Abstract

Pricing decisions for construction and demolition waste recycling are severely hampered by consumer uncertainty in assessing the value of recycled building materials. This paper uses a construction and demolition waste (CDW) recycling utilization model that consists of a building materials manufacturer and a building materials remanufacturer and compares both the prices and the profits under different carbon tax scenarios, i.e., consumer risk-averse and risk-neutral scenarios. The main conclusions are as follows. (1) The optimal price of traditional products is always negatively correlated with consumer risk aversion. Unlike traditional products, the optimal price of recycled building materials is negatively related to the degree of consumer risk aversion in the case of a low carbon tax; the opposite conclusion is obtained in the case of a high carbon tax. (2) When the abatement cost coefficient is below the threshold and the carbon tax is low, the profits of the building materials manufacturer and remanufacturer show a U-shaped trend with consumer risk aversion; in the case of a high carbon tax, the profits of the two enterprises are positively correlated with consumer risk aversion. In addition, when the abatement cost coefficient is above the threshold, there is an interval in which the profits of the building materials manufacturer are positively correlated with consumer risk aversion in the case in which the carbon tax satisfies this interval. In all the other cases, there is a U-shaped trend in profits and consumer risk aversion levels for both the building materials manufacturer and the remanufacturer.

1. Introduction

For the past few years, the global greenhouse effect has become more prominent. Annual carbon emissions from the construction industry have remained high [1,2]. In the UK, the construction industry accounts for more than half of total carbon emissions [3]. This seriously threatens the climate and the environment. The construction process generates enormous amounts of construction and demolition waste (CDW) [4,5]. This damage has drawn the attention of the government and scholars [6,7]. To reduce environmental damage, economists have called for carbon tax policies. These policies seek to restrict carbon emissions from product manufacturing [8,9]. Studies have shown that these methods can help to reduce carbon emissions [10,11]. Some European countries have been implementing carbon tax policies for several years. For example, Sweden implemented a carbon tax 30 years ago. Carbon emissions have been reduced by 35% [12]. Australia and Japan passed carbon tax legislation in 2011 and 2012, respectively [13,14]. In 2019, a carbon tax policy was announced in Canada [15]. Although the implementation of a carbon tax policy has increased the pressure on companies, it has in effect forced them to turn to remanufacturing firms; for example, the Linyi Lantai Environmental Protection Technology Co., located in southeastern Shandong, China [16]. Studies have shown that remanufacturing not only helps to reduce the production costs of enterprises but also significantly reduces carbon emissions per unit of product [17,18,19].

Existing supply chain research on carbon taxes focuses mainly on exploring how carbon taxes affect firms’ decisions by considering carbon taxes as an exogenous variable. There is early literature on how to formulate carbon tax policies to cater to a win–win situation of the synergistic development of the economy and the environment [20]. In fact, carbon tax policies not only help to highlight the great advantages of remanufacturing but also significantly affect the ability of enterprises to reduce production emissions [19,21]. As mentioned earlier, a carbon tax increases the burden on enterprises to a certain extent. At this point, if horizontal competition is included in the gaming system, firms with a weaker price advantage tend to reduce their investment in carbon emissions reduction, thus compensating for the disadvantage [22]. Unlike in the above literature, in the context of a carbon tax for supply chains in the transportation industry, the government can only set a reasonable carbon tax price to maximize social welfare by considering the relationship between the social cost of carbon, the threshold for modal shifts in transportation, and the maximum carbon tax that enterprises can afford [23]. Most scholars focus on the undifferentiated carbon tax, and some studies have creatively proposed the incremental carbon tax and proven that it is conducive to significantly reducing the economic burdens of enterprises and carbon emissions [24]. With environmental awareness on the rise, researchers have combined consumer awareness and carbon tax policy and found that they significantly influence manufacturers’ emissions reduction behaviors [25,26]. Interestingly, some scholars have included the government in the main body of the Stackelberg game to explore the optimal equilibrium strategy between the government and enterprises, with the carbon tax price set as an endogenous variable. Several scholars have used the Stackelberg game model to discuss government carbon tax policies and enterprise production decisions under both centralized and decentralized models. The study showed that the carbon tax under the decentralized decision-making mode is greater than that under the centralized decision-making mode, which leads to an increase in the sales price of products [27]. Under different contractual models, the carbon tax is highest under a revenue-sharing contract [28]. The above literature investigates how carbon taxes impact enterprise production decisions or how governments can formulate optimal carbon tax policies under different market scenarios. However, as a tool for market adjustment, scholars have overlooked the fact that a carbon tax can effectively regulate the negative impacts of other factors on the market economy. In fact, there is considerable resistance to promoting the full implementation of carbon tax policy due to practical issues such as the fairness of the carbon tax price [29,30]. Therefore, this paper sets the carbon tax as a background variable to reveal how consumer risk aversion influences CDW recycling utilization under different carbon tax scenarios to prove that the carbon tax policy benefits CDW recycling utilization and provide support for the continued implementation of the carbon tax policy.

In addition, the stakeholders are assumed to be risk neutral in the above literature. Considering the disruption and uncertainty factors that risk aversion behaviors bring to supply chains, risk management has attracted the attention of scholars. The first research stream on risk management investigated how the risk-averse behaviors of enterprises influences the operational decisions of supply chains. Researchers have found that the risk-averse behavior of members benefits other members and improves supply chain performance, contrasting with the common perception that the supply chain is influenced negatively by the risk-averse behavior of enterprises [31]. More importantly, the negative effects of risk-averse behavior can be offset by the strength of relationships between enterprises [32]. Specifically, regarding the impact on pricing decisions, risk-averse upstream and downstream enterprises tend to influence pricing decisions in opposite directions [33]. Some scholars have extended the study of risk management to the classical inventory problem. In general, the greater the level of risk aversion, the greater the number of orders. When considering return strategies in inventory problems, the risk-averse behavior of downstream enterprises has a significant positive effect on the return price per unit of product [34,35]. Interestingly, several studies have introduced risk aversion into green supply chains to analyze its impact on green development and found that risk aversion is detrimental to the greening process of supply chains [36]. However, in the case of government subsidies, risk aversion positively affects green investments [37]. The second stream of research on risk management focuses on how consumers’ risk-averse behavior influences enterprise performance. Although consumers’ risk-averse behavior is detrimental to their own interests, it contributes to the overall benefits of the supply chain [38,39]. To minimize losses from consumer risk aversion and demand uncertainty, retailers tend to adopt a pre-sale strategy when consumers have different levels of risk aversion [40]. Interestingly, with the growth of e-commerce and blockchain, some studies have creatively revealed that consumers’ risk-averse behaviors severely hinder blockchain adoption [41]. Most of the above literature explores how firms’ risk-averse behavior impacts supply chains. However, there is still a dearth of literature on how consumer risk aversion impacts supply chains; in particular, no study has focused on how consumer risk aversion influences CDW recycling utilization by using the Stackelberg game.

Consumption value theory suggests that five consumption values influence a consumer’s choice of products, namely functional, conditional, emotional, social, and cognitive values [42]. Consumption value theory has been applied to various fields, e.g., marketing, tourism, and management [43]. By reviewing the relevant literature, this paper finds that green consumption has been a hot research topic regarding consumers’ behaviors, and a large amount of the literature has focused on investigating how consumption value influences consumers’ green consumption behaviors. Research has shown that a lack of functional value can seriously weaken consumers’ green purchasing behavior [44]. However, in the process of exploring the conditions of young Chinese people’s green purchase intentions, researchers have found that young Chinese people’s green purchase intentions are not significantly correlated with functional value but are positively correlated with emotional value and social value [45]. In addition, some studies have shown that perceived value and conditional value are detrimental to consumers’ green purchasing behavior and consumers’ choices are related to green perceived value [46,47]. Many scholars have discovered the moderating role of consumer value, which promotes the research of consumer value theory. Considering the impact of the visibility of food delivery apps on consumers’ purchasing behaviors, researchers have concluded that consumer value can moderate the impact of visibility on consumers’ behavior [48]. In addition, as one of the five main elements of consumer value theory, emotional value can significantly modulate the impact of the other components on consumer behavior [46]. Unfortunately, there is still a gap in the study of consumer value theory in the field of remanufacturing markets. In fact, because remanufacturing is still in its infancy, the quality of remanufactured products is doubted by consumers [49]. In consumption value theory, the meaning of functional value is the perceived utility obtained by consumers and encompasses the product’s quality [43,46]. As a result, there is uncertainty in consumers’ assessments of the functional value of reproductions. Therefore, consumers tend to develop risk-averse behaviors, causing the demand for remanufactured products to decrease, which, in turn, affects remanufacturing operations management.

In summary, to fill the research gap shown in Table 1, this paper considers the uncertainty of consumers’ assessments of the value of recycled building materials by using a carbon tax policy as a research context and aims to construct a supply chain model consisting of a building materials remanufacturer and a building materials manufacturer to discuss how consumers’ risk avoidance behavior impacts the CDW recycling utilization supply chain. This paper answers the following two questions:

Table 1.

Comparison of relevant studies.

- (1)

- How does consumers’ risk-averse behavior affect the pricing and profitability of traditional products and recycled building materials compared to a consumer risk-neutral scenario?

- (2)

- How can carbon tax policies mitigate the negative effects of consumer risk-averse behavior on CDW resourcing operations?

The innovations of this paper are as follows. (1) This paper extends previous research on carbon tax policy by incorporating both carbon tax policy and consumer risk aversion into a CDW recycling utilization supply chain consisting of a building materials manufacturer and a building materials remanufacturer and considers the impact of consumer risk aversion on the CDW recycling utilization supply chain under different carbon tax scenarios. (2) While the literature has recognized the impact of corporate risk aversion on supply chain performance, it has neglected to study the impact of consumer risk aversion on the pricing and performance of the CDW recycling utilization supply chain. Unlike previous studies, this paper introduces the consumer risk aversion coefficient based on the uncertainty of consumers’ assessments of the value of recycled building materials and the Stackelberg game, compares the optimal solutions of pricing and profit under the two scenarios of consumer risk aversion and risk neutrality, and, thus, analyses the impact of consumer risk aversion behaviors on the operation of CDW recycling utilization. (3) Most studies related to supply chain management have explored only the moderating effect of government subsidies on supply chains and have not yet considered the moderating effect of government carbon tax policy. Accordingly, for the first time, we propose regulating the negative effects of consumer risk-averse behavior on CDW recycling utilization through a carbon tax policy. (4) Existing research on consumption value theory addresses consumers’ behaviors primarily through survey methods and statistical analysis [43] and has not yet focused on supply chain members’ behavioral economics perspectives. Therefore, we introduce the consumer risk aversion coefficient, develop a model using consumption value theory, and reveal how consumer risk aversion behavior influences the CDW recycling operation through consumption value theory.

2. Description of the Problem and Related Assumptions

2.1. Description of the Problem

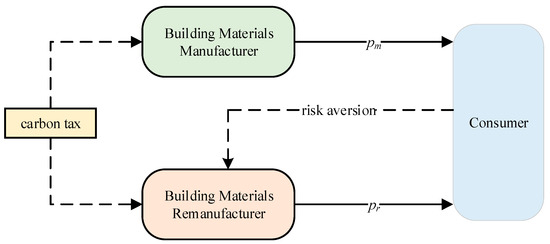

Referencing the relevant literature [50], a Stackelberg game model consisting of a building materials manufacturer, a building materials remanufacturer, and consumers was constructed, which is shown in Figure 1. Among them, as the leader of the supply chain system, a building materials manufacturer, such as the French cement materials supplier LafargeHolcim Group [51], use traditional materials to produce traditional products. The market price per unit of traditional products was , and the carbon emissions were . Moreover, as the follower in the supply chain system, a building material remanufacturer, such as Linyi Lantai Environmental Protection Technology Co., located in southeastern Shandong, China [16], uses CDW to produce recycled building materials. The market price per unit of recycled building materials was , and the carbon emissions were and [52]. The carbon tax policy set by the government was introduced to regulate the carbon emissions and the tax per unit of carbon emissions at . In this situation, the building materials manufacturer and building materials remanufacturer would adopt green innovation behaviors to reduce carbon emissions [53,54], with emission reduction efforts noted as and , respectively. Based on consumption value theory, consumers exhibited risk-neutral or risk-averse characteristics and purchased traditional products or recycled building materials based on their utility maximization.

Figure 1.

Game model.

The relevant parameters are displayed in Table 2.

Table 2.

Relevant parameters.

2.2. Assumptions

Assumption 1:

The abatement costs for the building materials manufacturer and building materials remanufacturer are related to the abatement cost coefficient and the abatement effort (), that is, [57].

Assumption 2:

This paper uses the mean-variance approach to measure consumer risk aversion [56]. Therefore, the consumer’s deterministic equivalent of utility is defined as follows:

Assumption 3:

This paper assumes that the model parameters are publicly available information; therefore, there is perfect symmetry between the information of the remanufacturer of the building materials and the manufacturer of the building materials [58].

Assumption 4:

Parameter is the coefficient of the consumer discount on the value of recycled building materials, and [19].

Assumption 5:

To simplify the calculations and refer to the relevant literature, this paper does not consider costs of remanufacturing and manufacturing [59].

3. Modeling and Solving

In this section, two separate models were constructed for considering whether consumers are risk averse. The building materials manufacturer first set the selling price of their traditional products and their own emission reduction efforts . On this basis, the building materials remanufacturer set the selling price of the recycled building materials and their own emission reduction efforts .

3.1. Consumer Risk Neutrality (NR)

Based on the relevant literature [55], the consumer’s deterministic equivalent of utility for traditional products was defined as follows:

The deterministic equivalent of consumer utility for recycled building materials was defined as follows:

Since , and are concave functions with respect to and , respectively. Let and solve for the following equation:

The building materials manufacturer’s profit function was defined as follows:

The building materials remanufacturer’s profit function was defined as follows:

We substituted Equations (3) and (4) into Equations (5) and (6). At this point, the Hessian matrix of with respect to and was defined as follows:

Then, . When , i.e., , was negatively determined, and was a joint concave function with respect to and ; thus, a unique set of optimal solutions existed. Moreover, the Hessian matrix of with respect to and was defined as follows:

Then, . When , i.e., , was negatively determined, and was a joint concave function with respect to and . In summary, a unique set of optimal solutions existed only when .

The solution was obtained by applying inverse induction as follows:

Substituting Equations (7)–(12) into Equations (5) and (6) yields the following equations:

3.2. Consumer Risk Aversion (TR)

The consumer’s deterministic equivalent of utility for traditional products was defined as follows:

The deterministic equivalent of consumer utility for recycled building materials was defined as follows:

Since , and were concave functions with respect to and , respectively. Let and solve for the following equation:

The building materials manufacturer’s profit function was defined as follows:

The building materials remanufacturer’s profit function was defined as follows:

Substitute Equations (17) and (18) into Equations (19) and (20). It is empirically calculated that a unique set of optimal solutions exits only when . The procedure used for analysis was the same as above.

The solution is obtained by applying inverse induction:

Substituting Equations (21)–(26) into Equations (19) and (20) yields the following equations:

4. Model Analysis

Proposition 1.

The relationship between the sales price of the building materials and the carbon tax is shown below.

- (1)

- If , then .

- (2)

- If , ; if , .

Proposition 1 shows that traditional products are more expensive when consumers are risk neutral. For recycled building materials, under the condition of a low carbon tax, the price of recycled building materials is greater when consumers are risk neutral. In the case of a high carbon tax, the opposite conclusion holds.

Proposition 2.

The relationship between and under the different carbon tax scenarios is shown below.

- (1)

- When , if , under the conditional of , then , under the condition of , for ; if , .

- (2)

- When , if , under the condition of , then , under the condition of , for ; if , then .

- (3)

- When , if , under the condition of , , under the condition of , for ; if , then .

Proposition 2 suggests that when the abatement cost coefficient is small, in the case of a low carbon tax, the building materials manufacturer is more profitable when consumers are risk averse only when their risk aversion exceeds the threshold. Otherwise, we obtain the opposite conclusion. Under the condition of a high carbon tax, the building materials manufacturer is more profitable when consumers are risk averse. When the abatement cost coefficient is large, there is an interval, and the building materials manufacturer is only always more profitable when consumers are risk averse when the carbon tax is set within the interval.

Proposition 3.

The relationship between and under the different carbon tax scenarios is shown below.

- (1)

- When , if , under the condition of , , under the condition of , for ; if , .

- (2)

- When , if , under the condition of , then ; under the condition of ,

Proposition 3 suggests that when the abatement cost coefficient is below a certain threshold, if the carbon tax is low, the remanufacturer of building materials is more profitable when the consumer is risk neutral, conditional on a low level of consumer risk aversion. Otherwise, the opposite conclusion is obtained. Under the condition of a high carbon tax, the remanufacturer of building materials is more profitable when consumers are risk averse. When the abatement cost coefficient is above the threshold, the profit of the remanufacturer of building materials is affected only by consumers’ risk aversion behavior.

Proposition 4.

The sales prices of the building materials and consumer risk aversion levels under the different carbon tax scenarios are shown below.

- (1)

- If , is negatively correlated with .

- (2)

- If , is negatively correlated with ; if , is positively correlated with .

From Proposition 4, we can see that the prices of traditional products are always negatively correlated with consumer risk aversion. For recycled building materials, under the condition of a low carbon tax, the prices of recycled building materials are negatively correlated with consumer risk aversion. The opposite conclusion is obtained in the case of a high carbon tax.

Proposition 5.

The relationship between and under the different carbon tax scenarios is shown below.

- (1)

- When , if , has a U-shaped trend about ; if , is positively correlated with .

- (2)

- When , if , has a U-shaped trend about ; if , is positively correlated with .

- (3)

- When , if , has a U-shaped trend about ; if , is positively correlated with .

Proposition 5 suggests that when the abatement cost coefficient is below the threshold, the manufacturer’s profit is only positively correlated with the degree of consumer risk aversion when the carbon tax is high. When the abatement cost coefficient is above the threshold, we only obtain the same conclusion if the carbon tax is moderate. In all the other cases, manufacturers’ profits show a U-shaped trend with respect to the degree of consumer risk aversion.

Proposition 6.

The relationship between and under different carbon tax scenarios is shown below.

- (1)

- When , if , has a U-shaped trend about ; if , is positively correlated with .

- (2)

- When , if , has a U-shaped trend about .

Proposition 6 suggests that when the abatement cost coefficient is below a certain threshold, the profits of the remanufacturer follow a U-shaped trend in terms of consumer risk aversion under the condition of a low-carbon tax. However, in the case of a high carbon tax, the profits of the remanufacturer of building materials increase with increasing consumer risk aversion. When the abatement cost coefficient is above the threshold, the building materials remanufacturer’s profits are influenced only by the risk-averse behaviors of consumers.

5. Numerical Simulation

This paper explores how consumers’ level of risk aversion influences the prices (, ) and profits (, ) of traditional products and recycled building materials. In addition, we verify the propositions in the analysis section of the model through numerical simulation. To correspond to the different carbon tax scenarios set out in the conclusion of the propositions, after discussion among the experts, we assume that h = 0.4, 1, and 5 represent the three scenarios of relatively low, relatively moderate, and relatively high carbon taxes, respectively. We also determined that [60], [61], [61], [55], [62], [63], and [60].

5.1. Impacts on the Prices of Traditional Products and Recycled Building Materials

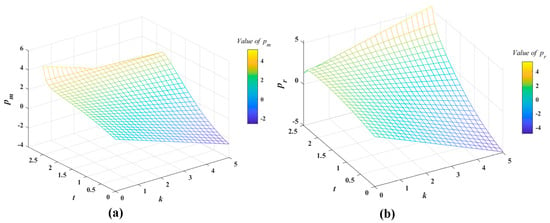

Figure 2 shows how consumer risk aversion influences the sales prices of traditional products and recycled building materials.

Figure 2.

Impacts on sales prices of traditional products and recycled building materials. Of these, (a) shows the impact on traditional products and (b) shows the impact on recycled building materials.

Figure 2 shows that for traditional products, the price gradually decreases as consumers become more risk averse. For recycled building materials, in the case of a low carbon tax, the price of recycled building materials is negatively correlated with consumer risk aversion. Under the condition of a high carbon tax, the price of recycled building materials is positively correlated with consumer risk aversion. Consumption value theory suggests that functional value is the main determinant of consumers’ buying behaviors compared to other consumer values [44]. Therefore, consumer skepticism regarding the quality of recycled building materials leads to a reduction in the functional value of recycled building materials, which, in turn, reduces consumer demand for recycled building materials. At this point, construction material remanufacturers can only resort to price reduction strategies to increase sales. However, under the condition of a high carbon tax, building material remanufacturers will, in turn, increase the sales prices of recycled building materials to pass the costs on to consumers.

These results are slightly different from the conclusions of Zou et al. [64]. They believe that firms will reduce their selling prices to maintain product sales as risk aversion increases. However, this paper argues that under the condition of a high carbon tax, the sales price of recycled building materials increases with increasing risk aversion. The difference between the two is because this paper examines how consumer risk aversion behavior influences the remanufacturing supply chain, while Zou et al. discuss how manufacturers’ risk aversion behavior impacts the supply chain.

5.2. Impacts on the Profitability of Building Materials Manufacturers

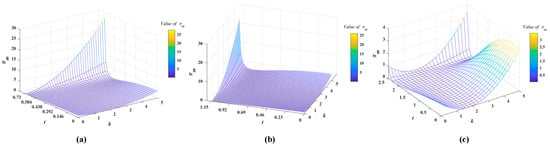

As mentioned earlier, according to the results of the Hesser matrix, the model is optimal only if the abatement cost coefficient and the carbon tax price satisfy a certain relationship, i.e., , and there is a unique optimal solution to the model. To verify Proposition 5, we strictly take three values for and restrict the range of . Figure 3 shows how consumer risk aversion influences the profits of building materials manufacturers.

Figure 3.

Impacts on the profits of construction material manufacturers. (a) h = 0.4; (b) h = 1; (c) h = 5.

Figure 3a shows that when the abatement cost coefficient is below the threshold, under the condition of a low carbon tax, the profits of building materials manufacturers show a U-shaped trend with respect to consumer risk aversion. However, this change was not significant. At this point, if the carbon tax is high, consumer risk-averse behavior leads to progressively higher profits for the building material manufacturer. This finding suggests that for the government, when the abatement cost coefficient is small, raising the carbon tax is a good measure for increasing the profits of the building material manufacturer.

Figure 3b,c show that under the condition in which the abatement cost coefficient is above the threshold, consumers’ risk-averse behaviors always favor the profits of the building materials manufacturer when the carbon tax is designed to be within a certain interval. In all the other cases, as consumer risk aversion increases, the profits of building materials manufacturers follow a U-shaped trend with respect to consumer risk aversion. Therefore, the government should formulate a moderate carbon tax policy to prevent consumers’ risk-averse behaviors from affecting the incomes of building materials manufacturers and, thus, incentivize them to reduce emissions. Additionally, building materials manufacturers should focus more on consumer risk attitudes to make the right decisions to mitigate risks in a timely manner.

The above findings differ slightly from those of Huang et al. [65]. Huang et al. argue that manufacturers’ profits increase with increasing consumer risk aversion. This is because the study by Huang et al. does not consider how the carbon tax policy influences manufacturers’ profits. This situation cannot be ignored. In addition, this paper examines consumers’ risk perceptions of the value of reproduction, whereas Huang et al.’s paper examines consumers’ risk perceptions of emergencies.

5.3. Impacts on the Profitability of Construction Material Remanufacturers

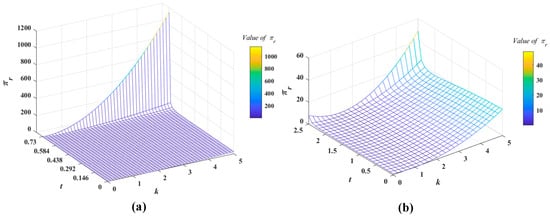

Figure 4 shows how consumer risk aversion impacts the profits of the remanufacturer of building materials and verifies Proposition 6.

Figure 4.

Impacts on the profits of the building materials remanufacturer. (a) h = 0.4; (b) h = 5.

As shown in Figure 4, in the case of a low abatement cost coefficient and a high carbon tax, the profits of building material remanufacturers are positively correlated with consumer risk aversion. Otherwise, there is a U-shaped trend between the profits of building materials remanufacturers and consumer risk aversion. In this case, lower consumer risk aversion is unfavorable to remanufacturers.

These findings are slightly different from those of Zang et al. [66]. Zang et al. concluded that the higher the level of risk aversion, the lower the enterprises gained. This may be because Zang et al. studied the vertical supply chain, whereas the focus of this paper is the horizontal supply chain.

6. Conclusions and Implications

6.1. Conclusions

This paper models a supply chain system of a building materials manufacturer and remanufacturer and studies how consumers’ risk-averse behaviors influences pricing decisions and profits, taking into account carbon tax regulation. The conclusions obtained are as follows:

- (1)

- For conventional products, consumer risk-averse behavior leads to lower sales prices. For recycled building materials, the price is negatively correlated with consumers’ risk aversion in the case of a low-carbon tax. In the case of a high carbon tax, we obtain the opposite result.

- (2)

- On one hand, when the abatement cost coefficient is lower than the threshold value, under the condition of a low carbon tax, the profits of the building materials manufacturer and remanufacturer show a U-shaped trend regarding consumer risk aversion. Under the condition of a high carbon tax, consumer risk-averse behavior always favors the profits of the building material manufacturer and the building material remanufacturer. On the other hand, when the abatement cost coefficient is above the threshold, there is an interval in which consumer risk-averse behavior only always positively affects the profits of building materials manufacturers if the carbon tax satisfies the interval. In other cases, the profits of the building materials manufacturer and remanufacturer show a U-shaped trend with respect to consumer risk aversion.

6.2. Implications

This paper compares pricing decisions and profits under consumer risk-averse and risk-neutral scenarios for a CDW recycling utilization supply chain system that contains a building materials manufacturer and building materials remanufacturer and analyses the impacts of consumer risk aversion on pricing decisions and profits under carbon tax scenarios. The management implications are as follows:

- (1)

- The remanufacturer of building materials should consider the carbon tax and consumer risk aversion to set the sales price of recycled building materials, while the manufacturer of building materials only needs to consider consumer risk aversion.

- (2)

- For the government, the risk aversion of consumers and the pressure of enterprises to reduce emissions should be taken into account when setting a carbon tax. When the pressure on enterprises is relatively low, consumers’ risk aversion can transform into a favorable factor to realize environmental and economic win–win situations by raising the carbon tax. When the pressure on enterprises is relatively high, setting a moderate carbon tax can help building materials manufacturers to cope with consumers’ risk-averse behaviors. However, whether this approach is beneficial for building material remanufacturers needs to be considered in conjunction with the degree of consumer risk aversion.

This paper analyses how consumer risk aversion behavior impacts the CDW recycling utilization supply chain in the context of carbon tax policy. However, in the actual market for building materials, as interested parties, the building materials manufacturer and remanufacturer also exhibit risk aversion. Therefore, their risk-averse behaviors need to be taken into account, but this would make the model more complex. Future research could include the risk-averse behavior of firms to make the model more realistic.

Author Contributions

Methodology, validation, formal analysis, investigation, resources, data curation, writing—original draft, writing—review and editing, and visualization, H.Z.; conceptualization, methodology, writing—original draft, supervision, and project administration, X.L.; writing—review and editing, W.C., J.P., Y.W., L.Z., P.G. and X.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the National Natural Science Foundation of China (grant number 72204178); the Sichuan Science and Technology Program; the Natural Science Foundation of Sichuan, China (grant number 2023NSFSC1053); and the National College Students Innovation and Entrepreneurship Training Plan (grant number 202310626041).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Hannouf, M.; Assefa, G.; Gates, I. Carbon intensity threshold for Canadian oil sands industry using planetary boundaries: Is a sustainable carbon-negative industry possible. Renew. Sustain. Energy Rev. 2021, 151, 111529. [Google Scholar] [CrossRef]

- Xavier, A.F.; Naveiro, R.M.; Aoussat, A.; Reyes, T. Systematic literature review of eco-innovation models: Opportunities and recommendations for future research. J. Clean. Prod. 2017, 149, 1278–1302. [Google Scholar] [CrossRef]

- Jackson, D.J.; Kaesehage, K. Addressing the challenges of integrating carbon calculation tools in the construction industry. Bus. Strategy Environ. 2020, 29, 2973–2983. [Google Scholar] [CrossRef]

- Chen, W.H.; Yin, W.J.; Yi, B.Y.; Xu, S.Q.; Zhang, H.; Li, X.W. Evolutionary Mechanism of Government Green Development Behavior in Construction and Demolition Waste Recycling Projects: A Perspective of Ecological Compensation. Buildings 2023, 13, 1762. [Google Scholar] [CrossRef]

- Liu, Y.X.; Hao, J.K.; Li, C.H.; Li, Y.J.; Zhou, C.Y.; Zheng, H.X.; Xu, S.Q.; Chen, W.H.; Li, X.W. How Can Construction and Demolition Waste Recycling Public-Private Partnership Projects Performance Compensate during the Operation Period? A Two-Stage Perspective of Recycling and Remanufacturing. Systems 2023, 11, 170. [Google Scholar] [CrossRef]

- Li, X.; He, J. Evolutionary mechanism of green product certification behavior in cement enterprises: A perspective of herd behavior. Environ. Technol. Innov. 2024, 33, 103508. [Google Scholar] [CrossRef]

- Barbudo, A.; Ayuso, J.; Lozano, A.; Cabrera, M.; Lopez-Uceda, A. Recommendations for the management of construction and demolition waste in treatment plants. Environ. Sci. Pollut. Res. 2020, 27, 125–132. [Google Scholar] [CrossRef]

- Mathur, A.; Morris, A.C. Distributional effects of a carbon tax in broader US fiscal reform. Energy Policy 2014, 66, 326–334. [Google Scholar] [CrossRef]

- Timilsina, G.R.; Dissou, Y.; Toman, M.; Heine, D. How can a carbon tax benefit developing economies with informality? A CGE analysis for Cote d’Ivoire. Clim. Policy, 2023; 1–16, in press. [Google Scholar] [CrossRef]

- Safi, A.; Chen, Y.; Wahab, S.; Zheng, L.; Rjoub, H. Does environmental taxes achieve the carbon neutrality target of G7 economies? Evaluating the importance of environmental R&D. J. Environ. Manag. 2021, 293, 112908. [Google Scholar]

- Levi, S. Why hate carbon taxes? Machine learning evidence on the roles of personal responsibility, trust, revenue recycling, and other factors across 23 European countries. Energy Res. Soc. Sci. 2021, 73, 101883. [Google Scholar] [CrossRef]

- Ma, S.; Zhang, L.L.; Cai, X. Optimizing joint technology selection, production planning and pricing decisions under emission tax: A Stackelberg game model and nested genetic algorithm. Expert Syst. Appl. 2024, 238, 122085. [Google Scholar] [CrossRef]

- Fahimnia, B.; Sarkis, J.; Choudhary, A.; Eshragh, A. Tactical supply chain planning under a carbon tax policy scheme: A case study. Int. J. Prod. Econ. 2015, 164, 206–215. [Google Scholar] [CrossRef]

- Mohammed, F.; Selim, S.Z.; Hassan, A.; Syed, M.N. Multi-period planning of closed-loop supply chain with carbon policies under uncertainty. Transp. Res. D Transp. Environ. 2017, 51, 146–172. [Google Scholar] [CrossRef]

- Dogan, B.; Chu, L.K.; Ghosh, S.; Truong, H.H.D.; Balsalobre-Lorente, D. How environmental taxes and carbon emissions are related in the G7 economies? Renew. Energy 2022, 187, 645–656. [Google Scholar] [CrossRef]

- China Economic Net. Available online: http://www.ce.cn/xwzx/gnsz/gdxw/202204/05/t20220405_37461133.shtml (accessed on 21 December 2023).

- Niu, B.; Xu, H.; Chen, L. Creating all-win by blockchain in a remanufacturing supply chain with consumer risk-aversion and quality untrust. Transport Res. E-Log. 2022, 163, 102778. [Google Scholar] [CrossRef]

- Ferguson, M.E.; Toktay, L.B. The effect of competition on recovery strategies. Prod. Oper. Manag. 2006, 15, 351–368. [Google Scholar] [CrossRef]

- Yenipazarli, A. Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur. J. Oper. Res. 2016, 249, 117–130. [Google Scholar] [CrossRef]

- Zhang, Y.; Zhang, T. Dynamic analysis of a dual-channel closed-loop supply chain with fairness concerns under carbon tax regulation. Environ. Sci. Pollut. Res. 2022, 29, 57543–57565. [Google Scholar] [CrossRef]

- Zhang, H.; Li, P.; Zheng, H.; Zhang, Y. Impact of carbon tax on enterprise operation and production strategy for low-carbon products in a co-opetition supply chain. J. Clean. Prod. 2021, 287, 125058. [Google Scholar] [CrossRef]

- Meng, X.; Yao, Z.; Nie, J.; Zhao, Y.; Li, Z. Low-carbon product selection with carbon tax and competition: Effects of the power structure. Int. J. Prod. Econ. 2018, 200, 224–230. [Google Scholar] [CrossRef]

- Wang, M.; Liu, K.; Choi, T.-M.; Yue, X. Effects of Carbon Emission Taxes on Transportation Mode Selections and Social Welfare. IEEE Trans. Syst. Man Cybern. Syst. 2015, 45, 1413–1423. [Google Scholar] [CrossRef]

- Zhou, D.; An, Y.; Zha, D.; Wu, F.; Wang, Q. Would an increasing block carbon tax be better? A comparative study within the Stackelberg Game framework. J. Environ. Manag. 2019, 235, 328–341. [Google Scholar] [CrossRef]

- Yu, B.; Wang, J.; Lu, X.; Yang, H. Collaboration in a low-carbon supply chain with reference emission and cost learning effects: Cost sharing versus revenue sharing strategies. J. Clean. Prod. 2020, 250, 119460. [Google Scholar] [CrossRef]

- Li, X.; Li, J.; Shen, Q. Infection mechanism of greenwashing behavior of construction material enterprises under multi-agent interaction. Dev. Built Environ. 2024, 17, 100321. [Google Scholar] [CrossRef]

- Wang, C.; Wang, W.; Huang, R. Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J. Clean. Prod. 2017, 152, 271–280. [Google Scholar] [CrossRef]

- Yang, H.; Chen, W. Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus Cost-sharing. Omega-Int. J. Manag. S 2018, 78, 179–191. [Google Scholar] [CrossRef]

- Maestre-Andres, S.; Drews, S.; van den Bergh, J. Perceived fairness and public acceptability of carbon pricing: A review of the literature. Clim. Policy 2019, 19, 1186–1204. [Google Scholar] [CrossRef]

- Baranzini, A.; van den Bergh, J.C.J.M.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon pricing in climate policy: Seven reasons, complementary instruments, and political economy considerations. Wiley Interdiscip. Rev. Clim. Chang. 2017, 8, e462. [Google Scholar] [CrossRef]

- Wang, R.; Zhou, X.; Li, B. Pricing strategy of dual-channel supply chain with a risk-averse retailer considering consumers’ channel preferences. Ann. Oper. Res. 2022, 309, 305–324. [Google Scholar] [CrossRef]

- Wang, D.; Liu, W.; Shen, X.; Wei, W. Service order allocation under uncertain demand: Risk aversion, peer competition, and relationship strength. Transport Res. E-Log. 2019, 130, 293–311. [Google Scholar] [CrossRef]

- Choi, T.-M.; Ma, C.; Shen, B.; Sun, Q. Optimal pricing in mass customization supply chains with risk-averse agents and retail competition. Omega-Int. J. Manag. S 2019, 88, 150–161. [Google Scholar] [CrossRef]

- Hsieh, C.-C.; Lu, Y.-T. Manufacturer’s return policy in a two-stage supply chain with two risk-averse retailers and random demand. Eur. J. Oper. Res. 2010, 207, 514–523. [Google Scholar] [CrossRef]

- Di Mauro, C.; Ancarani, A.; Schupp, F.; Crocco, G. Risk aversion in the supply chain: Evidence from replenishment decisions. J. Purch. Supply Manag. 2020, 26, 100646. [Google Scholar] [CrossRef]

- Huang, X.; Liu, G.; Zheng, P. Dynamic analysis of a low-carbon maritime supply chain considering government policies and social preferences. Ocean. Coast. Manag. 2023, 239, 106564. [Google Scholar] [CrossRef]

- Liu, P.F.; Yu, S.S.; Lin, Z.G. Supply chain decision based on green investment subsidy and risk aversion. PLoS ONE 2023, 18, e0293924. [Google Scholar] [CrossRef]

- Xu, X.; Choi, T.-M. Used-Part-Collection Programs in Manufacturing Systems for Products with Reusable Parts: Roles of Risk Aversion and Platforms. IEEE Trans. Syst. Man Cybern. Syst. 2022, 52, 6038–6047. [Google Scholar] [CrossRef]

- Yang, S.; Munson, C.L.; Chen, B. Using MSRP to enhance the ability of rebates to control distribution channels. Eur. J. Oper. Res. 2010, 205, 127–135. [Google Scholar] [CrossRef]

- Prasad, A.; Stecke, K.E.; Zhao, X. Advance Selling by a Newsvendor Retailer. Prod. Oper. Manag. 2011, 20, 129–142. [Google Scholar] [CrossRef]

- Song, Y.; Liu, J.; Zhang, W.; Li, J. Blockchain’s role in e-commerce sellers’ decision-making on information disclosure under competition. Ann. Oper. Res. 2023, 329, 1009–1048. [Google Scholar] [CrossRef]

- Sheth, J.N.; Newman, B.I.; Gross, B.L. Why we buy what we buy: A theory of consumption values. J. Bus. Res. 1991, 22, 159–170. [Google Scholar] [CrossRef]

- Tanrikulu, C. Theory of consumption values in consumer behaviour research: A review and future research agenda. Int. J. Consum. Stud. 2021, 45, 1176–1197. [Google Scholar] [CrossRef]

- Goncalves, H.M.; Lourenco, T.F.; Silva, G.M. Green buying behavior and the theory of consumption values: A fuzzy-set approach. J. Bus. Res. 2016, 69, 1484–1491. [Google Scholar] [CrossRef]

- Awuni, J.A.; Du, J. Sustainable Consumption in Chinese Cities: Green Purchasing Intentions of Young Adults Based on the Theory of Consumption Values. Sustain. Dev. 2016, 24, 124–135. [Google Scholar] [CrossRef]

- Khan, S.N.; Mohsin, M. The power of emotional value: Exploring the effects of values on green product consumer choice behavior. J. Clean. Prod. 2017, 150, 65–74. [Google Scholar] [CrossRef]

- Roh, T.; Seok, J.; Kim, Y. Unveiling ways to reach organic purchase: Green perceived value, perceived knowledge, attitude, subjective norm, and trust. J. Retail. Consum. Serv. 2022, 67, 102988. [Google Scholar] [CrossRef]

- Tandon, A.; Kaur, P.; Bhatt, Y.; Mantymaki, M.; Dhir, A. Why do people purchase from food delivery apps? A consumer value perspective. J. Retail. Consum. Serv. 2021, 63, 102667. [Google Scholar] [CrossRef]

- Sitcharangsie, S.; Ijomah, W.; Wong, T.C. Decision makings in key remanufacturing activities to optimise remanufacturing outcomes: A review. J. Clean. Prod. 2019, 232, 1465–1481. [Google Scholar] [CrossRef]

- Mawandiya, B.K.; Jha, J.K.; Thakkar, J.J. Optimal production-inventory policy for closed-loop supply chain with remanufacturing under random demand and return. Oper. Res.-Ger. 2020, 20, 1623–1664. [Google Scholar] [CrossRef]

- People’s Daily Online. Available online: http://gd.people.com.cn/n2/2022/0907/c123932-40114410.html (accessed on 21 December 2023).

- Wang, X.; Zhu, Y.; Sun, H.; Jia, F. Production decisions of new and remanufactured products: Implications for low carbon emission economy. J. Clean. Prod. 2018, 171, 1225–1243. [Google Scholar] [CrossRef]

- Xu, S.; Yin, W.; Li, X.; Chen, W.; Yi, B.; Wang, Y. Evolutionary mechanism of green technology innovation behavior in the operation period of construction and demolition waste recycling public-private partnership projects. Manag. Decis. Econ. 2023, 44, 4637–4650. [Google Scholar] [CrossRef]

- Li, X.; Dai, J.; Zhu, X.; Li, J.; He, J.; Huang, Y.; Liu, X.; Shen, Q. Mechanism of attitude, subjective norms, and perceived behavioral control influence the green development behavior of construction enterprises. Hum. Soc. Sci. Commun. 2023, 10, 266. [Google Scholar] [CrossRef]

- Zeng, L.; Wang, J. Retailer Optimal Channel Decision of Dual-channel Supply Chain Considering Consumer Risk-averse Behavior. Stat. Decis. 2020, 36, 163–167. (In Chinese) [Google Scholar]

- Cai, K.; He, Z.; Lou, Y.; He, S. Risk-aversion information in a supply chain with price and warranty competition. Ann. Oper. Res. 2020, 287, 61–107. [Google Scholar] [CrossRef]

- Jones, R.; Mendelson, H. Information Goods vs. Industrial Goods: Cost Structure and Competition. Manag. Sci. 2011, 57, 164–176. [Google Scholar] [CrossRef]

- Heydari, J.; Govindan, K.; Basiri, Z. Balancing price and green quality in presence of consumer environmental awareness: A green supply chain coordination approach. Int. J. Prod. Res. 2021, 59, 1957–1975. [Google Scholar] [CrossRef]

- Zhou, C.Y.; He, J.R.; Li, Y.J.; Chen, W.H.; Zhang, Y.; Zhang, H.; Xu, S.Q.; Li, X.W. Green Independent Innovation or Green Imitation Innovation? Supply Chain Decision-Making in the Operation Stage of Construction and Demolition Waste Recycling Public-Private Partnership Projects. Systems 2023, 11, 94. [Google Scholar] [CrossRef]

- Zhu, X.; Ren, M.; Chu, W.; Chiong, R. Remanufacturing subsidy or carbon regulation? An alternative toward sustainable production. J. Clean. Prod. 2019, 239, 117988. [Google Scholar] [CrossRef]

- Liu, B.Y.; Yang, H.D.; Ke, D. Effects of Carbon Emission Regulations on Operations Decisions of Manufacturers/Remanufacturers with Patent Licensing. Chin. J. Manag. Sci. 2023, 31, 198–208. (In Chinese) [Google Scholar]

- Chen, B.; Xie, W.; Huang, F.; Li, X. Energy-saving and pricing decisions in a sustainable supply chain considering behavioral concerns. PLoS ONE 2020, 15, e0236354. [Google Scholar] [CrossRef] [PubMed]

- Wu, L.; Guo, Q.; Nie, J. The Effect of Risk-Averse Medical Institutions’ Procurement Strategies on the Pharmaceutical Supply Chain. Chin. J. Manag. 2023, 5, 735–746. (In Chinese) [Google Scholar]

- Zou, H.; Qin, J.; Long, X. Coordination Decisions for a Low-Carbon Supply Chain Considering Risk Aversion under Carbon Quota Policy. Int. J. Environ. Res. Public Health 2022, 19, 2656. [Google Scholar] [CrossRef] [PubMed]

- Huang, R.; Nie, T.; Zhu, Y. Optimal Pricing and Information Provision in Supply Chain with Consumers’ Risk Perception. Emerg. Mark. Financ. Trade 2021, 57, 989–1007. [Google Scholar] [CrossRef]

- Zang, L.; Liu, M.; Wang, Z.; Wen, D. Coordinating a two-stage supply chain with external failure cost-sharing and risk-averse agents. J. Clean. Prod. 2022, 334, 130012. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).