1. Introduction

E-commerce breaks through the limitations of time and space and plays an increasingly important role in economic development. The global e-commerce market is expected to reach USD 6.5 trillion by 2023. In this rapid development trend, each e-commerce platform adopts different operating models according to its own situation. Some e-commerce platforms, such as Taobao and Tmall, adopt a pure platform model, whereby they only provide trading platforms for independent sellers and consumers and do not participate in specific transactions. They profit by charging commissions to independent sellers. In addition, platforms, such as Amazon, Suning Tesco, and Jingdong Mall, while providing platform services for buyers and sellers, also encroach on the retail market and make profits by opening their own stores [

1]. Statistics show that since 2023, Jingdong’s self-operated GMV has accounted for more than 70% of Jingdong Mall’s overall sales.

The encroachment of e-commerce platform owners into the retail market has an impact on the supply chain structure. The platform owner not only acts as an intermediary cooperating with independent sellers to facilitate transactions but also acts as an occupier competing with independent sellers for consumers in the same market. For more authoritative platforms, consumers tend to show a stronger sense of trust and have a higher preference for platform self-owned products. Product positioning is an effective way for independent sellers to enhance their competitive advantage. Product positioning involves two aspects: vertical product positioning and horizontal product positioning [

2]. Vertical product positioning emphasizes the professionalism and depth of the product, focusing on product quality and function. The difference in the material, process, and function of the product creates products of a different quality. According to the difference in product quality and value, the market can be roughly divided into low-, medium-, and high-end markets [

3]. Reliable and excellent quality is the key for medium- and high-end products, while low-end products have become a pragmatic choice for consumers with their high cost-effectiveness. Enterprises vertically position their market by selecting the quality of the products they sell. Faced with the threat of encroachment, some incumbent enterprises establish market competitive advantages through quality improvement in advance [

4]. There are also some incumbent enterprises that respond by reducing the level of product quality [

5]. On the e-commerce platform, some independent sellers are positioned in the high-end product market, and the platform owner will not engage in encroachment. For example, luxury brands such as LV and GUCCI have flagship stores on Jingdong Mall, and there are no Jingdong self-owned stores. At the same time, many independent sellers expect to take advantage of the high pricing of the platform’s self-owned products [

6], positioning in the low-end product market, such as the digital accessories market and the second-hand book market. When the platform’s self-owned stores enter, independent sellers may need a lot of resources to reposition vertically, which is very difficult for them [

7]. Therefore, in the face of serious product homogeneity and weak competitive position, independent sellers can form differences with the platform owner through horizontal product positioning [

8]. Unlike vertical product positioning, horizontal product positioning focuses on the breadth and diversity of products, that is, the appearance, design, characteristics, etc., necessary to distinguish them from competitors’ products, positioning on a specific attribute or feature to attract potential consumers. For example, clothing brands such as GLM and A21 specialize in selling certain styles in their flagship stores to differentiate them from products in the platform’s self-owned stores. Third-party sellers on Amazon try to tap into differentiated blue ocean products from Red Sea markets. The retailer of selfie ring lights, by analyzing user reviews on Amazon, developed the large-sized ring light and replaced the flimsy tripod with a sturdy circular base. In short, product positioning is a primary and important business decision for independent sellers.

The above analysis leads to the research questions of this paper: Under what conditions is the independent seller positioned in the high-end product market, and under what conditions is the independent seller positioned in the low-end product market? Is the platform owner willing to encroach on the retail market? How does platform encroachment affect the independent seller’s positioning decision? What is the equilibrium strategy for the interaction between the two parties? Which equilibrium strategy can yield more consumer surplus and social welfare?

In view of the above questions, we establish a Stackelberg game model under the framework of the Hotelling model, involving an independent seller and a platform owner. If there is no encroachment, then the independent seller as a monopoly only needs to carry out vertical product positioning and pricing. If there is platform encroachment, the independent seller also needs to carry out horizontal product positioning to alleviate competition by selling a product that is different from the platform’s self-owned product. We not only explore the optimal strategies of both parties but also develop an agent-based model for more complex consumer markets and conduct simulation experiments. In addition, we extend the model to further analyze the impact of positive production costs, pricing order, and the platform’s consumer surplus concerns.

The rest of this paper is arranged as follows.

Section 2 reviews the relevant literature and emphasizes the differences between this paper and the existing literature.

Section 3 establishes the main model and investigates the independent seller’s product positioning strategy and the platform owner’s encroachment strategy.

Section 4 conducts multi-agent simulation experiments and further analyzes the impact of heterogeneity of consumers’ ideal preferences on equilibrium decision making.

Section 5 considers several extensions to the main model.

Section 6 presents the conclusions of this study and discusses management insights and future research directions.

3. Modeling and Analysis

We consider an e-commerce platform supply chain consisting of a platform owner (O) and an independent seller (S). There are vertically differentiated categories and sellers within a category that sell horizontally differentiated variants (products). In our model, we consider two categories with a vertical differentiation of

α, one is a lower quality category L and the other is a higher quality category H. S chooses to sell one of the categories (that is, vertical product positioning) and transact with consumers through O. At the same time, S needs to pay a commission of

r (0 <

r < 1) per unit sales to O, and r is an exogenous variable [

36,

37,

38]. In addition, observing the category selection of S, O may introduce its own product into the market to encroach on S’s category (encroachment strategy is denoted as E, non-encroachment strategy is denoted as N).

Figure 1 illustrates the supply chain structure under the two platform strategies. In reality, in order to reduce the risk of new product development, platform owners often use information advantages to encroach on products with good sales performance [

12,

16], and the platform owner has product display advantages [

39]. To avoid being squeezed out of the market by the platform’s self-owned store, S will take the initiative to adopt a product differentiation strategy to distinguish from O’s product of the same level (i.e., horizontal product positioning) and establish its own competitive advantage [

40]. We denote S’s product and O’s product in category

j (

) as

Sj and

Oj, respectively, and the degree of horizontal differentiation between the two products is expressed as

, where S determines the optimal

value. For simplicity of analysis, we assume that both parties produce at zero cost (in

Section 5, we consider the case where the production costs are not zero, and the main result is still valid).

According to the Hotelling model, we assume that consumers are uniformly distributed along a straight line with density 1 [

41]. We use a modified Hotelling model where the line extends to infinity at both ends [

42]. The location of each consumer indicates its ideal variant (product) preference. If the consumer buys the non-ideal product, it will cause the loss of its purchase utility. Assume that the distance between the consumer’s ideal and each seller’s product is

(

,

). The utility loss caused by consumers purchasing product

ij without satisfying their preferences is

, where

t represents the utility loss per unit distance. We distinguish the consumer’s purchase behavior in the following two scenarios.

When O does not encroach, there is only S’s product in the linear space. The utility obtained by the consumer from purchasing

Sj is

, where

represents the category

j’s quality,

;

represents

Sj’s retail price. The value

is defined as the boundary position at which the consumer acquires non-disutility when purchasing S

j, i.e.,

when

.

Figure 2a shows the range in which consumers buy products from S in the case of non-encroachment. The market demand of S is

.

When O encroaches, there are

Sj and

Oj in the linear space. It is assumed that consumers have a higher value evaluation

δ (

δ > 1) for the platform owner’s products [

43,

44,

45]. The utility obtained by the consumer from purchasing

Oj is

. The utility obtained by the consumer from purchasing

Sj is

. The value

is defined as the boundary position at which the consumer acquires non-disutility when purchasing

Oj, i.e.,

when

. In addition, we define the value

as the undifferentiated location where the consumer purchases

Sj and

Oj. Let

,

, by solving

, we can obtain

.

Figure 2b shows consumers’ purchases of different sellers’ products in the case of encroachment. The market demand of S is

. The market demand of O is

. Note that the boundary values

and

are positive.

We only consider that both products have high enough valuations, so that there is a competitive relationship between the two parties. Specifically, the constraint is

. In

Table 1, we summarize all the main symbols.

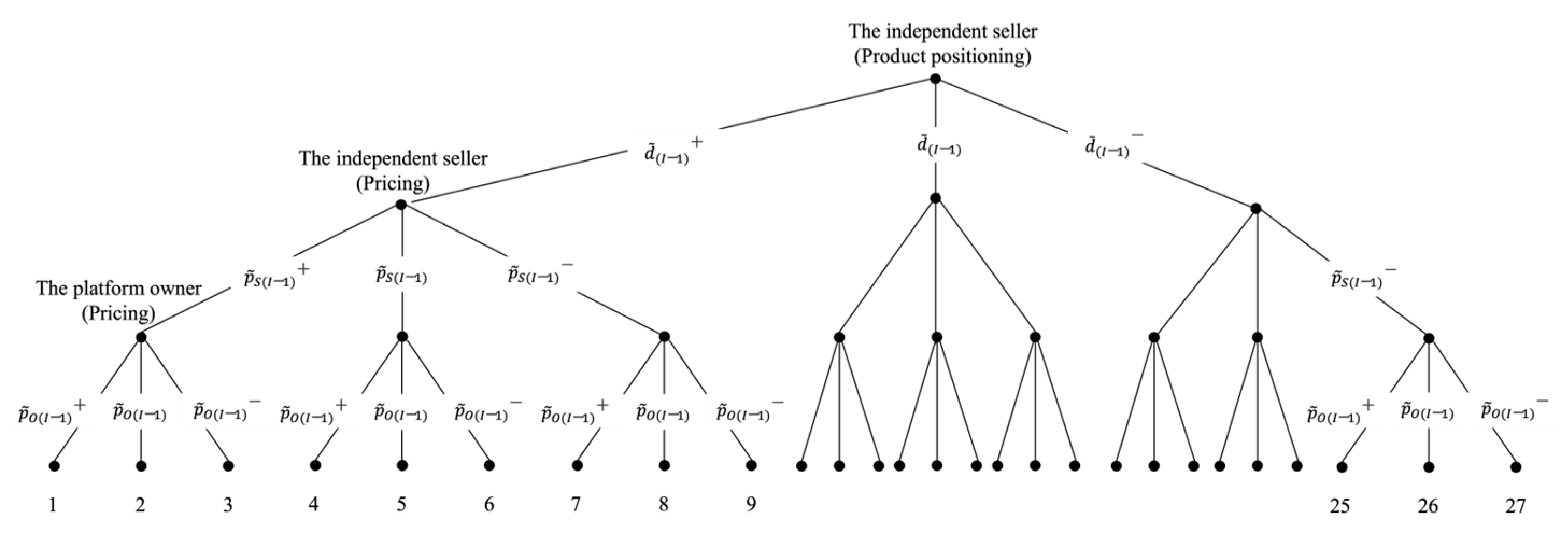

The sequence of events for this article is shown in

Figure 3. S first vertically positions its product (L or H), and then, observing S’s market position (category selection), O decides whether to encroach on the category. According to whether O encroaches, there are two sub-games: If O does not encroach, S decides the retail price

. If O encroaches, S takes the lead in determining the horizontal differentiation degree

from

Oj, and second, S and O successively decide the retail price

and

.

3.1. In the Case of Non-Encroachment

When O does not encroach, S’s profit is , and O’s profit is . S decides the retail price to maximize profit, and the equilibrium result is as described in Lemma 1.

Lemma 1. In the case of non-encroachment, S’s optimal retail price is , the market demand is , and the profit is . The profit of O is .

Proposition 1. In the case of non-encroachment, the independent seller is positioned in the high-end product market.

The result of Proposition 1 is intuitive. First, the higher the quality of the product, the higher the price consumers are willing to pay for it. Second, the high-quality product’s valuation advantage helps to make up for the utility loss caused by the product’s failure to meet the horizontal preferences of consumers, and there is a wider range of consumers to buy the product. As a result, the monopolistic independent seller chooses to sell high-quality products.

3.2. In the Case of Encroachment

When O encroaches, S’s profit is

, where

c represents the horizontal differentiation cost per unit [

46]. O’s profit is

. S first sets the horizontal differentiation from

Oj, then determines the retail price, and finally, O determines the retail price. According to backward induction, the equilibrium result is obtained as described in Lemma 2.

Lemma 2. In the case of platform encroachment, if the consumer’s valuation (product quality) is high enough to satisfy , then S and O compete for consumers in the competitive range.

Equilibrium decisions are , , and . The market demand of S and O are and . The profits of S and O are and .

Proposition 2. (1) when , and when ; is not related to ; . (2) ; is not related to ; . (3) ; ; . (4) .

Proposition 2 (1) shows that when δ is small, the horizontal differentiation between products is negatively correlated with ; when δ is large, the horizontal differentiation between products is positively correlated with . This is because, for lower quality products, S increases market demand by expanding horizontal differentiation between products, thereby increasing revenue. For higher quality products, S does not need to invest more in product differentiation costs. However, when δ is larger, the valuation advantage of Oj is significant, and because , the greater the δ, the greater the encroachment threat caused by the increase in product quality. To mitigate the threat of encroachment, S needs to broaden the differentiation from Oj. Moreover, unlike Proposition 1, Proposition 2 (1) shows that under platform encroachment, the retail price and market demand of Sj are independent of product quality. This is because S can regulate competition by endogenizing the degree of horizontal differentiation between its product and O’s product. Proposition 2 (2) further indicates that the greater the δ, the higher O’s pricing, and S will expand the horizontal differentiation from Oj to alleviate competition and ensure that the retail price and market demand remain unchanged.

Propositions 2 (3) and (4) show that the pricing of S and O and the degree of horizontal differentiation between their products are positively correlated with c and r. This is because the higher the cost coefficient of horizontal differentiation and the higher the commission rate, the more S will be forced to increase pricing. O then gets a free ride, and its retail price rises. In addition, due to the increase in the retail price, S will expand its horizontal differentiation from Oj to avoid excessive decline in market demand. Therefore, is positively correlated with c and r.

Proposition 3. In the case of platform encroachment, when , the independent seller is positioned in the high-end product market, and when , the independent seller is positioned in the low-end product market.

Proposition 3 shows that when δ is small, S chooses to sell category H; when δ is large, the excessive encroachment of O forces S to enter the low-end market to sell category L. Similar to Proposition 2 (1), if δ is small, the positive influence of on S will outweigh the negative influence, and S is positioned in the high-end product market. Conversely, if δ is large, the negative impact of on S is larger than the positive impact, and S is positioned in the low-end product market.

Proposition 4. (1) when , and when . (2) . (3) .

Proposition 4 shows that platform encroachment leads to reduced market demand and a lower retail price of Sj (when c is relatively small), thereby damaging S’s profit. Although the retail price of Sj under platform encroachment is higher when c is larger, its essence is the forced pricing increase caused by the increase in differentiation cost. The decrease in demand and the higher product differentiation cost ultimately reduce S’s profit.

3.3. O’s Encroachment Strategy

In this section, we examine the platform owner’s encroachment strategy, i.e., strategy N or strategy E. By comparing the profits of O under strategy N and strategy E, we obtain the conditions under which O adopts different encroachment strategies, as stated in Proposition 5.

Proposition 5. When ; and ; or , , and , the platform owner adopts strategy E; when , , and , the platform owner adopts strategy N.

Where is the root for the equation , .

Proposition 5 shows that when

δ is large, or

δ and

r are small, or

δ is small and

r and

c are large, O will encroach on S’s category; when

δ is small,

r is large, and

c is small, O does not encroach. This is because when

δ is large, O can earn higher profits by selling self-owned products. The lower the

r, the lower O’s shared profit from S. Therefore, O is willing to introduce self-owned products to the market. In addition, when

c is large, S will expand

, which encourages O’s category encroachment.

Figure 4 summarizes our findings.

In addition, Proposition 5 further shows that platform encroachment is related to category quality. When δ is small (i.e., ) and r is large (i.e., ), if , O will not encroach on any category of S; if , S’s positioning in the high-end market can prevent platform encroachment; if , O will encroach regardless of the vertical positioning strategy adopted by S. We obtain the following Proposition 6.

Where .

Proposition 6. The platform owner is more likely to encroach on the low-quality category of the independent seller.

As stated in Proposition 2 above, when δ is small, the degree of horizontal differentiation between two sellers’ products is inversely proportional to quality. The lower the , the greater the , and the more likely O is to encroach.

3.4. Equilibrium Strategy Analysis

As stated in Proposition 1 and Proposition 3 above, S’s positioning strategy is different in competitive and non-competitive environments, and, as stated in Proposition 6 above, O’s encroachment strategy is also different under a different vertical positioning of S. Therefore, in this section, we construct the game matrix as shown in

Table 2 and obtain the game equilibrium strategy and equilibrium conditions of S’s vertical positioning and O’s encroachment according to the profits of both parties under four different strategy combinations.

Proposition 7. The equilibrium strategy is the following: (1) When , , and or , the equilibrium strategy is {P,N}. (2) When , , and ; when and ; or when , the equilibrium strategy is {P,E}. (3) When , the equilibrium strategy is {T,E}.

Proposition 7 shows that when δ is small and r is large, O has little incentive to encroach. If α is large (i.e., ), the positioning of S in the high-end market can prevent O’s category encroachment. Even if the platform encroachment cannot be prevented (), S can still make a higher profit selling category H than selling category L. However, when r is small, O is willing to introduce self-owned products into the market even if the competitive advantage is not significant. Similarly, category H is the optimal vertical positioning strategy for S. In addition, when δ is large, O will inevitably encroach on the category of S to maximize the benefit. If δ is in the middle and the market competition is not fierce, category H can still bring more profits to S; if δ is too large, more consumers will buy high-quality products from O rather than S. Therefore, to ease competition and avoid more horizontal differentiation costs, S will be positioned in the low-end market.

3.5. Consumer Surplus and Social Welfare

In this section, we discuss the impact of the independent seller positioning strategy and platform encroachment strategies on consumer surplus and social welfare.

In the case of non-encroachment, the consumer surplus and social welfare are, respectively:

In the case of encroachment, the consumer surplus and social welfare are, respectively:

where

,

,

,

,

, and

.

Proposition 8. (1) , , , . (2) , .

Proposition 8 shows that high-quality products always enable consumers to obtain a higher surplus, and social welfare is always higher. Although both O and consumers prefer S to adopt a high-end market positioning strategy, S is only willing to sell high-quality products if δ is small. Proposition 8 shows that the increase in O’s profit and consumer surplus under the high-quality category positioning strategy can compensate for the decline in S’s profit. In addition, Proposition 8 shows that consumers are inclined to platform encroachment, and social welfare can always be improved under O’s strategy E. Although O’s profit is low under strategy E when δ is small (i.e., ), r is high (i.e., ), and c is low (i.e., ), the increase in consumer surplus under strategy E makes up for the decrease in the profit of S and O. Therefore, the overall social welfare is higher under platform encroachment.

5. Three Extensions

5.1. Positive Production Cost

In the main model, for the simplicity of analysis, we assume that sellers’ vertical production costs are normalized to zero. Therefore, we extend the model to explore whether positive vertical production costs affect the equilibrium outcome. Specifically, we define k as the cost per unit of product quality and as the vertical production cost, that is, the higher the quality of the product, the higher the vertical production cost.

In the case of non-encroachment, the profit functions of S and O are

and

. In the case of encroachment, the profit functions of S and O are

and

.

Table 3 shows the equilibrium results obtained by backward induction.

Proposition 9. (1) In the case of non-encroachment, the independent seller is positioned in the high-end product market. (2) In the case of platform encroachment, when or when and , the independent seller locates in the low-end product market; when and , the independent seller locates in the high-end product market.

Where and .

Consistent with the results of the main model, S chooses to sell products in a high-quality category in the absence of platform encroachment. Proposition 9 shows that in the case of platform encroachment, the vertical production cost has an impact on the vertical positioning strategy of S. When k is large, S will not target the high-quality category. When k is small, like the results of the main model, and if δ is large, S will target the low-quality category; otherwise, the high-quality category will be targeted. In addition, because , the positive vertical production cost makes it more likely that S will target the low-end market under platform encroachment.

Proposition 10. When ; and ; , , and ; or , , , and , the platform owner adopts strategy E; when , , , and , the platform owner adopts strategy N.

Where , , , and .

Proposition 10 shows that the influence of δ, r, and c on O’s encroachment decision is the same as that of the main model. In addition, Proposition 10 shows that when δ is small, r is large and c is small; if k is large, then O is willing to encroach the category; otherwise, O does not encroach. This is because a larger k allows S to set a higher retail price and horizontal product differentiation, and O gains more benefits by free riding through encroachment than by larger production costs.

5.2. Pricing Decision Order

Next, we assume that when O encroaches, S and O simultaneously determine the retail price of the product. Other settings remain unchanged. S first conducts vertical positioning, observes whether O encroaches, and then conducts horizontal positioning. Finally, S and O simultaneously determine the retail price of their respective products. Through backward induction, the equilibrium results under platform encroachment are obtained, as

Table 4 shows.

We find that the optimal vertical positioning strategy of S in the case of simultaneous pricing is consistent with Proposition 3.

Proposition 11. When ; and ; or , , and , the platform owner adopts strategy E; when , , and , the platform owner adopts strategy N.

Where is the root for the equation , .

Relative to Proposition 5 of our main model, we find that the encroachment strategy of O is essentially similar. In addition, Proposition 11 shows that in the simultaneous pricing scenario, O will choose to encroach only if there is a larger δ or a smaller r. This is because S loses the advantage of early pricing, leading to lower pricing and expanding the horizontal differentiation from Oj. Therefore, platform encroachment has a greater negative impact on S’s profit. To avoid an excessive decline in shared profits, platform encroachment motivation is weakened.

5.3. O’s Consumer Surplus Concern

More and more e-commerce platforms are not only pursuing their own profits but also pursuing the interests of consumers. Therefore, in this section, we consider the impact of O’s consumer surplus concern on S’s positioning strategy and O’s encroachment strategy.

In the case of non-encroachment, the profit functions of S and O are

and

. In the case of encroachment, the profit functions of S and O are

and

, where

μ (

μ > 0) represents the degree of O’s consumer surplus concern.

Table 5 shows the equilibrium results obtained by backward induction.

Proposition 12. When , or when and , the independent seller is positioned in the high-quality product market; when and , the independent seller is positioned in the low-quality product market.

By comparison with the results in the main model, we can confirm that the product positioning strategy structure of S is essentially similar when O pays less attention to consumer surplus. In addition, Proposition 12 shows that when O pays more attention to consumer surplus, S is positioned in the high-quality product market. This is because competition and conflict caused by larger consumer surplus concerns are dominant, and the higher quality product can reduce O’s sacrifice behavior to a certain extent, which is also beneficial to S.

We find that the equilibrium result obtained by backward induction is rather complex. Therefore, we numerically discuss the influence of consumer surplus concern on O’s encroachment strategy.

Figure 11 shows the equilibrium results when

μ = 0,

μ = 1, and

μ = 4.

We note that because platform encroachment is beneficial to consumer surplus, O is very willing to encroach when it starts to pay attention to consumer surplus. However, as O pays more attention to consumer surplus, O sacrifices more, resulting in excessive competition with S and hindering profits. Therefore, O does not encroach. In short, O’s proper attention to consumer surplus incentivizes encroachment, thereby enhancing social welfare.

6. Conclusions

Focusing on the vertical and horizontal positioning of S’s product under platform category encroachment, we build a Stackelberg game model under the framework of the Hotelling model to explore the interaction between O’s encroachment strategy and S’s product positioning strategy. We combine this with the multi-agent method to further analyze the influence of consumer preference heterogeneity on equilibrium decision making. In addition, we extend our model to consider the positive production cost, the simultaneous price game, and the platform owner’s focus on consumer surplus.

The research findings are as follows: (1) O’s category encroachment will encroach on the sales of S. Therefore, S will regulate competition through endogenous horizontal differentiation from O’s product. In particular, the greater the consumer preference for platform self-owned products, the greater the horizontal differentiation between the two products. However, when the horizontal differentiation between the two products is expanded, the horizontal differentiation cost is higher, determining, to some extent, the vertical positioning of S. When O’s encroachment effect is weak, S can often obtain higher profits by positioning in the high-end product market and even prevent platform encroachment. However, when O’s encroachment effect is strong, the positioning of S in the low-end product market can effectively alleviate competition. (2) O will decide whether to encroach by weighing self-operating income and shared income. When the consumer preference for platform self-owned products is large and the commission rate is small, O is more willing to profit from the self-operated products. In addition, the higher the unit cost of horizontal differentiation, the higher the pricing of S, which encourages O’s free riding and enhances the encroachment motivation. (3) Our simulation experiments show that when consumers’ ideal preferences are concentrated, S vertically locates in the low-end product market and horizontally locates close to the consumers’ ideal preference concentration area to obtain more market demand. Conversely, S locates in the high-end product market and adopts the strategy of expanding the horizontal differentiation of products. However, simultaneously, limited by the cost of horizontal differentiation, S will narrow the horizontal differentiation of products when consumers’ ideal preferences are relatively dispersed. Similarly, when the ideal preferences of consumers are concentrated, O is more likely to encroach on the low-end product market, and when the ideal preferences of consumers are dispersed, O’s encroachment does not increase its revenue. (4) Positive production costs have a negative impact on O’s encroachment and S’s high-end market positioning. The price decision order does not affect S’s vertical positioning strategy, but compared with the sequential order, the simultaneous pricing increases the horizontal differentiation between S’s product and O’s product. This is not conducive to S’s profit and hinders the platform encroachment to a certain extent. (5) Platform encroachment and high-end product positioning are good for consumer surplus and social welfare. O’s appropriate attention to consumer surplus encourages encroachment, while excessive attention to consumer surplus hinders encroachment but encourages S to locate in the high-end product market.

We obtain some management insights. It is critical for independent sellers to identify the heterogeneity of consumer preferences and understand platform encroachment. When consumers have a high preference for platform self-operation, independent sellers can choose to locate in the low-end product market to survive. Independent sellers can also improve consumer preferences by providing services that accompany products, as well as further improving product quality, reducing unit production cost, and raising barriers to imitation by improving production technology, thereby increasing revenue and preventing platform encroachment. In addition, when consumers’ ideal preferences are concentrated, independent sellers should adopt a high-demand strategy (positioning in the low-end product market with less competition), and when consumers’ ideal preferences are dispersed, independent sellers should adopt a high-margin profit strategy (positioning in the high-end product market with higher valuation advantages). From the perspective of platform owners, first, improving self-preference will certainly bring more self-operating profits, but excessive self-preference will lead to independent sellers positioning in the low-end product market, thus damaging supply chain profits; second, platform owners can encourage independent sellers to expand their horizontal differentiation between products by moderately increasing the commission rate, thereby alleviating competition and increasing revenue. In addition, platform owners can use their own information advantages to find and enter the product market where consumers’ ideal preferences are concentrated and quality competition is not fierce. Finally, platform owners should allow independent sellers to set prices first, considering both profit and consumer surplus, while keeping consumer surplus concerns within reasonable limits. Considering that the positioning of high-end product markets and platform encroachment have a positive impact on consumer surplus and social welfare, the government can take appropriate measures to guide platform owners to weaken their self-preference (for example, platform owners can narrow the gap between consumers’ preference for self-owned products and independent sellers’ products by helping independent sellers with marketing promotions) and reduce the commission rate.

Future research could take the following approaches: First, this paper focuses on the heterogeneity of consumers’ ideal preferences and channel preferences. However, the heterogeneity of consumer preferences is diverse, as is the heterogeneity of consumers’ product quality preferences. Future studies could complicate the model setting of consumer heterogeneity and compare the impact of horizontal and vertical preferences on consumer choice. Second, this paper assumes that platform owners collect deductible income from independent sellers, while some composite e-commerce platforms implement two-part fees. Moreover, this paper only considers the short-term behavior of platform owners, whereby the commission rate is an exogenous variable. In the future, we can compare the different charging modes of the platform and consider the long-term behavior of the platform owner with an endogenous commission rate and fixed membership fee and further study the coordination mechanism with independent sellers. Finally, this paper does not consider the encroachment cost of platform owners. In reality, because independent sellers may have more resource advantages for the products they sell, the fixed cost is usually silent, while platform owners need to pay a positive fixed cost to enter the product market, which is also a potential future research direction.