The Nexus Between Natural Resources, Renewable Energy and Economic Growth in the Gulf Cooperation Council Countries

Abstract

1. Introduction

2. Literature Review

2.1. Nexus Between Natural Resources and Economic Growth

2.2. Nexus Between Renewable Energy and Economic Growth

2.3. Summarizing Gaps in the Literature

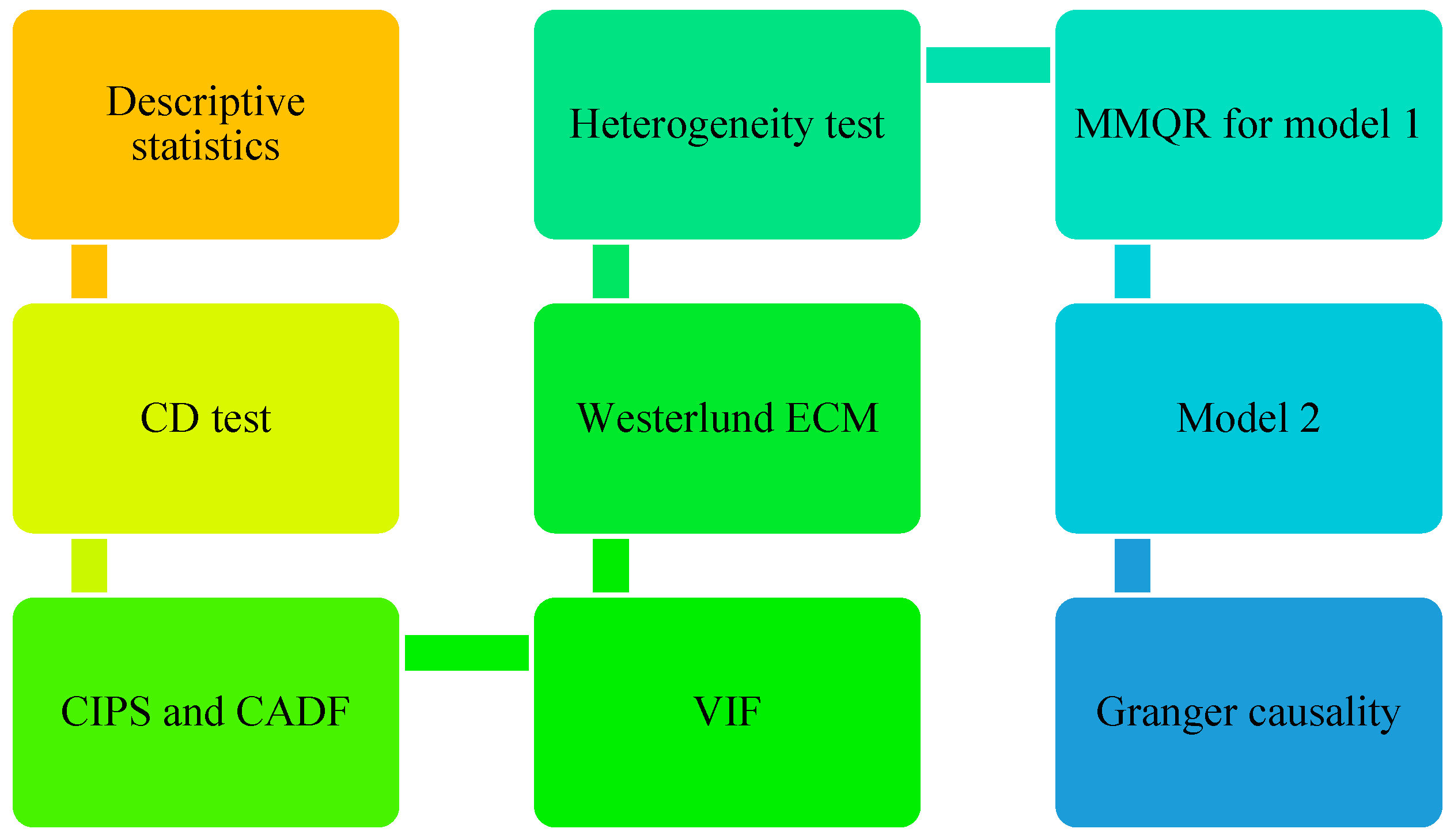

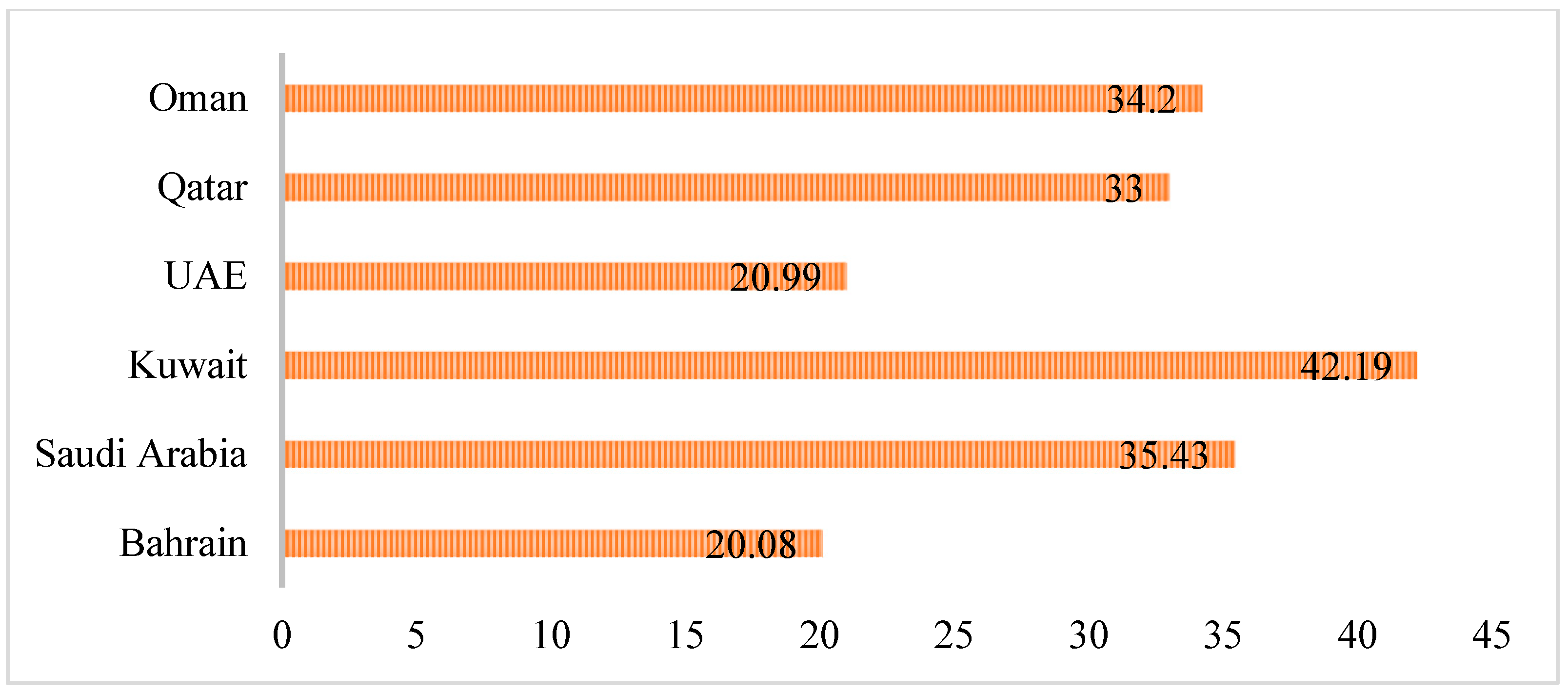

3. Material and Methods

3.1. Model Construction

3.2. Data and Methods

4. Empirical Results and Discussion

5. Conclusions and Policy Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| GCC | Gulf Cooperation Council Countries |

| MMQR | Method of Moments Quantile Regression |

| GDP | Gross Domestic Product |

| EG | Economic growth |

| CAP | Capital |

| LBR | Labor Force Participation |

| RE | Renewable Energy |

| NRE | Non-renewable Energy |

| NRR | Natural Resources Rent |

| TRD | Trade Openness |

| CD | Cross-sectional Dependence |

| SG | Second-generation |

| FG | First-generation |

| VIF | Variance Inflation Factor |

| ECM | Error Correction Model |

| CADF | Cross-sectionally Augmented Dickey–Fuller |

| CIPS | Cross-sectionally of Pesaran |

References

- Nurkse, R. Problems of Capital Formation in Undeveloped Countries; Oxford University Press: Oxford, UK, 1953. [Google Scholar]

- Rostow, W.W. The Stages of Economic Growth: A Non-Communist Manifesto; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Aldegheishem, A. Urban growth Management in Riyadh, Saudi Arabia: An assessment of technical policy instruments and institutional practices. Sustainability 2023, 15, 10616. [Google Scholar] [CrossRef]

- Aldegheishem, A. Assessing the progress of smart cities in Saudi Arabia. Smart Cities 2023, 6, 1958–1972. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. Fundamental sources of long-run growth. Am. Econ. Rev. 1997, 87, 184–188. [Google Scholar]

- Leite, M.C.; Weidmann, J. Does Mother Nature Corrupt? Natural Resources, Corruption, and Economic Growth; International Monetary Fund: Washington, DC, USA, 1999. [Google Scholar]

- Zhao, X.; Shang, Y.; Magazzino, C.; Madaleno, M.; Mallek, S. Multi-step impacts of environmental regulations on green economic growth: Evidence in the lens of natural resource dependence. Resour. Policy 2023, 85, 103919. [Google Scholar] [CrossRef]

- Destek, M.A.; Hossain, M.R.; Aydın, S.; Shakib, M.; Destek, G. Investigating the role of economic complexity in evading the resource curse. Resour. Policy 2023, 86, 104131. [Google Scholar] [CrossRef]

- Yu, C.; Moslehpour, M.; Tran, T.K.; Trung, L.M.; Ou, J.P.; Tien, N.H. Impact of non-renewable energy and natural resources on economic recovery: Empirical evidence from selected developing economies. Resour. Policy 2023, 80, 103221. [Google Scholar] [CrossRef]

- Kadir, M.O.; Deka, A.; Seraj, M.; Ozdeser, H. Capitalizing on natural resources rent and renewable energy in enhancing economic growth—New evidence with MMQR method. In Natural Resources Forum; Blackwell Publishing, Ltd.: Oxford, UK, 2024. [Google Scholar]

- Deka, A.; Ozdeser, H.; Seraj, M. The effect of GDP, renewable energy and total energy supply on carbon emissions in the EU-27: New evidence from panel GMM. Environ. Sci. Pollut. Res. 2023, 30, 28206–28216. [Google Scholar] [CrossRef] [PubMed]

- Zafar, M.W.; Shahbaz, M.; Hou, F.; Sinha, A. From nonrenewable to renewable energy and its impact on economic growth: The role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J. Clean. Prod. 2019, 212, 1166–1178. [Google Scholar] [CrossRef]

- Gozgor, G.; Lau, C.K.M.; Lu, Z. Energy consumption and economic growth: New evidence from the OECD countries. Energy 2018, 153, 27–34. [Google Scholar] [CrossRef]

- Inglesi-Lotz, R. The impact of renewable energy consumption to economic growth: A panel data application. Energy Econ. 2016, 53, 58–63. [Google Scholar] [CrossRef]

- Khan, I.; Zakari, A.; Dagar, V.; Singh, S. World energy trilemma and transformative energy developments as determinants of economic growth amid environmental sustainability. Energy Econ. 2022, 108, 105884. [Google Scholar] [CrossRef]

- Ivanovski, K.; Hailemariam, A.; Smyth, R. The effect of renewable and non-renewable energy consumption on economic growth: Non-parametric evidence. J. Clean. Prod. 2021, 286, 124956. [Google Scholar] [CrossRef]

- Bulut, U.; Muratoglu, G. Renewable energy in Turkey: Great potential, low but increasing utilization, and an empirical analysis on renewable energy-growth nexus. Energy Policy 2018, 123, 240–250. [Google Scholar] [CrossRef]

- Ocal, O.; Aslan, A. Renewable energy consumption–economic growth nexus in Turkey. Renew. Sustain. Energy Rev. 2018, 28, 494–499. [Google Scholar] [CrossRef]

- Arabeyyat, A.R.; Alnsour, J.A.; L-Bazaiah, S.A.; AL-Habees, M.A. Managing Urban Environment: Assessing the Role of Planning and Governance in Controlling Urbanization in the City of Amman, Jordan. J. Environ. Manag. Tour. 2024, 15, 263–271. [Google Scholar] [CrossRef]

- Becker, B.; Fischer, D. Promoting renewable electricity generation in emerging economies. Energy Policy 2013, 56, 446–455. [Google Scholar] [CrossRef]

- Machado, J.A.; Silva, J.S. Quantiles via moments. J. Econom. 2019, 213, 145–173. [Google Scholar] [CrossRef]

- Auty, R.M. Industrial policy reform in six large newly industrializing countries: The resource curse thesis. World Dev. 1994, 22, 11–26. [Google Scholar] [CrossRef]

- Havranek, T.; Horvath, R.; Zeynalov, A. Natural resources and economic growth: A meta-analysis. World Dev. 2016, 88, 134–151. [Google Scholar] [CrossRef]

- Ofori, P.E.; Grechyna, D. Remittances, natural resource rent and economic growth in Sub-Saharan Africa. Cogent Econ. Financ. 2021, 9, 1979305. [Google Scholar] [CrossRef]

- Kangning, X.; Jian, W. The relationship between Natural resource abundance and the level of economic development. Econ. Res. J. 2006, 1, 78–89. [Google Scholar]

- Aslan, A.; Altinoz, B. The impact of natural resources and gross capital formation on economic growth in the context of globalization: Evidence from developing countries on the continent of Europe, Asia, Africa, and America. Environ. Sci. Pollut. Res. 2021, 28, 33794–33805. [Google Scholar] [CrossRef]

- Gerelmaa, L.; Kotani, K. Further investigation of natural resources and economic growth: Do natural resources depress economic growth? Resour. Policy 2016, 50, 312–321. [Google Scholar] [CrossRef]

- Singh, S.; Sharma, G.D.; Radulescu, M.; Balsalobre-Lorente, D.; Bansal, P. Do natural resources impact economic growth: An investigation of P5+ 1 countries under sustainable management. Geosci. Front. 2024, 15, 101595. [Google Scholar] [CrossRef]

- Zhang, Y.; Khan, S.U.D. The role of energy poverty in the linkage between natural resources and economic performance: Resource curse or resource blessing? Resour. Policy 2023, 85, 103838. [Google Scholar] [CrossRef]

- Sha, Z. The effect of globalisation, foreign direct investment, and natural resource rent on economic recovery: Evidence from G7 economies. Resour. Policy 2023, 82, 103474. [Google Scholar] [CrossRef]

- Khan, Z.; Hossain, M.R.; Badeeb, R.A.; Zhang, C. Aggregate and disaggregate impact of natural resources on economic performance: Role of green growth and human capital. Resour. Policy 2023, 80, 103103. [Google Scholar] [CrossRef]

- Uri, N.D. An empirical re-examination of natural resource scarcity and economic growth. Appl. Stoch. Models Data Anal. 1996, 12, 45–61. [Google Scholar] [CrossRef]

- Asiedu, M.; Yeboah, E.N.; Boakye, D.O. Natural resources and the economic growth of West Africa economies. Appl. Econ. Financ. 2021, 8, 20–32. [Google Scholar] [CrossRef]

- Ahmad, M.; Jiang, P.; Majeed, A.; Umar, M.; Khan, Z.; Muhammad, S. The dynamic impact of natural resources, technological innovations and economic growth on ecological footprint: An advanced panel data estimation. Resour. Policy 2020, 69, 101817. [Google Scholar] [CrossRef]

- Meaton, J.; Alnsour, J. Spatial & Environmental Planning Challenges in Amman, Jordan. Plan. Pract. Res. 2012, 27, 376–386. [Google Scholar]

- Yasmeen, H.; Tan, Q.; Zameer, H.; Vo, X.V.; Shahbaz, M. Discovering the relationship between natural resources, energy consumption, gross capital formation with economic growth: Can lower financial openness change the curse into blessing. Resour. Policy 2021, 71, 102013. [Google Scholar] [CrossRef]

- Aljarallah, R.A. An assessment of the economic impact of natural resource rents in kingdom of Saudi Arabia. Resour. Policy 2021, 72, 102070. [Google Scholar] [CrossRef]

- Erdoğan, S.; Yıldırım, D.Ç.; Gedikli, A. Natural resource abundance, financial development and economic growth: An investigation on Next-11 countries. Resour. Policy 2020, 65, 101559. [Google Scholar] [CrossRef]

- Razzaq, A. Impact of fintech readiness, natural resources, and business freedom on economic growth in the CAREC region. Resour. Policy 2024, 90, 104846. [Google Scholar] [CrossRef]

- Zhang, C.; Waris, U.; Qian, L.; Irfan, M.; Rehman, M.A. Unleashing the dynamic linkages among natural resources, economic complexity, and sustainable economic growth: Evidence from G-20 countries. Sustain. Dev. 2024, 32, 3736–3752. [Google Scholar] [CrossRef]

- Chen, J.; Ma, W.; Kchouri, B.; Ribeiro-Navarrete, S. Resource rich yet debt ridden: The role of natural resources and debt servicing in sustainable economic growth. Resour. Policy 2024, 89, 104565. [Google Scholar] [CrossRef]

- Khan, I.; Muhammad, I.; Sharif, A.; Khan, I.; Ji, X. Unlocking the potential of renewable energy and natural resources for sustainable economic growth and carbon neutrality: A novel panel quantile regression approach. Renew. Energy 2024, 221, 119779. [Google Scholar] [CrossRef]

- Jiao, L.; Zhou, D.; Xu, R. Resource dynamics and economic expansion: Unveiling the asymmetric effects of natural resources and FDI on economic growth with a lens on energy efficiency. Resour. Policy 2024, 89, 104611. [Google Scholar] [CrossRef]

- Manigandan, P.; Alam, M.S.; Murshed, M.; Ozturk, I.; Altuntas, S.; Alam, M.M. Promoting sustainable economic growth through natural resources management, green innovations, environmental policy deployment, and financial development: Fresh evidence from India. Resour. Policy 2024, 90, 104681. [Google Scholar] [CrossRef]

- Xie, T.; Xu, Y.; Li, Y. Nonlinear relationship between natural resources and economic growth: The role of frontier technology. Resour. Policy 2024, 90, 104831. [Google Scholar] [CrossRef]

- Ze, F.; Yu, W.; Ali, A.; Hishan, S.S.; Muda, I.; Khudoykulov, K. Influence of natural resources, ICT, and financial globalization on economic growth: Evidence from G10 countries. Resour. Policy 2023, 81, 103254. [Google Scholar] [CrossRef]

- Tabash, M.I.; Mesagan, E.P.; Farooq, U. Dynamic linkage between natural resources, economic complexity, and economic growth: Empirical evidence from Africa. Resour. Policy 2022, 78, 102865. [Google Scholar] [CrossRef]

- Haseeb, M.; Kot, S.; Hussain, H.I.; Kamarudin, F. The natural resources curse-economic growth hypotheses: Quantile–on–Quantile evidence from top Asian economies. J. Clean. Prod. 2021, 279, 123596. [Google Scholar] [CrossRef]

- Hayat, A.; Tahir, M. Natural resources volatility and economic growth: Evidence from the resource-rich region. J. Risk Financ. Manag. 2021, 14, 84. [Google Scholar] [CrossRef]

- Imran, M.; Alam, M.S.; Jijian, Z.; Ozturk, I.; Wahab, S.; Doğan, M. From resource curse to green growth: Exploring the role of energy utilization and natural resource abundance in economic development. Nat. Resour. Forum 2025, 49, 2025–2047. [Google Scholar] [CrossRef]

- Osabohien, R.; Zogbassé, S.; Jaaffar, A.H.; Idowu, O.O.; Al-Faryan, M.A.S. Renewable energy, carbon footprints, natural resources depletion and economic growth in Africa. Int. J. Energy Sect. Manag. 2025, 19, 667–690. [Google Scholar] [CrossRef]

- Shuchun, B.; Alola, A.A. Role of education and natural resources in achieving green economic growth in China: A wavelet quantile correlation approach. Nat. Resour. Forum 2025, 49, 445–460. [Google Scholar] [CrossRef]

- Dai, Y.; Ding, Y.; Fu, S.; Zhang, L.; Cheng, J.; Zhu, D. Analyzing the impact of natural capital on socio-economic objectives under the framework of sustainable development goals. Environ. Impact. Assess. Rev. 2024, 2, 107322. [Google Scholar] [CrossRef]

- Ge, X.; Imran, M.; Ali, K. Natural resource-driven prosperity: Unveiling the catalysts of sustainable economic development in the United States. Nat. Resour. Forum 2025, 49, 1823–1841. [Google Scholar] [CrossRef]

- Raifu, I.A.; Obaniyi, F.A.; Nnamani, G.; Salihu, A.A. Revisiting causal relationship between renewable energy and economic growth in OECD countries: Evidence from a novel JKS’s Granger non-causality test. Renew. Energy 2025, 244, 122559. [Google Scholar] [CrossRef]

- Raihan, A.; Ibrahim, S.; Ridwan, M.; Rahman, M.S.; Bari, A.M.; Atasoy, F.G. Role of renewable energy and foreign direct investment toward economic growth in Egypt. Innov. Green Dev. 2025, 4, 100185. [Google Scholar] [CrossRef]

- Okunevičiūtė Neverauskienė, L.; Dirma, V.; Tvaronavičienė, M.; Danilevičienė, I. Assessing the Role of Renewable Energy in the Sustainable Economic Growth of the European Union. Energies 2025, 18, 760. [Google Scholar] [CrossRef]

- Fang, D.; Li, X.; Yu, B.; Han, Z. Refined decomposition analysis of renewable energy penetration and its nexus with economic growth in emerging industrialized economies: Evidence from China. J. Clean. Prod. 2025, 499, 145252. [Google Scholar] [CrossRef]

- Manal, A. The role of renewable energy in driving economic transformation and sustainable development in Saudi Arabia. Int. J. Energy Econ. Policy 2025, 15, 364. [Google Scholar] [CrossRef]

- Pea-Assounga, J.B.B.; Bambi, P.D.R.; Jafarzadeh, E.; Ngapey, J.D.N. Investigating the impact of crude oil prices, CO2 emissions, renewable energy, population growth, trade openness, and FDI on sustainable economic growth. Renew. Energy 2025, 241, 122353. [Google Scholar] [CrossRef]

- Keshavarzian, M.; Tabatabaienasab, Z. Application of bootstrap panel Granger causality test in Determining the relationship between renewable and non-renewable energy consumption and economic growth: A case study of OPEC countries. Technol. Econ. Smart Grids Sustain. Energy 2021, 6, 10. [Google Scholar] [CrossRef]

- Lin, B.; Moubarak, M. Renewable energy consumption–economic growth nexus for China. Renew. Sustain. Energy Rev. 2014, 40, 111–117. [Google Scholar] [CrossRef]

- Gyimah, J.; Yao, X.; Tachega, M.A.; Hayford, I.S.; Opoku-Mensah, E. Renewable energy consumption and economic growth: New evidence from Ghana. Energy 2022, 248, 123559. [Google Scholar] [CrossRef]

- Rafindadi, A.A.; Ozturk, I. Impacts of renewable energy consumption on the German economic growth: Evidence from combined cointegration test. Renew. Sustain. Energy Rev. 2017, 75, 1130–1141. [Google Scholar] [CrossRef]

- Mukhtarov, S.; Yüksel, S.; Dinçer, H. The impact of financial development on renewable energy consumption: Evidence from Turkey. Renew. Energy 2022, 187, 169–176. [Google Scholar] [CrossRef]

- Akpanke, T.A.; Deka, A.; Ozdeser, H.; Seraj, M. The role forest resources, energy efficiency, and renewable energy in promoting environmental quality. Environ. Monit. Assess. 2023, 195, 1071. [Google Scholar] [CrossRef] [PubMed]

- Zweifel, P.; Praktiknjo, A.; Erdmann, G. Energy Economics: Theory and Applications; Springer: Berlin/Heidelberg, Germany, 2017. [Google Scholar]

- Solow, R.M. A contribution to the theory of economic growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Romer, P.M. Endogenous technological change. J. Political Econ. 1990, 98 Pt 2, S71–S102. [Google Scholar] [CrossRef]

- Asif, M.; Bashir, S.; Khan, S. Impact of non-renewable and renewable energy consumption on economic growth: Evidence from income and regional groups of countries. Environ. Sci. Pollut. Res. 2021, 28, 38764–38773. [Google Scholar] [CrossRef]

- Asiedu, B.A.; Hassan, A.A.; Bein, M.A. Renewable energy, non-renewable energy, and economic growth: Evidence from 26 European countries. Environ. Sci. Pollut. Res. 2021, 28, 11119–11128. [Google Scholar] [CrossRef]

- Fang, Y. Economic welfare impacts from renewable energy consumption: The China experience. Renew. Sustain. Energy Rev. 2011, 15, 5120–5128. [Google Scholar] [CrossRef]

- World Bank. World Development Indicators. 2023. Available online: https://databank.worldbank.org/source/world-development-indicators (accessed on 4 November 2024).

- US Energy Information Administration. Total Energy. 2023. Available online: https://www.eia.gov/totalenergy/data/browser/ (accessed on 22 December 2024).

- Pesaran, M.H. General diagnostic tests for cross section dependence in panels. Cambridge Working Papers. Economics 2004, 1240, 1. [Google Scholar]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econom. 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. J. Econom. 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Shuayb, A.S.S.; Dube, S.; Khalifa, W.; Deka, A.; Kareem, P.H.; Cavusoglu, B. The impact of natural resources rent, renewable energy, and governance on the environmental sustainability—Evidence from resource-rich countries. Nat. Resour. Forum 2025, 49, 1842–1858. [Google Scholar] [CrossRef]

- Westerlund, J. Testing for error correction in panel data. Oxf. Bull. Econ. Stat. 2007, 69, 709–748. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. J. Econom. 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Akpanke, T.A.; Deka, A.; Ozdeser, H.; Seraj, M. Ecological footprint in the OECD countries: Do energy efficiency and renewable energy matter? Environ. Sci. Pollut. Res. 2024, 31, 15289–15301. [Google Scholar] [CrossRef]

- Pesaran, M.H. Testing weak cross-sectional dependence in large panels. Econom. Rev. 2015, 34, 1089–1117. [Google Scholar] [CrossRef]

- Friedman, M. The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J. Am. Stat. Assoc. 1937, 32, 675–701. [Google Scholar] [CrossRef]

- Frees, E.W. Assessing cross-sectional correlation in panel data. J. Econom. 1995, 69, 393–414. [Google Scholar] [CrossRef]

- Koenker, R.; Hallock, K.F. Quantile regression. J. Econ. Perspect. 2001, 15, 143–156. [Google Scholar] [CrossRef]

- Binder, M.; Coad, A. From Average Joe’s happiness to Miserable Jane and Cheerful John: Using quantile regressions to analyze the full subjective well-being distribution. J. Econ. Behav. Organ. 2011, 79, 275–290. [Google Scholar] [CrossRef]

- An, H.; Razzaq, A.; Haseeb, M.; Mihardjo, L.W.W. The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: New evidence from method of moments quantile regression. Environ. Sci. Pollut. Res. 2021, 28, 5254–5270. [Google Scholar] [CrossRef]

- Ojekemi, O.S.; Ağa, M.; Magazzino, C. Towards Achieving Sustainability in the BRICS Economies: The Role of Renewable Energy Consumption and Economic Risk. Energies 2023, 16, 5287. [Google Scholar] [CrossRef]

- Asif, M.; Li, J.Q.; Zia, M.A.; Hashim, M.; Bhatti, U.A.; Bhatti, M.A.; Hasnain, A. Environmental sustainability in BRICS economies: The nexus of technology innovation, economic growth, financial development, and renewable energy consumption. Sustainability 2024, 16, 6934. [Google Scholar] [CrossRef]

- Omar, S.A.; Khalifa, W.M.; Kareem, P.H. The Influence of Trade, Technology and Economic Growth on Environmental Sustainability in the Gulf Cooperation Countries—New Evidence with the MMQR Method. Sustainability 2025, 17, 419. [Google Scholar] [CrossRef]

- Ayad, H.; Ben-Salha, O.; Djellouli, N. Toward maritime sustainability in GCC countries: What role do economic freedom and human capital play? Mar. Pollut. Bull. 2024, 206, 116774. [Google Scholar] [CrossRef]

- Fatima, N.; Xuhua, H.; Alnafisah, H.; Akhtar, M.R. Synergy for climate actions in G7 countries: Unraveling the role of environmental policy stringency between technological innovation and CO2 emission interplay with DOLS, FMOLS and MMQR approaches. Energy Rep. 2024, 12, 1344–1359. [Google Scholar] [CrossRef]

- Luo, B.; Khan, A.A.; Wu, X.; Li, H. Navigating carbon emissions in G-7 economies: A quantile regression analysis of environmental-economic interplay. Environ. Sci. Pollut. Res. 2023, 30, 104697–104712. [Google Scholar] [CrossRef] [PubMed]

- Benaini, R.; Ayad, H.; Selka, B. Unveiling new insights about the influence of oil prices on GDP in OAPEC nations: MMQR investigation. Glob. Bus. 2025, 10, 125–135. [Google Scholar] [CrossRef]

- Kasperowicz, R.; Bilan, Y.; Štreimikienė, D. The renewable energy and economic growth nexus in European countries. Sustain. Dev. 2021, 28, 1086–1093. [Google Scholar] [CrossRef]

- Koengkan, M.; Fuinhas, J.A. The interactions between renewable energy consumption and economic growth in the Mercosur countries. Int. J. Sustain. Energy 2020, 39, 594–614. [Google Scholar] [CrossRef]

- Aydin, M. Renewable and non-renewable electricity consumption–economic growth nexus: Evidence from OECD countries. Renew. Energy 2019, 136, 599–606. [Google Scholar] [CrossRef]

- Soava, G.; Mehedintu, A.; Sterpu, M.; Raduteanu, M. Impact of renewable energy consumption on economic growth: Evidence from European Union countries. Technol. Econ. Dev. Econ. 2018, 24, 914–932. [Google Scholar] [CrossRef]

- Rahman, M.M.; Velayutham, E. Renewable and non-renewable energy consumption-economic growth nexus: New evidence from South Asia. Renew. Energy 2020, 147, 399–408. [Google Scholar] [CrossRef]

- Kahia, M.; Aïssa, M.S.B.; Lanouar, C. Renewable and non-renewable energy use-economic growth nexus: The case of MENA Net Oil Importing Countries. Renew. Sustain. Energy Rev. 2017, 71, 127–140. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Fereidouni, H.G.; Lee, J.Y. Electricity consumption from renewable and non-renewable sources and economic growth: Evidence from Latin American countries. Renew. Sustain. Energy Rev. 2014, 30, 290–298. [Google Scholar] [CrossRef]

- Keho, Y. The impact of trade openness on economic growth: The case of Cote d’Ivoire. Cogent Econ. Financ. 2017, 5, 1332820. [Google Scholar] [CrossRef]

- Liu, L.; Nath, H.K. Information and communications technology and trade in emerging market economies. Emerg. Mark. Financ. Trade 2013, 49, 67–87. [Google Scholar] [CrossRef]

| Author | Country/Time | Methods | Results |

|---|---|---|---|

| Razzaq [39] | CAREC region 2000–2020 | Method of moment quantile regression (MMQR) | Natural resources enhance economic growth |

| Zhang et al. [40] | G-20 countries 1990–2021 | CS-ARDL | Natural resources decrease economic growth |

| Chen et al. [41] | Highly indebted poor economies 1988–2021 | FMOLS DOLS CCR | Natural resources increase economic growth |

| Khan et al. [42] | Afghanistan, Bhutan, Nepal, Bangladesh, Pakistan, Sri Lanka, the Maldives, India 1990–2019 | Panel quantile regression | Natural resources improve economic growth |

| Jiao et al. [43] | USA 1990–2020 | Bootstrap quantile regression FMOLS, DOLS, and CCR | Natural gas rents increase economic growth, while mineral resources reduce growth |

| Manigandan et al. [44] | India 1990–2019 | Fourier-ARDL Fourier Toda-Yamamoto | Natural resources decrease economic growth |

| Xie et al. [45] | 57 developing countries 2008–2019 | GMM model | Inverse-U-shaped relationship |

| Ze et al. [46] | G10 economies 1992–2022 | CS-ARDL | Natural resources lower economic growth |

| Tabash et al. [47] | 24 African economies 1995–2017 | GMM | Natural resources decrease economic growth |

| Haseeb et al. [48] | China, India, Malaysia, Indonesia and Thailand 1970–2018 | Quantile-on-quantile regression | Natural resources increase economic growth, except India |

| Hayat and Tahir [49] | UAE, Saudi Arabia, Oman 1970–2016 | ARDL | Natural resources increase economic growth |

| Imran et al. [50] | BRICS 1991–2022 | ARDL | Natural resources improve economic growth |

| Osabohien et al. [51] | Africa 2000–2023 | GMM | Natural resources declines economic growth |

| Shuchun and Alola [52] | China | A-ARDL Wavelet quantile correlation | Natural resources hinder economic growth |

| Dai et al. [53] | 131 countries 2000–2018 | Baseline Regression | The link between natural resources and the economy is changing |

| Ge et al. [54] | United States 1991–2022 | FMOLS DOLS | Natural resources enhance economic growth |

| Variable | Measurement | Source |

|---|---|---|

| EG | GDP growth (annual%) | WDI |

| CAP | GCF as a percentage of GDP | WDI |

| LBR | Labor force participation rate, total (% of total population ages 15+) | WDI |

| RE | Consumption in quadrillion Btu | EIA |

| NRE | Consumption in quadrillion Btu | EIA |

| NRR | Percentage of GDP | WDI |

| TRD | Percentage of GDP | WDI |

| Variable | Obs. | Mean | Std. dev. | Min | Max | Kurtosis | Skewness | Jarque–Bera | p-Value |

|---|---|---|---|---|---|---|---|---|---|

| EG | 195 | 4.490 | 5.390 | −7.076 | 33.990 | 7.790 | 1.952 | 0.983 | 0.000 |

| CAP | 195 | 25.733 | 8.142 | 6.952 | 48.869 | −0.301 | 0.348 | 1.053 | 0.000 |

| LBR | 195 | 65.010 | 11.687 | 40.320 | 88.87 | −0.785 | 0.370 | 2.931 | 0.000 |

| RE | 195 | 0.032 | 0.098 | 0.001 | 0.222 | 9.432 | 3.086 | 0.787 | 0.000 |

| NRE | 195 | 2.335 | 2.805 | 0.183 | 12.27 | 3.585 | 2.039 | 1.245 | 0.000 |

| NRR | 195 | 30.710 | 11.548 | 9.648 | 59.069 | −0.692 | 0.339 | 4.567 | 0.000 |

| TRD | 195 | 84.448 | 36.250 | 16.962 | 202.332 | 1.329 | 0.635 | 1.475 | 0.000 |

| Variables | Statistic CD Test | p-Value |

|---|---|---|

| EG | 9.984 *** | 0.000 |

| CAP | - | - |

| LBR | 7.042 *** | 0.000 |

| RE | 16.560 *** | 0.000 |

| NRE | - | - |

| NRR | 10.041 *** | 0.000 |

| TRD | 7.895 *** | 0.000 |

| Variable | CIPS Level | First Difference | CADF Level | First Difference |

|---|---|---|---|---|

| EG | 4.124 *** | 2.681 *** | ||

| CAP | 3.758 *** | 2.224 * | 3.224 *** | |

| LBR | 1.600 | 3.528 *** | 1.362 | 1.894 * |

| RE | 2.135 | 5.344 *** | 1.804 | 2.953 *** |

| NRE | 1.702 | 4.673 *** | 1.605 | 2.597 *** |

| NRR | 2.614 *** | 1.911 | 3.112 *** | |

| TRD | 2.298 ** | 2.105 | 3.726 *** |

| Variable | VIF | 1/VIF | VIF | 1/VIF |

|---|---|---|---|---|

| Model 1 | Model 2 | |||

| RE | 5.534 | 0.180 | 5.302 | 0.188 |

| NRE | 5.114 | 0.195 | 4.423 | 0.226 |

| LBR | 2.018 | 0.495 | 1.798 | 0.556 |

| TRD | 1.560 | 0.641 | 1.602 | 0.624 |

| EG | 1.080 | 0.925 | ||

| NRR | 1.421 | 0.703 | ||

| CAP | 1.032 | 0.968 | 1.034 | 0.967 |

| Mean VIF | 2.78 | 2.54 | ||

| Statistic | Value | Z-Statistic | p-Value | Robust p-Value | Value | Z-Statistic | p-Value | Robust p-Value |

|---|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | |||||||

| Gt | 1.911 | 3.748 | 0.986 | 0.081 | 1.899 | 1.817 | 0.972 | 0.087 |

| Ga | 1.497 | 6.816 | 0.998 | 0.378 | 1.112 | 6.044 | 0.987 | 0.298 |

| Pt | 10.236 | 0.408 | 0.365 | 0.032 | 3.224 | 4.129 | 0.990 | 0.039 |

| Pa | 5.586 | 3.420 | 0.985 | 0.057 | 1.105 | 4.002 | 0.992 | 0.068 |

| Statistic | p-Value | Statistic | p-Value | |

|---|---|---|---|---|

| Model 1 | Model 2 | |||

| Δ | 3.798 *** | 0.000 | 5.778 *** | 0.000 |

| Δ adj. | 4.386 *** | 0.000 | 6.739 *** | 0.000 |

| Pesaran | 6.344 *** | 0.000 | 0.986 | 0.318 |

| Friedman | 67.002 *** | 0.000 | 39.218 *** | 0.000 |

| Frees | 0.306 *** | 0.000 | 0.523 *** | 0.000 |

| Quantiles | |||||

|---|---|---|---|---|---|

| 0.10 | 0.25 | 0.50 | 0.75 | 0.90 | |

| CAP | 2.231 ** (0.016) | 2.436 ** (0.016) | 2.548 *** (0.014) | 2.553 *** (0.015) | 2.561 *** (0.018) |

| LBR | 1.935 * (0.066) | 2.243 ** (0.046) | 2.333 ** (0.041) | 2.373 ** (0.040) | 2.447 ** (0.044) |

| RE | 1.635 * (0.056) | 1.785 * (0.062 | 1.849 * (0.068) | 1.973 * (0.064) | 1.968 * (0.059) |

| NRE | 2.434 ** (0.044) | 2.591 *** (0.041) | 2.625 *** (0.033) | 2.717 *** (0.034) | 2.802 *** (0.044) |

| NRR | 2.375 ** (0.038) | 2.451 ** (0.036) | 2.567 *** (0.037) | 2.604 *** (0.041) | 2.658 *** (0.042) |

| TRD | 1.842 * (0.080) | 1.873 * (0.075) | 1.886 * (0.078) | 1.891 * (0.076) | 1.198 * (0.068) |

| Quantiles | |||||

|---|---|---|---|---|---|

| 0.10 | 0.25 | 0.50 | 0.75 | 0.90 | |

| EG | 0.424 | 0.394 | 0.380 | 0.368 | 0.365 |

| (2.450 **) | (2.921 ***) | (3.472 ***) | (2.334 **) | (2.302 **) | |

| CAP | 0.631 | 0.668 | 0.685 | 0.671 | 0.694 |

| LBR | (3.55 **) | (3.624 **) | (2.668 **) | (2.716 **) | (0.773 **) |

| 0.346 | 0.369 | 0.378 | 0.383 | 0.394 | |

| (3.831 ***) | (5.403 ***) | (7.413 ***) | (5.62 ***) | (4.292 ***) | |

| RE | 0.169 | 0.122 | 0.0124 | 0.089 | 0.179 |

| (1.044) | (0.836) | (0.147) | (0.565) | (0.75) | |

| NRE | 0.749 | 0.772 | 0.814 | 0.223 | 0.253 |

| (3.942 **) | (4.365 **) | (0.484 **) | (0.534 **) | (0.721 **) | |

| TRD | 0.162 | 0.185 | 0.229 | 0.278 | 0.321 |

| (3.572 ***) | (5.412 ***) | (7.125 ***) | (6.723 ***) | (5.351 ***) |

| Variables | F-Statistic | p-Value | Variables | F-Statistic | p-Value |

|---|---|---|---|---|---|

| CAP→EG | 4.324 | 0.025 ** | CAP→TRD | 0.733 | 0.318 |

| EG→CAP | 0.027 | 0.857 | RE→LBR | 0.326 | 0.659 |

| LBR→EG | 3.635 | 0.037 ** | LBR→RE | 0.182 | 0.564 |

| EG→LBR | 0.4243 | 0.6544 | NRE→LBR | 3.346 | 0.035 ** |

| RE→EG | 3.094 | 0.041 ** | LBR→NRE | 4.844 | 0.006 *** |

| EG→RE | 11.218 | 1.876 | NRR→LBR | 3.678 | 0.033 |

| NRE→EG | 7.844 | 0.000 *** | LBR→NRR | 0.525 | 0.782 |

| EG→NRE | 0.683 | 0.0381 | TRD→LBR | 0.347 | 0.571 |

| NRR→EG | 7.148 | 0.000 *** | LBR→TRD | 0.189 | 0.738 |

| EG→NRR | 2.187 | 0.243 | NRE→RE | 0.429 | 0.183 |

| TRD→EG | 4.173 | 0.002 *** | RE→NRE | 0.398 | 0.285 |

| EG→TRD | 1.688 | 0.196 | NRR→RE | 0.323 | 0.317 |

| LBR→CAP | 1.322 | 0.452 | RE→NRR | 0.693 | 0.242 |

| CAP→LBR | 1.756 | 0.326 | TRD→RE | 0.294 | 0.164 |

| RE→CAP | 0.856 | 0.325 | RE→TRD | 0.336 | 0.633 |

| CAP→RE | 0.153 | 0.871 | NRR→NRE | 8.426 | 0.000 *** |

| NRE→CAP | 4.214 | 0.001 *** | NRE→NRR | 7.359 | 0.002 *** |

| CAP→NRE | 1.684 | 0.145 | TRD→ NRE | 2.113 | 0.197 |

| NRR→CAP | 2.745 | 0.041 ** | NRE→TRD | 5.742 | 0.007 *** |

| CAP→NRR | 0.649 | 0.239 | TRD→NRR | 0.446 | 0.528 |

| TRD→CAP | 2.768 | 0.038 ** | NRR→TRD | 3.614 | 0.029 ** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alnsour, J.; AlNsour, F.M. The Nexus Between Natural Resources, Renewable Energy and Economic Growth in the Gulf Cooperation Council Countries. Resources 2025, 14, 124. https://doi.org/10.3390/resources14080124

Alnsour J, AlNsour FM. The Nexus Between Natural Resources, Renewable Energy and Economic Growth in the Gulf Cooperation Council Countries. Resources. 2025; 14(8):124. https://doi.org/10.3390/resources14080124

Chicago/Turabian StyleAlnsour, Jamal, and Farah Mohammad AlNsour. 2025. "The Nexus Between Natural Resources, Renewable Energy and Economic Growth in the Gulf Cooperation Council Countries" Resources 14, no. 8: 124. https://doi.org/10.3390/resources14080124

APA StyleAlnsour, J., & AlNsour, F. M. (2025). The Nexus Between Natural Resources, Renewable Energy and Economic Growth in the Gulf Cooperation Council Countries. Resources, 14(8), 124. https://doi.org/10.3390/resources14080124