration between practitioners, professors, and researchers pertaining to both accounting and technological fields is strongly encouraged [16]. The sharing of practical cases and exchange of researched information will allow the parties involved to obtain relevant insights into areas that otherwise would have remained unavailable, gaining as well, a broader professional perspective.

3. Methodology

3.1. Research Questions Development

This paper has the purpose to provide answers to the following research questions:

- What is the status of the academic literature in regard to the main technologies digitalizing the accounting profession? The aim of the first question (R.Q.1.) is to provide a critical and analytical analysis of the existing literature.

- How are the emerging technologies, separately or as part of an ecosystem, impacting the accountancy organizations? The second question (R.Q.2.) synthesizes the present implications for education, practice, policy, and/or regulation.

3.2. Data Collection

In the interest of finding the relevant papers for this study, research has been conducted on the Clarivate Analytics database, of the Web of Science (WoS) platform. The search started depending on the “TOPIC” and the “KEY WORDS” introduced. Afterward, the full list of generated records was narrowed down by choosing to see the results that belonged to the following categories: “Business Finance”, “Business”, “Management”, “Operations Research Management” and “Economics”. The review was not constrained to a certain time period or list of journals with the purpose to find all the relevant papers, even if they are not published in famous internationally ranked journals.

The final selection consisted in marking only the articles that contained the keywords either in title and/or in the abstract. The standard formula used in this research process was composed of terms representative of our field of interest as “audit” or “account”, combined with one term and an abbreviation or synonym (where it was the case) for each technology investigated. Six searches have been accomplished in a single session, with results as shown in Table 1. The final marked list, saved on the WOS platform, was composed of 321 records.

Table 1.

Applied research formula and generated results. (Source: authors’ creation).

In order to have a higher degree of assurance in regard to our final sample, a second study has been performed. In the WOS database, academic studies were searched based on keywords found in paper titles, in business, economics, or management domains. Neither predefined search period nor a specific type of publication was selected, to have access to a broader set of data. The searched expressions included: (“Artificial intelligence” OR “AI” OR “RPA” OR “Robots” OR “Cloud” OR “Blockchain” OR “Big Data” OR “Data Analytics”) AND (“accounting” OR “audit”). In the end, a total of 358 WOS references were obtained. After realizing a cross-check between both of our samples, the duplicates were eliminated.

3.3. Data Sampling

Firstly, 86 proceeding papers have been eliminated because they were considered work in progress and in their scale and content, were not as complex as the other materials worthy of being analyzed more in-depth. Secondly, the process consisted in scanning the remaining results, this time, paying more attention to their title and abstract. On one hand, 54 of the papers have been eliminated because they contained keywords and information either on the field (accounting and/or audit) or on one technology or more (e.g., blockchain, big data) but, not in an interconnected way.

On the other hand, 23 articles have been removed, because even if the right mix of keywords was present in the title or in the abstract, the overall theme or the perspective showcased was not relevant to our study. Afterward, 44 papers have been cut out because some of them were not accessible to read, some were published in a timeframe between 1989–2011 having, therefore, outdated information and others, were simply duplicates. Consequently, the final sample consists of 114 scientific papers published between 2012–2021 (December) addressing the emerging technologies responsible for the digitalization of the accounting field topic.

3.4. Data Reliability

The final sample was then analyzed in order to have a certainty over its quality and importance. First, a cross-checking was made between our results and the final references of four relevant and inspirational papers of Moll and Yigitbasioglu [17], Tiron-Tudor and Deliu [7], Kroon et al. [18] and Tiron-Tudor et al. [8].

By completing this cross-checking, it was discovered that 85 results were cited in the above-mentioned papers. Having 74.56% of the final database found in other significant academic papers signifies that the searches have been made accurately and that they generated trustworthy results.

3.5. Data Coding and Interpretation

To explore the academic literature in an analytical way, the thematic analysis approach has been chosen. This type of analysis allows researchers to scan the content of the papers to identify and showcase the recurrent themes, most essential for the theme of interest [19,20]. The approach consists of coding specific sets of information, labeling the found themes, and finally, demonstrating the relationship between them [21,22]. Before researching the articles of a sample, a starting list of codes can be established, consisting of theory-derived categories. In our case, the texts have been coded to discover the main themes related to emerging technologies digitalizing the accounting profession.

The analytical framework that stood at the basis of the article coding process consists of four chosen criteria developed in subcriteria [17]. The first criteria correspond to the internet-related technology or technologies addressed in each paper (e.g., AI, BCT, big data, cloud, cybersecurity). The second criteria concern the main research method used in each paper (e.g., literature review, commentary, analytical, exploratory, interviews/ questionnaire, conceptual, case study). The third and the fourth criteria focus on the accounting area impacted (management or financial accounting, noted as MA/FA, and financial or internal audit, noted as F. Audit/I. Audit), respectively, on the interest groups of the accounting profession (researchers, educators, practitioners and/ or policymakers). In this way, it was possible to better extract code and classify the relevant information from the analyzed papers.

In recent years, there have been researchers that studied different themes using bibliometric analysis [8,23,24,25,26]. Our study aims to perform a bibliometric analysis to capture the accounting profession’s digitalization process and implications. First, with the help of bibliometric tools, a quantitative analysis was performed. Secondly, a qualitative analysis followed, in terms of the topic’s evolution and science mapping. This workflow permitted us to construct an overall image of current knowledge and to formulate possible future directions of research, based on the academic literature.

Bibliometrix package is chosen to perform the quantitative research, being easy to use for this purpose, and at the same time to avoid subjectivity, being transparent, reproducible, and providing reliable results. The software works with data extracted directly from the Clarivate Analytics Web of Science [27] and organizes a scientific subject by merging performance inquiry and science mapping in a simple method [26]. Bibliometrix tool performs a bibliometric analysis and builds data matrices for elements such as coupling, co-citation, scientific collaboration, and co-word analysis.

4. Results

The answers to the research questions are provided by the literature review performed, based on the analyzed sample. The results are presented from a quantitative and a qualitative perspective, as it follows.

4.1. Quantitative Results—R.Q.1

This section exposes the status of the academic literature in regard to the main technologies digitalizing the accounting profession (RQ1). Concerning the publication year and authorship, the interest in researching this topic was continuously increasing during the analyzed time frame (2012–2021). An ascending trend in the number of articles published starting from 2016 was noticed. However, the majority of the papers part of our sample (56, 25% of them) appeared in 2019.

Throughout the years, 48 journals present in our study had at least one article published on the correlations between emerging technologies and the accounting field. However, only four of them stand out as being the ones with more than seven articles published. These journals are Accounting Horizons (eleven articles), The International Journal of Accounting Information Systems (ten articles), The Journal of Emerging Technologies in Accounting (nine articles), and The Journal of Corporate Accounting and Finance (eight articles).

Of the 48 journals, 29 published an article at the intersection of the IT (information technology) field and the accounting field, one time only (during the analyzed time frame). The explanation for this might be given by the specifics of the journal itself, one being either focused on accounting matters (e.g., “Asian Journal of Business and Accounting” with one paper published in 2020), either focused mainly on the information technologies (e.g., “Sistemas and Gestao” with one article published in 2021).

Considering the interdisciplinary aspects of our theme, an ideal case would be if, for every written article the authors involved have both economic and technological knowledge and experience. That would require a minimum number of two researchers. For the papers included in our sample, in most of the cases (47.36%), three authors or more are involved in the publishing of an article, followed by collaborations of two researchers (30.70%).

From the comparative analysis performed (see Table 2), it is visible that there are thirteen papers with the highest number of citations. This indicates that these papers are indeed highly qualitative, having the greatest importance in the research field.

Table 2.

Top articles by citations ranking places. (Source: authors’ creation).

If we take into account the publication year and the total citations, we can notice for example that, Yigitbasioglu’s paper [28], has a total number of citations of 139, while his work in collaboration with Moll, [17] has reached the highest ranked place in our list, being cited 161 times.

This indicates, on one hand, the excellent work of the author and the quality of the papers included in our sample. On the other hand, it proves the constant interest shown in the last six years by researchers, academicians, or practitioners, towards the emerging technologies and their repercussions on the accounting profession.

Moreover, if we compare the 100 citations of the Issa et al. [38] paper, with the 161 citations of the Moll and Yigitbasioglu [17] paper, it becomes obvious that the interest in our researched topic, not only that it was constant, but it also increased throughout the years.

An overview of studies investigating internet-related technologies, based on the reviewed articles from the sample, can be observed below, in Table 3.

Table 3.

Percentual results of literature overview. (Source: authors’ creation).

The main focus of the articles is equal in accounting and auditing; some articles discuss more than one area. As a methodology, the majority of articles are using a qualitative approach.

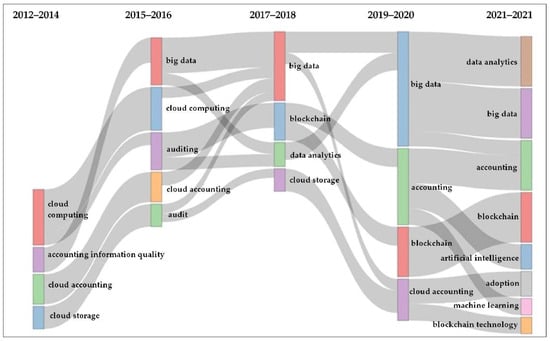

Figure 1 below depicts the evolution of debates in the academic literature, included in our sample. If at the beginning of the decade the focus was on cloud technology, as a tool to store and share accounting information, starting with 2018 new emerging technologies such as blockchain or big data, and their impact on accountancy, have been added to the main topics of interest. At the end of the decade, it is already visible how artificial intelligence, including machine learning, is also part of the disruptive technologies umbrella. The recurrent theme concerns the digital transformation of, and technology adoption in, the accounting activity.

Figure 1.

Topic evolution. (Source: authors’ creation).

4.2. Qualitative Results

This section provides answers to research question two and shows how the emerging technologies are impacting the work of accountants.

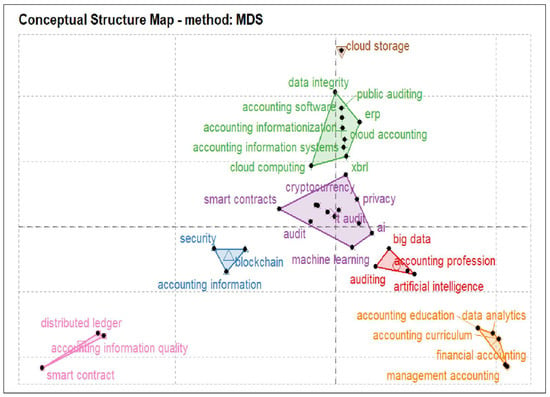

For the keywords in our dataset, a multiple correspondence analysis (MCA) was used to find other aspects of digitalization research. Figure 2 depicts a conceptual structure of the keywords linked to the digital resilience articles considered in this paper. It compresses large amounts of data with numerous variables into a low-dimensional space to generate a simple two-dimensional graph that shows keyword similarity using plane distance. In recent years, keywords that approach the center point have received a lot of attention. The relative placements of the points and their distribution along the dimensions are used to analyze the findings. The closer the terms are shown on the map, the more similar their distribution is, forming clusters that each have a different color.

Figure 2.

Conceptual structure map. (Source: authors’ creation).

As Figure 2 denotes, although part of different domains, topics from the information technology field (such as “big data”, “artificial intelligence”, “cloud computing” or “smart contracts”), together with topics from the accounting and auditing profession (as “audit”, “accounting profession”) all raise the interest of researchers, towards a common ground. For this reason, it can be considered that accounting professionals are open and willing to better understand the emergent technologies, while these internet-related technologies are indeed disruptive and relevant for the accountancy sector.

The same figure shows that at the opposite pole, the least similar connections are formed between terms such as “accounting curriculum”, “accounting information systems” or “accounting information quality”. This might indicate a lack of concordance between different areas of the accounting domain. The accounting curriculum has to keep up with the technological advancements of the market, influencing the accounting systems utilized by professionals and therefore, the quality of the accounting information. The curricula must include topics referring to big data analytics and artificial intelligence. These discrepancies can be explained by factors such as the slow integration of emerging technologies in some organizations, the lack of regulation, or even behavioral aspects. The use of cryptocurrencies and smart contracts arise issues related to privacy and how these transactions will be audited. Blockchain will connect the accounting and auditing systems in distributed ledgers and there are many questions in the area of data security and accounting information quality and integrity.

The following subsections are introducing the five internet-related technologies while offering relevant insight from the analyzed literature.

4.2.1. Artificial Intelligence—AI

The way control is exercised by companies in a shared economic environment might change radically causing a growth in the decision-making process based on algorithms. In this context, the usage of artificial intelligence (AI) by firms, in order to supervise employees’ work, is increasing in popularity [11,15,38,39]. This type of technological change has a major influence on the systems of control and management accounting [13,40,41]. AI can be a mediator helping information systems to become intelligent systems, increasing automation, and optimizing information systems.

Not only AI can build intelligent systems but once built, these systems can learn, reason, and function like human beings in various aspects. For these reasons, AI is thought to be smarter than traditional information systems [12,15,42].

In the broader accounting environment, the tasks and skills for the current professional positions will undergo significant change during the following ten years as a consequence of (AI-based) digital technologies [15,17,43]. Some of the key tasks and responsibilities will almost surely exist still in the future, while others will be undertaken by technology based on AI, rather than on humans [11,13,44].

In regular operations such as recording and collecting data for data reconciliation, gathering data for the appraisal of liabilities and assets, or preparing reporting components, AI-based technologies can take the position of human personnel, and then, they might also try to cooperate with humans by suggesting decision options [10,40].

Although AI systems or machines with forecasting capabilities are not yet globally spread or are still under development, their potential is expected to be of great importance in the future [13,42]. Even if accurate forecasts are hard to achieve, AI can help automate and support this process while humans can put into practice their cognitive abilities that machines do not have yet [9,34,41].

In the near future, accountants and bookkeepers, having fewer routine tasks to perform, will play a vital role in helping with the implementation process of any accounting software based on artificial intelligence [9,39,40]. Technical training and development of new skills will be required a priori, but humans will be responsible for training the AI-based technology according to specific user needs [12,15,38]. Considering that AI is a system that learns by itself, if its implementation has been performed correctly, the accountant’s intervention will be necessary for monitoring purposes and occasionally, when the digital technology is not capable of processing [11]. In that way, at the end of the day, humans and AI-based technology will effectively work together to fulfill the roles of accounting.

4.2.2. Blockchain Technology—BCT

Blockchain is an internet-based technology that functions as a peer-to-peer system that uses cryptography to secure data and can be built with an architecture that allows peers of the same network to share, record, and verify transactions at the same time, instantly [45]. The most crucial aspects of a blockchain are who owns the information and how it is communicated. In contrast to traditional databases, where records can get deleted, modified, or changed, within a blockchain, all the participants have a copy of the ledger that contains all transactions made since its creation [46].

In this way, the control inside the system is distributed among all of its members [45,46] eliminating the necessity to have intermediates reconciling the records between nodes and determining who is the “owner” of the information [16]. Blockchain systems can be diverse and customized according to different use cases, for instance: private or public, centralized or decentralized and last but not least, peer-to-peer or cloud-based systems [47]. For an efficient use of blockchain technology, it should be established what type of architecture is most suitable for CPA firms for example, in such a manner in which auditors may use this technology to perform audit and assurance services [48].

Another aspect that should be considered except the model of blockchain, is whether the implementation of this technology brings more benefits than issues to a firm, depending on its business model. In some cases, the adoption costs might be higher than the advantages and for this reason, not all companies can flourish with the help of blockchain [49]. As Pedreno et al. [50] stated, blockchain’s implementation in accounting will follow a similar path to previous technologies that have grown from their inception to adoption.

Despite the fact that blockchain is a technology with disruptive powers, its strength and usefulness are great if the implementation is performed in the same manner [51]. Considering that the use cases of blockchain in the accounting field are still developing, for the moment, entities should use this technology by benefiting from its advantages while taking measures for its disadvantages [49].

Some of the benefits of a blockchain system include having increased efficiencies and transparency, lower costs, access to an immutable audit history of all made transactions [46] or its immutability by itself, given the fact that transactions can be added as a block only after being validated by most of the participants in a network [16]. The pending obstacles for blockchain have been recognized as cybersecurity, flexibility, scalability, an appropriate architecture as well as the consensus required amongst regulators, auditors, and other stakeholders to incorporate this technology into a true accounting ecosystem [52].

At the same time, the most debated themes in scholarly works and professional sources criticizing the drawbacks of blockchain are connected to transparency, governance, and trust difficulties. These difficulties stem from a lack of trust in smart contract type of applications, a blockchain-type of ecosystem, the continuous audits enabled by this technology, and the change in paradigm in regard to accountants’ and auditors’ roles [45].

In a blockchain-based AIS, control and trust shift from a third party which is external, or from a central authority, to all the network members [16]. Consequently, blockchain has the power to improve market trust by making businesses’ accounting processes transparent, boosting the quality of external reporting information, and successfully eliminating between enterprises and outside investors the information asymmetry [53]. Blockchains in accounting could facilitate the improvement of information quality that reaches investors, by providing more trustworthy accounting information in a well-timed manner and significantly reducing the chances of data manipulation and fraud involving financial records registered in the blockchain [54].

If management makes access to the client’s blockchain in a real-time manner available, it will allow auditors to automate regular transactions while paying greater attention to internal controls and complicated operations [46]. In his paper from 2019 [55], Carlin states that: “It is possible to imagine the rise of technology-driven regional or global audit services hubs, in place of the existing, highly distributed disposition of the profession.”

However, blockchain should not be considered a full replacement for the auditor’s activity but rather just a tool that helps in speeding the delivery of results through automation and standardization. A blockchain-based accounting system can offer trust and assurance that a transaction happened inside the system which does not necessarily mean that it happened in the real world too [32,56]. In consequence, some transactions might still be unlawful, unauthorized, or fraudulent, although they are being recorded on blockchains [45]. It remains the auditor’s responsibility to determine whether the data in the blockchain is reliable or not [46].

4.2.3. Cloud

One of the most recent IT developments is cloud-based technologies. Increasingly, professional service firms and accounting firms promote cloud-based accounting solutions and services. However, according to industry evaluations, the adoption of cloud accounting has been slower and less than anticipated [37].

According to Eldalabeeh et al. [57], the intent to use cloud accounting is positively correlated with factors such as perceived ease of use and usefulness, the quality of the system and of service, the organizational competency, and the support of top management; therefore, the adoption of cloud accounting has a positive effect on cloud accounting usage.

Due to the disadvantages of cloud services in terms of privacy, trust, control, and data security, there are few investments in their use. For cloud auditing service provider satisfaction, the most noteworthy improvement priorities are related to availability, security, privacy, confidentiality, and processing integrity [43]. When choosing to use a service based on the cloud or a cloud service provider, there are some factors that must be examined, such as company size, workflow volume, employee number, and last but not least, the accounting system’ structure. Evaluation and judicious selection of cloud-based accounting software generate the manifestation of advantages for a corporation (convenience, cost savings, mobility, etc.). This permits the use of services that are more affordable than analogs and better suited to the business conditions in a particular nation [58].

Professional IT services are not always accessible to small and medium-sized organizations. The most major limitation is monetary. High-quality, correctly designed, consistent, and work-specific servers are expensive to maintain. Local market accounting software is quite expensive, and there are additional unplanned expenses, especially when the computer fails. The technology of cloud computing is a good alternative [59].

4.2.4. Big Data—Governance and Analytics

Big data’s attractiveness is due to the ever-increasing volume of information made accessible by improvements in computing and telecommunications technologies, especially the Internet and environmental sensing [60]. Big data analytics can be considered the process of analyzing, clearing, manipulating, and shaping enormous volumes of data in order to uncover and transmit key information and trends, make suggestions, and aid in making decisions [61]. Accounting and auditing big data originate from both internal and external sources. If an organization automatically collects a substantial number of transactions, the volume of data created internally by the company gets “huge.” What one firm perceives to be internal data, may be considered external data by another company in the supply chain. Oracle and SAP, for example, have created specialist data management capabilities [60].

Accounting and accountability in firms have already been transformed by big data and social media, but often outside of accounting processes (most commonly through the departments of marketing). Consequently, it is vital to study how accounting procedures interact with social media and how big data might be utilized to enhance transparency and capital allocation decision-making [62]. Arnaboldi et al. [63] propose a more comprehensive approach to understand better the effects of big data for accounting practice, raising interesting questions for accounting in regards to externality (pertaining to the source of information or data), abductivity (pertaining to the modification of the process of decision-making resulting from the availability of big data), and data inexhaustibility.

Accountants are seen to be more than prepared to lead a problem-driven type of analysis of structured or unstructured data and to assist data scientists in carrying-out exploratory analysis on large data. This is due to two key factors: accountants are familiar with organized data sets and have a solid understanding of business concepts [60,62]. For these reasons, big data analytics can supplement rather than replace accountants’ expertise. To solve the obstacles of big data analytics, educators must adapt their curriculum, standard setters must revise the standards, and professional organizations must update their frameworks [64].

Researchers have claimed that the accounting profession is the most suited to handle the big data function within firms, owing to the existing professional trust in accountants and their capacity to evaluate data. Furthermore, as part of organizational performance improvement, the accounting profession should play a larger role in analytics and less on cost control [65]. Accountants comprehend how financial and costing data are created, as well as why the models that are employed and connected with them are suitable. Accountants are particularly competent to construct data management and analytics models, appropriately evaluate their results, and apply the conclusions to decisions and operations [62,63,64,65,66]. Big data can help when traditional audit evidence is lacking, since relevant external big data can supplement a client’s internal information that is not easily accessible to auditors [67].

The major costs in this scenario are the data processing efforts, and the audit profession has the opportunity to engage in more complex predictive and prescriptive analytics [68]. As a result, big data analytics (BDA) can aid in the analysis and processing of complicated big data sets by lowering the impact of auditor cognitive mistakes [29]. BDA frees auditors from manual, time-consuming duties, allowing them to devote their brains and abilities to more pivotal work such as evaluation activity or, key audit judgments. In this context, regulators and norm setters must keep up with the accelerated evolution of IT and automation processes in the auditing industry [69].

Several international auditing standards have been particularly advocated for reform due to the fact that current auditing standards do not allow for big data analytics to be utilized to their fullest extent during an audit. While some auditors view the absence of guidance as a chance to innovate without fearing the potentially considerable legal limits, others have stated that they will not completely participate with BDA until standard-setters eliminate what they perceive to be the confusion around BDA’s usage [70].

4.2.5. Cybersecurity

Cybersecurity is commonly used interchangeably with information security. However, cybersecurity involves more than simply cyberspace protection; it is also the protection of people who operate in cyberspace and whatever assets they may have that are accessible via cyberspace [71,72]. Cybersecurity is the technology, methods, and policies put in place to protect data, networks, and systems against cyberattacks. Successfully implemented cybersecurity downsizes the risk of cyberattacks while also safeguarding individuals, society, and organizations from unauthorized use of networks, systems, and technology [73,74].

Maintaining the availability, integrity, and confidentiality of a modern information technology (IT) organization is a complex and time-consuming undertaking. The key ideas are confidentiality (data existing on a computer must remain secret), integrity (a system has to function properly), and availability (the system of a computer is available and ready to use when necessary) [35,71]. Despite the advantages of cloud computing, data confidentiality and engagement by other authorities remain concerns. To mitigate the dangers associated with cloud computing, many businesses deploy hybrid systems or private clouds comprised of national or specialized data centers [28]. According to Eaton et al. [73], accountants may assist with all phases of excellent cybersecurity risk management, including risk assessment and measurement, external reporting, control system design and testing, and independent assurance.

The existing audit architecture should be updated to include a modern class of assurance services including continuous control monitoring, continuous audit (internal and external), and continuous cybersecurity assurance [71]. Internal audit should play a major role in aiding the audit committee with cybersecurity oversight, since an internal auditor is expected to provide a future road plan that tackles various cybersecurity risk challenges. Because these sessions are considered due diligence, authorities advocate for regular audit committee meetings to promote communication among audit committee members and auditors [35].

5. Discussions

Encouraging academic research, developing applications and technologies according to real practical needs, and implementing them afterward in the work environment, are just some basic steps that can be taken by anyone willing to see progress in the field, be it students, teachers, professionals, or companies and institutions. In order to do so, one has to be motivated by the existing opportunities or in our case, the potential benefits of emerging technologies for accounting and audit [75,76,77,78,79].

After analyzing the academic literature included in both of our samples written at the crossroads of emergent technologies and the accounting profession, it was possible to highlight the main current challenges for our field of interest, triggered by the digitalization process. These four challenges are related to:

- How regulators can respond in front of rapid technological development.

- How companies can face technological progress in a more effective way.

- How the daily activities of the firms will probably change.

- How the role and skills of the practitioners are expected to evolve.

Starting from these challenges, the next section of the study presents four types of implications.

5.1. Implications for Regulators

An important aspect is the collaboration between the main financial and professional institutions, which needs to take place in a harmonious way in order to facilitate the transition towards or the adoption of a blockchain accounting system for example. The Big Four audit firms met in 2016 with the AICPAs to create a coalition to investigate blockchain-based technologies for accounting and audit, and in 2017 the Accounting Blockchain Coalition Conference was organized [80,81].

These developments prompted the arrangement of working groups to interact with standard setters and help with the elaboration of accounting rules to regulate blockchain use. Earlier that year, Deloitte claimed to have completed a blockchain audit in which established auditing standards have been used to assess a permissioned blockchain type of application [52,82,83].

Artificial intelligence has become a vital component in ensuring the accurate implementation of the most complicated current accounting regulations. With user-friendly AI solutions, reporting entities will not be afraid to engage in business practices for fear of not being able to account for them appropriately [34,39,44]. The rules of accounting and auditing lag behind the technological progress and continue to prioritize presentation, aggregate, and sample [9,12,30].

5.2. Implications for Firms

If we consider the economy a fast-moving system supported by real-time processes, then the faster the business reports and analyzes are provided, the better and more profitable the decisions taken. The implementation of emerging technologies within a firm has the potential to provide such rapid financial reports and outputs of accounting information. The traditional balance sheet and income statements disclosures could slowly turn into an almost real-time reporting basis which will generate a distinct type of business report in addition to a more accurate and visually enhanced disclosure.

In this way, both the accounting and the assurance processes can be enriched which in turn, will be very helpful for the overview and the planning activities of the management, auditors, or stakeholders [60,84,85]. Firms, for example, might use blockchain to save transactions into a shared register, resulting in a system of interlocked accounting records, rather than retaining records separately based on transaction receipts [8,52,86].

In terms of audit activities, if inventory items are digitally recorded, auditors may obtain inventory measured at a range of locations (e.g., warehouses, storerooms, or shipping docks) and utilize the GPS position of the trucks to authenticate the delivery and sale of specific products at any time. Such tight and real-time monitoring is useful for confirming purchases, preventing fraud, and eventually supporting audits and continuous monitoring of corporate operations [10,60,87].

The accounting shift to the “cloud” is considered a creative and innovative solution that may assist small and medium-sized businesses to save large costs [59,88], while also being a key disruptive technology for the accounting sector [33,89,90].

In the past, companies did not see cybersecurity as an important problem; but, in later years, cybersecurity has turned into a top concern for corporations, financial institutions, law enforcement, and multiple regulators [35,72]. As the frequency of cybersecurity incidents continues to increase and stakeholders grow more worried, businesses devote substantial resources to programs for the management of cybersecurity risks and related disclosures.

5.3. Implications for Daily Tasks

The larger the company, the bigger the data set of information that needs to be analyzed, sorted, organized, and reported. For this reason, some daily recurring tasks might be fully automated or replaced with new ones while the employees might be feeling overwhelmed by the big volume of data that has to be processed by them.

Auditing activities have their fair share of repetitive tasks that can be automated and considering what a challenge it is to analyze huge amounts of data structured and unstructured, in order to achieve an understanding regarding the financial and nonfinancial performance of firms, disruptive technologies and data analytics tools are more than suitable for auditing. For the time being, the influence of artificial intelligence in audits is more obvious in data gathering, having the capacity to identify relevant data, select it from documents, and convert it for the use of human auditors, allowing them to dedicate more time to areas in need of a higher-level judgment [38,42,91].

In an environment of big data (BD), auditors might have to deal with a similar problem of data existing in an overwhelming amount, which may lead to the analysis and selection of unnecessary information signals. To successfully use semi-structured and unstructured big data, auditors must have a better tolerance for ambiguity. Expect information overload to cloud audit judgment, making it harder to recognize essential information [60,70,92,93].

5.4. Implications for Practitioners

First and foremost, we may anticipate that present entry-level employment requiring low-level cognitive abilities will ultimately disappear [14,36,94], and secondly, what is more, essential from the standpoint of professionals in the accounting and financial field, is external pressure. Both professionals and practitioners will have to adopt the concept of continual learning and constant education to keep up with the fact that the demands and expectations of practitioners are changing from nearly every perspective and aspect [95,96,97].

Emergent technologies are capable of transforming the accounting profession by enabling accountants to have a more active role within companies. In a Blockchain-accounting type of work environment, practitioners will have to collaborate and share knowledge with data scientists, and IT colleagues, which is why they will have to keep up with technological advancement but also with the implications that this progress and these new digital tools have on their work and practices [97,98,99,100,101,102].

On one hand, accountants will not be any more the main authority in a blockchain-based AIS, but they will keep being the ones generating the financial reports required by regulations [102]. On the other hand, blockchain has the power to transform the accounting profession by enabling accountants to have a more active role within companies. Working with complex, large data sets, in order to deliver the information clearly and efficiently to the interested parties, the accountants will have to step outside their comfort zone. In doing so, they will interact with a variety of people, gain leadership abilities, practice their communication skills, and have increased chances of professional advancement.

Integrating internet-related technologies into accounting activity can increase the reliability of financial data and reports because they are derived from a transparent, open-access system with immutable storage, especially with the help of blockchain or cloud technologies and cybersecurity systems [9,103,104,105]. In this way, the auditor’s opinion is backed up by the system and has more value in front of investors or stakeholders who expect reliable information about an entity [106]. Therefore, emerging technologies can have implications in accountancy, for the planning and conduct of audits, but also for the new skills that accountants and auditors will be required to develop [31,97,107].

There are many questions still awaiting an answer, as follows: how digital technologies influence/change the accountant’s professional identity traditional markers: professional judgment, professional expertise, upskilling/ deskilling, radical change, and public interest. Another question refers to how digital technologies influence/change the role of the accounting and audit profession in society: the pivotal role of trust connecting professionals with clients and stakeholders. Additionally, it is important to research, which is the motivation/resistance, perception, assumptions, expectations, and knowledge of the practitioners. It is clear there will be a shift in the job description, thus another question might be how the technologies influence/change the accountant, and auditor job description, which might be the jurisdictions’ borders, boundaries, power relations, and knowledge production. New occupations and jobs are emerging, combining accounting and audit knowledge with IT skills and capabilities. New dynamics of expertise, competition, and collaboration create new space for research. Going further, the challenging human–machine interaction issues still require more research to be conducted. The bulk of the studies emphasize the use of emergent technologies in the accounting profession and possible directions for further studies but are overlooking the necessity to modernize the curriculum in the accounting education system in order to suit the technical requirements of the industry. Academics should evaluate current industry adoption of new technology while establishing an accounting program to equip graduates for the market and assure their employment [13].

6. Conclusions

Overall, understanding what tasks are nonprogrammable is essential for comprehending to what extent accounting or auditing operations might be automated. Nonetheless, digitization can provide substitutes for mundane jobs as well as complementarities for analytical and interactive operations. Automation may replace certain professionals in generating important data, significantly altering some areas of accountants’ work [108].

The accountant’s office is one highly “digitized” among businesses. In general, it is outfitted with five pieces of computer equipment for office and communication, as well as seven software items for accounting task automation. Nonetheless, university graduates claim that their knowledge and abilities cover just 45% of the needs of the digitally transformed accountant’s profession. Schools of higher education have trailed significantly behind in terms of accountants’ applied “digital” skills [109].

Accounting professionals must be able to reconcile the potential of technological tools with the realities on the ground. Investors, traders, and other persons working in financial services service sectors will also need to grasp how to read, comprehend, and report the volume of information collected and reported by various components of the company [110]. The audit every year will learn from the data of the previously performed audit, creating a base of knowledge that is self-enriching and indicates possible risk areas to better advise firms and their stakeholders [111].

The originality of this study is given by its researched theme: emerging technologies’ contribution to digital transformation in accountancy firms. The paper’s contribution consists in providing a thematic analysis of the literature existing at the crossroads of internet-related technologies and the accounting field. Furthermore, as an element of novelty, this study includes in its research design both quantitative and qualitative results, obtained after performing a bibliometric type of analysis. This made it possible for us to observe the evolution of debates in the literature and to showcase the keyword similarity with the help of science mapping tools. Due to this workflow, the paper presents a global image of the actual status of research in the academic literature and proposes possible future directions of research.

Another element of originality derives from the paper’s high degree of universality. The results obtained through the current study are not conclusive exclusively for accounting and audit, but rather have relevance for other fields as well; for example, domains with similar activities such as financial services. This can be explained by the fact that the external environment of a company’s activity and the practices in the field in which that firm operates, are significantly determining the degree to which digital technologies are applied.

Concerning the existing limitations of the paper, they are related to the empirical evidence that could not be added to completely support the theoretical results. It is still difficult to find, and afterward, gain access to, an accounting company advanced in its digital transformation journey that could also allow us to analyze the adopted technologies, the faced challenges, and taken measures. The timeframe of the study and the number of papers included in our sample can be mentioned as well.

The expected disruptions in the future digitized accounting ecosystem may lead to new roles, tasks, and opportunities for professionals and companies involved, who must learn how to implement and use emergent technologies efficiently and ethically. These technologies are not going to completely eliminate an individual’s tasks and contributions but rather, will cooperate with professionals and complement human decision-making, rather than replace it.

Author Contributions

A.T.-T. conceptualization and discussion, A.N.D. data collection and qualitative results presentation, V.P.B. data analysis and quantitative results. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Agrifoglio, R.; de Gennaro, D. New Ways of Working through Emerging Technologies: A Meta-Synthesis of the Adoption of Blockchain in the Accountancy Domain. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 836–850. [Google Scholar] [CrossRef]

- Bhimani, A.; Willcocks, L. Digitisation, ‘Big Data’ and the Transformation of Accounting Information. Account. Bus. Res. 2014, 44, 469–490. [Google Scholar] [CrossRef]

- Braccini, A.; Margherita, E. Exploring Organizational Sustainability of Industry 4.0 under the Triple Bottom Line: The Case of a Manufacturing Company. Sustainability 2018, 11, 36. [Google Scholar] [CrossRef]

- Schwab, K. The Fourth Industrial Revolution: What It Means, How to Respond; Crown Publishing Group: New York, NY, USA, 2017. [Google Scholar]

- Savastano, M.; Amendola, C.; Bellini, F.; D’Ascenzo, F. Contextual Impacts on Industrial Processes Brought by the Digital Transformation of Manufacturing: A Systematic Review. Sustainability 2019, 11, 891. [Google Scholar] [CrossRef]

- Pînzaru, F.; Dima, A.M.; Zbuchea, A.; Vereș, Z. Adopting Sustainability and Digital Transformation in Business in Romania: A Multifaceted Approach in the Context of the Just Transition. Amfiteatru Econ. 2022, 24, 28–45. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Deliu, D. Big Data’s Disruptive Effect on Job Profiles: Management Accountants’ Case Study. J. Risk Financ. Manag. 2021, 14, 376. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Deliu, D.; Farcane, N.; Dontu, A. Managing Change with and through Blockchain in Accountancy Organizations: A Systematic Literature Review. J. Organ. Chang. Manag. 2021, 34, 477–506. [Google Scholar] [CrossRef]

- Türegün, N. Impact of Technology in Financial Reporting: The Case of Amazon Go. J. Corp. Account. Financ. 2019, 30, 90–95. [Google Scholar] [CrossRef]

- Zhang, C. Intelligent Process Automation in Audit. J. Emerg. Technol. Account. 2019, 16, 69–88. [Google Scholar] [CrossRef]

- Leitner-Hanetseder, S.; Lehner, O.M.; Eisl, C.; Forstenlechner, C. A Profession in Transition: Actors, Tasks and Roles in AI-Based Accounting. J. Appl. Account. Res. 2021, 22, 539–556. [Google Scholar] [CrossRef]

- Cong, Y.; Du, H.; Vasarhelyi, M.A. Technological Disruption in Accounting and Auditing. J. Emerg. Technol. Account. 2018, 15, 1–10. [Google Scholar] [CrossRef]

- Qasim, A.; Kharbat, F.F. Blockchain Technology, Business Data Analytics, and Artificial Intelligence: Use in the Accounting Profession and Ideas for Inclusion into the Accounting Curriculum. J. Emerg. Technol. Account. 2020, 17, 107–117. [Google Scholar] [CrossRef]

- Zhang, C.; Dai, J.; Vasarhelyi, M.A. The Impact of Disruptive Technologies on Accounting and Auditing Education. How Should the Profession Adapt? CPA J. 2018, 88, 20–26. [Google Scholar]

- Damerji, H.; Salimi, A. Mediating Effect of Use Perceptions on Technology Readiness and Adoption of Artificial Intelligence in Accounting. Account. Educ. 2021, 30, 107–130. [Google Scholar] [CrossRef]

- Pimentel, E.; Boulianne, E. Blockchain in Accounting Research and Practice: Current Trends and Future Opportunities. Account. Perspect. 2020, 19, 325–361. [Google Scholar] [CrossRef]

- Moll, J.; Yigitbasioglu, O. The Role of Internet-Related Technologies in Shaping the Work of Accountants: New Directions for Accounting Research. Br. Account. Rev. 2019, 51, 100833. [Google Scholar] [CrossRef]

- Kroon, N.; Alves, M.D.C.; Martins, I. The Impacts of Emerging Technologies on Accountants’ Role and Skills: Connecting to Open Innovation—A Systematic Literature Review. J. Open Innov. Technol. Mark. Complex. 2021, 7, 163. [Google Scholar] [CrossRef]

- Fereday, J.; Muir-Cochrane, E. Demonstrating Rigor Using Thematic Analysis: A Hybrid Approach of Inductive and Deductive Coding and Theme Development. Int. J. Qual. Methods 2006, 5, 80–92. [Google Scholar] [CrossRef]

- Kiger, M.E.; Varpio, L. Thematic Analysis of Qualitative Data: AMEE Guide No. 131. Med. Teach. 2020, 42, 846–854. [Google Scholar] [CrossRef]

- Thorne, S. Data Analysis in Qualitative Research. Evid. Based Nurs. 2000, 3, 68–70. [Google Scholar] [CrossRef]

- Tuckett, A.G. Applying Thematic Analysis Theory to Practice: A Researcher’s Experience. Contemp. Nurse 2005, 19, 75–87. [Google Scholar] [CrossRef] [PubMed]

- Bartolacci, F.; Caputo, A.; Soverchia, M. Sustainability and Financial Performance of Small and Medium Sized Enterprises: A Bibliometric and Systematic Literature Review. Bus. Strat. Environ. 2020, 29, 1297–1309. [Google Scholar] [CrossRef]

- Chawla, R.N.; Goyal, P. Emerging Trends in Digital Transformation: A Bibliometric Analysis. Benchmarking Int. J. 2022, 29, 1069–1112. [Google Scholar] [CrossRef]

- Cricelli, L.; Strazzullo, S. The Economic Aspect of Digital Sustainability: A Systematic Review. Sustainability 2021, 13, 8241. [Google Scholar] [CrossRef]

- Pizzi, S.; Caputo, A.; Corvino, A.; Venturelli, A. Management Research and the UN Sustainable Development Goals (SDGs): A Bibliometric Investigation and Systematic Review. J. Clean. Prod. 2020, 276, 124033. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. Bibliometrix: An R-Tool for Comprehensive Science Mapping Analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Yigitbasioglu, O.M. External Auditors’ Perceptions of Cloud Computing Adoption in Australia. Int. J. Account. Inf. Syst. 2015, 18, 46–62. [Google Scholar] [CrossRef]

- Ahmad, F. A Systematic Review of the Role of Big Data Analytics in Reducing the Influence of Cognitive Errors on the Audit Judgement. Rev. Contab. 2019, 22, 187–202. [Google Scholar] [CrossRef]

- Gepp, A.; Linnenluecke, M.K.; O’Neill, T.J.; Smith, T. Big Data Techniques in Auditing Research and Practice: Current Trends and Future Opportunities. J. Account. Lit. 2018, 40, 102–115. [Google Scholar] [CrossRef]

- Brown-Liburd, H.; Issa, H.; Lombardi, D. Behavioral Implications of Big Data’s Impact on Audit Judgment and Decision Making and Future Research Directions. Account. Horiz. 2015, 29, 451–468. [Google Scholar] [CrossRef]

- Ferri, L.; Spanò, R.; Ginesti, G.; Theodosopoulos, G. Ascertaining Auditors’ Intentions to Use Blockchain Technology: Evidence from the Big 4 Accountancy Firms in Italy. Meditari Account. Res. 2020, 29, 1063–1087. [Google Scholar] [CrossRef]

- Cleary, P.; Quinn, M. Intellectual Capital and Business Performance: An Exploratory Study of the Impact of Cloud-Based Accounting and Finance Infrastructure. J. Intellect. Cap. 2016, 17, 255–278. [Google Scholar] [CrossRef]

- Munoko, I.; Brown-Liburd, H.L.; Vasarhelyi, M. The Ethical Implications of Using Artificial Intelligence in Auditing. J. Bus. Ethics 2020, 167, 209–234. [Google Scholar] [CrossRef]

- Islam, M.S.; Farah, N.; Stafford, T.F. Factors Associated with Security/Cybersecurity Audit by Internal Audit Function: An International Study. Manag. Audit. J. 2018, 33, 377–409. [Google Scholar] [CrossRef]

- Austin, A.A.; Carpenter, T.D.; Christ, M.H.; Nielson, C.S. The Data Analytics Journey: Interactions Among Auditors, Managers, Regulation, and Technology *. Contemp. Account. Res. 2021, 38, 1888–1924. [Google Scholar] [CrossRef]

- Yau-Yeung, D.; Yigitbasioglu, O.; Green, P. Cloud Accounting Risks and Mitigation Strategies: Evidence from Australia. Account. Forum 2020, 44, 421–446. [Google Scholar] [CrossRef]

- Issa, H.; Sun, T.; Vasarhelyi, M.A. Research Ideas for Artificial Intelligence in Auditing: The Formalization of Audit and Workforce Supplementation. J. Emerg. Technol. Account. 2016, 13, 1–20. [Google Scholar] [CrossRef]

- Lee, C.S.; Tajudeen, F.P. Usage and Impact of Artificial Intelligence on Accounting: 213 Evidence from Malaysian Organisations. Asian J. Bus. Account. 2020, 13, 213–240. [Google Scholar] [CrossRef]

- Avelar, E.A.; Jordão, R.V.D.; Ferreira, G.M.C.; da Silva, B.N.E.R. Artificial Intelligence to Support Management Accounting and Control Systems: An Analysis of App-Based Transportation Companies. SG J. 2021, 16, 59–64. [Google Scholar] [CrossRef]

- Losbichler, H.; Lehner, O.M. Limits of Artificial Intelligence in Controlling and the Ways Forward: A Call for Future Accounting Research. J. Appl. Account. Res. 2021, 22, 365–382. [Google Scholar] [CrossRef]

- Kokina, J.; Davenport, T.H. The Emergence of Artificial Intelligence: How Automation Is Changing Auditing. J. Emerg. Technol. Account. 2017, 14, 115–122. [Google Scholar] [CrossRef]

- Hu, K.-H.; Chen, F.-H.; Tzeng, G.-H. CPA Firm’s Cloud Auditing Provider for Performance Evaluation and Improvement: An Empirical Case of China. Technol. Econ. Dev. Econ. 2018, 24, 2338–2373. [Google Scholar] [CrossRef]

- Le Guyader, L.P. Artificial Intelligence in Accounting: GAAP’s “FAS133”. J. Corp. Account. Financ. 2020, 31, 185–189. [Google Scholar] [CrossRef]

- Schmitz, J.; Leoni, G. Accounting and Auditing at the Time of Blockchain Technology: A Research Agenda. Aust. Account. Rev. 2019, 29, 331–342. [Google Scholar] [CrossRef]

- White, B.S.; King, C.G.; Holladay, J. Blockchain Security Risk Assessment and the Auditor. J. Corp. Account. Financ. 2020, 31, 47–53. [Google Scholar] [CrossRef]

- O’Leary, D.E. Configuring Blockchain Architectures for Transaction Information in Blockchain Consortiums: The Case of Accounting and Supply Chain Systems. Intell. Syst. Account. Financ. Manag. 2017, 24, 138–147. [Google Scholar] [CrossRef]

- Vincent, N.E.; Skjellum, A.; Medury, S. Blockchain Architecture: A Design That Helps CPA Firms Leverage the Technology. Int. J. Account. Inf. Syst. 2020, 38, 100466. [Google Scholar] [CrossRef]

- Rîndaşu, S.-M. Blockchain in Accounting: Trick or Treat? Qual. Access Success 2019, 20, 143–147. [Google Scholar]

- Pedreño, E.P.; Gelashvili, V.; Nebreda, L.P. Blockchain and Its Application to Accounting. Intang. Cap. 2021, 17, 1–16. [Google Scholar] [CrossRef]

- Sinha, S. Blockchain—Opportunities and Challenges for Accounting Professionals. J. Corp. Account. Financ. 2020, 31, 65–67. [Google Scholar] [CrossRef]

- Bonsón, E.; Bednárová, M. Blockchain and Its Implications for Accounting and Auditing. Meditari Account. Res. 2019, 27, 725–740. [Google Scholar] [CrossRef]

- Yu, T.; Lin, Z.; Tang, Q. Blockchain: The Introduction and Its Application in Financial Accounting. J. Corp. Account. Financ. 2018, 29, 37–47. [Google Scholar] [CrossRef]

- Byström, H. Blockchains, Real-Time Accounting, and the Future of Credit Risk Modeling. Ledger 2019, 4, 40–47. [Google Scholar] [CrossRef]

- Carlin, T. Blockchain and the Journey Beyond Double Entry. Aust. Account. Rev. 2019, 29, 305–311. [Google Scholar] [CrossRef]

- Coyne, J.G.; McMickle, P.L. Can Blockchains Serve an Accounting Purpose? J. Emerg. Technol. Account. 2017, 14, 101–111. [Google Scholar] [CrossRef]

- Eldalabeeh, A.R.; Al-Shbail, M.O.; Almuiet, M.Z.; Bany Baker, M.; E’Leimat, D. Cloud-Based Accounting Adoption in Jordanian Financial Sector. J. Asian Financ. Econ. Bus. 2021, 8, 833–849. [Google Scholar] [CrossRef]

- Popivniak, Y. Cloud-Based Accounting Software: Choice Options in The Light of Modern International Tendencies. Balt. J. Econ. Stud. 2019, 5, 170–177. [Google Scholar] [CrossRef]

- Christauskas, C.; Miseviciene, R. Cloud–Computing Based Accounting for Small to Medium Sized Business. Eng. Econ. 2012, 23, 14–21. [Google Scholar] [CrossRef]

- Vasarhelyi, M.A.; Kogan, A.; Tuttle, B.M. Big Data in Accounting: An Overview. Account. Horiz. 2015, 29, 381–396. [Google Scholar] [CrossRef]

- Cao, M.; Chychyla, R.; Stewart, T. Big Data Analytics in Financial Statement Audits. Account. Horiz. 2015, 29, 423–429. [Google Scholar] [CrossRef]

- Eilifsen, A.; Kinserdal, F.; Messier, W.F., Jr.; McKee, T.E. An Exploratory Study into the Use of Audit Data Analytics on Audit Engagements. Account. Horiz. 2020, 34, 75–103. [Google Scholar] [CrossRef]

- Arnaboldi, M.; Busco, C.; Cuganesan, S. Accounting, Accountability, Social Media and Big Data: Revolution or Hype? Account. Audit. Account. J. 2017, 30, 762–776. [Google Scholar] [CrossRef]

- Richins, G.; Stapleton, A.; Stratopoulos, T.C.; Wong, C. Big Data Analytics: Opportunity or Threat for the Accounting Profession? J. Inf. Syst. 2017, 31, 63–79. [Google Scholar] [CrossRef]

- Cockcroft, S.; Russell, M. Big Data Opportunities for Accounting and Finance Practice and Research: Big Data in Accounting and Finance. Aust. Account. Rev. 2018, 28, 323–333. [Google Scholar] [CrossRef]

- Pickard, M.D.; Cokins, G. From Bean Counters to Bean Growers: Accountants as Data Analysts—A Customer Profitability Example. J. Inf. Syst. 2015, 29, 151–164. [Google Scholar] [CrossRef]

- Yoon, K.; Hoogduin, L.; Zhang, L. Big Data as Complementary Audit Evidence. Account. Horiz. 2015, 29, 431–438. [Google Scholar] [CrossRef]

- Appelbaum, D.; Kogan, A.; Vasarhelyi, M.A. Big Data and Analytics in the Modern Audit Engagement: Research Needs. Audit. J. Pract. Theory 2017, 36, 1–27. [Google Scholar] [CrossRef]

- Kend, M.; Nguyen, L.A. Big Data Analytics and Other Emerging Technologies: The Impact on the Australian Audit and Assurance Profession. Aust. Account. Rev. 2020, 30, 269–282. [Google Scholar] [CrossRef]

- Salijeni, G.; Samsonova-Taddei, A.; Turley, S. Big Data and Changes in Audit Technology: Contemplating a Research Agenda. Account. Bus. Res. 2019, 49, 95–119. [Google Scholar] [CrossRef]

- Kahyaoglu, S.B.; Caliyurt, K. Cyber Security Assurance Process from the Internal Audit Perspective. Manag. Audit. J. 2018, 33, 360–376. [Google Scholar] [CrossRef]

- Zadorozhnyi, Z.-M.; Muravskyi, V.V.; Shevchuk, O.; Muravskyi, V. The Accounting System as The Basis for Organising Enterprise Cybersecurity. Financ. Credit Act. Probl. Theory Pract. 2020, 3, 149–157. [Google Scholar] [CrossRef]

- Eaton, T.V.; Grenier, J.H.; Layman, D. Accounting and Cybersecurity Risk Management. Curr. Issues Audit. 2019, 13, C1–C9. [Google Scholar] [CrossRef]

- Haapamäki, E.; Sihvonen, J. Cybersecurity in Accounting Research. Manag. Audit. J. 2019, 34, 808–834. [Google Scholar] [CrossRef]

- Alles, M.G. Drivers of the Use and Facilitators and Obstacles of the Evolution of Big Data by the Audit Profession. Account. Horiz. 2015, 29, 439–449. [Google Scholar] [CrossRef]

- Alles, M.; Gray, G.L. Incorporating Big Data in Audits: Identifying Inhibitors and a Research Agenda to Address Those Inhibitors. Int. J. Account. Inf. Syst. 2016, 22, 44–59. [Google Scholar] [CrossRef]

- Dagilienė, L.; Klovienė, L. Motivation to Use Big Data and Big Data Analytics in External Auditing. Manag. Audit. J. 2019, 34, 750–782. [Google Scholar] [CrossRef]

- Dyball, M.C.; Seethamraju, R. The Impact of Client Use of Blockchain Technology on Audit Risk and Audit Approach—An Exploratory Study. Int. J. Audit. 2021, 25, 602–615. [Google Scholar] [CrossRef]

- Rezaee, Z.; Wang, J. Relevance of Big Data to Forensic Accounting Practice and Education. Manag. Audit. J. 2019, 34, 268–288. [Google Scholar] [CrossRef]

- Kokina, J.; Mancha, R.; Pachamanova, D. Blockchain: Emergent Industry Adoption and Implications for Accounting. J. Emerg. Technol. Account. 2017, 14, 91–100. [Google Scholar] [CrossRef]

- Rooney, H.; Aiken, B.; Rooney, M. Q&A. Is Internal Audit Ready for Blockchain? Technol. Innov. Manag. Rev. 2017, 7, 41–44. [Google Scholar] [CrossRef]

- Gauthier, M.P.; Brender, N. How Do the Current Auditing Standards Fit the Emergent Use of Blockchain? Manag. Audit. J. 2021, 36, 365–385. [Google Scholar] [CrossRef]

- Karajovic, M.; Kim, H.M.; Laskowski, M. Thinking Outside the Block: Projected Phases of Blockchain Integration in the Accounting Industry. Aust. Account. Rev. 2019, 29, 319–330. [Google Scholar] [CrossRef]

- Borthick, A.F.; Pennington, R.R. When Data Become Ubiquitous, What Becomes of Accounting and Assurance? J. Inf. Syst. 2017, 31, 1–4. [Google Scholar] [CrossRef]

- Dai, J.; Vasarhelyi, M.A. Toward Blockchain-Based Accounting and Assurance. J. Inf. Syst. 2017, 31, 5–21. [Google Scholar] [CrossRef]

- Calderón, J.; Stratopoulos, T.C. What Accountants Need to Know about Blockchain *. Account. Perspect. 2020, 19, 303–323. [Google Scholar] [CrossRef]

- Moffitt, K.C.; Rozario, A.M.; Vasarhelyi, M.A. Robotic Process Automation for Auditing. J. Emerg. Technol. Account. 2018, 15, 1–10. [Google Scholar] [CrossRef]

- Aman, A.; Mohamed, N. The Implementation of Cloud Accounting in Public Sector. Asian J. Account. Gov. 2017, 8, 1–6. [Google Scholar] [CrossRef]

- Ma, D.; Fisher, R.; Nesbit, T. Cloud-Based Client Accounting and Small and Medium Accounting Practices: Adoption and Impact. Int. J. Account. Inf. Syst. 2021, 41, 100513. [Google Scholar] [CrossRef]

- Saha, T.; Das, S.K.; Rahman, M.M.; Siddique, F.K.; Uddin, M.G. Prospects and Challenges of Implementing Cloud Accounting in Bangladesh. J. Asian Financ. Econ. Bus. 2020, 7, 275–282. [Google Scholar] [CrossRef]

- Omoteso, K. The Application of Artificial Intelligence in Auditing: Looking Back to the Future. Expert Syst. Appl. 2012, 39, 8490–8495. [Google Scholar] [CrossRef]

- Horák, J.; Bokšová, J. Influence of Big Data on Financial Accounting. Int. Adv. Econ. Res. 2018, 24, 205–206. [Google Scholar] [CrossRef]

- Perkhofer, L.M.; Hofer, P.; Walchshofer, C.; Plank, T.; Jetter, H.-C. Interactive Visualization of Big Data in the Field of Accounting: A Survey of Current Practice and Potential Barriers for Adoption. J. Appl. Account. Res. 2019, 20, 497–525. [Google Scholar] [CrossRef]

- Desplebin, O.; Lux, G.; Petit, N. To Be or Not to Be: Blockchain and the Future of Accounting and Auditing. Account. Perspect. 2021, 20, 743–769. [Google Scholar] [CrossRef]

- Fuller, S.H.; Markelevich, A. Should Accountants Care about Blockchain? J. Corp. Account. Financ. 2020, 31, 34–46. [Google Scholar] [CrossRef]

- Kokina, J.; Blanchette, S. Early Evidence of Digital Labor in Accounting: Innovation with Robotic Process Automation. Int. J. Account. Inf. Syst. 2019, 35, 100431. [Google Scholar] [CrossRef]

- Smith, S.S. Implications of Next Step Blockchain Applications for Accounting and Legal Practitioners: A Case Study. Australas. Account. Bus. Financ. J. 2018, 12, 77–90. [Google Scholar] [CrossRef]

- Fernandez, D.; Aman, A. Impacts of Robotic Process Automation on Global Accounting Services. Asian J. Account. Gov. 2018, 9, 123–132. [Google Scholar] [CrossRef]

- Heinzelmann, R. Occupational Identities of Management Accountants: The Role of the IT System. J. Appl. Account. Res. 2018, 19, 465–482. [Google Scholar] [CrossRef]

- Schmidt, P.J.; Riley, J.; Swanson Church, K. Investigating Accountants’ Resistance to Move beyond Excel and Adopt New Data Analytics Technology. Account. Horiz. 2020, 34, 165–180. [Google Scholar] [CrossRef]

- Sheldon, M.D. Using Blockchain to Aggregate and Share Misconduct Issues across the Accounting Profession. Curr. Issues Audit. 2018, 12, A27–A35. [Google Scholar] [CrossRef]

- Tan, B.S.; Low, K.Y. Blockchain as the Database Engine in the Accounting System. Aust. Account. Rev. 2019, 29, 312–318. [Google Scholar] [CrossRef]

- Asatiani, A.; Apte, U.; Penttinen, E.; Rönkkö, M.; Saarinen, T. Impact of Accounting Process Characteristics on Accounting Outsourcing—Comparison of Users and Non-Users of Cloud-Based Accounting Information Systems. Int. J. Account. Inf. Syst. 2019, 34, 100419. [Google Scholar] [CrossRef]

- Cai, C.W. Triple-entry Accounting with Blockchain: How Far Have We Come? Account. Financ. 2021, 61, 71–93. [Google Scholar] [CrossRef]

- Liu, M.; Wu, K.; Xu, J. How Will Blockchain Technology Impact Auditing and Accounting: Permissionless vs. Permissioned Blockchain. Curr. Issues Audit. 2019, 13, A19–A29. [Google Scholar] [CrossRef]

- McCallig, J.; Robb, A.; Rohde, F. Establishing the Representational Faithfulness of Financial Accounting Information Using Multiparty Security, Network Analysis and a Blockchain. Int. J. Account. Inf. Syst. 2019, 33, 47–58. [Google Scholar] [CrossRef]

- Cristea, L.M. Romanian Auditors’ Perception Concerning the IT Impact in the Big Data Era. Pénzü. Szle. Public Financ. Q. 2021, 66, 68–82. [Google Scholar] [CrossRef]

- Korhonen, T.; Selos, E.; Laine, T.; Suomala, P. Exploring the Programmability of Management Accounting Work for Increasing Automation: An Interventionist Case Study. Account. Audit. Account. J. 2020, 34, 253–280. [Google Scholar] [CrossRef]

- Zhyvets, A. Evolution of Professional Competencies of Accountants of Small Enterprises in The Digital Economy of Ukraine. Balt. J. Econ. Stud. 2019, 4, 87–89. [Google Scholar] [CrossRef]

- Stein Smith, S. Audit Implications of AI & Blockchain. In Blockchain, Artificial Intelligence and Financial Services; Springer International Publishing: Cham, Switzerland, 2020; pp. 165–173. ISBN 978-3-030-29760-2. [Google Scholar]

- Earley, C.E. Data Analytics in Auditing: Opportunities and Challenges. Bus. Horiz. 2015, 58, 493–500. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).