Diversification as a Method of Ensuring the Sustainability of Energy Supply within the Energy Transition

Abstract

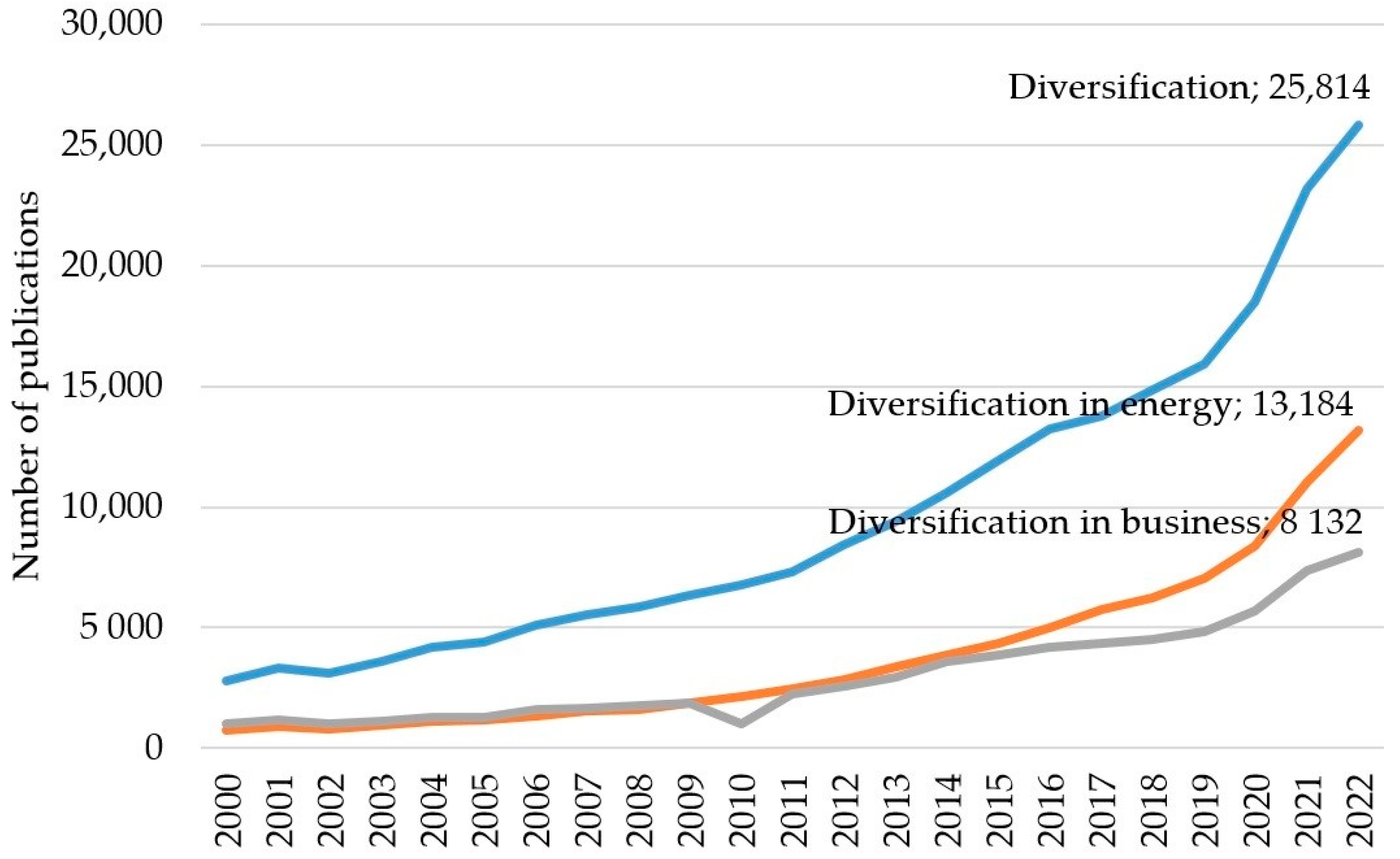

:1. Introduction

2. Theoretical Background: Hypothesis and Logic of the Study

3. Results

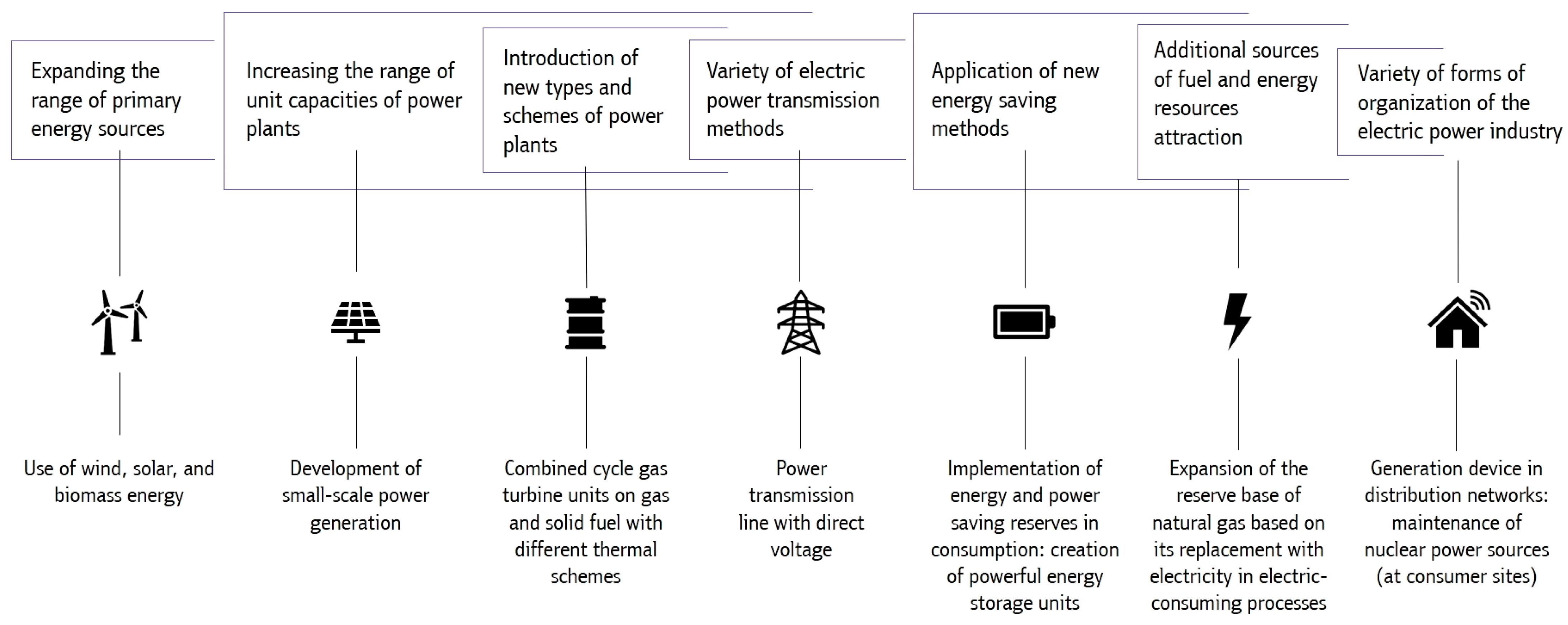

3.1. Forms and Methods of Diversification in the Electric Power Industry

- introduction of new technological elements into the structure of generating capacities of power systems (for example, combined cycle gas turbines [CCGT] on various circuits during work on gas and solid fuel);

- introduction of additional methods of energy supply based on demand-side management for energy and power;

- range extension of unit capacities of power plants based on the development of small-scale power generation;

- obtaining of additional natural gas resources through replacement with electricity in technical processes (fuel-saving direction of electrification).Diversification of the mechanisms of management methods involves:

- methods of direct public administration: strategy, programs, organization, and investments;

- administrative and legal measures to attract energy companies;

- methods of economic stimulation of the energy business (guaranteed investment mechanisms, tax incentives, etc.);

- market mechanisms.

3.2. Ensuring the Sustainability of Electricity Supply by Means of Diversification

- Sustainable functioning of the electric power industry. In this context, it means the ability of the industry to meet, at any given time, the electricity and capacity needs of the national economy of a country (or region) with the necessary level of power supply reliability, maintenance of quality indicators of electricity (frequency, voltage, etc.), minimal impact on the environment, and for this to be achieved as a socially acceptable cost (both for consumers and producers). The mode of sustainable operation supposes limited commissioning of new facilities to ensure the reserve and fixed capital renovation (replacement coverage and modernization), increasing electrical network transmission capacity, and the improvement of technological systems of operational dispatch management.

- Sustainable development of the electric power industry. In this context, it assumes the expansion of its scale (introduction of new capacity) to ensure economic growth and increase the level of electrification of the national economy by means of advanced electric-intensive processes introduction. At the same time, qualitative transformations of the industry are taking place (optimization of the generation structure, fuel-energy balance, and introduction of environmentally-friendly units). Sustainable development of the electric power industry is a condition and consequence of economic growth.

- At the first stage of the power system technical development design, the criterion of sustainability is put forward as a guiding imperative; it relates to the choice of standard sizes of power plants and power grid equipment, the formation of the structures of generation and transport capacities, and the determination of the optimal configuration of intra-system connections.

- Electricity consumers with a certain potential for demand regulation are involved in sustainability management in a proactive mode, especially in terms of rationalization of load schedules, as well as general energy saving.

- The power system is equipped with an automated control system based on the Smart Grid concept, which enables multi-criteria optimization of all processes.

- Monitoring the production, transmission, and consumption of electricity in real-time mode to provide self-monitoring, self-regulation and self-repair of equipment parameters.

- the type and thermal scheme of the power unit (for example, a CCGT-TPP with heat recovery steam generator);

- the type of primary energy resource (organic fuel, nuclear fuel, or natural power);

- the unit power of the power plant in the selected range (small, medium, large).

3.3. Diversification Supervision in the Time of Energy Transition

- Definition and planning of goals (based on the company’s mission);

- Forecasting of consumers’ electrical and thermal loads;

- Analysis of the available generation capacities and capabilities of the power system, balanced within the planning timeframe;

- Assessment of developed resources in energy demand, i.e., the potential to increase efficiency in energy consumption;

- Assessment of developed resources in production, i.e., the potential for efficiency improvement in energy generation;

- Analysis of environmental consequences for each element of the development of the energy system;

- Uncertainty and risk analysis;

- Plan selection for resource management;

- Public evaluation of the energy system development plan.

- electrical load forecast;

- analysis of the existing power system with all its sources and load diagrams;

- technical and economic assessment of all available resources, including energy conservation;

- simulation modeling of the power system’s operation.

- the final set of resources, which are ranked based on costs and risks associated with their use;

- regulations that should be followed when making decisions on the development of the energy system;

- a package of measures that, on the recommendation of the regional Council, should be taken over the next few years.

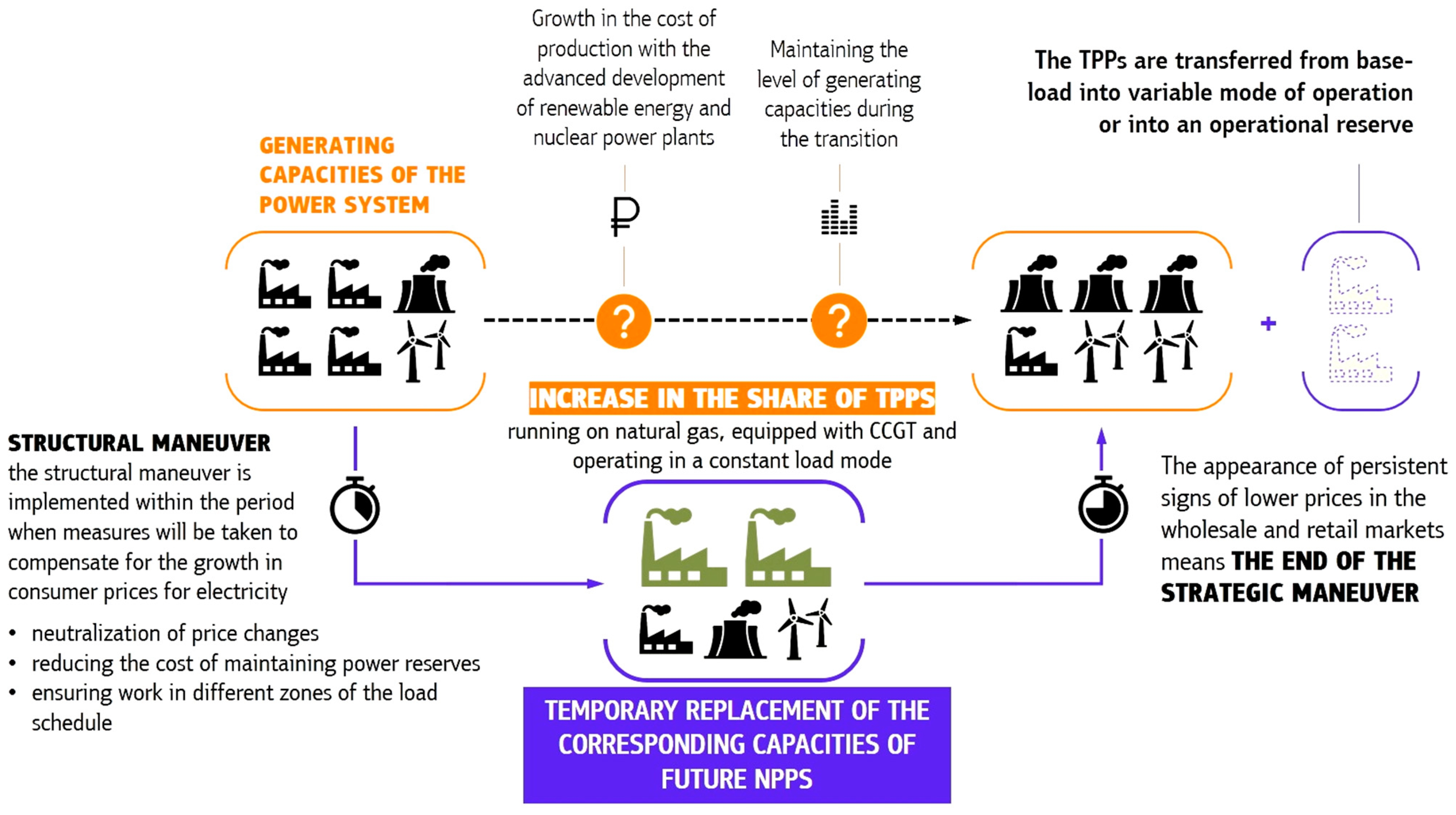

3.4. Structural Maneuver

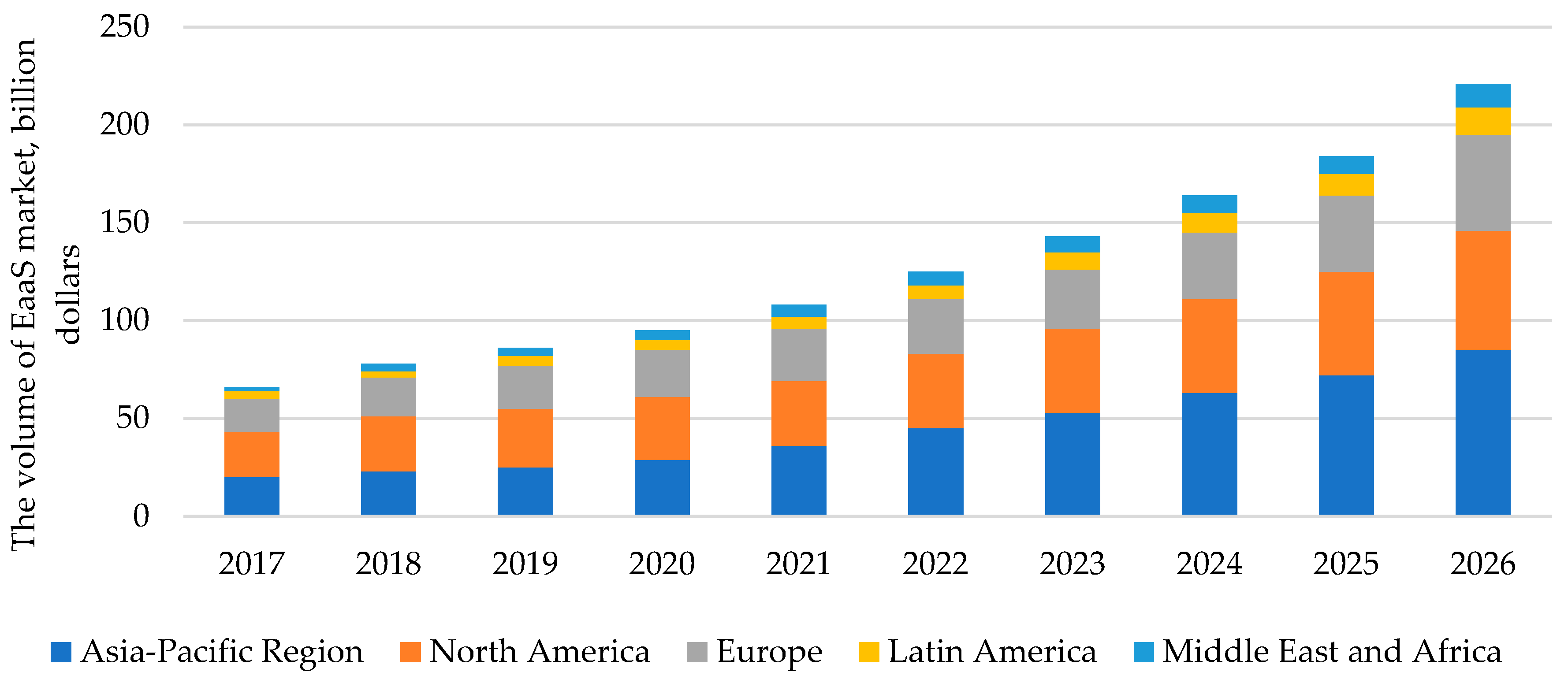

4. Discussion

- Political independence. When one country relies on another country to meet most of its energy needs it exposes itself to the risk of intimidation, coercion, and manipulation by the supplier [47,48]. The distribution of energy requirements among different suppliers allows the importing country to reduce its dependence on one supplier and strengthen its independence in world politics.

- Economic growth. Getting energy from multiple sources and suppliers insulates the importing country from energy disruptions when one source or supplier is unable or unwilling to meet demand [49,50]. Energy diversification ensures permanent energy security, which creates favorable conditions for entrepreneurship, innovation, research, and development.

- The obtaining of a power system balanced in terms of power and load;

- a decrease in the average unit capacity of power plants;

- improved maneuverability of high-performance power plants;

- reduction in the length of electrical networks of all voltage levels;

- reduction of electricity losses in distribution networks;

- increased capacity factor of renewable energy installations (including by equipping them with energy storage devices);

- reduction of the share of natural gas in the balance of TPPs;

- an overall reduction in the consumption of all types of fuel for electricity generation.

5. Conclusions

- range expansion of primary energy carriers with an increase in the share of RES and nuclear energy;

- equipping of TPPs with efficient gas turbine and combined-cycle plants that contribute to improving the environmental safety, efficiency, and technical sustainability of power systems;

- scale expansion of energy capacities with an emphasis on medium and small capacities;

- implementation of energy and capacity savings as an alternative to commissioning new generation and grid facilities;

- a new stage of electrification, comprehensively covering industry, transport, commercial, and household sectors, during which the primary hydrocarbon energy carriers are replaced by electricity.

- A radical increase in the controllability of energy flows based on the latest intelligent technologies;

- A comprehensive increase in energy efficiency, including through energy demand management programs;

- Change in energy market organizations, taking into account the shift towards the business model EaaS;

- Expansion of the generation capacities structure in the electric power industry through a combination of centralized and decentralized solutions;

- Legal regulation of issues related to the development, implementation, and operation of energy facilities, alongside the establishment of a legislative framework for the development of renewable energy;

- Effective tax system implementation for dirty energy facilities.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Marín-Rodríguez, N.J.; González-Ruiz, J.D.; Botero Botero, S. Dynamic Co-Movements among Oil Prices and Financial Assets: A Scientometric Analysis. Sustainability 2022, 14, 12796. [Google Scholar] [CrossRef]

- Andreev, O.; Lomakina, O.; Aleksandrova, A. Diversification of structural and crisis risks in the energy sector of the ASEAN member countries. Energy Strategy Rev. 2021, 35, 100655. [Google Scholar] [CrossRef]

- Sinsel, S.R.; Yan, X.; Stephan, A. Building resilient renewable power generation portfolios: The impact of diversification on investors’ risk and return. Appl. Energy 2019, 254, 113348. [Google Scholar] [CrossRef]

- Hashimzade, N.; Myles, G.; Black, J. A Dictionary of Economics; Oxford University Press: Oxford, UK, 2017; Available online: https://www.oxfordreference.com/view/10.1093/acref/9780198759430.001.0001/acref-9780198759430 (accessed on 10 December 2022).

- Sohl, T.; McCann, B.T.; Vroom, G. Business model diversification: Demand relatedness, entry sequencing, and curvilinearity in the diversification-performance relationship. Long Range Plan. 2022, 55, 102215. [Google Scholar] [CrossRef]

- Aversa, P.; Haefliger, S.; Hueller, F.; Reza, D.G. Customer complementarity in the digital space: Exploring Amazon’s business model diversification. Long Range Plan. 2021, 54, 101985. [Google Scholar] [CrossRef]

- Meirinhos, G.; Malebo, M.; Cardoso, A.; Silva, R.; Rêgo, R. Information and Public Knowledge of the Potential of Alternative Energies. Energies 2022, 15, 4928. [Google Scholar] [CrossRef]

- Xie, Z.; Wang, J.; Miao, L. Big data and emerging market firms’ innovation in an open economy: The diversification strategy perspective. Technol. Forecast. Soc. Change 2021, 173, 121091. [Google Scholar] [CrossRef]

- Nagasawa, T.; Pillay, C.; Beier, G.; Fritzsche, K.; Pougel, F.; Takama, T.; The, K.; Bobashev, I. Accelerating Clean Energy through Industry 4.0. Manufacturing the Next Revolution; United Nations Industrial Development Organization: Vienna, Austria, 2017; Available online: https://www.unido.org/sites/default/files/2017-08/REPORT_Accelerating_clean_energy_through_Industry_4.0.Final_0.pdf (accessed on 10 December 2022).

- Schwab, K. The Fourth Industrial Revolution; World Economic Forum: Geneva, Switzerland, 2016; Available online: https://law.unimelb.edu.au/__data/assets/pdf_file/0005/3385454/Schwab-The_Fourth_Industrial_Revolution_Klaus_S.pdf (accessed on 10 December 2022).

- Vaidya, S.; Ambad, P.; Bhosle, S. Industry 4.0—A Glimpse. Procedia Manuf. 2020, 20, 233–238. [Google Scholar] [CrossRef]

- Swiatowiec-Szczepanska, J.; Stepien, B. Drivers of Digitalization in the Energy Sector—The Managerial Perspective from the Catching Up Economy. Energies 2022, 15, 1437. [Google Scholar] [CrossRef]

- Digitalization and the future of energy. Beyond the Hype—How to Create Value by Combining Digital Technology, People and Business Strategy. DNV GL—Energy. 2019. Available online: https://smartenergycc.org/wp-content/uploads/2019/07/Digitalization_report_pages.pdf (accessed on 10 December 2022).

- The Energy Transition: Key Challenges for Incumbent and New Players in the Global Energy System. Oxford Institute for Energy Studies. 2021. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2021/09/Energy-Transition-Key-challenges-for-incumbent-players-in-the-global-energy-system-ET01.pdf (accessed on 10 December 2022).

- Theme Report on Energy Transition. Towards the Achievement of SDG 7 and Net-Zero Emissions. United Nations. 2021. Available online: https://www.un.org/sites/un2.un.org/files/2021-twg_2-062321.pdf (accessed on 10 December 2022).

- Global Energy Transformation. A Roadmap to 2050. IRENA. 2018. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Apr/IRENA_Report_GET_2018.pdf (accessed on 10 December 2022).

- ScienceDirect Database. Official Website. Available online: https://www.sciencedirect.com (accessed on 10 December 2022).

- Zakeri, B.; Paulavets, K.; Barreto-Gomez, L.; Echeverri, L.G.; Pachauri, S.; Boza-Kiss, B.; Zimm, C.; Rogelj, J.; Creutzig, F.; Ürge-Vorsatz, D.; et al. Pandemic, War, and Global Energy Transitions. Energies 2022, 15, 6114. [Google Scholar] [CrossRef]

- Shahzad, U.; Lv, Y.; Doğan, B.; Xia, W. Unveiling the heterogeneous impacts of export product diversification on renewable energy consumption: New evidence from G-7 and E-7 countries. Renew. Energy 2021, 164, 1457–1470. [Google Scholar] [CrossRef]

- Devaraj, D.; Syron, E.; Donnellan, P. Diversification of gas sources to improve security of supply using an integrated Multiple Criteria Decision Making approach. Clean. Responsible Consum. 2021, 3, 100042. [Google Scholar] [CrossRef]

- Ahmed, N.; Sheikh, A.A.; Mahboob, F.; Ali, M.S.E.; Jasi’nska, E.; Jasi’nski, M.; Leonowicz, Z.; Burgio, A. Energy Diversification: A Friend or Foe to Economic Growth in Nordic Countries? A Novel Energy Diversification Approach. Energies 2022, 15, 5422. [Google Scholar] [CrossRef]

- Bashir, M.A.; Sheng, B.; Doğan, B.; Sarwar, S.; Shahzad, U. Export product diversification and energy efficiency: Empirical evidence from OECD countries. Struct. Chang. Econ. Dyn. 2020, 55, 232–243. [Google Scholar] [CrossRef]

- Lampis, A.; Martín, M.M.M.; Zabaloy, M.F.; Soares, R.S.; Guzowski, C.; Mandai, S.S.; Lazaro, L.L.B.; Hermsdorff, S.M.G.L.; Bermann, C. Energy transition or energy diversification? Critical thoughts from Argentina and Brazil. Energy Policy 2022, 171, 113246. [Google Scholar] [CrossRef]

- Thanh, T.T.; Ha, L.T.; Dung, H.P.; Huong, T.T.L. Impacts of digitalization on energy security: Evidence from European countries. Environ. Dev. Sustain. 2022, 1–46. [Google Scholar] [CrossRef]

- Morris, W.; Bowen, R. Renewable energy diversification: Considerations for farm business resilience. J. Rural. Stud. 2020, 80, 380–390. [Google Scholar] [CrossRef]

- Rokicki, T.; Koszela, G.; Ochnio, L.; Wojtczuk, K.; Ratajczak, M.; Szczepaniuk, H.; Michalski, K.; Bórawski, P.; Bełdycka-Bórawska, A. Diversity and Changes in Energy Consumption by Transport in EU Countries. Energies 2021, 14, 5414. [Google Scholar] [CrossRef]

- Gitelman, L.D.; Kozhevnikov, M.V. Electrification as a development driver for “smart cities”. Econ. Reg. 2017, 4, 1199–1210. [Google Scholar] [CrossRef]

- Xiang, Y.; Zheng, J.; Tu, X. The Impact of Intermediate Goods Imports on Energy Efficiency: Empirical Evidence from Chinese Cities. Int. J. Environ. Res. Public Health 2022, 19, 13007. [Google Scholar] [CrossRef]

- Majumdar, S.; Paris, C.M. Environmental Impact of Urbanization, Bank Credits, and Energy Use in the UAE—A Tourism-Induced EKC Model. Sustainability 2022, 14, 7834. [Google Scholar] [CrossRef]

- Iqbal, M.; Ma, J.; Ahmad, N.; Hussain, K.; Wagas, M.; Liang, Y. Sustainable construction through energy management practices: An integrated hierarchal framework of drivers in the construction sector. Environ. Sci. Pollut. Res. 2022, 29, 90108–90127. [Google Scholar] [CrossRef] [PubMed]

- Borysiak, O.; Skowron, Ł.; Brych, V.; Manzhula, V.; Dluhopolskyi, O.; Sak-Skowron, M.; Wołowiec, T. Towards Climate Management of District Heating Enterprises’ Innovative Resources. Energies 2022, 15, 7841. [Google Scholar] [CrossRef]

- Giannuzzi, G.M.; Mostova, V.; Pisani, C.; Tessitore, S.; Vaccaro, A. Enabling Technologies for Enhancing Power System Stability in the Presence of Converter-Interfaced Generators. Energies 2022, 15, 8064. [Google Scholar] [CrossRef]

- Zafar, M.W.; Shahbaz, M.; Hou, F.; Sinha, A. From nonrenewable to renewable energy and its impact on economic growth: The role of research & development expenditures in Asia-Pacific Economic Cooperation countries. J. Clean. Prod. 2021, 350, 1145–1178. [Google Scholar] [CrossRef]

- Yilanci, V.; Haouas, I.; Ozgur, O.; Sarkodie, S.A. Energy Diversification and Economic Development in Emergent Countries: Evidence from Fourier Function-Driven Bootstrap Panel Causality Test. Front. Energy Res. 2021, 9, 632712. [Google Scholar] [CrossRef]

- Akrofi, M.M. An analysis of energy diversification and transition trends in Africa. Int. J. Energy Water Resour. 2021, 5, 1–12. [Google Scholar] [CrossRef]

- Cerović, L.; Maradin, D.; Čegar, S. From the Restructuring of the Power Sector to Diversification of Renewable Energy Sources: Preconditions for Efficient and Sustainable Electricity Market. Int. J. Energy Econ. Policy 2014, 4, 599–609. [Google Scholar]

- Wedekind, S. Energy as a Service: A Strategic Challenge and Key Opportunity for ESCOs. Available online: https://energycentral.com/o/Guidehouse/energy-service-strategic-challenge-and-key-opportunity-escos (accessed on 10 December 2022).

- Energy-as-a-Service. The Lights Are on. Is Anyone Home? Deloitte. 2019. Available online: https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/energy-resources/deloitte-uk-energy-as-a-service-report-2019.pdf (accessed on 10 December 2022).

- Järvi, K.; Sainio, L.-M.; Ritala, P.; Pellinen, A. Building a framework for a partnership business model. Int. J. Manag. Concepts Philos. 2010, 4, 100–117. [Google Scholar] [CrossRef]

- Chaurey, A.; Krithika, P.R.; Palit, D.; Rakesh, D.; Sovacool, B.K. New partnerships and business models for facilitating energy access. Energy Policy 2012, 47, 48–55. [Google Scholar] [CrossRef]

- Sharma, R.; Shahbaz, M.; Kautish, P.; Vo, X.V. Analyzing the impact of export diversification and technological innovation on renewable energy consumption: Evidences from BRICS nations. Renew. Energy 2021, 178, 1034–1045. [Google Scholar] [CrossRef]

- Gitelman, L.D.; Dobrodey, V.V.; Kozhevnikov, M.V. Tools for Sustainable Development of Regional Energy Systems. Econ. Reg. 2020, 16, 1208–1223. [Google Scholar] [CrossRef]

- Gitelman, L.D.; Gitelman, L.M.; Kozhevnikov, M.V. Managers for sustainable electric power industry of tomorrow. Int. J. Sustain. Dev. Plan. 2018, 13, 307–315. [Google Scholar] [CrossRef]

- Gitelman, L.D. Management education for a sustainable electric power industry in the 21st century. WIT Trans. Ecol. Environ. 2014, 190, 1197–1203. [Google Scholar] [CrossRef]

- Kozhevnikov, M.; Gitelman, L.; Magaril, E.; Magaril, R.; Aristova, A. Risk Reduction Methods for Managing the Development of Regional Electric Power Industry. Sustainability 2017, 9, 2201. [Google Scholar] [CrossRef]

- Mityakov, S.; Tang, H.; Tsui, K.K. International Politics and Import Diversification. J. Law Econ. 2013, 56, 1091–1121. [Google Scholar] [CrossRef]

- Kashcheeva, M.; Tsui, K.K. Political oil import diversification by financial and commercial traders. Energy Policy 2015, 82, 289–297. [Google Scholar] [CrossRef]

- Thomä, J.; Dupré, S.; Gorius, A.; Coeslier, M.; Guyatt, D. Optimal Diversification and the Energy Transition. Available online: https://2degrees-investing.org/wp-content/uploads/2014/07/Optimal-diversification-and-the-energy-transition-impact-of-equity-benchmarks-on-portfolio-diversification-and-climate-finance-2014.pdf (accessed on 10 December 2022).

- Karaeva, A.P.; Magaril, E.R.; Kiselev, A.V.; Cioca, L.-I. Screening of Factors for Assessing the Environmental and Economic Efficiency of Investment Projects in the Energy Sector. Int. J. Environ. Res. Public Health 2022, 19, 11716. [Google Scholar] [CrossRef]

- Udemba, E.N.; Tosun, M. Energy transition and diversification: A pathway to achieve sustainable development goals (SDGs) in Brazil. Energy 2022, 239, 122199. [Google Scholar] [CrossRef]

- Karaeva, A.; Magaril, E.; Torretta, V.; Viotti, P.; Rada, E.C. Public Attitude towards Nuclear and Renewable Energy as a Factor of Their Development in a Circular Economy Frame: Two Case Studies. Sustainability 2022, 14, 1283. [Google Scholar] [CrossRef]

- Dzyuba, A.; Solovyeva, I. Price-based Demand-side Management Model for Industrial and Large Electricity Consumers. Int. J. Energy Econ. Policy 2020, 10, 135–149. [Google Scholar] [CrossRef]

- Pau, M.; Mirz, M.; Dinkelbach, J.; McKeever, P.; Ponci, F.; Monti, M. A Service Oriented Architecture for the Digitalization and Automation of Distribution Grids. IEEE Access 2022, 10, 37050–37063. [Google Scholar] [CrossRef]

- Schaffer, M.; Bollhöfer, F.C.; Üpping, J. Load shifting potential of electric vehicles using management systems for increasing renewable energy share in smart grids. Int. J. Energy Prod. Manag. 2022, 7, 101–113. [Google Scholar] [CrossRef]

- Zhang, N.; Sun, Q.; Yang, L.; Li, Y. Event-Triggered Distributed Hybrid Control Scheme for the Integrated Energy System. IEEE Trans. Ind. Inform. 2022, 18, 835–846. [Google Scholar] [CrossRef]

- Jia, L.; Zhu, Y.; Du, S.; Wang, Y. Analysis of the Transition Between Multiple Operational Modes for Hybrid AC/DC Microgrids. CSEE J. Power Energy Syst. 2018, 4, 49–57. [Google Scholar] [CrossRef]

- Guan, Y.; Wei, B.; Guerrero, J.M.; Vasquez, J.C.; Gui, Y. An overview of the operation architectures and energy management system for multiple microgrid clusters. iEnergy 2022, 1, 306–314. [Google Scholar] [CrossRef]

- Pollitt, M.G. The Energy Market in Time of War. Available online: https://cerre.eu/wp-content/uploads/2022/09/The-War-Economy-and-Energy-CERRE_edited-TC_2AM-PDF.pdf (accessed on 10 December 2022).

- Current Energy Crises, the Energy Transition and the Design of Electricity Markets. The Oxford Institute for Energy Studies. 2022. Available online: https://a9w7k6q9.stackpathcdn.com/wpcms/wp-content/uploads/2022/08/Current-Energy-Crises-the-Energy-Transition-and-the-Design-of-Electricity-Markets.pdf (accessed on 10 December 2022).

- Basdekis, C.; Christopoulos, A.; Katsampoxakis, I.; Nastas, V. The Impact of the UkrainianWar on Stock and Energy Markets: A Wavelet Coherence Analysis. Energies 2022, 15, 8174. [Google Scholar] [CrossRef]

- Questions and Answers on the EU Taxonomy Complementary Climate Delegated Act Covering Certain Nuclear and Gas Activities. Available online: https://ec.europa.eu/commission/presscorner/detail/en/QANDA_22_712 (accessed on 10 December 2022).

- World Energy Outlook 2021. International Energy Agency. 2021. Available online: https://iea.blob.core.windows.net/assets/4ed140c1-c3f3-4fd9-acae-789a4e14a23c/WorldEnergyOutlook2021.pdf (accessed on 10 December 2022).

- Antonini, C.; Treyer, K.; Streb, A.; van der Spek, M.; Bauer, C.; Mazzotti, M. Hydrogen production from natural gas and biomethane with carbon capture and storage—A techno-environmental analysis. Sustain. Energy Fuels 2020, 4, 2967–2986. [Google Scholar] [CrossRef]

- Farghali, M.; Osman, A.I.; Umetsu, K.; Rooney, D.W. Integration of biogas systems into a carbon zero and hydrogen economy: A review. Environ. Chem. Lett. 2022, 20, 2853–2927. [Google Scholar] [CrossRef]

- Gitelman, L.; Kozhevnikov, M. Energy Transition Manifesto: A Contribution towards the Discourse on the Specifics Amid Energy Crisis. Energies 2022, 15, 9199. [Google Scholar] [CrossRef]

- Circular Economy in the Energy Industry. Summary of the Final Deloitte Report. 2018. Available online: https://energia.fi/files/2287/Deloitte_2018_-_Circular_economy_in_the_energy_industry_-_Summary_report....pdf (accessed on 10 December 2022).

- World Energy Outlook 2018. International Energy Agency. 2018. Available online: https://iea.blob.core.windows.net/assets/77ecf96c-5f4b-4d0d-9d93-d81b938217cb/World_Energy_Outlook_2018.pdf (accessed on 10 December 2022).

| Type of Power Facility | Advantages | Disadvantages | ||

|---|---|---|---|---|

| Power plants on RES |

|

| ||

| NPP |

|

| ||

| TPP with CCGT | By comparison with NPP |

| By comparison with NPP |

|

| By comparison with steam-turbine TPP |

| |||

| Unique Feature | Traditional Method | IRP Method |

|---|---|---|

| Type of product | Electricity and heat energy | Power services |

| Influence of energy company on demand (customer communication) | Power consumption—external uncontrolled characteristic | Power consumption—subject to control by the energy company |

| Power supply source (resources) | Own generation capacity | Additionally: end-use energy saving; independent energy producers in the region |

| Engineering policy | Mainly large-scale units on nuclear and organic fuel | Wide range of power plants and power layouts |

| Environmental factors | Taken into account indirectly through the corresponding costs | Taken into account directly through environmental criteria |

| Public influence | Involved in decision-making in a limited and non-systematic way | Gets access to the plans of the energy company and actively participates in their discussion and approval |

| Uncertainty and risk management | Not taken into account or taken into account indirectly | Special measures are being developed to reduce uncertainty and associated risk |

| Planning models | Optimization (deterministic) | Simulation (probabilistic, multivariative) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gitelman, L.; Kozhevnikov, M.; Visotskaya, Y. Diversification as a Method of Ensuring the Sustainability of Energy Supply within the Energy Transition. Resources 2023, 12, 19. https://doi.org/10.3390/resources12020019

Gitelman L, Kozhevnikov M, Visotskaya Y. Diversification as a Method of Ensuring the Sustainability of Energy Supply within the Energy Transition. Resources. 2023; 12(2):19. https://doi.org/10.3390/resources12020019

Chicago/Turabian StyleGitelman, Lazar, Mikhail Kozhevnikov, and Yana Visotskaya. 2023. "Diversification as a Method of Ensuring the Sustainability of Energy Supply within the Energy Transition" Resources 12, no. 2: 19. https://doi.org/10.3390/resources12020019

APA StyleGitelman, L., Kozhevnikov, M., & Visotskaya, Y. (2023). Diversification as a Method of Ensuring the Sustainability of Energy Supply within the Energy Transition. Resources, 12(2), 19. https://doi.org/10.3390/resources12020019