The Impact of Pay-As-You-Throw Schemes on Municipal Solid Waste Management: The Exemplar Case of the County of Aschaffenburg, Germany

Abstract

:1. Introduction

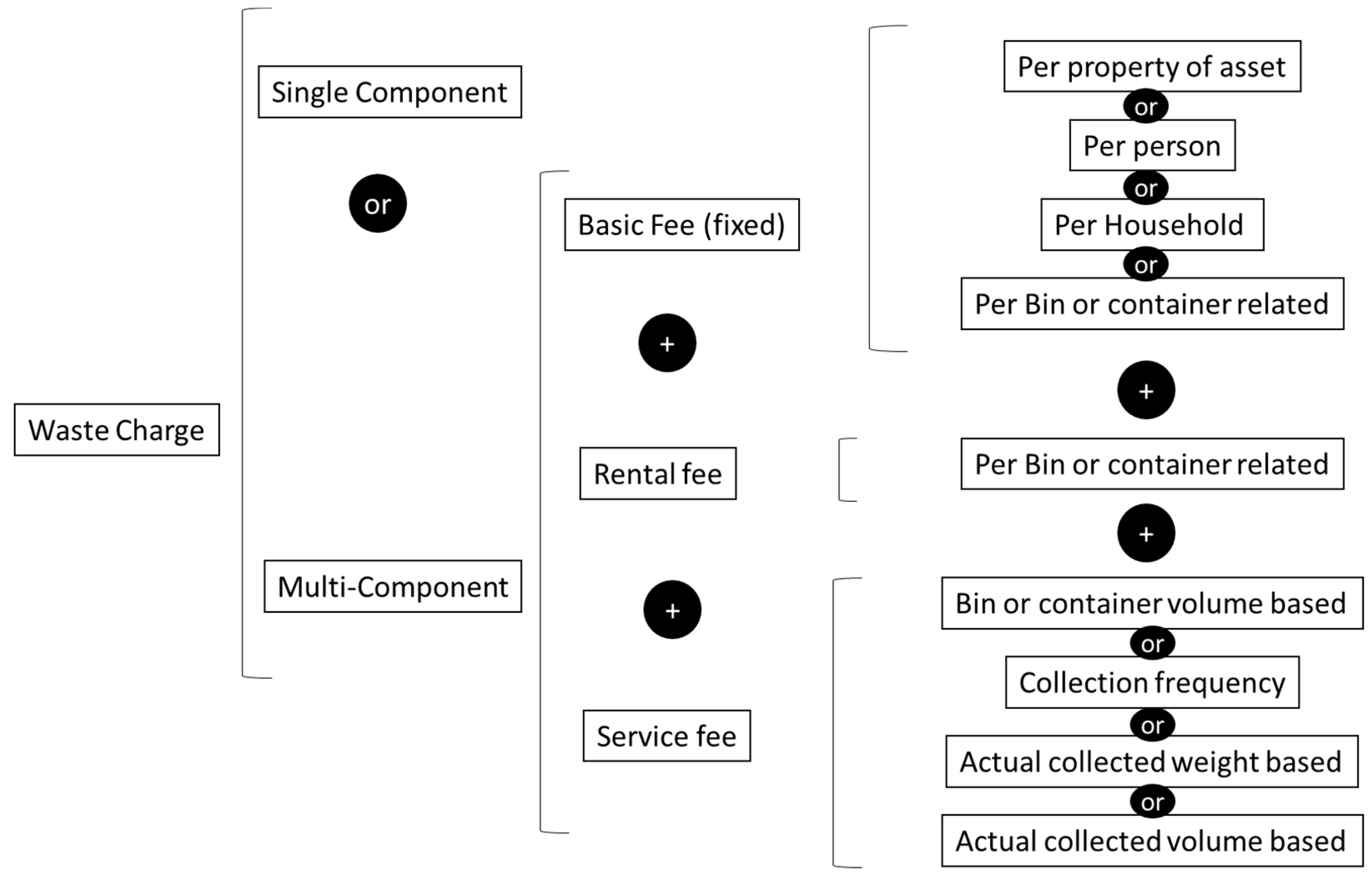

1.1. Fundamentals of Pay-As-You-Throw

- -

- Per user identifier:

- ▪

- Volume-based accounting

- ▪

- Weight-based accounting

- -

- Per bin identifier (individually or collectively assigned bins)

- ▪

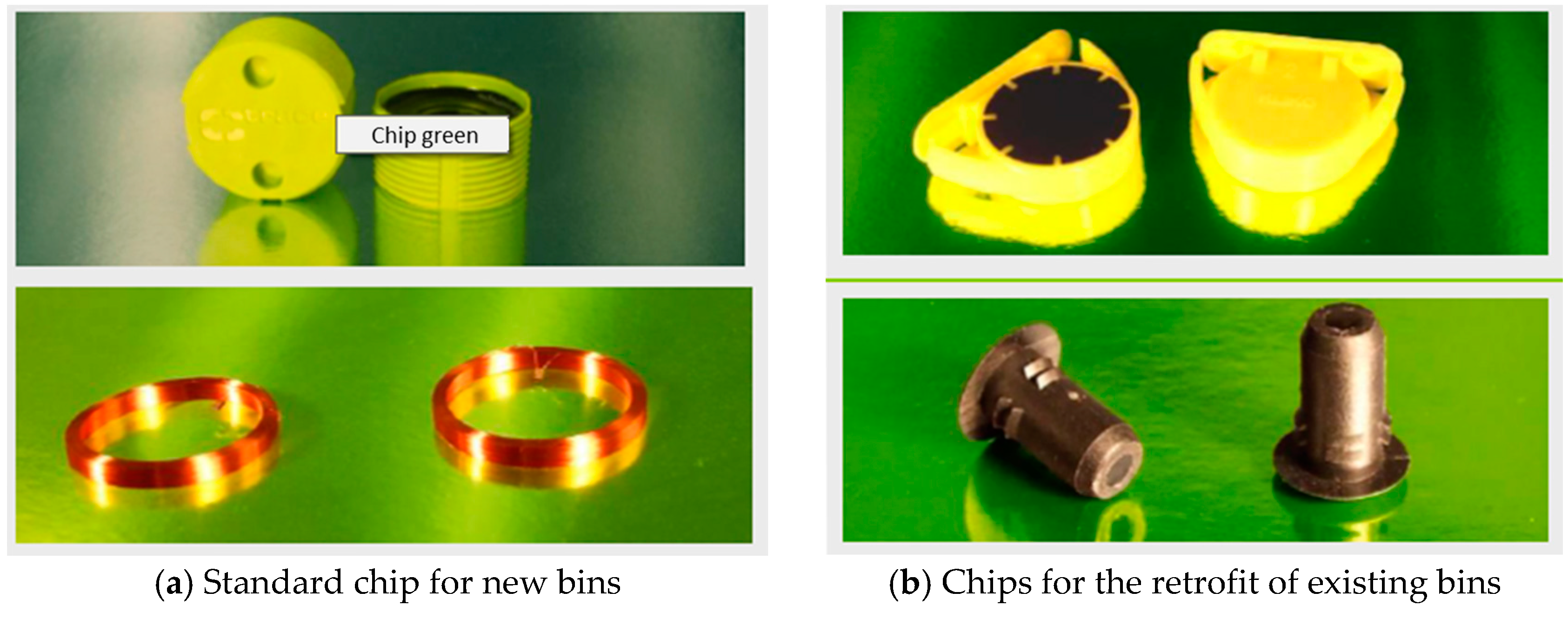

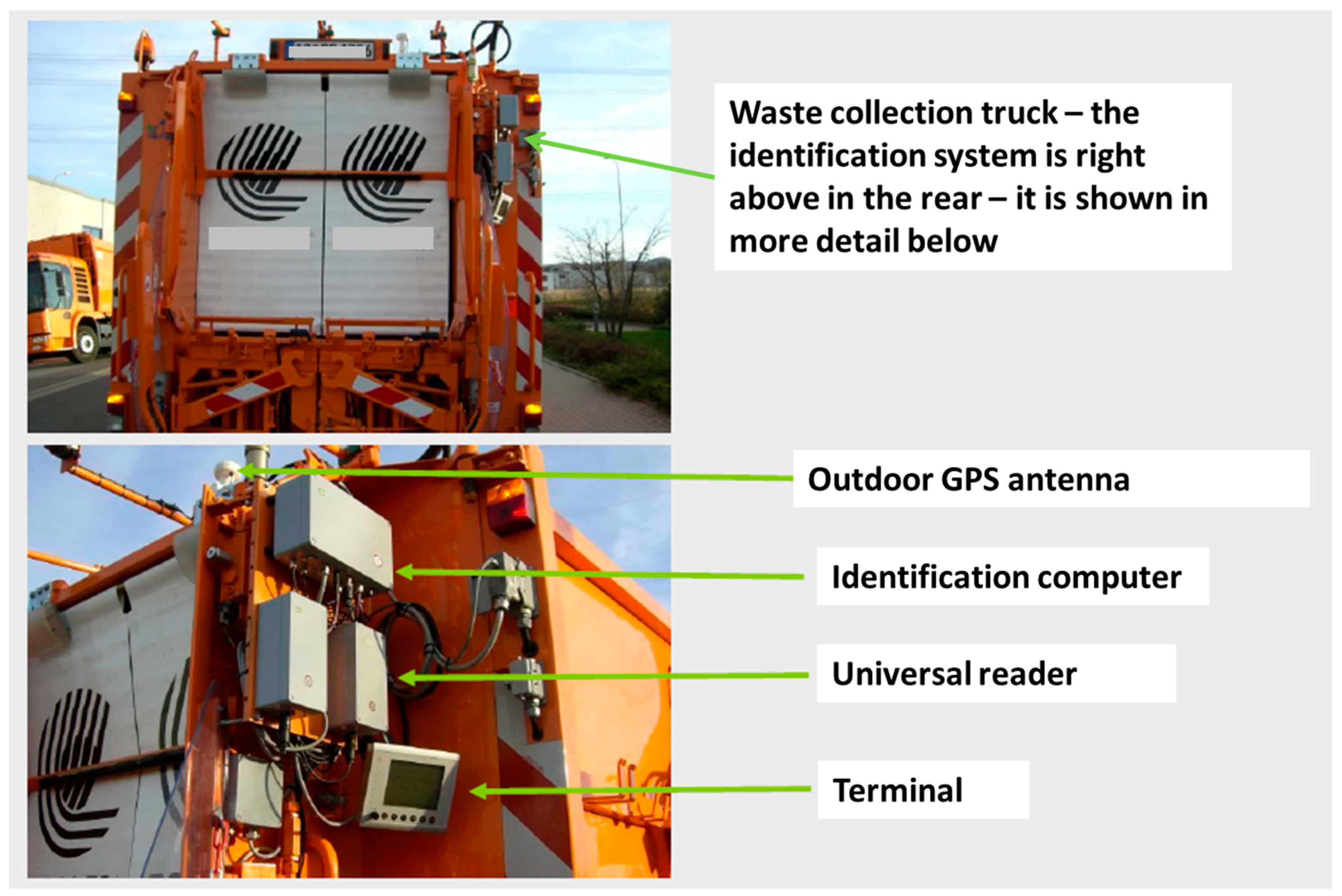

- Volume-based accounting (identification system)

- ▪

- Weight-based accounting

- -

- Pre-paid systems

- ▪

- Pre-paid sack

- ▪

- Tag, sticker, or token

1.2. The County of Aschaffenburg

1.3. PAYT as a Best Environmental Management Practice

- -

- Collection rate of recyclable materials (%). This indicator is frequently reported as “recycling rate”, but, given the amount of rejects from existing sorting and recycling plants, the term recyclables collection rate is preferred to avoid its misinterpretation. PAYT schemes are designed to increase the amount of recovered recyclable materials from municipal solid waste, so their implementation should increase values for this indicator.

- -

- Residual waste (kg·cap−1·yr−1). This is the amount of waste that the system user disposes in the residual waste bin. For practical recording reasons, this definition excludes the amount of waste rejected in recycling or sorting plants from the separately collected recyclable waste fraction(s) or illegally disposed waste.

1.4. Aim

2. Implementation of the System

3. Results

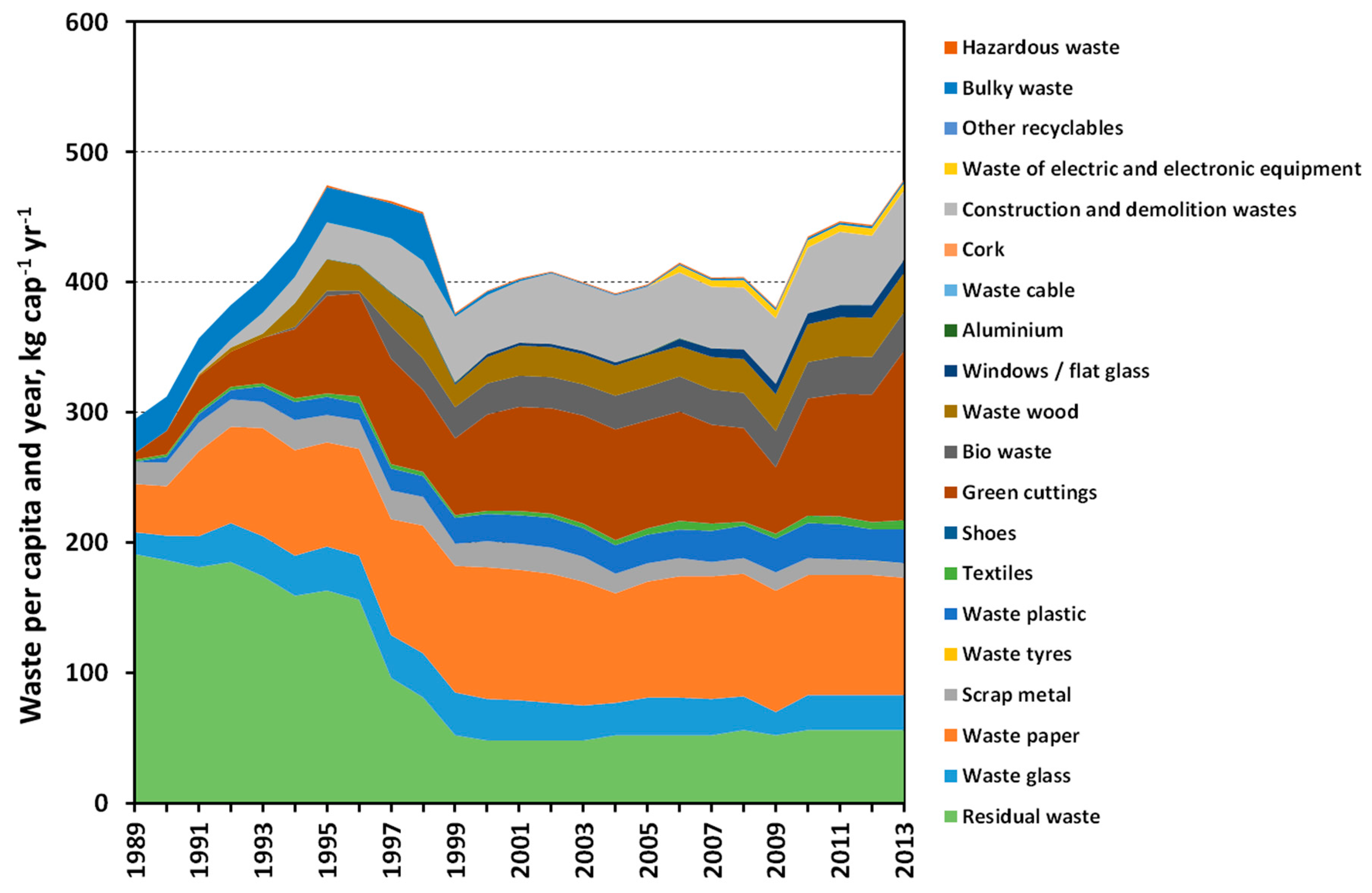

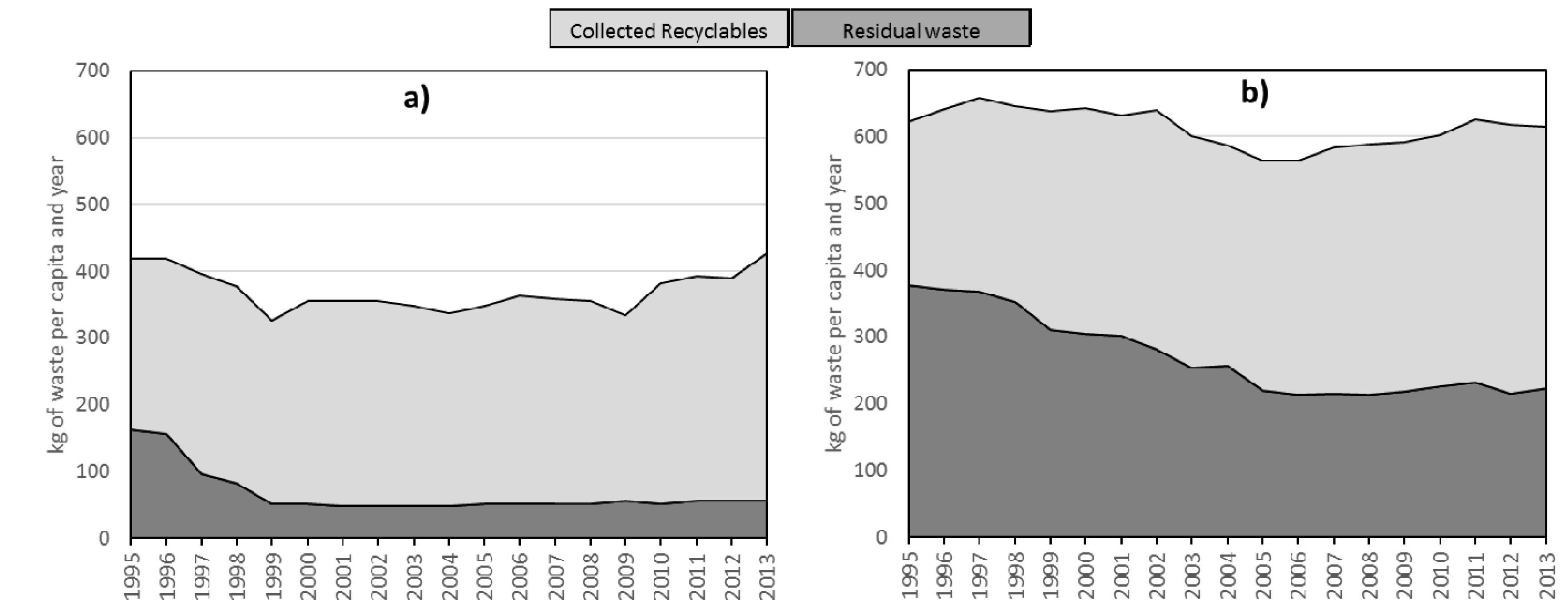

3.1. Environmental Performance

- -

- the use of a weighing system

- -

- provision of an extensive infrastructure for the collection of recyclable waste streams (see Table 1)

- -

- a high level of environmental awareness and active support from the citizens

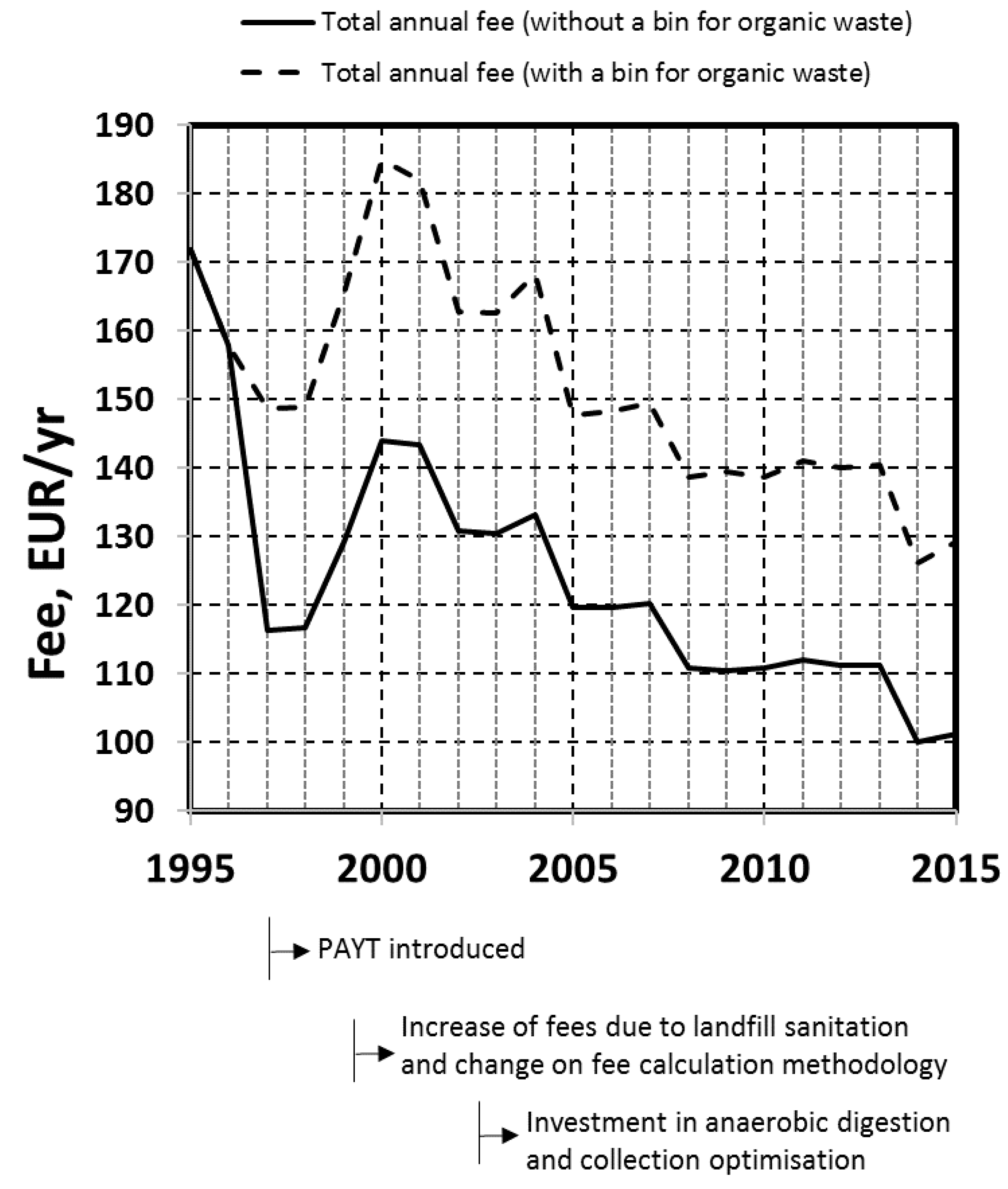

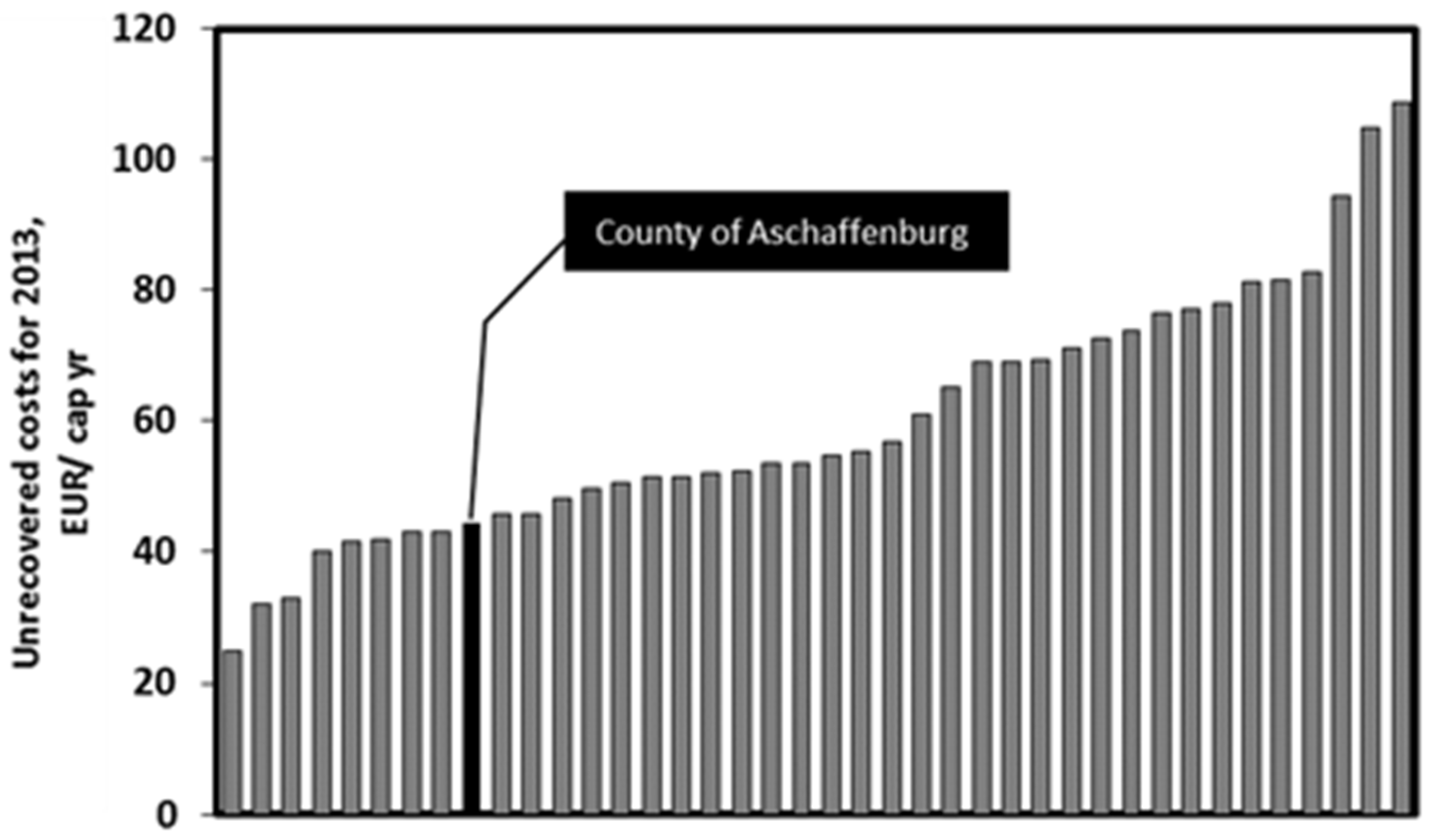

3.2. Economic Implications

- costs for collecting the different waste fractions (e.g., residual waste, bio waste, and paper)

- costs for the treatment/disposal of residual waste (e.g., incineration) and the recycling/energy recovery of waste fractions, distinguishing between municipality-owned and third-party plants

- costs for the operation, closure, and management of legacy landfills (leachate treatment, landscaping, etc.)

- costs for staff and administration related to waste management

- miscellaneous costs

- by private waste management companies on behalf of the municipality

- by the municipality itself

- by municipalities providing services for another municipality

- selling electricity or/and heat from the incineration of refuse derived fuels, residual waste, and biogas from the anaerobic digestion of bio waste or from landfills

- selling biogas from anaerobic digestion

- selling separately collected or separated paper/cardboard

- selling separately collected packaging

- selling separately collected or separated scrap metal

- selling compost

- fees charged to businesses for waste collection and disposal

4. Discussion

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Impacts on Unit-Based Waste Collection Charges. Available online: http://www1.oecd.org/officialdocuments/publicdisplaydocumentpdf/?cote=ENV/EPOC/WGWPR(2005)10/FINAL&docLanguage=En (accessed on 5 September 2016).

- Van Beukering, P.J.H.; Bartelings, H.; Linderhof, V.G.M.; Oosterhuis, F.H. Effectiveness of unit-based pricing of waste in the Netherlands: Applying a general equilibrium model. Waste Manag. 2009, 29, 2892–2901. [Google Scholar] [CrossRef] [PubMed]

- Dijkgraaf, E.; Gradus, R.H.J.M. Cost savings in unit-based pricing of household waste: The case of the Netherlands. Resour. Energy Econ. 2004, 26, 353–371. [Google Scholar] [CrossRef]

- Handbook on the Implementation of Pay-As-You-Throw as a Tool for Urban Management; Bilitewski, B.; Werner, P.; Reichenbach, J. (Eds.) Institute of Waste Management and Contaminated Site Treatment of Dresden University of Technology: Pirna, Germany, 2004.

- Bilitewski, B. From traditional to modern fee systems. Waste Manag. 2008, 28, 2760–2766. [Google Scholar] [CrossRef] [PubMed]

- Bilitewski, B.; Haerdtle, G.; Marek, K. Waste Management; Springer: Berlin, Germany, 1997; p. 650. [Google Scholar]

- Reichenbach, J. Status and prospects of pay-as-you-throw in Europe—A review of pilot research and implementation studies. Waste Manag. 2008, 28, 2809–2814. [Google Scholar] [CrossRef] [PubMed]

- Puig-Ventosa, I. Charging systems and PAYT experiences for waste management in Spain. Waste Manag. 2008, 28, 2767–2771. [Google Scholar] [CrossRef] [PubMed]

- Watkins, E.; Mitsios, A.; Mudgal, S.; Neubauer, A.; Reisinger, H.; Troeltzsch, J.; van Acoleyen, M. Use of Economic Instruments and Waste Management Performances. Available online: http://ec.europa.eu/environment/waste/pdf/final_report_10042012.pdf (accessed on 5 September 2016).

- County of Aschaffenburg. Proposal of the Waste Fee Dated 09.08.1995, submitted to the Council of the County (In German). 1995. Available online: http://www.landkreis-aschaffenburg.de (accessed on 5 September 2016).

- Conto, P. Contarina Spa. Verso l’obiettivo dei 10 kg/ab All’anno di Rifiuti Residui nel Trevigiano. 2015. Available online: http://www.forumrifiuti.it/files/forumrifiuti/docs/conto.pdf (accessed on 15 November 2015).

- Contarina Spa. Integrated Waste Management. 2015. Available online: http://www.contarina.it/files/en/ppt.pdf (accessed on 5 December 2015).

- Fedrizzi, S. Progetto di Riduzione dei Rifiuti nel Comune di Trento—Strategie di Prevenzione dei Rifiuti. 2015. Available online: http://blank.ecomondo.com/upload_ist/AllegatiProgrammaEventi/Fedrizzi_2508495.pdf (accessed on 5 December 2015).

- Regions for Recycling (R4R). Good Practice Flanders PAYT. 2014. Available online: http://www.regions4recycling.eu/upload/public/Good-Practices/GP_OVAM_PAYT.pdf (accessed on 5 December 2015).

- European Union. Regulation (EC) No 1221/2009 of the European Parliament and of the Council of 25 November 2009 on the Voluntary Participation by Organisations in a Community Eco-Management and Audit Scheme (EMAS), Repealing Regulation (EC) No 761/2001 and Commission Decisions 2001/681/EC and 2006/193/EC; Regulation 1221/2009; European Commission: Brussels, Belgium, 2009; pp. 1–45. [Google Scholar]

- Zeschmar-Lahl, B.; Schoenberger, H.; Styles, D.; Galvez-Martos, J.L. Background Report on Best Environmental Management Practice in the Waste Management Sector. Report for the European Commission’s Joint Research Centre, Seville, 2016. Available online: http://www.bzl-gmbh.de/de/sites/default/files/WasteManagementBackgroundReport.pdf (accessed on 5 September 2016).

- European Union. Council Directive (90/269/EEC) of 29 May 1990 on the minimum health and safety requirements for the manual handling of loads where there is a risk particularly of back injury to workers, (Fourth individual Directive within the meaning of article 16 (1) of Directive 89/391/EEC); European Commission: Brussels, Belgium, 1990; pp. 9–15. [Google Scholar]

- C-trace; Bielefeld, Germany. Personal Communication, 2014.

- County of Aschaffenburg. Erfahrungen bei der Einfuehrung Eines Identsystems mit Verwiegung (Experiences with the Introduction of an Identification System with Weighing). (In German)2013. Available online: http://www.landkreis-aschaffenburg.de/__tools/dl_tmp/www.landkreis-aschaffenburg.de/PG2C92G3784316G22FB/Informationen_zum_Wiegesystem.pdf (accessed on 5 September 2016).

- County of Aschaffenburg, Abfallwirtschaftsbericht 2013 (Waste Management Report 2013). (In German)Available online: http://www.landkreis-aschaffenburg.de/__tools/dl_tmp/www.landkreis-aschaffenburg.de/PH28D5H3343093H22FB/Abfallwirtschaftsbericht_2012_k.pdf (accessed on 5 September 2016).

- Abfallberatung Unterfranken, 2016: Landkreis Aschaffenburg: Abfallwirtschaftlicher Steckbrief (In German). Available online: http://www.abfallberatung-unterfranken.de/landkreis_aschaffenburg.html (accessed on 10 January 2017).

- Eurostat, Statistics Database. 2014. Available online: http://ec.europa.eu/eurostat (accessed on 15 December 2014).

- Kern, M. Orientierende Restmuellanalyse Abfallzweckverband Suedniedersachsen. Report Prepared by Witzenhausen Institut, 2012. Available online: http://www.as-nds.de/upload/Bericht_Analyse_AZV_Suedniedersachsen_2012.pdf (accessed on 23 September 2016).

- Ecoinvent Database; v.3.0; Ecoinvent: Zürich, Switzerland, 2014.

- Department for Business, Energy and Industrial Strategy. UK Government Conversion Factors for Company Reporting, 2016. Available online: https://www.gov.uk/government/publications/greenhouse-gas-reporting-conversion-factors-2016 (accessed on 12 October 2016).

- Styles, D.; Dominguez, E.M.; Chadwick, D. Environmental balance of the UK biogas sector: An evaluation by consequential life cycle assessment. Sci. Total Environ. 2016, 560–561, 241–253. [Google Scholar] [CrossRef] [PubMed]

- County of Aschaffenburg. Document on the Fee Calculation with All Figures Used after Introducing the Weight-Based System (In German). 1997. Available online: http://www.landkreis-aschaffenburg.de (accessed on 5 September 2016).

- Slavik, J.; Pavel, J. Do the variable charges really increase the effectiveness and economy of waste management? A case study of the Czech Republic. Resour. Conserv. Recycl. 2013, 70, 68–77. [Google Scholar] [CrossRef]

- IA GmbH. Abfallwirtschaftliche Gesamtkosten (Total Costs for Waste Management); IA GmbH: Munich, Germany, 2015. [Google Scholar]

- European Commission. Proposal for a Directive of the European Parliament and of the Council Amending Directive 2008/98EC 2015. Available online: http://ec.europa.eu/environment/waste/target_review.htm (accessed on 6 September 2016).

- Holmes, A.; Fulford, J.; Pitts-Tucker, C. Investigating the Impact of Recycling Incentive Schemes. Available online: https://www.serco.com/Images/Serco%20Eunomia%20Incentives%20Full%20Report_tcm3–44276.pdf (accessed on 6 September 2016).

- Orange, R. Waste Not Want Not: Sweden to Give Tax Breaks for Repairs. Available online: https://www.theguardian.com/world/2016/sep/19/waste-not-want-not-sweden-tax-breaks-repairs (accessed on 17 December 2016).

| Waste Type | Collection System |

|---|---|

| Residual waste | Residual waste bin: collection rate every 14 days, with weighing and identification; bin sizes: 120, 240, 660, or 1100 L, available upon request and with a lock |

| Reloading station: direct delivery for a fee | |

| Bio waste | Bio waste bin: collection rate every 14 days (every 7 days in the months of June, July, and August) with weighing and identification, bin sizes: 60 or 120 L |

| Garden waste/green cuttings | Household collection rounds twice per year in each municipality on advertised dates. |

| Delivery to municipal collection and shredding sites, or to the district recycling centre | |

| Waste paper | Paper bin (blue bin), which has been introduced throughout the entire county, four-week collection; bin sizes: 240, or 1100 L |

| Collection by a non-profit association, infrequent in every municipality | |

| 30 collection centres (also known as “container parks” or “civic amenity sites”) | |

| Sales packaging | Yellow recycling bags for light packaging: monthly collection |

| Metals: depot containers (180 locations) | |

| Glass: depot containers for white, green, and brown glass (180 locations) | |

| Bulky waste for disposal | Collection on call, written registration required, fee by weight |

| Reloading station: direct delivery for a fee | |

| Bulky waste for recycling | Waste wood, scrap metal, and electrical appliances (white goods, refrigerators, and display units) are collected twice a year at the kerbside with fixed collection schedules. |

| Special waste (hazardous waste in small quantities) | Mobile collection, twice a year in each municipality (46 stopping points) |

| Year-round acceptance of small quantities in the district recycling yard | |

| Collection centres | Waste metal, waste wood, flat glass, cans, hollow glass, waste paper, rubble, electrical appliances (IT and entertainment devices), non-ferrous metals, CDs, corks, used cooking oils, PU foam cans, and textiles |

| Waste Type | 1995 (A) | 2000 PAYT (B) | 2000 BAU (C) | Absolute Change (B−A) | PAYT Effect (B−C) |

|---|---|---|---|---|---|

| kg·cap−1·yr−1 | |||||

| Residual waste | 163.0 | 48.0 | 132.0 | −115.0 | −84.0 |

| Aluminium | 0.2 | 0.1 | 0.2 | −0.1 | −0.1 |

| Paper and cardboard | 80.0 | 101.0 | 85.7 | +21.0 | +15.3 |

| Mixed plastics | 14.0 | 21.0 | 15.9 | +7.0 | +5.1 |

| Glass | 34.0 | 32.0 | 33.5 | −2.0 | −1.5 |

| Steel & iron | 21.0 | 20.0 | 20.7 | −1.0 | −0.7 |

| Food waste | 4.0 | 24.0 | 9.4 | +20.0 | +14.6 |

| Green waste | 75.0 | 74.0 | 74.7 | −1.0 | −0.7 |

| Woody waste | 24.0 | 20.0 | 22.9 | −4.0 | −2.9 |

| Textiles | 2.6 | 2.4 | 2.5 | −0.2 | −0.1 |

| Construction | 28.0 | 45.0 | 32.6 | +17.0 | +12.4 |

| Hazardous | 1.5 | 0.6 | 1.3 | −0.9 | −0.7 |

| Bulky | 27.0 | 2.7 | 20.5 | −24.3 | −17.8 |

| Commercial | 0.0 | 10.0 | 10.0 | +10.0 | +10.0 |

| Change in residual waste not accounted for by increase in major separated fractions * | −50.0 | −36.5 | |||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Morlok, J.; Schoenberger, H.; Styles, D.; Galvez-Martos, J.-L.; Zeschmar-Lahl, B. The Impact of Pay-As-You-Throw Schemes on Municipal Solid Waste Management: The Exemplar Case of the County of Aschaffenburg, Germany. Resources 2017, 6, 8. https://doi.org/10.3390/resources6010008

Morlok J, Schoenberger H, Styles D, Galvez-Martos J-L, Zeschmar-Lahl B. The Impact of Pay-As-You-Throw Schemes on Municipal Solid Waste Management: The Exemplar Case of the County of Aschaffenburg, Germany. Resources. 2017; 6(1):8. https://doi.org/10.3390/resources6010008

Chicago/Turabian StyleMorlok, Juergen, Harald Schoenberger, David Styles, Jose-Luis Galvez-Martos, and Barbara Zeschmar-Lahl. 2017. "The Impact of Pay-As-You-Throw Schemes on Municipal Solid Waste Management: The Exemplar Case of the County of Aschaffenburg, Germany" Resources 6, no. 1: 8. https://doi.org/10.3390/resources6010008

APA StyleMorlok, J., Schoenberger, H., Styles, D., Galvez-Martos, J.-L., & Zeschmar-Lahl, B. (2017). The Impact of Pay-As-You-Throw Schemes on Municipal Solid Waste Management: The Exemplar Case of the County of Aschaffenburg, Germany. Resources, 6(1), 8. https://doi.org/10.3390/resources6010008