1. Introduction

Amid accelerating global energy transition and digital transformation, copper, as a critical strategic resource underpinning clean energy technologies, smart grids, and advanced manufacturing, is undergoing profound restructuring in its supply–demand dynamics [

1]. Over the past decade, global copper demand has surged by over 30%, with the International Energy Agency forecasting that clean energy applications will double copper requirements by 2040 to achieve carbon neutrality targets [

2]. China, accounting for over 50% of global copper consumption yet possessing merely 3% of worldwide copper reserves, maintains long-term import dependence exceeding 75% due to acute disparities between resource endowment and consumption scale. However, escalating geopolitical conflicts, resurgent resource nationalism, and pervasive opportunism in cross-border supply chains have compounded moral hazards and information asymmetries, threatening China’s copper supply chain security [

3]. This situation creates a complex strategic environment where firms must simultaneously compete for value while cooperating to ensure the stability of the entire supply chain—a dynamic known as coopetition. Recent studies highlight that such coopetitive relationships are critical for building startup resilience, particularly through the development of network-building and resource integration capabilities within a broader entrepreneurial ecosystem [

4]. The challenge, therefore, is not merely to mitigate risk but to design governance mechanisms that foster this productive form of coopetition. How to balance supervision cost and cooperation incentive through mechanism design, and achieve long-term stability of supply chain security in a dynamic game, has become a major practical problem related to national resource security and industrial competitiveness.

In recent years, research on copper has moved beyond single-dimension analyses of price and quantity volatility toward an integrated governance orientation that jointly considers import concentration, technological substitutability, and recycling. First, in supply chain risk measurement, prior work integrates the probability of external disruption, economic exposure, and absorptive capacity into a unified criticality index, thereby establishing a comparable and trackable assessment paradigm that serves as a methodological baseline for profiling risks across minerals and along industrial chains [

5]. Building on this, copper studies have advanced from single-indicator vulnerability to a joint depiction of network-system-scenario dynamics: on the one hand, by constructing multi-layer trade networks of primary and secondary resources to reveal structural heterogeneity and co-movement between upstream/downstream segments and the recycling end, and to test how policies perturb and re-balance the composite system [

6]; on the other hand, by leveraging mechanisms in multi-layer networks-such as cascading failures and the “strengthening” role of weak layers-to map cross-layer transmission chains and directed diffusion, showing that upstream hub nodes can generate pronounced amplification and threshold effects under particular scenarios [

7]. In short, the differential game complements multi-layer network evidence by endogenizing the parties’ incentives and mapping network shocks into feedback Nash paths of supply-security utility, which identifies self-enforcing cooperation thresholds under regulatory intensity and profit distribution parameters. From the perspective of market transmission and price formation, the relational structure of the industrial chain significantly shapes the level and strength of copper-price pass-through, underscoring the foundational role of network identification in supply chain security governance [

8]. Meanwhile, dynamic analyses of global copper flows uncover the temporal coupling and long-run constraints linking stocks, recycling, and re-use, implying that circularity indicators (e.g., recovery rates) should be embedded in medium- to long-term security assessments [

9]. Evidence for China further shows that provincial material footprints of copper-embedded in domestic and international trade exhibit structural differences and temporal shifts, reflecting the evolving exposure and spatial distribution of the chain; accordingly, early warning systems should embed both time and scenario dimensions [

10]. In addition, during crises, directional volatility, connectedness and structural breaks between metal and energy markets can amplify price and inventory fluctuations through financial-commodity channels, altering the propagation of supply-side pressures and necessitating explicit treatment of the persistence and spillovers of market-driven shocks in supply chain security analysis [

11].

On methodology, research on dynamic interactions in resources and the environment has shifted from static-equilibrium treatments to continuous-time frameworks. Differential games and stochastic optimal control permit multi-agent behaviour to be modelled within a unified system of strategic interaction, state evolution, and exogenous shocks; in particular, stochastic differential games, by incorporating Brownian perturbations, feedback strategies, and random horizons, can simultaneously address uncertainty and asymmetric information while delivering equilibrium concepts and stability conditions consistent with game-theoretic foundations [

12]. By contrast, many quantitative studies of copper import security still rely on static-weight index systems or discrete scenario simulations. Although these approaches are policy-relevant and data-granular-useful for identifying vulnerable links, proposing substitutions, and producing risk forecasts, they do not provide a unified dynamic-uncertainty framework to analyze (i) the co-evolution, in continuous time, of regulatory intensity, cooperative effort, and external shocks; (ii) self-enforcing cooperation thresholds under asymmetric regulation and revenue-sharing rules; or (iii) the impact of shock persistence on long-run stability.

Synthesising the above strands, structural facts, and network-based evidence on copper supply chain risk and resilience have become clearer: multi-layer network models capture the coupling between primary and secondary systems [

6]; multi-layer theory identifies cross-layer propagation and cascading amplification [

7]; the industrial-chain relational structure links network topology to market price transmission [

8]. At the same time, cross-market connectedness indicates that risks arise not only from physical supply–demand and geopolitics but are also amplified and redirected by financial channels [

11]. However, studies that integrate regulator-firm strategic interaction, firms’ effort choices, and the persistence of exogenous shocks within a single continuous-time framework remain scarce, especially under a game between importers and foreign suppliers, with the regulator’s actions treated as exogenous parameters that can identify the self-enforcing cooperation threshold and the trade-off between long-run stability and stochastic disturbances.

Relative to multi-layer trade-network models—which illuminate structural heterogeneity, path dependence, and co-movement across upstream, downstream, and recycling layers—a stochastic differential game offers a complementary, mechanism-based lens with clear methodological advantages. First, it micro-grounds observed linkages in incentive-compatible interaction between domestic importers and foreign suppliers, yielding equilibrium behaviour rather than reduced-form associations. Second, it treats regulatory intensity and profit distribution as structural primitives that determine continuous-time adjustment paths. Third, by embedding uncertainty through diffusion dynamics and feedback strategies, it produces testable stability domains and cooperation thresholds, along with diagnostics on shock persistence, that network model typically do not identify. In this sense, the differential-game perspective does not displace network analysis; it supplies the equilibrium mechanism and policy calculus that the latter abstracts from.

In response to these issues, this paper innovatively develops a stochastic differential game model that transcends the limitations of conventional static analysis and, within a unified dynamic-uncertainty framework, reveals three core mechanisms: (i) by treating regulatory intensity, cooperative effort, and random disturbances as coupled endogenous-exogenous drivers, it derives the co-evolution laws of the mean and variance of supply chain security across parameter regions; (ii) it delineates the minimal feasible set for asymmetric regulation and revenue sharing and the constraints on steady-state variance, thereby identifying the threshold conditions for self-enforcing cross-border cooperation; and (iii) it quantifies the persistence of external shocks and demonstrates the role of regulation in shaping long-run stability. The findings provide a tractable theoretical instrument for addressing the “high regulatory cost-low cooperation efficiency” dilemma and aim to contribute to the safeguarding of critical mineral resource security.

The rest of this paper is organized as follows:

Section 2 introduces core parameters, including regulatory intensity, incentive mechanisms, and safety utility, and develops a differential game model.

Section 3 and

Section 4 presents an analysis and discussion of the results to assess the variations in safety utility and the impact of different factors on its performance.

Section 5 conducts simulation analysis.

Section 6 concludes the paper and provides policy recommendations.

Section 7 discusses the research limitations and future research directions.

4. Discussion

From Equation (7), when term dominates, the domestic importers’ optimal security effort level is positively related to the breach benefit coefficient , but negatively related to the probability of breach detection and the breach penalty coefficient . When the denominator dominates, the optimal security effort is positively related to the subsidy rate and negatively related to the supply security utility decay rate . Taken together, the greater the gains domestic importers obtain from trade, the greater the security effort they will exert.

For further analysis, when international market supply sources are stable, the discount rate and supply security utility decay rate increase. In extreme cases where , factors such as the profit-sharing ratio and copper price cease to play pivotal roles in domestic importers’ decision-making. Firms prioritise short-term economic gains, with the dominant influencing factors shifting to the probability of breach detection and the magnitude of breach penalties.

Conversely, when international market supply is unstable, the discount rate and decay rate typically decrease. In extreme scenarios where , the profit-sharing ratio becomes critical to decision-making. Under such conditions, domestic importers disregard potential gains from breach and instead focus on maintaining supply stability and securing steady revenues through long-term cooperation with foreign suppliers.

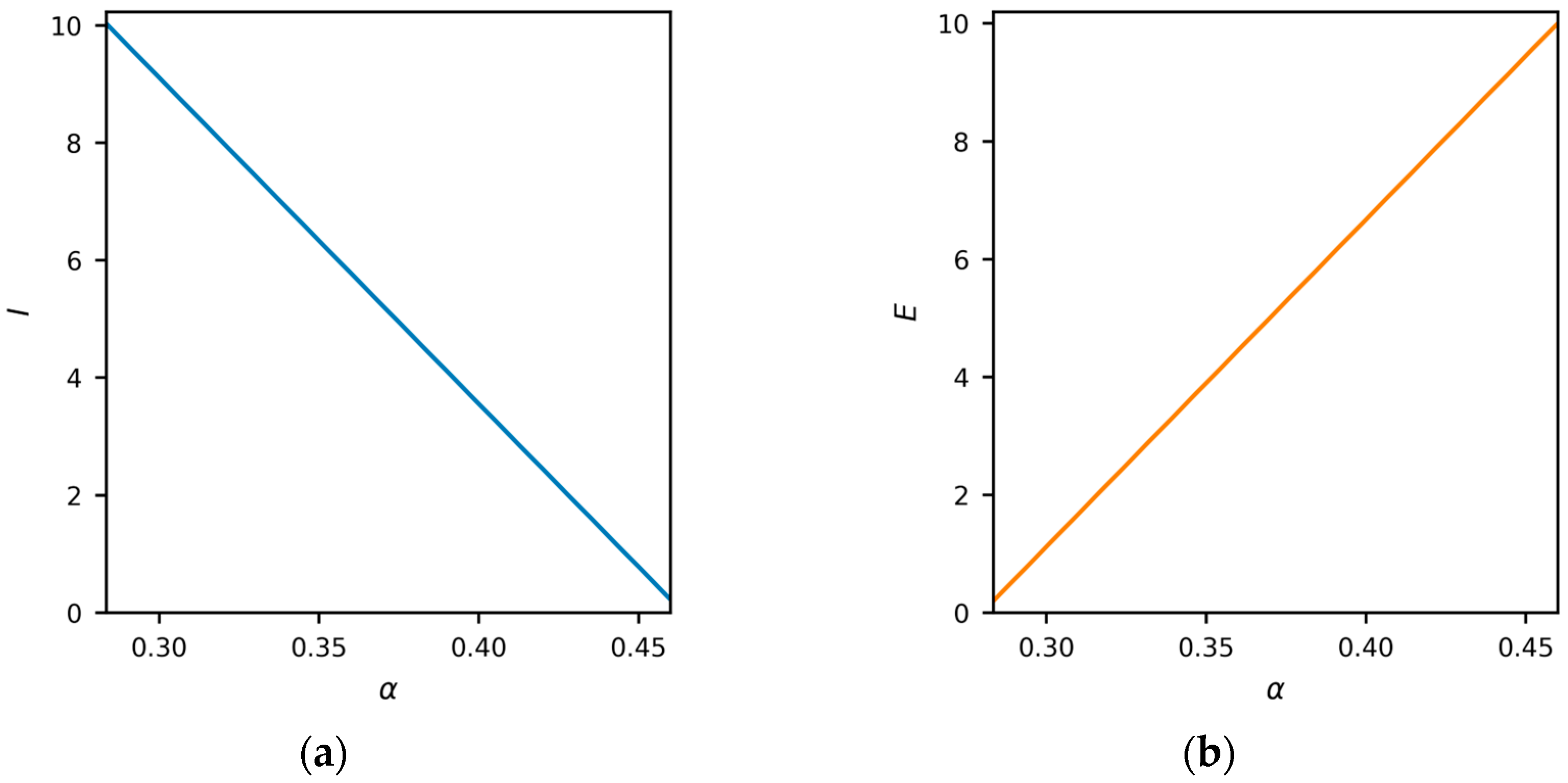

4.1. Regulatory Intensity

Corollary 1. When , enhancing regulatory intensity can significantly elevate the effort input level of domestic importers. A stringent regulatory environment effectively deters breach behaviour by domestic importers, while government subsidies exert a positive incentivising effect on their decision-making.

Proof of Corollary 1.

From Equation (7), when , equivalent to , and are directly proportional. The condition , equivalent to , indicates that the additional net gains from breach by domestic importers are lower than the income from keeping the contract, implying high breach costs. Consequently, enhancing regulatory intensity incentivises domestic importers to increase security effort input to sustain trade continuity and mitigate breach risks. Meanwhile, raising the government subsidy rate further amplifies their effort levels. □

Corollary 2. When , increasing regulatory intensity reduces domestic importers’ effort levels and lowers their total income.

However, government subsidies exert a positive incentive effect on both decision-making and total income.

Proof of Corollary 2.

From Equations (5) and (7),

where

,

,

,

,

,

.

The payoff function can be regarded as jointly determined by and , where both and are quadratic in . By the properties of quadratic functions, attains its extremum at and at , with . Considering the opening directions of the curves for and , when both and are increasing in ; therefore, is positively related to . Since , it follows that is negatively correlated with , while is positively correlated with . At this point, , demonstrating that heightened regulatory intensity reduces total income for domestic importers. The potential reasons are threefold. First, stringent regulations typically entail higher compliance costs—such as environmental mandates, labour protections, and safety standards—which raise production costs and compress profit margins. Second, extended inspection and approval processes reduce production time and output volume, further suppressing revenue. Additionally, regulatory tightening may drive up product prices; if consumers are price-sensitive, demand could decline, intensifying market competition and eroding domestic importers’ market share. Overall, regulatory uncertainty and latent compliance risks amplify operational risks and costs for domestic importers, diminishing profit margins and adversely affecting expected returns. However, increasing the government subsidy rate can enhance domestic importers’ total revenue levels.

When , equivalent to , and are inversely proportional, and directly proportional, and . Updating constraints to , with , equivalent to . This scenario indicates that the additional net gains domestic importers obtain from a breach in this regime exceed the net gains from compliance. Consequently, even when regulatory intensity is heightened, domestic importers prioritise short-term economic returns and exhibit a propensity toward breach. However, raising the government subsidy rate can elevate domestic importers’ effort input levels, effectively mitigating breach risks. □

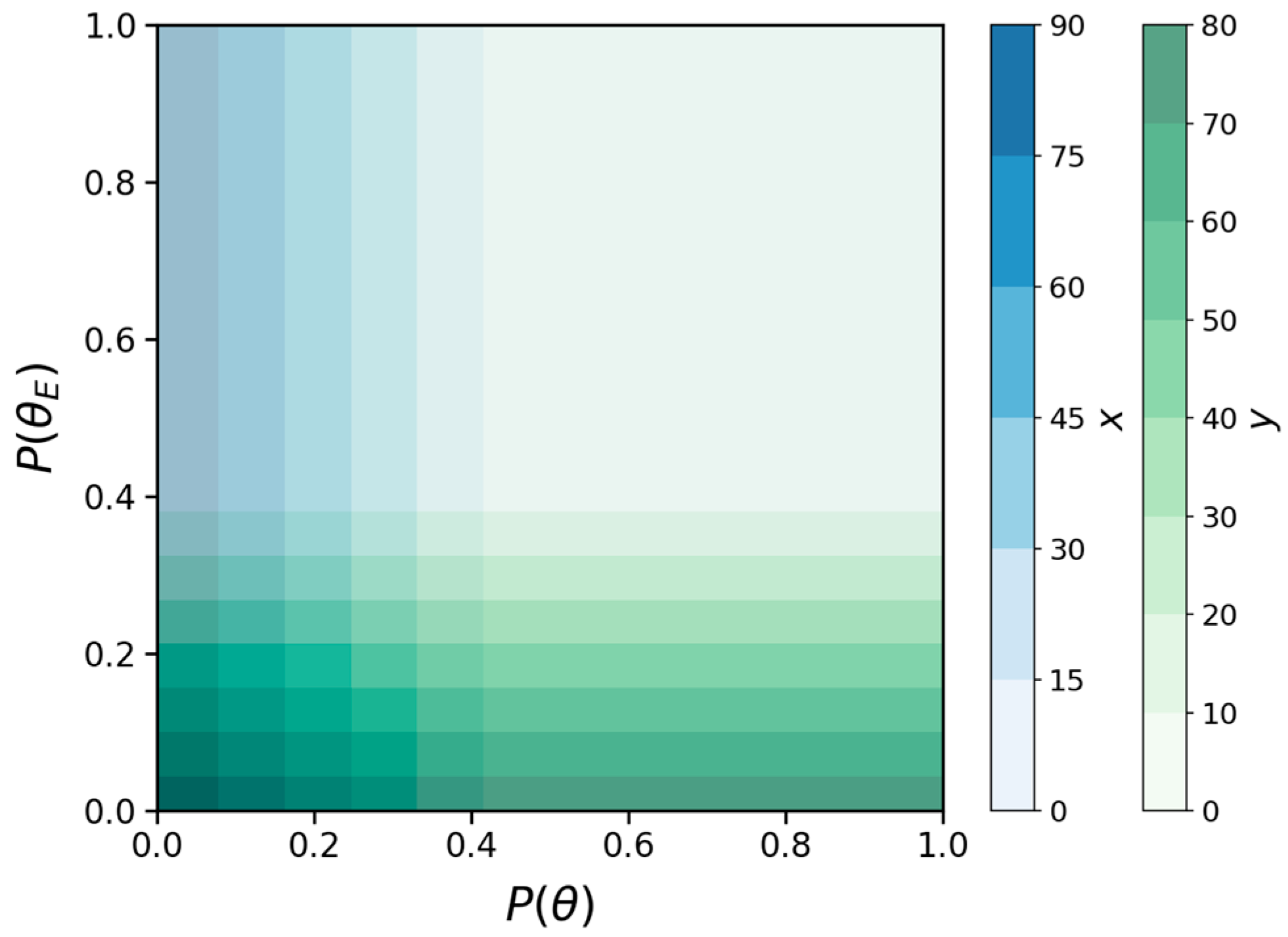

4.2. Income Distribution Ratio

Corollary 3. When and , the profit-sharing ratio exerts a positive incentivising effect on foreign suppliers’ security effort input levels, while also enhancing domestic importers’ total expected returns. However, under a lax regulatory environment, this mechanism fails to effectively promote domestic importers’ security effort levels.

Proof of Corollary 3. From Equations (7) and (8), is negatively correlated with but positively correlated with . Consequently, an increase in the profit-sharing ratio reduces the security effort input level of domestic importers, while conversely incentivising foreign suppliers to raise their security effort levels.

From Equation (31), when , equivalent to , both and are increasing functions of . Additionally, the x-coordinate of the extremum point of can be calculated as , and it can be determined . Based on this analysis, if and , the functions , and are increasing within their respective domains, with being proportional to , and at this point, . □

Corollary 4. When and , the profit-sharing ratio exerts a positive incentivising effect on foreign suppliers’ security effort levels, but fails to effectively enhance their total expected returns.

Proof of Corollary 4. From Equations (7) and (8),

is negatively correlated with

but positively correlated with

. Therefore, an increase in the profit-sharing ratio reduces the security effort input levels of domestic importers, while conversely incentivising foreign suppliers to raise their security effort input levels.

From Equations (6) and (8),

where

,

.

From Equation (32), when , equivalent to , both and are decreasing functions of . Additionally, the x-coordinate of the extremum point of can be calculated as , and it can be determined . Therefore, synthesising the above analysis, if , the functions , and are decreasing functions within the interval , where and are negatively correlated, and holds under these conditions. □

6. Conclusions and Policy Recommendations

6.1. Conclusions

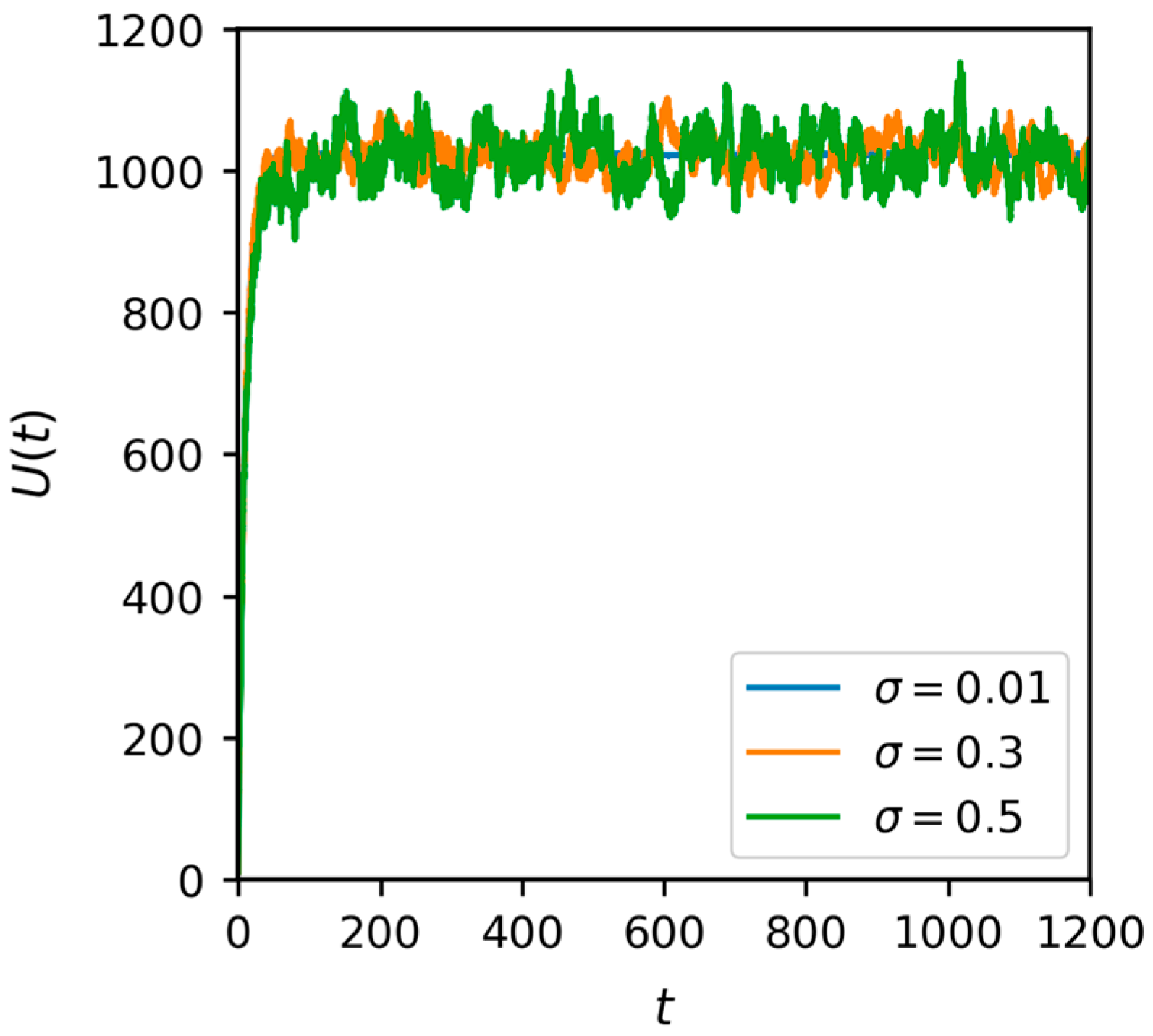

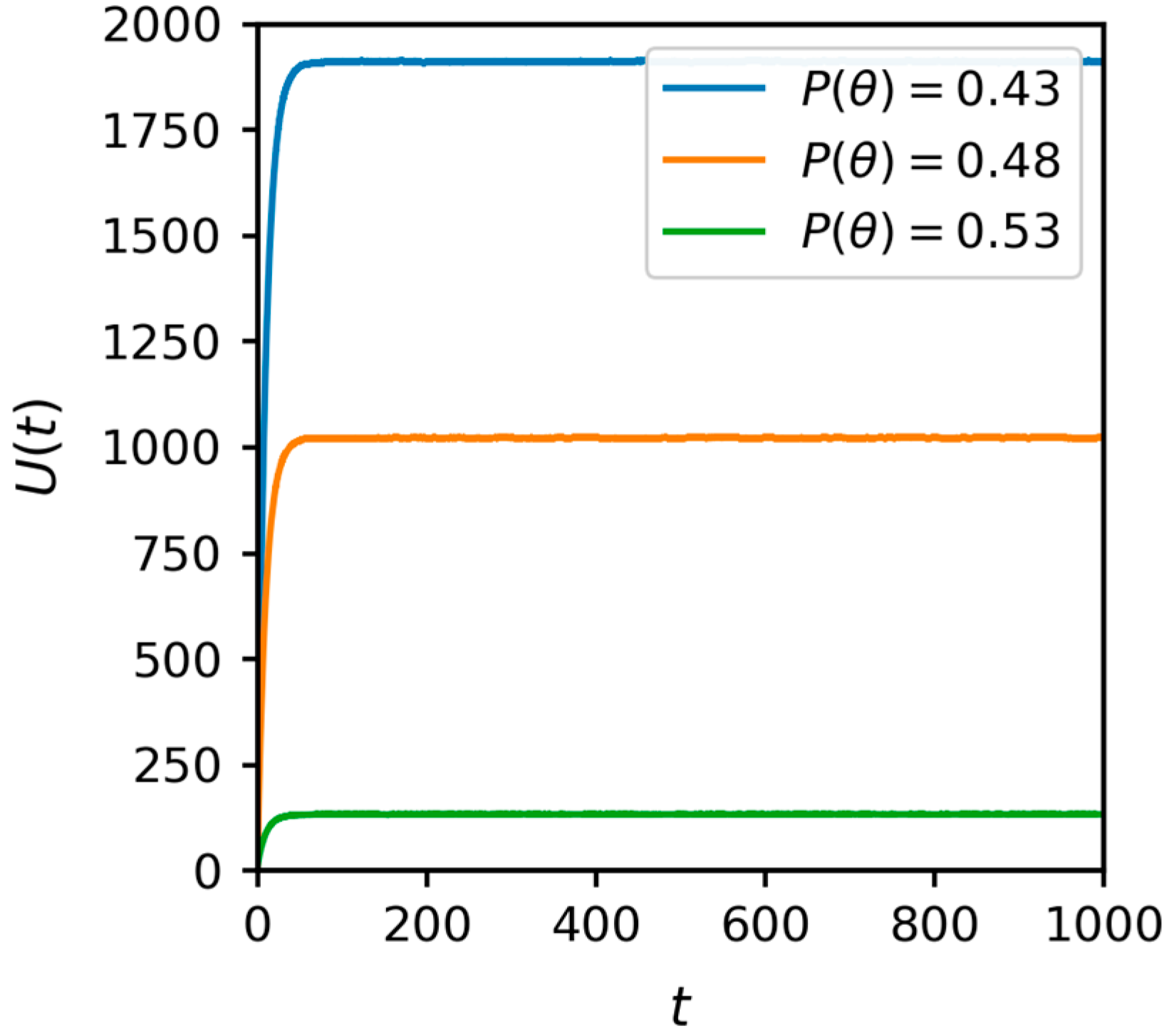

This study employs a stochastic differential game to characterise how China’s copper importers and foreign suppliers interact through incentives, constraints, and uncertainty in continuous time. Within a Hamilton-Jacobi-Bellman (HJB) framework, we derive closed-form feedback Nash equilibria and thereby link regulatory intensity, cooperative security effort, random disturbances, and a supply-security utility into an identifiable dynamic system. The approach not only relaxes the limitations of static analyses but also offers an operational route to conduct comparative statics and scenario simulations on policy parameters.

First, regarding the statistical properties of the utility measure, both the expected value and the variance of supply-security utility become increasingly sensitive to the parties’ security efforts over time. Although Brownian shocks cause realised trajectories to deviate around the expectation, these deviations remain bounded within the contract horizon, indicating forecastable and manageable volatility and providing a basis for designing safety bands [

20].

Second, at the institutional level, asymmetric regulation and profit-sharing jointly determine whether “self-enforcing cooperation” emerges. When domestic importers are subject to relatively stronger process-based regulation while foreign suppliers face lighter oversight, and the importer’s revenue share is set slightly below that of the supplier, cooperation becomes an endogenously stable equilibrium and regulatory costs decline. External shocks primarily manifest as short-term disturbances whose long-run effects are broadly controllable; however, if regulatory intensity exceeds a “moderate band,” rising compliance costs and an uncertainty premium depress the steady-state level of supply security [

15,

21], and revenue-sharing arrangements provide a canonical instrument for aligning incentives and sustaining participation under uncertainty [

22].

Third, comparative statics reveal a context-switching mechanism in behavioural drivers. The importer’s optimal security effort is positively associated with the subsidy rate and the short-term gains from default, and negatively associated with the detection probability, the penalty coefficient, and the utility decay rate. When international supply is stable and discount/decay factors are high, firms are disciplined primarily by detection and penalties; when the external environment is unstable and discount/decay factors are low, the revenue-sharing rule exerts a stronger marginal influence on effort. This mechanism yields specific policy rebalancing rules rather than a general claim: (i) in high-volatility or persistent-shock environments, increasing regulatory intensity beyond the endogenous threshold reduces equilibrium efforts and depresses the supply-security utility; policy emphasis should shift from stricter enforcement to incentive-compatible instruments, namely higher effort subsidies and a modest supplier-favored profit distribution, to keep cooperation self-enforcing; (ii) when volatility is low and detection/penalty effectiveness is high relative to deviation gains, emphasis can shift toward process oversight of domestic importers with lighter oversight of foreign suppliers; (iii) under elevated upstream uncertainty or capacity risk, policy should prioritize longer-term contracting and participation incentives for suppliers; conversely, when downstream deviation risk dominates, emphasis should pivot to importer-side oversight.

6.2. Policy Recommendations

Based on the findings of this study, the following policy recommendations are proposed to foster self-enforcing cooperation and maintain supply chain security within manageable bounds: The first recommendation is to adopt a principle of moderate and asymmetric regulation. Since excessive regulatory stringency can be counterproductive by elevating compliance costs and undermining long-term security, regulatory intensity should be calibrated to deter opportunism without stifling cooperation. This entails implementing stronger, process-based oversight for domestic importers—such as through enhanced operational transparency and performance bonds—given their responsiveness to direct scrutiny. Meanwhile, a lighter, outcome-focused approach centered on delivery reliability and creditworthiness should be applied to foreign suppliers. This asymmetric yet moderate strategy establishes the institutional conditions conducive to self-enforcing cooperation, thereby reducing the overall burden and cost of supervision.

The second recommendation is to structure incentives to align interests and sustain cooperation. The model confirms that financial mechanisms, particularly profit-sharing arrangements and targeted subsidies, are potent tools for influencing the security efforts of both parties. Contracts should be designed with a profit distribution slightly favoring foreign suppliers, as this grants them a direct economic stake in the partnership’s continuity and lowers the need for external enforcement. In parallel, government subsidies for security efforts should be explicitly linked to performance metrics, transforming such support into a targeted instrument that rewards measurable contributions to supply chain security and reinforces long-term cooperative behavior.

Finally, we recommend implementing a dynamic monitoring and evaluation system to enhance governance responsiveness. Given that supply security utility fluctuates within statistically bounded and predictable ranges, a data-driven regime can be established to track key performance indicators—such as delivery timeliness, quantity stability, and price volatility—against pre-defined safety bands. Entities maintaining performance within these bands would qualify for streamlined oversight, rewarding compliance and stability. Conversely, those breaching the bands would trigger intensified inspections. Such a closed-loop system enables efficient allocation of regulatory resources and supports adaptive recalibration of policy parameters in a changing operational environment, thereby preserving long-term stability.

In summary, securing China’s copper supply chain requires a sophisticated policy mix that leverages the strategic incentives of market participants. By embracing moderate and asymmetric regulation, structuring financial incentives to align interests, and instituting dynamic data-informed governance, policymakers can cultivate a resilient and cooperative import environment robust to external shocks.

7. Limitations and Future Directions

Despite its contributions, this research has several limitations that warrant acknowledgement. First, the stochastic differential game framework necessarily simplifies the complex realities of copper supply chains. The model treats importers and suppliers as relatively homogeneous actors, abstracting from the heterogeneity of firm size, governance structures, and contract types. In practice, variations in ownership, market power, and strategic behaviour may produce more diverse outcomes than the stylised dynamics captured here. Second, although the model incorporates random disturbances to approximate exogenous shocks, the calibration relies largely on theoretical parameter assignments and stylised sensitivity analysis. The absence of high-frequency empirical data from customs records, shipping contracts, or firm-level performance indicators limits the capacity to fully validate the quantitative predictions. Third, regulatory and institutional contexts are modelled in a static form, whereas in reality, government policies, enforcement capabilities, and international trade rules evolve dynamically and may interact with firm strategies in more complex, path-dependent ways.

Furthermore, to bridge the gap between this theoretical model and practical policy, future work could focus on integrating data-driven methodologies for parameter calibration and model validation. The current framework relies on stylized parameter assignments, but its predictive power would be greatly enhanced by empirically estimating key variables such as cost coefficients (

,

), the impact of security efforts (

,

), and the decay rate (

) from real-world trade and market data. This aligns with a broader trend of leveraging machine learning and explainable AI (XAI) to add physical or economic interpretability to complex models, as demonstrated in advanced manufacturing processes [

23]. Such an approach could help validate the non-linear relationships and threshold effects predicted by the game-theoretic model.

By addressing these limitations, future research can enhance both the theoretical rigour and the practical policy relevance of copper supply security studies, thereby contributing to more effective governance of critical mineral resources under conditions of global uncertainty.