1. Introduction

Transparency has become a modern expectation of business [

1,

2]. Big businesses consult with local communities and engage with international non-governmental organizations; firms report on sustainability efforts to investors, to the public, and to other stakeholders. Yet, firms struggle to see past their immediate suppliers, to understand the sources of raw materials, and to know what risks are present multiple tiers into the supply chain [

3,

4]. Some sectors, like food and pharmaceutical, are more advanced—driven by regulations and imperatives of quality, health, and safety—but in manufacturing sectors, like electronics, automotive, toys, and aerospace, such efforts are just beginning [

5,

6]. Thousands of suppliers feed raw materials and components into global manufacturing networks to make each product [

4]—and modern devices and equipment require a diverse array of rare materials [

7]. As such, manufacturers have typically managed only to the “visible horizon”, that is they can “see” only a couple tiers into their supply chains [

8]. Limited transparency also poses risks of supply disruption, both physical disruption and reputational disruption. Without knowing one’s suppliers, there is concern that things will be out of compliance to regulations or fail in quality. More broadly, it limits sustainable supply chain management and the mitigation of environmental impacts and social problems that may be present in distant global supply chains. Recent actions specifically to address “conflict minerals” requirements have begun to reduce this opaqueness in the case of four metals, and have opened opportunities for manufacturers to increase transparency and encourage improvements in social conditions in mining regions by performing “due diligence” [

6,

9].

This research looks at “responsible sourcing” of minerals and metals: how multinational manufacturing firms manage supply chains to improve supply chain transparency and reduce negative impacts at lower-tier suppliers and in supply chains. Downstream companies are driven by regulation in the United States (U.S.) (and forthcoming in Europe) and by corporate social responsibility (see, for example [

10]), supported by evolving market expectations (see, for example [

11]). Specifically, this project draws on data from both producer and end-user companies of tantalum, tin, tungsten, and gold (3TG) (

Figure 1), which are defined by U.S. regulation as “conflict minerals”. Previous research has examined assurance programs and reporting efforts by downstream firms to manage upstream 3TG metal smelters and refiners [

5,

12,

13], and has described characteristics of supplier firms [

14].

Given the expectations of transparency; given the visible horizon problem in multi-tier supply chains; and, given the importance of critical raw minerals, including several of the conflict minerals, this paper seeks to answer the question: How do global manufacturing firms engage with suppliers in mineral supply chains to enable responsible sourcing? We empirically investigate how top-tier firms have exercised power in multi-tier supply chains to implement sustainable supply chain management and how lower-tier suppliers of minerals and metals have responded to the pressures of sustainable practices.

Raw material supply chains are a relatively new topic for research. Minerals and metals have not been studied to the degree that forestry, food, fisheries, and agriculture have [

15,

16]. However, responsible sourcing of abiotic resources is emerging rapidly [

5,

17,

18], and this paper makes an empirical contribution in this area. Practically, the analysis presented herein provides insight that may support supply chain management solutions for a larger set of important materials: two of the four conflict minerals (tantalum and tungsten) are commonly characterized as critical raw materials [

7,

19] that present supply-risk yet are paramount in technologies for a low-carbon economy. Most raw material criticality assessments use data at the national scale [

19,

20], and few researchers have paid attention to managing real supply chains at the firm-level [

20,

21,

22,

23], where material choices are made. Looking at how businesses and governments addressed the conflict mineral problem, and develop responsible sourcing, can guide high-level policy and private-sector governance of minerals and raw materials [

19,

24,

25]. Whereas, technical avenues to the critical materials problem, like geological exploration, efficient mining and metallurgy, and materials substitution, are widely touted [

7,

19], management strategies for mineral governance, like responsible sourcing, are also needed. By better understanding their suppliers, manufacturing firms can “identify and manage critical suppliers” [

8] and improve their ability to mitigate sources of supply disruption while maintaining ethical and sustainable sources of raw materials [

24].

In this study, data on real firms were used to explore both ends of the mineral supply chain. Upstream, the analysis was on a population of 323 “deep suppliers”—our term for distant lower-tier producers who are positioned at a focal point to mitigate supply chain problems. Here, these firms were smelters and refiners: producers who purchase ore and mineral concentrates from mines and traders, and process these into refined metals and metal chemicals. Downstream, interviews were carried out with six conflict mineral managers in multinational manufacturing firms who are end-users of tantalum, tin, tungsten, and gold. The results showed both expected and novel tactics used by top-tier firms to reach deep suppliers and manage risks in mineral supply. Manufacturers work collaboratively through industry associations to identify, validate, and engage lower-tier suppliers. This includes emails and letter-writing, but also more extreme tactics, such as direct site visits by multi-national firms to small producers in remote regions. Downstream firms also provide financial incentives to deep suppliers to motivate their implementation of due diligence management systems. Surprisingly, it was revealed that manufacturers do not need line-of-sight visibility to lower-tier suppliers in order to manage their practices; rather, top-tier firms are “jumping the chain” to engage directly with deep suppliers who may—or may not—be their own actual physical suppliers.

In the next section, this paper reviews scholarship and practices in mineral supply chains. The Methods section describes the mixed-methods approach and data set, followed by Results, which consider the 3TG supply chains collectively and separately. The Discussion section redresses the research question, considers theoretical contributions, and then discusses practical implications for responsible sourcing of raw materials more generally.

3. Data and Methods

A parallel convergent mixed method was used, where both descriptive variables and qualitative interview data were analyzed separately, and then integrated. Descriptive data were provided by the Responsible Minerals Initiative, a global industry association based in the U.S. that runs a due diligence program on mineral supply chains. The program provided details on the 323 known smelters and refiners of tantalum, tin, tungsten, and gold (

Table 1). Data on upstream suppliers were complemented by interviews with downstream manufacturing firms. Semi-structured interviews were completed with six current and former members of the program’s smelter engagement team. Together, these approaches allowed us to produce a narrative of engagement, including nuances for each of the four 3TG metal industries, detailing external forces and tactics used by the initiative, and describing how downstream manufacturing firms identified and communicated with upstream metal producers.

The domain of conflict minerals provides a valuable and a rich source of data for applied research on responsible sourcing. Activity in due diligence is particularly advanced in 3TG supply chains, as compared to other metals and to other commodities. Data are available as far back as 2008 on supply chains, standards, and downstream firms concerned about conflict minerals.

The three main due diligence programs, which cross-recognize each other’s listings, operate for the benefit of downstream metal users: (1) the Responsible Minerals Initiative, which is described below; (2) the Responsible Jewellery Council, which has more than on thousand member companies from miners to manufacturers to retailers; and, (3) the London Bullion Market Association, whose members includes over one-hundred miners, refiners and other actors in the global market for precious metals. Smaller regional programs on conflict-free gold are operated at the Dubai Multi Commodities Center and the Shanghai Gold Exchange.

The 323 suppliers that are considered in the current study constitute the population of 3TG smelters and refiners (as of late 2017) known to the three main due diligence programs. Notably, the significant majority of suppliers are conformant to due diligence standards (

Figure 2). For tantalum, tin, and tungsten, more than 80% of suppliers are participating in due diligence programs. For gold the number is lower, with about 75% conformant. For gold, it should be noted that this value is the fraction of known of industrial gold refiners (i.e., those producing greater than about 1 tonne per year); however, many hundreds of small and very small (e.g., less than one kilogram per year) refineries are known, but are assumed not to supply industrial manufacturing networks. Note also, for all four metal industries, there is an observable variation in the population, as firms go out of business or new firms emerge. There is also the possibility that the programs have not identified and confirmed all operating facilities, most notably black-market operators.

The Conflict-Free Sourcing Initiative was founded in 2008 by members of two industry associations, the Electronic Industry Citizenship Coalition and the Global e-Sustainability Initiative, largely involving multinational brand name electronics firms [

49]. The roots of the effort go back to 2007 when a working group was struck to respond to claims made by civil society groups [

50]. By 2017, when the name was changed to the Responsible Minerals Initiative, the business initiative had over 350 members from companies and associations from ten industries (including electronics, automotive, retail, aerospace, apparel, telecommunications, and jewellery). The initiative aims to support company raw material sourcing decisions including regulatory compliance and responsible sourcing from conflict-affected and high-risk areas. The manufacturers and brand-name firms at the downstream end of the metals supply chain paying for membership in the initiative, and they are supported with tools to achieve and information to report on responsible sourcing. This relies on companies at the upstream end of the supply chain: metal smelters and refiners who are encouraged to “participate” in the Responsible Minerals Assurance Process (formally the Conflict-Free Sourcing Program) by implementing due diligence management systems based on the OECD guidance [

9]. The program developed due diligence standards for each the four metal industries. Participating companies pay the costs of implementing their own due diligence systems and usually pay for assurance audits. The Responsible Minerals Initiative provides training materials and guidance, manages third-party stakeholders, and maintains a list on their website of smelters and refiners who are conformant to each due diligence standard [

49].

Central to the current study was the Responsible Minerals Initiative smelter engagement team, composed of individuals from about fifty member firms who performed outreach to metal smelter and refinery companies. The team was created in 2013 but its efforts became more earnest in 2014 and 2015 after the U.S. Dodd–Frank Act rule reporting requirements came into effect.

3.1. Descriptive Data on Smelters and Refiners

The first stage of the research design involved investigating the pattern of smelter and refiner participation into the program. The master smelter database, provided by the Responsible Minerals Initiative, describes approximately 3000 entities, names, and brands that are associated with 3TG suppliers. Over the years, the Responsible Minerals Initiative determined more than 2000 of these names not to be actual smelters or refiners. As of late 2017, about 400 names remained under investigation but they were of low likelihood to be eligible smelters or refiners. The remaining 323 facilities constituted the population of known and confirmed smelters and refiners and, of these, 87% participated in a due diligence program and, as of late 2017, 78% had achieved conformance (see

Table 1).

Information was consolidated and formatted into timelines for each of the four metal industries. Documents from the program included training materials, the smelter database, templates used for emails and letters, program performance metrics, and summary reports. (In a parallel study, our research group assessed business characteristics for 212 of these facilities, including firm size, location, and management system experience [

14].) Key information on the 323 facilities included dates that smelters and refiners started participating in the program and outreach efforts that were made by member firms on behalf of the program to engage with suppliers and encourage them to participate in the program. Central to the analysis was the status of each facility: the date of commitment to participate, audit date, and date of conformance. Timelines were annotated with dates of external events (like regulation) and activities internal to the initiative (like creation of the smelter engagement team). The four timeline figures were used as a reference to support interviews with conflict mineral managers in downstream manufacturing firms.

3.2. Interviews with Downstream Firms

Semi-structured interviews with conflict mineral managers in downstream firms sought to expose how manufacturers engaged with, and persuaded upstream metal companies to participate in, due diligence programs. Interviewees were recruited through a combination of convenience sampling and purposive sampling. Based on the recommendation of the Responsible Minerals Initiative manager, twelve candidates were invited to participate in the study, with six interviews accepting and interviewed between January and March 2018. Interviewees were current or previous members of the supplier engagement team and experts in conflict minerals. These individuals typically had 10–15 years’ work experience in supply-chain or corporate social responsibility functions in multinational electronics firms. Interviewees were drawn from a cross-section of Responsible Minerals Initiative member companies, and they had experience working in different regions and different 3TG industries.

The theoretical basis used in designing the interviews was from Sauer and Seuring, who provide a framework for supply chain management of mineral supply chains [

37], which was selected given its roots in sustainable supply chain management scholarship [

26]. Their categories include government interventions, strategic orientation, supply chain continuity, collaboration, risk management, and proactive management. The timelines from the descriptive data analysis were provided to interviewees ahead of time as a starting basis for interview discussions. Interview questions helped to contextualize the timeline analysis, and they were designed to expose nuances and challenges of lower-tier supplier engagement (

Appendix A). Interviews were 30–60 minutes over the telephone, which were then transcribed and imported into QSR NVivo, a data analysis software. Following Miles and Huberman [

51], first-order concepts were identified using open coding, which were then grouped into second-order themes through axial coding. We then discussed emergent concepts and the connections between them in relation to the extant literature, specifically Sauer and Seuring’s framework, with new concepts being created where necessary.

A number of measures were taken to address concerns regarding the validity and reliability of data and results. Construct validity was enforced by using a preexisting research framework. Our dyadic approach linked data on upstream sellers of raw materials to independent data collected from downstream buyers in the supply chain. Internal validity was supported by selecting key informants with first-hand knowledge of the engagement processes. External validity was enforced given inclusion of the whole population of suppliers across the four parallel case industries. Reliability was assured given the sequential roles of the researchers in undertaking the research, as well as extensive discussions related to emergent concepts, which were discussed between researchers until consensus was reached. Furthermore, the use of a mixed method design allowed for the comparison of qualitative and quantitative data [

52] from both the interviews and the timeline analysis, revealed a convergence of results. Fuller information on the methods, including more data on the timelines for all four metal industries, is provided in the master’s thesis completed by one of the authors [

53].

4. Results

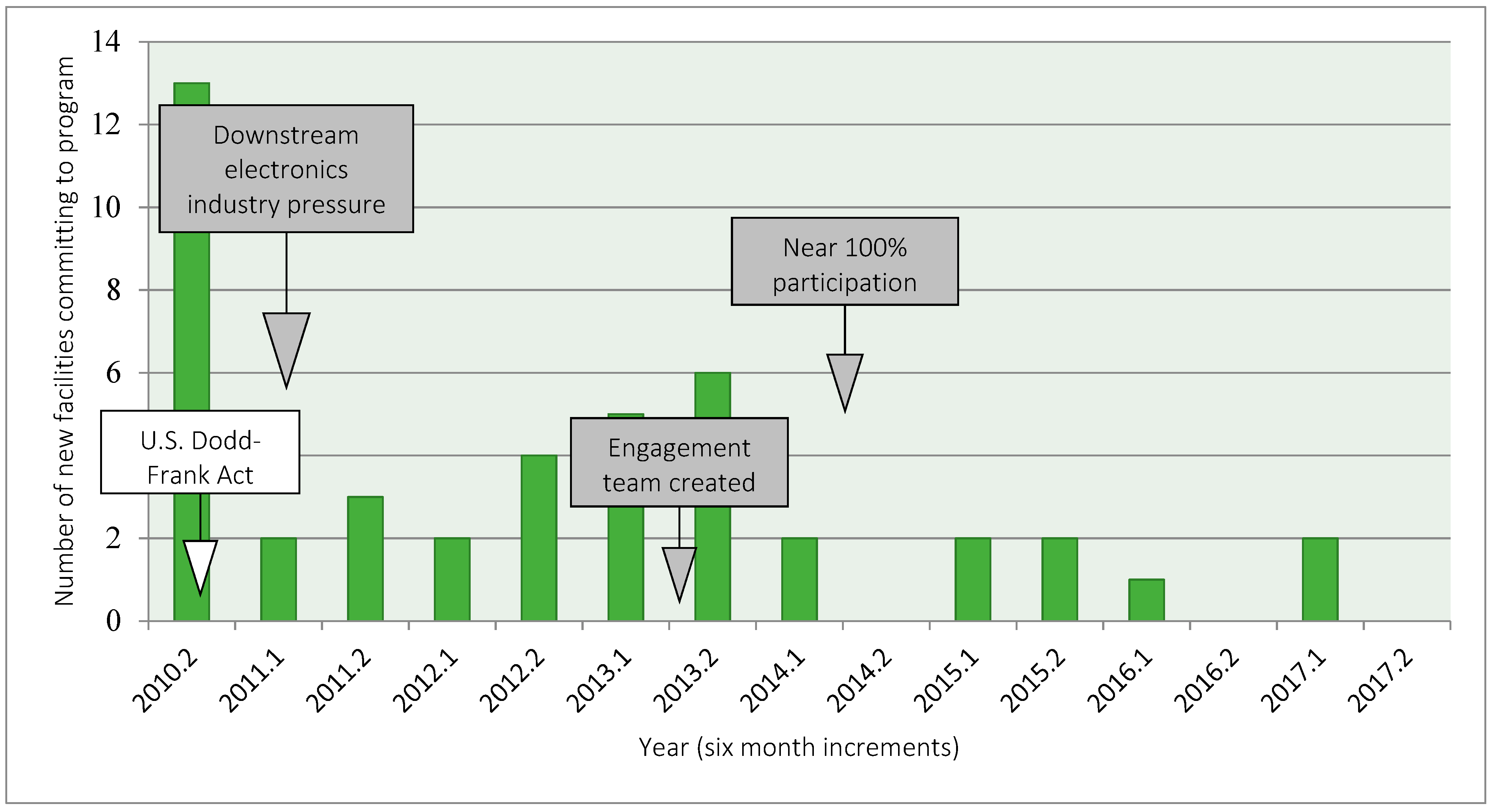

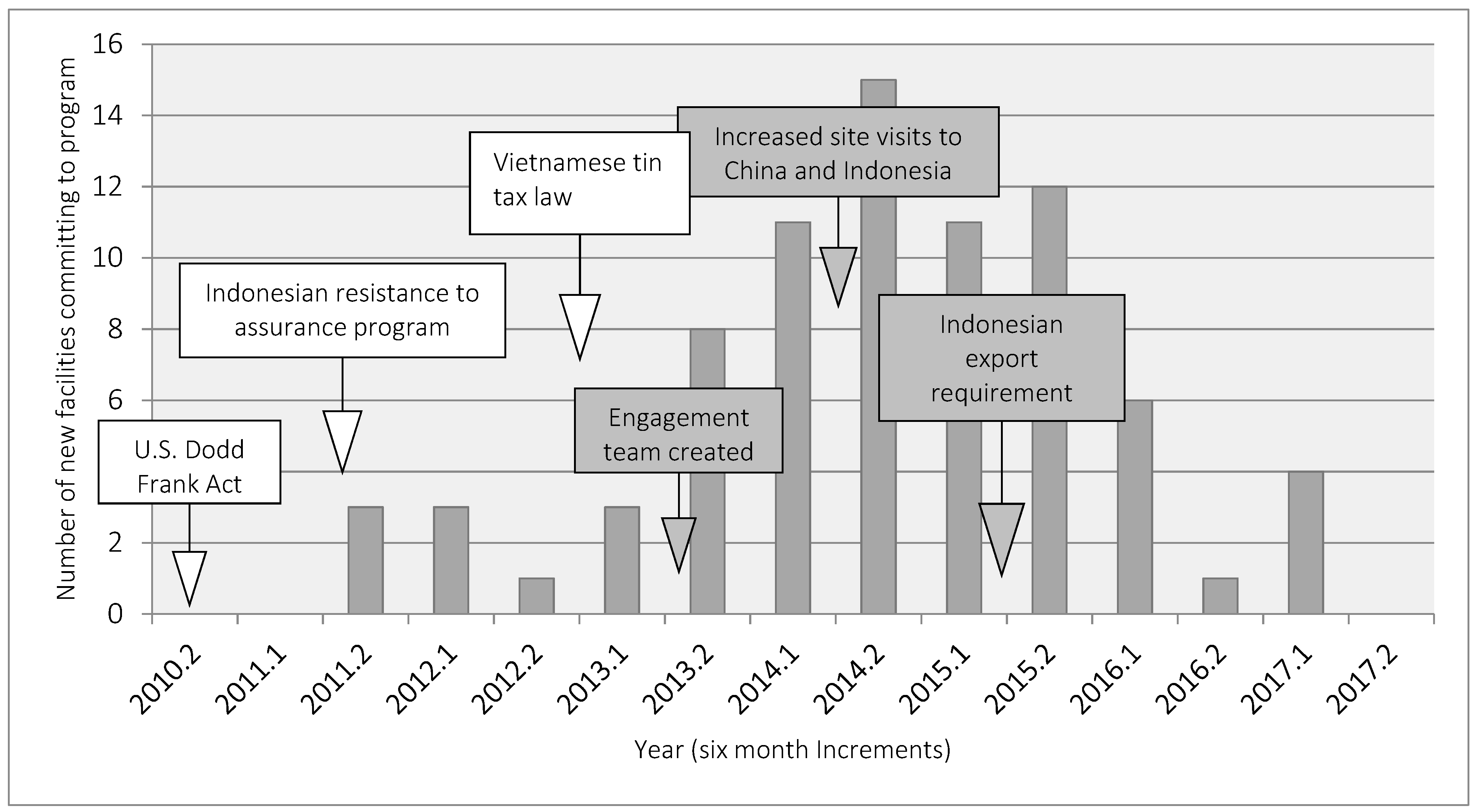

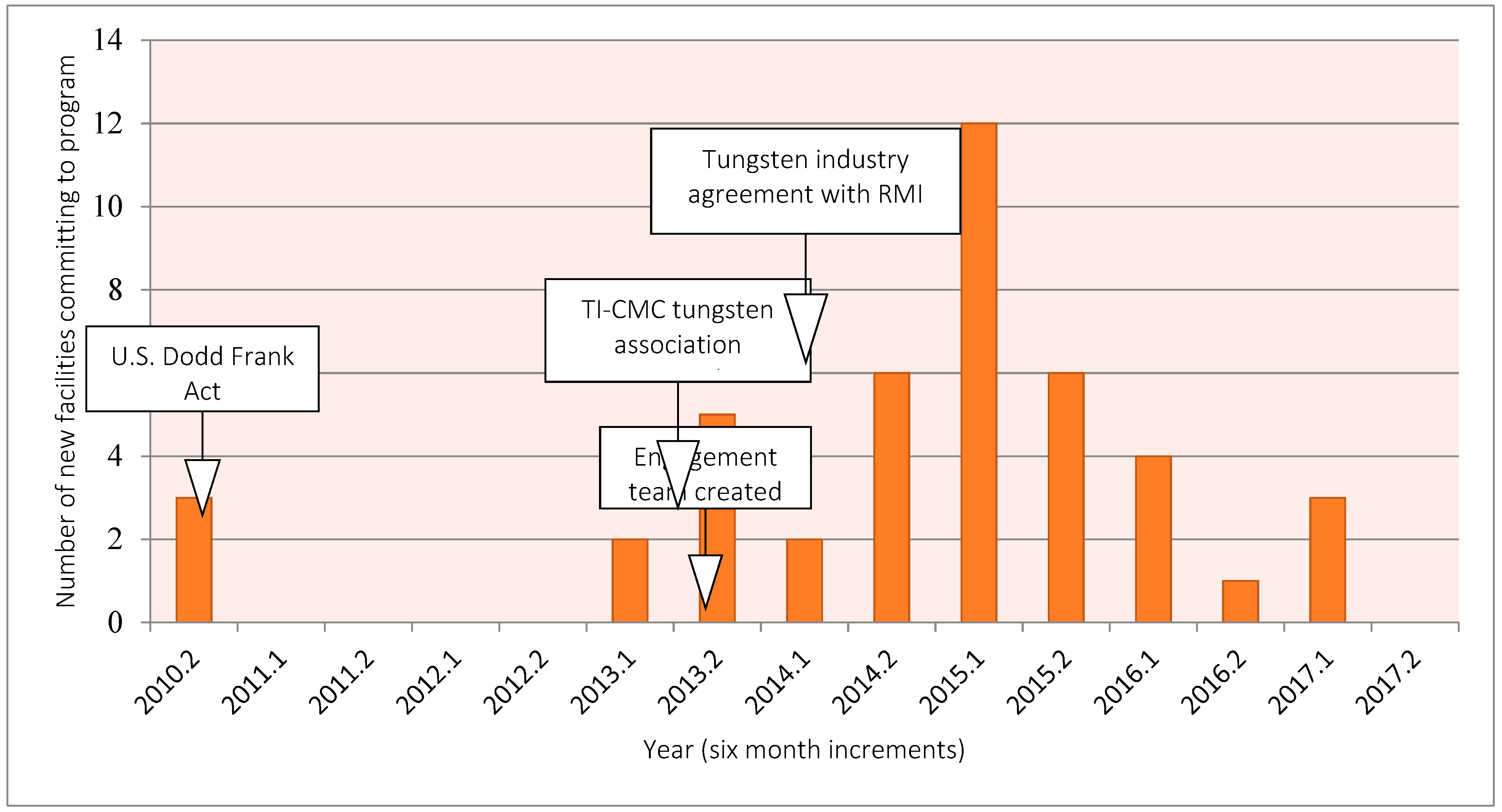

The industry timelines (

Figure 3,

Figure 4,

Figure 5 and

Figure 6) provide graphical summaries of supplier engagement for the four metal industries, showing patterns initial participation, growth in participation, and abatement of new participation. In the case of tantalum, the program achieved 100% smelter participation (allowing for some ebb and flow as companies do change management or ownership). For tin and tungsten industries, the total participation exceeded 80% by 2016 and continued to climb gradually; whereas, for gold the total participation seemed to have plateaued around 70% in 2015 (see

Figure 2). Based on these results and supplemented with information from the interviews (identified as P1–P6), a narrative was formed on smelter and refinery participation in due diligence programs.

About 2007, manufacturers realized they would need to understand sources of 3TG raw materials in their supply chains. Some of the larger electronics firms began sending enquiries to their suppliers, in hopes that their requests would penetrate through multiple tiers. Several issues became apparent:

tracing specific chains of metals all the way back to mines was largely infeasible (as discussed above, for physical and business reasons, see for example [

34]);

identification of mineral processors was confusing because there was blurring of roles and names of mines, smelters, refiners, alloy makers, metal casters, fabricators, traders, and brands; and,

end-product manufacturers in electronics share from many of the same 3TG metal suppliers.

Based on this, it was logical that downstream firms collaborate to better understand their lower-tier suppliers and to manage responsible sourcing. The Responsible Minerals Initiative was created and supplier engagement began. Early consultant analysis [

34,

54] suggested that refiners and “smelters were the pinch point in the supply chain” [P4]. They purchase mineral concentrates from mines or through traders, convert them to refined metals and metal chemicals, which then are sold to downstream manufacturers of parts and components. Smelters and refiners also purchase post-industrial and post-consumer sources that are recycled in the same facilities as process primary feedstocks. Smelters and refiners thus constitute a finite group of identifiable facilities (see

Table 1), mostly large-scale capital intensive metallurgical operations. “The smelters, the refiners, that we work with are pretty [deep in] our supply chain, so they are not our immediate next supplier, they are maybe 8 or 9 down the supply chain“ [P3].

Engagement of smelters and refiners was part of a three-stage process: (1) identification of potential facilities, (2) validation of alleged facilities to determine the legitimacy of smelters or refiners at the chokepoint, and (3) outreach to encourage facility participation in the due diligence program.

1. Identification

To identify metal smelters and refineries, the Responsible Minerals Initiative developed a standardized supplier survey for members in 2011. The survey provided common definitions, standard smelter and refinery names, and fields to characterize suppliers (location, capacity, ownership, etc.). This process also relieved survey fatigue experienced by suppliers. With the creation of the smelter engagement team in 2013, the program “started to be more tactical and strategic about engagement” [P4]. Supplier identification efforts were coordinated: downstream firms shared and aggregated survey results, then met to coordinate the identification of potential smelters and refiners. However, because surveys needed to be relayed from individual member firms back up the chain to identify metal processors, and then returned downstream via the same chain, interviewees noted that there were poor return rates (in the order of 1%). It was “tricky because we are so far removed from the smelter itself and even our direct suppliers are removed from the smelter itself so that can be challenging twisting through the supply chain” [P6]. Curiously, this approach meant that manufacturers identified their 3TG suppliers without actually knowing how their supply chains were connected. Supplier surveys were anonymized at each tier of the supply chain to preserve business confidentiality between competitive suppliers and prevent line-of-sight visibility to smelters and refiners. Survey results were additionally anonymized by the program, who managed the consolidated database.

2. Validation

Validation was necessary after suppliers were identified. Numerous product brand names, marketing and distribution companies, differences in ownership and location, and confusion about what actually constitutes a metallurgical processor complicated the process of identification and qualification. The smelter engagement team clarify which smelters and refineries were targeted (e.g., a facility needed to have the technical ability to process primary mineral concentrates) and performed additional enquiries through industry associations to confirm processors. Nonetheless, with enquiries aggregated among downstream firms and repeated annually, the efforts began to “build supply chain visibility” [P6]. Over the years, the collaborative effort developed a reliable database of qualified smelters and refiners for each of the four metals, which is updated regularly and provided to Responsible Minerals Initiative members.

3. Outreach

Priority for outreach was to facilities that were identified most frequently in member supplier surveys. “Smelters… that weren’t participating, would get letters, and lots of letters, and finally if you start to get enough letters from all these big brand name companies, I think that helped drive some of the participation. And so if you look at both tungsten and tin, you see that bump in 2013 about the time SET got started” [P3]. “After we conduct the survey we find smelter contact information and directly go talk to them, and…engage with the smelters. So we either try to email them, try to call them, and then meet them in person. We find that’s the most effective way to get them engaged and this can be done by going directly to the smelter facilities” [P6].

Efforts were coordinated to encourage constructive communication and to avoid overloading prospective participants. Depending on the type of company and the region involved, a plan for each supplier was developed. This included coordinated emails, letter writing, and social media, each urging the smelter to participate in the program. Messages could be escalated depending on the responses or commitments received (or not received) from the supplier. Importantly, a single-point-of-contact person was designated for each facility, to mitigate overloading a particular supplier with requests or mixed messages, and to provide a friendly liaison who could encourage program participation. “[W]e found that sometimes when too many companies are trying to reach the smelter or communicating with the smelter it can cause confusion and they eventually stop responding … it was probably better to assign one member company person to engage with the smelter” [P6].

Escalating their efforts of coordinated persuasion, manufacturers began to visit suppliers in-person at smelter facilities around the world. Depending on the culture and language and the nature of firms involved, the team would work with translators and a member of the engagement team might do a site visit. Other tactics included attending metal industry conferences and working with industry associations. This action conveyed the gravity and urgency of the conflict mineral problem, and was very effective: “So in terms of how smelters become active I think the most important thing is being very engaged and having not only your company brand but establish, but trying to establish a face-to-face relationship with the smelters” [P6]. “Thus downstream firms overcame barriers of distance, “breaching language, breaching communication or going to those places physically” [P6].

Somewhat surprisingly, top-tier manufacturers were visiting upstream companies who were not their own suppliers. For example, one target group was tin smelters in Indonesia, many of which are small in size. At the extreme, this meant a representative from a U.S. multinational electronics corporation travelled to the island of Belitung, Indonesia to knock on the door of a family-owned, 20-employee tin smelter. Another effort focused on tungsten facilities in China, many of which are located in Ganzhou, China. Gold refiners in Korea were another target group, which include numerous small operations doing recycling from manufacturing industries in that country.

According to a survey by the Responsible Minerals Initiative covering about one-third of the audits done from 2015–2018, metal suppliers expressed that they participated in the program because of their own company policy (85%), because of customer requests (80%) and because of requests from end-use manufacturers (50%). The last point aligns well with data in the timelines (see

Figure 3,

Figure 4,

Figure 5 and

Figure 6) showing that new participation of suppliers grew by 35%, 85%, 90%, and 80%, respectively for tantalum, tin, tungsten, and gold, following the creation of the supplier engagement team in 2013.

The program offered supplier development resources and also provided financial assistance to suppliers. Education and training were delivered in at least eight different languages, including online, seminars at conferences, and workshops for targeted groups, like tin producers in southern China. A fund was created, financed by individual member firms, and used to offset the costs of a supplier’s first audit, significantly reduced the financial barrier to smaller facilities to participate in the due diligence program. More than half of the conformant facilities benefited from the fund, which distributed approximately $2 million up to 2018: “you combine that with the face-to-face interaction and the hand holding of getting them ready for the audit then they’re more likely to be successful” [P6]. Interviewees and program managers expressed general satisfaction in the performance of the program in reaching suppliers over ten years of operation.

4.1. Tantalum

Smelters and refiners in the tantalum industry were quick adopters of due diligence systems for responsible sourcing (

Figure 3), as the majority of producers achieved conformance to the program in the first two years. Several factors were involved: electronic capacitors account for a high proportion of tantalum use, the DRC is a major region of metal supply, capacitor firms are closely aligned with the electronics industry, many midstream and downstream firms are U.S.-based and were therefore immediately subject to the Dodd–Frank Act rule, most electronics corporations already had strong corporate social responsibility commitments, and the upstream tantalum industry association rallied successfully around the issue.

As apparent in

Figure 3, the supplier engagement team did not contribute significantly to engagement in the tantalum industry. Unlike the other three metal industries, “the electronics industry had the leverage and the purchasing power to influence [and]… apply the pressure that we could” [P4]. After a couple of the leading capacitor manufacturers joined the program, and with the support of brand-name computer firms that faced reputational risks there was rapid acceptance in the industry for responsible sourcing standards written by the downstream initiative. “The tantalum industry was very a vicious industry without much collaboration. But when this came out, and this is where we saw a lot of collaboration occurring” [P4].

Of interest for tantalum, one interviewee referred to more advanced responsible sourcing efforts that were built off the collaborative responsible sourcing initiative. A “closed-pipe” system was described that directly connects a specific mine in DRC, where conflict was not a problem, to a conformant smelter, for example in China, to a capacitor manufacturer in the U.S., to a top-tier manufacturer of electronics. Thus material was securely and assuredly moved from extraction to end-product.

4.2. Tin

The tin industry, conversely, was not motivated by the Dodd–Frank Act (

Figure 4) and the role of the engagement team was significant. Indifference to the U.S. conflict minerals rule was understandable, given that the vast majority of tin processors are outside the U.S. (e.g., Indonesia, China, Peru, Bolivia) and the bulk of tin ore is sourced regionally, far away from the problems of Central Africa. Although several large producers did participate early, there was “slowness given the number of tin smelters that exist … [and] a lot of pushback from Indonesian tin smelters [and] a lot of pushback from [industry associations]” [P4].

The smelter engagement team played an important role in engagement tin smelters and refiners in due diligence programs. “What happened was these smelters started receiving letters…asking them what they know about responsible sourcing, have they done anything in the past” [P3]. However, it took more significant efforts to achieve commitments from tin industry actors. “[T]in smelters started getting active when we as member companies started visiting smelters for the program … I think the [engagement] team played a major role, face-to-face contact” [P3]. Regional outreach efforts resulted in participation by blocks of companies starting in 2012, including major refiners in Thailand, Malaysia, Peru and Bolivia. Indonesia and China were high-focus areas. “[We] recognized that its very very important, especially in Indonesia culturally to have that face to face relationship [and] stay in touch with the smelter” [P6]. Participation of small companies in Indonesia was particularly advanced in 2015 after the government-run Indonesia Commodity & Derivatives Exchange (ICDX) made compliance to the tin due diligence standard a requirement for tin export. In China, the world’s largest tin refining nation, the program engaged with larger state-owned firms and with government representatives, who provided an initial door for acceptance in that country. The program continued to work on the participation and the conformance of tin smelters and refiners in China as late as 2018.

4.3. Tungsten

Tungsten smelters and refiners took longer than the other metal industries to become active in due diligence efforts (

Figure 5). Although a small number of U.S. and European tungsten producers participated early-on, there was generally low interest: “Tungsten was really late to the table and such a small amount of tungsten actually came out of the region, they just didn’t really want to engage” [P4]. Program members constituted a relatively small portion of the tungsten market. “The electronics industry just did not have a lot of leverage over tungsten” [P4]. Moreover, given that a tiny fraction of tungsten is sourced from Central Africa (less than 2%), the lack of interest by tungsten producers was understandable.

A significant breakthrough occurred in 2013. The engagement team became more active. Numerous site visits were made by program representatives to tungsten facilities, many in China. Knowledge was gained both by the downstream manufacturers and by companies in the metal industry; interviewees spoke of trust-building to address concerns with “business confidential information [and] lack of awareness” [P5]. Concurrently, a new tungsten industry association was formed to facilitate responsible sourcing (the Tungsten Industry-Conflict Minerals Council). At the end of 2013, an agreement was struck between tungsten council and the Responsible Minerals Initiative. Tungsten producers who are members of the council are provided funding by the downstream program for facility audits and they are given a three-year (instead of one-year) audit cycle, and the tungsten due diligence standard provides streamlined procedures for the tungsten industry.

Notably, after the new agreement came into effect, competitive pressures in the tungsten industry appeared to motivate other tungsten producers, even those who were not council members, to participate in the due diligence program. Given that approximately 80% of tungsten production takes place in China, interviewees observed that the program was particularly successful in gaining traction in that country—far from the U.S. Dodd–Frank Act and European pressures.

4.4. Gold

Although the gold timeline (

Figure 6) looks similar to the other 3TG materials, the gold industry operates unlike other markets. As observed by one interviewee: “gold is a completely different animal” [P6]. Gold behaves more like currency than a metal. It is mined wherever possible, all around the world, and all but the smallest country has a gold refinery, often associated with the national mint. The value per mass is high, thus “it’s really hard to track and the quantities are much smaller for bigger profit” [P6]. Gold is readily recycled, resulting in significant mixing of old and new sources. Because of its value “it’s also used as currency, its used to wash money” [P4]. And, as several interviews noted, “they’re not paying the taxes on it, so miners actually get more per gram of gold through illegal channels than they do through legal channels” [P4].

With respect to encouraging participation in the Responsible Minerals Initiative due diligence program, “gold smelters and refiners were the most challenging to engage, and where [supplier engagement] tactics were the least successful” [P1]. “Gold is one of the hardest ones, because we don’t really have that much gold in the electronics industry, so it’s hard for us: we don’t really have any leverage to convince them” [P6]. For example, it was especially difficulty in convincing refiners who source gold from mines in China to “join an American program that determines whether they source from Africa” [P2].

To make gains on responsible sourcing, the Responsible Minerals Initiative relied on programs that were developed by two other industry associations, the Responsible Jewellery Council and the London Bullion Market Association. Although a significant volume of tantalum and tin go to electronics, about 90% of gold goes to non-industrial uses, such as in jewellery and bullion (including coins, gold bars, and ingots). To achieve greater reach relevant to all gold end-uses, the three associations agreed to cross-recognize their due diligence standards. The London Bullion Market Association is particularly relevant, as it includes more than one-hundred large gold refiners that, since 2014, must each maintain a responsible gold certificate that supports due diligence with respect to risks, including conflict, human rights abuses, terrorist financing practices, and money laundering [

55]. This certification requirement led to a clear uptick in conformant facilities, starting in 2014 (see

Figure 6). These partnerships allowed for electronics firms to overcome their inability to apply market pressure onto gold refiners.

Responsible sourcing remains an on-going challenge in the gold industry. From a transparency perspective interviewees noted that the commodity exchanges represent an important barrier. For example: “Within China, the Shanghai Gold Exchange, the gold would go in and go out, there was no tracking of who got what gold. … if you tried to chase the gold supply chain, it was always stopped at the exchange, and so you really didn’t know who your refiners were” [P4]. Non-conformant facilities are known to be all over the world (Mexico, Middle East, China, India, etc.) and they are often in regions where there is little or no market incentive to participate in due diligence programs.

5. Discussion

This study explored how global manufacturing firms engaged with suppliers in mineral supply chains to enable responsible sourcing. The research responds to Carter, Rogers, and Choi, who asked how organizations might “manage physical supply chains that reside beyond the visible horizon” [

8] (p. 94). Evidence revealed how top-tier firms in electronics and other sectors overcame barriers of geographic distance, physiological distance, and cultural distance in identifying and engaging with 3TG suppliers. General strategies for sustainable supply chain management, like communication, education, and development, and compliance approaches are relevant to all suppliers [

28], but for suppliers over the visible horizon [

8] management needs to include engagement steps, including identification, validation, and outreach.

The concept and value of a supply chain chokepoint at smelters and refiners [

13] has been confirmed. The chokepoint is where there is a concentration of firms in the upstream supply chain where sustainable management practices can influence lower-tier suppliers. This observation supports theory on diamond-shaped supply chains [

36] and specifically confirms what Seuring and Sauer refer to as “upstream focal firms” [

5,

37], who control the integrity of mineral feedstocks entering mineral supply chains.

A novel contribution of this study is what we call the “deep supplier”. A deep supplier is defined as a lower-tier supplier—beyond the visible horizon of top-tier firms—whose position at a supply chain focal point affords them leverage over their suppliers. In the context of 3TG metals, the management and purchasing actions of deep suppliers was shown to have a significant effect on the sustainability of the mining practices and hence contribute to overall supply chain sustainability. We believe this concept could have application beyond the 3TG metals, to other industries whose structure also reveals lower-tier supply chain focal points.

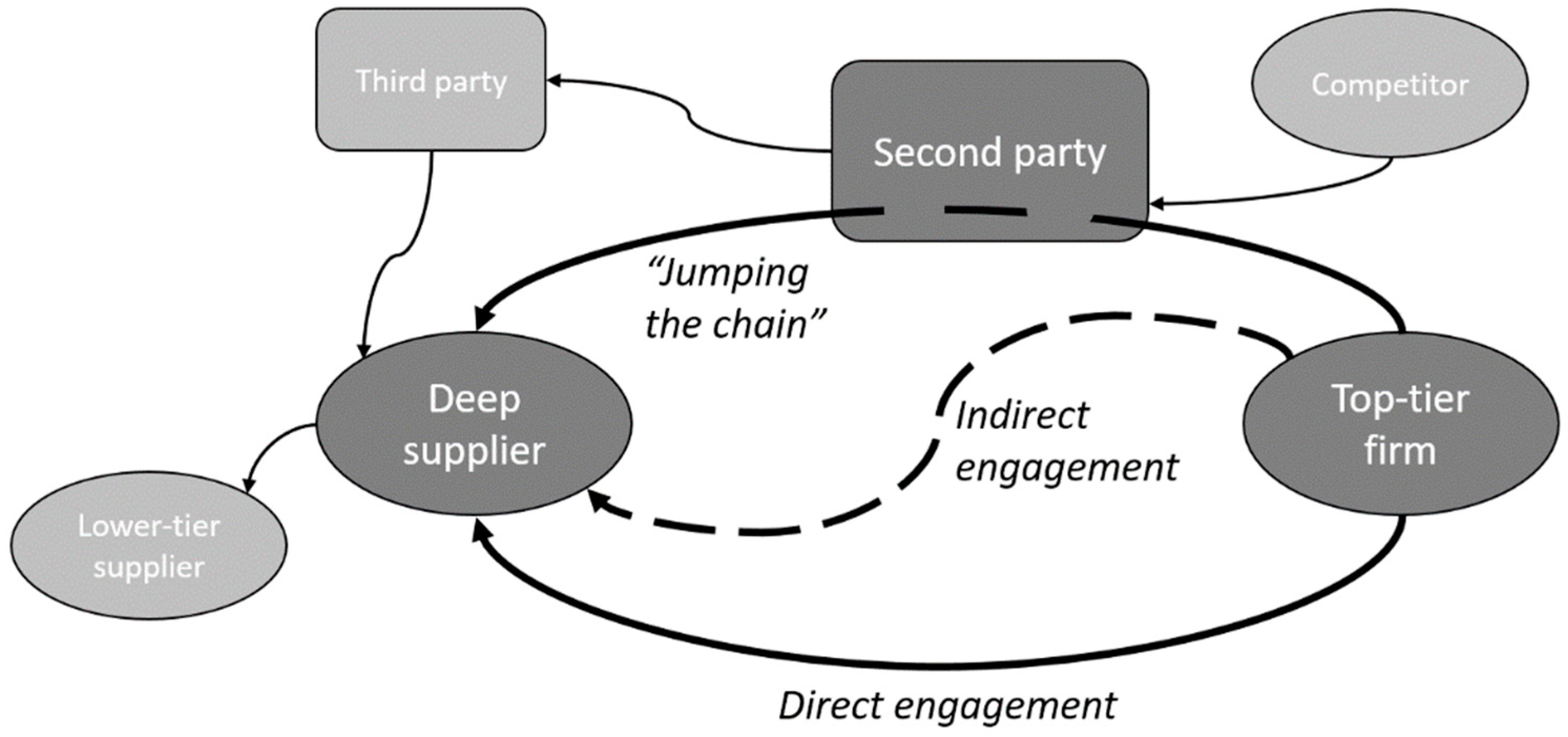

Surprisingly, lack of supply chain transparency does not present an impossible barrier for multinational manufacturers to manage deep suppliers. We observed top-tier firms “jumping the chain” to engage with deep suppliers, who are beyond their visible horizon and who may—or may not—be physical suppliers to all top-tier firms. The did this collaboratively, working through the standards program, a business-led initiative. Although individual manufacturers could conceivably invest greater resources to discover more about their mineral supply chains, it was both effective and sufficient for top-tier firms working together to jump-the-chain to manage deep suppliers.

5.1. Contribution to Theory

This study contributes empirical evidence to theory on sustainable supply chain management in multi-tier supply chains.

Figure 7 depicts a conceptual framework of engagement with deep suppliers. Whereas, the theoretical work of Tachizawa and Wong [

3] suggests four management practices by which top-tier firms engage with lower-tier suppliers (direct, indirect, “work with third party” and “don’t bother”), we have identified a potential intermediate practice, to “work with second party”, which more accurately describes the role of companies working in business-led efforts, like the Responsible Minerals Initiative. The members of the initiative were highly active in parts of the operation of the initiative, including efforts to engage suppliers. “Work with a second party” captures the practice of jumping-the-chain, whereby a top-tier firm works with the initiative and in collaboration with competitors to achieve engagement. This differs slightly with Sauer and Seuring [

35], who describe a mechanism of cascaded multi-tier sustainable supply chain management that links between downstream and upstream parts of mineral supply chains, in that, in our conception, the role of the second party is pivotal. Results are supportive of Hofmann, Schleper, and Blome, who describe due diligence in multi-tier supply chains [

6].

Our results contribute empirically to the limited body of research on engaging lower-tier suppliers in sustainability management. Gong, Jia, Brown, and Koh suggest a number of supply chain learning stages [

31], which were apparent in our study, including top-tier firms working in breadth with partners and working in depth to learn more about lower-tiers. By sending requests to their immediate suppliers as a means of indirect engagement, manufacturers learned the identity of deep suppliers. Thus, even with limited knowledge of lower-tiers, by partnering and collaborating focal companies were able to apply a direct approach to manage deep suppliers. Additionally, although well observed in the direct management of first-tier suppliers [

29,

56,

57], we add to the understanding of how focal companies work directly with lower-tier suppliers and with strategic partners to establish governance mechanisms to manage distant suppliers [

30,

31]. Beyond standards and compliance, “contributive” strategies [

57] include training, financial incentives, and other assistance intended to develop supplier risk management capacity. Interviewees identified more “pro-active” strategies [

57] undertaken by manufacturers for supply chain sustainability and risk mitigation, for example “closed-pipe” material supply networks (see

Figure 7) provide dedicated conflict-free sources of tantalum to end-users who are highly dependent on this critical material [

5,

58].

Results also confirm contingency variables that Tachizawa and Wong suggest affect supply chain relationships in multi-tier supply chains [

3]: each of the four metals is “critical” to electronics and other high-tech products and manufacturing; top-tier manufacturers are “dependent” on the concentration of smelters and refiners at the chokepoint; there is significant “stakeholder pressure” and reputational risk for top-tier firms; “industry dynamism” of smelters and refiners is low, as these facilities tend to be technically complex, capital intensive, and permanent; there is a significant physiological, geographic, and cultural “distance” from mostly-Western top-tier firms to many smelters and refiners in developing countries; and, top-tier firms have limited in their familiarity and industry “knowledge” of smelting and refining at deep suppliers. To mitigate this last variable and to engage deep suppliers, the Responsible Minerals Initiative relied significantly on metal industry associations and other upstream parties for metal industry expertise.

The study indicates how top-tier firms exercise power in multi-tier supply chains and how lower-tier suppliers responded to pressures of sustainable practices. Results support prior considerations on how the power of multinational firms is focused to influence lower-tier suppliers [

3,

6]. The extent to which downstream buyers influence upstream producers differs according to leverage available. In the case of tantalum, given that electronics applications account for the majority of use, top-tier firms used their economic power to leverage metal producers to implement responsible sourcing. For tin and tungsten, where market leverage was lower, power was exerted more softly through non-economic persuasion of deep suppliers. Coordinated letter-writing and site visits from “big brand name companies” helped to overcome supply chain distance and improve industry knowledge. To reach and motivate gold industry actors, even more indirect efforts were needed, primarily via partnering with third parties in the gold bullion and jewellery industries that had more direct power to influence gold refiners.

There is varying understanding of supply chain transparency. Hofmann, Schleper, and Blome describe four practices that increase transparency along supply chains [

6]: certification of firms, chain-of-custody along the value chain, traceability of materials, and due diligence of firms. Using their terminology, full transparency in the supply chain would include clear line-of-sight upstream, and this would require chain-of-custody traceability of raw materials backwards from end-users to source. However, in this study, top-tier firms described a more limited transparency that provides identification of deep suppliers but without line-of-sight traceability through the supply chain. To encourage due diligence management at deep suppliers, manufacturers gathered information to identify smelters and refiners, but they did not have enough knowledge on the operating structure of those supply chains to their supply chains link-by-link. Thus, in practice, firms are prioritizing due diligence over traceability. This finding is consistent with Kim and Davis who showed that very few corporations filing under the Dodd–Frank Act rule claim to know whether their products are “DRC conflict-free” [

32]. Knowing one’s suppliers by name is not sufficient to know the source of materials entering one’s specific products.

Traceability appears to be more complex and costlier than due diligence alone. Materials that were produced by lower-tier suppliers can be tracked

forward through multiple tiers in the supply chain to downstream manufacturers, but firms need separate instruments and more developed systems to trace materials

backwards, for example, to confirm suppliers in the chain, or to know the upstream sources of food that is subject to a health recall [

39]. For minerals traceability, Apple, a large electronics firm, began tracing its supply chains of tantalum, tin, tungsten, and gold in 2010. This involved looking upstream from manufacturing back to smelters. However, it was not until the end of 2016 that Apple could claim that all its known 3TG suppliers were participating due diligence programs [

10]. Traceability requires significant information and more sophisticated systems. Further research is necessary to tease apart and better understanding the nuances of responsible sourcing concepts, including transparency, due diligence, tracking, traceability, and chain-of-custody.

5.2. Implications for Practice

Responsible sourcing has emerged as an expectation of producers and users of metals and minerals. Transparency can improve confidence on sources of materials, which may improve security of supply, by knowing more about both physical flows and business information on actors in global markets. Without knowing one’s suppliers, there is concern that things will be out of compliance to regulations or fail in quality but, more broadly, it limits sustainable supply chain management and the mitigation of environmental impacts and social problems that may be present in distant global supply chains. Results here have suggested that simply by being known to downstream customers (and therefore visible to other stakeholders), there is pressure on deep suppliers to improve practices.

This study provides insights that may support responsible sourcing and supply chain management for a larger set of important materials. Two of the four conflict minerals (tantalum and tungsten) are commonly characterized as critical raw materials [

7,

19] that are paramount in low-carbon and other technologies yet also present geopolitical supply-risks. The Responsible Cobalt Initiative due diligence standard targets an important critical metal that also presents responsibility concerns. The London Metal Exchange expects responsible sourcing standards to be in place for the major base metals [

11]. The exchange specifies physical standards and it is the main global price-setting platform for aluminum, copper, zinc, nickel, lead, tin, molybdenum, and cobalt.

Moreover, the goals of responsible sourcing are expanding. Initial concerns were on conflict (and focused on the DRC), but the OECD guidance broadens consideration to “conflict-affected and high-risk areas”, which cover a variety of human rights, conflict, and governance concerns [

9]. The cobalt standard aims to improve responsible sourcing that includes labor conditions, like the prevention of forced labor and better health and safety [

59]. Other programs hit on additional aspects of sustainable development, notably in its responsibility standard the Aluminium Stewardship Initiative refers extensively to environmental objectives and to the rights of indigenous peoples [

60].

Several study informants made note of the success of supplier engagement and due diligence implementation in China. Reasons for this success were several, and they may inform other efforts in responsible sourcing, like those for sustainable wood and fisheries that have been less successful in China (see [

5]). First, given that China is important not just to upstream processing of metals (see

Table 1), but also to midstream manufacturing and downstream assembly of electronics, member firms could exercise market leverage (particularly of tantalum and tin suppliers). Second, was the ability to bridge cultural distance by member companies with significant local presence. Third, firms invested significant individual and collaborative resources, including repeated site visits and connections to partner organizations such as Chinese industry groups and government agencies. It appears that Chinese authorities accepted the value of responsible sourcing and, perhaps more importantly, accepted the value of third-party assurance of responsible sourcing. The success carried to cobalt supply chain responsibility, which started operation in 2018 as a collaboration of the Responsible Cobalt Initiative, the Responsible Minerals Initiative and the China Chamber of Commerce of Metals, Minerals & Chemicals Importers & Exporters [

59]—which is important given that China is a major cobalt processor and a maker of electric vehicle batteries.

The current research has elucidated strategies and mechanisms that top-tier firms use to identify suppliers of material resources and encourage lower-tier suppliers to implement due diligence systems. Top-tier firms are collaborating and “jumping the chain” in order to engage deep suppliers. Results have shown the considerable efforts that top-tier firms have made to discover the identity of companies who are suppliers of 3TG metals: coordinated outreach, face-to-face visits, and direct financial support. Compare this to raw material criticality assessments, which generally use data at the national scale [

19,

20]. Few researchers have paid attention to managing real supply chains at the firm-level [

20,

21,

22,

23] at the firm-level resolution shown here for 3TG sources.

Whereas, technical avenues to the critical materials problem, like geological exploration, efficient mining and metallurgy, and materials substitution, are widely touted [

7,

19], management strategies for mineral governance are less discussed. Firms need to manage risks in mineral supply chains, regardless of whether risks are associated with supply disruption, with conflict or with environmental hazards. One approach is simply to change the sources of raw materials, to shift sourcing away from high risk countries and companies. However, to do this, firms need to know where materials are actually sourced, and this is difficult due to complex long supply chains, multiple processing tiers, independent traders, and long transportation distances. Another difficulty for minor metals, which is a key contribution to the criticality of raw materials, is that there are often a limited number of producers or production concentrated within a region. For example, most tungsten, which is classified as both a critical raw material and a conflict mineral, is mined and processed in one region in China.

In managing risks in their supply chains, top-tier firms have begun to develop systems and risk management approaches, and they participate in audit and certification processes. By better understanding their suppliers, manufacturing firms can “identify and manage critical suppliers” [

8] and improve their ability to mitigate sources of supply disruption while maintaining ethical and sustainable sources of raw materials [

24]. If a top-tier firm has better knowledge of lower-tier suppliers, it can better assess risks and implement strategies to manage risks.

More broadly, we discern a “responsible sourcing regime” for global governance of minerals and metals supply chains. Businesses are undertaking efforts in responsible sourcing that is guided by high-level norms and policy, which is executed through private-sector governance of minerals and raw materials [

19,

24,

25]. Three levels are apparent: (1) principles and broad objectives like those in the OECD guidance on due diligence; (2) standards and requirements defined by industry-led programs, but also in government regulations like the U.S. and Europe conflict mineral rules; and, (3) company management systems. Firms need to select which responsible sourcing standards they should follow depending on their needs and capacities, and given the particulars of each industry and their position in the supply chain (upstream, midstream, downstream). Consequently, companies at all stages in the supply chain, and across a growing diversity of resource industries, are implementing responsible sourcing policies, procedures, management processes, and reporting systems.

6. Conclusions

Top-tier manufacturing firms collaboratively manage suppliers of critical metals to increase supply chain transparency and implement due diligence to reduce negative social impacts. We used data on real firms to look at both ends of the mineral supply chain. Upstream, we analysed a population of 323 “deep suppliers”—our term for lower-tier metal producers who are critically positioned to mitigate the conflict mineral problem. Downstream, we conducted interviews with six conflict mineral managers in multinational manufacturers who are end-users of tantalum, tin, tungsten, and gold.

Results showed both expected and novel tactics used to reach suppliers and manage risks in mineral supply. Manufacturers work collaboratively through industry associations to identify, validate, and engage lower-tier suppliers—targeting deep suppliers and persuading them to conform to responsible sourcing standards. Surprisingly, we found that manufacturers do not need line-of-sight visibility to lower-tier suppliers in order to do sustainable supply chain management; rather, global manufacturing firms “jump the chain” to engage directly with deep suppliers at the supply chain chokepoint. This work has contributed empirical evidence to understanding multi-tier supply chains, showing how power is exercised by top-tier firms to manage deep suppliers and to reach suppliers both directly and indirectly, and has helped to understand mechanisms for supply chain transparency.

Due diligence has emerged as an approach that is expected of companies, both upstream and downstream, involved in mineral supply chains where there is a risk of conflict, human rights, governance, or other concerns. For tantalum, tin, tungsten, and gold, the majority of smelters and refineries have implemented due diligence management systems. Responsible sourcing programs like the Responsible Minerals Initiative, the Responsible Jewellery Council, and the London Bullion Market Association have engaged hundreds of companies around the world.

The major limitations of this study are associated with the framing of the research and potential bias in data. The timelines that were developed relied on information provided by one industry association and cross-checked against industry and public information. We did not consult with suppliers or with other due diligence programs that may have differing perceptions of engagement practices. There was a potential selection-bias associated with interviewees. These persons may have skewed positive perspectives regarding their own efforts and programs.

Responsible sourcing, particularly of minerals and metals, is new and consequently numerous avenues for future research are available. Manufacturers have shone a light on deep suppliers, encouraging improvements in social aspects of companies and communities in which they operate. Theoretical work is recommended on the responsible sourcing regime for global governance of minerals and metals supply chains. Specifically:

Further investigation might consider environmental conditions or management performance of lower-tier suppliers who have no previous experience in corporate social responsibility. What have due diligence management systems done to change deep suppliers?

There is currently significant company implementation of the five-step process defined in the OECD guidelines. Consequently, future researchers should look for new data and public reports by various companies positioned at points along the supply chain.

As data become available on due diligence efforts in other industries, and with different objectives, new research questions and comparisons can be considered for conflict minerals, critical raw material, and base metals.

On a more theoretical level, concepts like transparency, responsible sourcing, and due diligence have just started to gain research interest [

6]. These concepts and their practical implementation need additional clarification in future research.

The impacts of governance initiatives related to mineral and metals are poorly studied, partially because they are relatively young but also given a lack of data and methods [

25]. Practical research is possible based on longitudinal data that are available since the Dodd–Frank Act was passed in 2010 on firms and industries, and at national and global scales.

Lastly, it should be emphasized that responsible sourcing and due diligence practices of companies cannot be easily correlated to tangible outcomes regarding mitigation of violence, improved human rights, or governance progress. Continued research, including field work in the DRC and other regions, is necessary to assess real circumstances and guide improvements in mining areas and communities.