Emission Reduction and Pricing Decisions of Dual-Channel Supply Chain Considering Price Reference Effect Under Carbon-Emission Policy

Abstract

1. Introduction

- The optimal decisions include emission reduction levels, wholesale price, online direct selling price, and offline retail price, along with supply chain profits under three policy scenarios;

- The impact of channel preferences, price reference effects, and carbon parameters on optimal outcomes;

- Comparing supply chains’ economic and environmental benefits under different policy scenarios.

2. Literature Review

2.1. Dual-Channel Supply Chain

2.2. Price Reference Effect

2.3. Carbon-Emission Policy

3. Research Methodology

4. Problem Description, Assumptions and Notations

5. Model Development and Analysis

5.1. Single Tax Policy (Model TA)

5.2. Single Cap-and-Trade Policy (Model CT)

5.3. Mixed Policy (Model M)

5.4. Model Analysis

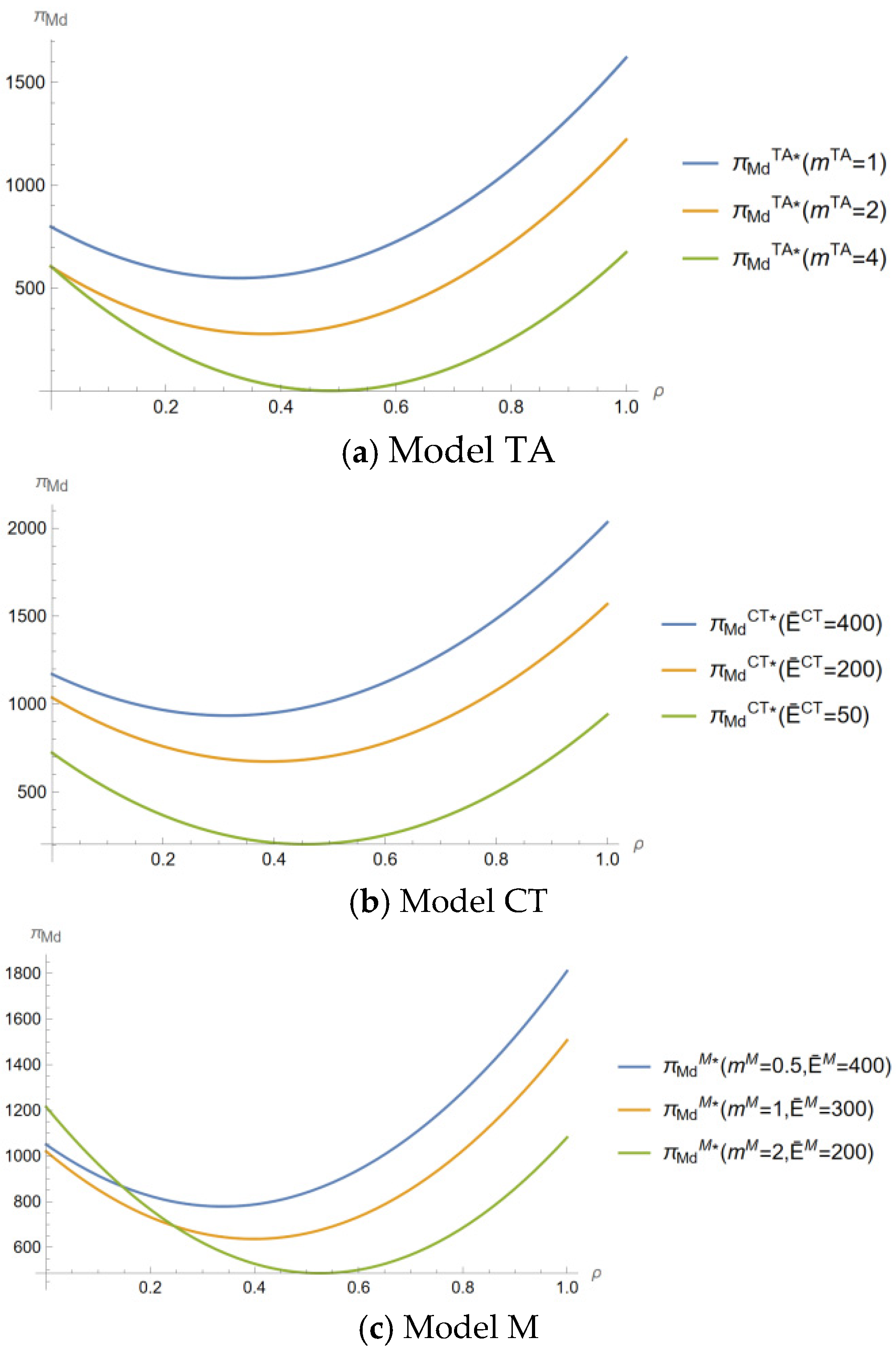

- (1)

- When or , online channel preference is positively correlated with manufacturer’s profit at , and has a negative correlation at .

- (2)

- When or , online channel preference is positively correlated with manufacturer’s profit at , and has a negative correlation at . Where

- (3)

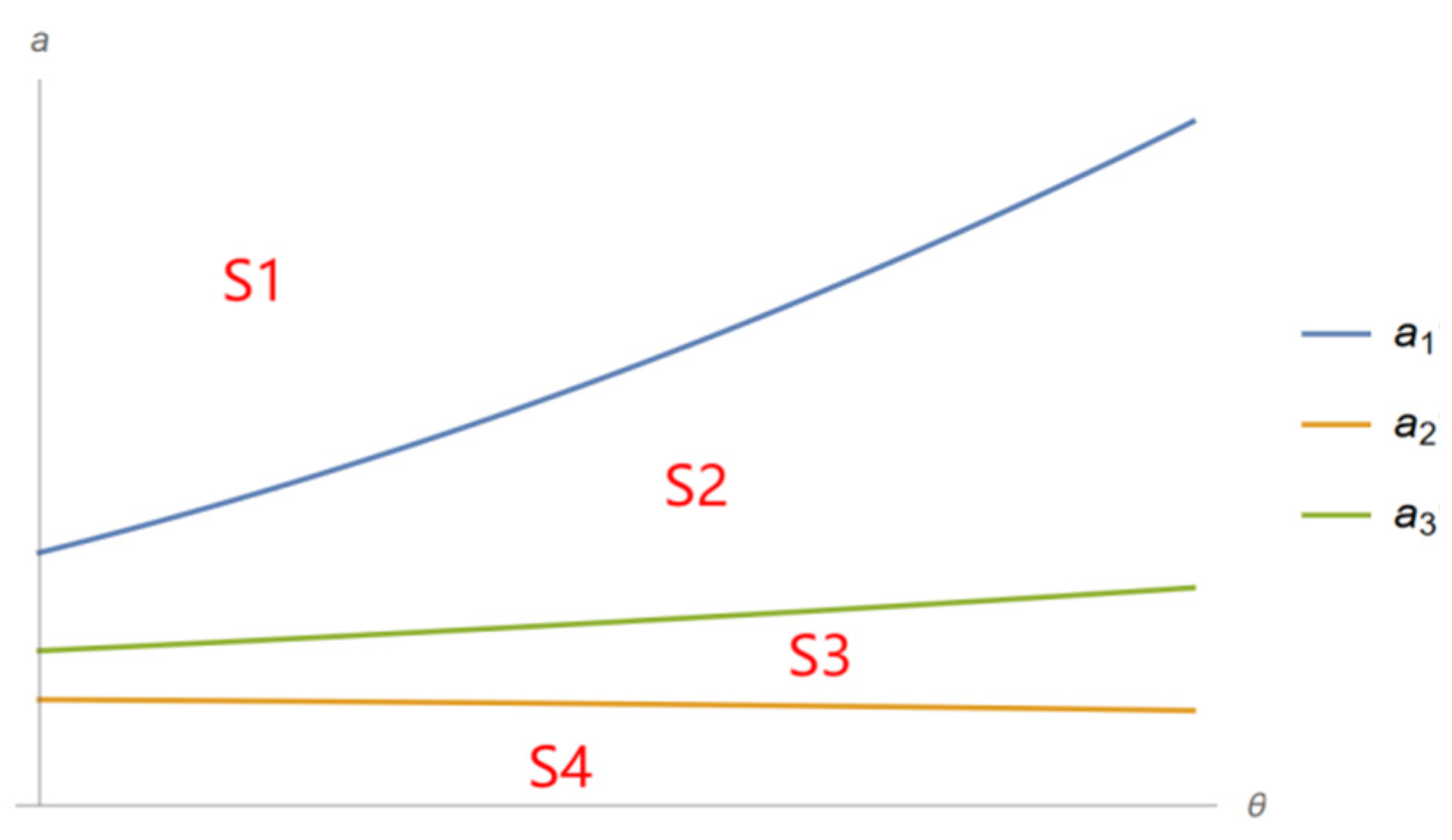

- At , basis market demand is negatively (positively) correlated with thresholds (); at , it has a positive (negative) relationship with thresholds ().

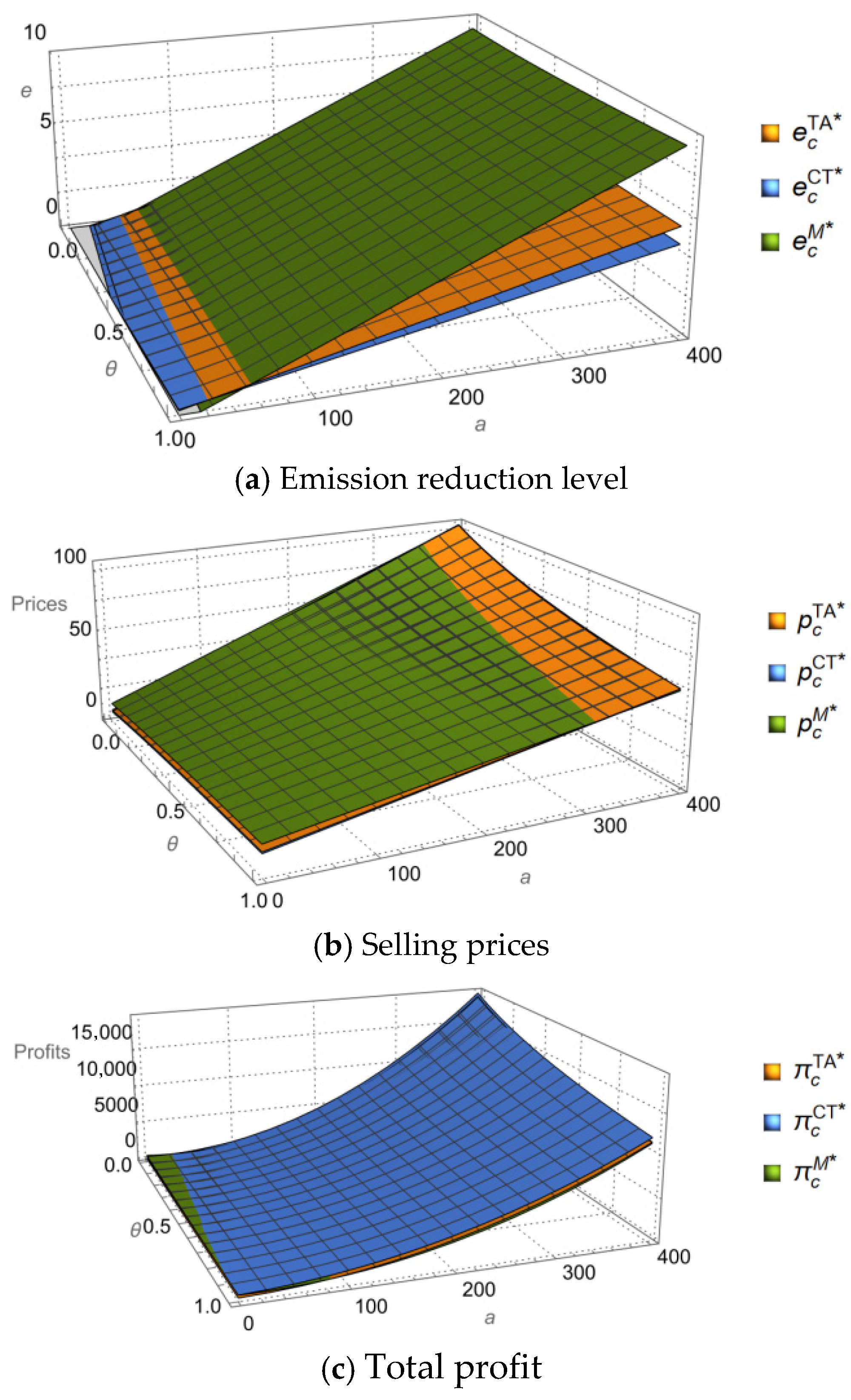

- (1)

- When , the price reference coefficient is positively correlated with the emission reduction level; when , they are negatively correlated.

- (2)

- When , the price reference coefficient is positively correlated with selling price; when , they are negatively correlated.

- (3)

- When , the price reference coefficient is positively correlated with the total profit; when , they are negatively correlated. Where

- ,, and .

- (4)

- The reference price is positively correlated with the threshold , , and

6. Comparative Analysis

6.1. Model M vs. Model TA

6.2. Model M vs. Model CT

6.3. Discussion

7. Numerical Analysis

7.1. Effect of Online Channel Preferences on the Optimal Manufacturer’s Profits

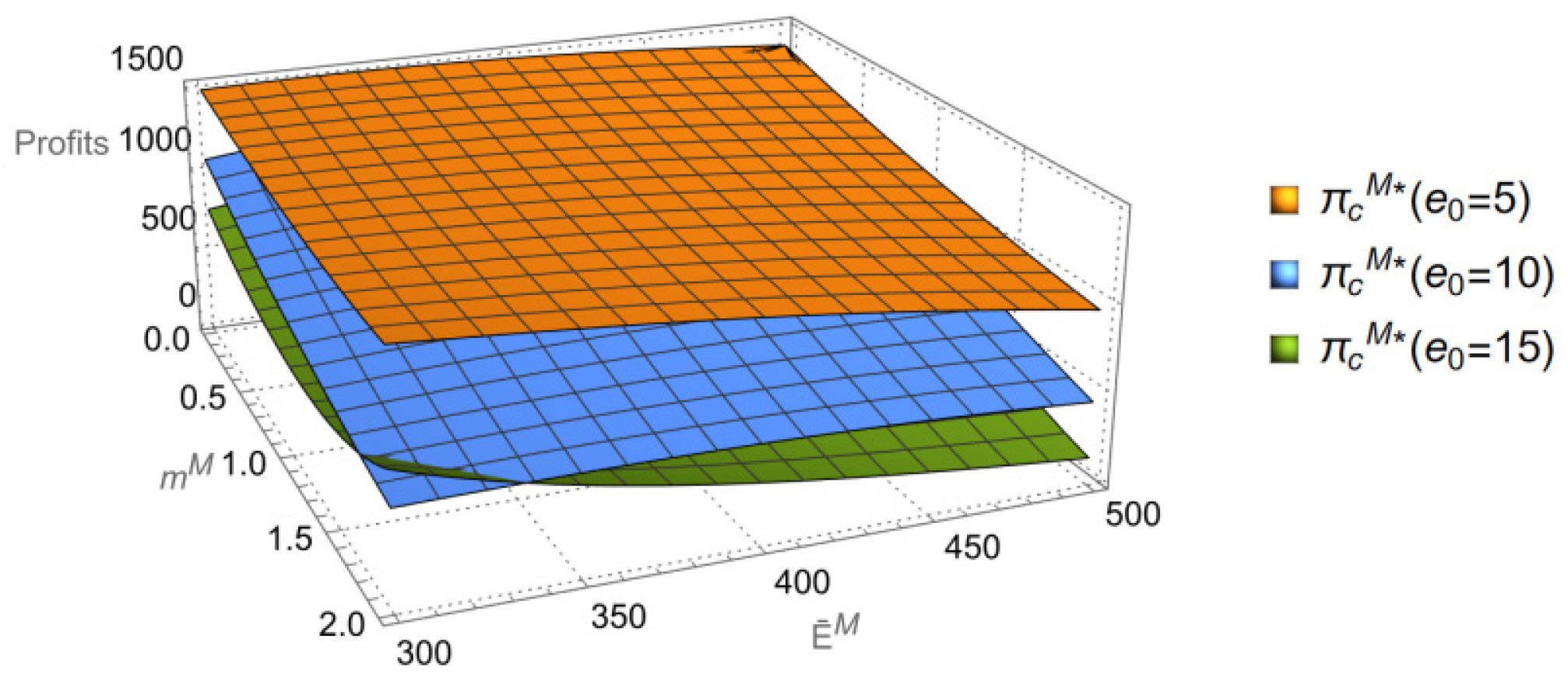

7.2. Effect of Price Reference Coefficient on the Optimal Outcomes

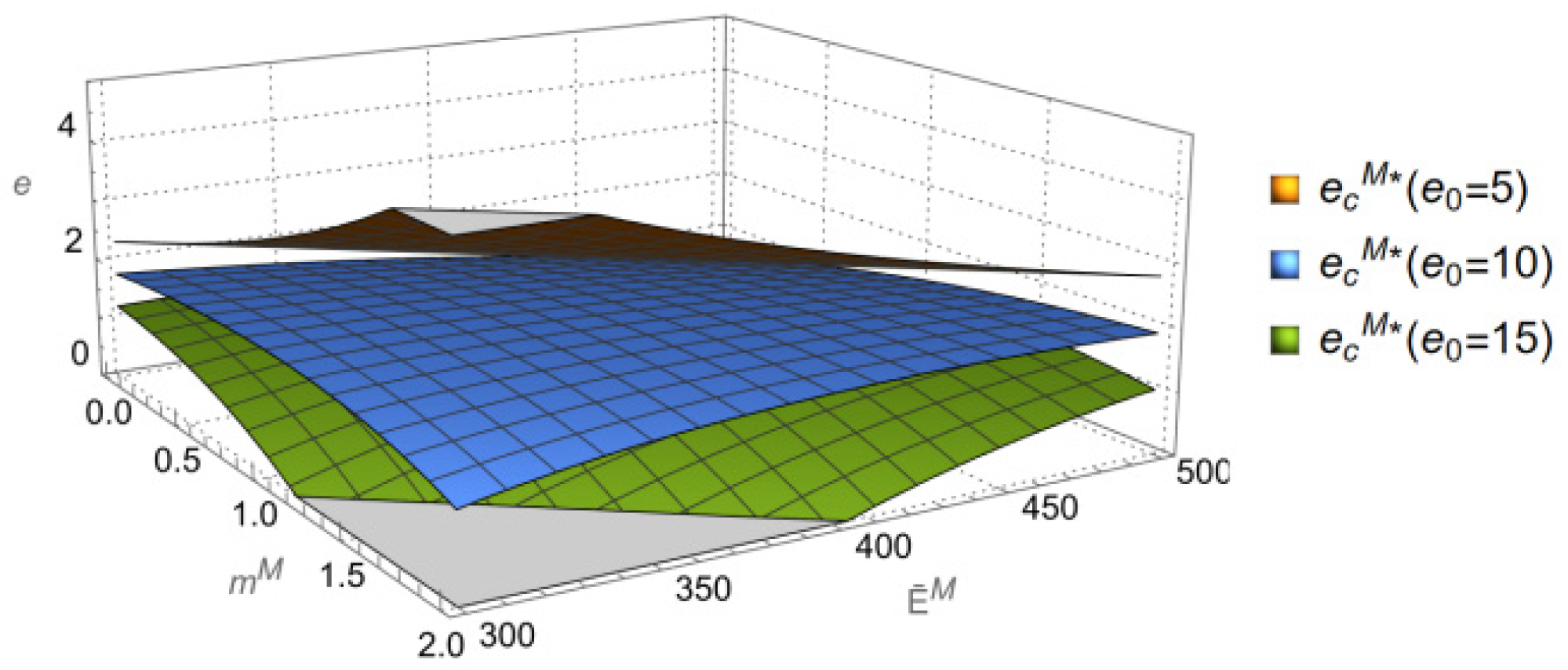

7.3. Effect of the Carbon Tax and Carbon Quota on the Optimal Outcomes

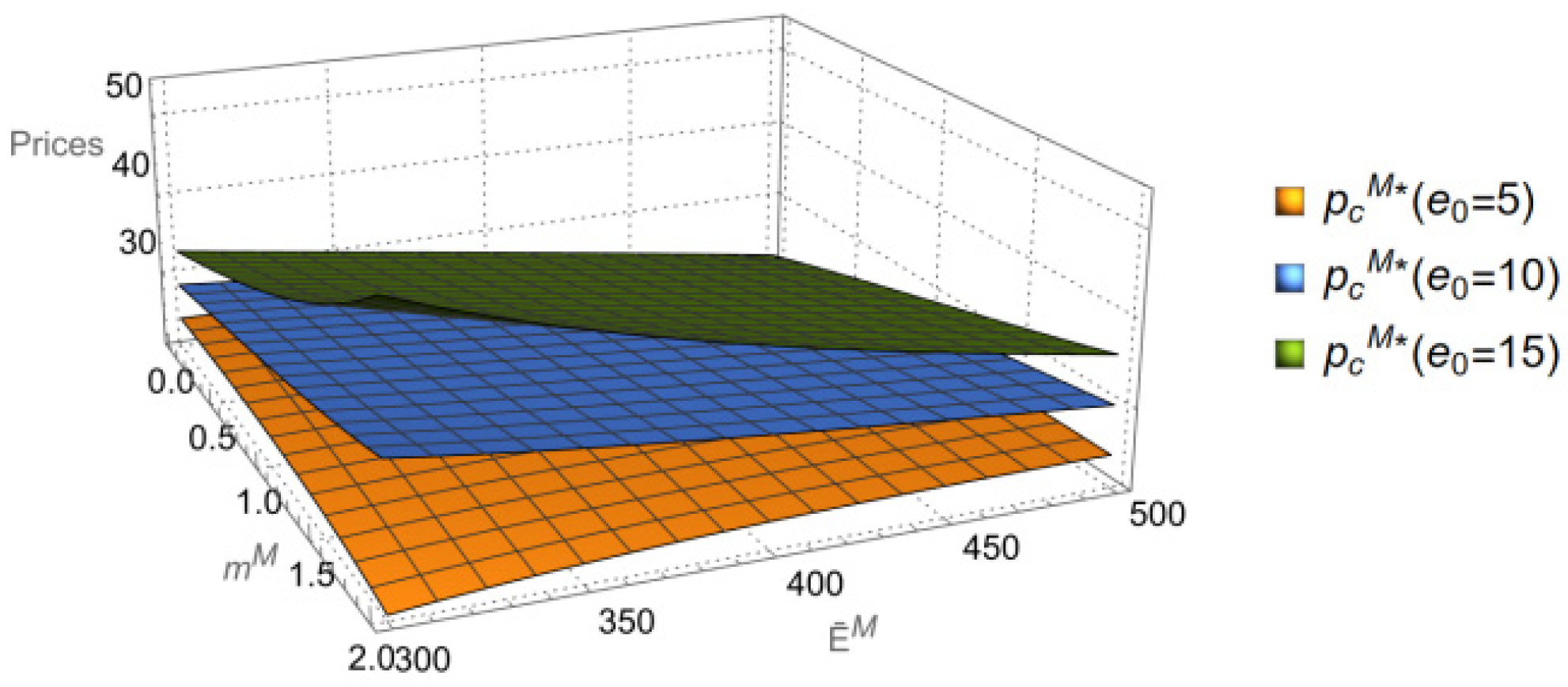

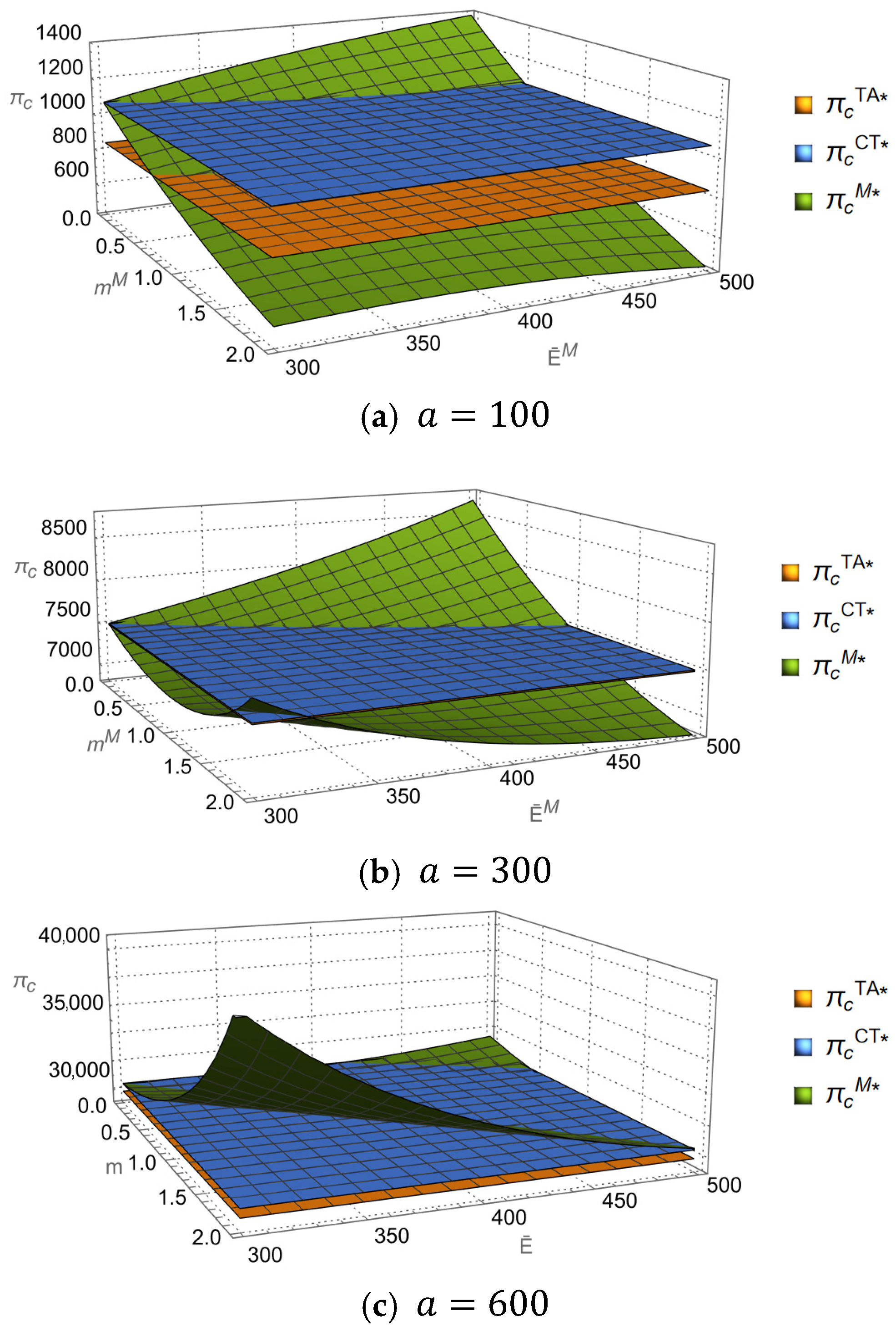

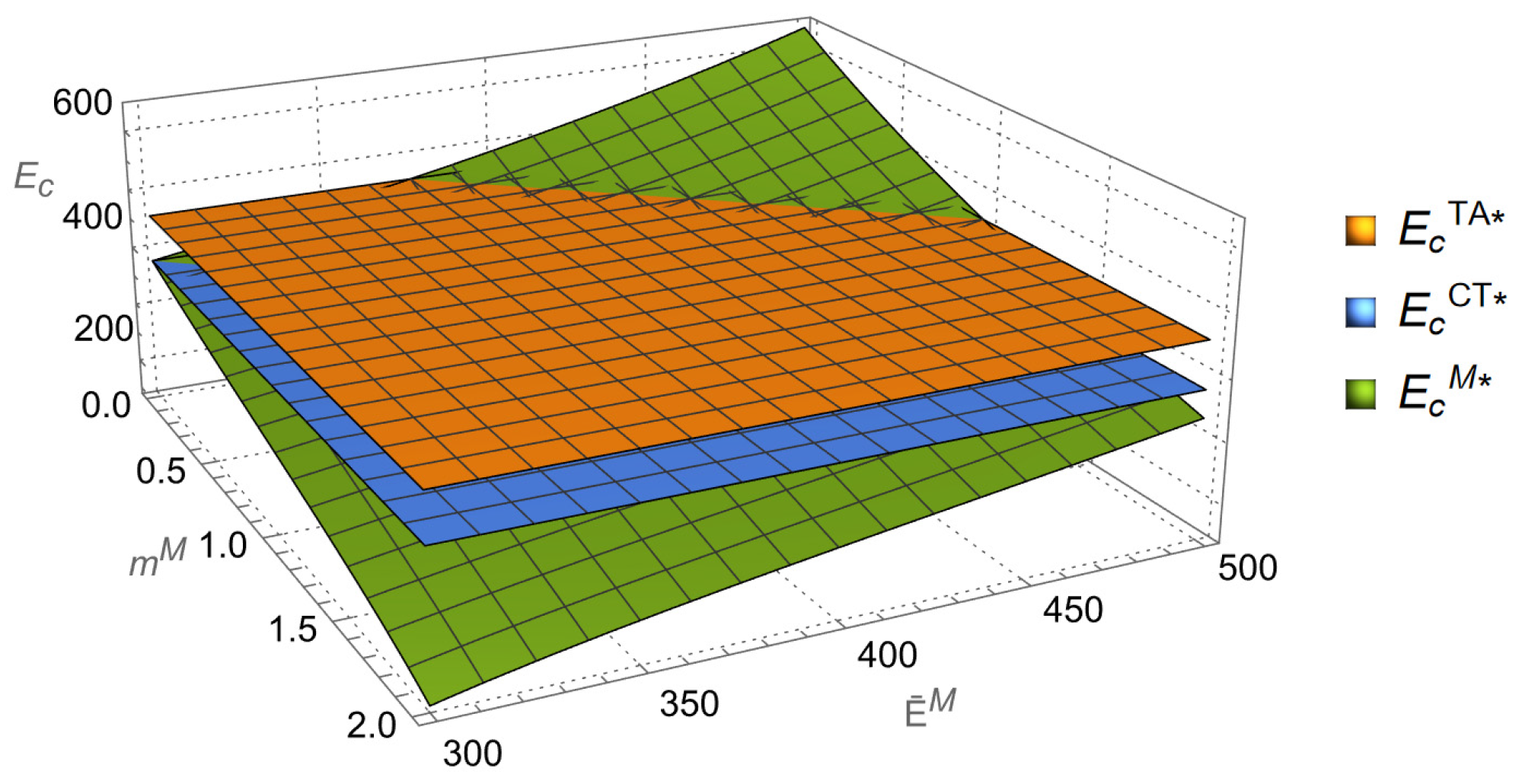

7.4. Comparison of Economic Benefits Under Different Policies

7.5. Comparison of Environmental Benefits Under Different Policies

8. Conclusions and Managerial Insights

8.1. Conclusions

- The optimal decisions under the three policy scenarios have been rigorously derived, elucidating the dual mechanism of “constraint and incentive” inherent in different carbon policies. This study provides precise solutions for optimal emission reduction level, wholesale price, and selling prices across policy contexts. All equilibrium outcomes emerge from strategic trade-offs between environmental compliance costs and market returns generated through channel competition and consumer preference dynamics.

- The impact of parameters such as channel preference, price reference effect, carbon tax, and carbon cap on optimal outcomes is context dependent. Firstly, a non-linear relationship exists between online channel preference and manufacturer profitability. Specifically, profit follows a U-shaped trajectory as online preference increases, initially declining before reaching a turning point and subsequently rising. Carbon policy parameters, tax rates and quota stringency, directly determine the location of this inflection point. More lenient carbon policies can prompt this profit turning point to occur earlier. Secondly, the impact of the price reference effect is contingent on market conditions. In markets with lower basic market demand, a strong price reference effect leads to enhanced emission reduction level, selling prices, and profitability. Conversely, in high-demand markets, it intensifies channel competition, leading to depressed prices and diminished profits, thereby complicating emission-reduction decisions. Thirdly, the effectiveness of carbon taxes and quotas is highly based on initial emission per unit. Low-emission producers can effectively manage compliance costs and maintain price stability, even achieving profit gains under tightening quotas. In contrast, high-emission manufacturers must resort to price adjustments and cost restructuring to mitigate regulatory pressure. Notably, the profitability is optimized under specific policy settings: either “low tax/lenient quota” or “high tax/stringent quota” regimes. It indicates that economic incentives and regulatory constraints jointly drive the advancement of green products.

- The mixed policy can achieve a “win-win” outcome for both economic and environmental performance through its synergistic effect under specific conditions. Based on a comparative analysis of the three policies, the mixed policy does not represent a mere superposition of single-policy instruments. Its core advantage lies in the synergistic effects; the carbon quota establishes a baseline for environmental performance, while the carbon tax provides continuous economic incentives to exceed this baseline. Numerical simulations further reveal that the mixed policy realizes its full synergistic potential in large and stable markets, particularly when governments set more flexible carbon quotas, thereby simultaneously improving supply chain profitability and emission reductions.

8.2. Managerial Insights and Limitations

- This study solely examines fixed reference prices; future research should account for variable reference prices influenced by market conditions, promotions, and competitor pricing to fully understand their impact on consumer behavior.

- Mixed policies, though beneficial for efficiency and emission reductions, are complex to implement. They require setting appropriate carbon taxes and quotas, establishing robust supervision, and customizing measures for different industries. Continuous adjustment and refinement are necessary to ensure their effectiveness.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1

- (a)

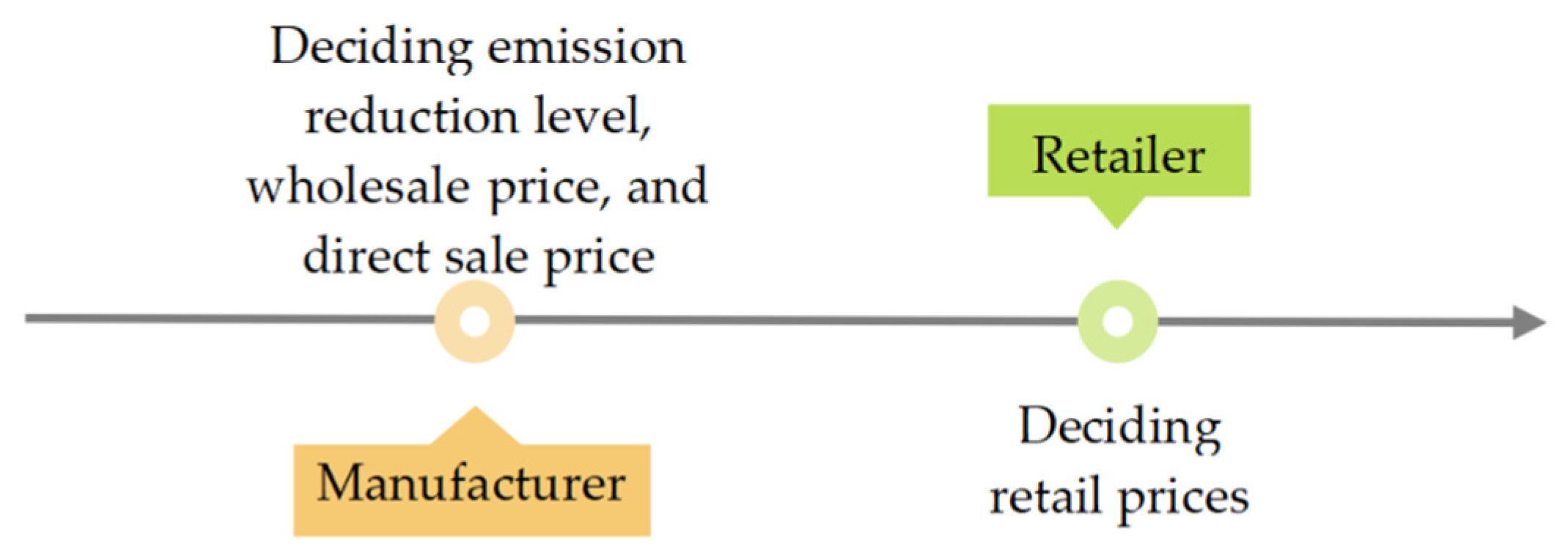

- Under decentralization, a Stackelberg game emerges between a manufacturer and a retailer, characterized by manufacturer dominance. The following is studied by backward induction.

- (1)

- At , , and

- (2)

- At , when , ; when , . Where

- (b)

- From the profit function of total supply chain, the Hessian matrix is

Appendix A.2

Appendix A.3

Appendix A.4

- (1)

- At , when , ; when , .

- (2)

- At , when , ; when ,

- (3)

- When , and ; when , and . □

Appendix A.5

- (1)

- When , , when ,

- (2)

- At , the selling prices in both channels are also equal (). When , , when , .

- (3)

- When , , when , .

- (4)

- , and . □

Appendix A.6

Appendix A.7

Appendix A.8

Appendix A.9

- (1)

- At , when , and ; when , and .

- (2)

- At , when , and ; when , and .

Appendix A.10

Appendix A.11

- (1)

- At , when , and ; when , and .

- (2)

- At , when , and ; when , and .

References

- Harvey, L.D.D. Allowable CO2 concentrations under the United Nations Framework Convention on Climate Change as a function of the climate sensitivity probability distribution function. Environ. Res. Lett. 2007, 2, 014001. [Google Scholar] [CrossRef]

- Christoff, P. The promissory note: COP 21 and the Paris Climate Agreement. Environ. Politics 2016, 25, 765–787. [Google Scholar] [CrossRef]

- Nguyen, K.H.; Kakinaka, M. Renewable energy consumption, carbon emissions, and development stages: Some evidence from panel cointegration analysis. Renew. Energy 2019, 132, 1049–1057. [Google Scholar] [CrossRef]

- Haque, F.; Ntim, C.G. Environmental Policy, Sustainable Development, Governance Mechanisms and Environmental Performance. Bus. Strategy Environ. 2017, 27, 415–435. [Google Scholar] [CrossRef]

- Sun, H.; Yang, J. Optimal decisions for competitive manufacturers under carbon tax and cap-and-trade policies. Comput. Ind. Eng. 2021, 156, 107244. [Google Scholar] [CrossRef]

- Nong, D.; Simshauser, P.; Nguyen, D.B. Greenhouse gas emissions vs CO2 emissions: Comparative analysis of a global carbon tax. Appl. Energy 2021, 298, 117223. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Buchner, B.K. Over-Allocation or Abatement? A Preliminary Analysis of the EU ETS Based on the 2005–06 Emissions Data. Environ. Resour. Econ. 2008, 41, 267–287. [Google Scholar] [CrossRef]

- Andersson, J.J. Carbon Taxes and CO2 Emissions: Sweden as a Case Study. Am. Econ. J. Econ. Policy 2019, 11, 1–30. [Google Scholar] [CrossRef]

- Zhao, L.; Jin, S.; Jiang, H. Investigation of complex dynamics and chaos control of the duopoly supply chain under the mixed carbon policy. Chaos Solitons Fractals 2022, 164, 112492. [Google Scholar] [CrossRef]

- Sun, L.; Cao, X.; Alharthi, M.; Zhang, J.; Taghizadeh-Hesary, F.; Mohsin, M. Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 2020, 264, 121664. [Google Scholar] [CrossRef]

- Zhang, J.; Kevin Chiang, W.y.; Liang, L. Strategic pricing with reference effects in a competitive supply chain. Omega 2014, 44, 126–135. [Google Scholar] [CrossRef]

- Lu, L.; Gou, Q.; Tang, W.; Zhang, J. Joint pricing and advertising strategy with reference price effect. Int. J. Prod. Res. 2016, 54, 5250–5270. [Google Scholar] [CrossRef]

- Sun, J.; Yuan, P.; Hua, L. Pricing and financing strategies of a dual-channel supply chain with a capital-constrained manufacturer. Ann. Oper. Res. 2022, 329, 1241–1261. [Google Scholar] [CrossRef]

- Hamzaoui, A.F.; Turki, S.; Rezg, N. Unified strategy of production, distribution and pricing in a dual-channel supply chain using leasing option. Int. J. Prod. Res. 2024, 62, 7167–7185. [Google Scholar] [CrossRef]

- Zhang, J.; Chiang, W.-Y.K. Durable goods pricing with reference price effects. Omega 2020, 91, 102018. [Google Scholar] [CrossRef]

- Wang, B.; Bi, W.; Liu, H. Dynamic Pricing with Parametric Demand Learning and Reference-Price Effects. Mathematics 2023, 11, 2387. [Google Scholar] [CrossRef]

- Xu, H.; Pan, X.; Li, J.; Feng, S.; Guo, S. Comparing the impacts of carbon tax and carbon emission trading, which regulation is more effective? J. Environ. Manag. 2023, 330, 117156. [Google Scholar] [CrossRef]

- Huang, Y.X.; He, P.F.; Cheng, T.; Xu, S.Y.; Pang, C.; Tang, H.J. Optimal strategies for carbon emissions policies in competitive closed-loop supply chains: A comparative analysis of carbon tax and cap-and-trade policies. Comput. Ind. Eng. 2024, 195, 22. [Google Scholar] [CrossRef]

- Lyu, R.; Zhang, C.; Li, Z.; Li, Y. Manufacturers’ integrated strategies for emission reduction and recycling: The role of government regulations. Comput. Ind. Eng. 2022, 163, 107769. [Google Scholar] [CrossRef]

- Xu, L.; Wang, C.; Zhao, J. Decision and coordination in the dual-channel supply chain considering cap-and-trade regulation. J. Clean. Prod. 2018, 197, 551–561. [Google Scholar] [CrossRef]

- Yan, R.; Pei, Z. Return policies and O2O coordination in the e-tailing age. J. Retail. Consum. Serv. 2019, 50, 314–321. [Google Scholar] [CrossRef]

- Nouri-Harzvili, M.; Hosseini-Motlagh, S.-M.; Pazari, P. Optimizing the competitive service and pricing decisions of dual retailing channels: A combined coordination model. Comput. Ind. Eng. 2022, 163, 107789. [Google Scholar] [CrossRef]

- Pal, B.; Sarkar, A.; Sarkar, B. Optimal decisions in a dual-channel competitive green supply chain management under promotional effort. Expert Syst. Appl. 2023, 211, 118315. [Google Scholar] [CrossRef]

- Chen, J.; Zhang, H.; Sun, Y. Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega 2012, 40, 571–583. [Google Scholar] [CrossRef]

- Giri, B.C.; Chakraborty, A.; Maiti, T. Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. J. Manuf. Syst. 2017, 42, 104–123. [Google Scholar] [CrossRef]

- Cao, B.; You, T.; Liu, C.; Zhao, J. Pricing and Channel Coordination in Online-to-Offline Supply Chain Considering Corporate Environmental Responsibility and Lateral Inventory Transshipment. Mathematics 2021, 9, 2623. [Google Scholar] [CrossRef]

- Xu, S.; Tang, H.; Lin, Z.; Xin, B. Inventory and Ordering Decisions in Dual-Channel Supply Chains Involving Free Riding and Consumer Switching Behavior with Supply Chain Financing. Complexity 2021, 2021, 530124. [Google Scholar] [CrossRef]

- Yang, S.; Lai, I.K.W.; Tang, H. Pricing and Contract Coordination of BOPS Supply Chain Considering Product Return Risk. Sustainability 2022, 14, 5055. [Google Scholar] [CrossRef]

- Xu, S.; Tang, H.; Lin, Z.; Lu, J. Pricing and sales-effort analysis of dual-channel supply chain with channel preference, cross-channel return and free riding behavior based on revenue-sharing contract. Int. J. Prod. Econ. 2022, 249, 108506. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Li, J.; Hu, Z.; Shi, V.; Wang, Q. Manufacturer’s encroachment strategy with substitutable green products. Int. J. Prod. Econ. 2021, 235, 108102. [Google Scholar] [CrossRef]

- Xu, S.; Tang, H.; Huang, Y. Decisions of pricing and delivery-lead-time in dual-channel supply chains with data-driven marketing using internal financing and contract coordination. Ind. Manag. Data Syst. 2023, 123, 1005–1051. [Google Scholar] [CrossRef]

- Xu, J.; Liu, N. Research on closed loop supply chain with reference price effect. J. Intell. Manuf. 2014, 28, 51–64. [Google Scholar] [CrossRef]

- Lin, Z. Price promotion with reference price effects in supply chain. Transp. Res. Part E Logist. Transp. Rev. 2016, 85, 52–68. [Google Scholar] [CrossRef]

- Prakash, D.; Spann, M. Dynamic pricing and reference price effects. J. Bus. Res. 2022, 152, 300–314. [Google Scholar] [CrossRef]

- Yan, X.; Zhao, W.; Yu, Y. Optimal product line design with reference price effects. Eur. J. Oper. Res. 2022, 302, 1045–1062. [Google Scholar] [CrossRef]

- Huang, S.; Du, B.; Chen, Z.; Cheng, J. The government subsidy design considering the reference price effect in a green supply chain. Environ. Sci. Pollut. Res. 2024, 31, 22645–22662. [Google Scholar] [CrossRef] [PubMed]

- Chen, X.; Hu, P.; Hu, Z. Efficient Algorithms for the Dynamic Pricing Problem with Reference Price Effect. Manag. Sci. 2017, 63, 4389–4408. [Google Scholar] [CrossRef]

- Entezaminia, A.; Gharbi, A.; Ouhimmou, M. A joint production and carbon trading policy for unreliable manufacturing systems under cap-and-trade regulation. J. Clean. Prod. 2021, 293, 125973. [Google Scholar] [CrossRef]

- Li, J.; Lai, K.K.; Li, Y. Remanufacturing and low-carbon investment strategies in a closed-loop supply chain under multiple carbon policies. Int. J. Logist. Res. Appl. 2022, 27, 170–192. [Google Scholar] [CrossRef]

- Yang, M.; Zhang, T.; Zhang, Y. Optimal pricing and green decisions in a dual-channel supply chain with cap-and-trade regulation. Environ. Sci. Pollut. Res. 2022, 29, 28208–28225. [Google Scholar] [CrossRef] [PubMed]

- Zhang, C.; Tian, Y.-X.; Han, M.-H. Recycling mode selection and carbon emission reduction decisions for a multi-channel closed-loop supply chain of electric vehicle power battery under cap-and-trade policy. J. Clean. Prod. 2022, 375, 134060. [Google Scholar] [CrossRef]

- Govindan, K.; Salehian, F.; Kian, H.; Hosseini, S.T.; Mina, H. A location-inventory-routing problem to design a circular closed-loop supply chain network with carbon tax policy for achieving circular economy: An augmented epsilon-constraint approach. Int. J. Prod. Econ. 2023, 257, 108771. [Google Scholar] [CrossRef]

- Harijani, A.M.; Mansour, S.; Fatemi, S. Closed-loop supply network of electrical and electronic equipment under carbon tax policy. Environ. Sci. Pollut. Res. 2023, 30, 78449–78468. [Google Scholar] [CrossRef]

- Chen, J.; Sun, C.; Wang, Y.; Liu, J.; Zhou, P. Carbon emission reduction policy with privatization in an oligopoly model. Environ. Sci. Pollut. Res. 2023, 30, 45209–45230. [Google Scholar] [CrossRef] [PubMed]

- Wang, Y.; Lin, F.; Cheng, T.C.E.; Jia, F.; Sun, Y. Carbon allowance approach for capital-constrained supply chain under carbon emission allowance repurchase strategy. Ind. Manag. Data Syst. 2023, 123, 2488–2521. [Google Scholar] [CrossRef]

- Zhu, C.; Xi, X.; Goh, M. Differential game analysis of joint emission reduction decisions under mixed carbon policies and CEA. J. Environ. Manag. 2024, 358, 120913. [Google Scholar] [CrossRef]

- Yang, M. Green investment and e-commerce sales mode selection strategies with cap-and-trade regulation. Comput. Ind. Eng. 2023, 177, 109036. [Google Scholar] [CrossRef]

- Wang, H.; Pang, C.; Tang, H. Pricing and Carbon-Emission-Reduction Decisions under the BOPS Mode with Low-Carbon Preference from Customers. Mathematics 2023, 11, 2736. [Google Scholar] [CrossRef]

- Fibich, G.; Gavious, A.; Lowengart, O. Explicit Solutions of Optimization Models and Differential Games with Nonsmooth (Asymmetric) Reference-Price Effects. Oper. Res. 2003, 51, 721–734. [Google Scholar] [CrossRef]

- Zhang, J.; Gou, Q.; Liang, L.; Huang, Z. Supply chain coordination through cooperative advertising with reference price effect. Omega 2013, 41, 345–353. [Google Scholar] [CrossRef]

- Mazumdar, T.; Raj, S.P.; Sinha, I. Reference Price Research: Review and Propositions. J. Mark. 2005, 69, 84–102. [Google Scholar] [CrossRef]

- Yang, L.; Zhang, Q.; Ji, J.N. Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. Prod. Econ. 2017, 191, 286–297. [Google Scholar] [CrossRef]

- Chuang, C.H.; Wang, C.X.; Zhao, Y.B. Closed-loop supply chain models for a high-tech product under alternative reverse channel and collection cost structures. Int. J. Prod. Econ. 2014, 156, 108–123. [Google Scholar] [CrossRef]

- Chen, C.K.; Akmalul’Ulya, M. Analyses of the reward-penalty mechanism in green closed-loop supply chains with product remanufacturing. Int. J. Prod. Econ. 2019, 210, 211–223. [Google Scholar] [CrossRef]

- Wang, Z.R.; Wu, Q.H. Carbon emission reduction and product collection decisions in the closed-loop supply chain with cap-and-trade regulation. Int. J. Prod. Res. 2021, 59, 4359–4383. [Google Scholar] [CrossRef]

- Zhu, C.; Ma, J.; Li, J. Dynamic production and carbon emission reduction adjustment strategies of the brand-new and the remanufactured product under hybrid carbon regulations. Comput. Ind. Eng. 2022, 172, 108517. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon Footprint and the Management of Supply Chains: Insights From Simple Models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Shen, L.; Lin, F.; Cheng, T.C.E. Low-Carbon Transition Models of High Carbon Supply Chains under the Mixed Carbon Cap-and-Trade and Carbon Tax Policy in the Carbon Neutrality Era. Int. J. Environ. Res. Public Health 2022, 19, 11150. [Google Scholar] [CrossRef]

- Pope, J.; Owen, A.D. Emission trading schemes: Potential revenue effects, compliance costs and overall tax policy issues. Energy Policy 2009, 37, 4595–4603. [Google Scholar] [CrossRef]

- Solilová, V.; Nerudová, D. Overall Approach of the EU in the Question of Emissions: EU Emissions Trading System and CO2 Taxation. Procedia Econ. Financ. 2014, 12, 616–625. [Google Scholar] [CrossRef]

| Related Literature | Dual Channel | Price Reference Effect | Low-Carbon Investment | Carbon-Emission Policy | Loop | |||

|---|---|---|---|---|---|---|---|---|

| Carbon Taxes | Cap-and-Trade | Mixed | Open | Closed | ||||

| Xu and Liu [33] | √ | √ | ||||||

| Giri et al. [25] | √ | √ | ||||||

| Xu et al. [20] | √ | √ | √ | √ | ||||

| Yan and Pei [21] | √ | √ | ||||||

| Sun and Yang [5] | √ | √ | √ | √ | ||||

| Lyu et al. [19] | √ | √ | √ | √ | ||||

| Yang et al. [41] | √ | √ | √ | |||||

| Pal et al. [23] | √ | √ | √ | |||||

| Yang [48] | √ | √ | √ | √ | ||||

| Zhu et al. [47] | √ | √ | √ | |||||

| This study | √ | √ | √ | √ | √ | √ | √ | |

| Notation | Description |

|---|---|

| Parameters | |

| Basic market demand | |

| Consumers’ online channel preferences | |

| Price elasticity coefficient | |

| Consumers’ low-carbon preference | |

| Price reference coefficient | |

| Reference price | |

| Cost coefficient of carbon-emission reduction | |

| Initial carbon emissions per unit of product | |

| Cost coefficient of recycling | |

| Recycling rate | |

| Unit recycling cost | |

| Unit carbon tax | |

| Carbon quotas from the government | |

| Constant | |

| Elasticity coefficient of carbon quota and trading prices | |

| Decision variables | |

| Emission reduction level | |

| Online direct selling price | |

| Offline retail prices | |

| Wholesale price | |

| Decentralized | Centralized | |

|---|---|---|

| - | ||

| Decentralized | Centralized | |

|---|---|---|

| - | ||

| Decentralized | Centralized | |

|---|---|---|

| - | ||

| Basic Market Demand | Area | |||

|---|---|---|---|---|

| Low | S4 | positive | positive | positive |

| Moderate | S2S3 | positive | negative | negativepositive |

| High | S1S2 | negativepositive | negative | negative |

| Carbon Parameters | Condition | Total Profits | Total Emissions |

|---|---|---|---|

| All | |||

| Carbon Parameters | Condition | Total Profits | Total Emissions |

|---|---|---|---|

| All | |||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Huang, Y.; Geng, S.; Yao, Y.; Zeng, F.; Tang, H. Emission Reduction and Pricing Decisions of Dual-Channel Supply Chain Considering Price Reference Effect Under Carbon-Emission Policy. Systems 2025, 13, 992. https://doi.org/10.3390/systems13110992

Huang Y, Geng S, Yao Y, Zeng F, Tang H. Emission Reduction and Pricing Decisions of Dual-Channel Supply Chain Considering Price Reference Effect Under Carbon-Emission Policy. Systems. 2025; 13(11):992. https://doi.org/10.3390/systems13110992

Chicago/Turabian StyleHuang, Yuxin, Shaoqing Geng, Yao Yao, Fan Zeng, and Huajun Tang. 2025. "Emission Reduction and Pricing Decisions of Dual-Channel Supply Chain Considering Price Reference Effect Under Carbon-Emission Policy" Systems 13, no. 11: 992. https://doi.org/10.3390/systems13110992

APA StyleHuang, Y., Geng, S., Yao, Y., Zeng, F., & Tang, H. (2025). Emission Reduction and Pricing Decisions of Dual-Channel Supply Chain Considering Price Reference Effect Under Carbon-Emission Policy. Systems, 13(11), 992. https://doi.org/10.3390/systems13110992