5.2.1. Effect of Deterioration Rate

Due to the perishability of fresh produce, the deterioration rate

affects the product demand

D, return quantity

R, and order quantity

q, as well as the optimal refund policy and the platform’s revenue. The following analysis examines the impact of the deterioration rate on the e-commerce platform under the three refund policies. First, we discuss how the platform’s expected revenue and order quantity are affected by

. Then, we study the impact of

on the platform’s various decision variables. Finally, we analyze the effect of

on the demand and return quantity. The corresponding results are shown in

Figure 2 and

Table 3.

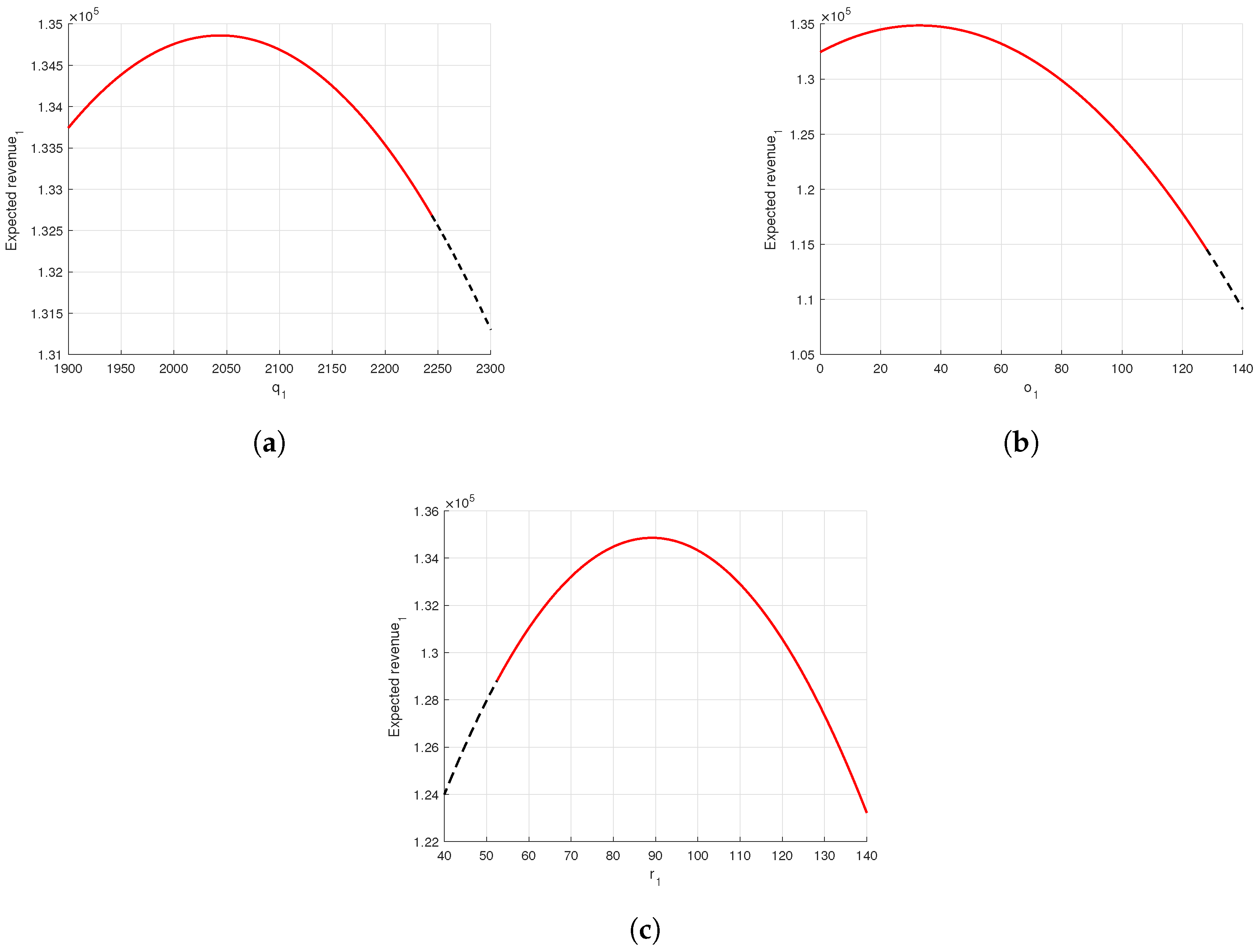

Figure 2a indicates that the expected revenue of the e-commerce platform is negatively correlated with the deterioration rate under three refund policies, consistent with the results of Corollary 2. Moreover, the platform always achieves the highest expected revenue under Policy I. However, while this indicates that as the deterioration rate increases, offering both basic refunds and refund guarantee option simultaneously yields more revenue for the platform compared to the other two refund policies, an increase in deterioration rate leads to a decrease in platform revenue. Therefore, managers need to invest efforts in preservation to reduce the deterioration rate and achieve more revenue.

Figure 2b shows that the order quantity of the e-commerce platforms under three refund policies initially increases and then decreases as the deterioration rate rises. In addition, the order quantity is higher under Policy I compared to Policies II and III. This curve is intuitive because some products spoil, and to meet demand, the platform needs to order more products to offset the spoiled ones. However, as the deterioration rate reaches a certain level, ordering too many products no longer aligns with the platform’s best interests. Therefore, the platform reduces the order quantity to minimize losses. Therefore, the optimal refund policy for fresh produce e-commerce platforms is to provide both basic refunds and refund guarantee option. When the deterioration rate is low, the platform should increase the order quantity as the deterioration rises. However, once the deterioration rate exceeds a certain threshold, the platform should reduce the order quantity.

The effect of deterioration rate on each variable is shown in

Table 4.

As shown in

Table 4 and

Figure 3c, when the deterioration rate is below a certain threshold, the greater the deterioration rate, the lower the basic refund price and expected revenue of the platform under the three refund policies. Conversely, the order quantity and the price of the refund guarantee option increase. Additionally, for the same deterioration rate, the platform’s expected profit and order quantity are highest under Policy I.

Therefore, when the deterioration rate is below a certain threshold, as the deterioration rate of fresh produce increases, the platform should offer a lower basic refund price, a higher order quantity, and a higher price for the refund guarantee option.

Next, we conduct a visual analysis of the impact of the deterioration rate on the demand and return quantity when the platform adopts Policy I. The corresponding results are shown in

Figure 4.

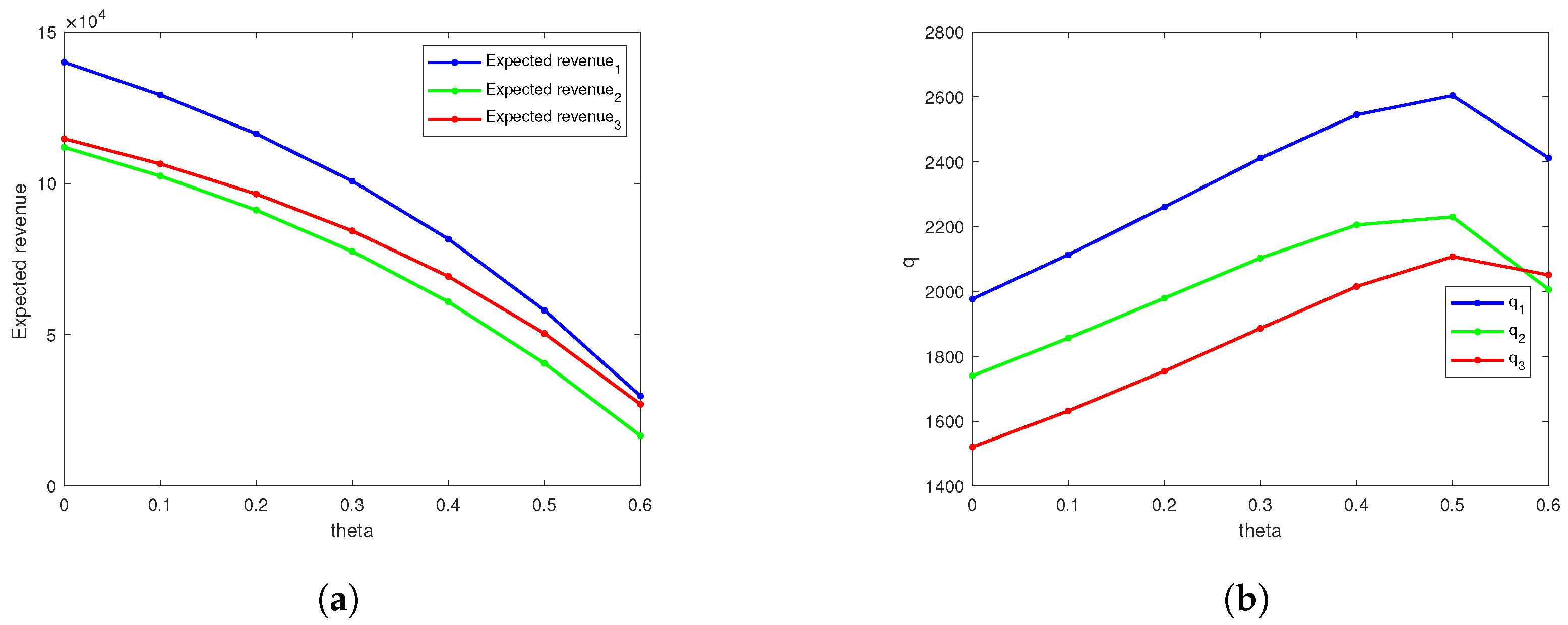

Figure 3a shows the changes in

q,

,

,

and

as

varies. As

increases, the demand decreases. This is because, with the increase in deterioration rate, the platform, aiming to protect its own profit, offers a lower basic refund price and a higher price for the refund guarantee option. Demand is positively correlated with the basic refund price and negatively correlated with the price of the refund guarantee option, leading to a decrease in demand. Secondly, the order quantity is higher than the demand, as the platform orders extra products to offset the spoiled portion. Finally, the figure shows that when the deterioration rate is low, the demand attracted by the basic refund policy is higher than that attracted by the option policy. When the deterioration rate is high, the opposite is true. This is because the basic refund policy deteriorates to such an extent that more people choose to purchase the refund guarantee option instead of the basic refund price, resulting in

being higher than

.

Figure 3b shows the graph of

,

,

and

varying with

. As

increases, the return quantity decreases. This is because with the increase in the deterioration rate, the platform offers a lower basic refund price and a higher price for the refund guarantee option. The return quantity is positively correlated with the basic refund price and negatively correlated with the price of the refund guarantee option, leading to a decrease in return quantity. Therefore, the platform can reduce the return quantity by appropriately lowering the basic refund price and increasing the refund guarantee option price.

5.2.3. Effects of Changes in Sensitivity Coefficients

In this section, we analyze how demand and return quantity sensitivity coefficients for the basic refund policy and the refund guarantee option policy affect various decision variables and the platform’s expected revenue. Specifically, we examine how the optimal order quantity , the optimal basic refund price , the optimal refund guarantee option price , and the platform’s expected revenue are influenced by , , , and . This analysis provides a reference for the platform to formulate refund policies and ordering decisions.

Table 5,

Table 6,

Table 7 and

Table 8 indicate that, under the same parameter settings, the optimal order quantity and expected revenue for Policy I are always higher than those for Policy II and Policy III. Below, we will specifically analyze how

,

, and

are influenced by

,

,

, and

.

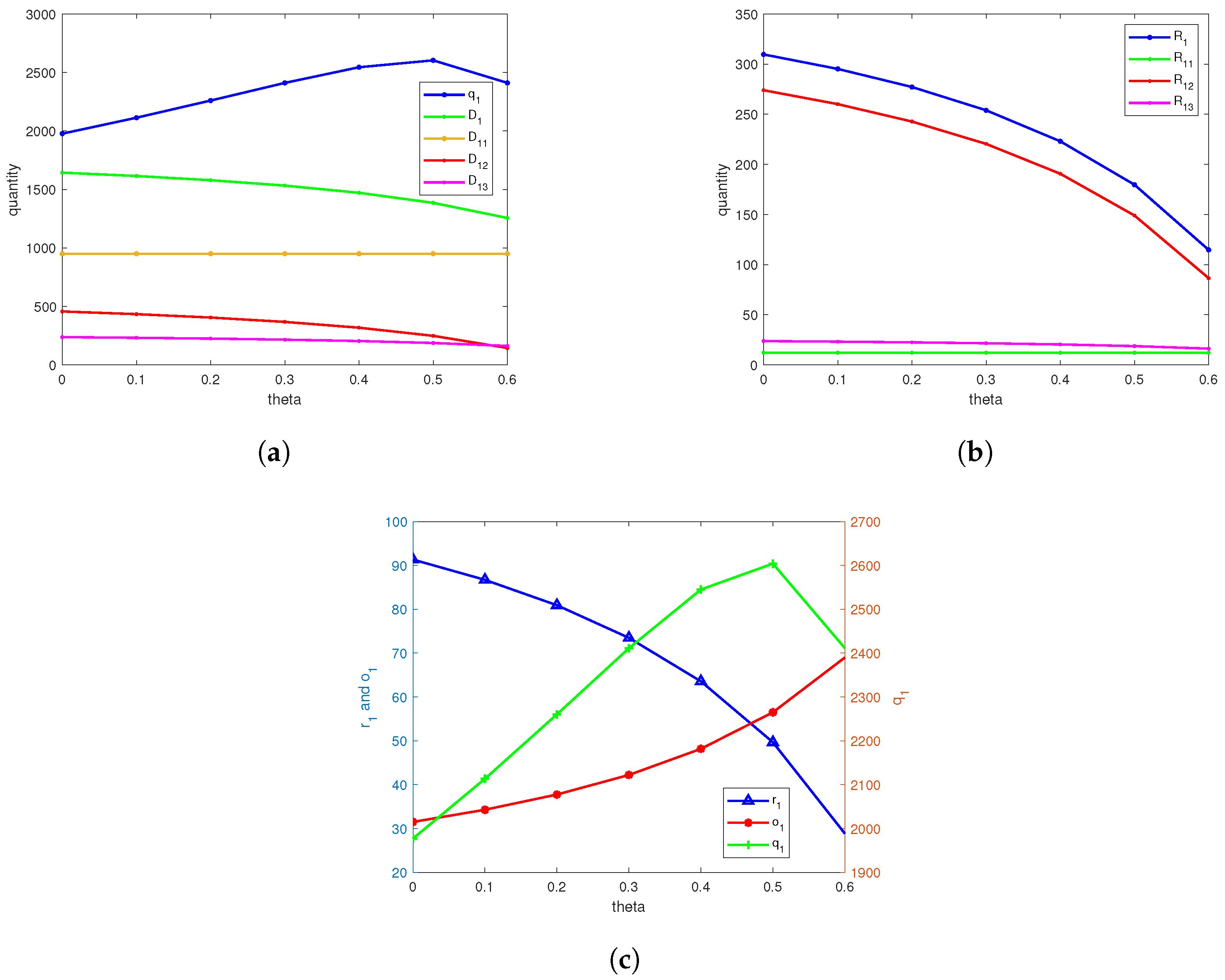

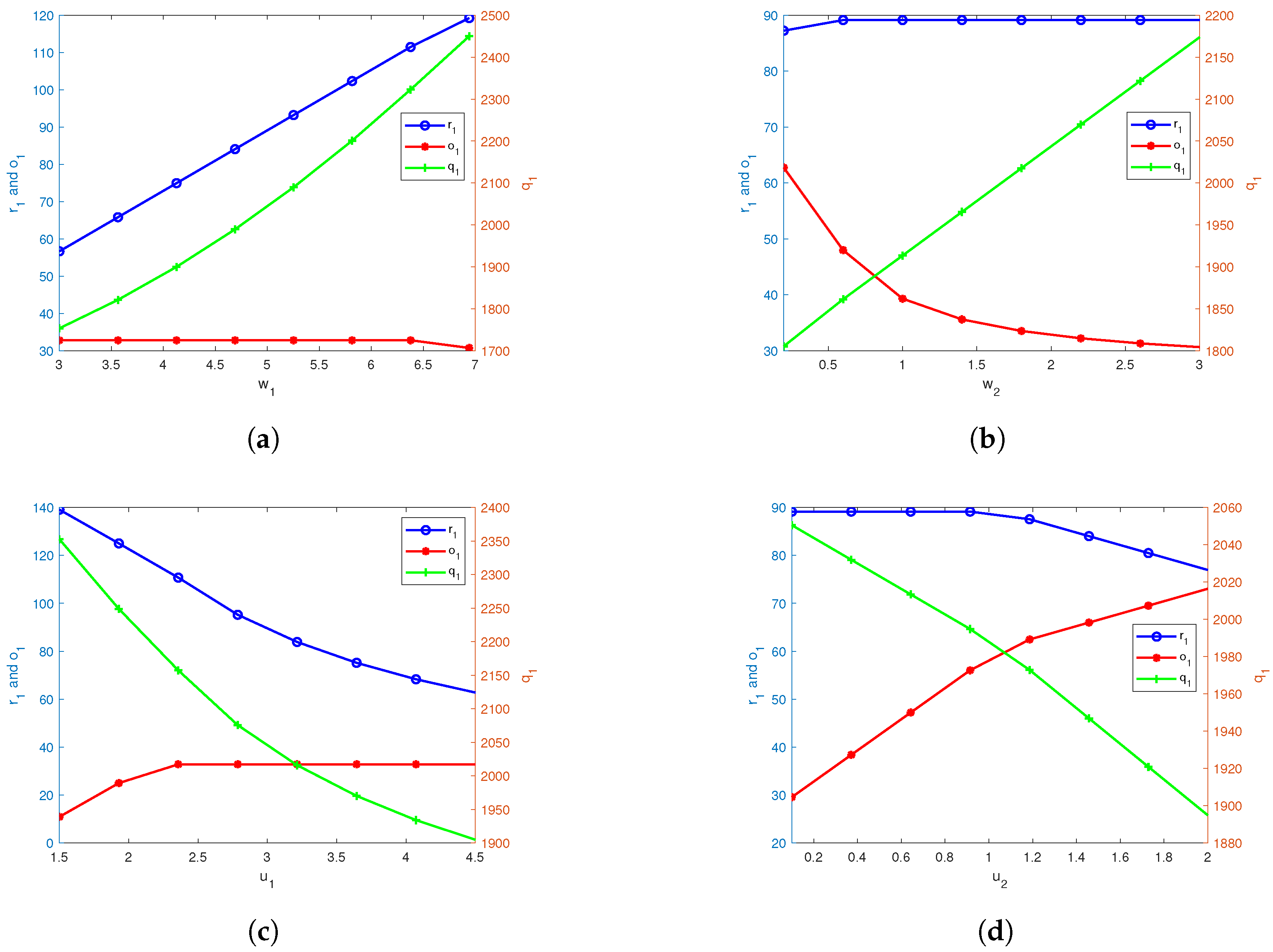

- (1)

Effects of the sensitivity of demand to the basic refund policy

The data in

Table 5 illustrate that in both Policy I and Policy II, as

increases, the platform’s

and

also increase. Additionally, from

Table 5 and

Figure 5a, it can be seen that in Policy I,

is not always independent of the sensitivity coefficient of demand to the basic refund policy. As

increases,

first stays constant and then decreases. This is because initially,

is unaffected by

, but as

continues to increase,

gradually increases. To maintain the constraint

,

then decreases. At this point, the KKT point is converted from the solution in the first case in

Section 4.2.1 to the solution in the second case. Specifically, when

ranges from 3.0 to 6.4, the KKT point is obtained in the first scenario of

Section 4.2.1, whereas when

ranges from 5.8 to 6.9, the KKT point is obtained in the second scenario of

Section 4.2.1.

In practice, if the consumer demand is more sensitive to the basic refund policy, the platform, after weighing the pros and cons, will choose to offer a better basic refund policy to attract more demand, leading to an increase in the platform’s order quantity. Furthermore, when consumer demand is highly sensitive to the basic refund policy, if the platform continues to offer a better basic refund policy without reducing the refund guarantee option price, consumers will not purchase the option when the basic refund policy is more favorable than the option policy. To encourage consumers to purchase the option, the platform will then lower the refund guarantee option price.

Therefore, when the platform adopts Policy I and Policy II, if consumer demand exhibits greater sensitivity to the basic refund policy, it should increase both the basic refund price and the order quantity. Furthermore, under Policy I, when the sensitivity coefficient surpasses a certain threshold, the platform should reduce the option price to optimize its policy.

Table 5.

Results of the sensitivity of demand to the basic refund policy.

Table 5.

Results of the sensitivity of demand to the basic refund policy.

| | | | | | | | | | |

|---|

| 3.0 | 1753.5 | 32.8 | 56.7 | 120,661.9 | 1506.8 | 56.7 | 93,197.6 | 1574.5 | 32.8 | 110,782.6 |

| 3.6 | 1821.3 | 32.8 | 65.8 | 124,018.8 | 1574.6 | 65.8 | 96,554.5 | 1574.5 | 32.8 | 110,782.6 |

| 4.1 | 1900.0 | 32.8 | 75.0 | 127,876.2 | 1653.3 | 75.0 | 100,411.9 | 1574.5 | 32.8 | 110,782.6 |

| 4.7 | 1989.5 | 32.8 | 84.1 | 132,234.2 | 1742.8 | 84.1 | 104,769.9 | 1574.5 | 32.8 | 110,782.6 |

| 5.3 | 2089.8 | 32.8 | 93.2 | 137,092.8 | 1843.1 | 93.2 | 109,628.5 | 1574.5 | 32.8 | 110,782.6 |

| 5.8 | 2200.9 | 32.8 | 102.4 | 142,452.0 | 1954.2 | 102.4 | 114,987.7 | 1574.5 | 32.8 | 110,782.6 |

| 6.4 | 2322.9 | 32.8 | 111.5 | 148,311.8 | 2076.2 | 111.5 | 120,847.5 | 1574.5 | 32.8 | 110,782.6 |

| 6.9 | 2450.0 | 30.8 | 119.2 | 154,658.0 | 2209.0 | 120.6 | 127,207.9 | 1574.5 | 32.8 | 110,782.6 |

- (2)

Effects of the sensitivity of demand to the refund guarantee option policy

Table 6 shows that in both Policy I and Policy III, as

increases,

and the expected revenue under the corresponding policy increase, while

decreases. Additionally, from

Table 6 and

Figure 5b, it can be seen that in Policy I,

is not always independent of the demand sensitivity coefficient for the refund guarantee option policy. As

increases,

first increases and then remains unchanged. This is also influenced by the constraint

, similar to the analysis in

Table 5. At this point, the KKT point shifts from the solution in the second scenario described in

Section 4.2.1 to the solution in the first scenario. Specifically, when

is 0.2, the KKT point is obtained in the second scenario of

Section 4.2.1, whereas when

ranges from 0.6 to 3.0, the KKT point is obtained in the first scenario of

Section 4.2.1. In practice, when the option price is high, if the basic refund policy is better than the option policy, consumers will be unwilling to purchase the option. Therefore, the basic refund price must be reduced. However, as the option price decreases, the option policy becomes more favorable than the basic refund policy, and it is no longer necessary to reduce the basic refund price. At this point, the basic refund price is unaffected by the sensitivity coefficient.

Therefore, when the platform adopts Policy I and Policy III, if consumer demand is increasingly sensitive to the refund guarantee option price, it should offer a lower refund guarantee option price and increase the order quantity. Additionally, under Policy I, when the sensitivity coefficient is relatively low, the platform should raise the basic refund price as the sensitivity increases. However, once the sensitivity coefficient surpasses a certain threshold, the basic refund price remains unchanged.

Table 6.

Results of the sensitivity of demand to the refund guarantee option policy.

Table 6.

Results of the sensitivity of demand to the refund guarantee option policy.

| | | | | | | | | | |

|---|

| 3.0 | 1753.5 | 32.8 | 56.7 | 120,661.9 | 1506.8 | 56.7 | 93,197.6 | 1574.5 | 32.8 | 110,782.6 |

| 0.2 | 1805.3 | 62.8 | 87.2 | 107,911.2 | 1797.0 | 89.1 | 107,396.3 | 1340.1 | 91.3 | 84,007.1 |

| 0.6 | 1861.4 | 48.0 | 89.1 | 113,640.9 | 1797.0 | 89.1 | 107,396.3 | 1392.2 | 48.0 | 89,562.9 |

| 1.0 | 1913.5 | 39.3 | 89.1 | 119,647.3 | 1797.0 | 89.1 | 107,396.3 | 1444.3 | 39.3 | 95,569.3 |

| 1.4 | 1965.5 | 35.6 | 89.1 | 125,718.2 | 1797.0 | 89.1 | 107,396.3 | 1496.4 | 35.6 | 101,640.2 |

| 1.8 | 2017.6 | 33.5 | 89.1 | 131,810.4 | 1797.0 | 89.1 | 107,396.3 | 1548.5 | 33.5 | 107,732.4 |

| 2.2 | 2069.7 | 32.2 | 89.1 | 137,912.5 | 1797.0 | 89.1 | 107,396.3 | 1600.5 | 32.2 | 113,834.5 |

| 2.6 | 2121.8 | 31.3 | 89.1 | 144,019.8 | 1797.0 | 89.1 | 107,396.3 | 1652.6 | 31.3 | 119,941.8 |

| 3.0 | 2173.9 | 30.6 | 89.1 | 150,130.2 | 1797.0 | 89.1 | 107,396.3 | 1704.7 | 30.6 | 126,052.2 |

- (3)

Effects of the sensitivity of return quantity to the basic refund policy

From

Table 7, it can be seen that in both Policy I and Policy II, if

increases, then

,

, and the expected revenue under the corresponding policy decrease. Additionally, from

Table 7 and

Figure 5c, it can be observed that in Policy I,

is not always independent of the sensitivity coefficient of return quantity to the basic refund policy. As

increases,

first increases and then remains constant, also influenced by the constraint

. At this point, the KKT point transitions from the solution in the second scenario of

Section 4.2.1 to the solution in the first scenario. Specifically, when

is between 1.5 and 1.9, the KKT point is obtained in the second scenario of

Section 4.2.1, whereas when

is between 2.4 and 4.5, the KKT point is obtained in the first scenario of

Section 4.2.1. In fact, if consumers are more sensitive to the basic refund policy in terms of return quantity, the platform will choose to offer a worse basic refund policy after weighing the pros and cons to reduce the return quantity caused by the basic refund policy.

Therefore, when the platform adopts Policy I and Policy II, if consumer returns are more sensitive to the basic refund policy, the platform should reduce the market order quantity and offer a lower basic refund price. Additionally, under Policy I, when the sensitivity coefficient is relatively low, the platform should set a lower refund guarantee option price. However, once this sensitivity coefficient exceeds a certain threshold, the refund guarantee option price remains unchanged as the sensitivity increases.

Table 7.

Results of the sensitivity of return quantity to the basic refund policy.

Table 7.

Results of the sensitivity of return quantity to the basic refund policy.

| | | | | | | | | | |

|---|

| 1.5 | 2352.6 | 10.9 | 139.1 | 151,262.3 | 2117.3 | 150.0 | 125,534.6 | 1574.5 | 32.8 | 110,782.6 |

| 1.9 | 2248.9 | 25.0 | 125.0 | 144,943.2 | 2028.4 | 133.1 | 117,727.9 | 1574.5 | 32.8 | 110,782.6 |

| 2.4 | 2157.3 | 32.8 | 110.7 | 139,920.8 | 1910.6 | 110.7 | 112,456.5 | 1574.5 | 32.8 | 110,782.6 |

| 2.8 | 2075.7 | 32.8 | 95.2 | 136,284.5 | 1829.0 | 95.2 | 108,820.3 | 1574.5 | 32.8 | 110,782.6 |

| 3.2 | 2015.9 | 32.8 | 83.9 | 133,629.4 | 1769.2 | 83.9 | 106,165.1 | 1574.5 | 32.8 | 110,782.6 |

| 3.6 | 1970.2 | 32.8 | 75.2 | 131,609.1 | 1723.4 | 75.2 | 104,144.8 | 1574.5 | 32.8 | 110,782.6 |

| 4.1 | 1934.0 | 32.8 | 68.3 | 130,023.1 | 1687.3 | 68.3 | 102,558.9 | 1574.5 | 32.8 | 110,782.6 |

| 4.5 | 1904.8 | 32.8 | 62.8 | 128,747.4 | 1658.1 | 62.8 | 101,283.1 | 1574.5 | 32.8 | 110,782.6 |

- (4)

Effects of the sensitivity of return quantity to the refund guarantee option policy

From

Table 8, it can be seen that in both Policy I and Policy III, if

increases, then

and the expected revenue under the corresponding policy decrease, while

increases. Additionally, from

Table 8 and

Figure 5d, it can be observed that in Policy I,

is not always independent of the sensitivity coefficient of the return quantity to the basic refund policy. As

increases,

first remains constant and then decreases, also constrained by the constraint

. At this point, the KKT point transitions from the solution in the first scenario of

Section 4.2.1 to the solution in the second scenario. Specifically, when

is between 0.1 and 0.9, the KKT point is obtained in the first scenario of

Section 4.2.1, whereas when

is between 1.2 and 2.0, the KKT point is obtained in the second scenario of

Section 4.2.1. In fact, if the consumers’ return quantity is more sensitive to the return guarantee option price, a lower option price will attract more returns. To reduce the return quantity, the platform will offer a worse return guarantee option policy.

Therefore, when the platform adopts Policy I and Policy III, if consumer returns are more sensitive to the refund guarantee option price, the platform should reduce the market order quantity and offer a higher refund guarantee option price. Additionally, under Policy I, when the sensitivity coefficient is relatively low, the platform should maintain a higher basic refund price. However, once the sensitivity coefficient exceeds a certain threshold, the platform should decrease the basic refund price as the sensitivity increases.

Table 8.

Results of the sensitivity of the return quantity to the refund guarantee option policy.

Table 8.

Results of the sensitivity of the return quantity to the refund guarantee option policy.

| | | | | | | | | | |

|---|

| 0.1 | 2050.5 | 29.6 | 89.1 | 136,405.1 | 1797.0 | 89.1 | 107,396.3 | 1581.3 | 29.6 | 112,327.1 |

| 0.4 | 2031.9 | 38.4 | 89.1 | 132,311.2 | 1797.0 | 89.1 | 107,396.3 | 1562.8 | 38.4 | 108,233.2 |

| 0.6 | 2013.4 | 47.2 | 89.1 | 128,528.5 | 1797.0 | 89.1 | 107,396.3 | 1544.2 | 47.2 | 104,450.5 |

| 0.9 | 1994.8 | 56.0 | 89.1 | 125,057.0 | 1797.0 | 89.1 | 107,396.3 | 1525.6 | 56.0 | 100,979.0 |

| 1.2 | 1972.9 | 62.5 | 87.5 | 121,877.7 | 1797.0 | 89.1 | 107,396.3 | 1507.1 | 64.9 | 97,818.9 |

| 1.5 | 1946.9 | 66.0 | 84.0 | 118,851.0 | 1797.0 | 89.1 | 107,396.3 | 1488.5 | 73.7 | 94,970.0 |

| 1.7 | 1920.9 | 69.5 | 80.5 | 115,948.7 | 1797.0 | 89.1 | 107,396.3 | 1469.9 | 82.5 | 92,432.4 |

| 2.0 | 1894.9 | 73.0 | 77.0 | 113,170.9 | 1797.0 | 89.1 | 107,396.3 | 1451.3 | 91.3 | 90,206.0 |

- (5)

Effects of sensitivity coefficients on expected revenue

Furthermore, we utilize three-dimensional graphs to analyze how the expected revenue is influenced by various sensitivity coefficients when adopting Policy I on the platform. The corresponding results are presented in

Figure 6. From the graphs, it is evident that the expected revenue increases as the sensitivity coefficient of demand to the basic refund policy (

) and the sensitivity coefficient of demand to the refund guarantee option policy (

) increase, while it decreases as the sensitivity coefficients of the return quantity to the basic refund policy (

) and the sensitivity coefficients of the return quantity to the refund guarantee option policy (

), deterioration rate (

), and price sensitivity coefficients (

b) increase. These findings are consistent with the theoretical conclusions outlined in

Section 4.4.

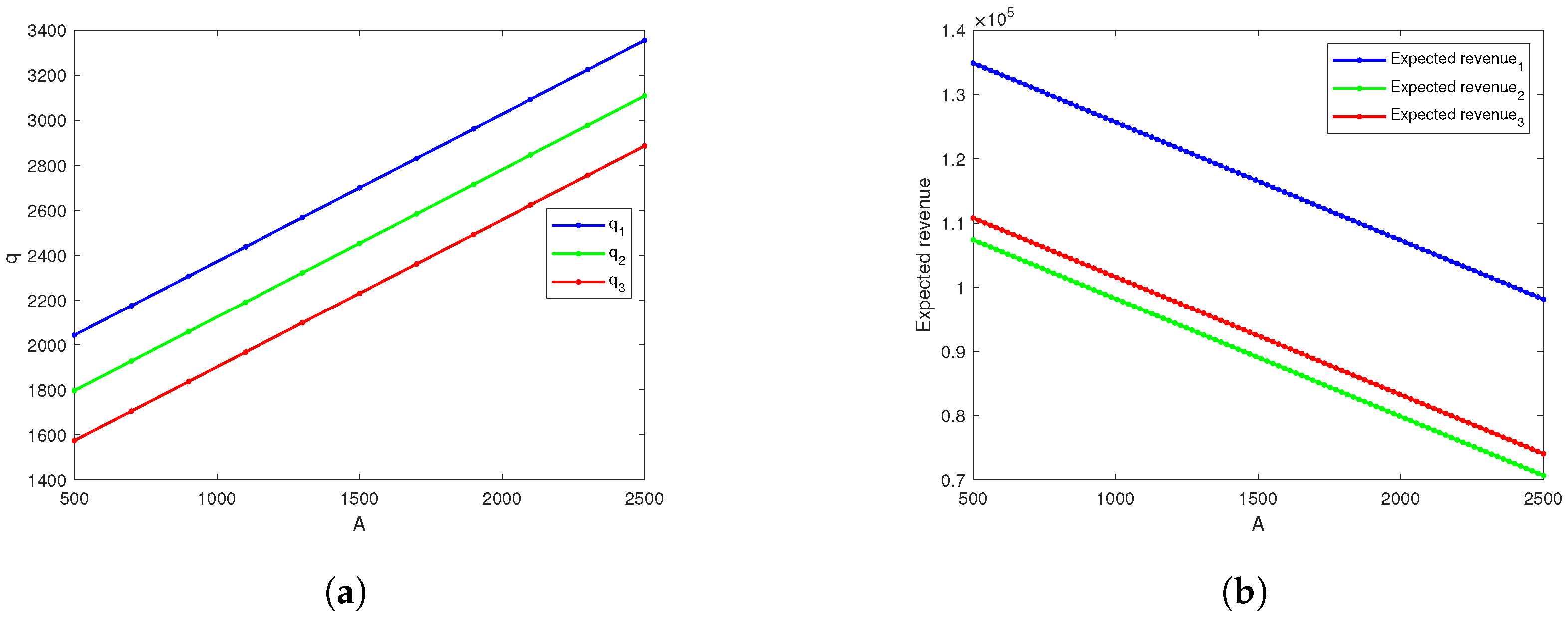

- (6)

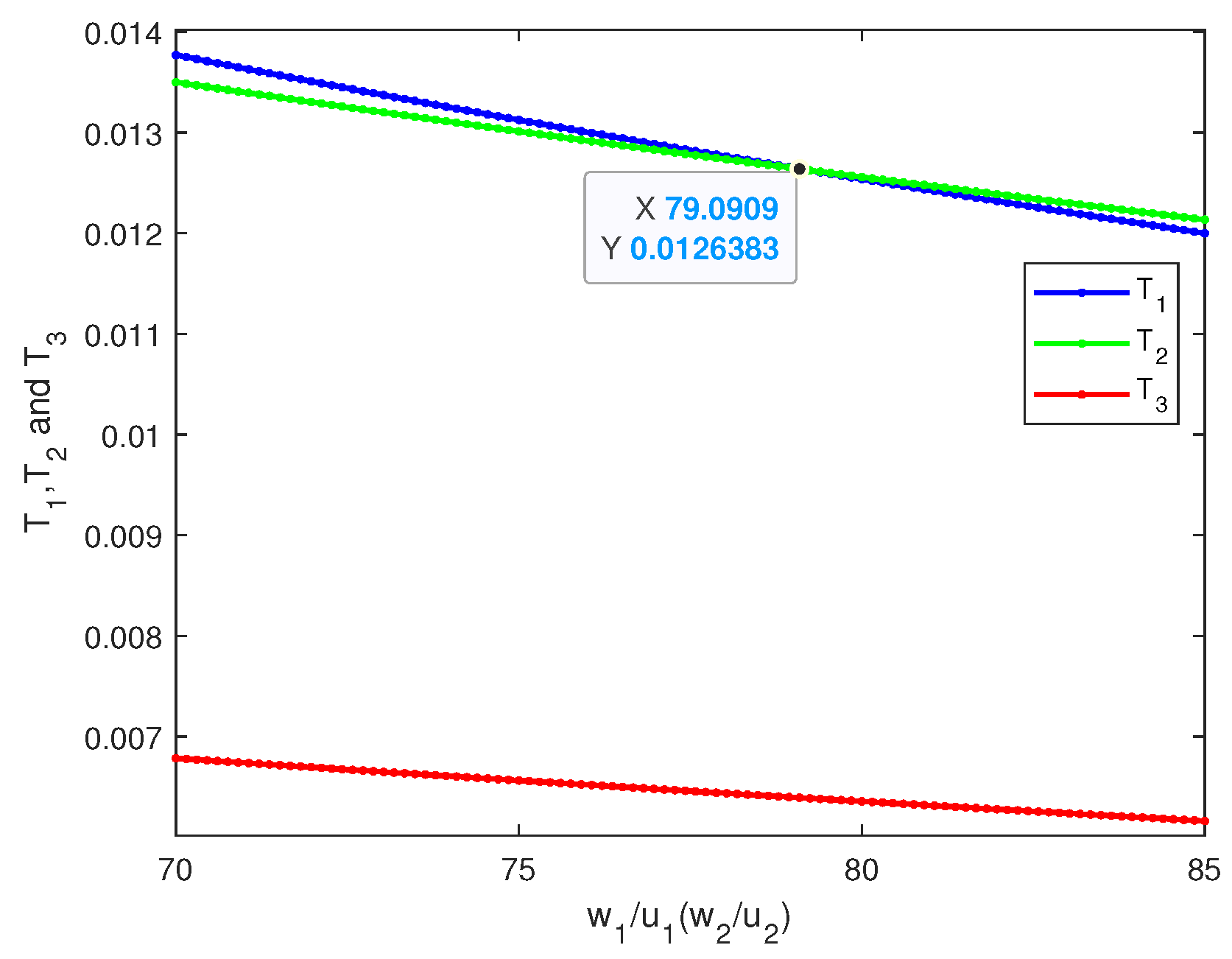

Effects of market uncertainty

Finally, we analyze the impact of market uncertainty on the platform’s decision variables and expected revenues under three refund policies.

Figure 7a and

Table 9 demonstrate that increasing market uncertainty (

A) does not affect the prices of the basic refund and refund guarantee option, but the platform will increase the order quantity to address market fluctuations. Nevertheless, the platform’s expected revenues will decrease as shown in

Figure 7b.