Enough Metals? Resource Constraints to Supply a Fully Renewable Energy System

Abstract

1. Introduction

2. Materials and Methods

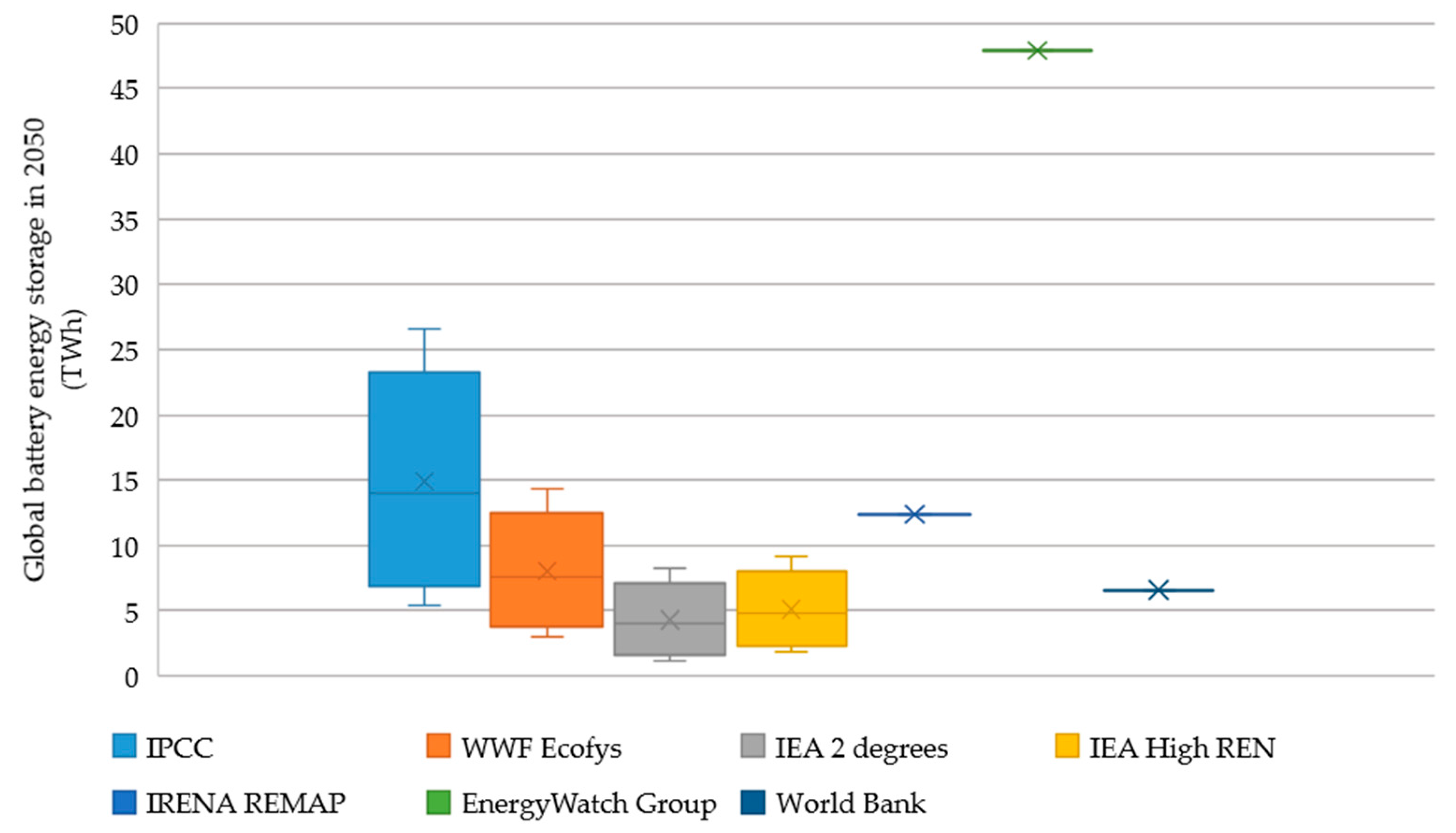

2.1. Energy Scenarios

2.2. Renewable Energy Technology Scenarios

2.2.1. Solar PV Scenarios

2.2.2. Biofuels

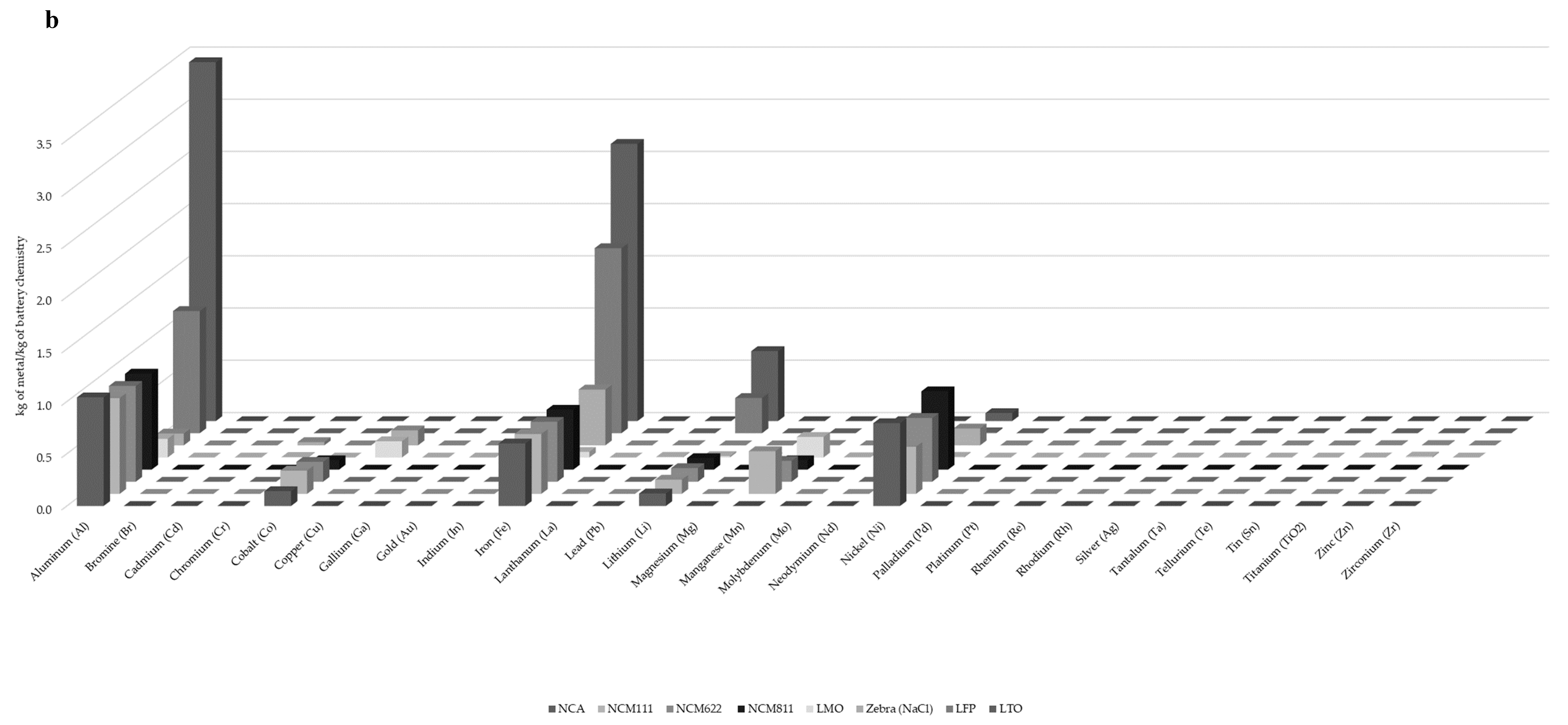

2.2.3. Storage Technologies

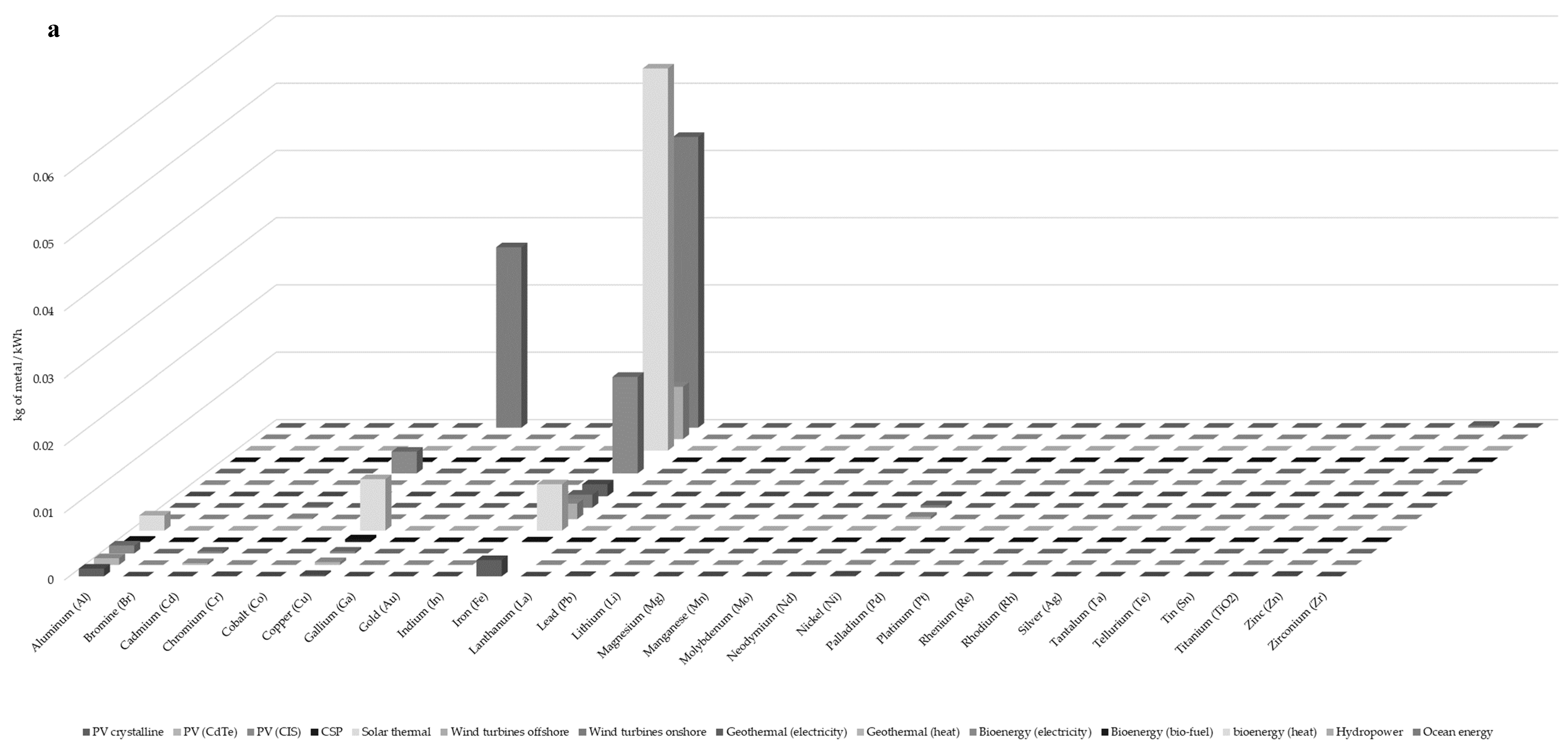

2.3. Metal Inventory of Renewable Energy Technologies

2.4. Metal Demand, Reserves and Resources

3. Results

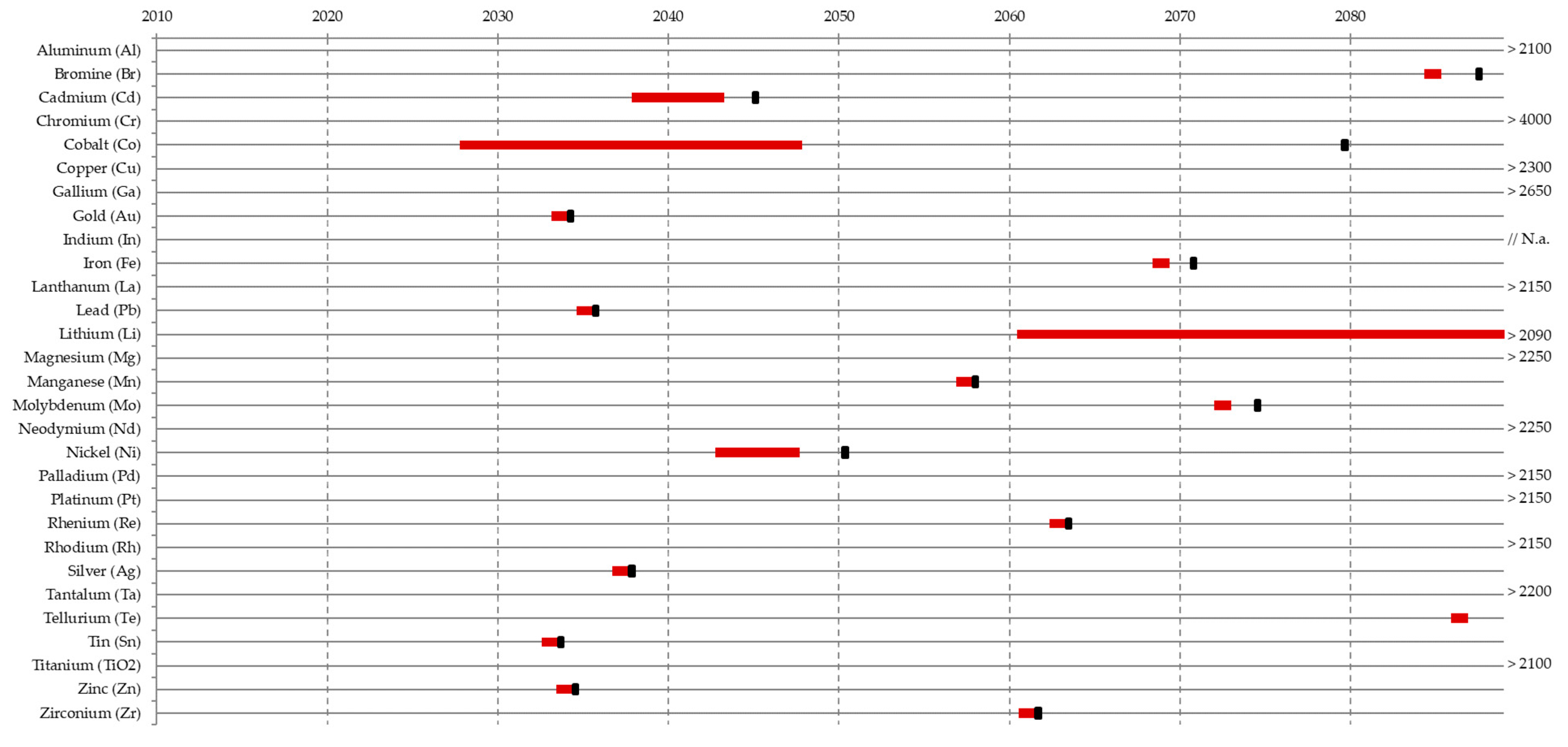

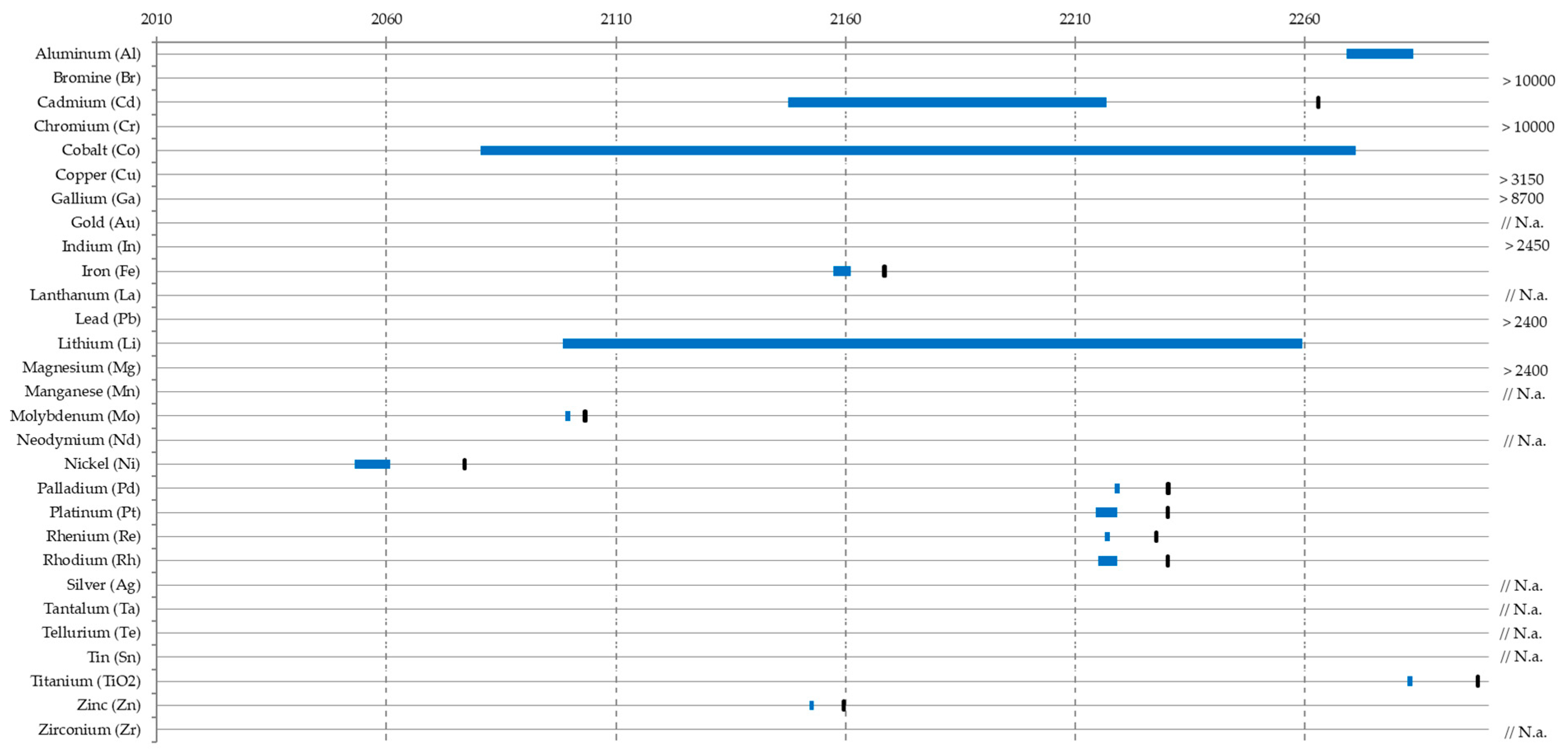

3.1. Depletion Horizons of Metal Reserves

3.2. Depletion Horizons of Metal Resources

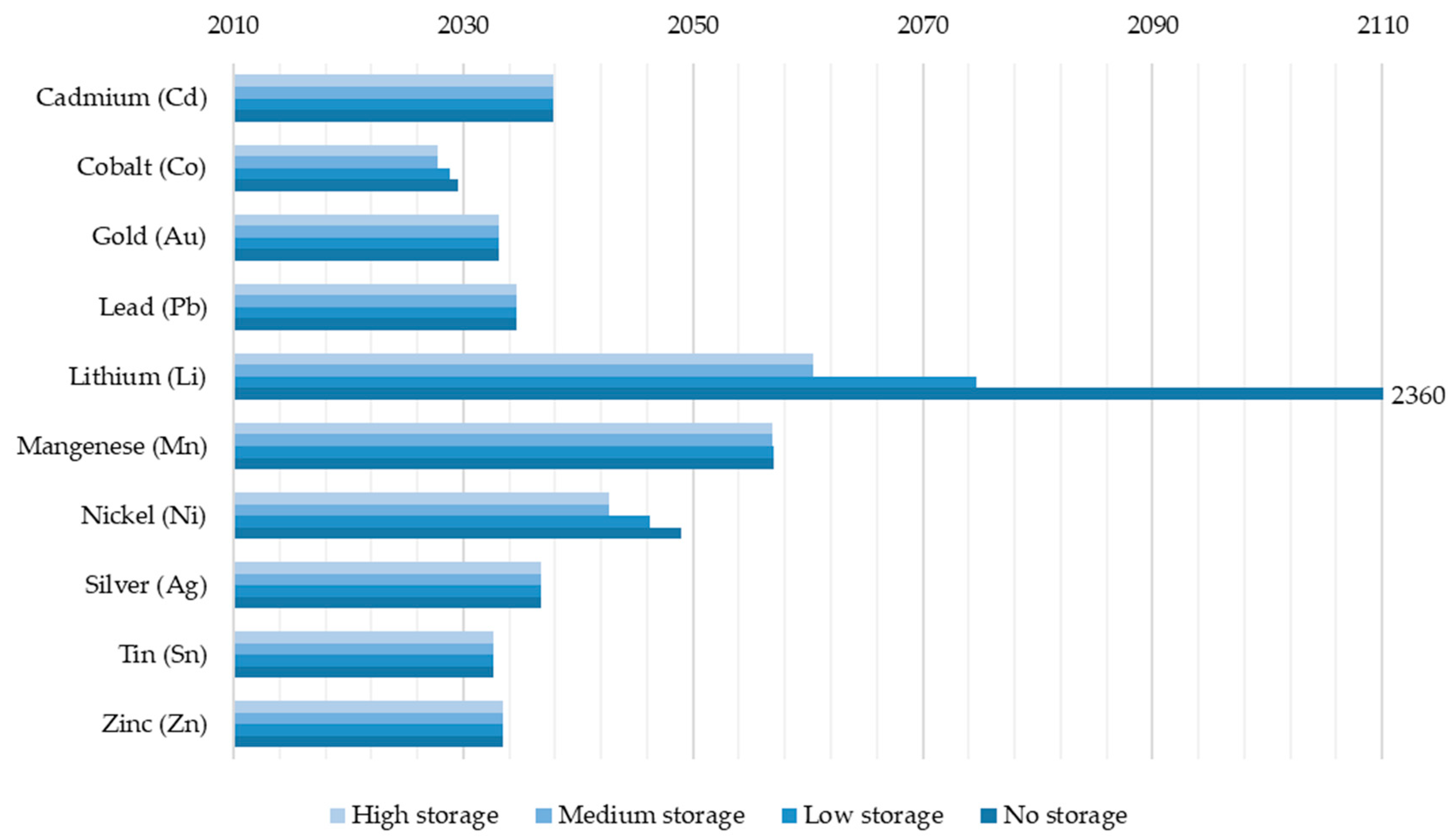

3.3. Storage Scenarios

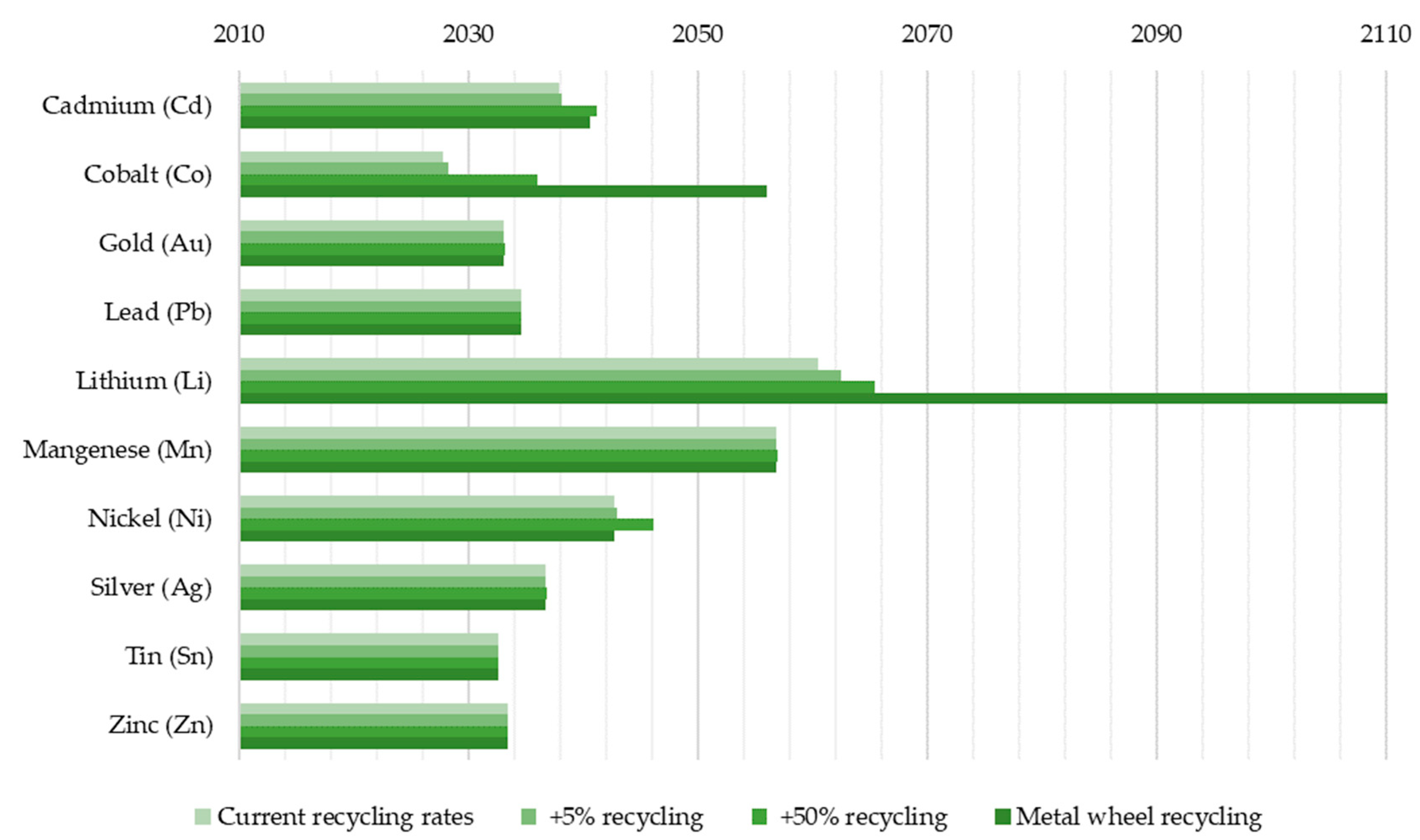

3.4. Recycling Scenarios

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| 2050 | MIX 1 | MIX 2 | MIX 3 |

|---|---|---|---|

| NCA | 20% | 25% | 20% |

| NCM622 | 0% | 5% | 0% |

| NCM811 | 30% | 45% | 80% |

| Zebra (NaNiCl) | 50% | 10% | 0% |

| LFP | 0% | 15% | 0% |

Appendix B

Appendix C

| Current | +5% | +50% | Parent Metal | |

|---|---|---|---|---|

| Aluminum (Al) | 50% | 53% | 76% | 50% |

| Bromine (Br) | 1% | 6% | 53% | 50% |

| Cadmium (Cd) | 10% | 15% | 57% | 50% |

| Chromium (Cr) | 50% | 53% | 76% | 50% |

| Cobalt (Co) | 50% | 53% | 76% | 94% |

| Copper (Cu) | 50% | 53% | 76% | 50% |

| Gallium (Ga) | 1% | 6% | 53% | 50% |

| Gold (Au) | 50% | 53% | 76% | 50% |

| Indium (In) | 1% | 6% | 53% | 50% |

| Iron (Fe) | 50% | 53% | 76% | 50% |

| Lanthanum (La) | 1% | 6% | 53% | 50% |

| Lead (Pb) | 50% | 53% | 76% | 50% |

| Lithium (Li) | 1% | 6% | 53% | 81% |

| Magnesium (Mg) | 25% | 29% | 64% | 25% |

| Manganese (Mn) | 50% | 53% | 76% | 50% |

| Molybdenum (Mo) | 25% | 29% | 64% | 25% |

| Neodymium (Nd) | 1% | 6% | 53% | 25% |

| Nickel (Ni) | 50% | 53% | 76% | 50% |

| Palladium (Pd) | 50% | 53% | 76% | 50% |

| Platinum (Pt) | 50% | 53% | 76% | 50% |

| Rhenium (Re) | 50% | 53% | 76% | 50% |

| Rhodium (Rh) | 50% | 53% | 76% | 50% |

| Silver (Ag) | 50% | 53% | 76% | 50% |

| Tantalum (Ta) | 1% | 6% | 53% | 50% |

| Tellurium (Te) | 1% | 6% | 53% | 50% |

| Tin (SN) | 1% | 6% | 53% | 50% |

| Titanium (TiO2) | 50% | 53% | 76% | 50% |

| Zinc (Zn) | 50% | 53% | 76% | 50% |

| Zirconium (Zr) | 1% | 6% | 53% | 25% |

Appendix D

| Metal | Cumulative production [Mt] | IPCC [Mt] | WWF [Mt] | IEA 2DS [Mt] | IEA High Ren [Mt] | IRENA REMAP [Mt] |

|---|---|---|---|---|---|---|

| Aluminum (Al) | 2.2 × 103 | 1.7 × 102 | 9.4 × 10 | 4.6 × 10 | 5.2 × 10 | 1.3 × 102 |

| Bromine (Br) | 1.2 × 10 | 2.3 × 10−4 | 1.2 × 10−4 | 4.9 × 10−5 | 7.9 × 10−5 | 1.0 × 10−4 |

| Cadmium (Cd) | 8.0 × 10−1 | 6.3 × 10−1 | 3.3 × 10−1 | 1.3 × 10−1 | 2.1 × 10−1 | 2.8 × 10−1 |

| Chromium (Cr) | 3.3 × 10−1 | 4.5 | 2.0 | 1.2 | 1.8 | 2.7 |

| Cobalt (Co) | 3.8 | 7.1 × 101 | 2.1 × 101 | 1.6 × 101 | 1.5 × 101 | 1.5 × 101 |

| Copper (Cu) | 6.9 × 10−1 | 1.5 × 102 | 5.7 × 101 | 3.2 × 101 | 1.8 × 101 | 7.8 × 101 |

| Gallium (Ga) | 1.7 × 10−2 | 5.8 × 10−3 | 3.1 × 10−3 | 1.2 × 10−3 | 2.0 × 10−3 | 2.6 × 10−3 |

| Gold (Au) | 1.1 × 10−1 | 3.5 × 10−4 | 1.8 × 10−4 | 7.6 × 10−5 | 1.2 × 10−4 | 1.6 × 10−4 |

| Indium (In) | 2.5 × 10−2 | 4.7 × 10−2 | 2.5 × 10−2 | 1.0 × 10−2 | 1.6 × 10−2 | 2.1 × 10−2 |

| Iron (Fe) | 5.2 × 104 | 1.2 × 103 | 8.4 × 102 | 1.5 × 103 | 1.9 × 102 | 9.0 × 102 |

| Lanthanum (La) | 1.2 | 1.6 × 10−4 | 8.8 × 10−5 | 3.5 × 10−5 | 5.7 × 10−5 | 7.5 × 10−5 |

| Lead (Pb) | 1.6 × 102 | 1.0 | 5.5 × 10−1 | 2.6 × 10−1 | 3.9 × 10−1 | 5.1 × 10−1 |

| Lithium (Li) | 1.5 | 2.0 × 10 | 1.0 × 10 | 5.7 | 6.9 | 1.7 × 10 |

| Magnesium (Mg) | 5.7 × 102 | 1.5 × 10−2 | 8.3 × 10−3 | 3.4 × 10−3 | 5.4 × 10−3 | 7.1 × 10−3 |

| Manganese (Mn) | 5.6 × 102 | 5.6 | 2.9 | 1.6 | 2.0 | 4.6 |

| Molybdenum (Mo) | 1.0 × 10 | 6.6 × 10−2 | 2.9 × 10−2 | 1.6 × 10−2 | 2.3 × 10−2 | 3.1 × 10−2 |

| Neodymium (Nd) | 8.1 × 10−1 | 1.9 × 10−2 | 7.8 × 10−3 | 9.3 × 10−3 | 1.1 × 10−2 | 1.5 × 10−2 |

| Nickel (Ni) | 7.3 × 10 | 8.5 × 10 | 4.5 × 10 | 2.4 × 10 | 3.0 × 10 | 7.2 × 10 |

| Palladium (Pd) | 7.7 × 10−3 | 4.1 × 10−5 | 1.1 × 10−5 | 1.0 × 10−5 | 7.9 × 10−6 | 5.7 × 10−6 |

| Platinum (Pt) | 7.1 × 10−3 | 1.9 × 10−4 | 5.3 × 10−5 | 5.1 × 10−5 | 3.5 × 10−5 | 2.3 × 10−5 |

| Rhenium (Re) | 1.8 × 10−3 | 1.6 × 10−8 | 7.3 × 10−9 | 3.7 × 10−9 | 4.8 × 10−9 | 5.9 × 10−9 |

| Rhodium (Rh) | 1.4 × 10−3 | 3.3 × 10−5 | 8.8 × 10−6 | 8.8 × 10−6 | 5.9 × 10−6 | 3.7 × 10−6 |

| Silver (Ag) | 8.7 × 10−1 | 4.5 × 10−2 | 2.2 × 10−2 | 8.5 × 10−3 | 1.4 × 10−2 | 1.0 × 10−2 |

| Tantalum (Ta) | 4.5 × 10−2 | 5.6 × 10−3 | 2.9 × 10−3 | 1.2 × 10−3 | 1.9 × 10−3 | 2.5 × 10−3 |

| Tellurium (Te) | 1.4 × 10−2 | 1.4 × 10−4 | 7.7 × 10−5 | 3.1 × 10−5 | 5.0 × 10−5 | 6.5 × 10−5 |

| Tin (Sn) | 1.0 × 10 | 3.3 × 10−2 | 1.7 × 10−2 | 7.3 × 10−3 | 1.1 × 10−2 | 1.4 × 10−2 |

| Titanium (TiO2) | 2.4 × 102 | 2.3 × 10−1 | 1.1 × 10−1 | 5.3 × 10−2 | 7.5 × 10−2 | 9.8 × 10−2 |

| Zinc (Zn) | 4.6 × 102 | 2.0 | 8.3 × 10−1 | 4.7 × 10−1 | 6.5 × 10−1 | 1.1 |

| Zirconium (Zr) | 4.1 × 10 | 4.1 × 10−2 | 2.2 × 10−2 | 8.9 × 10−3 | 1.4 × 10−2 | 1.8 × 10−2 |

References

- Figueres, C.; Schellnhuber, H.J.; Whiteman, G.; Rockström, J.; Hobley, A.; Rahmstorf, S. Three years to safeguard our climate. Nat. News 2017, 546, 593. [Google Scholar] [CrossRef] [PubMed]

- Vidal, O. Mineral Resources and Energy: Future Stakes in Energy Transition, 1st ed.; Elsevier: Amsterdam, The Netherlands, 2017; ISBN 978-1-78548-267-0. [Google Scholar]

- Arrobas, D.L.P.; Hund, K.L.; Mccormick, M.S.; Ningthoujam, J.; Drexhage, J.R. The Growing Role of Minerals and Metals for a Low Carbon Future; The World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Moss, R.; Willis, P.; Tercero, E.L.; Tzimas, E.; Arendorf, J.; Thompson, P.; Chapman, A.; Morley, N.; Sims, E.; Bryson, R. Critical Metals in the Path Towards the Decarbonisation of the EU Energy Sector: Assessing Rare Metals as Supply-chain Bottlenecks in Low-carbon Energy Technologies; Publications Office of the EU: Luxembourg, Luxembourg, 2013; ISBN 978-92-79-30390-6. [Google Scholar]

- Scholz, R.W.; Wellmer, F.-W. Approaching a dynamic view on the availability of mineral resources: What we may learn from the case of phosphorus? Glob. Environ. Chang. 2013, 23, 11–27. [Google Scholar] [CrossRef]

- Klee, R.J.; Graedel, T.E. ELEMENTAL CYCLES: A Status Report on Human or Natural Dominance. Annu. Rev. Environ. Resour. 2004, 29, 69–107. [Google Scholar] [CrossRef]

- Vidal, O.; Goffe, B.; Arndt, N. Metals for a low-carbon society. Nat. Geosci. 2013, 6, 894–896. [Google Scholar] [CrossRef]

- Reller, A.; Zepf, V.; Achzet, B. The Importance of Rare Metals for Emerging Technologies. In Factor X: Re-Source—Designing the Recycling Society; Angrick, M., Burger, A., Lehmann, H., Eds.; Springer: Dordrecht, The Netherlands, 2013; pp. 203–219. ISBN 978-94-007-5712-7. [Google Scholar]

- Grandell, L.; Lehtilä, A.; Kivinen, M.; Koljonen, T.; Kihlman, S.; Lauri, L.S. Role of critical metals in the future markets of clean energy technologies. Renew. Energy 2016, 95, 53–62. [Google Scholar] [CrossRef]

- Ohno, H.; Nuss, P.; Chen, W.-Q.; Graedel, T.E. Deriving the Metal and Alloy Networks of Modern Technology. Environ. Sci. Technol. 2016, 50, 4082–4090. [Google Scholar] [CrossRef] [PubMed]

- Elshkaki, A.; Graedel, T.E. Dynamic analysis of the global metals flows and stocks in electricity generation technologies. J. Clean. Prod. 2013, 59, 260–273. [Google Scholar] [CrossRef]

- Alonso, E.; Sherman, A.M.; Wallington, T.J.; Everson, M.P.; Field, F.R.; Roth, R.; Kirchain, R.E. Evaluating Rare Earth Element Availability: A Case with Revolutionary Demand from Clean Technologies. Environ. Sci. Technol. 2012, 46, 3406–3414. [Google Scholar] [CrossRef]

- Smil, V. Energy Transitions: History, Requirements, Prospects; Praeger: Santa Barbara, CA, USA, 2010. [Google Scholar]

- Peiró, L.T.; Méndez, G.V.; Ayres, R.U. Material Flow Analysis of Scarce Metals: Sources, Functions, End-Uses and Aspects for Future Supply. Environ. Sci. Technol. 2013, 47, 2939–2947. [Google Scholar] [CrossRef]

- Graedel, T.E. On the Future Availability of the Energy Metals. Annu. Rev. Mater. Res. 2011, 41, 323–335. [Google Scholar] [CrossRef]

- Lieberei, J.; Gheewala, S.H. Resource depletion assessment of renewable electricity generation technologies—Comparison of life cycle impact assessment methods with focus on mineral resources. Int. J. Life Cycle Assess. 2017, 22, 185–198. [Google Scholar] [CrossRef]

- Hoenderdaal, S.; Tercero Espinoza, L.; Marscheider-Weidemann, F.; Graus, W. Can a dysprosium shortage threaten green energy technologies? Energy 2013, 49, 344–355. [Google Scholar] [CrossRef]

- Valero, V.C.; Delgado, A.V. Thanatia: The Destiny of the Earth’s Mineral Resources: A Thermodynamic Cradle-to-cradle Assessment; World Scientific: Singpore, 2015; ISBN 981-4273-93-7. [Google Scholar]

- Kleijn, R.; van der Voet, E.; Kramer, G.J.; van Oers, L.; van der Giesen, C. Metal requirements of low-carbon power generation. Energy 2011, 36, 5640–5648. [Google Scholar] [CrossRef]

- Vidal, O.; Le Boulzec, H.; François, C. Modelling the material and energy costs of the transition to low-carbon energy. EPJ Web Conf. 2018, 189. [Google Scholar] [CrossRef]

- Vesborg, P.C.K.; Jaramillo, T.F. Addressing the terawatt challenge: Scalability in the supply of chemical elements for renewable energy. RSC Adv. 2012, 2, 7933–7947. [Google Scholar] [CrossRef]

- Andersson, B.A.; Azar, C.; Holmberg, J.; Karlsson, S. Material constraints for thin-film solar cells. Energy 1998, 23, 407–411. [Google Scholar] [CrossRef]

- Feltrin, A.; Freundlich, A. Material considerations for terawatt level deployment of photovoltaics. Renew. Energy 2008, 33, 180–185. [Google Scholar] [CrossRef]

- Fthenakis, V. Sustainability of photovoltaics: The case for thin-film solar cells. Renew. Sustain. Energy Rev. 2009, 13, 2746–2750. [Google Scholar] [CrossRef]

- Wadia, C.; Alivisatos, A.P.; Kammen, D.M. Materials Availability Expands the Opportunity for Large-Scale Photovoltaics Deployment. Environ. Sci. Technol. 2009, 43, 2072–2077. [Google Scholar] [CrossRef]

- Frenzel, M.; Tolosana-Delgado, R.; Gutzmer, J. Assessing the supply potential of high-tech metals—A general method. Resour. Policy 2015, 46, 45–58. [Google Scholar] [CrossRef]

- Nassar, N.T.; Graedel, T.E.; Harper, E.M. By-product metals are technologically essential but have problematic supply. Sci. Adv. 2015, 1, e1400180. [Google Scholar] [CrossRef] [PubMed]

- Frenzel, M.; Mikolajczak, C.; Reuter, M.A.; Gutzmer, J. Quantifying the relative availability of high-tech by-product metals—The cases of gallium, germanium and indium. Resour. Policy 2017, 52, 327–335. [Google Scholar] [CrossRef]

- Kavlak, G.; McNerney, J.; Jaffe, R.L.; Trancik, J.E. Metal production requirements for rapid photovoltaics deployment. Energy Environ. Sci. 2015, 8, 1651–1659. [Google Scholar] [CrossRef]

- Grandell, L.; Thorenz, A. Silver supply risk analysis for the solar sector. Renew. Energy 2014, 69, 157–165. [Google Scholar] [CrossRef]

- Harmsen, J.H.M.; Roes, A.L.; Patel, M.K. The impact of copper scarcity on the efficiency of 2050 global renewable energy scenarios. Energy 2013, 50, 62–73. [Google Scholar] [CrossRef]

- Elshkaki, A. An analysis of future platinum resources, emissions and waste streams using a system dynamic model of its intentional and non-intentional flows and stocks. Resour. Policy 2013, 38, 241–251. [Google Scholar] [CrossRef]

- Mudd, G.M.; Weng, Z.; Jowitt, S.M.; Turnbull, I.D.; Graedel, T.E. Quantifying the recoverable resources of by-product metals: The case of cobalt. Ore Geol. Rev. 2013, 55, 87–98. [Google Scholar] [CrossRef]

- Mao, J.; Graedel, T.E. Lead In-Use Stock. J. Ind. Ecol. 2009, 13, 112–126. [Google Scholar] [CrossRef]

- Habib, K.; Wenzel, H. Exploring rare earths supply constraints for the emerging clean energy technologies and the role of recycling. J. Clean. Prod. 2014, 84, 348–359. [Google Scholar] [CrossRef]

- Lund, H.; Mathiesen, B.V. Energy system analysis of 100% renewable energy systems—The case of Denmark in years 2030 and 2050. Energy 2009, 34, 524–531. [Google Scholar] [CrossRef]

- Kempton, W.; Tomić, J. Vehicle-to-grid power implementation: From stabilizing the grid to supporting large-scale renewable energy. J. Power Sources 2005, 144, 280–294. [Google Scholar] [CrossRef]

- Bradshaw, A.M.; Hamacher, T. Nonregenerative natural resources in a sustainable system of energy supply. ChemSusChem 2012, 5, 550–562. [Google Scholar] [CrossRef] [PubMed]

- Fizaine, F.; Court, V. Renewable electricity producing technologies and metal depletion: A sensitivity analysis using the EROI. Ecol. Econ. 2015, 110, 106–118. [Google Scholar] [CrossRef]

- Arvizu, D.; Bruckner, T.; Chum, H.; Edenhofer, O.; Estefen, S.; Faaij, A.; Fischedick, M.; Hansen, G.; Hiriart, G.; Hohmeyer, O.; et al. IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation; Edenhofer, O., Pichs-Madruga, R., Sokona, Y., Seyboth, K., Matschoss, P., Kadner, S., Zwickel, T., Eickemeier, P., Hansen, G., Schlamer, S., et al., Eds.; Technical Report; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2011. [Google Scholar]

- Ecofys. The Ecofys Energy Scenario; 100% Renewable Energy by 2050; WWF Ecofys OMA: Gland, Switzerland, 2011. [Google Scholar]

- IEA. Energy Technology Perspectives; International Energy Agency: Paris, France, 2016. [Google Scholar]

- IRENA. Global Energy Transformation—A Roadmap to 2050; International Renewable Energy Agency: Abu Dhabi, UAE, 2018. [Google Scholar]

- Fraunhofer ISE. Photovoltaics Report; Fraunhofer Institute for Solar Energy: Freiburg, Germany, 2018. [Google Scholar]

- Weckend, S.; Wade, A.; Heath, G. End-of-Life Management: Solar Photovoltaic Panels; IRENA: Abu Dhabi, UAE, 2016. [Google Scholar]

- Wernet, G.; Bauer, C.; Steubing, B.; Reinhard, J.; Moreno-Ruiz, E.; Weidema, B. The ecoinvent database version 3 (part I): Overview and methodology. Int. J. Life Cycle Assess. 2016, 21, 1218–1230. [Google Scholar] [CrossRef]

- Bauen, A.; Berndes, G.; Junginger, M.; Londo, M.; Vuille, F.; Ball, R.; Bole, T.; Chudziak, C.; Faaij, A.; Mozaffarian, H. Bioenergy: A Sustainable and Reliable Energy Source. A Review of Status and Prospects. Bioenergy Sustain. Reliab. Energy Source Rev. Status Prospects 2009. Available online: https://www.ieabioenergy.com/publications/main-report-bioenergy-a-sustainable-and-reliable-energy-source-a-review-of-status-and-prospects/ (accessed on 30 January 2019).

- Peters, J.; Weil, M. A Critical Assessment of the Resource Depletion Potential of Current and Future Lithium-Ion Batteries. Resources 2016, 5, 46. [Google Scholar] [CrossRef]

- Meylan, F.D.; Moreau, V.; Erkman, S. Material constraints related to storage of future European renewable electricity surpluses with CO2 methanation. Energy Policy 2016, 94, 366–376. [Google Scholar] [CrossRef]

- ENTSOE. Hourly RE Generation Data; European Network of Transmission System Operators for Electricity: Brussels, Belgium, 2018. [Google Scholar]

- US EIA. Hourly Load Data; US Energy Information Administration: Washington, DC, USA, 2018.

- Pleßmann, G.; Erdmann, M.; Hlusiak, M.; Breyer, C. Global Energy Storage Demand for a 100% Renewable Electricity Supply. Energy Procedia 2014, 46, 22–31. [Google Scholar] [CrossRef]

- Majeau-Bettez, G.; Hawkins, T.R.; Strømman, A.H. Life Cycle Environmental Assessment of Lithium-Ion and Nickel Metal Hydride Batteries for Plug-In Hybrid and Battery Electric Vehicles. Environ. Sci. Technol. 2011, 45, 4548–4554. [Google Scholar] [CrossRef]

- Hiremath, M.; Derendorf, K.; Vogt, T. Comparative Life Cycle Assessment of Battery Storage Systems for Stationary Applications. Environ. Sci. Technol. 2015, 49, 4825–4833. [Google Scholar] [CrossRef]

- Ram, M.; Bogdanov, D.; Aghahosseini, A.; Oyewo, A.S.; Gulag, A.; Child, M.; Fell, H.-J.; Breyer, C. Global Energy System Based on 100% Renewable Energy—Power Sector; Lappeenranta University of Technology and Energy Watch Group: Lapeeranta, Finland; Berlin, Germany, 2017. [Google Scholar]

- Weil, M.; Ziemann, S.; Peters, J. The Issue of Metal Resources in Li-Ion Batteries for Electric Vehicles. In Behaviour of Lithium-Ion Batteries in Electric Vehicles: Battery Health, Performance, Safety, and Cost; Pistoia, G., Liaw, B., Eds.; Springer International Publishing: Cham, Switzerland, 2018; pp. 59–74. ISBN 978-3-319-69950-9. [Google Scholar]

- IEA. Global EV Outlook 2018—Towards Cross-Modal Electrification; International Energy Agency: Paris, France, 2018. [Google Scholar]

- Moreau, V.; Dos Reis, P.C. Energy Metals SI Resources [Data Set]. Zenodo. Available online: http://doi.org/10.5281/zenodo.2553086 (accessed on 30 January 2019).

- Graedel, T.E.; Allwood, J.; Birat, J.-P.; Buchert, M.; Hagelüken, C.; Reck, B.K.; Sibley, S.F.; Sonnemann, G. What Do We Know About Metal Recycling Rates? J. Ind. Ecol. 2011, 15, 355–366. [Google Scholar] [CrossRef]

- Binnemans, K.; Jones, P.T.; Blanpain, B.; Van Gerven, T.; Yang, Y.; Walton, A.; Buchert, M. Recycling of rare earths: A critical review. J. Clean. Prod. 2013, 51, 1–22. [Google Scholar] [CrossRef]

- Reuter, M.; Hudson, C.; van Schaik, A.; Heiskanen, K.; Meskers, C.; Hagelüken, C. Metal Recycling Opportunities, Limits, Infrastructure. A Report of the Working Group on the Global Metal Flows to the International Resource Panel; UNEP: Nairobi, Kenya, 2013. [Google Scholar]

- USGS. Mineral Commodity Summaries; USGS: Reston, VA, USA, 2018.

- Allwood, J.; Cullen, J. Sustainable Materials with Both Eyes Open; UIT: Cambridge, UK, 2012. [Google Scholar]

- Månberger, A.; Stenqvist, B. Global metal flows in the renewable energy transition: Exploring the effects of substitutes, technological mix and development. Energy Policy 2018, 119, 226–241. [Google Scholar] [CrossRef]

- Zuser, A.; Rechberger, H. Considerations of resource availability in technology development strategies: The case study of photovoltaics. Resour. Conserv. Recycl. 2011, 56, 56–65. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moreau, V.; Dos Reis, P.C.; Vuille, F. Enough Metals? Resource Constraints to Supply a Fully Renewable Energy System. Resources 2019, 8, 29. https://doi.org/10.3390/resources8010029

Moreau V, Dos Reis PC, Vuille F. Enough Metals? Resource Constraints to Supply a Fully Renewable Energy System. Resources. 2019; 8(1):29. https://doi.org/10.3390/resources8010029

Chicago/Turabian StyleMoreau, Vincent, Piero Carlo Dos Reis, and François Vuille. 2019. "Enough Metals? Resource Constraints to Supply a Fully Renewable Energy System" Resources 8, no. 1: 29. https://doi.org/10.3390/resources8010029

APA StyleMoreau, V., Dos Reis, P. C., & Vuille, F. (2019). Enough Metals? Resource Constraints to Supply a Fully Renewable Energy System. Resources, 8(1), 29. https://doi.org/10.3390/resources8010029