Decreasing Metal Ore Grades—Is the Fear of Resource Depletion Justified?

Abstract

1. Introduction

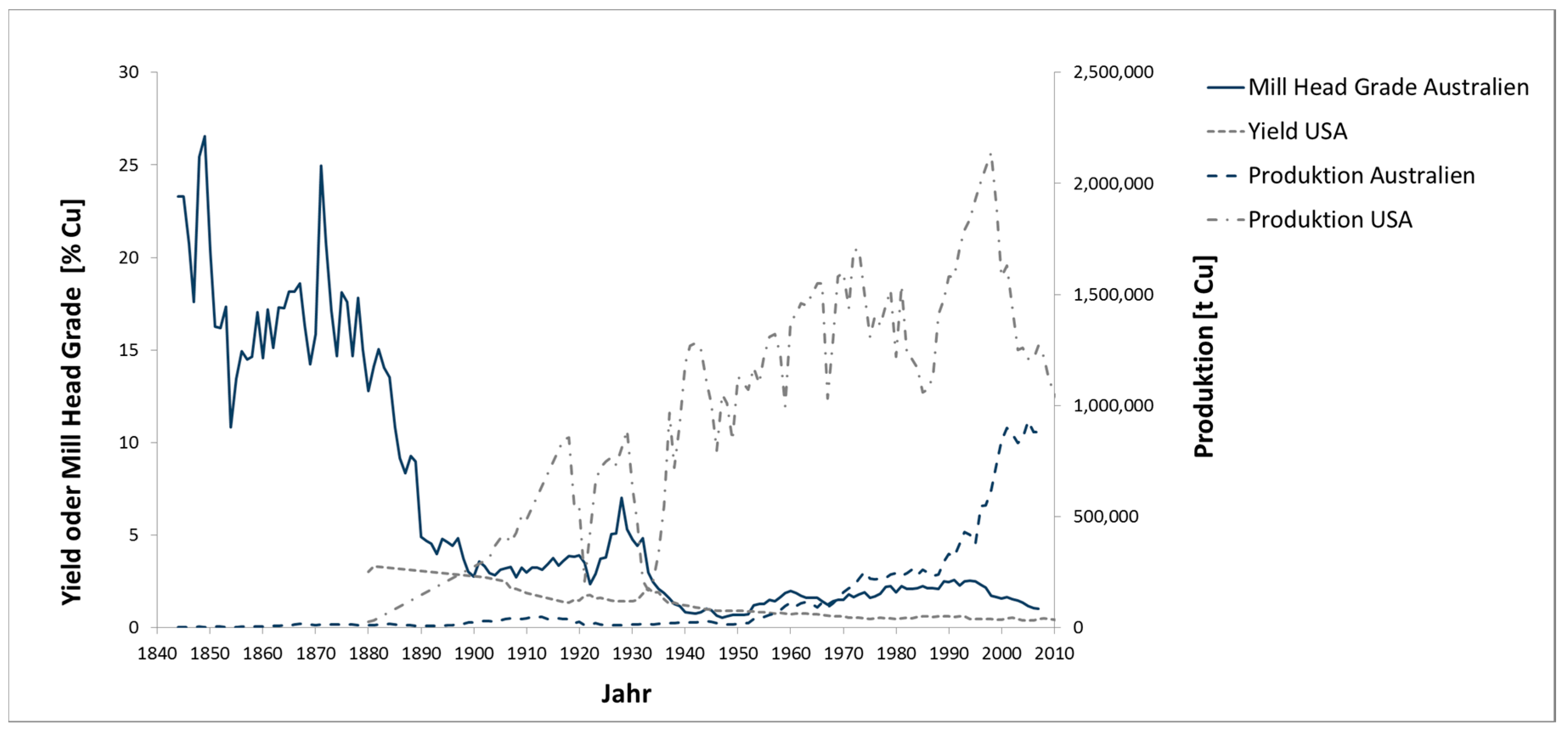

2. The Development of Ore Grades

3. Influencing Factors on the Ore Grade

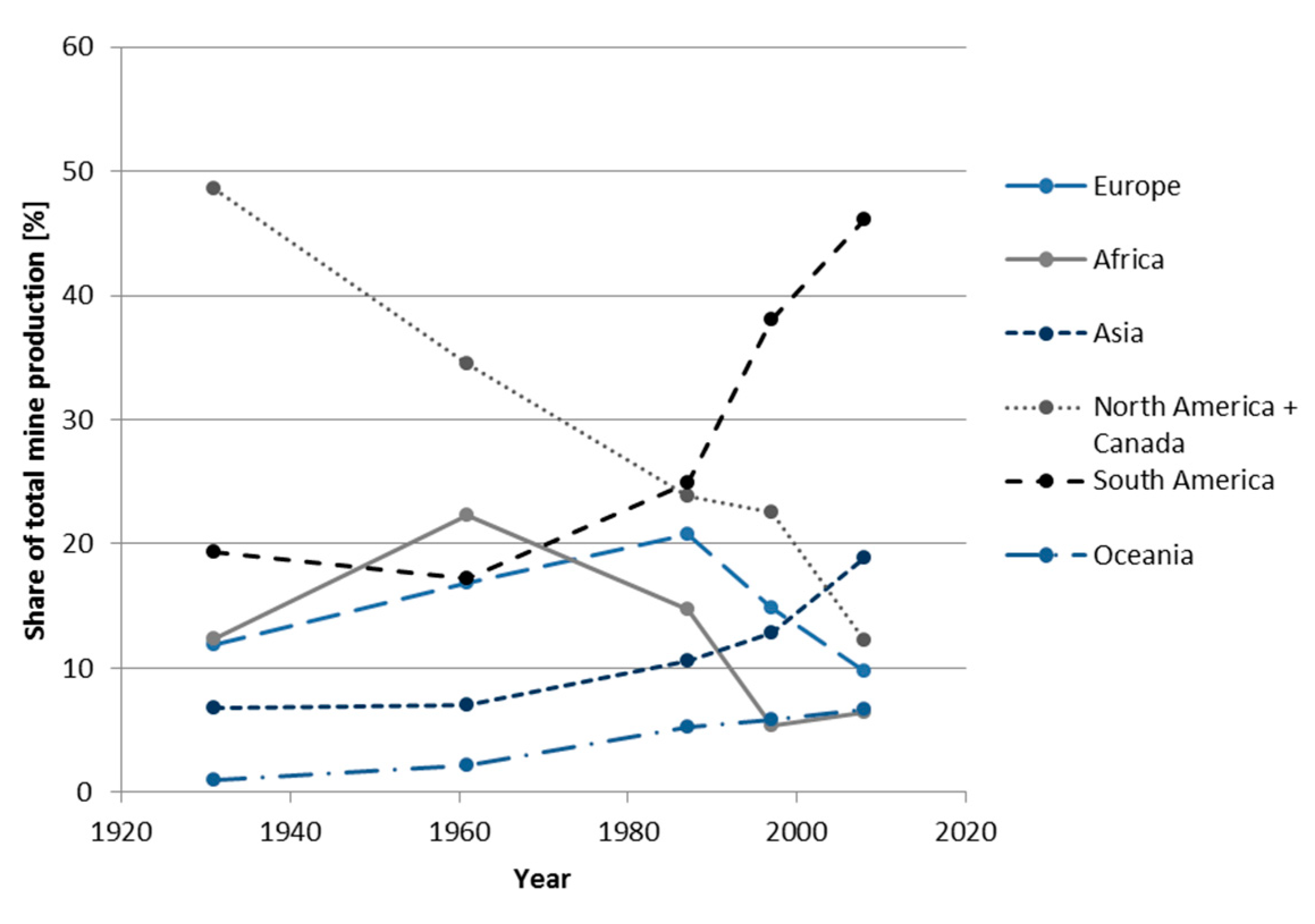

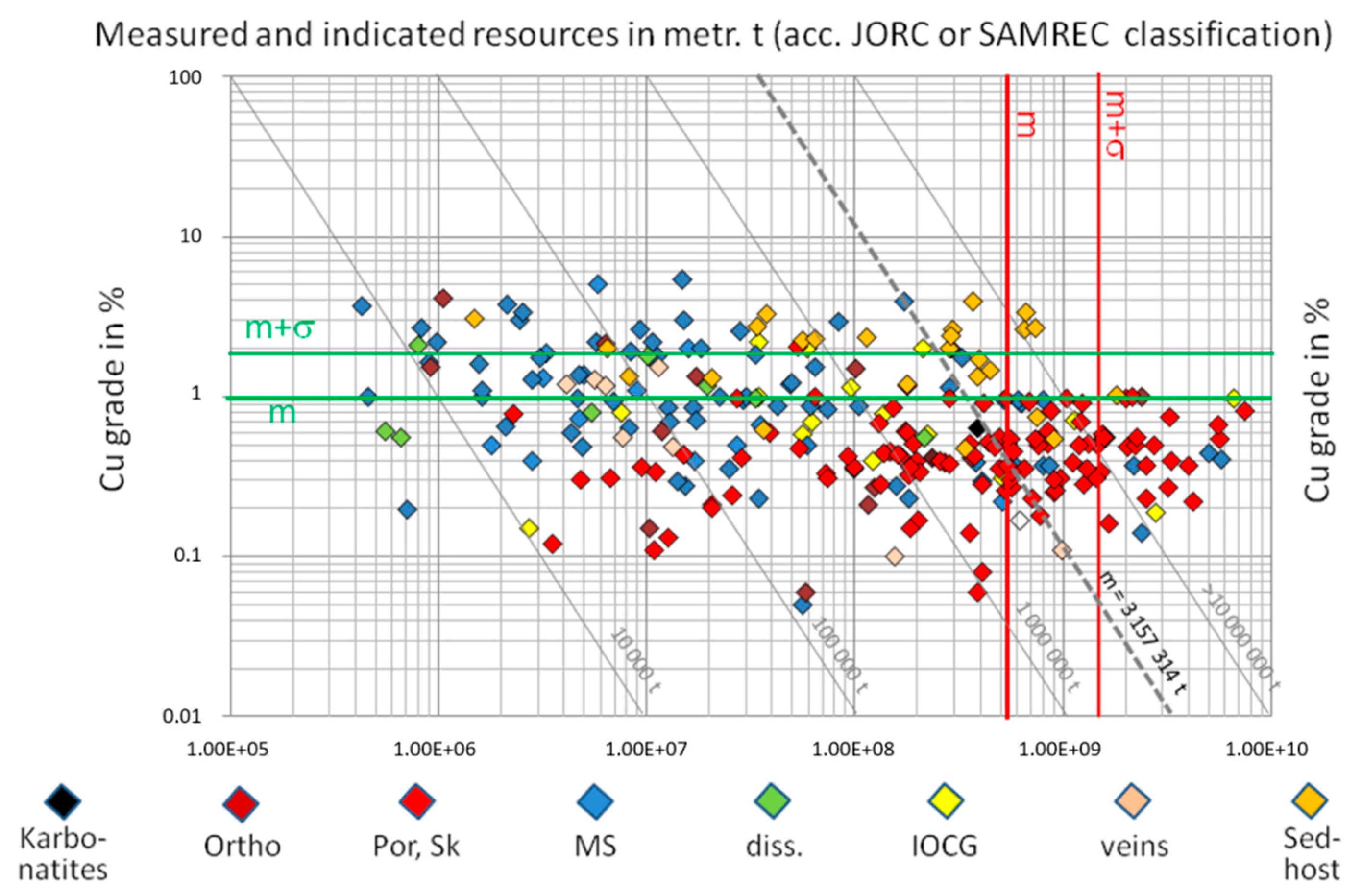

3.1. Deposit Types and Demand

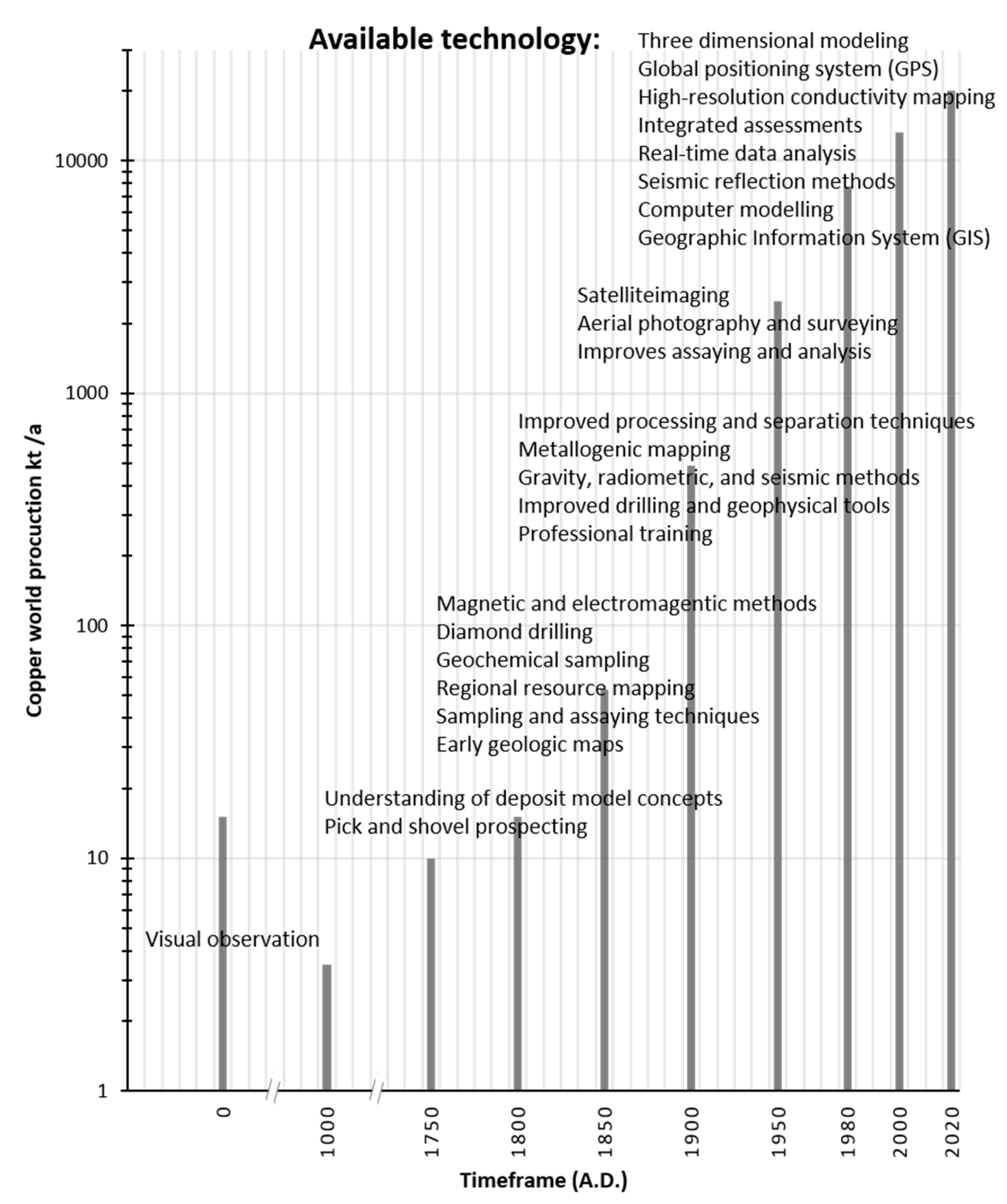

3.2. Exploration

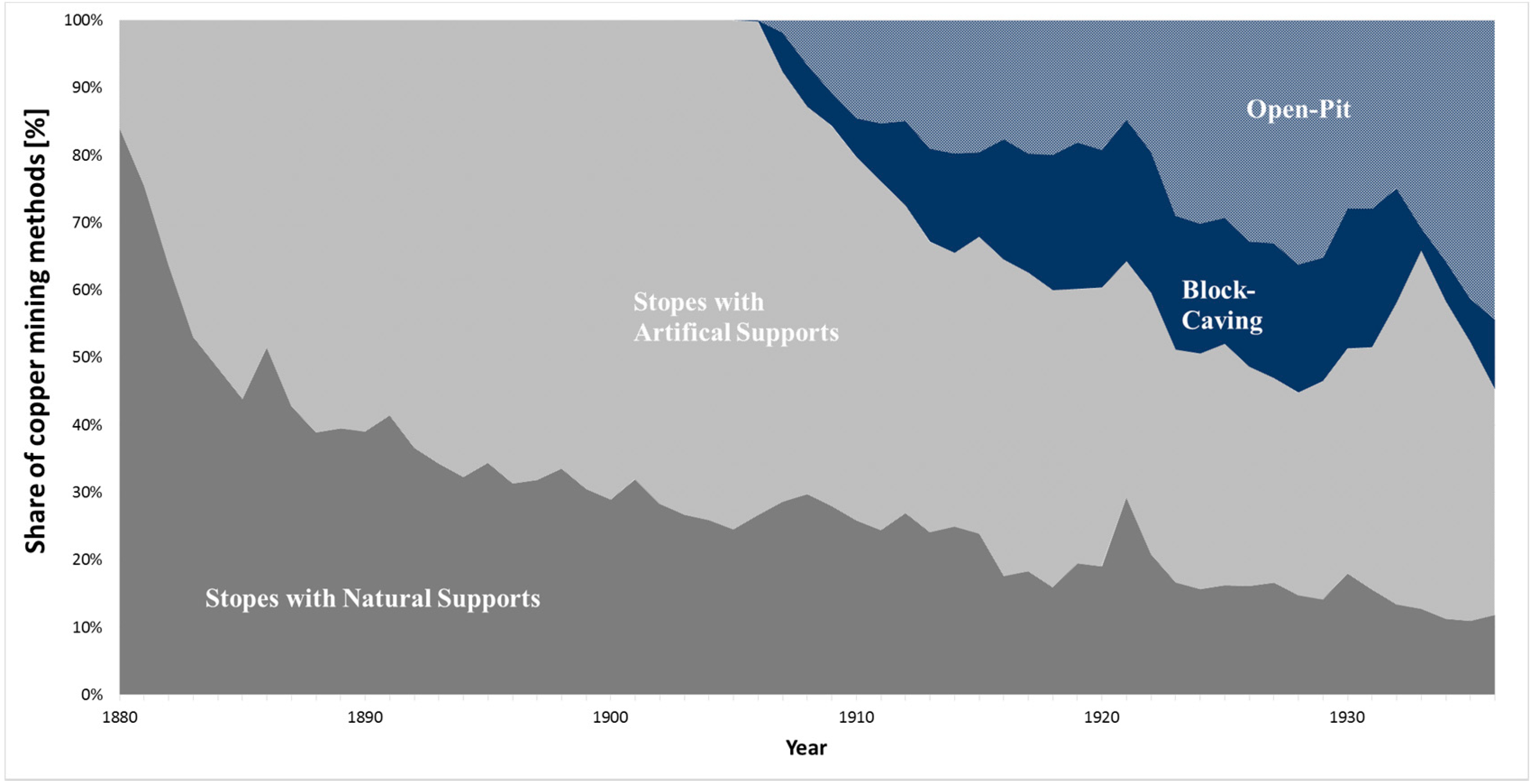

3.3. Mine Size and Structural Changes

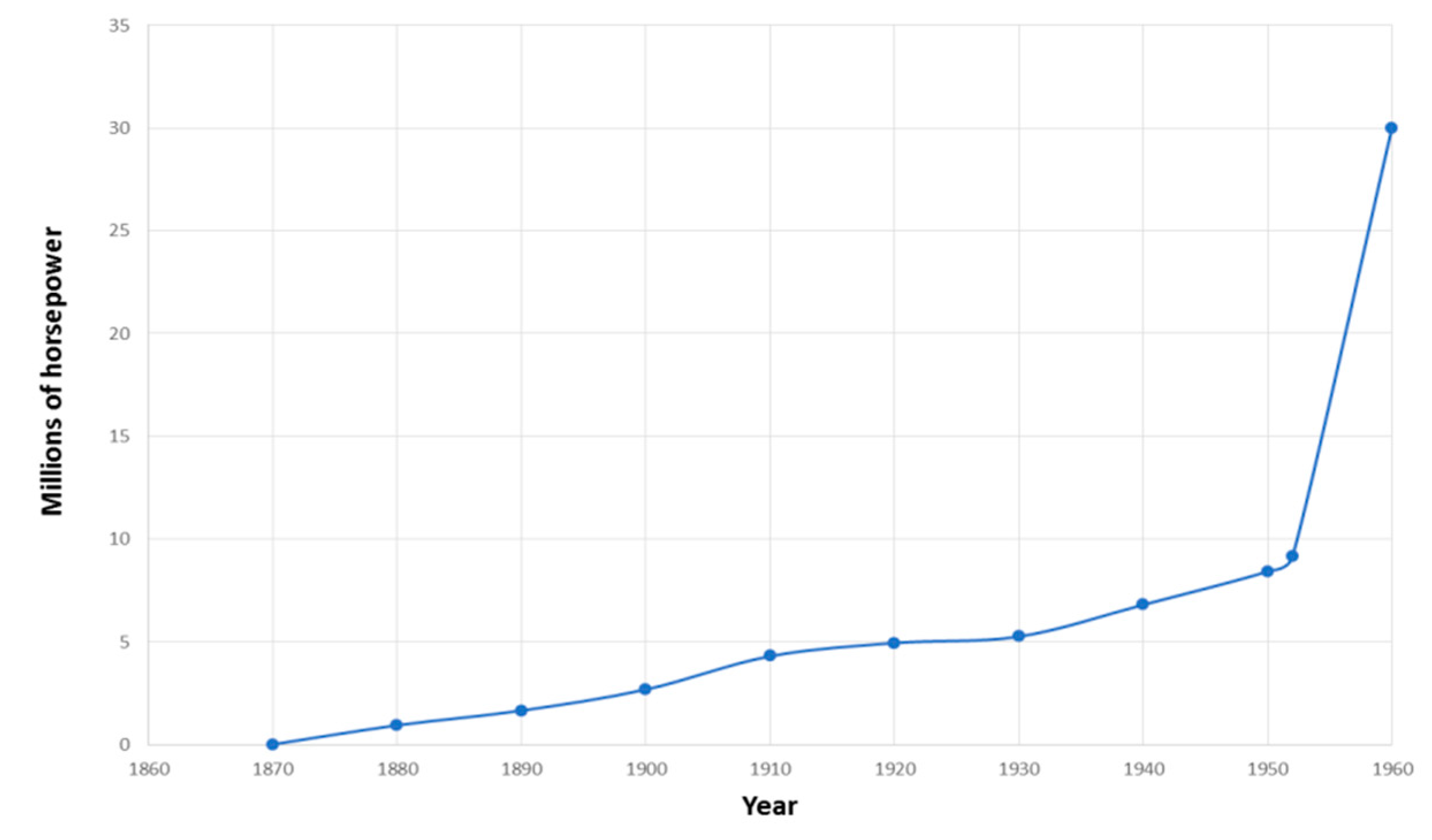

3.4. Technological Developments

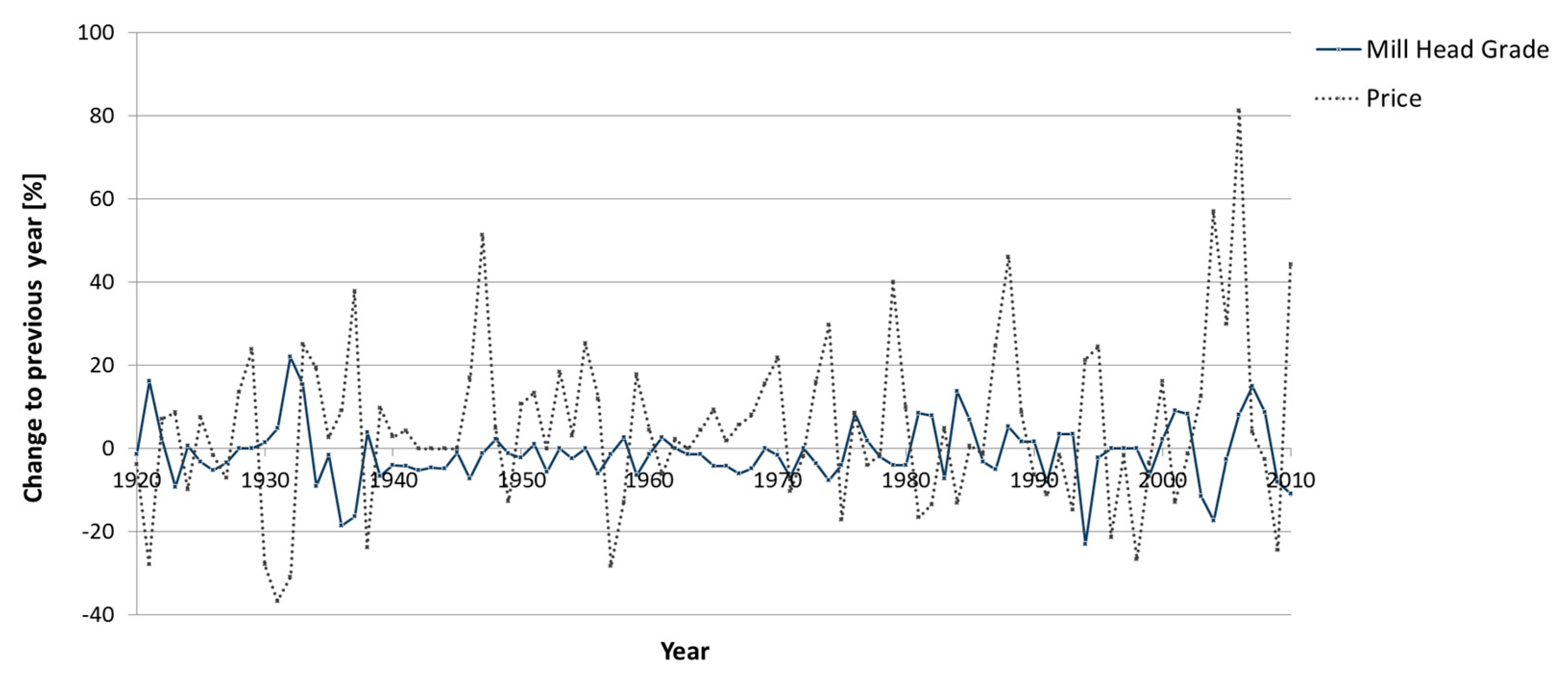

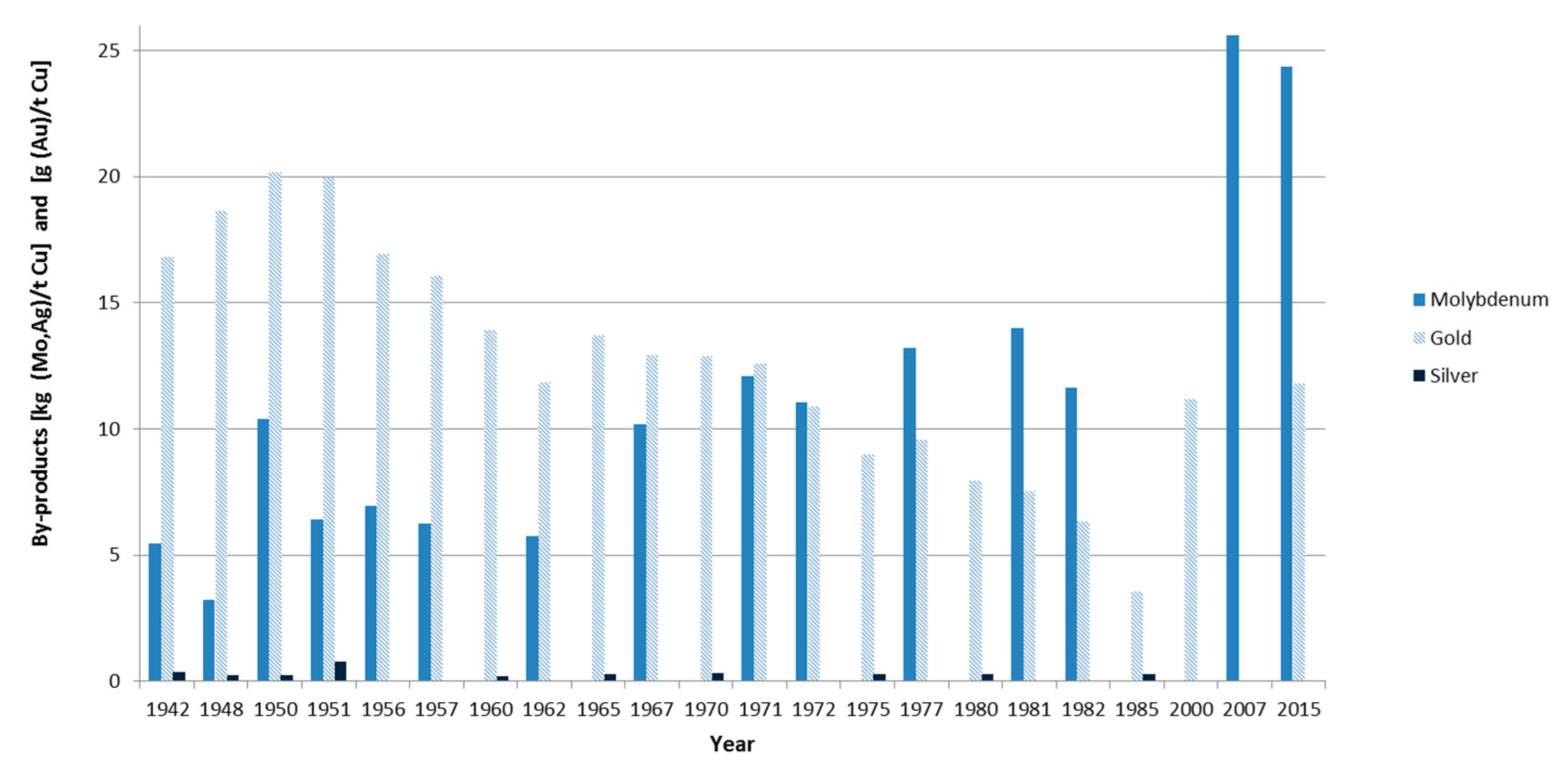

3.5. Price and By-Products

4. Discussion

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- European Commission. Report on Critical Raw Materials for the EU. Report of the Ad hoc Working Group on Defining Critical Raw Materials; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- Graedel, T.E.; Harper, E.M.; Nassar, N.T.; Nuss, P.; Reck, B.K. Criticality of metals and metalloids. Proc. Natl. Acad. Sci. USA 2015, 112, 4257–4262. [Google Scholar] [CrossRef]

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens III, W.W. The Limits to Growth. A Report for the Club of Rome’s Project on the Predicament of Mankind, 2nd ed.; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Rørbech, J.T.; Vadenbo, C.; Hellweg, S.; Astrup, T.F. Impact Assessment of Abiotic Resources in LCA: Quantitative Comparison of Selected Characterization Models. Environ. Sci. Technol. 2014, 48, 11072–11081. [Google Scholar] [CrossRef] [PubMed]

- Goedkoop, M.; Heijungs, R.; Huijbregts, M.; de Schryver, A.; Struijs, J.; van Zelm, R. ReCiPe 2008. A Life Cycle Assessment Method Which Comprises Harmonized Category Indicators at the Midpoint and the Endpoint Level; Report I: Characterisation; Ruimte en Milieu, Ministerie van Volkshuisvesting, Ruimtelijke Ordening en Milieubeheer: Amsterdam, The Netherlands, 2008. [Google Scholar]

- Jolliet, O.; Margni, M.; Charles, R.; Humbert, S.; Payet, J.; Rebitzer, G.; Rosenbaum, R. IMPACT 2002+: A new life cycle impact assessment methodology. Int. J. Life Cycle Assess. 2003, 8, 324. [Google Scholar] [CrossRef]

- Goedkoop, M.; Spriensma, R. The Eco-Indicator’99. A Damage Oriented Method for Life Cycle Impact Assessment; Methodology Report; PRé Consultants: Amersfoort, The Netherlands, 2001. [Google Scholar]

- Mudd, G.M. The Sustainability of Mining in Australia: Key Production Trends and Environmental Implications; Research Report No. RP5; Department of Civil Engineering, Monash University and Mineral Policy Institute: Melbourne, Australia, 2009. [Google Scholar]

- Northey, S.; Mohr, S.; Mudd, G.M.; Weng, Z.; Giurco, D. Modelling future copper ore grade decline based on a detailed assessment of copper resources and mining. Resour. Conserv. Recycl. 2014, 83, 190–201. [Google Scholar] [CrossRef]

- Calvo, G.; Mudd, G.M.; Valero, A.; Valero, A. Decreasing ore grades in global metallic mining: A theoretical issue or a global reality? Resources 2016, 5, 36. [Google Scholar] [CrossRef]

- Crowson, P. Some observations on copper yields and ore grades. Resour. Policy 2012, 37, 59–72. [Google Scholar] [CrossRef]

- Northey, S.A.; Mudd, G.M.; Werner, T.T. Unresolved Complexity in Assessments of Mineral Resource Depletion and Availability. Nat. Resour. Res. 2017, 543, 367. [Google Scholar] [CrossRef]

- Lasky, S.G. How tonnage and grade relationships help predict ore reserves. Eng. Mineral. J. 1950, 151, 81–85. [Google Scholar]

- Ahrens, L.H. A Fundamental Law of Geochemistry. Nature 1953, 172, 1148. [Google Scholar] [CrossRef]

- Ahrens, L.H. The lognormal distribution of the elements (A fundamental law of geochemistry and its subsidiary). Geochim. Cosmochim. Acta 1954, 5, 49–73. [Google Scholar] [CrossRef]

- Skinner, B.J. Second iron age ahead. Am. Sci 1976, 64, 258–269. [Google Scholar]

- USGS. Minerals Yearbook: Volume I.—Metals and Minerals. Years 1932–2015. Available online: https://minerals.usgs.gov/minerals/pubs/commodity/myb/ (accessed on 10 October 2018).

- Leong, Y.S.; Erdreich, E.; Burrit, J.C.; Kiessling, O.E.; Nighman, C.E.; Heikes, G.C. Technology, Employment and Output per Man in Copper Mining; Works Projects Administration National Research Project E-12; Work Projects Administration, National Research Project in cooperation with Dept. of the Interior, Bureau of Mines: Philadelphia, PA, USA, 1940. [Google Scholar]

- Schodde, R. The key drivers behind resource growth: An analysis of the copper industry over the last 100 years. Presented at the MEMS Conference Mineral and Metal Markets over the Long Turn, Phoenix, AZ, USA, 3 March 2010. [Google Scholar]

- Weber, L. Interpretation von Reserven- und Ressourcenangaben aus wirtschaftsgeologischer Sicht. Berg Huettenmaenn. Monatsh. 2015, 160, 71–78. [Google Scholar] [CrossRef]

- Jaireth, S.; Porritt, K.; Hoatson, D.M. Australian Copper Resources: Sheet 2: Deposit Types. 1:10,000,000 Scale Map. Available online: https://www.data.gov.au/dataset/australian-copper-resources-sheet-1-resources-by-region-sheet-2-deposit-types-may-2010 (accessed on 20 December 2017).

- Weber, L.; (Vienna, Austria). Personal communication, 2016.

- Corry, A.W.; Kiessling, O.E. Mineral Technology and Output per Man Studies. Grade of Ore; Works Projects Administration National Research Project E-6: Philadelphia, PA, USA, 1938. [Google Scholar]

- Gordon, R.B. Production residues in copper technological cycles. Resour. Conserv. Recyl. 2002, 36, 87–106. [Google Scholar] [CrossRef]

- Wellmer, F.-W. Wie lange reichen unsere Rohstoffvorräte?—Was sind Reserven und Ressourcen? UmweltWirtschaftsForum 2014, 22, 125–132. [Google Scholar] [CrossRef]

- Anderson, D.L. Theory of the Earth; Blackwell Scientific Publ.: Boston, MA, USA, 1989. [Google Scholar]

- Javoy, M. Chemical earth models. C. R. l’Acad. Sci.-Ser. IIA-Earth Planet. Sci. 1999, 329, 537–555. [Google Scholar] [CrossRef]

- Grotzinger, J.; Jordan, T. Press/Siever Allgemeine Geologie, 7th ed.; Springer Spektrum: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Rudnick, R.L.; Gao, S. Composition of the Continental Crust. In Treatise on Geochemistry, 2nd ed.; Holland, H.D., Turekian, K., Eds.; Elsevier: Oxford, UK, 2014; pp. 1–51. [Google Scholar]

- Evans, A.M. Erzlagerstättenkunde; Ferdinand Enke: Stuttgart, Germany, 1992. [Google Scholar]

- Evans, A.M. Ore Geology and Industrial Minerals. An Introduction, 3rd ed.; Blackwell Publ.: Malden, MA, USA, 2012. [Google Scholar]

- Nevsun Resources Ltd. Timok Project: Company Website. Available online: https://www.nevsun.com/projects/timok-project/ (accessed on 30 July 2018).

- Nevsun Resources Ltd. 2017 Press Releases: Mineral Resource Statement for Timok Upper Zone Project-Cukaru Peki Deposit-Serbia. Available online: http://www.nevsun.com/news/2017/october26-updated-pea-for-timok-upper-zone-copper-project/ (accessed on 6 December 2018).

- West, J. Decreasing metal ore grades: Are they really being driven by the depletion of high-grade deposits? J. Ind. Ecol. 2011, 15, 165–168. [Google Scholar] [CrossRef]

- Winter Birrell, R. The Development of Mining Technology in Australia. Ph.D. Thesis, University of Melbourne, Melbourne, Australia, 2005. [Google Scholar]

- Wilburn, D.R.; Goonan, T.G.; Bleiwas, D.I. Technological Advancement. A Factor in Increasing Resource Use; Open File Report 2001-197, Version 1.03; 2001. Available online: https://pubs.er.usgs.gov/publication/ofr01197 (accessed on 21 December 2017).

- Peters, W.C. Exploration and Mining Geology, 2nd ed.; John Wiley and Sons Inc.: New York, NY, USA, 1987. [Google Scholar]

- Wellmer, F.-W.; Böttcher, G.; Schmidt, H. Gewinnung mineralischer Rohstoffe und IDNDR. Geographische Rundschau 1994, 46, 450–456. [Google Scholar]

- Tilton, J.E.; Lagos, G. Assessing the long-run availability of copper. Resour. Policy 2007, 32, 19–23. [Google Scholar] [CrossRef]

- Mudd, G.M.; Jowitt, S.M. Growing Global Copper Resources, Reserves and Production: Discovery Is Not the Only Control on Supply. Econ. Geol. 2018, 113, 1235–1267. [Google Scholar] [CrossRef]

- Wellmer, F.-W.; Buchholz, P.; Gutzmer, J.; Hagelüken, C.; Herzig, P.; Littke, R.; Thauer, R.K. Raw Materials for Future Energy Supply; Springer: Cham, Switzerland, 2018. [Google Scholar]

- Bardi, U. Extracted. How the Quest for Mineral Wealth Is Plundering the Planet; Chelsea Green Pub Co.: White River Junction, VT, USA, 2014. [Google Scholar]

- Crowson, P. Mine size and the structure of costs. Resour. Policy 2003, 29, 15–36. [Google Scholar] [CrossRef]

- Schodde, R. What Do We Mean by a World-Class.-Deposit? And Why Are They Special? Presented at the AMEC Conference, Perth, Australia, 8 June 2006. [Google Scholar]

- Julihn, C.E.; Meyer, H.M. Minerals Yearbook 1932–1933; Kiessling, O.E., Ed.; United States Government Printing Office: Washington, DC, USA, 1933.

- Brunn, S.D. Engineering Earth. The Impacts of Megaengineering Projects; Springer: Dordrecht, The Netherlands, 2011. [Google Scholar]

- Arrington, L.J.; Hansen, G.B. The Richest Hole on Earth. A History of the Bingham Copper Mine; Utah State University Press: Logan, UT, USA, 1963. [Google Scholar]

- David, A.P.; Wright, G. Increasing returns and the genesis of American resource abundance. Ind. Corp Chang. 1997, 6, 203–245. [Google Scholar] [CrossRef]

- Hustrulid, W.A.; Bullock, R.C. Underground Mining Methods. Engineering Fundamentals and International Case Studies; Society for Mining, Metallurgy, and Exploration: Littleton, CO, USA, 2001. [Google Scholar]

- Giurco, D. Towards Sustainable Metal Cycles: The Case of Copper. Ph.D. Thesis, University of Sydney, Sydney, Australia, 2005. [Google Scholar]

- Committee on Resources and Man. Resources and Man. A Study and Recommendations; W. H. Freeman and Company: San Francisco, CA, USA, 1969.

- Furness, J.W.; Meyer, H.M. Copper. In Minerals Yearbook 1938; Hughes, H.H., Ed.; United States Government Printing Office: Washington, DC, USA, 1938; pp. 81–108. [Google Scholar]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rötzer, N.; Schmidt, M. Decreasing Metal Ore Grades—Is the Fear of Resource Depletion Justified? Resources 2018, 7, 88. https://doi.org/10.3390/resources7040088

Rötzer N, Schmidt M. Decreasing Metal Ore Grades—Is the Fear of Resource Depletion Justified? Resources. 2018; 7(4):88. https://doi.org/10.3390/resources7040088

Chicago/Turabian StyleRötzer, Nadine, and Mario Schmidt. 2018. "Decreasing Metal Ore Grades—Is the Fear of Resource Depletion Justified?" Resources 7, no. 4: 88. https://doi.org/10.3390/resources7040088

APA StyleRötzer, N., & Schmidt, M. (2018). Decreasing Metal Ore Grades—Is the Fear of Resource Depletion Justified? Resources, 7(4), 88. https://doi.org/10.3390/resources7040088