1. Introduction

In business-to-business financial relationships, it is a common practice to pay for some services or products with some delay—for example, several months later. In this situation, the provider (namely the

seller) might sell her future receivable finance (invoice from a

buyer) with a discount to a factoring entity (namely the

factor, e.g., a bank). Invoice factoring has been a popular way to provide cash flow for businesses [

1]. There are several issues and challenges in the traditional invoice factoring process [

2]. For example, it often requires several manual steps, and the information is dispersed among different systems and databases [

3,

4].

There are also trust issues related to factoring. The

factor has to trust the

buyer to have paid the amount of invoice by the due deadline, and the

buyer has to comply with the factoring contract between the

seller and the

factor. Moreover, a malicious

seller may try to cash an invoice at multiple

factors to fraudulently double the amount of received money. This issue is known as

double factoring, and it is a main problem that a factoring system needs to prevent. In more detail,

double factoring is possible because there are no insights between

factors, whether an invoice has already been financed or not [

5]. In general, the implication of the

buyer is necessary to provide awareness between

factors in whether an invoice has already been financed.

Usually, we can assume that the

buyer is a trusted party, since this entity does not have any economic incentives in the factoring process. This is clearly true when the

buyer is an administration or a government. To prevent double factoring, many ecosystems (e.g., countries) use one or several centralized entities to register factoring agreements. However, this puts a lot of power in the hands of these centralized entities and makes it difficult for users to dispute situations in which factoring data is unavailable, wrongly recorded or manipulated by negligence or on purpose. Besides, if there are several possible centralized registries for invoice factoring, which is quite common, another problem arises. In this case, the factoring information is scattered and it is the responsibility of the

buyer—the less involved entity in the factoring process—to check the records of all possible trusted third parties and make sure that the payment is made to the correct party. In this context, a public distributed ledger seems a natural tool to solve these issues because not only can it keep the record of factoring agreements but it can also prevent double factoring [

6]. A distributed ledger can make the record-keeping database distributed and highly available, as well as logically unique and secure from manipulations. This way, factoring agreements can be made faster with fewer errors and still carry the authenticity and credibility of manual contracts.

Several works have been proposed in the literature to implement new generation invoice factoring protocols using distributed ledger technologies [

2,

5,

7,

8]. However, as we discuss in detail in

Section 6.2, none of them is completely able to fulfill the requirements that such a new generation ledger-based protocol should cope with. Concretely, ledger-based invoice factoring solutions should operate without a single point-of-failure, provide privacy and protection of

personally identifiable information (PII) and business information, provide non-repudiation for handling disputes, be decentralized and secure against corruption, comply with Know-Your-Customer (KYC), be cost-efficient, and provide an easy user on-boarding.

In this article, we propose a protocol that fulfills all the previous requirements, that is optimal in terms of cost, and that is built over a public ledger, which is the most reliable, transparent, and secure type of ledger. Regarding other proposals, we address the entry barrier related to the fact that users have to manage cryptocurrencies for interacting with public ledgers. In general, many users, prefer not to use cryptocurrencies because they are highly volatile, risky, and non-compliant. To overcome this problem, we include a relayer in our architecture. Additionally, the proposed protocol also enables new functionality that is not available in any other related protocol. Specifically, the protocol allows parties to implement their self-sovereign identities making use of their self-managed identifiers (DIDs). The protocol also leverages the concept of Verifiable Credentials (VCs), which are credentials issued to self-sovereign identities and grant permission to the parties to participate in our invoice factoring architecture. Another advantage of using DIDs is that we can relay on new communications models that are being developed in this ecosystem, like DIDComm. DIDComm allows us to implement asynchronous and secure off-chain communications between participants, which means that a party does not need to be present at the moment that another party sends a message. The response can be received, processed, and approved asynchronously.

Our contributions are designing the system architecture, procedures, and communication protocols for an efficient system which is decentralized and highly available. We use different cryptographic primitives to make our architecture secure against attacks and preserve the privacy of involved parties. Our registration system relies on a public distributed ledger to prevent double-factoring and protect digital evidence from manipulations. The involved parties identify each other in a secure and privacy-preserving manner to comply with the KYC regulation. While we rely on a public distributed ledger, the parties are not required to use cryptocurrencies. Moreover, the buyer is not required to invest too many resources, nor be heavily involved in the factoring process.

The rest of this article is organized as follows: in

Section 2, we present the followed methodology; in

Section 3, we provide the background; in

Section 4, we present the related work; in

Section 5, we introduce our protocol; in

Section 6, we evaluate the proposal; and we conclude in

Section 7.

2. Methodology

For the design of our ledger-based invoice factoring solution, we followed the design-science research methodology [

9]. Following this methodology, we reviewed the literature to better understand invoice factoring services in the first step. Our study revealed that prevention of double-factoring is the critical motivation behind such services. In addition, ledger-based invoice factoring solutions should operate without a single point-of-failure, provide privacy and protection of

personally identifiable information (PII) and business information, provide non-repudiation for handling disputes, be decentralized and secure against corruption, comply with Know-Your-Customer (KYC), be cost-efficient, and provide an easy user on-boarding.

In the second step, the distributed-ledger technology motivated us to search for a solution based on this technology to completely prevent double-factoring while satisfying the other requirements. We reviewed several works which implemented new generation invoice factoring protocols using distributed ledger technologies [

2,

5,

7,

8]. However, as we discuss in detail in

Section 6.2, none of them was completely able to fulfill the requirements.

In the third step, we designed a system architecture, and developed its procedures and communication protocols based on the distributed ledger technology for an efficient invoice factoring system. We made use of proven and solid cryptographic primitives to make our design secure while being functional and efficient. In

Section 3, we briefly introduce the cryptographic primitives and the technology we use in our design.

The fourth step was to evaluate our solution and compare it with the related work. Our solution suites different cases for business use. Nonetheless, as an example, we demonstrate its applicability in a digital data marketplace in

Section 5.3. Besides that, we analyzed the security of our proposal and compared it with the related work. According to the methodology, the remainder of the article presents our research, design, and evaluations.

3. Background

3.1. Cryptographic Primitives

A number of cryptographic primitives have been used to secure our design, and we briefly introduce them next. The interested reader is referred to reference [

10] for more detail.

Encryption is a security mechanism to make data confidential. In particular, the data is transformed to a sequence of random-looking bytes that can only be understood by intended parties that have access to a decryption key. There are two types of encryption: symmetric and asymmetric. In symmetric encryption, a secret key is shared between intended parties and is used for both encryption and decryption. In contrast, in asymmetric encryption, a pair of keys (public and private) are used. The public key is available to everyone and can be used to encrypt data, but only one entity owns the private key and can decrypt the encrypted data.

A digital signature is a security mechanism to provide assurance about the originality of signed data and confirm the signatory’s informed consent. Digital signatures are a method of public-key (asymmetric) cryptography. More specifically, the private key is used to generate a fixed-size signature from the data, and everybody can validate the signature by the corresponding public key. If a fake private key is used or the data is manipulated, the signature does not match the data and the public key.

A hash function is a cryptographic primitive to derive a fixed-size digest of its input data. Secure hash functions (such as SHA-256) are irreversible in practice, and the original data cannot be guessed from their output value. However, brute-force guessing attacks are still possible if the length of the input is too short. Therefore, special families of hash functions with configurable (sliding) time-complexity and memory-consumption are used in security protocols to reduce the vulnerability of online and offline brute-force attacks. These algorithms (such as

scrypt [

11]) are built around the idea of iteratively applying the input data and a random number (a.k.a. the salt) to a secure cryptographic hash function. The salt is used to increase the cost of pre-computation.

Diffie-Hellmann (DH) Key Exchange protocol [

12] is the first key exchange protocol in a public-key (asymmetric) setting. It allows two parties to create a shared secret (key) without any prior secret sharing and secure it through an insecure communication channel. In a DH key exchange, participants agree on a finite cyclic group

of order

n and a generator

. One party selects a random number

and sends

to the other party. Then, the other party selects another random number

and sends

. The agreed DH secret is

. In order to use DH key exchange securely, the two ends should authenticate the received values to prevent man-in-the-middle attacks and apply a key derivation function (KDF) to the agreed DH secret.

3.2. Public Distributed Ledgers

The main technology to build a public ledger is a blockchain network. In a blockchain network, users can run a blockchain node to send their transactions or use some available node that allows them to do so. Then, in a distributed way, the blockchain network can create a unique sequence of ordered transactions. In more detail, the network creates a chain of blocks using a consensus algorithm to order transactions [

13]. A block contains several transactions, and an important property is that, once the consensus algorithm definitively accepts a block, all the nodes will know this block, and it will be impossible to manipulate or delete it [

14].

In a blockchain network, users can own one or more accounts. Accounts are identified via a public identifier (usually derived from a random public key using a hash function). New blockchain accounts can be created by simply generating a pair of asymmetric keys and deriving the account identifier from the public key. In general, account identifiers are not directly linked with any user data, so they can be considered pseudo-anonymous identifiers.

Transactions carry the source account identifier and a destination account identifier, and they are all digitally signed using the private key of the source account. All the nodes that form the blockchain network see the same state (also known as world state) that results from executing all the transactions in order [

15].

In most current public ledgers, the main use of blockchain is to create a cryptocurrency. As a result, the ledger state represents the balance of each account, and transactions are used to transfer the balance from one account to another. However, blockchain networks can be used to build other generic applications, like we will do for registering the factoring process. For this purpose, many distributed ledgers also provide users with the ability to use smart contracts [

16] and develop

decentralized applications (dapps).

Ethereum [

17] is the most popular public blockchain capable of running smart contracts, and the platform of choice for many developers for implementing dapps [

18]. Taking Ethereum as a reference, we can define a smart contract as code that implements business logic to manage a portion of the ledger state. Smart contracts are deployed (installed) in the ledger through transactions. Deployed contracts, like user accounts, also have an identifier. Then, the portion of the ledger state, which is controlled by the smart contract, can be modified by sending a transaction to a function of that smart contract. In this case, the smart contract makes the corresponding state changes according to its explicit and immutable logic. Moreover, once a smart contract is deployed on the blockchain, it can be automatically executed through transactions. The correct operation of smart contracts is guaranteed by thousands of nodes all over the world, so smart contracts cannot be censured or stopped [

19].

The main advantages of implementing business logic using smart contracts are that, on the one hand, the logic is publicly available and auditable, and, on the other hand, the logic is immutable and tamper-proof, which guarantees that the execution will always be as defined. These advantages can be used to enforce the terms of an agreement between parties without the need for intermediaries [

20].

3.3. Decentralized Identifiers

Identifiers (IDs), as their name suggests, are used to identify and distinguish between individuals/entities in the digital world. There are two important properties that an ID shall have:

uniqueness and

verifiability. The former property guarantees that two different entities do not have the same ID, and the latter one requires that the link between an ID and the related entity must be provable. Both properties are often provided by relying on a central server or a third-party called

identity provider. Decentralized identifiers (DIDs) [

21] are a means to implement

self-sovereign identities (SSIs)—IDs that are under full control of their related entity. DIDs are designed to allow for a verifiable and decentralized digital identity system for subjects and to decouple them from centralized registries, ID providers, and certificate authorities. A DID has a

controller which has full power over the

subject of the DID without requesting permission from any other entity. Other entities may only facilitate the discovery of information related to a DID.

A DID is a simple text in form of a URI, e.g., did:bc:1234, consisting of a URI scheme identifier (did), a DID method (bc), and a DID method-specific identifier (1234). This opaque string associates a DID subject with a DID document (DDO) to ensure secure and reliable interactions among subjects. When a user acknowledges a claim from an issuer, the corresponding DDO is generated. Each DDO can contain public cryptographic material (e.g., public keys and authentication mechanisms) or service endpoints in order to provide a set of mechanisms to reach the subject and communicate with it securely.

A DID method specification explains specific ways for creating, resolving/verifying, updating, and deleting DIDs, and these functionalities are implemented differently for each DID method. A list of registered DID methods (more than 80) and their specifications can be accessed from reference [

22]. Blockchains and distributed ledgers, in general, are suitable candidates for implementing the verifiable data registry required for implementing DIDs. Regardless of the type of blockchain (public, private, permissioned, or permission-less), specific methods are proposed. In particular, there are proposals based on Sovrin, Ethereum, Bitcoin, Tangle, Hyperledger, ICON, Corda, and other blockchains, and some of them are already operational.

For any identity management solution, privacy is a pivotal component; and blockchain-based DIDs must be carefully designed so that their immutable and transparent nature does not impair privacy. The following features of DIDs can implement privacy by design at the very lowest level of infrastructure and for building robust, modern, and privacy-preserving technologies:

Pairwise-pseudonymous DIDs: In addition to being used as well-known public identifiers, DIDs can be used as private identifiers issued on a per-relationship basis. In this way, subjects can have multiple pairwise-unique DIDs that cannot be correlated without their permission and, therefore, do not compel a subject to have a single DID, like a national ID number.

Off-chain private data: It is possible, and already implemented in some existing DID methods, that all private data are stored off-chain and shared only over encrypted, private, and peer-to-peer connections. Because there are two risks for storing personally identifiable information (PII) on a public blockchain, even encrypted or hashed: (1) When the information is shared with multiple parties, the encrypted or hashed data becomes a global correlation point. (2) When the encryption is eventually broken, e.g., by a quantum computer, the data will be accessible forever on an immutable public ledger.

Selective disclosure: DIDs can open the door for individuals to gain greater control over their personal data by using DIDs and the greater ecosystem of Verifiable Credentials [

23] based on them: (1) by privately sharing encrypted digital credentials only with intended parties, or (2) by using

zero-knowledge proofs (ZKP) to minimize data leakage. For example, a ZKP enables a user to disclose that he/she is over a certain age without disclosing his/her exact date of birth.

3.4. DIDComm

DIDComm is an asynchronous communication protocol for establishing secure and private channels between parties based on their DIDs [

24]. DIDComm supports both centralized and decentralized communication models. Different parties do not need a highly available webserver to be accessible for communications. Individuals on semi-connected mobile devices can also exchange messages in a decentralized fashion, and messages can pass through mixed networks, e.g., an email can connect A to B without a direct connection. DIDComm also supports HTTPS endpoints which can be used to communicate with standard HTTP servers over TLS.

All the information required for establishing a DIDComm channel exists in the DDOs of the involved parties. DIDComm uses public-key cryptography, and the privacy of communications are preserved in the sense that third parties do not learn about the content and the sender of a message. Each party utilizes a software agent to process requests and manage keys. All interactions actually take place between the two ends’ software agents. An agent can be implemented in a special desktop/mobile application or a web-based application and be run inside a standard web browser.

Next, we briefly explain how direct and indirect messaging work in DIDComm. In the direct case, Alice directly sends a message to the endpoint specified in Bob’s DDO [

25]. In a decentralized and ad-hoc case, the endpoint is Bob’s agent, who is accessible through the Internet [

26]. The confidentiality and integrity of the message are guaranteed by typical public-key cryptography and digital signature. To do so, their agents use the other party’s public key, which is specified in his/her DDO.

In the indirect case, Alice and Bob cannot connect directly, and Alice uses an intermediary Relay [

27]. She wraps her encrypted message in another message, encrypts the whole, and sends them to a Relay (direct messaging). The Relay decrypts and unwraps the message and forwards it to Bob (direct messaging). Finally, Bob decrypts and recovers the original message.

4. Related Work

This section describes solutions that have been published in the literature, and that propose similar approaches to us to solve invoice factoring. That is to say, approaches that propose solutions based on distributed ledger technologies.

The first work that is worth mentioning is DecReg [

5], which has been used by the Netherlands financial industry. DecReg can be used to track fiat payments and invoices that have been factored. The DecReg framework prevents double factoring by design and is implemented over a private blockchain. The operation of the framework requires that

buyers operate a node in the private blockchain. To do so,

buyers receive credentials from a Central Authority (CA). The CA not only provides credentials but also monitors the access to the private blockchain and prevents uncertified parties from accessing confidential information. Regarding dispute resolution, if an argument between a

seller and a

factor takes place, in DecReg, the signatures of transactions (of the private ledger) are used to resolve the dispute.

Battaiola et al. [

7] proposed a framework for registering factoring agreements that can prevent double factoring and preserve the privacy of involved parties. The proposed architecture employs a distributed ledger as the source of truth. All parties submit their private inputs in the form of commitments to ensure the integrity and confidentiality of factoring data. The protocol operates over a private blockchain network. In particular, authors suggest the use of Hyperledger Fabric [

28]. Involved parties have to operate the infrastructure of the private ledger. In addition, the registration of the factoring of an invoice requires that each involved party sends a transaction to the private ledger.

Guerar et al. [

8] propose a factoring scheme based on a public distributed ledger. In particular, authors suggest the use of the Ethereum public blockchain network [

17]. In the proposed protocol,

buyers are not considered trustworthy. Following this assumption, the authors develop a framework to assess the credibility of

buyers based on reputation. That is to say, a reputation record is created for each

buyer based on his previous behavior. To implement this reputation system, the platform is in charge of creating stable identifiers for linking reputation records to each

buyer. On the other hand, in the proposed framework, factoring is negotiated using an on-chain auction in which any investor, not just banks and financial institutions, can register as a

factor. Additionally, the protocol is specified for products rather than for services, as the authors mention that the invoice factoring negotiation process begins when transported goods are received. Finally, to provide data availability, authors suggest the use of a peer-to-peer distributed file system. In particular, authors base their solution in the Inter-Planetary File System (IPFS) [

29].

In reference [

2], the authors introduce a framework for factoring registration based on the use of a public distributed ledger. The proposed protocol is designed to reduce the

buyer’s involvement in the factoring process. In particular, the

buyer is only required to publish a hash of invoice details for

factor verification, and the rest of the process was carried out by

sellers and

factors using on-chain and off-chain communications. A smart contract is used to register invoice factoring details on-chain efficiently and to avoid double factoring. In particular, only the

seller needs to interact with the smart contract and only one transaction is sent to the public distributed ledger to complete the registration of the factoring process. In addition, authors use pseudo-anonymous identifiers, symmetric encryption for on-chain data and cryptographic commitments to improve the privacy of

sellers and

factors. In this protocol, the

buyer uses the registered information in the public distributed ledger to pay to the corresponding

factor. The payment is done off-chain via a bank transfer using fiat money. Finally, after the registration process takes place, the data stored on-chain can be used as digital evidence for the resolution of possible disputes between involved parties.

5. Proposed Architecture

In our architecture, we have the three classical entities of the factoring scenario: the buyer, the seller, and the factor. Additionally, we have a smart contract deployed on a public distributed ledger and a relayer that facilitates sending the transactions to the ledger. At a high level, our protocol works as follows:

The seller submits a request to the buyer for registering an invoice.

The buyer issues a cryptographic digest for the invoice.

The seller negotiates with several factoring companies and chooses a desired factor.

The factor verifies the cryptographic digest of the invoice by querying the buyer, and then sends the signed factoring agreement to the seller.

The seller uses a relayer to register the agreement in a smart contract that is available on a public ledger.

The factoring company queries the smart contract to ensure that it is actually selected as the factor.

Since the factoring decision registered in the smart contract is immutable, the factor pays the agreed amount () to the seller.

When the invoice payment deadline is reached, the buyer checks the smart contract and notices that the invoice is factored.

Finally, the buyer pays the invoice amount to the factor.

Next, we present a detailed explanation of our proposal, including our design goals, assumptions, and the detailed protocol.

5.1. Design Goals & Assumptions

In our architecture, we assume that the buyer is trustworthy for the factoring process. This is clearly true when the buyer is an administration or a government, which is our main use case. In the case of other types of buyers, the factor would need to check the corresponding creditworthiness before accepting to factor invoices issued by a specific buyer.

Our architecture is for a registration system but the actual payments are made off-chain using fiat transfers between bank accounts. All the interactions to complete a factoring registry are managed by a smart contract. All parties can trust the correct execution of transactions managed by the smart contract because the blockchain platform guarantees this execution. If the invoice has been factored, the buyer has to pay the invoice to the bank account of the entity registered by the smart contract. Therefore, all involved parties have to review the smart contract code and ensure its correctness. The smart contract address is also part of the negotiation between the seller and the factor.

An important obstacle against the adoption of distributed applications is the need of having cryptocurrency to pay the transaction fees. Managing cryptocurrencies may be difficult for institutions and companies because of their high volatility, financial risk, and regulation issues. This may lead to a situation in which parties refuse to use cryptocurrency and, hence, cannot interact directly with smart contracts.

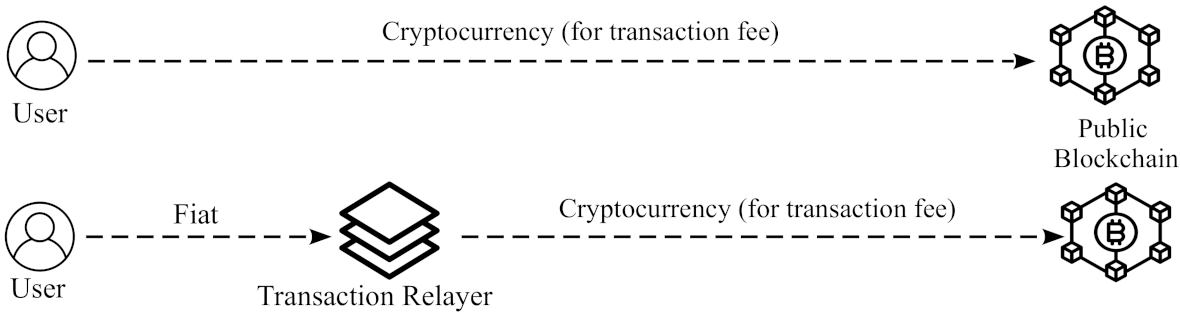

To overcome this problem, we use a

relayer, as shown in

Figure 1. A

relayer is a facilitator that sends the transactions on behalf of other users. The

relayer will pay the fees, but it is not a trusted party. In more detail, this means that the

seller is who authorizes the factoring registrations, and the

relayer is an entity to merely forward and pay the transaction fee. The advantage of this architecture is that the

seller can pay the

relayer with classical payment methods (e.g., credit cards, bank transfer, etc.).

Since the buyer does not have incentives in the factoring process, as a general rule, in our design, the factoring process is as less complex and resource-consuming as possible for the buyer. In particular, in our architecture, the buyer will not need specific digital certificates for the factoring process and will not perform digital signatures related to this process. Instead, the buyer’s software agent gives access to some minimal information about his invoices so that factors can check the information provided by sellers.

Another issue to take into account is that, when using a public ledger, we gain transparency, but, at the same time, everybody has access to the stored data. In the factoring process, there is sensitive business information which shall be appropriately protected. For privacy protection, we do not store sensitive data directly on the blockchain. Instead, some part of the data is symmetrically encrypted before being stored on-chain; another part of the data is stored off-chain, and we use cryptographic commitments to provide proofs of existence. Once an invoice factoring has been registered, we guarantee that:

There is no possibility of double factoring.

The relevant parties have access to the relevant data and its proof of existence.

There is no way to dispute the factoring once the smart contract has registered it.

In addition, to perform the registration process, all parties are identified by DIDs, and some communications use DIDComm. Our proposal is independent of any specific DID-method, but we have the following assumptions:

Sellers and factors may have multiple DIDs, but once a pair decides to enter a factoring agreement, they use a specific DID during the whole process. Their DIDs shall be bound to a pair of digital signature keys to sign requests for non-repudiation purposes.

While our architecture supports multiple buyers, but we focus on invoices related to one buyer and assume that the respected sellers and factors already know the DID of the buyer.

We have a relayer role in our architecture which is also identified by a DID. In addition to the DID, the relayer has a blockchain address for issuing transactions. However, there is no need for the DID and the address to be linked together.

The other entities in our proposal are not required to have blockchain addresses.

Finally, we assume that an invoice contains the following information: the seller and the buyer identities, invoice number, issuance date, due payment deadline, total amount (and currency code), and other details about the service/goods provided by the seller to the buyer. We assume that the identity of the seller and the invoice number are enough to identify the invoice uniquely; thus, the use of unique invoice numbers should be enforced. Besides, the identifier of the buyer, due payment deadline, and the total amount are necessary for factoring negotiations. Other information can be added to the invoice without affecting how our architecture works.

5.2. The Protocol

Our architecture is framed in a financial context; hence, strict regulatory restrictions apply to it. In particular, following the Know-Your-Customer (KYC) regulation, the involved parties need to be well identified to each other, and their agreements have to be persisted for later audits and law enforcement.

In order to comply with the KYC regulation, in our architecture, the buyer issues Verifiable Credentials (VCs) to certify the real identity of the factors, the sellers, and also exact details of the invoices. The buyer is supposed to pay the factor; therefore, as mentioned, we assume that factors can trust buyers for this purpose. Our protocol avoids the buyer from having to digitally sign a VC or any other data. Instead, the authenticity of VCs are verified by securely querying the (agent of the) buyer.

The process of factoring an invoice starts with the registration phase and is followed by factoring and payment phases. Each phase consists of several steps, which are explained in the following sections. In

Table 1, we show the notation that we utilize to describe our protocol.

5.2.1. Phase 1: Credential Registration

In this phase, VCs are registered by the buyer for identifying factors and for identifying invoices of sellers (seller-invoice VC). Both VCs are registered in essentially the same manner. We first explain the factors’ VC registration, and then the seller-invoice VCs.

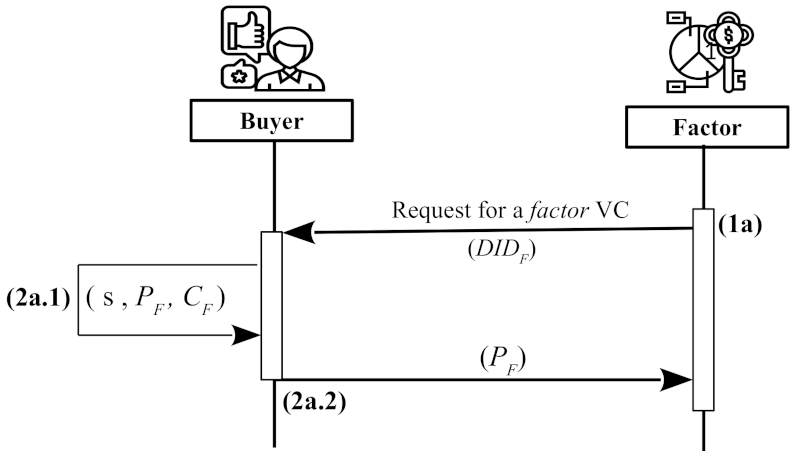

Factor’s credential: The VC of a

factor is registered as follows (see

Figure 2):

- 1a

The factor establishes a mutually authenticated DIDComm channel with the buyer and sends one of its DIDs (). This channel is re-used for other communications between these two entities.

- 2a.1

The

buyer selects a random number

s (salt) and generates an identifier for the credential as follows:

To generate the identifier for the factor (

), we use its decentralized identifier (

), the real identity of the

factor (

), and the public key of the

factor (

). The

factor’s public key is obtained from the DDO that resolves

. Finally, the verifiable credential for the

factor is the following tuple:

- 2a.2

The buyer keeps the VC and salt for further reference and replies to the factor with .

Note that having the value of

, the

factor can compose his/her credential (

). After that, any

seller with a copy of

can consult the

buyer’s agent, send

, and obtain

s to check the integrity of the VC content. Note that

is cryptographically bound to the contents of

. Therefore, if any of the contents are changed,

does not match them anymore. Secure hash functions which are resistant against brute-force guessing attacks (such as

scrypt [

11]) should be used here. They prevent an attacker from discovering the actual content of

by trying different values, and matching

with the guessed content. The security of the communication with the

buyer and pre-image resistance of the hash function assure the authenticity of the VC. The VC is kept private and only exchanged between intended parties. For better anonymity and prevention of linking attacks, a

factor can have multiple DIDs but can use only one of them during the whole process of factoring a particular invoice.

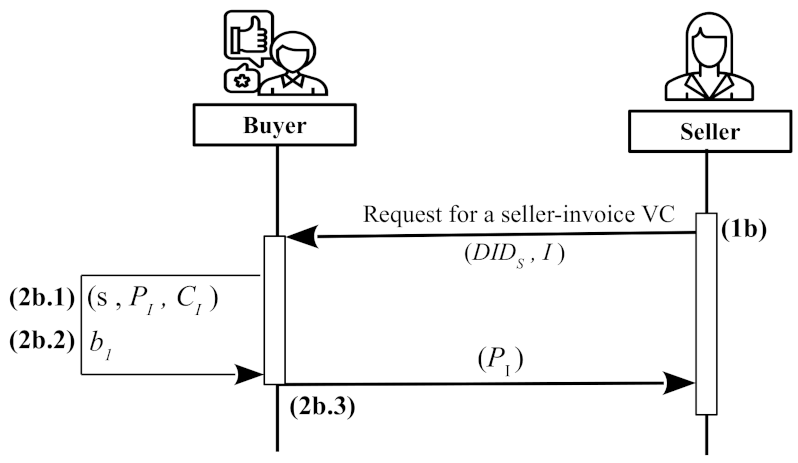

Seller-invoice credential: When a

seller decides to factor an invoice, she asks the

buyer to register a seller-invoice VC. The registration is independent of

factors’ registration. In particular, this registration consists of the following steps (see

Figure 3):

- 1b

The seller establishes a mutually authenticated DIDComm channel with the buyer and sends one of its DIDs () and the identifier (I) of the corresponding invoice. This channel is re-used for other communications between these two entities.

- 2b.1

The buyer checks that a credential has not been already registered for the invoice I. Then, they proceed by selecting a random salt s and generating the credential identifier.

A seller-invoice credential is similar to a

factor’s VC, but it contains not only the

seller identifiers but also invoice information:

where

and

are the

seller’s identifiers,

is the public key of the

seller,

I is the invoice number,

is the invoice amount,

is the invoice payment deadline, and

is the blockchain address of the factoring

smart contract. Finally,

is the identifier of the seller-invoice credential, which is generated in the same way as in Equation (

1), but computing the hash over the contents of

:

The verification process of is also the same as . As factors, sellers can also have multiple DIDs for better anonymity and prevention of linking attacks. However, as with factors, a seller can only use one of its DIDs to receive the seller-invoice credential for a particular invoice. The buyer performs the following additional processing for seller-invoice registration:

- 2b.2

The buyer selects another random number and stores it for later use. In particular, will be used by the selected factor to derive an encryption key using a Diffie-Hellman (DH) key exchange scheme. As we explain in the next phase of the protocol, we use DH to establish a shared secret key between the buyer and the selected factor using the buyer’s agent and on-chain information provided by the factor.

- 2b.3

The

buyer replies to the

seller with

. Having the value of

, the

seller can compose the corresponding seller-invoice credential

(see Equation (

3)).

5.2.2. Phase 2: Factoring

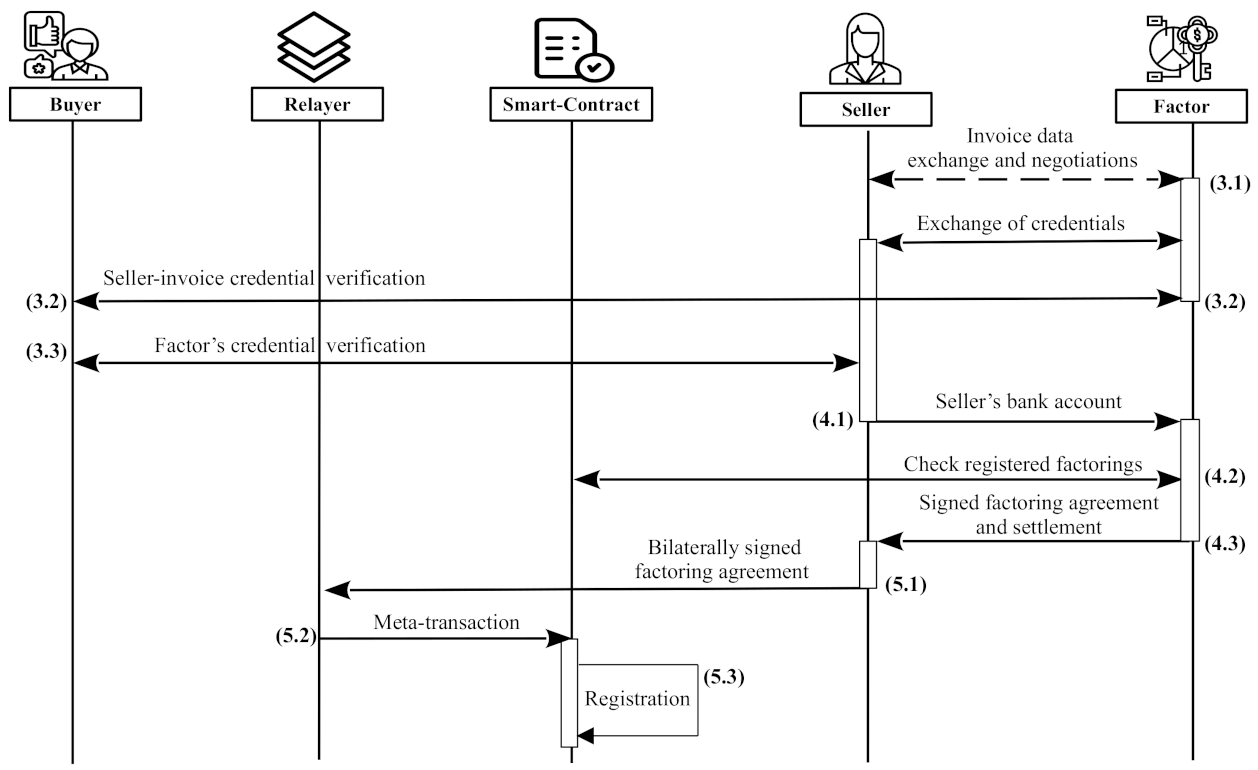

According to

Figure 4, the steps followed in this phase are the following:

- 3.1

The factoring phase starts with the seller contacting multiple factors to negotiate and compare the different offers and conditions for the possible invoice factoring. The seller provides her invoice details, including the invoice number (I), the total amount of the invoice (), and the payment due deadline (), to the factor. The factor specifies his/her offered amount for the invoice () and the deadline for completing the factoring registration (). Then, according to the received offers, the seller selects the best factor to continue with. After this decision, the factor sends its credential to () to the seller, and the seller sends the seller-invoice credential () to the factor. Remember that the seller-invoice credential identifies both, the seller and the invoice that is going to be factored.

- 3.2

The

factor extracts the seller-invoice credential identifier (

) from the credential received from the

seller and sends it to the

buyer agent using an end-to-end encrypted DIDComm channel. Then, the

buyer answers with the associated salt

s and the DH parameter

. Next, using Equation (

4) with the salt and the DH parameter received, the

factor can check whether the

provided by the

seller is valid and accepted by the

buyer or not. In the affirmative case, the protocol continues with the next step.

- 3.3

On the side of the

seller, a similar operation as the previous one is carried out to check the credential of the factor (

). This step begins with the

seller extracting the factor credential identifier (

) from the credential received from the

factor and sending this identifier to the

buyer agent using an end-to-end encrypted DIDComm channel. Then, the

buyer answers with the associated salt

s. Next, using Equation (

1) with the salt received, the

seller can check whether the

provided by the

factor is valid and accepted by the

buyer or not. In the affirmative case, the protocol continues with the next step.

- 4.1

When the verifiable credential presented by the selected factor is verified, the seller sends her bank account number () to the factor using the associated end-to-end encrypted DIDComm channel.

- 4.2

The factor checks the smart contract at address (as specified in ) to ensure that the invoice has not been already factored. In addition, he/she subscribes to one or several nodes of the distributed ledger to be notified about any factoring agreement registered by the smart contract in the ledger.

- 4.3

The

factor sends the agreement information (

) and settlement information (

) to the

seller. All these data are digitally signed using the public key

, which is resolved from

(the signature is noted as

):

where

r is a random number (salt),

is actually a confirmation for the

seller, and neither is given to the

buyer nor stored on-chain. However, the salted hash of

is included in the signature (

) as a commitment and for non-repudiation purposes. In contrast,

will be registered on-chain and a part of it is encrypted and hidden from the

seller. Notice that the encrypted part is essentially the account number of the

factor where the

buyer has to pay in case the invoice has been factored. Clearly, this information is not necessary to be known by the

seller. To create this symmetric encryption, the value

is provided on-chain by the

factor to allow the

buyer to reconstruct the shared key

and decrypt that part. To do so, the

factor selects a random number

and uses the DH key-exchange formula to generate the symmetric encryption key

:

After an agreement is reached, the relevant factoring and payment details have to be registered in the distributed ledger. In general, each interaction that modifies the state of a public ledger requires a fee to be paid. In our protocol, one of our main design goals is to have the minimum possible number of transactions for completing a factoring registration in order to avoid paying excessive fees. Actually, we only need one transaction per invoice factoring, and the majority of the communications between the different parties are off-chain. In particular, our protocol is designed so that only the seller has to pay for invoice registration, while interactions with the distributed ledger by the factor and the buyer are view-only, as well as are free of charge.

Moreover, as mentioned in

Section 5.1, managing cryptocurrencies to pay the fees may be difficult for institutions and companies. To overcome this problem, we use a

relayer. In order to explain how the

relayer works, we have to understand the purpose of the signature in a regular transaction. In this respect, the signature in a regular transaction has two different purposes. In the first place, it determines who pays the fee, and, in the second place, it is used to authenticate and authorize a user in front of a

smart contract. Introducing a

relayer in our protocol allows us to decouple the signature required for paying the transaction fee, which will be paid by the

relayer, from the signatures required for authentication/authorization, which will be performed bilaterally by both, the

seller and the

factor.

An advantage of using a relayer is that it enables a clear and easy-to-implement business model for our protocol. The relayer can charge sellers per usage (e.g., per transaction request), and the sellers may have to buy some credit to use the relayer’s API with any classical off-chain payment method, such as a credit card, bank transfer, etc.

- 5.1

The

seller checks that the

factor’s signature over the settlement data (

) is valid (Equation (

5)), that the agreement data (

) is what it has been negotiated with the

factor, and that the hash value included in the settlement information (

) is correct. The

seller records the

factor’s signature for possible later use as digital evidence. Then, the

seller creates a message for the bilateral settlement

:

Then, the

seller signs

and sends the bilateral settlement message and its signature to the

relayer:

Notice that we do not need to trust the relayer, and the seller does not share any confidential/private data with it. The signature authenticates the seller and prevents the relayer from changing any detail of the bilateral agreement. Therefore, the relayer only plays the role of a facilitator and nothing more. As mentioned, the factor and the buyer do not need to interact with the relayer because they only need to query the smart contract. These queries are performed directly from blockchain nodes and are free-of-charge.

- 5.2

The

relayer deduces the transaction fee plus probably some extra commission from the

seller’s credit, bundles the received information into a meta-transaction, and sends it to the

smart contract:

Notice that, in fact, the settlement data () is triply signed at this step: (i) by the relayer to pay its transaction fee, (ii) by the seller for registering the factoring agreement, and (iii) by the factor for promising to pay the invoice. The first signature is automatically verified by the blockchain platform, and the transaction fee is reduced from the balance of the relayer.

- 5.3

In the final step of this phase, the smart contract processes the meta-transaction () as follows:

Determines the public keys used for signing and , that is and , respectively. With these keys, it checks the signatures in the meta-transaction.

Verifies that the current blockchain time is smaller than the registration deadline (). This deadline is extracted from .

If the invoice is already registered by the seller, the meta-transaction is rejected.

If all the previous steps are correctly passed, the smart contract registers the factoring agreement by setting a flag in its key-value storage and storing the public keys and settlement information in a log.

In most distributed ledgers, logs are on-chain data produced by the transaction execution, but the log’s contents are not recorded in the ledger’s global state. This makes logs much cheaper than storing data in the smart contract storage and also makes them convenient if their content is not needed by successive transactions (the case in our registration protocol). More details about the registration by the smart contract are given next.

We efficiently store the data by using only one boolean flag per invoice in the key-value storage of the

smart contract:

Obviously, the mapping can only be set if it was not already set to another value and is sufficient for the correct functionality of the

smart contract and prevention of double-factoring. The complete settlement information (

) is not required anymore to be accessible by the

smart contract code, so we can store it in a log to get the immutability of blockchain:

is defined as an index field for quick search. We use again as the key of the log, which is known by all involved parties. The buyer can use it as the key to finding out whether the invoice is factored or not, and get access to the logged information. The contract cannot link the identities of the seller and the factor with the transaction. Therefore, the public keys are recorded for later verification by the buyer. The salted hash (fingerprint) of the factoring agreement is also included in , which can be used as a proof-of-existence by the seller or the factor in case of dispute. Finally, the seller and the factor can be subscribed to the smart contract, get automatically informed about the registration, and verify the contract log to ensure everything is recorded in line with their agreement.

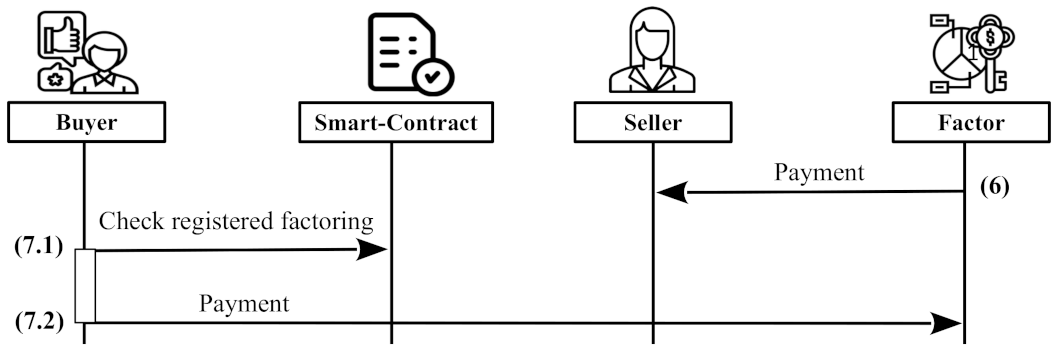

5.2.3. Phase 3: Payment

In the third and last phase, the

factor pays the

seller after checking the information registered by the

smart contract. Later, the

buyer will pay the complete invoice amount to the

factor also, after checking the information registered by the

smart contract. The steps followed in this phase are described next (see

Figure 5):

- 6.

The factor proceeds to pay to the account of the seller. This has to happen before the agreed payment deadline.

- 7.1

When the deadline of an invoice () expires, the buyer queries the smart contract to figure out whether the invoice has been factored or not. The buyer knows the address of the smart contract () and the pseudo-anonymous identifier of the invoice (). Using these two values, the buyer queries a node of the distributed ledger to obtain the log with the index field from the smart contract. From this on-chain log, the buyer obtains and .

- 7.2

The buyer computes and decrypts the encrypted part of the logged information using the obtained and the value that it stored in step (2b.2) for this invoice. Then, the buyer:

Verifies that the value which is recorded by the smart contract, belongs to . Otherwise, the factor has cheated because the seller has verified everything other than this encrypted part. In this case, the buyer cannot pay the factor because of the KYC regulation.

Obtains the seller-invoice credential related to from its database and matches its public key with the recorded . If the public key does not match, obviously both the seller and the factor are cheating because the invoice does not belong to this seller. In this case, the buyer will pay the invoice amount to the authentic seller.

If the verifications in the last step are passed, the buyer knows the correct selected factor and his/her associated IBAN and pays the invoice amount () to that .

5.3. Use Case

This section describes a typical scenario for better understanding the process in which our system is used to register a factoring agreement related to monetizing geolocation data. In our scenario, the buyer is the municipality of a city buying anonymized geolocation data from an online navigation platform (the seller). The municipality uses the data for better provisioning of city growth and land development in areas, such as public transport system, highway routing, housing and zoning, placement of new public services and utilities, and other land use plannings. In order to simplify things and avoid physical authentication complexities, we assume all parties are registered legal entities, and the government has issued them verifiable credentials. The credentials specify their tax identification number which can be used to identify them (real identity) in our protocols.

The municipality buys a lot of products and services from private companies, and many of them make factoring agreements with financial institutions. In order to reduce errors and prevent double-factoring, the municipality has accredited an implementation of our architecture, and the sellers have to register their factoring agreements in this system. The implementation provides a special agent to the buyer for performing the required operations. In addition, the municipality owns a government-issued VC and DID which is in the control of the agent.

The municipality invites different providers of online navigation systems to a tender, and after receiving their offers, selects the best candidate. During post-tender negotiations, the seller agrees to receive its money 90 days after supplying the data. However, the company lacks enough working capital to continue its service properly, and decides to factor the invoice. The seller connects to the buyer’s agent over DIDComm, authenticates itself using the government-issued VC, and proceeds until it receives a seller-invoice VC for the aforementioned invoice.

Then, the seller contacts multiple factors, negotiates with them, compares their offers and conditions, and, finally, selects one of them. The factor connects to the municipality’s agent over DIDComm, and registers a factor VC. After that, the seller and the factor establish a DIDComm channel and exchange and verify their seller-invoice and factor VCs. Note that their tax identification numbers are also evident from their VCs, and they register tax IDs for their paper work. The seller provides the factor with its bank account number, and the factor digitally signs the factoring agreement and sends the signed settlement information to the seller. The seller connects to a relayer and gives the bilaterally signed agreement to it, which subsequently hands all this information to the system’s smart contract. The smart contract verifies the request and registers the agreement in the public distributed ledger (blockchain). In this stage, the factor pays the seller a sub-total of the invoice amount according to their agreement. After the 90-day period is passed, the municipality’s agent checks the smart contract and finds out that the invoice has been factored. It decrypts the encrypted part of the logged information, verifies that everything is correct, and pays the complete invoice amount to the bank account of the factor.

7. Conclusions

In this article, we presented a protocol that uses a public distributed ledger to register invoice factorings. The protocol presented is based on some preliminary work [

2], but we added several enhancements and simplified the protocol to increase its efficiency and flexibility, as well as to facilitate user on-boarding. We used Decentralized IDentifiers (DIDs) and let the involved parties use their

self-sovereign identities (SSIs). One advantage of using DIDs is that we can relay on the new protocols being developed in this ecosystem, like DIDComm, which allows us to implement asynchronous secure communications between participants. When using DIDs, we can also leverage on the concept of Verifiable Credentials (VCs) to grant permission to parties allowed to participate in our invoice factoring ecosystem.

In this ecosystem, the buyer, who is considered to be the trusted party for the factoring process, issued Verifiable Credentials to DIDs of sellers and factors. The proposed protocol was very efficient, using only one meta-transaction per factoring registry. The seller used to pay the cost of executing the meta-transaction in the public distributed ledger since it was the party with the highest interest in the service. To provide sellers with an easy on-boarding, a relayer was introduced in our invoice factoring ecosystem. The advantage of using the relayer is that sellers can have the high security and availability levels provided by public distributed ledgers without having to deal with cryptocurrency. This is because sellers can pay to the relayer with off-chain methods, like credit card or bank transfer, but the relayer cannot alter any aspect of the invoice factoring agreement being recorded. As a result, the proposed architecture provided an efficient and friendly protocol for registering factored invoices.