A Study on the Spatiotemporal Coupling Characteristics and Driving Factors of China’s Green Finance and Energy Efficiency

Abstract

1. Introduction

2. Literature Review and Theoretical Framework

2.1. Literature Review

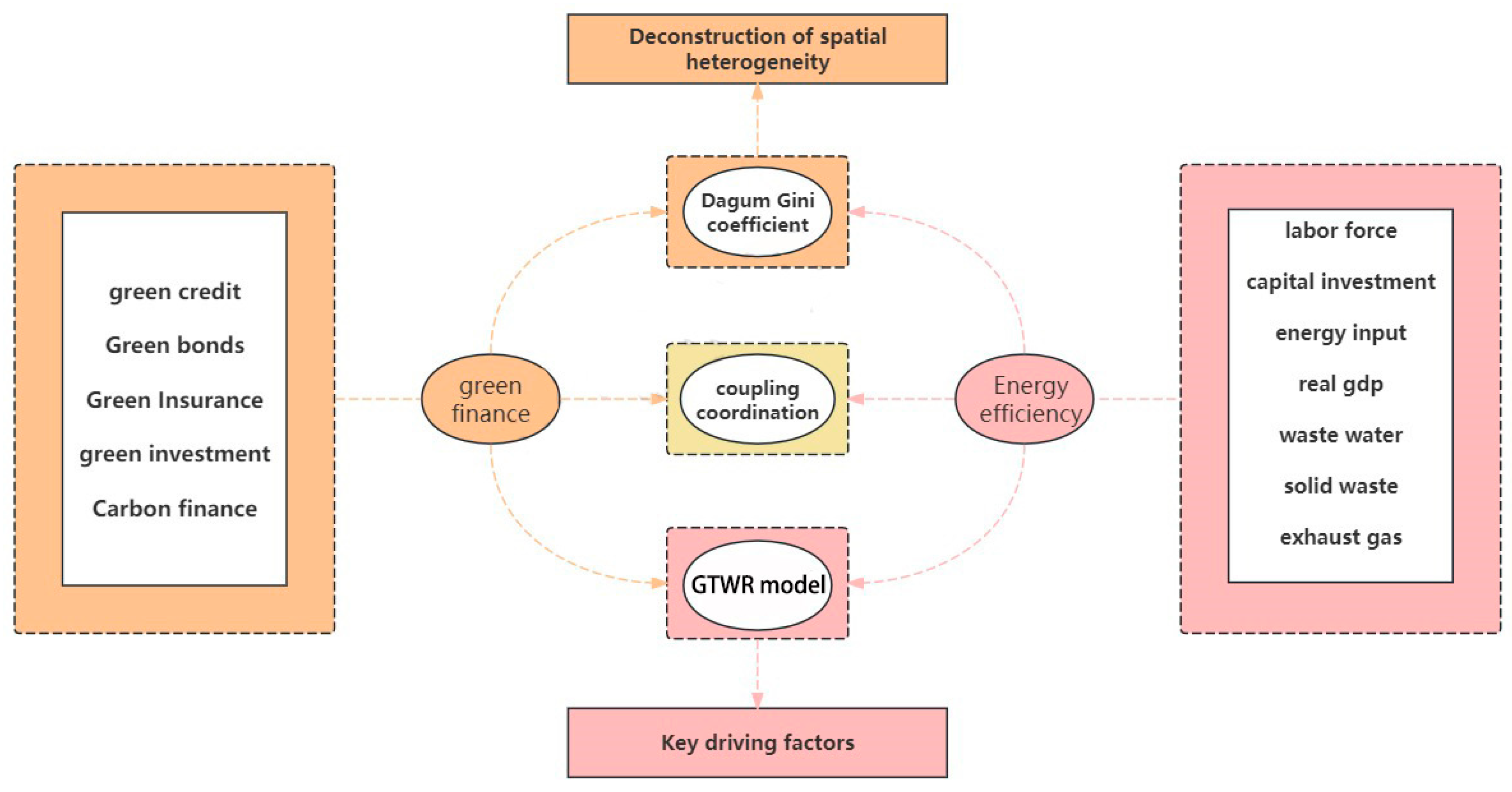

2.2. Theoretical Framework

3. Research Method, Construction of Index System, and Data Selection

3.1. Study Methods

- (1)

- Overview of the global reference super-efficient EBM model

- (2)

- Entropy method: purpose and application

- ➀

- Standardization of indicators.

- ➁

- Entropy value calculation.

- ➂

- Weighting is determined.

- (3)

- The CCD model measures the relationship between GF and EE.

- (4)

- The Dagum Gini coefficient explores the spatial–temporal interaction characteristics between China’s GF and EE in depth.

- (5)

- The spatial and temporal weighted regression model identifies the impact of driving factors on GECC.

3.2. The Construction of the Indicator System

3.3. Data Sources

4. Results Analysis

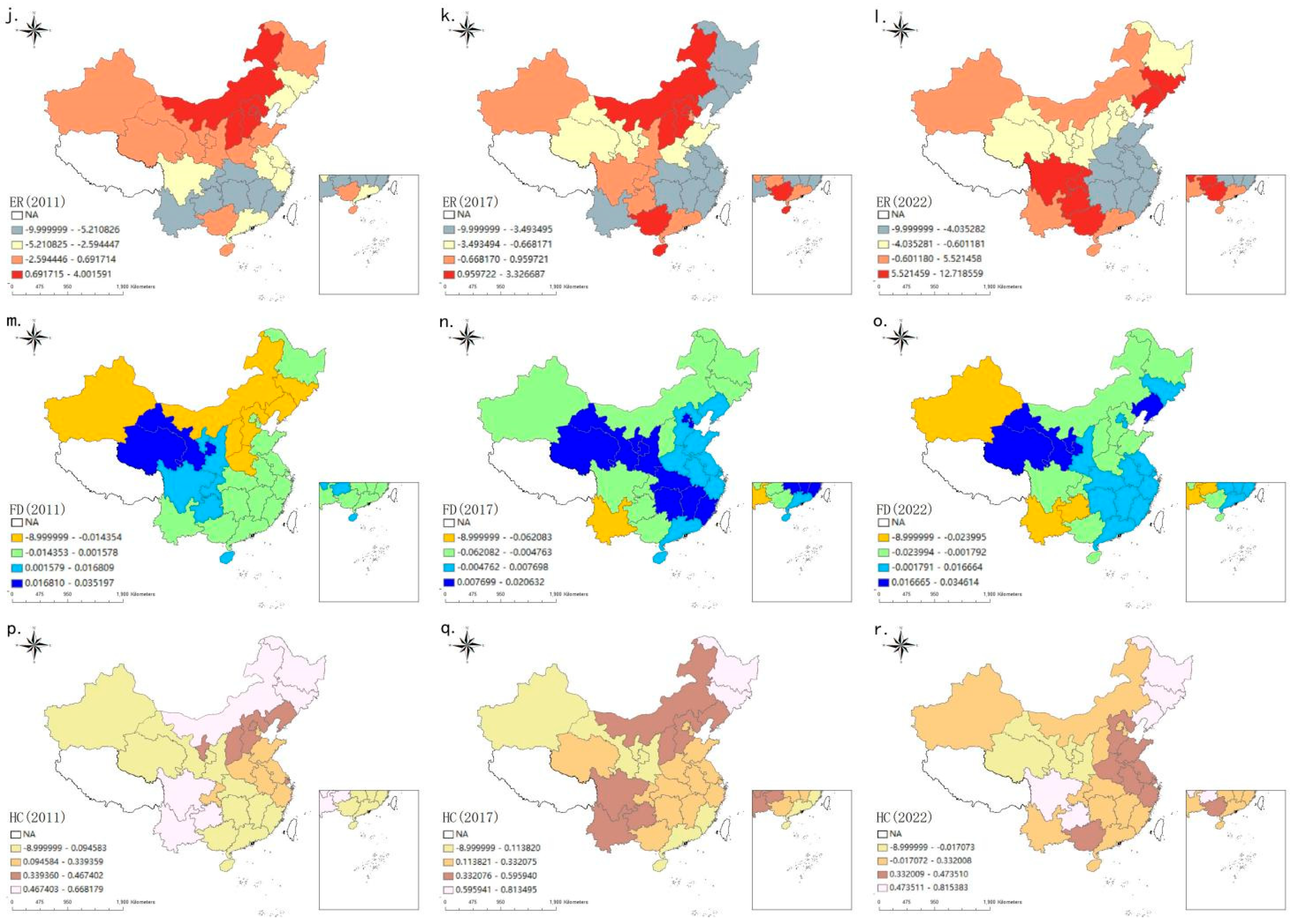

4.1. Spatio-Temporal Differentiation of the 30 Provinces in China

4.1.1. GF Analysis of Spatiotemporal Trends

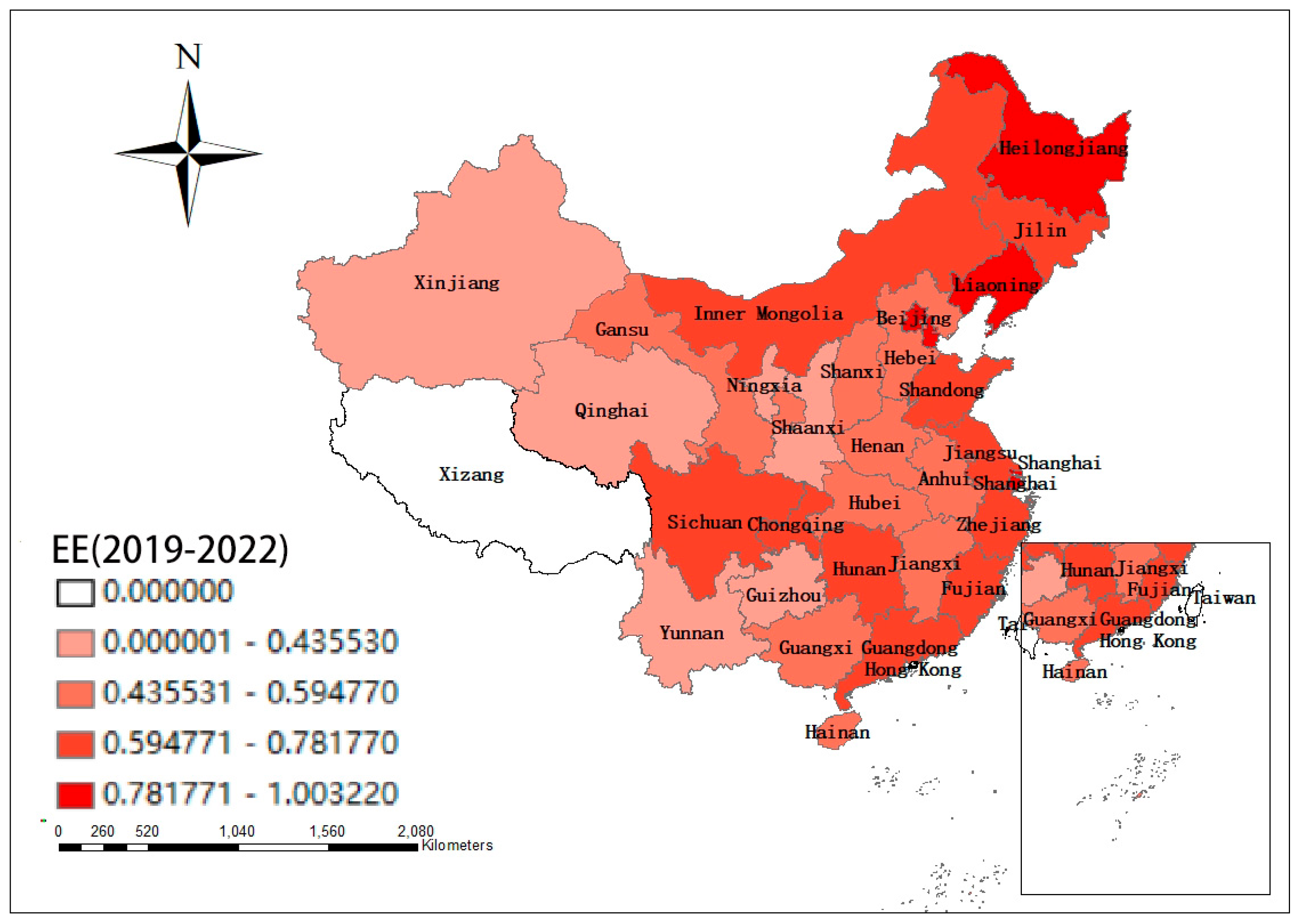

4.1.2. EE Spatial and Temporal Evolution Trend Analysis

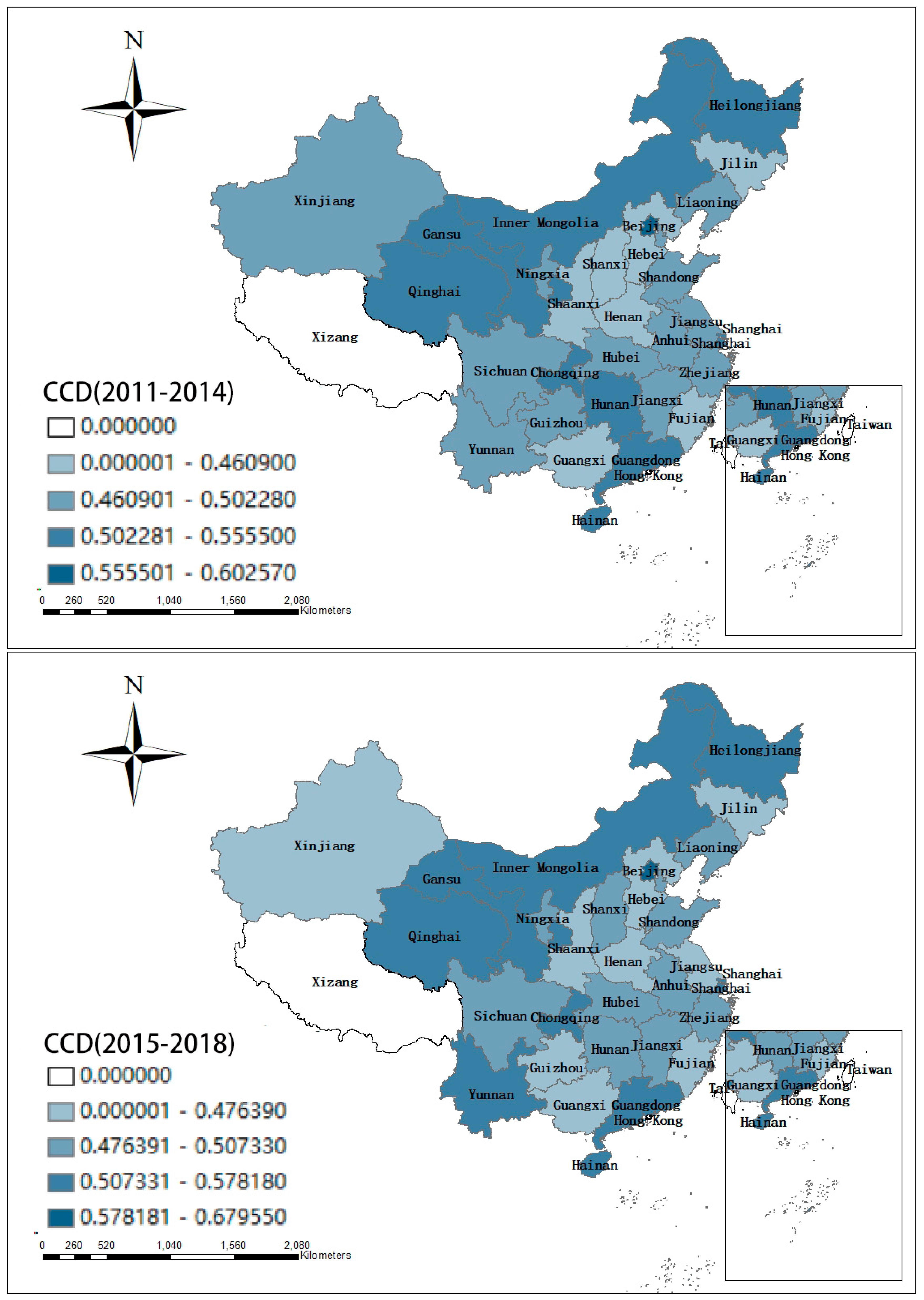

4.1.3. Analysis of the Spatial and Temporal Evolution Trend of CCD

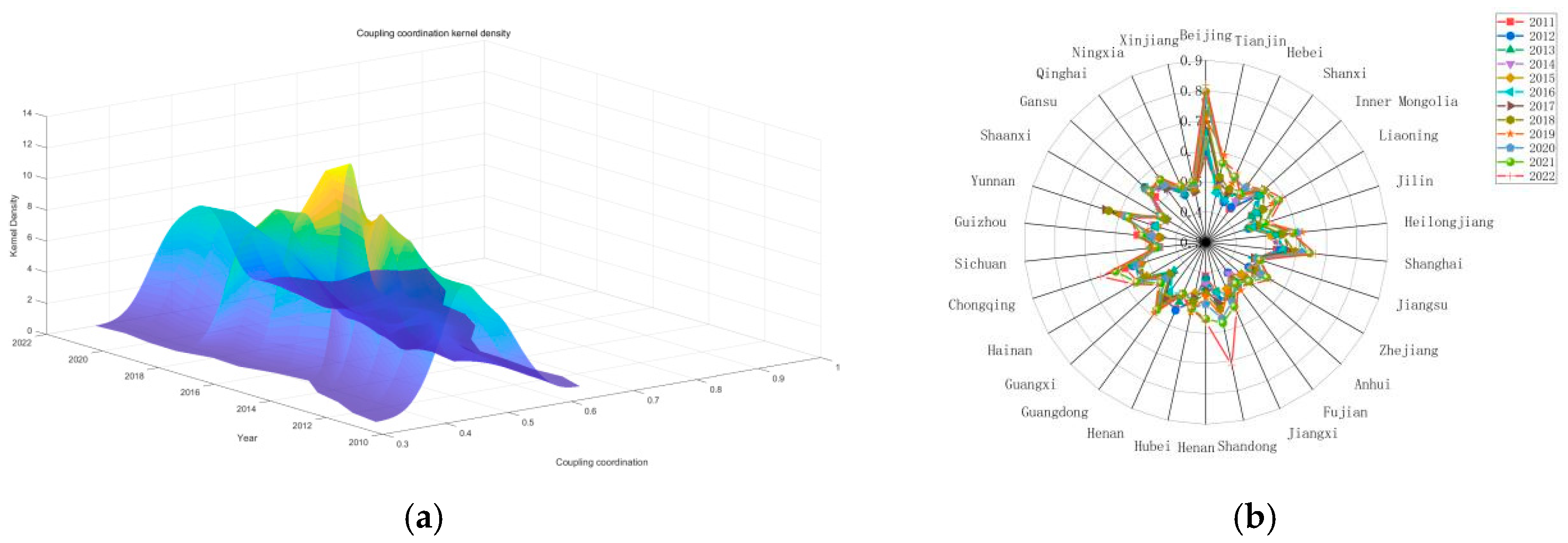

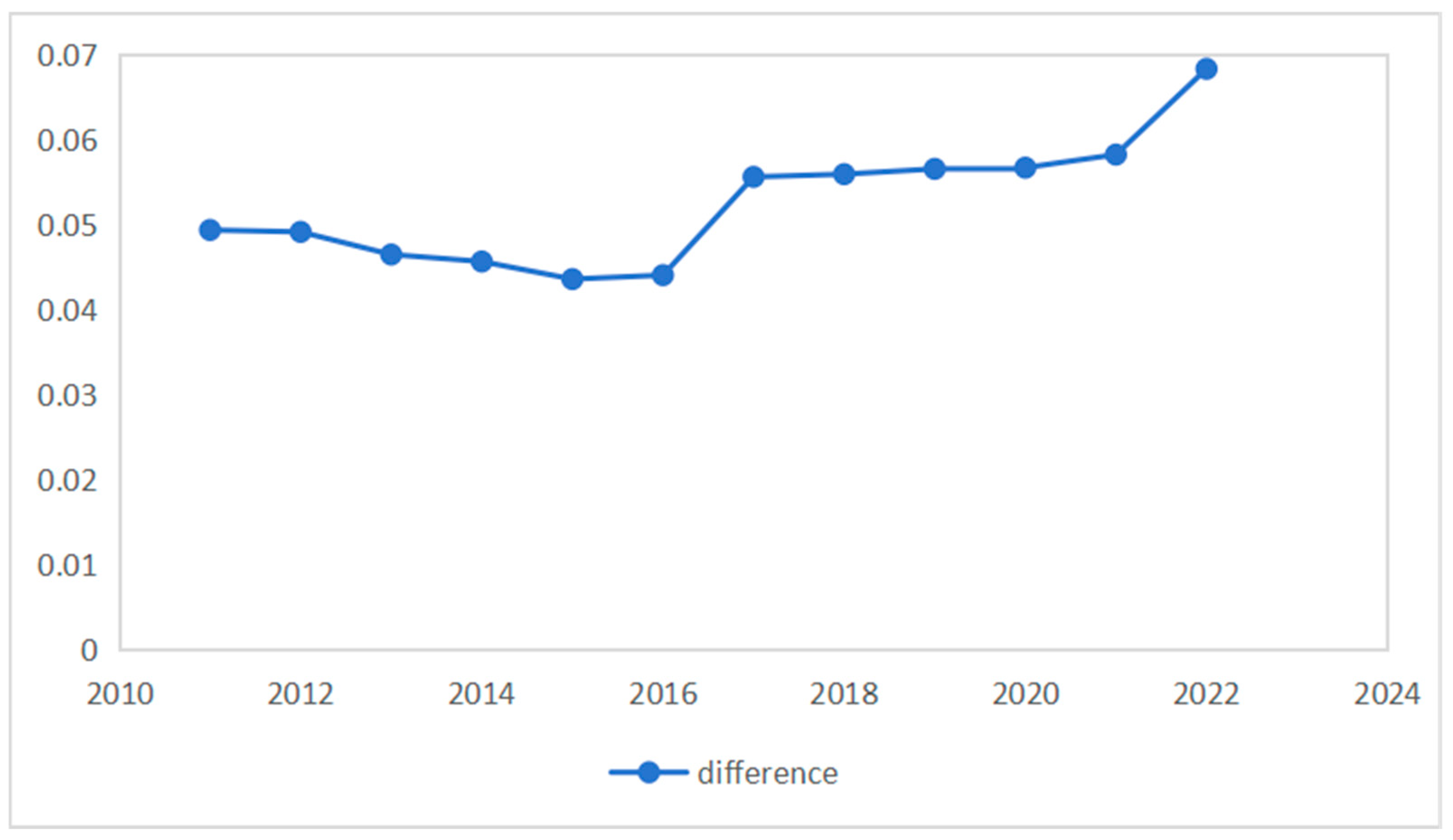

4.2. Dagum Gini Coefficient of GECC in 30 Provinces of China

4.3. Driver Factor Analysis

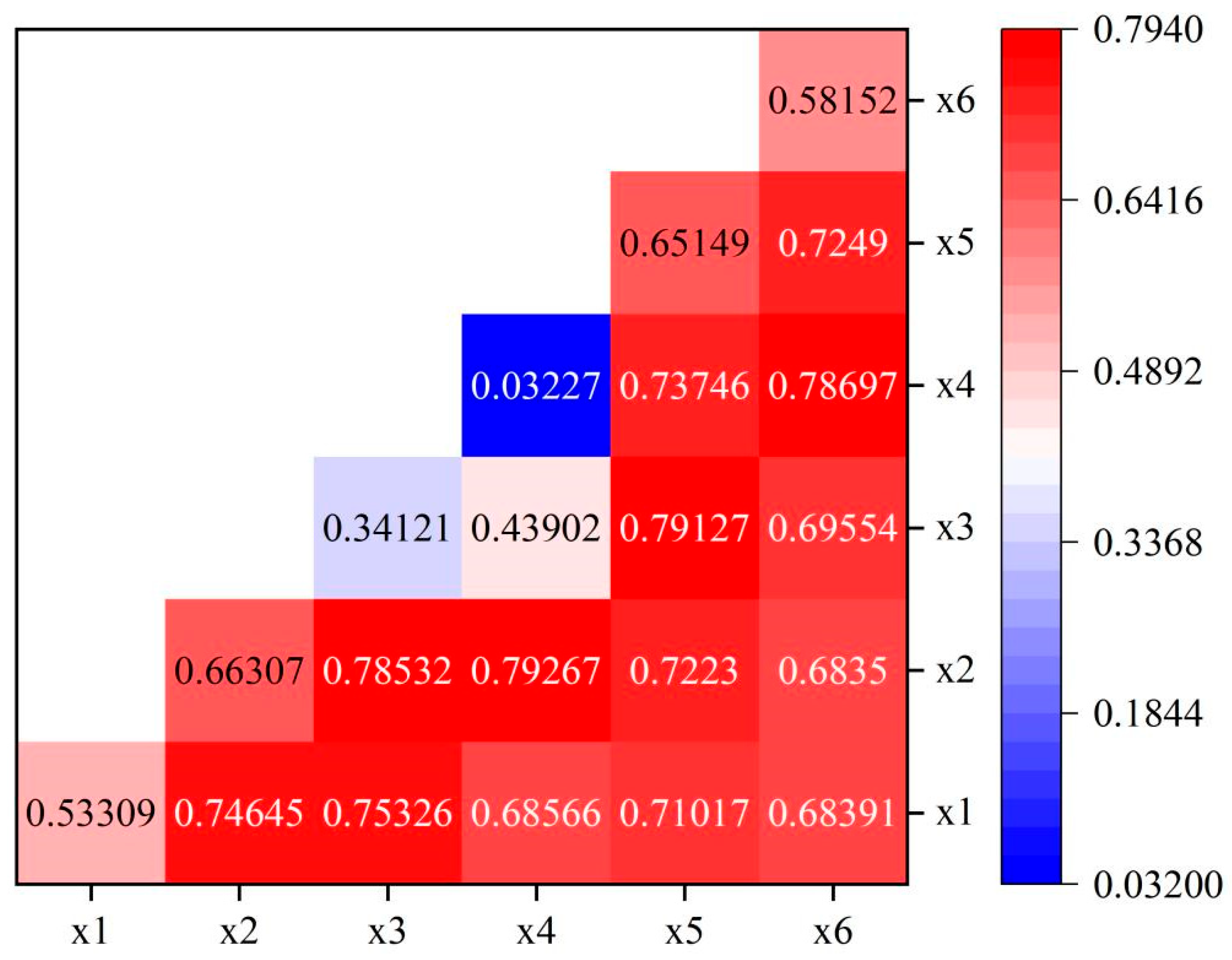

4.3.1. Single-Factor Detection

- The economic development level is an important factor affecting GECC. Higher GDP and per capita GDP imply that a region has more funds and technology to invest in the GF sector, which in turn promotes the improvement of EE;

- The tertiary industry is a low-energy-consuming and high-value-added sector. Enhancing its ratio contributes to the betterment of EE and fosters a positive interaction between GF and EE;

- The volume of applications for green patents may indicate a region’s capacity for innovation and the evolution of technological accomplishments. The application of technological innovation results can facilitate the in-depth coupling of GF and EE;

- Strict ER can prompt enterprises to increase environmental protection investment and adopt more advanced energy-saving and emission-reduction technologies, thereby improving EE. It also guides capital towards the green industry, promoting the development of GF;

- FD is capable of assessing the progression stage of a region’s financial market. An advanced financial market has the potential to bolster the green industry financially, fostering GF’s growth and subsequently enhancing EE;

- The proportion of highly educated population reflects a region’s population quality and talent reserve. Skilled individuals play a key role in advancing TI and spreading GF principles, thereby promoting the coordinated development of GF and EE.

4.3.2. Interactor Factor Detection

5. Discussion

5.1. Possible Reasons Behind the Geographical and Chronological Distribution Characteristics of GECC

5.2. Driving Mechanism of GECC

5.3. Policy Implications

5.4. Limitations

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Correction Statement

Nomenclature

| Full Name | Abbreviation |

| Green finance | GF |

| Energy efficiency | EE |

| Coupling coordination degree | CCD |

| The coupling degree of green finance and energy efficiency | GECC |

| Economics of scale | ES |

| Industrial structure | IS |

| Technical innovation | TI |

| Environmental regulation | ER |

| Financial development | FD |

| human capital | HC |

| Geographic weighted regression | GTWR |

| Comprehensive development level of green finance | CDGF |

| Yangtze River Delta | YRD |

| Pearl River Delta | PRD |

References

- Sillman, J.; Hynynen, K.; Dyukov, I.; Ahonen, T.; Jalas, M. Emission reduction targets and electrification of the Finnish energy system with low-carbon Power-to-X technologies: Potentials, barriers, and innovations—A Delphi survey. Technol. Forecast. Soc. Change 2023, 193, 122587. [Google Scholar] [CrossRef]

- Schweitzer, V.; Bach, V.; Holzapfel, P.K.; Finkbeiner, M. Holzapfel, Matthias Finkbeiner. Differences in science-based target approaches and implications for carbon emission reductions at a sectoral level in Germany. Sustain. Prod. Consum. 2023, 38, 199–209. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, J.; Zhao, Z.; Ren, J.; Chen, X. Research on carbon emission reduction effect of China’s regional digital trade under the “double carbon” target-- combination of the regulatory role of industrial agglomeration and carbon emissions trading mechanism. Clean. Prod. 2023, 405, 137049. [Google Scholar] [CrossRef]

- Yan, C.; Siddik, A.B.; Yong, L.; Dong, Q.; Zheng, G.-W.; Rahman, M.N. A Two-Staged SEM-Artificial Neural Network Approach to Analyze the Impact of FinTech Adoption on the Sustainability Performance of Banking Firms: The Mediating Effect of Green Finance and Innovation. Systems 2022, 10, 148. [Google Scholar] [CrossRef]

- Wang, Z.; Teng, Y.-P.; Wu, S.; Chen, H. Does Green Finance Expand China’s Green Development Space? Evidence from the Ecological Environment Improvement Perspective. Systems 2023, 11, 369. [Google Scholar] [CrossRef]

- Chen, J.; Yuan, Z.; Mei, P.; Adam, N.A.; Chen, X. Carbon dioxide emissions and mitigation in China’s hydrogen energy supply chain: Insights for sustainability and policy development. Int. J. Hydrogen Energy 2025, 114, 378–391. [Google Scholar] [CrossRef]

- Zhang, J.; Yang, K.; Wu, J.; Duan, Y.; Ma, Y.; Ren, J.; Yang, Z. Scenario simulation of carbon balance in carbon peak pilot cities under the background of the “dual carbon” goals. Sustain. Cities Soc. 2024, 116, 105910. [Google Scholar] [CrossRef]

- Li, Q.; Li, L.; Lei, Y.; Wu, S. Navigating the path to dual carbon goals: Understanding the driving forces of energy transition welfare performance. J. Environ. Manag. 2024, 358, 120941. [Google Scholar] [CrossRef]

- Li, S.; Chen, Z.; Diao, Y.; Chen, Z. The impact of green finance on debt financing costs from the perspective of strategic corporate signaling behavior—Evidence from China. Int. Rev. Financ. Anal. 2025, 102, 104024. [Google Scholar] [CrossRef]

- Ding, S.; Wu, X.; Cui, T.; Goodell, J.W.; Du, A.M. Modeling climate policy uncertainty into cryptocurrency volatilities. Int. Rev. Financ. Anal. 2025, 102, 104030. [Google Scholar] [CrossRef]

- Xing, Y.; Wang, J.; Liu, Z.; Xiao, D. The impact of corporate financialization on ESG performance: A perspective based on executive incentives. Financ. Res. Lett. 2025, 76, 106934. [Google Scholar] [CrossRef]

- Chen, M.; Su, Y.; Piao, Z.; Zhu, J.; Yue, X. The green innovation effect of urban energy saving construction: A quasi-natural experiment from new energy demonstration city policy. J. Clean. Prod. 2023, 428, 139392. [Google Scholar] [CrossRef]

- Tian, C.; Li, X.; Xiao, L.; Zhu, B. Exploring the impact of green credit policy on green transformation of heavy polluting industries. J. Clean. Prod. 2022, 335, 130257. [Google Scholar] [CrossRef]

- Cui, X.; Wang, P.; Sensoy, A.; Nguyen, D.K.; Pan, Y. Green Credit Policy and Corporate Productivity: Evidence from a Quasi-natural Experiment in China. Technol. Forecast. Soc. Change 2022, 177, 121516. [Google Scholar] [CrossRef]

- Lin, T.; Zhang, L.; Li, J. Coupling and coordinated development of green finance and renewable energy industry in China: Spatiotemporal differentiation and driving factors. Renew. Energy 2024, 235, 121255. [Google Scholar] [CrossRef]

- Lee, C.-C.; Lee, C.-C. How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 2022, 107, 105863. [Google Scholar] [CrossRef]

- Chen, Y.; Zhao, Z.; Yi, W.; Hong, J.; Zhang, B. Has China achieved synergistic reduction of carbon emissions and air pollution? Evidence from 283 Chinese cities. Environ. Impact Assess. Rev. 2023, 103, 107277. [Google Scholar] [CrossRef]

- Jing, R.; Liu, R. The impact of green finance on persistence of green innovation at firm-level: A moderating perspective based on environmental regulation intensity. Financ. Res. Lett. 2024, 62, 105274. [Google Scholar] [CrossRef]

- Huang, F.; Ren, Y. Harnessing the green frontier: The impact of green finance reform and digitalization on corporate green innovation. Financ. Res. Lett. 2024, 66, 105554. [Google Scholar] [CrossRef]

- Chang, L.; Moldir, M.; Zhang, Y.; Nazar, R. Asymmetric impact of green bonds on energy efficiency: Fresh evidence from quantile estimation. Util Policy 2023, 80, 101474. [Google Scholar] [CrossRef]

- Zhang, Q.; Huang, H.; Chen, L.; Wang, Y. How does green finance affect carbon emission intensity? The role of green technology innovation and internet development. IREF 2025, 99, 103995. [Google Scholar] [CrossRef]

- LZhao, L.; Chau, K.Y.; Tran, T.K.; Sadiq, M.; Xuyen, N.T.M.; Phan, T.T.H. Enhancing green economic recovery through green bonds financing and energy efficiency investments. Econ. Anal. Policy 2022, 76, 488–501. [Google Scholar]

- Zhang, Y.; Fang, X.; Yang, Z.; Sun, Y.; Wang, Q. Green finance, technological innovation, and energy efficiency improvements: Evidence from China’s green finance reform pilot zone. Financ. Trade 2023, 59, 3531–3549. [Google Scholar] [CrossRef]

- Zhao, X.; Zeng, B.; Zhao, X.; Zeng, S.; Jiang, S. Impact of green finance on green energy efficiency: A pathway to sustainable development in China. Impact of green finance on green energy efficiency: A pathway to sustainable development in China. J. Clean. Prod. 2024, 450, 141943. [Google Scholar] [CrossRef]

- Basílio, M. Renewable energy and energy efficiency: An exploratory study in EU countries. Sustain. Futur. 2025, 9, 100514. [Google Scholar] [CrossRef]

- Xiong, S.; Ma, X.; Ji, J. The impact of industrial structure efficiency on provincial industrial energy efficiency in China. J. Clean. Prod. 2019, 215, 952–962. [Google Scholar] [CrossRef]

- Yang, Z.; Shao, S.; Yang, L.; Miao, Z. Improvement pathway of energy consumption structure in China’s industrial sector: From the perspective of directed technical change. Energy Econ. 2018, 72, 166–176. [Google Scholar] [CrossRef]

- Li, K.; Lin, B. How to promote energy efficiency through technological progress in China? Energy 2018, 143, 812–821. [Google Scholar] [CrossRef]

- Cantore, N.; Calì, M.; te Velde, D.W. Does energy efficiency improve technological change and economic growth in developing countries? Energy Policy 2016, 92, 279–285. [Google Scholar] [CrossRef]

- Chen, Q.; Ning, B.; Pan, Y.; Xiao, J. Green finance and outward foreign direct investment: Evidence from a quasi-natural experiment of green insurance in China. Asia Pac. J. Manag. 2021, 39, 899–924. [Google Scholar] [CrossRef]

- Chen, G.; Wei, B. Low-carbon city pilots and site selection for migrant employment: Evidence from China. Energy Econ. 2024, 131, 107417. [Google Scholar] [CrossRef]

- Guo, B.; Wang, Y.; Zhang, H.; Liang, C.; Feng, Y.; Hu, F. Impact of the digital economy on high-quality urban economic development: Evidence from Chinese cities. Econ. Model. 2023, 120, 106194. [Google Scholar] [CrossRef]

- Mardani, A.; Zavadskas, E.K.; Streimikiene, D.; Jusoh, A.; Khoshnoudi, M. A comprehensive review of data envelopment analysis (DEA) approach in energy efficiency. Renew. Sustain. Energ. Rev. 2017, 70, 1298–1322. [Google Scholar] [CrossRef]

- Martín-Gamboa, M.; Iribarren, D.; García-Gusano, D.; Dufour, J. A review of life-cycle approaches coupled with data envelopment analysis within multi-criteria decision analysis for sustainability assessment of energy systems. J. Clean. Prod. 2017, 150, 164–174. [Google Scholar] [CrossRef]

- Wang, Z.; Feng, C. A performance evaluation of the energy, environmental, and economic efficiency and productivity in China: An application of global data envelopment analysis. Appl. Energy 2015, 147, 617–626. [Google Scholar] [CrossRef]

- Shu, T.; Liao, X.; Yang, S.; Yu, T. Towards sustainability: Evaluating energy efficiency with a super-efficiency SBM-DEA model across 168 economies. Appl. Energy 2024, 376, 124254. [Google Scholar] [CrossRef]

- Storto, C.L. Measuring the eco-efficiency of municipal solid waste service: A fuzzy DEA model for handling missing data. Util Policy 2024, 86, 101706. [Google Scholar] [CrossRef]

- Tone, K. A slacks-based measure of efficiency in data envelopment analysis. Eur. J. Oper. Res. 2001, 130, 498–509. [Google Scholar] [CrossRef]

- Tao, X.; Wang, P.; Zhu, B. Provincial green economic efficiency of China: A non-separable input–output SBM approach. Appl. Energy 2016, 171, 58–66. [Google Scholar] [CrossRef]

- Yu, J.; Zhou, K.; Yang, S. Regional heterogeneity of China’s energy efficiency in “new normal”: A meta-frontier Super-SBM analysis. Energy Policy 2019, 134, 110941. [Google Scholar] [CrossRef]

- Cong, D.; Liang, L.; Jing, S.; Han, Y.; Geng, Z.; Chu, C. Energy supply efficiency evaluation of integrated energy systems using novel SBM-DEA integrating Monte Carlo. Energy 2021, 231, 120834. [Google Scholar] [CrossRef]

- Fei, S.; Sun, C.; Jie, L.; An, Y.; Sun, H. Research on the efficiency of green development of industry in Chinese prefecture-level oil and gas cities based on super-efficient SBM-DEA model and Malmquist index. Front. Earth Sci. 2023, 10, 1121071. [Google Scholar] [CrossRef]

- Zhang, T. Can green finance policies affect corporate financing? Evidence from China’s green finance innovation and reform pilot zones. J. Clean. Prod. 2023, 419, 138289. [Google Scholar] [CrossRef]

- Chen, F.; Zeng, X.; Guo, X. Green finance, climate change, and green innovation: Evidence from China. Financ. Res. Lett. 2024, 63, 105283. [Google Scholar] [CrossRef]

- He, Y.; Liu, R. The impact of the level of green finance development on corporate debt financing capacity. Financ. Res. Lett. 2023, 52, 103552. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, J.; Yang, X.; Shi, M.; Ran, R. The mechanism of green finance’s impact on enterprises’ sustainable green innovation. Green Financ. 2023, 5, 452–478. [Google Scholar] [CrossRef]

- Zhang, L.; Saydaliev, H.B.; Ma, X. Does green finance investment and technological innovation improve renewable energy efficiency and sustainable development goals. Renew Energ. 2022, 193, 991–1000. [Google Scholar] [CrossRef]

- Wang, Z.; Wang, X. Research on the impact of green finance on energy efficiency in different regions of China based on the DEA-Tobit model. Resour. Policy 2022, 77, 102695. [Google Scholar] [CrossRef]

- Al-Emran, M. Beyond technology acceptance: Development and evaluation of technology-environmental, economic, and social sustainability theory. Technol. Soc. 2023, 75, 102383. [Google Scholar] [CrossRef]

- Işık, C.; Ongan, S.; Ozdemir, D.; Yan, J.; Demir, O. The sustainable development goals: Theory and a holistic evidence from the USA. Gondwana Res. 2024, 132, 259–274. [Google Scholar] [CrossRef]

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Furuoka, F. Financial development and energy consumption: Evidence from a heterogeneous panel of Asian countries. Renew. Sustain. Energ. Rev. 2015, 52, 430–444. [Google Scholar] [CrossRef]

- Omri, A.; Kahouli, B. Causal relationships between energy consumption, foreign direct investment and economic growth: Fresh evidence from dynamic simultaneous-equations models. Energ. Policy 2014, 67, 913–922. [Google Scholar] [CrossRef]

- Jovović, J.; Popović, S. Investigating volatility spillovers: Connectedness between green bonds, conventional bonds, and energy markets. Res. Int. Bus. Financ. 2025, 76, 102850. [Google Scholar] [CrossRef]

- Tone, K.; Tsutsui, M. An epsilon-based measure of efficiency in DEA—A third pole of technical efficiency. Eur. J. Oper. Res. 2021, 207, 1554–1563. [Google Scholar] [CrossRef]

- Wang, R.; Tan, J. Exploring the coupling and forecasting of financial development, technological innovation, and economic growth. Technol. Forecast. Soc. Change 2021, 163, 120466. [Google Scholar] [CrossRef]

- Mondal, K.; Chatterjee, C.; Singh, R. Examining the coupling and coordination of water-energy-food nexus at a sub-national scale in India—Insights from the perspective of Sustainable Development Goals. Sustain. Prod. Consump. 2023, 43, 140–154. [Google Scholar] [CrossRef]

- Liu, T.-L.; Song, Q.-J.; Lu, J.; Qi, Y. An integrated approach to evaluating the coupling coordination degree between low-carbon development and air quality in Chinese cities. Adv. Clim. Change Res. 2021, 12, 710–722. [Google Scholar] [CrossRef]

- Mussard, S.; Richard, P. Linking Yitzhaki’s and Dagum’s Gini decompositions. Appl. Econ. 2012, 44, 2997–3010. [Google Scholar] [CrossRef]

- Ma, X.; Zhang, J.; Ding, C.; Wang, Y. A geographically and temporally weighted regression model to explore the spatiotemporal influence of built environment on transit ridership. Comput. Environ. Urban 2018, 70, 113–124. [Google Scholar] [CrossRef]

| Index Level | Indicator Type | Basic Indicators | Unit |

|---|---|---|---|

| Elements input | Labor input | Total number of employees at the end of the year | Thousands of people |

| Capital input | Fixed capital stock | 100 million | |

| Energy input | Total energy consumption | Ten thousand tons | |

| Expect output | Reality GDP | Real GDP | 100 million |

| Undesired output | Waste water | Total amount of industrial wastewater discharged | Ten thousand tons |

| Solid waste | Solid waste | Ten thousand tons | |

| Waste gas | Industrial SO2 | Ten thousand tons | |

| CO2 emissions | Ten thousand tons |

| System | Level 1 Indicators | Secondary Indicators | Unit | Type |

|---|---|---|---|---|

| CDGF | Green-credit policy | Six major energy-intensive industrial interest expenditure/Industrial interest expenditure | % | - |

| A-share environmental protection listed company borrowing/A-share listed company borrowing | % | |||

| Green bonds | Total output value of environmental protection enterprises/Total market value of A shares | % | ||

| Total market value of six energy-intensive industries/Total market value of A shares | % | |||

| Green insurance | Agricultural insurance income/gross agricultural output value | % | ||

| Agricultural insurance expenditure/Agricultural insurance income | % | |||

| Green investment | Environmental pollution control investment/Total investment | % | ||

| Local fiscal and environmental expenditure amount/GDP | % | |||

| Carbon finance | Carbon emission/GDP | One million tons per 100 million yuan | - |

| Year | Difference | Within-Group Difference | Contribution Rate (%) | Between-Group Difference | Contribution Rate (%) | Supravariation Density Term | Contribution Rate (%) |

|---|---|---|---|---|---|---|---|

| 2011 | 0.0493726 | 0.0161444 | 32.699073 | 0.0108799 | 22.036399 | 0.0223483 | 45.264528 |

| 2012 | 0.0491497 | 0.0161784 | 32.916475 | 0.0066276 | 13.484533 | 0.0263438 | 53.598992 |

| 2013 | 0.0464914 | 0.0155328 | 33.410167 | 0.0072185 | 15.526522 | 0.0237400 | 51.063311 |

| 2014 | 0.0456655 | 0.0148273 | 32.469328 | 0.0133829 | 29.306456 | 0.0174553 | 38.224217 |

| 2015 | 0.0436000 | 0.0138931 | 31.864811 | 0.0162489 | 37.268026 | 0.0134581 | 30.867164 |

| 2016 | 0.0440655 | 0.0145376 | 32.990839 | 0.0130283 | 29.565693 | 0.0164996 | 37.443468 |

| 2017 | 0.0556149 | 0.0182866 | 32.880743 | 0.0176248 | 32.880743 | 0.0197034 | 35.428363 |

| 2018 | 0.0559356 | 0.0182832 | 32.686272 | 0.0184977 | 33.06959 | 0.0191546 | 34.244138 |

| 2019 | 0.0565592 | 0.0175612 | 31.04915 | 0.0213001 | 37.659797 | 0.0176980 | 31.291054 |

| 2020 | 0.0567000 | 0.0178084 | 31.408092 | 0.0230811 | 40.707459 | 0.0158105 | 27.884449 |

| 2021 | 0.0582374 | 0.0190428 | 32.698676 | 0.0197016 | 33.829774 | 0.0194930 | 33.47155 |

| 2022 | 0.0683199 | 0.0222418 | 32.555343 | 0.0190169 | 27.835147 | 0.0270612 | 39.60951 |

| Index | Computational Method | Unit |

|---|---|---|

| ES | Per capita GDP | Yuan |

| IS | The proportion of the tertiary industry in GDP | % |

| TI | Number of green patent applications | Piece |

| ER | Industrial pollution control completed Investment/industrial added value | Ten thousand yuan |

| FD | Balance of deposits and loans of financial institutions/GDP | 100 million |

| HC | College or above/population aged 6 and above | % |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, H.; Wen, X.; Wang, X.; Yu, X. A Study on the Spatiotemporal Coupling Characteristics and Driving Factors of China’s Green Finance and Energy Efficiency. Systems 2025, 13, 394. https://doi.org/10.3390/systems13050394

Wu H, Wen X, Wang X, Yu X. A Study on the Spatiotemporal Coupling Characteristics and Driving Factors of China’s Green Finance and Energy Efficiency. Systems. 2025; 13(5):394. https://doi.org/10.3390/systems13050394

Chicago/Turabian StyleWu, Hong, Xuewei Wen, Xifeng Wang, and Xuelian Yu. 2025. "A Study on the Spatiotemporal Coupling Characteristics and Driving Factors of China’s Green Finance and Energy Efficiency" Systems 13, no. 5: 394. https://doi.org/10.3390/systems13050394

APA StyleWu, H., Wen, X., Wang, X., & Yu, X. (2025). A Study on the Spatiotemporal Coupling Characteristics and Driving Factors of China’s Green Finance and Energy Efficiency. Systems, 13(5), 394. https://doi.org/10.3390/systems13050394